Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended DECEMBER 31, 2016

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the transition period from ___________ to___________

Commission file number 1-8339

NORFOLK SOUTHERN CORPORATION

(Exact name of registrant as specified in its charter)

Virginia (State or other jurisdiction of incorporation) | 52-1188014 (IRS Employer Identification No.) | |

Three Commercial Place Norfolk, Virginia (Address of principal executive offices) | 23510-2191 Zip Code | |

Registrant’s telephone number, including area code: | (757) 629-2680 | |

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each Class | Name of each exchange on which registered | |

Norfolk Southern Corporation | ||

Common Stock (Par Value $1.00) | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes (X) No ( )

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ( ) No (X)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes (X) No ( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes (X) No ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. (X)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer (X) Accelerated filer ( ) Non-accelerated filer ( ) Smaller reporting company ( )

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ( ) No (X)

The aggregate market value of the voting common equity held by non-affiliates at June 30, 2016, was $24,959,609,647 (based on the closing price as quoted on the New York Stock Exchange on that date).

The number of shares outstanding of each of the registrant’s classes of common stock, at January 31, 2017: 290,553,713 (excluding 20,320,777 shares held by the registrant’s consolidated subsidiaries).

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant’s definitive proxy statements to be filed electronically pursuant to Regulation 14A not later than 120 days after the end of the fiscal year, are incorporated herein by reference in Part III.

TABLE OF CONTENTS

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Page | |||

K 2

PART I

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Item 1. Business and Item 2. Properties

GENERAL – Our company, Norfolk Southern Corporation, is a Norfolk, Virginia based company that owns a major freight railroad, Norfolk Southern Railway Company (NSR). We were incorporated on July 23, 1980, under the laws of the Commonwealth of Virginia. Our common stock (Common Stock) is listed on the New York Stock Exchange (NYSE) under the symbol “NSC.”

Unless indicated otherwise, Norfolk Southern Corporation and its subsidiaries, including NSR, are referred to collectively as NS, we, us, and our.

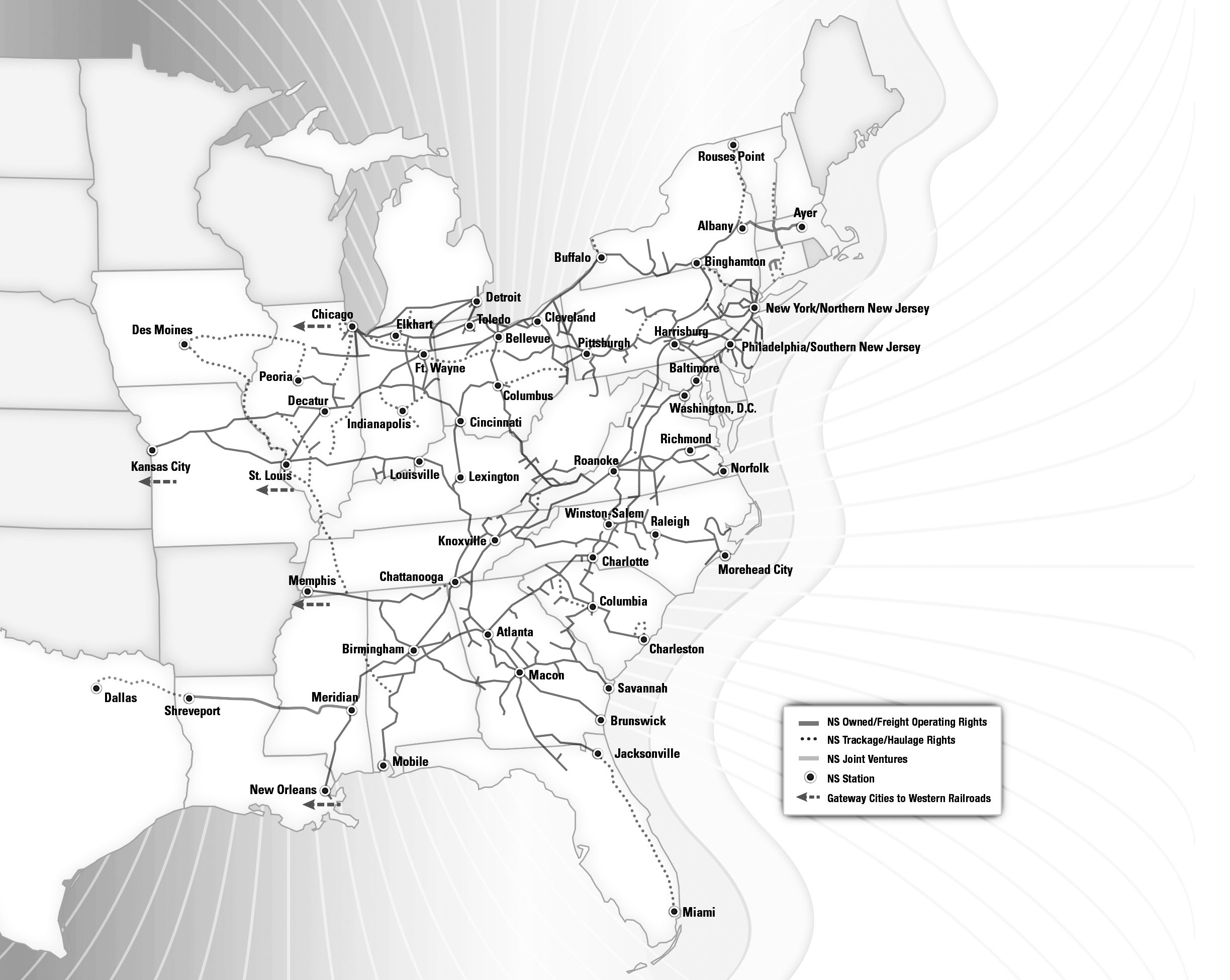

We are primarily engaged in the rail transportation of raw materials, intermediate products, and finished goods primarily in the Southeast, East, and Midwest and, via interchange with rail carriers, to and from the rest of the United States. We also transport overseas freight through several Atlantic and Gulf Coast ports. We offer the most extensive intermodal network in the eastern half of the United States.

We make available free of charge through our website, www.nscorp.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the U.S. Securities and Exchange Commission (SEC). In addition, the following documents are available on our website and in print to any shareholder who requests them:

• | Corporate Governance Guidelines |

• | Charters of the Committees of the Board of Directors |

• | The Thoroughbred Code of Ethics |

• | Code of Ethical Conduct for Senior Financial Officers |

• | Categorical Independence Standards for Directors |

• | Norfolk Southern Corporation Bylaws |

K 3

RAILROAD OPERATIONS – At December 31, 2016, our railroad operated approximately 19,500 miles of road in 22 states and the District of Columbia.

Our system reaches many manufacturing plants, electric generating facilities, mines, distribution centers, transload facilities, and other businesses located in our service area.

Corridors with heaviest freight volume:

• | New York City area to Chicago (via Allentown and Pittsburgh) |

• | Chicago to Macon (via Cincinnati, Chattanooga, and Atlanta) |

• | Central Ohio to Norfolk (via Columbus and Roanoke) |

• | Cleveland to Kansas City |

• | Birmingham to Meridian |

• | Memphis to Chattanooga |

K 4

The miles operated, which include major leased lines between Cincinnati, Ohio, and Chattanooga, Tennessee, and an exclusive operating agreement for trackage rights over property owned by North Carolina Railroad Company, were as follows:

Mileage Operated at December 31, 2016 | ||||||||||||||

Miles of Road | Second and Other Main Track | Passing Track, Crossovers and Turnouts | Way and Yard Switching | Total | ||||||||||

Owned | 14,713 | 2,735 | 1,950 | 8,311 | 27,709 | |||||||||

Operated under lease, contract or trackage | ||||||||||||||

rights | 4,756 | 1,916 | 398 | 836 | 7,906 | |||||||||

Total | 19,469 | 4,651 | 2,348 | 9,147 | 35,615 | |||||||||

The following table sets forth certain statistics relating to our railroads’ operations for the past five years:

Years ended December 31, | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Revenue ton miles (billions) | 191 | 200 | 205 | 194 | 186 | ||||||||||||||

Revenue per thousand revenue ton miles | $ | 51.91 | $ | 52.63 | $ | 56.70 | $ | 58.10 | $ | 59.47 | |||||||||

Revenue ton miles (thousands) per employee | 6,838 | 6,645 | 7,054 | 6,517 | 6,078 | ||||||||||||||

Ratio of railway operating expenses to railway operating | |||||||||||||||||||

revenues | 68.9% | 72.6% | 69.2% | 71.0% | 71.7% | ||||||||||||||

RAILWAY OPERATING REVENUES – Total railway operating revenues were $9.9 billion in 2016. Following is an overview of our three major market groups. See the discussion of merchandise revenues by commodity group, intermodal revenues, and coal revenues and tonnage in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

