Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GLAUKOS Corp | gkos-20210818x8k.htm |

Exhibit 99.1

| 1 © 2021 Glaukos Corporation August 2021 |

| 2 © 2021 Glaukos Corporation Disclaimer All statements other than statements of historical facts included in this presentation that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements are based on management’s current expectations, assumptions, estimates and beliefs. Although we believe that we have a reasonable basis for forward-looking statements contained herein, we caution you that they are based on current expectations about future events affecting us and are subject to risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that may cause our actual results to differ materially from those expressed or implied by forward-looking statements in this presentation. These potential risks and uncertainties that could cause actual results to differ materially from those described in forward-looking statements include, without limitation, uncertainties regarding the duration and severity of the COVID-19 pandemic and its impact on our business or the economy generally; our ability to continue to generate sales of our commercialized products and develop and commercialize additional products; our dependence on a limited number of third-party suppliers, some of which are single-source, for components of our products; the occurrence of a crippling accident, natural disaster, pandemic or other disruption at our primary facility, which may materially affect our manufacturing capacity and operations; securing or maintaining adequate coverage or reimbursement by government or third-party payors for procedures using the iStent, the iStent inject, our corneal cross-linking products or other products in development; our ability to properly train, and gain acceptance and trust from, ophthalmic surgeons in the use of our products; our ability to compete effectively in the highly competitive and rapidly changing medical device industry and against current and future competitors (including MIGS competitors); our compliance with federal, state and foreign laws and regulations for the approval and sale and marketing of our products and of our manufacturing processes; the lengthy and expensive clinical trial process and the uncertainty of timing and outcomes from any particular clinical trial; the risk of recalls or serious safety issues with our products and the uncertainty of patient outcomes; our ability to protect, and the expense and time-consuming nature of protecting, our intellectual property against third parties and competitors and the impact of any claims against us for infringement or misappropriation of third party intellectual property rights and any related litigation; and our ability to service our indebtedness. These and other known risks, uncertainties and factors are described in detail under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for 2020, which was filed with the SEC on March 1, 2021, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, which was filed with the SEC on August 5, 2021. Our filings with the SEC are available in the Investor Section of our website at www.glaukos.com or at www.sec.gov. In addition, information about the risks and benefits of our products is available on our website at www.glaukos.com. All forward- looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on the forward-looking statements in this presentation, which speak only as of the date hereof. We do not undertake any obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except as may be required under applicable securities law. |

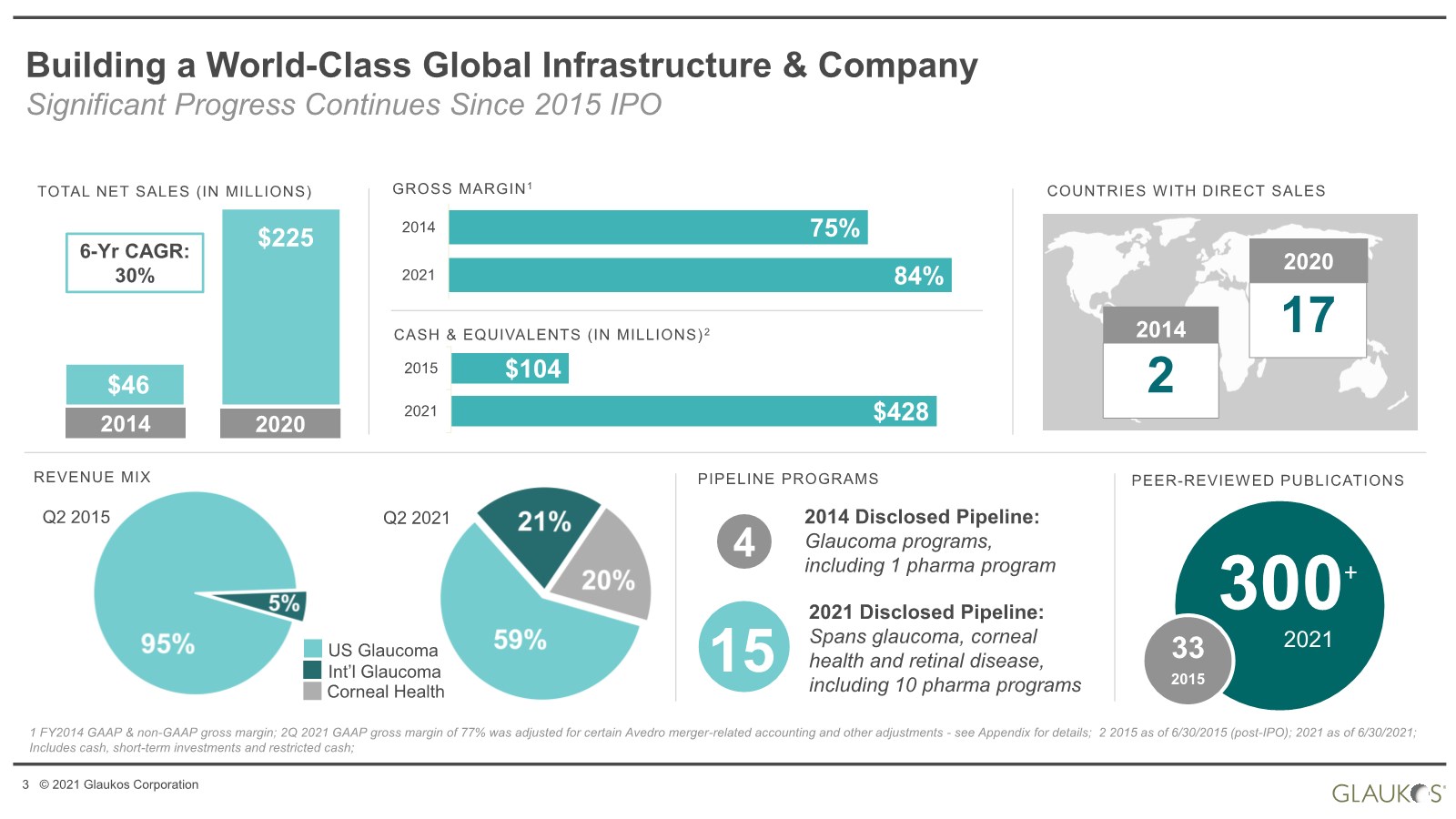

| 3 © 2021 Glaukos Corporation $428 $104 2021 2015 84% 75% 2021 2014 GROSS MARGIN1 CASH & EQUIVALENTS (IN MILLIONS) 2 1 FY2014 GAAP & non-GAAP gross margin; 2Q 2021 GAAP gross margin of 77% was adjusted for certain Avedro merger-related accounting and other adjustments - see Appendix for details; 2 2015 as of 6/30/2015 (post-IPO); 2021 as of 6/30/2021; Includes cash, short-term investments and restricted cash; Building a World-Class Global Infrastructure & Company Significant Progress Continues Since 2015 IPO 2014 2020 COUNTRIES WITH DIRECT SALES 2 17 REVENUE MIX Q2 2015 20% US Glaucoma Int’l Glaucoma Corneal Health $46 $225 6-Yr CAGR: 30% 2014 2020 TOTAL NET SALES (IN MILLIONS) Q2 2021 2021 33 2015 300+ PEER-REVIEWED PUBLICATIONS 2014 Disclosed Pipeline: Glaucoma programs, including 1 pharma program 2021 Disclosed Pipeline: Spans glaucoma, corneal health and retinal disease, including 10 pharma programs 4 15 PIPELINE PROGRAMS |

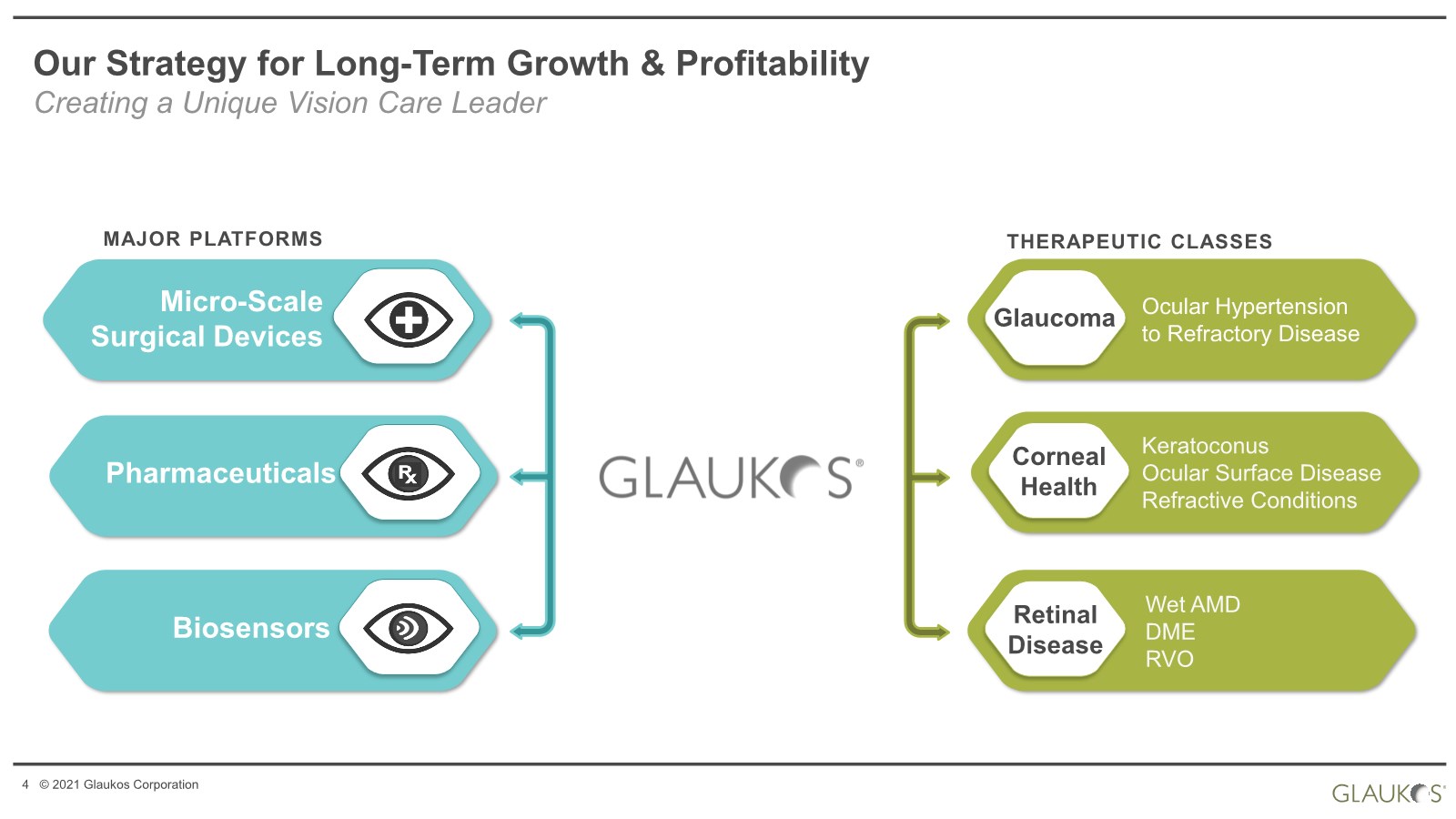

| 4 © 2021 Glaukos Corporation Our Strategy for Long-Term Growth & Profitability Creating a Unique Vision Care Leader Micro-Scale Surgical Devices Pharmaceuticals Biosensors Ocular Hypertension to Refractory Disease Glaucoma Corneal Health Keratoconus Ocular Surface Disease Refractive Conditions Retinal Disease Wet AMD DME RVO MAJOR PLATFORMS THERAPEUTIC CLASSES |

