Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33008

ICO GLOBAL COMMUNICATIONS

(HOLDINGS) LIMITED

(Exact name of registrant as specified in its charter)

| Delaware | 98-0221142 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Plaza America Tower I, 11700 Plaza America Drive, Suite 1010, Reston, Virginia 20190

(Address of principal executive offices including zip code)

(703) 964-1400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Class A common stock, par value $0.01 per share |

The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

As of June 30, 2009, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $81,403,420.

As of March 11, 2010, the registrant had 199,846,308 shares of Class A common stock and 53,660,000 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement for its 2010 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

Table of Contents

ICO GLOBAL COMMUNICATIONS (HOLDINGS) LIMITED

2009 ANNUAL REPORT ON FORM 10-K

INDEX

| Page | ||||

| PART I. | ||||

| Item 1. | 1 | |||

| Item 1A. | 11 | |||

| Item 1B. | 20 | |||

| Item 2. | 20 | |||

| Item 3. | 20 | |||

| Item 4. | 21 | |||

| PART II. | ||||

| Item 5. | 22 | |||

| Item 6. | 23 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 | ||

| Item 7A. | 36 | |||

| Item 8. | 37 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

73 | ||

| Item 9A. | 73 | |||

| Item 9B. | 75 | |||

| PART III. | ||||

| Item 10. | 75 | |||

| Item 11. | 75 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

75 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

75 | ||

| Item 14. | 75 | |||

| PART IV. | ||||

| Item 15. | 76 | |||

| Signatures | 77 | |||

Table of Contents

This Annual Report on Form 10-K (“Form 10-K”) contains certain forward-looking statements regarding future events and our future operating results that are subject to the safe harbors created under the Securities Act of 1933, as amended (“Securities Act”), and the Securities Exchange Act of 1934, as amended (“Exchange Act”). Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict, including those identified below under “Risk Factors.” Actual events or results could differ materially due to a number of factors, including those described herein and in the documents incorporated herein by reference.

| Item 1. | Business. |

Overview

ICO Global Communications (Holdings) Limited (“ICO Global”), along with its consolidated subsidiaries (collectively referred to as “us,” “we,” or the “Company”) is a development stage next-generation mobile satellite service (“MSS”) operator. We have one medium earth orbit (“MEO”) satellite in orbit (“F2”) and have ten additional MEO satellites in various stages of completion. Due to disagreements with Boeing Satellite Services International, Inc. (“BSSI”), the manufacturer and launch manager of our MEO satellite system, and the related litigation, as described below, we have not advanced the development of our MEO satellites since 2004. Prior to the cessation of our MEO development activities, we had invested approximately $2.6 billion into our MEO satellite system. We continue to explore ways to capitalize on our substantial investment in our MEO system and its related regulatory assets and to defend our spectrum assignments and claims. However, there is no assurance we will be successful, as discussed further below, and we could elect to discontinue our MEO-related efforts at such time as we conclude that we are unlikely to enhance stockholder value through such efforts.

Since August 2004, we have been engaged in litigation with The Boeing Company (“Boeing”) and BSSI arising out of agreements we had with BSSI for the development and launch of our MEO satellites. In October 2008, we received an award against Boeing and BSSI totaling $371 million in compensatory damages and $236 million in punitive damages. On January 2, 2009, the court presiding over the litigation entered judgment on the verdict, including pre-judgment interest, in the amount of $631.1 million. On February 26, 2009, the court denied most of Boeing and BSSI’s post-trial motions and granted one, and the judgment became final in the amount of $603.2 million. Since January 2, 2009, post-judgment interest has accrued on the full judgment amount at the rate of 10% simple interest per annum, or approximately $60 million per year. Boeing and BSSI filed their notice of appeal of the award on March 6, 2009, and we filed our notice of appeal on March 24, 2009. In May 2009, Boeing posted the full bond required to stay enforcement of the judgment, pending appeal, in the amount of approximately $904 million. Boeing and BSSI filed their appellate brief on October 26, 2009, and our appellate brief is currently due by March 22, 2010. Further reply briefing and oral argument will follow. We cannot predict the timing or outcome of the appeal process.

We are a Delaware corporation and were incorporated on March 17, 2000. Our principal executive office is located at 11700 Plaza America Drive, Suite 1010, Reston, Virginia 20190, and our telephone number is (703) 964-1400. Our website address is www.ico.com. The information contained in, or that can be accessed through, our website is not part of this Form 10-K.

In this Form 10-K, we use the terms “ICO,” “ICO Global,” the “Company,” “we,” “our” and “us” to refer to ICO Global Communications (Holdings) Limited and its consolidated subsidiaries and, where the context indicates, its predecessor corporation. Because, as described below, we deconsolidated DBSD North America, Inc. (formerly ICO North America, Inc.) and its subsidiaries from our financial operating results as of May 15, 2009, we do not include DBSD North America, Inc. or its subsidiaries in these terms for the period from May 15, 2009 forward. For various historical, operational and regulatory reasons, we have many subsidiaries through which we hold our assets and conduct our operations. We have included a chart with a summary of our organizational structure which appears in “Item 1—Business” within this Form 10-K.

1

Table of Contents

Recent Developments

Bankruptcy of DBSD North America, Inc.

On May 15, 2009, one of our majority-owned subsidiaries, DBSD North America, Inc., along with its subsidiaries (collectively referred to as “DBSD”) filed voluntary petitions for reorganization under Chapter 11 of Title 11 of the U.S. Bankruptcy Code (“Chapter 11 cases”) in the U.S. Bankruptcy Court for the Southern District of New York (“Bankruptcy Court”). In order to exit the Chapter 11 cases successfully, DBSD is required to propose, and obtain confirmation by the Bankruptcy Court of, a plan of reorganization that satisfies the requirements of the bankruptcy code. On May 30, 2009, DBSD filed its proposed plan of reorganization (as amended and modified by subsequent filing, the “Plan of Reorganization”). The primary purpose of the Plan of Reorganization is to effect the restructuring and substantial de-leveraging of DBSD’s capital structure. Under the Plan of Reorganization, holders of the DBSD’s $650 million aggregate principal amount of convertible notes would receive shares of common stock in the reorganized DBSD representing approximately 95% of its outstanding equity and we would receive shares of common stock representing approximately 5% of its outstanding equity, prior to dilution from any future new capital (beyond that committed in the exit financing) and made available to DBSD’s employees and other service providers. In addition, we would receive warrants, exercisable upon certain valuation events, to purchase at $0.01 per share up to an additional approximately 10% of the equity of reorganized DBSD. On October 26, 2009, the Bankruptcy Court issued a decision ruling in favor of confirmation of the Plan of Reorganization, and the Bankruptcy Court entered the order on November 23, 2009. On December 19, 2009, DBSD filed with the U.S. Federal Communications Commission (“FCC”) for approval of the transfer of control of DBSD spectrum licenses in accordance with the Plan of Reorganization, which is a condition precedent to DBSD’s exit from bankruptcy. The FCC is reviewing the transfer request, and if it does not approve the transfer, the Plan of Reorganization cannot be implemented in its current form. We cannot predict when the FCC will act on the request for transfer.

