Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANDEAVOR LOGISTICS LP | tllp8-k06x01x2016mlpconfer.htm |

© 2015 Tesoro Corporation. All Rights Reserved. Driving Distinctive Growth MLPA 2016 MLP Investor Conference June 2016 Exhibit 99.1

Tesoro Logistics 2 Forward Looking Statements This Presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things: • the ability to maintain and benefit from our competitive advantages; • the benefits of Tesoro Corporation’s (together with its subsidiaries and affiliates, “Tesoro”) strategy on our business and growth prospects; • execution of our strategy and vision, including organic investments for growth and expansion projects, acquisition opportunities and commercial opportunities; • our ability to improve operational efficiency and maximize asset utilization; • net earnings and EBITDA estimates, growth and targets for Tesoro Logistics LP and various portions of our businesses (including the EBITDA contribution from organic investments) and the relative contribution of those businesses; • the timing, amount of, and benefits from potential investments and capital expenditures, estimated internal rates of return; • timing, benefits and costs of any third-party acquisitions or opportunities to acquire drop down assets from Tesoro, including assets related to Tesoro’s recently announced acquisitions in Alaska and the Bakken; • changes to our market share and our ability to capture new demand, including capturing integrated crude oil and natural gas opportunities; •our ability to expand and enhance our capabilities in the Bakken and Rockies regions, and the costs and benefits from any expansion; • expectations regarding volume commitments from Tesoro and third-parties, how those commitments may change over time, and our ability to increase or diversify our revenue from third-parties; • the potential, timing, costs and benefits of expanding our business into new geographies; • our ability to maintain a balanced mixture of debt and equity, access the equity markets, achieve and maintain our leverage targets and achieve investment grade ratings; • expectations regarding our distribution growth rate; and • other aspects of future performance. We have used the words “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “should”, “will” and similar terms and phrases to identify forward-looking statements in this Presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations and anticipated transactions involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. Our management uses a variety of financial and operating measures to analyze operating segment performance and also uses additional measures that are known as “non- GAAP” financial measures in its evaluation of past performance and prospects for the future to supplement our financial information presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). These measures are significant factors in assessing our operating results and profitability and include earnings before interest, income taxes, loss attributable to Predecessor, and depreciation and amortization expense (“EBITDA”) and Adjusted EBITDA. We define adjusted EBITDA as EBITDA plus or minus amounts determined to be “special items” by our management based on their unusual nature and relative significance to earnings in a certain period. Special items are presented in detail in our reconciliation of EBITDA to adjusted EBITDA for each period presented. We have included various estimates of EBITDA, each of which is a non-GAAP financial measure, throughout the presentation. Please see the Appendix for reconciliation of these EBITDA estimates.

Tesoro Logistics 3 Tesoro Logistics’ Competitive Advantage • Leading provider of logistics services to oil and gas producers and refining and marketing companies within our strategic footprint • Tesoro’s strategy supports integration and drives high growth • Clear path to reach $650 million of net earnings and $1 billion of EBITDA by 2017 • Pursuing acquisitions that fit our integrated business model in proximity to Tesoro’s strategic footprint

Tesoro Logistics 4 Key Metrics Crude oil, refined product and natural gas pipelines 4,000+ miles Natural gas throughput capacity 2,900+ MMcf/d Natural gas inlet processing capacity 1,400+ MMcf/d Crude oil gathering pipeline throughput 215+ MBD Marketing terminal capacity 1,005+ MBD Marine terminal capacity 795 MBD Rail terminal capacity 50 MBD Dedicated storage capacity 15,000+ MBBLS Los Angeles, CA Martinez, CA Kenai, AK Salt Lake City, UT Anacortes, WA Asset Portfolio Provides Unique Platform for Growth Mandan, ND

Tesoro Logistics 5 Track Record of Robust Value Creation EBITDA growth of 1,414%; distribution growth of 140% 1.35 3.24 2Q1 1 2Q1 2 2Q1 3 2Q1 4 2Q1 5 Distributions Per LP Unit ($ annualized) 2011 $26 million net earnings $42 million EBITDA 2015 $275 million net earnings $636 million adjusted EBITDA Natural Gas Gathering & Processing Terminalling & Transportation Crude Oil Gathering Terminalling & Transportation IPO Natural Gas Gathering & Processing Crude Oil Gathering Terminalling & Transportation

