Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99 - NORFOLK SOUTHERN CORP | nsc201610-kexhibit992.htm |

| EX-32 - EXHIBIT 32 - NORFOLK SOUTHERN CORP | nsc201610-kexhibit322.htm |

| EX-31.B - EXHIBIT 31.B - NORFOLK SOUTHERN CORP | nsc201610-kexhibit31b2.htm |

| EX-31.A - EXHIBIT 31.A - NORFOLK SOUTHERN CORP | nsc201610-kexhibit31a2.htm |

| EX-23 - EXHIBIT 23 - NORFOLK SOUTHERN CORP | nsc201610-kexhibit232.htm |

| EX-21 - EXHIBIT 21 - NORFOLK SOUTHERN CORP | nsc10-kexhibit212.htm |

| EX-12 - EXHIBIT 12 - NORFOLK SOUTHERN CORP | nsc201610-kexhibit122.htm |

| EX-10.FFF - EXHIBIT 10.FFF - NORFOLK SOUTHERN CORP | nsc10-kexhibit10fff.htm |

| EX-10.EEE - EXHIBIT 10.EEE - NORFOLK SOUTHERN CORP | nsc10-kexhibit10eee.htm |

| EX-10.DDD - EXHIBIT 10.DDD - NORFOLK SOUTHERN CORP | nsc10-kexhibit10ddd.htm |

| EX-10.AA - EXHIBIT 10.AA - NORFOLK SOUTHERN CORP | nsc10-kexhibit10aa.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended DECEMBER 31, 2017

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the transition period from ___________ to___________

Commission file number 1-8339

NORFOLK SOUTHERN CORPORATION

(Exact name of registrant as specified in its charter)

Virginia (State or other jurisdiction of incorporation) | 52-1188014 (IRS Employer Identification No.) | |

Three Commercial Place Norfolk, Virginia (Address of principal executive offices) | 23510-2191 (Zip Code) | |

Registrant’s telephone number, including area code: | (757) 629-2680 | |

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each Class | Name of each exchange on which registered | |

Norfolk Southern Corporation | ||

Common Stock (Par Value $1.00) | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes (X) No ( )

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ( ) No (X)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes (X) No ( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes (X) No ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (X)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer (X) Accelerated filer ( ) Non-accelerated filer ( ) Smaller reporting company ( ) Emerging growth company ( )

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ( ) No (X)

The aggregate market value of the voting common equity held by non-affiliates at June 30, 2017, was $35,044,199,563 (based on the closing price as quoted on the New York Stock Exchange on that date).

The number of shares outstanding of each of the registrant’s classes of common stock, at January 31, 2018: 283,997,242 (excluding 20,320,777 shares held by the registrant’s consolidated subsidiaries).

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Registrant’s definitive proxy statement to be filed electronically pursuant to Regulation 14A not later than 120 days after the end of the fiscal year, are incorporated herein by reference in Part III.

TABLE OF CONTENTS

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Page | |||

K 87 | |||

K 2

PART I

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Item 1. Business and Item 2. Properties

GENERAL – Our company, Norfolk Southern Corporation, is a Norfolk, Virginia based company that owns a major freight railroad, Norfolk Southern Railway Company (NSR). We were incorporated on July 23, 1980, under the laws of the Commonwealth of Virginia. Our common stock (Common Stock) is listed on the New York Stock Exchange (NYSE) under the symbol “NSC.”

Unless indicated otherwise, Norfolk Southern Corporation and its subsidiaries, including NSR, are referred to collectively as NS, we, us, and our.

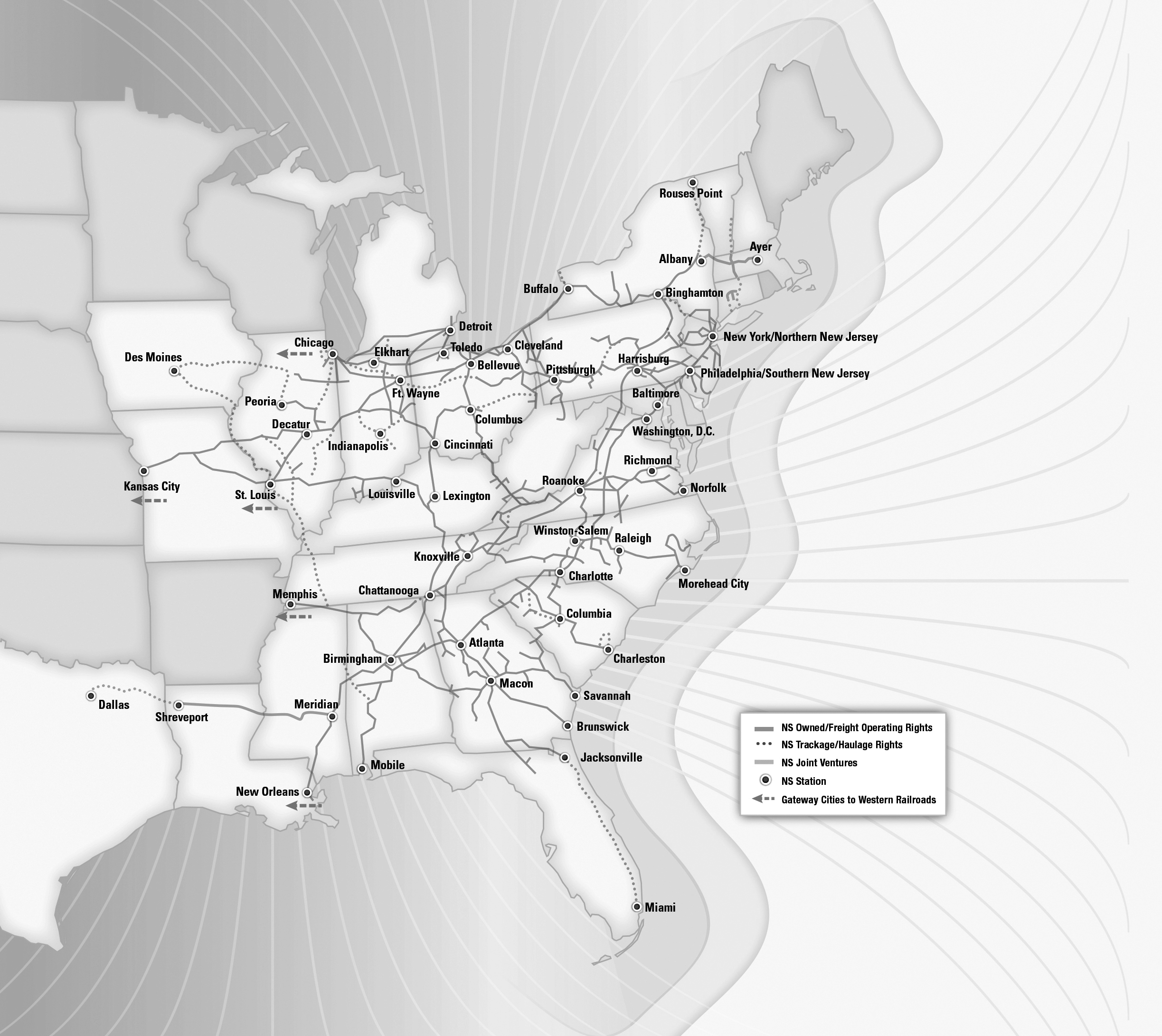

We are primarily engaged in the rail transportation of raw materials, intermediate products, and finished goods primarily in the Southeast, East, and Midwest and, via interchange with rail carriers, to and from the rest of the United States. We also transport overseas freight through several Atlantic and Gulf Coast ports. We offer the most extensive intermodal network in the eastern half of the United States.

We make available free of charge through our website, www.norfolksouthern.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the U.S. Securities and Exchange Commission (SEC). In addition, the following documents are available on our website and in print to any shareholder who requests them:

• | Corporate Governance Guidelines |

• | Charters of the Committees of the Board of Directors |

• | The Thoroughbred Code of Ethics |

• | Code of Ethical Conduct for Senior Financial Officers |

• | Categorical Independence Standards for Directors |

• | Norfolk Southern Corporation Bylaws |

K 3

RAILROAD OPERATIONS – At December 31, 2017, our railroad operated approximately 19,500 miles of road in 22 states and the District of Columbia.

Our system reaches many manufacturing plants, electric generating facilities, mines, distribution centers, transload facilities, and other businesses located in our service area.

