Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Education Realty Trust, Inc. | ex99220172018preleasingsta.htm |

| 8-K - 8-K - Education Realty Trust, Inc. | a8-k2017reitweek.htm |

1

2

Key Themes

Stable Industry With Significant Growth Potential

Superior Historical Shareholder Returns

Investment Strategy for Value Creation

Capital Structure to Support Growth

Best-in-Class Portfolio

Deep Experienced Management Team

3

Superior Historical Shareholder Return

Superior Historical Shareholder Return

Note: Period starting from the date Randy Churchey, Chairman and CEO and new management team was put in place.

Source: KeyBanc Leaderboard. Other REIT sector TSRs; self-storage 293%, industrial 218%, triple net 205%, mall 173%, shopping

ctr 149%, healthcare 120%, lodging 115% and office 102%.

275%

241% 217%

170% 145% 132%

EdR MFG

Housing

Data

Centers

MF RMZ ACC

TSR – January 2010 to December 2016

EdR TSR 12th

of 120 REITS.

Top 10%

4

Deep Experienced Management Team

Deep Experienced Management Team

Executives

Randy Churchey CEO & Chairman 7

Tom Trubiana President 28

Chris Richards COO 16

Bill Brewer CFO 3

Operations

Matt Fulton SVP 19

Frank Witt Regional VP 25

14 Other VPs and Regional Directors 10

Years of Tenure At EdR

Senior Development / Acq 10

Senior Finance and Other 8

Board of Directors (6) – Includes 3 current/former public REIT CEOs, former

CEO of public hospitality company, a former “big 4” audit partner and former head of

HR for a publicly traded company

5

6

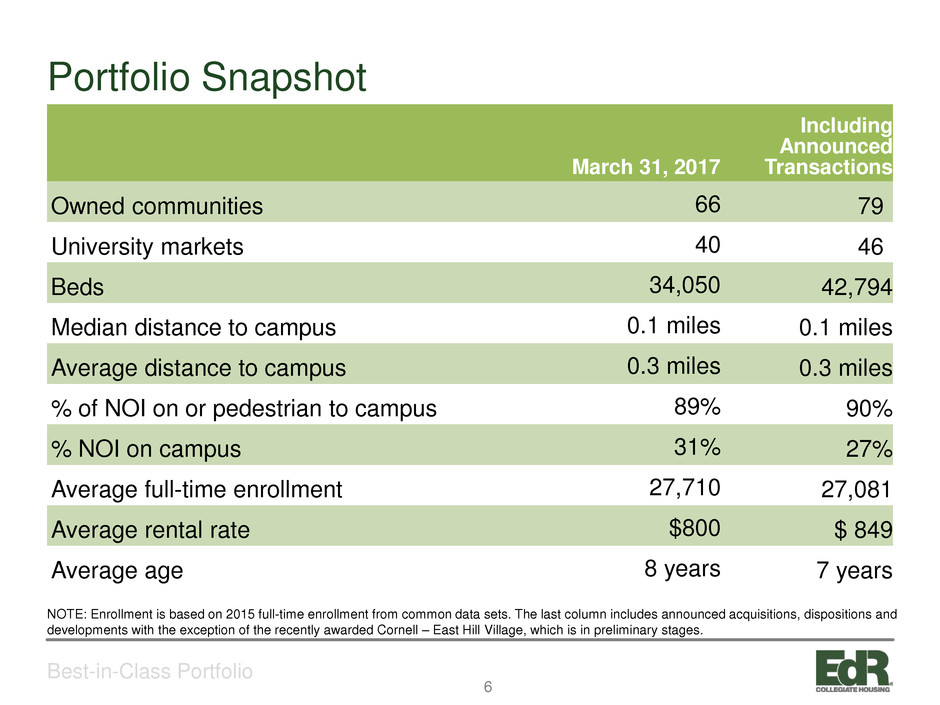

Portfolio Snapshot

Best-in-Class Portfolio

March 31, 2017

Including

Announced

Transactions

Owned communities 66 79

University markets 40 46

Beds 34,050 42,794

Median distance to campus 0.1 miles 0.1 miles

Average distance to campus 0.3 miles 0.3 miles

% of NOI on or pedestrian to campus 89% 90%

% NOI on campus 31% 27%

Average full-time enrollment 27,710 27,081

Average rental rate $800 $ 849

Average age 8 years 7 years

NOTE: Enrollment is based on 2015 full-time enrollment from common data sets. The last column includes announced acquisitions, dispositions and

developments with the exception of the recently awarded Cornell – East Hill Village, which is in preliminary stages.

7

Portfolio Characteristics

Best-in-Class Portfolio

HIGH DEMAND

UNIVERSITIES

1.8x

APPLICATION

TO ADMITTANCE

RATIO

(1) Represents our communities’ relative position in their respective market, based on a comparison of average rents to local

competitors.

82%

OF BEDS SERVE

UNIVERSITIES

WITH >20,000

ENROLLMENT

12%

56%

33%

R

en

ts

R

el

at

iv

e

to

C

om

ps

.

Well Positioned(1)

Low End Average

High End

25%

6%

47%

22%

Diverse Product

Garden Cottage

Mid-Rise High-Rise

8

Strong Operating Performance

Best-in-Class Portfolio

Source: Respective financial supplements.

$397

$745

2010 2016

Same-Community NAR

per Occupied Bed

51%

59%

2010 2016

Same-Community

Margins

9

Market Leading Internal Growth

Best-in-Class Portfolio

Source: Respective company’s disclosures. EdR’s proprietary leasing system, PILOT, which tracks market trends and

leasing velocity by unit type, gives EdR the tools to produce consistent and market leading leasing results.

