Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - LIFELOCK, INC. | lock-ex103xemploymentagree.htm |

| EX-10.2 - EXHIBIT 10.2 - LIFELOCK, INC. | lock-ex102xemploymentagree.htm |

| EX-10.5 - EXHIBIT 10.5 - LIFELOCK, INC. | lock-ex105xofferlettertshay.htm |

| EX-10.8 - EXHIBIT 10.8 - LIFELOCK, INC. | lock-ex108xadvisoryagreeme.htm |

| EX-31.1 - EXHIBIT 31.1 - LIFELOCK, INC. | lock-ex311x20160331x10q.htm |

| EX-31.2 - EXHIBIT 31.2 - LIFELOCK, INC. | lock-ex312x20160331x10q.htm |

| EX-32.1 - EXHIBIT 32.1 - LIFELOCK, INC. | lock-ex321x20160331x10q.htm |

| EX-10.6 - EXHIBIT 10.6 - LIFELOCK, INC. | lock-ex106xconsumerdisclos.htm |

| EX-10.7 - EXHIBIT 10.7 - LIFELOCK, INC. | lock-ex107xforwardrepurcha.htm |

| EX-10.4 - EXHIBIT 10.4 - LIFELOCK, INC. | lock-ex104xemploymentagree.htm |

| EX-10.9 - EXHIBIT 10.9 - LIFELOCK, INC. | lock-ex109xnonemployeersud.htm |

| EX-10.1 - EXHIBIT 10.1 - LIFELOCK, INC. | lock-ex101xemploymentagree.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2016

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________.

Commission file number: 001-35671

LifeLock, Inc. (Exact name of registrant as specified in its charter) |

Delaware | 56-2508977 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

60 East Rio Salado Parkway, Suite 400 Tempe, Arizona 85281 (Address of principal executive offices and zip code) (480) 682-5100 (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ý | Accelerated filer | ¨ | |

Non-accelerated filer (Do not check if a smaller reporting company) | ¨ | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of April 22, 2016, there were outstanding 94,079,569 shares of the registrant’s common stock, $0.001 par value.

1

LIFELOCK, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2016

TABLE OF CONTENTS

Page | |

i

PART I - FINANCIAL INFORMATION

Item 1. | Financial Statements (Unaudited) |

LIFELOCK, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

March 31, 2016 | December 31, 2015 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 44,907 | $ | 50,239 | |||

Marketable securities | 156,878 | 196,474 | |||||

Trade and other receivables, net | 13,005 | 13,974 | |||||

Prepaid expenses and other current assets | 13,663 | 12,303 | |||||

Total current assets | 228,453 | 272,990 | |||||

Property and equipment, net | 31,531 | 30,485 | |||||

Goodwill | 172,087 | 172,087 | |||||

Intangible assets, net | 27,132 | 30,174 | |||||

Deferred tax assets, net | 84,861 | 77,363 | |||||

Other non-current assets | 9,639 | 9,710 | |||||

Total assets | $ | 553,703 | $ | 592,809 | |||

Liabilities and stockholders’ equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 11,212 | $ | 24,747 | |||

Accrued expenses and other liabilities | 83,853 | 76,226 | |||||

Deferred revenue | 185,605 | 166,403 | |||||

Total current liabilities | 280,670 | 267,376 | |||||

Other non-current liabilities | 7,613 | 7,367 | |||||

Total liabilities | 288,283 | 274,743 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Common stock, $0.001 par value, 300,000,000 authorized at March 31, 2016 and December 31, 2015; 98,450,128 and 95,877,947 shares issued and 94,029,796 and 95,832,238 outstanding at March 31, 2016 and December 31, 2015, respectively | 98 | 96 | |||||

Preferred stock, $0.001 par value, 10,000,000 shares authorized and no shares issued and outstanding at March 31, 2016 and December 31, 2015 | — | — | |||||

Treasury stock, at cost; 3,885,695 shares and no shares held at March 31, 2016 and December 31, 2015, respectively | (38,048 | ) | — | ||||

Additional paid-in capital | 528,742 | 532,388 | |||||

Accumulated other comprehensive loss | (91 | ) | (361 | ) | |||

Accumulated deficit | (225,281 | ) | (214,057 | ) | |||

Total stockholders’ equity | 265,420 | 318,066 | |||||

Total liabilities and stockholders’ equity | $ | 553,703 | $ | 592,809 | |||

See accompanying notes to condensed consolidated financial statements.

1

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Revenue: | |||||||

Consumer revenue | $ | 151,930 | $ | 128,201 | |||

Enterprise revenue | 7,339 | 6,207 | |||||

Total revenue | 159,269 | 134,408 | |||||

Cost of services | 39,986 | 34,556 | |||||

Gross profit | 119,283 | 99,852 | |||||

Costs and expenses: | |||||||

Sales and marketing | 89,704 | 77,079 | |||||

Technology and development | 21,222 | 16,866 | |||||

General and administrative | 24,222 | 18,955 | |||||

Amortization of acquired intangible assets | 3,042 | 2,084 | |||||

Total costs and expenses | 138,190 | 114,984 | |||||

Loss from operations | (18,907 | ) | (15,132 | ) | |||

Other income (expense): | |||||||

Interest expense | (111 | ) | (89 | ) | |||

Interest income | 299 | 117 | |||||

Other, net | (5 | ) | (80 | ) | |||

Total other income (expense) | 183 | (52 | ) | ||||

Loss before income taxes | (18,724 | ) | (15,184 | ) | |||

Income tax benefit | (7,498 | ) | (6,026 | ) | |||

Net loss | $ | (11,226 | ) | $ | (9,158 | ) | |

Net loss per share | |||||||

Basic and diluted | $ | (0.12 | ) | $ | (0.10 | ) | |

Weighted-average common shares outstanding used in computing net loss per share: | |||||||

Basic and diluted | 94,749 | 94,033 | |||||

See accompanying notes to condensed consolidated financial statements.

2

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands)

(unaudited)

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Net loss | $ | (11,226 | ) | $ | (9,158 | ) | |

Other comprehensive income, net of tax | |||||||

Unrealized gain on marketable securities | 270 | 42 | |||||

Comprehensive loss | $ | (10,956 | ) | $ | (9,116 | ) | |

See accompanying notes to condensed consolidated financial statements.

3

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Operating activities | |||||||

Net loss | $ | (11,226 | ) | $ | (9,158 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation and amortization | 5,778 | 4,295 | |||||

Share-based compensation | 8,652 | 5,370 | |||||

Provision for doubtful accounts | 197 | 52 | |||||

Amortization of premiums on marketable securities | 635 | 670 | |||||

Deferred income tax benefit | (7,498 | ) | (6,026 | ) | |||

Other | 46 | 82 | |||||

Change in operating assets and liabilities: | |||||||

Trade and other receivables | 467 | (295 | ) | ||||

Prepaid expenses and other current assets | (1,360 | ) | (4,319 | ) | |||

Other non-current assets | 27 | (44 | ) | ||||

Accounts payable | (12,293 | ) | 2,563 | ||||

Accrued expenses and other liabilities | 7,991 | 4,556 | |||||

Deferred revenue | 19,203 | 22,777 | |||||

Other non-current liabilities | 246 | 7 | |||||

Net cash provided by operating activities | 10,865 | 20,530 | |||||

Investing activities | |||||||

Acquisition of property and equipment, including capitalization of internal use software | (4,830 | ) | (2,816 | ) | |||

Purchases of marketable securities | (25,521 | ) | (39,379 | ) | |||

Sales and maturities of marketable securities | 65,071 | 33,438 | |||||

Net cash provided by (used in) investing activities | 34,720 | (8,757 | ) | ||||

Financing activities | |||||||

Proceeds from stock-based compensation plans | 1,956 | 1,773 | |||||

Payments related to the repurchases of common stock | (51,923 | ) | — | ||||

Payments for employee tax withholdings related to restricted stock units and awards | (950 | ) | (230 | ) | |||

Net cash provided by (used in) financing activities | (50,917 | ) | 1,543 | ||||

Net increase (decrease) in cash and cash equivalents | (5,332 | ) | 13,316 | ||||

Cash and cash equivalents at beginning of period | 50,239 | 146,569 | |||||

Cash and cash equivalents at end of period | $ | 44,907 | $ | 159,885 | |||

See accompanying notes to condensed consolidated financial statements.

