Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K INVESTOR PRESENTATION 07.25.12 - TCF FINANCIAL CORP | 8-K_IP07252012.htm |

|

Exhibit 99.1 |

|

|

|

TCF

Financial Corporation |

|

1 |

|

|

|

|

|

Table of Contents |

|

2 |

|

|

|

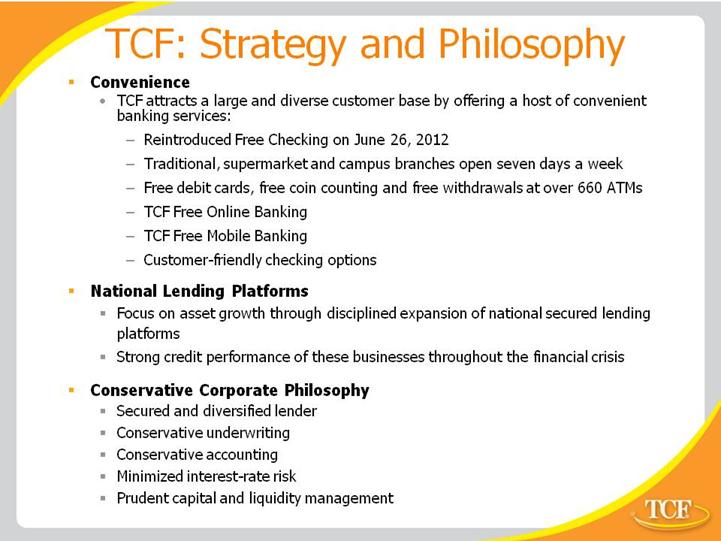

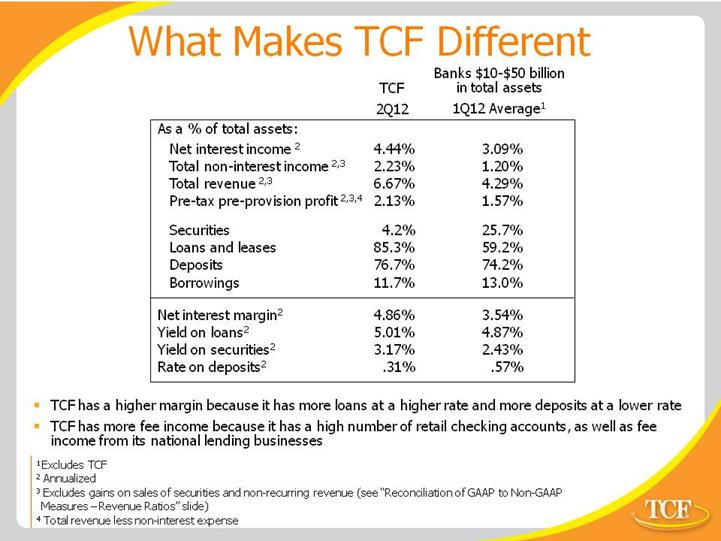

What Makes TCF Different |

|

5 |

|

|

|

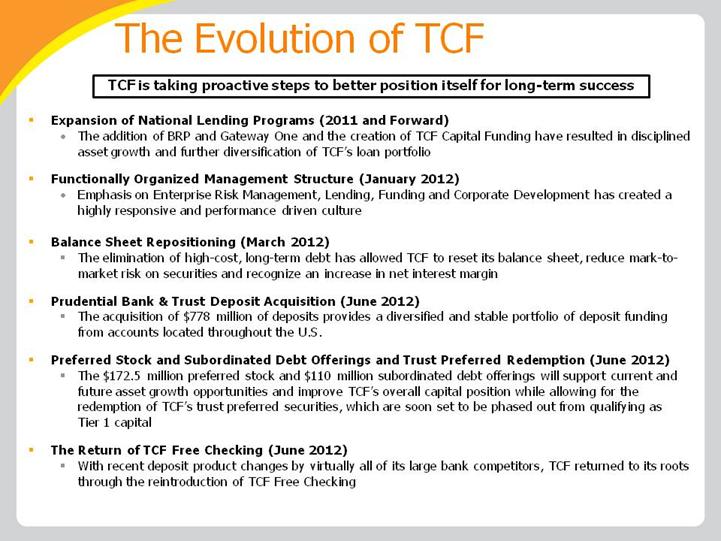

The Evolution of TCF |

|

6 |

|

|

|

|

|

Revenues & Expenses |

|

7 |

|

|

|

|

|

Diversified Core Revenue Base1 |

|

8 |

|

|

|

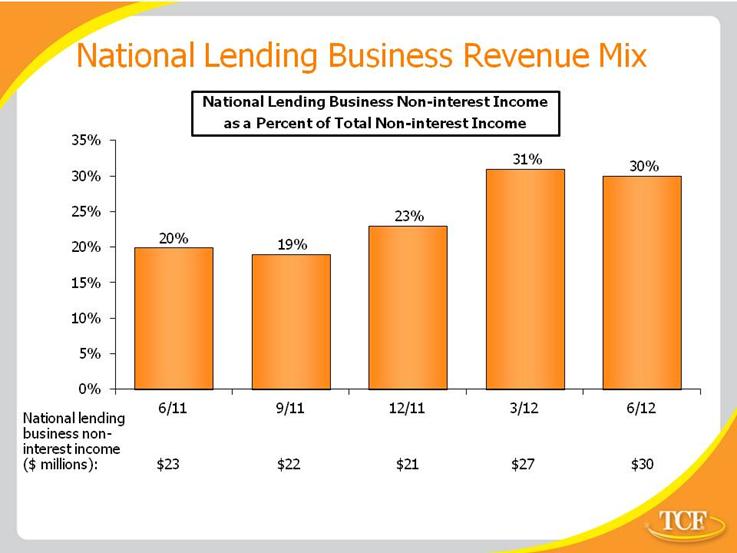

National Lending Business Revenue Mix |

|

9 |

|

|

|

|

|

Gains on sales of auto loans and other

revenue |

|

10 |

|

|

|

|

|

Core Operating Expenses 1 |

|

11 |

|

|

|

|

|

Credit Quality |

|

12 |

|

|

|

|

|

Credit Quality Summary |

|

13 |

|

|

|

|

|

Credit Quality Trends |

|

14 |

|

|

|

|

|

Credit Quality Trends (continued) |

|

15 |

|

|

|

|

|

Consumer Real Estate TDRs |

|

16 |

|

|

|

|

|

Consumer Real Estate TDR Process |

|

17 |

|

|

|

|

|

Capital |

|