Market-Leading

Leasing Results in

4 of Last 6

Years

3.6%

3.8%

2.8%

3.1%

Revenue NOI

EdR ACC

Same-Community Growth

Six-Year CAGR Through 2016

10

11

Stable Demand

Stable Industry With Significant Growth Potential

Projected Full-Time Enrollment Growth

Projected Average % Growth 2016-2024 = 1.4%

Sources: National Center for Education Statistics (NCES) report titled “Projections of Education Statistics to 2024, Forty-first edition" (Sept 2016), Pew

Research - Social & Demographic Trends: The Rising Cost of Not Going to College, February 11, 2014, Moody’s Investors Service, Special

Comment: More US Colleges Face Stagnating Enrollment and Tuition Revenue, According to Moody’s Survey, Jan. 10, 2013.

Enrollment Drivers

• Earnings gap between high school and college

graduates has stretched to its widest level in nearly a

half century

• US high school graduates will increase by an

average annual rate of 0.2% between 2016 and 2020

• Students seek the highest value education

• There is a correlation between university size and

enrollment trends, with the highest median

enrollment growth experienced at large, program-

diversified universities.

• Enrollment at public four-year institutions has out

performed four-year private and for-profit institutions

as well as two-year institutions

1.3%

2.2%

1.8%

1.2% 1.0%

1.3% 1.4% 1.6%

1.1%

2016 2017 2018 2019 2020 2021 2022 2023 2024

12

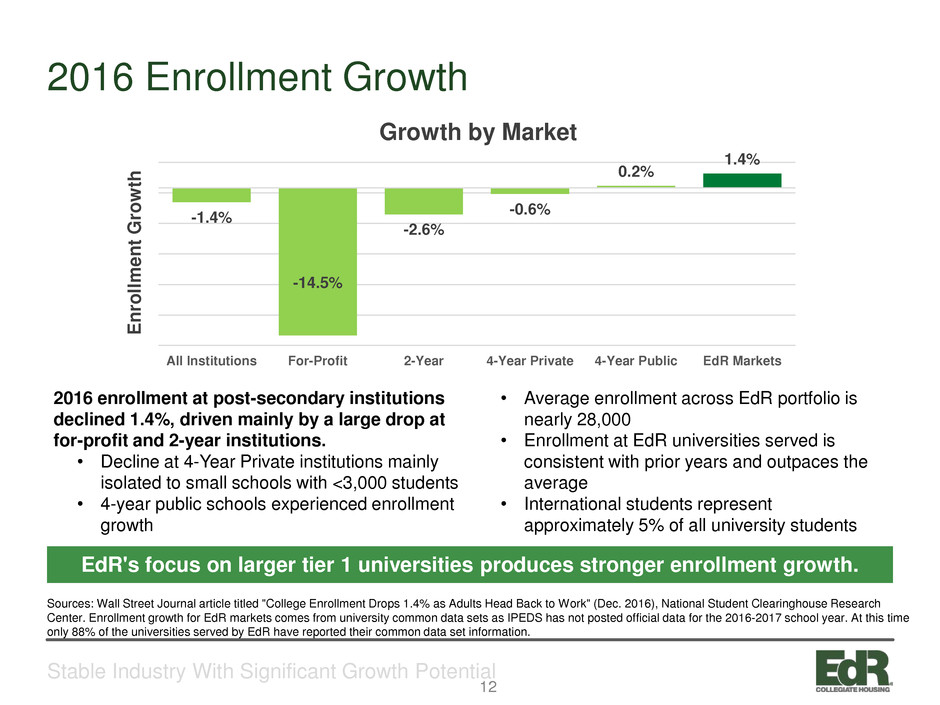

2016 Enrollment Growth

Stable Industry With Significant Growth Potential

2016 enrollment at post-secondary institutions

declined 1.4%, driven mainly by a large drop at

for-profit and 2-year institutions.

• Decline at 4-Year Private institutions mainly

isolated to small schools with <3,000 students

• 4-year public schools experienced enrollment

growth

Sources: Wall Street Journal article titled "College Enrollment Drops 1.4% as Adults Head Back to Work" (Dec. 2016), National Student Clearinghouse Research

Center. Enrollment growth for EdR markets comes from university common data sets as IPEDS has not posted official data for the 2016-2017 school year. At this time

only 88% of the universities served by EdR have reported their common data set information.

• Average enrollment across EdR portfolio is

nearly 28,000

• Enrollment at EdR universities served is

consistent with prior years and outpaces the

average

• International students represent

approximately 5% of all university students

EdR's focus on larger tier 1 universities produces stronger enrollment growth.

