Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - LIFELOCK, INC. | lock-ex321x20160930x10q.htm |

| EX-31.2 - EXHIBIT 31.2 - LIFELOCK, INC. | lock-ex312x20160930x10q.htm |

| EX-31.1 - EXHIBIT 31.1 - LIFELOCK, INC. | lock-ex311x20160930x10q.htm |

| EX-10.7 - EXHIBIT 10.7 - LIFELOCK, INC. | lock-ex107x20160930x10q.htm |

| EX-10.6 - EXHIBIT 10.6 - LIFELOCK, INC. | lock-ex106x20160930x10q.htm |

| EX-10.5 - EXHIBIT 10.5 - LIFELOCK, INC. | lock-ex105x20160930x10q.htm |

| EX-10.4 - EXHIBIT 10.4 - LIFELOCK, INC. | lock-ex104x20160930x10q.htm |

| EX-10.3 - EXHIBIT 10.3 - LIFELOCK, INC. | lock-ex103x20160930x10q.htm |

| EX-10.2 - EXHIBIT 10.2 - LIFELOCK, INC. | lock-ex102x20160930x10q.htm |

| EX-10.1 - EXHIBIT 10.1 - LIFELOCK, INC. | lock-ex101x20160930x10q.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________.

Commission file number: 001-35671

LifeLock, Inc. (Exact name of registrant as specified in its charter) |

Delaware | 56-2508977 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

60 East Rio Salado Parkway, Suite 400 Tempe, Arizona 85281 (Address of principal executive offices and zip code) (480) 682-5100 (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ý | Accelerated filer | ¨ | |

Non-accelerated filer (Do not check if a smaller reporting company) | ¨ | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of October 28, 2016, there were outstanding 94,146,117 shares of the registrant’s common stock, $0.001 par value.

LIFELOCK, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2016

TABLE OF CONTENTS

Page | |

LifeLock, LifeLock Standard, LifeLock Advantage, LifeLock Ultimate, LifeLock Ultimate Plus, LifeLock Junior, Id Analytics and the LockMan logo are registered trademarks of LifeLock, Inc. or its subsidiaries. All other trademarks are the property of their respective owners.

i

PART I - FINANCIAL INFORMATION

Item 1. | Financial Statements (Unaudited) |

LIFELOCK, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

September 30, 2016 | December 31, 2015 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 34,806 | $ | 50,239 | |||

Marketable securities | 131,298 | 196,474 | |||||

Trade and other receivables, net | 17,080 | 13,974 | |||||

Prepaid expenses and other current assets | 9,168 | 12,303 | |||||

Total current assets | 192,352 | 272,990 | |||||

Property and equipment, net | 44,665 | 30,485 | |||||

Goodwill | 172,087 | 172,087 | |||||

Intangible assets, net | 21,830 | 30,174 | |||||

Deferred tax assets, net | 81,164 | 77,363 | |||||

Other non-current assets | 13,627 | 9,710 | |||||

Total assets | $ | 525,725 | $ | 592,809 | |||

Liabilities and stockholders’ equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 8,645 | $ | 24,747 | |||

Accrued expenses and other liabilities | 57,362 | 76,226 | |||||

Deferred revenue | 189,034 | 166,403 | |||||

Total current liabilities | 255,041 | 267,376 | |||||

Other non-current liabilities | 20,113 | 7,367 | |||||

Total liabilities | 275,154 | 274,743 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Common stock, $0.001 par value, 300,000,000 authorized at September 30, 2016 and December 31, 2015; 100,850,257 and 95,877,947 shares issued and 93,647,679 and 95,832,238 outstanding at September 30, 2016 and December 31, 2015, respectively | 101 | 96 | |||||

Preferred stock, $0.001 par value, 10,000,000 shares authorized and no shares issued and outstanding at September 30, 2016 and December 31, 2015 | — | — | |||||

Treasury stock, at cost; 7,202,578 shares and no shares held at September 30, 2016 and December 31, 2015, respectively | (74,974 | ) | — | ||||

Additional paid-in capital | 544,009 | 532,388 | |||||

Accumulated other comprehensive loss | (118 | ) | (361 | ) | |||

Accumulated deficit | (218,447 | ) | (214,057 | ) | |||

Total stockholders’ equity | 250,571 | 318,066 | |||||

Total liabilities and stockholders’ equity | $ | 525,725 | $ | 592,809 | |||

See accompanying notes to condensed consolidated financial statements.

1

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Revenue: | |||||||||||||||

Consumer revenue | $ | 161,671 | $ | 144,648 | $ | 470,260 | $ | 411,178 | |||||||

Enterprise revenue | 8,623 | 7,304 | 23,746 | 20,139 | |||||||||||

Total revenue | 170,294 | 151,952 | 494,006 | 431,317 | |||||||||||

Cost of services | 34,782 | 33,988 | 118,410 | 103,470 | |||||||||||

Gross profit | 135,512 | 117,964 | 375,596 | 327,847 | |||||||||||

Costs and expenses: | |||||||||||||||

Sales and marketing | 68,416 | 62,850 | 240,492 | 209,470 | |||||||||||

Technology and development | 20,379 | 19,396 | 61,509 | 52,928 | |||||||||||

General and administrative | 21,882 | 120,984 | 73,700 | 160,815 | |||||||||||

Amortization of acquired intangible assets | 1,982 | 2,084 | 8,344 | 6,251 | |||||||||||

Total costs and expenses | 112,659 | 205,314 | 384,045 | 429,464 | |||||||||||

Income (loss) from operations | 22,853 | (87,350 | ) | (8,449 | ) | (101,617 | ) | ||||||||

Other income (expense): | |||||||||||||||

Interest expense | (111 | ) | (89 | ) | (403 | ) | (265 | ) | |||||||

Interest income | 272 | 219 | 875 | 498 | |||||||||||

Other, net | (85 | ) | — | (214 | ) | (183 | ) | ||||||||

Total other income | 76 | 130 | 258 | 50 | |||||||||||

Income (loss) before income taxes | 22,929 | (87,220 | ) | (8,191 | ) | (101,567 | ) | ||||||||

Income tax expense (benefit) | 8,527 | (22,075 | ) | (3,801 | ) | (27,784 | ) | ||||||||

Net income (loss) | $ | 14,402 | $ | (65,145 | ) | $ | (4,390 | ) | $ | (73,783 | ) | ||||

Net income (loss) per share attributable to common stockholders: | |||||||||||||||

Basic | $ | 0.16 | $ | (0.68 | ) | $ | (0.05 | ) | $ | (0.78 | ) | ||||

Diluted | $ | 0.15 | $ | (0.68 | ) | $ | (0.05 | ) | $ | (0.78 | ) | ||||

Weighted-average common shares outstanding used in computing net income (loss) per share attributable to common stockholders: | |||||||||||||||

Basic | 92,034 | 95,340 | 93,052 | 94,660 | |||||||||||

Diluted | 97,321 | 95,340 | 93,052 | 94,660 | |||||||||||

See accompanying notes to condensed consolidated financial statements.

2

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Net income (loss) | $ | 14,402 | $ | (65,145 | ) | $ | (4,390 | ) | $ | (73,783 | ) | ||||

Other comprehensive gain (loss), net of tax | |||||||||||||||

Unrealized gain (loss) on marketable securities | (89 | ) | 117 | 243 | 39 | ||||||||||

Comprehensive income (loss) | $ | 14,313 | $ | (65,028 | ) | $ | (4,147 | ) | $ | (73,744 | ) | ||||

See accompanying notes to condensed consolidated financial statements.