Tesoro Logistics 6 Tesoro’s Competitive Advantage • The leading integrated refining, marketing and logistics company in our strategic footprint • Driving significant business improvements and creating sustainable earnings growth • Demonstrated track record of delivering results and achieving ambitions • Well diversified earnings portfolio with strong growth opportunities • Disciplined approach to capital allocation to create significant shareholder value

Tesoro Logistics 7 Strategic Framework to Drive Continued Growth Focus on Stable, Fee-Based Business • Provide full-service logistics offering • Minimal commodity price exposure Optimize Existing Asset Base • Enhance operational efficiency and maximize asset utilization • Capture Tesoro volumes moving through non-TLLP assets • Expand third party business Pursue Organic Expansion Opportunities • Focus on low-risk, accretive growth projects • Invest to support Tesoro value chain optimization • Enhance and strengthen existing logistics system Grow through Strategic Acquisitions • Attractive opportunities in geographic footprint • Partner in Tesoro’s strategic growth • Capture full value of Tesoro’s logistics assets

Tesoro Logistics 8 Terminalling and Transportation Overview Los Angeles, CA Martinez, CA Kenai, AK Salt Lake City, UT Anacortes, WA Asset Overview: • 29 refined product and storage terminals with over 1,000MBD throughput capacity • Four marine terminals with 795MBD throughput capacity • 760 mile Northwest Products System pipeline • Over 100 miles of crude oil and refined products pipeline in Southern California distribution system • Dedicated storage capacity of over 15 million barrels

Tesoro Logistics 9 Terminaling and Transportation Market Drivers 80% 85% 90% 95% 100% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 PADD IV & V Refinery Utilization PADD IV PADD V 15.0 15.5 16.0 16.5 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 California Employment Millions of People 1,300 1,400 1,500 1,600 1,700 Jan Apr Jul Oct PADD V Gasoline Demand MBD 5 Yr Range 2016 2015 5 Yr Avg. 1,100 1,200 1,300 1,400 1,500 1,600 1,700 Jan Apr Jul Oct PADD V Vehicle Miles Travelled Million VMT/Day 5 Yr Range 2016 2015 5 Yr Avg. Source: US Bureau of Labor Statistics Source: Energy Information Administration Source: Energy Information Administration Source: Energy Information Administration

Tesoro Logistics 10 Terminaling and Transportation Volumes and Revenues 878 890 943 911 918 913 964 943 907 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Terminalling Throughput MBD 785 772 800 814 818 801 838 841 824 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Pipeline Transportation Throughput MPD 76 79 89 89 90 92 93 102 108 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Terminalling Revenue $ in millions 24 25 27 27 29 27 31 31 30 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Pipeline Transportation Revenue $ in millions

Tesoro Logistics 11 Terminalling and Transportation Growth Projects Terminalling: • Capture growth from expansion of Mandan, Stockton, Pasco and Anacortes product terminals • New Kenai, Alaska asphalt terminal • Crude storage expansion in Southern California Transportation Pipelines: • Expand Northwest Product System capacity and services • Los Angeles Refinery Interconnect Pipeline project under development

Tesoro Logistics 12 Crude Oil Gathering Well Positioned in Bakken Asset Overview: • Over 1,000 miles of crude oil gathering and trunkline pipeline • High Plains Pipeline throughput capacity over 250MBD • Bakken Area Storage Hub storage capacity over 1 million barrels Lake Sakakawea Tesoro High Plains Pipeline Tesoro Bakkenlink Pipeline Connection Point Source: North Dakota Department of Mineral Rights, April 2016