4

LIFELOCK, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), and applicable Securities and Exchange Commission, or SEC, rules and regulations regarding interim financial reporting. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, or 2015 Form 10-K.

The condensed consolidated balance sheet as of December 31, 2015 included herein was derived from the audited financial statements as of that date, but does not include all disclosures including notes required by U.S. GAAP.

The accompanying unaudited condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, and cash flows for the interim periods, but are not necessarily indicative of the anticipated results of operations for the entire year ending December 31, 2016 or any future period.

Basis of Consolidation

The condensed consolidated financial statements include our accounts and those of our wholly and indirectly owned subsidiaries. We eliminate all intercompany balances and transactions, including intercompany profits, in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires us to make certain estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We continually evaluate our estimates, including those related to the allocation of the purchase price associated with acquisitions; the carrying value of long-lived assets; the amortization period of long-lived assets; the carrying value, capitalization, and amortization of software and website development costs; the carrying value of goodwill and other intangible assets; the amortization period of intangible assets; the provision for income taxes and related deferred tax accounts, and realizability of deferred tax assets; certain accrued expenses; contingencies, litigation, and related legal accruals; and the value attributed to employee stock options and other stock-based awards. We base our estimates on historical experience, current business factors, and various other assumptions that we believe are necessary to consider to form a basis for making judgments. Actual results could be materially different from these estimates.

2. Summary of Significant Accounting Policies

There have been no material changes to our significant accounting policies from those disclosed in our 2015 Form 10-K.

Recently Issued Accounting Standards

In February 2016, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update (ASU) 2016-02, Leases, which requires lessees to recognize the assets and liabilities on their balance sheet for the rights and obligations created by operating leases and will also require disclosures designed to give users of financial statements information on the amount, timing, and uncertainty of cash flows arising from leases. The guidance provided by ASU 2016-02 is effective for annual periods beginning after December 15, 2018 and interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the effect of ASU 2016-06 on our consolidated financial statements and do not plan to early adopt this guidance.

In May 2014, the FASB, issued ASU 2014-09, Revenue from Contracts with Customers, which provides guidance for revenue recognition. The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under today’s guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price, and allocating the transaction price to each separate performance obligation. In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers: Deferral of the Effective Date, which defers the effective date of ASU 2014-09 for all entities for one year. Consequently, the guidance provided in ASU 2014-09 will be effective for us in the first quarter of our fiscal year ending December 31, 2018. Early adoption is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The guidance permits the use of either the retrospective or cumulative effect transition method. In March 2016, the FASB

5

issued ASU 2016-08, Revenue from Contracts with Customers: Principal versus Agent Considerations, which clarifies the implementation guidance on principal versus agent considerations. ASU 2016-08 is effective the same date as ASU 2014-09, Revenue from Contracts with Customers. In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarifies the guidance related to identifying performance obligations and licensing implementation guidance. ASU 2016-10 reduces the cost and complexity of applying certain aspects of the guidance both at implementation and on an ongoing basis. The effective date for ASU 2016-10 is the same as ASU 2014-09. We are currently in the process of evaluating the impact of the adoption of this guidance on our consolidated financial statements and have not yet selected a transition method.

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718) Improvements to Employee Share-Based Payment Accounting, which require all income tax effects of awards to be recognized in the income statement when the awards vest or are settled. ASU 2016-09 is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the effect of ASU 2016-09 on our consolidated financial statements and do not plan to early adopt this guidance.

3. Marketable Securities

The following is a summary of marketable securities designated as available-for-sale as of March 31, 2016 and December 31, 2015:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

March 31, 2016 | |||||||||||||||

Corporate bonds | $ | 115,144 | $ | 14 | $ | (90 | ) | $ | 115,068 | ||||||

Municipal bonds | 13,130 | — | (6 | ) | 13,124 | ||||||||||

Government securities | 11,693 | 12 | (2 | ) | 11,703 | ||||||||||

Commercial paper | 7,473 | — | — | 7,473 | |||||||||||

Agency securities | 7,267 | — | (1 | ) | 7,266 | ||||||||||

Certificates of deposit | 2,244 | — | — | 2,244 | |||||||||||

Total marketable securities | $ | 156,951 | $ | 26 | $ | (99 | ) | $ | 156,878 | ||||||

December 31, 2015 | |||||||||||||||

Corporate bonds | $ | 125,132 | $ | 1 | $ | (304 | ) | $ | 124,829 | ||||||

Commercial paper | 37,236 | — | — | 37,236 | |||||||||||

Municipal bonds | 16,228 | 2 | (6 | ) | 16,224 | ||||||||||

Government securities | 8,704 | 1 | (17 | ) | 8,688 | ||||||||||

Agency securities | 7,273 | — | (20 | ) | 7,253 | ||||||||||

Certificates of deposit | 2,244 | — | — | 2,244 | |||||||||||

Total marketable securities | $ | 196,817 | $ | 4 | $ | (347 | ) | $ | 196,474 | ||||||

We classify all marketable securities as current regardless of contractual maturity dates because we consider such investments to represent cash available for current operations.

As of March 31, 2016 and December 31, 2015, we did not consider any of our marketable securities to be other-than-temporarily impaired. When evaluating our investments for other-than-temporary impairment, we review factors such as the length of time and extent to which fair value has been below its cost basis, the financial condition of the issuer, our ability and intent to hold the security, and whether it is more likely than not that we will be required to sell the investment before recovery of its cost basis.

6

The following is a summary of amortized cost and estimated fair value of marketable securities as of March 31, 2016 and December 31, 2015, by maturity:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

March 31, 2016 | |||||||||||||||

Due in one year or less | $ | 145,592 | $ | 18 | $ | (89 | ) | $ | 145,521 | ||||||

Due after one year | 11,359 | 8 | (10 | ) | 11,357 | ||||||||||

Total marketable securities | $ | 156,951 | $ | 26 | $ | (99 | ) | $ | 156,878 | ||||||

December 31, 2015 | |||||||||||||||

Due in one year or less | $ | 164,147 | $ | 2 | $ | (221 | ) | $ | 163,928 | ||||||

Due after one year | 32,670 | 2 | (126 | ) | 32,546 | ||||||||||

Total marketable securities | $ | 196,817 | $ | 4 | $ | (347 | ) | $ | 196,474 | ||||||

4. Fair Value Measurements

As of March 31, 2016 and December 31, 2015, the fair value of our financial assets was as follows:

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(in thousands) | |||||||||||||||

March 31, 2016 | |||||||||||||||

Assets: | |||||||||||||||

Money market funds (1) | $ | 13,338 | $ | — | $ | — | $ | 13,338 | |||||||

Corporate bonds (2) | — | 115,068 | — | 115,068 | |||||||||||

Municipal bonds (2) | — | 13,124 | — | 13,124 | |||||||||||

Government securities (2) | — | 11,703 | — | 11,703 | |||||||||||

Commercial paper (2) | — | 7,473 | — | 7,473 | |||||||||||

Agency securities (2) | — | 7,266 | — | 7,266 | |||||||||||

Certificates of deposit (2) | — | 2,244 | — | 2,244 | |||||||||||

Total assets measured at fair value | $ | 13,338 | $ | 156,878 | $ | — | $ | 170,216 | |||||||