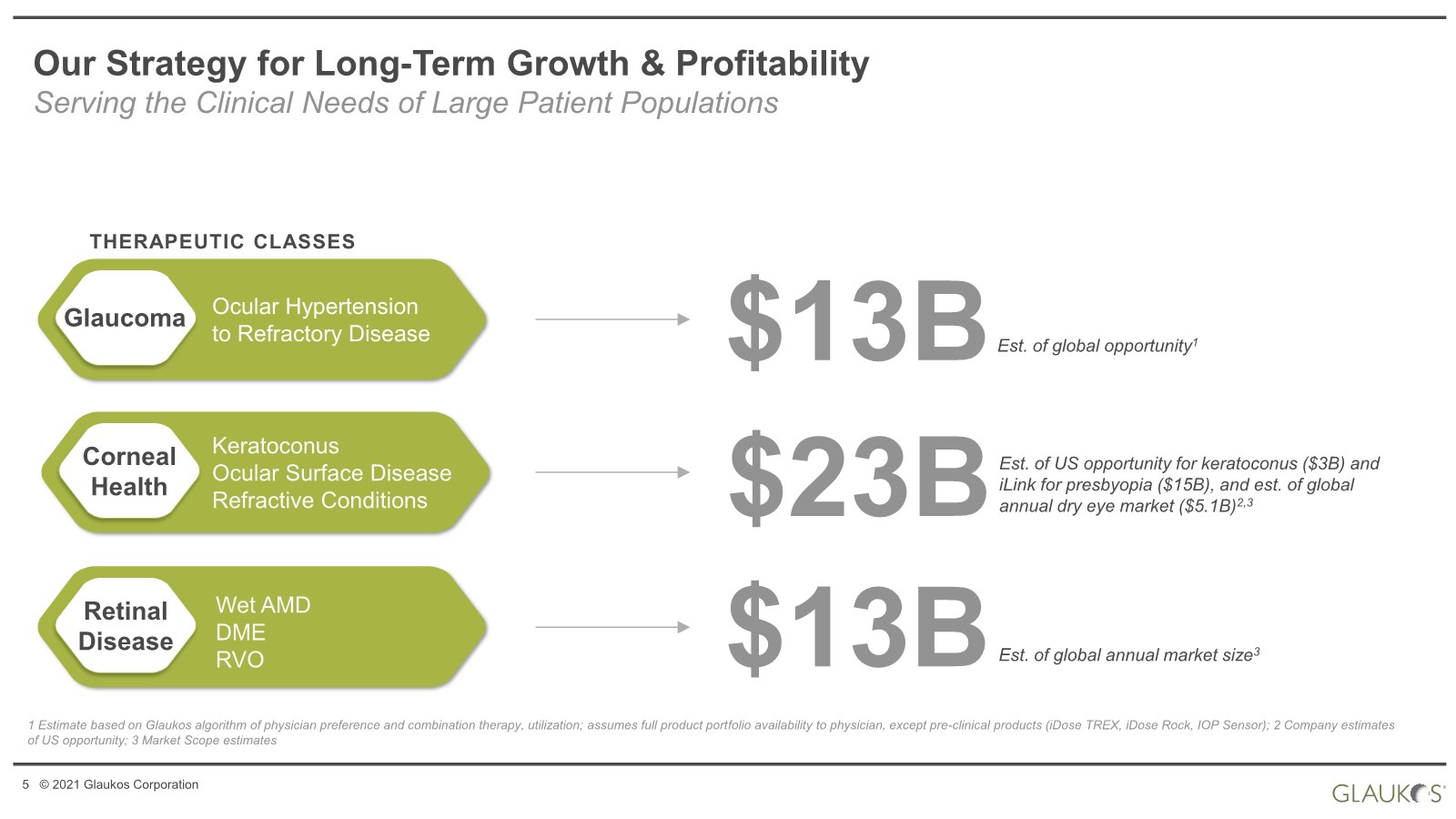

| 5 © 2021 Glaukos Corporation Our Strategy for Long-Term Growth & Profitability Serving the Clinical Needs of Large Patient Populations 1 Estimate based on Glaukos algorithm of physician preference and combination therapy, utilization; assumes full product portfolio availability to physician, except pre-clinical products (iDose TREX, iDose Rock, IOP Sensor); 2 Company estimates of US opportunity; 3 Market Scope estimates Ocular Hypertension to Refractory Disease Glaucoma Corneal Health Keratoconus Ocular Surface Disease Refractive Conditions Retinal Disease Wet AMD DME RVO $13B Est. of global opportunity1 $23B Est. of US opportunity for keratoconus ($3B) and iLink for presbyopia ($15B), and est. of global annual dry eye market ($5.1B)2,3 $13B Est. of global annual market size3 THERAPEUTIC CLASSES |

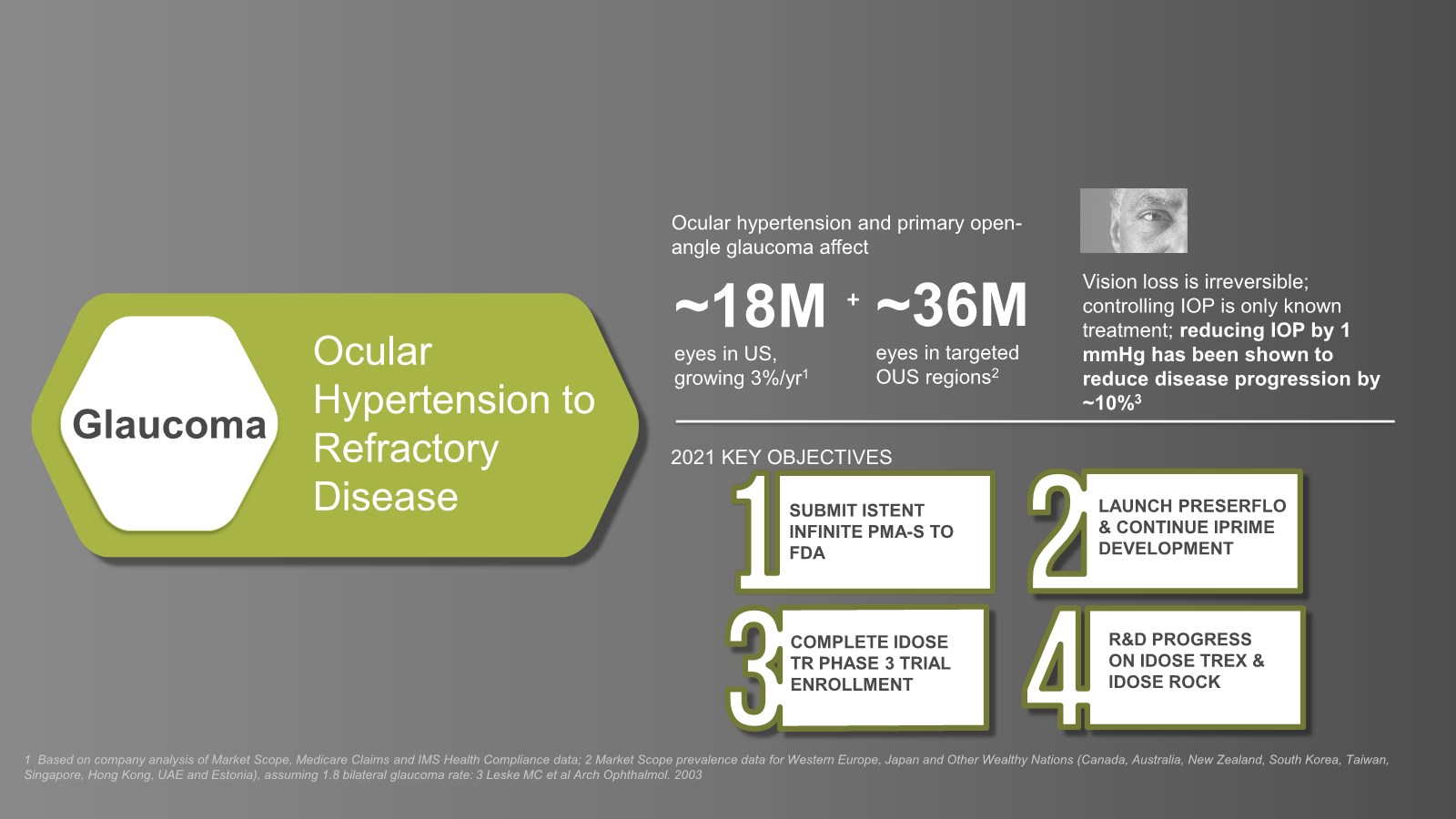

| 6 © 2021 Glaukos Corporation Ocular Hypertension to Refractory Disease Glaucoma SUBMIT ISTENT INFINITE PMA-S TO FDA COMPLETE IDOSE TR PHASE 3 TRIAL ENROLLMENT R&D PROGRESS ON IDOSE TREX & IDOSE ROCK LAUNCH PRESERFLO & CONTINUE IPRIME DEVELOPMENT 2021 KEY OBJECTIVES ~18M eyes in US, growing 3%/yr1 ~36M eyes in targeted OUS regions2 Ocular hypertension and primary open- angle glaucoma affect + 1 Based on company analysis of Market Scope, Medicare Claims and IMS Health Compliance data; 2 Market Scope prevalence data for Western Europe, Japan and Other Wealthy Nations (Canada, Australia, New Zealand, South Korea, Taiwan, Singapore, Hong Kong, UAE and Estonia), assuming 1.8 bilateral glaucoma rate: Vision loss is irreversible; controlling IOP is only known treatment; reducing IOP by 1 mmHg has been shown to reduce disease progression by ~10%3 3 Leske MC et al Arch Ophthalmol. 2003 |

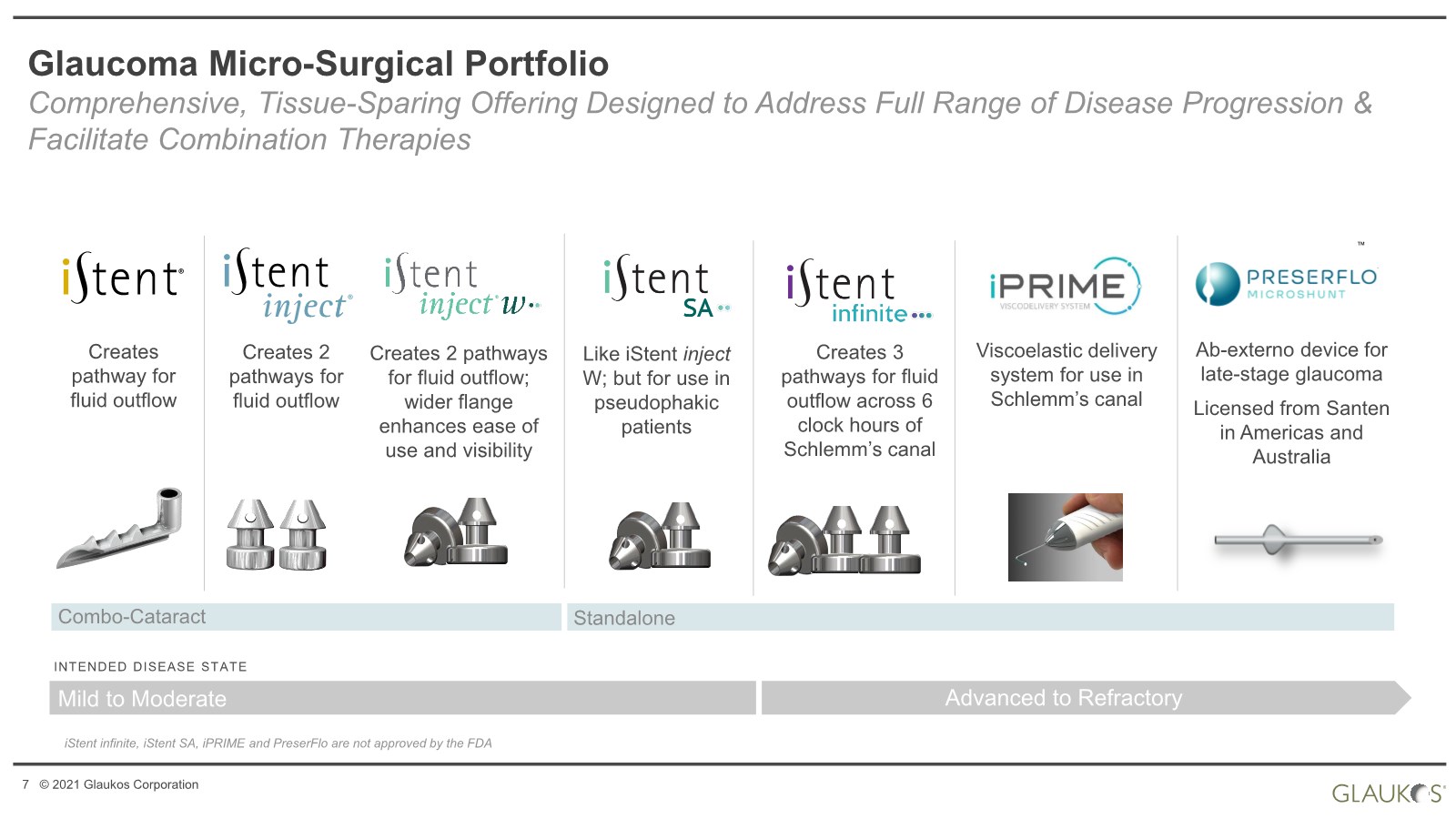

| 7 © 2021 Glaukos Corporation Glaucoma Micro-Surgical Portfolio Comprehensive, Tissue-Sparing Offering Designed to Address Full Range of Disease Progression & Facilitate Combination Therapies Creates 2 pathways for fluid outflow Creates 3 pathways for fluid outflow across 6 clock hours of Schlemm’s canal Like iStent inject W; but for use in pseudophakic patients Ab-externo device for late-stage glaucoma Licensed from Santen in Americas and Australia INTENDED DISEASE STATE Mild to Moderate Advanced to Refractory flexible microcatheter along with inserting viscoelastic to disconnect potential adhesions and debris in the canal and distal collector channels Creates pathway for fluid outflow Combo-Cataract Standalone ™ ™ Creates 2 pathways for fluid outflow; wider flange enhances ease of use and visibility Viscoelastic delivery system for use in Schlemm’s canal iStent infinite, iStent SA, iPRIME and PreserFlo are not approved by the FDA |

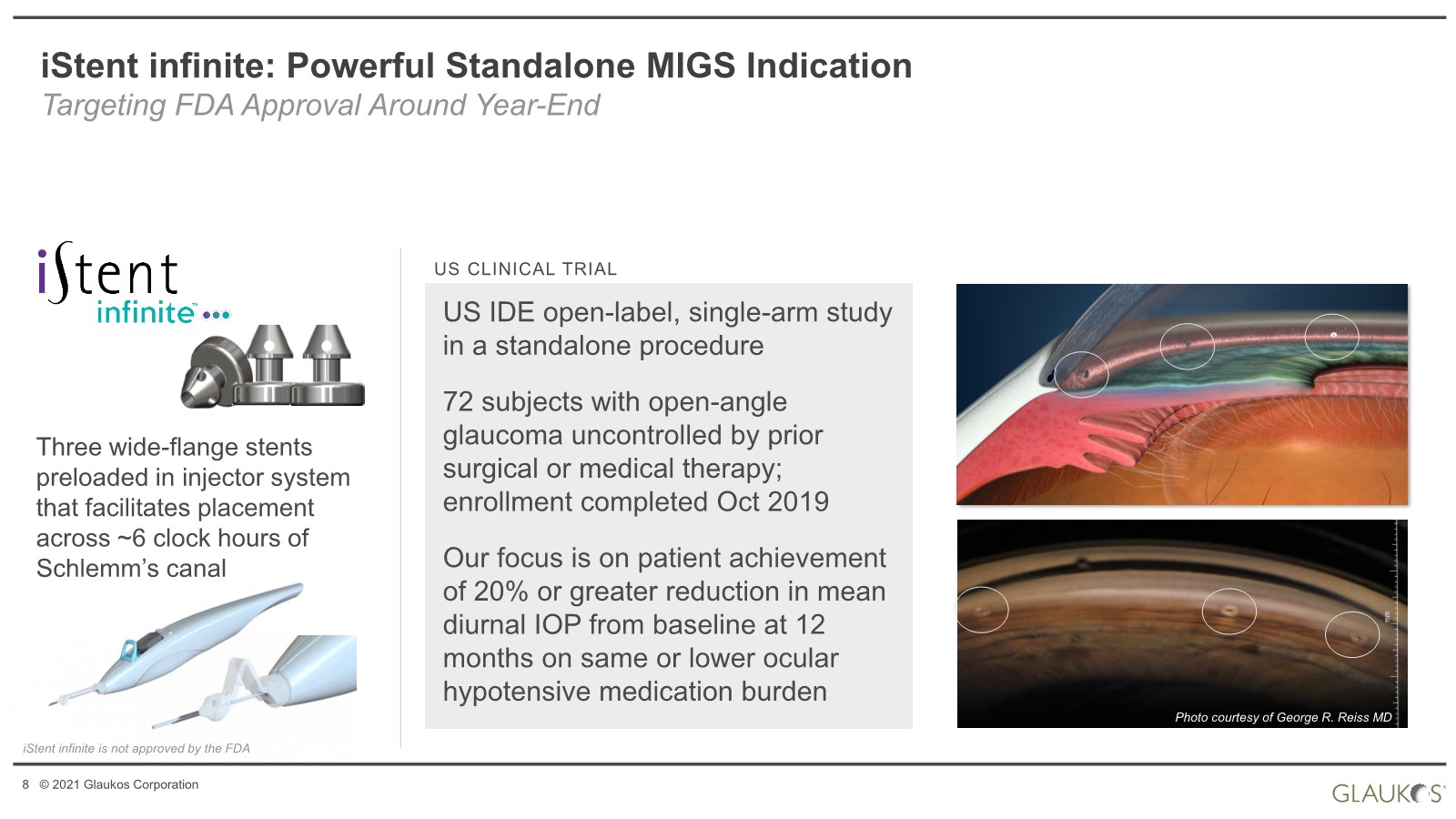

| 8 © 2021 Glaukos Corporation iStent infinite: Powerful Standalone MIGS Indication Targeting FDA Approval Around Year-End Three wide-flange stents preloaded in injector system that facilitates placement across ~6 clock hours of Schlemm’s canal US IDE open-label, single-arm study in a standalone procedure 72 subjects with open-angle glaucoma uncontrolled by prior surgical or medical therapy; enrollment completed Oct 2019 Our focus is on patient achievement of 20% or greater reduction in mean diurnal IOP from baseline at 12 months on same or lower ocular hypotensive medication burden US CLINICAL TRIAL iStent infinite is not approved by the FDA Photo courtesy of George R. Reiss MD |

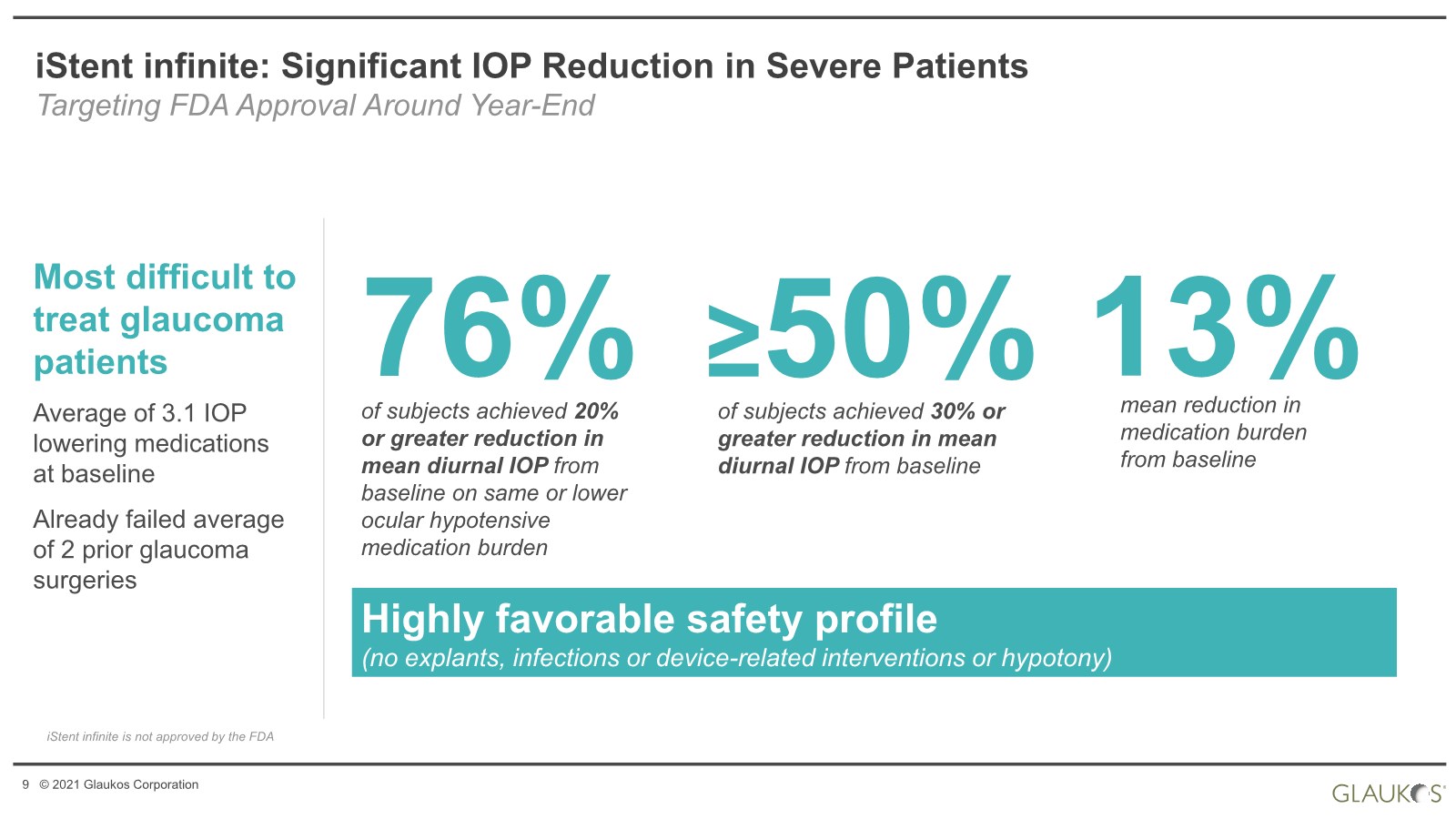

| 9 © 2021 Glaukos Corporation iStent infinite: Significant IOP Reduction in Severe Patients Targeting FDA Approval Around Year-End 76% of subjects achieved 20% or greater reduction in mean diurnal IOP from baseline on same or lower ocular hypotensive medication burden Highly favorable safety profile (no explants, infections or device-related interventions or hypotony) iStent infinite is not approved by the FDA 13% Most difficult to treat glaucoma patients Average of 3.1 IOP lowering medications at baseline Already failed average of 2 prior glaucoma surgeries ≥50% of subjects achieved 30% or greater reduction in mean diurnal IOP from baseline mean reduction in medication burden from baseline |

| 10 © 2021 Glaukos Corporation iStent infinite: Viable Alternative to More Complex Procedures Three-stent injectable will offer new compelling treatment option in standalone procedure with highly favorable safety profile Clinical data suggest iStent infinite may help patients with open- angle glaucoma uncontrolled by prior surgical or medical therapy Expect surgeons – glaucoma specialists and comprehensive ophthalmologists – to gravitate to iStent infinite before proceeding to tissue-destructive procedures Expect iStent infinite implantation to be reimbursed under newly established Category III CPT code (0X12T) iStent infinite is not approved by the FDA |

| 11 © 2021 Glaukos Corporation Santen PreserFlo MicroShunt An Alternative to Trabeculectomy & Tube Shunts 8.5 mm tube made of biocompatible material (SIBS); standalone, ab- externo procedure to filter fluid from anterior chamber to subconjunctival space Designed to treat late-stage, refractory glaucoma Attractive alternative to trabeculectomy, tubes, XEN and ExPress • Demonstrated IOP reduction (30+%) and medication burden reduction (2.4 meds) in pivotal study1 Favorable safety, efficacy and post-op care profile Development and license agreement provides Glaukos with exclusive commercialization and development rights in US, Australia, New Zealand, Canada, Brazil, Mexico and remainder of Latin America Approved in Canada and Australia Santen PreserFlo is not approved by the FDA 1 Santen press release issued Aug 30, 2019 |

| 12 © 2021 Glaukos Corporation Introducing iPRIME™ A New Viscodelivery System from Glaukos iPRIME is a minimally invasive viscoelastic delivery system that further supports the needs of physicians and patients This complementary technology further expands Glaukos’ broad portfolio of innovative ophthalmic solutions Late-stage development program, not FDA-approved Anticipated to be reimbursed under Category I CPT code (66174) iPRIME is not approved by the FDA or commercially available A viscoelastic delivery system for use in Schlemm’s canal |

| 13 © 2021 Glaukos Corporation Sustained-Release Pharmaceuticals The Next Stage in Glaucoma Therapy • Designed to provide longest duration intracameral pharmaceutical; secure and anchored design; facile implantation and exchange • Membrane designed to elute specially formulated travoprost, a commonly prescribed topical prostaglandin • Phase 3 clinical trial enrollment and randomization completed June 2021 iDose 1 Market opportunity estimates based on Glaukos algorithm of physician preference and combination therapy, utilization; assumes full product portfolio availability to physician, except pre-clinical products (iDose TREX, iDose Rock, IOP Sensor) Topical drugs subject to significant issues of patient non- adherence, impositions to quality-of-life and ocular surface disease and toxicity Unmet need and appetite among glaucoma specialists and ophthalmologists for sustained- release pharmaceutical alternatives Current mobile, intracameral bio- erodible implants limited by endothelial cell loss, labeling restrictions and relatively short durations of activity CLINICAL NEED • AMA approved Cat III codes for implantation, removal and re-implantation of drug delivery system into anterior chamber, effective 7/21 • Estimated annual US opportunity of 3M eyes1 Ocular Hypertension to Refractory OAG iDose TR is not approved by the FDA |

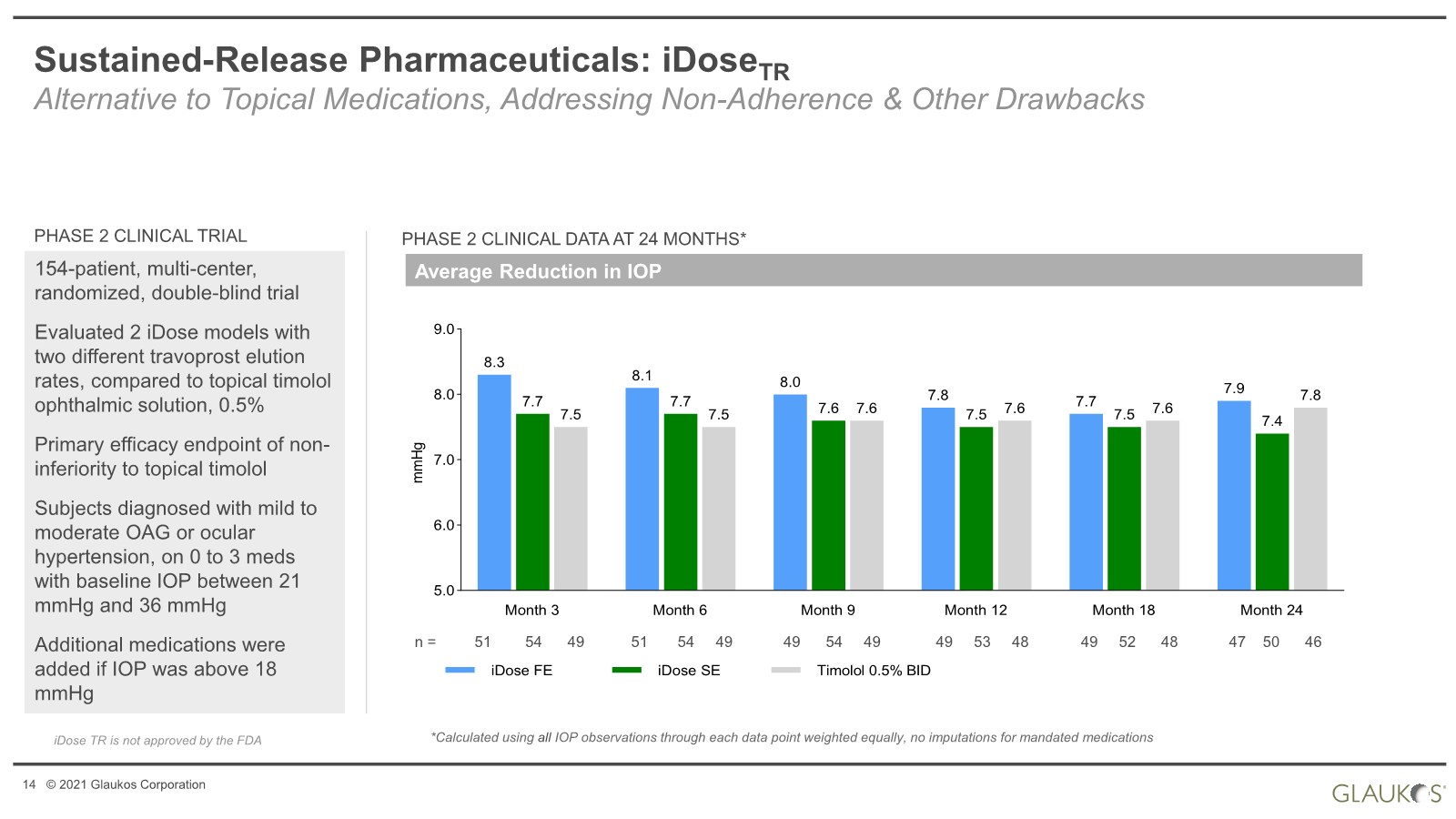

| 14 © 2021 Glaukos Corporation Sustained-Release Pharmaceuticals: iDoseTR Alternative to Topical Medications, Addressing Non-Adherence & Other Drawbacks iDose TR is not approved by the FDA Average Reduction in IOP PHASE 2 CLINICAL DATA AT 24 MONTHS* 154-patient, multi-center, randomized, double-blind trial Evaluated 2 iDose models with two different travoprost elution rates, compared to topical timolol ophthalmic solution, 0.5% Primary efficacy endpoint of non- inferiority to topical timolol Subjects diagnosed with mild to moderate OAG or ocular hypertension, on 0 to 3 meds with baseline IOP between 21 mmHg and 36 mmHg Additional medications were added if IOP was above 18 mmHg Month 3 Month 6 Month 9 Month 12 Month 18 Month 24 5.0 6.0 7.0 8.0 9.0 7.5 7.5 7.6 7.6 7.6 7.8 7.7 7.7 7.6 7.5 7.5 7.4 8.3 8.1 8.0 7.8 7.7 7.9 m m H g iDose FE iDose SE Timolol 0.5% BID *Calculated using all IOP observations through each data point weighted equally, no imputations for mandated medications PHASE 2 CLINICAL TRIAL n = 51 54 49 51 54 49 49 54 49 49 53 48 49 52 48 47 50 46 |

| 15 © 2021 Glaukos Corporation Sustained-Release Pharmaceuticals: iDoseTR Alternative to Topical Medications, Addressing Non-Adherence & Other Drawbacks iDose patients experienced robust IOP-lowering over 24 months with continuous 24/7 compliance Over 24 months, iDose and timolol control groups progressed with similar number of protocol-mandated medications added iDose 24-month data validate favorable safety profile and duration of IOP-lowering effect iDose TR is not approved by the FDA |

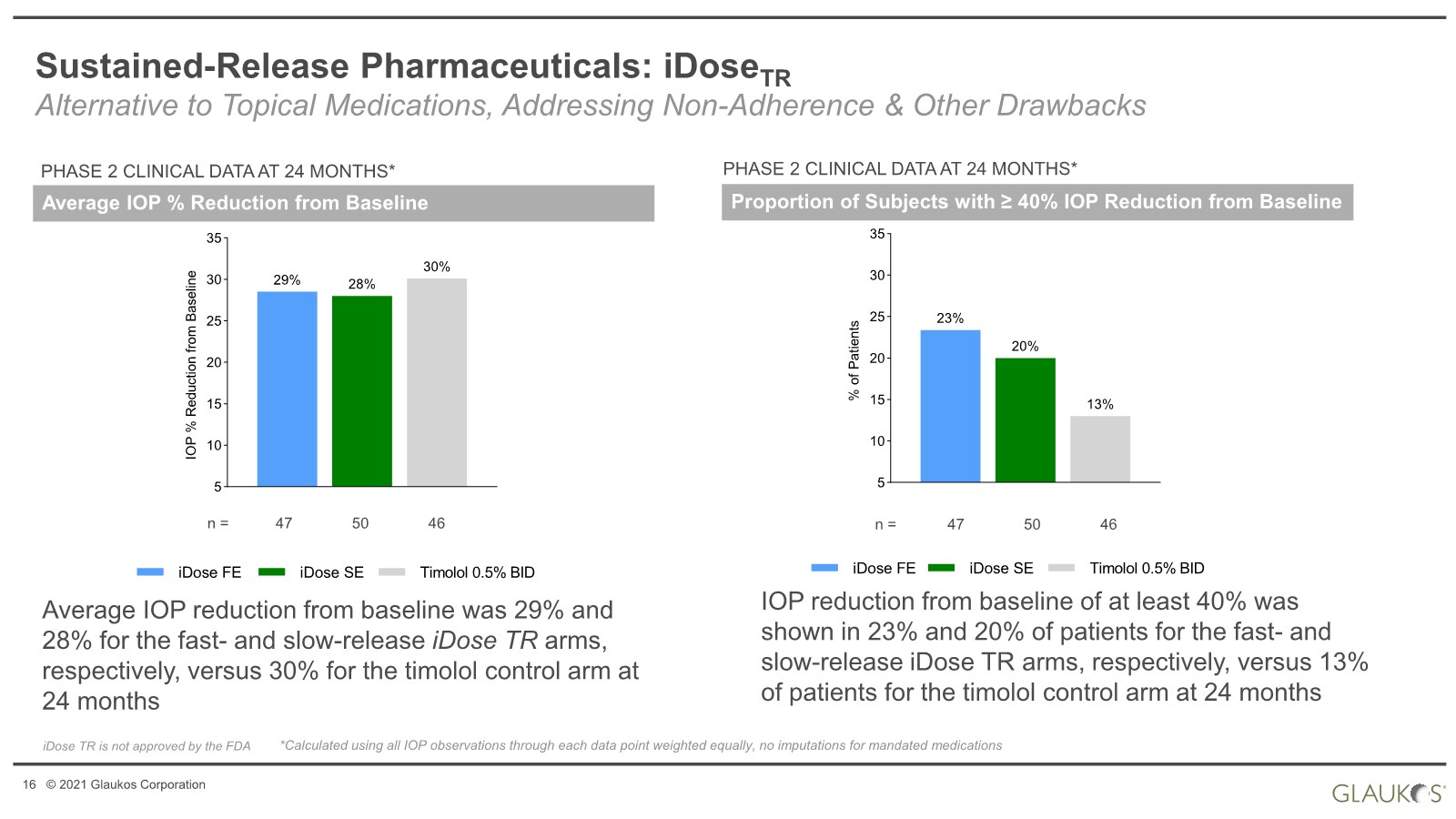

| 16 © 2021 Glaukos Corporation Sustained-Release Pharmaceuticals: iDoseTR Alternative to Topical Medications, Addressing Non-Adherence & Other Drawbacks Average IOP % Reduction from Baseline PHASE 2 CLINICAL DATA AT 24 MONTHS* iDose TR is not approved by the FDA 5 10 15 20 25 30 35 30% 28% 29% I O P % R e d u c t i o n f r o m B a s e l i n e iDose FE iDose SE Timolol 0.5% BID *Calculated using all IOP observations through each data point weighted equally, no imputations for mandated medications Average IOP reduction from baseline was 29% and 28% for the fast- and slow-release iDose TR arms, respectively, versus 30% for the timolol control arm at 24 months n = 47 50 46 5 10 15 20 25 30 35 13% 20% 23% % o f P a t i e n t s iDose FE iDose SE Timolol 0.5% BID n = 47 50 46 Proportion of Subjects with ≥ 40% IOP Reduction from Baseline PHASE 2 CLINICAL DATA AT 24 MONTHS* IOP reduction from baseline of at least 40% was shown in 23% and 20% of patients for the fast- and slow-release iDose TR arms, respectively, versus 13% of patients for the timolol control arm at 24 months |

