Attached files

| file | filename |

|---|---|

| 8-K - BDCA VENTURE, INC. 8-K - CROSSROADS LIQUIDATING TRUST | a51066729.htm |

| EX-99.1 - EXHIBIT 99.1 - CROSSROADS LIQUIDATING TRUST | a51066729_ex991.htm |

Exhibit 99.2

Q4 2014 Investor Presentation Nasdaq: BDCV www.BDCV.com BDCA Venture, Inc.

Disclaimer 2 BDCA Venture, Inc. (“BDCA Venture”), a Maryland corporation, is a closed-end fund that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. BDCA Venture Adviser, LLC is an SEC registered investment adviser and acts as the investment adviser to, and receives base management and/or incentive fees from, BDCA Venture. This presentation is a general communication of BDCA Venture and is not intended to be a solicitation to purchase or sell any security. This presentation may contain certain forward-looking statements, including statements with regard to the future performance of BDCA Venture. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors that could cause actual results to differ materially are included in BDCA Venture’s Form 10-K and Form 10-Q, and other SEC filings, and include uncertainties of economic, competitive, and market conditions, and future business decisions all of which are difficult or impossible to predict accurately, and many of which are beyond the control of BDCA Venture. Although BDCA Venture believes that the assumptions underlying the forward-looking statements included herein are reasonable, any of the assumptions could be inaccurate and therefore there can be no assurance that the forward-looking statements included herein will prove to be accurate. Except as required by the federal securities laws, BDCA Venture undertakes no obligation to revise or update this presentation (including the slides presented) or any forward-looking statements contained herein, whether as a result of new information, future events or otherwise.

