Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - LIFELOCK, INC. | Financial_Report.xls |

| EX-31.1 - EX-31.1 - LIFELOCK, INC. | lock-ex311_20140630126.htm |

| EX-32.2 - EX-32.2 - LIFELOCK, INC. | lock-ex322_20140630129.htm |

| EX-32.1 - EX-32.1 - LIFELOCK, INC. | lock-ex321_20140630128.htm |

| EX-31.2 - EX-31.2 - LIFELOCK, INC. | lock-ex312_20140630127.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2014

Commission file number: 001-35671

LifeLock, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

56-2508977 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

60 East Rio Salado Parkway, Suite 400

Tempe, Arizona 85281

(Address of principal executive offices and zip code)

(480) 682-5100

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

x |

Accelerated filer |

¨ |

|

|

|

|

|

|

Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of July 25, 2014, there were outstanding 92,775,848 shares of the registrant’s common stock, $0.001 par value.

LIFELOCK, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2014

TABLE OF CONTENTS

i

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

LIFELOCK, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

|

|

June 30, 2014 |

|

|

December 31, 2013 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

166,650 |

|

|

$ |

123,911 |

|

|

Marketable securities |

|

49,385 |

|

|

|

48,688 |

|

|

Trade and other receivables, net |

|

12,087 |

|

|

|

10,906 |

|

|

Deferred tax assets, net |

|

18,585 |

|

|

|

13,117 |

|

|

Prepaid expenses and other current assets |

|

8,426 |

|

|

|

6,961 |

|

|

Total current assets |

|

255,133 |

|

|

|

203,583 |

|

|

Property and equipment, net |

|

20,604 |

|

|

|

16,504 |

|

|

Goodwill |

|

159,342 |

|

|

|

159,342 |

|

|

Intangible assets, net |

|

42,751 |

|

|

|

47,213 |

|

|

Deferred tax assets, net – noncurrent |

|

34,796 |

|

|

|

34,796 |

|

|

Other non-current assets |

|

1,307 |

|

|

|

1,812 |

|

|

Total assets |

$ |

513,933 |

|

|

$ |

463,250 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

4,748 |

|

|

$ |

2,422 |

|

|

Accrued expenses and other liabilities |

|

42,638 |

|

|

|

34,926 |

|

|

Deferred revenue |

|

148,817 |

|

|

|

119,106 |

|

|

Total current liabilities |

|

196,203 |

|

|

|

156,454 |

|

|

Other non-current liabilities |

|

5,927 |

|

|

|

4,640 |

|

|

Total liabilities |

|

202,130 |

|

|

|

161,094 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 300,000,000 authorized at June 30, 2014 and December 31, 2013; 92,610,621 and 91,441,771 shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

|

92 |

|

|

|

91 |

|

|

Preferred stock, $0.001 par value, 10,000,000 shares authorized and no shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

487,240 |

|

|

|

469,636 |

|

|

Accumulated other comprehensive loss |

|

(6 |

) |

|

|

(18 |

) |

|

Accumulated deficit |

|

(175,523 |

) |

|

|

(167,553 |

) |

|

Total stockholders’ equity |

|

311,803 |

|

|

|

302,156 |

|

|

Total liabilities and stockholders’ equity |

$ |

513,933 |

|

|

$ |

463,250 |

|

See accompanying notes to condensed consolidated financial statements.

1

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

||||||||||

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer revenue |

$ |

109,338 |

|

|

$ |

82,574 |

|

|

$ |

210,333 |

|

|

$ |

157,667 |

|

|

Enterprise revenue |

|

6,375 |

|

|

|

6,946 |

|

|

|

12,966 |

|

|

|

13,947 |

|

|

Total revenue |

|

115,713 |

|

|

|

89,520 |

|

|

|

223,299 |

|

|

|

171,614 |

|

|

Cost of services |

|

29,536 |

|

|

|

25,227 |

|

|

|

59,603 |

|

|

|

49,031 |

|

|

Gross profit |

|

86,177 |

|

|

|

64,293 |

|

|

|

163,696 |

|

|

|

122,583 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

58,774 |

|

|

|

43,248 |

|

|

|

115,621 |

|

|

|

85,041 |

|

|

Technology and development |

|

13,524 |

|

|

|

10,370 |

|

|

|

26,672 |

|

|

|

19,394 |

|

|

General and administrative |

|

16,329 |

|

|

|

10,900 |

|

|

|

30,301 |

|

|

|

20,323 |

|

|

Amortization of acquired intangible assets |

|

2,231 |

|

|

|

1,966 |

|

|

|

4,462 |

|

|

|

3,932 |

|

|

Total costs and expenses |

|

90,858 |

|

|

|

66,484 |

|

|

|

177,056 |

|

|

|

128,690 |

|

|

Loss from operations |

|

(4,681 |

) |

|

|

(2,191 |

) |

|

|

(13,360 |

) |

|

|

(6,107 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(88 |

) |

|

|

(79 |

) |

|

|

(175 |

) |

|

|

(146 |

) |

|

Interest income |

|

56 |

|

|

|

26 |

|

|

|

116 |

|

|

|

46 |

|

|

Other |

|

(6 |

) |

|

|

— |

|

|

|

(17 |

) |

|

|

(4 |

) |

|

Total other expense |

|

(38 |

) |

|

|

(53 |

) |

|

|

(76 |

) |

|

|

(104 |

) |

|

Loss before provision for income taxes |

|

(4,719 |

) |

|

|

(2,244 |

) |

|

|

(13,436 |

) |

|

|

(6,211 |

) |

|

Income tax benefit |

|

(1,919 |

) |

|

|

(179 |

) |

|

|

(5,467 |

) |

|

|

(29 |

) |

|

Net loss |

$ |

(2,800 |

) |

|

$ |

(2,065 |

) |

|

$ |

(7,969 |

) |

|

$ |

(6,182 |

) |

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

|

Diluted |

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

|

Weighted-average common shares outstanding used in computing net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

92,471 |

|

|

|

87,533 |

|

|

|

92,189 |

|

|

|

87,089 |

|

|

Diluted |

|

92,471 |

|

|

|

87,533 |

|

|

|

92,189 |

|

|

|

87,089 |

|

See accompanying notes to condensed consolidated financial statements.