MERCHANDISE – Our merchandise market group is composed of five major commodity groupings:

• | Chemicals includes sulfur and related chemicals, petroleum products (including crude oil), chlorine and bleaching compounds, plastics, rubber, industrial chemicals, and chemical wastes. |

• | Agriculture, consumer products, and government includes soybeans, wheat, corn, fertilizer, livestock and poultry feed, food oils, flour, beverages, canned goods, sweeteners, consumer products, ethanol, transportation equipment, and items for the U.S. military. |

• | Metals and construction includes steel, aluminum products, machinery, scrap metals, cement, aggregates, sand, and minerals. |

• | Automotive includes finished vehicles for BMW, FCA, Ford, General Motors, Honda, Hyundai, Mercedes-Benz, Mitsubishi, Subaru, Toyota, and Volkswagen, and auto parts for BMW, FCA, Ford, General Motors, Honda, Hyundai, Mercedes-Benz, Nissan, Tesla, and Toyota. |

• | Paper, clay and forest products includes lumber and wood products, pulp board and paper products, wood fibers, wood pulp, scrap paper, and clay. |

Merchandise carloads handled in 2016 were 2.5 million, the revenues from which accounted for 63% of our total railway operating revenues.

K 5

INTERMODAL – Our intermodal market group consists of shipments moving in trailers, domestic and international containers, and RoadRailer® equipment. These shipments are handled on behalf of intermodal marketing companies, international steamship lines, truckers, and other shippers. Intermodal units handled in 2016 were 3.9 million, the revenues from which accounted for 22% of our total railway operating revenues.

COAL – Revenues from coal accounted for about 15% of our total railway operating revenues in 2016. We handled 100 million tons, or 0.9 million carloads, in 2016, most of which originated on our lines from major eastern coal basins, with the balance from major western coal basins received via the Memphis and Chicago gateways. Our coal franchise supports the electric generation market, serving approximately 78 coal generation plants, as well as the export, metallurgical and industrial markets, primarily through direct rail and river, lake, and coastal facilities, including various terminals on the Ohio River, Lamberts Point in Norfolk, Virginia, the Port of Baltimore, and Lake Erie.

FREIGHT RATES – Our predominant pricing mechanisms, private contracts and exempt price quotes, are not subject to regulation. In general, market forces are the primary determinant of rail service prices.

In 2016, our railroad was found by the U.S. Surface Transportation Board (STB), the regulatory board that has broad jurisdiction over railroad practices, to not be “revenue adequate” on an annual basis based on results for the year 2015. The STB has not made its revenue adequacy determination for the year 2016. A railroad is “revenue adequate” on an annual basis under the applicable law when its return on net investment exceeds the rail industry’s composite cost of capital. This determination is made pursuant to a statutory requirement.

PASSENGER OPERATIONS – Amtrak operates regularly scheduled passenger trains on our lines between the following locations:

• | Alexandria and Lynchburg, Virginia |

• | Alexandria, Virginia and New Orleans, Louisiana |

• | Alexandria and Orange, Virginia |

• | Petersburg and Norfolk, Virginia |

• | Raleigh and Charlotte, North Carolina |

• | Selma and Charlotte, North Carolina |

• | Chicago, Illinois, and Porter, Indiana |

• | Chicago, Illinois, and Cleveland, Ohio |

• | Chicago, Illinois, and Pittsburgh, Pennsylvania |

• | Pittsburgh and Harrisburg, Pennsylvania |

A consortium of two transportation commissions of the Commonwealth of Virginia operate commuter trains on our line between Manassas and Alexandria.

We lease the Chicago to Manhattan, Illinois, line to the Commuter Rail Division of the Regional Transportation Authority of Northeast Illinois (METRA).

We operate freight service over lines with significant ongoing Amtrak and commuter passenger operations, and conduct freight operations over trackage owned or leased by:

• | Amtrak |

• | New Jersey Transit |

• | Southeastern Pennsylvania Transportation Authority |

• | Metro-North Commuter Railroad Company |

• | Maryland Department of Transportation |

• | Michigan Department of Transportation |

Amtrak and various commuter agencies conduct passenger operations over trackage owned by Conrail Inc. (Conrail) in the Shared Assets Areas (Note 5 to the Consolidated Financial Statements).

K 6

NONCARRIER OPERATIONS – Our noncarrier subsidiaries engage principally in the leasing or sale of rail property and equipment; the development of commercial real estate; telecommunications; and the acquisition, leasing, and management of coal, oil, gas and minerals. In 2016, no such noncarrier subsidiary or industry segment grouping of noncarrier subsidiaries met the requirements for a reportable business segment under relevant authoritative accounting guidance.

RAILWAY PROPERTY

Our railroad infrastructure makes us capital intensive with net property of approximately $30 billion on a historical cost basis.

Property Additions – Property additions for the past five years were as follows:

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

($ in millions) | |||||||||||||||||||

Road and other property | $ | 1,292 | $ | 1,514 | $ | 1,406 | $ | 1,421 | $ | 1,465 | |||||||||

Equipment | 595 | 658 | 712 | 550 | 776 | ||||||||||||||

Delaware & Hudson acquisition | — | 213 | — | — | — | ||||||||||||||

Total | $ | 1,887 | $ | 2,385 | $ | 2,118 | $ | 1,971 | $ | 2,241 | |||||||||

Our capital spending and replacement programs are and have been designed to assure the ability to provide safe, efficient, and reliable rail transportation services. For 2017, we have budgeted $1.9 billion of property additions. See further discussion of our planned capital spending and replacement programs in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” under the subheading “Financial Condition, Liquidity, and Capital Resources.”

K 7

Equipment – At December 31, 2016, we owned or leased the following units of equipment:

Owned | Leased | Total | Capacity of Equipment | ||||||||

Locomotives: | (Horsepower) | ||||||||||

Multiple purpose | 4,041 | — | 4,041 | 15,215,400 | |||||||

Auxiliary units | 172 | — | 172 | — | |||||||

Switching | 55 | — | 55 | 82,050 | |||||||

Total locomotives | 4,268 | — | 4,268 | 15,297,450 | |||||||

Freight cars: | (Tons) | ||||||||||

Gondola | 27,964 | 2,653 | 30,617 | 3,353,749 | |||||||

Hopper | 12,042 | — | 12,042 | 1,352,882 | |||||||

Covered hopper | 10,065 | 85 | 10,150 | 1,122,115 | |||||||

Box | 9,997 | 1,362 | 11,359 | 964,680 | |||||||

Flat | 1,900 | 1,485 | 3,385 | 325,861 | |||||||

Other | 1,718 | 12 | 1,730 | 80,050 | |||||||

Total freight cars | 63,686 | 5,597 | 69,283 | 7,199,337 | |||||||

Other: | |||||||||||

Chassis | 28,710 | — | 28,710 | ||||||||

Containers | 19,210 | 1,738 | 20,948 | ||||||||

Work equipment | 5,824 | 258 | 6,082 | ||||||||

Vehicles | 3,842 | — | 3,842 | ||||||||

Miscellaneous | 2,418 | 27 | 2,445 | ||||||||

Total other | 60,004 | 2,023 | 62,027 | ||||||||

K 8

The following table indicates the number and year built for locomotives and freight cars owned at December 31, 2016:

2016 | 2015 | 2014 | 2013 | 2012 | 2007- 2011 | 2002- 2006 | 2001 & Before | Total | ||||||||||||||||||

Locomotives: | ||||||||||||||||||||||||||

No. of units | 66 | 8 | 83 | 50 | 60 | 259 | 536 | 3,206 | 4,268 | |||||||||||||||||

% of fleet | 2 | % | 1 | % | 2 | % | 1 | % | 1 | % | 6 | % | 12 | % | 75 | % | 100 | % | ||||||||

Freight cars: | ||||||||||||||||||||||||||

No. of units | 776 | 2,093 | 900 | — | 2,017 | 8,109 | 468 | 49,323 | 63,686 | |||||||||||||||||

% of fleet | 1 | % | 3 | % | 1 | % | — | % | 3 | % | 13 | % | 1 | % | 78 | % | 100 | % | ||||||||

The following table shows the average age of our owned locomotive and freight car fleets at December 31, 2016, and information regarding 2016 retirements:

Locomotives | Freight Cars | ||

Average age – in service | 24.1 years | 28.6 years | |

Retirements | 130 units | 7,894 units | |

Average age – retired | 37.2 years | 37.3 years | |

Track Maintenance – Of the approximately 35,600 total miles of track on which we operate, we are responsible for maintaining approximately 28,500 miles, with the remainder being operated under trackage rights from other parties responsible for maintenance.