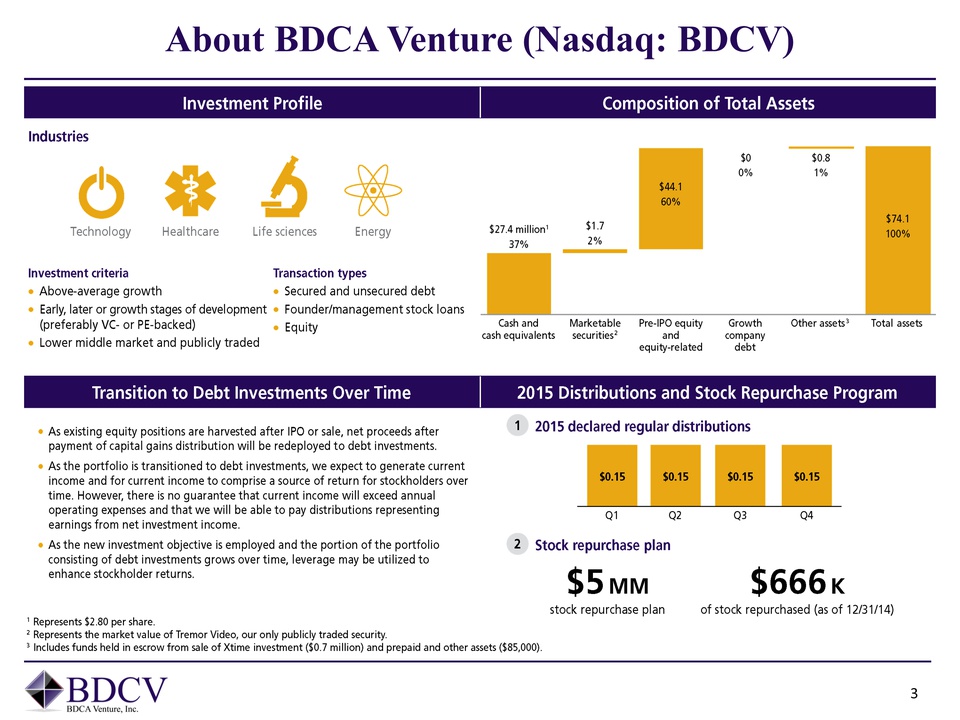

About BDCA Venture (Nasdaq: BDCV) 3 Investment Profile Composition of Total Assets Industries Technology Healthcare Life sciences Energy Investment criteria Transaction types Above-average growth Early, later or growth stages of development (preferably VC- or PE- backed) Lower middle market and publicly traded Transaction types Secured and unsecured debt Founder/management stock loans Equity Cash and cash equivalents Marketable securities Pre-IPO equity and equity-related Growth company debt Other assets Total assets $27.4 million 37% $1.7 2% $44.1 60% $0 0% $0.8 1% $74.1 100% Transition to Debt Investments Over Time As existing equity positions are harvested after IPO or sale, net proceeds after payment of capital gains distribution will be redeployed to debt investments. As the portfolio is transitioned to debt investments, we expect to generate current income and for current income to comprise a source of return for stockholders over time. However, there is no guarantee that current income will exceed annual operating expenses and that we will be able to pay distributions representing earnings from net investment income. As the new investment objective is employed and the portion of the portfolio consisting of debt investments grows over time, leverage may be untilized to enhance stockholder returns. Represents $2.80 per share. Represents the market value of Tremor Video, our only publicly traded security. Includes funds held inescrow from sale of Xtime investment ($.07 million) and prepaid and other assisets ($85,000). 2015 Distributions and Stock Repurchase Program 2015 declared regular distributions Q1 Q2 Q3 Q4 Stock repurchase plan $5 MM $666 k of stock repurchased (as of 12/31/14) $0.18

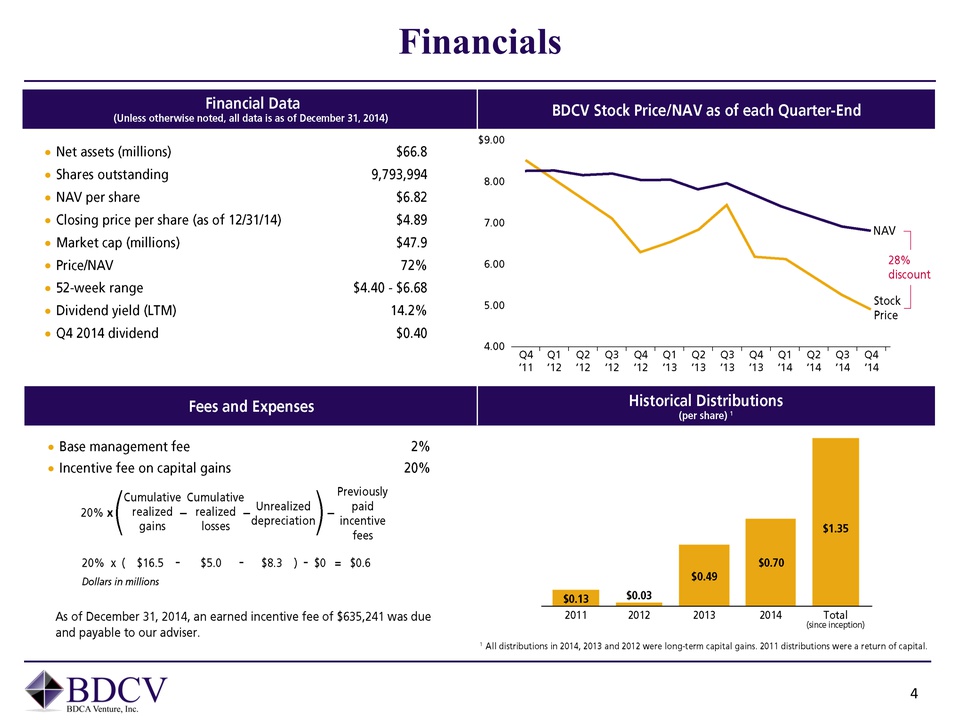

Financials 4 Financial Date (Unless otherwise noted, all data is as of December 31, 2014) Net assets (millions) Shares outstanding NAV per share Closing price per share (as 12/31/14) Market cp (millions) Price/NAV 52-week rance Dividend yield (LTM) A4 2014 dividend $66.8 9,793,994 $6.82 $4.89 $47.9 72% $4.40-$6.68 14.2% $0.40 $9.00 8.00 7.00 6.00 5.00 4.00 Q4 ’11 Q1 ’12 Q2 ’12 Q3 ’12 Q4 ’12 Q1 ’13 Q2 ’13 Q3 ’13 Q4 ’13 Q1 ’14 Q2 ’14 Q3 ’14 Q4 ’14 Historical Distributions (per share)1 $0.13 2011 $0.03 2012 $0.49 2013 $0.70 2014 $1.35 Total (since inception) 1 All distributions in 2014, 2013 and 2012 were long-term capital gains,. 2011 distributions were a return of capital. Fees and Expenses Base management fee 2% Incentive fee on capital gains 20% 20% x (cumulative realized gains – cumulative realized losses – unrealized depreciation – Previously paid incentive fees 20% x ($16.5 - $5.0 - $8.3) - $0 = $0.6 Dollars in millions As of December 31, 2014, an earned incentive fee of $635,241 was due and payable to our adviser.

