Attached files

| file | filename |

|---|---|

| 8-K - ANDEAVOR LOGISTICS LP | tllp125118-k.htm |

| EX-10.1 - TRUCKING TRANSPORTATION SERVICES AGREEMENT - ANDEAVOR LOGISTICS LP | exhibit101.htm |

| EX-99.1 - PRESS RELEASE - ANDEAVOR LOGISTICS LP | exhibit991pressrelease.htm |

Tesoro Logistics LP NYSE: TLLP 2012 Business Plan Update December 2011 Exhibit 99.2

2 This Presentation includes forward-looking statements. These statements relate to, among other things, projections of operational volumetrics and improvements, growth projects, cash flows, capital expenditures and future performance. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,“ “potential” and similar terms and phrases to identify forward-looking statements in this Presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside of our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward- looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. Please see our Risk Factor disclosures included in Form S-1/A filed with the SEC. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. We have estimated annual EBITDA, a non-GAAP financial measure, for the company and certain acquisitions and growth projects. Please see the Appendix for the definition and reconciliation of these annual EBITDA estimates. Forward Looking Statements

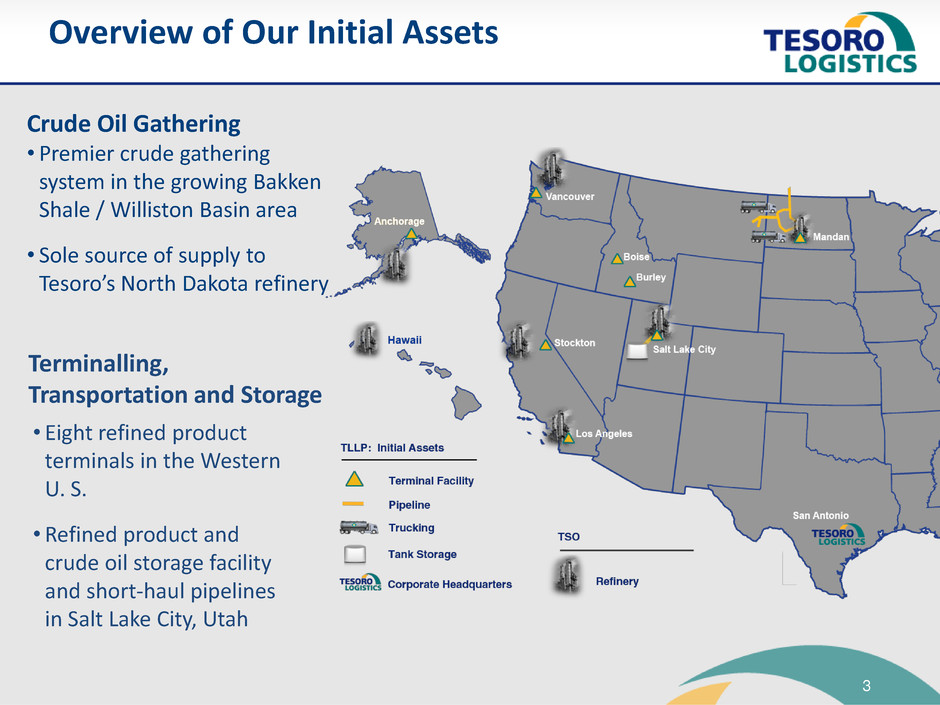

3 Overview of Our Initial Assets Crude Oil Gathering • Premier crude gathering system in the growing Bakken Shale / Williston Basin area • Sole source of supply to Tesoro’s North Dakota refinery Terminalling, Transportation and Storage • Eight refined product terminals in the Western U. S. • Refined product and crude oil storage facility and short-haul pipelines in Salt Lake City, Utah

