Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Evolve Transition Infrastructure LP | spp-20150518ex9919daa41.htm |

| 8-K/A - 8-K/A - Evolve Transition Infrastructure LP | spp-20150518x8ka.htm |

Sanchez Production Partners LP

Unaudited Pro Forma Combined Financial Information

On March 31, 2015, Sanchez Production Partners LP (the “Partnership,” “SPP,” “we,” “us,” “our,” or similar terms) and its wholly owned subsidiary, SEP Holdings IV, LLC (the “Buyer”) completed its acquisition of wellbore interests in certain producing oil and natural gas properties in Gonzales County, Texas (the “Eagle Ford properties,” and such acquisition, the “Eagle Ford acquisition”) located in the Eagle Ford Shale in Gonzales County, Texas from SEP Holdings III, LLC, a wholly owned subsidiary of Sanchez Energy Corporation (“SN”) (the “Seller”), for an adjusted purchase price of $83.6 million, subject to normal and customary closing adjustments.

The Eagle Ford acquisition relates to the purchase by the Buyer from the Seller of escalating amounts of partial working interests in 59 wellbores at existing producing intervals in the non-operated Palmetto Field in the Eagle Ford. The aggregate average working interest percentage initially being conveyed is 18.25% per wellbore and, upon January 1 of each subsequent year after the closing, the Buyer’s working interest will automatically increase (and the Seller’s will correspondingly decrease) in incremental amounts until January 1, 2019, at which point the Buyer will own a 47.5% working interest and the Seller will own a 2.5% working interest in each of the wellbores.

The adjusted purchase price of $83.6 million was funded at closing with net proceeds from the private placement of 10,625,000 newly created Class A Preferred Units which were issued for a cash purchase price of $1.60 per unit, resulting in gross proceeds to SPP of $17.0 million, the issuance of 1,052,632 common units to the Seller valued at approximately $2.0 million, borrowings under the Partnership’s Third Amended and Restated Credit Agreement, and available cash. The purchase price allocation for the Eagle Ford acquisition is preliminary and is subject to further adjustments and the settlement of certain post-closing adjustments with the Seller.

The effective date of the transaction was January 1, 2015. As part of the closing, SN novated certain oil and gas hedging transactions related to the production of the wellbores that it previously entered into with Royal Bank of Canada to SPP.

The following unaudited pro forma combined financial information is based on the historical consolidated financial statements of the Partnership adjusted to reflect the Eagle Ford acquisition. The Eagle Ford acquisition is reflected in the Partnership’s historical consolidated balance sheet as of March 31, 2015 and as such it has not been presented. The Partnership’s historical consolidated statements of operations for the year ended December 31, 2014 and the three months ended March 31, 2015 and 2014 have been adjusted to give pro forma effect to the Eagle Ford acquisition as presented in Note 2 to the unaudited pro forma combined financial information.

The unaudited pro forma combined financial statements give effect to the events set forth below:

|

· |

The Eagle Ford acquisition completed March 31, 2015. |

|

· |

The increase in borrowings under the Third Amended and Restated Credit Agreement to finance a portion of the Eagle Ford acquisition, and the related adjustments to interest expense. |

|

· |

Issuance of 10,625,000 Class A Preferred Units to finance a portion of the Eagle Ford acquisition, and related adjustments to preferred paid-in-kind distributions. |

|

· |

Issuance of common units to the Seller to finance a portion of the Eagle Ford acquisition. |

The unaudited pro forma combined statements of operations combine the results of operations of the Partnership for the year ended December 31, 2014 and the three months ended March 31, 2015 and 2014 as if the Eagle Ford acquisition, including the financing discussed above, had occurred on January 1, 2014.

The unaudited pro forma combined financial information should be read in conjunction with the Partnership’s Form 10-K for the year ended December 31, 2014 and the Partnership’s Form 10-Q for the quarterly period ended March 31, 2015.

The unaudited pro forma combined financial information is for informational purposes only and is not intended to represent or to be indicative of the combined results of operations or financial position that the Partnership would have reported had the Eagle Ford acquisition been completed as of the date set forth in this unaudited pro forma combined financial information and should not be taken as indicative of the Partnership’s

Sanchez Production Partners LP

Unaudited Pro Forma Combined Financial Information

future combined results of operations or financial position. The actual results may differ significantly from that reflected in the unaudited pro forma combined financial information for a number of reasons, including, but not limited to, differences in assumptions used to prepare the unaudited pro forma combined financial information and actual results.

