Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-kre3q2016release.htm |

| EX-99.2 - EXHIBIT 99.2 PRESENTATION - BROADRIDGE FINANCIAL SOLUTIONS, INC. | exhibit992q3fy16presenta.htm |

| EX-99.3 - EXHIBIT 99.3 STATS - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex993stats16q3.htm |

Exhibit 99.1 BROADRIDGE REPORTS THIRD QUARTER 2016 RESULTS Announces Adjusted Diluted EPS Growth of 23% and Recurring Fee Revenue Growth of 12% Reaffirms Full Year Guidance LAKE SUCCESS, N.Y., May 5, 2016 – Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the third quarter of its fiscal year 2016. Results for the three months ended March 31, 2016 compared with the same period last year were as follows: Third Quarter Fiscal Year 2016 Results: - Recurring fee revenues increased 12% to $455 million - Total revenues increased 9% to $689 million - Adjusted Operating income increased 14% to $110 million - Operating income increased 13% to $101 million - Adjusted Net earnings increased 19% to $70 million - Net earnings increased 18% to $64 million - Adjusted Diluted earnings per share increased 23% to $0.58 - Diluted earnings per share increased 21% to $0.52 - Closed sales increased 7% to $29 million Commenting on the results, Richard J. Daly, President and Chief Executive Officer, said, "I am pleased with the strong third quarter results which give us a high level of confidence to achieve our full year guidance. We anticipate our full year Adjusted EPS growth to be around the midpoint of our 8-12% guidance range. The first three quarters were driven by solid business performance across Broadridge enhanced by the acquisitions we made in the prior year. Our broad product set and great value proposition keep us firmly on track to achieve our long term objectives.” Mr. Daly added, “We also delivered solid sales in the third quarter keeping us well positioned to achieve our closed sales guidance for the full year. Given our solid results, our 98% revenue retention, and our continuing sales momentum, I remain confident in Broadridge’s ability to achieve its three-year objectives.” Financial Results for Third Quarter Fiscal Year 2016 Revenues for the third quarter of fiscal year 2016 increased 9% to $689 million, compared to $634 million for the prior year period. The $55 million increase was driven by: (i) higher recurring fee revenues of $49 million, or 12%; (ii) higher distribution revenues of $13 million, or 7%; and (iii) higher event-driven fee revenues of $1 million, or 2%. The positive contribution from recurring fee revenues reflected gains from Net New Business (6pts), contributions from acquisitions (4pts), and internal growth (2pts). The higher distribution revenues of $13 million include $1 million from acquisitions. The Company defines Net New Business as recurring revenue from closed sales less recurring revenue from client losses.