4 Investment Highlights

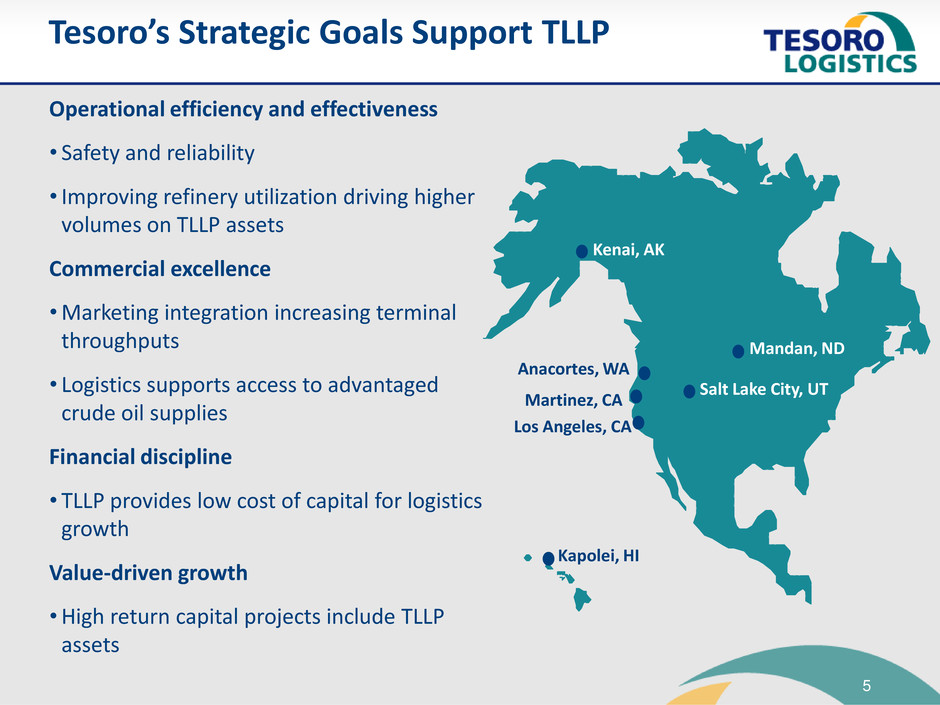

5 Tesoro’s Strategic Goals Support TLLP Operational efficiency and effectiveness • Safety and reliability • Improving refinery utilization driving higher volumes on TLLP assets Commercial excellence •Marketing integration increasing terminal throughputs • Logistics supports access to advantaged crude oil supplies Financial discipline • TLLP provides low cost of capital for logistics growth Value-driven growth •High return capital projects include TLLP assets Kenai, AK Mandan, ND Salt Lake City, UT Anacortes, WA Martinez, CA Los Angeles, CA Kapolei, HI

