Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIAA REAL ESTATE ACCOUNT | tiaarealestatefactsheet331.htm |

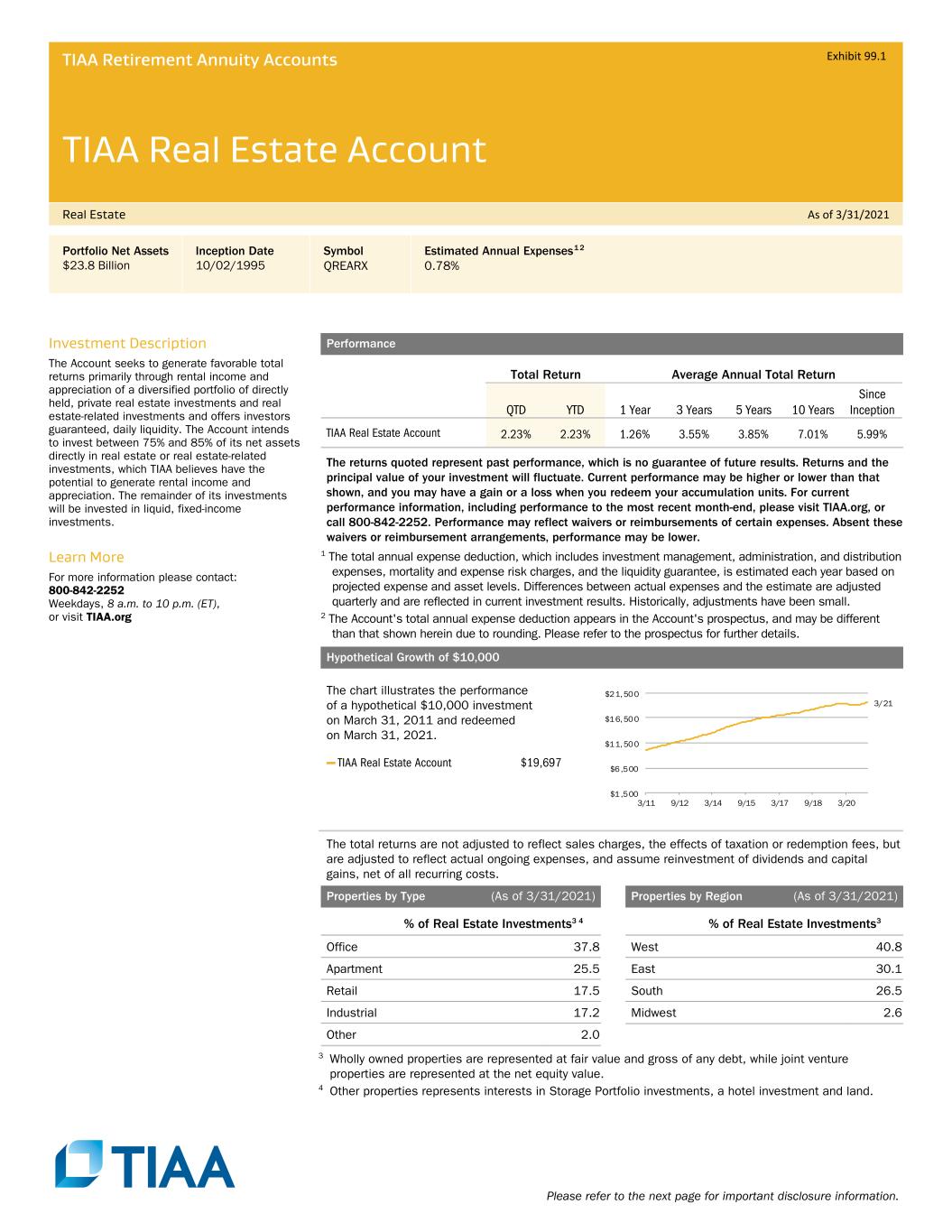

Please refer to the next page for important disclosure information. TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 3/31/2021 Portfolio Net Assets $23.8 Billion Inception Date 10/02/1995 Symbol QREARX Estimated Annual Expenses 1 2 0.78% Investment Description The Account seeks to generate favorable total returns primarily through rental income and appreciation of a diversified portfolio of directly held, private real estate investments and real estate-related investments and offers investors guaranteed, daily liquidity. The Account intends to invest between 75% and 85% of its net assets directly in real estate or real estate-related investments, which TIAA believes have the potential to generate rental income and appreciation. The remainder of its investments will be invested in liquid, fixed-income investments. Learn More For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), or visit TIAA.org Performance Total Return Average Annual Total Return QTD YTD 1 Year 3 Years 5 Years 10 Years Since Inception TIAA Real Estate Account 2.23% 2.23% 1.26% 3.55% 3.85% 7.01% 5.99% The returns quoted represent past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org, or call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. 1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. 2 The Account's total annual expense deduction appears in the Account's prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. Hypothetical Growth of $10,000 The chart illustrates the performance of a hypothetical $10,000 investment on March 31, 2011 and redeemed on March 31, 2021. — TIAA Real Estate Account $19,697 The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. Properties by Type (As of 3/31/2021) % of Real Estate Investments3 4 Office 37.8 Apartment 25.5 Retail 17.5 Industrial 17.2 Other 2.0 Properties by Region (As of 3/31/2021) % of Real Estate Investments3 West 40.8 East 30.1 South 26.5 Midwest 2.6 3 Wholly owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. 4 Other properties represents interests in Storage Portfolio investments, a hotel investment and land. 3/21 $1,500 $6,500 $11,500 $16,500 $21,500 3/11 9/12 3/14 9/15 3/17 9/18 3/20 Exhibit 99.1

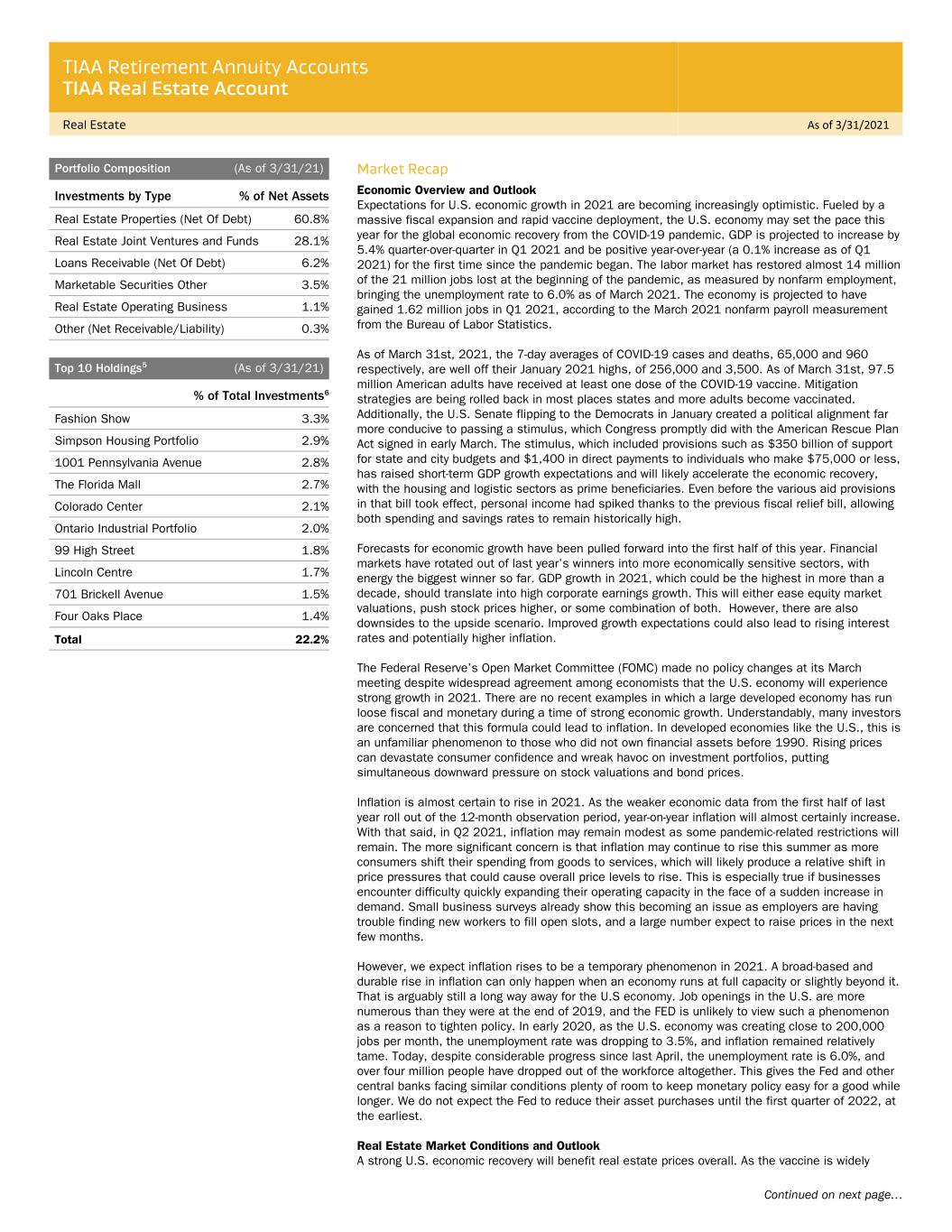

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 3/31/2021 Continued on next page… Portfolio Composition (As of 3/31/21) Investments by Type % of Net Assets Real Estate Properties (Net Of Debt) 60.8% Real Estate Joint Ventures and Funds 28.1% Loans Receivable (Net Of Debt) 6.2% Marketable Securities Other 3.5% Real Estate Operating Business 1.1% Other (Net Receivable/Liability) 0.3% Top 10 Holdings 5 (As of 3/31/21) % of Total Investments 6 Fashion Show 3.3% Simpson Housing Portfolio 2.9% 1001 Pennsylvania Avenue 2.8% The Florida Mall 2.7% Colorado Center 2.1% Ontario Industrial Portfolio 2.0% 99 High Street 1.8% Lincoln Centre 1.7% 701 Brickell Avenue 1.5% Four Oaks Place 1.4% Total 22.2% Market Recap Economic Overview and Outlook Expectations for U.S. economic growth in 2021 are becoming increasingly optimistic. Fueled by a massive fiscal expansion and rapid vaccine deployment, the U.S. economy may set the pace this year for the global economic recovery from the COVID-19 pandemic. GDP is projected to increase by 5.4% quarter-over-quarter in Q1 2021 and be positive year-over-year (a 0.1% increase as of Q1 2021) for the first time since the pandemic began. The labor market has restored almost 14 million of the 21 million jobs lost at the beginning of the pandemic, as measured by nonfarm employment, bringing the unemployment rate to 6.0% as of March 2021. The economy is projected to have gained 1.62 million jobs in Q1 2021, according to the March 2021 nonfarm payroll measurement from the Bureau of Labor Statistics. As of March 31st, 2021, the 7-day averages of COVID-19 cases and deaths, 65,000 and 960 respectively, are well off their January 2021 highs, of 256,000 and 3,500. As of March 31st, 97.5 million American adults have received at least one dose of the COVID-19 vaccine. Mitigation strategies are being rolled back in most places states and more adults become vaccinated. Additionally, the U.S. Senate flipping to the Democrats in January created a political alignment far more conducive to passing a stimulus, which Congress promptly did with the American Rescue Plan Act signed in early March. The stimulus, which included provisions such as $350 billion of support for state and city budgets and $1,400 in direct payments to individuals who make $75,000 or less, has raised short-term GDP growth expectations and will likely accelerate the economic recovery, with the housing and logistic sectors as prime beneficiaries. Even before the various aid provisions in that bill took effect, personal income had spiked thanks to the previous fiscal relief bill, allowing both spending and savings rates to remain historically high. Forecasts for economic growth have been pulled forward into the first half of this year. Financial markets have rotated out of last year’s winners into more economically sensitive sectors, with energy the biggest winner so far. GDP growth in 2021, which could be the highest in more than a decade, should translate into high corporate earnings growth. This will either ease equity market valuations, push stock prices higher, or some combination of both. However, there are also downsides to the upside scenario. Improved growth expectations could also lead to rising interest rates and potentially higher inflation. The Federal Reserve’s Open Market Committee (FOMC) made no policy changes at its March meeting despite widespread agreement among economists that the U.S. economy will experience strong growth in 2021. There are no recent examples in which a large developed economy has run loose fiscal and monetary during a time of strong economic growth. Understandably, many investors are concerned that this formula could lead to inflation. In developed economies like the U.S., this is an unfamiliar phenomenon to those who did not own financial assets before 1990. Rising prices can devastate consumer confidence and wreak havoc on investment portfolios, putting simultaneous downward pressure on stock valuations and bond prices. Inflation is almost certain to rise in 2021. As the weaker economic data from the first half of last year roll out of the 12-month observation period, year-on-year inflation will almost certainly increase. With that said, in Q2 2021, inflation may remain modest as some pandemic-related restrictions will remain. The more significant concern is that inflation may continue to rise this summer as more consumers shift their spending from goods to services, which will likely produce a relative shift in price pressures that could cause overall price levels to rise. This is especially true if businesses encounter difficulty quickly expanding their operating capacity in the face of a sudden increase in demand. Small business surveys already show this becoming an issue as employers are having trouble finding new workers to fill open slots, and a large number expect to raise prices in the next few months. However, we expect inflation rises to be a temporary phenomenon in 2021. A broad-based and durable rise in inflation can only happen when an economy runs at full capacity or slightly beyond it. That is arguably still a long way away for the U.S economy. Job openings in the U.S. are more numerous than they were at the end of 2019, and the FED is unlikely to view such a phenomenon as a reason to tighten policy. In early 2020, as the U.S. economy was creating close to 200,000 jobs per month, the unemployment rate was dropping to 3.5%, and inflation remained relatively tame. Today, despite considerable progress since last April, the unemployment rate is 6.0%, and over four million people have dropped out of the workforce altogether. This gives the Fed and other central banks facing similar conditions plenty of room to keep monetary policy easy for a good while longer. We do not expect the Fed to reduce their asset purchases until the first quarter of 2022, at the earliest. Real Estate Market Conditions and Outlook A strong U.S. economic recovery will benefit real estate prices overall. As the vaccine is widely

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 3/31/2021 Continued on next page… administered and pandemic-related restrictions are removed, the U.S. real estate recovery will track with the broader economic recovery; however, we expect certain regions, cities, and property types to continue to outperform and others to continue to underperform. Commercial real estate should benefit from a low-interest-rate environment, attracting more investors to the space as they seek higher-yielding alternatives relative to fixed income assets. The pandemic severely impacted real estate property types that depend on social interactions such as retail and lodging, but while the retail has sector has continued to struggle, the lodging sector is showing signs that it will recover more quickly. Simultaneously, the pandemic has accelerated online shopping, the movement to the suburbs and Sunbelt cities, and the shift to the digital economy. As a result, warehouse, single-family rentals, and data center values have risen since the onset of the pandemic and have continued to outperform during recent quarters. Additionally, health care and medical research spending is increasing, which has benefitted the life science and medical office sectors. According to Real Capital Analytics, real estate transaction volumes were down 37% year-over-year as of Q1 2021 relative to Q1 2020. During this period, apartments and industrial captured almost 59% of total U.S. transaction volumes, illustrating the strong investor interest in these two property types. The Account experienced materially positive appreciation within the warehouse, apartment, and alternative real estate sectors during the first quarter of 2021, driving a net participant return of 2.23%. Attractive supply and demand fundamentals, favorable borrowing costs, and heightened investor appetite for the industrial and apartment sectors, in particular, have largely contributed to property appreciation in the first quarter. Rent collections continued to hold up across all sectors, tracking closely with the National Council of Real Estate Investment Fiduciaries (NCREIF) collection numbers as of March 31st, 2021. The Account benefits from its low leverage position of 18.2% as of March 31st, 2021, and minimal near-term debt maturities. This allows the Account to opportunistically deploy capital during periods of market volatility when other funds may focus on shoring up balance sheets. For the remainder of 2021, the Account will seek to further improve diversification by selling lower productivity assets and acquiring assets with higher growth potential and economic resiliency. Important Information 5 The commercial real property holdings listed are subject to change and may not be representative of the Account’s current or future investments. The property holdings listed are part of the Account’s long-term investments and exclude liquid, fixed-income investments and other securities held by the Account. The property holdings do not include the Account’s entire investment portfolio and should not be considered a recommendation to buy, sell or hold a particular security or other investment. 6Real estate fair value is presented gross of debt. Investments in joint ventures are presented at the Account's ownership interest. Fashion Show is held in a joint venture with General Growth Properties, in which the Account holds 50% interest, and is presented gross of debt. As of March 31, 2021, the debt had a fair value of $425.1 million. Simpson Housing Portfolio is held in a joint venture with Simpson Housing LP, in which the Account holds an 80% interest, and is presented gross of debt. As of March 31, 2021, the debt had a fair value of $393.5 million. 1001 Pennsylvania Avenue is presented gross of debt. As of March 31, 2021, the debt had a fair value of $314.2 million. The Florida Mall is held in a joint venture with Simon Property Group, LP, in which the Account holds a 50% interest, and is presented gross of debt. As of March 31, 2021, the debt had a fair value of $151.5 million. Colorado Center is held in a joint venture with EOP Operating LP, in which the Account holds a 50% interest, and is presented gross of debt. As of March 31, 2021, the debt had a fair value of $279.7 million. 99 High Street is presented gross of debt. As of March 31, 2021, the debt had a fair value of $285.9 million. 701 Brickell Avenue is presented gross of debt. As of March 31, 2021, the debt had a fair value of $186.3 million. Four Oaks Place is held in a joint venture with Allianz US Private REIT LP, in which the Account holds a 51% interest, and is presented gross of debt. As of March 31, 2021, the debt had a fair value of $83.3 million. Real estate investment portfolio turnover rate for the Account was 7.1% for the year ended 12/31/2020. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. Marketable securities portfolio turnover rate for the Account was 113.4% for the year ended 12/31/2020. Marketable securities portfolio turnover rate is calculated by dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. This material is for informational or educational purposes only and does not constitute investment advice under ERISA, a securities recommendation under federal securities laws, or an insurance product recommendation under state insurance laws or regulations. This material is intended to provide you with

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 3/31/2021 Continued on next page… information to help you make informed decisions. You should not view or construe the availability of this information as a suggestion that you take or refrain from taking a particular course of action, as the advice of an impartial fiduciary, as an offer to sell or a solicitation to buy or hold any securities, as a recommendation of any securities transactions or investment strategy involving securities (including account recommendations), a recommendation to rollover or transfer assets to TIAA or a recommendation to purchase an insurance product. In making this information available to you, TIAA assumes that you are capable of evaluating the information and exercising independent judgment. As such, you should consider your other assets, income and investments and you should not rely on the information as the primary basis for making investment or insurance product purchase or contribution decisions. The information that you may derive from this material is for illustrative purposes only and is not individualized or based on your particular needs. This material does not take into account your specific objectives or circumstances, or suggest any specific course of action. Investment, insurance product purchase or contribution decisions should be made based on your own objectives and circumstances. The purpose of this material is not to predict future returns, but to be used as education only. Contact your tax advisor regarding the tax implications. You should read all associated disclosures. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC, distributes securities products. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161. A Note About Risks In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. ©2021 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 1586051