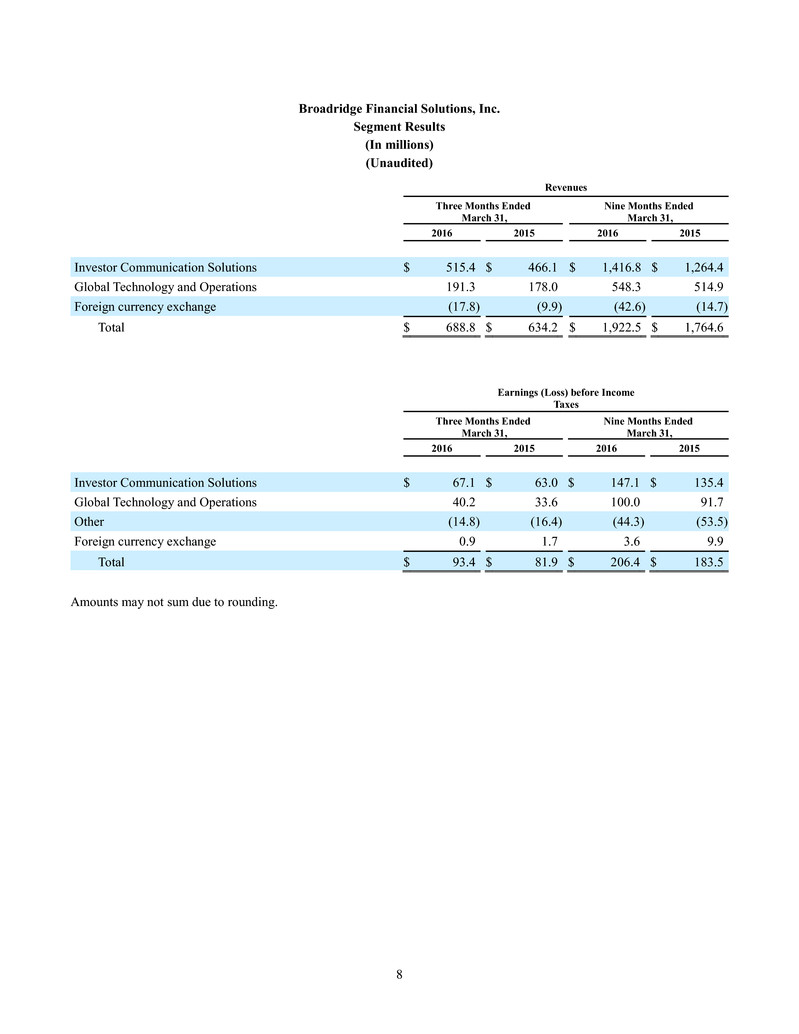

2 Operating income for the third quarter ended March 31, 2016 was $101 million, an increase of $12 million, or 13%, compared to $89 million for the prior year period. The increase is due to higher revenues, partially offset by higher operating expenses including $2 million of increased amortization from acquired intangibles. Operating income margins increased to 14.6% compared to 14.0% for the comparable prior year period. Adjusted operating income margins increased to 15.9% compared to 15.2% for the comparable prior year period. For the third quarter of fiscal year 2016, Net earnings increased 18% to $64 million, compared to $54 million for the prior year period, primarily due to higher revenues. Adjusted Net earnings increased 19% to $70 million compared to $59 million for the same period last year. Diluted earnings per share increased to $0.52 per share compared to $0.43 per share for the same period last year. Adjusted Diluted earnings per share were $0.58 per share compared to $0.47 per share for the same period last year. Acquisition Amortization and Other Costs, net of taxes, decreased Diluted earnings per share by $0.05 and $0.04 for the three months ended March 31, 2016 and 2015, respectively. In addition, during the third quarter, the Company repurchased 1.6 million shares of Broadridge common stock at an average price of $54.80 per share under its stock repurchase program. Analysis of Third Quarter Fiscal Year 2016 Investor Communication Solutions Investor Communication Solutions segment Revenues for the three months ended March 31, 2016 increased $49 million, or 11%, to $515 million compared to $466 million in the third quarter of fiscal year 2015. The increase was attributable to higher recurring fee revenues which increased $35 million, or 15%, higher event-driven fee revenues which contributed $1 million and higher distribution revenues which contributed $13 million. Higher recurring fee revenues of 15% were driven by: (i) contributions from our recent acquisitions (7pts); (ii) Net New Business primarily driven by increases in revenues from closed sales (8pts); and (iii) positive internal growth (1pt). Higher event-driven fee revenues were the result of increased mutual fund proxy and corporate actions communications activity. Global Technology and Operations Global Technology and Operations segment Revenues for the three months ended March 31, 2016 increased $13 million, or 7%, to $191 million compared to $178 million for the three months ended March 31, 2015. The increase was attributable to: (i) higher Net New Business from closed sales (3 pts) and (ii) positive internal growth (4 pts) due to higher trade activity levels and revenues associated with a contract modification, partially offset by contract renewals at lower rates. Other Pre-tax loss decreased by $2 million in the third quarter of fiscal year 2016. The decreased loss was mainly due to lower compensation expenses and a gain on the sale of assets, partially offset by an increase in interest expense. Financial Results for the Nine Months ended March 31, 2016 Revenues for the nine months ended March 31, 2016 increased 9% to $1,923 million, compared to $1,765 million for the comparable period last year. The increase was primarily driven by: (i) higher recurring fee revenues of $112 million, or 10%; (ii) higher distribution revenues of $51 million, or 10%; and (iii) higher event-driven fee revenues of $23 million, or 19%. The higher recurring fee revenues of $112 million reflected gains from Net New Business (5pts), contributions from acquisitions (4pts) and internal growth (1pt). The higher distribution revenues of $51 million include $19 million from acquisitions. Operating income for the nine months ended March 31, 2016 was $230 million, an increase of $25 million, or 12%, compared to $205 million for the nine months ended March 31, 2015. The increase is due to higher revenues, partially offset by higher operating expenses including $6 million of increased amortization from acquired intangibles. Operating income