-1.4%

-14.5%

-2.6%

-0.6%

0.2%

1.4%

All Institutions For-Profit 2-Year 4-Year Private 4-Year Public EdR Markets

E

nr

ol

lm

en

t G

ro

w

th

Growth by Market

13

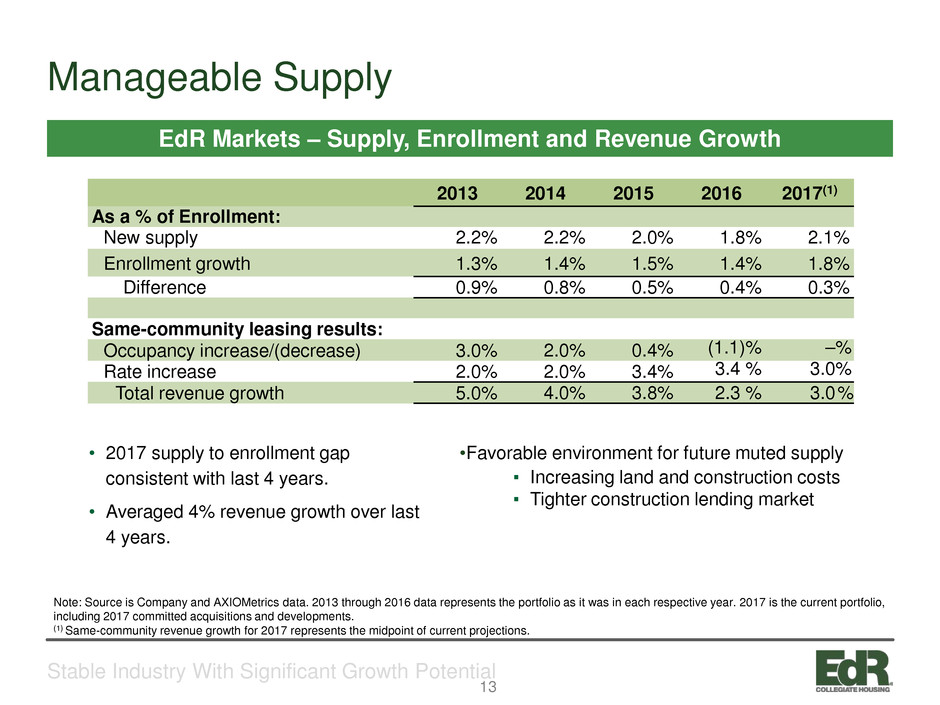

Manageable Supply

Stable Industry With Significant Growth Potential

EdR Markets – Supply, Enrollment and Revenue Growth

Note: Source is Company and AXIOMetrics data. 2013 through 2016 data represents the portfolio as it was in each respective year. 2017 is the current portfolio,

including 2017 committed acquisitions and developments.

(1) Same-community revenue growth for 2017 represents the midpoint of current projections.

(14%) (23%) (22%)

2013 2014 2015 2016 2017(1)

As a % of Enrollment:

New supply 2.2% 2.2% 2.0% 1.8% 2.1%

Enrollment growth 1.3% 1.4% 1.5% 1.4% 1.8%

Difference 0.9% 0.8% 0.5% 0.4% 0.3%

Same-community leasing results:

Occupancy increase/(decrease) 3.0% 2.0% 0.4% (1.1)% –%

Rate increase 2.0% 2.0% 3.4% 3.4 % 3.0%

Total revenue growth 5.0% 4.0% 3.8% 2.3 % 3.0%

• 2017 supply to enrollment gap

consistent with last 4 years.

• Averaged 4% revenue growth over last

4 years.

•Favorable environment for future muted supply

▪ Increasing land and construction costs

▪ Tighter construction lending market

14

Modernization

Stable Industry With Significant Growth Potential

Modernization is in full swing with new purpose-built housing

supply replacing older duplexes, single-family homes, etc.

Source: Company and AXIOMetrics data. Represents EdR’s markets

Other Housing

47%

On-Campus

Housing 27%

Off-Campus

Purpose Built

26%

15

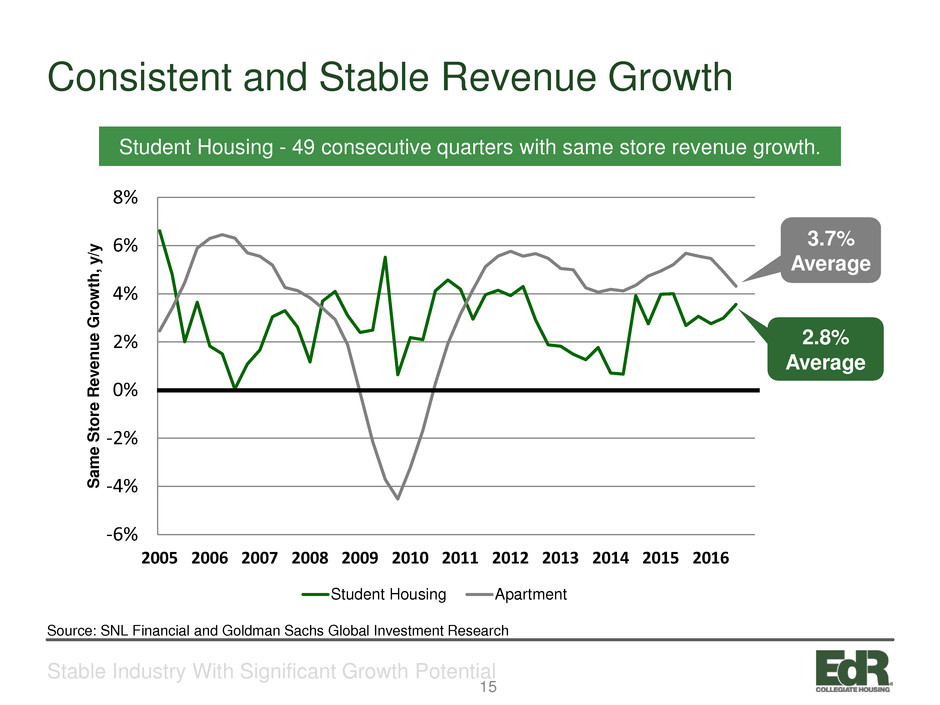

Consistent and Stable Revenue Growth

Stable Industry With Significant Growth Potential

Student Housing - 49 consecutive quarters with same store revenue growth.