3

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

For the Nine Months Ended September 30, | |||||||

2016 | 2015 | ||||||

Operating activities | |||||||

Net loss | $ | (4,390 | ) | $ | (73,783 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation and amortization | 17,082 | 13,292 | |||||

Stock-based compensation | 25,509 | 20,287 | |||||

Provision for doubtful accounts | 352 | 150 | |||||

Amortization of premiums on marketable securities | 1,521 | 2,310 | |||||

Deferred income tax benefit | (3,801 | ) | (27,784 | ) | |||

Other | 343 | 250 | |||||

Change in operating assets and liabilities: | |||||||

Trade and other receivables | (3,956 | ) | (3,469 | ) | |||

Prepaid expenses and other current assets | 3,136 | (1,022 | ) | ||||

Other non-current assets | 167 | 357 | |||||

Accounts payable | (14,622 | ) | 1,548 | ||||

Accrued expenses and other liabilities | (18,120 | ) | 117,693 | ||||

Deferred revenue | 22,631 | 25,629 | |||||

Other non-current liabilities | 408 | 265 | |||||

Net cash provided by operating activities | 26,260 | 75,723 | |||||

Investing activities | |||||||

Acquisition of business, net of cash acquired | — | (12,797 | ) | ||||

Acquisition of property and equipment, including capitalization of internal use software | (11,299 | ) | (9,057 | ) | |||

Purchases of marketable securities | (83,896 | ) | (191,846 | ) | |||

Sales and maturities of marketable securities | 148,298 | 122,936 | |||||

Premiums paid for company-owned life insurance policies | (4,337 | ) | (4,337 | ) | |||

Net cash provided by (used in) investing activities | 48,766 | (95,101 | ) | ||||

Financing activities | |||||||

Proceeds from stock-based compensation plans | 15,780 | 10,144 | |||||

Payments related to the repurchases of common stock | (100,000 | ) | — | ||||

Payments for employee tax withholdings related to restricted stock units and awards | (6,239 | ) | (1,793 | ) | |||

Net cash provided by (used in) financing activities | (90,459 | ) | 8,351 | ||||

Net decrease in cash and cash equivalents | (15,433 | ) | (11,027 | ) | |||

Cash and cash equivalents at beginning of period | 50,239 | 146,569 | |||||

Cash and cash equivalents at end of period | $ | 34,806 | $ | 135,542 | |||

Supplemental cash flow information: | |||||||

Non-cash financing and investing activities: | |||||||

Building in progress - leased facility acquired under financing obligation | $ | 12,338 | $ | — | |||

See accompanying notes to condensed consolidated financial statements.

4

LIFELOCK, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), and applicable Securities and Exchange Commission (SEC), rules and regulations regarding interim financial reporting. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, or fiscal 2015 Form 10-K.

The condensed consolidated balance sheet as of December 31, 2015 included herein was derived from the audited financial statements as of that date, but does not include all disclosures including notes required by U.S. GAAP.

The accompanying unaudited condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, and cash flows for the interim periods, but are not necessarily indicative of the anticipated results of operations for the entire year ending December 31, 2016 or any future period.

Basis of Consolidation

The condensed consolidated financial statements include our accounts and those of our wholly and indirectly owned subsidiaries. We eliminate all intercompany balances and transactions, including intercompany profits, in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires us to make certain estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We continually evaluate our estimates, including those related to the allocation of the purchase price associated with acquisitions; the carrying value of long-lived assets; the amortization period of long-lived assets; the carrying value, capitalization, and amortization of software and website development costs; the carrying value of goodwill and other intangible assets; the amortization period of intangible assets; the provision for income taxes and related deferred tax accounts, and realizability of deferred tax assets; certain accrued expenses; contingencies, litigation, and related legal accruals; and the value attributed to employee stock options and other stock-based awards. We base our estimates on historical experience, current business factors, and various other assumptions that we believe are necessary to consider to form a basis for making judgments. Actual results could be materially different from these estimates.

2. Summary of Significant Accounting Policies

Leases

We lease office space and data centers in various locations under operating leases with original lease periods up to 11 years. Rent expense is recognized on a straight-line basis from the day we take possession of the premises through the end of the lease term. Rent abatements and rent escalation provisions are considered in determining the straight-line rent expense with any difference between rent expense and rent payable recorded as an increase or decrease in deferred rent. Tenant improvement allowances are recorded as leasehold improvements within property and equipment and within deferred rent.

We record assets and liabilities for the present value of estimated construction costs incurred under build-to-suit lease arrangements to the extent we are involved in the construction of structural improvements or take substantially all of the construction period risk prior to commencement of a lease. Ground rents are imputed and accrued for during the construction period, and are recorded in rent expense. At completion of a construction project, we perform an analysis to determine if the transfer to the owner/lessor meets the requirements for sale-leaseback treatment. If we maintain significant continuing involvement, we will continue to carry the construction costs and corresponding financing obligation on our balance sheet until the involvement or the term of the lease ends. If it is determined that we will not maintain significant continuing involvement, we record a sale of the premises back to the owner/lessor, and remove the construction costs and financing obligation from our consolidated balance sheet.

There have been no other material changes to our significant accounting policies from those disclosed in our fiscal 2015 Form 10-K.

5

Recently Issued Accounting Standards

In May 2014, the FASB, issued ASU 2014-09, Revenue from Contracts with Customers, which provides guidance for revenue recognition. The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under today’s guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price, and allocating the transaction price to each separate performance obligation. In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers: Deferral of the Effective Date, which defers the effective date of ASU 2014-09 for all entities for one year. Consequently, the guidance provided in ASU 2014-09 will be effective for us in the first quarter of our fiscal year ending December 31, 2018. Early adoption is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The guidance permits the use of either the retrospective or cumulative effect transition method. In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers: Principal versus Agent Considerations, which clarifies the implementation guidance on principal versus agent considerations. ASU 2016-08 is effective the same date as ASU 2014-09, Revenue from Contracts with Customers. In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarifies the guidance related to identifying performance obligations and licensing implementation guidance. ASU 2016-10 reduces the cost and complexity of applying certain aspects of the guidance both at implementation and on an ongoing basis. The effective date for ASU 2016-10 is the same as ASU 2014-09. We are currently in the process of evaluating the impact of the adoption of this guidance on our consolidated financial statements and have not yet selected a transition method.

In February 2016, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update (ASU) 2016-02, Leases, which requires lessees to recognize the assets and liabilities on their balance sheet for the rights and obligations created by operating leases and will also require disclosures designed to give users of financial statements information on the amount, timing, and uncertainty of cash flows arising from leases. The guidance provided by ASU 2016-02 is effective for annual periods beginning after December 15, 2018 and interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the effect of ASU 2016-06 on our consolidated financial statements and do not plan to early adopt this guidance.

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718) Improvements to Employee Share-Based Payment Accounting, which require all income tax effects of awards to be recognized in the income statement when the awards vest or are settled, as well as revising guidance around classification of awards as either equity or liabilities, forfeitures and classification on the statement of cash flows. ASU 2016-09 is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the effect of ASU 2016-09 on our consolidated financial statements and do not plan to early adopt this guidance.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, which makes changes to how certain cash receipt and cash payments are presented and classified in the cash flow statement. ASU 2016-15 is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. The amendments in ASU 2016-15 will be applied using a retrospective transition method for each period presented unless it is impracticable to apply the amendments retrospectively, in which case prospective application would be applied as of the earliest date practicable. Early adoption is permitted. We are currently evaluating the effect of ASU 2016-15 on our consolidated financial statements and do not plan to early adopt this guidance.

3. Marketable Securities

We classify all marketable securities as current regardless of contractual maturity dates because we consider such investments to represent cash available for current operations.