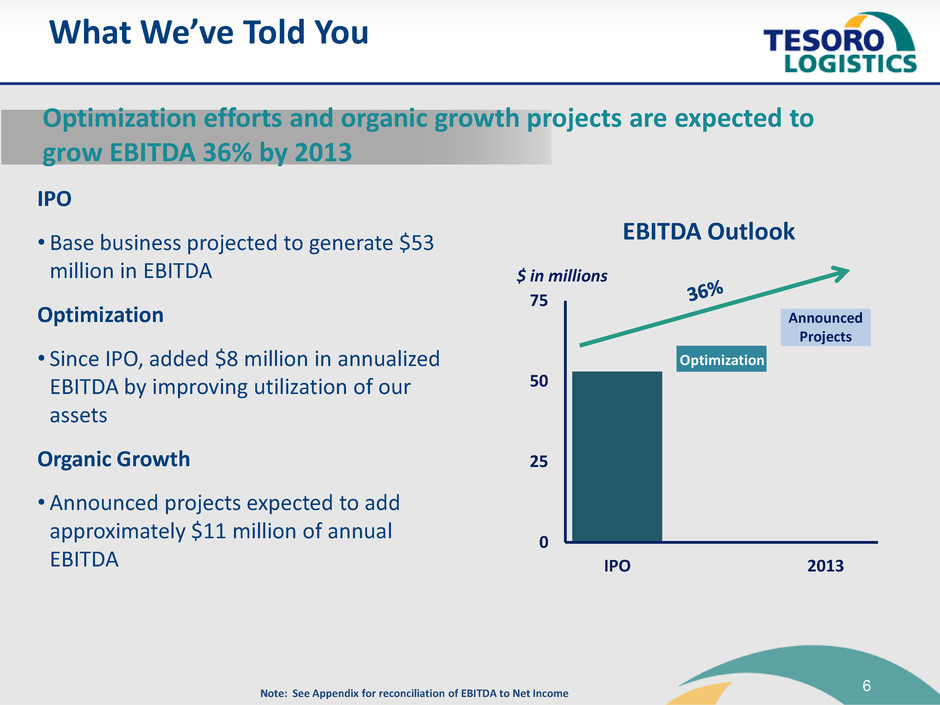

6 What We’ve Told You IPO • Base business projected to generate $53 million in EBITDA Optimization • Since IPO, added $8 million in annualized EBITDA by improving utilization of our assets Organic Growth • Announced projects expected to add approximately $11 million of annual EBITDA Optimization efforts and organic growth projects are expected to grow EBITDA 36% by 2013 0 25 50 75 IPO 2013 $ in millions Optimization Announced Projects EBITDA Outlook Note: See Appendix for reconciliation of EBITDA to Net Income

7 What’s New Organic Growth •Grow Bakken business: Double volume on our existing system backed by Tesoro demand • Grow terminal volumes supported by Tesoro’s marketing expansion and increased third party business • Invest $100 million through 2013, including approximately $15 million of previously announced projects Drop Downs • First drop down in 2012 of the Martinez Crude Oil Marine Terminal at the Martinez Refinery – Projected EBITDA of $8 million annually • Additional drop downs from Tesoro expected $100 million of planned EBITDA in 2013 driven by organic growth and drop downs Note: See Appendix for reconciliation of EBITDA to Net Income

