Attached files

| file | filename |

|---|---|

| 8-K - 8-K - StoneX Group Inc. | a8-kiff2015stmtoffincond.htm |

INTL FCSTONE FINANCIAL INC. (A Wholly Owned Subsidiary of INTL FCStone Inc.) Statement of Financial Condition and Supplementary Information September 30, 2015 (With Report of Independent Registered Public Accounting Firm Thereon)

Report of Independent Registered Public Accounting Firm The Board of Directors INTL FCStone Financial Inc.: We have audited the accompanying statement of financial condition of INTL FCStone Financial Inc. (the Company) as of September 30, 2015 (the financial statement). The financial statement is the responsibility of the Company’s management. Our responsibility is to express an opinion on the financial statement based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statement is free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statement. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the financial statement referred to above presents fairly, in all material respects, the financial position of the Company as of September 30, 2015, in conformity with U.S. generally accepted accounting principles. The supplemental information contained in Schedules I, II, III, IV, and V has been subjected to audit procedures performed in conjunction with the audit of the Company’s financial statement. The supplemental information is the responsibility of the Company’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statement or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with 17 C.F.R. § 240.17a-5 and 17 C.F.R. §1.10. In our opinion, the supplemental information contained in Schedules I, II, III, IV, and V is fairly stated, in all material respects, in relation to the financial statement as a whole. November 30, 2015 KPMG LLP Suite 1000 1000 Walnut Street Kansas City, MO 64106-2162 KPMG LLP is a Delaware limited liability partnership, the U.S. member firm of KPMG International Cooperative (“KPMG International”), a Swiss entity.

1 INTL FCStone Financial Inc. Statement of Financial Condition September 30, 2015 (Amounts in thousands, except par value and share amounts) Assets Cash and cash equivalents $ 27,849 Cash, securities and other assets segregated under federal and other regulations (including $515,495 at fair value) 709,143 Securities purchased under agreements to resell 324,749 Deposits with and receivables from: Exchange-clearing organizations (including $976,531 at fair value) 1,368,477 Broker-dealers, clearing organizations and counterparties (including $159 at fair value) 89,440 Receivables from customers, net 10,889 Securities owned, at fair value (includes securities pledged as collateral that can be sold or repledged of $170,671) 1,363,357 Exchange memberships and stock, at cost 5,571 Deferred income taxes, net 6,245 Property and equipment, net 3,247 Goodwill and intangible assets, net 23,168 Due from affiliates 586 Other assets 4,599 Total assets $ 3,937,320 Liabilities and Stockholder’s Equity Liabilities: Payables to: Customers $ 1,959,696 Broker-dealers, clearing organizations and counterparties (including $1,585 at fair value) 190,485 Affiliates 21,722 Accounts payable and accrued expenses 39,440 Securities sold under agreements to repurchase 1,007,330 Securities sold, not yet purchased, at fair value 458,787 Income taxes payable to INTL FCStone Inc. 15,689 Total liabilities 3,693,149 Commitments and contingencies (note 11) Stockholder’s equity: Common stock, $0.01 par value. Authorized 10,000 shares; issued and outstanding 1,000 shares — Additional paid-in capital 157,063 Retained earnings 87,108 Total stockholder’s equity 244,171 Total liabilities and stockholder’s equity $ 3,937,320 See accompanying notes to statement of financial condition.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 2 Note 1 - Summary of Significant Accounting Policies and Related Matters (a) Description of Business INTL FCStone Securities Inc. (“INTL Securities”), a corporation, was organized under the laws of the State of Florida on May 29, 1998. INTL Securities is a wholly owned subsidiary of INTL FCStone Inc. (the “Parent” or “INTL FCStone”). On July 1, 2015, the Parent merged three of its wholly owned subsidiaries (FCStone, LLC, INTL FCStone Partners L.P., and FCC Investments, Inc.) into INTL Securities and renamed the surviving subsidiary INTL FCStone Financial Inc. (“the Company”). The Company operates three primary divisions, including the Equities Division, which includes the former activities of INTL Securities, and the FCM Division, which includes the activities formerly in FCStone, LLC (“FCStone”), a futures commission merchant (“FCM”). Effective January 1, 2015, the Parent acquired G.X. Clarke & Co. (“GXCO”), an institutional dealer in fixed income securities, and changed the name to INTL FCStone Partners L.P. (“INTL Partners”). Following the aforementioned July 1, 2015 merger, the activities of INTL Partners comprise the Rates Division of the Company. The Company is a registered broker-dealer with the Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Municipal Securities Rulemaking Board (“MSRB”). In addition, the Company is a registered FCM and a member of various commodities and futures exchanges in the United States (“U.S.”) and abroad and, accordingly, is subject to the exchanges’ various requirements and the regulatory requirements of the U.S. Commodity Futures Trading Commission (“CFTC”). Through its Equities Division, the Company makes markets in international equities and American Depository Receipts (“ADRs”). The Company deals in trading international bonds and fixed income securities. The Company also engages in corporate debt origination, structuring, and distribution and provides global brokerage services to institutions and individual investors, including hedge funds, pension funds, broker-dealers and banks located in Latin America, North America and Europe. The Company participates in underwriting and trading in municipal securities. The Company clears its securities transactions primarily through Pershing LLC, a BNY Mellon company (“Pershing”), and Broadcort, a division of Merrill Lynch, Pierce, Fenner & Smith, Inc. (“Broadcort”) on a fully disclosed basis. Through its FCM Division, the Company provides risk management consulting, execution and clearing services in futures and options on futures contracts for its producer, processors and end-user customers, primarily in agricultural and energy commodities. In addition, the Company seeks to provide competitive and efficient clearing and execution services to the institutional and professional trader market segments. Through its Rates Division, the Company acts as an institutional dealer in U.S. Treasury, U.S. government agency and agency mortgage-backed securities, and has a client base consisting of asset managers, commercial bank trust and investment departments, broker-dealers, and insurance companies. The Company conducts business activities throughout the U.S. and abroad, with offices or a presence in 14 states, China, Brazil, England, Singapore, Argentina, Paraguay and Columbia. Transactions in international markets are primarily settled in U.S. dollars. (b) Use of Estimates The preparation of the statement of financial condition in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the statement of financial condition. These estimates are based on management’s best knowledge of current events and actions the Company may undertake in the future. The Company reviews all significant estimates affecting the statement of financial condition on a recurring basis and