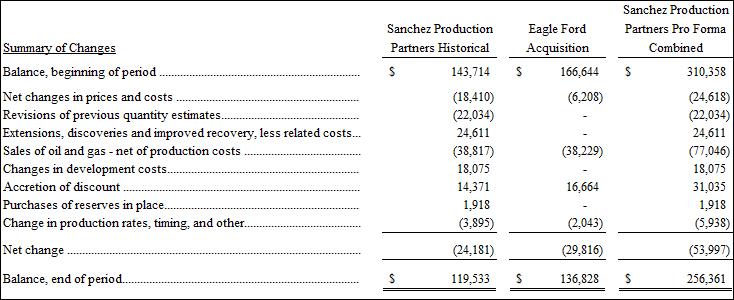

Unaudited Pro Forma Combined

Statement of Operations

For the Three Months Ended March 31, 2015

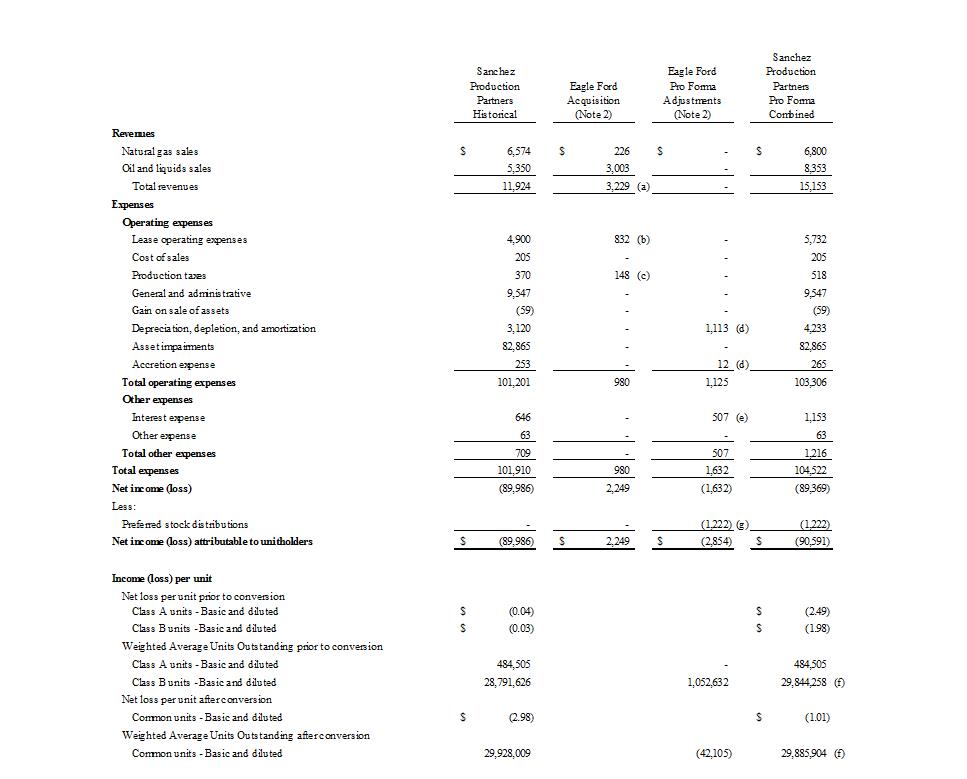

Unaudited Pro Forma Combined

Statement of Operations

For the Three Months Ended March 31, 2014

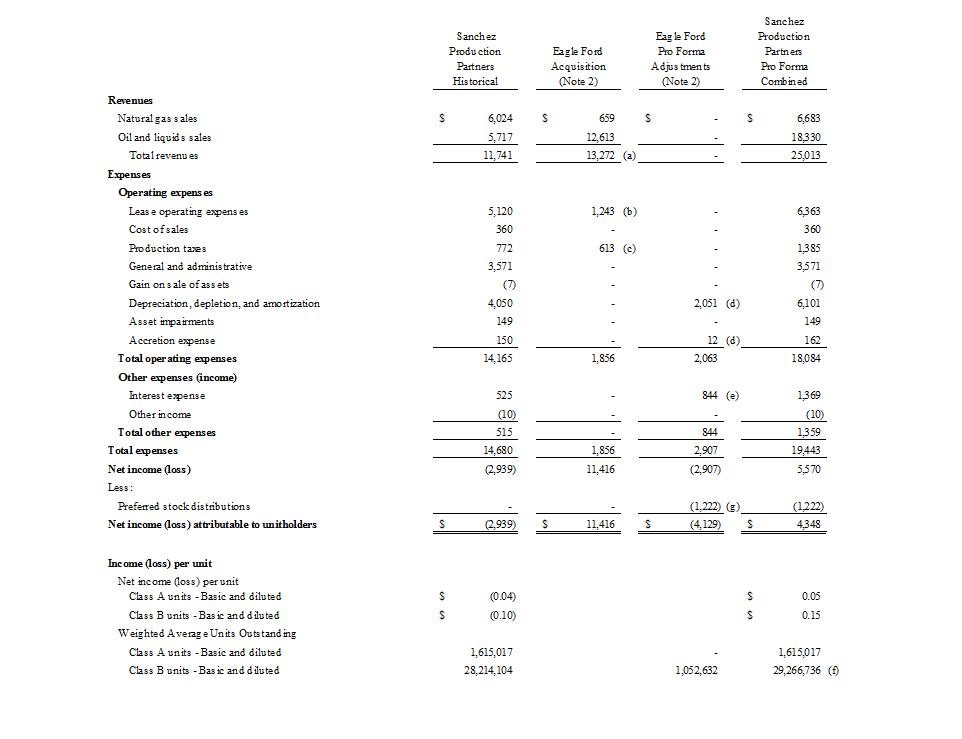

Unaudited Pro Forma Combined

Statement of Operations

For the Year Ended December 31, 2014

Notes to Unaudited Pro Forma

Combined Financial Information

Note 1. Basis of Presentation

On March 31, 2015, the Partnership completed the Eagle Ford acquisition for an aggregate adjusted purchase price of $83.6 million. The effective date of the transaction was January 1, 2015.

The adjusted purchase price of $83.6 million was funded at closing with net proceeds from the private placement of 10,625,000 newly created Class A Preferred Units which were issued for a cash purchase price of $1.60 per unit, resulting in gross proceeds to SPP of $17.0 million, the issuance of 1,052,632 common units to the Seller valued at approximately $2.0 million, borrowings under the Partnership’s Third Amended and Restated Credit Agreement, and available cash. The total purchase price was allocated to the assets purchased and liabilities assumed in the Eagle Ford acquisition based upon fair values on the date of acquisition.

The Eagle Ford acquisition is reflected in the Partnership’s historical consolidated balance sheet as of March 31, 2015. The unaudited pro forma combined statements of operations have been prepared to give effect to the Eagle Ford acquisition, including the increase in borrowings under the Third Amended and Restated Credit Agreement and the issuance of preferred and common units discussed above, as if they had occurred on January 1, 2014.