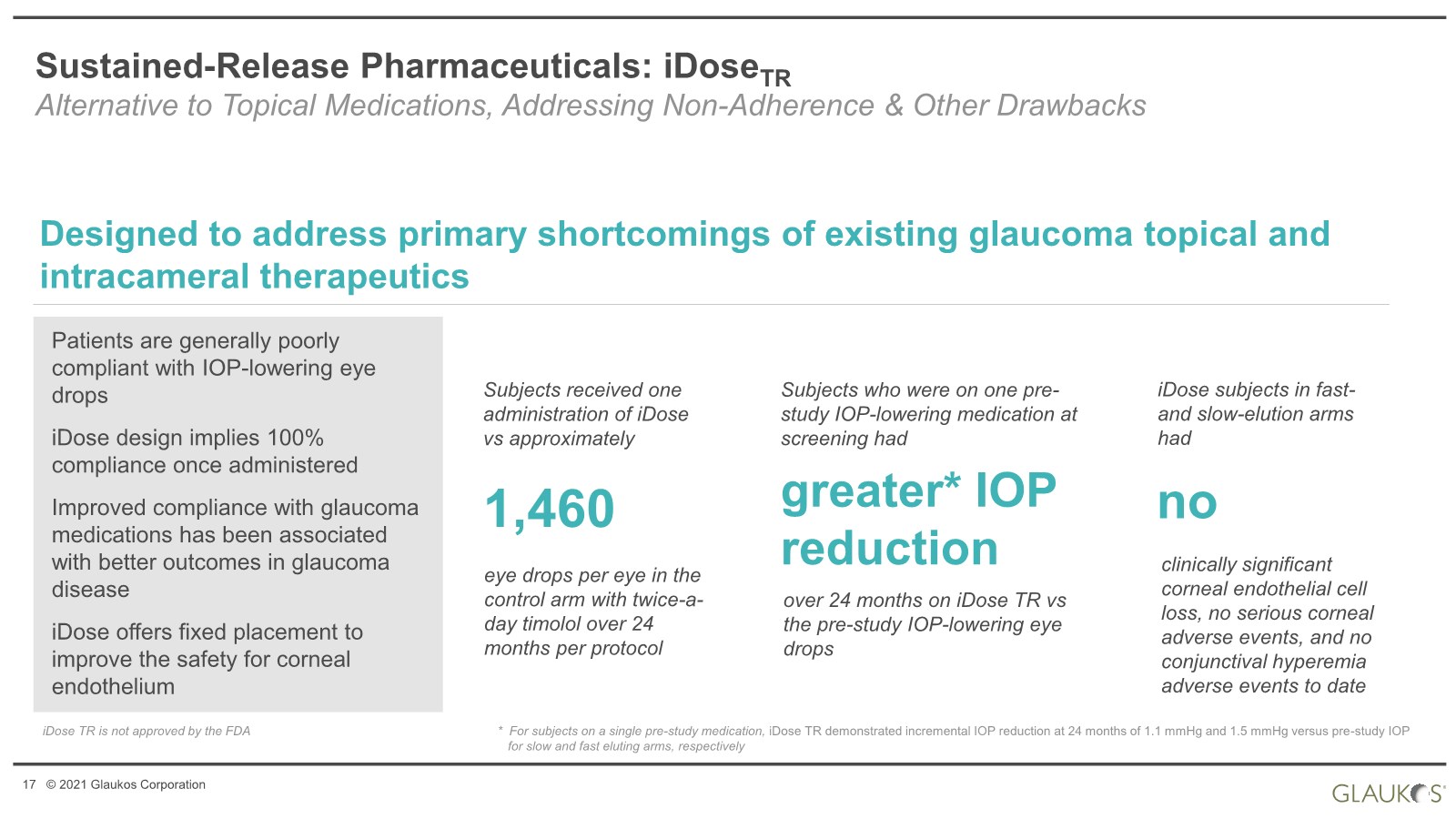

| 17 © 2021 Glaukos Corporation Sustained-Release Pharmaceuticals: iDoseTR Alternative to Topical Medications, Addressing Non-Adherence & Other Drawbacks Designed to address primary shortcomings of existing glaucoma topical and intracameral therapeutics Patients are generally poorly compliant with IOP-lowering eye drops iDose design implies 100% compliance once administered Improved compliance with glaucoma medications has been associated with better outcomes in glaucoma disease iDose offers fixed placement to improve the safety for corneal endothelium 1,460 Subjects received one administration of iDose vs approximately eye drops per eye in the control arm with twice-a- day timolol over 24 months per protocol greater* IOP reduction Subjects who were on one pre- study IOP-lowering medication at screening had over 24 months on iDose TR vs the pre-study IOP-lowering eye drops iDose subjects in fast- and slow-elution arms had clinically significant corneal endothelial cell loss, no serious corneal adverse events, and no conjunctival hyperemia adverse events to date no iDose TR is not approved by the FDA * For subjects on a single pre-study medication, iDose TR demonstrated incremental IOP reduction at 24 months of 1.1 mmHg and 1.5 mmHg versus pre-study IOP for slow and fast eluting arms, respectively |

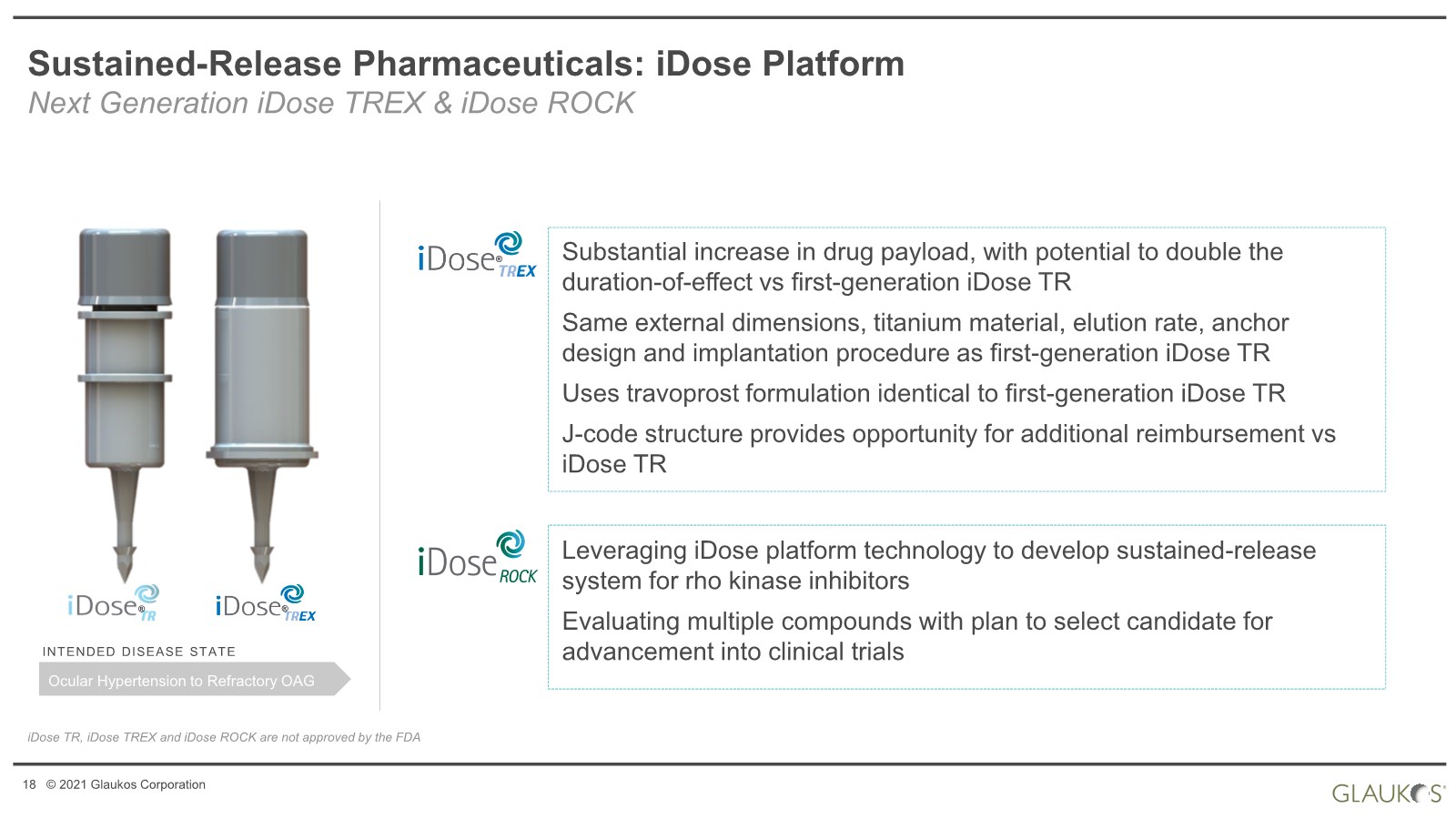

| 18 © 2021 Glaukos Corporation iDose TR, iDose TREX and iDose ROCK are not approved by the FDA ® Sustained-Release Pharmaceuticals: iDose Platform Next Generation iDose TREX & iDose ROCK INTENDED DISEASE STATE Ocular Hypertension to Refractory OAG Substantial increase in drug payload, with potential to double the duration-of-effect vs first-generation iDose TR Same external dimensions, titanium material, elution rate, anchor design and implantation procedure as first-generation iDose TR Uses travoprost formulation identical to first-generation iDose TR J-code structure provides opportunity for additional reimbursement vs iDose TR ® Leveraging iDose platform technology to develop sustained-release system for rho kinase inhibitors Evaluating multiple compounds with plan to select candidate for advancement into clinical trials ® |

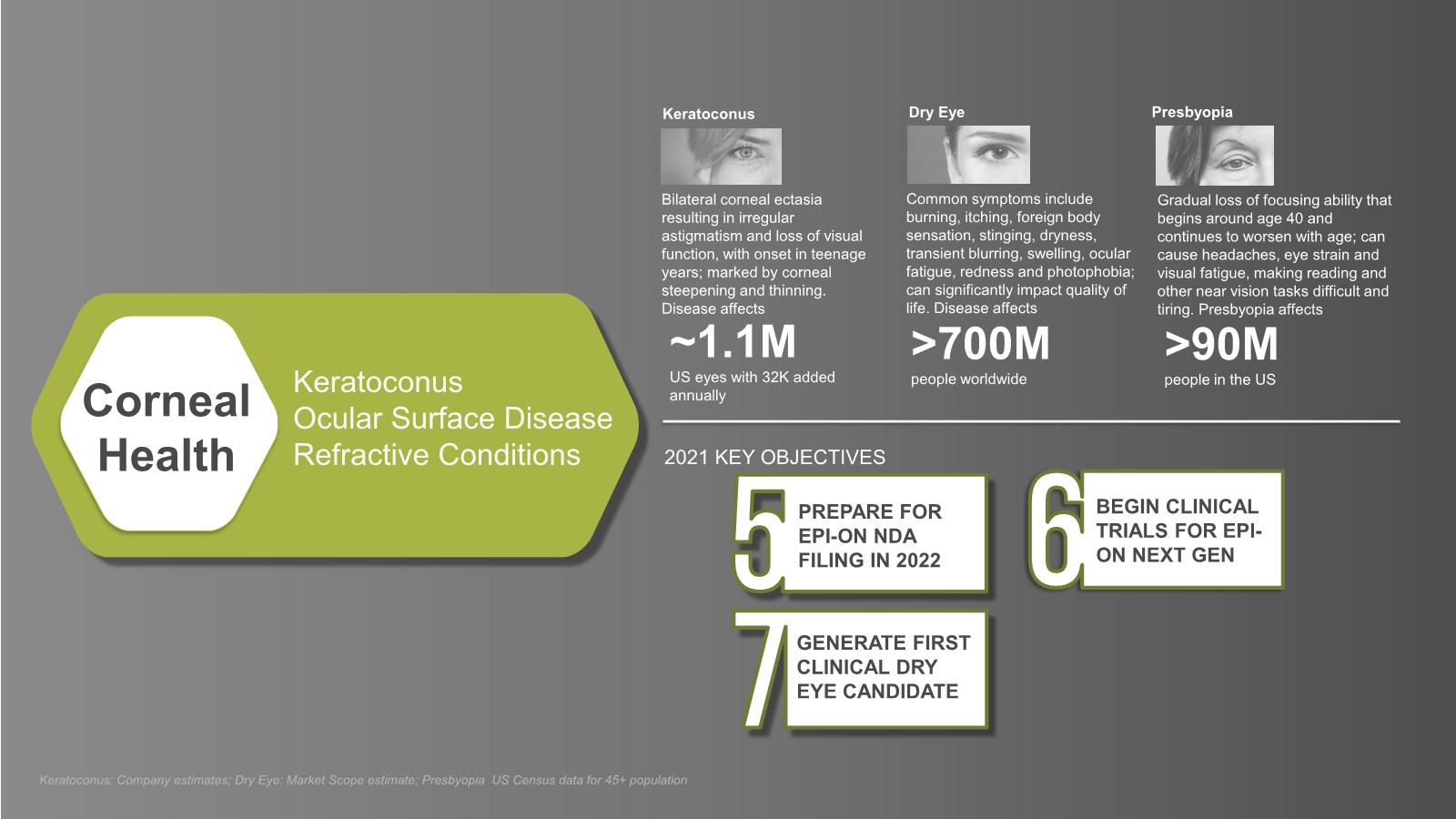

| 19 © 2021 Glaukos Corporation 2021 KEY OBJECTIVES Corneal Health Keratoconus Ocular Surface Disease Refractive Conditions PREPARE FOR EPI-ON NDA FILING IN 2022 BEGIN CLINICAL TRIALS FOR EPI- ON NEXT GEN GENERATE FIRST CLINICAL DRY EYE CANDIDATE Common symptoms include burning, itching, foreign body sensation, stinging, dryness, transient blurring, swelling, ocular fatigue, redness and photophobia; can significantly impact quality of life. Disease affects >700M people worldwide Dry Eye Keratoconus: Company estimates; Dry Eye: Market Scope estimate; Presbyopia US Census data for 45+ population Gradual loss of focusing ability that begins around age 40 and continues to worsen with age; can cause headaches, eye strain and visual fatigue, making reading and other near vision tasks difficult and tiring. Presbyopia affects >90M people in the US Presbyopia ~1.1M US eyes with 32K added annually Keratoconus Bilateral corneal ectasia resulting in irregular astigmatism and loss of visual function, with onset in teenage years; marked by corneal steepening and thinning. Disease affects |

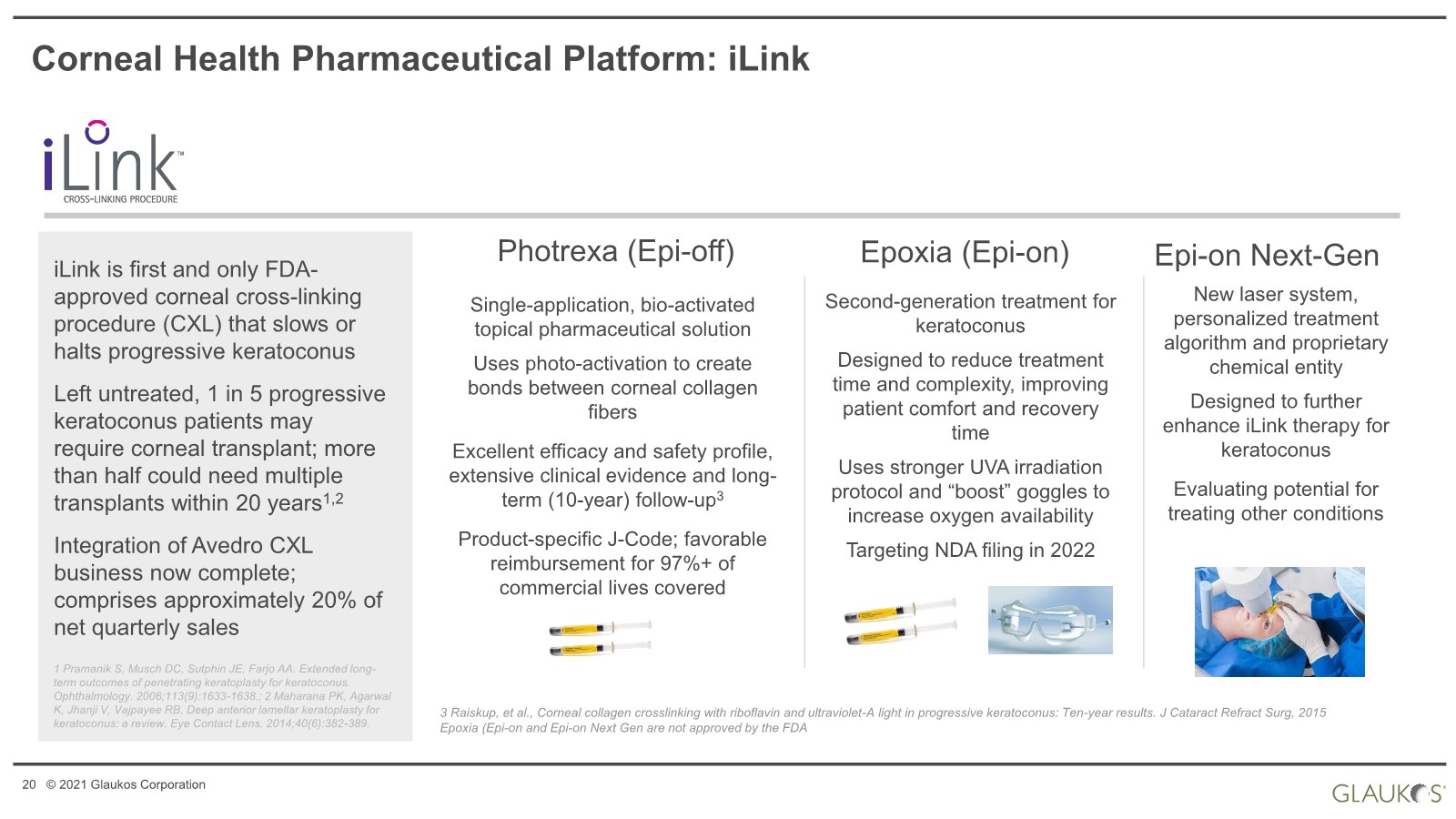

| 20 © 2021 Glaukos Corporation Corneal Health Pharmaceutical Platform: iLink Epoxia (Epi-on) Photrexa (Epi-off) Single-application, bio-activated topical pharmaceutical solution Uses photo-activation to create bonds between corneal collagen fibers Excellent efficacy and safety profile, extensive clinical evidence and long- term (10-year) follow-up3 Product-specific J-Code; favorable reimbursement for 97%+ of commercial lives covered Epi-on Next-Gen Second-generation treatment for keratoconus Designed to reduce treatment time and complexity, improving patient comfort and recovery time Uses stronger UVA irradiation protocol and “boost” goggles to increase oxygen availability Targeting NDA filing in 2022 New laser system, personalized treatment algorithm and proprietary chemical entity Designed to further enhance iLink therapy for keratoconus Evaluating potential for treating other conditions 3 Raiskup, et al., Corneal collagen crosslinking with riboflavin and ultraviolet-A light in progressive keratoconus: Ten-year results. J Cataract Refract Surg, 2015 Epoxia (Epi-on and Epi-on Next Gen are not approved by the FDA 1 Pramanik S, Musch DC, Sutphin JE, Farjo AA. Extended long- term outcomes of penetrating keratoplasty for keratoconus. Ophthalmology. 2006;113(9):1633-1638.; 2 Maharana PK, Agarwal K, Jhanji V, Vajpayee RB. Deep anterior lamellar keratoplasty for keratoconus: a review. Eye Contact Lens. 2014;40(6):382-389. iLink is first and only FDA- approved corneal cross-linking procedure (CXL) that slows or halts progressive keratoconus Left untreated, 1 in 5 progressive keratoconus patients may require corneal transplant; more than half could need multiple transplants within 20 years1,2 Integration of Avedro CXL business now complete; comprises approximately 20% of net quarterly sales |

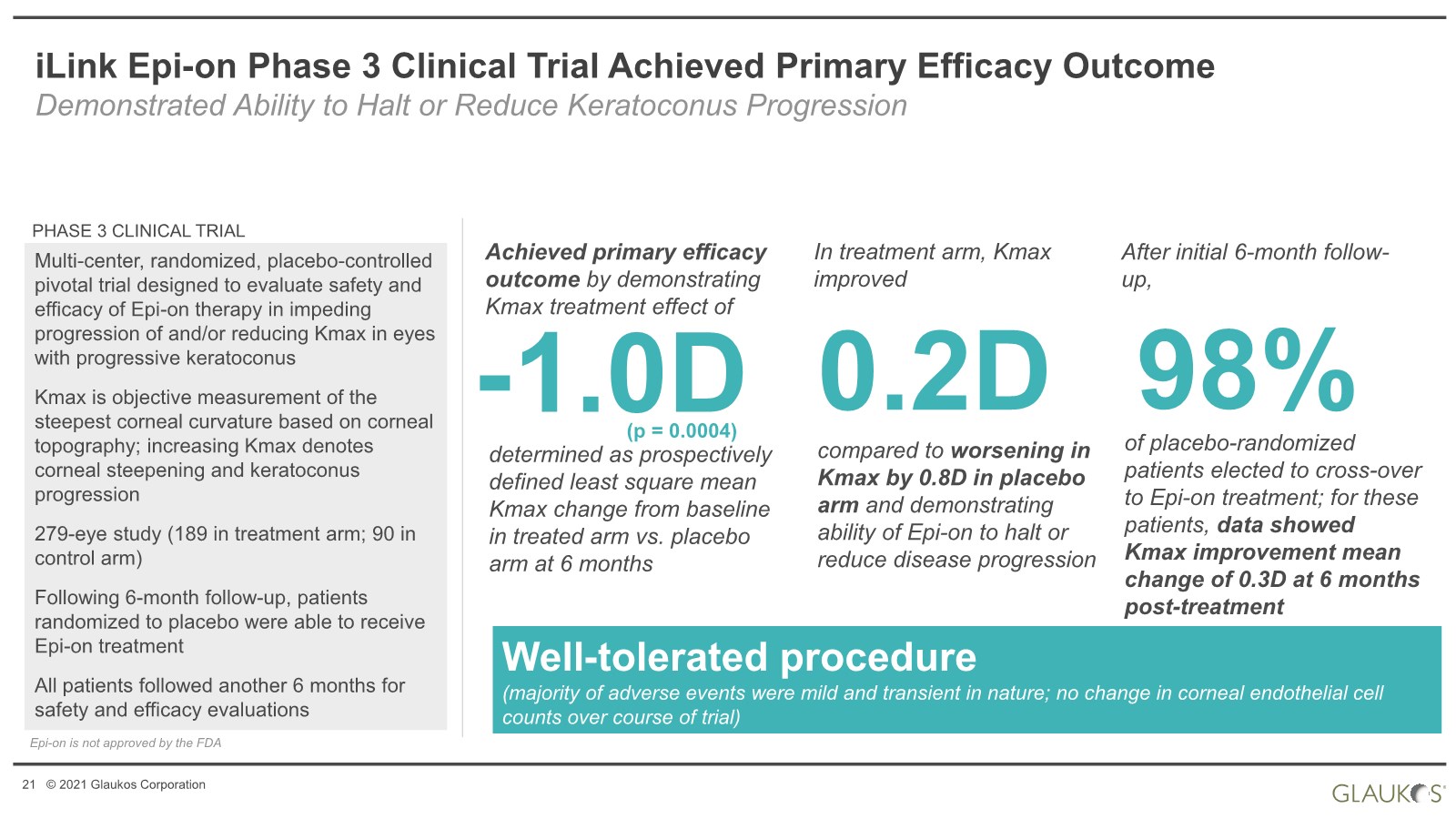

| 21 © 2021 Glaukos Corporation iLink Epi-on Phase 3 Clinical Trial Achieved Primary Efficacy Outcome Demonstrated Ability to Halt or Reduce Keratoconus Progression -1.0D Achieved primary efficacy outcome by demonstrating Kmax treatment effect of Well-tolerated procedure (majority of adverse events were mild and transient in nature; no change in corneal endothelial cell counts over course of trial) Epi-on is not approved by the FDA Multi-center, randomized, placebo-controlled pivotal trial designed to evaluate safety and efficacy of Epi-on therapy in impeding progression of and/or reducing Kmax in eyes with progressive keratoconus Kmax is objective measurement of the steepest corneal curvature based on corneal topography; increasing Kmax denotes corneal steepening and keratoconus progression 279-eye study (189 in treatment arm; 90 in control arm) Following 6-month follow-up, patients randomized to placebo were able to receive Epi-on treatment All patients followed another 6 months for safety and efficacy evaluations PHASE 3 CLINICAL TRIAL determined as prospectively defined least square mean Kmax change from baseline in treated arm vs. placebo arm at 6 months (p = 0.0004) 0.2D In treatment arm, Kmax improved compared to worsening in Kmax by 0.8D in placebo arm and demonstrating ability of Epi-on to halt or reduce disease progression 98% After initial 6-month follow- up, of placebo-randomized patients elected to cross-over to Epi-on treatment; for these patients, data showed Kmax improvement mean change of 0.3D at 6 months post-treatment |

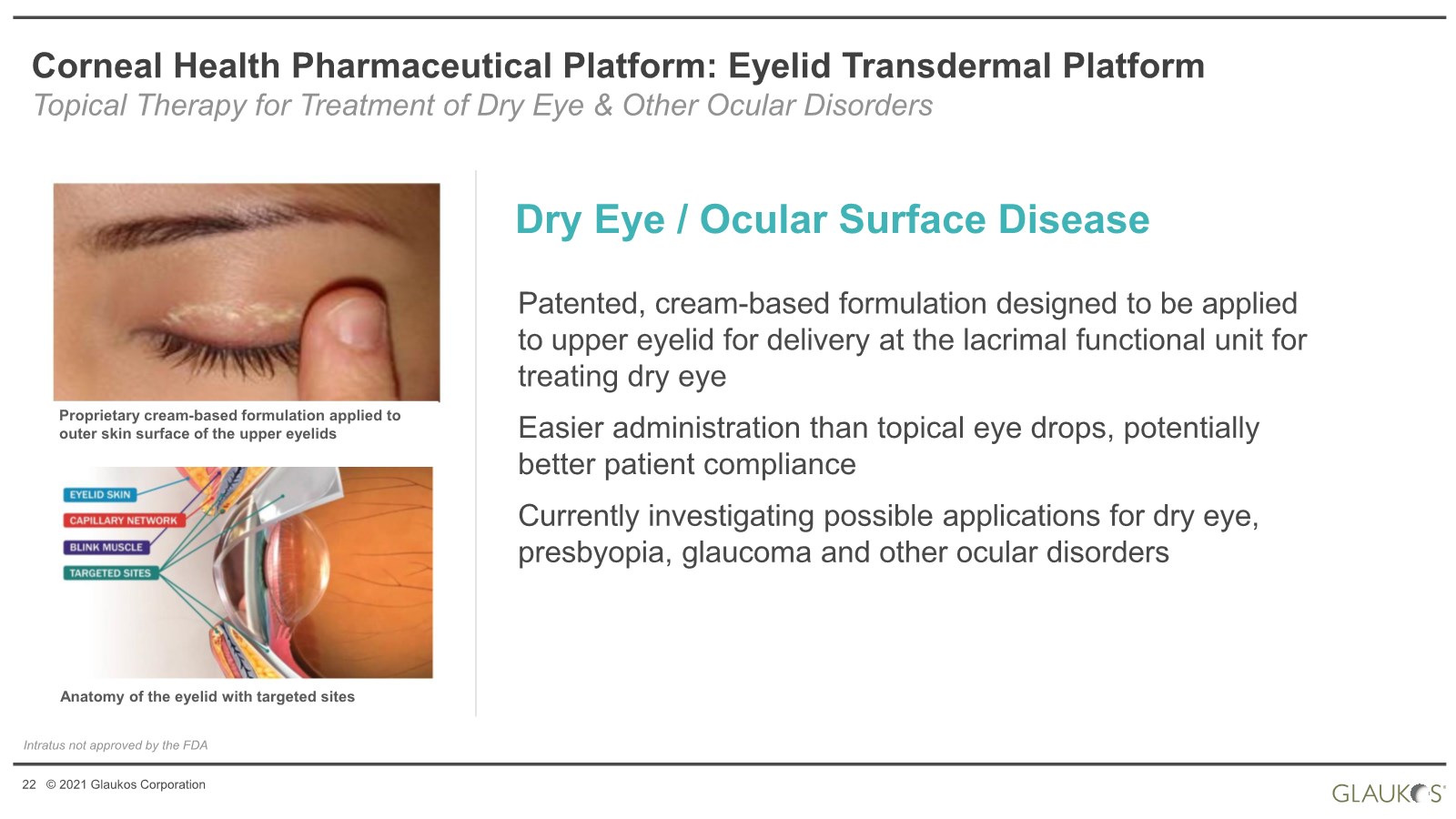

| 22 © 2021 Glaukos Corporation Corneal Health Pharmaceutical Platform: Eyelid Transdermal Platform Topical Therapy for Treatment of Dry Eye & Other Ocular Disorders Proprietary cream-based formulation applied to outer skin surface of the upper eyelids Anatomy of the eyelid with targeted sites Intratus not approved by the FDA Patented, cream-based formulation designed to be applied to upper eyelid for delivery at the lacrimal functional unit for treating dry eye Easier administration than topical eye drops, potentially better patient compliance Currently investigating possible applications for dry eye, presbyopia, glaucoma and other ocular disorders Dry Eye / Ocular Surface Disease |

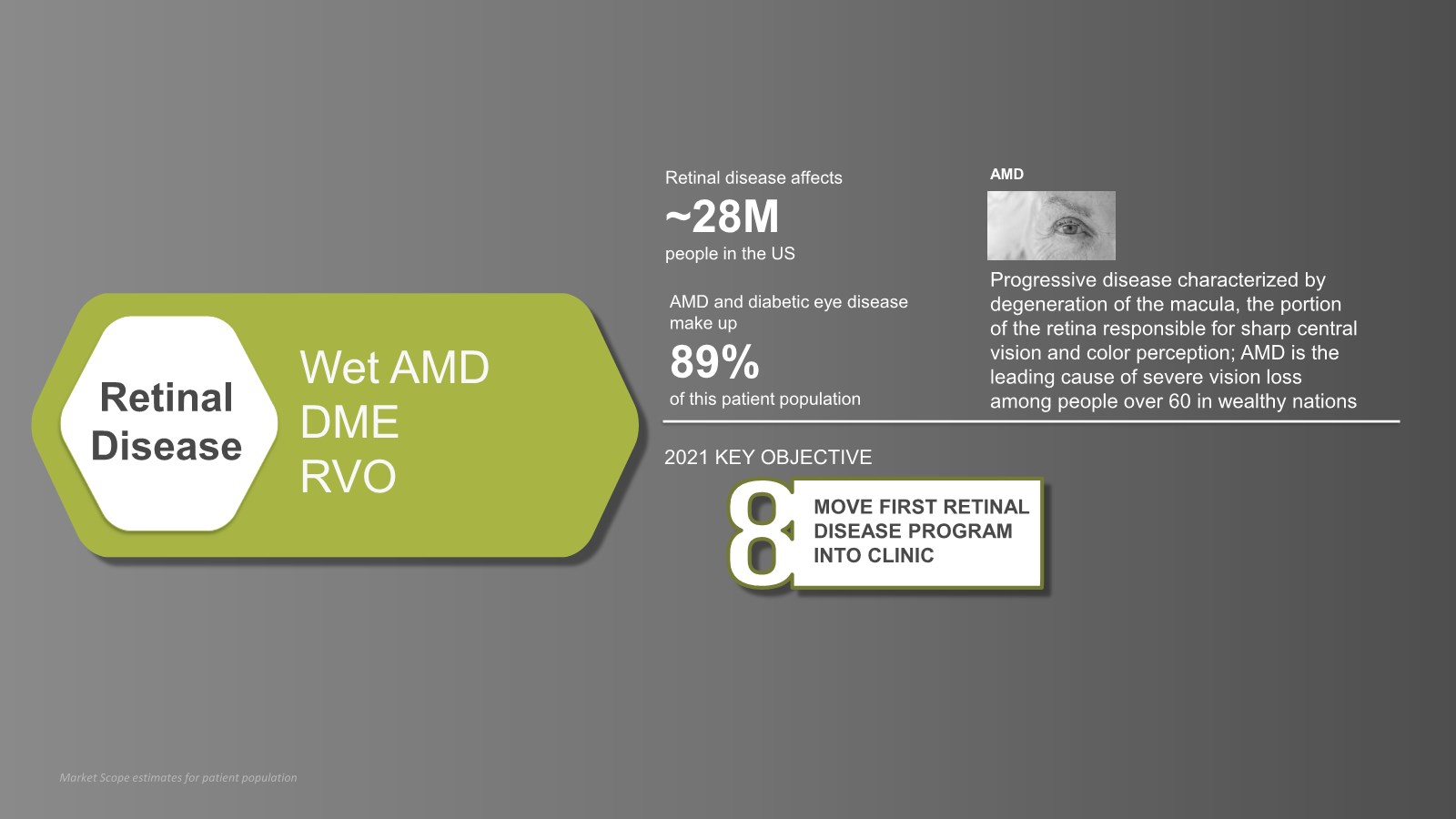

| 23 © 2021 Glaukos Corporation 2021 KEY OBJECTIVE Retinal Disease Wet AMD DME RVO MOVE FIRST RETINAL DISEASE PROGRAM INTO CLINIC Retinal disease affects ~28M people in the US AMD and diabetic eye disease make up 89% of this patient population Progressive disease characterized by degeneration of the macula, the portion of the retina responsible for sharp central vision and color perception; AMD is the leading cause of severe vision loss among people over 60 in wealthy nations AMD Market Scope estimates for patient population |

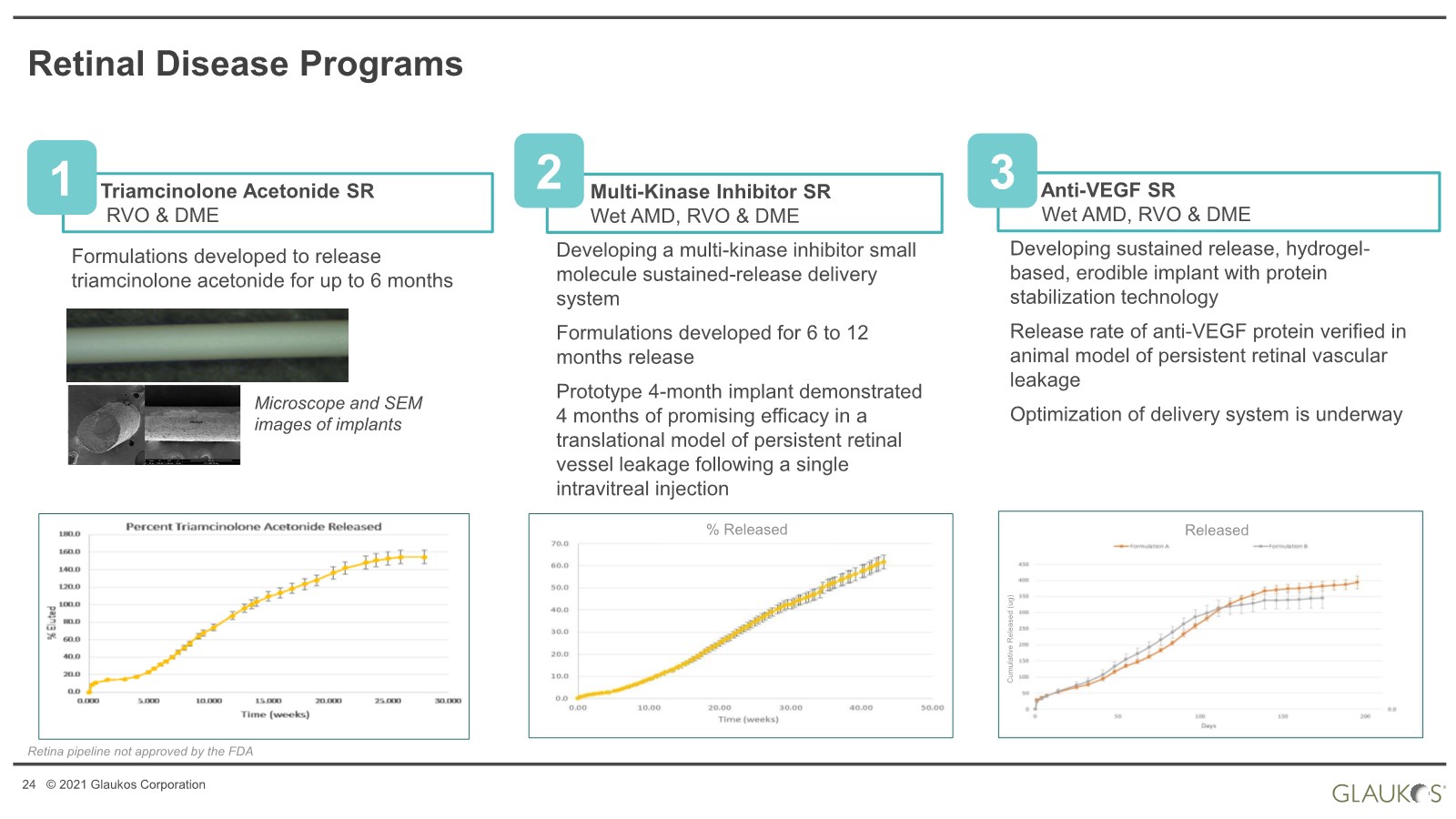

| 24 © 2021 Glaukos Corporation Triamcinolone Acetonide SR RVO & DME Formulations developed to release triamcinolone acetonide for up to 6 months Microscope and SEM images of implants 1 Multi-Kinase Inhibitor SR Wet AMD, RVO & DME Developing a multi-kinase inhibitor small molecule sustained-release delivery system Formulations developed for 6 to 12 months release Prototype 4-month implant demonstrated 4 months of promising efficacy in a translational model of persistent retinal vessel leakage following a single intravitreal injection 2 % Released Anti-VEGF SR Wet AMD, RVO & DME Developing sustained release, hydrogel- based, erodible implant with protein stabilization technology Release rate of anti-VEGF protein verified in animal model of persistent retinal vascular leakage Optimization of delivery system is underway Released Cumulative Released (ug) 3 Retinal Disease Programs Retina pipeline not approved by the FDA |

