Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NORFOLK SOUTHERN CORP | ns8k021016.htm |

| EX-99.2 - NON-GAAP FINANCIALS - NORFOLK SOUTHERN CORP | nsnon-gaap021016.htm |

1 2016 BB&T Annual Transportation Services Conference February 10, 2016 Marta R. Stewart Executive Vice President Finance and Chief Financial Officer

Forward-Looking Statements 2 Certain statements in this presentation are forward-looking statements within the meaning of the safe harbor provision of the Private Securities Litigation Reform Act of 1995, as amended. In some cases, forward-looking statements may be identified by the use of words like “believe,” “expect,” “anticipate,” “estimate,” “plan,” “consider,” “project,” and similar references to the future. Forward-looking statements are made as of the date they were first issued and reflect the good-faith evaluation of Norfolk Southern Corporation’s (NYSE: NSC) (“Norfolk Southern” or the “Company”) management of information currently available. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company’s control. These and other important factors, including those discussed under “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2015, as well as the Company’s other public filings with the SEC, may cause our actual results, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, the occurrence of certain events or otherwise, unless otherwise required by applicable securities law.

Business Update 2015 Overview 2016 Outlook Strategic Plan to Reduce Costs and Accelerate Growth Capital Allocation Priorities 3

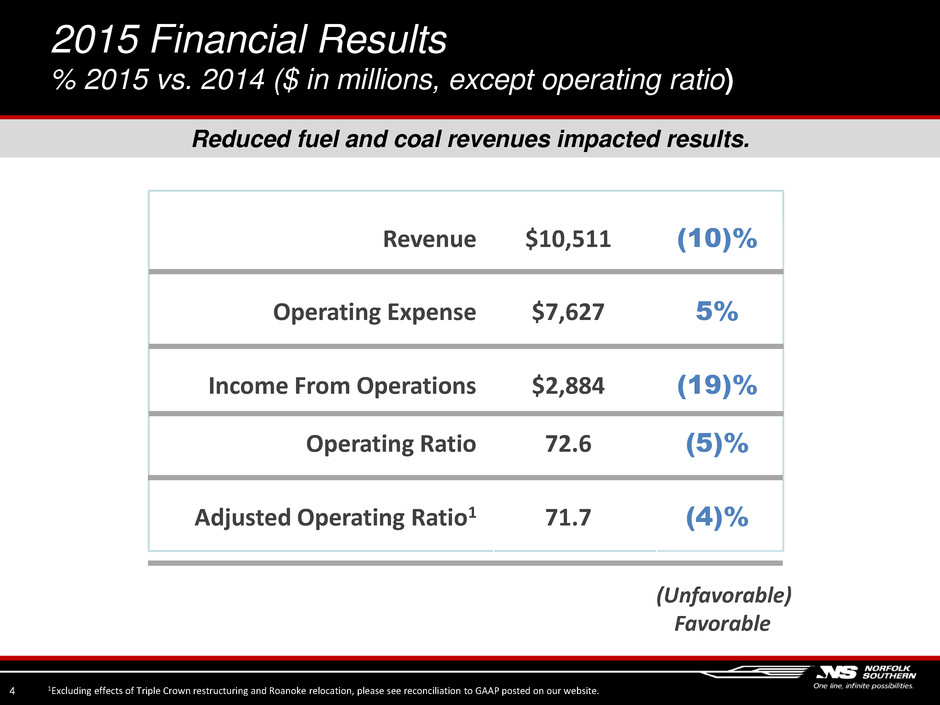

Revenue $10,511 (10)% Operating Expense $7,627 5% Income From Operations $2,884 (19)% Operating Ratio 72.6 (5)% Adjusted Operating Ratio1 71.7 (4)% 2015 Financial Results % 2015 vs. 2014 ($ in millions, except operating ratio) Reduced fuel and coal revenues impacted results. 4 (Unfavorable) Favorable 1Excluding effects of Triple Crown restructuring and Roanoke relocation, please see reconciliation to GAAP posted on our website.

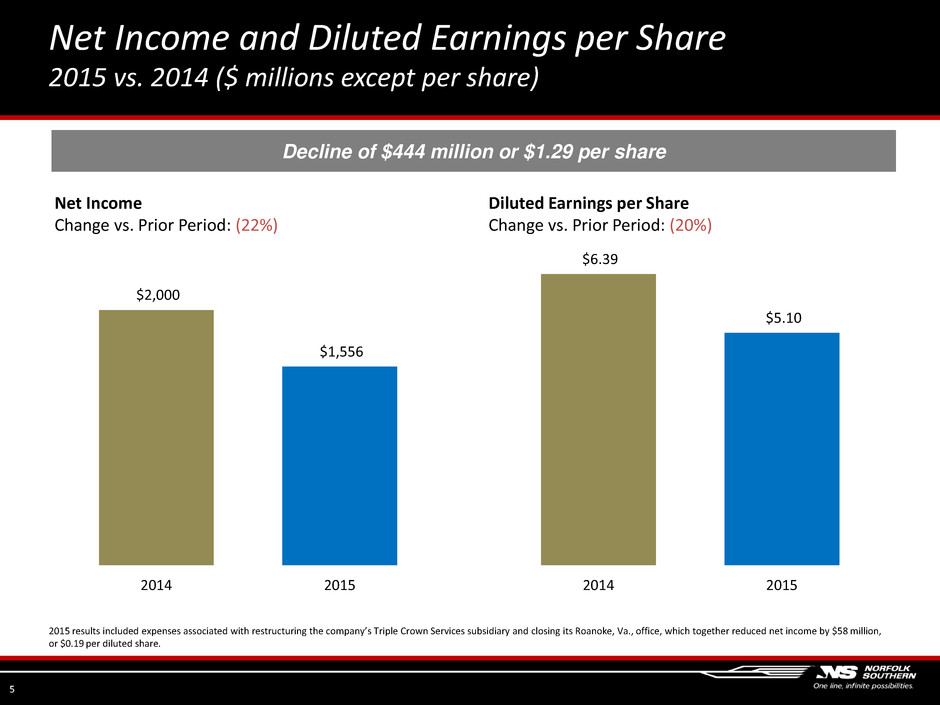

Net Income and Diluted Earnings per Share 2015 vs. 2014 ($ millions except per share) 5 Diluted Earnings per Share Change vs. Prior Period: (20%) Net Income Change vs. Prior Period: (22%) Decline of $444 million or $1.29 per share $6.39 $5.10 2014 2015 $2,000 $1,556 2014 2015 2015 results included expenses associated with restructuring the company’s Triple Crown Services subsidiary and closing its Roanoke, Va., office, which together reduced net income by $58 million, or $0.19 per diluted share.