Corridors with heaviest freight volume:

• | New York City area to Chicago (via Allentown and Pittsburgh) |

• | Chicago to Macon (via Cincinnati, Chattanooga, and Atlanta) |

• | Central Ohio to Norfolk (via Columbus and Roanoke) |

• | Birmingham to Meridian |

• | Memphis to Chattanooga |

• | Cleveland to Kansas City |

K 4

The miles operated, which include major leased lines between Cincinnati, Ohio, and Chattanooga, Tennessee, and an exclusive operating agreement for trackage rights over property owned by North Carolina Railroad Company, were as follows:

Mileage Operated at December 31, 2017 | ||||||||||||||

Miles of Road | Second and Other Main Track | Passing Track, Crossovers and Turnouts | Way and Yard Switching | Total | ||||||||||

Owned | 14,711 | 2,753 | 1,952 | 8,320 | 27,736 | |||||||||

Operated under lease, contract or trackage | ||||||||||||||

rights | 4,756 | 1,932 | 398 | 835 | 7,921 | |||||||||

Total | 19,467 | 4,685 | 2,350 | 9,155 | 35,657 | |||||||||

We operate freight service over lines with significant ongoing Amtrak and commuter passenger operations, and conduct freight operations over trackage owned or leased by Amtrak, New Jersey Transit, Southeastern Pennsylvania Transportation Authority, Metro-North Commuter Railroad Company, Maryland Department of Transportation, and Michigan Department of Transportation.

The following table sets forth certain statistics relating to our railroads’ operations for the past five years:

Years ended December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Revenue ton miles (billions) | 201 | 191 | 200 | 205 | 194 | ||||||||||||||

Revenue per thousand revenue ton miles | $ | 52.38 | $ | 51.91 | $ | 52.63 | $ | 56.70 | $ | 58.10 | |||||||||

Revenue ton miles (thousands) per railroad employee | 7,474 | 6,838 | 6,645 | 7,054 | 6,517 | ||||||||||||||

Ratio of railway operating expenses to railway operating | |||||||||||||||||||

revenues | 67.4 | % | 1 | 68.9% | 72.6% | 69.2% | 71.0% | ||||||||||||

1Note: See reconciliation to U.S. Generally Accepted Accounting Principles (GAAP) in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

RAILWAY OPERATING REVENUES – Total railway operating revenues were $10.6 billion in 2017. Following is an overview of our three major market groups. See the discussion of merchandise revenues by commodity group, intermodal revenues, and coal revenues and tonnage in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

MERCHANDISE – Our merchandise market group is composed of five major commodity groupings:

• | Chemicals includes sulfur and related chemicals, petroleum products (including crude oil), chlorine and bleaching compounds, plastics, rubber, industrial chemicals, and chemical wastes. |

• | Agriculture, consumer products, and government includes soybeans, wheat, corn, fertilizer, livestock and poultry feed, food oils, flour, beverages, canned goods, sweeteners, consumer products, ethanol, transportation equipment, and items for the U.S. military. |

• | Metals and construction includes steel, aluminum products, machinery, scrap metals, cement, aggregates, sand, and minerals. |

• | Automotive includes finished motor vehicles and automotive parts. |

K 5

• | Paper, clay and forest products includes lumber and wood products, pulp board and paper products, wood fibers, wood pulp, scrap paper, and clay. |

Merchandise carloads handled in 2017 were 2.5 million, the revenues from which accounted for 60% of our total railway operating revenues.

INTERMODAL – Our intermodal market group consists of shipments moving in domestic and international containers and trailers. These shipments are handled on behalf of intermodal marketing companies, international steamship lines, truckers, and other shippers. Intermodal units handled in 2017 were 4.1 million, the revenues from which accounted for 23% of our total railway operating revenues.

COAL – Revenues from coal accounted for 17% of our total railway operating revenues in 2017. We handled 116 million tons, or 1.0 million carloads, in 2017, most of which originated on our lines from major eastern coal basins, with the balance from major western coal basins received via the Memphis and Chicago gateways. Our coal franchise supports the electric generation market, serving approximately 76 coal generation plants, as well as the export, domestic metallurgical and industrial markets, primarily through direct rail and river, lake, and coastal facilities, including various terminals on the Ohio River, Lamberts Point in Norfolk, Virginia, the Port of Baltimore, and Lake Erie.

FREIGHT RATES – Our predominant pricing mechanisms, private contracts and exempt price quotes, are not subject to regulation. In general, market forces are the primary determinant of rail service prices.

In 2017, our railroad was found by the U.S. Surface Transportation Board (STB), the regulatory board that has broad jurisdiction over railroad practices, to be “revenue adequate” on an annual basis based on results for the year 2016. The STB has not made its revenue adequacy determination for the year 2017. A railroad is “revenue adequate” on an annual basis under the applicable law when its return on net investment exceeds the rail industry’s composite cost of capital. This determination is made pursuant to a statutory requirement.

RAILWAY PROPERTY

Our railroad infrastructure makes us capital intensive with net property of approximately $30 billion on a historical cost basis.

Property Additions – Property additions for the past five years were as follows:

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

($ in millions) | |||||||||||||||||||

Road and other property | $ | 1,210 | $ | 1,292 | $ | 1,514 | $ | 1,406 | $ | 1,421 | |||||||||

Equipment | 513 | 595 | 658 | 712 | 550 | ||||||||||||||

Delaware & Hudson acquisition | — | — | 213 | — | — | ||||||||||||||

Total | $ | 1,723 | $ | 1,887 | $ | 2,385 | $ | 2,118 | $ | 1,971 | |||||||||

Our capital spending and replacement programs are and have been designed to assure the ability to provide safe, efficient, and reliable rail transportation services. For 2018, we have budgeted $1.8 billion of property additions.

K 6

Equipment – At December 31, 2017, we owned or leased the following units of equipment:

Owned | Leased | Total | Capacity of Equipment | ||||||||

Locomotives: | (Horsepower) | ||||||||||

Multiple purpose | 3,911 | 14 | 3,925 | 14,948,800 | |||||||

Auxiliary units | 175 | — | 175 | — | |||||||

Switching | 55 | — | 55 | 82,050 | |||||||

Total locomotives | 4,141 | 14 | 4,155 | 15,030,850 | |||||||

Freight cars: | (Tons) | ||||||||||

Gondola | 25,265 | 2,549 | 27,814 | 3,086,465 | |||||||

Hopper | 11,266 | — | 11,266 | 1,272,224 | |||||||

Covered hopper | 9,061 | 85 | 9,146 | 1,013,837 | |||||||

Box | 8,248 | 1,362 | 9,610 | 829,014 | |||||||

Flat | 1,776 | 1,484 | 3,260 | 316,534 | |||||||

Other | 1,606 | 4 | 1,610 | 74,100 | |||||||

Total freight cars | 57,222 | 5,484 | 62,706 | 6,592,174 | |||||||

Other: | |||||||||||

Chassis | 28,710 | — | 28,710 | ||||||||

Containers | 16,190 | 1,738 | 17,928 | ||||||||

Work equipment | 7,213 | 287 | 7,500 | ||||||||

Vehicles | 4,072 | 156 | 4,228 | ||||||||

Miscellaneous | 2,387 | 189 | 2,576 | ||||||||

Total other | 58,572 | 2,370 | 60,942 | ||||||||

The following table indicates the number and year built for locomotives and freight cars owned at December 31, 2017:

2017 | 2016 | 2015 | 2014 | 2013 | 2008- 2012 | 2003- 2007 | 2002 & Before | Total | ||||||||||||||||||

Locomotives: | ||||||||||||||||||||||||||

No. of units | 53 | 66 | 8 | 83 | 50 | 231 | 624 | 3,026 | 4,141 | |||||||||||||||||

% of fleet | 1 | % | 2 | % | — | % | 2 | % | 1 | % | 6 | % | 15 | % | 73 | % | 100 | % | ||||||||

Freight cars: | ||||||||||||||||||||||||||

No. of units | 470 | 775 | 2,091 | 897 | — | 8,889 | 1,658 | 42,442 | 57,222 | |||||||||||||||||

% of fleet | 1 | % | 1 | % | 4 | % | 1 | % | — | % | 16 | % | 3 | % | 74 | % | 100 | % | ||||||||

K 7

The following table shows the average age of our owned locomotive and freight car fleets at December 31, 2017, and information regarding 2017 retirements:

Locomotives | Freight Cars | ||

Average age – in service | 24.4 years | 28.5 years | |

Retirements | 180 units | 6,947 units | |

Average age – retired | 33.2 years | 44.7 years | |

Track Maintenance – Of the approximately 35,700 total miles of track on which we operate, we are responsible for maintaining approximately 28,500 miles, with the remainder being operated under trackage rights from other parties responsible for maintenance.

Over 83% of the main line trackage (including first, second, third, and branch main tracks, all excluding rail operated pursuant to trackage rights) has rail ranging from 131 to 155 pounds per yard with the standard installation currently at 136 pounds per yard. Approximately 46% of our lines, excluding rail operated pursuant to trackage rights, carried 20 million or more gross tons per track mile during 2017.