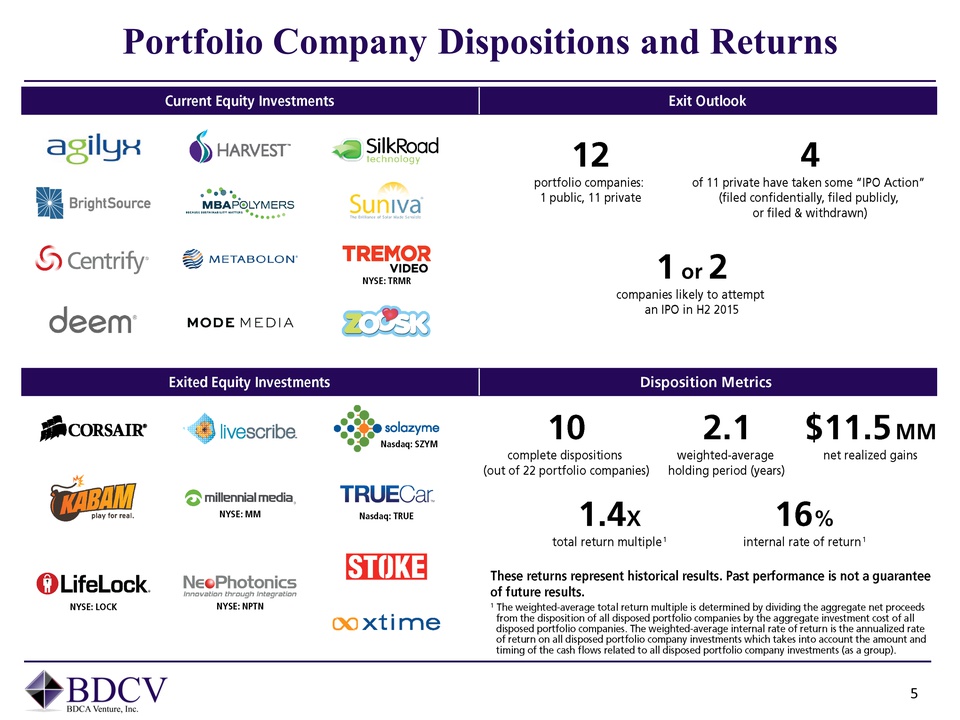

Portfolio Company Dispositions and Returns Current: Equity Investments Exit Outlook 12 portfolio companies: 1 public, 11 private 4 of 11 private have taken some “IPO Action” (filed confidentially, filed publicly, or filed & withdrawn 1 or 2 companies likely to attempt an IPO in H2 2015 Disposition Metrics 10 complete dispositions (out of 22 portfolio companies) 2.1 weighted-average holding period (years) $11.5 MM net realized gains 16% internal rate of return These returns represent historial results. Past performance is not a guarantee of future results. The weighted-average total return multiple is determined by dividing the aggregate net proceeds from the disposition of all disposed portfolio companies by the aggregate investment cost of all disposed portfolio companies. The weighted-average internal rate of return is the annualized rate of return on all disposed portfolio company investments which takes into account the amount and timing of the cash flows related to all disposed portfolio company investments (as a group). Exited Equity Investments Agilyx Harvest SilkRoad BrightSource MBA Polymers Suniva Centrify Metabolon Tremor Video NYSE: TRMR deem Mode Media zoosk Corsair livescribe solazyme Nasdaq: SZYM Kabam play for real millennial media NYSE: MM TrueCar Nasdaq: TRUE LifeLock NYSE: LOCK NeoPhotonics NYSE: NPTN Innovation through integration Stoke xtime