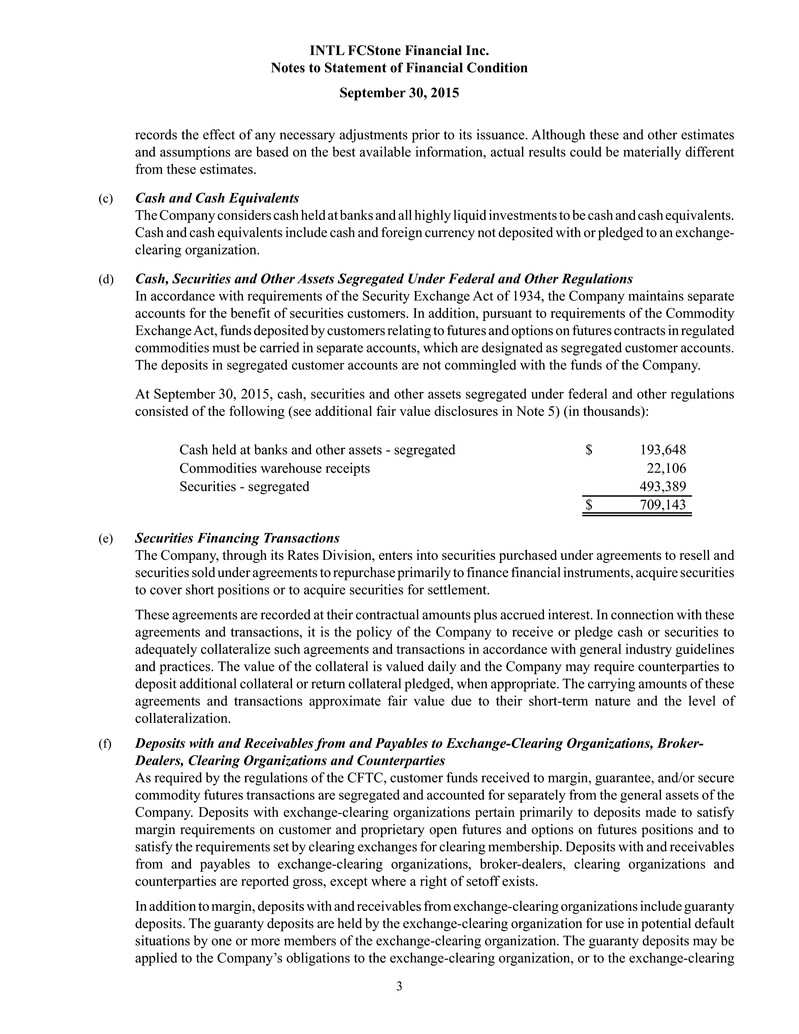

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 3 records the effect of any necessary adjustments prior to its issuance. Although these and other estimates and assumptions are based on the best available information, actual results could be materially different from these estimates. (c) Cash and Cash Equivalents The Company considers cash held at banks and all highly liquid investments to be cash and cash equivalents. Cash and cash equivalents include cash and foreign currency not deposited with or pledged to an exchange- clearing organization. (d) Cash, Securities and Other Assets Segregated Under Federal and Other Regulations In accordance with requirements of the Security Exchange Act of 1934, the Company maintains separate accounts for the benefit of securities customers. In addition, pursuant to requirements of the Commodity Exchange Act, funds deposited by customers relating to futures and options on futures contracts in regulated commodities must be carried in separate accounts, which are designated as segregated customer accounts. The deposits in segregated customer accounts are not commingled with the funds of the Company. At September 30, 2015, cash, securities and other assets segregated under federal and other regulations consisted of the following (see additional fair value disclosures in Note 5) (in thousands): Cash held at banks and other assets - segregated $ 193,648 Commodities warehouse receipts 22,106 Securities - segregated 493,389 $ 709,143 (e) Securities Financing Transactions The Company, through its Rates Division, enters into securities purchased under agreements to resell and securities sold under agreements to repurchase primarily to finance financial instruments, acquire securities to cover short positions or to acquire securities for settlement. These agreements are recorded at their contractual amounts plus accrued interest. In connection with these agreements and transactions, it is the policy of the Company to receive or pledge cash or securities to adequately collateralize such agreements and transactions in accordance with general industry guidelines and practices. The value of the collateral is valued daily and the Company may require counterparties to deposit additional collateral or return collateral pledged, when appropriate. The carrying amounts of these agreements and transactions approximate fair value due to their short-term nature and the level of collateralization. (f) Deposits with and Receivables from and Payables to Exchange-Clearing Organizations, Broker- Dealers, Clearing Organizations and Counterparties As required by the regulations of the CFTC, customer funds received to margin, guarantee, and/or secure commodity futures transactions are segregated and accounted for separately from the general assets of the Company. Deposits with exchange-clearing organizations pertain primarily to deposits made to satisfy margin requirements on customer and proprietary open futures and options on futures positions and to satisfy the requirements set by clearing exchanges for clearing membership. Deposits with and receivables from and payables to exchange-clearing organizations, broker-dealers, clearing organizations and counterparties are reported gross, except where a right of setoff exists. In addition to margin, deposits with and receivables from exchange-clearing organizations include guaranty deposits. The guaranty deposits are held by the exchange-clearing organization for use in potential default situations by one or more members of the exchange-clearing organization. The guaranty deposits may be applied to the Company’s obligations to the exchange-clearing organization, or to the exchange-clearing

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 4 organization’s obligations to other clearing members or third parties. Deposits with clearing organizations also includes cash on deposit with Pershing and Broadcort, as a condition of their clearing relationships. The Company maintains customer omnibus and proprietary accounts with other clearing organizations, and the equity balances in those accounts along with any margin cash or securities deposited with the clearing organizations are included in deposits with and receivables from broker-dealers, clearing organizations and counterparties. Receivables from exchange-clearing organizations primarily comprise amounts due from or due to exchange-clearing organizations for daily variation settlements on open futures and options on futures positions. The variation settlements due from or due to exchange-clearing organizations are settled in cash on the following business day. Deposits with and receivables from exchange-clearing organizations also include the unrealized gains and losses associated with customers’ options on futures contracts. See discussion in the Derivative Financial Instruments section below for additional information on the treatment of derivative contracts. For customer owned derivative contracts, the fair value is offset against the payable to or receivable from customers. Receivables from broker-dealers and counterparties also include amounts receivable for securities sold but not yet delivered by the Company on settlement date (“fails-to-deliver”) and net receivables arising from unsettled trades. Payables to broker-dealers and counterparties primarily include amounts payable for securities purchased but not yet received by the Company on settlement date (“fails-to-receive”) and net payables arising from unsettled trades. These balances also include securities pledged by the Company on behalf of customers and customer- owned securities that are pledged. Securities pledged include U.S. Treasury bills and notes and instruments backed by U.S. government sponsored entities. The securities are adjusted to their fair value. For customer- owned securities, the change in fair value is offset against the payable to or receivables from customers. The securities, primarily U.S. government obligations, held by the Company as collateral or as margin have been deposited with exchange-clearing organizations, broker-dealers, clearing organizations and counterparties. Management has considered accounting guidance as it relates to assets pledged by customers to margin their accounts. Based on a review of the agreements with the customer, management believes that a legal basis exists to support that the transferor surrenders control over those assets if all of the following three conditions are met: (a) the transferred assets have been isolated from the transferor - put presumptively beyond the reach of the transferor and its creditors, even in bankruptcy or other receivership, (b) each transferee has the right to pledge or exchange the assets (or beneficial interests) it received, and no condition both constrains the transferee (or holder) from taking advantage of its right to pledge or exchange and provides more than a trivial benefit to the transferor and (c) the transferor does not maintain effective control over the transferred assets through either (1) an agreement that both entitles and obligates the transferor to repurchase or redeem them before their maturity or (2) the ability to unilaterally cause the holder to return specific assets. Under this guidance, it is the Company’s practice to reflect the customer collateral assets and corresponding liabilities in the statement of financial condition, as the rights to those securities have been transferred to the Company under the terms of the trading agreements.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 5 At September 30, 2015, deposits with and receivables from and payables to exchange-clearing organizations, broker-dealers, clearing organizations and counterparties consisted of the following (see additional fair value disclosures in Note 5) (in thousands): Deposits and receivables: Cash and money market funds held with exchange-clearing organizations, broker-dealers, clearing organizations and counterparties $ 821,882 Due from or due to exchange-clearing organizations, clearing brokers and organizations and counterparties 31,613 Securities pledged to exchange-clearing organizations 471,059 Net option value 43,388 Clearing fund deposits 750 Guaranty deposits - cash and securities 63,487 To be announced (“TBA”) and forward settling securities 144 Securities failed to deliver 25,594 $ 1,457,917 Payables: Clearing brokers and organizations and counterparties $ 12,830 TBA and forward settling securities 1,585 Securities failed to receive 176,070 $ 190,485 (g) Receivables from and Payables to Customers Receivables from customers include the total of net deficits in individual exchange-traded trading accounts carried by the Company, amounts due from investment banking advisory fees and other services provided to the Company’s clients. Customer deficits arise from realized and unrealized trading losses on futures and options on futures and amounts due on cash and margin transactions. Customer deficit accounts are reported gross of customer accounts that contain net credit or positive balances, except where a right of setoff exists. Net deficits in individual exchange-traded trading accounts include both secured and unsecured deficit balances due from customers as of the statement of financial condition date. Secured deficit amounts are backed by U.S. Treasury bills and notes with a fair value of $1.1 million and commodity warehouse receipts with a fair value of $3.5 million as of September 30, 2015. These U.S. Treasury bills and notes and commodity warehouse receipts are not netted against the secured deficit amounts, as the conditions for right of setoff have not been met. Payables to customers represent the total of customer accounts with credit or positive balances. Customer accounts are used primarily in connection with commodity derivative transactions and include gains and losses on open commodity trades as well as securities and other deposits made as required by the Company. Customer accounts with credit or positive balances are reported gross of customer deficit accounts, except where a right of setoff exists. The future collectibility of receivables from customers can be impacted by the Company’s collection efforts, the financial stability of its customers, and the general economic climate in which it operates. The Company evaluates accounts that it believes may become uncollectible on a specific-identification basis, through reviewing daily margin deficit reports, the historical daily aging of the receivables, and by monitoring the financial strength of its customers. The Company may unilaterally close customer trading positions in certain circumstances. In addition, to evaluate customer margining and collateral requirements, customer positions are stress tested regularly and monitored for excessive concentration levels relative to the overall market size. The Company has no allowance for doubtful accounts as of September 30, 2015.