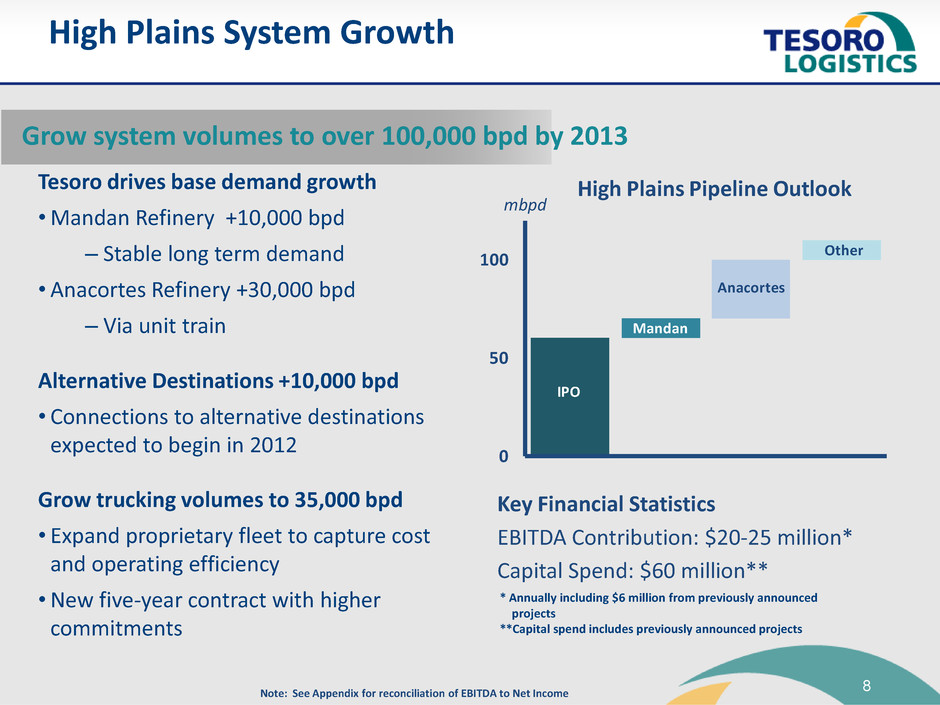

8 High Plains System Growth Tesoro drives base demand growth •Mandan Refinery +10,000 bpd – Stable long term demand • Anacortes Refinery +30,000 bpd – Via unit train Alternative Destinations +10,000 bpd • Connections to alternative destinations expected to begin in 2012 Grow trucking volumes to 35,000 bpd • Expand proprietary fleet to capture cost and operating efficiency •New five-year contract with higher commitments Grow system volumes to over 100,000 bpd by 2013 Key Financial Statistics EBITDA Contribution: $20-25 million* Capital Spend: $60 million** IPO Mandan Anacortes Other 0 50 100 High Plains Pipeline Outlook mbpd * Annually including $6 million from previously announced projects **Capital spend includes previously announced projects Note: See Appendix for reconciliation of EBITDA to Net Income

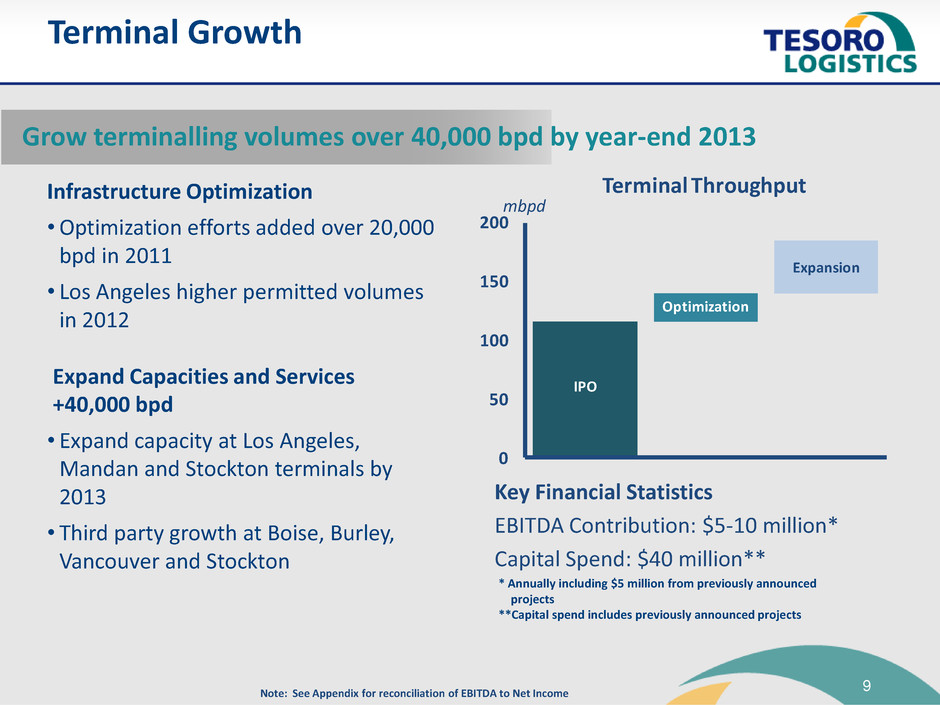

9 Terminal Growth Infrastructure Optimization •Optimization efforts added over 20,000 bpd in 2011 • Los Angeles higher permitted volumes in 2012 Expand Capacities and Services +40,000 bpd • Expand capacity at Los Angeles, Mandan and Stockton terminals by 2013 • Third party growth at Boise, Burley, Vancouver and Stockton Grow terminalling volumes over 40,000 bpd by year-end 2013 Key Financial Statistics EBITDA Contribution: $5-10 million* Capital Spend: $40 million** IPO Optimization Expansion 0 50 100 150 200 Terminal Throughput mbpd Note: See Appendix for reconciliation of EBITDA to Net Income * Annually including $5 million from previously announced projects **Capital spend includes previously announced projects