Over 83% of the main line trackage (including first, second, third, and branch main tracks, all excluding rail operated pursuant to trackage rights) has rail ranging from 131 to 155 pounds per yard with the standard installation currently at 136 pounds per yard. Approximately 43% of our lines, excluding rail operated pursuant to trackage rights, carried 20 million or more gross tons per track mile during 2016.

The following table summarizes several measurements regarding our track roadway additions and replacements during the past five years:

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||

Track miles of rail installed | 518 | 523 | 507 | 549 | 509 | |||||||||

Miles of track surfaced | 4,984 | 5,074 | 5,248 | 5,475 | 5,642 | |||||||||

New crossties installed (millions) | 2.3 | 2.4 | 2.7 | 2.5 | 2.6 | |||||||||

Traffic Control – Of the approximately 16,400 route miles we dispatch, about 11,300 miles are signalized, including 8,500 miles of centralized traffic control (CTC) and 2,800 miles of automatic block signals. Of the 8,500 miles of CTC, approximately 7,600 miles are controlled by data radio originating at 355 base station radio sites.

ENVIRONMENTAL MATTERS – Compliance with federal, state, and local laws and regulations relating to the protection of the environment is one of our principal goals. To date, such compliance has not had a material effect on our financial position, results of operations, liquidity, or competitive position. See “Personal Injury, Environmental, and Legal Liabilities” in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations;” and Note 16 to the Consolidated Financial Statements.

K 9

EMPLOYEES – The following table shows the average number of employees and the average cost per employee for wages and benefits:

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Average number of employees | 28,044 | 30,456 | 29,482 | 30,103 | 30,943 | ||||||||||||||

Average wage cost per employee | $ | 76,000 | $ | 77,000 | $ | 76,000 | $ | 72,000 | $ | 69,000 | |||||||||

Average benefit cost per employee | $ | 35,000 | $ | 32,000 | $ | 35,000 | $ | 40,000 | $ | 38,000 | |||||||||

Approximately 80% of our railroad employees are covered by collective bargaining agreements with various labor unions. See the discussion of “Labor Agreements” in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

GOVERNMENT REGULATION – In addition to environmental, safety, securities, and other regulations generally applicable to all business, our railroads are subject to regulation by the STB. The STB has jurisdiction to varying extents over rates, routes, customer access provisions, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers.

The relaxation of economic regulation of railroads, following the Staggers Rail Act of 1980, included exemption from STB regulation of the rates and most service terms for intermodal business (trailer-on-flat-car, container-on-flat-car), rail boxcar shipments, lumber, manufactured steel, automobiles, and certain bulk commodities such as sand, gravel, pulpwood, and wood chips for paper manufacturing. Further, all shipments that we have under contract are effectively removed from commercial regulation for the duration of the contract. Approximately 90% of our revenues comes from either exempt shipments or shipments moving under transportation contracts; the remainder comes from shipments moving under public tariff rates.

Efforts have been made over the past several years to increase federal economic regulation of the rail industry, and such efforts are expected to continue in 2017. The Staggers Rail Act of 1980 substantially balanced the interests of shippers and rail carriers, and encouraged and enabled rail carriers to innovate, invest in their infrastructure, and compete for business, thereby contributing to the economic health of the nation and to the revitalization of the industry. Accordingly, we will continue to oppose efforts to reimpose increased economic regulation.

Government regulations are discussed within Item 1A. “Risk Factors” and the safety and security of our railroads are discussed within the “Security of Operations” section contained herein.

COMPETITION – There is continuing strong competition among rail, water, and highway carriers. Price is usually only one factor of importance as shippers and receivers choose a transport mode and specific hauling company. Inventory carrying costs, service reliability, ease of handling, and the desire to avoid loss and damage during transit are also important considerations, especially for higher-valued finished goods, machinery, and consumer products. Even for raw materials, semi-finished goods, and work-in-progress, users are increasingly sensitive to transport arrangements that minimize problems at successive production stages.

Our primary rail competitor is CSX Corporation (CSX); both railroads operate throughout much of the same territory. Other railroads also operate in parts of the territory. We also compete with motor carriers, water carriers, and with shippers who have the additional options of handling their own goods in private carriage, sourcing products from different geographic areas, and using substitute products.

Certain marketing strategies to expand reach and shipping options among railroads and between railroads and motor carriers enable railroads to compete more effectively in specific markets.

SECURITY OF OPERATIONS – We continue to take measures to enhance the security of our rail system. Our comprehensive security plan is modeled on and was developed in conjunction with the security plan prepared by the

K 10

Association of American Railroads (AAR) post September 11, 2001. The AAR Security Plan defines four Alert Levels and details the actions and countermeasures that are being applied across the railroad industry as a terrorist threat increases or decreases. The Alert Level actions include countermeasures that will be applied in three general areas: (1) operations (including transportation, engineering, and mechanical); (2) information technology and communications; and, (3) railroad police. All of our Operations Division employees are advised by their supervisors or train dispatchers, as appropriate, of any change in Alert Level and any additional responsibilities they may incur due to such change.

Our plan also complies with U.S. Department of Transportation (DOT) security regulations pertaining to training and security plans with respect to the transportation of hazardous materials. As part of the plan, security awareness training is given to all railroad employees who directly affect hazardous material transportation safety, and is integrated into hazardous material training programs. Additionally, location-specific security plans are in place for certain metropolitan areas and each of the six port facilities we serve. With respect to the ports, each facility’s security plan has been approved by the applicable Captain of the Port and remains subject to inspection by the U.S. Coast Guard (USCG).

Additionally, we continue to engage in close and regular coordination with numerous federal and state agencies, including the U.S. Department of Homeland Security (DHS), the Transportation Security Administration, the Federal Bureau of Investigation, the Federal Railroad Administration (FRA), the USCG, U.S. Customs and Border Protection, and various state Homeland Security offices. Similarly, we follow guidance from DHS and DOT regarding rail corridors in High Threat Urban Areas (HTUA). Particular attention is aimed at reducing risk in HTUA by: (1) the establishment of secure storage areas for rail cars carrying toxic-by-inhalation (TIH) materials; (2) the expedited movement of trains transporting rail cars carrying TIH materials; (3) substantially reducing the number of unattended loaded tank cars carrying TIH materials; and (4) cooperation with federal, state, local, and tribal governments to identify those locations where security risks are the highest.

In 2016, through participation in the Transportation Community Awareness and Emergency Response (TRANSCAER) Program, we provided rail accident response training to approximately 5,573 emergency responders, such as local police and fire personnel. Our other training efforts throughout 2016 included participation in drills for local, state, and federal agencies. We also have ongoing programs to sponsor local emergency responders at the Security and Emergency Response Training Course conducted at the AAR Transportation Technology Center in Pueblo, Colorado.

Item 1A. Risk Factors

The risks set forth in the following risk factors could have a materially adverse effect on our financial condition, results of operations, or liquidity in a particular year or quarter, and could cause those results to differ materially from those expressed or implied in our forward-looking statements. The information set forth in this Item 1A. Risk Factors should be read in conjunction with the rest of the information included in this annual report, including Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8. “Financial Statements and Supplementary Data.”

Significant governmental legislation and regulation over commercial, operating and environmental matters could affect us, our customers, and the markets we serve. Congress can enact laws that could increase economic regulation of the industry. Railroads presently are subject to commercial regulation by the STB, which has jurisdiction to varying extents over rates, routes, customer access provisions, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers. Additional economic regulation of the rail industry by Congress or the STB, whether under new or existing laws, could have a significant negative impact on our ability to determine prices for rail services and on the efficiency of our operations. This potential material adverse effect could also result in reduced capital spending on our rail network or abandonment of lines.

K 11

Railroads are also subject to the enactment of laws by Congress and regulation by the DOT and the DHS (which regulate most aspects of our operations) related to safety and security. The Rail Safety Improvement Act of 2008 (RSIA), the Surface Transportation Extension Act of 2015, and the implementing regulations promulgated by the FRA require us and each other Class I railroad to implement an interoperable positive train control system (PTC) on certain of our respective lines by December 31, 2018.

Full implementation of PTC in compliance with RSIA will result in additional operating costs and capital expenditures, and PTC implementation may result in reduced operational efficiency and service levels, as well as increased compensation and benefits expenses, and increased claims and litigation costs.