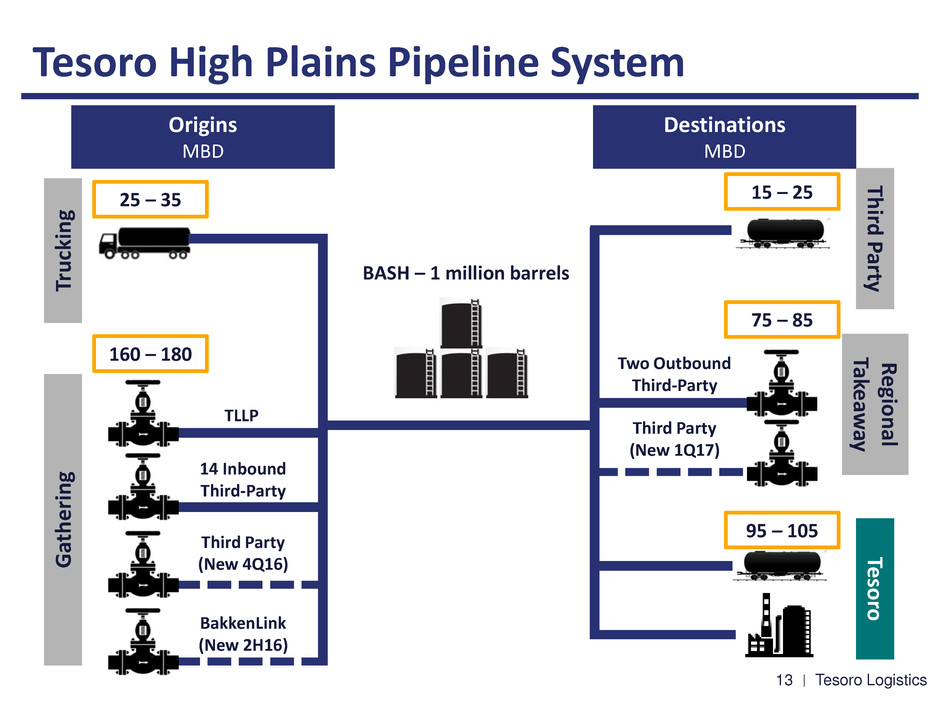

Tesoro Logistics 13 75 – 85 95 – 105 15 – 25 160 – 180 25 – 35 Tesoro High Plains Pipeline System TLLP 14 Inbound Third-Party Third Party (New 4Q16) Origins MBD Destinations MBD BASH – 1 million barrels G ath e ri n g Trucki n g Te so ro R e gio n al Take aw ay Thi rd P art y Two Outbound Third-Party Third Party (New 1Q17) BakkenLink (New 2H16)