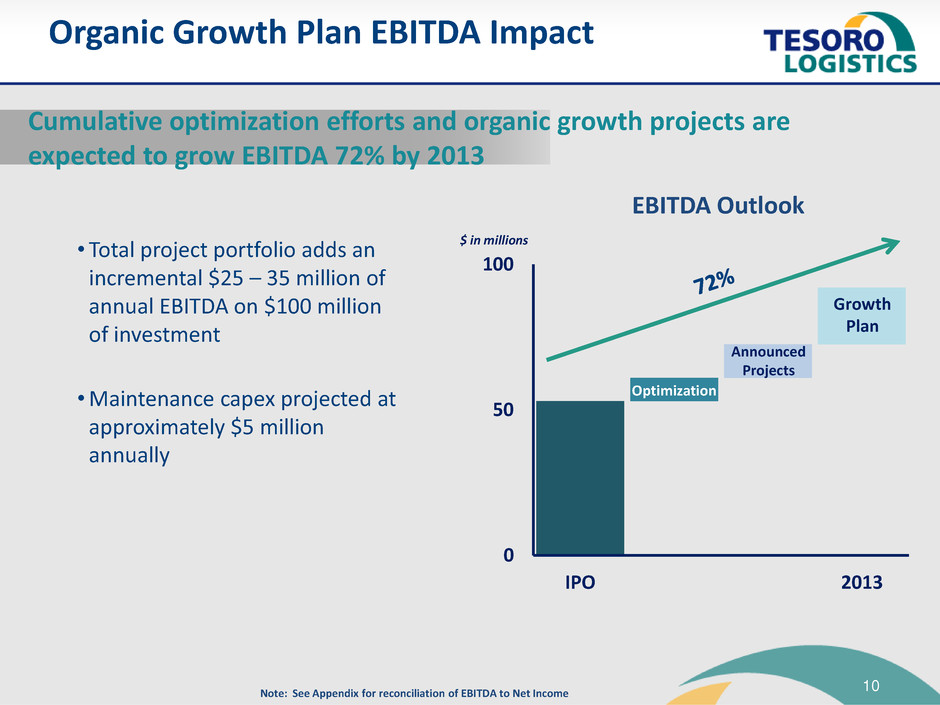

10 0 50 100 IPO 2013 $ in millions Organic Growth Plan EBITDA Impact • Total project portfolio adds an incremental $25 – 35 million of annual EBITDA on $100 million of investment •Maintenance capex projected at approximately $5 million annually Cumulative optimization efforts and organic growth projects are expected to grow EBITDA 72% by 2013 Announced Projects Optimization Growth Plan EBITDA Outlook Note: See Appendix for reconciliation of EBITDA to Net Income

11 First Drop Down Martinez Crude Oil Marine Terminal, Martinez, CA •Projected volume: 70,000 bpd •Wharf capacity of 145,000 bpd • Storage capacity of 425,000 barrels • Pipelines connecting to Tesoro’s Martinez, CA Refinery • EBITDA projected at $8 million annually •Average maintenance capex projected at approximately $0.5 million annually Long Term/Fee-Based Commitment •10-year commitment with two 5-year renewals •Minimum volume commitment at 90% of projected volumes Expected transaction closing in early 2012 • Expect to fund from available revolver capacity Note: See Appendix for reconciliation of EBITDA to Net Income