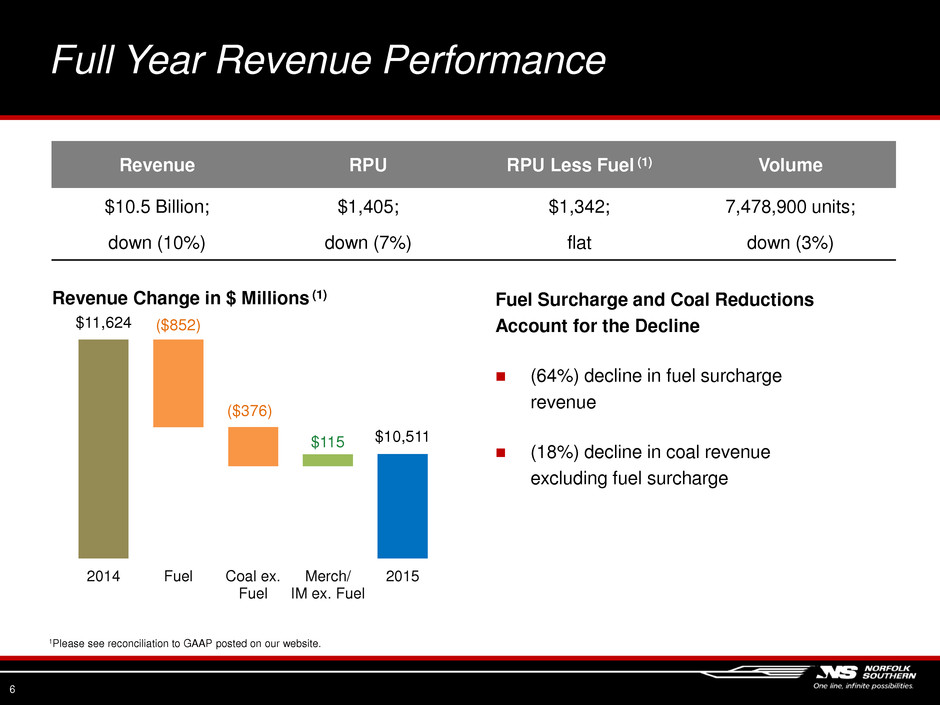

Full Year Revenue Performance 6 Fuel Surcharge and Coal Reductions Account for the Decline (64%) decline in fuel surcharge revenue (18%) decline in coal revenue excluding fuel surcharge Revenue Change in $ Millions (1) 1Please see reconciliation to GAAP posted on our website. $11,624 $10,511 ($852) ($376) $115 2014 Fuel Coal ex. Fuel Merch/ IM ex. Fuel 2015 Revenue RPU RPU Less Fuel (1) Volume $10.5 Billion; $1,405; $1,342; 7,478,900 units; down (10%) down (7%) flat down (3%)

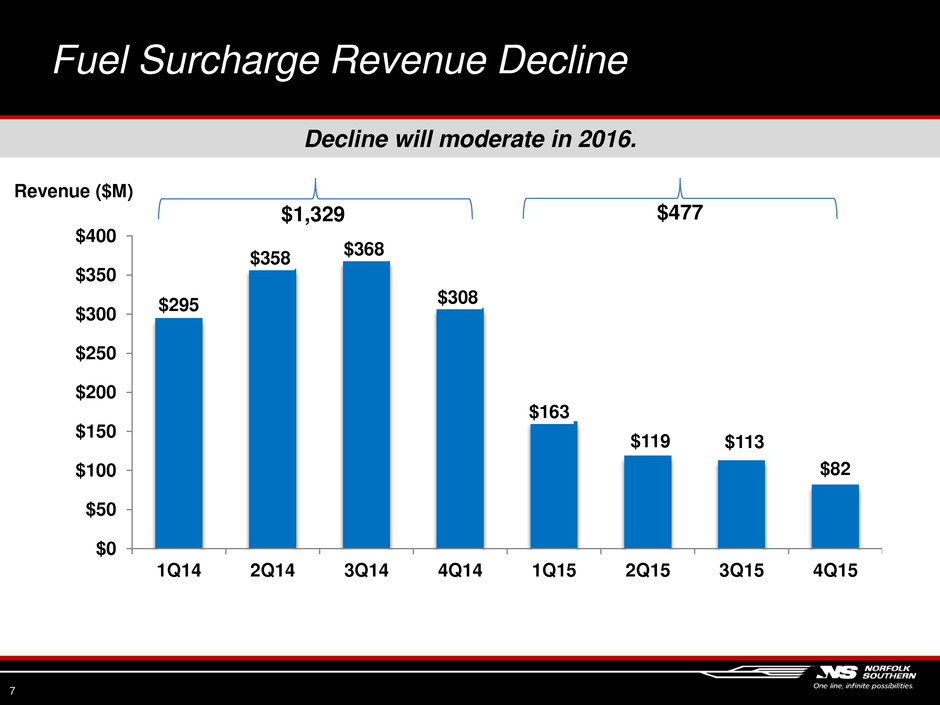

7 $295 $358 $368 $308 $163 $119 $113 $82 $0 $50 $100 $150 $200 $250 $300 $350 $400 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Revenue ($M) $1,329 $477 Decline will moderate in 2016. Fuel Surcharge Revenue Decline