Our operations are subject to extensive federal and state environmental laws and regulations concerning, among other things, emissions to the air; discharges to waterways or groundwater supplies; handling, storage, transportation, and disposal of waste and other materials; and the cleanup of hazardous material or petroleum releases. The risk of incurring environmental liability, for acts and omissions, past, present, and future, is inherent in the railroad business. This risk includes property owned by us, whether currently or in the past, that is or has been subject to a variety of uses, including our railroad operations and other industrial activity by past owners or our past and present tenants.

Environmental problems that are latent or undisclosed may exist on these properties, and we could incur environmental liabilities or costs, the amount and materiality of which cannot be estimated reliably at this time, with respect to one or more of these properties. Moreover, lawsuits and claims involving other unidentified environmental sites and matters are likely to arise from time to time.

Concern over climate change has led to significant federal, state, and international legislative and regulatory efforts to limit greenhouse gas (GHG) emissions. Restrictions, caps, taxes, or other controls on GHG emissions, including diesel exhaust, could significantly increase our operating costs, decrease the amount of traffic handled, and decrease the value of coal reserves we own.

In addition, legislation and regulation could negatively affect the markets we serve and our customers, including those related to GHGs. Even without legislation or regulation, government incentives and adverse publicity relating to GHGs could negatively affect the markets for certain of the commodities we carry and our customers that (1) use commodities that we carry to produce energy, including coal, (2) use significant amounts of energy in producing or delivering the commodities we carry, or (3) manufacture or produce goods that consume significant amounts of energy.

As a common carrier by rail, we must offer to transport hazardous materials, regardless of risk. Transportation of certain hazardous materials could create catastrophic losses in terms of personal injury and property (including environmental) damage, and compromise critical parts of our rail network. The cost of a catastrophic rail accident involving hazardous materials could exceed our insurance coverage. We have obtained insurance for potential losses for third-party liability and first-party property damages (see Note 16 to the Consolidated Financial Statements); however, insurance is available from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to us.

We may be affected by general economic conditions. Prolonged negative changes in domestic and global economic conditions could affect the producers and consumers of the commodities we carry. Economic conditions could also result in bankruptcies of one or more large customers.

Significant increases in demand for rail services could result in the unavailability of qualified personnel and locomotives. In addition, workforce demographics and training requirements, particularly for engineers and conductors, could have a negative impact on our ability to meet demand for rail service. Unpredicted increases in demand for rail services may exacerbate such risks.

K 12

We may be affected by energy prices. Volatility in energy prices could have a significant effect on a variety of items including, but not limited to: the economy; demand for transportation services; business related to the energy sector, including crude oil, natural gas, and coal; fuel prices; and fuel surcharges.

We face competition from other transportation providers. We are subject to competition from motor carriers, railroads and, to a lesser extent, ships, barges, and pipelines, on the basis of transit time, pricing, and quality and reliability of service. While we have used primarily internal resources to build or acquire and maintain our rail system, trucks and barges have been able to use public rights-of-way maintained by public entities. Any future improvements, expenditures, legislation, or regulation materially increasing the quality or reducing the cost of alternative modes of transportation in the regions in which we operate (such as granting materially greater latitude for motor carriers with respect to size or weight limitations or adoption of autonomous commercial vehicles) could have a material adverse effect on our operations.

The operations of carriers with which we interchange may adversely affect our operations. Our ability to provide rail service to customers in the U.S. and Canada depends in large part upon our ability to maintain collaborative relationships with connecting carriers (including shortlines and regional railroads) with respect to, among other matters, freight rates, revenue division, car supply and locomotive availability, data exchange and communications, reciprocal switching, interchange, and trackage rights. Deterioration in the operations of or service provided by connecting carriers, or in our relationship with those connecting carriers, could result in our inability to meet our customers’ demands or require us to use alternate train routes, which could result in significant additional costs and network inefficiencies. Additionally, any significant consolidations, mergers or operational changes among other railroads may significantly redefine our market access and reach.

We rely on technology and technology improvements in our business operations. If we experience significant disruption or failure of one or more of our information technology systems, including computer hardware, software, and communications equipment, we could experience a service interruption, a security breach, or other operational difficulties. Accordingly, we also face cybersecurity threats which may result in breaches of systems, or compromises of sensitive data, which may result in an inability to access or operate systems necessary for conducting operations and providing customer service, thereby impacting our efficiency and/or damaging our corporate reputation. Additionally, if we do not have sufficient capital to acquire new technology or we are unable to implement new technology, we may suffer a competitive disadvantage within the rail industry and with companies providing other modes of transportation service.

The vast majority of our employees belong to labor unions, and labor agreements, strikes, or work stoppages could adversely affect our operations. Approximately 80% of our railroad employees are covered by collective bargaining agreements with various labor unions. If unionized workers were to engage in a strike, work stoppage, or other slowdown, we could experience a significant disruption of our operations. Additionally, future national labor agreements, or renegotiation of labor agreements or provisions of labor agreements, could significantly increase our costs for healthcare, wages, and other benefits.

We may be subject to various claims and lawsuits that could result in significant expenditures. The nature of our business exposes us to the potential for various claims and litigation related to labor and employment, personal injury, commercial disputes, freight loss and other property damage, and other matters. Job-related personal injury and occupational claims are subject to the Federal Employer’s Liability Act (FELA), which is applicable only to railroads. FELA’s fault-based tort system produces results that are unpredictable and inconsistent as compared with a no-fault worker’s compensation system. The variability inherent in this system could result in actual costs being very different from the liability recorded.

Any material changes to current litigation trends or a catastrophic rail accident involving any or all of freight loss property damage, personal injury, and environmental liability could have a material adverse effect on us to the extent not covered by insurance. We have obtained insurance for potential losses for third-party liability and first-party property damages (see Note 16 to the Consolidated Financial Statements); however, insurance is available

K 13

from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to us.

Severe weather could result in significant business interruptions and expenditures. Severe weather conditions and other natural phenomena, including hurricanes, floods, fires, and earthquakes, may cause significant business interruptions and result in increased costs, increased liabilities, and decreased revenues.

We may be affected by terrorism or war. Any terrorist attack, or other similar event, any government response thereto, and war or risk of war could cause significant business interruption. Because we play a critical role in the nation’s transportation system, we could become the target of such an attack or have a significant role in the government’s preemptive approach or response to an attack or war.

Although we currently maintain insurance coverage for third-party liability arising out of war and acts of terrorism, we maintain only limited insurance coverage for first-party property damage and damage to property in our care, custody, or control caused by certain acts of terrorism. In addition, premiums for some or all of our current insurance programs covering these losses could increase dramatically, or insurance coverage for certain losses could be unavailable to us in the future.

We may be affected by supply constraints resulting from disruptions in the fuel markets or the nature of some of our supplier markets. We consumed approximately 462 million gallons of diesel fuel in 2016. Fuel availability could be affected by any limitation in the fuel supply or by any imposition of mandatory allocation or rationing regulations. A severe fuel supply shortage arising from production curtailments, increased demand in existing or emerging foreign markets, disruption of oil imports, disruption of domestic refinery production, damage

to refinery or pipeline infrastructure, political unrest, war or other factors could impact us as well as our customers and other transportation companies.

Due to the capital intensive nature, as well as the industry-specific requirements of the rail industry, high barriers of entry exist for potential new suppliers of core railroad items, such as locomotives and rolling stock equipment. Additionally, we compete with other industries for available capacity and raw materials used in the production of locomotives and certain track and rolling stock materials. Changes in the competitive landscapes of these limited supplier markets could result in increased prices or significant shortages of materials.

The state of capital markets could adversely affect our liquidity. From time-to-time we rely on the capital markets to provide some of our capital requirements, including the issuance of long-term debt instruments and commercial paper, as well as the sale of certain receivables. Significant instability or disruptions of the capital markets, including the credit markets, or deterioration of our financial condition due to internal or external factors could restrict or eliminate our access to, and/or significantly increase the cost of, various financing sources, including bank credit facilities and issuance of corporate bonds. Instability or disruptions of the capital markets and deterioration of our financial condition, alone or in combination, could also result in a reduction in our credit rating to below investment grade, which could prohibit or restrict us from accessing external sources of short- and long-term debt financing and/or significantly increase the associated costs.

Item 1B. Unresolved Staff Comments

None.

K 14

Item 3. Legal Proceedings

On November 6, 2007, various antitrust class actions filed against us and other Class I railroads in various Federal district courts regarding fuel surcharges were consolidated in the District of Columbia by the Judicial Panel on Multidistrict Litigation. On June 21, 2012, the court certified the case as a class action. The defendant railroads appealed this certification, and the Court of Appeals for the District of Columbia vacated the District Court’s decision and remanded the case for further consideration. We believe the allegations in the complaints are without merit and intend to vigorously defend the cases. We do not believe the outcome of these proceedings will have a material effect on our financial position, results of operations, or liquidity.