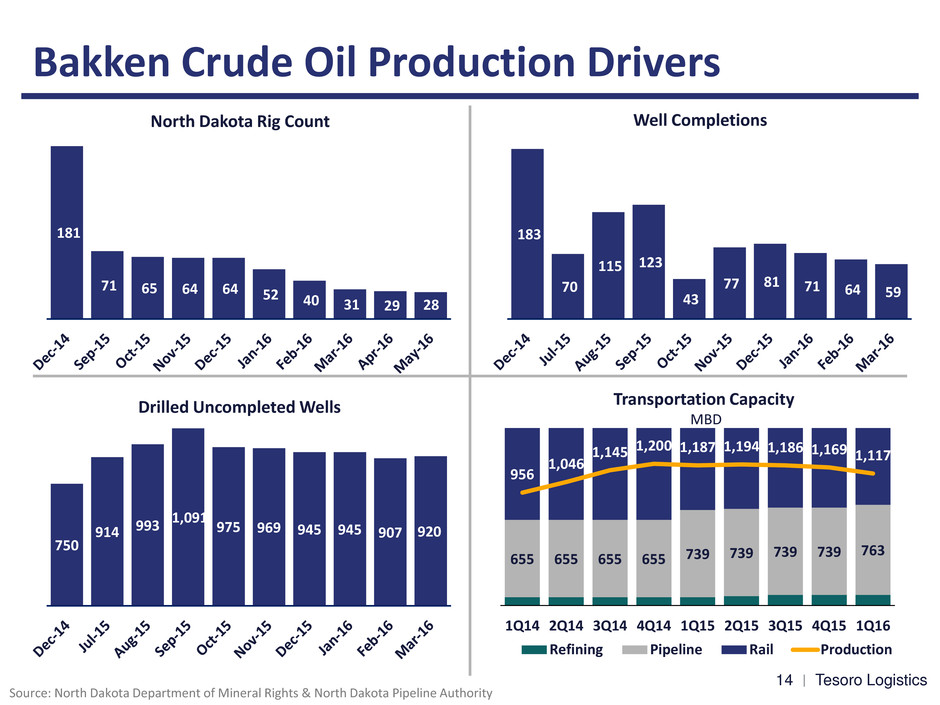

Tesoro Logistics 14 Bakken Crude Oil Production Drivers 181 71 65 64 64 52 40 31 29 28 North Dakota Rig Count 750 914 993 1,091 975 969 945 945 907 920 Drilled Uncompleted Wells 183 70 115 123 43 77 81 71 64 59 Well Completions Source: North Dakota Department of Mineral Rights & North Dakota Pipeline Authority 655 655 655 655 739 739 739 739 763 956 1,046 1,145 1,200 1,187 1,194 1,186 1,169 1,117 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Refining Pipeline Rail Production Transportation Capacity MBD

Tesoro Logistics 15 Bakken Production & Efficiency Gains Source: North Dakota Department of Mineral Rights, unless noted 1) 2015 weighted average to date 81 85 94 1 2 3 4 5 6 7 8 9 10 11 12 First Year Total Well Production MBBL 2013 2014 2015 475 684 703 721 737 753 768 783 799 815 Dec-14 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Production Added Per Rig BPD Source: EIA Bakken Drilling Productivity Report, May 2016 378 143 407 162 1 2 3 4 5 6 7 8 9 10 11 12 First Year Well Decline BPD 2013 2014 2015 1 1 Month Month

Tesoro Logistics 16 TLLP Crude Oil Volumes and Revenues Growing 98 109 136 150 156 187 199 205 216 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Crude Oil Gathering Pipeline Throughput MBD 12 13 17 24 27 30 31 35 35 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Crude Oil Gathering Pipeline Revenues $ in millions

Tesoro Logistics 17 TLLP Rockies Natural Gas Gathering and Processing Asset Overview: • Approximately 2,000 miles of natural gas gathering pipeline • Natural gas gathering capacity of over 2,900 MMcf/d • Four natural gas processing complexes and one fractionation facility • Over 1,400 MMcf/d of processing capacity and over 15MBD of fractionation capacity • Operations in Pinedale, Vermillion and Uinta basins

Tesoro Logistics 18 Pinedale Uintah Vermillion Blacks Fork Processing Ironhorse/ Stagecoach Processing Vermillion Processing Moxa Arch Emigrant Trail Processing Questar Pipeline Overthrust Pipeline Colorado Interstate Gas Northwest Pipeline Mid-America Pipeline NGL Truck & Rail Loading Questar Pipeline Northwest Pipeline Mid-America Pipeline Questar Pipeline Mid-America Pipeline Natural Gas System Overview Basin System Processing Facility Residue Pipelines / NGL Pipelines 15 - 20 195 - 210 90 - 105 335 - 370 25 - 30 275 - 290 15 - 25 Approximate Gathering Volume1 Approximate Processing Volume1 565 – 615 1) Thousands of MMBtu/day Uin ta V e rmillio n G re e n R iv e r

Tesoro Logistics 19 Rockies Natural Gas Production Drivers 21 14 14 16 15 14 11 6 5 5 Natural Gas Rig Count 59 46 26 29 36 37 23 14 21 27 Gas Well Completions Source: Baker Hughes & State websites for Sublette, Uinta, Lincoln, Sweetwater counties in WY; Moffat county in CO; Uintah county in UT 2.0 3.0 4.0 5.0 6.0 7.0 8.0 Wyoming and Utah Natural Gas Production Bcf/d WY/UT Natural Gas Production

Tesoro Logistics 20 Natural Gas Gathering Volumes and Revenues 36 46 46 42 43 1Q15 2Q15 3Q15 4Q15 1Q16 Natural Gas Gathering Revenues $ in millions 874 925 973 970 903 1Q15 2Q15 3Q15 4Q15 1Q16 Natural Gas Gathering Volume1 Thousands of MMBtu/d 1) 1Q15 through 4Q15 adjusted for RGS deconsolidation

