Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LIFELOCK, INC. | d728800d8k.htm |

1

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com LIFELOCK

MAY 2014

EXHIBIT 99.1 |

Safe

Harbor Statement ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 2

This presentation contains “forward-looking” statements that are based on

our beliefs and assumptions and on information currently available to us.

Forward-looking statements include information concerning our possible or assumed future results of operations, financial goals,

business strategies, financing plans, competitive position, product development,

membership growth, strategic and enterprise opportunities and partnerships,

marketing and advertising plans, industry environment, potential growth opportunities, potential market opportunities and

the effects of competition.

Forward-looking statements include all statements that are not historical facts and

can be identified by terms such as “anticipates,”

“believes,” “could,” “seeks,” “estimates,”

“intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or

similar expressions and the negatives of those terms. Forward-looking statements

involve known and unknown risks, uncertainties and other factors that may cause

our actual results, performance or achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements.

Forward-looking statements represent our beliefs and assumptions only as of

the date of this presentation. You should read the documents that we file with the Securities and Exchange Commission (SEC), including

the risks detailed from time to time therein, completely and with the understanding

that our actual future results may be different from what we expect. Except as

required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons

actual results could differ materially from those anticipated in the

forward-looking statements, even if new information becomes available in the

future. This presentation includes certain non-GAAP financial measures as

defined by SEC rules. As required by Regulation G, we have provided a

reconciliation of those measures to the most directly comparable GAAP measures, which

is available in the Appendix. |

Recent

Business Highlights ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 3

•

Recorded the 36th consecutive quarter of sequential growth in revenue and cumulative

ending members.

•

Added approximately 344,000 gross new members in the first quarter of 2014 and

ended the quarter with approximately 3.22 million members.

•

Achieved a retention rate of 87.5% for the first quarter of 2014, compared with 87.2%

for the first quarter of 2013.

•

Increased

monthly

average

revenue

per

member

by

10%

to

$10.81

for

the

first

quarter

of 2014 from

$9.80

for the first quarter of 2013.

•

Launched

a

partnership

with

Vivint

TM

,

one

of

the

largest

home

automation

services

providers

in

North

America,

that

will

provide

VivintTM

customers

the

ability

to

bundle

their new or existing service package with LifeLock’s identity theft protection

offerings.

•

Exceeded Q1 guidance on top and bottom line. Raised full year guidance on

revenue, Adj EBITDA, Adj EPS and free cash flow. |

The Cost

of Identity Fraud ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 4

MILLION

US victims of

identity fraud

in 12 month period**

BILLION

cost of

identity fraud

in US in 2012

***

MILLION

number of

records exposed by

data breach in 2013

****

data breach

notification recipients

became a fraud victim

**

Identity theft is the

#1 COMPLAINT

reported in the US

for the last 14 years

*

* Colleen Tressler, ‘Identity theft tops list of consumer complaints for 14th

consecutive year,” Federal Trade Commission, Feb 27, 2014.

** Q32013; Identity Theft Tracking Study; a commissioned survey conducted July/August by

Forrester Consulting on behalf of LifeLock for period ending July/August 2013.

*** The Bureau of Justice Statistics bulletin, Victims of Identity Theft, 2012

(December 2013)

**** Online Trust Alliance, 2014 Data Protection & Breach (2014)

|

The

Increasing Risk of Identity Fraud ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 5

*2013 estimated users eMarketer (2013).

**Forrester research custom forecast for LifeLock (2013).

***2013 sales estimate. eMarketer (2013).

****FTC Consumer Sentinel Data Book for 2013 (2014). Based on the number of complaints

filed with FTC.