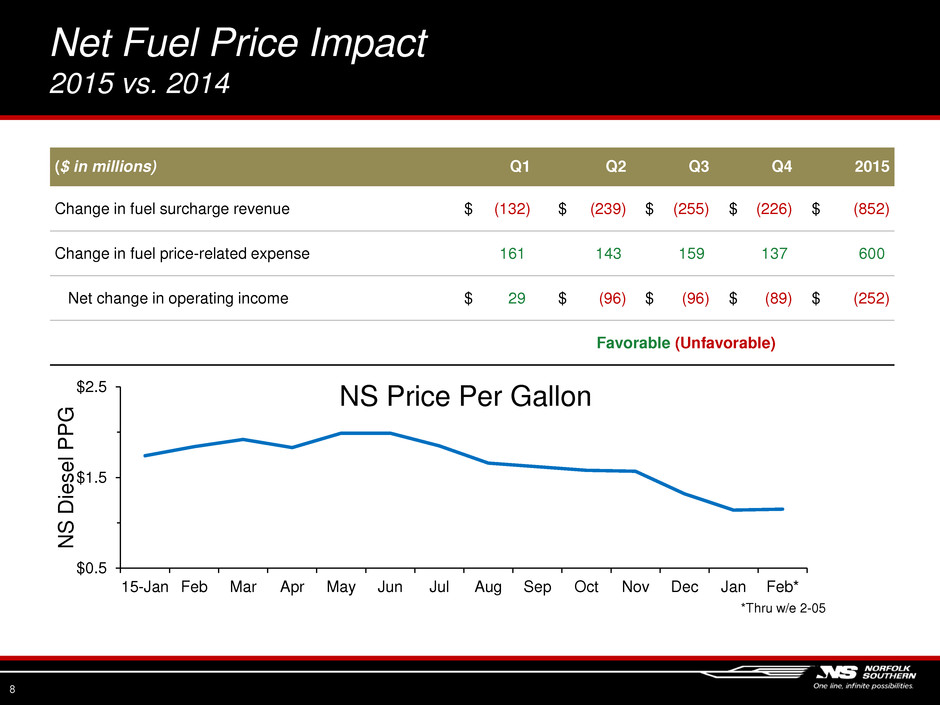

Net Fuel Price Impact 2015 vs. 2014 8 $0.5 $1.5 $2.5 15-Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb* NS D ie s e l P P G NS Price Per Gallon ($ in millions) Q1 Q2 Q3 Q4 2015 Change in fuel surcharge revenue $ (132) $ (239) $ (255) $ (226) $ (852) Change in fuel price-related expense 161 143 159 137 600 Net change in operating income $ 29 $ (96) $ (96) $ (89) $ (252) Favorable (Unfavorable) *Thru w/e 2-05

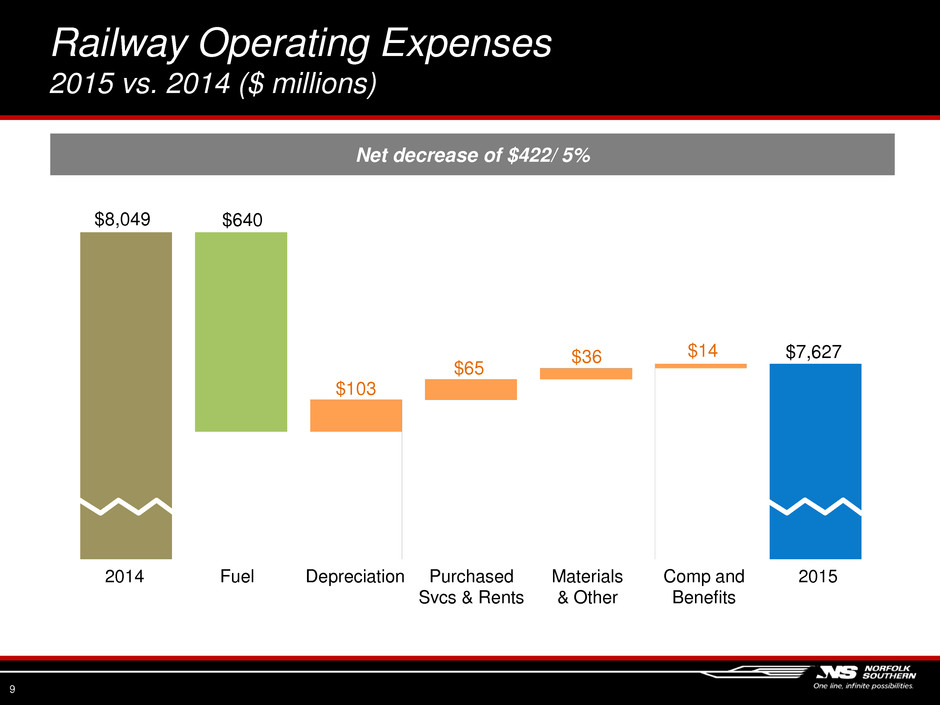

Railway Operating Expenses 2015 vs. 2014 ($ millions) Net decrease of $422/ 5% $8,049 $640 $103 $65 $36 $14 $7,627 Fuel Purchased Svcs & Rents Comp and Benefits Depreciation 2014 Materials & Other 2015 9

Actions Taken Have Established Foundation for Success Restructurings Support Lower Cost Structure Triple Crown subsidiary Roanoke office closure and G&A reductions Restored service to near all-time best levels Reduced capital spending by over $100 million in 2015 Completed Delaware & Hudson Railway Company line acquisition Began line rationalizations and division consolidation 10