Source: SNL Financial and Goldman Sachs Global Investment Research

2.8%

Average

-6%

-4%

-2%

0%

2%

4%

6%

8%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

S

am

e

S

to

re

R

ev

en

ue

G

ro

w

th

, y

/y

Student Housing Apartment

3.7%

Average

16

17

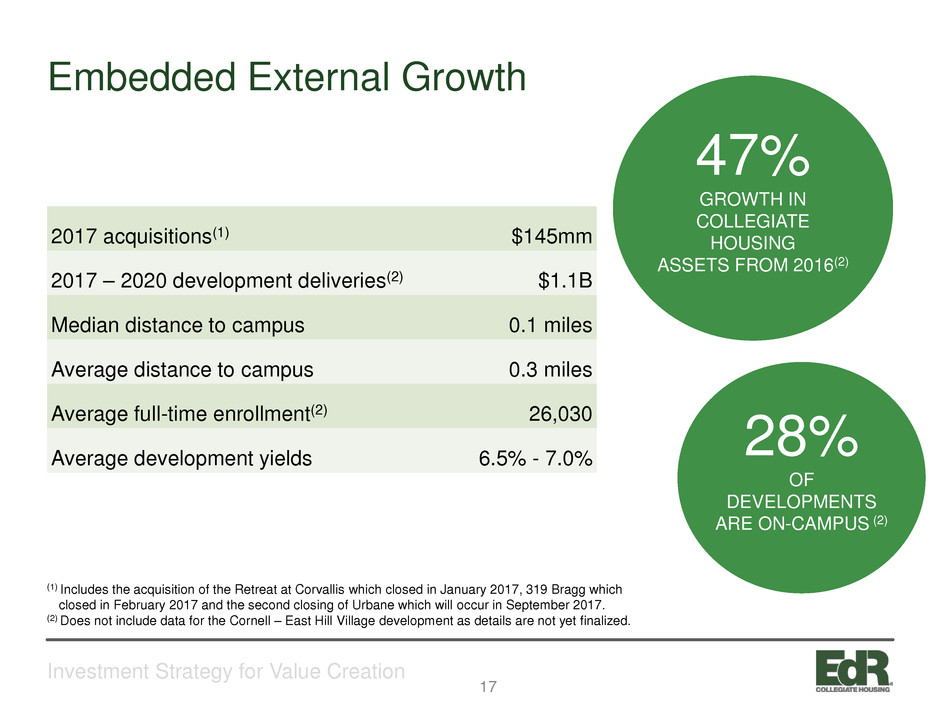

2017 acquisitions(1) $145mm

2017 – 2020 development deliveries(2) $1.1B

Median distance to campus 0.1 miles

Average distance to campus 0.3 miles

Average full-time enrollment(2) 26,030

Average development yields 6.5% - 7.0%

47%

GROWTH IN

COLLEGIATE

HOUSING

ASSETS FROM 2016(2)

28%

OF

DEVELOPMENTS

ARE ON-CAMPUS (2)

Embedded External Growth

Investment Strategy for Value Creation

(1) Includes the acquisition of the Retreat at Corvallis which closed in January 2017, 319 Bragg which

closed in February 2017 and the second closing of Urbane which will occur in September 2017.

(2) Does not include data for the Cornell – East Hill Village development as details are not yet finalized.

18

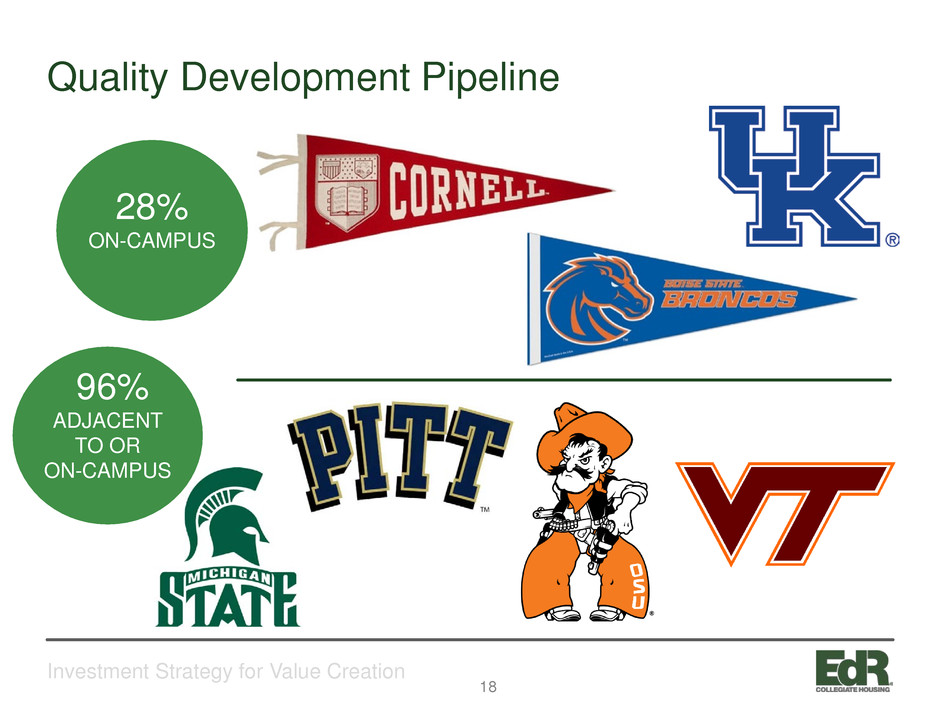

Quality Development Pipeline

Investment Strategy for Value Creation

28%

ON-CAMPUS

96%

ADJACENT

TO OR

ON-CAMPUS

19

5.25%

5.25%

1.25% - 1.75%

0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00%

Development Yields

Market Cap Rates

Acquisition Cap Rates Development Premium

Development Premiums Drive Growth

Investment Strategy for Value Creation

Yield Premium For Low-Risk Developments(1)

(1) Current market cap rates for adjacent to campus assets in EdR type markets range from 5.0 to 5.5%.

30% Premium

20

Development Year

Percentage

On-Campus

Total

Cost

EdR’s

Economic

Ownership

Cost

Market

Value(1)

Additional

AV Creation

Incremental

NAV per

Share(2)

2017 Deliveries 56% $338 $315 $424 $109 $1.11

2018 Deliveries 18% $617 $502 $660 $158 $1.61

2019 Deliveries 0% $110 $99 $127 $28 $0.29

Total Active

Developments 28% $1,065 $916 $1,211 $295 $3.01

Value Creation from Announced Developments

Investment Strategy for Value Creation

(1) Based on a 6.75% average project yield and cap rates of 4.75% for on-campus and 5.25% for off-campus developments.