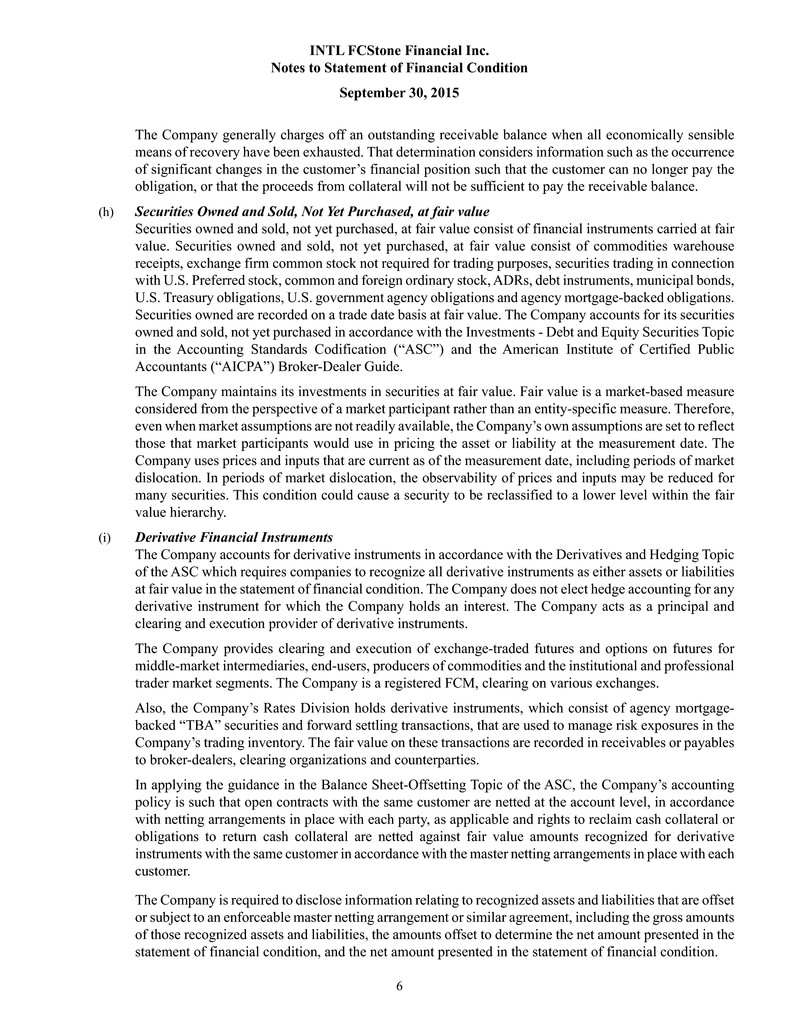

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 6 The Company generally charges off an outstanding receivable balance when all economically sensible means of recovery have been exhausted. That determination considers information such as the occurrence of significant changes in the customer’s financial position such that the customer can no longer pay the obligation, or that the proceeds from collateral will not be sufficient to pay the receivable balance. (h) Securities Owned and Sold, Not Yet Purchased, at fair value Securities owned and sold, not yet purchased, at fair value consist of financial instruments carried at fair value. Securities owned and sold, not yet purchased, at fair value consist of commodities warehouse receipts, exchange firm common stock not required for trading purposes, securities trading in connection with U.S. Preferred stock, common and foreign ordinary stock, ADRs, debt instruments, municipal bonds, U.S. Treasury obligations, U.S. government agency obligations and agency mortgage-backed obligations. Securities owned are recorded on a trade date basis at fair value. The Company accounts for its securities owned and sold, not yet purchased in accordance with the Investments - Debt and Equity Securities Topic in the Accounting Standards Codification (“ASC”) and the American Institute of Certified Public Accountants (“AICPA”) Broker-Dealer Guide. The Company maintains its investments in securities at fair value. Fair value is a market-based measure considered from the perspective of a market participant rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Company’s own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date. The Company uses prices and inputs that are current as of the measurement date, including periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced for many securities. This condition could cause a security to be reclassified to a lower level within the fair value hierarchy. (i) Derivative Financial Instruments The Company accounts for derivative instruments in accordance with the Derivatives and Hedging Topic of the ASC which requires companies to recognize all derivative instruments as either assets or liabilities at fair value in the statement of financial condition. The Company does not elect hedge accounting for any derivative instrument for which the Company holds an interest. The Company acts as a principal and clearing and execution provider of derivative instruments. The Company provides clearing and execution of exchange-traded futures and options on futures for middle-market intermediaries, end-users, producers of commodities and the institutional and professional trader market segments. The Company is a registered FCM, clearing on various exchanges. Also, the Company’s Rates Division holds derivative instruments, which consist of agency mortgage- backed “TBA” securities and forward settling transactions, that are used to manage risk exposures in the Company’s trading inventory. The fair value on these transactions are recorded in receivables or payables to broker-dealers, clearing organizations and counterparties. In applying the guidance in the Balance Sheet-Offsetting Topic of the ASC, the Company’s accounting policy is such that open contracts with the same customer are netted at the account level, in accordance with netting arrangements in place with each party, as applicable and rights to reclaim cash collateral or obligations to return cash collateral are netted against fair value amounts recognized for derivative instruments with the same customer in accordance with the master netting arrangements in place with each customer. The Company is required to disclose information relating to recognized assets and liabilities that are offset or subject to an enforceable master netting arrangement or similar agreement, including the gross amounts of those recognized assets and liabilities, the amounts offset to determine the net amount presented in the statement of financial condition, and the net amount presented in the statement of financial condition.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 7 (j) Exchange Memberships and Stock, at Cost The Company is required to hold certain exchange membership seats and exchange firm common stock and pledge them for clearing purposes, in order to provide the Company the right to process trades directly with the various exchanges. Exchange memberships and firm common stocks pledged for clearing purposes are recorded at cost. The cost and fair value for exchange memberships and firm common stock pledged for clearing purposes were $5.6 million and $4.1 million, respectively, at September 30, 2015. The fair value of exchange firm common stock is determined by quoted market prices, and the fair value of exchange memberships is determined by recent sale transactions. (k) Property and Equipment, net Property and equipment is stated at cost, net of accumulated depreciation and amortization, and includes furniture, equipment, software, and leasehold improvements. Expenditures that increase the value or productive capacity of assets are capitalized. When property and equipment are retired, sold, or otherwise disposed of, the asset’s carrying amount and related accumulated depreciation are removed from the accounts. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Furniture, equipment, and software are depreciated over three to seven years. Amortization of leasehold improvements is computed using the straight-line method over the shorter of the remaining lease term or the estimated useful life of the improvement. (l) Goodwill and Intangible Assets, net Goodwill is the cost of acquired companies in excess of the fair value of identifiable net assets at acquisition date. In accordance with the Intangibles – Goodwill and Other Topic of the ASC, goodwill is tested for impairment on an annual basis at the fiscal year-end, and between annual tests if indicators of potential impairment exist, using a fair-value-based approach. No impairment of goodwill has been identified during the period presented. Identifiable intangible assets subject to amortization are amortized using the straight-line method over their estimated period of benefit, ranging from two to twenty years. Identifiable intangible assets are tested for impairment whenever events or changes in circumstances suggest that an asset’s, or asset group’s, carrying value may not be fully recoverable in accordance with the Intangibles – Goodwill and Other Topic of the ASC. Residual value is presumed to be zero. Identifiable intangible assets not subject to amortization are reviewed at each reporting period to re-evaluate if the intangible asset’s useful life remains indefinite. Additionally, intangible assets not subject to amortization are tested annually for impairment at the fiscal year-end, and between annual tests if indicators of potential impairment exist, using a fair-value-based approach. (m) Other Assets Other assets primarily include prepaid assets, cash deposits paid on leased office space and dividend and accrued interest receivable. Prepaid assets primarily consist of advance payments made for services. (n) Income Taxes The Company is included in the consolidated federal and state income tax returns of its Parent. Income taxes are allocated to the Company using the pro-rata method. Tax accounts are settled periodically with the Parent. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the statement of financial condition carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period that includes the

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 8 enactment date. Valuation allowances are established when necessary to reduce deferred tax assets to an amount that, in the opinion of management, is more likely than not to be realized. FASB ASC Topic 740 prescribes a recognition threshold and a measurement attribute for the financial statement recognition and measurement of tax positions taken or expected to be taken in a tax return. For those benefits to be recognized, a tax position must be more likely than not of being sustained upon examination by taxing authorities. The Company did not have any uncertain tax positions as of September 30, 2015. No amounts have been accrued for the payment of interest and penalties at September 30, 2015. (o) Recent Accounting Pronouncements In June 2014, the FASB issued ASU 2014-11, Transfers and Servicing: Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures, which changes the accounting for repurchase-to- maturity transactions to secured borrowing accounting. Additionally, for repurchase financing arrangements, the amendments of this ASU require separate accounting for a transfer of a financial asset executed contemporaneously with a repurchase agreement with the same counterparty, which will result in secured borrowing accounting for the repurchase agreement. For public entities, the ASU is effective for the first interim or annual period beginning after December 15, 2014. Earlier application is not permitted. The Company adopted this guidance in fiscal year 2015. The adoption of this guidance did not have a material impact on the Company’s statement of financial condition. In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements - Going Concern: Disclosures of Uncertainties about an Entity’s Ability to Continue as a Going Concern, which requires management to evaluate whether there are conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date that the statement of financial condition is issued or is available to be issued. This ASU also requires management to disclose certain information depending on the results of the going concern evaluation. The provisions of this ASU are effective for annual periods ending after December 15, 2016, and for interim and annual periods thereafter. Early adoption is permitted. This amendment is applicable to the Company for the fiscal year ending September 30, 2017. The adoption of this standard is not expected to have a material impact on the statement of financial condition. (p) Subsequent Events Management has evaluated events and transactions through November 30, 2015, which is the date the statement of financial condition was issued, for potential recognition or disclosure herein and has determined that no additional disclosures or adjustments are required. Note 2 - Transfer of Net Assets Between Entities Under Common Control Effective January 1, 2015, the Parent acquired GXCO. The purchase price payable by the Parent is equal to GXCO’s net tangible book value at closing of $25.9 million plus a premium of $1.5 million, and up to an additional $1.5 million over the next three years, subject to the achievement of certain profitability thresholds. The contingent payment is recorded as a liability of the Parent. In conjunction with the acquisition, the name of GXCO was changed to INTL Partners. The acquisition agreement includes the purchase of certain tangible assets and assumption of certain liabilities. For the acquisition, management made an initial fair value estimate of the assets acquired and liabilities assumed as of January 1, 2015. The Company believes that due to the short-term nature of many of the tangible assets acquired and liabilities assumed, that their carrying values, as included in the historical statement of financial condition of GXCO, approximate their fair values. The Parent finalized its purchase accounting estimates with the assistance of a third-party valuation expert. The portion of the purchase price representing the initial premium of $1.5 million and the contingent consideration of $126 thousand has been assigned to the customer base and