Tesoro Logistics 21 Natural Gas Processing Volumes and Revenues 689 768 767 748 675 1Q15 2Q15 3Q15 4Q15 1Q16 Fee-Based Processing Throughput Thousands of MMBtu/d 7 8 8 8 8 1Q15 2Q15 3Q15 4Q15 1Q16 NGL Processing Throughput MBD 67 67 71 73 71 1Q15 2Q15 3Q15 4Q15 1Q16 Natural Gas Processing Total Revenue Thousands of MMBtu/d

Tesoro Logistics 22 Gathering and Processing Growth Projects Bakken • Expand High Plains Pipeline in Bakken to capture core production to aggregate volumes for take-away pipelines • Increase storage at Bakken Area Storage Hub (BASH) Rockies • Walker Hollow compression project supports Uinta deep gas drilling and brings new committed volumes to system

Tesoro Logistics 23 Future Drop Downs to Capture Additional Value 23 Growing inventory of drop downs drives $500 - $800 million of new growth • Marine terminals • Crude oil pipelines • Refinery tank terminals • Rail terminals • Petroleum coke handling • Refined products distribution terminals • Refined products pipelines • Rail and truck unloading terminals • Wholesale distribution system $350 - $550 million of Earnings from Existing Assets $150 - $250 million of Earnings from New Business Investments • Bakken pipeline & rail • Mixed xylenes logistics infrastructure • Vancouver Energy • Distribution expansion in support of Marketing growth • Alaska logistics

Tesoro Logistics 24 • Pursuing opportunities that provide Tesoro access to advantaged feedstocks and new markets • Principally focused on Tesoro’s strategic footprint • Expanding acquisition horizon to include adjacent geographies • Participating in Tesoro-driven acquisitions that include embedded logistics assets • Continuing to reduce Tesoro’s third party logistics costs • Continuing to diversify revenue from third parties Strategic Approach to Acquisitions

Tesoro Logistics 25 New Alaska Marketing and Logistics Business • Tesoro’s planned acquisition of wholesale marketing and logistics business in Anchorage and Fairbanks − Integrates with existing TLLP facilities − Includes over 600 MBD of storage, truck racks, rail loading capabilities • Enhances ability to economically serve customers in interior market • More than 10,000 barrels per day of additional wholesale marketing volume • Expect Tesoro to negotiate drop down to TLLP in 2016 along with other existing Alaska assets • Tesoro acquisition expected to close first half of 2016 Fairbanks Anchorage

