Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - CROSSROADS LIQUIDATING TRUST | a6622330ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - CROSSROADS LIQUIDATING TRUST | a6622330ex31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - CROSSROADS LIQUIDATING TRUST | a6622330ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - CROSSROADS LIQUIDATING TRUST | a6622330ex32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

|

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

FOR THE TRANSITION PERIOD FROM TO

|

COMMISSION FILE NUMBER: 0-53504

KEATING CAPITAL, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

26-2582882

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification Number)

|

|

5251 DTC Parkway, Suite 1000

Greenwood Village, CO

|

80111

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (720) 889-0139

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value

$0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ¨ | ||

|

Non-accelerated filer x

|

Smaller reporting company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x.

No established market exists for the Registrant’s shares of common stock. Based upon the $10 offering price of the shares issued in connection with the Registrant’s continuous public offering, approximately $11,790,460 of the Registrant’s common stock was held by non-affiliates as of June 30, 2010. For the purpose of calculating the above amount, all directors and executive officers of the Registrant have been treated as affiliates. There were 3,711,476 shares of the Registrant’s common stock outstanding as of February 25, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to the 2011 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission, are incorporated by reference in Part III of this Annual Report on Form 10-K as indicated herein.

2

KEATING CAPITAL, INC.

FORM 10-K FOR THE FISCAL YEAR

ENDED DECEMBER 31, 2010

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

4

|

||

|

39

|

||

|

57

|

||

|

57

|

||

|

57

|

||

|

57

|

||

|

PART II

|

||

|

58

|

||

|

61

|

||

|

61

|

||

|

76

|

||

|

77

|

||

|

100

|

||

|

100

|

||

|

100

|

||

|

PART III

|

||

|

101

|

||

|

101

|

||

|

101

|

||

|

101

|

||

|

101

|

||

|

PART IV

|

||

|

102

|

||

|

104

|

||

3

PART I

|

Business

|

In this annual report, unless otherwise indicated, the “Company”, “we”, “us” or “our” refer to Keating Capital, Inc.

We were incorporated on May 9, 2008 under the laws of the State of Maryland, and we filed an election to be regulated as a business development company under the Investment Company Act of 1940, as amended (the “1940 Act”) on November 20, 2008. Keating Investments, LLC (“Keating Investments”) serves as our investment adviser and also provides us with the administrative services necessary for us to operate.

Congress created business development companies in 1980 in an effort to help public capital reach smaller and growing private and public companies. We are designed to do precisely that. We seek to make minority, non-controlling equity investments in private businesses that are seeking growth capital and that we believe are committed to, and capable of, becoming public, which we refer to as “public ready” or “primed to become public.”

We seek to invest principally in equity securities, including convertible preferred securities, and other debt securities convertible into equity securities, of primarily non-public U.S.-based companies. Our investment objective is to maximize our portfolio’s capital appreciation while generating current income from our portfolio investments. In accordance with our investment objective, we seek to provide capital principally to U.S.-based, private companies with an equity value of less than $250 million, which we refer to as “micro-cap companies,” and U.S.-based, private companies with an equity value of between $250 million and $1 billion, which we refer to as “small-cap companies.” Our primary emphasis is to attempt to generate capital gains through our equity investments in micro-cap and small-cap companies, including through the conversion of the convertible preferred or convertible debt securities we may acquire in such companies. While a portion of our investments may, at any given time, include a component of interest or dividends, we do not expect to generate significant current yield on our portfolio company investments. To date, none of our portfolio company investments have generated, nor are they expected to generate, interest or dividend income. We may also make investments on an opportunistic basis in U.S.-based publicly-traded companies with market capitalizations of less than $250 million, as well as foreign companies that otherwise meet our investment criteria, subject to certain limitations imposed under the 1940 Act.

Our investments will generally take the form of either “sponsored deals” or “financing participation deals.” In a sponsored deal, we are generally the lead or primary investor, and are principally responsible for setting the terms and conditions of the investment, establishing the going public process, milestones and timing, generally assisting the portfolio company in raising any additional capital from co-investors and providing going public assistance and guidance. While we may in certain circumstances make an initial seed investment in prospective portfolio companies in sponsored deals, we typically attempt to avoid the risk associated with an initial seed investment where the potential portfolio company may abandon the going public process due to its inability or unwillingness to undertake and complete the audit, governance and other requirements to become public. We also believe it is important for a potential portfolio company to demonstrate its commitment to the going public process by funding any upfront legal and audit costs. All of the investment process steps set forth below will typically be applicable in a sponsored deal.

In a financing participation deal, typically we participate in a current private offering round being self-underwritten by the potential portfolio company or distributed by placement agents. Typically, the terms of a financing participation deal, which are generally already established consistent with a financing intended to be the last financing round prior to a traditional initial public offering, or pre-IPO financing, have already been established by the issuer and/or the placement agent. In these types of deals, we generally are dealing with existing management and principal investors with a greater level of public company experience or knowledge and an expectation to go public within our targeted time frame.

Financing participation deals arise when we have the opportunity to participate in current pre-IPO financing rounds of later stage, venture capital-backed private companies that otherwise meet our investment criteria. In these transactions, we are able to focus our investment process on a single investment, eliminating the need for an initial investment to fund certain upfront going public costs in a prospective portfolio company.

4

In financing participation deals, we believe we are generally able to avoid the risk associated with an initial seed investment where the potential portfolio company may abandon the going public process due to its inability or unwillingness to undertake and complete the audit, governance and other requirements to become public. We also believe it is important for a potential portfolio company to demonstrate its commitment to the going public process by funding any upfront legal and audit costs. Our belief is that potential portfolio companies which meet our investment criteria will generally be able and willing to fund these upfront going public costs or will have already substantially completed certain audit and governance requirements. Financing participation deals, which typically do not require us to seek co-investors, are also attractive to us while our investment size is limited as we attempt to increase our capital base. Unlike sponsored deals, certain of the investment process steps may not be applicable to financing participation deals as identified below.

In a financing participation deal, we will typically make a single investment, principally consisting of convertible debt, convertible preferred stock or other equity, after we are satisfied that a potential portfolio company is committed to and capable of becoming public and obtaining a senior exchange listing (as defined below) within our desired timeframes and has substantially completed certain audit and governance requirements to our satisfaction prior to the closing of our investment.

While we have specifically identified sponsored deals and financing participation deals, we believe there may be other types of investment opportunities which may not have the specific characteristics of a sponsored deal or financing participation deal, but which may still meet our general investment criteria and which are still relevant to our focus on micro-cap and small-cap companies capable of and committed to becoming public. We may make investments in such portfolio companies on an opportunistic basis. In all cases, we expect our portfolio companies will generally be able to file a registration statement with the SEC within three to twelve months after our investment and will generally be able to obtain an exchange listing within 12 to 18 months after our investment.