The following table summarizes several measurements regarding our track roadway additions and replacements during the past five years:

2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

Track miles of rail installed | 466 | 518 | 523 | 507 | 549 | |||||||||

Miles of track surfaced | 5,368 | 4,984 | 5,074 | 5,248 | 5,475 | |||||||||

Crossties installed (millions) | 2.5 | 2.3 | 2.4 | 2.7 | 2.5 | |||||||||

Traffic Control – Of the approximately 16,400 route miles we dispatch, about 11,300 miles are signalized, including 8,500 miles of centralized traffic control (CTC) and 2,800 miles of automatic block signals. Of the 8,500 miles of CTC, approximately 7,600 miles are controlled by data radio originating at 355 base station radio sites.

ENVIRONMENTAL MATTERS – Compliance with federal, state, and local laws and regulations relating to the protection of the environment is one of our principal goals. To date, such compliance has not had a material effect on our financial position, results of operations, liquidity, or competitive position. See Note 16 to the Consolidated Financial Statements.

EMPLOYEES – The following table shows the average number of employees and the average cost per employee for wages and benefits:

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Average number of employees | 27,110 | 28,044 | 30,456 | 29,482 | 30,103 | ||||||||||||||

Average wage cost per employee | $ | 79,000 | $ | 76,000 | $ | 77,000 | $ | 76,000 | $ | 72,000 | |||||||||

Average benefit cost per employee | $ | 42,000 | $ | 35,000 | $ | 32,000 | $ | 35,000 | $ | 40,000 | |||||||||

Approximately 80% of our railroad employees are covered by collective bargaining agreements with various labor unions. See the discussion of “Labor Agreements” in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

K 8

GOVERNMENT REGULATION – In addition to environmental, safety, securities, and other regulations generally applicable to all business, our railroads are subject to regulation by the STB. The STB has jurisdiction to varying extents over rates, routes, customer access provisions, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers.

The relaxation of economic regulation of railroads, following the Staggers Rail Act of 1980, included exemption from STB regulation of the rates and most service terms for intermodal business (trailer-on-flat-car, container-on-flat-car), rail boxcar shipments, lumber, manufactured steel, automobiles, and certain bulk commodities such as sand, gravel, pulpwood, and wood chips for paper manufacturing. Further, all shipments that we have under contract are effectively removed from commercial regulation for the duration of the contract. Approximately 90% of our revenues comes from either exempt shipments or shipments moving under transportation contracts; the remainder comes from shipments moving under public tariff rates.

Efforts have been made over the past several years to increase federal economic regulation of the rail industry, and such efforts are expected to continue in 2018. The Staggers Rail Act of 1980 substantially balanced the interests of shippers and rail carriers, and encouraged and enabled rail carriers to innovate, invest in their infrastructure, and compete for business, thereby contributing to the economic health of the nation and to the revitalization of the industry. Accordingly, we will continue to oppose efforts to reimpose increased economic regulation.

Government regulations are discussed within Item 1A. “Risk Factors” and the safety and security of our railroads are discussed within the “Security of Operations” section contained herein.

COMPETITION – There is continuing strong competition among rail, water, and highway carriers. Price is usually only one factor of importance as shippers and receivers choose a transport mode and specific hauling company. Inventory carrying costs, service reliability, ease of handling, and the desire to avoid loss and damage during transit are also important considerations, especially for higher-valued finished goods, machinery, and consumer products. Even for raw materials, semi-finished goods, and work-in-progress, users are increasingly sensitive to transport arrangements that minimize problems at successive production stages.

Our primary rail competitor is CSX Corporation (CSX); both NS and CSX operate throughout much of the same territory. Other railroads also operate in parts of the territory. We also compete with motor carriers, water carriers, and with shippers who have the additional options of handling their own goods in private carriage, sourcing products from different geographic areas, and using substitute products.

Certain marketing strategies to expand reach and shipping options among railroads and between railroads and motor carriers enable railroads to compete more effectively in specific markets.

SECURITY OF OPERATIONS – We continue to enhance the security of our rail system. Our comprehensive security plan is modeled on and was developed in conjunction with the security plan prepared by the Association of American Railroads (AAR) post September 11, 2001. The AAR Security Plan defines four Alert Levels and details the actions and countermeasures that are being applied across the railroad industry as a terrorist threat increases or decreases. The Alert Level actions include countermeasures that will be applied in three general areas: (1) operations (including transportation, engineering, and mechanical); (2) information technology and communications; and, (3) railroad police. All of our Operations Division employees are advised by their supervisors or train dispatchers, as appropriate, of any change in Alert Level and any additional responsibilities they may incur due to such change.

Our plan also complies with U.S. Department of Transportation (DOT) security regulations pertaining to training and security plans with respect to the transportation of hazardous materials. As part of the plan, security awareness training is given to all railroad employees who directly affect hazardous material transportation safety, and is integrated into hazardous material training programs. Additionally, location-specific security plans are in place for certain metropolitan areas and each of the six facilities we operate that are under U.S. Coast Guard (USCG)

K 9

Maritime Security Regulations. With respect to these facilities, each facility’s security plan has been approved by the applicable Captain of the Port and remains subject to inspection by the USCG.

Additionally, we continue to engage in close and regular coordination with numerous federal and state agencies, including the U.S. Department of Homeland Security (DHS), the Transportation Security Administration, the Federal Bureau of Investigation, the Federal Railroad Administration (FRA), the USCG, U.S. Customs and Border Protection, the Department of Defense, and various state Homeland Security offices. Similarly, we follow guidance from DHS and DOT regarding rail corridors in High Threat Urban Areas (HTUA). Particular attention is aimed at reducing risk in HTUA by: (1) the establishment of secure storage areas for rail cars carrying toxic-by-inhalation (TIH) materials; (2) the expedited movement of trains transporting rail cars carrying TIH materials; (3) substantially reducing the number of unattended loaded tank cars carrying TIH materials; and (4) cooperation with federal, state, local, and tribal governments to identify those locations where security risks are the highest.

In 2017, through participation in the Transportation Community Awareness and Emergency Response (TRANSCAER) Program, we provided rail accident response training to approximately 8,185 emergency responders, such as local police and fire personnel. Our other training efforts throughout 2017 included participation in drills for local, state, and federal agencies. We also have ongoing programs to sponsor local emergency responders at the Security and Emergency Response Training Course conducted at the AAR Transportation Technology Center in Pueblo, Colorado.

Item 1A. Risk Factors

The risks set forth in the following risk factors could have a materially adverse effect on our financial condition, results of operations, or liquidity in a particular year or quarter, and could cause those results to differ materially from those expressed or implied in our forward-looking statements. The information set forth in this Item 1A. “Risk Factors” should be read in conjunction with the rest of the information included in this annual report, including Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8 “Financial Statements and Supplementary Data.”

Significant governmental legislation and regulation over commercial, operating and environmental matters could affect us, our customers, and the markets we serve. Congress can enact laws that could increase economic regulation of the industry. Railroads presently are subject to commercial regulation by the STB, which has jurisdiction to varying extents over rates, routes, customer access provisions, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers. Additional economic regulation of the rail industry by Congress or the STB, whether under new or existing laws, could have a significant negative impact on our ability to determine prices for rail services and on the efficiency of our operations. This potential material adverse effect could also result in reduced capital spending on our rail network or abandonment of lines.

Railroads are also subject to the enactment of laws by Congress and regulation by the DOT and the DHS (which regulate most aspects of our operations) related to safety and security. The Rail Safety Improvement Act of 2008 (RSIA), the Surface Transportation Extension Act of 2015, and the implementing regulations promulgated by the FRA (collectively “the PTC laws and regulations”) require us (and each other Class I railroad) to implement, on certain mainline track where intercity and commuter passenger railroads operate and where TIH hazardous materials are transported, an interoperable positive train control system (PTC). PTC is a set of highly advanced technologies designed to prevent train-to-train collisions, speed-related derailments, and certain other accidents caused by human error, but PTC will not prevent all types of train accidents or incidents. The PTC laws and regulations require us to install all hardware and to implement the PTC system on some of those rail lines by December 31, 2018, and to implement such system on the remainder of those rail lines by December 31, 2020.

Full implementation of PTC in compliance with RSIA, as amended, will result in additional operating costs and capital expenditures, and PTC implementation may result in reduced operational efficiency and service levels, as well as increased compensation and benefits expenses, and increased claims and litigation costs.

K 10

Our operations are subject to extensive federal and state environmental laws and regulations concerning, among other things, emissions to the air; discharges to waterways or groundwater supplies; handling, storage, transportation, and disposal of waste and other materials; and the cleanup of hazardous material or petroleum releases. The risk of incurring environmental liability, for acts and omissions, past, present, and future, is inherent in the railroad business. This risk includes property owned by us, whether currently or in the past, that is or has been subject to a variety of uses, including our railroad operations and other industrial activity by past owners or our past and present tenants.