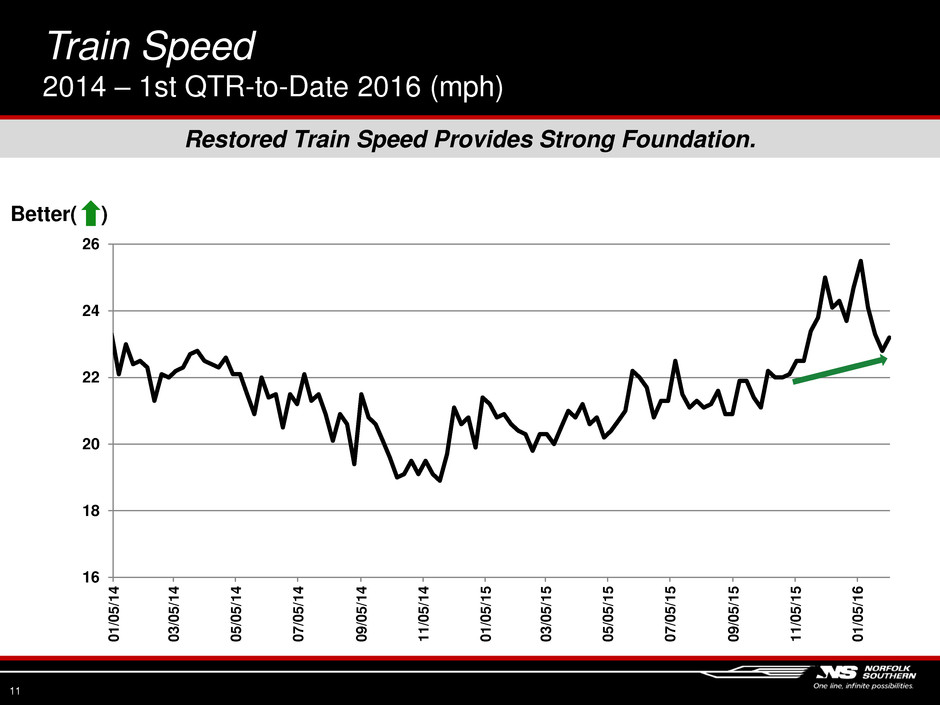

Better( ) 16 18 20 22 24 26 0 1 /0 5 /1 4 0 3 /0 5 /1 4 0 5 /0 5 /1 4 0 7 /0 5 /1 4 0 9 /0 5 /1 4 1 1 /0 5 /1 4 0 1 /0 5 /1 5 0 3 /0 5 /1 5 0 5 /0 5 /1 5 0 7 /0 5 /1 5 0 9 /0 5 /1 5 1 1 /0 5 /1 5 0 1 /0 5 /1 6 Restored Train Speed Provides Strong Foundation. Train Speed 2014 – 1st QTR-to-Date 2016 (mph) 11

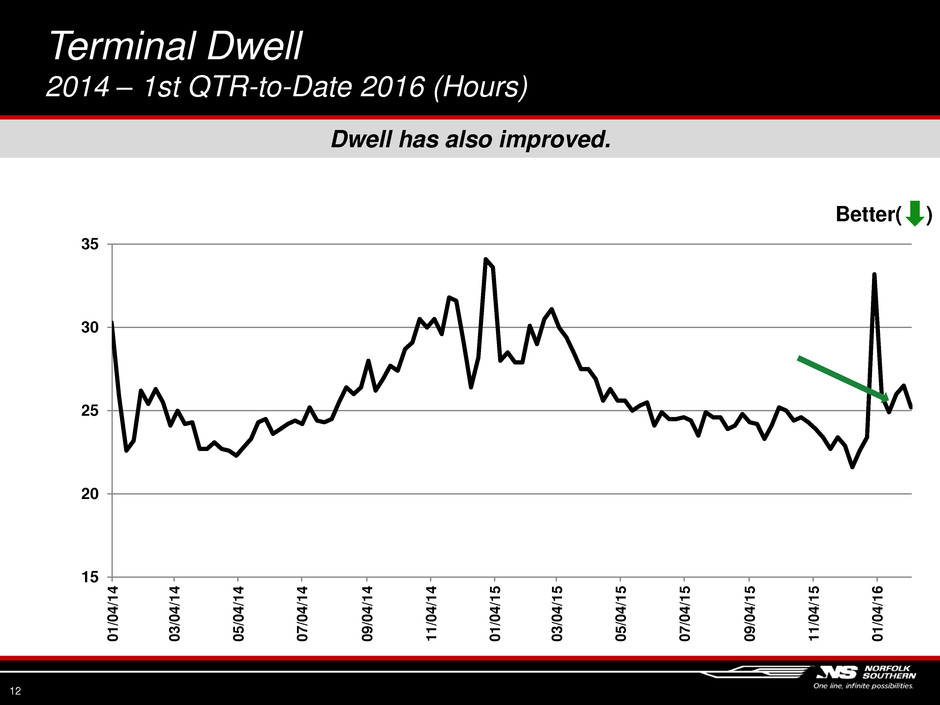

Better( ) 15 20 25 30 35 0 1 /0 4 /1 4 0 3 /0 4 /1 4 0 5 /0 4 /1 4 0 7 /0 4 /1 4 0 9 /0 4 /1 4 1 1 /0 4 /1 4 0 1 /0 4 /1 5 0 3 /0 4 /1 5 0 5 /0 4 /1 5 0 7 /0 4 /1 5 0 9 /0 4 /1 5 1 1 /0 4 /1 5 0 1 /0 4 /1 6 Dwell has also improved. Terminal Dwell 2014 – 1st QTR-to-Date 2016 (Hours) 12

13 Resources Crews and Locomotives Agreement Headcount Reductions in 4th Quarter – T&E: -440 – Non T&E: -175 Additional 1st Quarter Reductions / Furloughs – T&E: -600 – Non T&E: -350 Operations Manpower 300 Locomotives Removed From Service DC to AC Rebuild program, significantly more cost effective than purchasing new locomotives Locomotives

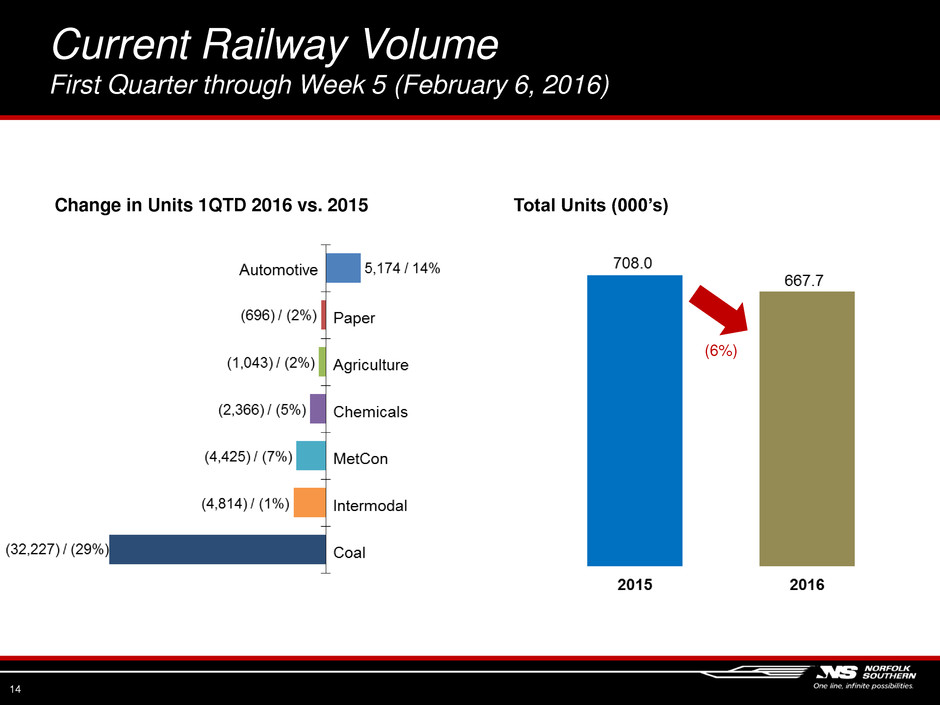

Current Railway Volume First Quarter through Week 5 (February 6, 2016) 14 Total Units (000’s) Change in Units 1QTD 2016 vs. 2015 (6%)