3 margins increased to 12.0% for the nine months ended March 31, 2016, compared to 11.6% for the nine months ended March 31, 2015. Adjusted Operating income margins increased to 13.4% compared to 12.8% for the comparable prior year period. For the nine months ended March 31, 2016, Net earnings increased 13% to $137 million compared to $121 million for the comparable period last year, primarily due to higher revenues. Adjusted Net earnings increased 15% to $156 million compared to $135 million for the same period last year. Diluted earnings per share increased to $1.13 per share compared to $0.97 per share for the comparable period last year. Adjusted Diluted earnings per share were $1.28 compared to $1.09 per share for the comparable period last year. Acquisition Amortization and Other Costs, net of taxes, decreased Diluted earnings per share by $0.15 and $0.11 for the nine months ended March 31, 2016 and 2015, respectively. Fiscal Year 2016 Financial Guidance The Company continues to anticipate: • Recurring fee revenue growth in the range of 10% to 12% and total revenue growth in the range of 8% to 10% • Adjusted Operating income margin of ~18.4% • Effective tax rate of ~34.8% • Adjusted Diluted earnings per share growth in the range of 8% to 12% • Free cash flows in the range of $350 million to $400 million • Closed sales in the range of $120 million to $160 million Our guidance does not take into consideration the effect of any future acquisitions, additional debt or share repurchases. Explanation of the Company’s Use of Non-GAAP Financial Measures The Company's results in this press release are presented in accordance with generally accepted accounting principles in the United States ("GAAP") except where otherwise noted. In certain circumstances, results have been presented on an adjusted basis and are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company's reported results. With regard to statements in this press release that include certain Non-GAAP financial measures, the adjusted operating income and adjusted earnings measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing performance. These adjusted measures exclude the impact of Acquisition Amortization and Other Costs which represent the amortization charges associated with intangible asset values as well as other deal costs associated with the Company’s acquisition activities. The Adjusted Operating income margin and Adjusted Diluted earnings per share fiscal year 2016 guidance provided above is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. We provide information on our Free cash flows because we believe this helps investors understand the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments. Free cash flows is a Non-GAAP measure and is defined by the Company as Net cash flows provided by operating activities less capital expenditures, software purchases and capitalized internal use software. The Company believes Non-GAAP financial information helps investors understand the effect of these items on our reported results and provides a better representation of our operating performance. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between our current results and prior reported results, and as a basis for planning and forecasting for future periods. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this press release.

4 Earnings Conference Call An analyst conference call will be held today, Thursday, May 5, 2016 at 8:30 a.m. ET. A live webcast of the call will be available to the public on a listen-only basis. To listen to the webcast and view the slide presentation, go to www.broadridge- ir.com. The presentation will also be available to download and print approximately one hour before the webcast. Broadridge’s news releases, current financial information, SEC filings and Investor Relations presentations are accessible on the same website. About Broadridge Broadridge Financial Solutions, Inc. (NYSE:BR) is the leading provider of investor communications and technology-driven solutions for broker-dealers, banks, mutual funds and corporate issuers globally. Broadridge’s investor communications, securities processing and managed services solutions help clients reduce their capital investments in operations infrastructure, allowing them to increase their focus on core business activities. With over 50 years of experience, Broadridge’s infrastructure underpins proxy voting services for over 90% of public companies and mutual funds in North America, and processes on average $5 trillion in equity and fixed income trades per day. Broadridge employs approximately 7,400 full-time associates in 14 countries. For more information about Broadridge, please visit www.broadridge.com.

5 Forward-Looking Statements This press release and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2016 Financial Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Contact Information Investors: Brian S. Shipman, CFA Broadridge Financial Solutions, Inc. Vice President, Head of Investor Relations (516) 472-5129