Environmental problems that are latent or undisclosed may exist on these properties, and we could incur environmental liabilities or costs, the amount and materiality of which cannot be estimated reliably at this time, with respect to one or more of these properties. Moreover, lawsuits and claims involving other unidentified environmental sites and matters are likely to arise from time to time.

Concern over climate change has led to significant federal, state, and international legislative and regulatory efforts to limit greenhouse gas (GHG) emissions. Restrictions, caps, taxes, or other controls on GHG emissions, including diesel exhaust, could significantly increase our operating costs, decrease the amount of traffic handled, and decrease the value of coal reserves we own.

In addition, legislation and regulation related to GHGs could negatively affect the markets we serve and our customers. Even without legislation or regulation, government incentives and adverse publicity relating to GHGs could negatively affect the markets for certain of the commodities we carry and our customers that (1) use commodities that we carry to produce energy, including coal, (2) use significant amounts of energy in producing or delivering the commodities we carry, or (3) manufacture or produce goods that consume significant amounts of energy.

As a common carrier by rail, we must offer to transport hazardous materials, regardless of risk. Transportation of certain hazardous materials could create catastrophic losses in terms of personal injury and property (including environmental) damage, and compromise critical parts of our rail network. The cost of a catastrophic rail accident involving hazardous materials could exceed our insurance coverage. We have obtained insurance for potential losses for third-party liability and first-party property damages (see Note 16 to the Consolidated Financial Statements); however, insurance is available from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to us.

We may be affected by general economic conditions. Prolonged negative changes in domestic and global economic conditions could affect the producers and consumers of the commodities we carry. Economic conditions could also result in bankruptcies of one or more large customers.

Significant increases in demand for rail services could result in the unavailability of qualified personnel and locomotives. In addition, workforce demographics and training requirements, particularly for engineers and conductors, could have a negative impact on our ability to meet short-term demand for rail service. Unpredicted increases in demand for rail services may exacerbate such risks.

We may be affected by energy prices. Volatility in energy prices could have a significant effect on a variety of items including, but not limited to: the economy; demand for transportation services; business related to the energy sector, including crude oil, natural gas, and coal; fuel prices; and fuel surcharges.

We face competition from other transportation providers. We are subject to competition from motor carriers, railroads and, to a lesser extent, ships, barges, and pipelines, on the basis of transit time, pricing, and quality and reliability of service. While we have used primarily internal resources to build or acquire and maintain our rail system, trucks and barges have been able to use public rights-of-way maintained by public entities. Any future improvements, expenditures, legislation, or regulation materially increasing the quality or reducing the cost of alternative modes of transportation in the regions in which we operate (such as granting materially greater latitude

K 11

for motor carriers with respect to size or weight limitations or adoption of autonomous commercial vehicles) could have a material adverse effect on our operations.

The operations of carriers with which we interchange may adversely affect our operations. Our ability to provide rail service to customers in the U.S. and Canada depends in large part upon our ability to maintain collaborative relationships with connecting carriers (including shortlines and regional railroads) with respect to, among other matters, freight rates, revenue division, car supply and locomotive availability, data exchange and communications, reciprocal switching, interchange, and trackage rights. Deterioration in the operations of or service provided by connecting carriers, or in our relationship with those connecting carriers, could result in our inability to meet our customers’ demands or require us to use alternate train routes, which could result in significant additional costs and network inefficiencies. Additionally, any significant consolidations, mergers or operational changes among other railroads may significantly redefine our market access and reach.

We rely on technology and technology improvements in our business operations. If we experience significant disruption or failure of one or more of our information technology systems, including computer hardware, software, and communications equipment, we could experience a service interruption, a security breach, or other operational difficulties. We also face cybersecurity threats which may result in breaches of systems, or compromises of sensitive data, which may result in an inability to access or operate systems necessary for conducting operations and providing customer service, thereby impacting our efficiency and/or damaging our corporate reputation. Additionally, if we do not have sufficient capital to acquire new technology or we are unable to implement new technology, we may suffer a competitive disadvantage within the rail industry and with companies providing other modes of transportation service.

The vast majority of our employees belong to labor unions, and labor agreements, strikes, or work stoppages could adversely affect our operations. Approximately 80% of our railroad employees are covered by collective bargaining agreements with various labor unions. If unionized workers were to engage in a strike, work stoppage, or other slowdown, we could experience a significant disruption of our operations. Additionally, future national labor agreements, or renegotiation of labor agreements or provisions of labor agreements, could significantly increase our costs for health care, wages, and other benefits.

We may be subject to various claims and lawsuits that could result in significant expenditures. The nature of our business exposes us to the potential for various claims and litigation related to labor and employment, personal injury, commercial disputes, freight loss and other property damage, and other matters. Job-related personal injury and occupational claims are subject to the Federal Employer’s Liability Act (FELA), which is applicable only to railroads. FELA’s fault-based tort system produces results that are unpredictable and inconsistent as compared with a no-fault worker’s compensation system. The variability inherent in this system could result in actual costs being different from the liability recorded.

Any material changes to current litigation trends or a catastrophic rail accident involving any or all of freight loss property damage, personal injury, and environmental liability could have a material adverse effect on us to the extent not covered by insurance. We have obtained insurance for potential losses for third-party liability and first-party property damages; however, insurance is available from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to us.

Severe weather could result in significant business interruptions and expenditures. Severe weather conditions and other natural phenomena, including hurricanes, floods, fires, and earthquakes, may cause significant business interruptions and result in increased costs, increased liabilities, and decreased revenues.

We may be affected by terrorism or war. Any terrorist attack, or other similar event, any government response thereto, and war or risk of war could cause significant business interruption. Because we play a critical role in the nation’s transportation system, we could become the target of such an attack or have a significant role in the government’s preemptive approach or response to an attack or war.

K 12

Although we currently maintain insurance coverage for third-party liability arising out of war and acts of terrorism, we maintain only limited insurance coverage for first-party property damage and damage to property in our care, custody, or control caused by certain acts of terrorism. In addition, premiums for some or all of our current insurance programs covering these losses could increase dramatically, or insurance coverage for certain losses could be unavailable to us in the future.

We may be affected by supply constraints resulting from disruptions in the fuel markets or the nature of some of our supplier markets. We consumed approximately 458 million gallons of diesel fuel in 2017. Fuel availability could be affected by any limitation in the fuel supply or by any imposition of mandatory allocation or rationing regulations. A severe fuel supply shortage arising from production curtailments, increased demand in existing or emerging foreign markets, disruption of oil imports, disruption of domestic refinery production, damage

to refinery or pipeline infrastructure, political unrest, war or other factors could impact us as well as our customers and other transportation companies.

Due to the capital intensive nature, as well as the industry-specific requirements of the rail industry, high barriers of entry exist for potential new suppliers of core railroad items, such as locomotives and rolling stock equipment. Additionally, we compete with other industries for available capacity and raw materials used in the production of locomotives and certain track and rolling stock materials. Changes in the competitive landscapes of these limited supplier markets could result in increased prices or significant shortages of materials.

The state of capital markets could adversely affect our liquidity. We rely on the capital markets to provide some of our capital requirements, including the issuance of debt instruments, as well as the sale of certain receivables. Significant instability or disruptions of the capital markets, including the credit markets, or deterioration of our financial condition due to internal or external factors could restrict or eliminate our access to, and/or significantly increase the cost of, various financing sources, including bank credit facilities and issuance of corporate bonds. Instability or disruptions of the capital markets and deterioration of our financial condition, alone or in combination, could also result in a reduction in our credit rating to below investment grade, which could prohibit or restrict us from accessing external sources of short- and long-term debt financing and/or significantly increase the associated costs.

Item 1B. Unresolved Staff Comments

None.

Item 3. Legal Proceedings

In 2007, various antitrust class actions filed against us and other Class I railroads in various Federal district courts regarding fuel surcharges were consolidated in the District of Columbia by the Judicial Panel on Multidistrict Litigation. In 2012, the court certified the case as a class action. The defendant railroads appealed this certification, and the Court of Appeals for the District of Columbia vacated the District Court’s decision and remanded the case for further consideration. On October 10, 2017, the District Court denied class certification; the findings are subject to appeal. We believe the allegations in the complaints are without merit and intend to vigorously defend the cases. We do not believe the outcome of these proceedings will have a material effect on our financial position, results of operations, or liquidity.

Item 4. Mine Safety Disclosures

Not applicable.

K 13

Executive Officers of the Registrant

Our executive officers generally are elected and designated annually by the Board of Directors at its first meeting held after the annual meeting of stockholders, and they hold office until their successors are elected. Executive officers also may be elected and designated throughout the year as the Board of Directors considers appropriate. There are no family relationships among our officers, nor any arrangement or understanding between any officer and any other person pursuant to which the officer was selected. The following table sets forth certain information, at February 1, 2018, relating to our officers.