***** A commissioned survey conducted by Forrester Consulting on behalf of LifeLock, Q4

2013. Incidence of social network usage, mobile devices for smart phone users, e-commerce sales.

BILLION

Social Network

Users

*

7%

Incidence

Rate

*****

BILLION

Mobile

Devices**

8%

Incidence

Rate

*****

TRILLION

E-Commerce

Sales

***

7%

Incidence

Rate

*****

OF ALL

Reported

Claims

**** |

Concerned

About

Security

–

78

Million

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 6

30+ Million are doing something

40+ Million are doing nothing

Current Market Share

3 Million |

Adults

in US ©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 7

240 Million

Income of $50K Plus |

Enterprise Market Opportunity

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 8

216 Million

Transactions in 2013

3.4 Billion

Target Opportunity |

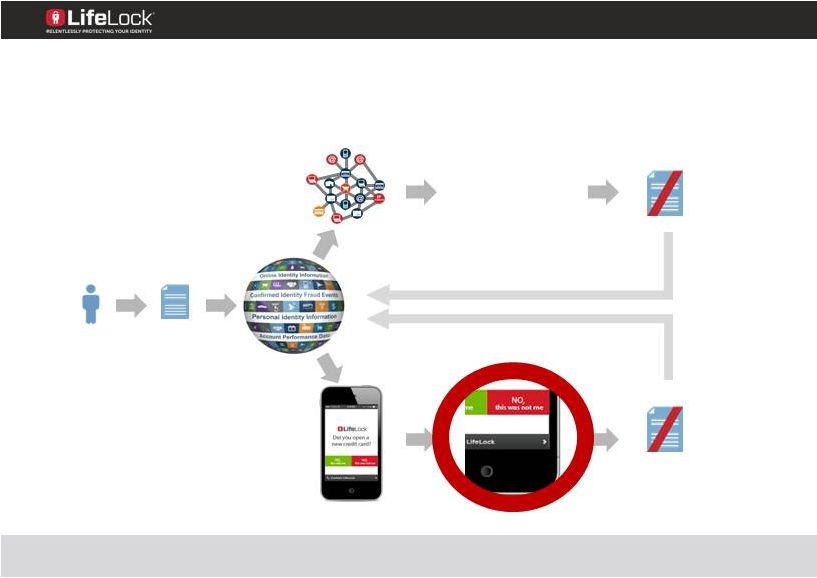

Proactive Identity

Use Alerts

The LifeLock Ecosystem

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 9

Real-time ID

Scores

Technology

Platform

Predictive

Analytics

Data

Repository

Data growth builds

momentum

Member Data

Elements &

Authenticating

Responses

Cross-Industry

Data Elements |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 10

Growth Strategy

Take advantage of our unique ecosystem

Expand data inputs

Evolve targeting and messaging

Leverage mobile

Grow partner channel

Long Term Vision –

Identity Bureau |

IDA

Market: Leading Enterprises across a wide range of industries

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 11

Wireless Providers

4 of the Top 5 Carriers

Credit Card Issuers

7 of the Top 10 Issuers

Retail Card Issuers

Over 75% Market Share

Alternative Lenders

Auto Lenders

Alternative Payments |

Superior Performance From Differentiated Data

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com •

Over 1 trillion data elements

•

Over 2 billion high-value

consumer events

•

Unique data others don’t see

•

Over 3.3 million known identity frauds

•

Can score 100% of US adult population

ID

Network:

A

real-time,

cross-industry

network

of

consumer behavioral data

12 |

A broad

network of identity behavioral connections and linkages provides deep insight into