2

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands)

(unaudited)

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

||||||||||

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

||||

|

Net loss |

$ |

(2,800 |

) |

|

$ |

(2,065 |

) |

|

$ |

(7,969 |

) |

|

$ |

(6,182 |

) |

|

Other comprehensive gain, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on marketable securities |

|

4 |

|

|

|

— |

|

|

|

12 |

|

|

|

— |

|

|

Comprehensive loss |

$ |

(2,796 |

) |

|

$ |

(2,065 |

) |

|

$ |

(7,957 |

) |

|

$ |

(6,182 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

3

LIFELOCK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

|

For the Six Months Ended June 30, |

|

|||||

|

|

2014 |

|

|

2013 |

|

||

|

Operating activities |

|

|

|

|

|

|

|

|

Net loss |

$ |

(7,969 |

) |

|

$ |

(6,182 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

8,165 |

|

|

|

6,360 |

|

|

Share-based compensation |

|

12,521 |

|

|

|

6,261 |

|

|

Provision for doubtful accounts |

|

300 |

|

|

|

95 |

|

|

Amortization of premium on marketable securities |

|

732 |

|

|

|

— |

|

|

Deferred income tax benefit |

|

(5,468 |

) |

|

|

(212 |

) |

|

Other |

|

2 |

|

|

|

4 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Trade and other receivables |

|

(2,189 |

) |

|

|

(3,244 |

) |

|

Prepaid expenses and other current assets |

|

(1,465 |

) |

|

|

(470 |

) |

|

Other non-current assets |

|

505 |

|

|

|

432 |

|

|

Accounts payable |

|

2,052 |

|

|

|

(134 |

) |

|

Accrued expenses and other liabilities |

|

7,828 |

|

|

|

3,179 |

|

|

Deferred revenue |

|

29,711 |

|

|

|

25,089 |

|

|

Other non-current liabilities |

|

1,288 |

|

|

|

2,408 |

|

|

Net cash provided by operating activities |

|

46,013 |

|

|

|

33,586 |

|

|

Investing activities |

|

|

|

|

|

|

|

|

Acquisition of property and equipment |

|

(7,662 |

) |

|

|

(3,652 |

) |

|

Purchase of marketable securities |

|

(19,662 |

) |

|

|

— |

|

|

Maturities of marketable securities |

|

18,990 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(8,334 |

) |

|

|

(3,652 |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

Proceeds from share-based compensation plans |

|

5,501 |

|

|

|

5,753 |

|

|

Payments for employee tax withholdings related to restricted stock |

|

(441 |

) |

|

|

— |

|

|

Payments for debt issuance costs |

|

— |

|

|

|

(440 |

) |

|

Net cash provided by financing activities |

|

5,060 |

|

|

|

5,313 |

|

|

Net increase in cash and cash equivalents |

|

42,739 |

|

|

|

35,247 |

|

|

Cash and cash equivalents at beginning of period |

|

123,911 |

|

|

|

134,197 |

|

|

Cash and cash equivalents at end of period |

$ |

166,650 |

|

|

$ |

169,444 |

|

See accompanying notes to condensed consolidated financial statements.

4

LIFELOCK, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

(unaudited)

1. Description of Business and Basis of Presentation

We provide proactive identity theft protection services to our consumer subscribers, whom we refer to as our members, on an annual or monthly subscription basis. We also provide fraud and risk solutions to our enterprise customers.

We were incorporated in Delaware on April 12, 2005 and are headquartered in Tempe, Arizona. On March 14, 2012, we acquired ID Analytics, Inc. and its wholly owned subsidiary IDA, Inc., collectively, ID Analytics, each of which is incorporated in Delaware. On December 11, 2013, we acquired Lemon, Inc., or Lemon, which is incorporated in Delaware.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, and applicable rules and regulations of the Securities and Exchange Commission, or SEC, regarding interim financial reporting. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

The condensed consolidated balance sheet as of December 31, 2013 included herein was derived from the audited financial statements as of that date, but does not include all disclosures including notes required by U.S. GAAP.

The accompanying unaudited condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, and cash flows for the interim periods, but are not necessarily indicative of the results of operations to be anticipated for the entire year ending December 31, 2014 or any future period.

Basis of Consolidation

The condensed consolidated financial statements include our accounts and those of our wholly owned subsidiaries. We eliminate all intercompany balances and transactions, including intercompany profits, and unrealized gains and losses in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires us to make certain estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. We base our estimates on historical experience, current business factors, and various other assumptions that we believe are necessary to consider in forming a basis for making judgments about the carrying values of assets and liabilities, the recorded amounts of revenue and expenses, and the disclosure of contingent assets and liabilities.

2. Summary of Significant Accounting Policies

Significant Accounting Policies

There have been no material changes to our significant accounting policies as compared to the significant accounting policies described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

Recently Issued Accounting Standards

In April 2014, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update (ASU) No. 2014-08, Reporting Discontinued Operations and Disclosures of Components of an Entity, which changes the criteria for determining which disposals can be presented as discontinued operations and modifies related disclosure requirements. The updated guidance defines discontinued operations as a disposal of a component or group of components that is disposed of or is classified as held for sale and represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results and expands the disclosure requirements for discontinued operations and adds new disclosures for individually significant dispositions that do not qualify as discontinued operations. ASU No. 2014-08 is effective for fiscal years, and interim reporting periods within those years, beginning after December 15, 2014. ASU No. 2014-08 would be applied to any future applicable transaction.

5

In May 2014, the FASB issued ASU 2014-09, which provides guidance for revenue recognition. The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under today’s guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. This guidance will be effective for us in the first quarter of our fiscal year ending December 31, 2017. Early adoption is not permitted. We are currently in the process of evaluating the impact of adoption of this ASU on our consolidated financial statements.