The unaudited pro forma combined financial statements and underlying pro forma adjustments are based upon currently available information and certain estimates and assumptions made by the Partnership’s management; therefore, actual results could differ materially from the pro forma information. However, management believes the assumptions provide a reasonable basis for presenting the significant effect of the Eagle Ford acquisition. The Partnership believes the pro forma adjustments give appropriate effect to those assumptions and are properly applied in the pro forma information.

Note 2. Unaudited Pro Forma Combined Statement of Operations

The unaudited pro forma combined statements of operations for the three months ended March 31, 2015 and 2014 and the year ended December 31, 2014 include adjustments to reflect the following:

|

(a) |

Represents the oil, natural gas liquids and natural gas sales attributable to the Eagle Ford acquisition completed on March 31, 2015. |

|

(b) |

Represents the lease operating expenses attributable to the Eagle Ford acquisition completed on March 31, 2015. |

|

(c) |

Represents the production taxes attributable to the Eagle Ford acquisitions completed on March 31, 2015. |

|

(d) |

Represents the increase in depreciation, depletion, amortization and accretion resulting from the Eagle Ford acquisition completed on March 31, 2015. |

|

(e) |

Represents the pro forma interest expense and amortization of debt issuance costs related to borrowings under the Partnership’s Third Amended and Restated Credit Agreement to fund a portion of the Eagle Ford acquisition completed on March 31, 2015, using an interest rate of 2.93%. An increase or decrease in the interest rate of 0.125% would change the pro forma interest expense for the three months ended March 31, 2015 and 2014 by $26,000 and for the year ended December 31, 2014 by $106,000, respectively. |

|

(f) |

Represents the pro forma weighted average units outstanding, including 1,052,632 common units issued related to the Eagle Ford acquisition completed on March 31, 2015. |

|

(g) |

Represents the pro forma preferred stock paid-in-kind distributions related to the Class A Preferred Units, proceeds of which were used to fund a portion of the Eagle Ford acquisition completed on March 31, 2015. |