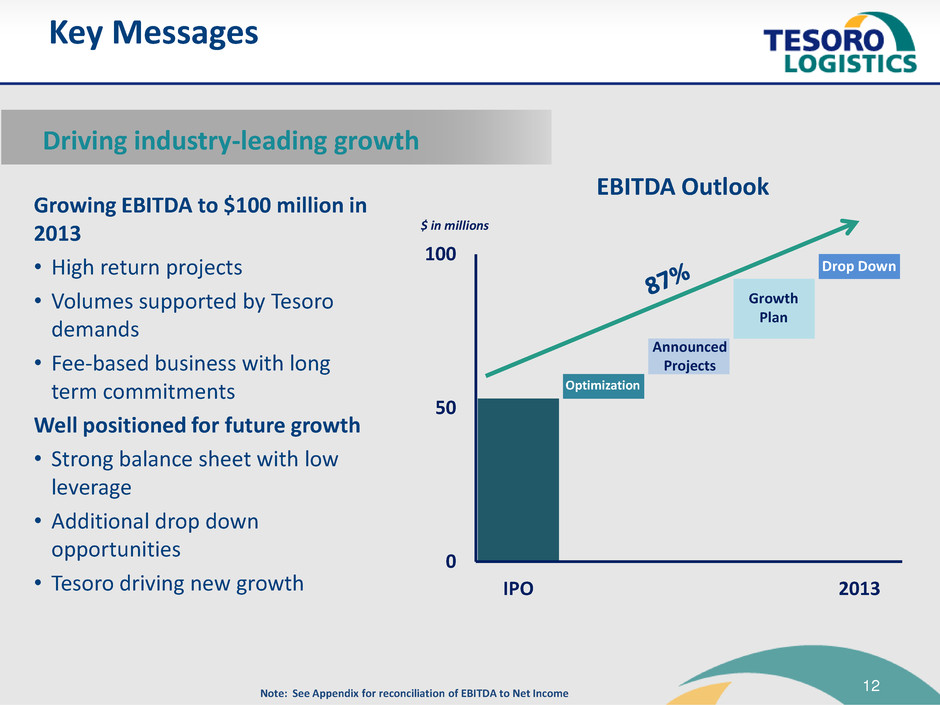

12 0 50 100 IPO 2013 Key Messages Growing EBITDA to $100 million in 2013 • High return projects • Volumes supported by Tesoro demands • Fee-based business with long term commitments Well positioned for future growth • Strong balance sheet with low leverage • Additional drop down opportunities • Tesoro driving new growth Driving industry-leading growth EBITDA Outlook $ in millions Optimization Announced Projects Growth Plan Drop Down Note: See Appendix for reconciliation of EBITDA to Net Income