2016: Building on a Strong Foundation 15 Volume Pricing Continue to diversify franchise, mitigating risk from commodity price volatility − Low commodity prices will continue to hinder crude oil, frac sand, steel, and utility and export coal volumes − Coal volumes will decline Consumer-driven growth opportunities − Automotive, housing and construction- related commodities − Domestic and international Intermodal Improved service will be a springboard to growth Pricing increases accelerated throughout 2015, with fourth quarter strongest of the year − Full-year impact in 2016 − Both realized and negotiated − Strongest pricing since 3Q 2012 Long term pricing plan on multiyear contracts Fuel Surcharges Shifting from WTI-based to OHD-based fuel surcharge programs

Norfolk Southern’s Strategic Plan 16 Revenue Plan − Optimized pricing − Contribution growth from service-sensitive markets − Conservative pricing and volume forecasts Cost Reduction Plan − Commitment to drive operating ratio below 65 by 2020 − Specific initiatives underway to achieve more than $650MM of annual productivity savings by 2020

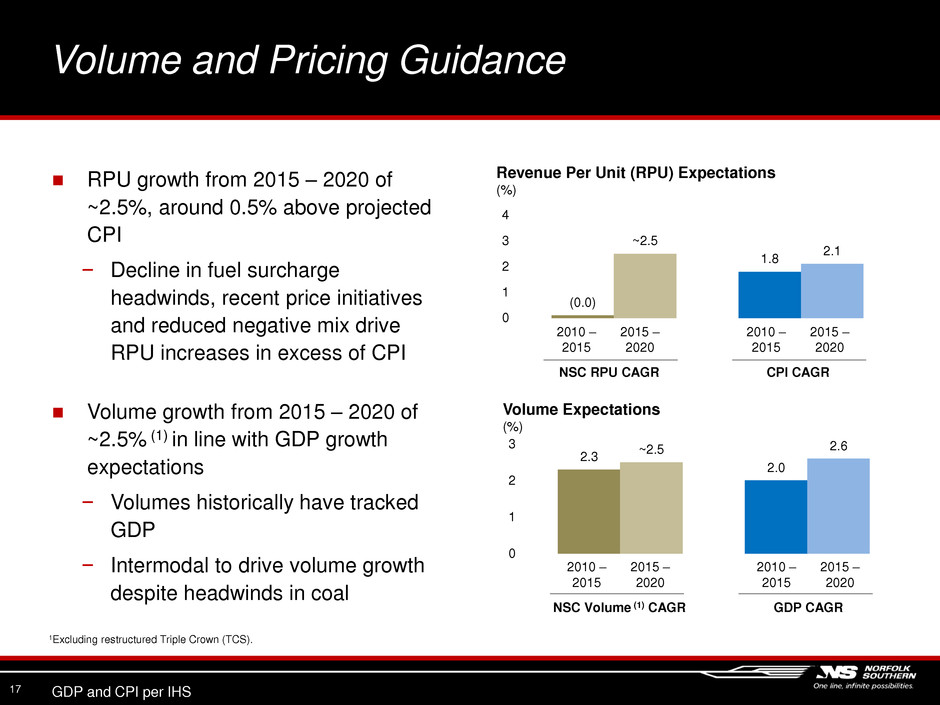

Volume and Pricing Guidance 17 1Excluding restructured Triple Crown (TCS). RPU growth from 2015 – 2020 of ~2.5%, around 0.5% above projected CPI − Decline in fuel surcharge headwinds, recent price initiatives and reduced negative mix drive RPU increases in excess of CPI Volume growth from 2015 – 2020 of ~2.5% (1) in line with GDP growth expectations − Volumes historically have tracked GDP − Intermodal to drive volume growth despite headwinds in coal Volume Expectations (%) 2.3 2.0 ~2.5 2.6 0 1 2 3 NSC Volume (1) CAGR GDP CAGR 2010 – 2015 2015 – 2020 2010 – 2015 2015 – 2020 Revenue Per Unit (RPU) Expectations (%) NSC RPU CAGR CPI CAGR 2010 – 2015 2015 – 2020 2010 – 2015 2015 – 2020 (0.0) 1.8 ~2.5 2.1 0 1 2 3 4 GDP and CPI per IHS