Name, Age, Present Position | Business Experience During Past Five Years |

James A. Squires, 56, Chairman, President and Chief Executive Officer | Present position since October 1, 2015. Served as CEO since June 1, 2015. Served as President since June 1, 2013. Served as Executive Vice President – Administration from August 1, 2012 to June 1, 2013. Served as Executive Vice President – Finance and Chief Financial Officer from July 1, 2007 to August 1, 2012. |

Cynthia C. Earhart, 56, Executive Vice President – Finance and Chief Financial Officer | Present position since August 15, 2017. Served as Executive Vice President - Administration and Chief Information Officer from October 1, 2015 to August 15, 2017. Served as Executive Vice President - Administration from June 1, 2013 to October 1, 2015. Served as Vice President Human Resources from March 1, 2007 to June 1, 2013. |

William A. Galanko, 61, Executive Vice President – Law and Administration | Present position since October 1, 2017. Served as Senior Vice President - Law and Corporate Communications from December 1, 2016 to October 1, 2017. Served as Vice President Law from April 1, 2006 to December 1, 2016. |

Alan H. Shaw, 50, Executive Vice President and Chief Marketing Officer | Present position since May 16, 2015. Served as Vice President Intermodal Operations from November 1, 2013 to May 16, 2015. Served as Group Vice President Industrial Products from November 16, 2009 to November 1, 2013. |

Michael J. Wheeler, 55, Executive Vice President and Chief Operating Officer | Present position since February 1, 2016. Served as Senior Vice President Operations from October 1, 2015 to February 1, 2016. Served as Vice President Engineering from November 1, 2012 to October 1, 2015. Served as Vice President Transportation from February 1, 2009 to November 1, 2012. |

Thomas E. Hurlbut, 53, Vice President and Controller | Present position since November 1, 2013. Served as Vice President Audit and Compliance from February 1, 2010 to November 1, 2013. |

K 14

PART II

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

STOCK PRICE AND DIVIDEND INFORMATION

Common Stock is owned by 25,737 stockholders of record as of December 31, 2017, and is traded on the New York Stock Exchange under the symbol “NSC.” The following table shows the high and low sales prices as reported by Bloomberg L.P. on its internet-based service and dividends per share, by quarter, for 2017 and 2016.

Quarter | |||||||||||||||

2017 | 1st | 2nd | 3rd | 4th | |||||||||||

Market Price | |||||||||||||||

High | $ | 123.77 | $ | 124.51 | $ | 133.04 | $ | 145.82 | |||||||

Low | 107.39 | 112.07 | 112.28 | 126.45 | |||||||||||

Dividends per share | 0.61 | 0.61 | 0.61 | 0.61 | |||||||||||

2016 | 1st | 2nd | 3rd | 4th | |||||||||||

Market Price | |||||||||||||||

High | $ | 85.37 | $ | 93.15 | $ | 96.83 | $ | 110.52 | |||||||

Low | 66.41 | 78.93 | 83.89 | 90.77 | |||||||||||

Dividends per share | 0.59 | 0.59 | 0.59 | 0.59 | |||||||||||

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares (or Units) Purchased(1) | Average Price Paid per Share (or Unit) | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs(2) | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that may yet be Purchased under the Plans or Programs(2) | |||||||||

October 1-31, 2017 | 776,328 | $ | 131.53 | 772,572 | 57,935,286 | ||||||||

November 1-30, 2017 | 786,387 | 129.44 | 785,106 | 57,150,180 | |||||||||

December 1-31, 2017 | 679,945 | 142.33 | 679,945 | 56,470,235 | |||||||||

Total | 2,242,660 | 2,237,623 | |||||||||||

(1) | Of this amount, 5,037 represents shares tendered by employees in connection with the exercise of stock options under the stockholder-approved Long-Term Incentive Plan. |

(2) | On September 26, 2017, our Board of Directors authorized the repurchase of up to an additional 50 million shares of Common Stock through December 31, 2022. As of December 31, 2017, 56.5 million shares remain authorized for repurchase. |

K 15

Item 6. Selected Financial Data

FIVE-YEAR FINANCIAL REVIEW

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

($ in millions, except per share amounts) | |||||||||||||||||||

RESULTS OF OPERATIONS | |||||||||||||||||||

Railway operating revenues | $ | 10,551 | $ | 9,888 | $ | 10,511 | $ | 11,624 | $ | 11,245 | |||||||||

Railway operating expenses | 6,965 | 6,814 | 7,627 | 8,049 | 7,988 | ||||||||||||||

Income from railway operations | 3,586 | 3,074 | 2,884 | 3,575 | 3,257 | ||||||||||||||

Other income – net | 92 | 71 | 103 | 104 | 233 | ||||||||||||||

Interest expense on debt | 550 | 563 | 545 | 545 | 525 | ||||||||||||||

Income before income taxes | 3,128 | 2,582 | 2,442 | 3,134 | 2,965 | ||||||||||||||

Income taxes | (2,276 | ) | 914 | 886 | 1,134 | 1,055 | |||||||||||||

Net income | $ | 5,404 | $ | 1,668 | $ | 1,556 | $ | 2,000 | $ | 1,910 | |||||||||

PER SHARE DATA | |||||||||||||||||||

Net income – basic | $ | 18.76 | $ | 5.66 | $ | 5.13 | $ | 6.44 | $ | 6.10 | |||||||||

– diluted | 18.61 | 5.62 | 5.10 | 6.39 | 6.04 | ||||||||||||||

Dividends | 2.44 | 2.36 | 2.36 | 2.22 | 2.04 | ||||||||||||||

Stockholders’ equity at year end | 57.57 | 42.73 | 40.93 | 40.26 | 36.55 | ||||||||||||||

FINANCIAL POSITION | |||||||||||||||||||

Total assets | $ | 35,711 | $ | 34,892 | $ | 34,139 | $ | 33,033 | $ | 32,259 | |||||||||

Total debt | 9,836 | 10,212 | 10,093 | 8,985 | 9,404 | ||||||||||||||

Stockholders’ equity | 16,359 | 12,409 | 12,188 | 12,408 | 11,289 | ||||||||||||||

OTHER | |||||||||||||||||||

Property additions | $ | 1,723 | $ | 1,887 | $ | 2,385 | $ | 2,118 | $ | 1,971 | |||||||||

Average number of shares outstanding (thousands) | 287,861 | 293,943 | 301,873 | 309,367 | 311,916 | ||||||||||||||

Number of stockholders at year end | 25,737 | 27,288 | 28,443 | 29,575 | 30,990 | ||||||||||||||

Average number of employees: | |||||||||||||||||||

Rail | 26,955 | 27,856 | 30,057 | 29,063 | 29,698 | ||||||||||||||

Nonrail | 155 | 188 | 399 | 419 | 405 | ||||||||||||||

Total | 27,110 | 28,044 | 30,456 | 29,482 | 30,103 | ||||||||||||||

Note: In 2017, as a result of the enactment of tax reform, “Railway operating expenses” includes a $151 million benefit and “Income taxes” includes a $3,331 million benefit, which added $3,482 million to “Net income” and $12.00 to “Diluted earnings per share.”

See accompanying consolidated financial statements and notes thereto.

K 16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Norfolk Southern Corporation and Subsidiaries

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and Notes.

OVERVIEW

We are one of the nation’s premier transportation companies. Our Norfolk Southern Railway Company subsidiary operates approximately 19,500 miles of road in 22 states and the District of Columbia, serves every major container port in the eastern United States, and provides efficient connections to other rail carriers. We operate the most extensive intermodal network in the East and are a major transporter of coal, automotive and industrial products.

Throughout 2017 we further pursued our strategic plan, focused on a balanced approach of growth, increasing efficiency, and delivering a strong customer service product. We achieved a record-setting railway operating ratio for the year (a measure of the amount of operating revenues consumed by operating expenses) and delivered approximately $150 million of productivity savings, the direct result of our commitment to achieving the targets set forth in our plan. Operational leverage allowed us to grow our business by providing a competitive service product to our customers while simultaneously driving productivity.

In 2018, we will continue to implement our balanced, dynamic strategic plan. We remain committed to consistently providing high levels of rail service and increasing the efficiency of our resources, thereby generating higher returns on capital and increasing shareholder value.