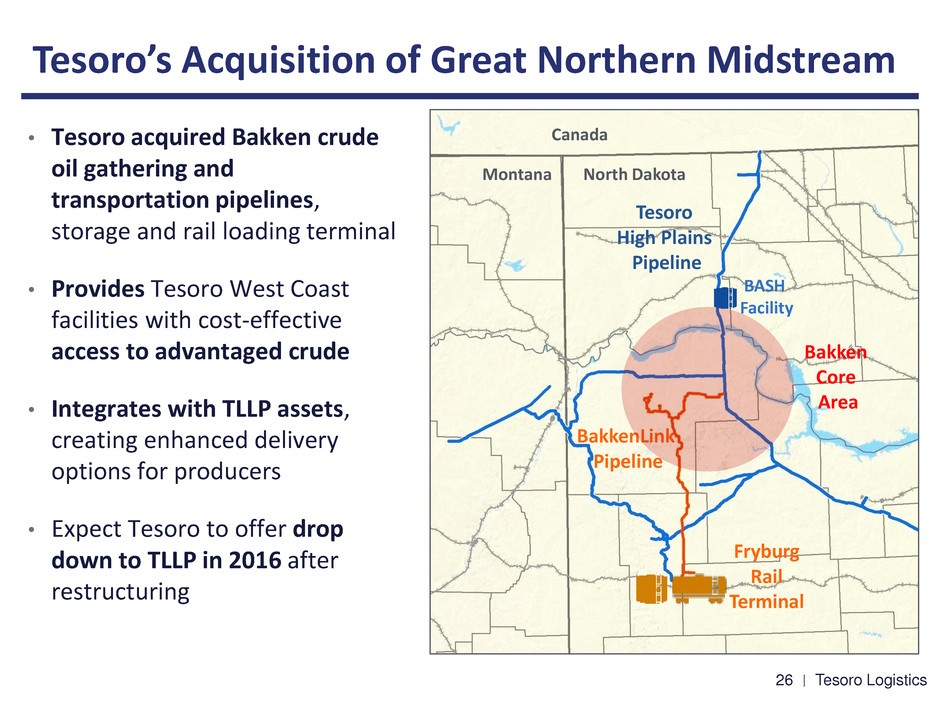

Tesoro Logistics 26 • Tesoro acquired Bakken crude oil gathering and transportation pipelines, storage and rail loading terminal • Provides Tesoro West Coast facilities with cost-effective access to advantaged crude • Integrates with TLLP assets, creating enhanced delivery options for producers • Expect Tesoro to offer drop down to TLLP in 2016 after restructuring Canada North Dakota Montana BASH Facility Tesoro High Plains Pipeline BakkenLink Pipeline Bakken Core Area Fryburg Rail Terminal Tesoro’s Acquisition of Great Northern Midstream

Tesoro Logistics 27 Prudent Funding and Ample Liquidity • Pursue growth through a balanced mixture of debt and equity • Active ATM program allows access to cost efficient equity capital • $1.6 billion credit facilities maturing in 2021 Pursue Balanced Capital Structure • Proven track record of strengthening credit profile • Leverage target of 3x – 4x Adjusted EBITDA • Commitment to achieve investment grade ratings at TSO and TLLP Supportive Sponsor • Strategically linked to TLLP • TSO is the largest unit holder – 36% TLLP LP unit ownership • Supportive in dropdowns and acquisitions – over $900 million in equity taken to date • Attractive and improving credit profile Maintain Flexibility to Achieve Growth Objectives Flexible Capital Structure

Tesoro Logistics 28 Current Metrics As of 3/31/16 Total Assets 4,793 Total Debt1 2,821 Total Equity 1,696 Debt-to-EBITDA Ratio2 4.1x Remaining Capacity on Revolving Credit Facility3 600 Remaining Capacity on Dropdown Credit Facility3 1,000 1) Total debt, net of current maturities and unamortized issuance costs of $42 million 2) Pro-forma debt-to-EBITDA ratio calculated using total debt, net of current maturities and unamortized issuance costs and run rate 1Q16 adjusted EBITDA 3) As of 5/12/16 Financial Flexibility Full Year 2016 Outlook Net earnings before drop down opportunities from Tesoro 385 – 415 Adjusted EBITDA before drop down opportunities from Tesoro 735 – 765 Net earnings from drop down acquisitions from Tesoro 50 – 80 Annual EBITDA from drop down acquisitions from Tesoro 70 – 100 Annual Distribution Growth Rate 17% $ in millions

Tesoro Logistics 29 Continuing to Drive Unitholder Value 29 Well-Positioned Assets Attractive, Visible Growth Opportunities Experienced Management Team Strong Sponsorship Stable, Fee-Based Cash Flow