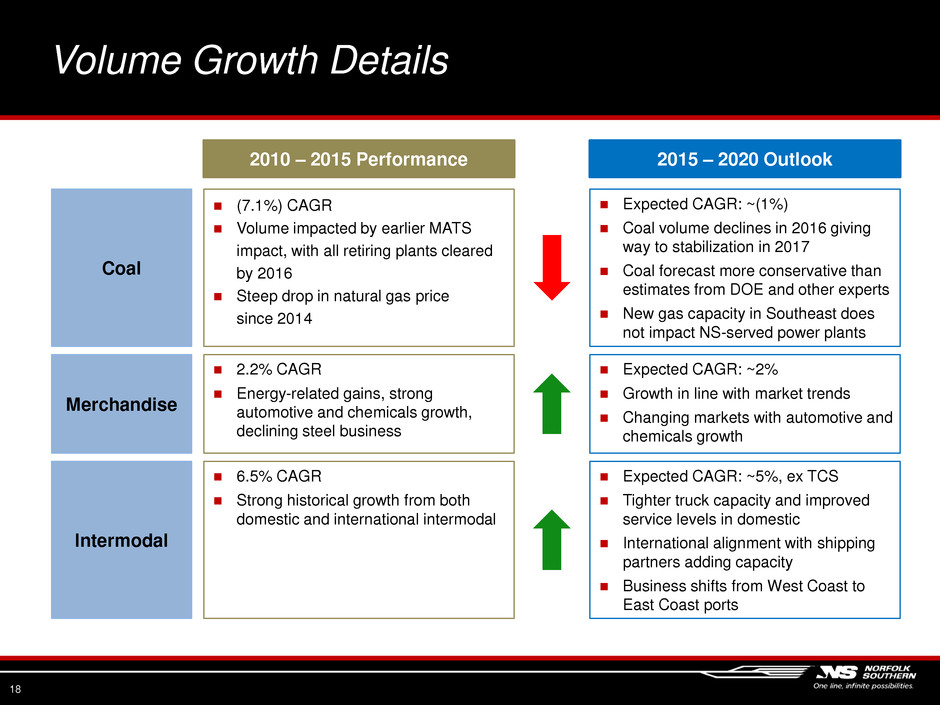

Volume Growth Details 18 2010 – 2015 Performance 2015 – 2020 Outlook Coal Merchandise Intermodal (7.1%) CAGR Volume impacted by earlier MATS impact, with all retiring plants cleared by 2016 Steep drop in natural gas price since 2014 Expected CAGR: ~(1%) Coal volume declines in 2016 giving way to stabilization in 2017 Coal forecast more conservative than estimates from DOE and other experts New gas capacity in Southeast does not impact NS-served power plants 2.2% CAGR Energy-related gains, strong automotive and chemicals growth, declining steel business Expected CAGR: ~2% Growth in line with market trends Changing markets with automotive and chemicals growth 6.5% CAGR Strong historical growth from both domestic and international intermodal Expected CAGR: ~5%, ex TCS Tighter truck capacity and improved service levels in domestic International alignment with shipping partners adding capacity Business shifts from West Coast to East Coast ports

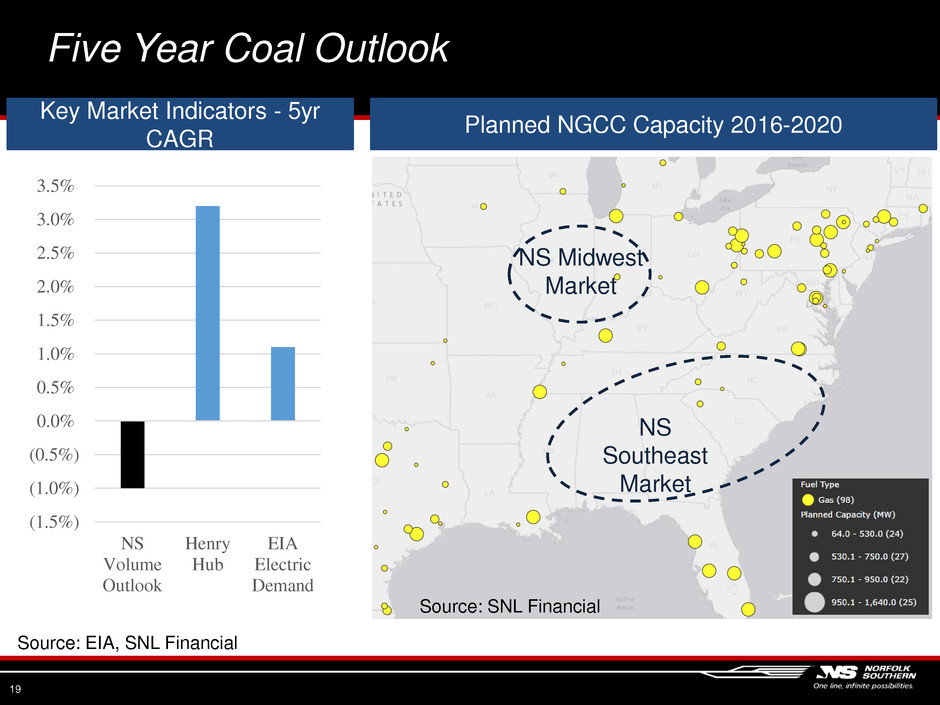

Key Market Indicators - 5yr CAGR Five Year Coal Outlook Planned NGCC Capacity 2016-2020 Source: EIA, SNL Financial NS Midwest Market NS Southeast Market (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% NS Volume Outlook Henry Hub EIA Electric Demand Source: SNL Financial 19

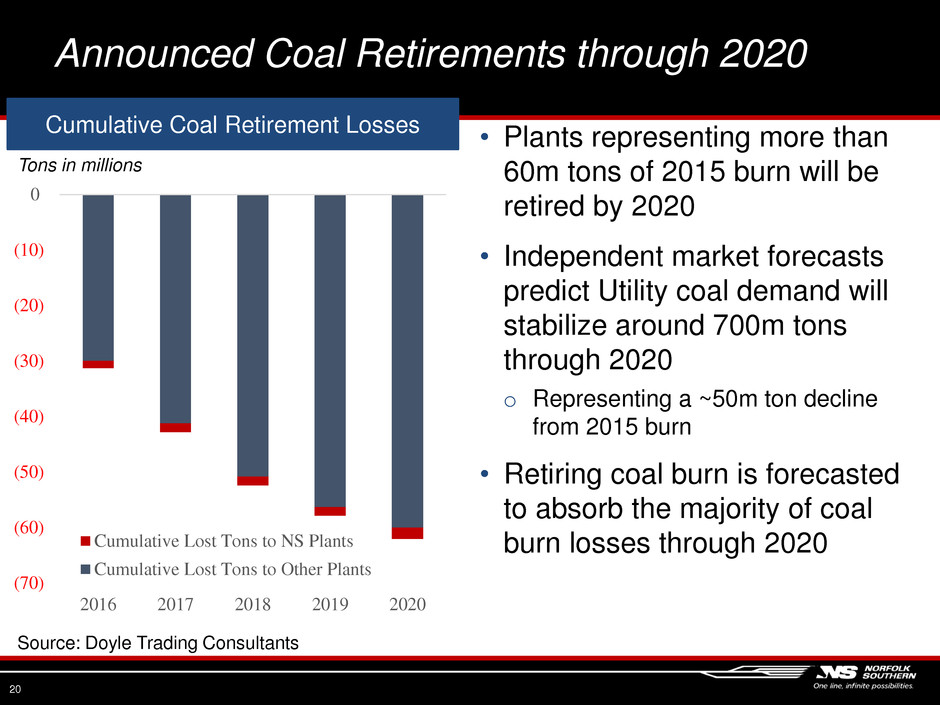

Cumulative Coal Retirement Losses Announced Coal Retirements through 2020 Tons in millions Source: Doyle Trading Consultants • Plants representing more than 60m tons of 2015 burn will be retired by 2020 • Independent market forecasts predict Utility coal demand will stabilize around 700m tons through 2020 o Representing a ~50m ton decline from 2015 burn • Retiring coal burn is forecasted to absorb the majority of coal burn losses through 2020 (70) (60) (50) (40) (30) (20) (10) 0 2016 2017 2018 2019 2020 Cumulative Lost Tons to NS Plants Cumulative Lost Tons to Other Plants 20