Rights Offering

On February 17, 2010, ICO Global launched a rights offering to its existing stockholders (“Rights Offering”), pursuant to which ICO Global offered to its stockholders shares of its Class A common stock at a purchase price of $0.70 per share (“Subscription Right”). Pursuant to the Rights Offering, we distributed one non-transferrable Subscription Right, at no charge, to each holder of our Class A common stock and one non-transferrable Subscription Right for each share of our Class B common stock held as of 5:00 p.m., New York City time, on February 8, 2010, the record date for the Rights Offering. Each non-transferrable Subscription Right represents the right to purchase 0.2056 of a share of our Class A common stock at a price of $0.70 per share. Subscription Rights were exercisable at any time prior to 5:00 p.m., New York City time, on March 9, 2010, the scheduled expiration of the Rights Offering. In total, Subscription Rights were distributed for the purchase of up to approximately 42,870,000 shares of our Class A common stock. The Subscription Rights are not transferable and were evidenced by Subscription Rights certificates. Fractional shares of our Class A common stock were not issued.

In connection with the Rights Offering, each of Eagle River Partners, LLC (“ERP”), certain accounts managed by Highland Capital Management, L.P. (collectively, “Highland Capital”) and Harbinger Capital Partners Masters Fund I, Ltd (“Harbinger”), each an existing stockholder of the Company or affiliates thereof, agreed to acquire from us, at the same subscription price of $0.70 per share, any shares of Class A common stock that are not purchased by the Company’s other stockholders (pursuant to the exercise of their basic subscription privilege and/or over-subscription privilege) in the Rights Offering, subject to certain conditions (“Standby Commitment”). Subsequently, Knighthead Master Fund, L.P. (“Knighthead”) and Caspian Capital Advisors, LLC (“Caspian”), or affiliates thereof, each agreed to assume one-half of Harbinger’s Standby Commitment. The maximum commitments accepted by ERP, Highland Capital, Knighthead and Caspian were $17.25 million, $8.5 million, $2.125 million and $2.125 million, respectively. We did not need to call on the Standby Commitment because the exercise of basic subscription and over-subscription privileges was sufficient to complete the Rights Offering. No compensation was paid to the standby purchasers for these standby arrangements.

2

Table of Contents

The Rights Offering closed on March 9, 2010 and we received proceeds of approximately $30 million. The proceeds from the Rights Offering are currently expected to be used for ongoing operational expenses. We may also use a portion of the net proceeds to acquire or invest in complementary businesses, products and technologies, as well as for capital expenditures. Pending these uses, we expect to invest the net proceeds in short-term, investment-grade securities.

Tax Benefits Preservation Plan

Effective January 29, 2010, our Board of Directors adopted a Tax Benefits Preservation Plan (“Tax Benefits Plan”) designed to preserve stockholder value and the value of certain tax assets primarily associated with net operating loss carry forwards (“NOLs”) under Section 382 of the Internal Revenue Code (“Section 382”). In connection with the Tax Benefits Plan, a dividend of Class A Rights and Class B rights, described more fully below, was paid to our stockholders of record at the close of business on February 8, 2010.

The Board of Directors adopted the Tax Benefits Plan in an effort to help us preserve our ability to utilize fully our NOLs, and to preserve potential future NOLs, in order to reduce potential future federal income tax obligations. As of December 31, 2009, we have substantial existing NOLs of approximately $353 million as well as additional potential NOLs. Under the Internal Revenue Code and the Treasury Regulations issued thereunder, we may “carry forward” these losses in certain circumstances to offset any current and future income and thus reduce its federal income tax liability, subject to certain restrictions. To the extent that the NOLs do not otherwise become limited, we believe that we will be able to carry forward a significant amount of NOLs, and therefore the NOLs could be a substantial asset for us. However, if we experience an “ownership change,” as defined in Section 382, the timing of usage and our ability to use the NOLs could be significantly limited.

The Tax Benefits Plan is intended to act as a deterrent to any person or group acquiring, without the approval of our Board of Directors, beneficial ownership of 4.9% or more of our securities, defined to include (i) shares of our Class A common stock and Class B common stock, (ii) shares of our preferred stock, (iii) warrants, rights, or options to purchase our securities, and (iv) any interest that would be treated as “stock” of the Company for purposes of Section 382 of the Internal Revenue Code or pursuant to Treasury Regulation § 1.382-2T(f)(18).

Pursuant to the Tax Benefits Plan, we issued one Class A Right for each share of our Class A common stock and one Class B Right for each share of our Class B common stock outstanding at the close of business on February 8, 2010, the record date, and our Board of Directors has authorized the issuance of one Class A Right for each share of Class A common stock and one Class B Right for each share of Class B common stock issued (except as otherwise provided in the Tax Benefits Plan, as defined below) between the record date and the Distribution Date (as defined below). Upon the occurrence of certain events, each Class A Right entitles the registered holder to purchase from us one one-thousandth of a share (“Unit”) of our Series A Junior Participating Preferred Stock, par value $0.01 per share (“Series A Preferred”) and each Class B Right entitles the registered holder to purchase from us one Unit of our Series B Junior Participating Preferred Stock, par value $0.01 per share (“Series B Preferred”) in each case at a purchase price of $12.40 per Unit, subject to adjustment. The description and terms of the Class A Rights and Class B Rights are set forth in the Tax Benefits Plan. Pursuant to the Tax Benefits Plan, subject to certain conditions and determinations by our Board of Directors, the “Distribution Date” will occur upon the earlier of (i) ten business days following a public announcement that a person or group of affiliated or associated persons has acquired or otherwise obtained beneficial ownership of 4.9% of our then-outstanding securities (as described below) and (ii) ten business days (or such later date as may be determined by our Board of Directors) following the commencement of a tender offer or exchange offer that would result in a person or group acquiring or otherwise obtaining beneficial ownership of 4.9% of our then-outstanding securities.

Holders of 4.9% or more of our securities outstanding as of the close of business on January 29, 2010 will not trigger the Tax Benefits Plan so long as they do not (i) acquire additional securities constituting one-half of

3

Table of Contents

one percent (0.5%) or more of our securities outstanding as of the date of the Tax Benefits Plan (as adjusted), or (ii) fall under 4.9% ownership of our securities and then re-acquire 4.9% or more of our securities (as adjusted).

History and Development of Our Business

Pre-reorganization. We were incorporated in the State of Delaware in 2000 in order to purchase the assets and assume certain liabilities of ICO Global Communication (Holdings) Limited, a Bermuda company (“Old ICO”). Our predecessor company, Old ICO, was established in 1995 to provide global, mobile communications services using a MEO satellite system. Old ICO’s original business plan was based on a global MEO satellite system designed to provide voice and data service to a wide-ranging customer base, including traditional mobile phone users, aeronautical and maritime vessels and semi-fixed installations.

On August 27, 1999, Old ICO filed for protection from its creditors under Chapter 11 of the U.S. Bankruptcy Code and commenced related bankruptcy proceedings in Bermuda and the Cayman Islands with respect to certain of Old ICO’s subsidiaries. From its inception in 1995 to May 16, 2000, Old ICO had recorded an aggregate net loss of $592.6 million and had capitalized approximately $2.6 billion of costs relating to the construction of its MEO satellites, procurement of launch vehicles and a ground station network.

On October 31, 1999, Eagle River Investments, LLC (“Eagle River Investments”) and affiliates, executed a binding letter agreement with Old ICO. Pursuant to the binding letter agreement, Eagle River Investments and several other investors advanced $225 million to Old ICO under a debtor-in-possession (“DIP”) credit agreement. From February 9, 2000 through May 16, 2000, an Eagle River Investments affiliate, ICO Global Limited, advanced Old ICO an additional $275 million under a separate debtor-in-possession credit agreement.