3. Business Combinations

Acquisition of Lemon

On December 11, 2013, we acquired Lemon, a mobile wallet innovator. In connection with this acquisition, we launched our new LifeLock mobile application. The aggregate purchase price consisted of approximately $42,369 of cash paid at the closing (net of cash acquired of $3,315). We preliminarily allocated the total purchase consideration to the assets acquired and liabilities assumed at their estimated fair values as of the date of acquisition, as determined by management, and, with respect to identifiable intangible assets, by management with the assistance of a valuation provided by a third-party valuation firm. We recorded the excess of the purchase price over the amounts allocated to assets acquired and liabilities assumed as goodwill in our consumer segment.

The allocation of the purchase price of the acquired assets and liabilities as of December 31, 2013 was based on provisional measurements of fair value as determined by management. Subsequent to the filing of our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, we determined that approximately $7,894 and $7,991 of Lemon’s federal and state net operating loss carryforwards, respectively, would expire as a result of limitations under Section 382 of the Internal Revenue Code. As such, we reduced deferred tax assets, net – noncurrent by $3,222, increasing goodwill. This adjustment has been reflected in the December 31, 2013 balances of deferred tax assets, net – noncurrent and goodwill in the accompanying condensed consolidated balance sheets.

We accounted for this acquisition using the acquisition method in accordance with Accounting Standards Codification, or ASC, 805, Business Combinations. Accordingly, we allocated the purchase price of the acquired assets and liabilities based on their estimated fair values as of the acquisition date as summarized in the following table:

|

Net assets assumed |

|

$ |

3,184 |

|

|

Deferred tax assets, net - noncurrent |

|

|

8,706 |

|

|

Intangible assets acquired |

|

|

3,880 |

|

|

Goodwill |

|

|

29,914 |

|

|

Total purchase price consideration |

|

$ |

45,684 |

|

4. Marketable Securities

The following is a summary of marketable securities designated as available-for-sale as of June 30, 2014:

|

|

|

|

|

|

Gross |

|

|

Gross |

|

|

|

|

|

||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Corporate bonds |

$ |

35,914 |

|

|

$ |

— |

|

|

$ |

(17 |

) |

|

$ |

35,897 |

|

|

Municipal bonds |

|

12,989 |

|

|

|

2 |

|

|

|

(1 |

) |

|

|

12,990 |

|

|

Certificates of deposit |

|

498 |

|

|

|

— |

|

|

|

— |

|

|

|

498 |

|

|

Total marketable securities |

$ |

49,401 |

|

|

$ |

2 |

|

|

$ |

(18 |

) |

|

$ |

49,385 |

|

All marketable securities are classified as current regardless of contractual maturity dates because we consider such investments to represent cash available for current operations.

As of June 30, 2014, we did not consider any of our marketable securities to be other-than-temporarily impaired. When evaluating our investments for other-than-temporary impairment, we review factors such as the length of time and extent to which fair

6

value has been below its cost basis, the financial condition of the issuer, our ability and intent to hold the security and whether it is more likely than not that we will be required to sell the investment before recovery of its cost basis.

The following is a summary of amortized cost and estimated fair value of marketable securities as of June 30, 2014, by maturity:

|

|

|

|

|

|

Gross |

|

|

Gross |

|

|

|

|

|

||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Due in one year or less |

$ |

48,132 |

|

|

$ |

2 |

|

|

$ |

(18 |

) |

|

$ |

48,116 |

|

|

Due after one year |

|

1,269 |

|

|

|

— |

|

|

|

— |

|

|

|

1,269 |

|

|

Total marketable securities |

$ |

49,401 |

|

|

$ |

2 |

|

|

$ |

(18 |

) |

|

$ |

49,385 |

|

The following is a summary of marketable securities designated as available-for-sale as of December 31, 2013:

|

|

|

|

|

|

Gross |

|

|

Gross |

|

|

|

|

|

||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Corporate bonds |

$ |

37,399 |

|

|

$ |

1 |

|

|

$ |

(29 |

) |

|

$ |

37,371 |

|

|

Municipal bonds |

|

10,820 |

|

|

|

2 |

|

|

|

(3 |

) |

|

|

10,819 |

|

|

Certificates of deposit |

|

498 |

|

|

|

- |

|

|

|

- |

|

|

|

498 |

|

|

Total marketable securities |

$ |

48,717 |

|

|

$ |

3 |

|

|

$ |

(32 |

) |

|

$ |

48,688 |

|

The following is a summary of amortized cost and estimated fair value of marketable securities as of December 31, 2013, by maturity:

|

|

|

|

|

|

Gross |

|

|

Gross |

|

|

|

|

|

||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Due in one year or less |

$ |

47,398 |

|

|

$ |

3 |

|

|

$ |

(32 |

) |

|

$ |

47,369 |

|

|

Due after one year |

|

1,319 |

|

|

|

- |

|

|

|

- |

|

|

|

1,319 |

|

|

Total marketable securities |

$ |

48,717 |

|

|

$ |

3 |

|

|

$ |

(32 |

) |

|

$ |

48,688 |

|

5. Stockholders’ Equity

Share-Based Compensation

We issue share-based awards to our employees in the form of stock options, restricted stock units, and restricted stock. We also have an employee stock purchase plan. The following table summarizes the components of share-based compensation expense included in our condensed consolidated statements of operations for the three- and six-month periods ended June 30:

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

||||||||||

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

||||

|

|

(in thousands) |

|

|

(in thousands) |

|

||||||||||

|

Cost of services |

$ |

489 |

|

|

$ |

206 |

|

|

$ |

832 |

|

|

$ |

412 |

|

|

Sales and marketing |

|

1,309 |

|

|

|

386 |

|

|

|

2,203 |

|

|

|

719 |

|

|

Technology and development |

|

1,942 |

|

|

|

824 |

|

|

|

3,915 |

|

|

|

1,339 |

|

|

General and administrative |

|

3,306 |

|

|

|

2,121 |

|

|

|

5,571 |

|

|

|

3,791 |

|

|

Total share-based compensation |

$ |

7,046 |

|

|

$ |

3,537 |

|

|

$ |

12,521 |

|

|

$ |

6,261 |

|

Unrecognized share-based compensation expenses totaled $81,947 as of June 30, 2014, which we expect to recognize over a weighted-average time period of 3.2 years.