(2) Based on 73.6 million shares outstanding as of December 31, 2016.

in Millions, except

per share data

32% Value

Creation

21

EdR’s

Share of

Cost

(in millions)

First Year

Occupancy

Second Year

Occupancy

First-Year

Economic

Yield

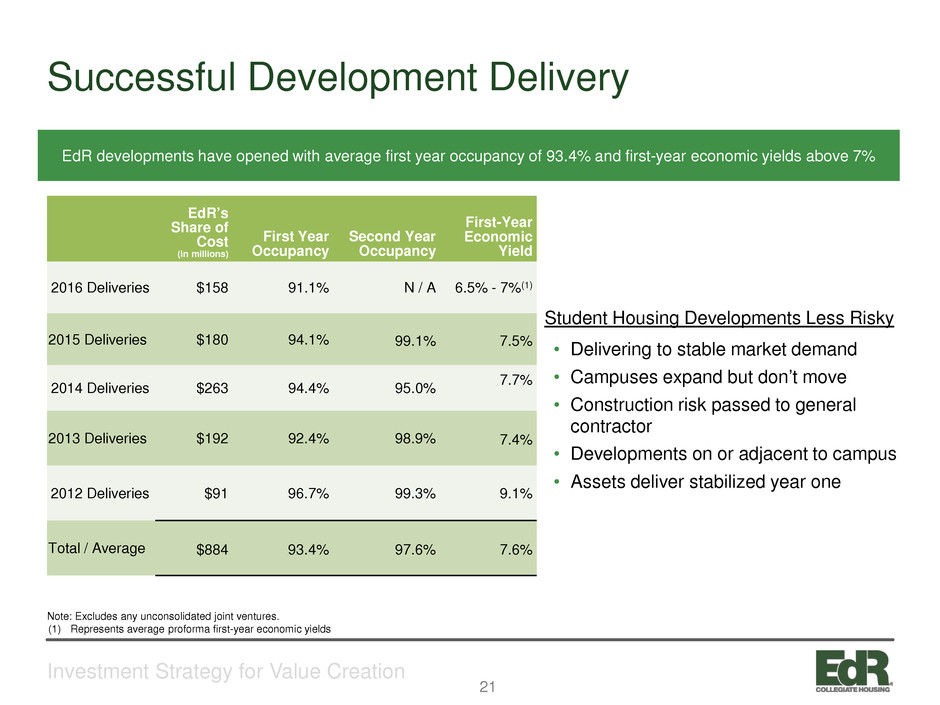

2016 Deliveries $158 91.1% N / A 6.5% - 7%(1)

2015 Deliveries $180 94.1% 99.1% 7.5%

2014 Deliveries $263 94.4% 95.0% 7.7%

2013 Deliveries $192 92.4% 98.9% 7.4%

2012 Deliveries $91 96.7% 99.3% 9.1%

Total / Average $884 93.4% 97.6% 7.6%

Note: Excludes any unconsolidated joint ventures.

(1) Represents average proforma first-year economic yields

EdR developments have opened with average first year occupancy of 93.4% and first-year economic yields above 7%

Student Housing Developments Less Risky

• Delivering to stable market demand

• Campuses expand but don’t move

• Construction risk passed to general

contractor

• Developments on or adjacent to campus

• Assets deliver stabilized year one

Successful Development Delivery

Investment Strategy for Value Creation

22

Investment Strategy for Value Creation

23

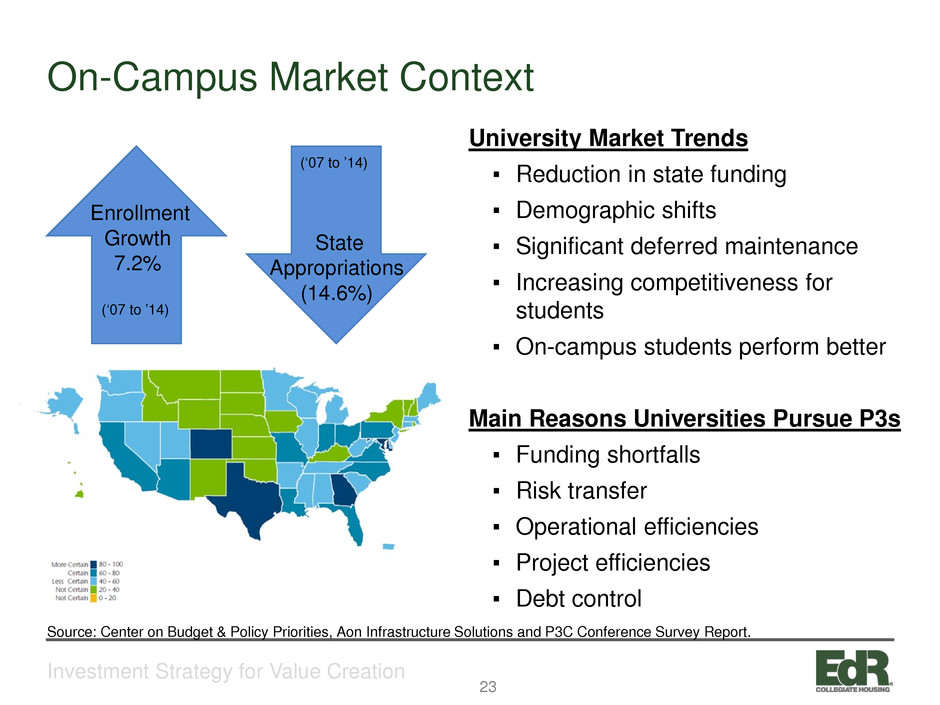

On-Campus Market Context

Investment Strategy for Value Creation

University Market Trends

▪ Reduction in state funding

▪ Demographic shifts

▪ Significant deferred maintenance

▪ Increasing competitiveness for

students

▪ On-campus students perform better

Main Reasons Universities Pursue P3s

▪ Funding shortfalls

▪ Risk transfer

▪ Operational efficiencies

▪ Project efficiencies

▪ Debt control

Enrollment

Growth

7.2%

State

Appropriations

(14.6%)

Source: Center on Budget & Policy Priorities, Aon Infrastructure Solutions and P3C Conference Survey Report.