As of September 30, 2016 and December 31, 2015, we did not consider any of our marketable securities to be other-than-temporarily impaired. When evaluating our investments for other-than-temporary impairment, we review factors such as the length of time and extent to which fair value has been below its cost basis, the financial condition of the issuer, our ability and intent to hold the security, and whether it is more likely than not that we will be required to sell the investment before recovery of its cost basis.

6

The following is a summary of marketable securities designated as available-for-sale as of September 30, 2016:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

Corporate bonds | $ | 100,964 | $ | 14 | $ | (126 | ) | $ | 100,852 | ||||||

Government securities | 9,695 | 10 | — | 9,705 | |||||||||||

Commercial paper | 8,187 | — | — | 8,187 | |||||||||||

Agency securities | 7,255 | 3 | — | 7,258 | |||||||||||

Municipal bonds | 4,050 | — | (2 | ) | 4,048 | ||||||||||

Certificates of deposit | 1,248 | — | — | 1,248 | |||||||||||

Total marketable securities | $ | 131,399 | $ | 27 | $ | (128 | ) | $ | 131,298 | ||||||

The following is a summary of amortized cost and estimated fair value of marketable securities as of September 30, 2016 by maturity:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

Due in one year or less | $ | 121,461 | $ | 27 | $ | (94 | ) | $ | 121,394 | ||||||

Due after one year | 9,938 | — | (34 | ) | $ | 9,904 | |||||||||

Total marketable securities | $ | 131,399 | $ | 27 | $ | (128 | ) | $ | 131,298 | ||||||

The following is a summary of marketable securities designated as available-for-sale as of December 31, 2015:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

Corporate bonds | $ | 125,132 | $ | 1 | $ | (304 | ) | $ | 124,829 | ||||||

Commercial paper | 37,236 | — | — | 37,236 | |||||||||||

Municipal bonds | 16,228 | 2 | (6 | ) | 16,224 | ||||||||||

Government securities | 8,704 | 1 | (17 | ) | 8,688 | ||||||||||

Agency securities | 7,273 | — | (20 | ) | 7,253 | ||||||||||

Certificates of deposit | 2,244 | — | — | 2,244 | |||||||||||

Total marketable securities | $ | 196,817 | $ | 4 | $ | (347 | ) | $ | 196,474 | ||||||

The following is a summary of amortized cost and estimated fair value of marketable securities as of December 31, 2015 by maturity:

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

Due in one year or less | $ | 164,147 | $ | 2 | $ | (221 | ) | $ | 163,928 | ||||||

Due after one year | 32,670 | 2 | (126 | ) | 32,546 | ||||||||||

Total marketable securities | $ | 196,817 | $ | 4 | $ | (347 | ) | $ | 196,474 | ||||||

7

4. Fair Value Measurements

As of September 30, 2016 and December 31, 2015, the fair value of our financial assets was as follows:

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

(in thousands) | |||||||||||||||

September 30, 2016 | |||||||||||||||

Assets: | |||||||||||||||

Money market funds (1) | $ | 14,733 | $ | — | $ | — | $ | 14,733 | |||||||

Corporate bonds (2) | — | 100,852 | — | 100,852 | |||||||||||

Government securities (2) | — | 9,705 | — | 9,705 | |||||||||||

Commercial paper (2) | — | 8,187 | — | 8,187 | |||||||||||

Agency securities (2) | — | 7,258 | — | 7,258 | |||||||||||

Municipal bonds (2) | — | 4,048 | — | 4,048 | |||||||||||

Certificates of deposit (2) | — | 1,248 | — | 1,248 | |||||||||||

Total assets measured at fair value | $ | 14,733 | $ | 131,298 | $ | — | $ | 146,031 | |||||||

December 31, 2015 | |||||||||||||||

Assets: | |||||||||||||||

Money market funds (1) | $ | 18,114 | $ | — | $ | — | $ | 18,114 | |||||||

Corporate bonds (2) | — | 124,829 | — | 124,829 | |||||||||||

Commercial paper (3) | — | 47,294 | — | 47,294 | |||||||||||

Municipal bonds (2) | — | 16,223 | — | 16,223 | |||||||||||

Government securities (2) | — | 8,688 | — | 8,688 | |||||||||||

Agency securities (2) | — | 7,253 | — | 7,253 | |||||||||||

Certificates of deposit (2) | — | 2,244 | — | 2,244 | |||||||||||

Total assets measured at fair value | $ | 18,114 | $ | 206,531 | $ | — | $ | 224,645 | |||||||

(1) | Classified in cash and cash equivalents |

(2) | Classified in marketable securities. |

(3) | Includes commercial paper with maturities of three months or less at time of purchase of $10.1 million classified in cash and cash equivalents and commercial paper with maturities of greater than three months of $37.2 million classified in marketable securities. |

5. Financing Arrangements

There have been no changes in our Credit Agreement and related documents with Bank of America, which we refer to as our Senior Credit Facility, from the disclosure in our fiscal 2015 Form 10-K. At September 30, 2016 and December 31, 2015 we were in compliance with all the covenants of the Senior Credit Facility.

As of September 30, 2016, we had outstanding letters of credit in the amount of $1.3 million.

6. Leases

In April 2016, we entered into a lease agreement for approximately 60,000 rentable square feet of office space located in Mountain View, CA. We rented the total office space available in the building, which is currently under construction. As a result of our involvement during the construction period, we are deemed to be the owner of the construction project for accounting purposes. Accordingly, we recorded a $12.3 million construction in process asset in property and equipment, net, representing the total fair value of the building paid by the lessor including estimated construction period costs to date and a corresponding noncurrent financing obligation liability in our September 30, 2016 condensed consolidated balance sheet. We have also recorded imputed ground rent expense of $0.6 million for the three- and nine-months ended September 30, 2016. Construction is expected to be completed in the first quarter of 2017 at which point we will evaluate whether or not we meet the requirements for sale-leaseback treatment. If we do meet the requirements for sale-leaseback treatment upon completion of construction, we will record the sale of the premises back to the owner/lessor and remove the construction in process asset and corresponding noncurrent financing obligation liability from our consolidated balance sheet and the lease will be accounted for as an operating lease under which we expect to recognize rent expense of approximately $4.0 million per year during the term of the lease. If we are unable to meet the requirements for sale-leaseback treatment, the lease will be treated as a financing obligation and we will continue to carry the value of the building and construction costs on our balance sheet. Rent payments

8

will be treated as principal and interest payments on the financing obligation, with an amount recorded as estimated ground lease expense each period. The capitalized costs of the building will be depreciated over an estimated useful life of 30 years.

The following summarizes the future minimum lease payments for all outstanding lease agreements as of September 30, 2016:

Financing | |||||||

Obligation, | |||||||

Building in | |||||||

Operating | Progress - | ||||||

Leases | Leased Facility | ||||||

Remaining 2016 | $ | 1,959 | $ | — | |||

2017 | 7,429 | 1,717 | |||||

2018 | 6,751 | 4,222 | |||||

2019 | 6,355 | 4,349 | |||||

2020 | 4,773 | 4,480 | |||||

Thereafter | 14,151 | 27,605 | |||||

Gross future minimum lease payments | 41,418 | 42,373 | |||||

Less: expected proceeds from sublease rentals | (776 | ) | — | ||||

Net future minimum lease payments | $ | 40,642 | $ | 42,373 | |||

Rent expense for the three- and nine-months ended September 30, 2016 was $2.4 million and $6.4 million, respectively, net of sublease income. Rent expense for the three- and nine-months ended September 30, 2015 was $1.5 million and $4.3 million, respectively.

7. Stockholders’ Equity

Stock Repurchases

In November 2015, we announced that our board of directors approved the repurchase of up to $100 million of our common stock, representing approximately 7% of our outstanding common stock. The repurchase program was completed in the second quarter of 2016, with the final settlement of shares completed in the third quarter 2016. Repurchases under the program were made through open market and privately negotiated transactions as described below.