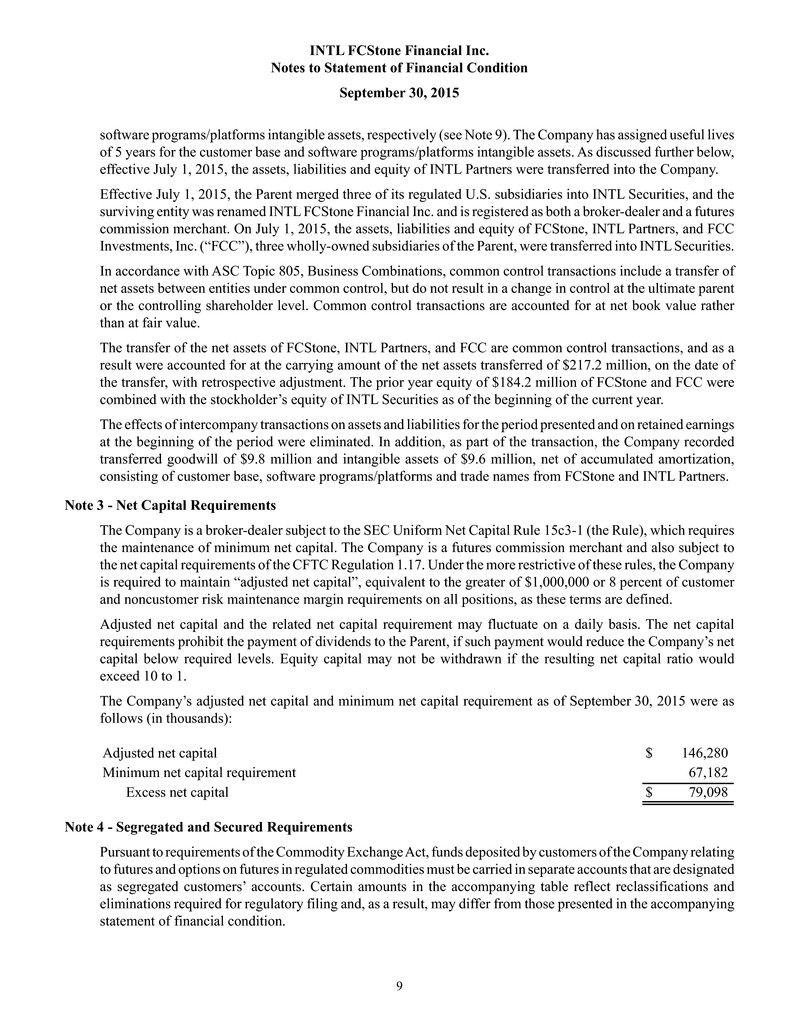

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 9 software programs/platforms intangible assets, respectively (see Note 9). The Company has assigned useful lives of 5 years for the customer base and software programs/platforms intangible assets. As discussed further below, effective July 1, 2015, the assets, liabilities and equity of INTL Partners were transferred into the Company. Effective July 1, 2015, the Parent merged three of its regulated U.S. subsidiaries into INTL Securities, and the surviving entity was renamed INTL FCStone Financial Inc. and is registered as both a broker-dealer and a futures commission merchant. On July 1, 2015, the assets, liabilities and equity of FCStone, INTL Partners, and FCC Investments, Inc. (“FCC”), three wholly-owned subsidiaries of the Parent, were transferred into INTL Securities. In accordance with ASC Topic 805, Business Combinations, common control transactions include a transfer of net assets between entities under common control, but do not result in a change in control at the ultimate parent or the controlling shareholder level. Common control transactions are accounted for at net book value rather than at fair value. The transfer of the net assets of FCStone, INTL Partners, and FCC are common control transactions, and as a result were accounted for at the carrying amount of the net assets transferred of $217.2 million, on the date of the transfer, with retrospective adjustment. The prior year equity of $184.2 million of FCStone and FCC were combined with the stockholder’s equity of INTL Securities as of the beginning of the current year. The effects of intercompany transactions on assets and liabilities for the period presented and on retained earnings at the beginning of the period were eliminated. In addition, as part of the transaction, the Company recorded transferred goodwill of $9.8 million and intangible assets of $9.6 million, net of accumulated amortization, consisting of customer base, software programs/platforms and trade names from FCStone and INTL Partners. Note 3 - Net Capital Requirements The Company is a broker-dealer subject to the SEC Uniform Net Capital Rule 15c3-1 (the Rule), which requires the maintenance of minimum net capital. The Company is a futures commission merchant and also subject to the net capital requirements of the CFTC Regulation 1.17. Under the more restrictive of these rules, the Company is required to maintain “adjusted net capital”, equivalent to the greater of $1,000,000 or 8 percent of customer and noncustomer risk maintenance margin requirements on all positions, as these terms are defined. Adjusted net capital and the related net capital requirement may fluctuate on a daily basis. The net capital requirements prohibit the payment of dividends to the Parent, if such payment would reduce the Company’s net capital below required levels. Equity capital may not be withdrawn if the resulting net capital ratio would exceed 10 to 1. The Company’s adjusted net capital and minimum net capital requirement as of September 30, 2015 were as follows (in thousands): Adjusted net capital $ 146,280 Minimum net capital requirement 67,182 Excess net capital $ 79,098 Note 4 - Segregated and Secured Requirements Pursuant to requirements of the Commodity Exchange Act, funds deposited by customers of the Company relating to futures and options on futures in regulated commodities must be carried in separate accounts that are designated as segregated customers’ accounts. Certain amounts in the accompanying table reflect reclassifications and eliminations required for regulatory filing and, as a result, may differ from those presented in the accompanying statement of financial condition.