Reorganization. On May 3, 2000, the U.S. Bankruptcy Court approved Old ICO’s plan of reorganization. We subsequently raised $122.9 million from outside investors and $577.1 million from Eagle River Investments to fund our acquisition of the assets and assumption of certain liabilities of Old ICO. On May 17, 2000, when Old ICO’s plan of reorganization became effective, the following transactions occurred:

| • | We acquired the assets and assumed certain liabilities from Old ICO in exchange for: |

| • | $117.6 million in cash; |

| • | 43 million shares of our Class A common stock which were issued to Old ICO’s former creditors and shareholders; |

| • | Warrants to purchase 20 million shares of our Class A common stock at $30 per share which were issued to Old ICO’s former creditors; |

| • | Warrants to purchase 30 million shares of our Class A common stock at $45 per share which were issued to Old ICO’s former shareholders; |

| • | The $225 million in advances by Eagle River Investments and the other investors were converted into 50 million shares of our Class A common stock; and |

| • | The $275 million in advances by ICO Global Limited were converted into 31 million shares of our Class B common stock. |

Subsequent to May 17, 2000, a group of Old ICO sales and distribution partners received 1.8 million shares of our Class A common stock, and Old ICO’s former creditors received an additional 700,000 shares of our Class A common stock in connection with the bankruptcy settlement.

As a result of the events described above, following the reorganization, Eagle River Investments, directly and indirectly through its control of ICO Global Limited, held a controlling interest in us. Effective November 28, 2001, one of our wholly-owned subsidiaries and ICO Global Limited merged with 0.93 shares of our capital stock exchanged for each outstanding share of ICO Global Limited capital stock. As a result of the

4

Table of Contents

merger, we issued 25,128,321 shares of our Class A common stock and 55,800,000 shares of our Class B common stock to the stockholders of ICO Global Limited, including Eagle River Investments. Eagle River Investments subsequently assigned its shares of our stock to its affiliate, Eagle River Satellite Holdings, LLC (“ERSH”).

As of March 11, 2010, we had 199,846,308 shares of Class A common stock (which has one vote per share) and 53,660,000 shares of Class B common stock (which has ten votes per share) outstanding. ERSH remains our controlling stockholder, and has an economic interest of approximately 31.6% and a voting interest of approximately 67.2%.

Post-reorganization. After the reorganization, we established a new management team who oversaw the construction of our MEO satellites and ground systems and developed our technical plan for the MEO satellite system. Following the launch failure of our first MEO satellite in March of 2000, as well as disagreements with the manufacturer and launch manager of our MEO satellites, disagreements that are the subject of litigation commenced in 2004, we significantly curtailed construction activity on our MEO satellite system. Nonetheless, we continue to explore the potential development of a MEO business plan outside of the United States and Canada.

As we focused on our MSS strategy for the United States, we devised and introduced to the FCC the concept of using MSS spectrum for an ancillary terrestrial component (“ATC”) or terrestrial re-use of MSS spectrum in order to address service coverage and economic limitations inherent to the MSS business plan. This ATC capability would allow us full access to urban customers by overcoming signal blockage related to buildings or terrain and capacity limitations inherent in satellite communications, thereby giving us greater flexibility to provide integrated satellite-terrestrial services.

In February 2003, the FCC issued an order establishing rules permitting MSS operators to seek authorization to integrate ATC into their networks. In May 2005, the FCC granted DBSD’s request to modify its reservation of spectrum for the provision of MSS in the United States using a geosynchronous earth orbit (“GEO”) satellite system rather than a MEO satellite system. On December 8, 2005, the FCC increased the assignment to DBSD of 2 GHz MSS spectrum from 8 MHz to 20 MHz due in part to the inability of all but one other licensee of the eight original MSS 2 GHz licensees to meet regulatory milestones and other matters.

In December 2004, we formed a new subsidiary, ICO North America, Inc. (subsequently renamed DBSD North America, Inc.) to develop an advanced next-generation hybrid mobile satellite service/ancillary terrestrial component system (“MSS/ATC System”), using a GEO satellite with the goal of providing wireless voice, video, data and/or Internet service throughout the United States on mobile and portable devices. DBSD procured a GEO satellite (“DBSD G1”) to support the new authorization in 2005. Also, in August 2005, DBSD issued $650 million aggregate principal amount of convertible notes due on August 15, 2009 (“2009 Notes”) to fund the development of its MSS/ATC System, and, in February 2006, it sold to certain of its note holders 323,000 shares of Class A common stock (approximately 0.2% of the outstanding shares of DBSD common stock) and stock options (exercisable at $4.25 per share) to purchase an additional 3,250,000 shares of Class A common stock (approximately 1.6% on a fully diluted share basis).

On July 14, 2006, our registration statement under the Exchange Act became effective with the U.S. Securities and Exchange Commission (“SEC”) and on September 13, 2006 our stock, which had previously traded on pink sheets, began trading on the NASDAQ Global Stock Market under the symbol “ICOG.”

On April 14, 2008, DBSD successfully launched DBSD G1 and on May 9, 2008, it certified to the FCC that its MSS system was operational, satisfying its final FCC milestone. On May 30, 2008, DBSD received its 2 GHz authorization and was granted its spectrum selection in the 2 GHz band, 2010 – 2020 MHz and 2180 – 2190 MHz. On January 15, 2009, the FCC approved DBSD’s application to integrate ATC into its MSS system,

5

Table of Contents

subject to meeting certain FCC gating criteria. DBSD has constructed terrestrial networks in Las Vegas, Nevada, and Reston, Virginia, and is currently using DBSD G1 to conduct an alpha trial of a wide range of satellite-terrestrial services in these trial markets. DBSD also recently concluded a one year alpha trial of its MSS/ATC services in Raleigh-Durham, North Carolina. During the alpha trials, tests have been conducted over the satellite-terrestrial network for a variety of services, including two-way cellular capabilities, Internet broadband services, and a mobile interactive media service which combined live television content, enhanced navigation and two-way communications service in a mobile environment.

On May 15, 2009, DBSD filed voluntary petitions for reorganization under Chapter 11 of Title 11 of the U.S. Bankruptcy Code with the Bankruptcy Court, which is expected to result in our retention of an approximately 5% equity interest in reorganized DBSD if the Plan of Reorganization for DBSD is approved. Due to our loss of control over DBSD as a result of the Chapter 11 cases, we deconsolidated DBSD from our financial operating results as of May 15, 2009. DBSD is currently carried as a cost method investment in our consolidated balance sheet.

Business Opportunity and Strategy

We are a next-generation MSS operator. We have coordinated the spectrum to operate a MEO satellite system globally outside of the United States (with the exception of two Middle Eastern countries) in the 2 GHz S-band in compliance with regulations promulgated by the United Kingdom and by the International Telecommunication Union (“ITU”), an international organization within the United Nations system. We have in orbit one MEO satellite, through which we currently provide a service on commercial terms for an agency of the U.S. government. We have ten additional MEO satellites in storage, most of which are in advanced stages of completion. We are currently using one gateway equipped with five antennas located in the United States in Brewster, Washington, to uplink and downlink to/from the satellite as well as monitor our MEO satellite in orbit. In addition, we have other gateways around the world which we believe could be made operational with reasonable efforts to enhance coverage of our global system.

