Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex992earningspresentatio.htm |

| EX-99.1 - EXHIBIT 99.1 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex991earningsrelease-20160.htm |

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-kre1q2017earnings.htm |

BROADRIDGE FINANCIAL SOLUTIONS

SUPPLEMENTAL REPORTING DETAIL

FISCAL YEAR 2017 FIRST QUARTER

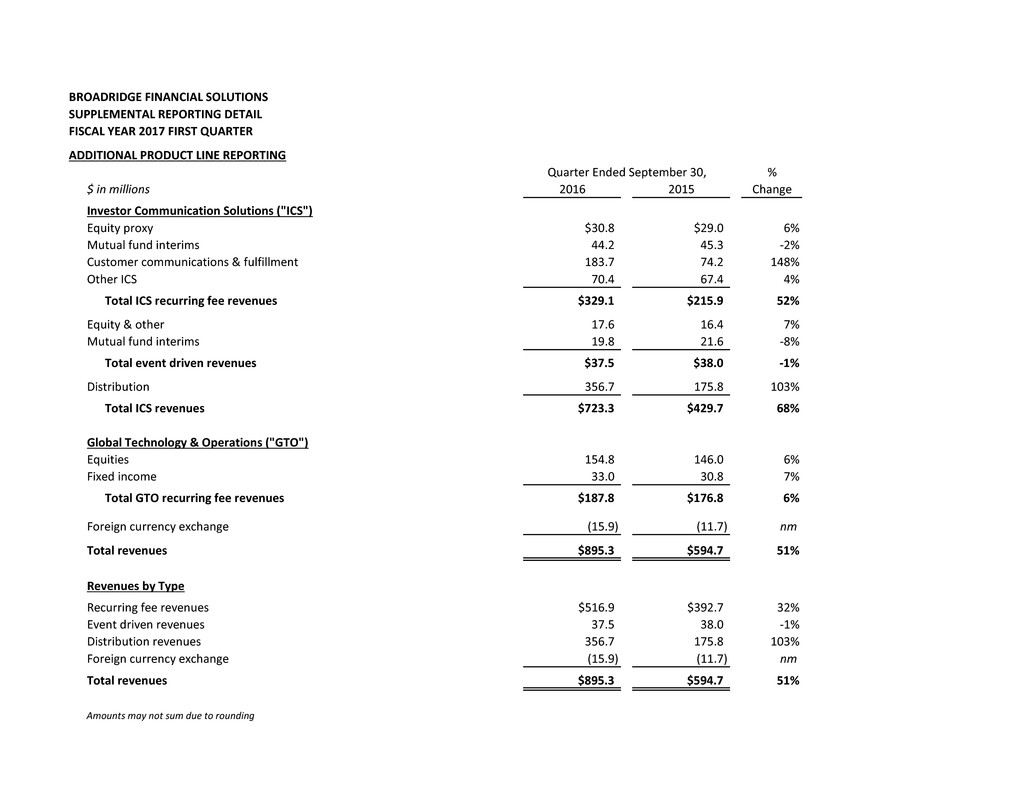

ADDITIONAL PRODUCT LINE REPORTING

Quarter Ended September 30, %

$ in millions 2016 2015 Change

Investor Communication Solutions ("ICS")

Equity proxy $30.8 $29.0 6%

Mutual fund interims 44.2 45.3 -2%

Customer communications & fulfillment 183.7 74.2 148%

Other ICS 70.4 67.4 4%

Total ICS recurring fee revenues $329.1 $215.9 52%

Equity & other 17.6 16.4 7%

Mutual fund interims 19.8 21.6 -8%

Total event driven revenues $37.5 $38.0 -1%

Distribution 356.7 175.8 103%

Total ICS revenues $723.3 $429.7 68%

Global Technology & Operations ("GTO")