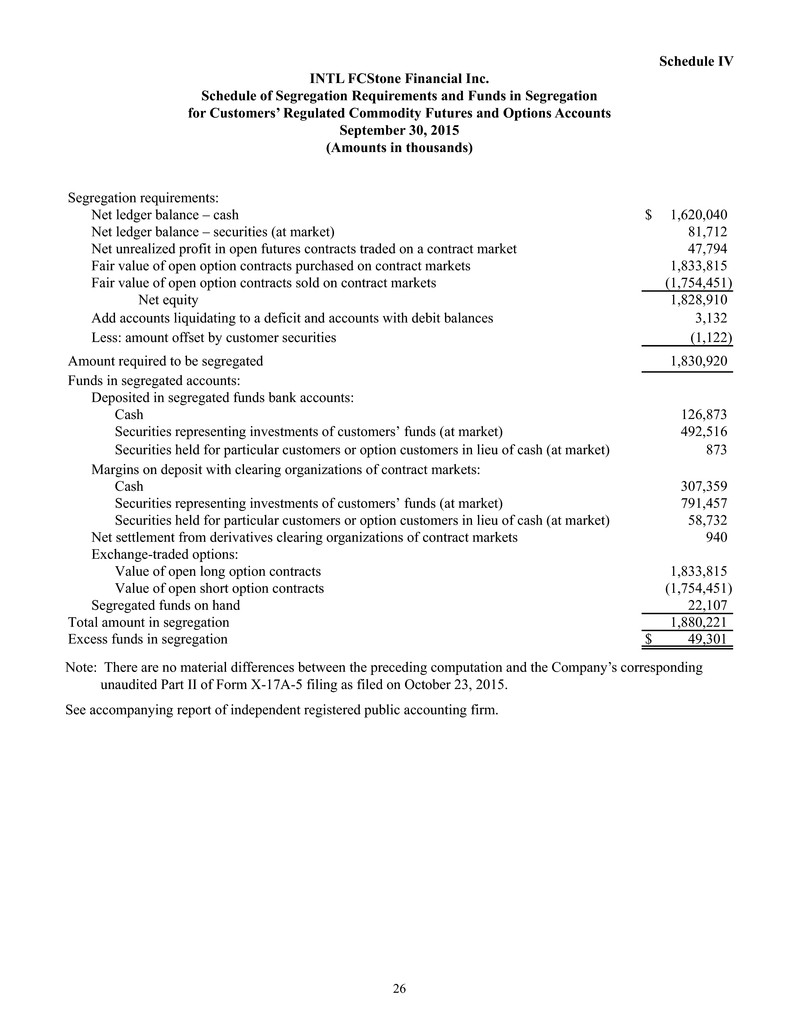

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 10 Funds deposited by customers and other assets, which have been segregated as belonging to the commodity customers as of September 30, 2015 are as follows (in thousands): Cash, at banks - segregated $ 126,873 Securities representing investments of customers' funds, at banks 492,516 Securities held for customers in lieu of cash, at banks 873 Deposits with and receivables from: Exchange-clearing organizations, including securities, net of omnibus eliminations 1,237,852 Securities held for customers in lieu of cash 22,107 Total customer-segregated funds 1,880,221 Amount required to be segregated 1,830,920 Excess funds in segregation $ 49,301 Funds deposited by customers and other assets, which are held in separate accounts for customers trading foreign futures and foreign options on foreign commodity exchanges or boards of trade, as of September 30, 2015 are as follows (in thousands): Cash - secured $ 64,677 Equities with registered futures commission merchants 2,641 Amounts held by members of foreign boards of trade 18,240 Total customer-secured funds 85,558 Amount required to be set aside as secured 65,176 Excess set aside for secured amount $ 20,382 Note 5 - Fair Value of Financial and Nonfinancial Assets and Liabilities The Fair Value Measurements Topic of the ASC provides guidance for all financial and nonfinancial assets and liabilities that are required to be reported at fair value. The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). A market is active if there are sufficient transactions on an ongoing basis to provide current pricing information for the asset or liability, pricing information is released publicly, and price quotations do not vary substantially either over time or among market makers. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. The guidance requires the Company to consider counterparty credit risk of all parties to outstanding derivative instruments that would be considered by a market participant in the transfer or settlement of such contracts (exit price). The Company has very limited exposure to credit risk on derivative financial instruments as all exchange-traded or cleared contracts held can be settled on an active market with the credit guarantee by the respective exchange. The majority of financial assets and liabilities on the statement of financial condition are reported at fair value. Cash and cash equivalents are reported at the balance held at financial institutions and include the value of cash held in banks and money market funds. Deposits with and receivables from exchange-clearing organizations, broker-dealers, clearing organizations, and counterparties, as well as payables to customers include the value of cash collateral as well as the value of money market funds and other pledged investments, primarily U.S. Treasury bills and securities issued by federal agencies. These balances also include the fair value of exchange-traded futures and options on futures and exchange-cleared swaps and options. Securities owned include the value of

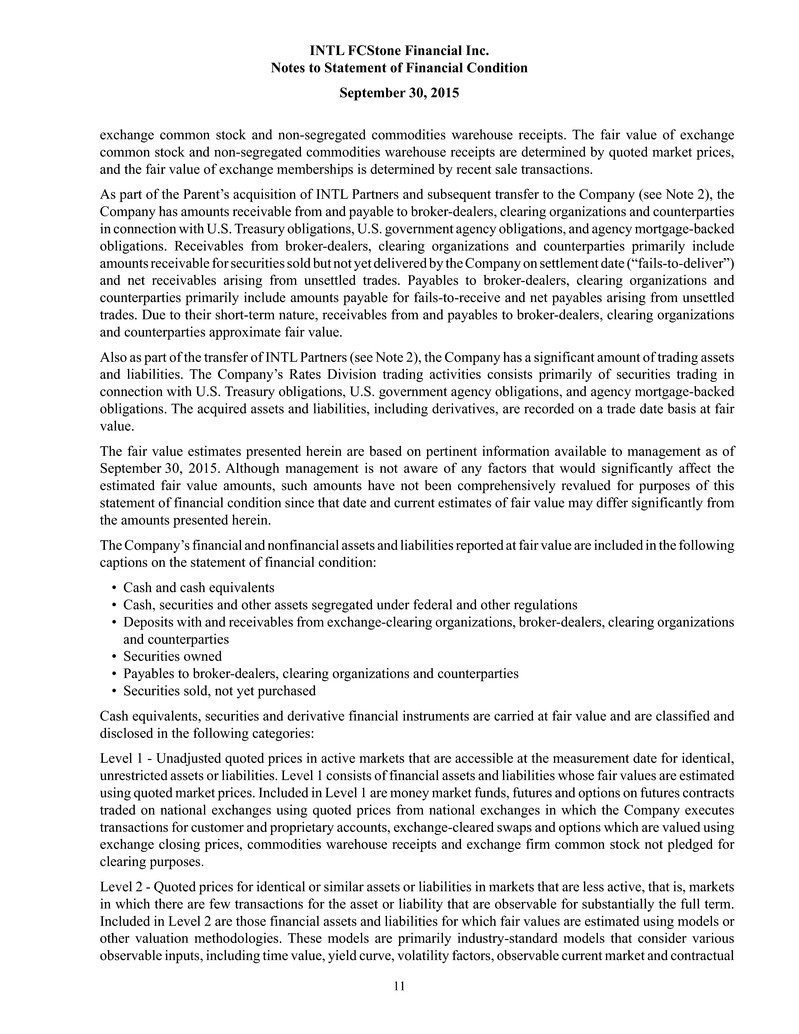

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 11 exchange common stock and non-segregated commodities warehouse receipts. The fair value of exchange common stock and non-segregated commodities warehouse receipts are determined by quoted market prices, and the fair value of exchange memberships is determined by recent sale transactions. As part of the Parent’s acquisition of INTL Partners and subsequent transfer to the Company (see Note 2), the Company has amounts receivable from and payable to broker-dealers, clearing organizations and counterparties in connection with U.S. Treasury obligations, U.S. government agency obligations, and agency mortgage-backed obligations. Receivables from broker-dealers, clearing organizations and counterparties primarily include amounts receivable for securities sold but not yet delivered by the Company on settlement date (“fails-to-deliver”) and net receivables arising from unsettled trades. Payables to broker-dealers, clearing organizations and counterparties primarily include amounts payable for fails-to-receive and net payables arising from unsettled trades. Due to their short-term nature, receivables from and payables to broker-dealers, clearing organizations and counterparties approximate fair value. Also as part of the transfer of INTL Partners (see Note 2), the Company has a significant amount of trading assets and liabilities. The Company’s Rates Division trading activities consists primarily of securities trading in connection with U.S. Treasury obligations, U.S. government agency obligations, and agency mortgage-backed obligations. The acquired assets and liabilities, including derivatives, are recorded on a trade date basis at fair value. The fair value estimates presented herein are based on pertinent information available to management as of September 30, 2015. Although management is not aware of any factors that would significantly affect the estimated fair value amounts, such amounts have not been comprehensively revalued for purposes of this statement of financial condition since that date and current estimates of fair value may differ significantly from the amounts presented herein. The Company’s financial and nonfinancial assets and liabilities reported at fair value are included in the following captions on the statement of financial condition: • Cash and cash equivalents • Cash, securities and other assets segregated under federal and other regulations • Deposits with and receivables from exchange-clearing organizations, broker-dealers, clearing organizations and counterparties • Securities owned • Payables to broker-dealers, clearing organizations and counterparties • Securities sold, not yet purchased Cash equivalents, securities and derivative financial instruments are carried at fair value and are classified and disclosed in the following categories: Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. Level 1 consists of financial assets and liabilities whose fair values are estimated using quoted market prices. Included in Level 1 are money market funds, futures and options on futures contracts traded on national exchanges using quoted prices from national exchanges in which the Company executes transactions for customer and proprietary accounts, exchange-cleared swaps and options which are valued using exchange closing prices, commodities warehouse receipts and exchange firm common stock not pledged for clearing purposes. Level 2 - Quoted prices for identical or similar assets or liabilities in markets that are less active, that is, markets in which there are few transactions for the asset or liability that are observable for substantially the full term. Included in Level 2 are those financial assets and liabilities for which fair values are estimated using models or other valuation methodologies. These models are primarily industry-standard models that consider various observable inputs, including time value, yield curve, volatility factors, observable current market and contractual

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 12 prices for the underlying financial instruments, as well as other relevant economic measures. Financial assets and liabilities in this category include U.S. government securities and U.S. government agency obligations. Level 3 - Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity). Level 3 comprises financial assets and liabilities whose fair value is estimated based on internally developed models or methodologies utilizing significant inputs that are not readily observable from objective sources. As of September 30, 2015, the Company did not have any Level 3 financial assets or liabilities.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 13 The following table summarizes the Company’s financial assets and liabilities as of September 30, 2015, by level within the fair value hierarchy (in thousands): September 30, 2015 Level 1 Level 2 Level 3 Netting and Collateral (1) Total Assets: Commodities warehouse receipts $ 22,106 $ — $ — $ — $ 22,106 U.S. government obligations — 493,389 — — 493,389 Securities and other assets segregated under federal and other regulations 22,106 493,389 — — 515,495 Money market funds 431,769 — — — 431,769 U.S. government obligations — 501,389 — — 501,389 Derivatives 3,491,713 — — (3,448,340) 43,373 Deposits with and receivables from exchange- clearing organizations 3,923,482 501,389 — (3,448,340) 976,531 TBA and forward settling securities — 1,167 — (1,023) 144 Derivatives 1,095 — — (1,080) 15 Deposits with and receivables from broker- dealers, clearing organizations and counterparties 1,095 1,167 — (2,103) 159 Common and preferred stock and ADRs 23,791 1,856 — — 25,647 Exchangeable foreign ordinary equities and ADRs 82,944 6,581 — — 89,525 Corporate and municipal bonds 26,121 — — — 26,121 Agency mortgage-backed securities — 699,488 — — 699,488 U.S. government obligations — 513,419 — — 513,419 Foreign government obligations — 777 — — 777 Commodities warehouse receipts 2,813 — — — 2,813 Exchange firm common stock 5,567 — — — 5,567 Securities owned, at fair value 141,236 1,222,121 — — 1,363,357 Total assets at fair value $ 4,087,919 $ 2,218,066 $ — $ (3,450,443) $ 2,855,542 Liabilities: TBA and forward settling securities $ — $ 2,608 $ — $ (1,023) $ 1,585 Derivatives 3,401,020 — — (3,401,020) — Payables to broker-dealers, clearing organizations and counterparties 3,401,020 2,608 — (3,402,043) 1,585 Common and preferred stock and ADRs 17,978 634 — — 18,612 Exchangeable foreign ordinary equities and ADRs 88,979 962 — — 89,941 Corporate and municipal bonds 35 — — — 35 Agency mortgage-backed securities — 2,840 — — 2,840 U.S. government obligations — 340,934 — — 340,934 Foreign government obligations — 6,425 — — 6,425 Securities sold, not yet purchased, at fair value 106,992 351,795 — — 458,787 Total liabilities at fair value $ 3,508,012 $ 354,403 $ — $ (3,402,043) $ 460,372 (1) Represents cash collateral and the impact of netting across the levels of the fair value hierarchy. Netting among positions classified within the same level are included in that level.

