Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-kre3q2016release.htm |

| EX-99.1 - EXHIBIT 99.1 PR - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex991earningsreleasefina.htm |

| EX-99.2 - EXHIBIT 99.2 PRESENTATION - BROADRIDGE FINANCIAL SOLUTIONS, INC. | exhibit992q3fy16presenta.htm |

BROADRIDGE FINANCIAL SOLUTIONS, INC. - KEY STATS Exhibit 99.3 INVESTOR COMMUNICATION SOLUTIONS SEGMENT RC = Recurring Q3 FY'16 ED = Event Driven (in millions) Fee Revenues 3Q15 3Q16 YTD FY15 YTD FY16 Type Proxy Equities 38.8$ 42.3$ 93.0$ 103.3$ RC Stock Record Position Growth 12% 9% 8% 4% Pieces 32.0 36.0 76.4 85.2 Mutual Funds 16.7$ 17.7$ 37.7$ 48.4$ ED Pieces 21.6 22.0 53.0 68.8 Contests/Specials 4.5$ 4.2$ 16.7$ 18.2$ ED Pieces 4.8 4.1 17.0 18.8 Total Proxy 60.0$ 64.2$ 147.4$ 169.9$ Total Pieces 58.4 62.1 146.4 172.8 Notice and Access Opt-in % 74% 72% 69% 73% Suppression % 64% 66% 62% 64% Interims Mutual Funds (Annual/Semi- Annual Reports/Annual Prospectuses) 53.4$ 57.4$ 133.8$ 145.6$ RC Position Growth 8% 4% 8% 5% Pieces 254.3 258.6 644.0 653.0 Mutual Funds (Supplemental Prospectuses) & Other 15.2$ 14.1$ 38.3$ 38.7$ ED Pieces 74.0 71.4 184.4 199.2 Total Interims 68.6$ 71.5$ 172.1$ 184.4$ Total Pieces 328.3 330.0 828.4 852.3 Page 1

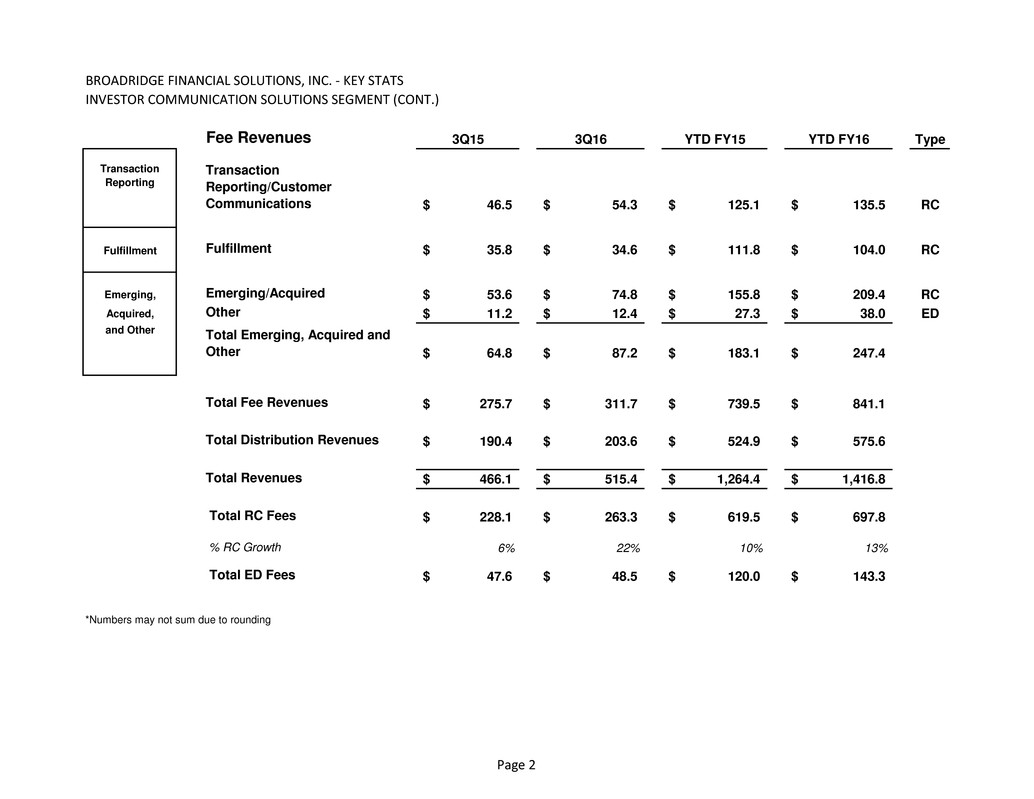

BROADRIDGE FINANCIAL SOLUTIONS, INC. - KEY STATS INVESTOR COMMUNICATION SOLUTIONS SEGMENT (CONT.) Fee Revenues 3Q15 3Q16 YTD FY15 YTD FY16 Type Transaction Reporting Transaction Reporting/Customer Communications 46.5$ 54.3$ 125.1$ 135.5$ RC Fulfillment Fulfillment 35.8$ 34.6$ 111.8$ 104.0$ RC Emerging, Emerging/Acquired 53.6$ 74.8$ 155.8$ 209.4$ RC Acquired, Other 11.2$ 12.4$ 27.3$ 38.0$ ED and Other Total Emerging, Acquired and Other 64.8$ 87.2$ 183.1$ 247.4$ Total Fee Revenues 275.7$ 311.7$ 739.5$ 841.1$ Total Distribution Revenues 190.4$ 203.6$ 524.9$ 575.6$ Total Revenues 466.1$ 515.4$ 1,264.4$ 1,416.8$ Total RC Fees 228.1$ 263.3$ 619.5$ 697.8$ % RC Growth 6% 22% 10% 13% Total ED Fees 47.6$ 48.5$ 120.0$ 143.3$ *Numbers may not sum due to rounding Page 2

BROADRIDGE FINANCIAL SOLUTIONS, INC. - KEY STATS RC = Recurring GLOBAL TECHNOLOGY AND OPERATIONS SEGMENT Q3 FY'16 ($ in millions, except trade statistics) 3Q15 3Q16 FY15 YTD FY16 YTD Type Equity Transaction-Based Equity Trades 35.1$ 36.4$ 101.9$ 102.4$ RC Internal Trade Volume (Average Trades per Day in '000) 1,063 1,098 989 1,005 Internal Trade Growth 0% 3% 2% 2% Trade Volume (Average Trades per Day in '000) 1,066 1,114 990 1,014 Non-Transaction Other Equity Services 112.0 123.4 321.0 352.5 RC Total Equity 147.0$ 159.8$ 422.9$ 454.9$ Fixed Income Transaction-Based Fixed Income Trades 14.7$ 14.7$ 43.6$ 43.7$ RC Internal Trade Volume (Average Trades per Day in '000) 317 323 314 317 Internal Trade Growth 6% 0% 1% 1% Trade Volume (Average Trades per Day in '000) 336 332 324 325 Non-Transaction Other Fixed Income Services 16.3$ 16.7$ 48.3$ 49.7$ RC Total Fixed Income 31.0$ 31.5$ 91.9$ 93.4$ Total Revenues 178.0$ 191.3$ 514.9$ 548.3$ *Numbers may not sum due to rounding