In February 2016, we entered into an issuer forward repurchase transaction confirmation (the ASR Agreement) with Bank of America, N.A. to repurchase common stock as part of the approved $100 million share repurchase program. Under the ASR Agreement, we paid Bank of America, N.A. $50 million and received an initial delivery of 4.2 million shares of common stock. The total number of shares purchased was determined based on the volume weighted average price of our common stock during the term of the ASR Agreement. In the second quarter 2016, Bank of America, N.A. delivered approximately 76,000 shares for the final settlement of the ASR Agreement.

We accounted for the ASR Agreement as two separate transactions: (i) approximately 4.2 million shares of common stock initially delivered, which represented approximately $42.5 million, was accounted for as a treasury stock transaction and (ii) the remaining $7.5 million unsettled portion of the ASR Agreement was determined to be a forward contract indexed to our common stock. The initial repurchase of shares resulted in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and diluted net income (loss) per share on the delivery date. We determined that the forward contract indexed to our common stock met all of the applicable criteria for equity classification, and therefore the contract was not accounted for as a derivative. We recorded the $7.5 million unsettled portion of the ASR Agreement, which represents the implied value of the forward contract, in additional paid-in capital on the condensed consolidated balance sheet upon execution of the ASR Agreement. Upon the final delivery of shares of the ASR Agreement, the forward contract was reclassified from additional paid-in capital to treasury stock for the value of the additional shares received, which amounted to approximately $1.0 million.

9

In May 2016, we entered into a second issuer forward repurchase transaction confirmation (the Second ASR Agreement) with Bank of America, N.A. to repurchase common stock as the final part of our approved $100 million share repurchase program. Under the Second ASR Agreement, we paid Bank of America, N.A. approximately $48.1 million and received an initial delivery of 3.5 million shares of common stock. The total number of shares purchased was determined based on the volume weighted average price of our common stock during the term of the Second ASR Agreement (the Valuation Period). In July 2016, we returned approximately 0.3 million shares to Merill Lynch, Pierce, Fenner & Smith pursuant to the Second ASR Agreement as a result of the increase in our stock price during the Valuation Period.

We accounted for the Second ASR Agreement as two separate transactions: (i) approximately 3.5 million shares of common stock initially delivered, which represented approximately $40.9 million, was accounted for as a treasury stock transaction; and (ii) the remaining $7.2 million unsettled portion of the Second ASR Agreement was determined to be a forward contract indexed to our common stock. The initial repurchase of shares resulted in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and diluted net income (loss) per share on the delivery date. We determined that the forward contract indexed to our common stock met all of the applicable criteria for equity classification, and therefore the contract was not accounted for as a derivative. We recorded the $7.2 million unsettled portion of the Second ASR Agreement, which represented the implied value of the forward contract, in additional paid-in capital. Upon final settlement of the Second ASR Agreement in August 2016, the value of the shares delivered to Merill Lynch, Pierce, Fenner & Smith was reclassified to additional paid-in capital from treasury stock for approximately $4.8 million.

We were authorized by our board of directors pursuant to the $100 million share repurchase program to repurchase shares of common stock in the open market pursuant to trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, (the Exchange Act). During the nine-month period ended September 30, 2016, we repurchased 0.2 million shares of common stock at an average price of $10.49 per share under such trading plans. In connection with the Second ASR Agreement, we terminated our trading plans.

Stock-Based Compensation

We issue stock-based awards to our employees in the form of stock options, restricted stock units, and restricted stock. We also have an Employee Stock Purchase Plan, or ESPP. The following table summarizes the components of stock-based compensation expense included in our condensed consolidated statements of operations:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(in thousands) | |||||||||||||||

Cost of services | $ | 486 | $ | 449 | $ | 1,445 | $ | 1,286 | |||||||

Sales and marketing | 1,672 | 1,238 | 4,793 | 3,385 | |||||||||||

Technology and development | 2,574 | 2,514 | 7,893 | 6,226 | |||||||||||

General and administrative | 3,880 | 3,662 | 11,378 | 9,390 | |||||||||||

Total stock-based compensation | $ | 8,612 | $ | 7,863 | $ | 25,509 | $ | 20,287 | |||||||

Unrecognized stock-based compensation expenses totaled $78.4 million as of September 30, 2016, which we expect to recognize over a weighted-average time period of 2.9 years.

Stock Warrants

During the nine-month period ended September 30, 2016, warrants to purchase common shares of 2,334,044 were net exercised for a total of 2,210,335 shares. There are no warrants outstanding as of September 30, 2016.

8. Net Income (Loss) Per Share

We compute basic net income (loss) per share using the two-class method required for participating securities. We consider unvested restricted stock to be participating because holders of such shares have non-forfeitable one-for-one dividend rights. The holders of unvested restricted stock do not have a contractual obligation to share in net losses. Basic net income (loss) per share attributable to common stockholders is calculated by dividing net income (loss) attributable to common stockholders by the weighted-average number of common shares outstanding for the period. We compute diluted net income (loss) per share attributable to common stockholders giving effect to all potential dilutive common stock, including awards granted under our equity compensation plans and warrants to acquire common stock.

10

The following table sets forth the computation of basic and diluted net income (loss) per share attributable to common stockholders:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(in thousands, except share and per share data) | |||||||||||||||

Numerator: | |||||||||||||||

Net income (loss) | $ | 14,402 | $ | (65,145 | ) | $ | (4,390 | ) | $ | (73,783 | ) | ||||

Less: Net income attributable to participating securities | (109 | ) | — | — | — | ||||||||||

Net income (loss) attributable to common stockholders | $ | 14,293 | $ | (65,145 | ) | $ | (4,390 | ) | $ | (73,783 | ) | ||||

Denominator (basic): | |||||||||||||||

Weighted average common shares outstanding | 92,034,474 | 95,340,136 | 93,052,376 | 94,659,931 | |||||||||||

Denominator (diluted): | |||||||||||||||

Weighted average common shares outstanding | 92,034,474 | 95,340,136 | 93,052,376 | 94,659,931 | |||||||||||

Dilutive stock options outstanding | 3,716,283 | — | — | — | |||||||||||

Dilutive restricted stock units and awards | 1,557,016 | — | — | — | |||||||||||

Dilutive shares purchased under ESPP | 13,530 | — | — | — | |||||||||||

Net weighted average common shares outstanding | 97,321,303 | 95,340,136 | 93,052,376 | 94,659,931 | |||||||||||

Net income (loss) per share attributable to common stockholders: | |||||||||||||||

Basic | $ | 0.16 | $ | (0.68 | ) | $ | (0.05 | ) | $ | (0.78 | ) | ||||

Diluted | $ | 0.15 | $ | (0.68 | ) | $ | (0.05 | ) | $ | (0.78 | ) | ||||

Potentially dilutive securities, including common equivalent shares in which the exercise price together with other assumed proceeds exceed the average market price of common stock for the applicable period, were not included in the calculation of diluted net income (loss) per share attributable to common stockholders as their impact would be anti-dilutive. The following weighted-average number of outstanding employee stock options, restricted stock units and restricted stock awards, warrants to purchase common stock, and shares purchased under our ESPP were excluded from the computation of diluted net income (loss) per share attributable to common stockholders:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||

Stock options outstanding | 5,006,875 | 10,328,593 | 9,268,689 | 8,876,984 | |||||||

Restricted stock units and restricted stock awards | 210,720 | 2,574,405 | 2,469,961 | 1,888,205 | |||||||

Common equivalent shares from stock warrants | — | 2,168,299 | 276,937 | 2,210,012 | |||||||

Shares purchased under ESPP | — | 54,271 | — | 67,858 | |||||||

5,217,595 | 15,125,568 | 12,015,587 | 13,043,059 | ||||||||

9. Income Taxes

Income taxes for the interim periods presented have been included in the accompanying condensed consolidated financial statements on the basis of an estimated annual effective tax rate. Based on an estimated annual effective tax rate and discrete items, the estimated income tax expense for the three-month period ended September 30, 2016 was $8.5 million and the estimated income tax benefit for the three-month period ended September 30, 2015 was $22.1 million. For the nine-month periods ended September 30, 2016 and 2015, the estimated income tax benefit was $3.8 million and $27.8 million, respectively. The determination of the interim period income tax provision utilizes the effective tax rate method, which requires us to estimate certain annualized components of the calculation of the income tax provision, including the annual effective tax rate by entity and jurisdiction. Our effective tax rate differed from the U.S. federal and state statutory rate for the three- and -month periods ended September 30, 2016 and 2015 primarily as a result of tax return to provision adjustments which resulted in an income tax benefit of $0.8 million and $0.4 million, respectively.

