Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - LIFELOCK, INC. | lock-ex312x20150930x10q.htm |

| EX-31.1 - EXHIBIT 31.1 - LIFELOCK, INC. | lock-ex311x20150930x10q.htm |

| EX-32.1 - EXHIBIT 32.1 - LIFELOCK, INC. | lock-ex321x20150930x10q.htm |

| EX-10.1 - EXHIBIT 10.1 - LIFELOCK, INC. | lock-ex101xsatyavoluofferl.htm |

| EX-10.2 - EXHIBIT 10.2 - LIFELOCK, INC. | lock-ex102xsatyavolusevera.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________.

Commission file number: 001-35671

LifeLock, Inc. (Exact name of registrant as specified in its charter) |

Delaware | 56-2508977 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

60 East Rio Salado Parkway, Suite 400 Tempe, Arizona 85281 (Address of principal executive offices and zip code) (480) 682-5100 (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ý | Accelerated filer | ¨ | |

Non-accelerated filer (Do not check if a smaller reporting company) | ¨ | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of October 30, 2015, there were outstanding 95,515,268 shares of the registrant’s common stock, $0.001 par value.

LIFELOCK, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2015

TABLE OF CONTENTS

Page | |

i

PART I - FINANCIAL INFORMATION

Item 1. | Financial Statements (Unaudited) |

LIFELOCK, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

September 30, 2015 | December 31, 2014 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 135,542 | $ | 146,569 | |||

Marketable securities | 196,697 | 127,305 | |||||

Trade and other receivables, net | 10,508 | 10,220 | |||||

Deferred tax assets, net | 48,808 | 21,243 | |||||

Prepaid expenses and other current assets | 8,862 | 7,841 | |||||

Total current assets | 400,417 | 313,178 | |||||

Property and equipment, net | 25,973 | 24,204 | |||||

Goodwill | 172,139 | 159,342 | |||||

Intangible assets, net | 32,064 | 38,315 | |||||

Deferred tax assets, net – non-current | 22,713 | 22,494 | |||||

Other non-current assets | 9,593 | 5,783 | |||||

Total assets | $ | 662,899 | $ | 563,316 | |||

Liabilities and stockholders’ equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 13,362 | $ | 11,543 | |||

Accrued expenses and other liabilities | 184,166 | 67,025 | |||||

Deferred revenue | 170,835 | 145,206 | |||||

Total current liabilities | 368,363 | 223,774 | |||||

Other non-current liabilities | 6,970 | 6,706 | |||||

Total liabilities | 375,333 | 230,480 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Common stock, $0.001 par value, 300,000,000 authorized at September 30, 2015 and December 31, 2014; 95,486,687 and 93,944,742 shares issued and 95,441,078 and 93,899,968 outstanding at September 30, 2015 and December 31, 2014, respectively | 95 | 94 | |||||

Preferred stock, $0.001 par value, 10,000,000 shares authorized and no shares issued and outstanding at September 30, 2015 and December 31, 2014 | — | — | |||||

Additional paid-in capital | 524,385 | 495,912 | |||||

Accumulated other comprehensive loss | (77 | ) | (116 | ) | |||

Accumulated deficit | (236,837 | ) | (163,054 | ) | |||

Total stockholders’ equity | 287,566 | 332,836 | |||||

Total liabilities and stockholders’ equity | $ | 662,899 | $ | 563,316 | |||

See accompanying notes to condensed consolidated financial statements.

1

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Revenue: | |||||||||||||||

Consumer revenue | $ | 144,648 | $ | 116,115 | $ | 411,178 | $ | 326,448 | |||||||

Enterprise revenue | 7,304 | 6,916 | 20,139 | 19,882 | |||||||||||

Total revenue | 151,952 | 123,031 | 431,317 | 346,330 | |||||||||||

Cost of services | 33,988 | 30,327 | 103,470 | 89,675 | |||||||||||

Gross profit | 117,964 | 92,704 | 327,847 | 256,655 | |||||||||||

Costs and expenses: | |||||||||||||||

Sales and marketing | 62,850 | 51,818 | 209,470 | 166,710 | |||||||||||

Technology and development | 19,396 | 12,341 | 52,928 | 37,996 | |||||||||||

General and administrative | 120,984 | 16,781 | 160,815 | 45,489 | |||||||||||

Amortization of acquired intangible assets | 2,084 | 2,231 | 6,251 | 6,693 | |||||||||||

Total costs and expenses | 205,314 | 83,171 | 429,464 | 256,888 | |||||||||||

Income (loss) from operations | (87,350 | ) | 9,533 | (101,617 | ) | (233 | ) | ||||||||

Other income (expense): | |||||||||||||||

Interest expense | (89 | ) | (89 | ) | (265 | ) | (264 | ) | |||||||

Interest income | 219 | 73 | 498 | 189 | |||||||||||

Other, net | — | (134 | ) | (183 | ) | (151 | ) | ||||||||

Total other income (expense) | 130 | (150 | ) | 50 | (226 | ) | |||||||||

Income (loss) before income taxes | (87,220 | ) | 9,383 | (101,567 | ) | (459 | ) | ||||||||

Income tax expense (benefit) | (22,075 | ) | 3,933 | (27,784 | ) | (116 | ) | ||||||||

Net income (loss) | $ | (65,145 | ) | $ | 5,450 | $ | (73,783 | ) | $ | (343 | ) | ||||

Net income (loss) per share | |||||||||||||||

Basic | $ | (0.68 | ) | $ | 0.06 | $ | (0.78 | ) | $ | (0.00 | ) | ||||

Diluted | $ | (0.68 | ) | $ | 0.06 | $ | (0.78 | ) | $ | (0.00 | ) | ||||

Weighted-average common shares outstanding used in computing net income (loss) per share: | |||||||||||||||

Basic | 95,340 | 92,925 | 94,660 | 92,437 | |||||||||||

Diluted | 95,340 | 98,524 | 94,660 | 92,437 | |||||||||||

See accompanying notes to condensed consolidated financial statements.

2

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Net income (loss) | $ | (65,145 | ) | $ | 5,450 | $ | (73,783 | ) | $ | (343 | ) | ||||

Other comprehensive gain (loss), net of tax | |||||||||||||||

Unrealized gain (loss) on marketable securities | 117 | (78 | ) | 39 | (66 | ) | |||||||||

Comprehensive income (loss) | $ | (65,028 | ) | $ | 5,372 | $ | (73,744 | ) | $ | (409 | ) | ||||

See accompanying notes to condensed consolidated financial statements.