identity risk 13

Visibility into unusual identity

behavior such as high velocity

Uncovering Risk

-

Name

-

Phone

-

Date of Birth

-

Email Address

-

Address

-

SSN

-

Fraud Application

-

Application

Legend

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 20

9

41

17

Confirmed fraud connected to

identity elements

3 |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 14

Enable the Enterprise, Empower the Consumer

ID Score: 721 |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 15

Growth Strategy: 3.4 Billion Alertable Transactions

Expand the Core

580 Million

Penetrate Adjacent Markets

360 Million

Establish eCommerce Market

2.5 Billion

Market Opportunity |

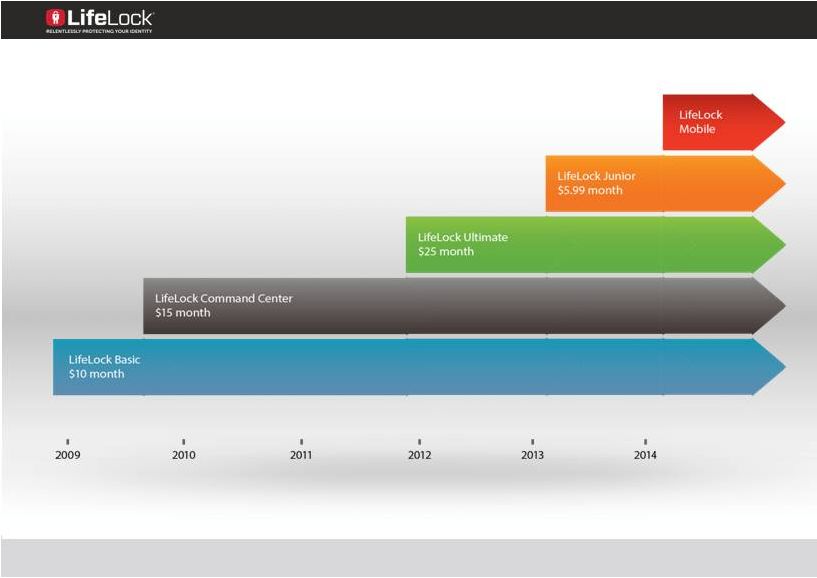

Product

Evolution ©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 16 |

LifeLock Consumer -3 Layers of Protection

17

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com Proactive alerts

that empower

consumers

24x7 Certified

resolution

specialists to

handle your case

Monitor over a

trillion data points

every minute of

every day |

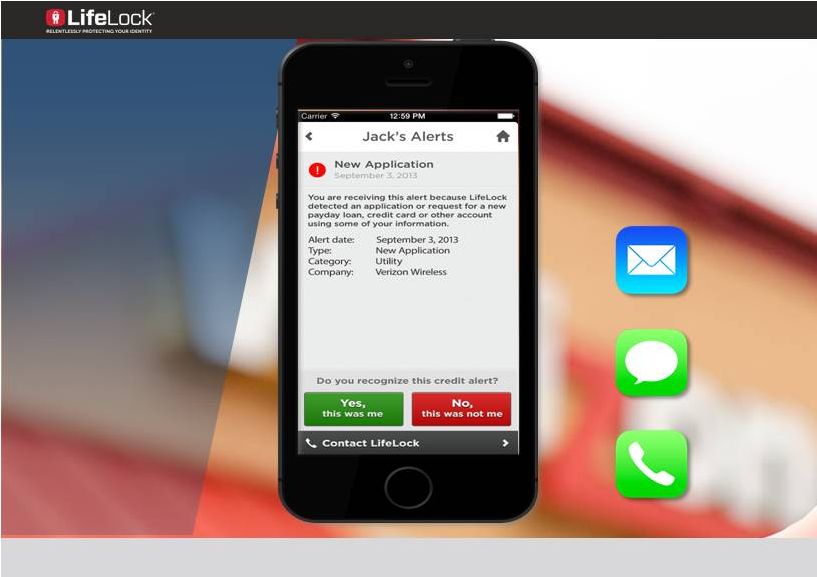

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com Live free in

an always

connected

world

18

email

SMS /

TEXT

Integrated

Voice

Response |

Priorities

19

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com REACH

CONVERSION

Members

VIRALITY

MONETIZATION

Continuum Process

1

2

3

4

$

$

$ |

Myth

#1: “My credit card protects me” 20

•

Narrow Visibility

•

Card

Fraud

Not

Identity

Protection

Credit Card |

Myth

#2: “I can do this by myself” 21

DIY

•

Limited DIY Steps

•

Not Realistic

•

Not Real Time

•

Not Effective |

Myth

#3: “Credit monitoring is good enough” 22

Credit Monitoring

•

Not Comprehensive

•

Speed Matters

•

Reactive Not Proactive |

The

LifeLock Difference… 23

Unique

Data

Superior

Technology

Trusted

Brand

Growth, Retention, Customer Satisfaction |

Multi-Channel GTM Strategy

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 24

Direct To Consumer

Marketing

Partner Distribution

Channels |

25

Television: A More Diverse Mix |

Shifting Media Spend Towards Digital

26

2012

2013

2014 (est)

Online

Offline

$ |

Educate, Educate, Educate

27 |

A

commissioned survey conducted in January 2014 by MSI International on behalf of LifeLock.

Base: Total Respondents (aware)

Q10b.

Imagine you were signing up for Security Identity Protection service. Which number

best describes how likely you would be to consider the following companies? (10-point scale: 10=extremely likely

to consider; 1=not at all likely to consider)

Brand Leadership

28 |

Top

Decile Net Promoter Score ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 29

Member Retention –

87.5% |

Partner

Overview ©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 30

Co-Marketing

Embedded

Affiliates

Employee Benefits

Breach

Direct Response |

2014

Partner Channel Growth ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 31

Strategic partner investments in 2014. |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 32

Profile:

Mid-Size Community Bank

Bank had $2.5 billion

in assets

Overview:

A commercial bank displaced

a credit monitoring offer

with LifeLock.