11

We continually evaluate all positive and negative information to determine if our deferred tax assets are realizable in accordance with ASC 740-10-30, which states that "all available evidence shall be considered in determining whether a valuation allowance for deferred tax assets is needed." In December 2015, the proposed comprehensive settlement agreements resolving outstanding litigation relating to our past marketing representations and information security programs were approved by the Federal Trade Commission, (FTC), the representatives of the Ebarle class action (as described in more detail in Note 11), and were approved by the court presiding over the Ebarle lass action. As a result of the expense of $96 million and $20 million recorded in the years ended December 31, 2015 and 2014, respectively, we have three years of cumulative pretax net losses. We reviewed the cumulative settlement of $116 million and determined that it was non-recurring in nature, not indicative of future performance, and, as such, would not materially affect our ability to generate taxable income in the future. In addition to excluding the impact of the non-recurring settlement amounts, we have seen improving pre-tax book income over the past five years and we are forecasting to continue generating pre-tax book income. As a result of the consideration of the factors discussed above, we believe that it is more likely than not that we will be able to realize our net deferred tax assets not currently subject to a valuation allowance.

10. Segment Reporting

We operate our business and our Chief Operating Decision Maker, or CODM, who is our Chief Executive Officer and President, reviews and assesses our operating performance using two reportable segments: our consumer segment and our enterprise segment. In our consumer segment, we offer proactive identity theft protection services to consumers on an annual or monthly subscription basis. In our enterprise segment, we offer consumer risk management services to our enterprise customers.

Revenue and income (loss) from operations by operating segment for the three-month period ended September 30, 2016 and goodwill and total assets by operating segment as of September 30, 2016 were:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 161,671 | $ | 8,623 | $ | — | $ | 170,294 | |||||||

Intersegment revenue | — | 2,253 | (2,253 | ) | — | ||||||||||

Income (loss) from operations | 26,636 | (3,783 | ) | — | 22,853 | ||||||||||

Goodwill | 112,550 | 59,537 | — | 172,087 | |||||||||||

Total assets | 434,517 | 91,979 | (771 | ) | 525,725 | ||||||||||

Revenue and income (loss) from operations by operating segment for the nine-month period ended September 30, 2016 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 470,260 | $ | 23,746 | $ | — | $ | 494,006 | |||||||

Intersegment revenue | — | 6,866 | (6,866 | ) | — | ||||||||||

Income (loss) from operations | 4,881 | (13,330 | ) | — | (8,449 | ) | |||||||||

Revenue and loss from operations by operating segment for the three-month period ended September 30, 2015 and goodwill and total assets by operating segment as of December 31, 2015 were:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 144,648 | $ | 7,304 | $ | — | $ | 151,952 | |||||||

Intersegment revenue | — | 2,068 | (2,068 | ) | — | ||||||||||

Loss from operations | (84,249 | ) | (3,101 | ) | — | (87,350 | ) | ||||||||

Goodwill | 112,550 | 59,537 | — | 172,087 | |||||||||||

Total assets | 492,796 | 100,753 | (740 | ) | 592,809 | ||||||||||

12

Revenue and loss from operations by operating segment for the nine-month period ended September 30, 2015 was as follows:

Consumer | Enterprise | Eliminations | Total | ||||||||||||

(in thousands) | |||||||||||||||

Revenue | |||||||||||||||

External customers | $ | 411,178 | $ | 20,139 | $ | — | $ | 431,317 | |||||||

Intersegment revenue | — | 6,232 | (6,232 | ) | — | ||||||||||

Loss from operations | (90,456 | ) | (11,161 | ) | — | (101,617 | ) | ||||||||

We derive all of our revenue from sales in the United States, and substantially all of our long-lived assets are located in the United States.

11. Contingencies

As part of our consumer services, we offer broad member service support. If a member’s identity has been compromised, our member service team and remediation specialists will assist the member with its resolution. This includes our $1 million service guarantee, which is backed by an identity theft insurance policy, under which we will spend up to $1 million to cover certain third-party costs and expenses incurred in connection with the remediation, such as legal and investigatory fees, subject to certain terms and conditions. This insurance also covers certain out-of-pocket expenses, such as loss of income, replacement of fraudulent withdrawals, and costs associated with child and elderly care, travel, stolen purse/wallet, and replacement of documents, subject to certain terms and conditions. While we have reimbursed members for claims under this guarantee, the amounts in aggregate for the nine-month periods ended September 30, 2016 and 2015 were not material.

On July 21, 2015 the FTC lodged, under seal, in the United States District Court for the District of Arizona, a motion seeking to hold us in contempt of the consent decree we entered into with the FTC in 2010 (the FTC Order). On December 17, 2015, we entered into a comprehensive settlement agreement with the FTC, pursuant to which we resolved all matters related to the FTC Contempt Action and provided a mechanism to fund a settlement of the Ebarle Class Action described below.

On January 19, 2015, plaintiffs Napoleon Ebarle and Jeanne Stamm filed a nationwide putative consumer class action lawsuit against us in the United States District Court for the Northern District of California. A second amended complaint was filed on November 4, 2015 on behalf of four plaintiffs who alleged that we engaged in deceptive marketing and sales practices in connection with our membership plans in violation of the Arizona Consumer Fraud Act, Breach of Contract, unjust enrichment and violation of the Federal Declaratory Judgment Act.

Under the terms of the FTC settlement, $100 million, was paid in December 2015 and was placed into the registry of the court overseeing the FTC Contempt Action, $68 million of which was authorized to be distributed to fund the consumer redress contemplated by the Ebarle Class Action settlement. Those funds have been transferred to the supervision of the court overseeing the Ebarle Class Action Settlement.

On September 20, 2016, the court overseeing the Ebarle Class Action entered judgment and an order granting plaintiffs’ motion for final approval of the parties’ proposed settlement agreement, awarding plaintiffs’ counsel $10.2 million in fees and costs and awarding each of the four plaintiffs $2,000 as a service award, these amounts were previously expensed in the third quarter of 2015. Beginning on October 11, 2016, the Court-appointed settlement administrator distributed settlement checks to settlement class members using the $68 million transferred in February 2016 to the court-appointed settlement administrator from the court’s registry in the FTC Contempt Action. The remaining $32 million of the settlement remains in the registry of the Arizona court. In addition, we have $3.0 million accrued for a potential settlement with states attorneys general for related claims.