© 2015 Tesoro Corporation. All Rights Reserved. Appendix

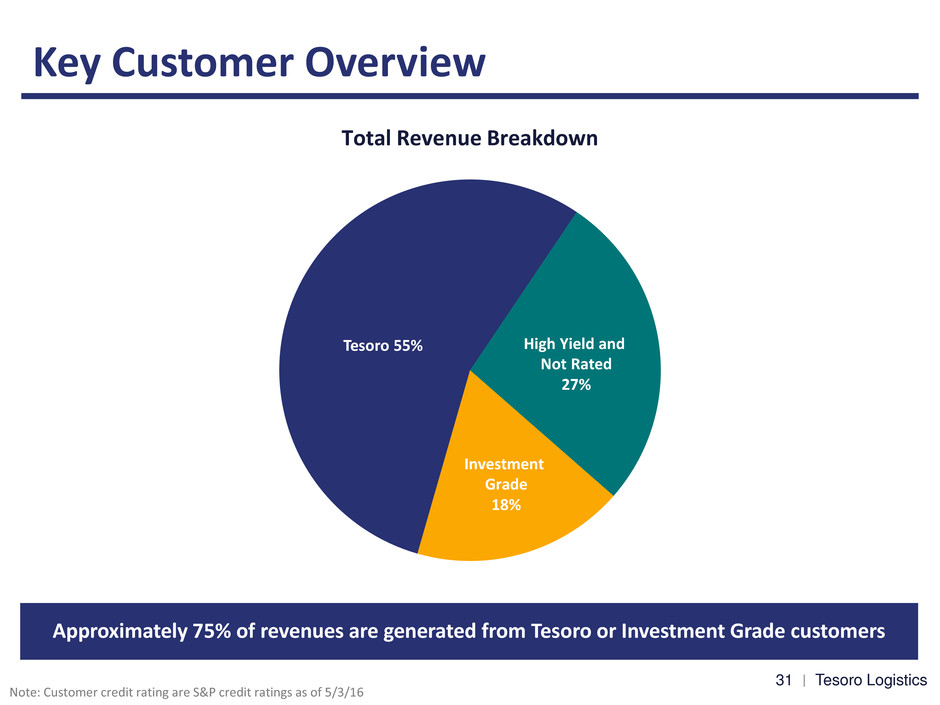

Tesoro Logistics 31 Key Customer Overview Tesoro 55% High Yield and Not Rated 27% Investment Grade 18% Total Revenue Breakdown Approximately 75% of revenues are generated from Tesoro or Investment Grade customers Note: Customer credit rating are S&P credit ratings as of 5/3/16