SUMMARIZED RESULTS OF OPERATIONS

2017 | 2016 | |||||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | ||||||||||||||

$ in millions, except per share amounts | % change | |||||||||||||||||

Income from railway operations | $ | 3,586 | $ | 3,074 | $ | 2,884 | 17 | % | 7 | % | ||||||||

Net income | $ | 5,404 | $ | 1,668 | $ | 1,556 | 224 | % | 7 | % | ||||||||

Diluted earnings per share | $ | 18.61 | $ | 5.62 | $ | 5.10 | 231 | % | 10 | % | ||||||||

Railway operating ratio | 66.0 | 68.9 | 72.6 | (4 | %) | (5 | %) | |||||||||||

On December 22, 2017, the Tax Cuts and Jobs Act (“tax reform”) was signed into law. For more information on the impact of tax reform, see Note 3. As a result of the enactment of this law, “Purchased services and rents” includes a $151 million benefit and “Income taxes” includes a $3,331 million benefit, which added $3,482 million to “Net income” and $12.00 to “Diluted earnings per share.” The operating ratio was favorably impacted by 1.4 percentage points.

The following table adjusts our GAAP financial results to exclude the effects of tax reform (specifically, the effects of remeasurement of net deferred tax liabilities related to the reduction of the federal tax rate from 35% to 21%). We use these non-GAAP financial measures internally and believe this information provides useful supplemental information to investors to facilitate making period-to-period comparisons by excluding the effects of tax reform. While we believe that these non-GAAP financial measures are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant to be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not be the same as similar measures presented by other companies.

K 17

Reconciliation of Non-GAAP Financial Measures

Reported results (GAAP) | Tax reform | Adjusted results (non-GAAP) | ||||||||||

$ in millions, except per share amounts | ||||||||||||

Income from railway operations | $ | 3,586 | $ | (151 | ) | $ | 3,435 | |||||

Net income | $ | 5,404 | $ | (3,482 | ) | $ | 1,922 | |||||

Diluted earnings per share | $ | 18.61 | $ | (12.00 | ) | $ | 6.61 | |||||

Railway operating ratio | 66.0 | 1.4 | 67.4 | |||||||||

In the table below and the paragraph following, references to 2017 results and related comparisons use the adjusted, non-GAAP results from the reconciliation in the table above.

Adjusted | Adjusted | |||||||||||||||||

2017 | 2017 vs. 2016 | 2016 | ||||||||||||||||

(non-GAAP) | 2016 | 2015 | (non-GAAP) | vs. 2015 | ||||||||||||||

$ in millions, except per share amounts | % change | |||||||||||||||||

Income from railway operations | $ | 3,435 | $ | 3,074 | $ | 2,884 | 12 | % | 7 | % | ||||||||

Net income | $ | 1,922 | $ | 1,668 | $ | 1,556 | 15 | % | 7 | % | ||||||||

Diluted earnings per share | $ | 6.61 | $ | 5.62 | $ | 5.10 | 18 | % | 10 | % | ||||||||

Railway operating ratio | 67.4 | 68.9 | 72.6 | (2 | %) | (5 | %) | |||||||||||

The increases in net income for both comparisons resulted from higher income from railway operations. For 2017, a 7% increase in revenues was partially offset by a 4% rise in adjusted operating expenses. For 2016, an 11% decline in operating expenses more than offset a 6% decrease in revenues. The higher percentage increases in diluted earnings per share compared with the percentage increases in net income for both years was largely the result of our share repurchase program.

K 18

DETAILED RESULTS OF OPERATIONS

Railway Operating Revenues

The following tables present a three-year comparison of revenues, volumes (units), and average revenue per unit by market group.

Revenues | 2017 | 2016 | ||||||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | ||||||||||||||||

$ in millions | % change | |||||||||||||||||||

Merchandise: | ||||||||||||||||||||

Chemicals | $ | 1,668 | $ | 1,648 | $ | 1,760 | 1 | % | (6 | %) | ||||||||||

Agr./consumer/gov’t. | 1,547 | 1,548 | 1,516 | — | 2 | % | ||||||||||||||

Metals/construction | 1,426 | 1,267 | 1,263 | 13 | % | — | ||||||||||||||

Automotive | 955 | 975 | 969 | (2 | %) | 1 | % | |||||||||||||

Paper/clay/forest | 761 | 744 | 771 | 2 | % | (4 | %) | |||||||||||||

Merchandise | 6,357 | 6,182 | 6,279 | 3 | % | (2 | %) | |||||||||||||

Intermodal | 2,452 | 2,218 | 2,409 | 11 | % | (8 | %) | |||||||||||||

Coal | 1,742 | 1,488 | 1,823 | 17 | % | (18 | %) | |||||||||||||

Total | $ | 10,551 | $ | 9,888 | $ | 10,511 | 7 | % | (6 | %) | ||||||||||

Units | 2017 | 2016 | |||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | |||||||||||||

in thousands | % change | ||||||||||||||||

Merchandise: | |||||||||||||||||

Chemicals | 467.2 | 475.7 | 527.6 | (2 | %) | (10 | %) | ||||||||||

Agr./consumer/gov’t. | 589.0 | 601.2 | 609.0 | (2 | %) | (1 | %) | ||||||||||

Metals/construction | 727.5 | 685.8 | 672.4 | 6 | % | 2 | % | ||||||||||

Automotive | 423.1 | 440.5 | 429.3 | (4 | %) | 3 | % | ||||||||||

Paper/clay/forest | 284.6 | 284.0 | 299.9 | — | (5 | %) | |||||||||||

Merchandise | 2,491.4 | 2,487.2 | 2,538.2 | — | (2 | %) | |||||||||||

Intermodal | 4,074.1 | 3,870.4 | 3,861.0 | 5 | % | — | |||||||||||

Coal | 1,046.0 | 902.1 | 1,079.7 | 16 | % | (16 | %) | ||||||||||

Total | 7,611.5 | 7,259.7 | 7,478.9 | 5 | % | (3 | %) | ||||||||||

Revenue per Unit | 2017 | 2016 | |||||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | |||||||||||||||

$ per unit | % change | ||||||||||||||||||

Merchandise: | |||||||||||||||||||

Chemicals | $ | 3,571 | $ | 3,465 | $ | 3,335 | 3 | % | 4 | % | |||||||||

Agr./consumer/gov’t. | 2,627 | 2,575 | 2,489 | 2 | % | 3 | % | ||||||||||||

Metals/construction | 1,960 | 1,847 | 1,879 | 6 | % | (2 | %) | ||||||||||||

Automotive | 2,257 | 2,213 | 2,258 | 2 | % | (2 | %) | ||||||||||||

Paper/clay/forest | 2,673 | 2,620 | 2,573 | 2 | % | 2 | % | ||||||||||||

Merchandise | 2,552 | 2,486 | 2,474 | 3 | % | — | |||||||||||||

Intermodal | 602 | 573 | 624 | 5 | % | (8 | %) | ||||||||||||

Coal | 1,665 | 1,650 | 1,688 | 1 | % | (2 | %) | ||||||||||||

Total | 1,386 | 1,362 | 1,405 | 2 | % | (3 | %) | ||||||||||||

K 19

Revenues increased $663 million in 2017, following a $623 million decline in 2016. As reflected in the table below, the rise in 2017 was largely the result of increased volume, particularly in our coal and intermodal markets, coupled with pricing gains. The decline in 2016 reflected lower revenue per unit, the effects of reduced fuel surcharges and changes in traffic mix, which more than offset price increases, as well as lower volume, primarily driven by reductions in energy-related markets and the restructuring of our Triple Crown Services (TCS) subsidiary.

Revenue Variance Analysis Increase (Decrease) | |||||||

2017 vs. 2016 | 2016 vs. 2015 | ||||||

$ in millions | |||||||

Revenue per unit | $ | 184 | $ | (315 | ) | ||

Volume (units) | 479 | (308 | ) | ||||

Total | $ | 663 | $ | (623 | ) | ||

Fuel surcharge revenues | $ | 123 | $ | (241 | ) | ||

Most of our contracts include negotiated fuel surcharges, typically tied to either West Texas Intermediate Crude Oil (WTI) or On-Highway Diesel (OHD). Approximately 90% of our revenue base is covered by these negotiated fuel surcharges, with about two-thirds tied to OHD. For both 2017 and 2016, contracts tied to OHD accounted for about 90% of our fuel surcharge revenue, as oil price levels were below most of our surcharge trigger points in contracts tied to WTI. Revenues associated with fuel surcharges totaled $359 million, $236 million, and $477 million in 2017, 2016, and 2015, respectively.

MERCHANDISE revenues increased in 2017, but decreased in 2016, compared with the years before. In 2017, the growth was a result of higher average revenue per unit, driven by pricing gains. Volume was relatively flat compared to the prior year, as gains in the metals and construction group were offset by declines in automotive, agriculture, and chemicals traffic. In 2016, the effects of lower volume were offset in part by a slight increase in average revenue per unit. Price increases were tempered by reduced fuel surcharge revenues and unfavorable changes in traffic mix.

For 2018, merchandise revenues are expected to increase, primarily the result of pricing gains and higher fuel surcharge revenues.