(‘07 to ’14)

(‘07 to ’14)

24

Public REITs Dominate Equity P3s

Investment Strategy for Value Creation

NOTE: Combined public company results from company financial supplements.

$0.3

Billion

$1.6

Billion

2009 2016

Delivered On-Campus

Equity Developments

Significant Competitive Advantages

Proven on-campus development and

management expertise

Well-capitalized balance sheet

Size and depth of resources

Public company transparency

Long-term owner of assets

25

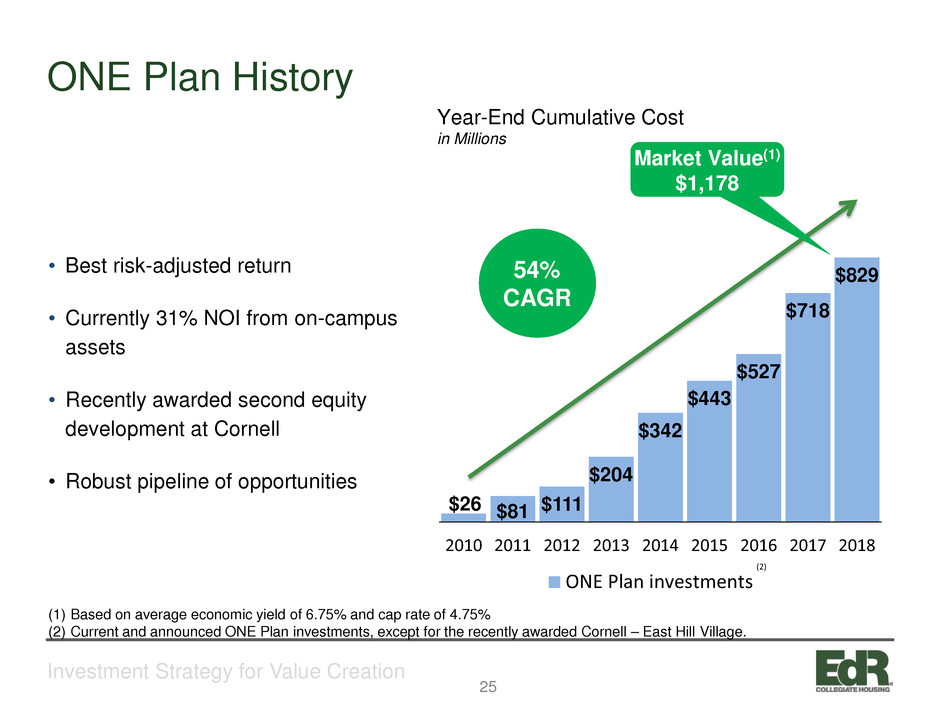

ONE Plan History

Investment Strategy for Value Creation

• Best risk-adjusted return

• Currently 31% NOI from on-campus

assets

• Recently awarded second equity

development at Cornell

• Robust pipeline of opportunities

(1) Based on average economic yield of 6.75% and cap rate of 4.75%

(2) Current and announced ONE Plan investments, except for the recently awarded Cornell – East Hill Village.

$26 $81 $111

$204

$342

$443

$527

$718

$829

2010 2011 2012 2013 2014 2015 2016 2017 2018

ONE Plan investments

Market Value(1)

$1,178

Year-End Cumulative Cost

in Millions

(2)