Financial Services Case Study

Credit

Monitoring

# of Members

LifeLock

1055

3738

LTV Revenue per Member

Credit

Monitoring

LifeLock

$415

$810 |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 33

Team

Tenure

Experience

Don Beck

Ten Months

Involver, Postini, Adobe

Seth Greenberg

Eleven Months

Intuit, eHobbies

Mike Hargis

Seven Months

CareerBuilder, GE

Villi Iltchev

Ten Months

Salesforce, HP, Merrill Lynch

Larry McIntosh

Eight Years

Pepsi, McAfee

Jill Nash

Eleven Months

Levi Strauss,

Yahoo!, Gap Inc.

Charles Schwab

Steve Seoane

Three Years

ID Analytics, LexisNexis, Capital One

Connie Suoo

Four Years

Gateway, Experian |

34

©2014 LifeLock Inc. 1-800-LifeLock

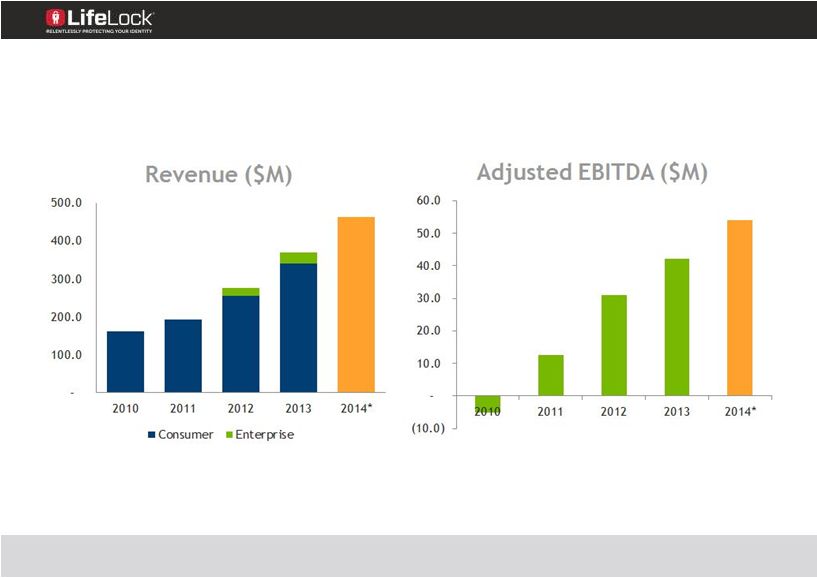

LifeLock.com * 2014 Revenue and Adjusted EBITDA figures are based on

the mid-point of the guidance provided in our Earnings Results call on April 30, 2014 for the full year ending December 31, 2014