Chemicals revenues were modestly higher in 2017, following a decline in 2016. The increase in 2017 was due to higher average revenue per unit, a result of favorable mix and price improvements, which outweighed declines in volume. Both periods reflected fewer shipments of crude oil from the Bakken oil fields, and 2017 reflected lower shipments of coal ash; in both periods, these reductions were partially offset by more shipments of plastics. The 2016 volume decline also reflected lower chlor-alkali and rock salt traffic, the result of market consolidations and softened demand. The 2016 volume decrease was offset in part by higher average revenue per unit, due to favorable mix as increased volumes of higher-rated plastics more than offset reduced fuel surcharge revenues.

For 2018, chemicals revenues are anticipated to increase, as average revenue per unit is expected to be higher, the effect of favorable mix influenced by increased volumes of higher-rated plastics and organic chemicals, as well as, overall pricing gains. We expect carload declines of liquefied petroleum gas to be offset by gains in plastics, industrial chemicals, and crude oil.

One of our chemical customers, Sunbelt Chlor Alkali Partnerships (Sunbelt), filed in 2011 a rate reasonableness complaint before the STB alleging that our tariff rates for transportation of regulated movements are unreasonable. Since April 1, 2011, we have been billing and collecting amounts based on the challenged tariff rates. In 2014, the

K 20

STB resolved this rate reasonableness complaint in our favor and in June 2016, the STB resolved petitions for reconsideration. The matter remains decided in our favor; however, the findings are still subject to appeal. We believe the estimate of any reasonably possible loss will not have a material effect on our financial position, results of operations, or liquidity.

Agriculture, consumer products, and government revenues were flat in 2017 after rising in 2016. In 2017, lower traffic volume was offset by higher revenue per unit, driven by pricing gains. Volume declines in ethanol and soybeans, reflecting reduced market demand, more than offset increases in fertilizer. The improvement in 2016 was driven by higher average revenue per unit, primarily the result of pricing gains, offset in part by lower fuel surcharge revenues. Volumes decreased in 2016, driven by weaker demand for feed shipments and the effects of customer sourcing changes on corn volumes, offset in part by an increase in soybean export shipments and higher food oil volumes driven by service improvements.

For 2018, agriculture, consumer products, and government revenues are expected to increase, driven by more shipments of ethanol, corn and feed products, and by increased average revenue per unit, primarily a result of pricing gains.

Metals and construction revenues rose in both periods, reflecting higher traffic volume and, for 2017, higher average revenue per unit. In 2017, volume growth was a result of more frac sand shipments for use in natural gas drilling in the Marcellus and Utica regions and more iron and steel shipments driven by continued improvement in construction activity. These increases were partially offset by a decline in coil steel traffic due to customer sourcing changes. Revenue per unit growth in 2017 was driven by favorable changes in traffic mix. The volume increase in 2016 was driven by higher demand for aggregates and iron and steel shipments, and more coil steel traffic due to customer sourcing changes. These increases were offset in part by lower demand for materials used in natural gas and oil drilling as a result of depressed commodity prices. Average revenue per unit declined in 2016, driven by lower fuel surcharge revenues and changes in traffic mix.

For 2018, metals and construction revenues are expected to rise, primarily driven by increased revenue per unit, a result of pricing gains and positive mix. Traffic volume growth should result from the continued rise in frac sand shipments in addition to more shipments of steel related products.

Automotive revenues fell in 2017, but rose in 2016. The decline in 2017 was driven mainly by decreases in U.S. light vehicle production, as well as temporary shutdowns for retooling of several NS-served facilities. Average revenue per unit increased for the year, driven by pricing gains and higher fuel surcharge revenue. In 2016, volumes increased as a result of higher automotive parts shipments and growth in the production of U.S. light vehicles. Lower fuel surcharge revenues offset in part by pricing gains drove the decrease in average revenue per unit in 2016.

For 2018, automotive revenues are expected to increase as a result of higher revenue per unit driven by price increases and higher fuel surcharge, partially offset by volume declines due to reduced customer demand.

Paper, clay and forest products revenues rose in 2017 following a decline in 2016. The increase in 2017 was due to higher revenue per unit, a result of pricing gains and changes in the traffic mix. Traffic was flat for the year as increases in waste and pulp shipments were offset by continued losses in woodchip volume due to customer sourcing changes. The decline in 2016 reflected volume decreases in our pulpboard and woodchip markets due to customer sourcing changes, in addition to lower paper shipments as a result of decreased demand and further contraction of the paper market. Average revenue per unit increased in 2016 driven by pricing gains, offset in part by lower fuel surcharge revenues.

For 2018, paper, clay, and forest products revenues are anticipated to increase, reflecting pricing gains and increased volume, driven by growth in pulpboard as a result of tightening truck capacity, lumber due to more construction activity, and our miscellaneous waste markets. These increases may be partially offset by weaker export demand for kaolin shipments, and further contraction of the paper market.

K 21

INTERMODAL revenues increased in 2017, but declined in 2016, compared to the prior years. The 2017 increase resulted from higher traffic volume and higher average revenue per unit, driven by fuel surcharge revenue and pricing gains. The decline in 2016 was due to lower average revenue per unit that more than offset a small volume increase. Reduced fuel surcharge revenues and the effects of the TCS subsidiary restructuring (which together lowered average revenue per unit $57) offset the effects of price increases.

For 2018, we expect higher intermodal revenues due to increased average revenue per unit, driven by higher fuel surcharge revenues and rate increases, as well as, higher volumes.

Intermodal units by market were as follows:

2017 | 2016 | |||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | ||||||||||||

units in thousands | % change | |||||||||||||||

Domestic | 2,585.0 | 2,416.2 | 2,500.4 | 7 | % | (3 | %) | |||||||||

International | 1,489.1 | 1,454.2 | 1,360.6 | 2 | % | 7 | % | |||||||||

Total | 4,074.1 | 3,870.4 | 3,861.0 | 5 | % | — | ||||||||||

Total domestic volume increased in 2017, but decreased 2016, a result of the restructuring of our TCS subsidiary which decreased overall domestic volume. Domestic volumes in both years benefitted from continued highway conversions and growth from new and existing accounts.

For 2018, we expect higher domestic volumes driven by strong demand due to favorable economic conditions combined with continued highway conversions.

International volume increased in both years reflecting increased demand from existing customers and market share gains.

For 2018, we expect continued growth in our international volume largely driven by more traffic from both new and existing customers.

COAL revenues increased in 2017, but decreased in 2016, compared with the prior years. The increase in 2017 was a result of higher volume, primarily in the export market, and higher revenue per unit, driven by fuel surcharge revenue and pricing gains. The 2016 decline was a result of lower carload volumes across all markets and decreased average revenue per unit, primarily due to reduced fuel surcharge revenues that lowered average revenue per unit by $34 in 2016.

For 2018, coal revenues are expected to decline, driven by lower export and utility volumes, in addition to decreased revenue per unit, primarily the result of lower pricing in our export market.

K 22

As shown in the following table, tonnage increased in 2017, but decreased in 2016.

2017 | 2016 | ||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | |||||||||||

tons in thousands | % change | ||||||||||||||

Utility | 67,899 | 65,033 | 81,137 | 4 | % | (20 | %) | ||||||||

Export | 26,460 | 14,608 | 16,193 | 81 | % | (10 | %) | ||||||||

Domestic metallurgical | 15,675 | 13,884 | 14,450 | 13 | % | (4 | %) | ||||||||

Industrial | 5,545 | 6,152 | 8,201 | (10 | %) | (25 | %) | ||||||||

Total | 115,579 | 99,677 | 119,981 | 16 | % | (17 | %) | ||||||||

Utility coal tonnage increased in 2017, driven by market share gains. Both years were affected by limited coal burn due to milder weather and sustained lower natural gas prices. The decline in 2016 was additionally impacted by residual customer stockpile overhang.

For 2018, we expect utility tonnage to decrease, the result of continued pressure from natural gas prices and new renewable and natural gas capacity.

Export coal tonnage grew significantly in 2017 as continued tightening of international coal supply drove incremental production increases and higher demand for U.S. coal. In 2016, the decrease was a result of strong competition faced by U.S. coal suppliers as excess coal supply, weak seaborne coal prices, and a strong U.S. dollar reduced demand. Volume through Norfolk was up 5.5 million tons, or 57%, in 2017, following a drop of 1.7 million tons, or 15%, in 2016. Volume through Baltimore was up 6.4 million tons, or 129%, in 2017 and was up slightly in 2016.

For 2018, we expect export coal tonnage to decrease due to expected contraction of the elevated 2017 market.

Domestic metallurgical coal tonnage was up in 2017, but down in 2016. In 2017, the increase was a result of market share gains while the 2016 decline was largely driven by softness in the metallurgical market.

For 2018, domestic metallurgical coal tonnage is expected to remain relatively flat year-over-year.

Industrial coal tonnage decreased in both years, a result of plant outages, natural gas conversions and decreased coal burn.