December 31, 2015 | |||||||||||||||

Assets: | |||||||||||||||

Money market funds (1) | $ | 18,114 | $ | — | $ | — | $ | 18,114 | |||||||

Corporate bonds (2) | — | 124,829 | — | 124,829 | |||||||||||

Municipal bonds (2) | — | 16,223 | — | 16,223 | |||||||||||

Commercial paper (3) | — | 47,294 | — | 47,294 | |||||||||||

Government securities (2) | — | 8,688 | — | 8,688 | |||||||||||

Agency securities (2) | — | 7,253 | — | 7,253 | |||||||||||

Certificates of deposit (2) | — | 2,244 | — | 2,244 | |||||||||||

Total assets measured at fair value | $ | 18,114 | $ | 206,531 | $ | — | $ | 224,645 | |||||||

(1) | Classified in cash and cash equivalents |

(2) | Classified in marketable securities |

(3) | Includes commercial paper with maturities of three months or less at time of purchase of $10.1 million classified in cash and cash equivalents and commercial paper with maturities of greater than three months of $37.2 million classified in marketable securities. |

5. Financing Arrangements

There have been no changes in our Credit Agreement and related documents with Bank of America, which we refer to as our Senior Credit Facility, from the disclosure in our 2015 Form 10-K. At March 31, 2016 and December 31, 2015 we were in compliance with all the covenants of the Senior Credit Facility.

As of March 31, 2016, we had outstanding letters of credit in the amount of $0.3 million.

7

6. Stockholders’ Equity

Stock Repurchases

In November 2015, we announced that our Board of Directors approved the repurchase of up to $100 million of our common stock, representing approximately 7% of our outstanding common stock. The repurchase program has no expiration date, but is intended to be completed by the end of fiscal 2016. Repurchases under the program may be made through open market or privately negotiated transactions at times and in such amounts as determined by our management, subject to market conditions and in accordance with the requirements of the Securities and Exchange Commission.

In February 2016, we entered into an issuer forward repurchase transaction confirmation (the ASR Agreement) with Bank of America, N.A. to repurchase common stock as part of the approved $100 million share repurchase program. Under the ASR Agreement, we paid Bank of America, N.A. $50 million and received an initial delivery of 4.2 million shares of common stock. The total number of shares to be ultimately purchased will be determined based on the volume weighted average price of our common stock during the term of the ASR Agreement (the Valuation Period). The transactions contemplated by the ASR Agreement are expected to be completed in the second fiscal quarter of 2016, but must be completed by no later than August 25, 2016. The shares of common stock delivered after the initial delivery of shares will be delivered by Bank of America, N.A. to us on the third business day following the Valuation Period.

We accounted for the ASR Agreement as two separate transactions (i) approximately 4.2 million shares of common stock initially delivered which represented approximately $42.5 million was accounted for as a treasury stock transaction and (ii) the remaining $7.5 million unsettled portion of the ASR Agreement was determined to be a forward contract indexed to our common stock. The initial repurchase of shares resulted in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and diluted net income (loss) per share on the delivery date. We determined that the forward contract indexed to our common stock met all of the applicable criteria for equity classification, and therefore the contract was not accounted for as a derivative. We recorded the $7.5 million unsettled portion of the ASR Agreement, which represents the implied value of the forward contract, in additional paid-in capital on the condensed consolidated balance sheet as of March 31, 2016. Upon final settlement of the ASR Agreement, the forward contract will be reclassified from additional paid-in capital to treasury stock for the value of the additional shares received.

We are authorized pursuant to the $100 million share repurchase program approved in 2015 to repurchase shares of common stock in the open market pursuant to trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934 (the Exchange Act). During the three-month period ended March 31, 2016, we repurchased 0.2 million shares of common stock at an average price of $10.49 per share under such trading plans.

Share-Based Compensation

We issue share-based awards to our employees in the form of stock options, restricted stock units, and restricted stock. We also have an Employee Stock Purchase Plan, or ESPP. The following table summarizes the components of share-based compensation expense included in our condensed consolidated statements of operations:

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

(in thousands) | |||||||

Cost of services | $ | 497 | $ | 372 | |||

Sales and marketing | 1,618 | 932 | |||||

Technology and development | 2,793 | 1,709 | |||||

General and administrative | 3,744 | 2,357 | |||||

Total share-based compensation | $ | 8,652 | $ | 5,370 | |||

Unrecognized share-based compensation expenses totaled $81.9 million as of March 31, 2016, which we expect to recognize over a weighted-average time period of 3.1 years.

Stock Warrants

During the period ended March 31, 2016, warrants to purchase common shares of 2,334,044 were net exercised for a total of 2,210,335 shares. There are no warrants outstanding as of March 31, 2016.

8

7. Net Loss Per Share

We compute basic net loss per share by dividing net loss by the weighted-average number of common shares outstanding for the period. We compute diluted net loss per share giving effect to all potential dilutive common stock, including awards granted under our equity compensation plans and warrants to acquire common stock.

The following table sets forth the computation of basic and diluted net loss:

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

(in thousands, except share and per share data) | |||||||

Net loss | $ | (11,226 | ) | $ | (9,158 | ) | |

Denominator (basic and diluted): | |||||||

Weighted average common shares outstanding | 94,748,645 | 94,033,035 | |||||

Net loss per share: | |||||||

Basic and diluted | $ | (0.12 | ) | $ | (0.10 | ) | |

Potentially dilutive securities, including common equivalent shares in which the exercise price together with other assumed proceeds exceed the average market price of common stock for the applicable period, were not included in the calculation of diluted net loss per share as their impact would be anti-dilutive. The following weighted-average number of outstanding employee stock options, restricted stock units and restricted stock awards, warrants to purchase common stock, and shares purchased under our ESPP were excluded from the computation of diluted net loss per share:

For the Three Months Ended March 31, | |||||

2016 | 2015 | ||||

Stock options outstanding | 11,497,626 | 7,287,369 | |||

Restricted stock units and restricted stock awards | 2,841,861 | 578,657 | |||

Common equivalent shares from stock warrants | 1,045,303 | 2,219,671 | |||

15,384,790 | 10,085,697 | ||||

8. Income Taxes

Income taxes for the interim periods presented have been included in the accompanying condensed consolidated financial statements on the basis of an estimated annual effective tax rate. Based on an estimated annual effective tax rate and discrete items, the estimated income tax benefit for the three-month periods ended March 31, 2016 and 2015 was $7.5 million and $6.0 million, respectively. The determination of the interim period income tax provision utilizes the effective tax rate method, which requires us to estimate certain annualized components of the calculation of the income tax provision, including the annual effective tax rate by entity and jurisdiction.

We continually evaluate all positive and negative information to determine if our deferred tax assets are realizable in accordance with ASC 740-10-30, which states that "all available evidence shall be considered in determining whether a valuation allowance for deferred tax assets is needed". In December 2015, the proposed comprehensive settlement agreements resolving outstanding litigation relating to our past marketing representations and information security programs were approved by the Federal Trade Commission, (FTC), the representatives of a national class of consumers, and the court. As a result of these settlements, we paid $100 million in December 2015, resulting in a remaining cumulative accrual of $16 million. Based on the reserves of $96 million and $20 million recorded in the years ended December 31, 2015 and 2014, respectively, we have three years of cumulative pretax net losses. We reviewed the cumulative settlement of $116 million and determined that it was non-recurring in nature, not indicative of future performance, and, as such, would not materially affect our ability to generate taxable income in the future. In addition to excluding the impact of the non-recurring settlement amounts, we have seen improving pre-tax book income over the past 5 years and we are forecasting to continue generating pre-tax book income. As a result of the consideration of the factors discussed above, we believe that it is more likely than not that we will be able to realize our net deferred tax assets not currently subject to a valuation allowance.