We continue to explore the potential development of a MEO business plan outside of the United States and Canada. Such a business plan would require Boeing’s agreement to complete our MEO satellites in storage, or we would need to construct new satellites. In either case, it would require substantial funding. We have taken numerous steps to explore business opportunities for F2, which provides global MSS coverage, and for deployment of a MEO constellation. We have conducted extensive research and analysis on services that can be provided by F2, including low-bit rate “store and send” capabilities for remote operations, real time voice and data connectivity and the potential future capability to support any number of voice, data, Internet and video services worldwide if a MEO constellation is deployed. We are also exploring ways to capitalize on the significant investment we have already made in our MEO system, which, in the absence of reaching agreement with Boeing, could involve the outright divestiture of our MEO assets. In any event, we intend to thoroughly evaluate how we can optimize shareholder value through the proceeds, if any, from the Boeing litigation, leveraging our substantial investment in our MEO assets and our potential tax losses, and our ongoing interest in and relationship with DBSD.

In February 2010, ICO Global and DBSD responded to an appeal from the ITU to provide communications capability for international relief agencies operating in response to the Haitian earthquake. ICO Global and DBSD are providing equipment from DBSD’s North American demonstration trials and utilizing ICO’s international spectrum assignments to provide Internet connectivity in fixed and mobile environments in Haiti pursuant to the 2007 memorandum of understanding between ICO, the Commonwealth Business Council (“CBC”) and the ITU. We are providing this service at no charge, and expect to provide this service at least until the second quarter of 2010.

We also maintain a cost basis investment in DBSD, which is developing an advanced next-generation hybrid MSS/ATC System. DBSD is authorized by the FCC to offer MSS throughout the United States using

6

Table of Contents

DBSD G1. DBSD is also authorized (subject to meeting certain criteria) to integrate ATC into its MSS system in order to provide integrated satellite and terrestrial services.

DBSD successfully launched DBSD G1, which was built by Space Systems/Loral, Inc. (“Loral”), on April 14, 2008. In December 2008, it completed DBSD G1 in-orbit testing and testing of the ground-based beam forming (“GBBF”) system. The DBSD G1 satellite design is based on a Loral 1300 standard satellite platform that has been optimized for GEO MSS/ATC communications requirements. It has an expected service life of 15 years and has a 12-meter reflector (antenna). DBSD G1 was designed to provide continuous service coverage in all 50 states in the United States, as well as Puerto Rico and the U.S. Virgin Islands. If appropriate regulatory approval is granted by other countries, DBSD G1 is capable of providing service in Canada. The same 20 MHz frequency band allocated for 2 GHz MSS in the United States is also designated for MSS use in Canada. It is also adjacent to bands proposed for advanced wireless services and near existing personal communications services bands. DBSD has filed an application to provide MSS to significant portions of Canada.

The MSS/ATC System will allow DBSD to provide wireless voice, video, data and/or Internet service throughout the United States on mobile and portable devices. DBSD is currently in the process of demonstrating the operational status of its MSS/ATC System on a trial basis. DBSD has constructed terrestrial networks in Las Vegas, Nevada and Reston, Virginia, and recently concluded a one year trial of its MSS/ATC services in Raleigh-Durham, North Carolina. DBSD conducted the first-ever trials in North America of DVB-SH technology over a satellite-terrestrial network.

Competition

The communications industry is highly competitive. Any communications service offering we provide would compete with a number of other communications services, including existing satellite services offered by Iridium LLC (“Iridium”), Globalstar LLC (“Globalstar”), Inmarsat Global Ltd (“Inmarsat”) and Thuraya Telecommunications Company (“Thuraya”). Globalstar and Iridium are both licensed and operational in the Big LEO band and provide voice and data services using dozens of LEO satellites. Iridium’s coverage is nearly global, while Globalstar covers numerous countries. Inmarsat owns and operates a fleet of geostationary satellites, and its offerings consist of maritime voice, facsimile and data, as well as global land-based and aeronautical communications services. Inmarsat is the leading provider of satellite communications services to the maritime sector. Thuraya owns two geostationary satellites operating in the L Band across Europe, the Middle East, Africa and Asia, and offers voice and data products from small handheld terminals to data only modems in all types of vertical market segments.

We expect that the competition for customers and strategic partners will increase as the entities described above continue with their respective business plans. We believe that competition will be based in part on the ability to support a full set of satellite and terrestrial service offerings, time to market and product offerings, as well as the ability to use spectrum in the most efficient manner.

Regulation

Our ownership and operation of satellite and wireless communication systems is subject to regulation from the FCC, the ITU and U.K. Office of Communications (“Ofcom”).

Federal Communications Commission

The FCC generally regulates the construction, launch and operation of satellites, the use of satellite spectrum at particular orbital locations, the licensing of earth stations and mobile terminals, and the provision of satellite services in the United States. Although we are generally focused outside of the United States, the FCC regulates the U.S. earth station that controls F2.

7

Table of Contents

International Telecommunication Union

The ITU regulates, on a global basis, the use of radio frequency bands and orbital locations used by satellite networks to provide communications services. The use of spectrum and orbital resources by us and other satellite networks must be coordinated pursuant to the ITU’s radio regulations in order to avoid interference among the respective networks. In 2004, Ofcom informed the ITU that our MEO system (also known as ICO-P) has been brought into operation and is using the spectrum assignments in 2 GHz band. In 2007, the ITU certified that request by entering our MEO system in the Master International Frequency Register (“ITU Master Register”) maintained by the ITU. For such a recorded assignment, other administrations take that system into account when making their own assignments, in order to avoid harmful interference.

U.K. Office of Communications

Our satellites are permitted to operate subject to compliance with regulations promulgated by the ITU and the United Kingdom through Ofcom and the U.K. Department for Business Enterprise and Regulatory Reform. The MEO satellite system was first filed at the ITU by the United Kingdom in 1994. Handsets to be used in the MEO satellite system for the provision of MSS were authorized in a 1999 U.K. statute. Under the ITU constitution, only nations that have full standing as ITU members may make filings to the ITU, and therefore we must rely on the United Kingdom for regulatory filings and coordination of our spectrum use and orbital location with all other potentially affected satellite operators that are represented by their respective national administrations. Ofcom has submitted our ITU filings on our behalf pursuant to our compliance with U.K. due diligence requirements for our MEO system. U.K. due diligence requirements include obligations to proceed with our business plans and to comply with Ofcom and ITU requirements related to filings made.

We have submitted materials that we believe comply with Ofcom’s due diligence requests, while preserving our legal rights regarding the propriety of the information we provided, but Ofcom stated that, pending the filing by a subsidiary of ICO Global of a judicial review (“Judicial Review”), it intended to write to the ITU on May 23, 2009 to “instruct that the ICO-P assignments currently recorded in the ITU Master Register be cancelled.” We have filed for a Judicial Review, which has been accepted for hearing by the U.K. court and is currently pending. If Ofcom were to file a letter with the ITU to cancel these rights and the ITU accepted such letter for cancellation, we would lose our ability to operate a MEO system based on our current ITU filing priority and MEO authorization, which in turn could have a material adverse effect on our ability to develop and operate the MEO satellite system. See “Risk Factors—Regulatory Risks.” In order to maintain our U.K. authorization to operate our MEO satellite system, we will need to continue to progress the build and launch of our MEO satellites. In addition, we must diligently participate in international coordination meetings arranged by Ofcom and coordinate with other national administrations in good faith.

European Community

On February 14, 2007, the European Commission (“EC”) adopted a decision on the “harmonized use of radio spectrum in the 2 GHz bands for the implementation of systems providing MSS.” This decision states that radio spectrum is available and planned to be used for MSS in the frequency bands 1980 - 2010 MHz and 2170 - 2200 MHz. Under this decision, systems capable of providing MSS must include one or more space stations and may include complementary ground components, such as ground based stations used at fixed locations (similar to ATC).

On June 30, 2008, the European Parliament passed Decision No. 626/2008/EC under which, on August 7, 2008, the EC made a call for applications by October 7, 2008 for pan-European systems to provide MSS (“EC Call”). On September 26, 2008, we initiated proceedings in the European Court of First Instance seeking the annulment of Decision No. 626/2008/EC of the European Parliament, contending that the Decision is illegal and should be annulled pursuant to Articles 230 and 231 of the Treaty establishing the European Community (“First Proceeding”). As this proceeding had not been completed by the October 7, 2008 deadline to submit applications

8

Table of Contents

in response to the EC Call, ICO Satellite Limited filed an application with the EC as called for in the above mentioned EC Call, without prejudice, pending the outcome of the First Proceeding in the European Court of First Instance. On November 12, 2008, the EC admitted our application into the EC Call and, on May 14, 2009, the EC announced that it had not selected the application of ICO Satellite Limited. In response to this decision, on September 4, 2009, we filed an additional proceeding to challenge in the European Court of First Instance the outcome of the EU Call (“Second Proceeding” and together with the First Proceeding, “EC Proceedings”). The European Court has not yet ruled on our filing, and there is currently no set timeline for the case.

There remains significant uncertainty about our ability to continue development of our physical and regulatory MEO assets for use in Europe, depending on the outcome of the EC Proceedings.

Our MEO Satellite System

We have in orbit one MEO satellite, F2, launched in June 2001. Primary satellite control is provided under an agreement with Intelsat, Ltd. (“Intelsat”), with backup satellite control provided by us in Slough, United Kingdom. We are required to have the capability of controlling F2 from the United Kingdom as part of our U.K. authorization. We are currently using one gateway ground station equipped with five antennas to monitor F2.

In addition, we have ten MEO satellites, most of which are in advanced stages of completion, stored in a climate controlled leased storage facility in El Segundo, California. The MEO satellites, including F2, are a modified Hughes 601 and Hughes 702 design and have a designed in-orbit life of 12 years. The MEO satellites feature an active phased array S-band antenna capable of forming up to 490 beams for satellite-user links and with C-band hardware for satellite to gateway links.

Construction of our MEO satellites ceased in 2004 and is the subject of our litigation with Boeing and BSSI as discussed under “Item 3—Legal Proceedings.” In 2003, we also decided that we would no longer provide full funding to certain of our subsidiaries to pay the operators of gateways for the MEO satellite system unless the agreements with such operators were restructured to reduce service levels and payment obligations. As a result, eight of the ten operators have terminated their agreements, five of which have been successfully renegotiated and our obligations in four of these have been satisfied and thereunder released, and in the last case a payment plan agreed. In the other three gateways where the agreements have been terminated, we have not yet reached a settlement. In the case of the two gateways where we have agreements that have not been terminated, one agreement has been extended and the other one we continue to perform under as previously agreed. We also own a gateway facility in Itaborai, Brazil, on which certain gateway equipment for the MEO satellite system is located; however, this facility is not currently operational.

We have written down the assets related to our MEO satellite system to zero for accounting purposes in our consolidated financial statements. However, we continue to explore ways to capitalize on our substantial investment in our MEO satellite system and related regulatory assets.

The outcome of our efforts relating to our MEO assets remains uncertain at this time.

9

Table of Contents

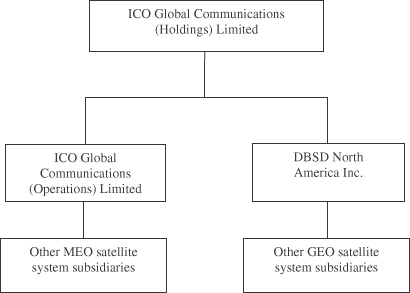

Summary Organizational Chart

The following chart is a summary of our organizational structure as of December 31, 2009. For various historical, operational and regulatory reasons, we have many subsidiaries through which we hold our assets and conduct our operations. This chart only lists our primary subsidiaries, including DBSD, which we no longer consolidate effective May 15, 2009.

ICO Global Communications (Operations) Limited is permitted to operate a MEO satellite system globally in compliance with regulations promulgated by the United Kingdom and by the ITU. Our operations outside of North America are primarily conducted by this wholly-owned subsidiary and its subsidiaries.

DBSD North America, Inc. was formed to develop the MSS/ATC System, and operations in North America are conducted by this subsidiary and its subsidiaries, collectively referred to as DBSD. DBSD has historically been 99.84% owned by ICO Global, but ICO Global’s ownership will be reduced to approximately 5% when the Plan of Reorganization for DBSD becomes effective.

Financial Information About Geographic Areas

As of December 31, 2009, our long-lived fixed assets primarily consist of furniture and fixtures, software and leasehold improvements held in the United States. As of December 31, 2008, our long-lived fixed assets were primarily associated with development activities related to the business operated by DBSD in North America, which was deconsolidated effective May 15, 2009. The following table contains the location of our long-lived assets as of December 31, 2009 and 2008 (in thousands):

| December 31, | ||||||

| 2009 | 2008 | |||||

| United States |

$ | 377 | $ | 545,569 | ||

| Foreign |

6 | 4 | ||||

| $ | 383 | $ | 545,573 | |||

Intellectual Property

ICO and the ICO logo are trademarks or registered trademarks of ours in the United States and other countries.

10

Table of Contents

Employees

As of December 31, 2009, we had a total of 41 employees, including employees of DBSD. We have also engaged full and part-time consultants for the purpose of providing human resources, accounting services, strategy, regulatory and certain engineering specialties. Our employees are not subject to any collective bargaining agreements.

Available Information

The address of our website is www.ico.com. You can find additional information about us and our business on our website. We make available on this website, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. You may read and copy this Form 10-K at the SEC’s public reference room at 100 F Street, NE, Washington, DC 20549-0102. Information on the operation of the public reference room can be obtained by calling the SEC at 1-800-SEC-0330. These filings are also accessible on the SEC’s website at www.sec.gov.

We also make available on our website in a printable format the charters for certain of our various Board of Director committees, including the Audit Committee and Compensation Committee, and our Code of Conduct and Ethics in addition to our Certificate of Incorporation and Bylaws. This information is available in print without charge to any stockholder who requests it by sending a request to ICO Global Communications (Holdings) Limited, 11700 Plaza America Drive, Suite 1010, Reston, VA 20190, Attn: Corporate Secretary. The material on our website is not incorporated into or is a part of this Form 10-K.

| Item 1A. | Risk Factors. |

The risks below address some of the factors that may affect our future operating results and financial performance. If any of the following risks develop into actual events, then our business, financial condition, results of operations or prospects could be materially adversely affected.

Risks Related to Our Business

We are engaged in litigation with Boeing and BSSI and expect to incur material expenses in pursuing this litigation.