3

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

For the Nine Months Ended September 30, | |||||||

2015 | 2014 | ||||||

Operating activities | |||||||

Net loss | $ | (73,783 | ) | $ | (343 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation and amortization | 13,292 | 12,259 | |||||

Share-based compensation | 20,287 | 13,229 | |||||

Provision for doubtful accounts | 150 | 333 | |||||

Amortization of premiums on marketable securities | 2,310 | 1,213 | |||||

Deferred income tax benefit | (27,784 | ) | (124 | ) | |||

Other | 250 | 39 | |||||

Change in operating assets and liabilities: | |||||||

Trade and other receivables | (3,469 | ) | 566 | ||||

Prepaid expenses and other current assets | (1,022 | ) | (701 | ) | |||

Other non-current assets | 357 | 716 | |||||

Accounts payable | 1,548 | 5,282 | |||||

Accrued expenses and other liabilities | 117,693 | 11,303 | |||||

Deferred revenue | 25,629 | 26,742 | |||||

Other non-current liabilities | 265 | 1,617 | |||||

Net cash provided by operating activities | 75,723 | 72,131 | |||||

Investing activities | |||||||

Acquisition of business, net of cash acquired | (12,797 | ) | — | ||||

Acquisition of property and equipment, including capitalization of internal use software | (9,057 | ) | (11,127 | ) | |||

Purchases of marketable securities | (191,846 | ) | (95,686 | ) | |||

Sales and maturities of marketable securities | 122,936 | 34,418 | |||||

Premiums paid for company-owned life insurance policies | (4,337 | ) | (4,337 | ) | |||

Net cash used in investing activities | (95,101 | ) | (76,732 | ) | |||

Financing activities | |||||||

Proceeds from stock-based compensation plans | 10,144 | 9,704 | |||||

Proceeds from warrant exercises | — | 375 | |||||

Payments for employee tax withholdings related to restricted stock units and awards | (1,793 | ) | (760 | ) | |||

Net cash provided by financing activities | 8,351 | 9,319 | |||||

Net increase (decrease) in cash and cash equivalents | (11,027 | ) | 4,718 | ||||

Cash and cash equivalents at beginning of period | 146,569 | 123,911 | |||||

Cash and cash equivalents at end of period | $ | 135,542 | $ | 128,629 | |||

See accompanying notes to condensed consolidated financial statements.

4

LIFELOCK, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Corporation Information

We provide proactive identity theft protection services to our consumer subscribers, whom we refer to as our members, on an annual or monthly subscription basis. We also provide consumer risk management services to our enterprise customers.

We were incorporated in Delaware on April 12, 2005, and are headquartered in Tempe, Arizona. On March 14, 2012, we acquired ID Analytics, LLC (formerly, ID Analytics, Inc.) and its wholly owned subsidiary SageStream, LLC (formerly IDA Inc.), each of which is incorporated in Delaware. On December 11, 2013, we acquired Lemon, LLC (formerly, Lemon, Inc.), or Lemon, which is incorporated in Delaware.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), and applicable Securities and Exchange Commission, or SEC, rules and regulations regarding interim financial reporting. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, or 2014 Form 10-K.

The condensed consolidated balance sheet as of December 31, 2014 included herein was derived from the audited financial statements as of that date, but does not include all disclosures including notes required by U.S. GAAP.

The accompanying unaudited condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, and cash flows for the interim periods, but are not necessarily indicative of the anticipated results of operations for the entire year ending December 31, 2015 or any future period.

Basis of Consolidation

The condensed consolidated financial statements include our accounts and those of our wholly and indirectly owned subsidiaries. We eliminate all intercompany balances and transactions, including intercompany profits, in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires us to make certain estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We continually evaluate our estimates, including those related to the allocation of the purchase price associated with acquisitions; the carrying value of long-lived assets; the amortization period of long-lived assets; the carrying value, capitalization, and amortization of software and website development costs; the carrying value of goodwill and other intangible assets; the amortization period of intangible assets; the provision for income taxes and related deferred tax accounts, and realizability of deferred tax assets, certain accrued expenses; incurred but not reported medical claims, contingencies, litigation, and related legal accruals; and the value attributed to employee stock options and other stock-based awards. We base our estimates on historical experience, current business factors, and various other assumptions that we believe are necessary to consider to form a basis for making judgments. Actual results could be materially different from these estimates.

2. Summary of Significant Accounting Policies

There have been no material changes to our significant accounting policies from those disclosed in our Form 10-K for the year ended December 31, 2014.

Recently Issued Accounting Standards

In May 2014, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers, which provides guidance for revenue recognition. The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under today’s guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price, and allocating the transaction price to each separate performance obligation. In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers: Deferral of the Effective Date, which defers the effective date of ASU 2014-09 for all entities for one year. Consequently, the guidance provided in ASU 2014-09 will be effective for us in the first

5

quarter of our fiscal year ending December 31, 2018. Early adoption is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The guidance permits the use of either the retrospective or cumulative effect transition method. We are currently in the process of evaluating the impact of the adoption of this guidance on our consolidated financial statements and have not yet selected a transition method.

In February 2015, the FASB issued ASU 2015-02, Consolidation, which changes the analysis that a reporting entity must perform to determine whether it should consolidate certain legal entities. The amendments in the standard affect limited partnerships and similar legal entities, evaluating fees paid to a decision maker or a service provider as a variable interest, the effect of fee arrangements on the primary beneficiary determination, the effect of related parties on the primary beneficiary determination, and certain investment funds. This guidance is effective for public business entities for fiscal years, and for interim fiscal periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted. We do not expect the adoption of this ASU to have a significant impact on our consolidated financial statements.

In April 2015, the FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs, which changes the presentation of debt issuance costs in financial statements. The guidance requires an entity to present such costs in the balance sheet as a direct deduction from the related debt liability rather than as an asset, with amortization of the costs continuing to be reported as interest expense. In August 2015, the FASB issued ASU 2015-15, Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements, which provides that the SEC staff would not object to an entity deferring and presenting debt issuance costs as an asset and subsequently amortizing the deferred debt issuance costs ratably over the term of the line-of-credit arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. This guidance is effective for annual reporting periods beginning after December 15, 2016, and will be applied retrospectively to each prior period presented. Early adoption is permitted. We do not expect the adoption of these ASUs to have a material impact on our consolidated financial statements.

In April 2015, the FASB issued ASU 2015-05, Customer's Accounting for Fees paid in a Cloud Computing Arrangement, which provides a basis for evaluating whether a cloud computing arrangement includes a software license. If a cloud computing arrangement includes a license to internal-use software, then the software license should be accounted for in accordance with Subtopic 350-40. A license to software other than internal-use software should be accounted for in accordance with other applicable U.S. GAAP. If a cloud computing arrangement does not include a software license, then the arrangement should be accounted for as a service contract. The guidance is effective for annual periods, including interim periods within those annual periods, beginning after December 15, 2015. Early adoption is permitted. We do not expect the adoption of this ASU to have a material impact on our consolidated financial statements.

In September 2015, the FASB issued ASU 2015-16, Simplifying the Accounting for Measurement-Period Adjustments, which eliminates the requirement for an acquirer to retrospectively adjust provisional amounts recognized in a business combination. The guidance requires the acquirer to recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amount is determined. Additionally, the guidance requires the acquirer to record the effect on earnings of changes in depreciation, amortization, or other income effects, if any, as a result of the change to the provisional amounts, calculated as if the accounting had been completed at the acquisition date in the same period's financial statements. An acquirer is also required to present separately on the face of the income statement or disclose in the notes to the financial statements the portion of the amount recorded in current period earnings by line item that would have been recorded in previous reporting periods if the adjustment to the provisional amounts had been recognized as of the acquisition date. The guidance is effective for public entities for annual periods, including interim periods within those annual periods, beginning after December 15, 2015. Early adoption is permitted. We plan to early adopt this guidance and do not expect the adoption of this ASU to have a significant impact on our consolidated financial statements.

3. Business Combinations

Acquisition of Assets from BitYota, Inc.

On August 21, 2015, we acquired a team of product and development data experts with experience in large scale data processing from BitYota, a provider of data warehouse as a service, for an aggregate purchase price of approximately $12.8 million. The team will focus on developing new data-based products within our consumer segment.

We accounted for this asset acquisition as a business combination, using the acquisition method in accordance with ASC 805 Business Combinations. We reviewed all identifiable tangible and intangible assets acquired and determined that any fair value was immaterial based on the information available as of the acquisition date. As a result we preliminarily determined that the entire purchase price of acquired assets will be assigned to goodwill within our consumer segment, as the primary asset acquired was the assembled workforce, a team with expertise in the development of data-based products, who could use their ability to develop new products within our consumer segment. The goodwill resulting from the acquisition of BitYota is deductible for tax purposes. We expect to finalize the valuation as soon as practicable, but no later than one year from the date of acquisition.