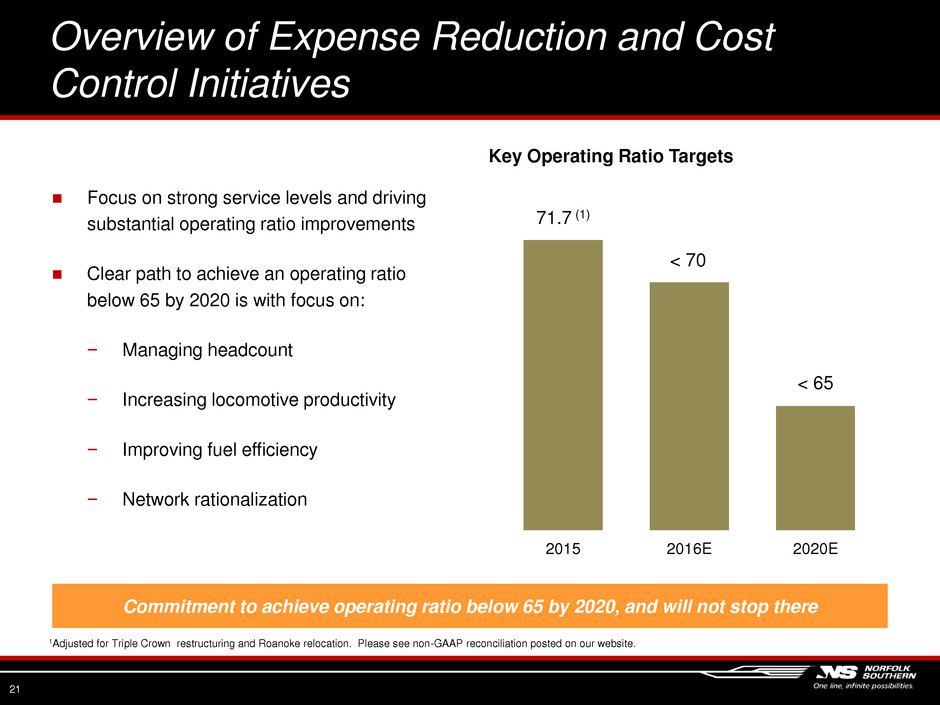

Overview of Expense Reduction and Cost Control Initiatives 21 Focus on strong service levels and driving substantial operating ratio improvements Clear path to achieve an operating ratio below 65 by 2020 is with focus on: − Managing headcount − Increasing locomotive productivity − Improving fuel efficiency − Network rationalization Key Operating Ratio Targets 71.7 (1) < 70 < 65 2015 2016E 2020E Commitment to achieve operating ratio below 65 by 2020, and will not stop there 1Adjusted for Triple Crown restructuring and Roanoke relocation. Please see non-GAAP reconciliation posted on our website.

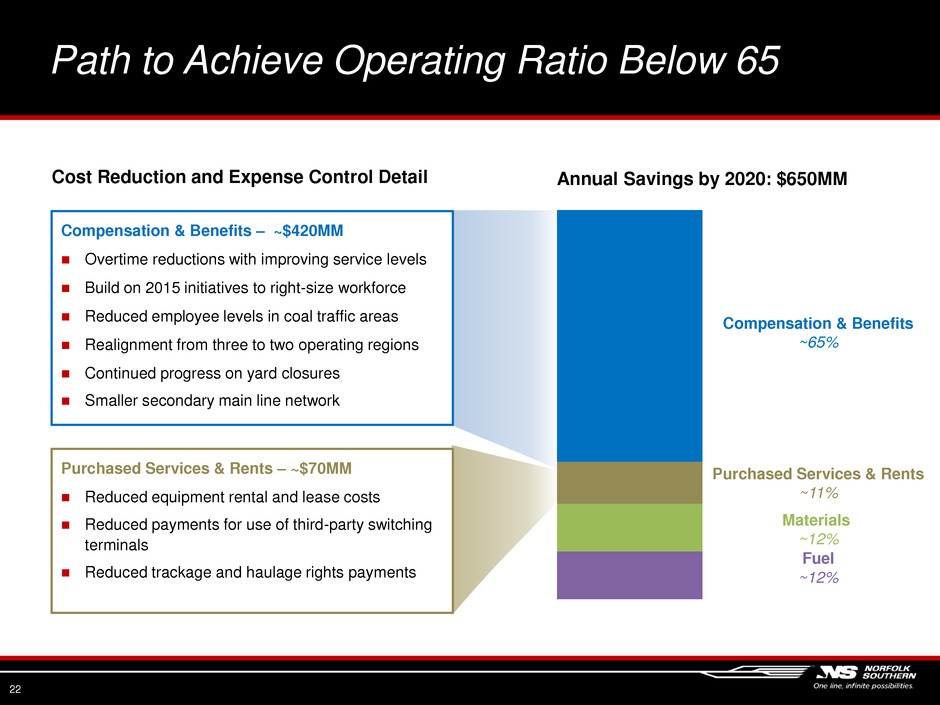

Path to Achieve Operating Ratio Below 65 22 Compensation & Benefits ~65% Materials ~12% Fuel ~12% Purchased Services & Rents ~11% Cost Reduction and Expense Control Detail Annual Savings by 2020: $650MM Compensation & Benefits – ~$420MM Overtime reductions with improving service levels Build on 2015 initiatives to right-size workforce Reduced employee levels in coal traffic areas Realignment from three to two operating regions Continued progress on yard closures Smaller secondary main line network Purchased Services & Rents – ~$70MM Reduced equipment rental and lease costs Reduced payments for use of third-party switching terminals Reduced trackage and haulage rights payments