9

9. Segment Reporting

We operate our business and our Chief Operating Decision Maker, or CODM, who is our Chief Executive Officer and President, reviews and assesses our operating performance using two reportable segments: our consumer segment and our enterprise segment. In our consumer segment, we offer proactive identity theft protection services to consumers on an annual or monthly subscription basis. In our enterprise segment, we offer consumer risk management services to our enterprise customers.

Revenue and loss from operations by operating segment for the three-month period ended March 31, 2016 and goodwill and total assets by operating segment as of March 31, 2016 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 151,930 | $ | 7,339 | $ | — | $ | 159,269 | |||||||

Intersegment revenue | — | 2,286 | (2,286 | ) | — | ||||||||||

Loss from operations | (13,477 | ) | (5,430 | ) | — | (18,907 | ) | ||||||||

Goodwill | 112,550 | 59,537 | — | 172,087 | |||||||||||

Total assets | 459,314 | 95,179 | (790 | ) | 553,703 | ||||||||||

Revenue and loss from operations by operating segment for the three-month period ended March 31, 2015 and goodwill and total assets by operating segment as of December 31, 2015 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 128,201 | $ | 6,207 | $ | — | $ | 134,408 | |||||||

Intersegment revenue | — | 2,056 | (2,056 | ) | — | ||||||||||

Loss from operations | (10,755 | ) | (4,377 | ) | — | (15,132 | ) | ||||||||

Goodwill | 112,550 | 59,537 | — | 172,087 | |||||||||||

Total assets | 492,796 | 100,753 | (740 | ) | 592,809 | ||||||||||

We derive all of our revenue from sales in the United States, and substantially all of our long-lived assets are located in the United States.

10. Contingencies

As part of our consumer services, we offer comprehensive member service support. If a member’s identity has been compromised, our member service team and remediation specialists will assist the member with its resolution. This includes our $1 million service guarantee, which is backed by an identity theft insurance policy, under which we will spend up to $1 million to cover certain third-party costs and expenses incurred in connection with the remediation, such as legal and investigatory fees, subject to certain terms and conditions. This insurance also covers certain out-of-pocket expenses, such as loss of income, replacement of fraudulent withdrawals, and costs associated with child and elderly care, travel, stolen purse/wallet, and replacement of documents. While we have reimbursed members for claims under this guarantee, the amounts in aggregate for the three-month periods ended March 31, 2016 and 2015 were not material.

On March 13, 2014, we received a request from the FTC for documents and information related to our compliance with the consent decree we entered into in 2010 (the FTC Order). Prior to our receipt of the FTC’s request, we met with FTC Staff on January 17, 2014, at our request, to discuss issues regarding allegations that have been asserted in a whistleblower claim against us relating to our compliance with the FTC Order. On October 29, 2014, we completed our responses to the FTC’s March 13, 2014 request for information, and on January 5, 2015, we provided responses to subsequent FTC requests for additional information. On July 21, 2015 the FTC lodged, under seal, in the United States District Court for the District of Arizona, a motion seeking to hold us in contempt of the FTC Order. On December 17, 2015, we entered into a comprehensive settlement agreement with the FTC, pursuant to which we resolved all matters related to the FTC Contempt Action and provided a mechanism to fund a settlement of the Ebarle Class Action. Under the terms of the settlement, $100 million was placed into the registry of the court overseeing the FTC Contempt Action, $68 million of which was to be distributed to fund the consumer redress contemplated by the Ebarle Class Action settlement, and the remaining $32 million of which is authorized

10

to fund consumer redress ordered by any states’ attorneys general, provided that certain conditions are met. If all or part of the $32 million is not used for that purpose, it will revert to the FTC.

On January 19, 2015, plaintiffs Napoleon Ebarle and Jeanne Stamm filed a nationwide putative consumer class action lawsuit against us in the United States District Court for the Northern District of California. The plaintiffs allege that we have engaged in deceptive marketing and sales practices in connection with our membership plans in violation of the Arizona Consumer Fraud Act and seek declaratory judgment under the Federal Declaratory Judgment Act. On March 27, 2015, plaintiffs filed an amended complaint, adding an additional plaintiff, Brian Litton, adding a breach of contract claim, and expanding the class period to include all members enrolled in one of the company’s identity theft protection plans since January 1, 2010. On January 20, 2016, the court overseeing the Ebarle Class Action granted the plaintiffs’ motion for preliminary approval conditionally approving the parties’ proposed settlement agreement and allowing plaintiffs to file a second amended complaint naming Reiner Jerome Ebarle as an additional plaintiff. On February 11, 2016, the court overseeing the FTC Action entered an order allowing the $68 million to be transferred from the court's registry to the court-ordered settlement administrator in the Ebarle Class Action to fund the settlement. Notice has been sent to the class members. The deadline for class members to object was April 14, 2016, and the deadline for class members to submit claims is April 29, 2016. A hearing on final approval is scheduled for June 23, 2016. As of March 31, 2016 we have $13.0 million accrued for settlement of this claim, which was not included within the $100 million settlement paid to the FTC for settlement of the FTC Contempt Action and nationwide class action claims. In addition, we have $3.0 million accrued for a potential settlement with states attorneys general for related claims.

On August 1, 2014, our subsidiaries Lemon and Lemon Argentina, S.R.L. (Lemon Argentina, and together, the Lemon Entities) filed a lawsuit in Santa Clara Superior Court in San Jose, California, against Wenceslao Casares, former General Manager of Lemon, Cynthia McAdam, former General Counsel of Lemon, and Federico Murrone, Martin Apesteguia and Fabian Cuesta, each a former employee and former member of the Board of Directors of Lemon Argentina (the Argentine Executives). The complaint alleges breaches of employment-related contracts and breaches of fiduciary duty involving each named individual’s work for third-party Xapo, Inc. and/or Xapo, Ltd. during their employment by the applicable Lemon Entity. The parties, including the Argentine Executives, engaged in mediation in August 2014 in Buenos Aires, Argentina, and again in December 2014 in San Francisco, California, but were unable to settle any claims. On January 30, 2015, the Lemon Entities filed a second amended complaint alleging breaches of employment-related contracts, breaches of fiduciary duties, and fraud, and seeking declaratory relief against Mr. Casares, Ms. McAdam, and the Argentine Executives. Mr. Casares and Ms. McAdam demurred to the Second Amended Complaint on May 1, 2015, which the court overruled in its entirety on July 2, 2015. Mr. Casares and Ms. McAdam answered the Second Amended Complaint on July 24, 2015. The Argentine Executives entered their appearances in the litigation on July 24, 2015 and filed a motion to dismiss for inconvenient forum on September 8, 2015. That motion was heard on December 4, 2015 and granted on January 4, 2016, with an order staying the action in its entirety. The Lemon Entities filed a notice of appeal on March 1, 2016.

Mr. Casares also filed a cross-claim against us and Lemon, Inc. (now Lemon, LLC) on July 24, 2015, for breach of contract, breach of the implied covenant of good faith and fair dealing, conversion, unjust enrichment, and declaratory relief, all arising from the termination of his employment. He filed an amended cross-claim asserting the same causes of action on September 22, 2015. We, along with Lemon, LLC, filed a motion to dismiss the amended cross-claim on October 22, 2015. Because of the January 4, 2016 order staying the case in its entirety, the court did not rule on the motion to dismiss.