7

Stock Warrants

As of June 30, 2014, we had the following warrants to purchase common stock outstanding:

|

Expiration Date |

|

Shares |

|

|

Exercise |

|

||

|

October 3, 2014 |

|

|

2,334,044 |

|

|

|

0.70 |

|

|

December 19, 2014 |

|

|

166,666 |

|

|

|

4.50 |

|

6. Fair Value Measurements

As of June 30, 2014 and December 31, 2013, the fair value of our financial assets was as follows:

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

June 30, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial paper (1) |

$ |

45,156 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

45,156 |

|

|

Money market funds (1) |

|

60,054 |

|

|

|

— |

|

|

|

— |

|

|

|

60,054 |

|

|

Corporate bonds (2) |

|

— |

|

|

|

35,897 |

|

|

|

— |

|

|

|

35,897 |

|

|

Municipal bonds (3) |

|

— |

|

|

|

13,175 |

|

|

|

— |

|

|

|

13,175 |

|

|

Certificates of deposit (2) |

|

— |

|

|

|

498 |

|

|

|

— |

|

|

|

498 |

|

|

Total assets measured at fair value |

$ |

105,210 |

|

|

$ |

49,570 |

|

|

$ |

— |

|

|

$ |

154,780 |

|

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial paper (1) |

$ |

— |

|

|

$ |

45,110 |

|

|

$ |

— |

|

|

$ |

45,110 |

|

|

Money market funds (1) |

|

911 |

|

|

|

— |

|

|

|

— |

|

|

|

911 |

|

|

Corporate bonds (2) |

|

— |

|

|

|

37,371 |

|

|

|

— |

|

|

|

37,371 |

|

|

Municipal bonds (2) |

|

— |

|

|

|

10,819 |

|

|

|

— |

|

|

|

10,819 |

|

|

Certificates of deposit (2) |

|

— |

|

|

|

498 |

|

|

|

— |

|

|

|

498 |

|

|

Total assets measured at fair value |

$ |

911 |

|

|

$ |

93,798 |

|

|

$ |

— |

|

|

$ |

94,709 |

|

|

(1) |

Classified in cash and cash equivalents |

|

(2) |

Classified in marketable securities |

|

(3) |

Includes a short-term, highly rated, highly liquid investment that is included in cash and cash equivalents as the original maturity date was less than three months at the time of purchase. Municipal bond investments with original maturity dates greater than three months at the time of purchase are classified in marketable securities. |

The fair values of our cash equivalents and available-for-sale securities included in the Level 1 and Level 2 categories are obtained from an independent pricing service, which uses a model driven valuation technique using observable market data or inputs corroborated by observable market data.

8

7. Net Loss Per Share

The following table sets forth the computation of basic and diluted net loss per share for the three- and six-month periods ended June 30:

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

||||||||||

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

||||

|

Net loss |

$ |

(2,800 |

) |

|

$ |

(2,065 |

) |

|

$ |

(7,969 |

) |

|

$ |

(6,182 |

) |

|

Denominator (basic and diluted): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

92,471,009 |

|

|

|

87,532,810 |

|

|

|

92,188,591 |

|

|

|

87,088,642 |

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

|

Diluted |

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

For the three- and six-month periods ended June 30, 2014 and 2013, potentially dilutive securities are not included in the calculation of diluted loss per share as their impact would be anti-dilutive. The following weighted-average number of outstanding stock options, restricted stock units and restricted stock awards, common equivalent shares from stock warrants, and shares purchased under our Employee Stock Purchase Plan, or ESPP, were excluded from the computation of diluted net loss per share for the three- and six-month periods ended June 30:

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

||||||||||

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

||||

|

Stock options outstanding |

|

3,021,735 |

|

|

|

5,016,362 |

|

|

|

3,714,028 |

|

|

|

5,276,932 |

|

|

Restricted stock units and awards |

|

116,119 |

|

|

|

62,299 |

|

|

|

218,577 |

|

|

|

64,436 |

|

|

Common equivalent shares from stock warrants |

|

2,326,302 |

|

|

|

2,262,543 |

|

|

|

2,356,681 |

|

|

|

2,292,039 |

|

|

Shares purchased under ESPP |

|

7,063 |

|

|

|

— |

|

|

|

29,190 |

|

|

|

— |

|

|

|

|

5,471,219 |

|

|

|

7,341,204 |

|

|

|

6,318,476 |

|

|

|

7,633,407 |

|

8. Segment Reporting

Following our acquisition of ID Analytics in the first quarter of 2012, we began operating our business and reviewing and assessing our operating performance using two reportable segments: our consumer segment and our enterprise segment. In our consumer segment, we offer proactive identity theft protection services to our members on an annual or monthly subscription basis. In our enterprise segment, we offer fraud and risk solutions to our enterprise customers.

Financial information about our segments during the three-month period ended June 30, 2014 and as of June 30, 2014 was as follows:

|

|

Consumer |

|

|

Enterprise |

|

|

Eliminations |

|

|

Total |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

$ |

109,338 |

|

|

$ |

6,375 |

|

|

$ |

— |

|

|

$ |

115,713 |

|

|

Intersegment revenue |

|

— |

|

|

|

1,635 |

|

|

|

(1,635 |

) |

|

|

— |

|

|

Loss from operations |

|

(278 |

) |

|

|

(4,403 |

) |

|

|

— |

|

|

|

(4,681 |

) |

|

Goodwill |

|

99,805 |

|

|

|

59,537 |

|

|

|

— |

|

|

|

159,342 |

|

|

Total assets |

|

405,617 |

|

|

|

108,878 |

|

|

|

(562 |

) |

|

|

513,933 |

|

Loss from operations in our consumer and enterprise segments for the three-month period ended June 30, 2014 includes amortization of acquired intangible assets of $265 and $1,966, respectively.