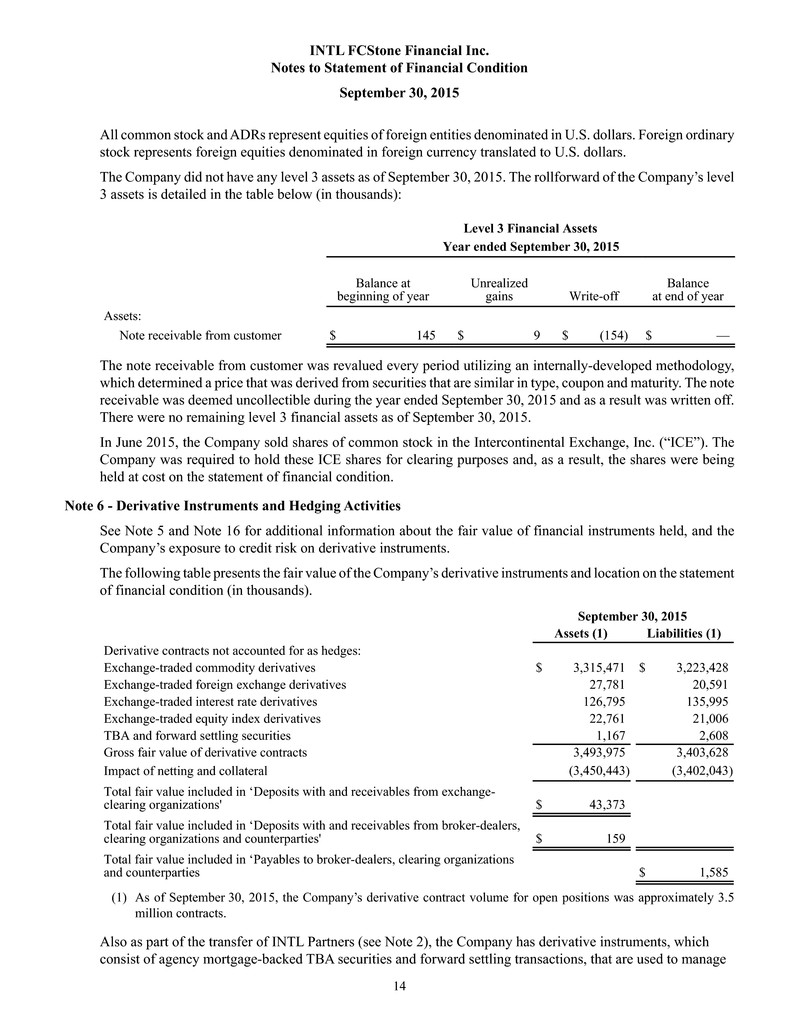

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 14 All common stock and ADRs represent equities of foreign entities denominated in U.S. dollars. Foreign ordinary stock represents foreign equities denominated in foreign currency translated to U.S. dollars. The Company did not have any level 3 assets as of September 30, 2015. The rollforward of the Company’s level 3 assets is detailed in the table below (in thousands): Level 3 Financial Assets Year ended September 30, 2015 Balance at beginning of year Unrealized gains Write-off Balance at end of year Assets: Note receivable from customer $ 145 $ 9 $ (154) $ — The note receivable from customer was revalued every period utilizing an internally-developed methodology, which determined a price that was derived from securities that are similar in type, coupon and maturity. The note receivable was deemed uncollectible during the year ended September 30, 2015 and as a result was written off. There were no remaining level 3 financial assets as of September 30, 2015. In June 2015, the Company sold shares of common stock in the Intercontinental Exchange, Inc. (“ICE”). The Company was required to hold these ICE shares for clearing purposes and, as a result, the shares were being held at cost on the statement of financial condition. Note 6 - Derivative Instruments and Hedging Activities See Note 5 and Note 16 for additional information about the fair value of financial instruments held, and the Company’s exposure to credit risk on derivative instruments. The following table presents the fair value of the Company’s derivative instruments and location on the statement of financial condition (in thousands). September 30, 2015 Assets (1) Liabilities (1) Derivative contracts not accounted for as hedges: Exchange-traded commodity derivatives $ 3,315,471 $ 3,223,428 Exchange-traded foreign exchange derivatives 27,781 20,591 Exchange-traded interest rate derivatives 126,795 135,995 Exchange-traded equity index derivatives 22,761 21,006 TBA and forward settling securities 1,167 2,608 Gross fair value of derivative contracts 3,493,975 3,403,628 Impact of netting and collateral (3,450,443) (3,402,043) Total fair value included in ‘Deposits with and receivables from exchange- clearing organizations' $ 43,373 Total fair value included in ‘Deposits with and receivables from broker-dealers, clearing organizations and counterparties' $ 159 Total fair value included in ‘Payables to broker-dealers, clearing organizations and counterparties $ 1,585 (1) As of September 30, 2015, the Company’s derivative contract volume for open positions was approximately 3.5 million contracts. Also as part of the transfer of INTL Partners (see Note 2), the Company has derivative instruments, which consist of agency mortgage-backed TBA securities and forward settling transactions, that are used to manage

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 15 risk exposures in the newly acquired subsidiary’s trading inventory. The fair value on these transactions are recorded in receivables or payables to broker-dealers, clearing organizations and counterparties. The Company enters into TBA securities transactions for the sole purpose of managing risk associated with the purchase of mortgage pass-through securities. TBA securities are included within payables to broker- dealers, clearing organizations and counterparties. Forward settling securities represent non-regular way securities and are included in payables to broker-dealers, clearing organizations and counterparties. As of September 30, 2015, these transactions are summarized as follows (in thousands): Gain / (Loss) Notional Amounts Unrealized gain on TBA securities purchased within payables to broker-dealers, clearing organizations and counterparties and related notional amounts (1) $ 634 $ 194,635 Unrealized loss on TBA securities purchased within payables to broker-dealers, clearing organizations and counterparties and related notional amounts (1) $ (249) $ 163,723 Unrealized gain on TBA securities sold within payables to broker-dealers, clearing organizations and counterparties and related notional amounts (1) $ 389 $ (314,138) Unrealized loss on TBA securities sold within payables to broker-dealers, clearing organizations and counterparties and related notional amounts (1) $ (1,990) $ (563,834) Unrealized gain on forward settling securities purchased within receivables from broker-dealers, clearing organizations and counterparties and related notional amounts $ 144 $ 163,398 Unrealized loss on forward settling securities sold within payables to broker- dealers, clearing organizations and counterparties and related notional amounts $ (369) $ (286,293) (1) The notional amounts of these instruments reflect the extent of the Company's involvement in TBA securities and do not represent risk of loss due to counterparty non-performance. Note 7 - Repurchase Agreements and Collateralized Transactions The Company enters into securities purchased under agreements to resell and payables under repurchase agreements primarily to finance securities owned, acquire securities to cover short positions or to acquire securities for settlement. These agreements are recorded at their contractual amounts plus accrued interest. In connection with these agreements and transactions, it is the policy of the Company to receive or pledge cash or securities to adequately collateralize such agreements and transactions in accordance with general industry guidelines and practices. The value of the collateral is valued daily and the Company may require counterparties to deposit additional collateral or return collateral pledged, when appropriate. The carrying amounts of these agreements and transactions approximate fair value due to their short-term nature and the level of collateralization. The Company pledges securities owned to collateralize repurchase agreements. At September 30, 2015, on a settlement date basis, securities owned of $170.7 million were pledged as collateral under repurchase agreements. The counterparty has the right to repledge the collateral in connection with these transactions. These securities owned have been pledged as collateral and have been parenthetically disclosed on the statement of financial condition. In addition, as of September 30, 2015, the Company pledged settlement date securities owned of $843.5 million and securities received under reverse repurchase agreements of $84.3 million to cover collateral for tri-party repurchase agreements. For these securities, the counterparty does not have the right to sell or repledge the collateral. At September 30, 2015, the Company has accepted collateral that it is permitted by contract or custom to sell or repledge. This collateral consists primarily of securities received in reverse repurchase agreements. The fair value of such collateral at September 30, 2015, was $396.6 million of which $315.3 million was used to cover