13 Appendix

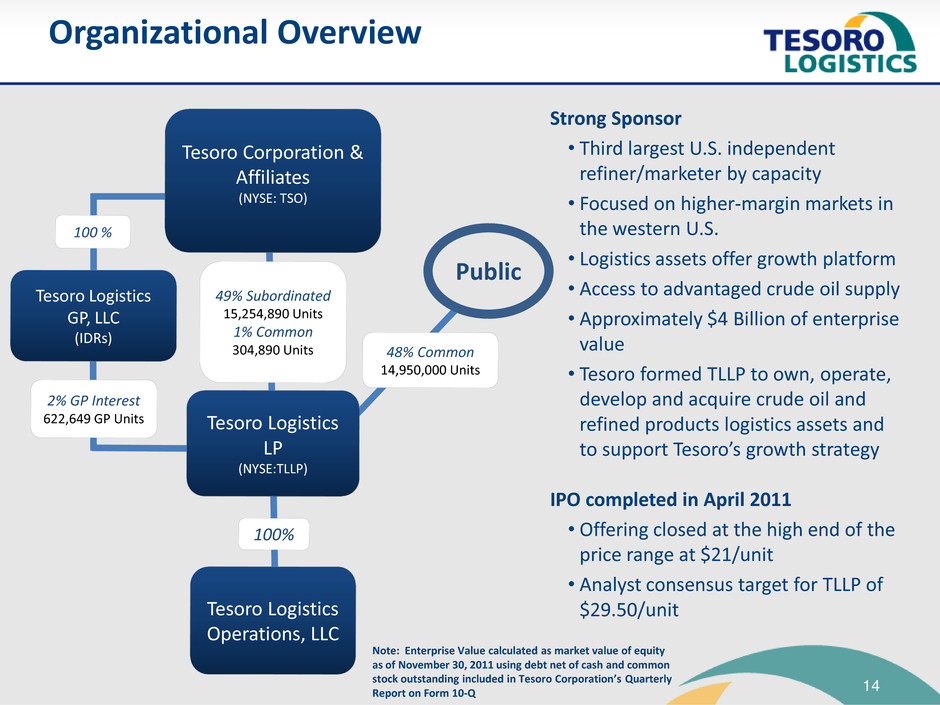

14 Strong Sponsor • Third largest U.S. independent refiner/marketer by capacity • Focused on higher-margin markets in the western U.S. • Logistics assets offer growth platform • Access to advantaged crude oil supply • Approximately $4 Billion of enterprise value • Tesoro formed TLLP to own, operate, develop and acquire crude oil and refined products logistics assets and to support Tesoro’s growth strategy IPO completed in April 2011 • Offering closed at the high end of the price range at $21/unit • Analyst consensus target for TLLP of $29.50/unit Organizational Overview Tesoro Corporation & Affiliates (NYSE: TSO) 100 % Tesoro Logistics GP, LLC (IDRs) Tesoro Logistics LP (NYSE:TLLP) Tesoro Logistics Operations, LLC 2% GP Interest 622,649 GP Units 49% Subordinated 15,254,890 Units 1% Common 304,890 Units 100% Public 48% Common 14,950,000 Units Note: Enterprise Value calculated as market value of equity as of November 30, 2011 using debt net of cash and common stock outstanding included in Tesoro Corporation’s Quarterly Report on Form 10-Q

15 Drop Down Growth Opportunities Product Terminals •Kenai, AK •Anacortes, WA •Martinez, CA Pipelines •Los Angeles, CA •Kenai, AK Marine Terminals •Kenai, AK •Anacortes, WA •Martinez, CA (2) •Long Beach, CA ROFO Assets