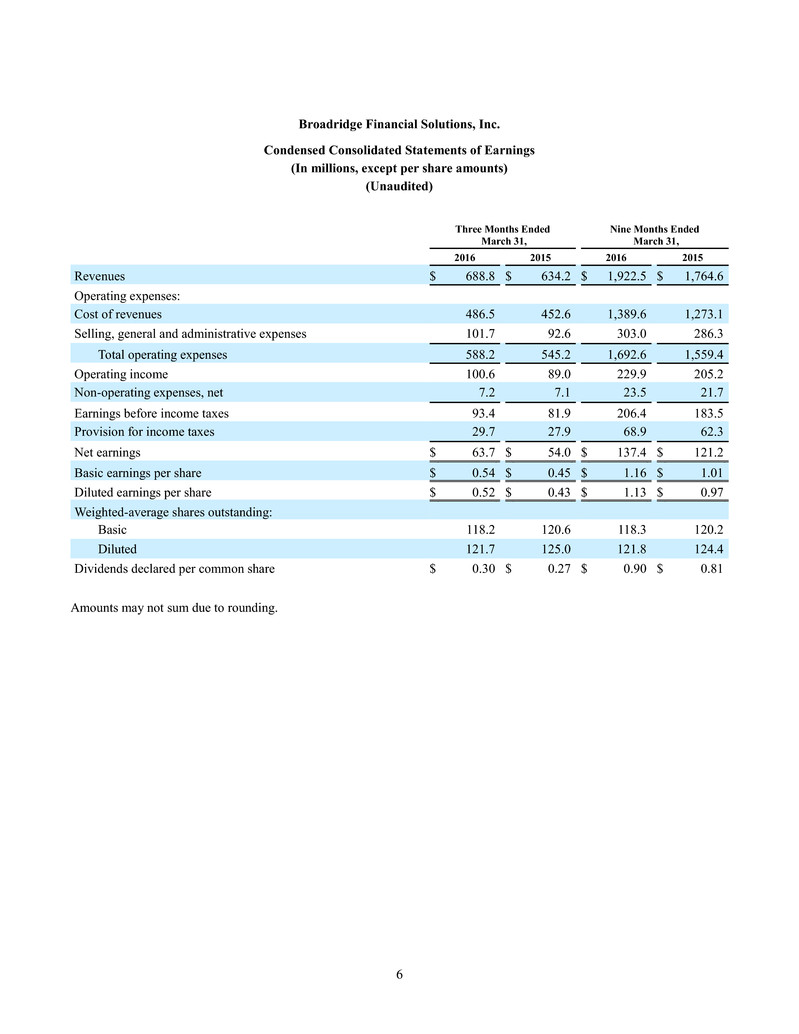

6 Broadridge Financial Solutions, Inc. Condensed Consolidated Statements of Earnings (In millions, except per share amounts) (Unaudited) Three Months Ended March 31, Nine Months Ended March 31, 2016 2015 2016 2015 Revenues $ 688.8 $ 634.2 $ 1,922.5 $ 1,764.6 Operating expenses: Cost of revenues 486.5 452.6 1,389.6 1,273.1 Selling, general and administrative expenses 101.7 92.6 303.0 286.3 Total operating expenses 588.2 545.2 1,692.6 1,559.4 Operating income 100.6 89.0 229.9 205.2 Non-operating expenses, net 7.2 7.1 23.5 21.7 Earnings before income taxes 93.4 81.9 206.4 183.5 Provision for income taxes 29.7 27.9 68.9 62.3 Net earnings $ 63.7 $ 54.0 $ 137.4 $ 121.2 Basic earnings per share $ 0.54 $ 0.45 $ 1.16 $ 1.01 Diluted earnings per share $ 0.52 $ 0.43 $ 1.13 $ 0.97 Weighted-average shares outstanding: Basic 118.2 120.6 118.3 120.2 Diluted 121.7 125.0 121.8 124.4 Dividends declared per common share $ 0.30 $ 0.27 $ 0.90 $ 0.81 Amounts may not sum due to rounding.

7 Broadridge Financial Solutions, Inc. Condensed Consolidated Balance Sheets (In millions, except per share amounts) (Unaudited) March 31, 2016 June 30, 2015 Assets Current assets: Cash and cash equivalents $ 354.4 $ 324.1 Accounts receivable, net of allowance for doubtful accounts of $3.2 and $3.8, respectively 503.8 444.5 Other current assets 145.6 92.8 Total current assets 1,003.8 861.4 Property, plant and equipment, net 108.2 97.3 Goodwill 973.3 970.5 Intangible assets, net 181.6 195.7 Other non-current assets 257.0 243.2 Total assets $ 2,524.0 $ 2,368.1 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $ 123.8 $ 115.9 Accrued expenses and other current liabilities 291.5 320.4 Deferred revenues 166.0 72.6 Total current liabilities 581.3 508.9 Long-term debt 819.5 689.4 Deferred taxes 41.4 61.7 Deferred revenues 76.3 75.2 Other non-current liabilities 103.1 105.1 Total liabilities 1,621.5 1,440.3 Commitments and contingencies Stockholders’ equity: Preferred stock: Authorized, 25.0 shares; issued and outstanding, none — — Common stock, $0.01 par value: Authorized, 650.0 shares; issued, 154.5 and 154.5 shares, respectively; outstanding, 117.5 and 118.2 shares, respectively 1.6 1.6 Additional paid-in capital 901.3 855.5 Retained earnings 1,163.2 1,132.0 Treasury stock, at cost: 37.0 and 36.3 shares, respectively (1,115.8 ) (1,040.4 ) Accumulated other comprehensive loss (47.7 ) (20.9 ) Total stockholders’ equity 902.6 927.8 Total liabilities and stockholders’ equity $ 2,524.0 $ 2,368.1 Amounts may not sum due to rounding.