Mr. Casares filed a separate complaint against us, Lemon, LLC, and Shareholder Representative Services LLC (SRS) in Delaware Chancery Court on October 7, 2015 for breach of contract and seeking a declaratory judgment. The action concerns a December 12, 2014 settlement agreement that resolved certain disputes against other former shareholders of Lemon, Inc. arising out of our December 11, 2013 Lemon acquisition. We, along with Lemon, LLC, moved to dismiss the complaint on October 28, 2015. Mr. Casares responded by filing an amended complaint on January 8, 2016. LifeLock, Inc. and Lemon, LLC moved to dismiss the amended complaint. LifeLock, Inc. and Lemon, LLC filed their brief in support of the motion to dismiss on February 24, 2016. Mr. Casares filed his opposition on March 25, 2016. LifeLock, Inc. and Lemon, LLC's reply in support of the motion is due April 25, 2016.

On July 22, 2015, Miguel Avila, representing himself and seeking to represent a class of persons who acquired our securities from July 30, 2014 to July 20, 2015, inclusive, filed a class action complaint in the United States District Court for the District of Arizona. His complaint alleges that Todd Davis, Christopher Power, and we violated Sections 10(b) and 20(a) of the Securities Exchange Act by making materially false or misleading statements, or failing to disclose material facts about our business, operations, and prospects, including with regard to our information security program, advertising, recordkeeping, and our compliance with the FTC Order. The complaint seeks certification as a class action, compensatory damages, and attorney’s fees and costs. On September 21, 2015, four other Company stockholders, Oklahoma Police Pension and Retirement System, Oklahoma Firefighters Pension and Retirement System, Larisa Gassel, and Donna Thompson, and their respective attorneys all filed motions seeking to be appointed the lead plaintiff and lead counsel in this class action. On October 9, 2015, the Court appointed Oklahoma Police Pension and Retirement System and Oklahoma Firefighters Pension and Retirement System as lead

11

plaintiffs. On October 19, 2015, the Court entered a scheduling order pursuant to which, and consistent with that order, lead plaintiffs filed an amended complaint on December 10, 2015. We, along with Mr. Davis and Mr. Power, moved to dismiss the amended complaint on January 29, 2016. A hearing on that motion to dismiss is scheduled for May 2, 2016. lead plaintiffs moved to lift a statutory discovery stay imposed by the Private Securities Litigation Reform Act on January 21, 2016. We, along with Mr. Davis and Mr. Power, opposed that motion on February 8, 2016. On April 22, 2016, the Court denied lead plaintiffs’ motion.

On March 3, 2014, and March 10, 2014, two securities class action complaints were filed in the United States District Court for the District of Arizona, against us, Mr. Davis, and Mr. Power. On June 16, 2014, the court consolidated the complaints into a single action captioned In re LifeLock, Inc. Securities Litigation and appointed a lead plaintiff and lead counsel. On August 15, 2014, the lead plaintiff filed the Consolidated Amended Class Action Complaint (the Consolidated Amended Complaint), seeking to represent a class of persons who acquired our securities from February 26, 2013 to May 16, 2014, inclusive (the Class Period). The Consolidated Amended Complaint alleged that we, along with Mr. Davis, Mr. Power, and Ms. Schneider, violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, by making materially false or misleading statements, or failing to disclose material facts regarding certain of our business, operational, and compliance policies, including with regard to certain of our services, our data security program, and Mr. Davis’ compliance with the FTC Order. The Consolidated Amended Complaint alleged that, as a result, certain of our financial statements issued during the Class Period and certain public statements made by Ms. Schneider, Mr. Davis, and Mr. Power during the Class Period, were false and misleading. The Consolidated Amended Complaint sought certification as a class action, compensatory damages, and attorneys’ fees and costs. On September 15, 2014, we, along with our President, Mr. Davis, and Mr. Power, filed a motion to dismiss the Consolidated Amended Complaint. On December 17, 2014, the court dismissed the Consolidated Amended Complaint and gave the lead plaintiff 21 days to seek leave to amend. On January 16, 2015, lead plaintiff filed his Second Consolidated Amended Complaint which contained similar allegations, but no longer named Ms. Schneider as a defendant. On January 30, 2015, we, along with Mr. Davis and Mr. Power, filed a motion to dismiss the Second Consolidated Amended Complaint. On July 21, 2015, the court granted the motion to dismiss, without leave to amend, and entered judgment in our favor. On August 18, 2015, the lead plaintiff along with another shareholder, City of Hallandale Beach Police and Firefighters’ Personnel Retirement Fund, moved to vacate the judgment on the grounds that the FTC’s July 21, 2015 motion seeking to hold us in contempt of the FTC Order constituted surprise and newly discovered evidence. Plaintiffs also sought permission to file a Third Consolidated Amended Complaint. We, Mr. Davis, and Mr. Power opposed plaintiffs’ motion. On September 18, 2015, the court denied plaintiffs’ motion to vacate the July 21, 2015 judgment and plaintiffs’ request to file another complaint. On September 21, 2015, plaintiffs filed a notice of appeal with the Ninth Circuit Court of Appeals. Plaintiffs appeal from the lower court’s July 21, 2015 order dismissing the Second Consolidated Amended Complaint and entering judgment in our favor, and the court’s September 18, 2015 order denying plaintiffs’ motion to vacate that judgment. Briefing of the appeal has been completed, but oral argument on the appeal has not been set by the Ninth Circuit.

On September 23, 2015, Sridhar Manthangodu, a stockholder of ours, filed a derivative complaint captioned Manthangodu v. Davis, et al., in the Superior Court of the State of Arizona, Maricopa County (Arizona Superior Court). This derivative complaint, purportedly filed on our behalf (we are named as a nominal defendant in the action), alleges that certain of our directors (the Director Defendants) violated their fiduciary duties to LifeLock stockholders by failing to ensure that we complied with the FTC Order. According to the complaint, the Director Defendants’ alleged breach of their fiduciary oversight duties has exposed us to “material liability,” because we must defend against the FTC’s July 21, 2015 motion seeking to hold us in contempt of the FTC Order, and the shareholder securities class action filed on July 22, 2015 discussed above. The complaint seeks unspecified monetary damages, a return to the company of all personal compensation received by the Director Defendants, as well as unspecified corporate governance reforms. On October 16, 2015, the parties jointly moved for a transfer of this matter to the Commercial Court of Maricopa County Superior Court. On October 20, 2015, that motion was granted and the action was transferred to the Commercial Court. On November 17, 2015, and December 16, 2015, the Court held status conferences. At these conferences, the parties stated that they were engaged in continued discussions aimed at potential resolution of the action. On December 24, 2015 the Court issued an Order directing the parties to continue to engage in settlement discussions, including at a mediation before former Chief Justice of the Arizona Supreme Court, Stanley Feldman. The Court also appointed Plaintiff Manthangodu lead plaintiff and his counsel lead counsel. The parties have engaged in multiple mediation sessions before Justice Feldman and made substantial progress. Negotiations are ongoing. If the parties reach agreement on all terms, the agreement will be subject to approval by the Board of Directors. If the Directors approve any settlement of the derivative suit, that settlement will then be subject to Court approval. We cannot guarantee that we will be able to settle the suit or that any settlement would be approved.