We are engaged in litigation with Boeing and BSSI, arising out of agreements for the development and launch of MEO satellites for our subsidiary, ICO Global Communications (Operations) Limited (“ICO Operations”). In October 2008, after a three-month trial, the jury found that BSSI had breached its contract with ICO Operations and engaged in fraud, and that BSSI’s parent, Boeing, had tortiously interfered with our contract. The jury further found that in dealing with us, BSSI and Boeing acted with malice, oppression or fraud. The verdicts totaled $370.6 million in compensatory damages and $236 million in punitive damages. On February 26, 2009, after post-trial motions, final judgment was entered in favor of ICO in the amount of $603.2 million. Beginning January 2, 2009, post-judgment interest began accruing on the full judgment amount at the rate of 10% per annum (simple interest), or approximately $60 million per year.

Boeing and BSSI filed their notice of appeal on March 6, 2009, and we filed our notice of appeal on March 24, 2009. Boeing and BSSI filed their appellate brief on October 26, 2009, and our appellate brief is currently due by March 22, 2010. Further reply briefing and oral argument will follow. We cannot predict the timing or outcome of the appeal process. Even if we prevail on appeal, Boeing and BSSI may pursue additional review procedures. Through December 31, 2009, we have incurred approximately $19.8 million in pursuing this litigation and expect we will continue to incur substantial additional costs through the ultimate resolution which

11

Table of Contents

is uncertain. Given the appeals filed by Boeing and BSSI, and their potential post-appeal requests, it is unlikely that we will generate any liquidity from this verdict in the next 12 months. If we are unable to continue to fund the litigation, or if we do not substantially prevail on appeal, this could materially negatively impact our liquidity, cash position and value. Moreover, there is no certainty how we will use the proceeds, if any.

Under the prearranged bankruptcy plan of DBSD, our equity ownership of DBSD is being reduced to approximately 5% (with warrants for an additional 10% under certain circumstances), and it is possible that we could retain less or no equity in DBSD based on the final restructuring plan confirmed by the Bankruptcy Court.

On May 15, 2009, DBSD filed voluntary petitions for relief under Chapter 11 of Title 11 of the U.S. Code in the Bankruptcy Court. We did not file a petition for relief and are not a debtor in the Chapter 11 cases. Pursuant to the Plan of Reorganization of DBSD submitted to the Bankruptcy Court, the entire outstanding principal amount and accrued interest of DBSD’s 2009 Notes would be converted into a number of shares of common stock in reorganized DBSD equal to approximately 95% of its total outstanding common stock. If the Plan of Reorganization becomes effective, our equity ownership interest in DBSD will be reduced to approximately 5% of reorganized DBSD after accounting for the dilutive effect of shares to be issued to DBSD’s general unsecured creditors and reorganized DBSD’s exit financing lenders. In addition, we are expected to receive warrants to purchase at $0.01 per share up to an additional approximately 10% of the common stock of reorganized DBSD, which shall be exercisable upon certain events concerning the valuation of DBSD. On October 26, 2009, the Bankruptcy Court issued a decision ruling in favor of confirmation of the Plan of Reorganization, and it entered its order on November 23, 2009.

The ability of the Plan of Reorganization to become effective, and our ability to retain any equity interest in reorganized DBSD, is subject to a number of risks and uncertainties. Although the Bankruptcy Court approved the Plan of Reorganization, parties that challenged the Plan of Reorganization have appealed entry of the confirmation order. The entity holding the debt under DBSD’s prepetition working capital facility (“First Lien Lender”) and Sprint Nextel Corporation challenged the Plan of Reorganization on a number of grounds, including feasibility, the proposed treatment of the First Lien Lender’s debt, and the appropriateness of the equity distribution provided to us. Moreover, the FCC must approve the transfer of DBSD’s licenses to the reorganized DBSD under the Plan of Reorganization, and if it does not do so, the Plan of Reorganization cannot be implemented in its current form. Any of these risks could cause us to own less equity of reorganized DBSD than that contemplated by the Plan of Reorganization, or no equity at all. If we own less equity than is contemplated by the Plan of Reorganization, or hold no equity in reorganized DBSD at all, it could negatively affect our value.

We are a development stage enterprise and have no significant operations, revenues or operating cash flow and will need additional liquidity to fund our operations and fully fund all necessary capital expenditures.

We were restructured in a bankruptcy and, since May 2000, have had no significant operations or revenues and do not generate any cash from operations. With the exception of 2005, when we recognized net income due to non-cash gains recognized on certain contract settlements, and 2009, when we recognized net income due to a gain recognized on the deconsolidation of DBSD, we have incurred net losses since our inception. We expect to have losses for the foreseeable future. We continue to incur expenses, which must be funded out of cash reserves or the proceeds, if any, of future financings, including the Rights Offering. Successful completion of our development program and, ultimately, the attainment of profitable operations, are dependent upon future events, including obtaining adequate financing to fulfill our development activities, obtaining regulatory approval, and achieving a level of sales adequate to support our cost structure.

The implementation of our MEO satellite system requires significant funding, and the completion and launch of our MEO satellites currently in storage would require the agreement of BSSI to complete construction

12

Table of Contents

of those satellites. BSSI has to date been unwilling to complete our MEO satellites and there can be no assurance BSSI will ever agree to do so. In addition, our current assets will not be sufficient to fund our expenses through deployment of our MEO satellite system and commencement of revenue-generating operations based on that system. It is unclear when, or if, we will be able to generate sufficient cash from operations to cover our ongoing expenses and fund capital expenditures. There is a risk that we will not be able to obtain the additional funding required in the amounts or at the time the funds are required. If we are unable to obtain a partner or sufficient funds, we will not be able to pursue a MEO satellite system or any business plan requiring a MEO satellite system.

The ongoing financial instability and uncertainty about global economic conditions could have a material negative effect on our business, liquidity, results of operations, and financial condition.

The financial crisis that affected the banking system and financial markets and the ongoing financial instability and uncertainty about global economic conditions have resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in credit, equity and fixed income markets. There could be a number of follow-on effects from these economic developments on our business, including the difficulty in raising sufficient money to fund our operations and anticipated capital expenditures until we are able to generate positive cash flow, as well as the depression of the value of any assets that we may determine to sell or deploy together with strategic partners.

We may not be successful in completing our MEO satellite constellation, and this failure would have a material effect on our financial condition and ability to generate revenues from operations and realize earnings.

We may be unable to complete and launch our remaining MEO satellites. Only BSSI, the builder of our system, can complete the unlaunched satellites, and we have been involved in litigation with BSSI since 2004. We therefore may be unable to develop a full MEO network, or we may be unsuccessful at selling the services provided by such a network. If we are unable to complete and launch additional MEO satellites, or are unable to sell the services provided by such a network, our financial condition and ability to commence revenue-generating operations and realize earnings would be harmed.

There are significant risks associated with operating our satellite constellation.

Our business contemplates operating a constellation of MEO satellites, exposing us to risks inherent in satellite operations, including failure of the satellite to perform as specified. Satellites generally are subject to significant operational risks while in orbit. These risks include malfunctions, commonly referred to as anomalies, which can occur as a result of various factors, such as satellite manufacturers’ errors, problems with the power or control systems of the satellites and general failures resulting from operating satellites in the harsh environment of space. For example, in the past F2 has experienced an anomaly in orbit that interrupted some functionality on a number of occasions. We carry only third party liability insurance on F2.

There are significant intellectual property risks associated with development of our MEO system.