6

Acquisition related costs recognized for the nine-month period ended September 30, 2015 amounted to $3.1 million, which we have classified in technology and development and general and administrative expenses in our condensed consolidated statements of operations. Transaction costs included expenses such as signing bonuses, legal, accounting, and other professional services.

Had the acquisition of assets from BitYota occurred on January 1, 2014, our pro forma consolidated revenue for the three- and nine-month periods ended September 30, 2015 and 2014, would have increased by less than 0.1%.

4. Marketable Securities

The following is a summary of marketable securities designated as available-for-sale as of September 30, 2015 and December 31, 2014:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

September 30, 2015 | |||||||||||||||

Corporate bonds | $ | 131,740 | $ | 6 | $ | (116 | ) | $ | 131,630 | ||||||

Municipal bonds | 17,957 | 14 | (1 | ) | 17,970 | ||||||||||

Commercial paper | 36,118 | — | — | 36,118 | |||||||||||

Agency securities | 7,279 | 7 | — | 7,286 | |||||||||||

Certificates of deposit | 2,492 | — | — | 2,492 | |||||||||||

Government securities | 1,199 | 2 | — | 1,201 | |||||||||||

Total marketable securities | $ | 196,785 | $ | 29 | $ | (117 | ) | $ | 196,697 | ||||||

December 31, 2014 | |||||||||||||||

Corporate bonds | $ | 99,592 | $ | 1 | $ | (119 | ) | $ | 99,474 | ||||||

Municipal bonds | 18,146 | 1 | (10 | ) | 18,137 | ||||||||||

Commercial paper | 9,196 | — | — | 9,196 | |||||||||||

Certificates of deposit | 498 | — | — | 498 | |||||||||||

Total marketable securities | $ | 127,432 | $ | 2 | $ | (129 | ) | $ | 127,305 | ||||||

We classify all marketable securities as current regardless of contractual maturity dates because we consider such investments to represent cash available for current operations.

As of September 30, 2015 and December 31, 2014, we did not consider any of our marketable securities to be other-than-temporarily impaired. When evaluating our investments for other-than-temporary impairment, we review factors such as the length of time and extent to which fair value has been below its cost basis, the financial condition of the issuer, our ability and intent to hold the security, and whether it is more likely than not that we will be required to sell the investment before recovery of its cost basis.

The following is a summary of amortized cost and estimated fair value of marketable securities as of September 30, 2015 and December 31, 2014, by maturity:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

September 30, 2015 | |||||||||||||||

Due in one year or less | $ | 147,745 | $ | 13 | $ | (75 | ) | $ | 147,683 | ||||||

Due after one year | 49,040 | 16 | (42 | ) | 49,014 | ||||||||||

Total marketable securities | $ | 196,785 | $ | 29 | $ | (117 | ) | $ | 196,697 | ||||||

December 31, 2014 | |||||||||||||||

Due in one year or less | $ | 127,029 | $ | 2 | $ | (129 | ) | $ | 126,902 | ||||||

Due after one year | 403 | — | — | 403 | |||||||||||

Total marketable securities | $ | 127,432 | $ | 2 | $ | (129 | ) | $ | 127,305 | ||||||

7

5. Fair Value Measurements

As of September 30, 2015 and December 31, 2014, the fair value of our financial assets was as follows:

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(in thousands) | |||||||||||||||

September 30, 2015 | |||||||||||||||

Assets: | |||||||||||||||

Money market funds (1) | $ | 18,085 | $ | — | $ | — | $ | 18,085 | |||||||

Corporate bonds (2) | — | 131,630 | — | 131,630 | |||||||||||

Municipal bonds (2) | — | 17,970 | — | 17,970 | |||||||||||

Commercial paper (3) | — | 46,171 | — | 46,171 | |||||||||||

Certificates of deposit (2) | — | 2,492 | — | 2,492 | |||||||||||

Agency securities (2) | — | 7,286 | — | 7,286 | |||||||||||

Government securities (2) | — | 1,201 | — | 1,201 | |||||||||||

Total assets measured at fair value | $ | 18,085 | $ | 206,750 | $ | — | $ | 224,835 | |||||||

December 31, 2014 | |||||||||||||||

Assets: | |||||||||||||||

Money market funds (1) | $ | 11,903 | $ | — | $ | — | $ | 11,903 | |||||||

Corporate bonds (2) | — | 99,474 | — | 99,474 | |||||||||||

Municipal bonds (2) | — | 18,137 | — | 18,137 | |||||||||||

Commercial paper (4) | — | 54,399 | — | 54,399 | |||||||||||

Certificates of deposit (2) | — | 498 | — | 498 | |||||||||||

Total assets measured at fair value | $ | 11,903 | $ | 172,508 | $ | — | $ | 184,411 | |||||||

(1) | Classified in cash and cash equivalents |

(2) | Classified in marketable securities |

(3) | Includes commercial paper with maturities of three months or less at time of purchase of $10.1 million classified in cash and cash equivalents and commercial paper with maturities of greater than three months of $36.1 million classified in marketable securities. |

(4) | Includes commercial paper with maturities of three months or less at time of purchase of $45.2 million classified in cash and cash equivalents and commercial paper with maturities of greater than three months of $9.2 million classified in marketable securities. |

6. Financing Arrangements

On January 9, 2013, we refinanced our existing credit agreement and entered into a new credit agreement, or the Credit Agreement, with Bank of America, N.A. as administrative agent, swing line lender and L/C issuer, Silicon Valley Bank as syndication agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated as sole lead arranger and sole book manager, and the lenders from time to time party thereto. We refer to the Credit Agreement and related documents as the Senior Credit Facility.

The Senior Credit Facility provides for an $85.0 million revolving line of credit, which we can increase to $110.0 million subject to the conditions set forth in the Credit Agreement. The revolving line of credit also includes a letter of credit subfacility of $10.0 million and a swing line loan subfacility of $5.0 million. The Senior Credit Facility has a maturity date of January 9, 2018. As of September 30, 2015, we had no debt outstanding under our Senior Credit Facility. For the nine-month period ended September 30, 2015, we incurred unused commitment fees of $0.1 million, which are included in interest expense in the consolidated statements of operations.

Borrowings under the Senior Credit Facility bear interest at a per annum rate equal to, at our option, either (a) a base rate equal to the highest of (i) the Federal Funds Rate plus 0.50%, (ii) the rate of interest in effect for such day as publicly announced from time to time by Bank of America as its “prime rate,” and (iii) the eurodollar rate for base rate loans plus 1.00%, plus an applicable rate ranging from 0.50% to 1.25%, or (b) the eurodollar rate for eurodollar rate loans plus an applicable rate ranging from 1.50% to 2.25%. The initial applicable rate is 0.50% for base rate loans and 1.50% for eurodollar rate loans, subject to adjustment from time to time based upon our achievement of a specified consolidated leverage ratio.

8

In addition to paying interest on the outstanding principal under the Senior Credit Facility, we are also required to pay a commitment fee to the administrative agent at a rate per annum equal to the product of (a) an applicable rate ranging from 0.25% to 0.50% multiplied by (b) the actual daily amount by which the aggregate revolving commitments exceed the sum of (1) the outstanding amount of revolving borrowings, and (2) the outstanding amount of letter of credit obligations. The initial applicable rate is 0.25%, subject to adjustment from time to time based upon our achievement of a specified consolidated leverage ratio.