Following the filing of the Manthangodu action discussed above, additional substantively similar Stockholder derivative actions were purportedly filed on our behalf against certain of our current and former directors and officers (the Individual Defendants) in the United States District Court for the District of Arizona (the Arizona Federal Court), the Delaware Court of Chancery (the Delaware Court), and the Arizona Superior Court. On October 28, 2015, a stockholder filed a derivative complaint captioned Gassel v. Davis, et al., in the Arizona Federal District Court. On November 19, 2015 and November 25,

12

2015, two stockholders filed derivative complaints captioned Stein v. Davis, et al. and John L. Munson Revocable Trust v. Davis, et al., respectively, in the Delaware Court of Chancery. On January 22, 2016, January 26, 2016, and February 1, 2016, three stockholders filed derivative complaints captioned, City of Pontiac General Employees’ Retirement Sys. v. Guthrie, et al.; Liang Jiawei v. Davis, et al.; and Russell Sprouse v. Davis, et al., in the Arizona Superior Court. Like the Manthangodu action, all of these actions allege that the Individual Defendants breached their fiduciary duties to LifeLock stockholders by failing to ensure that our business and operations complied with the FTC Order and/or by making materially false or misleading statements, or failing to disclose material facts regarding our business, operations, and prospects, including with regard to certain of our services, our data security program, and our compliance with the FTC Order, and make other related allegations and claims. Like the Manthangodu action, these actions seek relief including unspecified monetary damages, restitution to the Company from the Individual Defendants, certain corporate governance reforms, attorneys’ fees and costs, and/or punitive damages.

On January 8, 2016, we and the Individual Defendants moved to stay the Gassel action as duplicative of the first-filed Manthangodu action. On April 13, 2016, the Arizona Federal Court granted a non-indefinite stay of the action and directed us to file a status update on the Manthangodu action on July 12, 2016.

On February 11, 2016, the Arizona Superior Court entered an order consolidating the Sprouse Action with the first-filed Manthangodu Action. On February 24, 2016, the Court entered an order consolidating the City of Pontiac and Jiawei actions with the Manthangodu and Sprouse actions. The consolidated action is captioned In re: LifeLock, Inc. Derivative Litigation. On February 22, 2016, plaintiffs Sprouse and City of Pontiac each filed motions seeking to modify the Court’s December 24, 2016 order appointing lead counsel and lead plaintiff to add Sprouse and City of Pontiac as co-lead plaintiff and their respective counsel as co-lead counsel. Lead plaintiff Manthangodu opposed those motions on March 10, 2016. On March 18, 2016 the Court set a hearing on these motions for May 13, 2016, which hearing was later vacated by the Court on April 7, 2016, upon stipulation of defendants and plaintiffs Manthangodu, Sprouse, City of Pontiac, and Jiawei. Also on March 18, 2016, the plaintiffs in the Stein and Munson actions voluntarily dismissed their actions. On March 23, 2016, these plaintiffs jointly filed a derivative complaint captioned, Stein and Munson v. Davis et al., in the Arizona Superior Court against certain of our current directors. This derivative complaint makes the same allegations and seeks the same relief as in the original actions filed in the Delaware Chancery Court. On April 7, 2016, the Court entered an Order consolidating the Stein and Munson action with the previously consolidated Manthangodu, Sprouse, Jiawei, and City of Pontiac actions.

We are subject to other legal proceedings and claims that have arisen in the ordinary course of business. Although there can be no assurance as to the ultimate disposition of these matters, we believe, based upon the information available at this time, that, except as disclosed above, a material adverse outcome related to the matters is neither probable nor estimable.

11. Subsequent Events

In April 2016, we entered into a lease for an office building located in Mountain View, CA. The term of the lease is nine years with the expected delivery date of the premises to occur on or around November 1, 2016. Under the terms of the lease, we will incur additional rent expense of approximately $4.2 million per year. Pursuant to the lease, we also provided a letter of credit to the landlord in the amount of $1.0 million.

13

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion of our financial condition and results of operations in conjunction with the condensed consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our 2015 Form 10-K. This Quarterly Report on Form 10-Q contains “forward-looking statements” that involve substantial risks and uncertainties. The statements contained in this Quarterly Report on Form 10-Q that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act, including, but not limited to, statements regarding our expectations, beliefs, including beliefs in our services and in the identity theft protection services industry, intentions, strategies, investments and expenditures for new member acquisitions and to grow our business, including investments in sales and marketing and in technology and development, future operations, future financial position, fluctuations in our financial performance from period to period, future revenue, projected expenses, our ability to fund continuing operations and plans and objectives of management. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words.

These forward-looking statements reflect our current views about future events and involve known risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievement to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included in this Quarterly Report on Form 10-Q and our 2015 Form 10-K. Furthermore, such forward-looking statements speak only as of the date on which they are made. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Overview

We are a leading provider of proactive identity theft protection services for consumers and consumer risk management services for enterprises. We protect our members by monitoring identity-related events, such as new account openings, credit-related applications and other non-credit related information. If we detect that someone is using a member’s personally identifiable information, we offer notifications and alerts, including actionable alerts for new account openings and applications, and allow our members to confirm valid or unauthorized identity use. If a member confirms that the use of his or her identity is unauthorized, we can take actions designed to help protect the member’s identity and help determine whether there has been an identity theft. In the event that an identity theft has actually occurred, we can take actions designed to help restore the member’s identity through our remediation services. Our remediation service team works directly with government agencies, merchants, and creditors to remediate the impact of the identity theft event utilizing our remediation expertise on behalf of our members. We protect our enterprise customers by delivering on-demand identity risk, identity-authentication, and credit information about consumers. Our enterprise customers utilize this information to make decisions about opening or modifying accounts and providing products, services, or credit to consumers to reduce financial losses from identity fraud.

The foundation of our identity theft protection services is the LifeLock ecosystem. This ecosystem combines large data repositories of personally identifiable information and consumer transactions, proprietary predictive analytics, and a highly scalable technology platform. Our members and enterprise customers enhance our ecosystem by continually contributing to the identity and transaction data in our repositories. We apply predictive analytics to the data in our repositories to provide our members and enterprise customers actionable intelligence that helps protect against identity theft and identity fraud. As a result of our combination of scale, reach, and technology, as well as our comprehensive transaction and new account alerting, remediation services, and $1 million service guarantee backed by an identity theft insurance policy, we believe that we have proactive and comprehensive identity theft protection services available, as well as a leading brand in the identity theft protection services industry.

We derive the substantial majority of our revenue from member subscription fees. We also derive revenue from transaction fees from our enterprise customers. We currently offer our identity theft protection services to consumer subscribers under our LifeLock Standard, LifeLock Advantage, LifeLock Ultimate Plus, and LifeLock Junior Services. In 2015 we announced LifeLock Benefit Elite, identity theft protection, created specifically for employers and brokers to offer as a benefit for employees. We also continue to offer, on a limited basis and for a limited time in connection with certain of our partnerships, our basic LifeLock, LifeLock Command Center, and premium LifeLock Ultimate services and continue to provide services to our existing members currently enrolled in our basic LifeLock, LifeLock Command Center, and premium LifeLock Ultimate services. Our consumer services are offered on a monthly or annual subscription basis. Our average revenue per member is lower than our retail list prices due to wholesale or bulk pricing that we offer to strategic partners in our

14

embedded product, employee benefits, and breach distribution channels to drive our membership growth. In our embedded product channel, our strategic partners embed our consumer services into their products and services and pay us on behalf of their customers; in our employee benefit channel, our strategic partners offer our consumer services as a voluntary benefit as part of their employee benefit enrollment process; and in our breach channel, enterprises that have experienced a data breach pay us a fee to provide our services to the victims of the data breach. We also offer special discounts and promotions from time to time as incentives to prospective members to enroll in one of our consumer services. Our members pay us the full subscription fee at the beginning of each subscription period, in most cases by authorizing us to directly charge their credit or debit cards. We initially record the subscription fee as deferred revenue and then recognize it ratably on a daily basis over the subscription period. The prepaid subscription fees enhance our visibility of revenue and allow us to collect cash prior to paying our fulfillment partners.