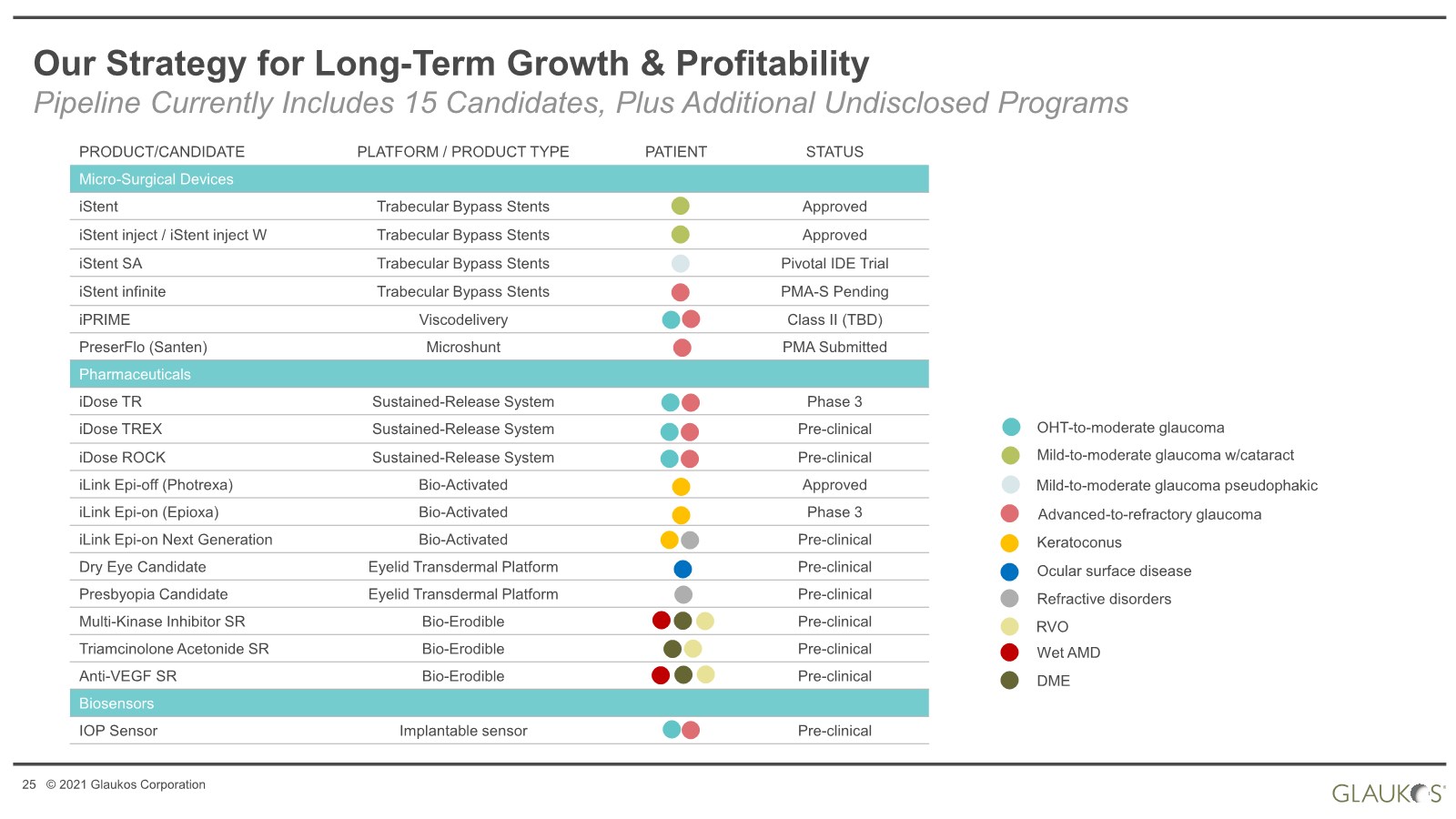

| 25 © 2021 Glaukos Corporation PRODUCT/CANDIDATE PLATFORM / PRODUCT TYPE PATIENT STATUS Micro-Surgical Devices iStent Trabecular Bypass Stents Approved iStent inject / iStent inject W Trabecular Bypass Stents Approved iStent SA Trabecular Bypass Stents Pivotal IDE Trial iStent infinite Trabecular Bypass Stents PMA-S Pending iPRIME Viscodelivery Class II (TBD) PreserFlo (Santen) Microshunt PMA Submitted Pharmaceuticals iDose TR Sustained-Release System Phase 3 iDose TREX Sustained-Release System Pre-clinical iDose ROCK Sustained-Release System Pre-clinical iLink Epi-off (Photrexa) Bio-Activated Approved iLink Epi-on (Epioxa) Bio-Activated Phase 3 iLink Epi-on Next Generation Bio-Activated Pre-clinical Dry Eye Candidate Eyelid Transdermal Platform Pre-clinical Presbyopia Candidate Eyelid Transdermal Platform Pre-clinical Multi-Kinase Inhibitor SR Bio-Erodible Pre-clinical Triamcinolone Acetonide SR Bio-Erodible Pre-clinical Anti-VEGF SR Bio-Erodible Pre-clinical Biosensors IOP Sensor Implantable sensor Pre-clinical Our Strategy for Long-Term Growth & Profitability Pipeline Currently Includes 15 Candidates, Plus Additional Undisclosed Programs Mild-to-moderate glaucoma w/cataract Mild-to-moderate glaucoma pseudophakic Advanced-to-refractory glaucoma Keratoconus Ocular surface disease OHT-to-moderate glaucoma Refractive disorders Wet AMD DME RVO |

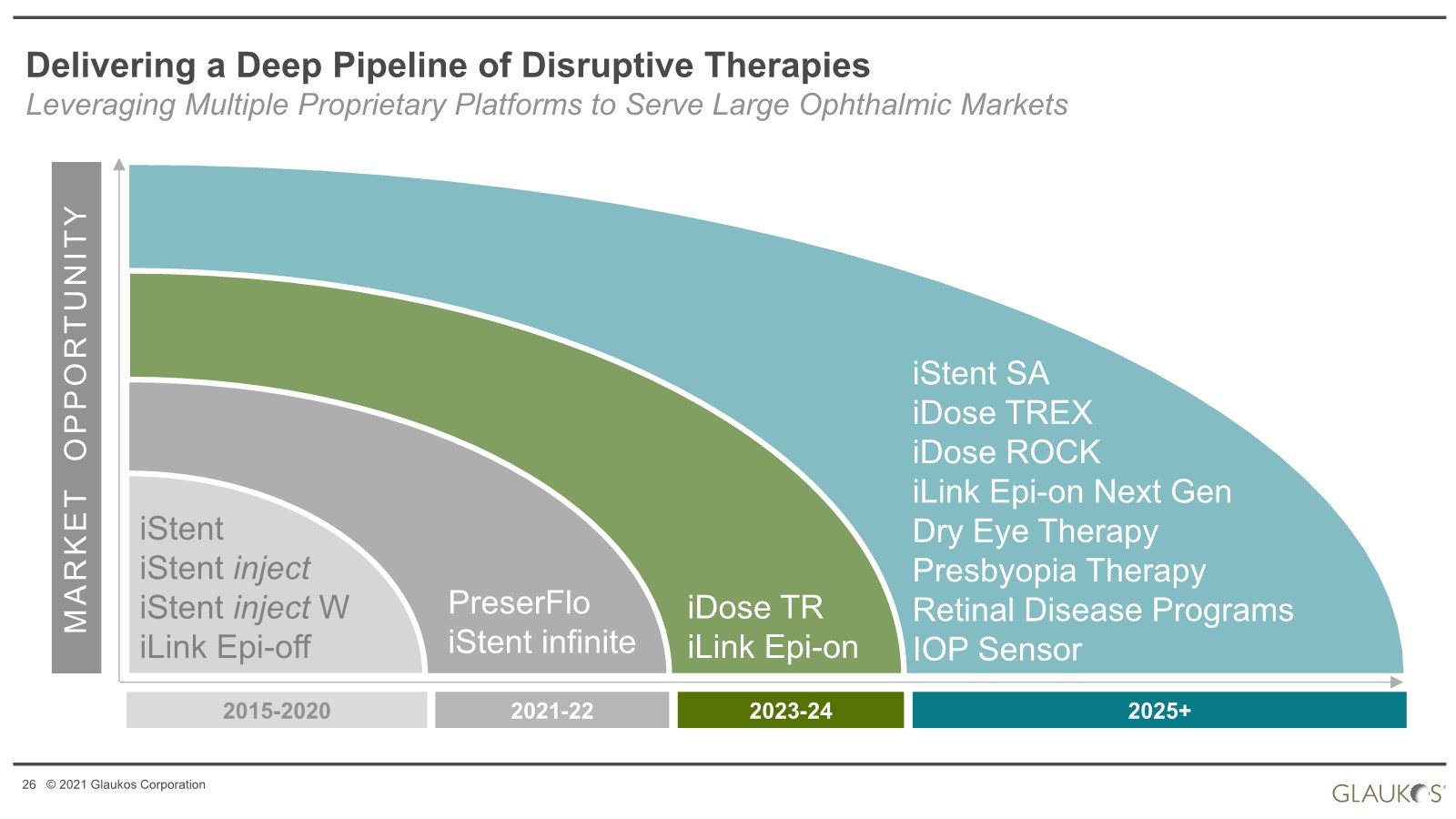

| 26 © 2021 Glaukos Corporation MARKET OPPORTUNITY 2015-2020 2021-22 2023-24 2025+ Delivering a Deep Pipeline of Disruptive Therapies Leveraging Multiple Proprietary Platforms to Serve Large Ophthalmic Markets iStent iStent inject iStent inject W iLink Epi-off PreserFlo iStent infinite iStent SA iDose TREX iDose ROCK iLink Epi-on Next Gen Dry Eye Therapy Presbyopia Therapy Retinal Disease Programs IOP Sensor iDose TR iLink Epi-on |

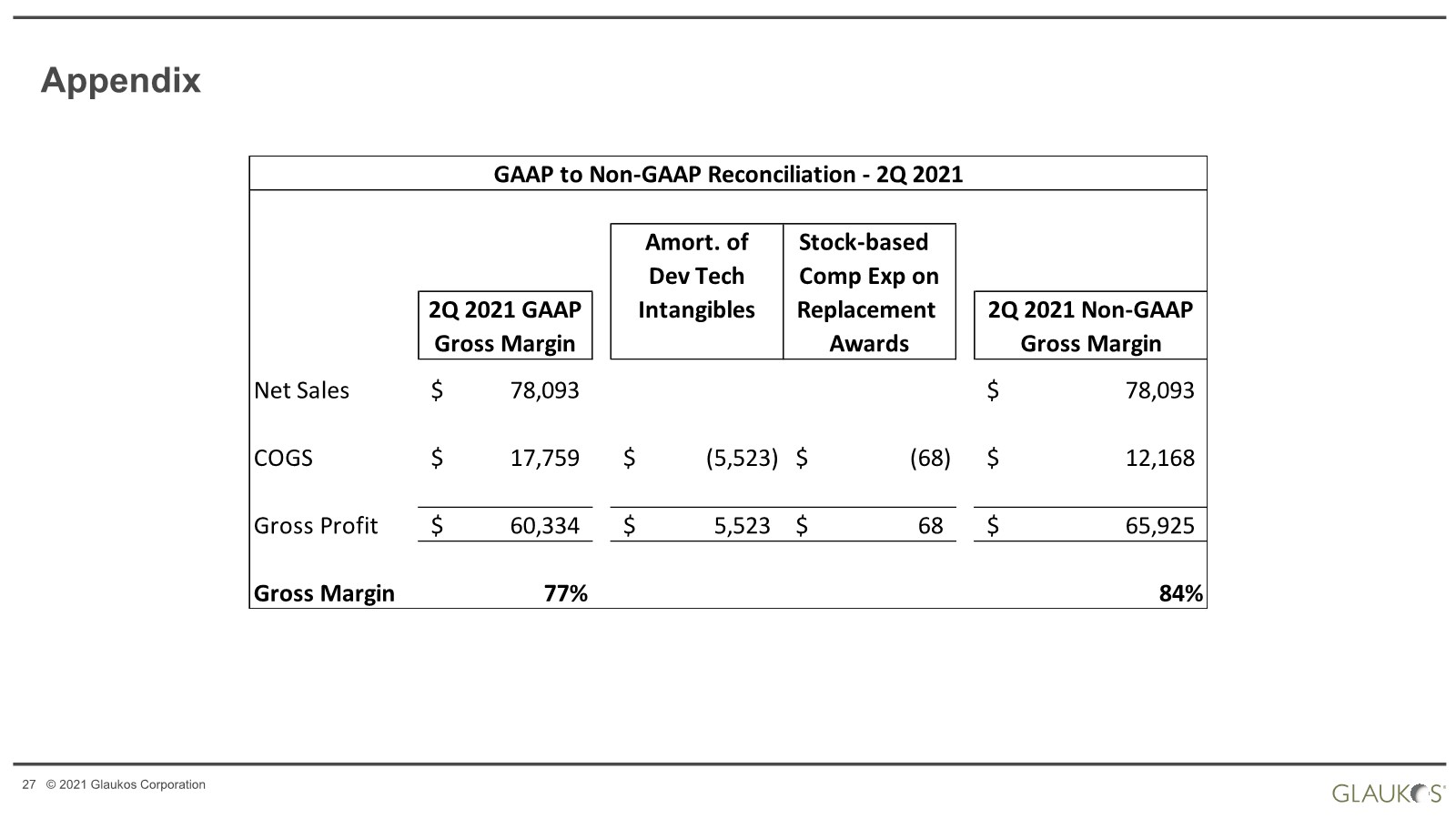

| 27 © 2021 Glaukos Corporation Appendix Amort. of Stock-based Dev Tech Comp Exp on 2Q 2021 GAAP Intangibles Replacement 2Q 2021 Non-GAAP Gross Margin Awards Gross Margin Net Sales 78,093 $ 78,093 $ COGS 17,759 $ (5,523) $ (68) $ 12,168 $ Gross Profit 60,334 $ 5,523 $ 68 $ 65,925 $ Gross Margin 77% 84% GAAP to Non-GAAP Reconciliation - 2Q 2021 |

| 28 © 2021 Glaukos Corporation |