54%

CAGR

26

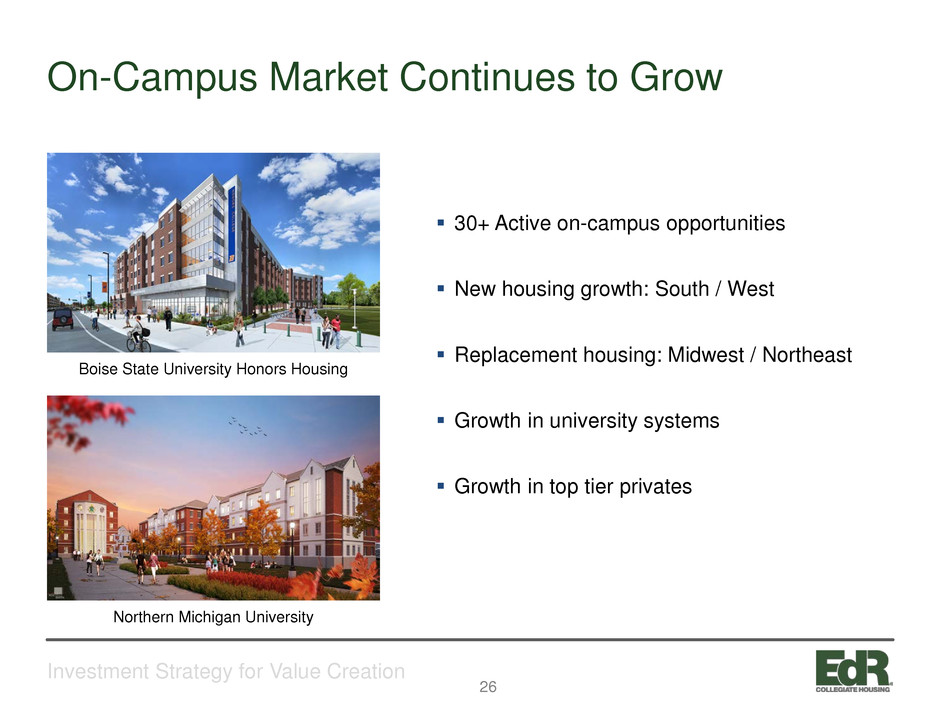

On-Campus Market Continues to Grow

Investment Strategy for Value Creation

Boise State University Honors Housing

Northern Michigan University

30+ Active on-campus opportunities

New housing growth: South / West

Replacement housing: Midwest / Northeast

Growth in university systems

Growth in top tier privates

27

28

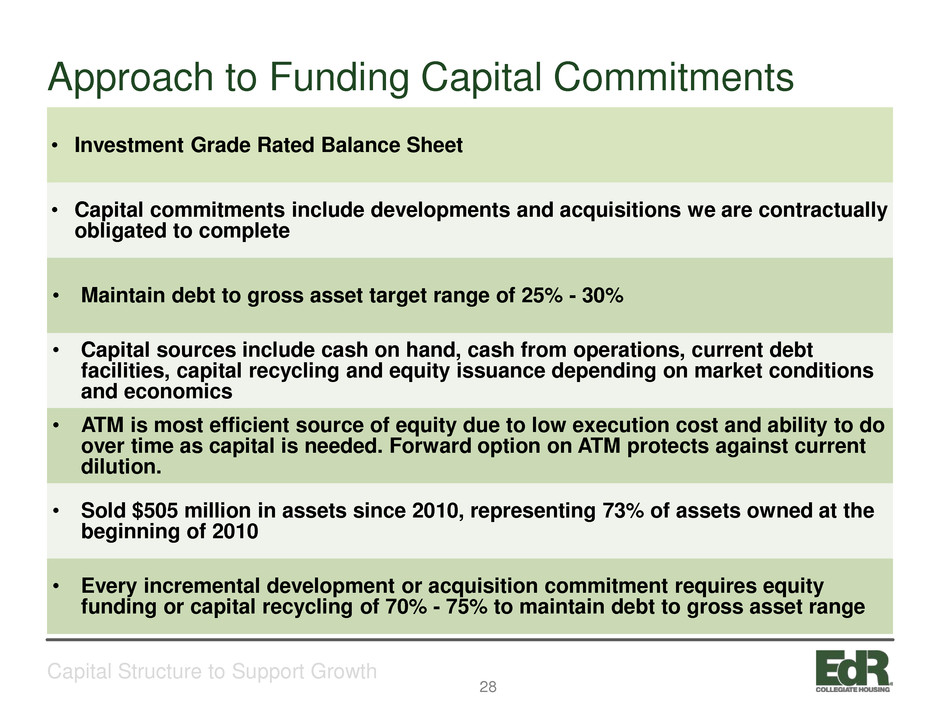

Approach to Funding Capital Commitments

Capital Structure to Support Growth

• Investment Grade Rated Balance Sheet

• Capital commitments include developments and acquisitions we are contractually

obligated to complete

• Maintain debt to gross asset target range of 25% - 30%

• Capital sources include cash on hand, cash from operations, current debt

facilities, capital recycling and equity issuance depending on market conditions

and economics

• ATM is most efficient source of equity due to low execution cost and ability to do

over time as capital is needed. Forward option on ATM protects against current

dilution.

• Sold $505 million in assets since 2010, representing 73% of assets owned at the

beginning of 2010

• Every incremental development or acquisition commitment requires equity

funding or capital recycling of 70% - 75% to maintain debt to gross asset range

29

Capital Commitments and Funding

Capital Structure to Support Growth

Estimated Capital Commitments:

Total Project

Development

Cost

Acquisition or

Development Costs

funded by EdR

(Excludes Partner

Contributions)

Cost Incurred to

Date

Remaining Capital

Needs

2017 Announced acquisitions $ 16 $ 16 $ — $ 16

2017 Development deliveries 339 333 234 99

2018 Development deliveries 617 583 69 514

2019 Development deliveries 109 106 23 83

Total Capital Commitments $ 1,081 $ 1,038 $ 326 $ 712

Estimated Capital Funding: 2017 Thereafter Capital Sources

Cash on hand at 3/31/2017 $ 35 $ — $ 35

Equity proceeds Available from ATM

Forward Sales 288 23 311

Additional debt, including draws on Line of

Credit 89 277 366

Total Capital Funding $ 412 $ 300 $ 712

3/31/2017

Pro Forma for

Funding Needs

Through

12/31/2017

Pro Forma

Assuming All

Funding Completed

Debt to Gross Assets(1) 24% 24% 29%

Note: Capital Commitments include announced and pending acquisitions and EdR’s share of announced and active developments. See the First Quarter 2017 Supplemental Package

for further details.

(1) Debt to gross assets is defined as total debt, excluding the unamortized debt premium and deferred financing costs, divided by gross assets, or total assets excluding accumulated

depreciation on real estate assets.

30

Leverage Target and Philosophy

Capital Structure to Support Growth

• Target - 25% to 30% debt to gross assets

• Philosophy - run our balance sheet such that we can fund current commitments with

cash on hand, cash from operations and current debt facilities and stay within target

debt to gross asset range

• Results in balance sheet capacity and flexibility to take advantage of opportunities

(1) Reflects funding all announced developments and recently completed acquisitions with cash on hand, proceeds from completed ATM forward sales and draws on

EdR’s revolving credit facility without any additional equity.

(2) Net debt to gross assets is defined as total debt, excluding the unamortized debt premium and deferred financing costs, less cash, divided by gross assets, or

total assets excluding accumulated depreciation on real estate assets.

42%

35%

27%

17%

24% 24%

2013 2014 2015 2016 Q1 2017 2017 F (1)

N

et

D

eb

t t

o

G

ro

ss

A

ss

et

s(

2)

November '15 new debt to gross

asset target range established.