Item 4. Mine Safety Disclosures

Not applicable.

K 15

Executive Officers of the Registrant

Our executive officers generally are elected and designated annually by the Board of Directors at its first meeting held after the annual meeting of stockholders, and they hold office until their successors are elected. Executive officers also may be elected and designated throughout the year as the Board of Directors considers appropriate. There are no family relationships among our officers, nor any arrangement or understanding between any officer and any other person pursuant to which the officer was selected. The following table sets forth certain information, at February 1, 2017, relating to our officers.

Name, Age, Present Position | Business Experience During Past Five Years |

James A. Squires, 55, Chairman, President and Chief Executive Officer | Present position since October 1, 2015. Served as CEO since June 1, 2015. Served as President since June 1, 2013. Served as Executive Vice President – Administration from August 1, 2012 to June 1, 2013. Served as Executive Vice President – Finance and Chief Financial Officer from July 1, 2007 to August 1, 2012. |

Cynthia C. Earhart, 55, Executive Vice President – Administration and Chief Information Officer | Present position since October 1, 2015. Served as Executive Vice President - Administration since June 1, 2013. Served as Vice President Human Resources from March 1, 2007 to June 1, 2013. |

Alan H. Shaw, 49 Executive Vice President and Chief Marketing Officer | Present position since May 16, 2015. Served as Vice President Intermodal Operations from November 1, 2013 to May 15, 2015. Served as Group Vice President Industrial Products from November 16, 2009 to October 31, 2013. |

Marta R. Stewart, 59, Executive Vice President – Finance and Chief Financial Officer | Present position since November 1, 2013. Served as Vice President and Treasurer from April 1, 2009 to November 1, 2013. |

Michael J. Wheeler, 54, Executive Vice President and Chief Operating Officer | Present position since February 1, 2016. Served as Senior Vice President Operations October 1, 2015 to January 31, 2016. Served as Vice President Engineering November 1, 2012 to September 30, 2015. Served as Vice President Transportation February 1, 2009 to October 31, 2012. |

William A. Galanko, 60, Senior Vice President – Law and Corporate Communications | Present position since December 1, 2016. Served as Vice President Law from April 1, 2006 to November 30, 2016. |

Thomas E. Hurlbut, 52, Vice President and Controller | Present position since November 1, 2013. Served as Vice President Audit and Compliance from February 1, 2010 to November 1, 2013. |

K 16

PART II

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

STOCK PRICE AND DIVIDEND INFORMATION

Common Stock is owned by 27,288 stockholders of record as of December 31, 2016, and is traded on the New York Stock Exchange under the symbol “NSC.” The following table shows the high and low sales prices as reported by Bloomberg L.P. on its internet-based service and dividends per share, by quarter, for 2016 and 2015.

Quarter | |||||||||||||||

2016 | 1st | 2nd | 3rd | 4th | |||||||||||

Market Price | |||||||||||||||

High | $ | 85.37 | $ | 93.15 | $ | 96.83 | $ | 110.52 | |||||||

Low | 66.41 | 78.93 | 83.89 | 90.77 | |||||||||||

Dividends per share | 0.59 | 0.59 | 0.59 | 0.59 | |||||||||||

2015 | 1st | 2nd | 3rd | 4th | |||||||||||

Market Price | |||||||||||||||

High | $ | 111.63 | $ | 106.47 | $ | 88.03 | $ | 97.07 | |||||||

Low | 100.14 | 87.24 | 73.57 | 77.19 | |||||||||||

Dividends per share | 0.59 | 0.59 | 0.59 | 0.59 | |||||||||||

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares (or Units) Purchased(1) | Average Price Paid per Share (or Unit) | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs(2) | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that may yet be Purchased under the Plans or Programs(2) | |||||||||

October 1-31, 2016 | 680,891 | $ | 94.73 | 680,891 | 16,007,556 | ||||||||

November 1-30, 2016 | 680,714 | 100.05 | 677,148 | 15,330,408 | |||||||||

December 1-31, 2016 | 625,893 | 108.24 | 625,893 | 14,704,515 | |||||||||

Total | 1,987,498 | 1,983,932 | |||||||||||

(1) | Of this amount, 3,566 represents shares tendered by employees in connection with the exercise of stock options under the stockholder-approved Long-Term Incentive Plan. |

(2) | Our Board of Directors authorized a share repurchase program, pursuant to which up to 50 million shares of Common Stock through December 31, 2017. |

K 17

Item 6. Selected Financial Data

FIVE-YEAR FINANCIAL REVIEW

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

($ in millions, except per share amounts) | |||||||||||||||||||

RESULTS OF OPERATIONS | |||||||||||||||||||

Railway operating revenues | $ | 9,888 | $ | 10,511 | $ | 11,624 | $ | 11,245 | $ | 11,040 | |||||||||

Railway operating expenses | 6,814 | 7,627 | 8,049 | 7,988 | 7,916 | ||||||||||||||

Income from railway operations | 3,074 | 2,884 | 3,575 | 3,257 | 3,124 | ||||||||||||||

Other income – net | 71 | 103 | 104 | 233 | 129 | ||||||||||||||

Interest expense on debt | 563 | 545 | 545 | 525 | 495 | ||||||||||||||

Income before income taxes | 2,582 | 2,442 | 3,134 | 2,965 | 2,758 | ||||||||||||||

Provision for income taxes | 914 | 886 | 1,134 | 1,055 | 1,009 | ||||||||||||||

Net income | $ | 1,668 | $ | 1,556 | $ | 2,000 | $ | 1,910 | $ | 1,749 | |||||||||

PER SHARE DATA | |||||||||||||||||||

Net income – basic | $ | 5.66 | $ | 5.13 | $ | 6.44 | $ | 6.10 | $ | 5.42 | |||||||||

– diluted | 5.62 | 5.10 | 6.39 | 6.04 | 5.37 | ||||||||||||||

Dividends | 2.36 | 2.36 | 2.22 | 2.04 | 1.94 | ||||||||||||||

Stockholders’ equity at year end | 42.73 | 40.93 | 40.26 | 36.55 | 31.08 | ||||||||||||||

FINANCIAL POSITION | |||||||||||||||||||

Total assets | $ | 34,892 | $ | 34,139 | $ | 33,033 | $ | 32,259 | $ | 30,135 | |||||||||

Total debt | 10,212 | 10,093 | 8,985 | 9,404 | 8,642 | ||||||||||||||

Stockholders’ equity | 12,409 | 12,188 | 12,408 | 11,289 | 9,760 | ||||||||||||||

OTHER | |||||||||||||||||||

Property additions | $ | 1,887 | $ | 2,385 | $ | 2,118 | $ | 1,971 | $ | 2,241 | |||||||||

Average number of shares outstanding (thousands) | 293,943 | 301,873 | 309,367 | 311,916 | 320,864 | ||||||||||||||

Number of stockholders at year end | 27,288 | 28,443 | 29,575 | 30,990 | 32,347 | ||||||||||||||

Average number of employees: | |||||||||||||||||||

Rail | 27,856 | 30,057 | 29,063 | 29,698 | 30,543 | ||||||||||||||

Nonrail | 188 | 399 | 419 | 405 | 400 | ||||||||||||||

Total | 28,044 | 30,456 | 29,482 | 30,103 | 30,943 | ||||||||||||||

See accompanying consolidated financial statements and notes thereto.

K 18

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Norfolk Southern Corporation and Subsidiaries

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and Notes.

OVERVIEW

We are one of the nation’s premier transportation companies. Our Norfolk Southern Railway Company subsidiary operates approximately 19,500 miles of road in 22 states and the District of Columbia, serves every major container port in the eastern United States, and provides efficient connections to other rail carriers. We operate the most extensive intermodal network in the East and are a major transporter of coal, automotive and industrial products.

Our 2016 results reflect our progress and commitment to achieving the goals set forth in our strategic plan. Through a disciplined cost-control focus, we achieved a record-setting railway operating ratio (a measure of the amount of operating revenues consumed by operating expenses) of 68.9% and delivered approximately $250 million of productivity savings, despite the economic challenges that continue to affect our industry. Operational improvements allowed us to maintain near all-time best service levels and achieve high levels of network fluidity, which improved train performance and asset utilization. In addition to these improvements, the implementation of multiple cost-control initiatives drove savings in operating expenses across all categories.

In 2017, we expect to maintain high levels of service and see continued improvement in our operating ratio. Railway operating revenues are expected to increase, driven by volume growth in our coal and intermodal markets, in addition to higher average revenue per unit, a result of pricing gains and fuel surcharge revenue increases largely driven by higher expected fuel prices. Railway operating expenses are expected to increase next year, driven in large part by medical and wage inflation as well as volume-related expenses, offset in part by the continuation of targeted expense reductions as we balance resources with the demand for our high-quality rail service. We continue to focus on executing our strategic plan and remain committed to maintaining our strong levels of rail service, generating higher returns on capital, and increasing the efficiency of our resources.

SUMMARIZED RESULTS OF OPERATIONS

2016 | 2015 | |||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | ||||||||||||||

$ in millions, except per share amounts | % change | |||||||||||||||||

Income from railway operations | $ | 3,074 | $ | 2,884 | $ | 3,575 | 7 | % | (19 | %) | ||||||||

Net income | $ | 1,668 | $ | 1,556 | $ | 2,000 | 7 | % | (22 | %) | ||||||||

Diluted earnings per share | $ | 5.62 | $ | 5.10 | $ | 6.39 | 10 | % | (20 | %) | ||||||||

Railway operating ratio | 68.9 | 72.6 | 69.2 | (5 | %) | 5 | % | |||||||||||

The increase in net income for 2016, compared to 2015, was driven by higher income from railway operations, as railway operating expense decreases (down $813 million, or 11%) more than offset declines in railway operating revenues (down $623 million, or 6%). The decrease in net income for 2015, compared to 2014, reflected lower income from railway operations, driven by a sharp decline in railway operating revenues (down $1.1 billion, or 10%) offset in part by lower railway operating expenses (down $422 million, or 5%). The 2015 results include $93 million of costs associated with the restructuring of our Triple Crown Services (TCS) subsidiary and the closure of our Roanoke, Virginia corporate office, which reduced net income by $58 million, or $0.19 per diluted share.

K 19

DETAILED RESULTS OF OPERATIONS

Railway Operating Revenues

The following tables present a three-year comparison of revenues, volumes (units), and average revenue per unit by market group.

Revenues | 2016 | 2015 | |||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | |||||||||||||||

$ in millions | % change | ||||||||||||||||||

Merchandise: | |||||||||||||||||||

Chemicals | $ | 1,648 | $ | 1,760 | $ | 1,863 | (6 | %) | (6 | %) | |||||||||

Agr./consumer/gov’t. | 1,548 | 1,516 | 1,498 | 2 | % | 1 | % | ||||||||||||

Metals/construction | 1,267 | 1,263 | 1,521 | — | (17 | %) | |||||||||||||

Automotive | 975 | 969 | 1,004 | 1 | % | (3 | %) | ||||||||||||

Paper/clay/forest | 744 | 771 | 794 | (4 | %) | (3 | %) | ||||||||||||

Merchandise | 6,182 | 6,279 | 6,680 | (2 | %) | (6 | %) | ||||||||||||

Intermodal | 2,218 | 2,409 | 2,562 | (8 | %) | (6 | %) | ||||||||||||

Coal | 1,488 | 1,823 | 2,382 | (18 | %) | (23 | %) | ||||||||||||

Total | $ | 9,888 | $ | 10,511 | $ | 11,624 | (6 | %) | (10 | %) | |||||||||

Units | 2016 | 2015 | |||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | |||||||||||||

in thousands | % change | ||||||||||||||||

Merchandise: | |||||||||||||||||

Chemicals | 475.7 | 527.6 | 502.6 | (10 | %) | 5 | % | ||||||||||

Agr./consumer/gov’t. | 601.2 | 609.0 | 603.8 | (1 | %) | 1 | % | ||||||||||

Metals/construction | 685.8 | 672.4 | 725.6 | 2 | % | (7 | %) | ||||||||||

Automotive | 440.5 | 429.3 | 410.1 | 3 | % | 5 | % | ||||||||||

Paper/clay/forest | 284.0 | 299.9 | 303.2 | (5 | %) | (1 | %) | ||||||||||

Merchandise | 2,487.2 | 2,538.2 | 2,545.3 | (2 | %) | — | |||||||||||

Intermodal | 3,870.4 | 3,861.0 | 3,845.2 | — | — | ||||||||||||

Coal | 902.1 | 1,079.7 | 1,284.4 | (16 | %) | (16 | %) | ||||||||||

Total | 7,259.7 | 7,478.9 | 7,674.9 | (3 | %) | (3 | %) | ||||||||||

Revenue per Unit | 2016 | 2015 | ||||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | ||||||||||||||||

$ per unit | % change | |||||||||||||||||||

Merchandise: | ||||||||||||||||||||

Chemicals | $ | 3,465 | $ | 3,335 | $ | 3,707 | 4 | % | (10 | %) | ||||||||||

Agr./consumer/gov’t. | 2,575 | 2,489 | 2,481 | 3 | % | — | ||||||||||||||

Metals/construction | 1,847 | 1,879 | 2,096 | (2 | %) | (10 | %) | |||||||||||||

Automotive | 2,213 | 2,258 | 2,447 | (2 | %) | (8 | %) | |||||||||||||

Paper/clay/forest | 2,620 | 2,573 | 2,619 | 2 | % | (2 | %) | |||||||||||||

Merchandise | 2,486 | 2,474 | 2,624 | — | (6 | %) | ||||||||||||||

Intermodal | 573 | 624 | 666 | (8 | %) | (6 | %) | |||||||||||||

Coal | 1,650 | 1,688 | 1,855 | (2 | %) | (9 | %) | |||||||||||||

Total | 1,362 | 1,405 | 1,515 | (3 | %) | (7 | %) | |||||||||||||

K 20

Revenues decreased $623 million in 2016 and $1.1 billion in 2015. As reflected in the table below, both declines resulted from lower average revenue per unit and reduced volume. In 2016, the effects of reduced fuel surcharges and changes in traffic mix more than offset price increases. Volume decreases were primarily driven by reductions in energy-related markets and the restructuring of our TCS subsidiary. For 2015, a large drop in fuel surcharge revenues more than offset pricing gains to drive average revenue per unit lower. The volume decline was driven by continued weakness in the coal markets.

Revenue Variance Analysis (Decrease) | |||||||

2016 vs. 2015 | 2015 vs. 2014 | ||||||

$ in millions | |||||||

Revenue per unit | $ | (315 | ) | $ | (816 | ) | |

Volume (units) | (308 | ) | (297 | ) | |||

Total | $ | (623 | ) | $ | (1,113 | ) | |

Fuel surcharge revenues | $ | (241 | ) | $ | (852 | ) | |

Most of our contracts include negotiated fuel surcharges, typically tied to either West Texas Intermediate Crude Oil (WTI) or On-Highway Diesel (OHD). Approximately 90% of our revenue base is covered by these negotiated fuel surcharges, with more than half tied to OHD. For 2016, contracts tied to OHD accounted for about 90% of our fuel surcharge revenue, as price levels were below most of our surcharge trigger points in contracts tied to WTI. Revenues associated with fuel surcharges totaled $236 million, $477 million, and $1,329 million in 2016, 2015, and 2014, respectively.

MERCHANDISE revenues decreased for both 2016 and 2015, compared with the years before. In 2016, the effects of lower volume were offset in part by a slight increase in average revenue per unit. Price increases were tempered by reduced fuel surcharge revenues (which lowered average revenue per unit by $31) and unfavorable changes in traffic mix. The 2015 decline reflected lower average revenue per unit, the result of lower fuel surcharge revenues (which reduced average revenue per unit by $185) that offset the effects of higher rates. Volume was relatively flat in 2015 compared to 2014.

For 2017, merchandise revenues are expected to increase, primarily the result of pricing gains and higher fuel surcharge revenues.

Chemicals revenues were lower year-over-year in 2016 and 2015. The 2016 decline was due to lower traffic volume, reflecting fewer shipments of crude oil originated from the Bakken oil fields, in addition to lower chlor-alkali and rock salt traffic, the result of market consolidations and softened demand. These declines were offset in part by higher average revenue per unit due to favorable mix, as increased volumes of higher-rated plastics more than offset reduced fuel surcharge revenues.

In 2015, the decline was the result of lower average revenue per unit, driven by reduced fuel surcharge revenues and negative mix resulting from increased shipments of lower-rated liquefied petroleum gas, which more than offset the effect of higher rates. Volumes increased for the year, largely driven by liquefied petroleum gas volume gains as well as strong demand for shipments of polypropylene due to lower feedstock prices. These volume increases were partially offset by fewer shipments of crude oil from the Bakken oil fields.

For 2017, chemicals revenues are anticipated to increase, as average revenue per unit is expected to be higher, largely the effect of favorable mix, driven by increased volumes of higher-rated plastics, and pricing gains. However, we expect these gains to be mitigated by lower shipments of crude oil from the Bakken oil fields and liquefied petroleum gas in the Utica Shale region.