9

Financial information about our segments during the six-month period ended June 30, 2014 was as follows:

|

|

Consumer |

|

|

Enterprise |

|

|

Eliminations |

|

|

Total |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

$ |

210,333 |

|

|

$ |

12,966 |

|

|

$ |

— |

|

|

$ |

223,299 |

|

|

Intersegment revenue |

|

— |

|

|

|

3,149 |

|

|

|

(3,149 |

) |

|

|

— |

|

|

Loss from operations |

|

(4,801 |

) |

|

|

(8,559 |

) |

|

|

— |

|

|

|

(13,360 |

) |

Loss from operations in our consumer and enterprise segments for the six-month period ended June 30, 2014 includes amortization of acquired intangible assets of $530 and $3,932, respectively.

Financial information about our segments during the three-month period ended June 30, 2013 and as of December 31, 2013 was as follows:

|

|

Consumer |

|

|

Enterprise |

|

|

Eliminations |

|

|

Total |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

$ |

82,574 |

|

|

$ |

6,946 |

|

|

$ |

— |

|

|

$ |

89,520 |

|

|

Intersegment revenue |

|

— |

|

|

|

1,307 |

|

|

|

(1,307 |

) |

|

|

— |

|

|

Income (loss) from operations |

|

762 |

|

|

|

(2,953 |

) |

|

|

— |

|

|

|

(2,191 |

) |

|

Goodwill |

|

99,805 |

|

|

|

59,537 |

|

|

|

— |

|

|

|

159,342 |

|

|

Total assets |

|

349,394 |

|

|

|

114,337 |

|

|

|

(481 |

) |

|

|

463,250 |

|

Loss from operations in our enterprise segment for the three-month period ended June 30, 2013 includes amortization of acquired intangible assets of $1,966.

Financial information about our segments during the six-month period ended June 30, 2013 was as follows:

|

|

Consumer |

|

|

Enterprise |

|

|

Eliminations |

|

|

Total |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External customers |

$ |

157,667 |

|

|

$ |

13,947 |

|

|

$ |

— |

|

|

$ |

171,614 |

|

|

Intersegment revenue |

|

— |

|

|

|

2,544 |

|

|

|

(2,544 |

) |

|

|

— |

|

|

Income (loss) from operations |

|

129 |

|

|

|

(6,236 |

) |

|

|

— |

|

|

|

(6,107 |

) |

Loss from operations in our enterprise segment for the six-month period ended June 30, 2013 includes amortization of acquired intangible assets of $3,932.

We had no amortization of acquired intangible assets within our consumer segment for the three- and six-month periods ended June 30, 2013, as our consumer segment did not have acquired intangible assets until our purchase of Lemon in December 2013.

We allocated goodwill between our segments by estimating the expected synergies to each segment.

We derive all of our revenue from sales in the United States, and substantially all of our long-lived assets are located in the United States.

9. Income Taxes

Income taxes for the interim periods presented have been included in the accompanying condensed consolidated financial statements on the basis of an estimated annual effective tax rate. Based on an estimated annual effective tax rate and discrete items, the estimated income tax benefit from operations for the three- and six-month periods ended June 30, 2014 was approximately $1,919 and $5,467, respectively. For the three- and six-month periods ended June 30, 2013, the estimated income tax benefit from operations was $179 and $29, respectively. The determination of the interim period income tax provision utilizes the effective tax rate method, which requires us to estimate certain annualized components of the calculation of the income tax provision, including the annual effective tax rate by entity and jurisdiction.

10

In the fourth quarter of 2013, in connection with the acquisition of Lemon and the preliminary purchase price allocation, we analyzed Lemon’s prior ownership changes, including the change which arose as a result of our acquisition of Lemon. As a result of the preliminary analysis, we estimated that none of Lemon’s net operating loss carryforwards would expire as a result of limitations under Section 382 of the Internal Revenue Code. Subsequent to the filing of our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, we received responses from certain former shareholders who had held a 5% or greater ownership interest in Lemon prior to the acquisition and determined that due to the ownership changes of those former shareholders, approximately $7,894 and $7,991 of Lemon’s federal and state net operating loss carryforwards, respectively, will expire solely as a result of the Section 382 limitations. As such, we retrospectively adjusted our preliminary purchase price allocation to reflect this information.

10. Contingencies

As part of our consumer services, we offer 24x7x365 member service support. If a member’s identity has been compromised, our member service team and remediation specialists will assist the member until the issue has been resolved. This includes our $1 million service guarantee, which is backed by an identity theft insurance policy, under which we will spend up to $1 million to cover certain third-party costs and expenses incurred in connection with the remediation, such as legal and investigatory fees. This insurance also covers certain out-of-pocket expenses, such as loss of income, replacement of fraudulent withdrawals, and costs associated with child and elderly care, travel, stolen purse/wallet, and replacement of documents. While we have reimbursed members for claims under this guarantee, the amounts in aggregate for the three- and six-month periods ended June 30, 2014 and 2013 were not material.

In September 2012, Denise Richardson filed a complaint against our company and Todd Davis. Ms. Richardson claims that she was improperly classified as an independent contractor instead of an employee and that we breached the terms of an alleged employment agreement. Ms. Richardson claims she is entitled to equitable relief, compensatory damages, liquidated damages, statutory penalties, punitive damages, interest, costs, and attorneys’ fees. On March 31, 2014, our motion to dismiss was granted in part and denied in part with the court dismissing nine of the ten counts that were subject to the motion to dismiss, including the single count against Mr. Davis. On April 23, 2014, Ms. Richardson filed an amended complaint against our company and Mr. Davis again claiming that she was improperly classified as an independent contractor instead of an employee and that we breached the terms of an alleged employment agreement. Ms. Richardson claims she is entitled to equitable relief, compensatory damages, liquidated damages, statutory penalties, punitive damages, interest, costs, and attorneys’ fees. On April 29, 2014, Mr. Davis and we filed a motion to dismiss all but one of the counts in such amended complaint. On June 11, 2014, Ms. Richardson filed a Notice of Voluntary Dismissal by which she voluntarily dismissed her ERISA claims against us, as well as her only claim against Mr. Davis. With respect to the remaining claims that are the subject of our motion to dismiss, the motion is awaiting decision by the court. The court has set a scheduling conference in the matter for August 18, 2014.