We also will pay a letter of credit fee to the administrative agent for the account of each lender in accordance with its applicable percentage of a letter of credit for each letter of credit, equal to the applicable rate then in effect, multiplied by the daily maximum amount available to be drawn under the letter of credit. The initial applicable rate for the letter of credit is 1.50%, subject to adjustment from time to time based upon our achievement of a specified consolidated leverage ratio.

We have the right to prepay our borrowings under the Senior Credit Facility from time to time in whole or in part, without premium or penalty, subject to the procedures set forth in the Senior Credit Facility.

All of our obligations under the Senior Credit Facility are unconditionally and jointly and severally guaranteed by each of our existing and future, direct or indirect, domestic subsidiaries, subject to certain exceptions. In addition, all of our obligations under the Senior Credit Facility, and the guarantees of those obligations, are secured, subject to permitted liens and certain other exceptions, by a first-priority lien on our and our subsidiaries’ tangible and intangible personal property, including a pledge of all of the capital stock of our subsidiaries.

The Senior Credit Facility requires us to maintain certain financial covenants. In addition, the Senior Credit Facility requires us to maintain all material proprietary databases and software with a third-party escrow agent in accordance with an escrow agreement that we reaffirmed in connection with the Senior Credit Facility. The Senior Credit Facility also contains certain affirmative and negative covenants limiting, among other things, additional liens and indebtedness, investments and distributions, mergers and acquisitions, liquidations, dissolutions, sales of assets, prepayments and modification of debt instruments, transactions with affiliates, and other matters customarily restricted in such agreements. The Senior Credit Facility also contains customary events of default, including payment defaults, breaches of representations and warranties, covenant defaults, cross defaults to other contractual agreements, events of bankruptcy and insolvency, and a change of control.

On November 6, 2015, we entered into a First Amendment and Consent to our Senior Credit Facility (the “First Amendment”).

The First Amendment modifies the calculation of cash EBITDA under the Senior Credit Facility to exclude up to $130 million of expenses related to the proposed settlements with the FTC and representatives of a national class of consumers, potential settlements with certain states' attorneys general and fees incurred in relation to the litigation and potential settlements.

In addition, pursuant to the First Amendment, through the end of the fourth full fiscal quarter ending after the date on which the courts have approved the settlement agreements with the FTC and the national class of consumers (the “Settlement Date”), we are required to comply with certain additional financial and reporting covenants in the Senior Credit Facility.

Further, until the later of the one year anniversary of the Settlement Date, and the date on which we have received court approval with at least 50% of the state attorney generals that have proceedings currently pending or initiated on or before November 6, 2016 related to the issues presented in the FTC Order, if any, the revolving line of credit under the Senior Credit Facility is limited to letters of credit in the ordinary course of business not to exceed $2 million in the aggregate at any one time and certain permitted acquisitions of up to $25 million in the aggregate, unless a higher amount is consented to by the holders of 66 2/3% of the aggregate revolving commitments.

Pursuant to terms of the First Amendment, we are also subject to additional limitations and conditions on acquisitions and making certain types of payments (including dividends, redemptions or other distributions) with respect to our equity interests.

At September 30, 2015 we were in compliance with all the covenants of the Senior Credit Facility.

As of September 30, 2015, we had an outstanding letter of credit in the amount of $0.3 million.

9

7. Stockholders’ Equity

Share-Based Compensation

We issue share-based awards to our employees in the form of stock options, restricted stock units, and restricted stock. We also have an Employee Stock Purchase Plan, or ESPP. The following table summarizes the components of share-based compensation expense included in our condensed consolidated statements of operations:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(in thousands) | |||||||||||||||

Cost of services | $ | 449 | $ | 334 | $ | 1,286 | $ | 910 | |||||||

Sales and marketing | 1,238 | 761 | 3,385 | 2,235 | |||||||||||

Technology and development | 2,514 | 867 | 6,226 | 3,766 | |||||||||||

General and administrative | 3,662 | 2,340 | 9,390 | 6,318 | |||||||||||

Total share-based compensation | $ | 7,863 | $ | 4,302 | $ | 20,287 | $ | 13,229 | |||||||

Unrecognized share-based compensation expenses totaled $86.9 million as of September 30, 2015, which we expect to recognize over a weighted-average time period of 3.10 years.

Stock Warrants

As of September 30, 2015, we had the following warrants to purchase common stock outstanding:

Expiration Date | Shares | Exercise Price | ||||

October 3, 2016 | 2,334,044 | 0.70 | ||||

8. Net Income (Loss) Per Share

We compute basic net income (loss) per share by dividing net loss by the weighted-average number of common shares outstanding for the period. We compute diluted net income (loss) per share giving effect to all potential dilutive common stock, including awards granted under our equity compensation plans and warrants to acquire common stock.

The following table sets forth the computation of basic and diluted net income (loss):

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(in thousands, except share and per share data) | |||||||||||||||

Net income (loss) | $ | (65,145 | ) | $ | 5,450 | (73,783 | ) | (343 | ) | ||||||

Denominator (basic): | |||||||||||||||

Weighted average common shares outstanding | 95,340,136 | 92,924,516 | 94,659,931 | 92,436,628 | |||||||||||

Denominator (diluted): | |||||||||||||||

Weighted average common shares outstanding | 95,340,136 | 92,924,516 | 94,659,931 | 92,436,628 | |||||||||||

Dilutive stock options outstanding | — | 3,136,115 | — | — | |||||||||||

Dilutive restricted stock units and awards | — | 152,357 | — | — | |||||||||||

Dilutive shares purchased under ESPP | — | 6,115 | — | — | |||||||||||

Weighted average common shares from warrants | — | 2,304,931 | — | — | |||||||||||

Net weighted average common shares outstanding | 95,340,136 | 98,524,034 | 94,659,931 | 92,436,628 | |||||||||||

Net income (loss) per share: | |||||||||||||||

Basic | $ | (0.68 | ) | $ | 0.06 | $ | (0.78 | ) | $ | (0.00 | ) | ||||

Diluted | $ | (0.68 | ) | $ | 0.06 | $ | (0.78 | ) | $ | (0.00 | ) | ||||

10

Potentially dilutive securities, including common equivalent shares in which the exercise price together with other assumed proceeds exceed the average market price of common stock for the applicable period, were not included in the calculation of diluted net income (loss) per share as their impact would be anti-dilutive. The following weighted-average number of outstanding employee stock options, restricted stock units and restricted stock awards, warrants to purchase common stock, and shares purchased under our ESPP were excluded from the computation of diluted net income (loss) per share:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

Stock options outstanding | 10,328,593 | 5,817,422 | 8,876,984 | 7,229,252 | |||||||

Restricted stock units and restricted stock awards | 2,574,405 | 489,060 | 1,888,205 | 556,606 | |||||||

Common equivalent shares from stock warrants | 2,168,299 | — | 2,210,012 | 2,340,061 | |||||||

Shares purchased under ESPP | 54,271 | — | 67,858 | 13,088 | |||||||

15,125,568 | 6,306,482 | 13,043,059 | 10,139,007 | ||||||||

9. Income Taxes

Income taxes for the interim periods presented have been included in the accompanying condensed consolidated financial statements on the basis of an estimated annual effective tax rate. Based on an estimated annual effective tax rate and discrete items, the estimated income tax benefit for the three- and nine-month periods ended September 30, 2015 was $22.1 million and $27.8 million, respectively. The estimated income tax expense for the three-month period ended September 30, 2014 was $3,933, and the estimated income tax benefit for the nine-month period ended September 30, 2014 was $0.1 million. The determination of the interim period income tax provision utilizes the effective tax rate method, which requires us to estimate certain annualized components of the calculation of the income tax provision, including the annual effective tax rate by entity and jurisdiction.