Appeals of the final approval order and judgment were filed by six objectors prior to the filing deadline and are pending in the Ninth Circuit Court of Appeals. The appeals do not impact the timing of the payment of settlement checks to settlement class members or payment of the attorneys’ fees, costs and service awards to plaintiffs. A mediation assessment conference is scheduled with the Court of Appeals for November 9, 2016, in connection with the initial appeal filed, and the appeal briefs are currently due on various dates in January through March 2017. However, the parties have agreed to consolidate the appeals which is likely to have an impact on the current schedule.

On August 1, 2014, our subsidiaries Lemon and Lemon Argentina, S.R.L. (Lemon Argentina, and together, the Lemon Entities) filed a lawsuit in Santa Clara Superior Court in San Jose, California, against Wenceslao Casares, former General Manager of Lemon, Cynthia McAdam, former General Counsel of Lemon, and Federico Murrone, Martin Apesteguia and Fabian Cuesta, each a former employee and former member of the board of directors of Lemon Argentina (the Argentine Executives). The complaint alleges breaches of employment-related contracts and breaches of fiduciary duties involving each named individual’s work for

13

third-party Xapo, Inc. and/or Xapo, Ltd. during their employment by the applicable Lemon Entity. On January 30, 2015, the Lemon Entities filed a second amended complaint alleging breaches of employment-related contracts, breaches of fiduciary duties, and fraud, and seeking declaratory relief against Mr. Casares, Ms. McAdam, and the Argentine Executives. The Argentine Executives entered their appearances in the litigation on July 24, 2015 and filed a motion to dismiss for inconvenient forum on September 8, 2015. That motion was heard on December 4, 2015 and granted on January 4, 2016, with an order staying the action in its entirety. The Lemon Entities filed a notice of appeal on March 1, 2016.

Mr. Casares filed a cross-claim against us and Lemon, Inc. (now Lemon, LLC) on July 24, 2015, for breach of contract, breach of the implied covenant of good faith and fair dealing, conversion, unjust enrichment, and declaratory relief, all arising from the termination of his employment. Because of the January 4, 2016 order staying the case in its entirety, the court did not rule on the motion to dismiss. Mr. Casares filed a separate complaint against us, Lemon, LLC, and Shareholder Representative Services LLC (SRS) in Delaware Chancery Court on October 7, 2015 for breach of contract and seeking a declaratory judgment. The action concerns a December 12, 2014 settlement agreement that resolved certain disputes against other former stockholders of Lemon, Inc. arising out of our December 11, 2013 Lemon acquisition. We, along with Lemon, LLC, moved to dismiss the complaint on October 28, 2015. Mr. Casares responded by filing an amended complaint on January 8, 2016. LifeLock, Inc. and Lemon, LLC moved to dismiss the amended complaint. That motion was heard on September 27, 2016 and granted in part and denied in part the same day. The Court has not yet set a schedule for pretrial or trial proceedings in the case.

On September 19, 2016, LifeLock and its subsidiary Lemon. LLC, filed a lawsuit in Delaware Chancery Court against Mr. Casares and Ms. McAdam, stemming from the December 11, 2013 merger between LifeLock and Lemon. Specifically, the complaint alleges that both Mr. Casares and Ms. McAdam breached the representations and warranties in the merger agreement and associated contracts, such as their respective non-disclosure agreement, by failing to disclose Lemon’s pre-merger development of Xapo. The complaint also alleges that Mr. Casares and Ms. McAdam fraudulently induced LifeLock to enter into the merger agreement, breached their fiduciary duties to Lemon, and were unjustly enriched from their fraudulent conduct. Defendants filed a motion to dismiss on October 24, 2016. The parties have not yet agreed to a briefing schedule for the motion.

On July 22, 2015, Miguel Avila, representing himself and seeking to represent a class of persons who acquired our securities from July 30, 2014 to July 20, 2015, inclusive, filed a class action complaint in the United States District Court for the District of Arizona. His complaint alleged that Todd Davis, Christopher Power, and we violated Sections 10(b) and 20(a) of the Exchange Act by making materially false or misleading statements, or failing to disclose material facts about our business, operations, and prospects, including with regard to our information security program, advertising, recordkeeping, and our compliance with the FTC Order. The complaint sought certification as a class action, compensatory damages, and attorney’s fees and costs. On September 21, 2015, four other Company stockholders, Oklahoma Police Pension and Retirement System, Oklahoma Firefighters Pension and Retirement System, Larisa Gassel, and Donna Thompson, and their respective attorneys all filed motions seeking to be appointed the lead plaintiff and lead counsel in this class action. On October 9, 2015, the Court appointed Oklahoma Police Pension and Retirement System and Oklahoma Firefighters Pension and Retirement System as lead plaintiffs. On December 10, 2015 lead plaintiffs filed a substantively similar amended complaint. Lead plaintiffs moved to lift the discovery stay imposed by the Private Securities Litigation Reform Act on January 21, 2016. On February 8, 2016, we, along with Mr. Davis and Mr. Power, opposed that motion and on April 22, 2016, the Court denied lead plaintiffs’ motion. We, along with Mr. Davis and Mr. Power, moved to dismiss the amended complaint on January 29, 2016. On August 3, 2016 the Court granted our motion to dismiss and later permitted lead plaintiffs until September 23, 2016 to seek leave to amend their complaint. On September 23, 2016, lead plaintiffs moved for leave to file a proposed Second Amended Complaint, which we did not oppose. On October 13, 2016, the Court granted lead plaintiffs’ motion for leave to file a second amended complaint. On October 14, 2016, lead plaintiffs filed the Second Amended Complaint, which is substantively similar to the amended complaint but adds our President, Hilary Schneider, as a named defendant. We, along with Ms. Schneider and Messrs. Davis and Power will move to dismiss the Second Amend Complaint by December 16, 2016, pursuant to a schedule stipulated by the parties and order by the Court.

On March 3, 2014, and March 10, 2014, two securities class action complaints were filed in the United States District Court for the District of Arizona, against us, Mr. Davis, and Mr. Power. On June 16, 2014, the court consolidated the complaints into a single action captioned In re LifeLock, Inc. Securities Litigation and appointed a lead plaintiff and lead counsel. On August 15, 2014, the lead plaintiff filed the Consolidated Amended Class Action Complaint (the Consolidated Amended Complaint), seeking to represent a class of persons who acquired our securities from February 26, 2013 to May 16, 2014, inclusive (the Class Period). The Consolidated Amended Complaint alleged that we, along with Mr. Davis, Mr. Power, and Ms. Schneider, violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, by making materially false or misleading statements, or failing to disclose material facts regarding certain of our business, operational, and compliance policies, including with regard to certain of our services, our data security program, and Mr. Davis’ compliance with the FTC Order. The Consolidated Amended Complaint alleged that, as a result, certain of our financial statements issued during the Class Period and certain public statements made by Ms. Schneider, Mr. Davis, and Mr. Power during the Class Period, were false and misleading. The Consolidated Amended Complaint sought certification as a class action, compensatory damages, and

14

attorneys’ fees and costs. On December 17, 2014, the court granted our and the other defendants’ motion and dismissed the Consolidated Amended Complaint, giving the lead plaintiff 21 days to seek leave to amend. On January 16, 2015, lead plaintiff filed his Second Consolidated Amended Complaint which contained similar allegations, but no longer named Ms. Schneider as a defendant. On July 21, 2015, the court granted our and the other defendants’ motion to dismiss the Second Consolidated Amended Complaint, without leave to amend, and entered judgment in our favor. On August 18, 2015, the lead plaintiff along with another stockholder, City of Hallandale Beach Police and Firefighters’ Personnel Retirement Fund, moved to vacate the judgment on the grounds that the FTC’s July 21, 2015 motion seeking to hold us in contempt of the FTC Order constituted surprise and newly discovered evidence. Plaintiffs also sought permission to file a Third Consolidated Amended Complaint. We, Mr. Davis, and Mr. Power opposed plaintiffs’ motion. On September 18, 2015, the court denied plaintiffs’ motion to vacate the July 21, 2015 judgment and plaintiffs’ request to file another complaint. On September 21, 2015, plaintiffs filed a notice of appeal with the Ninth Circuit Court of Appeals. Plaintiffs appeal from the lower court’s July 21, 2015 order dismissing the Second Consolidated Amended Complaint and entering judgment in our favor, and the court’s September 18, 2015 order denying plaintiffs’ motion to vacate that judgment. Briefing of the appeal has been completed, but oral argument on the appeal has not been set by the Ninth Circuit.