On March 3, 2014, Dawn B. Bien, representing herself and seeking to represent a class of persons who acquired our securities from February 26, 2013 to February 19, 2014, inclusive, or the Class Period, filed a complaint in United States District Court for the District of Arizona against us, Todd Davis, and Chris Power. We refer to this complaint as the Bien Complaint. The Bien Complaint alleges that we and Messrs. Davis and Power, in violation of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, disseminated materially false or misleading information, or failed to disclose material facts during the Class Period in connection with our business and our operational and compliance policies, including our and Mr. Davis’s compliance with the Stipulated Final Judgment and Order for Permanent Injunction and Other Equitable Relief entered into in March 2010 with the Federal Trade Commission, or the FTC Order, wherein we settled allegations by the Federal Trade Commission challenging certain of our advertising and marketing. The Bien Complaint also contends that as a result of alleged violations of governmental laws, regulations, and the FTC Order, our financial statements were materially false and misleading at all relevant times. The Bien Complaint seeks certification as a class action, compensatory damages, and attorneys’ fees and costs. On March 10, 2014, Joseph F. Scesny, representing himself and seeking to represent a class of persons who acquired our securities during the Class Period filed a complaint in United States District Court for the District of Arizona against us, Todd Davis, and Chris Power. We refer to this complaint as the Scesny Complaint. The Scesny Complaint is substantially similar to the Bien Complaint and seeks substantially similar relief. On June 16, 2014, the court consolidated the Scesny Complaint and the Bien Complaint into a single action captioned In re LifeLock, Inc. Securities Litigation. The court also appointed a lead plaintiff and lead counsel. Pursuant to the parties’ stipulation, and the order of the court dated July 2, 2014, a consolidated amended complaint is due to be filed no later than August 15, 2014. We anticipate filing a motion to dismiss that complaint by September 15, 2014.

On March 13, 2014, we received a request from the Federal Trade Commission, or the FTC, for documents and information related to our compliance with the FTC Order. Prior to our receipt of the FTC’s request, we met with FTC Staff on January 17, 2014, at our request, to discuss issues regarding allegations that have been asserted in a whistleblower claim against us relating to our compliance with the FTC Order. On March 13, 2014, we received a request from the FTC for documents and information related to our compliance with the FTC Order. We are in the process of completing our response to the FTC’s March 13, 2014 request for information regarding our information security program and alert and notification processing, along with a subsequent request for clarification regarding certain information that we previously submitted.

11

On March 20, 2014, Michael D. Peters filed a complaint in United States District Court for the District of Arizona against our company, Kim Jones, and Cristy Schaan. Mr. Jones is not affiliated with us. Ms. Schaan is our Chief Information Security Officer. In his complaint, Mr. Peters alleges that we violated the whistleblower protection provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, by terminating Mr. Peters’ employment as a result of alleged disclosures that he made to us, and that Ms. Schaan defamed Mr. Peters. Mr. Peters seeks from us two times his back pay, two times the value of certain stock options and bonus, moving expenses, damages for emotional harm and anxiety, damages for harm to reputation, litigation costs including attorneys’ fees, and interest, and seeks from Ms. Schaan actual damages, punitive damages, and interest. On April 21, 2014, we filed an answer, affirmative defenses, and counterclaims, answering Mr. Peters’ claim under the Sarbanes-Oxley Act and asserting counterclaims against Mr. Peters for fraud, negligent misrepresentation, breach of contract, and unjust enrichment, based on our allegations that we were induced to hire Mr. Peters by his false statements and misrepresentations regarding his employment history and seeking to recover actual and consequential damages, punitive damages, attorneys’ fees, and the $15 signing bonus paid to Mr. Peters. Mr. Peters answered our counterclaims on May 7, 2014. On April 21, 2014, we also filed a motion to dismiss Mr. Peters’ claim under the Dodd-Frank Act. On April 25, 2014, Ms. Schaan filed a motion to dismiss Mr. Peters’ claim against her. On June 2, 2014, Mr. Peters filed a motion for judgment on the pleadings directed to our unjust enrichment counterclaim, one of the four counterclaims we brought against Mr. Peters. All three of the motions are awaiting decision by the court.

We are subject to other legal proceedings and claims that have arisen in the ordinary course of business. Although there can be no assurance as to the ultimate disposition of these matters and the proceedings disclosed above, we believe, based upon the information available at this time, that a material adverse outcome related to the matters is neither probable nor estimable.

12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion of our financial condition and results of operations in conjunction with the condensed consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013. This Quarterly Report on Form 10-Q contains “forward-looking statements” that involve substantial risks and uncertainties. The statements contained in this Quarterly Report on Form 10-Q that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act, including, but not limited to, statements regarding our expectations, beliefs, intentions, strategies, future operations, future financial position, future revenue, projected expenses, and plans and objectives of management. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements reflect our current views about future events and involve known risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievement to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Overview

We are a leading provider of proactive identity theft protection services for consumers and fraud and risk solutions for enterprises. We protect our members by constantly monitoring identity-related events, such as new account openings and credit-related applications. If we detect that a member’s personally identifiable information is being used, we offer notifications and alerts, including proactive, near real-time, actionable alerts that provide our members peace of mind that we are monitoring use of their identity and allow our members to confirm valid or unauthorized identity use. If a member confirms that the use of his or her identity is unauthorized, we can proactively take actions designed to protect the member’s identity. We also provide remediation services to our members in the event that an identity theft actually occurs. We protect our enterprise customers by delivering on-demand identity risk and authentication information about consumers. Our enterprise customers utilize this information in real time to make decisions about opening or modifying accounts and providing products, services, or credit to consumers to reduce financial losses from identity fraud.

The foundation of our differentiated services is the LifeLock ecosystem. This ecosystem combines large data repositories of personally identifiable information and consumer transactions, proprietary predictive analytics, and a highly scalable technology platform. Our members and enterprise customers enhance our ecosystem by continually contributing to the identity and transaction data in our repositories. We apply predictive analytics to the data in our repositories to provide our members and enterprise customers actionable intelligence that helps protect against identity theft and identity fraud. As a result of our combination of scale, reach, and technology, we believe that we have the most proactive and comprehensive identity theft protection services available, as well as the most recognized brand in the identity theft protection services industry.