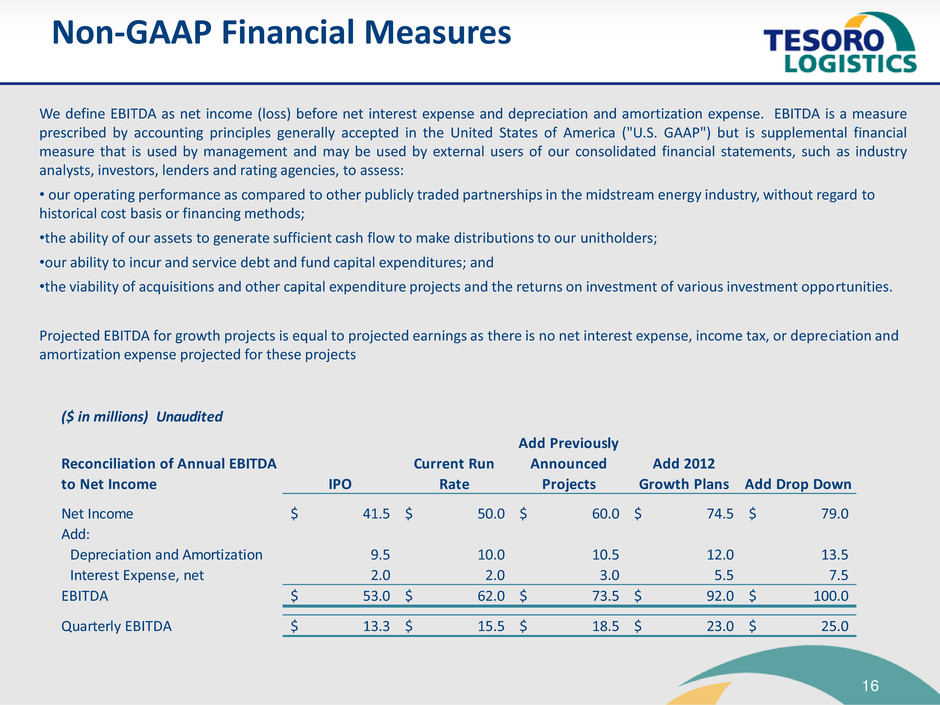

16 We define EBITDA as net income (loss) before net interest expense and depreciation and amortization expense. EBITDA is a measure prescribed by accounting principles generally accepted in the United States of America ("U.S. GAAP") but is supplemental financial measure that is used by management and may be used by external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, to assess: • our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; •the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; •our ability to incur and service debt and fund capital expenditures; and •the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. Projected EBITDA for growth projects is equal to projected earnings as there is no net interest expense, income tax, or depreciation and amortization expense projected for these projects Non-GAAP Financial Measures ($ in million ) Unaudited Re nciliation of Annual EBITDA N t Inc me IPO Current Run Rate Add Previously Announced Projects Add 2012 Growth Plans Add Drop Down N t Incom 41.5$ 50.0$ 60.0$ 74.5$ 79.0$ Add: Depreciation and Amortization 9.5 10.0 10.5 12.0 13.5 Interest Expense, net 2.0 2.0 3.0 5.5 7.5 EBITDA 53.0$ 62.0$ 73.5$ 92.0$ 100.0$ Quarterly EBITDA 13.3$ 15.5$ 18.5$ 23.0$ 25.0$

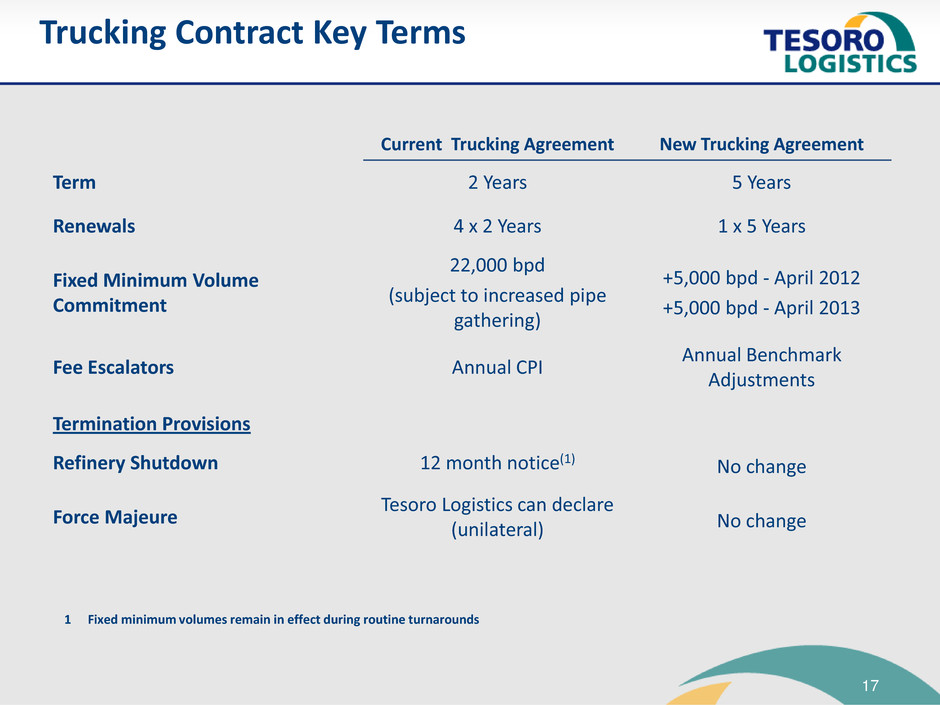

17 Trucking Contract Key Terms Current Trucking Agreement New Trucking Agreement Term 2 Years 5 Years Renewals 4 x 2 Years 1 x 5 Years Fixed Minimum Volume Commitment 22,000 bpd (subject to increased pipe gathering) +5,000 bpd - April 2012 +5,000 bpd - April 2013 Fee Escalators Annual CPI Annual Benchmark Adjustments Termination Provisions Refinery Shutdown 12 month notice(1) No change Force Majeure Tesoro Logistics can declare (unilateral) No change 1 Fixed minimum volumes remain in effect during routine turnarounds