Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Evolve Transition Infrastructure LP | spp-20150518xex992.htm |

| 8-K/A - 8-K/A - Evolve Transition Infrastructure LP | spp-20150518x8ka.htm |

Board of Directors and Unitholders

Sanchez Production Partners LP

Houston, TX

We have audited the accompanying statements of revenues and direct operating expenses of the wellbore interests in certain producing oil and natural gas properties (“Eagle Ford properties”) acquired in the acquisition by Sanchez Production Partners LP and subsidiaries from SEP Holdings III, LLC, a wholly owned subsidiary of Sanchez Energy Corporation (collectively “SN”) for each of the years in the two-year period ended December 31, 2014 and the related notes to the statements of revenues and direct operating expenses.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the statements of revenues and direct operating expenses referred to above present fairly, in all material respects, the revenues and direct operating expenses of the Eagle Ford properties for each of the years in the two-year period ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

Emphasis of Matter

As described in Note 1, the accompanying statements of revenues and direct operating expenses were prepared for the purpose of complying with the rules and regulations of the Securities and Exchange Commission and are not

intended to be a complete presentation of the results of operations of the Eagle Ford properties. Our opinion is not modified with respect to this matter.

[Signed BDO USA, LLP]

Houston, Texas

May 18, 2015

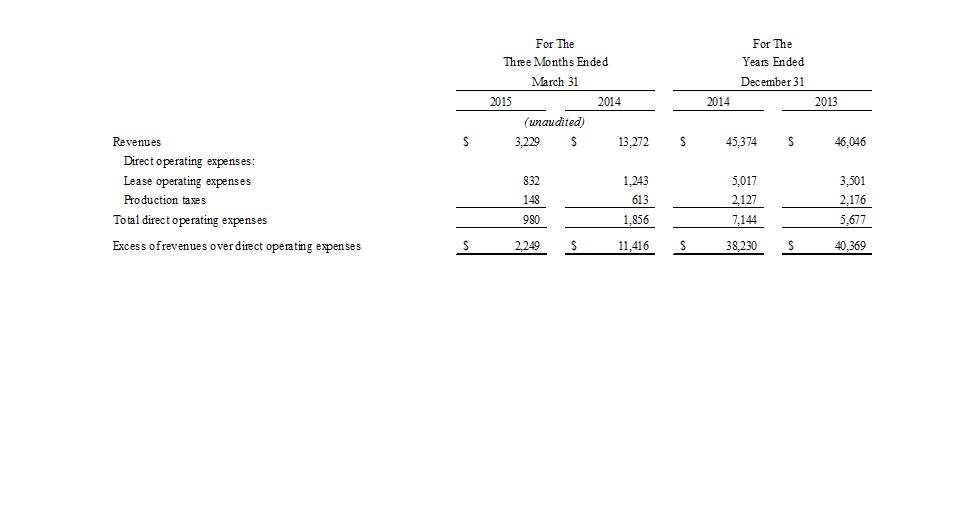

Statements of Revenues and Direct Operating Expenses

Of the Oil and Natural Gas Properties in the acquisition by

Sanchez Production Partners LP from SEP Holdings III, LLC, a wholly owned subsidiary of

Sanchez Energy Corporation

(in thousands)

The accompanying notes are an integral part of these statements of revenues and direct operating expenses.

Statements of Revenues and Direct Operating Expenses

Of the Oil and Natural Gas Properties in the acquisition by

Sanchez Production Partners LP from SEP Holdings III, LLC, a wholly owned subsidiary of

Sanchez Energy Corporation

Notes to the Financial Statements

Note 1. The Properties

On March 31, 2015, Sanchez Production Partners LP (the “Partnership,” “SPP,” “we,” “us,” “our,” or similar terms) and its wholly owned subsidiary, SEP Holdings IV, LLC (the “Buyer”) completed its acquisition of wellbore interests in certain producing oil and natural gas properties in Gonzales County, Texas (the “Eagle Ford properties,” and such acquisition, the “Eagle Ford acquisition”) located in the Eagle Ford Shale in Gonzales County, Texas from SEP Holdings III, LLC, a wholly owned subsidiary of Sanchez Energy Corporation (“SN”) (the “Seller”), for an adjusted purchase price of $83.6 million, subject to normal and customary closing adjustments.

