Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Pendrell Corp | Financial_Report.xls |

| EX-31.1 - EX-31.1 - Pendrell Corp | d825222dex311.htm |

| EX-23.1 - EX-23.1 - Pendrell Corp | d825222dex231.htm |

| EX-32.1 - EX-32.1 - Pendrell Corp | d825222dex321.htm |

| EX-21.1 - EX-21.1 - Pendrell Corp | d825222dex211.htm |

| EX-23.2 - EX-23.2 - Pendrell Corp | d825222dex232.htm |

| EX-10.21 - EX-10.21 - Pendrell Corp | d825222dex1021.htm |

| EX-10.14 - EX-10.14 - Pendrell Corp | d825222dex1014.htm |

| EX-10.15 - EX-10.15 - Pendrell Corp | d825222dex1015.htm |

| EX-10.20 - EX-10.20 - Pendrell Corp | d825222dex1020.htm |

| EX-10.22 - EX-10.22 - Pendrell Corp | d825222dex1022.htm |

| EX-10.16 - EX-10.16 - Pendrell Corp | d825222dex1016.htm |

| EX-10.18 - EX-10.18 - Pendrell Corp | d825222dex1018.htm |

| EX-31.2 - EX-31.2 - Pendrell Corp | d825222dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33008

PENDRELL CORPORATION

(Exact name of registrant as specified in its charter)

| Washington | 98-0221142 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

2300 Carillon Point, Kirkland, Washington 98033

(Address of principal executive offices including zip code)

(425) 278-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Class A common stock, par value $0.01 per share | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

As of June 30, 2014, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $304,995,185

As of February 26, 2015, the registrant had 212,811,443 shares of Class A common stock and 53,660,000 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement for its 2015 Annual Meeting of Shareholders are incorporated by reference in Part III of this Form 10-K.

Table of Contents

PENDRELL CORPORATION

2014 ANNUAL REPORT ON FORM 10-K

Table of Contents

This Annual Report on Form 10-K (“Form 10-K”) contains certain forward-looking statements regarding future events and our future operating results that are subject to the safe harbors created under the Securities Act of 1933, as amended (“Securities Act”), and the Securities Exchange Act of 1934, as amended (“Exchange Act”). These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All of these forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from those contemplated by the relevant forward-looking statements. Factors that might cause or contribute to such a difference include, but are not limited to, those discussed under “Item 1A of Part I—Risk Factors” and elsewhere in this Form 10-K. The forward-looking statements included in this document are made only as of the date of this report, and we undertake no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances.

| Item 1. | Business. |

Overview

Pendrell Corporation (“Pendrell”), together with its consolidated subsidiaries, is referred to as “us,” we,” or the “Company.” Through our consolidated subsidiaries, we have invested in, acquired and developed businesses with unique technologies that are often protected by intellectual property (“IP”) rights, and that present the opportunity to address large, global markets. Our subsidiaries create value from our innovations, both by making our IP available for use by third parties and by developing and bringing to market products using our IP. We regularly evaluate our existing investments to determine whether retention or disposition is appropriate, and we investigate new investment and business acquisition opportunities. We also advise clients on various IP strategies and transactions.

Pendrell was originally incorporated in 2000 as New ICO Global Communications (Holdings) Limited, a Delaware corporation. In July 2011, we changed our name to Pendrell Corporation. On November 14, 2012, we reincorporated from Delaware to Washington. The reincorporation merely changed our legal domicile. Our consolidated financial condition and results of operations immediately after consummation of the reincorporation were the same as those immediately prior to the reincorporation. Our principal executive office is located at 2300 Carillon Point, Kirkland, Washington 98033, and our telephone number is (425) 278-7100. Our website address is www.pendrell.com. The information contained in or that can be accessed through our website is not part of this Form 10-K.

Our Business

Revenue Generating Activities

We generate revenues by licensing and selling our IP rights to others, and by advising clients on various IP matters. We also develop products that rely on our IP rights, although these offerings do not presently generate revenue. Our subsidiaries held approximately 1,200 patents as of December 31, 2014, with expiration dates ranging from 2015 to 2033, and with an average remaining life of approximately 6.2 years. These patents support four IP licensing programs that we own and manage: (i) digital media, (ii) digital cinema, (iii) wireless technologies, and (iv) memory and storage technologies.

Our digital media program is supported by patents and patent applications designed to protect against unauthorized duplication and use of digital content that is transferred from a source to one or more electronic devices. The majority of our digital media patents and patent applications came to us through our October 2011 purchase of a 90.1% interest in ContentGuard, where we partnered with Time Warner to expand the development and licensing of ContentGuard’s industry-leading portfolio of digital rights management (“DRM”) technologies. At that time, ContentGuard held more than 260 issued patents and more than 160 pending applications

1

Table of Contents

worldwide. Our digital media licensees include manufacturers, distributors and providers of consumer products, including Casio Hitachi Mobile Communications, Fujitsu, LG Electronics, Microsoft Corporation, Nokia, Panasonic, Pantech, Sharp, Sony, Toshiba, Technicolor, S.A., Time Warner and Xerox Corporation. Other companies that manufacture, distribute or provide DRM-enabled consumer products and that we believe use ContentGuard’s innovations, including Amazon, Apple, Blackberry, DirecTV, Google, HTC, Huawei, Motorola Mobility and Samsung (the “ContentGuard Defendants”), have not agreed to license our digital media assets, which prompted us to file claims against them for patent infringement.

Our digital cinema program is supported by patents and patent applications designed to protect against unauthorized creation, duplication and use of digital cinema content that is authored and distributed to movie theaters globally, many of which also came to us through our acquisition of ContentGuard. Potential digital cinema licensees include distributors and exhibitors of digital content, including motion picture producers, motion picture distributors and equipment vendors. We launched our digital cinema program in June 2013, and have engaged in licensing discussions with leading feature film studios.

Our wireless technologies program is supported by approximately 800 U.S. and foreign patents and patent applications, many of which enable key functionality in cellular and digital wireless devices and infrastructure. These patents and patent applications were developed by leading innovators in the wireless space, including Philips, IBM and ETRI, and cover key innovations in the cellular industry and digital wireless arena. Key technologies covered include 3G (e.g., W-CDMA, HSDPA, HSUPA), 4G (e.g., LTE, VoLTE), Bluetooth, Wi-Fi, and NFC technologies. Potential licensees include suppliers, manufacturers, distributors, and providers of wireless devices and infrastructure, including manufacturers and distributors of handsets, tablets, laptops, and other connected devices. We launched our wireless technologies program in Fall 2012, and are in discussions with several manufacturers of products that we believe rely on our wireless innovations.

Our memory and storage technologies program is supported by approximately 160 patents and patent applications, the majority of which were acquired from Nokia Corporation in March 2013, of which 81 have been declared by Nokia to be essential to standards that are applicable to memory and storage technologies used in electronic devices. These patents cover embedded memory components and storage subsystems. Potential licensees include flash memory component suppliers, solid state disk manufacturers and device vendors. We commenced discussions with potential licensees in late 2013, and subsequently entered into two license agreements with leading technology companies in 2014, and another license with a leading technology company in early 2015. Currently, our memory and storage technologies licensees include Samsung Electronics and SK hynix.