Revenue and Adjusted EBITDA |

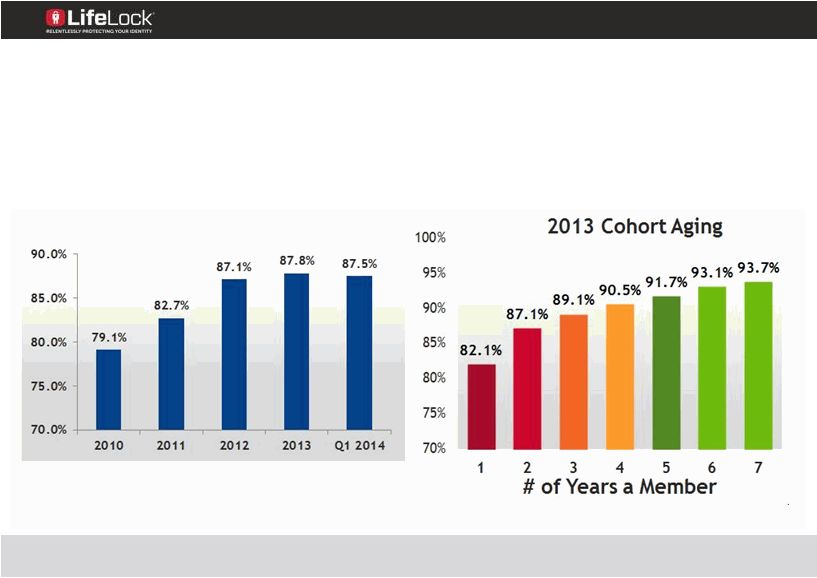

35

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com Member Metrics |

Revenue

per Member ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 36

Rev/Mbr

YOY Growth

Rev/Member

YOY Growth

0%

2%

4%

6%

8%

10%

12%

7.50

8.50

9.50

10.50

11.50

2010

2011

2012

2013

Q1 2014 |

Product

Mix ©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 37

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2010

2011

2012

2013

2013 GNM

LifeLock Ultimate

LifeLock Command Center |

38

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com Annual Retention Rate |

©2014 LifeLock Inc. 1-800-LifeLock

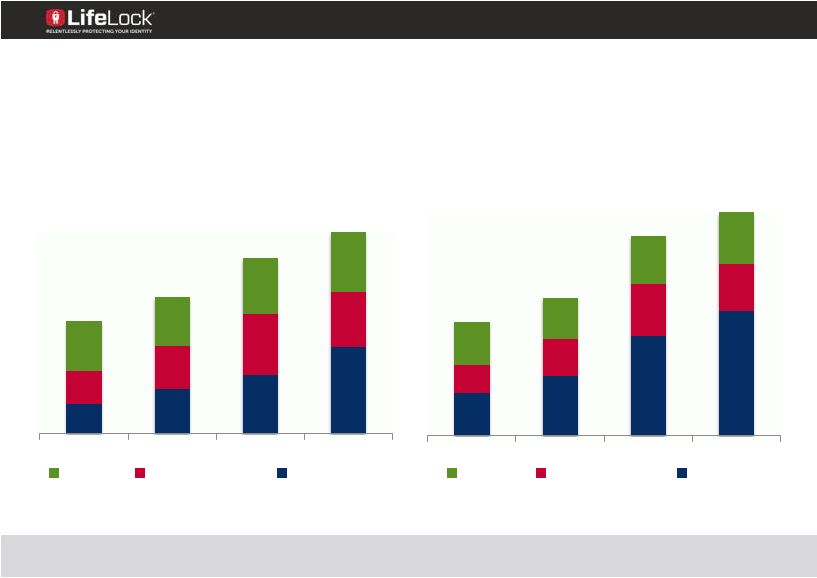

LifeLock.com 39

Growing Lifetime Value

Member Base

New Members

2010

2011

2012

2013

COA

Fulfillment

Net LTV

2010

2011

2012

2013

COA

Fulfillment

Net LTV |

Free

Cash Flow ©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 40

* 2014 Free Cash Flow is based on the mid-point of the guidance provided in our

Earnings Results call on April 30, 2014 for the full year ending December 31, 2014

$(30.0)

$(10.0)