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 16 securities sold short which are recorded in securities sold, not yet purchased on the statement of financial condition. In the normal course of business, this collateral is used by the Company to cover financial instruments sold, not yet purchased and to obtain financing in the form of repurchase agreements. At September 30, 2015, substantially all of the above collateral had been delivered against securities sold, not yet purchased or repledged by the Company to obtain financing. Note 8 - Property and Equipment, net Property and equipment includes furniture, equipment, software, and leasehold improvements, at cost less accumulated depreciation. The following is a summary of property and equipment as of September 30, 2015 (in thousands): Furniture and equipment $ 1,406 Computer software and hardware 2,778 Leasehold improvements 4,377 8,561 Less accumulated depreciation (5,314) $ 3,247 Note 9 - Goodwill and Intangible Assets, net As part of the merger of three of its regulated U.S. subsidiaries as discussed in Note 2, the Company recorded transferred goodwill of $9.8 million during the year ended September 30, 2015. The Company has total goodwill of $12.6 million as of September 30, 2015. In addition, during the year ended September 30, 2015, the Company recorded transferred intangible assets of $12.6 million and accumulated amortization of $3.0 million as part of the merger. The gross and net carrying values of intangible assets as of September 30, 2015 by major intangible asset class are as follows: September 30, 2015 (in thousands) Gross Amount Accumulated Amortization Net Amount Intangible assets subject to amortization: Software programs/platforms $ 1,505 $ (1,041) $ 464 Customer base 12,778 (3,774) 9,004 14,283 (4,815) 9,468 Intangible assets not subject to amortization: Trade name 1,134 — 1,134 Total intangible assets $ 15,417 $ (4,815) $ 10,602 Note 10 - Credit Facilities On March 30, 2015, the Company amended its committed unsecured line of credit agreement, with a syndicate of lenders, administered by Bank of Montreal, under which the Company may borrow up to $75.0 million. This credit facility provides short-term funding of margin to commodity exchanges as necessary. The credit facility expires on April 7, 2016, and is subject to annual review. Effective July 1, 2015, the credit agreement was further amended to incorporate the changes resulting from the merger transaction, as described in Note 2.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 17 The continued availability of this credit facility is subject to the Company’s financial condition and operating results continuing to be satisfactory as set forth in the agreement. Borrowings under the credit facility are on a demand basis and bear interest at the Base Rate, as defined, plus 2.00%, which was 5.25% as of September 30, 2015. The agreement contains financial covenants related to the Company’s tangible net worth, excess net capital, and maximum net loss over a trailing twelve month period, as defined. The Company was in compliance with these covenants throughout the fiscal year, including as of September 30, 2015. Unused portions of the margin line require a commitment fee of 0.50% on the unused commitment. There were no borrowings outstanding under this credit facility at September 30, 2015. During the next twelve months, the Company’s committed credit facility is scheduled to expire. While there is no guarantee that the Company will be successful in renewing this agreement as it expires, the Company believes it will be able to do so. On May 5, 2015, the Company entered into a secured, uncommitted loan facility, under which the Company may borrow up to $50.0 million, collateralized by commodity warehouse receipts, to facilitate U.S. commodity exchange deliveries of its customers, subject to certain terms and conditions of the credit agreement. Borrowings under the credit facility bear interest at the Fed Funds Rate, as defined, plus 2.5%. There are no commitment fees related to this credit arrangement. There were no borrowings outstanding under this credit facility at September 30, 2015. Note 11 - Commitments and Contingencies Operating Leases The Company leases office facilities, equipment, and automobiles for various terms under noncancelable operating lease agreements. The leases expire on various dates through 2023, and provide for renewal options. In the normal course of business, it is expected that these leases will be renewed or replaced by similar lease agreements. Most of the leases provide that the Company pay taxes, maintenance, insurance, and other expenses. Minimum rent payments under operating leases are recognized on a straight-line basis over the term of the lease, including rent concessions or holidays. The following table summarizes future minimum lease payments required under the various operating lease agreements (in thousands): Fiscal year ending September 30, 2016 $ 3,413 2017 2,756 2018 2,595 2019 2,608 2020 and beyond 6,482 Total $ 17,854 Purchase and Other Commitments Purchase and other commitments primarily include certain service agreements related to the use of front-office and back-office trading software systems and clearing agreements. Purchase and other commitments as of September 30, 2015 for less than one year. one to three years and three to five years were $1.1 million, $1.3 million and $0.1 million, respectively and none after five years. Securities sold, not yet purchased represent obligations of the Company to purchase specified financial instruments in the market at prevailing prices. Consequently, the Company’s ultimate obligation to satisfy

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 18 securities sold, not yet purchased may exceed the amounts recognized on the accompanying statement of financial condition. Securities Clearing Arrangement Indemnifications and Termination Fees The Company clears most of its securities transactions through Broadcort and Pershing, under clearing agreements with both parties. The agreements call for termination fees if the Company terminates either agreement without cause, or if one of the parties terminates either agreement for cause, as specified within the agreements. The maximum amount of termination fees related to these parties is $0.5 million. In the normal course of its business, the Company indemnifies and holds Broadcort and Pershing harmless against specified potential losses in connection with their acting as an agent of, or providing services to, the Company or its affiliates. The maximum potential amount of future payments that the Company could be required to make under these indemnifications cannot be estimated. However, the Company believes that it is unlikely it will have to make material payments under these arrangements and has not recorded any contingent liability in the statement of financial condition for these indemnifications. Exchange Member Guarantees The Company is a member of various exchanges that trade and clear futures and options on futures contracts. Associated with its membership, the Company may be required to pay a proportionate share of the financial obligations of another member who may default on its obligations to the exchange. While the rules governing different exchange memberships vary, in general, the Company’s guarantee obligations would arise only if the exchange had previously exhausted its resources. In addition, any such guarantee obligation would be apportioned among the other nondefaulting members of the exchange. Any potential contingent liability under these membership agreements cannot be estimated. The Company has not recorded any contingent liability in the statement of financial condition for these agreements and believes that any potential requirement to make payments under these agreements is remote. Legal Proceedings Certain conditions may exist as of the date the statement of financial condition is issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. The Company accrues legal fees related to contingent liabilities as they are incurred. In addition to the matters discussed below, from time to time and in the ordinary course of business, the Company is involved in various legal actions and proceedings, including tort claims, contractual disputes, employment matters, workers’ compensation claims and collections. The Company carries insurance that provides protection against certain types of claims, up to the limits of the respective policy. The following is a summary of a potentially significant legal matter involving the Company. Sentinel Litigation Prior to the July 1, 2015 merger of certain wholly owned subsidiaries of INTL FCStone (see notes 1 and 2), FCStone had a portion of its excess segregated funds invested with Sentinel Management Group Inc. (“Sentinel”), a registered FCM and an Illinois-based money manager that provided cash management services to other FCMs. In August 2007, Sentinel halted redemptions to customers and sold certain of the assets it managed to an unaffiliated third party at a significant discount. On August 17, 2007, subsequent to Sentinel’s sale of certain