In evaluating both sponsored and financing participation deals, we utilize an investment process focused on the following factors:

| ● | Qualification. We obtain information from the potential portfolio company’s management, conduct a preliminary evaluation of threshold issues and make a determination as to whether the opportunity is qualified and deserving of additional investigation. |

| ● |

Evaluation. We undertake an in-depth evaluation of the opportunity with primary focus on understanding the business, historical and projected financial information, industry, competition and valuation to ascertain whether we have interest in pursuing the investment.

|

| ● |

Report Preparation. We prepare an internal investment report which discusses our evaluation findings and recommendations, together with an internal valuation report outlining our acceptable valuation ranges for an investment.

|

| ● |

Approval. Our investment adviser’s Investment Committee reviews the investment and valuation reports and, when appropriate, approves the investment subject to completion of satisfactory due diligence.

|

| ● |

Term Sheet. We prepare, negotiate and execute a term sheet with the portfolio company which, among other things, will establish the due diligence process and set a transaction closing time table (including the achievement of going public milestones). This step is not applicable to our financing participation deals since the terms and conditions of such an investment have typically already been set by the portfolio company.

|

| ● |

Due Diligence. We conduct an on-site due diligence visit and complete the gathering and review of due diligence materials.

|

| ● |

Co-Investment Documents. As required, we assist the portfolio company in the review, revision and preparation of a confidential business memorandum, company investment PowerPoint presentation and executive summary that will be used by us to approach co-investors on a selected basis or by the portfolio company and its placement agents to undertake a private placement offering. This step is typically not applicable to our financing participation deals as these documents or comparable information will normally already be available.

|

| ● |

Governance. We establish, and assist the portfolio company in satisfying, certain governance matters which may be required for an exchange listing and which we may designate as a condition to the closing of our investment (including the appointment of an independent board and the audit and compensation committees, the hiring, or the engagement of an executive recruiter to conduct a search for a qualified CFO, the engagement of a qualified independent auditor and completion of the audit).

|

5

| ● |

Placement Agent. As required, we assist the portfolio company in identifying potential placement agents to raise additional capital beyond the investment amount we intend to provide. This step is typically not applicable to our financing participation deals since either a placement agent will have already been engaged or the portfolio company will be handling the offering itself on a self-underwritten basis.

|

| ● |

Capital Raising; Going Public Preparation. We assist the portfolio company in monitoring the capital raising process, by introducing co-investors on a selected basis, and in achieving certain “going public” milestones which we may designate as a condition to the closing of our investment. This step is typically not applicable to our financing participation deals; however, on a selected basis, we may introduce certain co-investors to the portfolio company.

|

| ● |

Investment Closing. At closing, we make our investment, principally consisting of convertible debt or convertible preferred stock or other equity.

|

| ● |

Completion of Going Public Process. Following the closing of our investment, we will provide managerial assistance to the portfolio company in their completion of the going public process, as needed, within the general time frames set forth below:

|

|

●

|

For a Sponsored Deal:

|

|

| (i) If we believe that the portfolio company is able to complete a traditional IPO based primarily on its current or anticipated revenue and profitability levels measured against recent comparable IPO transactions, which we refer to herein as “IPO qualified” or an “IPO qualified company,” we expect that the portfolio company will file a registration statement under the Securities Act within approximately nine months after closing and complete the IPO and obtain a senior exchange listing within approximately 15 months after closing. If the portfolio company fails to complete an IPO within the 15-month time frame, the portfolio company is expected to file a registration statement under the Exchange Act and become a reporting company within 18 months after closing. The final terms of a sponsored deal will be subject to negotiation, and there is no assurance that we will be able to include terms in our sponsored deals which will require the portfolio company to undertake all or any of these actions within these time periods. | ||

| (ii) If we believe that the portfolio company is not IPO qualified at the time of our investment, we expect that the portfolio company will file a registration statement under the Exchange Act within three to six months after closing and obtain a junior or senior exchange listing within 15 months after closing. | ||

| ● | For a Financing Participation Deal: | |

| We expect that the portfolio company, which will typically be IPO qualified, will file a registration statement under the Securities Act within 12 months after closing and complete an IPO and obtain a senior exchange listing within 18 months after closing. |

6

Investment Process Steps and Activities

| Qualification, Evaluation and Report Preparation |

Obtain Company Information

|

|

|

(2 - 3 weeks)

|

Preliminary Evaluation of Threshold Issues

|

|

|

Prepare Summary Analysis

|

||

|

Assess Investment Criteria

|

||

|

In-depth Company Evaluation

|

||

|

Review Industry and Analyst Reports

|

||

|

Management and Third Party Interviews

|

||

|

Analyze Transaction Structure

|

||

|

Prepare Investment and Valuation Report

|

||

| Approval, Term Sheet and Due Diligence |

Investment Committee Review and Approval

|

|

|

(1 - 2 weeks)

|

Set Primary Terms and Conditions of Investment*

|

|

|

Establish Critical Going Public Milestones

|

||

|

Discuss Co-Investment Strategy with Company*

|

||

|

Approve Investment

|

||

|

Prepare Term Sheet*

|

||

|

Establish Transaction Time Table*

|

||

|

Distribute Due Diligence Checklist

|

||

|

Conduct On-Site Visit and Complete Due Diligence

|

||

| Co-Investment Documents, Governance and Placement Agent |

Complete Business Memorandum and Investor Presentation*

|

|

|

(2 - 3 weeks)

|

Identify Qualified Agents and Co-Investors*

|

|

|

Assist in Governance Matters

|

||

|

Begin Search/Hire Qualified CFO

|

||

|

Engage PCAOB Registered Auditor

|

||

|

Delivery of Audited Financial Statements

|

||

|

Engage Placement Agent*

|

||

| Capital Raising, Going Public Preparation |

Monitor Capital Raising Process*

|

|

|

(6 - 8 weeks)

|

Introduce Selected Co-Investors

|

|

|

Satisfy Going Public Milestones

|

||

|

Investment Closing

|

Prepare Investment Documents*

|

|

|

(1 - 2 weeks)

|

Fund Investment

|

|

| Completion of Going Public Process |

Assist in Going Public Matters

|

|

|

(within 18 months after closing)

|

Prepare/File Registration Statement

|

|

|

Regulatory Approval

|

||

|

Complete IPO

|

||

|

Listing on/Upgrade to Senior Exchange

|

||

|

*Indicates typically not part of financing participation deals.

|

||

7

As an integral part of our investment, we intend to partner with our portfolio companies to become public companies that meet the governance and eligibility requirements for a listing on the New York Stock Exchange, Nasdaq (Global Select, Global or Capital Market) or NYSE Amex Equities, formerly known as the American Stock Exchange (collectively, “U.S. Senior Exchanges”). We will also consider listings by foreign portfolio companies on the Toronto Stock Exchange, London Stock Exchange, Frankfurt Stock Exchange, Hong Kong Stock Exchange and other foreign exchanges that we may determine as acceptable venues (collectively, “Foreign Senior Exchanges”). As a business development company, however, we cannot invest more than 30% of our assets in foreign investments.