We continually evaluate all positive and negative information to determine if our deferred tax assets are realizable in accordance with ASC 740-10-30, which states that "all available evidence shall be considered in determining whether a valuation allowance for deferred tax assets is needed". In October 2015, we reached proposed agreements with the staff of the Federal Trade Commission (“FTC”), which remains subject to approval by the Commission and entry by the court, and with representatives of a national class of consumers, which remains subject to approval by the court, on a comprehensive settlement resolving outstanding litigation relating to our past marketing representations and information security programs. As a result of these proposed settlements, as well as a reserve for potential settlements with certain states' attorneys general of $3 million, we accrued a settlement amount of $96 million in the three and nine month periods ended September 30, 2015. In the twelve month period ended December 31, 2014 we accrued $20 million based on discussions with the FTC at that time. As a result of the cumulative $116 million of accrued expenses related to the proposed settlements and potential settlements, we have three years of cumulative pre tax net losses. We reviewed the accrued expense, including performing an analysis of the proposed settlements, and determined that it was non-recurring in nature, not indicative of future performance and as such would not materially affect our ability to generate taxable income in the future. In addition to excluding the impact of the non-recurring accrued expenses for the proposed settlements we have seen improving pre-tax book income over the past 5 years and we expect to continue generating pre-tax book income. As a result of the consideration of the factors discussed above, we believe that it is more likely than not that we will be able to realize our net deferred tax assets not currently subject to a valuation allowance.

11

10. Segment Reporting

We operate our business and our Chief Operating Decision Maker, or CODM, who is our Chief Executive Officer, reviews and assesses our operating performance using two reportable segments: our consumer segment and our enterprise segment. In our consumer segment, we offer proactive identity theft protection services to consumers on an annual or monthly subscription basis. In our enterprise segment, we offer consumer risk management services to our enterprise customers.

Financial information about our segments for the three-month period ended September 30, 2015 and as of September 30, 2015 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 144,648 | $ | 7,304 | $ | — | $ | 151,952 | |||||||

Intersegment revenue | — | 2,068 | (2,068 | ) | — | ||||||||||

Income (loss) from operations | (84,249 | ) | (3,101 | ) | — | (87,350 | ) | ||||||||

Goodwill | 112,602 | 59,537 | — | 172,139 | |||||||||||

Total assets | 561,812 | 101,761 | (674 | ) | 662,899 | ||||||||||

Financial information about our segments during the nine-month period ended September 30, 2015 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 411,178 | $ | 20,139 | $ | — | $ | 431,317 | |||||||

Intersegment revenue | — | 6,232 | (6,232 | ) | — | ||||||||||

Loss from operations | (90,456 | ) | (11,161 | ) | — | (101,617 | ) | ||||||||

Financial information about our segments for the three-month period ended September 30, 2014 and as of December 31, 2014 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 116,115 | $ | 6,916 | $ | — | $ | 123,031 | |||||||

Intersegment revenue | — | 1,718 | (1,718 | ) | — | ||||||||||

Income (loss) from operations | 12,703 | (3,170 | ) | — | 9,533 | ||||||||||

Goodwill | 99,805 | 59,537 | — | 159,342 | |||||||||||

Total assets | 455,035 | 108,905 | (624 | ) | 563,316 | ||||||||||

Financial information about our segments for the nine-month period ended September 30, 2014 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 326,448 | $ | 19,882 | $ | — | $ | 346,330 | |||||||

Intersegment revenue | — | 4,868 | (4,868 | ) | — | ||||||||||

Loss from operations | 11,292 | (11,525 | ) | — | (233 | ) | |||||||||

We derive all of our revenue from sales in the United States, and substantially all of our long-lived assets are located in the United States.

12

11. Contingencies

As part of our consumer services, we offer 24x7x365 member service support. If a member’s identity has been compromised, our member service team and remediation specialists will assist the member until the issue has been resolved. This includes our $1 million service guarantee, which is backed by an identity theft insurance policy, under which we will spend up to $1 million to cover certain third-party costs and expenses incurred in connection with the remediation, such as legal and investigatory fees. This insurance also covers certain out-of-pocket expenses, such as loss of income, replacement of fraudulent withdrawals, and costs associated with child and elderly care, travel, stolen purse/wallet, and replacement of documents. While we have reimbursed members for claims under this guarantee, the amounts in aggregate for the three- and nine-month periods ended September 30, 2015 and 2014 were not material.

In 2010, we entered into a consent decree (the “FTC Order”) with the Federal Trade Commission ("FTC"). On July 21 2015, the FTC initiated a contempt action alleging that we had violated the FTC Order. Federal Trade Commission v. LifeLock, Inc., et al., No. CV-10-00530-PHX-JJT (D. Ariz.). On January 19, 2015 a putative class action, Napoleon Ebarle et al. v. LifeLock, Inc., No. 3:15-cv-258 (N.D. Cal.), was filed against us on behalf of all LifeLock members from September 1, 2010 to the present alleging that we misrepresented our services in various ways and failed to deliver certain promised services (the "Ebarle Class Action").

On October 28, 2015, we signed an offer of settlement that we negotiated with FTC staff to present to the FTC to resolve the contempt allegations. The offer remains subject to the FTC’s approval and entry by the court. On November 3, 2015, we signed an agreement to settle the Ebarle Class Action and release all of the class’s related claims. The Ebarle Class Action settlement remains subject to court approval. On November 4, 2015, the plaintiffs filed a motion for preliminary approval. A hearing on the motion for preliminary approval is currently scheduled for December 17, 2015. As of September 30, 2015, we have accrued $113.0 million for these two matters based on the proposed settlement agreements.

In 2010, at the same time we entered into the FTC Order, we entered into companion orders with 35 states' attorneys general that imposed on us similar injunctive provisions as the FTC Order relating to our advertising and marketing of our identity theft protection services. At this stage, no states' attorneys general have initiated proceedings against us alleging that we violated the companion orders from 2010. However, in light of our initial discussions with several states' attorneys general, we have accrued $3 million for a potential settlement with certain states' attorneys general to resolve allegations that we violated the companion orders from 2010. The ultimate resolution of the matter with the states' attorneys general is uncertain and may involve a materially higher settlement than $3 million.

On January 29, 2015, plaintiff Etan Goldman filed a California putative consumer class action complaint against us in Santa Clara Superior Court in San Jose, California. The complaint alleges that we violated California’s Automatic Renewal Law and Unfair Competition Law by failing to provide required disclosures concerning our auto renewal terms and cancellation policies. The complaint also seeks certification of a class consisting of all persons in California who had purchased subscriptions to identity theft protection services from us since December 1, 2010, injunctive relief, compensatory damages, restitution, and attorneys’ fees and costs. On May 15, 2015, the parties executed a class-wide settlement agreement. On July 24, 2015, the Court preliminarily approved the settlement. If the settlement is finally approved, current and former LifeLock members with a California billing address who were enrolled in a LifeLock protection plan or subscription service between December 1, 2010, and July 24, 2015, and paid one or more auto renewed monthly or annual membership fees will automatically receive a cash payment, unless they opt-out of the settlement. Notice of the settlement has been distributed to the class. Class members have until November 23, 2015, to object to the Settlement or opt-out of the Settlement. The final approval hearing is currently scheduled for February 5, 2016. As of September 30, 2015, we have accrued $2.5 million for this matter based on the proposed settlement agreement.