8 Broadridge Financial Solutions, Inc. Segment Results (In millions) (Unaudited) Revenues Three Months Ended March 31, Nine Months Ended March 31, 2016 2015 2016 2015 Investor Communication Solutions $ 515.4 $ 466.1 $ 1,416.8 $ 1,264.4 Global Technology and Operations 191.3 178.0 548.3 514.9 Foreign currency exchange (17.8 ) (9.9 ) (42.6 ) (14.7 ) Total $ 688.8 $ 634.2 $ 1,922.5 $ 1,764.6 Earnings (Loss) before Income Taxes Three Months Ended March 31, Nine Months Ended March 31, 2016 2015 2016 2015 Investor Communication Solutions $ 67.1 $ 63.0 $ 147.1 $ 135.4 Global Technology and Operations 40.2 33.6 100.0 91.7 Other (14.8 ) (16.4 ) (44.3 ) (53.5 ) Foreign currency exchange 0.9 1.7 3.6 9.9 Total $ 93.4 $ 81.9 $ 206.4 $ 183.5 Amounts may not sum due to rounding.

9 Broadridge Financial Solutions, Inc. Reconciliation of Non-GAAP to GAAP Measures (In millions, except per share amounts) (Unaudited) Three Months Ended March 31, Nine Months Ended March 31, 2016 2015 2016 2015 ($ in millions) Adjusted Operating income (Non-GAAP) $ 109.8 $ 96.3 $ 257.9 $ 226.7 Acquisition Amortization and Other Costs (9.1 ) (7.3 ) (28.0 ) (21.6 ) Operating income (GAAP) $ 100.6 $ 89.0 $ 229.9 $ 205.2 Adjusted Operating income margin (Non-GAAP) 15.9 % 15.2 % 13.4 % 12.8 % Operating income margin (GAAP) 14.6 % 14.0 % 12.0 % 11.6 % Three Months Ended March 31, Nine Months Ended March 31, 2016 2015 2016 2015 ($ in millions) Adjusted Net earnings (Non-GAAP) $ 70.0 $ 58.8 $ 156.1 $ 135.4 Acquisition Amortization and Other Costs, net of taxes (6.3 ) (4.8 ) (18.7 ) (14.2 ) Net earnings (GAAP) $ 63.7 $ 54.0 $ 137.4 $ 121.2 Three Months Ended March 31, Nine Months Ended March 31, 2016 2015 2016 2015 Adjusted Diluted earnings per share (Non-GAAP) $ 0.58 $ 0.47 $ 1.28 $ 1.09 Acquisition Amortization and Other Costs, net of taxes (0.05 ) (0.04 ) (0.15 ) (0.11 ) Diluted earnings per share (GAAP) $ 0.52 $ 0.43 $ 1.13 $ 0.97 Nine Months Ended March 31, 2016 2015 ($ in millions) Free cash flows (Non-GAAP) $ 105.0 $ 126.0 Capital expenditures, software purchases and capitalized internal use software 56.1 30.6 Net cash flows provided by operating activities (GAAP) $ 161.1 $ 156.6 Amounts may not sum due to rounding.

10 Broadridge Financial Solutions, Inc. Reconciliation of Non-GAAP to GAAP Measures Diluted Earnings Per Share Growth and Operating Income Margin Fiscal Year 2016 Guidance (Unaudited) Earnings Per Share Growth Rate (1) FY16 Guidance Adjusted Diluted earnings per share (Non-GAAP) 8% - 12% growth Diluted earnings per share (GAAP) 7% - 12% growth Operating Income Margin (2) FY16 Guidance Adjusted Operating income margin % (Non-GAAP) ~18.4% Operating income margin % (GAAP) ~17.3% (1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Diluted EPS guidance estimates exclude Acquisition Amortization and Other Costs, net of taxes, of $0.18 per share. (2) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Operating income margin guidance estimates exclude Acquisition Amortization and Other Costs of $34 million. Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.