We refer to the U.S. Senior Exchanges and the Foreign Senior Exchanges herein collectively as the “senior exchanges” or individually as a “senior exchange.” We intend for our portfolio companies to go public either through the filing of a registration statement under the Securities Act or the Exchange Act. For portfolio companies that we believe are IPO qualified, we expect these companies to go public by filing a registration statement under the Securities Act and completing an IPO. For portfolio companies that are either not IPO qualified at the time of our investment or fail to complete an IPO under the Securities Act in a timely manner, we expect these companies to go public by filing a registration statement under the Exchange Act, which makes them a non-listed publicly reporting company initially.

In general, we seek to invest in micro-cap and small-cap companies that we believe will be able to file a registration statement with the SEC within approximately three to twelve months after our investment. These registration statements may take the form of a registration statement under the Securities Act registering the primary sale of common stock of a portfolio company in an IPO, a registration statement registering the common stock of a portfolio company under the Exchange Act without a concurrent registered offering under the Securities Act, or a resale registration statement filed by a portfolio company under the Securities Act to register shares held by existing stockholders coupled with a concurrent registration of the portfolio company’s common stock under the Exchange Act.

We expect the common stock of our portfolio companies that are not IPO qualified at the time of our investment, or fail to complete an IPO in a timely manner, to typically be initially quoted on the Over-the-Counter Bulletin Board (the “OTC Bulletin Board”) or, in the case of foreign portfolio companies, the Toronto Stock Exchange Venture, the Shenzhen Stock Exchange (Chinext) or other foreign exchanges that we may determine as an acceptable initial foreign listing venue (collectively, “Foreign Junior Exchange”), following the completion of the registration process, depending upon satisfaction of the applicable listing requirements. We refer to the OTC Bulletin Board and the Foreign Junior Exchanges herein collectively as the “junior exchanges” or individually as a “junior exchange.”

We can provide no assurance, however, that the micro-cap and small-cap companies in which we invest will be able to successfully complete the SEC registration process, or that they will be successful in obtaining a listing on either a junior or senior exchange within the expected timeframe, if at all. If, for any reason, a traditional IPO is unavailable due to either market conditions or an underwriter’s minimum requirements, we believe that we can provide each of our portfolio companies with an alternative and more certain solution to becoming public and obtaining an exchange listing through our investment adviser’s going public, aftermarket support and public markets expertise.

We intend to maximize our potential for capital appreciation by taking advantage of the premium we believe is generally associated with having a more liquid asset, such as a publicly traded security. Specifically, we believe that a senior exchange listing, if obtained, will generally provide our portfolio companies with greater visibility, marketability and liquidity than they would otherwise be able to achieve without such a listing. Since we intend to be more patient investors, we believe that our portfolio companies may have an even greater potential for capital appreciation if they are able to demonstrate sustained earnings growth and are correspondingly rewarded by the public markets with a price-to-earnings (P/E) multiple appropriately linked to earnings performance. We can provide no assurance, however, that the micro-cap and small-cap companies in which we invest will be able to achieve such sustained earnings growth, or that the public markets will recognize such growth, if any, with an appropriate market premium.

To the extent that we receive convertible debt instruments in connection with our investments, such instruments will likely be

unsecured or subordinated debt securities. The convertible preferred stock we have received to date, and which we expect to receive in the future, in connection with our equity investments will typically be non-controlling investments, meaning we will not be in a position to control the management, operation and strategic decision-making of the companies in which we invest.

8

During 2010, we satisfied the requirements to qualify as a regulated investment company (“RIC”). We will elect to be treated as a RIC under Subchapter M of the Internal Revenue Code (the “Code”) for our 2010 taxable year when we file our 2010 tax return. In order to qualify for and maintain RIC status, the size of our individual portfolio company investments will be restricted in order to comply with specified asset diversification requirements on a quarterly basis. As a result, to comply with these diversification requirements, we expect that the average size of our individual portfolio company investments will represent approximately 5% of our total assets. Based on our total assets as of December 31, 2010 and the $50 million to $100 million in total capital that we expect to raise in our continuous public offering which concludes on June 30, 2011, we anticipate that the average size of our future portfolio company investments will range from approximately $2.5 million to $5 million. However, we may invest more than this amount in certain opportunistic situations, provided we do not invest more than 25% of the value of our total assets in any portfolio company and the value of our portfolio company investments representing more than 5% of our total assets do not in the aggregate exceed 50% of our total assets.

We expect that our capital will primarily be used by our portfolio companies to finance organic growth. To a lesser extent, our capital may be used to finance acquisitions and recapitalizations. Our investment adviser’s investment decisions are based on an analysis of potential portfolio companies’ management teams and business operations supported by industry and competitive research, an understanding of the quality of their revenues and cash flow, variability of costs and the inherent value of their assets, including proprietary intangible assets and intellectual property. Our investment adviser also assesses each potential portfolio company as to its appeal in the public markets, its suitability for achieving and maintaining public company status and its eligibility for a senior exchange listing.

Our debt and equity investments in portfolio companies could be impaired to the extent such portfolio companies experience financial difficulties arising out of the current economic environment. Our inability to locate attractive investment opportunities, or the impairment of our portfolio investments as a result of economic conditions, could have a material adverse effect on our financial condition and results of operations.

Our principal executive offices are located at 5251 DTC Parkway, Suite 1000, Greenwood Village, Colorado 80111, and our telephone number is (720) 889-0139. We maintain a website at www.keatingcapital.com. Information contained on our website is not incorporated by reference into this annual report, and you should not consider information contained on our website to be part of this annual report.

Private Issuances of Securities

On May 14, 2008, our investment adviser, Keating Investments, purchased 100 shares of our common stock at a price of $10.00 per share as our initial capital. On November 12, 2008, we completed the final closing of our private placement offering. We sold a total of 569,800 shares of our common stock in our private placement offering at a price of $10.00 per share raising aggregate gross proceeds of $5,698,000. After the payment of commissions and other offering costs of approximately $454,566, we received aggregate net proceeds of approximately $5,243,434 in connection with our private placement offering.

All shares of our common stock issued in our private placement were restricted shares and cannot be sold by the holders thereof without registration under the Securities Act or an available exemption from registration under the Securities Act. We believe that the shares of our common stock issued in our private placement are eligible for resale under one or more exemptions from registration under the Securities Act. Accordingly, subject to certain lock-up agreements currently in place with certain of our officers and directors, the holders of shares issued in our private placement will be able to sell their shares once we obtain a listing of our shares of common stock on the Nasdaq Capital Market, which we expect to occur by the end of 2011. Although we currently satisfy the requirements to obtain a listing of our shares of common stock on the Nasdaq Capital Market and will file for such listing after conclusion of our continuous public offering, we cannot provide you with any assurance that we will be successful in obtaining a listing of our shares on the Nasdaq Capital Market within the timeframe we propose.