On August 1, 2014, our subsidiaries Lemon and Lemon Argentina, S.R.L. (Lemon Argentina, and together, the Lemon Entities) filed a lawsuit in Santa Clara Superior Court in San Jose, California, against Wenceslao Casares, former General Manager of Lemon, Cynthia McAdam, former General Counsel of Lemon, and Federico Murrone, Martin Apesteguia and Fabian Cuesta, each a former employee and former member of the Board of Directors of Lemon Argentina (the “Argentine Executives”). The complaint alleges breaches of employment-related contracts and breaches of fiduciary duty involving each named individual’s work for third-party Xapo, Inc. and/or Xapo, Ltd. during their employment by the applicable Lemon Entity. The parties, including the Argentine Executives, engaged in mediation in August 2014 in Buenos Aires, Argentina, and again in December 2014 in San Francisco, California, but were unable to settle any claims. On January 30, 2015, the Lemon Entities filed a second amended complaint alleging breaches of employment-related contracts, breaches of fiduciary duties, and fraud, and seeking declatory relief against Mr. Casares, Ms. McAdam, and the Argentine Executives. Mr. Casares and Ms. McAdam demurred to the Second Amended Complaint on May 1, 2015, which the court overruled in its entirety on July 2, 2015. Mr. Casares and Ms. McAdam answered the Second Amended Complaint on July 24, 2015 and are currently participating in active written discovery with the Lemon Entities. The Argentine Executives entered their appearances in the litigation on July 24, 2015. They filed a motion to dismiss for inconvenient forum on September 8, 2015, set to be heard on December 4, 2016.

13

Mr. Casares also filed a cross-claim against us and Lemon, Inc. (now Lemon, LLC) on July 24, 2015, for breach of contract, breach of the implied covenant of good faith and fair dealing, conversion, unjust enrichment, and declaratory relief, all arising from the termination of his employment. He filed an amended cross-claim asserting the same causes of action on September 22, 2015. We, along with Lemon, LLC, filed a motion to dismiss the amended cross-claim on October 22, 2015.

Mr. Casares filed a separate complaint against us, Lemon, LLC, and Shareholder Representative Services LLC (“SRS”) in Delaware Chancery Court on October 7, 2015 for breach of contract and seeking a declaratory judgment. The action concerns a December 12, 2014 settlement agreement that resolved certain disputes against other former shareholders of Lemon, Inc. arising out of the our December 11, 2013 Lemon acquisition. We, along with Lemon, LLC, moved to dismiss the complaint on October 28, 2015. We have been informed that SRS sought and received an extension of time to respond to the complaint on or before November 9, 2015.

On July 22, 2015, Miguel Avila, representing himself and seeking to represent a class of persons who acquired our securities from July 30, 2014 to July 20, 2015, inclusive, filed a class action complaint in the United States District Court for the District of Arizona. His complaint alleges that our CEO, our CFO, and we violated Sections 10(b) and 20(a) of the Securities Exchange Act by making materially false or misleading statements, or failing to disclose material facts about the Company’s business, operations, and prospects, including with regard to our information security program, advertising, recordkeeping, and our compliance with the FTC Order. The complaint seeks certification as a class action, compensatory damages, and attorney’s fees and costs. On September 21, 2015, four other Company stockholders, Oklahoma Police Pension and Retirement System, Oklahoma Firefighters Pension and Retirement System, Larisa Gassel, and Donna Thompson, and their respective attorneys all filed motions seeking to be appointed the lead plaintiff and lead counsel in this class action. On October 9, 2015, the Court appointed Oklahoma Police Pension and Retirement System and Oklahoma Firefighters Pension and Retirement System as Lead Plaintiffs. On October 19, 2015, the Court entered a scheduling order pursuant to which Lead Plaintiffs will file an amended complaint by December 10, 2015, and we, along with our CEO and CFO, will file a motion to dismiss that complaint by January 29, 2016.

On September 23, 2015, Sridhar Manthangodu, a stockholder of the Company, filed a derivative complaint captioned Manthangodu v. Davis, et al., in the Superior Court of the State of Arizona, Maricopa County. This derivative complaint, purportedly filed on our behalf (the Company is named as a nominal defendant in the action), alleges that certain of our directors (the “Director Defendants”) violated their fiduciary duties to LifeLock stockholders (and or aided and abetted in the violation of same) by failing to ensure that the we complied with the FTC Order. According to the complaint, the Director Defendants’ alleged breach of their fiduciary oversight duties has exposed us to “material liability,” because we must defend against the FTC’s July 21, 2015 motion seeking to hold us in contempt of the FTC Order, and the shareholder securities class action filed on July 22, 2015 discussed above. The complaint seeks unspecified monetary damages, a return to the Company of all personal compensation received by the Director Defendants, as well as unspecified corporate governance reforms. On October 16, 2015, the parties jointly moved for a transfer of this matter to the Commercial Court of Maricopa County Superior Court. On October 20, 2015, that motion was granted and the action was transferred to the Commercial Court. We anticipate filing a Joint Pre-Trial Report and Proposed Scheduling Order soon.

On October 28, 2015, Larisa Gassel, a stockholder of the Company, filed a derivative complaint captioned Gassel v. Davis, et al., in the United States District Court for the District of Arizona. This derivative complaint was purportedly filed on our behalf (the Company is named as a nominal defendant in the action), against certain of our directors (the “Individual Defendants”). The complaint alleges that the Individual Defendants violated their fiduciary duties to LifeLock stockholders (and/ or aided and abetted or conspired to commit such violations) by making materially false or misleading statements, or failing to disclose material facts regarding our business, operations, and prospects, including with regard to certain of our services, our data security program, and our compliance with the FTC Order, in certain public statements made by us, our CEO, and CFO during the period July 30, 2014 through April 30, 2015. Based on these same allegations, the complaint also makes claims of gross mismanagement, abuse of control, and unjust enrichment against the Individual Defendants. According to the complaint, the Individual Defendants’ conduct has damaged us through costs associated with the defense of the securities class actions discussed above and the compensation and benefits provided to the Individual Defendants, as well as through loss of reputation and goodwill. The complaint seeks unspecified monetary damages, unspecified restitution to the Company from the Individual Defendants, certain corporate governance reforms, and attorneys’ fees and costs. As this action was very recently filed, there has been no significant activity in the case to date.

We are subject to other legal proceedings and claims that have arisen in the ordinary course of business. Although there can be no assurance as to the ultimate disposition of these matters, we believe, based upon the information available at this time, that, except as disclosed above, a material adverse outcome related to the matters is neither probable nor estimable.

14

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion of our financial condition and results of operations in conjunction with the condensed consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our 2014 Form 10-K. This Quarterly Report on Form 10-Q contains “forward-looking statements” that involve substantial risks and uncertainties. The statements contained in this Quarterly Report on Form 10-Q that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act, including, but not limited to, statements regarding our expectations, beliefs, intentions, strategies, future operations, future financial position, future revenue, projected expenses, and plans and objectives of management. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements reflect our current views about future events and involve known risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievement to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included in this Quarterly Report on Form 10-Q and our 2014 Form 10-K. Furthermore, such forward-looking statements speak only as of the date on which they are made. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Overview

We are a leading provider of proactive identity theft protection services for consumers and consumer risk management services for enterprises. We protect our members by monitoring identity-related events, such as new account openings and credit-related applications. If we detect that someone is using a member’s personally identifiable information, we offer notifications and alerts, including actionable alerts for new account openings and applications, in order to provide our members peace of mind that we are monitoring use of their identity and allow our members to confirm valid or unauthorized identity use. If a member confirms that the use of his or her identity is unauthorized, we can take actions designed to help protect the member’s identity and help determine whether there has been an identity theft. In the event that an identity theft has actually occurred, we can take actions designed to help restore the member’s identity through our remediation services. Our remediation service team works directly with government agencies, merchants, and creditors to remediate the impact of the identity theft event utilizing our remediation expertise on behalf of our members. We protect our enterprise customers by delivering on-demand identity risk, identity-authentication, and credit information about consumers. Our enterprise customers utilize this information in real-time to make decisions about opening or modifying accounts and providing products, services, or credit to consumers to reduce financial losses from identity fraud.

