Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NORFOLK SOUTHERN CORP | ns8k021016.htm |

| EX-99.1 - M. STEWART PRESENTATION - NORFOLK SOUTHERN CORP | nsppoint021016.htm |

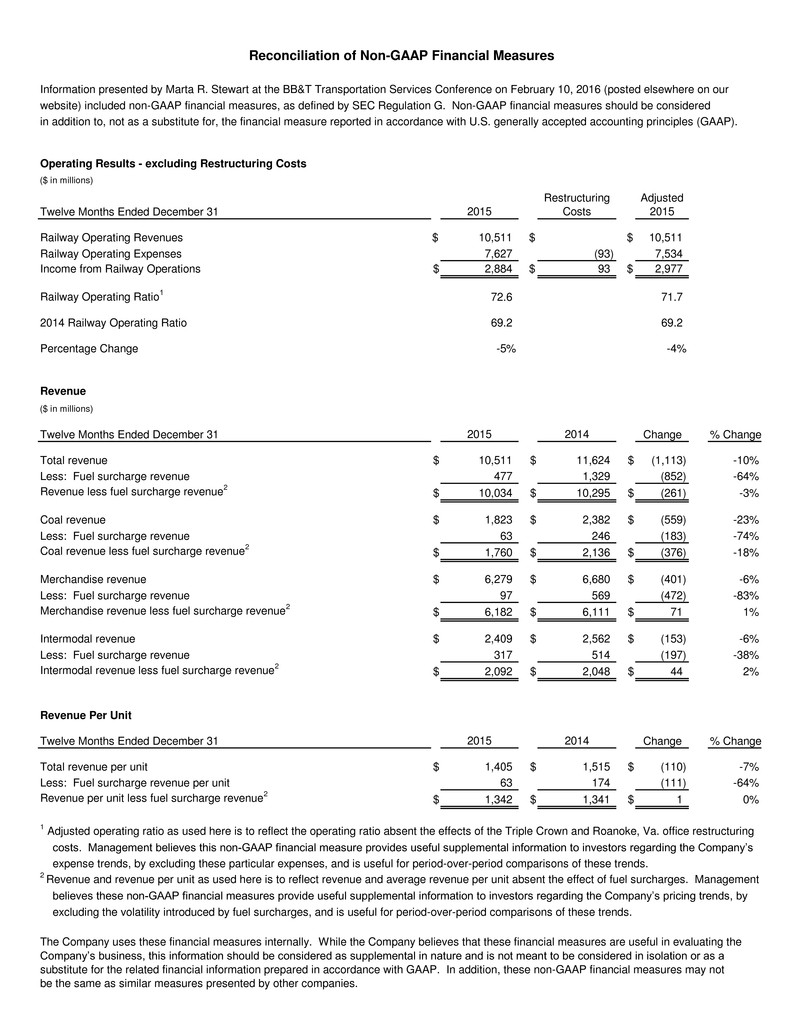

Information presented by Marta R. Stewart at the BB&T Transportation Services Conference on February 10, 2016 (posted elsewhere on our website) included non-GAAP financial measures, as defined by SEC Regulation G. Non-GAAP financial measures should be considered in addition to, not as a substitute for, the financial measure reported in accordance with U.S. generally accepted accounting principles (GAAP). Operating Results - excluding Restructuring Costs ($ in millions) Twelve Months Ended December 31 2015 Restructuring Costs Adjusted 2015 Railway Operating Revenues $ 10,511 $ $ 10,511 Railway Operating Expenses 7,627 (93) 7,534 Income from Railway Operations $ 2,884 $ 93 $ 2,977 Railway Operating Ratio 1 72.6 71.7 2014 Railway Operating Ratio 69.2 69.2 Percentage Change -5% -4% Revenue ($ in millions) Twelve Months Ended December 31 2015 2014 Change % Change Total revenue $ 10,511 $ 11,624 $ (1,113) -10% Less: Fuel surcharge revenue 477 1,329 (852) -64% Revenue less fuel surcharge revenue 2 $ 10,034 $ 10,295 $ (261) -3% Coal revenue $ 1,823 $ 2,382 $ (559) -23% Less: Fuel surcharge revenue 63 246 (183) -74% Coal revenue less fuel surcharge revenue 2 $ 1,760 $ 2,136 $ (376) -18% Merchandise revenue $ 6,279 $ 6,680 $ (401) -6% Less: Fuel surcharge revenue 97 569 (472) -83% Merchandise revenue less fuel surcharge revenue 2 $ 6,182 $ 6,111 $ 71 1% Intermodal revenue $ 2,409 $ 2,562 $ (153) -6% Less: Fuel surcharge revenue 317 514 (197) -38% Intermodal revenue less fuel surcharge revenue 2 $ 2,092 $ 2,048 $ 44 2% Revenue Per Unit Twelve Months Ended December 31 2015 2014 Change % Change Total revenue per unit $ 1,405 $ 1,515 $ (110) -7% Less: Fuel surcharge revenue per unit 63 174 (111) -64% Revenue per unit less fuel surcharge revenue 2 $ 1,342 $ 1,341 $ 1 0% 1 Adjusted operating ratio as used here is to reflect the operating ratio absent the effects of the Triple Crown and Roanoke, Va. office restructuring costs. Management believes this non-GAAP financial measure provides useful supplemental information to investors regarding the Company’s expense trends, by excluding these particular expenses, and is useful for period-over-period comparisons of these trends. 2 Revenue and revenue per unit as used here is to reflect revenue and average revenue per unit absent the effect of fuel surcharges. Management believes these non-GAAP financial measures provide useful supplemental information to investors regarding the Company’s pricing trends, by excluding the volatility introduced by fuel surcharges, and is useful for period-over-period comparisons of these trends. The Company uses these financial measures internally. While the Company believes that these financial measures are useful in evaluating the Company’s business, this information should be considered as supplemental in nature and is not meant to be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not be the same as similar measures presented by other companies. Reconciliation of Non-GAAP Financial Measures