$10.0

$30.0

$50.0

$70.0

$90.0

2009

2010

2011

2012

2013

2014*

Free Cash Flow |

Strong

Balance Sheet ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 41

Dec 31, 2013

$Millions

Mar 31, 2014

$Millions

Cash and Marketable Securities

172.6

191.2

Goodwill & Intangible Assets

205.3

203.1

Deferred Tax Assets

49.1

52.7

Total Other Assets

36.3

40.0

Deferred Revenue

119.1

136.3

Debt

-

-

Total Other Liabilities

42.0

44.0

Stockholder’s Equity

302.2

306.7 |

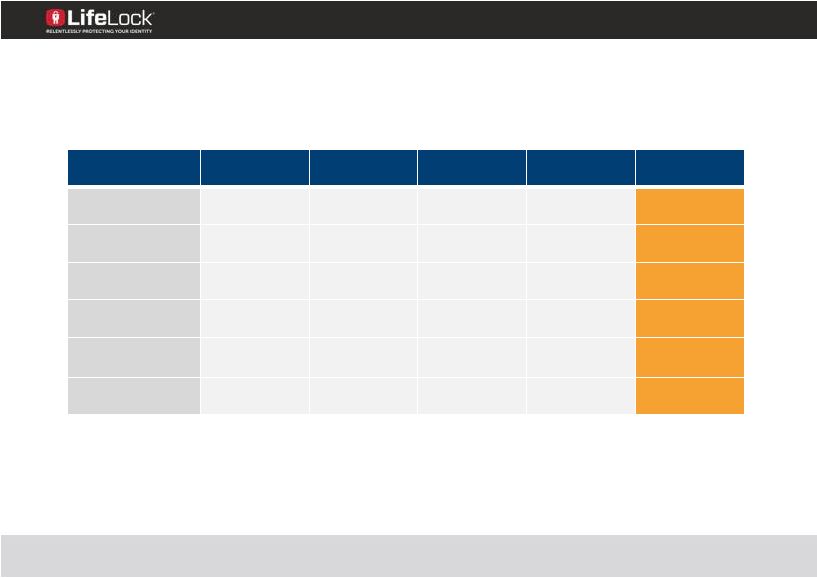

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 42

Long Term Goals

2010

2011

2012

2013

LT

Goals

Adj GM%

68%

68%

71%

73%

75% -

77%

Adj S&M

48%

47%

44%

44%

36% -

39%

Adj T&D

13%

9%

10%

10%

9% -

10%

Adj G&A

13%

8%

7%

9%

7% -

8%

Adj EBITDA

(3.2)%

6.4%

11.2%

11.4%

20% -

25%

FCF

(10)%

12%

15%

18%

18 –

23%

1

1

These goals are forward-looking, are subject to significant business,

economic, regulatory, competitive, and other uncertainties and contingencies,

many of which are beyond the control of the Company and its management, and are based

upon assumptions with respect to future decisions, which are subject to change.

Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause

these variations, please consult the “Risk Factors” section in our filings

with the Securities and Exchange Commission from time to time, including our Form

10-K for the year ended December 31, 2013 . Nothing in this presentation should be regarded as a representation by any person that these

goals will be achieved and the Company undertakes no duty to update its goals.

|

SaaS +

Internet + Security (128 companies) ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 43

Revenue >$100mm

115 companies |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 44

SaaS + Internet + Security

Revenue >$100mm

Revenue Growth >20%

Gross Margin >70%

EBITDA Margin >10%

FCF Margin >10%

10 companies |

Key

Investment Highlights ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 45

Large

and

growing

addressable

market

Leader

in

consumer

identity

theft

and

enterprise

fraud

protection

Industry

leading

service

offering

Strong

barriers

to

entry:

data,

analytics,

technology

platform,

and

brand

Experienced

management

team

with

track

record

of

execution

Predictable

subscription

model

Compelling

combination

of

growth,

profitability,

and

cash

flow |

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 46

Appendix |

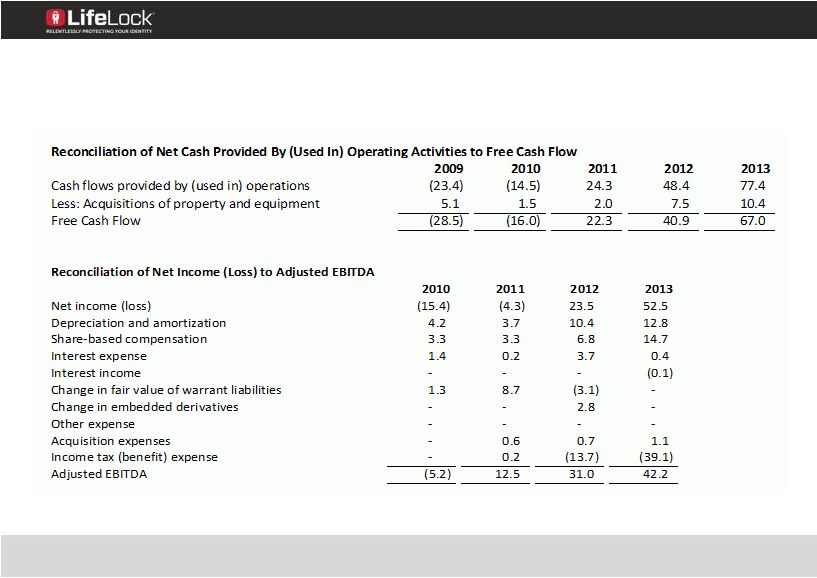

GAAP to

Non-GAAP Reconciliations ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 47

|

GAAP to

Non-GAAP Reconciliations ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 48

Reconciliation

of

Cost

of

Services

to

Adjusted

Cost

of

Services

2010

2011

2012

2013

Cost

of

services

43.1

51.4

79.9

100.2

Share-based

compensation

(0.2)

(0.3)

(0.6)

(0.9)

Adjusted

Cost

of

Services

42.9

51.1

79.3

99.3

Reconciliation

of

Gross

Profit

to

Adjusted

Gross

Profit

2010

2011

2012

2013

Gross

Profit

110.8

131.3

19

6.5

269.4

Share-based

compensation

0.2

0.3

0.6

0.9

Adjusted

Gross

Profit

111.0

131.6

19

7.2

270.4 |

GAAP to

Non-GAAP Reconciliations ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 49