We typically license our patents via agreements that cover entire patent portfolios or large segments of portfolios. We expect licensing negotiations with prospective licensees to take approximately 12 to 24 months, and perhaps longer, measured from inception of technical discussions regarding the scope of our patents. If we are unable to secure reasonable, negotiated licenses, we may resort to litigation to enforce our IP rights. For example, in late 2013 and early 2014, ContentGuard asserted infringement claims against the ContentGuard Defendants.

Our IP revenue generation activities are not limited to licensing and litigation. Patents that we believe may generate greater value through a sales transaction may be sold. In addition, we provide IP valuation services, analysis and strategic advice to third parties, including IP portfolio development, strategic assessment of IP assets, IP landscape analysis and risk mitigation strategies. Although our revenue may occur in different forms, we regard our IP monetization activities as integrated and not separate revenue streams.

Product Development Activities

Through our subsidiaries we continue our efforts to develop new solutions to complex problems, including the development of products that commercialize our IP rights. For instance, in December 2013, through ContentGuard, we launched a digital content protection application for mobile device users, the functionality of which we continued to expand throughout 2014. During October 2014, ContentGuard launched Yovo®, our next-generation ephemeral photo and messaging application. Yovo® facilitates ephemeral photo sharing. Designed for

2

Table of Contents

sending scrambled photo messages via email, texting, Facebook and Twitter, Yovo® offers features such as full encryption, screen capture scrambling and a self-destruct timer that allows a sender to grant viewing rights for as little as one second and as long as 24 hours. These mobile applications, based on technologies developed by ContentGuard over the past fifteen years, are designed to address consumer demand for enhanced Internet privacy through solutions that restrict access to and limit the life of content. Our continuing development of these ephemeral content protection solutions reflects our commitment to continued innovation, including the development of products to commercialize our IP rights.

In early 2015, we suspended further development of the Provitro™ proprietary micro-propagation technology and related laboratory processes that are designed to facilitate production on a commercial scale of certain plants, particularly timber bamboo. Although we continued to pursue revenue generating business opportunities through the fourth quarter, we were unable to identify opportunities to justify continued commercialization efforts. In the absence of opportunities, we determined that we should not sustain the cost structure required for continued development of the technology. As a result, we began seeking a buyer for Provitro’s assets and took an impairment charge equal to our unamortized investment in the Provitro™ technology and related goodwill in our 2014 results of operations. In addition, in early 2015, we reached agreement with Provitro’s minority partner to cancel the ownership interest in Provitro that we did not already own for nominal consideration, thereby leaving us with 100% ownership of Provitro.

Business Outlook

From 2011 through late 2014, we focused on acquiring and growing companies that developed or possess unique, innovative technologies that can be licensed to third parties or provide a competitive advantage to products we develop and bring to market. In pursuit of this strategy, we invested our capital in companies with IP that we believe is undervalued, underutilized or not fully commercialized, or directly in IP assets. We also regularly explored acquisition and investment opportunities to supplement our existing businesses or to expand the scope of our businesses.

We explored a number of business development opportunities during 2014. However, due to escalating valuations which we attribute to inexpensive and widely available capital, we did not complete any transactions during the year. We expect this trend to continue and have therefore slowed our exploratory activity and reduced our costs by eliminating certain positions, abandoning certain patent assets that do not support our existing licensing programs, and lowering facilities costs. This does not mean we discontinued our assessment of opportunities to commercialize unique technologies and related businesses or otherwise invest our capital in opportunities which may be unrelated to our historical IP monetization activities, but until market conditions change, we expect to take a thoughtful and measured approach to potential transactions. In the meantime, we will concentrate our efforts on generating revenue from our existing assets.

Competition

Due to the unique nature of our IP rights, we do not compete directly with other patent holders or patent applicants. However, to the extent that multiple parties seek royalties on the same product or service, we might as a practical matter compete for a share of reasonable royalties from manufacturers and distributors.

If we continue to pursue IP rights to strengthen our existing licensing programs or launch new ones, we may compete with well-capitalized companies pursuing those same IP rights. We may also face indirect competition from prospective licensees, some of whom may be evaluating and implementing technologies that obviate the need to obtain a license to our IP rights.

Divestiture of Satellite Assets

When we were formed in 2000, our intent was to develop and operate a next generation global mobile satellite communications system. In 2011, we started selling assets associated with the satellite business,

3

Table of Contents

including our interests in DBSD North America, Inc. and its subsidiaries (collectively referred to as “DBSD”) to DISH Network Corporation for $325 million, from which we recognized a gain of approximately $301 million associated with the disposition. During 2012, we divested the remaining vestiges of our satellite business, including the sale of our remaining medium earth orbit satellites and related equipment and our real property in Brazil, the transfer to a liquidating trust (the “Liquidating Trust”) of certain former subsidiaries associated with the satellite business (the “International Subsidiaries”) to address the winding down of the International Subsidiaries, and the settlement of our litigation with The Boeing Company (“Boeing”).

The 2012 disposal of our satellite assets and the transfer of the International Subsidiaries to the Liquidating Trust resulted in the elimination of approximately $61.9 million in satellite-related liabilities, a one-time $48.7 million gain, and the triggering of tax losses of approximately $2.4 billion, which we believe can be carried forward for up to twenty years. Additionally, our settlement with Boeing yielded a $10.0 million payment from Boeing and Boeing’s waiver of its right to appellate costs in exchange for the withdrawal of our appeal of the Boeing judgment.

Employees

As of December 31, 2014, on a consolidated basis, we had 57 full-time employees located in Washington, California, Texas, Washington D.C. and Finland.

Available Information

The address of our website is www.pendrell.com. You can find additional information about us and our business on our website. We make available on this website, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the Securities and Exchange Commission (“SEC”). You may read and copy this Form 10-K at the SEC’s public reference room at 100 F Street, NE, Washington, DC 20549-0102. Information on the operation of the public reference room can be obtained by calling the SEC at 1-800-SEC-0330. These filings are also accessible on the SEC’s website at www.sec.gov.

We also make available on our website in a printable format the charters for certain of our various Board of Director committees, including the Audit Committee, the Compensation Committee and the Nominating and Governance Committee, and our Code of Conduct and Ethics in addition to our Articles of Incorporation, Bylaws and Tax Benefits Preservation Plan. This information is available in print without charge to any shareholder who requests it by sending a request to Pendrell Corporation, 2300 Carillon Point, Kirkland, Washington 98033, Attn: Corporate Secretary. The material on our website is not incorporated into or part of this Form 10-K.

| Item 1A. | Risk Factors. |

The risks below address some of the factors that may affect our future operating results and financial performance. If any of the following risks develop into actual events, then our business, financial condition, results of operations or prospects could be materially adversely affected.

Risks Related to our Patents and Monetization Activities

Success of our licensing efforts depends on our ability to enter into new license agreements or otherwise enforce our intellectual property rights.

Our licensing business depends on sustaining and growing our IP licensing revenue. IP licensing revenues are dependent on our ability to enter into new license agreements with, or otherwise enforce our intellectual property rights against, users of our patented inventions. If users refuse to sign or renew license agreements, we may need to resort to litigation or other measures to compel the payment of fair consideration, which may or may

4

Table of Contents

not be effective. This risk applies not only to new license agreements, but to existing license agreements with fixed expiration dates. If we fail to sign or renew license agreements on terms that are favorable to us or obtain favorable outcomes through litigation or other enforcement actions, our business opportunity could be negatively impacted.

If we fail to expand our portfolios, revenue opportunities from our IP monetization efforts will be limited.

Patents have finite lives. Our IP portfolio currently consists of patents that expire between 2015 and 2033, as well as patent applications. Our portfolio has an average remaining life of approximately 6.2 years. If we fail to develop or acquire new patentable inventions prior to the expiration of our patents, our licensing opportunities will be limited.

We may have a limited number of prospective licensees.

The patent portfolios that we own and may acquire in the future may be applicable to only a limited number of prospective licensees. As such, if we are unable to enter into licenses with this limited group, and if we fail to expand the breadth and depth of our patent portfolios, licensing revenue will be adversely impacted.

Our licensing cycle is lengthy, and our licensing efforts may be unsuccessful.

The process of licensing to customers can be lengthy, sometimes spanning a number of years. We expect to incur significant legal and sales expenses prior to entering into license agreements and generating license revenues. We also expect to spend considerable resources educating prospective licensees on the benefits of a license arrangement with us. As such, we may incur significant losses in any particular period before any associated revenue is generated. Moreover, if our portfolio is not demonstrably applicable to prospective licensees’ products or services, whether due to poor quality, lack of breadth or otherwise, parties may refuse to enter into license agreements.

Enforcement proceedings may be costly and ineffective and could lead to impairment of our IP assets.

We may choose to pursue litigation or other enforcement action to protect our intellectual property rights, such as the litigation we initiated against the ContentGuard Defendants. Enforcement proceedings are typically protracted and complex, and might require cooperation of inventors and others who are unwilling or unable to assist with enforcement. Litigation also involves several stages, including the potential for a prolonged appeals process. The costs are typically substantial, and the outcomes are unpredictable. We may receive a ruling or judgment, or we may enter into licenses or settlement agreements that might compel us to revalue the IP assets that we are enforcing or the goodwill value of our enforcing subsidiary, which in turn might result in a reduction to the financial statement carrying value of such assets through a corresponding impairment charge which would adversely affect our results of operations and our financial position. Enforcement actions will likely divert our managerial, technical, legal and financial resources from business operations. In certain cases, we may conclude that these costs and risks outweigh the potential benefits that would arise from successful enforcement, in which event we may opt not to pursue enforcement.

Our business could be negatively impacted if our inventions are not incorporated into products.

Our licensing revenues have been generated from manufacturers and distributors of products that incorporate our patented inventions. Our business prospects could be negatively impacted if prospective licensees do not include our inventions in their products, or if they later modify their products to eliminate use of our inventions.

As we incorporate our IP into product offerings, we could face new risks.

As we seek to commercialize our IP through product offerings, we could face risks that we have not previously confronted, including IP infringement risks, product liability risks, and other risks. The outcome of

5

Table of Contents

proceedings arising from or related to such risks could have a material adverse effect on our results of operations or cash flows in any particular period. In addition, any growth associated with product offerings is largely dependent on the timing and market acceptance of any new product offerings, including our ability to continually modernize our products and bring those products to market. If any products we offer are not commercially successful, our results of operation and reputation could be adversely affected.

We may not recover costs of our commercialization activities.

We may incur significant costs to advance our commercialization efforts that might not be recovered if our efforts are unsuccessful. Our failure to recover such costs could adversely affect our results of operations and our financial position.

Future innovations could make our inventions obsolete.

Our success depends, in part, on continued demand for products that incorporate our patented inventions. Changes in technology or customer requirements could render our patented inventions obsolete or unmarketable.

Challenges to the validity or enforceability of our key patents could significantly harm our business.

Our assets include patents that are integral to our business and revenues. Prospective licensees or competitors may challenge the validity, scope, enforceability and ownership of our patents. Their challenges may include review requests in the relevant patent and trademark office, such as the inter partes review and covered business method proceedings initiated by certain ContentGuard Defendants. Review proceedings are costly and time-consuming, and we cannot predict their outcome or consequences. Such proceedings may narrow the scope of our claims or may cancel some or all of our claims. If some or all of our patent claims are canceled, we could be prevented from enforcing or earning future revenues from such patents. Even if our claims are not canceled, enforcement actions against alleged infringers, such as our litigation against the ContentGuard Defendants, may be stayed pending resolution of reviews, or courts or tribunals reviewing our patent claims could make findings adverse to our interests based on facts presented in review proceedings. Irrespective of outcome, review challenges may result in substantial legal expenses and diversion of management’s time and attention away from our other business operations. Adverse decisions could impair the value of our inventions or result in a loss of our proprietary rights and may adversely affect our results of operations and our financial position.

Delays in issuance of patents could harm our business.

We may acquire and pursue additional patents and related intellectual property rights. If we do, our patent applications will add to a growing number of patent applications, which may result in longer delays in obtaining approval of such patent applications. The application delays could cause delays in recognizing revenue from new patents and could cause us to miss opportunities to license or enforce patents before other competing technologies are developed or introduced into the market.

Changes in patent law could adversely impact our business.

Patent laws may continue to change, and may alter protections afforded to owners of patent rights, impose additional enforcement risks, increase the costs of enforcement, or increase our licensing cycles. For instance, during 2013, legislative initiatives were introduced to address perceived patent abuses by non-practicing entities. Although legislation was not enacted, similar legislation has been introduced in 2015. Even if legislative initiatives do not directly impact our business, such initiatives might encourage manufacturers to infringe our IP rights, lengthen our licensing cycles, increase the likelihood that we will litigate to enforce our IP rights, or make it more difficult and expensive to license our patents or enforce our patents against parties using our inventions without a license. Moreover, increased focus on the growing number of patent-related lawsuits may result in legislative changes which increase our costs and related risks of asserting patent enforcement actions.

6

Table of Contents

Changes of interpretations of patent law could adversely impact our business.

Our success in review and enforcement proceedings relies in part on the historically consistent application of patent laws and regulations. Interpretations of patent laws and regulations by the courts and applicable regulatory bodies have evolved, and may continue to evolve, particularly with the introduction of new laws and regulations. Changes or potential changes in judicial interpretation could have a negative impact on our ability to monetize our patent rights.

Risks Related to our Acquisition Activities

We may over-estimate the value of assets or businesses we acquire.

We make investments from which we intend to generate a return. We estimate the value of these investments prior to acquisition, using both objective and subjective methodologies. If we over-estimate such value, we may not generate desired returns on our investment, or we may need to adjust the value of the investments to fair value and record a corresponding impairment charge, either of which could adversely affect our results of operations and our financial position.

We may not capitalize on acquired assets.

Even if we accurately value the investments we make, we must succeed in generating a return on the investments. For instance, our subsidiaries that own IP rights must commercialize, license, or otherwise monetize the IP rights in order to generate a return on our investment. Our success in generating a return, particularly with respect to our IP rights, depends on effective efforts of our employees and outside professionals, which typically requires complex analysis, the exercise of sound professional judgment and effective education of prospective licensees and customers. If we do not generate desired returns on our investments or if we are compelled to adjust the value of the investments to fair value and record a corresponding impairment charge, it could adversely affect our results of operations and our financial position.

We may pursue other acquisition or investment opportunities that do not yield desired results.

We intend to continue investigating potential acquisitions that support our business objectives and strategy. Acquisitions are time-consuming, complex and costly. The terms of acquisition agreements tend to be heavily negotiated. As a result, we may incur significant transactional expenses, regardless of whether or not acquisitions are consummated. Moreover, the integration of acquired companies prompts significant challenges, and we can provide no assurances that the integration of acquired businesses with our business will result in the realization of the full benefits we anticipate from such acquisitions. Investigating businesses and assets and integrating newly acquired businesses or assets may be costly and time-consuming, and such activities could divert our attention from other business concerns. In addition, we might lose key employees while integrating new organizations. Acquisitions could also result in potentially dilutive issuances of equity securities or the incurrence of debt, the assumption or incurrence of contingent liabilities, possible impairment charges related to goodwill or other intangible assets or other unanticipated events or circumstances, any of which could negatively impact our financial position. We might not be successful in integrating acquired businesses, and might not achieve desired revenues and cost benefits.

We rely on representations, warranties and opinions from third parties that might not be accurate.

When we acquire assets or businesses or establish relationships with inventors or strategic partners, we may rely on representations and warranties made by third parties. We also may rely on opinions of lawyers and other professionals. We may not have the opportunity to independently investigate and verify the facts upon which such representations, warranties and opinions are made. By relying on these representations, warranties and opinions, we may be exposed to unforeseen liabilities that could have a material adverse effect on our operating results and financial condition.

7

Table of Contents

Risks Related to our Operations

Our financial and operating results have been and may continue to be uneven.

Our operating results may fluctuate and, as such, our operating results are difficult to predict. You should not rely on quarterly or annual comparisons of our results of operations as an indication of our future performance. Factors that could cause our operating results to fluctuate during any period or that could adversely affect our operating results include the timing of license, sales and consulting agreements, compliance with such agreements, the terms and conditions for payment under those agreements, our ability to protect and enforce our intellectual property rights, changes in demand for products that incorporate our inventions, the time period between commencement and completion of license negotiations or enforcement proceedings, revenue recognition principles, and changes in accounting policies.

Our revenues have not and may not offset our operating expenses.

Through 2014, we developed and expanded our business by acquiring IP assets, developing new solutions and products and expanding the reach and scope of our IP business. We also incurred expenses to hire new personnel, including employees for IP services, patent research and analysis, development of reporting systems and general and administrative functions and to pay legal fees for IP enforcement activities. As a result, our costs exceeded our revenues, and although we have recently scaled back our expansion efforts, we anticipate that costs will continue to exceed revenues until and unless we generate additional revenue from our existing assets. If we are not successful in generating revenue that is sufficient to offset our expenses, our financial position will be negatively impacted.

Failure to effectively manage the composition of our employee base could strain our business.

Our success depends, in large part, on continued contributions of our key managers and employees, many of whom are highly skilled and would be difficult to replace. Our success also depends on our ability to attract, train and retain highly skilled personnel, and on the abilities of new personnel to function effectively, both individually and as a group. Recently, we terminated the employment of certain individuals (including IP consultants) who we believe were redundant or unnecessary to advance our current and anticipated business initiatives. If we misjudged our ongoing personnel needs or lose any of our remaining senior managers or key personnel, it could lead to dissatisfaction among our clients or licensees, which could slow our growth or result in a loss of business. Moreover, if we fail to manage the composition of our employee base effectively or otherwise strain our relationships with our personnel, our business and financial results may be materially harmed.

Our provision of IP-related services could result in professional liability that may damage our reputation.

Our provision of IP-related services typically involves complex analysis and the exercise of professional judgment. As a result, we are subject to the risk of professional liability. If a client questions the quality of our work, the client could threaten or bring a lawsuit to recover damages or contest its obligation to pay fees. Litigation alleging that we performed negligently or breached any other obligations to a client could expose us to legal liabilities and, regardless of outcome, could be costly, distract our management and damage our reputation.

Rights of minority shareholders may limit future value.

The governing documents for certain subsidiaries which we do not wholly own describe certain actions that require unanimous consent of their respective shareholders. For instance, we entered into a voting agreement with Time Warner that survives so long as Time Warner holds a material interest in ContentGuard, and which requires the prior written consent of both us and Time Warner before ContentGuard commits its patents to a standards body or patent pool, grants any license that facilitates copyright theft, undertakes certain litigation, or sells or transfers any material patents free of these three restrictions. Historically, shareholder consent requirements have not adversely impacted our business, but circumstances could change. Moreover, we may enter into investments in the future that involve similar or more restrictive governance provisions. If our interests

8

Table of Contents

and the interests of our partners or other shareholders in these investments diverge, we may be unable to capitalize on business opportunities or prevented from realizing favorable returns on investments.

If we need financing and cannot obtain financing on favorable terms, our business may suffer.

We have relied on revenues from clients and licensees and existing cash reserves to finance our operations. If we deploy a significant portion of our capital or encounter unforeseen difficulties in the future that deplete our capital resources more rapidly than anticipated, we may need to obtain additional financing. Financing might not be available on favorable terms, if at all, may dilute our existing shareholders, and may prompt us to pursue structural changes that could impact shareholder concentration and liquidity. If we fail to obtain additional capital as and when needed, such failure could have a material adverse impact on our business, results of operations and financial condition.

Future changes in standards, rules, practices or interpretation may impact our financial results.

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. These principles are subject to interpretations by the SEC and various accounting bodies. In addition, we are subject to various taxation rules in many jurisdictions. The existing taxation rules are generally complex, voluminous, frequently changing and often ambiguous. Changes to existing taxation rules, changes to the financial accounting standards, or any changes to the interpretations of these standards or rules, or changes in practices under these standards and rules, may adversely affect our reported financial results or the way we conduct our business.

Unauthorized use or disclosure of our confidential information could adversely affect our business.

We rely primarily on a combination of license agreements, nondisclosure agreements, other contractual relationships and patent, trademark, trade secret and copyright laws to protect our confidential and proprietary information, our technology and our intellectual property. We cannot be certain that these protections have not been and will not be breached, that we will be able to timely detect unauthorized use or transfer of our trade secrets or intellectual property, that we will have adequate remedies for any breach, or that our trade secrets will not otherwise become known or be independently discovered by competitors. If we are unable to detect in a timely manner the unauthorized use or disclosure of our proprietary or other confidential information or if we are unable to enforce our rights under our agreements or applicable laws, the misappropriation of such information could harm our business.

Risks Related to the Tax Losses Generated from Our Former Satellite Communications Business

Our ability to benefit from our United States federal income tax loss carryforward may be impacted by changes in the tax laws.

We have substantial historical net operating losses (“NOLs”) for United States federal income tax purposes. As of December 31, 2014, we had NOL carryforwards of approximately $2.5 billion. A significant portion of our NOL was triggered when we disposed of our satellite business. We believe these NOLs can be carried forward to offset certain future taxable income. However, our ability to benefit from these historical NOLs is dependent on the generation of future taxable income during the loss carryforward period. The NOL carryforward period begins to expire in 2025 with the bulk of the NOLs expiring in 2032. If the tax laws are amended to limit or eliminate our ability to carryforward the NOLs for any reason, or to lower income tax rates, the value of the NOLs may be significantly reduced.

An Ownership Change under Section 382 of the Internal Revenue Code may significantly limit Pendrell’s ability to use its NOLs to offset future taxable income.

Our use of our NOLs will be significantly limited if we undergo a Tax Ownership Change, as defined in Section 382 of the Internal Revenue Code. Broadly, Pendrell will have a Tax Ownership Change if, over a three-

9

Table of Contents

year testing period, the portion of all stock of Pendrell, by value, owned by one or more 5% shareholder increases by more than 50 percentage points. For purposes of this test, shareholders that own less than 5% of the stock of Pendrell are aggregated into one or more separate “public groups,” each of which is treated as a 5% shareholder. In general, shares traded within a public group are not included in the Tax Ownership Change test. Despite our adoption of certain protections against a Tax Ownership Change (such as our Tax Benefits Preservation Plan), we cannot control the trading activity of our significant shareholders. If significant shareholders divest their shares in a manner or at times that do not account for the loss-limiting provisions of the Internal Revenue Code or regulations adopted thereunder, a Tax Ownership Change could occur. If a Tax Ownership Change occurs when the value of the Class A Common Stock is low, Pendrell will be permanently unable to use most of its NOLs.

Our NOLs cannot be used to offset the Personal Holding Company tax.

The Internal Revenue Code imposes an additional tax on the undistributed income of a Personal Holding Company (“PHC”). In general, a corporation will be classified as a PHC if more than 50% of its outstanding shares, measured by value, are owned directly or indirectly by five or fewer individuals and at least 60% of its adjusted gross income is Personal Holding Company Income (“PHCI”). Broadly, PHCI includes income such as dividends, interest, rents and royalties, among others. We believe that any income from ContentGuard’s resolution of its claims against the ContentGuard Defendants will be classified as PHCI. Due to the significant number of shares held by our largest shareholders, we must continually assess share ownership of Pendrell and each of our consolidated subsidiaries, including ContentGuard. To date neither Pendrell, as the parent company, nor any of our consolidated subsidiaries have incurred a PCH tax obligation. However, it is possible that action or inaction by significant shareholders could result in a future PHC tax liability. The PHC tax, which is in addition to the income tax, is currently levied at 20% of the net PHCI not distributed to the corporation’s shareholders.

Our NOLs cannot be used to completely offset the Alternative Minimum Tax or other taxes.

We may also be subject to the corporate Alternative Minimum Tax (“AMT”) in a year in which we have net taxable income because the AMT cannot be completely offset by available NOLs, as losses carried forward generally can offset no more than 90% of a corporation’s AMT liability. In addition, our federal NOLs will not shield us from foreign withholding taxes, state and local income taxes, or revenue-based taxes incurred in jurisdictions that impose such taxes.

Our ability to utilize our NOLs is dependent on the generation of future taxable income.

Our ability to utilize our NOLs is dependent upon the generation of future taxable income before the expiration of the carry forward period attributable to the NOLs, which begin to expire in 2025. We did not generate taxable income in 2013 or 2014 and we may not generate sufficient taxable income in future years to use the NOLs before they begin expiring.

Risks Related to Our Class A Common Stock

Future sales of our Class A common stock could depress the market price.

The average trading volume of our Class A common stock is low in relation to the number of outstanding shares of Class A common stock. As a result, the market price of our Class A common stock could decline as a result of sales of a large number of shares. These sales might also make it more difficult for us to sell shares in the future at a time and price that we deem appropriate.

A sale of a large number of shares by our largest shareholders could depress the market price of our Class A common stock.

A small number of our shareholders hold a majority of our Class A common stock and our Class B common stock, which is convertible at the option of the holders into Class A common stock. The sale or prospect of the

10

Table of Contents

sale of a substantial number of these shares could have an adverse effect on the market price of our Class A common stock.

The interests of our controlling shareholder may conflict with the interests of other Class A holders.

Eagle River Satellite Holdings, LLC, together with its affiliates Eagle River Investments, LLC, Eagle River, Inc. and Eagle River Partners, LLC (collectively, “Eagle River”) controls approximately 65% of the voting power of our outstanding capital stock. As a result, Eagle River has control over the outcome of matters requiring shareholder approval, including the election of directors, amendments to our governing documents, the adoption or prevention of mergers, consolidations or sales of all or substantially all of our assets, or control changes. Eagle River is not restricted or prohibited from competing with us.

We are a “controlled company” within the meaning of the NASD Marketplace Rules and, as a result, will qualify for, and may rely on, exemptions from certain corporate governance requirements.

Eagle River controls approximately 65% of the voting power of our outstanding capital stock. As a result, we are a “controlled company” within the meaning of the Nasdaq Global Select Market corporate governance standards, and therefore may elect not to comply with certain Nasdaq Global Select Market corporate governance requirements, including (i) the requirement that a majority of the board of directors consist of independent directors, (ii) the requirement that the compensation of officers be determined, or recommended to the board of directors for determination, by a majority of the independent directors or a compensation committee comprised solely of independent directors, and (iii) the requirement that director nominees be selected, or recommended for the board of directors’ selection, by a majority of the independent directors or a nominating committee comprised solely of independent directors with a written charter or board resolution addressing the nomination process. We do not currently rely on any of these exemptions, but reserve the right to do so in the future. If we choose to do so, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq Global Select Market corporate governance requirements.

Our Tax Benefits Preservation Plan, as well as certain provisions in our restated articles of incorporation, may discourage takeovers, which could affect the rights of holders of our Class A common stock.

Our Tax Benefits Preservation Plan is intended to act as a deterrent against any person or group acquiring or otherwise obtaining beneficial ownership of more than 4.9% of our securities without the approval of our board of directors. In addition, our articles of incorporation require us to take all necessary and appropriate action to protect certain rights of our common shareholders, including voting, dividend and conversion rights and rights in the event of a liquidation, merger, consolidation or sale of substantially all of our assets. Our articles of incorporation also provide that we will not avoid or seek to avoid the observance or performance of those rights by charter amendment, entry into an inconsistent agreement or reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution or the issuance or sale of securities. The rights protected by these provisions of the articles of incorporation include our Class B common shareholders’ right to ten votes per share on matters submitted to a vote of our shareholders and option to convert each share of Class B common stock into one share of Class A common stock. The provisions of the Tax Benefits Preservation Plan and our articles of incorporation could discourage takeovers of our company, which could adversely affect the rights of our shareholders.

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties. |

Our corporate headquarters are located in Kirkland, Washington, where we occupy approximately 8,050 square feet of space. Our employees are primarily located in offices in California, Texas and Washington. Upon expiration of our various leases, we do not anticipate any difficulty in obtaining renewals or alternative space.

11

Table of Contents

The following table lists our leased properties for our principal places of business as of December 31, 2014:

| Location |

Lease Term | Square Footage (Approx.) | ||

| Berkeley, CA | Expires October 31, 2017 | 5,671 | ||

| Plano, TX | Expires December 31, 2018 | 2,995 | ||

| Kirkland, WA | Expires July 31, 2019 | 8,050 |

We believe our facilities are adequate for our current business and operations.

| Item 3. | Legal Proceedings. |

Enforcement Action against Amazon et. al.—On December 18, 2013, ContentGuard filed a patent infringement lawsuit against Amazon.com, Inc., Apple Inc., Blackberry Corporation (fka Research in Motion Corporation), Huawei Device USA, Inc. and Motorola Mobility LLC in the Eastern District of Texas, in which ContentGuard alleged that these ContentGuard Defendants infringed and continue to infringe nine of its patents by making, using, selling or offering for sale certain mobile communication and computing devices (the “Amazon Litigation”). On January 17, 2014, ContentGuard filed an amended complaint in the Amazon Litigation adding certain affiliates of the original defendants, along with HTC Corporation, HTC America Inc., Samsung Electronics Co., Ltd., Samsung Electronics America, Inc. and Samsung Telecommunications America, LLC. In August 2014, DirecTV intervened in the case and thereby became an additional ContentGuard Defendant, against whom ContentGuard asserted additional infringement claims. In February 2015, the presiding judge heard claim construction arguments from all parties. Trials are scheduled for September 2015. We are unable to anticipate the timing or outcome of the Amazon Litigation.

Google Actions—On January 31, 2014, Google Inc. (“Google”) filed a declaratory judgment suit in the Northern District of California alleging that Google does not infringe the nine patents asserted in the Amazon Litigation. On February 5, 2014, ContentGuard filed a patent infringement action in the Eastern District of Texas against Google, in which ContentGuard alleges that Google has infringed and continues to infringe the same nine patents. In April 2014, the presiding judge in the Eastern District of Texas, with the endorsement of the presiding judge in the Northern District of California, ruled that all claims by and against Google will be resolved in the Eastern District of Texas, and not in the Northern District of California. The presiding judge also declined to consolidate the Google actions with the Amazon Litigation. In February 2015, the presiding judge heard claim construction arguments. Trial is scheduled for September 2015. We are unable to anticipate the timing or outcome of the actions by and against Google.

IPR and CBM Petitions by ContentGuard Defendants—In December 2014, Apple filed with the United States Patent and Trademark Office (the “USPTO”) twenty-nine inter partes review (“IPR”) petitions and three covered business method (“CBM”) petitions, through which Apple is challenging the validity of all nine patents asserted in the Amazon Litigation. Also in December 2014, Google filed three CBMs, challenging the validity of three of the nine asserted patents. The USPTO will decide in the coming months whether to initiate review proceedings on some or all of the IPR and CBM petitions. The USPTO’s Patent Trial and Appeal Board (“PTAB”), which hears all IPR and CBM challenges, will administer and hear argument in any initiated proceedings. We are unable to predict whether or not proceedings will be initiated, or whether or not such proceedings will impact the timing or outcome of our claims against the ContentGuard Defendants.

ZTE IPRs —In early 2012, ContentGuard and its subsidiaries filed lawsuits in United States and German courts, alleging that ZTE Corporation, ZTE (USA) Inc. and ZTE Deutschland GmbH (collectively “ZTE”) infringed and continue to infringe ContentGuard patents by making, using, selling or offering for sale certain mobile communication and computing devices. ZTE subsequently filed IPR petitions with the USPTO, challenging the validity of six U.S. patents asserted by ContentGuard against ZTE. The PTAB terminated proceedings with respect to two patents, both of which emerged with valid patent claims. ZTE’s claims against

12

Table of Contents

the other four patents, all of which are also asserted against the ContentGuard Defendants, went to trial. Following trial, the PTAB rejected ZTE’s remaining challenges, and confirmed the validity of all claims in the four patents. ZTE’s time for appeal expired with no appeals filed. As a result, the decisions of the PTAB, as against ZTE, are now final. Nonetheless, all four affirmed patents have been challenged in fourteen new IPRs filed by Apple, as described in the paragraph above. We are unable to predict whether, and to what extent, the PTAB will allow Apple to challenge these patents in new proceedings.

ZTE Enforcement Actions— Meanwhile, in response to the claims filed against ZTE in Germany, in which ContentGuard GmbH alleged infringement of three European patents, ZTE filed a nullity action against two of the patents and an opposition proceeding against the third patent. The infringement and nullity proceedings in Germany, along with all U.S. court actions, were “put to rest” or stayed as the result of a standstill agreement signed by ContentGuard and ZTE in December 2013. ZTE prevailed in the opposition proceeding, resulting in the revocation of one European patent. ContentGuard must decide whether to appeal the revocation prior to end of the first quarter of 2015. We are unable to anticipate the timing or outcome of the opposition proceedings.

J&J Collection—In November 2012, we obtained an arbitration judgment in the U.K. against Jay and Jayendra (Pty), a South African corporation (“J&J Group”) for approximately $4.0 million. J&J Group submitted multiple appeals to the U.K. courts, the last of which was rejected in July 2013. In December 2014, we obtained an enforcement judgment against J&J Group from a South African court. J&J’s time to appeal the enforcement judgment expired with no appeals filed, and we have commenced action to enforce the judgment. Due to the uncertainty of collection, we have not recognized the gain associated with the judgment. We are unable to anticipate the timing or outcome of the collection proceedings against J&J Group.

| Item 4. | Mine Safety Disclosures. |

Not Applicable.

13

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market for Our Class A Common Stock

Our Class A common stock trades on the Nasdaq Global Select Market under the symbol “PCO.” Effective July 21, 2011, we changed our name from ICO Global Communications (Holdings) Limited to Pendrell Corporation, and adopted “PCO” as our new ticker symbol. Previously, our Class A common stock traded on the Nasdaq Global Select Market under the symbol “ICOG.”

The table below sets forth the high and low sales prices of our Class A common stock in U.S. dollars for each of the periods presented. Stock prices represent amounts published on the Nasdaq Global Select Market. As of February 26, 2015, the closing sales price of our Class A common stock was $1.12 per share.

| 2014 | 2013 | |||||||||||||||

| Period |

High | Low | High | Low | ||||||||||||

| First Quarter |

$ | 1.91 | $ | 1.34 | $ | 1.66 | $ | 1.26 | ||||||||

| Second Quarter |

$ | 1.85 | $ | 1.39 | $ | 2.70 | $ | 1.55 | ||||||||

| Third Quarter |

$ | 1.84 | $ | 1.31 | $ | 2.70 | $ | 1.88 | ||||||||

| Fourth Quarter |

$ | 1.67 | $ | 1.26 | $ | 2.30 | $ | 1.76 | ||||||||

As of February 26, 2015, there were approximately 340 record holders of our Class A common stock.

Market for Our Class B Common Stock

There is no established trading market for our Class B common stock, of which we have 53,660,000 shares outstanding with two holders of record. Each share of Class B common stock is convertible at any time at the option of its holder into one share of Class A common stock.

Dividends

We have never paid a cash dividend on shares of our equity securities. So long as we do not become a personal holding company that is subject to personal holding company tax, we do not intend to pay any cash dividends on our common shares during the foreseeable future. It is anticipated that future earnings, if any, from our operations will be used to finance growth.

14

Table of Contents

Performance Measurement Comparison

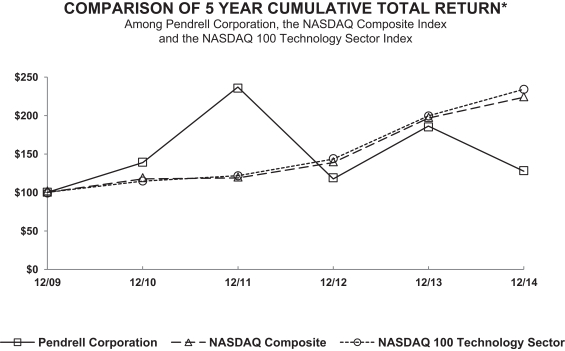

The following graph shows the total shareholder return as of the dates indicated of an investment of $100 in cash on December 31, 2009 for: (i) our Class A common stock; (ii) the Nasdaq Composite Index; and (iii) the Nasdaq 100 Technology Sector Index. All values assume reinvestment of the full amount of any dividends; however, no dividends have been declared on our Class A common stock to date.

The stock price performance graph below is not necessarily indicative of future performance.

*$100 invested on 12/31/09 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

| 12/09 | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 | |||||||||||||||||||

| Pendrell Corporation |

100.00 | 138.89 | 237.04 | 117.59 | 186.11 | 127.78 | ||||||||||||||||||

| NASDAQ Composite |

100.00 | 117.61 | 118.70 | 139.00 | 196.83 | 223.74 | ||||||||||||||||||

| NASDAQ 100 Technology Sector |

100.00 | 114.80 | 121.87 | 143.60 | 199.67 | 234.29 | ||||||||||||||||||

15

Table of Contents

| Item 6. | Selected Financial Data. |

The following selected consolidated financial data should be read in conjunction with “Item 7— Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and accompanying notes included in this Form 10-K.

| Year Ended December 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Revenue(1) |

$ | 42,534 | $ | 13,128 | $ | 33,775 | $ | 2,637 | $ | — | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Cost of revenues(2) |

14,170 | 7,872 | 314 | — | — | |||||||||||||||

| Patent administration and related costs(2) |

6,386 | 4,405 | 3,655 | 193 | — | |||||||||||||||

| Patent litigation(2) |

9,880 | 4,564 | 2,538 | — | — | |||||||||||||||

| General and administrative(2) |

27,467 | 25,939 | 29,844 | 21,822 | 14,392 | |||||||||||||||

| Stock-based compensation |

9,405 | 12,345 | 8,597 | 5,369 | 1,794 | |||||||||||||||

| Amortization of intangibles |

15,929 | 15,864 | 13,471 | 1,986 | — | |||||||||||||||

| Impairment of finite-lived intangibles and goodwill(3) |

11,013 | — | — | — | — | |||||||||||||||

| Gain on contract settlements(4)/(5) |

— | — | — | (4,735 | ) | (15,666 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses, net |

94,250 | 70,989 | 58,419 | 24,635 | 520 | |||||||||||||||

| Operating loss |

(51,716 | ) | (57,861 | ) | (24,644 | ) | (21,998 | ) | (520 | ) | ||||||||||

| Net interest expense |

(99 | ) | (64 | ) | (2,245 | ) | (4,450 | ) | (4,316 | ) | ||||||||||

| Gain on deconsolidation of subsidiaries(6) |

— | — | 48,685 | — | — | |||||||||||||||

| Gain on settlement of Boeing litigation(7) |

— | — | 10,000 | — | — | |||||||||||||||

| Gain associated with disposition of assets(8) |

— | — | 5,599 | 300,886 | — | |||||||||||||||

| Gain on liquidation of subsidiaries |

— | — | — | — | 2,459 | |||||||||||||||

| Other income (expense) |

(16 | ) | (55 | ) | 1,588 | 1,223 | (1,094 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

(51,831 | ) | (57,980 | ) | 38,983 | 275,661 | (3,471 | ) | ||||||||||||

| Income tax benefit (expense)(9) |

(6,303 | ) | — | 1,034 | 42,925 | 787 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

(58,134 | ) | (57,980 | ) | 40,017 | 318,586 | (2,684 | ) | ||||||||||||

| Net loss attributable to noncontrolling interest |

(7,132 | ) | (2,918 | ) | (67 | ) | (274 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Pendrell |

$ | (51,002 | ) | $ | (55,062 | ) | $ | 40,084 | $ | 318,860 | $ | (2,684 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic income (loss) per share attributable to Pendrell |

$ | (0.19 | ) | $ | (0.21 | ) | $ | 0.16 | $ | 1.26 | $ | (0.01 | ) | |||||||

| Diluted income (loss) per share attributable to Pendrell |

$ | (0.19 | ) | $ | (0.21 | ) | $ | 0.15 | $ | 1.23 | $ | (0.01 | ) | |||||||

| Total assets |

$ | 304,104 | $ | 351,994 | $ | 381,415 | $ | 435,047 | $ | 45,577 | ||||||||||

| Long-term obligations, including current portion of capital lease obligations(10) |

$ | 1,521 | $ | 6,695 | $ | 2,241 | $ | 76,406 | $ | 27,921 | ||||||||||

| (1) | Prior to the acquisition of Ovidian and ContentGuard during the year ended December 31, 2011, we were a development stage enterprise and did not generate any revenue from operations. |

| (2) | Certain prior period amounts have been reclassified to conform to the current year presentation of expenses in our consolidated statements of operations, including the presentation of “cost of revenues” and “patent litigation” as separate captions; as such costs were previously included in “patent administration, litigation and related costs” and “general and administrative” in prior years. |

| (3) | During the fourth quarter of the year ended December 31, 2014, we recorded a non-cash impairment of Provitro’s goodwill and proprietary micro-propagation technology. Although we believe the technology is sound, we were unable to identify near-term opportunities to commercialize the technology. |

16

Table of Contents

| (4) | During the year ended December 31, 2011, we recognized a $4.7 million gain associated with a reduction of our estimated liability for gateway obligations as a result of our agreement to purchase Deutsche Telekom AG’s claim against one of our subsidiaries. |

| (5) | Prior to 2013, certain of our subsidiaries had agreements with ten operators of gateways for our MEO satellite system. Nine of the ten operators terminated their agreements with us. Of these nine, five were settled with no further obligation by us. In 2010, upon reaching settlement with our Mexico operator, pursuant to which the operators’ claims were legally released, we eliminated the corresponding accrued liability and recognized a gain on contract settlement of $15.7 million. With respect to the gateways that had not been settled, we continued to accrue expenses according to our subsidiaries’ contractual obligation until the liabilities were transferred to the Liquidating Trust. |

| (6) | During the year ended December 31, 2012, we transferred our International Subsidiaries to the Liquidating Trust and recognized a gain of $48.7 million upon their deconsolidation. |

| (7) | We had been in litigation with Boeing regarding the development and launch of our former MEO satellites and related launch vehicles. In February 2009, the trial court entered judgment in our favor for approximately $603 million. On April 13, 2012, the California Court of Appeal overturned the judgment. The reversal was the culmination of a three year Court of Appeal process. The Court of Appeal also ordered us to reimburse Boeing for its appellate costs. On June 25, 2012, we settled our litigation against Boeing. As part of the settlement, we agreed to withdraw our petition for review to the California Supreme Court in exchange for a $10.0 million payment from Boeing and Boeing’s waiver of its right to appellate costs. The settlement agreement and mutual release between ourselves and Boeing fully released and discharged any and all claims between us and Boeing. As a result of the settlement agreement, we recorded a gain of $10.0 million during the year ended December 31, 2012. |

| (8) | In March 2011, upon the sale of our DBSD subsidiary for $325 million we recognized a $301 million gain associated with the disposition of DBSD and certain other assets pursuant to various agreements entered into with DISH Network. During the year ended December 31, 2012, we sold our real property located in Brazil for approximately $5.6 million. |

| (9) | During the year ended December 31, 2014, we recorded a tax provision of $6.3 million related to foreign taxes withheld on revenue generated from a license agreement executed with a licensee domiciled in a foreign jurisdiction. During the year ended December 31, 2011, as a result of recording net deferred tax liabilities pursuant to the acquisition of ContentGuard, we were able to reduce a portion of our deferred tax valuation allowance resulting in a tax benefit of $40.7 million. |

| (10) | Long-term obligations at December 31, 2014, 2012 and 2011 consisted primarily of deferred tax liabilities. Long-term obligations at December 31, 2013 include an installment payment obligation arising from the 2013 acquisition of our memory and storage technologies portfolio, expense related to restricted stock awards that is required to be treated as a liability and deferred tax liabilities. Long-term obligations at December 31, 2010 consisted primarily of capital lease obligations and income tax obligations associated with uncertain tax positions. |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion and analysis should be read in conjunction with our consolidated financial statements and accompanying notes included elsewhere in this Form 10-K.