The Eagle Ford acquisition relates to the purchase by the Buyer from the Seller of escalating amounts of partial working interests in 59 wellbores at existing producing intervals in the non-operated Palmetto Field in the Eagle Ford. The aggregate average working interest percentage initially being conveyed is 18.25% per wellbore and, upon January 1 of each subsequent year after the closing, the Buyer’s working interest will automatically increase (and the Seller’s will correspondingly decrease) in incremental amounts until January 1, 2019, at which point the Buyer will own a 47.5% working interest and the Seller will own a 2.5% working interest in each of the wellbores.

The adjusted purchase price of $83.6 million was funded at closing with net proceeds from the private placement of 10,625,000 newly created Class A Preferred Units which were issued for a cash purchase price of $1.60 per unit, resulting in gross proceeds to SPP of $17.0 million, the issuance of 1,052,632 common units to the Seller valued at approximately $2.0 million, borrowings under the Partnership’s Third Amended and Restated Credit Agreement, and available cash. The purchase price allocation for the Eagle Ford acquisition is preliminary and is subject to further adjustments and the settlement of certain post-closing adjustments with the seller.

The effective date of the transaction was January 1, 2015. As part of the closing, SN novated certain oil and gas hedging transactions related to the production of the wellbores that it previously entered into with Royal Bank of Canada to SPP.

Note 2. Basis of Presentation

During the periods presented, the financial statements of the Eagle Ford properties were never prepared on a stand-alone basis. Certain costs, such as depreciation, depletion and amortization, accretion, general and administrative expenses, interest and corporate income taxes were not allocated to the individual properties. Accordingly, full separate financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) do not exist and are not practicable to obtain in these circumstances.

Revenues and direct operating expenses included in the accompanying financial statements represent SPP’s net working interest in the properties acquired for the years ended December 31, 2014 and 2013, respectively, and the three months ended March 31, 2015 and 2014 and are presented on the accrual basis of accounting. The revenues and direct operating expenses presented herein relate only to the interest in the producing oil and natural gas properties acquired and do not represent all of the oil and natural gas operations of SN or other third party working interest owners. Depreciation, depletion and amortization, accretion, general and administrative expenses, interest and corporate income taxes have been excluded. The financial statements presented are not indicative of the results of operations of the properties described above going forward due to changes in the business.

The accompanying financial statements are prepared in conformity with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

Statements of Revenues and Direct Operating Expenses

Of the Oil and Natural Gas Properties in the acquisition by

Sanchez Production Partners LP from SEP Holdings III, LLC, a wholly owned subsidiary of

Sanchez Energy Corporation

Notes to the Financial Statements

revenues and direct operating expenses during the reporting period. Actual results could differ materially from those estimates.

The accompanying financial statements for the three months ended March 31, 2015 and 2014 are unaudited, but, in the opinion of management, reflect all adjustments necessary for a fair presentation of the revenues and expenses for those periods. These interim results are not necessarily indicative of results for a full year.

The Partnership reviewed events occurring after the date of the latest financial statement which could affect the Eagle Ford properties’ results of operations for the period ended March 31, 2015. The Partnership reviewed and evaluated events through May 18, 2015, the date these financial statements were available to be issued.

Note 3. Commitments and Contingencies

Pursuant to the terms of the definitive agreement between the Buyer and the Seller, any claims, litigation or disputes pending as of the effective date (January 1, 2015) and any matters arising in connection with ownership of the Eagle Ford properties prior to the effective date are retained by the Seller. Notwithstanding this indemnification, the Partnership is not aware of any legal, environmental or other commitments or contingencies that would have a material effect on the statements of revenue and direct operating expenses.

Statements of Revenues and Direct Operating Expenses

Of the Oil and Natural Gas Properties in the acquisition by

Sanchez Production Partners LP from Sanchez Energy Corporation

Supplemental Oil and Natural Gas Information

(Unaudited)

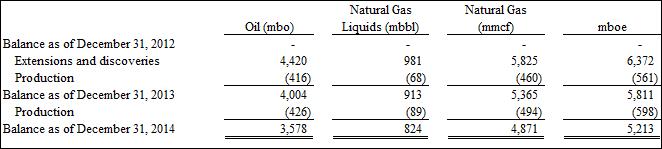

Oil and Natural Gas Reserve Information

Proved oil, natural gas liquids (“NGLs”) and natural gas reserve quantities are based on estimates prepared by Netherland Sewell & Associates, Inc. and from information provided by SN, in accordance with guidelines established by the Securities and Exchange Commission.