Reconciliation

of

Technology

and

Development

Expenses

to

Adjusted

Technology

and

Development

Expenses

2010

201

1

2012

2013

Technology

and

development

expenses

21.3

17.7

29.5

40

.9

Share-based

compensation

(0.8)

(0.8)

(1.7)

(3.8

)

Acquisition

related

expenses

-

-

-

-

Adjusted

technology

and

development

expenses

20.5

16.9

27.8

37

.1

Reconciliation

of

Sales

and

Marketing

Expenses

to

Adjusted

Sales

and

Marketing

Expenses

20

10

201

1

2012

2013

Sales

and

marketing

expenses

78.8

9

1.2

12

3.0

162

.9

Share-based

compensation

(0.7)

(0.7)

(1

.1)

(1.9)

Adjusted

sales

and

marketing

expenses

78.1

9

0.5

12

1.9

161

.0 |

GAAP to

Non-GAAP Reconciliations ©2014 LifeLock Inc.

1-800-LifeLock LifeLock.com 50

Reconciliation

of

General

and

Adm

inistrative

Expenses

to

Adjusted

General

and

Administrative

Expenses

2010

2011

2012

2013

General

and

administrative

expenses

23.3

17.5

24.6

44.1

Share-based

compensation

(1.5)

(1.5)

(3.3)

(8.1)

Acquisition

related

expenses

-

(0.6)

(0.7)

(1.0)

Adjusted

general

and

administrative

expenses

21.8

15.4

20.6

34.9 |

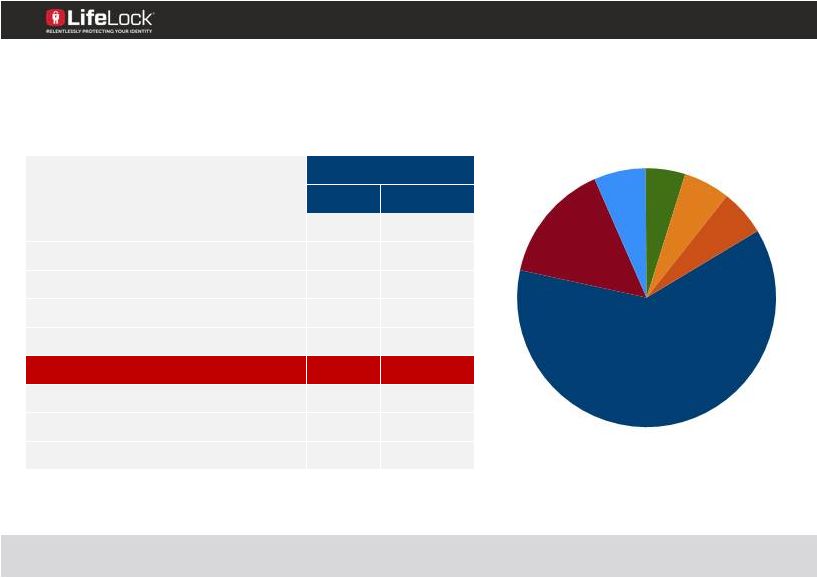

Components of Profit and Loss

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 51

Cost of Service

2013

$M

% of Rev

Consumer revenue

340.1

92.0%

Enterprise revenue

29.5

8.0%

Total revenue

369.7

100.0%

Adj COS

99.3

26.9%

Adj GM

270.4

73.1%

Adj S&M

161.0

43.5%

Adj T&D

37.1

10.0%

Adj G&A

34.9

9.4%

Adj EBITDA

42.2

11.4%

Credit

Card Fees

Enterprise

Depn/Other

Member

Services

Fulfillment

Partners

(incl

Insurance) |

Components of Profit and Loss

©2014 LifeLock Inc. 1-800-LifeLock

LifeLock.com 52

Sales and Marketing

2013

$M

% of Rev

Consumer revenue

340.1

92.0%

Enterprise revenue

29.5

8.0%

Total revenue

369.7

100.0%

Adj COS

99.3

26.9%

Adj GM

270.4

73.1%

Adj S&M

161.0

43.5%

Adj T&D

37.1

10.0%

Adj G&A

34.9

9.4%

Adj EBITDA

42.2

11.4%

Production

Media

Enterprise

Personnel

Depn/

Other

Commissions |