Equities 154.8 146.0 6%

Fixed income 33.0 30.8 7%

Total GTO recurring fee revenues $187.8 $176.8 6%

Foreign currency exchange (15.9) (11.7) nm

Total revenues $895.3 $594.7 51%

Revenues by Type

Recurring fee revenues $516.9 $392.7 32%

Event driven revenues 37.5 38.0 -1%

Distribution revenues 356.7 175.8 103%

Foreign currency exchange (15.9) (11.7) nm

Total revenues $895.3 $594.7 51%

Amounts may not sum due to rounding

BROADRIDGE FINANCIAL SOLUTIONS

SUPPLEMENTAL REPORTING DETAIL

FISCAL YEAR 2017 FIRST QUARTER

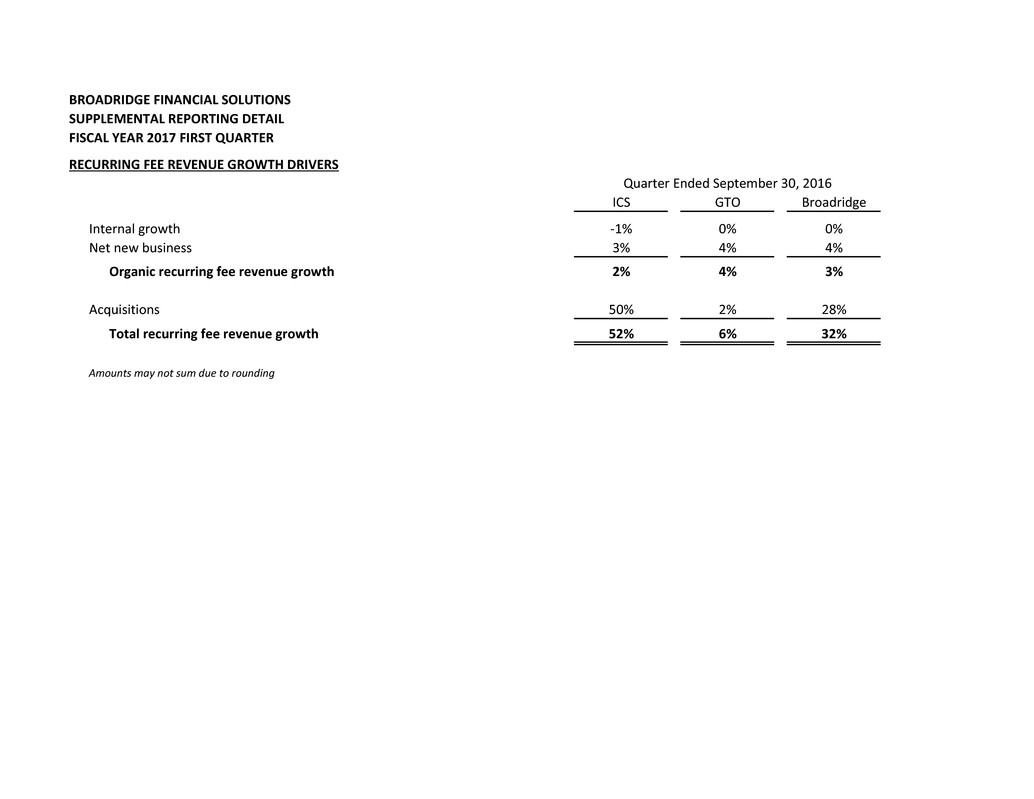

RECURRING FEE REVENUE GROWTH DRIVERS

Quarter Ended September 30, 2016

ICS GTO Broadridge

Internal growth -1% 0% 0%

Net new business 3% 4% 4%

Organic recurring fee revenue growth 2% 4% 3%

Acquisitions 50% 2% 28%

Total recurring fee revenue growth 52% 6% 32%

Amounts may not sum due to rounding

BROADRIDGE FINANCIAL SOLUTIONS

SUPPLEMENTAL REPORTING DETAIL

FISCAL YEAR 2017 FIRST QUARTER

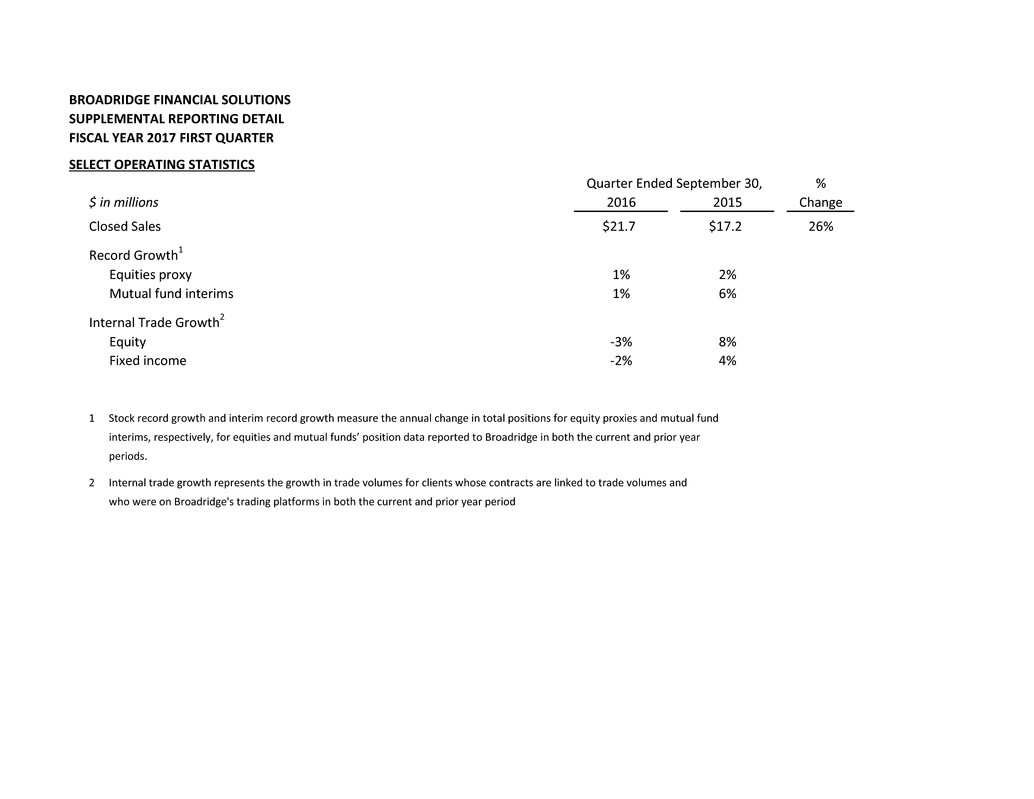

SELECT OPERATING STATISTICS

Quarter Ended September 30, %

$ in millions 2016 2015 Change

Closed Sales $21.7 $17.2 26%

Record Growth

1

Equities proxy 1% 2%

Mutual fund interims 1% 6%

Internal Trade Growth2

Equity -3% 8%

Fixed income -2% 4%

1

2

who were on Broadridge's trading platforms in both the current and prior year period

Internal trade growth represents the growth in trade volumes for clients whose contracts are linked to trade volumes and

Stock record growth and interim record growth measure the annual change in total positions for equity proxies and mutual fund

interims, respectively, for equities and mutual funds’ position data reported to Broadridge in both the current and prior year

periods.