The foundation of our identity theft protection services is the LifeLock ecosystem. This ecosystem combines large data repositories of personally identifiable information and consumer transactions, proprietary predictive analytics, and a highly scalable technology platform. Our members and enterprise customers enhance our ecosystem by continually contributing to the identity and transaction data in our repositories. We apply predictive analytics to the data in our repositories to provide our members and enterprise customers actionable intelligence that helps protect against identity theft and identity fraud. As a result of our combination of scale, reach, and technology, as well as our comprehensive transaction and new account alerting, remediation services, and $1 million service guarantee backed by an identity theft insurance policy, we believe that we have the most proactive and comprehensive identity theft protection services available, as well as the most recognized brand in the identity theft protection services industry.

We derive the substantial majority of our revenue from member subscription fees. We also derive revenue from transaction fees from our enterprise customers.

At the end of July 2014, we launched our LifeLock Standard, LifeLock Advantage, and LifeLock Ultimate Plus services. We will also continue to offer our LifeLock Junior services and, on a limited basis and for a limited time in connection with certain of our partnerships, our basic LifeLock, LifeLock Command Center, and LifeLock Ultimate services. We will continue to provide services to our existing members currently enrolled in our basic LifeLock, LifeLock Command Center, and LifeLock Ultimate services. Our consumer services are offered on a monthly or annual subscription basis. Our average revenue per member is lower than our retail list prices due to wholesale or bulk pricing that we offer to strategic partners in our embedded product, employee benefits, and breach distribution channels to drive our membership growth. In our embedded product channel, our strategic partners embed our consumer services into their products and services and pay us on behalf of their customers; in our employee benefit channel, our strategic partners offer our consumer services as a voluntary benefit as part of their employee benefit enrollment process; and in our breach channel, enterprises that have experienced a data breach pay us a fee to provide our services to the victims of the data breach. We also offer special discounts and promotions from time to time

15

as incentives to prospective members to enroll in one of our consumer services. Our members pay us the full subscription fee at the beginning of each subscription period, in most cases by authorizing us to directly charge their credit or debit cards. We initially record the subscription fee as deferred revenue and then recognize it ratably on a daily basis over the subscription period. The prepaid subscription fees enhance our visibility of revenue and allow us to collect cash prior to paying our fulfillment partners. In December 2013, we acquired mobile wallet innovator Lemon and launched our LifeLock Wallet mobile application. The LifeLock Wallet mobile application allows consumers to replicate and store a digital copy of their personal wallet contents on their smart device for records backup, as well as mobile use of items such as credit, identification, ATM, insurance, and loyalty cards. The LifeLock Wallet mobile application also offers our members access to our identity theft protection services.

Our enterprise customers pay us based on their monthly volume of transactions with us, with approximately 30% of our enterprise customers committed to monthly transaction minimums. We recognize revenue at the end of each month based on transaction volume for that month and bill our enterprise customers at the conclusion of each month.

We have historically invested significantly in new member acquisition and expect to continue to do so for the foreseeable future. Our largest operating expense is advertising for member acquisition, which we record as a sales and marketing expense. This includes radio, television, and print advertisements; direct mail campaigns; online display advertising; paid search and search-engine optimization; third-party endorsements; and education programs. We also pay internal and external sale commissions, which we record as a sales and marketing expense. In general, increases in revenue and cumulative ending members occur during and after periods of significant and effective direct retail marketing efforts.

Our Business Model

We operate our business and our CODM, who is our CEO, reviews and assesses our operating performance using two reportable segments: our consumer segment and our enterprise segment. We review and assess our operating performance using segment revenue, income (loss) from operations, and total assets. These performance measures include the allocation of operating expenses to our reportable segments based on management’s specific identification of costs associated to those segments.

Consumer Services

We evaluate the lifetime value of a member relationship over its anticipated lifecycle. While we generally incur member acquisition costs in advance of or at the time we acquire the member, we recognize revenue ratably over the subscription period. As a result, a member relationship is not profitable at the beginning of the subscription period even though it is likely to have value to us over the lifetime of the member relationship.

When a member’s subscription automatically renews in each successive period, the relative value of that member increases because we do not incur significant incremental acquisition costs. We also benefit from decreasing fulfillment and member support costs related to that member, as well as economies of scale in our capital and operating and other support expenditures.

Enterprise Services

In our enterprise business, the majority of our costs relate to personnel primarily responsible for data analytics, data management, software development, sales and operations, and various support functions. Our enterprise customers typically provide us with their customer transaction data as part of our service, allowing us to build and refine our models without incurring significant third-party data expenses. We continually evaluate third-party data sources and acquire data from such sources when we believe such data will enhance the performance of our models. New customer acquisition is often a lengthy process. We make a significant investment in the sales team, including costs related to detailed retrospective data analysis to help demonstrate the return on investment to prospective customers had our services been deployed over a specific period of time. Because most of our enterprise business expenses are fixed, we typically incur modest incremental costs when we add new enterprise customers, resulting in additional economies of scale.

Key Metrics

We regularly review a number of operating and financial metrics to evaluate our business, determine the allocation of our resources, measure the effectiveness of our sales and marketing efforts, make corporate strategy decisions, and assess operational efficiencies.

16

Key Operating Metrics

The following table summarizes our key operating metrics:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(in thousands, except percentages and per member data) (Unaudited) | |||||||||||||||

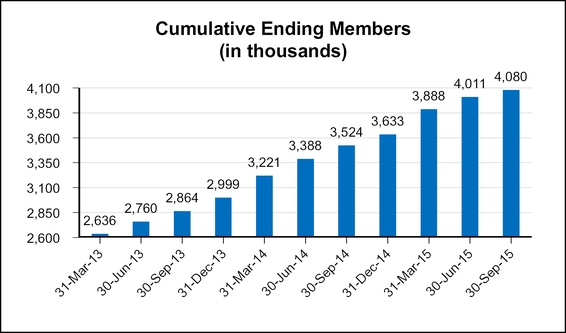

Cumulative ending members | 4,080 | 3,524 | 4,080 | 3,524 | |||||||||||

Gross new members | 251 | 264 | 989 | 912 | |||||||||||

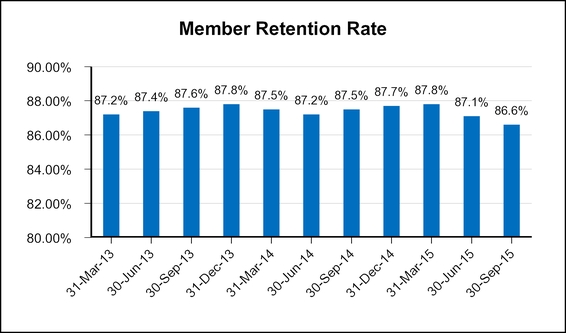

Member retention rate | 86.6 | % | 87.5 | % | 86.6 | % | 87.5 | % | |||||||

Average cost of acquisition per member | $ | 237 | $ | 184 | $ | 202 | $ | 173 | |||||||

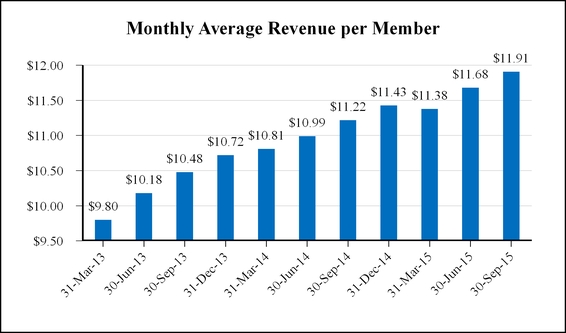

Monthly average revenue per member | $ | 11.91 | $ | 11.22 | $ | 11.68 | $ | 11.02 | |||||||

Enterprise transactions | 74,280 | 66,104 | 208,324 | 173,360 | |||||||||||

Cumulative ending members. We calculate cumulative ending members as the total number of members at the end of the relevant period. The majority of our members are paying subscribers who have enrolled in our consumer services directly with us on a monthly or annual basis. Our remaining members receive our consumer services through third-party enterprises that pay us directly, because of a breach within the enterprise. Those enterprises embed our service within a broader third- party offering, or as an employee benefit paid for by the member's employer. We monitor cumulative ending members because it provides an indication of the revenue and expenses that we expect to recognize in the future.