K 21

One of our chemical customers, Sunbelt Chlor Alkali Partnership (Sunbelt), filed a rate reasonableness complaint before the STB alleging that our tariff rates for transportation of regulated movements are unreasonable. Since April 1, 2011, we have been billing and collecting amounts based on the challenged tariff rates. In 2014, the STB resolved this rate reasonableness complaint in our favor. In June 2016, the STB resolved petitions for reconsideration. The matter remains decided in our favor; however, the findings are still subject to appeal. We believe the estimate of any reasonably possible loss will not have a material effect on our financial position, results of operations, or liquidity. With regard to rate cases, we record adjustments to revenues in the periods if and when such adjustments are probable and reasonably estimable.

Agriculture, consumer products, and government revenues increased for both years, compared with the years before. The improvement in 2016 was driven by higher average revenue per unit primarily the result of pricing gains, offset in part by lower fuel surcharge revenues. Volumes decreased for the year driven by weaker demand for feed shipments and the effects of customer sourcing changes on corn volumes, offset in part by an increase in soybean export shipments and higher food oil volumes driven by service improvements.

The increase in 2015 was the result of more ethanol shipments due to higher gasoline consumption, offset in part by lower fuel surcharge revenues and fewer revenue shipments of empty rail cars as part of the conclusion of a hopper re-body program.

For 2017, agriculture, consumer products, and government revenues are expected to increase, driven by more shipments of corn and feed products, and by increased average revenue per unit, primarily a result of pricing gains.

Metals and construction revenues were up slightly in 2016 after falling in 2015, compared with the prior years. The increase in 2016 was driven by higher demand for aggregates and iron and steel shipments, and more coil steel traffic due to customer sourcing changes. These increases were offset in part by lower demand for materials used in natural gas and oil drilling as a result of depressed commodity prices. Average revenue per unit declined for the year, driven by lower fuel surcharge revenues and changes in traffic mix.

In 2015, the decline was driven by a drop in average revenue per unit, largely the result of lower fuel surcharge revenues partially offset by pricing gains, and a decrease in carloads. The volume decline was the result of lower demand for materials used in the construction of pipe for drilling activity, fewer shipments of fractionating sand and ceramic proppant used in natural gas drilling, and declines in scrap metal and coil shipments, resulting from declines in steel production due to global over-supply. These decreases were offset in part by increased shipments of aggregates as a result of higher demand in the Southeast for project work and strong highway and construction related markets.

For 2017, metals and construction revenues are expected to increase, as average revenue per unit is expected to be higher, primarily due to changes in the mix of traffic. We also expect volumes to increase next year, driven by growth in steel related products, in addition to higher cement shipments driven by increased construction activity.

Automotive revenues rose in 2016 after falling in 2015, compared with the prior years. For 2016, volumes increased as a result of higher automotive parts shipments and growth in the production of North American light vehicles. Average revenue per unit declined for the year, driven by lower fuel surcharge revenues offset in part by pricing gains.

The decline in 2015 reflected a drop in average revenue per unit primarily due to lower fuel surcharge revenues, offset in part by pricing gains. Volumes increased for the year, driven by gains in production of North American light vehicles.

For 2017, automotive revenues are expected to decrease as a result of volume declines related to extended retooling at several NS-served assembly plants and expected decreases in U.S. vehicle production, offset in part by higher average revenue per unit driven by pricing gains and higher fuel surcharge revenues.

K 22

Paper, clay and forest products revenues were down in both 2016 and 2015, compared to the prior years. The decline in 2016 reflected volume decreases in our pulpboard and woodchip markets due to customer sourcing changes, in addition to lower paper shipments as a result of decreased demand and further contraction of the paper market. Average revenue per unit increased for the year driven by pricing gains, offset in part by lower fuel surcharge revenues.

In 2015, both average revenue per unit and volumes decreased. The decline in average revenue per unit was driven primarily by lower fuel surcharge revenues and negative mix (fewer higher-rated kaolin shipments) offset by pricing gains. Volume changes reflected lower waste, kaolin, woodchip, and graphic paper volumes as a result of customer sourcing changes, softened demand, and mill closures, offset by higher carloads of pulpboard, lumber, and pulp due to continued recovery of the housing market.

For 2017, paper, clay, and forest products revenues are anticipated to increase, as we expect average revenue per unit to be higher, largely due to pricing gains. Additionally, we expect volume to increase next year, driven by growth in our miscellaneous waste and lumber markets as a result of higher construction activity, and increased pulp volumes driven by growth in consumer demand. These volume increases will be partially offset by lower pulpboard shipments due to customer sourcing changes, weaker export demand for kaolin shipments, and further contraction of the paper market.

INTERMODAL revenues decreased in both years, a result of lower average revenue per unit that more than offset small volume increases. In 2016, reduced fuel surcharge revenues and the effects of the TCS subsidiary restructuring (which together lowered average revenue per unit $57) offset the effects of price increases. Volume was up slightly for the year as growth in our domestic and international business offset the losses from the restructuring of our TCS subsidiary. In 2015, lower average revenue per unit was the result of lower fuel surcharges (which decreased average revenue per unit by $51). Volume gains in international shipments were almost fully offset by declines in domestic shipments.

For 2017, we expect higher intermodal revenues due to increased volumes and average revenue per unit, primarily driven by higher fuel surcharge revenues and pricing gains.

Intermodal units by market were as follows:

2016 | 2015 | ||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | |||||||||||||

units in thousands | % change | ||||||||||||||||

Domestic (excluding Triple Crown) | 2,348.7 | 2,250.4 | 2,277.7 | 4 | % | (1 | %) | ||||||||||

Triple Crown | 67.5 | 250.0 | 288.5 | (73 | %) | (13 | %) | ||||||||||

Total Domestic | 2,416.2 | 2,500.4 | 2,566.2 | (3 | %) | (3 | %) | ||||||||||

International | 1,454.2 | 1,360.6 | 1,279.0 | 7 | % | 6 | % | ||||||||||

Total | 3,870.4 | 3,861.0 | 3,845.2 | — | — | ||||||||||||

K 23

Total domestic volume decreased in both years, driven by the restructuring of our TCS subsidiary. In 2016, domestic volumes excluding TCS increased due to growth from new and existing accounts that exceeded the negative effects of increased trucking capacity. In 2015, volumes were also affected by ongoing service challenges during the first three quarters of the year, an increase in available trucking capacity, and weaker overall demand, all partially offset by growth from continued highway conversions.

For 2017, we expect higher domestic volumes driven from continued highway conversions and growth associated with new and existing customers.

International volume increased in both years reflecting increased demand from existing customers and market share gains.

For 2017, we expect continued growth in our international volume largely driven by more traffic from both new and existing customers.

COAL revenues decreased in each of 2016 and 2015, compared with the prior years. Both declines reflected lower carload volumes and decreased average revenue per unit, primarily due to reduced fuel surcharge revenues, which lowered average revenue per unit by $34 in 2016 and $134 in 2015.

For 2017, coal revenues are expected to increase driven largely by higher utility and export volumes, in addition to an improved average revenue per unit, primarily the result of pricing gains in our export market and higher fuel surcharges.

As shown in the following table, tonnage decreased in all markets both years.

2016 | 2015 | ||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | |||||||||||

tons in thousands | % change | ||||||||||||||

Utility | 65,033 | 81,137 | 93,884 | (20 | %) | (14 | %) | ||||||||

Export | 14,608 | 16,193 | 23,218 | (10 | %) | (30 | %) | ||||||||

Domestic metallurgical | 13,884 | 14,450 | 16,130 | (4 | %) | (10 | %) | ||||||||

Industrial | 6,152 | 8,201 | 8,599 | (25 | %) | (5 | %) | ||||||||

Total | 99,677 | 119,981 | 141,831 | (17 | %) | (15 | %) | ||||||||

Utility coal tonnage in 2016 reflected residual stockpile overhang and limited coal burn due to milder weather and sustained lower natural gas prices. For 2015, the decline was driven by reduced coal burn as significantly lower natural gas prices caused utilities to shift away from coal generation. In addition, volumes were adversely affected by coal plant retirements and mild weather during the last half of 2015.

For 2017, we expect utility tonnage to increase driven by higher natural gas prices and weather-related normalization, in addition to market share gains.

Export coal tonnage also decreased both years, a result of strong competition faced by U.S. coal suppliers as excess coal supply, weak seaborne coal prices, and a strong U.S. dollar reduced demand for export coal. Volume through Norfolk was down 1.7 million tons, or 15%, in 2016, following a drop of 5.5 million tons, or 33%, in 2015. Volume through Baltimore was up slightly in 2016 but was down 1.5 million tons, or 23%, in 2015.