Continuous Public Offering of Securities

On June 11, 2009, we commenced a continuous public offering pursuant to which we intend to sell from time-to-time up to 10 million shares of our common stock at an initial offering price of $10.00 per share, adjusted for volume discounts and commission waivers, through the period ending on June 30, 2011. There can be no assurance that we will be able to sell all of the shares we are presently offering.

9

During the year ended December 31, 2010, we sold 2,290,399 shares of common stock in our continuous public offering at an average price of approximately $9.96 per share, resulting in gross proceeds of $22,809,653 and net proceeds of $20,613,587, after payment of $2,196,066 in dealer manager fees and commissions. During 2011 through February 22, 2011, we sold an additional 851,177 shares of common stock in our continuous public offering at an average price of approximately $9.95 per share, resulting in gross proceeds of $8,469,970 and net proceeds of $7,660,599, after payment of $809,371 in dealer manager fees and commissions.

The following table summarizes the sales of our common stock under our continuous public offering by month since the offering commenced on June 11, 2009:

|

Dealer Manager

|

||||||||||||||||||||

|

Shares

|

Average Price

|

Gross

|

Fees and

|

Net

|

||||||||||||||||

|

Month

|

Sold (1)

|

Per Share (1)

|

Proceeds

|

Commissions

|

Proceeds

|

|||||||||||||||

|

January 2010 (first closing)

|

114,695 | $ | 10.00 | $ | 1,146,500 | $ | 114,243 | $ | 1,032,257 | |||||||||||

|

February 2010

|

54,638 | 9.99 | 546,000 | 54,261 | 491,739 | |||||||||||||||

|

March 2010

|

175,283 | 9.98 | 1,749,436 | 171,896 | 1,577,540 | |||||||||||||||

|

April 2010

|

151,554 | 9.84 | 1,491,050 | 127,062 | 1,363,988 | |||||||||||||||

|

June 2010

|

233,277 | 9.98 | 2,327,331 | 227,840 | 2,099,491 | |||||||||||||||

|

July 2010

|

113,780 | 9.99 | 1,136,483 | 112,457 | 1,024,026 | |||||||||||||||

|

August 2010

|

203,128 | 9.99 | 2,028,643 | 200,493 | 1,828,150 | |||||||||||||||

|

September 2010

|

146,716 | 9.95 | 1,459,215 | 138,771 | 1,320,444 | |||||||||||||||

|

October 2010

|

249,310 | 9.96 | 2,482,410 | 238,622 | 2,243,788 | |||||||||||||||

|

November 2010

|

371,395 | 9.96 | 3,697,520 | 354,967 | 3,342,553 | |||||||||||||||

|

December 2010

|

476,623 | 9.96 | 4,745,065 | 455,454 | 4,289,611 | |||||||||||||||

|

January 2011

|

315,143 | 9.97 | 3,141,484 | 305,195 | 2,836,289 | |||||||||||||||

|

February 2011

|

536,034 | 9.94 | 5,328,486 | 504,176 | 4,824,310 | |||||||||||||||

| 3,141,576 | $ | 9.96 | $ | 31,279,623 | $ | 3,005,437 | $ | 28,274,186 | ||||||||||||

(1) All shares were sold at a price of either $9.30 or $10.00, depending on whether or not sales commissions were waived by the dealer manager.

Portfolio Companies

During the year ended December 31, 2010, we made four portfolio company investments in an aggregate amount of $3,600,491. On February 22, 2011, we made an additional investment of $900,000 in an existing portfolio company, MBA Polymers, Inc. We anticipate that it will take us up to 12 to 24 months after conclusion of our continuous public offering to invest substantially all of the proceeds from the continuous public offering in accordance with our investment strategy and depending on the availability of appropriate investment opportunities consistent with our investment objective and market conditions.

On January 25, 2010, we completed our first portfolio company investment, a $1,000,000 investment in the convertible preferred stock of NeoPhotonics Corporation (“NeoPhotonics”). NeoPhotonics is headquartered in San Jose, California and develops and manufactures photonic integrated circuit based components, modules and subsystems for use in telecommunications networks. NeoPhotonics completed an initial public offering on February 2, 2011 selling 7,500,000 shares of common stock at a price of $11.00 per share. NeoPhotonics is listed on the New York Stock Exchange under the ticker symbol NPTN. Prior to the initial public offering, our NeoPhotonics preferred stock converted into 160,000 shares of NeoPhotonics common stock, which common shares are subject to a 180-day lock-up provision.

On July 1, 2010, we completed our second portfolio company investment, a $500,500 investment in the convertible preferred stock and warrants of Livescribe, Inc. (“Livescribe”). Livescribe is a private company headquartered in Oakland, California and is a developer and marketer of a mobile, paper-based computing platform consisting of smartpens, dot paper, smartpen applications, accessories, desktop software, an online community and development tools.

On July 16, 2010, we completed our third portfolio company investment, a $999,991 investment in the convertible preferred stock of Solazyme, Inc. (“Solazyme”). Solazyme is a private company headquartered in South San Francisco, California and is considered a leader in the development and commercialization of algal oil and bioproducts for the fuels and chemicals, nutritionals and health sciences markets.

10

On October 15, 2010, we completed our fourth portfolio company investment, a $1,100,000 investment in the convertible preferred stock of MBA Polymers, Inc. (“MBA Polymers”). MBA Polymers is a private company headquartered in Richmond, California and is a global manufacturer of recycled plastics sourced from end of life durable goods, such as computers, electronics, appliances and automobiles. On February 22, 2011, we made an additional investment of $900,000 in the same series of convertible preferred stock as our initial investment. Our additional investment was part of an aggregate additional offering of approximately $14.6 million.

Beginning in 2011, we anticipate making five to ten investments per year depending upon the amount of capital we have available for investment. We cannot assure you we will achieve our targeted investment pace. We are subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objective and that the value of your investment could decline substantially.

Targeted Investments

We seek to provide capital primarily to micro-cap companies with an equity value of less than $250 million and small-cap companies with an equity value of between $250 million and $1 billion. With micro-cap and certain small-cap companies historically having difficulty accessing the traditional capital markets and having less analyst coverage, less institutional ownership and lower trading volume, we believe an opportunity exists to become a preferred source of capital to such micro-cap and small-cap companies, particularly given our public markets strategy and the expertise of our investment adviser. Our investment activities will generally be focused on micro-cap and small-cap companies that have demonstrated attractive revenue and earnings growth relative to their peers, and whose management teams are committed to becoming public reporting companies. We expect these public ready companies will also have some or all of the following characteristics:

| ● |

Operates in an attractive growth industry. We focus on micro-cap and small-cap companies across a broad range of attractive growth industries that we believe are being transformed or created anew by technological, economic and social forces and are capable of attracting interest from both retail and institutional investors.

|

| ● |

Immediate need for external capital. We target micro-cap and small-cap companies whose organic growth is currently constrained by limited capital, and which have reached a point in their development where we believe external capital is required. As part of our investment, we offer a more stable form of equity capital for our portfolio companies, while requiring that their ownership structure align the economic interests of their management team with the success of the enterprise.

|

| ● |

Demonstrated revenue stream. We invest in micro-cap and small-cap companies that have a demonstrated revenue stream that we believe will make them attractive as publicly traded companies. However, in certain opportunistic situations, we may invest in development stage, pre-revenue stage and early revenue stage companies if there is a clear and verifiable path to generating meaningful revenue within the next 12 months.

|

| ● |

Demonstrated profitability. We focus on micro-cap and small-cap companies that are at or near profitability on an earnings before interest, taxes, depreciation and amortization (“EBITDA”) or cash flow from operations basis, or where there is a clear path to generating positive EBITDA or cash flow from operations within the next 12 months. With the capital we provide, together with the projected EBITDA or cash flow from operations of our portfolio companies, we expect each of our portfolio companies to be able to finance their development over the next 12 to 18 months without requiring additional outside capital subsequent to completion of our investment. Once our portfolio companies become eligible to be listed on a senior exchange, which we generally expect to occur within 12 to 18 months after completion of our investment, we would expect our portfolio companies to be positioned to conduct, if appropriate, a registered offering either simultaneous with obtaining a senior exchange listing or within a reasonable time thereafter.

|

In addition to the foregoing, we seek to primarily concentrate our investments in micro-cap and small-cap companies having annual revenues in excess of $10 million that we believe have a strong prospect of revenue and earnings growth. We also expect our portfolio companies to generally have an equity valuation, before our investment, of at least $25 million. These criteria provide general guidelines for our investment decisions; however, we may not require each prospective portfolio company in which we choose to invest to meet all of these criteria.

11

The success of our strategy depends largely on our ability to identify micro-cap and small-cap companies that are committed to becoming, and that we believe we can assist in becoming, public companies. With over ten years experience sponsoring going public transactions, we believe that our investment adviser has the experience and expertise to assess which micro-cap and small-cap companies are public ready and to assist such companies in achieving public status in a timely and cost-effective manner. Our investment structure is designed to ensure that there is a shared commitment to going public between us and the management teams of each of our portfolio companies. As part of our investment, we will typically require that our portfolio companies undertake certain steps, prior to our investment, that we believe are important to becoming a public reporting company, and the completion of such steps will provide us satisfactory evidence of the portfolio company’s commitment to filing a registration statement under the Securities Act or the Exchange Act and obtaining a senior exchange listing within approximately 18 months after the closing of our investment.

In the event a portfolio company fails to complete the going public process in a satisfactory manner, we will likely take steps to exit the investment. However, in such cases, it may be difficult to sell the investment and we may have little or no recourse against the portfolio company. Our options to liquidate the investment in such cases will likely be limited to a private sale of the investment to a third party or a strategic sale or merger involving the portfolio company. There are also a number of private secondary markets that specialize in the sale of private securities that may provide us a source of qualified buyers in the event that we have to liquidate the investment privately, subject to any contractual restrictions on a private resale transaction that may be imposed on us by a portfolio company.

We believe the structure of our investments as convertible preferred stock or convertible debt instruments may provide an economic incentive for our portfolio companies to complete the going public process since these instruments typically automatically convert into common stock upon completion of an IPO or a senior exchange listing, in which case future preferred dividends or interest obligations, if any, would cease. We also protect our investments by typically requiring certain governance and audit requirements be completed prior to the closing of our investment, including the delivery of audited financial statements in final or in draft, but substantially completed, form. There can be no assurance that a portfolio company will become a public company and obtain a listing on an acceptable exchange. In addition, we consider the real incentive for our portfolio companies to become public to be what we believe are the advantages of becoming a public company, primarily, the access to the broader public capital markets for future capital raises and the potentially higher equity valuations that are typically afforded more liquid public companies. An important part of our investment adviser’s evaluation and due diligence process focuses on assessing the appeal that a prospective portfolio company may have in the public markets, as well as its suitability for achieving and maintaining public company status. In addition, while we expect to make passive, non-controlling investments where we have little power to control the management, operations and strategic decision-making of our portfolio companies, we expect to provide managerial assistance to our portfolio companies, upon their request, throughout the investment process, especially as it pertains to the engagement of third party advisers and consultants with which our investment adviser has relationships, the completion of the going public process through the filing of a registration statement, and the design of an overall public markets strategy.

In order to qualify for and maintain RIC status, the size of our individual portfolio company investments will be restricted in order to comply with specified asset diversification requirements on a quarterly basis. As a result, to comply with these diversification requirements, we expect that the average size of our individual portfolio company investments will represent approximately 5% of our total assets. Based on our total assets as of December 31, 2010 and the $50 million to $100 million in total capital that we expect to raise in our continuous public offering which concludes on June 30, 2011, we anticipate that the average size of our future portfolio company investments will range from approximately $2.5 million to $5 million. However, we may invest more than this amount in certain opportunistic situations, provided we do not invest more than 25% of the value of our total assets in any portfolio company and the value of our portfolio company investments representing more than 5% of our total assets do not in the aggregate exceed 50% of our total assets.

In our sponsored deals, we will be the lead investor in our portfolio investments and, to the extent our portfolio companies require more financing than we desire to invest, we anticipate seeking non-affiliated co-investors to participate in the financing of our portfolio companies. In addition, in our sponsored deals, our portfolio companies may engage one or more placement agents with whom our investment adviser has relationships to assist in capital raising from non-affiliated co-investors. We may also seek non-affiliated co-investors to participate in the financing of our portfolio companies in our financing participation deals.

12

Keating Investments

Our investment activities are managed by Keating Investments. Keating Investments was founded in 1997 and is an investment adviser registered under the Investment Advisers Act of 1940, as amended. The managing member and majority owner of Keating Investments is Timothy J. Keating. Our investment adviser’s senior investment professionals are Timothy J. Keating, our President, Chief Executive Officer and Chairman of our Board of Directors, Ranjit P. Mankekar, our Chief Financial Officer, Treasurer and a member of our Board of Directors, Frederic M. Schweiger, our Chief Operating Officer, Chief Compliance Officer and Secretary and Kyle L. Rogers, our Chief Investment Officer. In addition, Keating Investments’ other investment professionals consist of two portfolio company originators, an investor relations director and a financial analyst. Under our Investment Advisory and Administrative Services Agreement with Keating Investments, we have agreed to pay Keating Investments, for its investment advisory services, an annual base management fee based on our gross assets as well as an incentive fee based on our performance. See “Investment Advisory and Administrative Services Agreement.”

Market Opportunity

We believe the following market opportunity exists to provide financing for public ready micro-cap and small-cap companies.

Continued need for growth capital by public ready micro-cap and small-cap companies looking for an equity partner. We believe a significant opportunity exists to provide growth, expansion and other types of capital to public ready micro-cap and small-cap companies that have reached a point in their development where additional equity capital is needed. We believe our investment model offering non-controlling equity investments will provide an attractive vehicle for our portfolio companies to meet their capital needs. While we expect our portfolio companies to become public reporting companies, we believe that we will be viewed by prospective portfolio companies as a provider of “patient” capital, given our focus on longer-term growth versus short-term gains, which we believe will serve as a key differentiator for us. We believe there are a significant number of companies that are looking for the type of “patient” capital we will be able to provide. We also bring enhanced value to our portfolio companies through our investment adviser’s going public, aftermarket support and public markets expertise, rather than through financial engineering or as a strategic business adviser to our portfolio companies.

We intend for our portfolio companies to go public either through the filing of a registration statement under the Securities Act or the Exchange Act. For portfolio companies that we believe are IPO qualified, with the additional growth capital we provide through our investment, we expect these companies to go public by filing a registration statement under the Securities Act and completing an IPO. For portfolio companies that are either not IPO qualified or fail to complete an IPO under the Securities Act in a timely manner, we expect these companies to go public by filing a registration statement under the Exchange Act.

In general, we seek to invest in micro-cap and small-cap companies that we believe will generally be able to file a registration statement with the SEC within approximately three to twelve months after our investment is completed and obtain an exchange listing within approximately 18 months after the closing of our investment. If, for any reason, a traditional IPO is unavailable due to either market conditions or an underwriter’s minimum requirements, we believe that we can provide each of our portfolio companies with an alternative and more certain solution to becoming public and obtaining an exchange listing through our investment adviser’s going public, aftermarket support and public markets expertise. We can provide no assurance, however, that the micro-cap and small-cap companies in which we invest will be able to successfully complete the SEC registration process, or that they will be successful in obtaining a listing on either a junior or senior exchange within the expected timeframe, if at all.

Difficult market for private equity and venture capital funds. We believe that the public ready micro-cap and small-cap companies in which we intend to invest are also feeling the adverse impacts from the difficulties in current private equity and venture capital markets. Private equity funds that typically relied on commercial banks or a syndicate of lenders to provide the debt capital necessary to produce their “leveraged” returns have seen these traditional sources of capital become largely closed. We believe that the impact of these substantially tightened credit markets will be even more pronounced on the micro-cap and small-cap companies we intend to target, as they tend to be unable to support large debt burdens. As a result, we believe private equity firms will be less interested in providing growth capital to public ready micro-cap and small-cap companies where leverage is limited.

We believe that venture capital funds are typically the least desired financing for our targeted growth companies due to pricing and control issues. While many venture capital firms have cash to invest, they typically insist on a controlling interest in their portfolio companies. While the market for venture-backed IPOs has recently shown signs of improvement, there continue to be liquidity pressures on venture capital funds that are seeking attractive exit alternatives and prospects of extended holding periods and possible “mark to market” valuation write-downs. We also believe that venture capital funds, which currently have limited exit alternatives for their investments, will be required to fund all or a portion of any additional pre-IPO financing rounds for their existing portfolio companies. As venture capital funds seek to bring in co-investors for these additional pre-IPO rounds, we believe that we are well positioned, through our financing participation deals, to participate in these later round financings of typically later-stage micro-cap and small-cap companies, which in some cases may be attractively priced compared to prior rounds.

13

Accordingly, we believe that many viable public ready micro-cap and small-cap companies that fit our investment criteria will have limited, if any, access to the private equity market or venture capital financing, or that we will have the opportunity to participate in pre-IPO financing rounds with venture-backed later-stage companies, and we believe this trend is likely to continue for the foreseeable future.

Further, since our typical equity investment will be a non-controlling interest, we believe there is a significant opportunity for us to become a capital provider of choice for entrepreneurial businesses that are unwilling to give up a controlling interest typically mandated by both private equity and venture capital funds. While we generally have no direct control over the management and strategic direction of our portfolio companies, we intend to ensure that our portfolio companies’ management teams have a meaningful equity stake and that their interests are aligned with our interests as an investor – mainly, to create stockholder value through a widely held and actively traded public stock. As part of the going public process, we intend to also provide our portfolio companies with recommendations on the composition of their Board of Directors, which we will typically require to be comprised of a majority of independent directors so as to satisfy the initial listing requirements of most senior exchanges.

IPO financing alternative. We believe that there exist significant and continuing opportunities to originate and lead investments in public ready micro-cap and small-cap companies. We believe that the market for the companies that we are targeting has historically been characterized by continual change, which creates an ongoing need for capital within that marketplace. We believe that there exists a significant market opportunity to meet the capital requirements of a growing number of these businesses as they find access to the U.S. public and private capital markets relatively limited. In addition, we believe that the capital markets have tended in recent years to be focused on larger funds and larger deals – deals which are magnitudes larger than what is required by the public ready micro-cap and small-cap companies we target.

We believe that we can offer public ready micro-cap and small-cap companies that have solid financial qualifications and strong growth prospects with an attractive, well-structured capital markets alternative which is supported by our investment adviser’s going public, aftermarket support and public markets expertise. We believe that we can provide each of our portfolio companies with an alternative and more certain solution to becoming public and obtaining an exchange listing if, for any reason, a traditional IPO is unavailable due to either market conditions or an underwriter’s minimum requirements. Our focus will be to identify these companies and provide an investment once they have proven they are ready to become a public company. We also believe our investment process and going public through the filing of a registration statement under the Securities Act or the Exchange Act may prove more time-effective and less costly than a traditional IPO for the micro-cap and small-cap companies we intend to target that are not currently IPO qualified. In addition, our investment in each portfolio company, unlike an IPO, will not generally depend on general market conditions or prevailing investor sentiment. We also believe that our investment adviser’s going public expertise and access to third-party advisers and consultants, that we expect will be retained by our portfolio companies, will allow our portfolio companies’ management teams to concentrate on maximizing their business potential and marketplace influence as we proceed through our disciplined and systematic going public process.

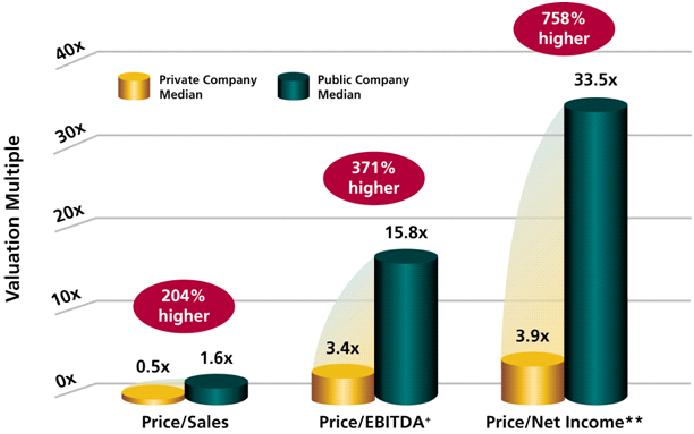

Benefits of being a public company. Typically, we believe investors place a premium on liquidity, or having the ability to sell stock quickly. As a result, we believe that public companies typically trade at higher valuations than private companies with similar financial attributes. By going public, we believe that our portfolio companies may be able to receive the benefit of this liquidity premium, provided that they are successful in obtaining a listing on a senior exchange; however, there can be no assurance that our portfolio companies will trade at these higher valuations.

14

Source: Pratt’s Stats® at BVMarketData.com, Public StatsTM at BVMarketData.com as of February 17, 2011, for transaction between January 1, 2006, and December 31, 2010. Used with permission from Business Valuation Resources, LLC.

+Valuation based on 6,000+ private and public company transactions under $100 million. EBITDA means earnings before interest, taxes, deprecation and amortization.

**Keating Investments, LLC calculations based on those companies having positive net income and EBITDA; valuation data based on private and public company transactions under $100 million.

| In addition to higher valuations, we believe that public companies also enjoy other benefits, including: | ||

| ● |

Lower cost of capital, superior access to the capital markets, and less stock dilution to founders when raising additional capital;

|

|

| ● |

Creation of a stock currency to fund acquisitions;

|

| ● |

Equity-based compensation to retain and attract management and employees;

|

| ● |

More liquidity for founders, minority shareholders, and investors; and

|

| ● |

Added corporate prestige and visibility with customers, suppliers, employees and the financial community.

|

Of course, public companies also incur significant obligations, such as the cost of periodic financial reporting, compliance with the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), required disclosure of sensitive company information and restrictions on stock sales by major or controlling shareholders. But for the type of micro-cap and small-cap companies we intend to target, we believe that the capital-raising opportunities and other benefits of being public may substantially outweigh these disadvantages. Additionally, under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) signed into law in July 2010, publicly reporting companies with a public float below $75 million are now permanently exempt from the auditor attestation requirements under Section 404(b) of the Sarbanes-Oxley Act. While all public companies will continue to be required to assess the effectiveness of their internal control over financial reporting, the more costly requirement for the company’s independent auditors to report on management’s assessment will no longer be required for public companies with a public float below $75 million.

15

However, we can provide no assurance that the portfolio companies in which we may invest will be successful in completing the SEC registration process to become a public company, or if they do so, that they will be able to obtain a subsequent listing on either a junior or senior exchange. Any failure to do so could substantially reduce or eliminate the market premium associated with being a publicly traded company.

Investment Objective

Our investment objective is to maximize our portfolio’s capital appreciation while generating current income from our portfolio investments. In furtherance of that objective, our primary emphasis will be to attempt to generate capital gains through our equity investments in micro-cap and small-cap companies, including through the conversion of the convertible debt or convertible preferred securities we will seek to acquire in such companies. While a portion of our investments may, at any given time, include a component of interest or dividends, we do not expect to generate significant current yield on our portfolio company investments. To date, none of our portfolio company investments have generated, nor are they expected to generate, interest or dividend income.

Investment Strategy

We implement the following strategies to take advantage of the market opportunity for providing capital to public ready micro-cap and small-cap companies that we believe have strong prospects for growth and which are at a point in their development where we believe a significant equity investment is required:

Visionary, industry leading management. We seek to invest in businesses with a strong management team with industry experience, a visionary business strategy, a passionate commitment to achieve results, the proven ability to execute and lead, and a track record of being able to attract experienced industry talent. At the time of our investment, our portfolio companies must typically have in place, or be committed to hiring, a qualified chief financial officer with a strong background in SEC reporting and compliance with proven experience in managing a micro-cap or small-cap public company’s financial reporting, internal controls, accounting and finance functions, and investor relations.

Innovative and quality products. We focus our investments on companies where there is a proven demand for the products or services they offer rather than focusing on ideas that have not been proven or situations in which a completely new market must be created. We look for businesses that are innovators, have technologies or products that extend, accelerate, or disrupt identified markets, have premium niche products capable of higher and more sustainable margins, and are able to attract top sales and engineering talent. We target companies whose business will benefit from exposure as a public company and have appeal to retail and institutional investors alike.

Large potential markets. We seek to provide capital to established micro-cap and small-cap companies with demonstrated growth that we believe is sustainable in industries where we believe there are substantial, leading edge market opportunities. We focus on micro-cap and small-cap companies across a broad range of industries and markets that we believe will be capable of attracting interest from retail and institutional investors. We focus on industries that we believe are being transformed or created anew by technological, economic and social forces – such as globalization, demographics, environment, energy, the knowledge economy and the Internet. We look for businesses whose products or services are capable of moving into the mass market and disrupt existing, more mature markets. We tend to limit our exposure to companies where long-term growth is dependent on favorable economic factors – such as a strong economy, rising consumer and business sentiment, lowering interest rates, falling inflation and stable financial markets.

Consistent and predictable results. We focus on micro-cap and small-cap companies that have realistic operating targets set by management that are consistently achieved, have a demonstrated ability to grow market share profitably, have growing and sustainable profits, generate or have the potential to generate recurring revenue streams, have recognized technological barriers to market entry and have a commitment to stay ahead of innovation. We seek to invest in micro-cap and small-cap companies that we believe will be rewarded in the public markets for consistent and predictable financial results.

Aligned interests. We target micro-cap and small-cap companies that we believe offer growth opportunities and proactively approach them regarding investment possibilities. We believe that the experience of our investment adviser’s senior investment professionals and their understanding of public ready micro-cap and small-cap companies, our financing structure, our public markets strategy and our investment adviser’s going public expertise, and the opportunity to capture a potential liquidity premium as a publicly traded company will be attractive to prospective portfolio companies. We believe it is important that each of our portfolio companies’ management teams have a meaningful equity stake in their business and that their interests are aligned with our interests as investors in the portfolio company to create substantial stockholder value through a widely held and actively traded public stock.

16

Competitive Advantages

We believe that we have the following competitive advantages over other providers of capital to public ready micro-cap and small-cap companies including private equity firms, venture capital firms and reverse merger sponsors:

Public markets focus. We seek to invest in micro-cap and small-cap companies that are committed to, and capable of, becoming public companies and have defensible valuations to support our initial investment pricing. We believe we have expertise in evaluating whether a portfolio company is capable of becoming a successful public company – both management commitment and skills and public market appeal. By providing capital to micro-cap and small-cap companies that are at a point in their development where we believe an equity investment is required, we hope to accelerate their growth with a properly timed going public strategy. The going public process is a critical step in our overall investment process for each portfolio company that we expect certain audit and governance requirements will be substantially completed before we make our investment.

Going public expertise. We believe that our investment adviser’s senior investment professionals and various third party advisers and consultants, with which our investment adviser has relationships, have extensive experience in taking companies public and designing capital markets and investor relations programs. Our investment adviser had been a reverse merger sponsor for nearly a decade and completed 19 going public transactions between 2001 and 2007. Our investment adviser’s senior investment professionals and various third party advisers and consultants will assist our portfolio companies in this going public process. To the extent a portfolio company does not have sufficient qualified in-house personnel, we will generally require that one of our recommended third party advisers or consultants be retained by our portfolio companies to actively participate in and lead the going public process. The third party advisers or consultants will assist our portfolio companies by organizing and coordinating the due diligence process for the portfolio companies, providing information to the portfolio companies’ senior management on the regulatory framework and compliance requirements of public companies under the Securities Act and the Exchange Act, reviewing and analyzing the portfolio companies’ existing corporate governance, financial documents and structure, material contracts and business and financial plans, and assisting in the preparation of the portfolios companies’ registration statements and any other documents related to the going public process. We believe that these third party advisers and consultants are experienced in the going public process, SEC compliance matters, public company reporting, and legal and financial matters associated with micro-cap and small-cap companies. We believe the involvement of a third party adviser or consultant will result in a more coordinated, timely and cost-effective going public process – allowing each portfolio company’s management team to remain focused on growing their business.