As of September 30, 2015, our cumulative ending member base increased 16% year over year. Several factors drove this increase, including the success of our marketing campaigns, increased awareness of data breaches, media coverage of identity theft, and our member retention rate.

Gross new members. We calculate gross new members as the total number of new members who enroll in one of our consumer services during the relevant period. Many factors may affect the volume of gross new members in each period, including the effectiveness of our marketing campaigns, the timing of our marketing programs, the effectiveness of our strategic partnerships, and the general level of identity theft coverage in the media. We monitor gross new members because it provides an indication of the revenue and expenses that we expect to recognize in the future. Gross new members decreased 5% for the three-month period ended September 30, 2015 compared to the same period last year. The decrease in our gross new members for the three-month period ended September 30, 2015 was driven by the announcement of the FTC litigation which impacted our marketing effectiveness. In light of the FTC announcement we also reduced our marketing in certain channels.

17

Gross new members increased 8% for the nine-month period ended September 30, 2015 compared to the same period last year. The year over increase in gross new members for the nine-month period ended September 30, 2015 was primarily driven by the success of our marketing campaigns, our product enhancements, including the release of our new suite of products in July 2014, increased media attention to large data breaches, during the period and the growth in our employee benefit channel. The growth in gross new members was partially offset by a decrease in enrollments through our breach channel as we had several large breach contracts in the first half of 2014.

Member retention rate. We define member retention rate as the percentage of members on the last day of the prior year who remain members on the last day of the current year. Similarly, for quarterly presentations, we use the percentage of members on the last day of the comparable quarterly period in the prior year who remain members on the last day of the current quarterly period. A number of factors may increase our member retention rate, including increases in the number of members enrolled on an annual subscription, increases in the number of alerts a member receives, and increases in the number of members enrolled through strategic partners with whom the member has a strong association. Conversely, factors that may reduce our member retention rate include increases in the number of members enrolled on a monthly subscription and the end of enrollment programs in our embedded product and breach channels. In addition, the length of time a member has been enrolled in one of our services will affect our member retention rate with longer-term members having a positive impact. Historically, the member retention rate for our premium services has been lower than the member retention rate for our basic-level services, which we believe is driven primarily by price.

Our member retention rate as of September 30, 2015 was significantly impacted by the high number of cancellations of breach members during the first and second quarters of 2015, who enrolled in the first half of 2014. Our breach contracts typically have a one year term. The cancellation of these breach members are expected to have a similar impact on our member retention rate for the next few quarters. In addition we experienced a higher level of cancellations driven by the announcement of the FTC litigation during the three month period ended September 30, 2015, which had a negative impact on the member retention rate.

Average cost of acquisition per member. We calculate average cost of acquisition per member as our sales and marketing expense for our consumer segment during the relevant period divided by our gross new members for the period. A number of factors may influence this metric, including shifts in the mix of our media spend. For example, when we engage in marketing efforts to build our brand, our short-term cost of acquisition per member increases with the expectation that it will decrease over the long term. In addition, when we introduce new partnerships, such as partnerships in our embedded product channel, our average cost of acquisition per member may decrease due to the volume of members that enroll in our consumer services in a relatively short period of time. We monitor average cost of acquisition per member to evaluate the efficiency of our marketing programs in acquiring new members. Our average cost of acquisition per member increased for the three and nine month periods ended September 30, 2015 when compared with the three and nine month periods ended September 30, 2014 due in part to the impact of the announcement of the FTC litigation on our marketing effectiveness. In addition we reduced certain marketing initiatives with several strategic partners in light of the FTC announcement, enrollments through

18

these relationships with strategic partners are typically at a lower average cost of acquisition per member. In addition, our average cost of acquisition per member increased in the nine month period ended September 30, 2015 when compared to the nine month period ended September 30, 2014 due to the high level of breach enrollments in the nine month period ended September 30, 2014, which typically have a lower average cost of acquisition per member. Our member retention rate and the increasing monthly average revenue per member, primarily from the continued penetration of our premium service offerings, results in a higher lifetime value of a member relationship. This enables us to absorb a higher average cost of acquisition per member.

Monthly average revenue per member. We calculate monthly average revenue per member as our consumer revenue during the relevant period divided by the average number of cumulative ending members during the relevant period (determined by taking the average of the cumulative ending members at the beginning of the relevant period and the cumulative ending members at the end of each month in the relevant period), divided by the number of months in the relevant period. A number of factors may influence this metric, including whether a member enrolls in one of our premium services; whether we offer the member any promotional discounts upon enrollment; the distribution channel through which we acquire the member, as we offer wholesale pricing in our embedded product, employee benefit, and breach channels; and whether a new member subscribes on a monthly or annual basis, as members enrolling on an annual subscription receive a discount for paying for a year in advance. While our retail list prices have historically remained unchanged, we have seen our monthly average revenue per member increase primarily due to increased adoption of our higher-priced premium services by a greater percentage of our members, a trend we expect to continue. We monitor monthly average revenue per member because it is a strong indicator of revenue in our consumer business and of the performance of our premium services.

Our monthly average revenue per member increased approximately 6% for the three- and nine-month periods ended September 30, 2015, compared to the same periods last year. The increases resulted primarily from the continued success of our premium service offerings, which accounted for more than 40% of our gross new members for the three- and nine-month periods ended September 30, 2015.

Enterprise transactions. Our enterprise transactions are processed by ID Analytics and are calculated as the total number of enterprise transactions processed for either an identity risk or credit risk score during the relevant period. Enterprise transactions have historically been higher in the fourth quarter as the level of credit applications and general consumer spending increases. We monitor the volume of enterprise transactions because it is a strong indicator of revenue in our enterprise business.

Enterprise transactions increased 12% and 20% for the three- and nine-month periods ended September 30, 2015, compared to the same periods last year. Enterprise transactions increased as we continued to add new customers and expand our offerings with our current customer base.

19

Key Financial Metrics

The following table summarizes our key financial metrics:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(in thousands) | |||||||||||||||

Consumer revenue | $ | 144,648 | $ | 116,115 | $ | 411,178 | $ | 326,448 | |||||||

Enterprise revenue | 7,304 | 6,916 | 20,139 | 19,882 | |||||||||||

Total revenue | 151,952 | 123,031 | 431,317 | 346,330 | |||||||||||

Adjusted net income | 27,579 | 15,909 | 32,323 | 19,455 | |||||||||||

Adjusted EBITDA | 29,797 | 17,929 | 39,314 | 25,255 | |||||||||||

Free cash flow | 18,378 | 22,653 | 68,302 | 61,004 | |||||||||||

Adjusted Net Income