Our enterprise customers pay us based on their monthly volume of transactions with us, with approximately 30% of our enterprise customers committed to monthly transaction minimums. We recognize revenue at the end of each month based on transaction volume for that month and bill our enterprise customers at the conclusion of each month.

We have historically invested significantly in new member acquisition and expect to continue to do so for the foreseeable future. Our largest operating expense is advertising for member acquisition, which we record as a sales and marketing expense. This is comprised of radio, television, and print advertisements; direct mail campaigns; online display advertising; paid search and search-engine optimization; third-party endorsements; and education programs. We also pay internal and external sale commissions, which we record as a sales and marketing expense. In general, increases in revenue and cumulative ending members occur during and after periods of significant and effective direct retail marketing efforts.

Our Business Model

We operate our business and our Chief Operating Decision Maker, or CODM, who is our CEO and President, reviews and assesses our operating performance using two reportable segments: our consumer segment and our enterprise segment. We review and assess our operating performance primarily using segment revenue, income (loss) from operations, and total assets. These performance measures include the allocation of operating expenses to our reportable segments based on management’s specific identification of costs associated to those segments.

Consumer Services

We evaluate the lifetime value of a member relationship over its anticipated lifecycle. While we generally incur member acquisition costs in advance of or at the time we acquire the member, we recognize revenue ratably over the subscription period. As a result, a member relationship is not profitable at the beginning of the subscription period even though it is likely to have value to us over the lifetime of the member relationship.

When a member’s subscription automatically renews in each successive period, the relative value of that member increases because we do not incur significant incremental acquisition costs. We also benefit from decreasing fulfillment and member support costs related to that member, as well as economies of scale in our capital and operating and other support expenditures.

Enterprise Services

In our enterprise business, the majority of our costs relate to personnel primarily responsible for data analytics, data management, software development, sales and operations, and various support functions. Our enterprise customers typically provide us with their customer transaction data as part of our service, allowing us to build and refine our models without incurring significant third-party data expenses. We continually evaluate third-party data sources and acquire data from such sources when we believe such data will enhance the performance of our models. New customer acquisition is often a lengthy process. We make a significant investment in the sales team, including costs related to detailed retrospective data analysis to help demonstrate the return on investment to prospective customers had our services been deployed over a specific period of time. Because most of our enterprise business expenses are fixed, we typically incur modest incremental costs when we add new enterprise customers, resulting in additional economies of scale.

Key Metrics

We regularly review a number of operating and financial metrics to evaluate our business, determine the allocation of our resources, measure the effectiveness of our sales and marketing efforts, make corporate strategy decisions, and assess operational efficiencies.

15

Key Operating Metrics

The following table summarizes our key operating metrics:

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

(in thousands, except percentages and per member data) (Unaudited) | |||||||

Cumulative ending members | 4,323 | 3,888 | |||||

Gross new members | 345 | 421 | |||||

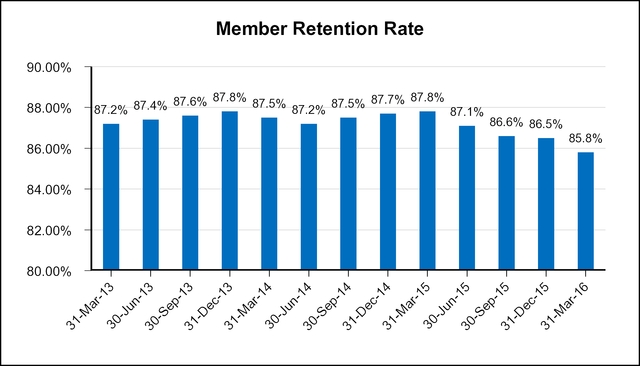

Member retention rate | 85.8 | % | 87.8 | % | |||

Average cost of acquisition per member | $ | 250 | $ | 176 | |||

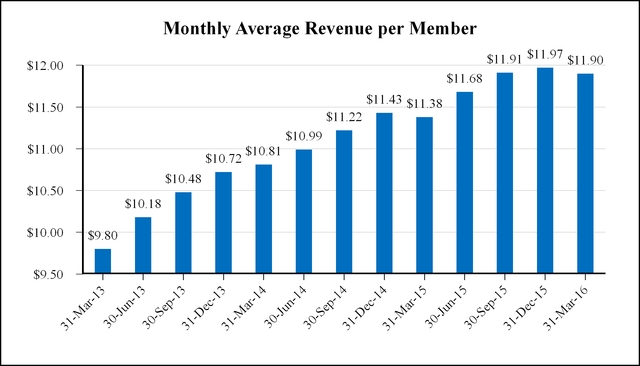

Monthly average revenue per member | $ | 11.90 | $ | 11.38 | |||

Enterprise transactions | 76,080 | 61,535 | |||||

Cumulative ending members. We calculate cumulative ending members as the total number of members at the end of the relevant period. The majority of our members are paying subscribers who have enrolled in our consumer services directly with us on a monthly or annual basis. Other members receive our consumer services through third-party entities that pay us directly, because of a breach within the entity. Entities also embed our service within a broader third- party offering, or as an employee benefit paid for by the member's employer, which adds to our member total. We monitor cumulative ending members because it provides an indication of the revenue and expenses that we expect to recognize in the future.

As of March 31, 2016, our cumulative ending member base increased 11% year over year. Several factors drove this increase, including the success of our marketing campaigns, increased awareness of data breaches, media coverage of identity theft, and our member retention rate. The year over year increase as of March 31, 2016 is lower than the year over year increase of 21% as of March 31, 2015, primarily as a result of an increase in members during the three-month period ended March 31, 2015 as a result of a large breach in the medical insurance industry.

16

Gross new members. We calculate gross new members as the total number of new members who enroll in one of our consumer services during the relevant period. Many factors may affect the volume of gross new members in each period, including the effectiveness of our marketing campaigns, the timing of our marketing programs, the effectiveness of our strategic partnerships, and the general level of identity theft coverage in the media. We monitor gross new members because it provides an indication of the revenue and expenses that we expect to recognize in the future. Gross new members decreased 18% for the three-month period ended March 31, 2016 compared to the same period last year. The decrease in our gross new members for the three-month period ended March 31, 2016 was primarily due to the media attention related to a large breach at a health insurance company in the three-months period ended March 31, 2015, which resulted in our most successful gross new member quarter in the history of the Company.

Member retention rate. We define member retention rate as the percentage of members on the last day of the prior year who remain members on the last day of the current year. Similarly, for quarterly presentations, we use the percentage of members on the last day of the comparable quarterly period in the prior year who remain members on the last day of the current quarterly period. A number of factors may increase our member retention rate, including increases in the proportion of members enrolled on an annual subscription, increases in the number of alerts a member receives, and increases in the proportion of members enrolled through strategic partners with whom the member has a strong association. Conversely, factors that may reduce our member retention rate include increases in the number of members enrolled on a monthly subscription and the end of enrollment programs in our embedded product and breach channels. In addition, the length of time a member has been enrolled in one of our services will affect our member retention rate with longer-term members having a positive impact. Historically, the member retention rate for our premium services has been lower than the member retention rate for our basic-level services, which we believe is driven primarily by price.

Our member retention rate as of March 31, 2016 was significantly impacted by the high number of cancellations of members who enrolled during the three-month period ended March 31, 2015 as a result of the breach at a large health insurance company during the three-month period ended March 31, 2015, and failed to renew on their first anniversary. Historically the first renewal date is when we experience our lowest member retention.