Other parties may have patents or pending patent applications related to satellite communications. Those parties may claim that our products or services infringe their intellectual property rights and bring suit against us for infringement of patent or other intellectual property rights. Although we believe that we do not (and we do not intend to), we may be found to infringe on or otherwise violate the intellectual property rights of others. If our products or services are found to infringe or otherwise violate the intellectual property rights of others, we may need to obtain licenses from those parties or design around such rights, increasing development costs and potentially making our system less efficient. We may not be able to obtain the necessary licenses on commercially reasonable terms, or at all, or to design around such rights. In addition, if a court finds that we infringe or otherwise violate the intellectual property rights of others, we could be required to pay substantial

13

Table of Contents

damages or be enjoined from making, using or selling the infringing product or technology. We could also be enjoined while an infringement suit was pending. Any such claim, suit or determination could have a material adverse effect on the operation of the MEO system or our competitive position and ability to generate revenues.

We will have to license hardware and software for our MEO system and products. There is a risk that the necessary licenses will not be available on acceptable commercial terms. Failure to obtain such licenses or other rights could have a material adverse effect on the operation of the MEO system and our ability to remain competitive and generate revenues from operations.

We face significant competition from companies that are larger or have greater resources.

We face significant competition from companies that are larger or have greater resources than us, and from companies that may introduce new technologies and new wireless spectrum. We face competition from many well-established and well-financed competitors, including existing wireless operators who have large established customer bases. Many of these competitors have substantially greater access to capital and have significantly more operating experience than we do. Further, due to their larger size, many of these competitors enjoy economies of scale benefits that are not available to us.

We may face competition from other MSS operators planning to offer services. We may also face competition from the entry of new competitors or from companies with new technologies, and we cannot at this time project the impact that this would have on our business plan or our future results of operations.

We may be unable to protect the proprietary information and intellectual property rights that our operations and future growth will depend on.

The success of our business plan depends, in part, on our ability to develop or acquire technical know-how and remain current on new technological developments. As a result, our ability to compete effectively will depend, in part, on our ability to protect our proprietary technologies and systems designs. While we have attempted to safeguard and maintain our proprietary rights, we do not know whether we have been or will be successful in doing so. We rely on licensed patents, trademarks, copyrights, trade secret laws and policies and procedures related to confidentiality to protect our technology, products and services. Some of our technology, products and services, however, are not covered by any of these protections.

In addition, we do not know whether we will be successful in maintaining the rights to our granted trademarks and these trademark rights may be challenged. Moreover, patent and trademark applications filed in foreign countries may be subject to laws, rules and procedures that are substantially different from those of the United States, and any resulting foreign patents may be difficult and expensive to enforce. We could, therefore, incur substantial costs and diversion of resources in prosecuting patent and trademark infringement suits or otherwise protecting our intellectual property rights, which could have a material adverse effect on our financial condition and results of operations, regardless of the final outcome. Despite our efforts to protect our proprietary rights, we may not be successful in doing so or our competitors may be able to independently develop or patent technologies equivalent or superior to our technologies.

We also rely upon unpatented proprietary technology and other trade secrets. While it is our policy to enter into confidentiality agreements with our employees and third parties to protect our proprietary expertise and other trade secrets, these agreements may not be enforceable, and, even if they are legally enforceable, we may not have adequate remedies for breaches of such agreements. The failure of our patents or confidentiality agreements to protect our proprietary technology or trade secrets could have an adverse effect on our results of operations.

We may be unable to determine when third parties are using our intellectual property rights without our authorization. The unremedied use of our intellectual property rights or the legitimate development or acquisition

14

Table of Contents

of intellectual property similar to ours by third parties could reduce or eliminate any competitive advantage we have as a result of our intellectual property, adversely affecting our financial condition and results of operations. If we must take legal action to protect, defend or enforce our intellectual property rights, any suits or proceedings could result in significant costs and diversion of our resources and management’s attention, and there is a risk that we may not prevail in any such suits or proceedings.

We are in the process of amending or terminating most of our MEO gateway agreements and may incur additional material expenses in terminating these agreements.

Certain of our subsidiaries have agreements with the operators of the gateways for our MEO satellite system. We have discontinued the funding of certain of the gateway agreements and may discontinue the funding of certain of our subsidiaries who are parties to the gateway agreements. We may incur costs associated with further terminations and the operators of the gateways may try to hold us liable for these agreements. As of December 31, 2009, we had an accrued liability of $58.5 million related to these unsettled agreements. If we are unable to terminate and settle the remaining agreements on favorable terms, the cash required to settle the entire amount may have a material adverse effect on our financial condition.

Our success depends on certain key management personnel, and our limited liquidity and related business risks may make it difficult to maintain our key managers and, if necessary, attract new managers.

Our future success depends largely on the expertise and reputation of our senior management team. Our key managers have employment contracts limited to six months of severance in the event of a termination of employment, and some key managers have shorter severance periods or no severance periods. In addition, some of these contracts are with DBSD and are subject to limitations prescribed by the DBSD Chapter 11 cases. This severance protection is less than provided at some other companies, including some competitors and other peer entities. These factors create the risk that we may lose our key management personnel to other companies. For example, Michael P. Corkery, our then acting Chief Executive Officer and Chief Financial Officer, resigned on December 31, 2009. Benjamin G. Wolff was appointed Chairman of the Board of Directors, and Chief Executive Officer. Although other companies may face some or all of these risks, and the employment market is generally weak, many companies face fewer or none of these risks, and the market for key management personnel continues to exist, even if currently at a reduced level. The loss of any of our key personnel or the inability to recruit and retain qualified individuals could adversely affect our ability to implement our business strategy and operate our business.

Our ability to utilize our NOLs is dependent on avoiding an ownership change and securing future income.

As of December 31, 2009, we had substantial existing NOLs of approximately $353 million, as well as additional potential NOLs. Under the Internal Revenue Code and the Treasury Regulations issued thereunder, we may “carry forward” these losses in certain circumstances to offset any current and future income and thus reduce our federal income tax liability, subject to certain restrictions. To the extent that the NOLs do not otherwise become limited, we believe that we will be able to carry forward a significant amount of NOLs, and therefore the NOLs could be a substantial asset for us. However, if we experience an “ownership change,” as defined in Section 382, our ability to use the NOLs will be significantly limited, and the timing of the usage of the NOLs could be significantly limited, which could therefore significantly impair the value of that asset. The Rights Offering is not currently expected to result in an ownership change, but it may increase the likelihood that we may undergo an ownership change for purposes of Section 382 of the Internal Revenue Code in the future, which would limit our ability to use any U.S. federal and state NOLs as described above. Moreover, no assurances can be given that an ownership change under Section 382 of the Internal Revenue Code has not occurred prior to the Rights Offering or will not occur as a result of the Rights Offering. Our ability to fully utilize the NOLs is also dependent upon the generation of future taxable income before the expiration of the carry forward period attributable to these NOLs, which begin to expire in 2020.

15

Table of Contents

Risks Related to our Rights Offering

The Rights Offering may limit our ability to use some or all of our NOLs.

As of December 31, 2009, we had NOLs for federal income tax purposes of approximately $353 million. Although there can be no assurance that our ability to use NOLs has not already become limited as a result of an ownership change, we expect to be able to carry NOLs forward to reduce taxable income in future years. These NOLs begin to expire in 2020. Our ability to utilize our NOLs could become subject to significant limitations under Section 382 of the Internal Revenue Code if we undergo an ownership change. We would undergo an ownership change if, among other things, the stockholders who own or have owned, directly or indirectly, five percent (5%) or more of our securities, or are otherwise treated as five percent (5%) stockholders under Section 382 and the regulations promulgated thereunder, increase their aggregate percentage ownership of our stock by more than 50 percentage points over the lowest percentage of the stock owned by these stockholders at any time during the testing period, which is generally the three-year period preceding the potential ownership change. In the event of an ownership change, Section 382 imposes an annual limitation on the amount of taxable income a corporation may offset with NOLs. Any unused annual limitation may be carried over to later years until the applicable expiration date for the respective NOLs.