We are subject to other legal proceedings and claims that have arisen in the ordinary course of business. Although there can be no assurance as to the ultimate disposition of these matters and those discussed above, we believe, based upon the information available at this time, that, except as disclosed above, a material adverse outcome related to the matters is neither probable nor estimable.

15

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion of our financial condition and results of operations in conjunction with the condensed consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our Annual Report on Form 10-K for fiscal year 2015, (the fiscal 2015 Form 10-K). This Quarterly Report on Form 10-Q contains “forward-looking statements” that involve substantial risks and uncertainties. The statements contained in this Quarterly Report on Form 10-Q that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act, including, but not limited to, statements regarding our expectations, beliefs, intentions and strategies, including our expectations and beliefs and intentions regarding our services, the identity theft protection services industry and competitive landscape, our strategic partner channel, our investments, our expected expenditures for new member acquisitions and to grow our business, investments in sales and marketing and in technology and development, future operations, future financial position, fluctuations in our financial performance from period to period, future revenue, projected expenses, our ability to fund continuing operations and plans and objectives of management and adapt our products and service offerings to evolving regulatory or data source requirements . In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words.

These forward-looking statements reflect our current views about future events and involve known risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievement to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included in this Quarterly Report on Form 10-Q and the other filings we make with the Securities and Exchange Commission (SEC). Furthermore, such forward-looking statements speak only as of the date on which they are made. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Overview

We are a leading provider of proactive identity theft protection services for consumers and consumer risk management services for enterprises. In our consumer business, we help protect our members by monitoring identity-related events, such as new account openings, credit-related applications and other non-credit related information. If we detect that someone is using a member’s personally identifiable information, we offer notifications and alerts, including actionable alerts for certain new account openings and applications, and allow our members to confirm valid or unauthorized identity use. If a member confirms that the use of his or her identity is unauthorized, we can take actions designed to help protect the member’s identity and help determine whether there has been an identity theft. In the event that an identity theft has actually occurred, we can take actions designed to help rectify the impact of the theft of the member’s identity through our remediation services. Our remediation service team works directly with government agencies, merchants, and creditors to help remediate the impact of the identity theft event utilizing our remediation expertise on behalf of our members. In our enterprise business, we help protect our enterprise customers by delivering on-demand identity risk, identity-authentication, and credit information about consumers. Our enterprise customers utilize this information to make decisions about additional steps required before opening or modifying accounts and providing products, services, or credit to consumers to reduce financial losses from identity fraud.

The foundation of our identity theft protection services is the LifeLock ecosystem. This ecosystem combines large data repositories of personally identifiable information and consumer transactions, proprietary predictive analytics, and a scalable technology platform. Our members and enterprise customers enhance our ecosystem by continually contributing to the identity and transaction data in our repositories. We apply predictive analytics to the data in our repositories to provide our members and enterprise customers actionable intelligence that helps protect against identity theft and identity fraud.

We derive the substantial majority of our revenue from member subscription fees from our consumer business. We primarily offer our identity theft protection services to consumer subscribers under our LifeLock Standard, LifeLock Advantage, LifeLock Ultimate Plus, and LifeLock Junior Services. We also offer LifeLock Benefit Elite, identity theft protection, created specifically for employers and brokers to offer as a benefit for employees. Our consumer services are offered on a monthly or annual subscription basis. Our average revenue per member is lower than our retail list prices due to wholesale or bulk pricing that we offer to strategic partners in our embedded product, employee benefits, and breach distribution channels to drive our membership growth. In our embedded product channel, our strategic partners embed our consumer services into their products and services and pay us on behalf of their customers; in our employee benefit channel, employers primarily offer our consumer services as a voluntary benefit as part of their employee benefit enrollment process; and in our breach channel, enterprises that have experienced a data breach pay us a fee to provide our services to the victims of

16

the data breach. We also offer special discounts and promotions from time to time as incentives to prospective members to enroll in one of our consumer services. Our members pay us the full subscription fee at the beginning of each subscription period, in most cases by authorizing us to directly charge their credit or debit cards. We initially record the subscription fee as deferred revenue and then recognize it ratably on a daily basis over the subscription period. The prepaid subscription fees enhance our visibility of revenue and allow us to collect cash prior to paying our fulfillment partners.

We also derive revenue from transaction fees from our enterprise customers. Our enterprise customers pay us based on their monthly volume of transactions with us, with over 30% of our enterprise customers committed to monthly transaction minimums. We recognize revenue at the end of each month based on transaction volume for that month and bill our enterprise customers at the conclusion of each month.

We have historically invested significantly in new member acquisition and expect to continue to do so for the foreseeable future. Our largest operating expense is advertising for member acquisition, which we record as a sales and marketing expense. This is comprised of radio, television, and print advertisements; direct mail campaigns; online display advertising; paid search and search-engine optimization; third-party endorsements; and education programs. We also pay internal and external sales commissions, which we record as a sales and marketing expense. In general, increases in revenue and cumulative ending members occur during and after periods of significant and effective direct retail marketing efforts.

Our Business Model

We operate our business and our Chief Operating Decision Maker, or CODM, who is our CEO and President, reviews and assesses our operating performance using two reportable segments: our consumer segment and our enterprise segment. We review and assess our operating performance primarily using segment revenue, income (loss) from operations, total assets and other key financial and operating metrics discussed below. These performance measures include the allocation of operating expenses to our reportable segments based on management’s specific identification of costs associated to those segments.

Consumer Services

We evaluate the lifetime value of a member relationship over its anticipated lifecycle. While we generally incur member acquisition costs in advance of or at the time we acquire the member, we recognize revenue ratably over the subscription period. As a result, a member relationship is not profitable at the beginning of the subscription period even though it is likely to have value to us over the lifetime of the member relationship.

When a member’s subscription automatically renews in each successive period, the relative value of that member increases because we do not incur significant incremental acquisition costs. We also benefit from decreasing fulfillment and member support costs related to that member, as well as economies of scale in our capital and operating and other support expenditures.

Enterprise Services

In our enterprise business, the majority of our costs relate to personnel primarily responsible for data analytics, data management, software development, sales and operations, and various support functions. Our enterprise customers typically provide us with their customer transaction data as part of our service, allowing us to build and refine our models without incurring significant third-party data expenses. We continually evaluate third-party data sources and acquire data from such sources when we believe such data will enhance the performance of our models. New customer acquisition is often a lengthy process. We make a significant investment in the sales team, including costs related to detailed retrospective data analysis to help demonstrate the return on investment to prospective customers had our services been deployed over a specific period of time. Because most of our enterprise business expenses are fixed, we typically incur modest incremental costs when we add new enterprise customers, resulting in additional economies of scale.

Key Metrics

We regularly review a number of operating and financial metrics to evaluate our business, determine the allocation of our resources, measure the effectiveness of our sales and marketing efforts, make corporate strategy decisions, and assess operational efficiencies.