Portf

Portf

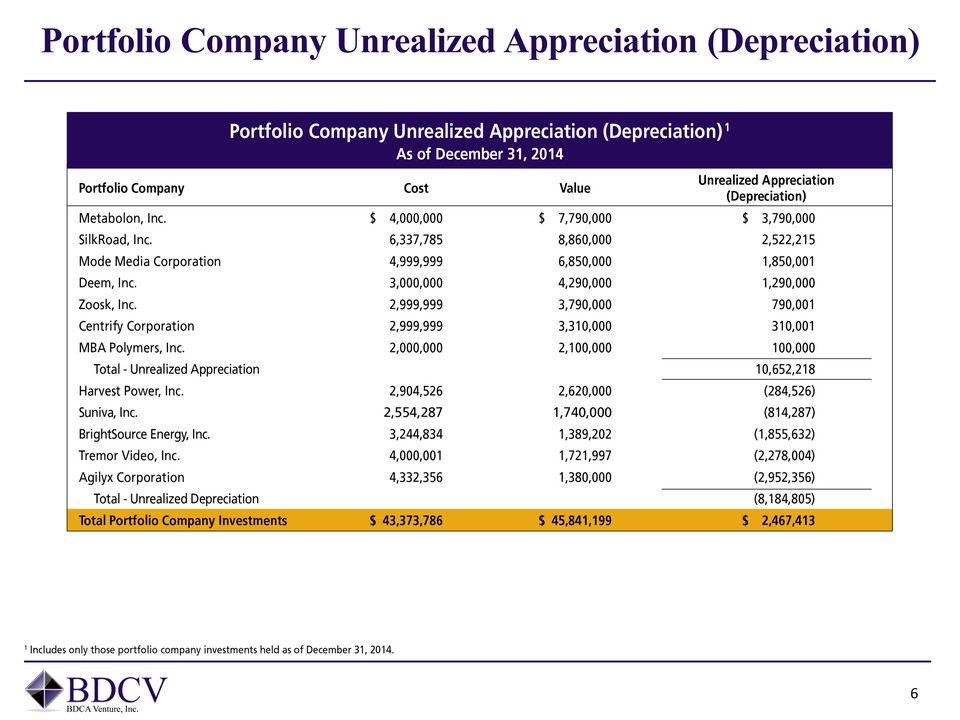

olio company unrealized appreciation (depreciation)as of December 31, 2014 portfolio company cost value unrealized appreciation (depreciation) metabolon, inc. silkroad, inc. mode media corporation deem, inc. zoosk, inc. centrify corporation mba polymers, inc. total – unrealized appreciation harvest power, inc. suniva, inc. brightsource energy, inc. tremor video, inc. agilyx corporation total – unrealized depreciation total portfolio company investments $ 4,000,000 6,337,785 4,999,999 3,000,000 2,999,999 2,904,526 2,554,287 3,244,834 4,000,001 4,332,356 43,373,786 7,790,000 8,860,000 6,850,000 4,290,000 3,790,000 3,310,000 2,100,000 2,620,000 1,740,000 1,389,202 1,721,997 1,380,000 45,841,199 2,522,215 1,850,001 1,290,000 790,001 310,001 100,000 10,652,218 (284,526) (814,287) (1,855,632) (2,278,004) (2,952,356) (8,184,805) 2,467,413 1 includes only those portfolio company investments held as of December 31, 2014 6