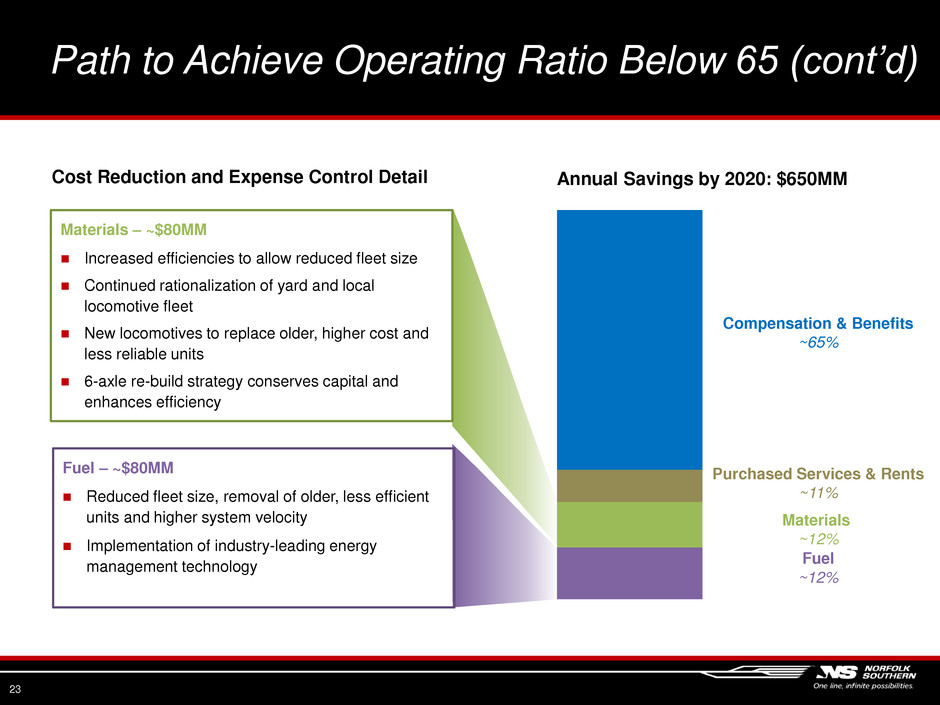

Path to Achieve Operating Ratio Below 65 (cont’d) 23 Cost Reduction and Expense Control Detail Annual Savings by 2020: $650MM Materials – ~$80MM Increased efficiencies to allow reduced fleet size Continued rationalization of yard and local locomotive fleet New locomotives to replace older, higher cost and less reliable units 6-axle re-build strategy conserves capital and enhances efficiency Fuel – ~$80MM Reduced fleet size, removal of older, less efficient units and higher system velocity Implementation of industry-leading energy management technology Compensation & Benefits ~65% Materials ~12% Fuel ~12% Purchased Services & Rents ~11%

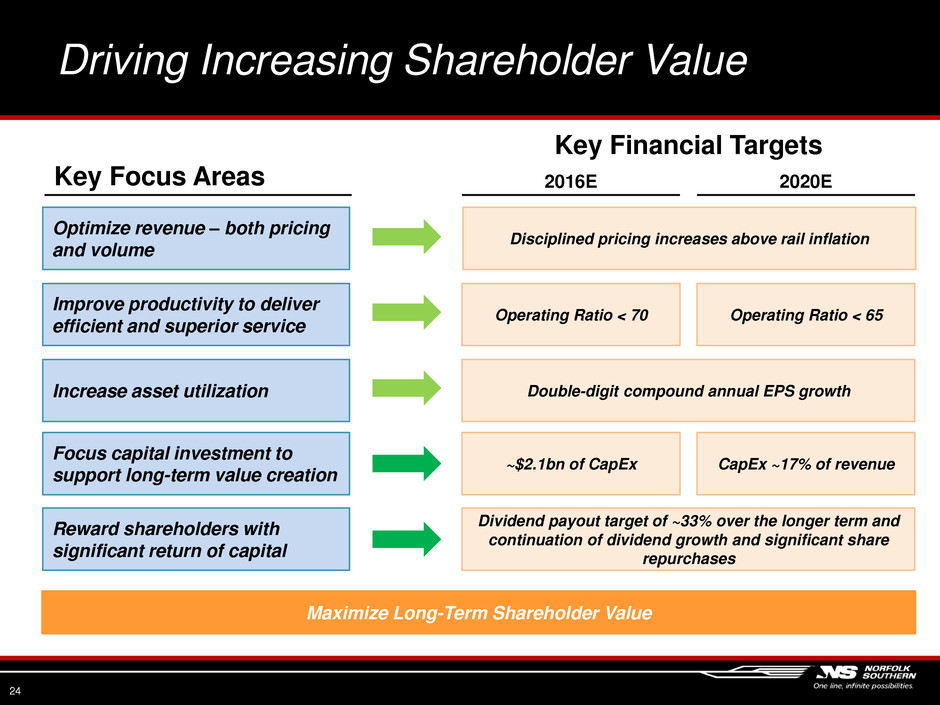

Driving Increasing Shareholder Value 24 Increase asset utilization Optimize revenue – both pricing and volume Double-digit compound annual EPS growth Improve productivity to deliver efficient and superior service Reward shareholders with significant return of capital Operating Ratio < 70 Focus capital investment to support long-term value creation ~$2.1bn of CapEx Key Focus Areas Key Financial Targets Operating Ratio < 65 Dividend payout target of ~33% over the longer term and continuation of dividend growth and significant share repurchases CapEx ~17% of revenue 2016E 2020E Disciplined pricing increases above rail inflation Maximize Long-Term Shareholder Value

Important Additional Information and Where to Find It Norfolk Southern Corporation (the “Company”), its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Company’s 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”). The Company plans to file a proxy statement with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the 2016 Annual Meeting (the “2016 Proxy Statement”). Additional information regarding the identity of these potential participants, none of whom owns in excess of 1 percent of the Company’s shares of Common Stock, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the 2016 Proxy Statement and other materials to be filed with the SEC in connection with the 2016 Annual Meeting. This information can also be found in the Company’s definitive proxy statement for its 2015 Annual Meeting of Stockholders (the “2015 Proxy Statement”), filed with the SEC on March 25, 2015, or the Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 8, 2016 (the “Form 10-K”). To the extent holdings of the Company’s securities by such potential participants have changed since the amounts printed in the 2015 Proxy Statement, such changes have been or will be reflected on Statements of Ownership and Change in Ownership on Forms 3 and 4 filed with the SEC. STOCKHOLDERS ARE URGED TO READ THE 2016 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), 2015 PROXY STATEMENT, FORM 10-K AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY HAS FILED OR WILL FILE WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain, free of charge, copies of the 2016 Proxy Statement (when filed), 2015 Proxy Statement, Form 10-K and any other documents (including the WHITE proxy card) filed or to be filed by the Company with the SEC in connection with the 2016 Annual Meeting at the SEC’s website (http://www.sec.gov) or at the Company’s website (http://www.nscorp.com) or by writing to Denise Hutson, Corporate Secretary, Norfolk Southern Corporation, Three Commercial Place, Norfolk, Virginia 23510. 25

Thank You 26