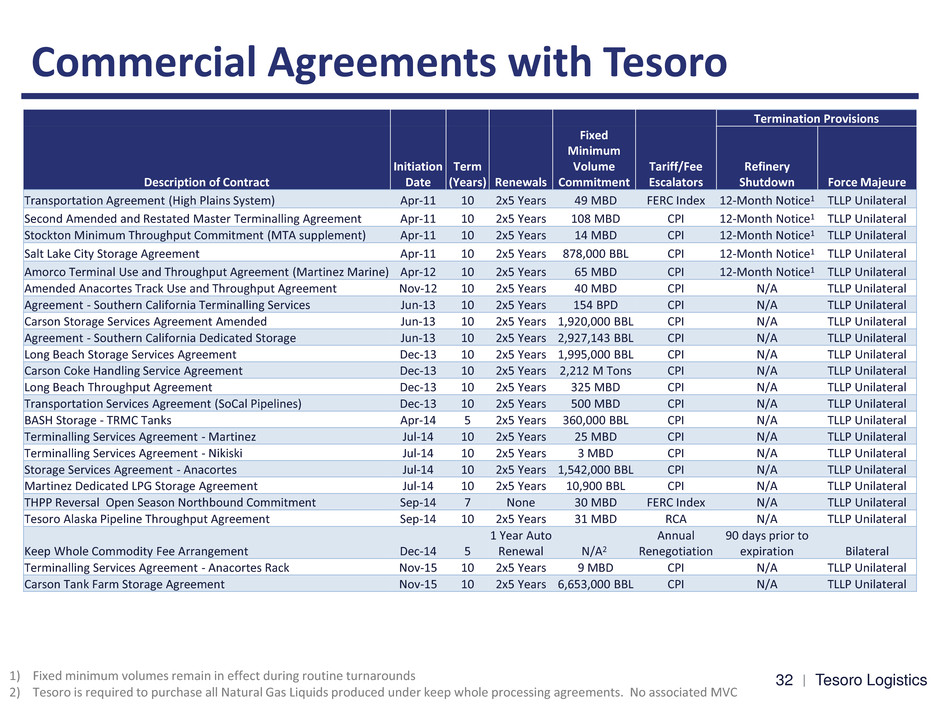

Tesoro Logistics 32 Commercial Agreements with Tesoro 1) Fixed minimum volumes remain in effect during routine turnarounds 2) Tesoro is required to purchase all Natural Gas Liquids produced under keep whole processing agreements. No associated MVC Termination Provisions Description of Contract Initiation Date Term (Years) Renewals Fixed Minimum Volume Commitment Tariff/Fee Escalators Refinery Shutdown Force Majeure Transportation Agreement (High Plains System) Apr-11 10 2x5 Years 49 MBD FERC Index 12-Month Notice1 TLLP Unilateral Second Amended and Restated Master Terminalling Agreement Apr-11 10 2x5 Years 108 MBD CPI 12-Month Notice1 TLLP Unilateral Stockton Minimum Throughput Commitment (MTA supplement) Apr-11 10 2x5 Years 14 MBD CPI 12-Month Notice1 TLLP Unilateral Salt Lake City Storage Agreement Apr-11 10 2x5 Years 878,000 BBL CPI 12-Month Notice1 TLLP Unilateral Amorco Terminal Use and Throughput Agreement (Martinez Marine) Apr-12 10 2x5 Years 65 MBD CPI 12-Month Notice1 TLLP Unilateral Amended Anacortes Track Use and Throughput Agreement Nov-12 10 2x5 Years 40 MBD CPI N/A TLLP Unilateral Agreement - Southern California Terminalling Services Jun-13 10 2x5 Years 154 BPD CPI N/A TLLP Unilateral Carson Storage Services Agreement Amended Jun-13 10 2x5 Years 1,920,000 BBL CPI N/A TLLP Unilateral Agreement - Southern California Dedicated Storage Jun-13 10 2x5 Years 2,927,143 BBL CPI N/A TLLP Unilateral Long Beach Storage Services Agreement Dec-13 10 2x5 Years 1,995,000 BBL CPI N/A TLLP Unilateral Carson Coke Handling Service Agreement Dec-13 10 2x5 Years 2,212 M Tons CPI N/A TLLP Unilateral Long Beach Throughput Agreement Dec-13 10 2x5 Years 325 MBD CPI N/A TLLP Unilateral Transportation Services Agreement (SoCal Pipelines) Dec-13 10 2x5 Years 500 MBD CPI N/A TLLP Unilateral BASH Storage - TRMC Tanks Apr-14 5 2x5 Years 360,000 BBL CPI N/A TLLP Unilateral Terminalling Services Agreement - Martinez Jul-14 10 2x5 Years 25 MBD CPI N/A TLLP Unilateral Terminalling Services Agreement - Nikiski Jul-14 10 2x5 Years 3 MBD CPI N/A TLLP Unilateral Storage Services Agreement - Anacortes Jul-14 10 2x5 Years 1,542,000 BBL CPI N/A TLLP Unilateral Martinez Dedicated LPG Storage Agreement Jul-14 10 2x5 Years 10,900 BBL CPI N/A TLLP Unilateral THPP Reversal Open Season Northbound Commitment Sep-14 7 None 30 MBD FERC Index N/A TLLP Unilateral Tesoro Alaska Pipeline Throughput Agreement Sep-14 10 2x5 Years 31 MBD RCA N/A TLLP Unilateral Keep Whole Commodity Fee Arrangement Dec-14 5 1 Year Auto Renewal N/A2 Annual Renegotiation 90 days prior to expiration Bilateral Terminalling Services Agreement - Anacortes Rack Nov-15 10 2x5 Years 9 MBD CPI N/A TLLP Unilateral Carson Tank Farm Storage Agreement Nov-15 10 2x5 Years 6,653,000 BBL CPI N/A TLLP Unilateral

Tesoro Logistics 33 Non-GAAP Financial Measures 1) When a range of estimated EBITDA has been disclosed and/or previously disclosed, we have included the EBITDA reconciliation for the mid-point range Tesoro Logistics LP EBITDA Reconciliation (in millions) Unaudited 2011 2015 Net earnings $ 26 $ 275 Add loss attributable to Predecessor 8 17 Add depreciation and amortization expense 6 178 Add interested and financing costs, net 2 150 Add income tax expense - 1 EBITDA $ 42 $ 621 Add acquisition costs included in general and administrative expenses - 2 Add billing of deficiency payments - 13 Adjusted EBITDA $ 42 $ 636 Tesoro Logistics LP EBITDA Reconciliation (in millions) Unaudited 2016E 2017E Projected net earnings $ 400 $ 650 Add depreciation and amortization expense 175 175 Add interested and financing costs, net 175 175 Projected EBITDA (1) $ 750 $ 1,000 Tesoro Logistics LP (in millions) Unaudited Drop Down EBITDA Reconciliation Projected annual net earnings $ 65 Add depreciation and amortization expense 17 Add interested and financing costs, net 3 Projected annual EBITDA (1) $ 85