E

E

xperienced investment team name prior experience years in industry timothy j. keating ceo, investment committee mr. keating is the chief executive officer of bdca venture, inc. previously, he held senior management positions in the equity and equity derivatives departments of bear stearns, nomura and kidder, Peabody in both London and new York he is a 1985 cum laude graduate of Harvard college with an a.b. in economics years in industry 29 peter m. budko investment committee mr. budko is a founding partner and chief investment officer of ar capital, llc. Additionally he serves as chief executive officer of business development corporation of America *bdca) and business development corporation of America ll (bdca ll) and their respective investment advisers prior to the formation of arc, mr. budko had senior management positions in the structured asset finance group at Wachovia and in the corporate real estate finance group at nationsbank capital markets (predecessor to bank of America securities) he holds a b.a. in physics from the university of north Carolina at chapel hill 25 rober k. Grunewald investment committee mr. Grunewald serves as chief executive officer and president of bdca venture adviser, llc. Additionally he serves as chief investment officer of business development corporation of America and its investment adviser within the finance industry mr. Grunewald has participated as a lender, investment banker, m&a advisor, portfolio manager and hedge fund manager at institutions including nationsbank/Montgomery securities and wells fargo securities. He is a 1984 graduate of the university of notre dame with a b.b.a in accounting and finance and holds an m.b.a from Georgia state university 22 kyle l. rogers, cfa mr. rogers is a managing director of bdca venture adviser, llc. Previously he was a financial analyst at goldman sachs in both new York and Chicago he is a cfa charterholder and 1999 graduate of Dartmouth college with an a.b. in government and a minor in environmental studies 15 rexford a. darko mr. darko is a managing director of bdca venture adviser, llc. Previously he founded griffen-rose a boutique equity research firm, was a senior analyst at prospect street ventures and founded goldline entertainment services he is 2002 dean’s list graduate of Columbia business school with an m.b.a., a 1992 graduate of the university of London with an l.l.m. (distinction and merit in environmental and media laws) and a 1988 graduate of king’s college, London with an L.L.B and an a.k.c. 7

Co

Co

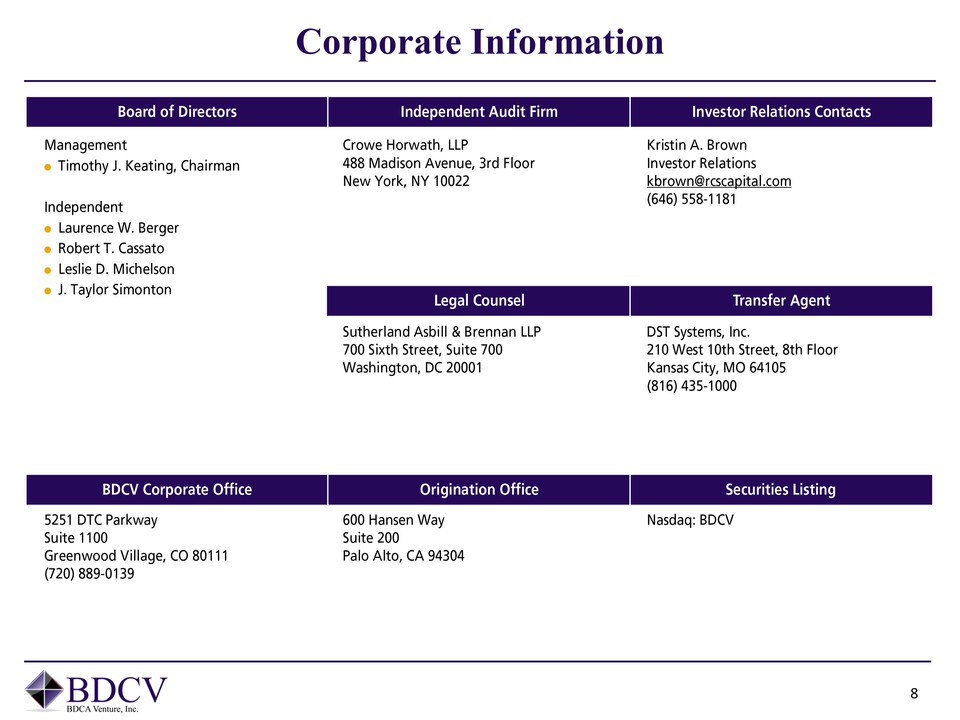

rporate information board of directors independent audit firm investor relations contacts legal counsel transfer agent bdcv corporate office origination office securities listing management timothy j. keating chairman independent Laurence w. berger Robert t. cassato leslie d. Michelson j. taylor Simonton crowe horwath llp 488 madison avenue 3rd floor new York, ny 10022 kristin a. brown investor relations kbrown@rcscapital.com (646) 558-1181 sutherland asbill & brennan llp 700 sixth street, suite 700 washington dc 20001 dst systems, inc. 210 west 10th street, 8th floor Kansas city mo 64105 (816) 435-1000 5251 dtc parkway suite 1100 greenwood village, co 80111 (720) 889-0139 600 hansen way suite 200 palo alto ca 94304 nasdaq: bdcv 8