On December 11, 2013, we acquired mobile wallet innovator Lemon for approximately $42.4 million in cash and launched our new LifeLock Wallet mobile application. The LifeLock Wallet mobile application technology allows consumers to replicate and store a digital copy of their personal wallet contents on their smart device for records backup, as well as transaction monitoring and mobile use of items such as credit, identification, ATM, insurance, and loyalty cards. The LifeLock Wallet mobile application technology also offers our members one-touch access to our identity theft protection services. On May 16, 2014, we announced that we had determined that certain aspects of the LifeLock Wallet mobile application were not fully compliant with applicable payment card industry (PCI) security standards. As a result, we temporarily suspended the LifeLock Wallet mobile application, and deleted the affected data from our servers, until we can operate the LifeLock Wallet mobile application in accordance with those standards. We have no indication that the data included in the LifeLock Wallet mobile application servers was compromised. The LifeLock Wallet mobile application storage processes are separate and independent from LifeLock’s core identity theft protection services business, including the enrollment and related credit card storage processes used in our services. As such, we do not expect the suspension of the LifeLock Wallet mobile application to impact in any manner the core functionality or utility of the identity theft protection services we provide to our members.

We derive the substantial majority of our revenue from member subscription fees. We also derive revenue from transaction fees from our enterprise customers.

13

At the end of July 2014, we announced the launch of our LifeLock Standard, LifeLock Advantage, and LifeLock Ultimate Plus services. We will also continue to offer our LifeLock Junior services and, on a limited basis and for a limited time in connection with certain of our partnerships, our basic LifeLock, LifeLock Command Center, and LifeLock Ultimate services. We will continue to provide services to our existing members currently enrolled in our basic LifeLock, LifeLock Command Center, and LifeLock Ultimate services. Our consumer services are offered on a monthly or annual subscription. Our average revenue per member is lower than our retail list prices due to wholesale or bulk pricing that we offer to strategic partners in our embedded product, employee benefits, and breach distribution channels to drive our membership growth. In our embedded product channel, our strategic partners embed our consumer services into their products and services and pay us on behalf of their customers; in our employee benefit channel, our strategic partners offer our consumer services as a voluntary benefit as part of their employee benefit enrollment process; and in our breach channel, enterprises that have experienced a data breach pay us a fee to provide our services to the victims of the data breach. We also offer special discounts and promotions from time to time to incentivize prospective members to enroll in one of our consumer services. Our members pay us the full subscription fee at the beginning of each subscription period, in most cases by authorizing us to directly charge their credit or debit cards. We initially record the subscription fee as deferred revenue and then recognize it ratably on a daily basis over the subscription period. The prepaid subscription fees enhance our visibility of revenue and allow us to collect cash prior to paying our fulfillment partners.

Our enterprise customers pay us based on their monthly volume of transactions with us, with approximately 30% of our enterprise customers committed to monthly transaction minimums. We recognize revenue at the end of each month based on transaction volume for that month and bill our enterprise customers at the conclusion of each month.

We have historically invested significantly in new member acquisition and expect to continue to do so for the foreseeable future. Our largest operating expense is advertising for member acquisition, which we record as a sales and marketing expense. This is comprised of radio, television, and print advertisements; direct mail campaigns; online display advertising; paid search and search-engine optimization; third-party endorsements; and education programs. We also pay internal and external sales commissions, which we record as a sales and marketing expense. In general, increases in revenue and cumulative ending members occur during and after periods of significant and effective direct retail marketing efforts.

Our revenue grew from $89.5 million for the three-month period ended June 30, 2013 to $115.7 million for the three-month period ended June 30, 2014, an increase of 29%, including year-over-year growth within our consumer segment of 32%. We generated a loss from operations of $4.7 million and a net loss of $2.8 million for the three-month period ended June 30, 2014.

Our revenue grew from $171.6 million for the six-month period ended June 30, 2013 to $223.3 million for the six-month period ended June 30, 2014, an increase of 30%, including year-over-year growth within our consumer segment of 33%. We generated a loss from operations of $13.4 million and a net loss of $8.0 million for the six-month period ended June 30, 2014.

Our Business Model

We operate our business and review and assess our operating performance using two reportable segments: our consumer segment and our enterprise segment. We review and assess our operating performance using segment revenue, income (loss) from operations, and total assets. These performance measures include the allocation of operating expenses to our reportable segments based on management’s specific identification of costs associated to those segments.

Consumer Services

We evaluate the lifetime value of a member relationship over its anticipated lifecycle. While we generally incur member acquisition costs in advance of or at the time of the acquisition of the member, we recognize revenue ratably over the subscription period. As a result, a member relationship is not profitable at the beginning of the subscription period even though it is likely to have value to us over the lifetime of the member relationship.

When a member’s subscription automatically renews in each successive period, the relative value of that member increases because we do not incur significant incremental acquisition costs. We also benefit from decreasing fulfillment and member support costs related to that member, as well as economies of scale in our capital and operating and other support expenditures.

Enterprise Services

In our enterprise business, the majority of our costs relate to personnel primarily responsible for data analytics, data management, software development, sales and operations, and various support functions. We incur minimal third-party data expenses, as our enterprise customers typically provide us with their customer transaction data as part of our service. New customer acquisition is often a lengthy process requiring significant investment in the sales team, including costs related to detailed retrospective data

14

analysis to demonstrate the return on investment to prospective customers had our services been deployed over a specific period of time. Since most of the expenses in our enterprise business are fixed in nature, as we add new enterprise customers, there are typically modest incremental costs resulting in additional economies of scale.

Key Metrics

We regularly review a number of operating and financial metrics to evaluate our business, determine the allocation of our resources, measure the effectiveness of our sales and marketing efforts, make corporate strategy decisions, and assess operational efficiencies.