Average cost of acquisition per member. We calculate average cost of acquisition per member as our sales and marketing expense for our consumer segment during the relevant period divided by our gross new members for the period. A number of factors may influence this metric, including shifts in the mix of our media spend. For example, when we engage in marketing efforts to build our brand, our short-term cost of acquisition per member increases with the expectation that it will decrease over the long term. In addition, when we introduce new partnerships, such as partnerships in our embedded product channel, our average cost of acquisition per member may decrease due to the volume of members that enroll in our consumer services in a relatively short period of time. We monitor average cost of acquisition per member to evaluate the efficiency of our marketing programs in acquiring new members. Our average cost of acquisition per member increased for the three month

17

period ended March 31, 2016 when compared with the three month period ended March 31, 2015 due in part to the impact of the breach on a large health insurance company in the three months period ended March 31, 2015. As a result of the high level of impacted people and the media coverage related to the breach we were able to acquire gross new members at a lower cost of acquisition. In addition, in light of the FTC matter, which we settled at the end of 2015, enrollments through relationships with strategic partners were lower than in prior periods. Typically enrollments through relationships with strategic partner are at a lower average cost of acquisition per member.

Our member retention rate and the increasing monthly average revenue per member, primarily from the continued penetration of our premium service offerings, results in a higher lifetime value of a member relationship. This enables us to absorb a higher average cost of acquisition per member.

Monthly average revenue per member. We calculate monthly average revenue per member as our consumer revenue during the relevant period divided by the average number of cumulative ending members during the relevant period (determined by taking the average of the cumulative ending members at the beginning of the relevant period and the cumulative ending members at the end of each month in the relevant period), divided by the number of months in the relevant period. A number of factors may influence this metric, including whether a member enrolls in one of our premium services; whether we offer the member any promotional discounts upon enrollment; the distribution channel through which we acquire the member, as we offer wholesale pricing in our embedded product, employee benefit, and breach channels; and whether a new member subscribes on a monthly or annual basis, as members enrolling on an annual subscription receive a discount for paying for a year in advance. While our retail list prices have historically remained unchanged, we have seen our monthly average revenue per member increase primarily due to increased adoption of our higher-priced premium services by a greater percentage of our members, a trend we expect to continue. We monitor monthly average revenue per member because it is a strong indicator of revenue in our consumer business and of the performance of our premium services.

Our monthly average revenue per member increased approximately 5% for the three-month period ended March 31, 2016, compared to the same period last year. The increases resulted primarily from the continued success of our premium service offerings, which accounted for more than 40% of our gross new members for the three-month period ended March 31, 2016.

Enterprise transactions. Our enterprise transactions are processed by ID Analytics and are calculated as the total number of enterprise transactions processed for either an identity risk or credit risk score during the relevant period. Enterprise transactions have historically been higher in the fourth quarter as the level of credit applications and general consumer spending increases. We monitor the volume of enterprise transactions because it is a strong indicator of revenue in our enterprise business.

18

Enterprise transactions increased 24% for the three-month period ended March 31, 2016, compared to the same period last year. Enterprise transactions increased as we continued to add new customers and expand our offerings with our current customer base.

Key Financial Metrics

The following table summarizes our key financial metrics:

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

(in thousands) | |||||||

Consumer revenue | $ | 151,930 | $ | 128,201 | |||

Enterprise revenue | 7,339 | 6,207 | |||||

Total revenue | 159,269 | 134,408 | |||||

Adjusted net loss | (4,768 | ) | (5,230 | ) | |||

Adjusted EBITDA | (2,215 | ) | (2,967 | ) | |||

Free cash flow | 10,576 | 17,714 | |||||

Adjusted Net Income (Loss)

Adjusted net income (loss) is a non-U.S. GAAP financial measure that we calculate as net income (loss) excluding amortization of acquired intangible assets, share-based compensation, income tax benefits and expenses resulting from changes in our deferred tax assets, and acquisition related expenses. For the three-month period ended March 31, 2016, we excluded the expenses for the FTC and related litigation. For the three-month period ended March 31, 2015, we excluded the impact of the legal reserve for a settlement of a class action lawsuit. We included adjusted net income (loss) in this Quarterly Report on Form 10-Q because it is a key measure we use to understand and evaluate our operating performance and trends. In particular, the exclusion of certain expenses in calculating adjusted net income (loss) can provide a useful measure for period-to-period comparisons of our core business.

Accordingly, we believe that adjusted net income (loss) provides useful information to investors and others in understanding and evaluating our operating results in the same manner as we do. We believe that the exclusion of certain items of income and expense from net income (loss) in calculating adjusted net income (loss) is useful because (i) the amount of such income and expense in any specific period may not directly correlate to the underlying operational performance of our business, and/or (ii) such income and expense can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets.

Our use of adjusted net income (loss) has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our operating results as reported under U.S. GAAP. Some of these limitations include the following:

• | although amortization of intangible assets is a non-cash charge, additional intangible assets may be acquired in the future and adjusted net income (loss) does not reflect cash capital expenditure requirements for new acquisitions; |

• | adjusted net income (loss) does not reflect the cash requirements for new acquisitions; |

• | adjusted net income (loss) does not reflect changes in, or cash requirements for, our working capital needs; |

• | adjusted net income (loss) does not consider the potentially dilutive impact of share-based compensation; |

• | adjusted net income (loss) does not reflect the deferred income tax benefit from the release of the valuation allowance or income tax expenses which reduce our deferred tax asset for net operating losses or other net changes in deferred tax assets; |

• | adjusted net income (loss) does not reflect the expenses incurred for new acquisitions; and |

• | other companies, including companies in our industry, may calculate adjusted net income (loss) or similarly titled measures differently, limiting their usefulness as a comparative measure. |

19

Because of these limitations, you should consider adjusted net income (loss) alongside other financial performance measures, including various cash flow metrics, net income (loss), and our other U.S. GAAP results. The following table presents a reconciliation of net income (loss) to adjusted net income (loss) for applicable items of income and expense that impacted each of the periods indicated:

For the Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Reconciliation of Net Loss to Adjusted Net Loss: | (in thousands) | ||||||

Net loss | $ | (11,226 | ) | $ | (9,158 | ) | |

Amortization of acquired intangible assets | 3,042 | 2,084 | |||||

Share-based compensation | 8,652 | 5,370 | |||||

Deferred income tax benefit | (7,498 | ) | (6,026 | ) | |||

Legal reserves and settlements | — | 2,500 | |||||

Expenses related to the FTC litigation | 2,262 | — | |||||

Adjusted net loss | $ | (4,768 | ) | $ | (5,230 | ) | |

Adjusted EBITDA

Adjusted EBITDA is a non-U.S. GAAP financial measure that we calculate as net income (loss) excluding depreciation and amortization, share-based compensation, interest expense, interest income, other income (expense), income tax (benefit) expense, and acquisition related expenses. For the three-month period ended March 31, 2016, we excluded the expenses for the FTC and related litigation. For the three-month period ended March 31, 2015, we excluded the impact of the legal reserve for a settlement with a class action lawsuit. We have included adjusted EBITDA in this Quarterly Report on Form 10-Q because it is a key measure we use to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, adjusted EBITDA is a key financial measure used in determining management’s incentive compensation.

Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as we do. We believe that the exclusion of certain items of income and expense from net income (loss) in calculating adjusted EBITDA is useful because (i) the amount of such income and expense in any specific period may not directly correlate to the underlying operational performance of our business, and/or (ii) such income and expense can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets.