Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GRAHAM CORP | d63499d8k.htm |

Exhibit 99.1

Dear Fellow Shareholders,

As I reflect on fiscal 2021, it will clearly stand out as the most challenging of these past 15 years in which I have had the privilege to be President and CEO of Graham. The global slowdown created by the COVID-19 pandemic was unprecedented. End markets ground to a halt, people around the world were unable to work, fear and uncertainty were everywhere and businesses’ near-term planning was turned upside down. Nevertheless, Graham’s values and operating principles served as our compass to navigate these difficulties. Moreover, we continued to focus on the areas of our business that we could influence with the belief that by controlling well what we could, Graham would be stronger on the other side of this once in a lifetime event.

A fundamental guiding value for Graham is maintaining a strong, vibrant and engaged workforce. To protect our employees, our most valuable asset, we shut down operations for a period of time in the first quarter of fiscal 2021. Despite this, wages were maintained at 100%. I am extremely proud that we supported all employees with wage continuity even while operating at just 50% capacity. Shutting down operations also enabled employees to address the many, varied issues of personal life that were thrust upon us all when COVID-19 hit. We believe that our decision to protect our human capital and focus on the retention of our highly trained workforce will benefit customers and shareholders as end markets recover.

We operated at approximately 90% throughput during the third and fourth quarters of fiscal 2021. We focused on workplace protocols and safety processes intended to create a safe work environment, while at the same time we ensured the needs of our customers were continuing to be met.

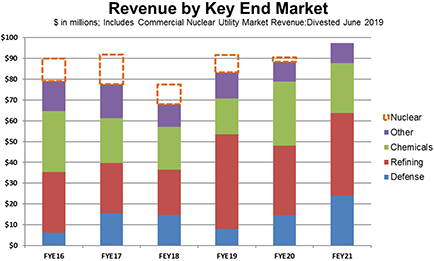

Given the adverse environment, I am proud to report Graham delivered $97.5 million in revenue, up 8% over the prior fiscal year. Profitability was impacted due to the under-absorption of overhead costs given our proactive measures to protect the financial well-being of all our employees, but nonetheless improved over the prior fiscal year. Net income was $2.4 million, up $0.5 million or 27% from fiscal 2020.

Executing on our Defense Strategy

The underpinning strength of our Defense strategy is the industry itself. This market is less cyclical, uncorrelated to our traditional crude oil and chemical markets and measurably less volatile. The projects for this industry also provide longer term contract awards that enable greater visibility for revenue and demand potential. We initiated the strategy about 10 years ago, and it has progressed well since our first project win with a single component for the U.S. Navy nuclear propulsion program for aircraft carriers. Today, we are providing seven different components over three

|

|

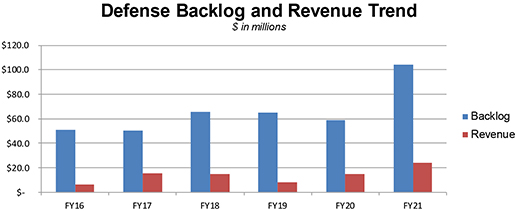

Naval nuclear propulsion programs – two submarine programs along with the carrier program. In total, revenue to the Defense industry in fiscal 2021 grew 64% to $24 million and was 25% of consolidated revenue. Based on the timing of backlog conversion, we expect modest growth in organic defense revenue in fiscal 2022, which is then expected to reach more than $40 million by fiscal 2025. |

Our team that is driving the defense strategy has surpassed my expectations. The success of their efforts to diversify our markets was clearly demonstrated in the growth of our defense backlog, which exceeded $100 million at fiscal 2021 year-end and was 76% of total backlog. Graham has a high quality, multi-year level of defense backlog which we expect will provide excellent loading of our operating assets.

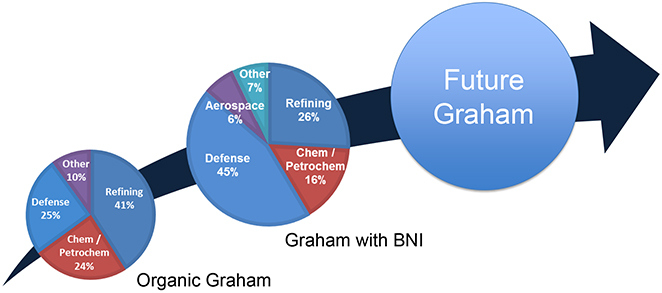

Accelerating Diversification Strategy with Acquisition of Barber-Nichols

Following the end of fiscal 2021, we successfully acquired Barber-Nichols (“BNI”) on June 1, 2021. This was a transformative acquisition for Graham and accelerates our diversification strategy into the less cyclical defense sector. BNI revenue in calendar year 2020 was $56 million and it is expected to contribute $45 million to $48 million in revenue for the ten months we will own it in fiscal 2022. Importantly, BNI provides a new platform for Graham for both organic and follow on acquisitive growth.

The BNI acquisition took nearly three years to bring to fruition. The time during those years was spent well, as we forged relations and created a shared vision for the value of the combination. Importantly, we observed BNI’s management in action – their planning process, forecasting and projection fidelity, organizational development practices and their ability to achieve stretch performance objectives. This provided tremendous insight into the company and its leadership team.

Their products serve the defense, aerospace/space, advanced power and cryogenic industries. While also a defense industry supplier, BNI does not overlap with Graham’s traditional products. Therefore, it expands our addressable market within Defense while also providing access to new and growing markets, such as aerospace and advanced power.

Truly transformed, Graham is a very different company with the addition of BNI. We believe we now have greater revenue potential, broader defense industry participation, access to new markets and a platform for further capital deployment to enhance growth.

I will close by acknowledging all my Graham associates for their admirable diligence, commitment and passion provided to deliver top line growth under such adverse conditions. I am proud of the management team for their demonstrated agility and focus during such an extraordinary time. I also want to credit the business development efforts of Jeff Glajch, our CFO, and Chris Johnston, Director of Business Development, and to thank our Board of Directors for their engagement, counsel and strategic oversight. We believe BNI is a great addition to Graham Corporation.

Dan Thoren, former chairman, CEO, President and major shareholder of BNI, joins Graham as our President and Chief Operating Officer. Dan has a proven track record of strong leadership and ability to execute growth, develop a strong culture and build a talented organization. We believe he will be a valuable asset for Graham.

Lastly, I thank you, our shareholders, for your investment in GHM and the trust you have placed in me, the leadership team and the Board of Directors.

| Sincerely, |

|

| James R. Lines Chief Executive Officer |

| June 8, 2021 |