There are numerous uncertainties inherent in estimating quantities of proved reserves and projecting future rates of production and timing of development expenditures. Prior year reserve data was calculated using only production and new discovery quantities and valuation. The following reserve data represents estimates only and should not be considered exact:

All balances in the table above relate to proved developed reserves. No proved undeveloped reserves were acquired in the Eagle Ford acquisition.

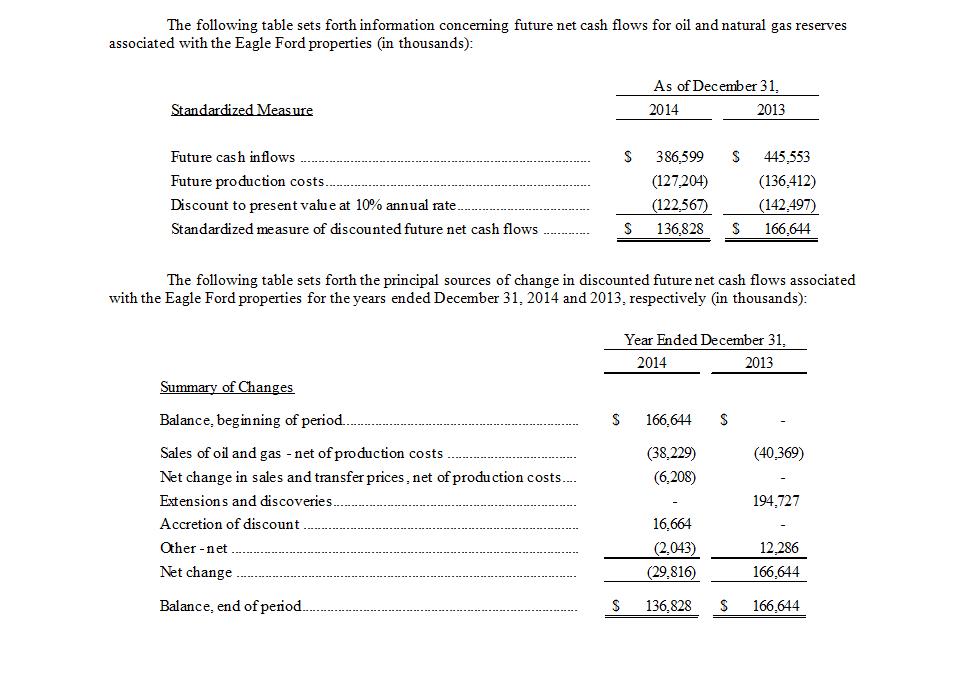

Future Net Cash Flows

The standardized measure of discounted future net cash flows relating to proved oil and natural gas reserves (“Standardized Measure”) is a disclosure requirement under Accounting Standards Codification (“ASC”) 932. The Standardized Measure does not purport to be, nor should it be interpreted to present, the fair market value of the proved oil and natural gas reserves of the Eagle Ford properties acquired by the Partnership, but does present a standardized disclosure concerning possible future net cash flows that would result under the assumptions used. An estimate of fair market value would also take into account, among other things, the recovery of reserves not presently classified as proved, the value of unproved properties, and consideration of expected future economic and operating conditions.

For the December 31, 2014 and 2013 calculations in the following table, estimated future cash inflows were based on the average prices during the 12-month period prior to the ending date of the period, determined as the unweighted arithmetic average of the prices in effect on the first-day-of-the month for each month within such period. The pricing used for the estimates of the reserves of oil and condensate as of December 31, 2014 and 2013 was based on unweighted twelve month average West Texas Intermediate posted prices of $94.99 and $96.78, respectively. For NGLs, the average prices were based on unweighted twelve month average Mt. Belvieu posted prices of $44.84 and $41.23 for the years ended December 31, 2014 and 2013, respectively. For natural gas, the average prices were based on unweighted twelve month average Henry Hub spot natural gas price averages of $4.35 and $3.67 for the years ended December 31, 2014 and 2013, respectively. Operating costs, production and ad valorem taxes and future development costs are based on current costs with no escalation in future years. There are no future income tax expenses because SPP is a non-taxable entity. The estimated future net cash flows are then discounted at a rate of 10%. No deduction has been made for general and administrative expense, interest expense or depreciation, depletion and amortization.

Statements of Revenues and Direct Operating Expenses

Of the Oil and Natural Gas Properties in the acquisition by

Sanchez Production Partners LP from Sanchez Energy Corporation

Supplemental Oil and Natural Gas Information

(Unaudited)