Possibility of obtaining a senior exchange listing. We believe that a senior exchange listing, if obtained, generally will provide our portfolio companies with visibility, marketability, liquidity and third party established valuations, all of which will aid in their future capital raising efforts. More specifically, the advantages that a senior exchange listing would be expected to have for our portfolio companies include:

| ● |

Visibility – greater access to investment analyst coverage to disseminate our portfolio companies’ stories, and added corporate prestige and visibility with exchange listing;

|

| ● |

Valuation and liquidity – potential for more stock liquidity as retail brokers become more interested in making a market in the stock and soliciting their clients to purchase the stock and as institutional investors who typically do not invest in junior exchange-listed stocks consider investments; and

|

| ● |

Access to capital – greater interest from top- and mid-tier investment banking firms to conduct a subsequent registered offering for our portfolio companies.

|

We will utilize our investment adviser’s expertise in public markets strategies to assist our portfolio companies in the design of a comprehensive aftermarket support program aimed at achieving a senior exchange listing. We also will leverage our investment adviser’s expertise and access to their contacts and third party consultants to develop and execute a disciplined plan to upgrade our portfolio companies from a junior exchange listing to a senior exchange listing, which we anticipate will take 12 to 18 months after completion of our investment in each portfolio company.

We believe our public markets strategy, if successfully implemented and coupled with a successful listing on a senior exchange, will give us an expected portfolio company investment horizon of generally one to three years via an orderly public market exit, which we believe represents a substantially shorter investment horizon when compared to traditional private equity and venture capital investments which have investment periods of five to seven years from their initial investment.

17

However, we can provide no assurance that the portfolio companies in which we may invest will be successful in completing the SEC registration process to become a public company, or if they do so, that they will be able to obtain a subsequent listing on either a junior or senior exchange. Any failure to do so could substantially reduce or eliminate the market premium associated with being a publicly traded company.

Investment structure. We typically make a single investment, principally consisting of convertible debt, convertible preferred stock or other equity, after we are satisfied that a potential portfolio company is committed to and capable of becoming public and obtaining an exchange listing within our desired timeframes and has substantially completed certain audit and governance requirements to our satisfaction prior to the closing of our investment.

In evaluating both sponsored and financing participation deals, we utilize an investment process focused on the following factors:

| ● | Qualification. We obtain information from the potential portfolio company’s management, conduct a preliminary evaluation of threshold issues and make a determination as to whether the opportunity is qualified and deserving of additional investigation. |

| ● |

Evaluation. We undertake an in-depth evaluation of the opportunity with primary focus on understanding the business, historical and projected financial information, industry, competition and valuation to ascertain whether we have interest in pursuing the investment.

|

| ● |

Report Preparation. We prepare an internal investment report which discusses our evaluation findings and recommendations, together with an internal valuation report outlining our acceptable valuation ranges for an investment.

|

| ● |

Approval. Our investment adviser’s Investment Committee reviews the investment and valuation reports and, when appropriate, approves the investment subject to completion of satisfactory due diligence.

|

| ● |

Term Sheet. We prepare, negotiate and execute a term sheet with the portfolio company which, among other things, will establish the due diligence process and set a transaction closing time table (including the achievement of going public milestones). This step is not applicable to our financing participation deals since the terms and conditions of such an investment have typically already been set by the portfolio company.

|

| ● |

Due Diligence. We conduct an on-site due diligence visit and complete the gathering and review of due diligence materials.

|

| ● |

Co-Investment Documents. As required, we assist the portfolio company in the review, revision and preparation of a confidential business memorandum, company investment PowerPoint presentation and executive summary that will be used by us to approach co-investors on a selected basis or by the portfolio company and its placement agents to undertake a private placement offering. This step is typically not applicable to our financing participation deals as these documents or comparable information will normally already be available.

|

| ● |

Governance. We establish, and assist the portfolio company in satisfying, certain governance matters which may be required for an exchange listing and which we may designate as a condition to the closing of our investment (including the appointment of an independent board and the audit and compensation committees, the hiring, or the engagement of an executive recruiter to conduct a search for a qualified CFO, the engagement of a qualified independent auditor and completion of the audit).

|

| ● |

Placement Agent. As required, we assist the portfolio company in identifying potential placement agents to raise additional capital beyond the investment amount we intend to provide. This step is typically not applicable to our financing participation deals since either a placement agent will have already been engaged or the portfolio company will be handling the offering itself on a self-underwritten basis.

|

| ● |

Capital Raising; Going Public Preparation. We assist the portfolio company in monitoring the capital raising process, by introducing co-investors on a selected basis, and in achieving certain “going public” milestones which we may designate as a condition to the closing of our investment. This step is typically not applicable to our financing participation deals; however, on a selected basis, we may introduce certain co-investors to the portfolio company.

|

18

| ● |

Investment Closing. At closing, we make our investment, principally consisting of convertible debt or convertible preferred stock or other equity.

|

| ● |

Completion of Going Public Process. Following the closing of our investment, we will provide managerial assistance to the portfolio company in their completion of the going public process, as needed, within the general time frames set forth below:

|

|

●

|

For a Sponsored Deal:

|

|

| (i) If we believe that the portfolio company is able to complete a traditional IPO based primarily on its current or anticipated revenue and profitability levels measured against recent comparable IPO transactions, which we refer to herein as “IPO qualified” or an “IPO qualified company,” we expect that the portfolio company will file a registration statement under the Securities Act within approximately nine months after closing and complete the IPO and obtain a senior exchange listing within approximately 15 months after closing. If the portfolio company fails to complete an IPO within the 15-month time frame, the portfolio company is expected to file a registration statement under the Exchange Act and become a reporting company within 18 months after closing. The final terms of a sponsored deal will be subject to negotiation, and there is no assurance that we will be able to include terms in our sponsored deals which will require the portfolio company to undertake all or any of these actions within these time periods. | ||

| (ii) If we believe that the portfolio company is not IPO qualified at the time of our investment, we expect that the portfolio company will file a registration statement under the Exchange Act within three to six months after closing and obtain a junior or senior exchange listing within 15 months after closing. | ||

| ● | For a Financing Participation Deal: | |

| We expect that the portfolio company, which will typically be IPO qualified, will file a registration statement under the Securities Act within 12 months after closing and complete an IPO and obtain a senior exchange listing within 18 months after closing. |