The recently completed Rights Offering is not currently expected to result in an ownership change, but it may increase the likelihood that we may undergo an ownership change for purposes of Section 382 of the Internal Revenue Code in the future, which would limit our ability to use any U.S. federal and state NOLs as described above. Moreover, no assurances can be given that an ownership change under Section 382 of the Internal Revenue Code has not occurred prior to the Rights Offering or will not occur as a result of the Rights Offering.

The subscription price determined for the Rights Offering is not an indication of our value.

The subscription price of $0.70 per share for our recently completed Rights Offering may not necessarily bear any relationship to the book value of our assets, past operations, cash flows, losses, financial condition or any other established criteria for value. You should not consider the subscription price as an indication of the value of our Class A common stock. In addition, you should not rely on the indications of interest by the standby purchasers to participate in the Rights Offering, or by other potential investors to purchase unsubscribed shares of our Class A common stock, as a recommendation or other indication that the subscription price is reflective of our value. After the date of our prospectus supplement, our Class A common stock may trade at prices above or below the subscription price.

Our management will have broad discretion in how we use our funds, including but not limited to the net proceeds from our Rights Offering and any proceeds we may receive from the Boeing litigation, and we may use the proceeds in ways with which you disagree or which does not yield a favorable, or any, return for us.

We have broad discretion in how we use our funds. This includes but is not limited to the net proceeds from our Rights Offering and any proceeds we may receive from the Boeing litigation. We may use our funds in ways with which you disagree or which does not yield a favorable, or any, return for us. We have not allocated specific amounts of our existing or possible future funds for any specific purpose. Our management will have significant flexibility in applying our funds and, accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds and will not have the opportunity, as part of your investment decision, to assess whether the proceeds will be used in ways with which you disagree. It is possible that our management may invest the net proceeds in ways that our some of our stockholders may not desire, or may not yield a favorable, or any, return for us. The failure of our management to use our funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

16

Table of Contents

Risks Related to Our Class A Common Stock

Future sales of our Class A common stock could depress the market price.

The market price of our Class A common stock could decline as a result of sales of a large number of shares. Most of our Class A common stock that is held by non-affiliates can be sold without limitation under Rule 144 and certain holders of our Class A common stock are able to sell their shares in compliance with Rule 144. In addition, certain holders of our Class A common stock have the ability to cause us to register the resale of their shares, including, in the case of ERSH, shares of Class A common stock acquired upon conversion of their Class B common stock. These sales might also make it more difficult for us to sell shares in the future at a time and price that we deem appropriate.

The interests of our controlling stockholder may conflict with the interests of the holders of our Class A common stock.

ERSH controls approximately 68% of the voting power of our outstanding capital stock. As a result, ERSH has control over the outcome of matters requiring stockholder approval, including:

| • | the election of our directors; |

| • | amendments to our charter or certain amendments to our bylaws; and |

| • | the adoption or prevention of mergers, consolidations or the sale of all or substantially all of our assets or the assets of our subsidiaries. |

ERSH also will be able to delay, prevent or cause a change of control of us.

Eagle River Investments has made significant investments in other telecommunications companies and may in the future make additional investments. Some of these companies may compete with us. Eagle River Investments and ERSH are not obligated to advise us of any investment or business opportunities of which it is aware, and they are not restricted or prohibited from competing with us.

Craig O. McCaw, a member of our Board of Directors, is the Chairman, Chief Executive Officer and sole manager and beneficial member of Eagle River Investments, which is the sole member of ERSH. Benjamin G. Wolff, our Chairman and Chief Executive Officer, is the President of Eagle River Investments, and is compensated by Eagle River Investments and the Company. ERP, which is also wholly owned by Craig McCaw, was a standby purchaser in the Rights Offering.

We are a “controlled company” within the meaning of the NASD Marketplace Rules and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements.

ERSH controls approximately 68% of the voting power of our outstanding capital stock. As a result, we are a “controlled company” within the meaning of the NASDAQ Global Market corporate governance standards. Under the NASD Marketplace Rules, a company of which more than 50% of the voting power is held by another company is a “controlled company” and may elect not to comply with certain NASDAQ Global Market corporate governance requirements, including (1) the requirement that a majority of the board of directors consist of independent directors, (2) the requirement that the compensation of officers be determined, or recommended to the board of directors for determination, by a majority of the independent directors or a compensation committee comprised solely of independent directors, and (3) the requirement that director nominees be selected, or recommended for the board of directors’ selection, by a majority of the independent directors or a nominating committee comprised solely of independent directors with a written charter or board resolution addressing the nomination process. We have currently elected to utilize these exemptions. As a result, our stockholders may not have the same protections afforded to stockholders of companies that are subject to all of the NASDAQ Global Market corporate governance requirements.

17

Table of Contents

The Tax Benefits Plan that we entered into on January 29, 2010, as well as certain provisions in our restated certificate of incorporation, may discourage takeovers, which could affect the rights of holders of our Class A common stock.

The Tax Benefits Plan we have in place is intended to act as a deterrent against any person or group acquiring or otherwise obtaining beneficial ownership of more than 4.9% of our securities without the approval of our Board of Directors. In addition, our restated certificate of incorporation provides that we will take all necessary and appropriate action to protect certain rights of our common stockholders that are set forth in the restated certificate of incorporation, including voting, dividend and conversion rights and their rights in the event of a liquidation, merger, consolidation or sale of substantially all of our assets. It also provides that we will not avoid or seek to avoid the observance or performance of those rights by charter amendment, entry into an inconsistent agreement or reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution or the issuance or sale of securities. In particular, these rights include our Class B common stockholder’s right to ten votes per share on matters submitted to a vote of our stockholders and option to convert each share of Class B common stock into one share of Class A common stock. The provisions of the Tax Benefits Plan and our restated certificate of incorporation could discourage takeovers of our Company, which could adversely affect the rights of our stockholders.

We do not expect to pay cash dividends on our Class A common stock for the foreseeable future.

We have never paid a cash dividend on shares of our equity securities, and do not intend to pay any cash dividends on our Class A common shares in the foreseeable future. Since we were restructured in a bankruptcy in May 2000, we have had no significant operations or revenues and have incurred net losses (other than in 2005, due solely to gains on gateway contract settlements in that year, and 2009, due to a gain recognized on the deconsolidation of DBSD). We continue to incur expenses, which must be funded out of cash reserves or the proceeds (if any) of future financings. We expect to have losses for the foreseeable future.

We do not have any revenue generating operations. Our ability to generate cash in the future will depend on our ability to successfully develop the system and implement and manage projected growth and development. There is a risk that we will not be successful in these endeavors.

Regulatory Risks

We are subject to significant international governmental regulation.

Our ownership and operation of satellite and wireless communication systems is subject to regulation by the ITU, Ofcom, and the FCC. In general, laws, policies and regulations affecting the satellite and wireless communications industries are subject to change in response to industry developments, new technology or political considerations. Legislators or regulatory authorities in the United States, the United Kingdom and at the ITU are considering or may consider, or may in the future adopt, new laws, policies and regulations or changes to existing regulations regarding a variety of matters that could, directly or indirectly, affect our operations or increase the cost of providing services over our MEO system.