Summary Unaudited Pro Forma Combined

Oil, Natural Gas Liquids and Natural Gas

Reserve Data

The following tables set forth summary pro forma information with respect to the Partnership’s and the Eagle Ford acquisitions’ pro forma combined estimated net proved, proved developed and proved undeveloped oil, natural gas liquids and natural gas reserves as of and for the year ended December 31, 2014. This pro forma information gives effect to the Eagle Ford acquisition as if it had occurred on January 1, 2014. Future exploration, exploitation and development expenditures, as well as future commodity prices and services costs, will affect the reserve volumes attributable to the acquired properties and the standardized measure of discounted future net cash flows.

Estimated quantities of oil, natural gas liquids and natural gas reserves as of December 31, 2014:

Summary Unaudited Pro Forma Combined

Oil, Natural Gas Liquids and Natural Gas

Reserve Data

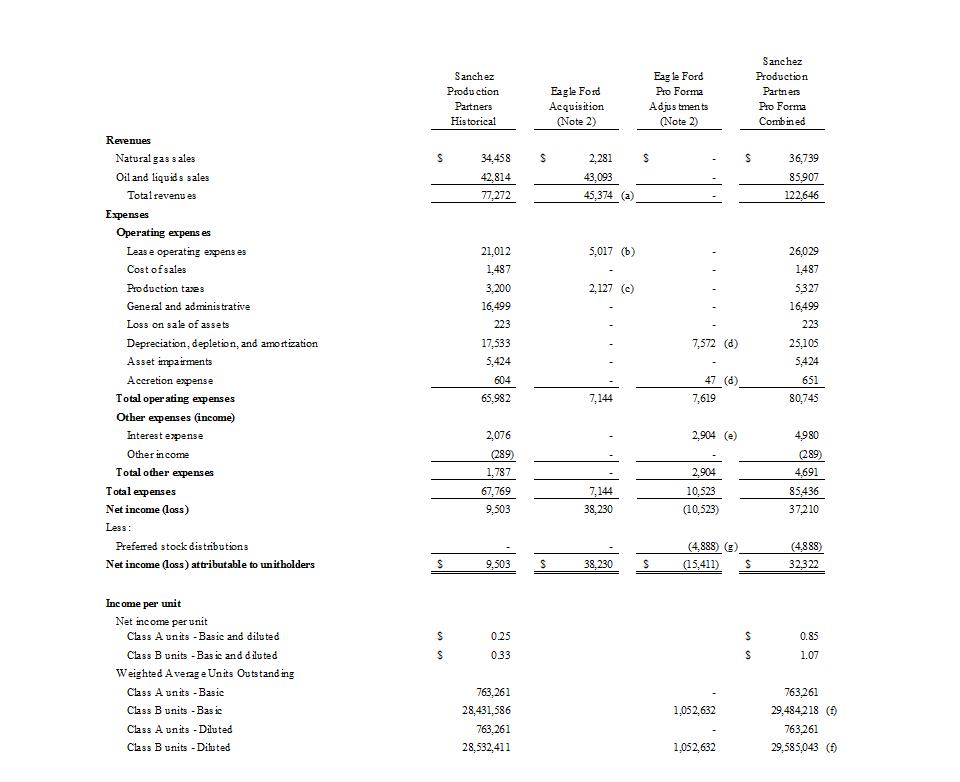

The standardized measure of discounted future net cash flows relating to the combined proved oil, natural gas liquids and natural gas reserves at December 31, 2014 is as follows (in thousands):

For the December 31, 2014 calculations in the preceding table, estimated future cash inflows from estimated future production of proved reserves were computed for oil and condensate using an unweighted twelve month average West Texas Intermediate posted price of $94.99 for both the SPP historical and the Eagle Ford acquisition. For NGLs, the average price was based on an unweighted twelve month average Mt. Belvieu posted price of $44.84 for both the SPP historical and the Eagle Ford acquisition. For natural gas, the average price was based on an unweighted twelve month average Henry Hub spot natural gas price average of $4.35 for both the SPP historical and the Eagle Ford acquisition.

The following are the principal sources of change in the combined standardized measure of discounted future net cash flows (in thousands):

Summary Unaudited Pro Forma Combined

Oil, Natural Gas Liquids and Natural Gas

Reserve Data