Key Operating Metrics

The following table summarizes our key operating metrics for the three- and six-month periods ended June 30:

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

||||||||||

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

||||

|

|

(in thousands, except percentages and per member data) |

|

|

(in thousands, except percentages and per member data) |

|

||||||||||

|

|

(Unaudited) |

|

|

(Unaudited) |

|

||||||||||

|

Cumulative ending members |

|

3,388 |

|

|

|

2,760 |

|

|

|

3,388 |

|

|

|

2,760 |

|

|

Gross new members |

|

304 |

|

|

|

230 |

|

|

|

648 |

|

|

|

480 |

|

|

Member retention rate |

|

87.2 |

% |

|

|

87.4 |

% |

|

|

87.2 |

% |

|

|

87.4 |

% |

|

Average cost of acquisition per member |

$ |

183 |

|

|

$ |

175 |

|

|

$ |

169 |

|

|

$ |

165 |

|

|

Monthly average revenue per member |

$ |

10.99 |

|

|

$ |

10.18 |

|

|

$ |

10.90 |

|

|

$ |

10.00 |

|

|

Enterprise transactions |

|

54,547 |

|

|

|

48,325 |

|

|

|

107,256 |

|

|

|

106,808 |

|

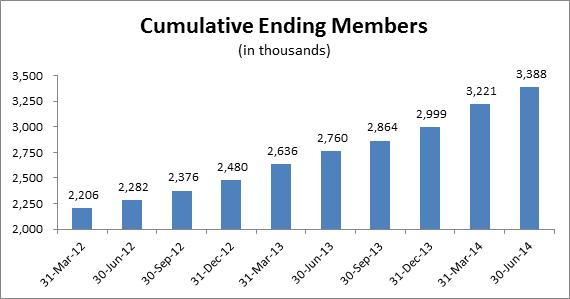

Cumulative ending members. We calculate cumulative ending members as the total number of members at the end of the relevant period. The majority of our members are paying subscribers who have enrolled in our consumer services directly with us on a monthly or annual basis. Our remaining members receive our consumer services through third-party enterprises that pay us directly, often as a result of a breach within the enterprise or by embedding our service within a broader third-party offering or as a benefit to their employees. We monitor cumulative ending members because it provides an indication of the revenue and expenses that we expect to recognize in the future.

As of June 30, 2014, we had approximately 3.4 million cumulative ending members, an increase of 23% from June 30, 2013. This increase was driven by several factors, including the success of our marketing campaigns, increased awareness of data breaches, media coverage of identity theft, and our member retention rate.

15

Gross new members. We calculate gross new members as the total number of new members who enroll in one of our consumer services during the relevant period. Many factors may affect the volume of gross new members in each period, including the effectiveness of our marketing campaigns, the timing of our marketing programs, the effectiveness of our strategic partnerships, and the general level of identity theft coverage in the media. We monitor gross new members because it provides an indication of the revenue and expenses that we expect to recognize in the future. For the three-month period ended June 30, 2014, we enrolled approximately 304,000 gross new members, up from approximately 230,000 for the three-month period ended June 30, 2013. For the six-month period ended June 30, 2014, we enrolled approximately 648,000 gross new members, up from approximately 480,000 for the six-month period ended June 30, 2013. This increase was driven by the success of our marketing campaigns, the continued success of our LifeLock Ultimate service, which accounted for more than 40% our gross new members during the three- and six-month periods ended June 30, 2014, and increased awareness of data breaches and identity theft.

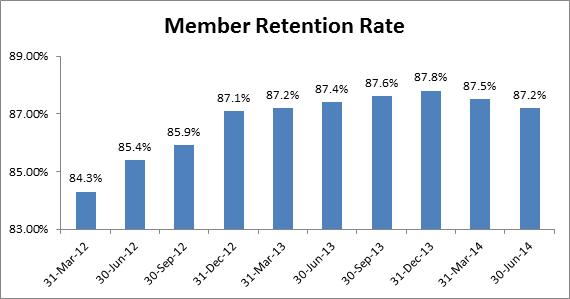

Member retention rate. We define member retention rate as the percentage of members on the last day of the prior year who remain members on the last day of the current year, or for quarterly presentations, the percentage of members on the last day of the comparable quarterly period in the prior year who remain members on the last day of the current quarterly period. A number of factors may increase our member retention rate, including increases in the number of members enrolled on an annual subscription, increases in the number of alerts a member receives, and increases in the number of members enrolled through strategic partners with which the member has a strong association. Conversely, factors reducing our member retention rate may include increases in the number of members enrolled on a monthly subscription, and the end of programs in our embedded product and breach channels. In addition, the length of time a member has been enrolled in one of our services will impact our member retention rate with longer term members having a positive impact. Historically, the member retention rate for our premium services has been lower than the member retention rate for our LifeLock Basic service, which we believe is driven primarily by price.

As of June 30, 2014, our member retention rate was 87.2%, which was our seventh consecutive quarter above 87%. The decrease in retention rate in the first six months of 2014 was driven, in part, by the cancellation of breach members who enrolled in previous years and the impact of an increased number of member credit and debit cards that were replaced as a result of large data breaches in the fourth quarter of 2013.

Average cost of acquisition per member. We calculate average cost of acquisition per member as our sales and marketing expense for our consumer segment during the relevant period divided by our gross new members for the period. A number of factors may influence this metric, including shifts in the mix of our media spend. For example, when we engage in marketing efforts to build our brand, our cost of acquisition per member increases in the short term with the expectation that it will decrease over the long term. In addition, when we introduce new partnerships in our embedded product channel, such as our partnership with AOL in the fourth quarter of 2011, our average cost of acquisition per member decreases due to the volume of members that enroll in our consumer services in a relatively short period of time. We monitor average cost of acquisition per member to evaluate the efficiency of our marketing programs in acquiring new members. For the three-month period ended June 30, 2014, our average cost of acquisition per member was $183, up from $175 for the three-month period ended June 30, 2013. For the six-month period ended June 30, 2014, our average cost of acquisition per member was $169, up from $165 for the six-month period ended June 30, 2013. Our member retention rate and the increasing monthly average revenue per member, primarily from the continued penetration of our LifeLock Ultimate

16

service, results in a higher lifetime value of a member relationship which enables us to absorb a higher average cost of acquisition per member.