For 2018, industrial coal tonnage is expected to increase driven by increased customer demand, but will continue to face pressure due to natural gas conversions and customer sourcing changes.

K 23

Railway Operating Expenses

Railway operating expenses summarized by major classifications were as follows:

2017 | 2016 | |||||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | ||||||||||||||

$ in millions | % change | |||||||||||||||||

Compensation and benefits | $ | 2,915 | $ | 2,743 | $ | 2,911 | 6 | % | (6 | %) | ||||||||

Purchased services and rents | 1,414 | 1,548 | 1,752 | (9 | %) | (12 | %) | |||||||||||

Fuel | 840 | 698 | 934 | 20 | % | (25 | %) | |||||||||||

Depreciation | 1,055 | 1,026 | 1,054 | 3 | % | (3 | %) | |||||||||||

Materials and other | 741 | 799 | 976 | (7 | %) | (18 | %) | |||||||||||

Total | $ | 6,965 | $ | 6,814 | $ | 7,627 | 2 | % | (11 | %) | ||||||||

In 2017, we experienced an overall increase in expense compared to the prior year, reflecting higher fuel expense, incentive compensation, inflationary increases, and volume-related costs, partially offset by improved productivity and increased equity in earnings of certain investees as a result of the enactment of tax reform. In 2016, expenses were lower across all categories driven largely from cost-control initiatives, lower fuel expense, the absence of restructuring costs incurred in 2015, and service improvements.

Compensation and benefits increased in 2017, reflecting changes in:

• | incentive and stock-based compensation (up $125 million) |

• | higher health and welfare benefit rates for agreement employees (up $62 million), |

• | pay rates (up $43 million), |

• | increased overtime (up $24 million), and |

• | employment levels (down $81 million). |

In 2016, compensation and benefits decreased, a result of changes in:

• | employment levels, including overtime and trainees (down $184 million), |

• | pension costs (down $38 million), |

• | payroll taxes (down $27 million), |

• | labor agreement payments in 2015 ($24 million), |

• | pay rates (up $34 million), |

• | health and welfare benefit costs for agreement employees (up $35 million), which reflected higher rates, offset in part by favorability from reduced headcount, and |

• | bonus accruals (up $59 million). |

Our employment averaged 27,110 in 2017, compared with 28,044 in 2016, and 30,456 in 2015.

K 24

Purchased services and rents includes the costs of services purchased from outside contractors, including the net costs of operating joint (or leased) facilities with other railroads and the net cost of equipment rentals. As previously discussed, this line item includes a $151 million benefit from the enactment of tax reform ($36 million in purchased services and $115 million in equipment rents) in the form of higher income of certain equity investees.

2017 | 2016 | |||||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | ||||||||||||||

$ in millions | % change | |||||||||||||||||

Purchased services | $ | 1,233 | $ | 1,242 | $ | 1,433 | (1 | %) | (13 | %) | ||||||||

Equipment rents | 181 | 306 | 319 | (41 | %) | (4 | %) | |||||||||||

Total | $ | 1,414 | $ | 1,548 | $ | 1,752 | (9 | %) | (12 | %) | ||||||||

The remaining increase in purchased services expense was a result of higher intermodal volume-related costs. The 2016 decrease reflected lower TCS operational costs, reduced repair and maintenance expenses, and decreased transportation activity costs, offset in part by higher intermodal volume-related costs.

Equipment rents, which includes our cost of using equipment (mostly freight cars) owned by other railroads or private owners less the rent paid to us for the use of our equipment, decreased in both 2017 and 2016. In 2017, in addition to the effects of tax reform, the decline was a result of lower automotive volume. In 2016, the decrease was largely from improved network velocity, partly offset by higher rates and conventional intermodal volumes.

Fuel expense, which includes the cost of locomotive fuel as well as other fuel used in railway operations, increased in 2017, but decreased in 2016. The change in both years was principally due to locomotive fuel prices (up 22% in 2017 and down 18% in 2016). Locomotive fuel consumption decreased 1% in 2017 despite an increase in volume of 5% and declined 5% in 2016 with a volume decrease of 3%, both the direct result of our strategic initiative to increase fuel efficiency. We consumed approximately 458 million gallons of diesel fuel in 2017, compared with 462 million gallons in 2016 and 487 million gallons in 2015.

Depreciation expense increased in 2017, but decreased in 2016. Both periods reflect growth in our roadway and equipment capital base as we continue to invest in our infrastructure and rolling stock. In 2016, the decrease was a result of the effects of $63 million in accelerated depreciation related to the TCS restructuring in 2015.

Materials and other expenses decreased in both periods as shown in the following table.

2017 | 2016 | |||||||||||||||||

2017 | 2016 | 2015 | vs. 2016 | vs. 2015 | ||||||||||||||

$ in millions | % change | |||||||||||||||||

Materials | $ | 348 | $ | 364 | $ | 469 | (4 | %) | (22 | %) | ||||||||

Casualties and other claims | 145 | 150 | 137 | (3 | %) | 9 | % | |||||||||||

Other | 248 | 285 | 370 | (13 | %) | (23 | %) | |||||||||||

Total | $ | 741 | $ | 799 | $ | 976 | (7 | %) | (18 | %) | ||||||||

Material usage declined in both periods, a result of lower freight car repairs associated with cost-control initiatives and improved asset utilization.

K 25

Casualties and other claims expenses include the estimates of costs related to personal injury, property damage, and environmental matters. The decrease in 2017 was the result of lower loss and damage, offset in part by unfavorable developments in personal injury cases. The increase in 2016 was primarily driven by higher derailment expenses.

Both declines in other expenses reflected more gains from the sale of operating properties (up $42 million in 2017 and $37 million in 2016). The 2016 decline was also driven by the absence of expenses that occurred in 2015 for relocating employees in connection with the closure of our Roanoke, Virginia office.

Income Taxes

Income taxes in 2017 includes a benefit of $3,331 million related to the effects of the enactment of tax reform from the reduction in our net deferred tax liabilities driven by the change in the federal rate. Our tax benefit on 2017 income resulted in an effective rate of negative 72.8%, which includes negative 106.5% related to tax reform, compared with 35.4% in 2016 and 36.3% in 2015. Both 2017 and 2016 benefited from favorable tax benefits associated with stock-based compensation and higher returns from corporate-owned life insurance. The 2016 and 2015 years also benefited from favorable reductions in deferred taxes for state tax law changes and certain business tax credits.

We expect our effective tax rate to approximate 24% on a go-forward basis. In addition, we expect cash paid for income taxes to be approximately 25% lower than 2017 levels, which is less than the percentage decline in the effective rate, as 2017 benefited from accelerated tax deductions related to our two debt exchanges (see Note 8).

FINANCIAL CONDITION, LIQUIDITY, AND CAPITAL RESOURCES

Cash provided by operating activities, our principal source of liquidity, was $3.3 billion in 2017, $3.0 billion in 2016, and $2.9 billion in 2015. The increases in both 2017 and 2016 were primarily the result of improved operating results. We had working capital deficits of $396 million and $48 million at December 31, 2017 and 2016, respectively. Cash and cash equivalents totaled $690 million and $956 million at December 31, 2017 and 2016, respectively. We expect cash on hand combined with cash provided by operating activities will be sufficient to meet our ongoing obligations.

Contractual obligations at December 31, 2017, were comprised of long-term debt, interest on fixed-rate long-term debt (Note 8), unconditional purchase obligations (Note 16), operating leases (Note 9), agreements with Consolidated Rail Corporation (CRC) and long-term advances from Conrail (Note 5), and unrecognized tax benefits (Note 3):

Total | 2018 | 2019 - 2020 | 2021 - 2022 | 2023 and Subsequent | Other | ||||||||||||||||||

$ in millions | |||||||||||||||||||||||

Long-term debt principal | $ | 10,584 | $ | 600 | $ | 899 | $ | 1,184 | $ | 7,901 | $ | — | |||||||||||

Interest on fixed-rate long-term debt | 10,105 | 493 | 884 | 782 | 7,946 | — | |||||||||||||||||

Unconditional purchase obligations | 1,050 | 438 | 315 | 297 | — | — | |||||||||||||||||

Operating leases | 660 | 69 | 126 | 106 | 359 | — | |||||||||||||||||

Agreements with CRC | 281 | 38 | 76 | 76 | 91 | — | |||||||||||||||||

Long-term advances from Conrail | 280 | — | — | — | 280 | — | |||||||||||||||||

Unrecognized tax benefits* | 17 | — | — | — | — | 17 | |||||||||||||||||

Total | $ | 22,977 | $ | 1,638 | $ | 2,300 | $ | 2,445 | $ | 16,577 | $ | 17 | |||||||||||

* This amount is shown in the Other column because the year of settlement cannot be reasonably estimated.

K 26