For 2017, we expect export coal tonnage to increase, as higher prices from a tightening of the international coal supply, a continued trend from the last quarter of 2016, is expected to drive incremental production increases.

K 24

Domestic metallurgical coal tonnage was down in both years, compared with the prior periods. The 2016 decline was largely driven by softness in the metallurgical market, offset in part by customer-specific gains. The 2015 decrease reflected volume losses related to plant curtailments and sourcing shifts resulting from steel producers looking for opportunities to reduce costs that were offset in part by market share gains.

For 2017, domestic metallurgical coal tonnage is expected to remain relatively flat as customer-specific gains will offset losses from sourcing shifts and supply issues driven by increased demand in export markets.

Industrial coal tonnage dropped in both years, compared with the prior periods. Both years reflected volume losses related to natural gas conversions and decreased coal burn, both of which accelerated in 2016. In addition, 2016 volumes were further affected by a partial plant closure that took place in the first half of the year.

For 2017, industrial coal tonnage is expected to decrease driven by continued pressure from natural gas conversions and customer sourcing changes.

Railway Operating Expenses

Railway operating expenses summarized by major classifications were as follows:

2016 | 2015 | ||||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | |||||||||||||||

$ in millions | % change | ||||||||||||||||||

Compensation and benefits | $ | 2,743 | $ | 2,911 | $ | 2,897 | (6 | %) | — | ||||||||||

Purchased services and rents | 1,548 | 1,752 | 1,687 | (12 | %) | 4 | % | ||||||||||||

Fuel | 698 | 934 | 1,574 | (25 | %) | (41 | %) | ||||||||||||

Depreciation | 1,026 | 1,054 | 951 | (3 | %) | 11 | % | ||||||||||||

Materials and other | 799 | 976 | 940 | (18 | %) | 4 | % | ||||||||||||

Total | $ | 6,814 | $ | 7,627 | $ | 8,049 | (11 | %) | (5 | %) | |||||||||

In 2016, we experienced decreases across all categories driven largely from cost-control initiatives, lower fuel expense, the absence of restructuring costs incurred in 2015, and service improvements. In 2015, decreases in fuel costs and incentive compensation were offset in part by costs associated with the TCS restructuring and closure of our Roanoke, Virginia corporate office, in addition to higher wage rates.

K 25

Compensation and benefits decreased in 2016, compared to 2015, reflecting changes in:

• | employee levels, including decreased overtime and trainees (down $184 million), |

• | pension costs (down $38 million) |

• | payroll taxes (down $27 million), |

• | labor agreement payments in 2015 ($24 million), |

• | pay rates (up $34 million), |

• | health and welfare benefit costs for agreement employees (up $35 million), which reflected higher rates, offset in part by favorability from reduced headcount, and |

• | bonus accruals (up $59 million). |

In 2015, compensation and benefits increased slightly, a result of changes in:

• | pay rates (up $83 million), |

• | payroll taxes (up $37 million), |

• | labor agreement payments ($24 million), |

• | employee levels, including overtime and increased trainees (up $21 million), and |

• | incentive compensation (down $151 million). |

Our employment averaged 28,044 in 2016, compared with 30,456 in 2015, and 29,482 in 2014. Looking forward to 2017, we expect higher compensation and benefit expenses, a result of wage increases, medical cost inflation and higher levels of incentive compensation. We anticipate that cost-control initiatives will keep employment levels flat notwithstanding expected volume increases.

Purchased services and rents includes the costs of services purchased from outside contractors, including the net costs of operating joint (or leased) facilities with other railroads and the net cost of equipment rentals.

2016 | 2015 | |||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | ||||||||||||||

$ in millions | % change | |||||||||||||||||

Purchased services | $ | 1,242 | $ | 1,433 | $ | 1,394 | (13 | %) | 3 | % | ||||||||

Equipment rents | 306 | 319 | 293 | (4 | %) | 9 | % | |||||||||||

Total | $ | 1,548 | $ | 1,752 | $ | 1,687 | (12 | %) | 4 | % | ||||||||

The 2016 decrease in purchased services expense reflected lower TCS operational costs, reduced repair and maintenance expenses, and decreased transportation activity costs, offset in part by higher volume-related costs in intermodal operations. The increase in 2015 reflected higher costs associated with intermodal operations, information technology, maintenance and repair, and the Roanoke, Virginia corporate office closure, partially offset by TCS restructuring-related savings.

Equipment rents, which includes our cost of using equipment (mostly freight cars) owned by other railroads or private owners less the rent paid to us for the use of our equipment, decreased in 2016 largely from improved network velocity, offset in part by higher rates and conventional intermodal volumes. The 2015 increase was principally due to higher automotive and intermodal rates and volumes.

Fuel expense, which includes the cost of locomotive fuel as well as other fuel used in railway operations, decreased in both 2016 and 2015 compared with the prior years. Both declines were principally the result of lower locomotive fuel prices (down 18% in 2016 and 40% in 2015). Locomotive fuel consumption decreased 5% in 2016 and 1% in 2015. We consumed approximately 462 million gallons of diesel fuel in 2016, compared with 487 million gallons in 2015 and 494 million gallons in 2014.

K 26

Depreciation expense decreased in 2016, but increased in 2015, compared to prior years, a result of the effects of the TCS restructuring. In 2015 we recognized $63 million in accelerated depreciation on TCS assets as a result of the restructuring. Both periods also reflect growth in our roadway and equipment capital base as we continue to invest in our infrastructure and rolling stock.

Materials and other expenses decreased in 2016 but increased in 2015, as shown in the following table.

2016 | 2015 | ||||||||||||||||||

2016 | 2015 | 2014 | vs. 2015 | vs. 2014 | |||||||||||||||

$ in millions | % change | ||||||||||||||||||

Materials | $ | 364 | $ | 469 | $ | 470 | (22 | %) | — | ||||||||||

Casualties and other claims | 150 | 137 | 135 | 9 | % | 1 | % | ||||||||||||

Other | 285 | 370 | 335 | (23 | %) | 10 | % | ||||||||||||

Total | $ | 799 | $ | 976 | $ | 940 | (18 | %) | 4 | % | |||||||||

In 2016, lower materials and other expenses more than offset higher costs for casualties and other claims. Material usage costs declined for the year primarily driven by lower locomotive, roadway and freight car repair costs associated with cost-control initiatives and improved asset utilization.

Casualties and other claims expenses include the estimates of costs related to personal injury, property damage, and environmental matters. The increase in 2016 was primarily driven by higher derailment expenses. The small rise in 2015 reflected less favorable personal injury reserve adjustments for prior years’ claim amounts, offset in part by reduced environmental remediation costs as a result of less unfavorable development for our environmental liability.

Other expense this year reflected $37 million of gains from the sale of operating land. Both year-over-year variances were affected by higher than normal expenses in 2015 relocating employees in connection with the closure of our Roanoke, Virginia office. The 2015 increase also included higher travel costs for train service employees and higher property taxes.

Income Taxes

The effective income tax rate was 35.4% in 2016, compared with 36.3% in 2015 and 36.2% in 2014. The decrease in 2016 reflects favorable tax benefits associated with stock-based compensation and higher returns from corporate-owned life insurance. All three years benefited from favorable reductions in deferred taxes for state tax law changes and certain business tax credits.

Internal Revenue Service (IRS) examinations have been completed for all years prior to 2013. We are not currently under audit by the IRS.

K 27

FINANCIAL CONDITION, LIQUIDITY, AND CAPITAL RESOURCES

Cash provided by operating activities, our principal source of liquidity, was $3.0 billion in 2016 and $2.9 billion in both 2015 and 2014. The increase in 2016 was primarily the result of improved operating results. Lower cash from operations in 2015 compared with 2014 was offset by reduced tax payments. We had a working capital deficit of $48 million at December 31, 2016, compared with working capital of $281 million at December 31, 2015. Cash and cash equivalents totaled $1.0 billion and $1.1 billion at December 31, 2016 and 2015, respectively, and were invested in accordance with our corporate investment policy. The portfolio contains securities that are subject to market risk. There are no limits or restrictions on our access to these assets. We expect cash on hand combined with cash provided by operating activities will be sufficient to meet our ongoing obligations.

Contractual obligations at December 31, 2016, were comprised of interest on fixed-rate long-term debt, long-term debt (Note 8), unconditional purchase obligations (Note 16), operating leases (Note 9), long-term advances from Conrail and agreements with Consolidated Rail Corporation (CRC) (Note 5), and unrecognized tax benefits (Note 3):

Total | 2017 | 2018 - 2019 | 2020 - 2021 | 2022 and Subsequent | Other | ||||||||||||||||||

$ in millions | |||||||||||||||||||||||