17

Key Operating Metrics

The following table summarizes our key operating metrics:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(in thousands, except percentages and per member data) (Unaudited) | |||||||||||||||

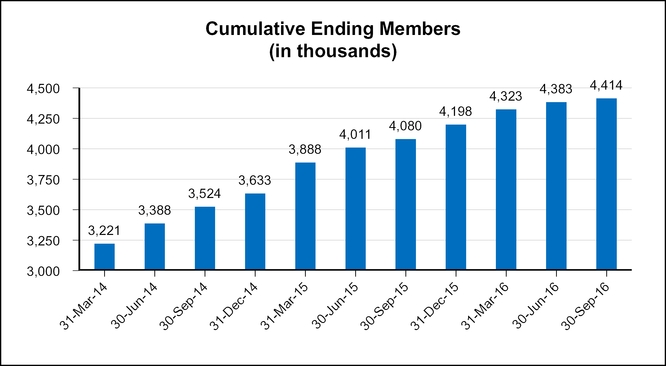

Cumulative ending members | 4,414 | 4,080 | 4,414 | 4,080 | |||||||||||

Gross new members | 254 | 251 | 903 | 989 | |||||||||||

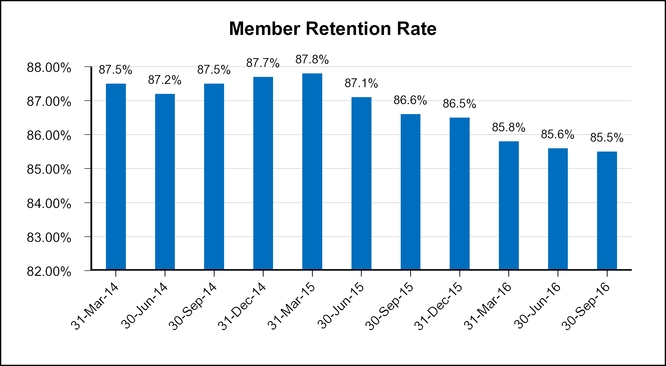

Member retention rate | 85.5 | % | 86.6 | % | 85.5 | % | 86.6 | % | |||||||

Average cost of acquisition per member | $ | 255 | $ | 237 | $ | 255 | $ | 202 | |||||||

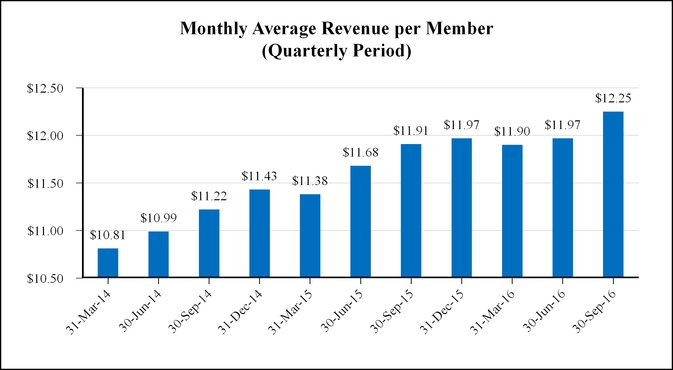

Monthly average revenue per member | $ | 12.25 | $ | 11.91 | $ | 12.05 | $ | 11.68 | |||||||

Enterprise transactions | 103,240 | 74,280 | 272,504 | 208,324 | |||||||||||

Cumulative ending members. We calculate cumulative ending members as the total number of members at the end of the relevant period. The majority of our members are paying subscribers who have enrolled in our consumer services directly with us on a monthly or annual basis. Other members receive our consumer services through third-party entities that pay us directly because of a breach within the entity. Entities also embed our service within a broader third-party offering, or as an employee benefit paid for by the member's employer, which adds to our member total. We monitor cumulative ending members because it provides an indication of the revenue and expenses that we expect to recognize in the future.

As of September 30, 2016, our cumulative ending member base increased 8% year over year. Several factors drove this increase, including the success of our marketing campaigns, increased awareness of data breaches, media coverage of identity theft, and our member retention rate. The year over year increase as of September 30, 2016 is lower than the year over year increase of 16% as of September 30, 2015, primarily as a result of an increase in members during the nine-month period ended September 30, 2015 as a result of a breach at a large health insurance company in the first quarter of 2015, which resulted in our most successful gross new member quarter in our history. In addition, as a result of the FTC litigation which commenced in the quarter ended September 30, 2015, we reduced marketing expenses with our strategic partners and certain other campaigns resulting in reduced enrollments. While new member growth from our direct to consumer channel has improved through the first nine months of 2016, we do not expect new member growth from our strategic partner channel to return to previous levels for several quarters. We have also experienced an increase in cancellations through the first nine months of 2016 due to the expiration of a large number of breach contracts and a higher number of cancellations from our online affiliates.

18

Gross new members. We calculate gross new members as the total number of new members who enroll in one of our consumer services during the relevant period. Many factors may affect the volume of gross new members in each period, including the effectiveness of our marketing campaigns, the timing of our marketing programs, the effectiveness of our strategic partnerships, and the general level of identity theft coverage in the media, including the occurrence of material breach events. In addition, enrollments from our employee benefit channel are expected to be heavily weighted to the fourth fiscal quarter when the majority of employers have open enrollment periods. We monitor gross new members because it provides an indication of the revenue and expenses that we expect to recognize in the future. Gross new members increased 1% for the three-month period ended September 30, 2016 and decreased 9% for the nine-month period ended September 30, 2016 compared to the same periods last year. The decrease in our gross new members for the nine-month periods ended September 30, 2016 was primarily due to the media attention related to the large breach at a health insurance company in the first quarter of 2015, which resulted in our most successful gross new member quarter in our history. In addition, we continue to develop the strategic partner channel which was significantly impacted by the FTC litigation which commenced in the quarter ended September 30, 2015. Due to the impact of the FTC litigation and a shift to focus on larger partners, we do not expect the strategic partner channel to have a material impact in the current year, but we expect the channel to have a positive impact in future years.

Member retention rate. We define member retention rate as the percentage of members on the last day of the prior year who remain members on the last day of the current year. Similarly, for quarterly presentations, we use the percentage of members on the last day of the comparable quarterly period in the prior year who remain members on the last day of the current quarterly period. A number of factors may increase our member retention rate, including increases in the proportion of members enrolled on an annual subscription, increases in the number of alerts a member receives, and increases in the proportion of members enrolled through strategic partners with whom the member has a strong association. Conversely, factors that may reduce our member retention rate include increases in the number of members enrolled on a monthly subscription and the end of enrollment programs in our embedded product and breach channels. In addition, the length of time a member has been enrolled in one of our services will affect our member retention rate with longer-term members having a positive impact. Historically, the member retention rate for our premium services has been lower than the member retention rate for our basic-level services, which we believe is driven primarily by the price difference of those services.

Our member retention rate as of September 30, 2016 was significantly impacted by the high number of cancellations of members who enrolled during the first quarter of 2015 as a result of the breach at a large health insurance company who failed to renew on their first anniversary during the first nine months of 2016. Historically the first renewal date for our members is when we experience our lowest member retention. In addition, there was a large number of cancellations in the nine-month period ended September 30, 2016 from oil and gas employers within our employee benefit channel as a result of a downturn in the oil and gas industry. We also saw a number of cancellations which resulted from the expiration of breach contracts. In addition we experienced an increase in cancellations in the last six months of fiscal 2015 associated with the announcement of

19

the FTC litigation. As our retention rate is determined on an annual basis these factors will continue to impact the annual retention rate for several quarters. We also continue to see an on-going shift of our enrollments to premium products and monthly billing plans. Both of these cohorts tend to have slightly higher cancellation rates than our standard product and annual payment plans, so we expect this trend to continue. We further expect that our retention rates may be affected by payments to class members related to our FTC litigation related Ebarle class action that began during the fourth quarter of 2016.