18 |

|

|

|

Capital Ratios – Holding Company |

|

19 |

|

|

|

Balance Sheet Growth |

|

20 |

|

|

|

Strong Deposit Franchise |

|

21 |

|

|

|

Loan & Lease Balances |

|

22 |

|

|

|

Loan & Lease Geographic

Diversification |

|

23 |

|

|

|

Leasing & Equipment Finance |

|

24 |

|

|

|

TCF Inventory Finance |

|

25 |

|

|

|

Auto Finance |

|

26 |

|

|

|

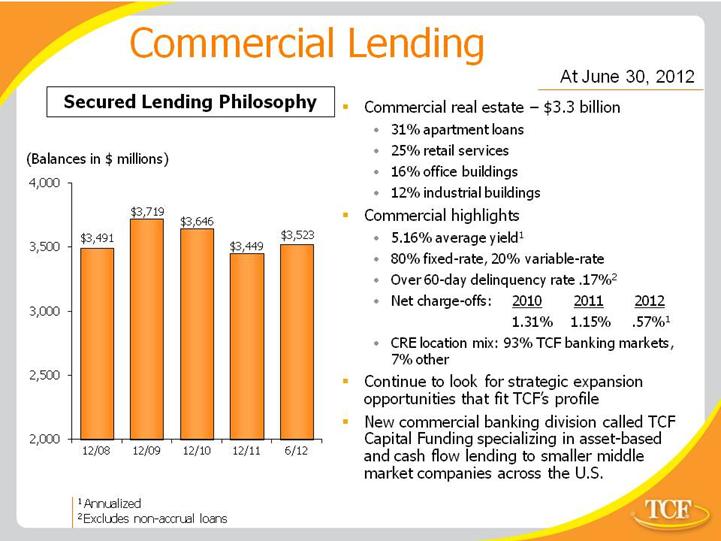

Commercial Lending |

|

27 |

|

|

|

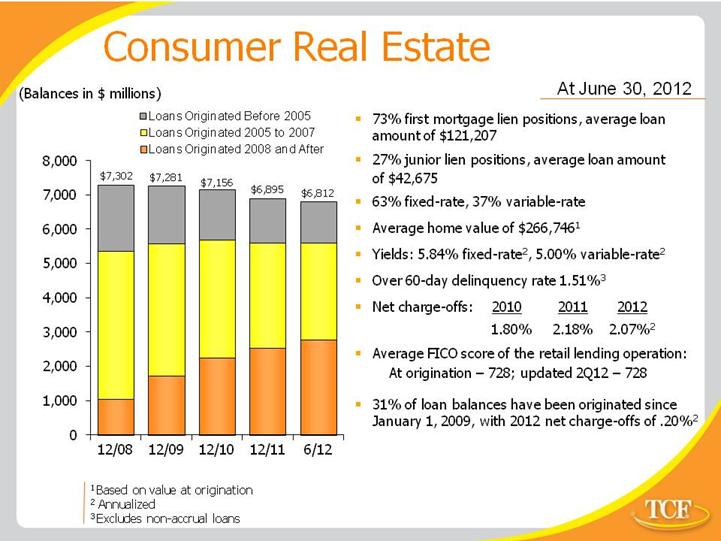

Consumer Real Estate |

|

28 |

|

|

|

Appendix |

|

29 |

|

|

|

Cautionary Statements for Purposes of the Safe

Harbor Provisions of the Securities Litigation Reform Act

|

|

30

|

|

|

|

Reconciliation of GAAP to Non-GAAP Measures

–Tangible Realized Common Equity1 |

|

32 |

|

|

|

Reconciliation of GAAP to Non-GAAP Measures

–Revenue Ratios |

|

33 |

|

|

|

Reconciliation of GAAP to Non-GAAP Measures

–Core Operating Expenses |

|

34 |

|

|

|

Reconciliation of GAAP to Non-GAAP Measures

–Total Tier 1 Common Capital Ratio1 |

|

35 |

|

|

|

Source References & Footnotes |

|

36 |