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 19 assets, Sentinel filed for bankruptcy protection. In aggregate, $15.5 million of FCStone’s $21.9 million in invested funds were returned to it before and after Sentinel’s bankruptcy petition. In August 2008, the bankruptcy trustee of Sentinel filed adversary proceedings against FCStone, and a number of other FCMs in the Bankruptcy Court for the Northern District of Illinois. The case was subsequently reassigned to the United States District Court, for the Northern District of Illinois. In the complaint, the trustee sought avoidance of alleged transfers or withdrawals of funds received by FCStone and other FCMs within 90 days prior to the filing of the Sentinel bankruptcy petition, as well as avoidance of post-petition distributions and disallowance of the proof of claim filed by the Company. The trustee sought recovery of pre- and post-petition transfers totaling approximately $15.5 million. The trial of this matter took place, as a test case, during October 2012. The trial court entered a judgment against FCStone on January 4, 2013. On January 17, 2013, the trial court entered an agreed order, staying execution and enforcement, pending an appeal of the judgment. On March 19, 2014, the appeal court ruled in favor of FCStone. In April 2014, the trustee filed a petition for rehearing of the appeal. In May 2014, the U.S. Court of Appeals for the Seventh Circuit denied the petition. The trustee did not file a writ for certiorari with the U.S. Supreme Court during the time allowed to do so. The Company continues to be involved in litigation against the trustee to recover its share of the cash held in reserve accounts under Sentinel’s Fourth Amended Chapter 11 Plan of Liquidation. On February 10, 2015, based on a new theory, the trustee filed a motion for judgment against FCStone in the United States District Court, for the Northern District of Illinois, seeking to claw back the post-petition transfer of $14.5 million and to recover the funds held in reserve in the name of FCStone. FCStone filed its opposition brief and an associated motion for judgment on March 17, 2015. The trustee filed its reply briefs on April 7, 2015 and FCStone filed its reply briefs on April 22, 2015. The Company has determined that losses related to this matter are neither probable nor reasonably possible. The Company believes the case is without merit and intends to defend itself vigorously. Note 12 - Share-Based Compensation INTL FCStone sponsors a share-based stock option plan (the Plan) available for its directors, officers, employees and consultants. The Plan permits the issuance of shares of INTL FCStone common stock to key employees of the Company. Awards that expire or are canceled generally become available for issuance again under the Plan. INTL FCStone settles stock option exercises with newly issued shares of common stock. There were 39,000 stock options awarded to the Company’s employees during the year ended September 30, 2015. The strike price was set at the market value on the January 8, 2015 date of grant at $20.54, with the value calculated using the Black-Scholes option pricing model of $4.31 per share based on assumptions including a risk-free rate of 0.66%, no dividends, volatility of 28.42% and an expected life of 3.22 years.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 20 Stock option activity of the Company during the year ended September 30, 2015 is as follows: Number of Options Outstanding Weighted Average Exercise Price Weighted Average Remaining Term (in years) Aggregate Intrinsic Value (in millions) Balances at September 30, 2014 634,641 $ 31.07 3.03 $ — Granted 39,000 $ 20.54 Exercised (101,424) $ 18.59 Forfeited (667) $ 23.49 Expired (37,137) $ 28.98 Balances at September 30, 2015 534,413 $ 33.57 2.53 $ 1.0 Exercisable at September 30, 2015 303,256 $ 40.85 1.18 $ 0.7 The total intrinsic value of options exercised during fiscal 2015 was $1.0 million determined as of the date of exercise. Note 13 - Retirement Plans Defined Benefit Retirement Plans The Company participates in the qualified and nonqualified noncontributory retirement plans of FCStone Group, Inc., an affiliate. The retirement plans are defined benefit pension plans that cover certain employees of the Company. The plans were closed to new employees hired subsequent to April 1, 2006, and amended effective September 1, 2008, to freeze all benefit accruals, therefore no additional benefits accrue for active participants under the plans. Information on the overall costs and funded status of FCStone Group Inc.’s plans are included for informational purposes only. For purposes of computing minimum capital requirements pursuant to the rules, regulations and requirements of the CFTC, the Company, through a charge to net capital, reflects its estimated proportion of the liability related to the qualified plan’s unfunded defined benefit pension obligation. FCStone Group’s net liability for retirement costs as of September 30, 2015 had an unfunded status of $6.9 million. As of September 30, 2015, FCStone’s plans have both accumulated benefit obligations and projected benefit obligations of $37.1 million, which are in excess of plan assets of $30.2 million. Defined Contribution Retirement Plan The Company offers participation in the INTL FCStone Inc. 401(k) Plan (“401(k) Plan”), a defined contribution plan providing retirement benefits, to all employees who have reached 21 years of age, and provided four months of service to the Company. Employees may contribute from 1% to 80% of their annual compensation to the 401(k) Plan, limited to a maximum annual amount as set periodically by the Internal Revenue Service. The Company makes matching contributions to the 401(k) Plan in an amount equal to 62.5% of each participant’s eligible elective deferral contribution to the 401(k) Plan, up to 8% of employee compensation. Matching contributions vest, by participant, based on the following years of service schedule: less than two years - none, after two years - 33%, after three years - 66%, and after four years - 100%. During the year ended September 30, 2015, the Company contributed $2.1 million to this plan.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 21 Note 14 - Income Taxes Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the Company’s deferred tax assets and liabilities as of September 30, 2015 are as follows (in thousands): Deferred tax assets: Net operating losses $ 2,794 Amortization of intangibles 3,405 Deferred compensation 973 Share-based compensation 1,230 Deferred rent 487 Other assets 230 Total gross deferred tax assets 9,119 Less valuation allowance (700) Total deferred tax assets 8,419 Deferred tax liabilities: Depreciation of property and equipment (635) Prepaid expenses (314) Unrealized gains on marketable securities and exchange seats (1,225) Total deferred tax liabilities (2,174) Deferred income taxes, net $ 6,245 As of September 30, 2015, the Company has net operating loss carryforwards for state income tax purposes of $2.1 million, net of valuation allowances, which are available to offset future state taxable income. The net operating loss carryforwards expire in tax years ending in 2020 through 2030. The valuation allowance for deferred tax assets as of September 30, 2015 is $0.7 million. The valuation allowance as of September 30, 2015 is primarily related to state net operating loss carryforwards that, in the judgment of management, are not more likely than not to be realized. In assessing the realizability of deferred tax assets, management considers whether it is more likely than not that some or all of the deferred tax assets will not be realized. When evaluating the need for a valuation allowance, the Company considers the operating and tax results of INTL FCStone, as income taxes are allocated to the Company on a pro-rata basis. INTL FCStone earned U.S. federal, state, and local taxable income (losses) for the years ending September 30, 2015, 2014, and 2013 of $17.7 million, ($18.4 million), and ($24.5 million), respectively. There are no significant differences between actual levels of past taxable income (losses) and pre-tax book income (losses) in these jurisdictions. INTL FCStone considered the existence of deferred tax liabilities and available tax planning strategies when evaluating the realizability of deferred tax assets. Based on the reversal of deferred tax liabilities and tax planning strategies that can be implemented by INTL FCStone, management believes that it is more likely than not that the Company will realize the tax benefit of the deferred tax assets, net of the existing valuation allowance, within 10 years. INTL FCStone has open tax years, that include the activities of the Company, ranging from September 30, 2010 through September 30, 2015 with various taxing authorities.

INTL FCStone Financial Inc. Notes to Statement of Financial Condition September 30, 2015 22 Note 15 - Transactions with Affiliated Companies The Company had borrowings under a subordinated note agreement with the Parent totaling $3.0 million, which was repaid on July 1, 2015, prior to its maturity date of August 28, 2015. The Parent holds the operating assets and liabilities for the Company’s debt origination business, and transfers the net revenues from these activities to the Company on a monthly basis. As of September 30, 2015, there were notes receivable of $41.4 million, loans payable under participation agreements of $30.7 million, along with the related accrued interest receivable of $740 thousand and accrued interest payable of $223 thousand, and $1.6 million of deferred revenues, net of costs recorded on the books of the Parent. In the ordinary course of business, the Company completes transactions and pays certain costs on behalf of the Parent and affiliated subsidiaries of INTL FCStone. As of September 30, 2015, the Company had receivables from affiliates of $0.6 million, primarily related to revenues charged to affiliates and the reimbursement of expenses paid on behalf of affiliates. Additionally, the Company pays introducing broker commissions and management fees to certain affiliates based on revenues generated for the Company, and reimburses certain affiliates for costs paid on its behalf. As of September 30, 2015, the Company had payables to affiliates of $21.7 million related to introducing broker commissions and management fees and reimbursement of expenses. There can be no assurances that such transactions would have occurred under the same terms and conditions with an unrelated party. The Company settles its receivable and payable balances with its affiliates in a timely manner. The Company has commodity futures and options on futures accounts for its customers with its affiliates. In addition, the Company maintains commodity futures and options on futures accounts on behalf of its affiliates and the customers of its affiliates. As of September 30, 2015 the net balances of these accounts, which totaled $21.4 million and $129.6 million, are included in deposits with and receivables from broker-dealers, clearing organizations and counterparties and payables to customers, respectively, on the statement of financial condition. During the current year, the Company acquired three exchange memberships from an affiliated subsidiary, in a transfer at book value of $2.1 million. Note 16 - Financial Instruments with Off-Statement of Financial Condition Risk The Company is a party to financial instruments in the normal course of its business through customer trading accounts in exchange-traded derivative instruments. These instruments are primarily the execution of orders for commodity futures and options-on-futures contracts on behalf of its customers, substantially all of which are transacted on a margin basis. Such transactions may expose the Company to significant credit risk in the event margin requirements are not sufficient to fully cover losses which customers may incur. The Company controls the risks associated with these transactions by requiring customers to maintain margin deposits in compliance with individual exchange regulations and internal guidelines. The Company monitors required margin levels daily and, therefore, may require customers to deposit additional collateral or reduce positions when necessary. The Company also establishes contract limits for customers, which are monitored daily. The Company evaluates each customer’s creditworthiness on a case-by-case basis. Clearing, financing, and settlement activities may require the Company to maintain funds with or pledge securities as collateral with other financial institutions. Generally, these exposures to both customers and exchanges are subject to netting, or customer agreements, which reduce the exposure to the Company by permitting receivables and payables with such customers to be offset in the event of a customer default. Management believes that the margin deposits held are adequate to minimize the risk of material loss that could be created by positions held as of September 30, 2015. Additionally, the Company monitors collateral fair value on a daily basis and adjusts collateral levels in the event of excess market exposure. Generally, these exposures to both customers and counterparties are subject to master netting, or customer agreements which reduce the exposure to the Company. Derivative financial instruments involve varying degrees of off-statement of financial condition market risk whereby changes in the fair values of underlying financial instruments may result in changes in the fair value