31

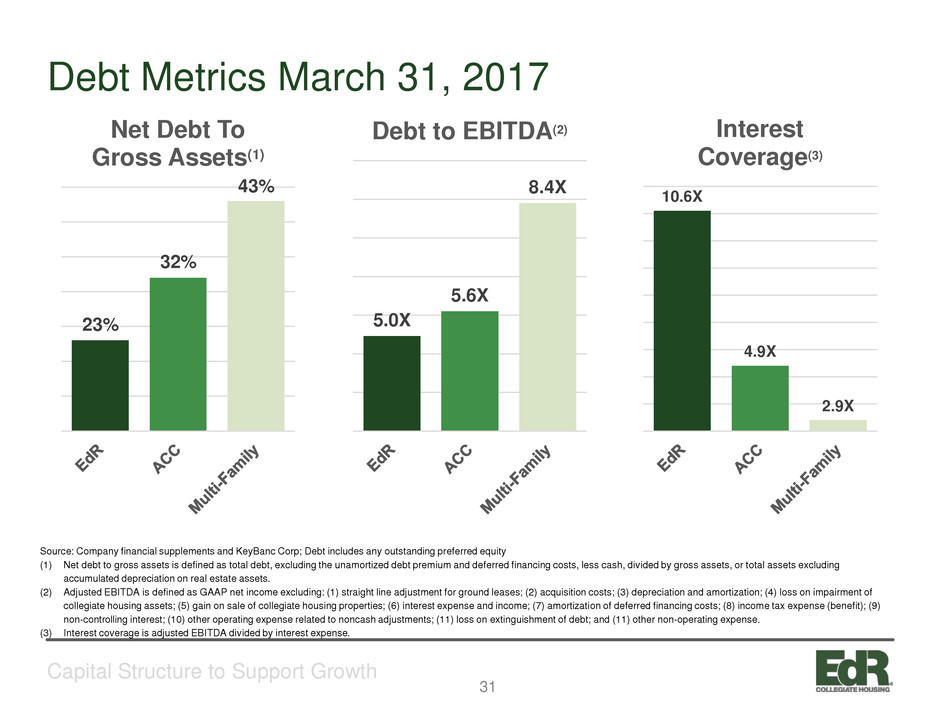

Debt Metrics March 31, 2017

Capital Structure to Support Growth

Source: Company financial supplements and KeyBanc Corp; Debt includes any outstanding preferred equity

(1) Net debt to gross assets is defined as total debt, excluding the unamortized debt premium and deferred financing costs, less cash, divided by gross assets, or total assets excluding

accumulated depreciation on real estate assets.

(2) Adjusted EBITDA is defined as GAAP net income excluding: (1) straight line adjustment for ground leases; (2) acquisition costs; (3) depreciation and amortization; (4) loss on impairment of

collegiate housing assets; (5) gain on sale of collegiate housing properties; (6) interest expense and income; (7) amortization of deferred financing costs; (8) income tax expense (benefit); (9)

non-controlling interest; (10) other operating expense related to noncash adjustments; (11) loss on extinguishment of debt; and (11) other non-operating expense.

(3) Interest coverage is adjusted EBITDA divided by interest expense.

23%

32%

43%

Net Debt To

Gross Assets(1)

5.0X

5.6X

8.4X

Debt to EBITDA(2)

10.6X

4.9X

2.9X

Interest

Coverage(3)

32

Current Capital Structure

Capital Structure to Support Growth

• Conservative Leverage Levels

• Net Debt to Gross Assets: 23%

• Net Debt to Adjusted EBITDA: 2.3x

• Secured Debt to Gross Assets: 1%

• Variable Rate Debt to Total Debt: 40%

• Strong Coverage Levels

• Interest Coverage Ratio: 10.6x

• Well-staggered debt maturities

• $500 million unsecured Credit Facility

expandable to $1 billion(1)

• $311 million equity proceeds available

from completed and settled ATM forward

sales

• Attractive and well covered dividend(2)

• Dividend Yield: 3.7%

(1) The unsecured revolving credit facility has an initial maturity in November 2018 and has a one-year extension option that may be exercised if certain conditions are met. The

Company has locked rates on $150 million of unsecured private placement notes with an average interest rate of 4.26%. The notes are evenly split between a 12-year and 15-

year term, are expected to close in the second quarter of 2017 and a portion of the proceeds is expected to be used to pay down the revolver. The current commitments have

customary contingencies and closing of the transaction is not guaranteed.

(2) Based on current annual dividend of $1.52 and stock price of $40.85 on March 31, 2017.

$30

$123

65

$250 $260

2017 2018 2019 2020 2021 2022 2023 2024

Debt Maturities as of March 31, 2017

(in Millions)

Unsecured revolving credit facility

Unsecured Senior Notes

Unsecured Term Loan - Fixed Rate

Construction Loans - Variable Rate

34

Safe Harbor Statement

Statements about the Company’s business that are not historical facts are “forward-looking

statements,” which relate to expectations, beliefs, projections, future plans and strategies,

anticipated events or trends, and similar expressions. In some cases, you can identify forward-

looking statements by the use of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or the

negative of these words and phrases or similar words or phrases which are predictions of or

indicate future events or trends and which do not relate solely to historical matters. Forward-

looking statements are based on current expectations. You should not rely on our forward-looking

statements because the matters that they describe are subject to known and unknown risks and

uncertainties that could cause the Company’s business, financial condition, liquidity, results of

operations, Core FFO, FFO and prospects to differ materially from those expressed or implied by

such statements. Such risks are set forth under the captions “Risk Factors,” “Forward-Looking

Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” (or similar captions) in our most recent Annual Report on Form 10-K and our quarterly

reports on Form 10-Q, and as described in our other filings with the Securities and Exchange

Commission. Forward-looking statements speak only as of the date on which they are made, and,

except as otherwise may be required by law, the Company undertakes no obligation to update

publicly or revise any guidance or other forward-looking statement, whether as a result of new

information, future developments, or otherwise, except as required by law.