Special Note Regarding Forward-Looking Statements

With the exception of historical facts, the statements contained in this management’s discussion and analysis are “forward-looking” statements. All of these forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from those contemplated by the relevant forward-looking statements. Factors that might cause or contribute to such a difference include, but are not limited to, those discussed under “Item 1A of Part I—Risk Factors” and elsewhere in this Form 10-K. The forward-looking statements included in this document are made only as of the date of this report, and we undertake no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances.

17

Table of Contents

Overview

Through our consolidated subsidiaries, we have invested in, acquired and developed businesses with unique technologies that are often protected by intellectual property (“IP”) rights, and that present the opportunity to address large, global markets. Our subsidiaries create value from our innovations, both by making our IP available for use by third parties and by developing and bringing to market products using our IP. We regularly evaluate our existing investments to determine whether retention or disposition is appropriate, and we investigate new investment and business acquisition opportunities. We also advise clients on various IP strategies and transactions.

During 2014, we entered into license agreements with two leading technology companies, under which we authorized the use of patents covering memory and storage technologies. One of the license agreements yielded a significant upfront license fee, while the other generated a smaller upfront license fee and future royalties. We followed those 2014 signings with an additional memory and storage license in January 2015 that generated another significant upfront license fee. We intend to continue licensing our memory and storage assets to flash memory component suppliers, solid state disk manufacturers and device vendors, among others.

We also continue to pursue and advance our other licensing programs. However, the programs supported by our DRM patents (digital media and digital cinema) have been slowed by ContentGuard’s ongoing litigation with Amazon, Apple, DirecTV, Google, Huawei, HTC, Motorola Mobility and Samsung (the “ContentGuard Defendants”), which ContentGuard felt compelled to file after negotiations with ContentGuard Defendants failed to yield negotiated license agreements. Until a court rules on ContentGuard’s claims against these companies, we anticipate that potential licensees of our DRM assets may eschew serious license negotiations.

ContentGuard’s claims also elicited a series of IPR review petitions and CBM petitions by certain ContentGuard Defendants. Specifically, in December 2014, Google filed CBM petitions against three of the nine patents that ContentGuard asserted in the litigation. Apple filed twenty-nine IPR petitions and three CBM petitions challenging the validity of all nine asserted patents, including four patents that previously withstood IPR challenges by ZTE. The United States Patent and Trademark Office will decide in the coming months whether to initiate review proceedings on some or all of the IPR and CBM petitions. We are unable to predict whether or not proceedings will be initiated, or whether or not such proceedings will impact the timing or outcome of the litigation.

Meanwhile, in 2014, our ContentGuard subsidiary launched Yovo®, our next-generation ephemeral photo and messaging application. Yovo® facilitates ephemeral posts on social networking sites, as well as private messaging via text and email. Designed for integration with Facebook and Twitter, Yovo® offers features such as forward lock, full encryption, screen capture scrambling and a self-destruct timer that allows a sender to grant viewing rights for as little as one second and as long as 24 hours. Yovo® follows on the heels of the ContentGuard™ mobile digital content protection application for business users that was initially launched in December 2013 and updated in May 2014. These mobile applications, based on technologies developed by ContentGuard over the past fifteen years, are designed to address consumer demand for enhanced Internet privacy through solutions that restrict access to and limit the life of content. Our continuing development of these ephemeral content protection solutions reflects our commitment to continued innovation, including the development of products to commercialize our IP rights.

We explored a number of business development opportunities during 2014. However, due to escalating valuations which we attribute to inexpensive and widely available capital, we did not complete any transactions during the year. We expect this trend to continue and have therefore slowed our exploratory activity and reduced our costs by eliminating certain positions, abandoning certain patent assets that do not support our existing licensing programs, and lowering facilities costs. This does not mean that we have discontinued our assessment of opportunities to commercialize unique technologies and related businesses or otherwise invest our capital in opportunities which may be unrelated to our historical IP monetization activities, but until market conditions change, we expect to take a thoughtful and measured approach to potential transactions. In the meantime, we will concentrate our efforts on generating revenue from our existing assets.

18

Table of Contents

In February 2013, we acquired a 68.75% interest in Provitro Biosciences LLC, the developer of the Provitro™ proprietary micro-propagation technology that is designed to facilitate the production on a commercial scale of certain plants, particularly timber bamboo. The activities of Provitro from the date of acquisition through December 31, 2014 have been included in our consolidated statement of operations. The assets and liabilities of Provitro were measured at fair value as of the acquisition date and included in our December 31, 2013 consolidated balance sheet.

In early 2015, we suspended further development of the Provitro™ proprietary micro-propagation technology and related laboratory processes that are designed to facilitate production on a commercial scale of certain plants, particularly timber bamboo. Although we continued to pursue revenue generating business opportunities through the fourth quarter, we were unable to identify opportunities to justify continued commercialization efforts. In the absence of opportunities, we determined that we should not sustain the cost structure required for continued development of the technology. As a result, we began seeking a buyer for Provitro’s assets and took an impairment charge equal to our unamortized investment in the Provitro™ technology and related goodwill, reducing their fair values from approximately $11.0 million to zero at December 31, 2014. In addition, in early 2015, we reached agreement with Provitro’s minority partner to cancel the ownership interest in Provitro that we did not already own for nominal consideration, thereby leaving us with 100% ownership of Provitro.

2013 Events

In the first quarter of 2013, we acquired from Nokia Corporation 125 patents and patent applications worldwide, 81 of which have been declared by Nokia to be essential to standards that are applicable to memory and storage technologies used in electronic devices. In connection with the acquisition, we formed a wholly owned development company to continue innovation efforts in memory and storage technology begun by Nokia. Our resulting memory and storage technologies program has thus far generated three licenses, and we remain in active negotiations with other potential licensees.

2012 Events

During 2012, we completed our exit from the satellite business, which included (i) the receipt of the final payment associated with the sale of our interests in DBSD North America, Inc. and our subsidiaries to DISH Network Corporation, (ii) the sale of our medium earth orbit (“MEO”) satellite assets (“MEO Assets”) that had been in storage for nominal consideration, (iii) the transfer of our in-orbit MEO satellite (“F2”) to a new operator who assumed responsibility for all F2 operating costs, (iv) the sale of our property in Brazil, and (v) the deconsolidation of our MEO-related international subsidiaries (“International Subsidiaries”). Our exit from the satellite business generated approximately $2.4 billion in net operating losses which we believe can be carried forward for up to twenty years.

Critical Accounting Policies