Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CION Investment Corp | tm2112647d1_8k.htm |

Exhibit 99.1

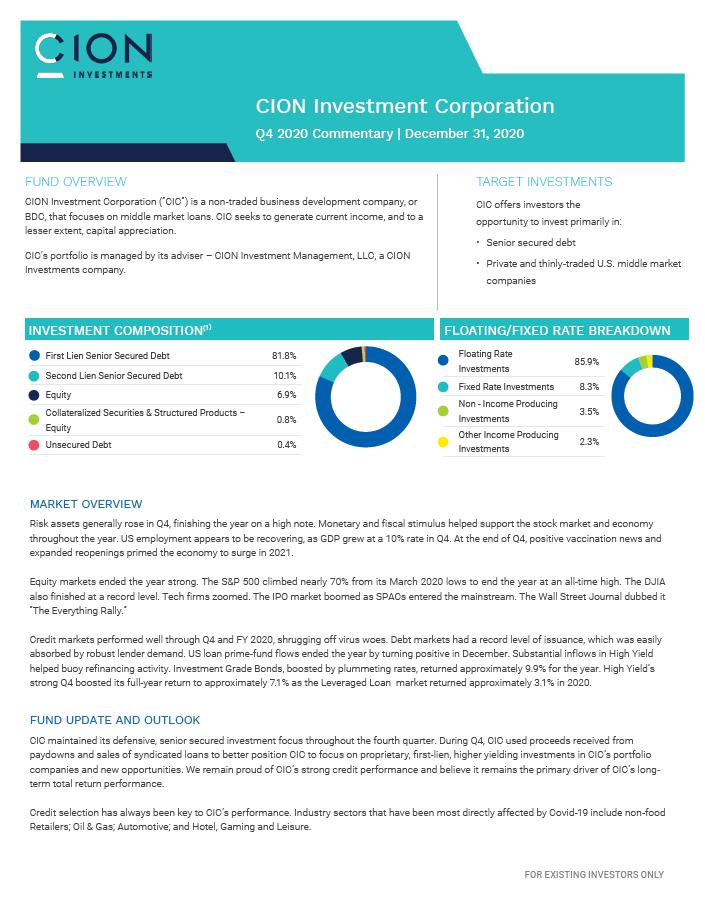

CION Investment Corporation Q4 2020 Commentary | December 31, 2020 FUND OVERVIEW CION Investment Corporation (“CIC”) is a non-traded business development company, or BDC, that focuses on middle market loans. CIC seeks to generate current income, and to a lesser extent, capital appreciation. CIC’s portfolio is managed by its adviser – CION Investment Management, LLC, a CION Investments company. TARGET INVESTMENTS CIC offers investors the opportunity to invest primarily in: • Senior secured debt • Private and thinly-traded U.S. middle marketcompanies FLOATING/FIXED RATE BREAKDOWN INVESTMENT COMPOSITION(1) First Lien Senior Secured Debt 81.8% Second Lien Senior Secured Debt 10.1% Equity 6.9% Collateralized Securities & Structured Products – Equity 0.8% Unsecured Debt 0.4% Floating Rate Investments 85.9% Fixed Rate Investments 8.3% Non - Income Producing Investments 3.5% Other Income Producing Investments 2.3% MARKET OVERVIEWRisk assets generally rose in Q4, finishing the year on a high note. Monetary and fiscal stimulus helped support the stock market and economy throughout the year. US employment appears to be recovering, as GDP grew at a 10% rate in Q4. At the end of Q4, positive vaccination news and expanded reopenings primed the economy to surge in 2021. Equity markets ended the year strong. The S&P 500 climbed nearly 70% from its March 2020 lows to end the year at an all-time high. The DJIA also finished at a record level. Tech firms zoomed. The IPO market boomed as SPACs entered the mainstream. The Wall Street Journal dubbed it “The Everything Rally.” Credit markets performed well through Q4 and FY 2020, shrugging off virus woes. Debt markets had a record level of issuance, which was easily absorbed by robust lender demand. US loan prime-fund flows ended the year by turning positive in December. Substantial inflows in High Yield helped buoy refinancing activity. Investment Grade Bonds, boosted by plummeting rates, returned approximately 9.9% for the year. High Yield’s strong Q4 boosted its full-year return to approximately 7.1% as the Leveraged Loan market returned approximately 3.1% in 2020. FUND UPDATE AND OUTLOOKCIC maintained its defensive, senior secured investment focus throughout the fourth quarter. During Q4, CIC used proceeds received from paydowns and sales of syndicated loans to better position CIC to focus on proprietary, first-lien, higher yielding investments in CIC’s portfolio companies and new opportunities. We remain proud of CIC’s strong credit performance and believe it remains the primary driver of CIC’s long- term total return performance. Credit selection has always been key to CIC’s performance. Industry sectors that have been most directly affected by Covid-19 include non-food Retailers; Oil & Gas; Automotive; and Hotel, Gaming and Leisure.

As of 12/31/20, these industry sectors represented approximately 4.6% of CIC’s portfolio. The Covid-19 effect on CIC’s portfolio has not been uniform, with each portfolio company experiencing its own unique supply chain and revenue impacts from the pandemic. Not only does the performance of a portfolio company matter, but also who its equity holders are. We estimate that approximately 95% of CIC’s portfolio is sponsored by private equity and multi-disciplinary institutional platforms. With respect to CIC’s larger sponsored portfolio companies in industries that have been directly impacted by Covid-19, their respective private equity sponsors have been very constructive and have injected substantial capital to support such portfolio companies. We believe that CIC’s continued strategic concentration on first lien assets at the top of the capital stack helped it cushion the impact of the turbulent Covid-19 environment. We continue to believe that investors will not be adequately compensated for reaching deeper into the capital structure for yield. CIC’s portfolio consists of approximately 82% first lien senior secured loans as of 12/31/20, up from approximately 78% at 12/31/19. We continue to adhere to CIC’s defensive and disciplined approach to credit and believe that CIC continues to outperform its peers on a fundamental credit basis. 1. Information is based on the relative fair value of the underlying portfolio holdings. Percentages represent approximate figures. Data excludes short term investments, which represent an investment in a fund that invests in highly liquid investments with average original maturity dates of three months or less. This is neither an offer to sell nor a solicitation of an offer to purchase any securities. CIC’s offering period ended and is no longer open to new investors. This fund commentary summarizes some of the features and transactions of CIC as of the date indicated above (unless otherwise indicated). There is no assurance that additional similar transactions will be available to CIC or that CIC’s investment portfolio composition going forward will be as described herein. Any past performance or actions are not indicative of future results or behaviors. Any other commentary provided is the sole opinion of the author and should not be considered a recommendation. Forward-Looking StatementsCertain information in this commentary contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are identified by words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” and variations of these words and similar expressions, including references to assumptions and forecasts of future results. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. CIC undertakes no obligation to update any forward- looking statements contained herein to conform the statements to actual results or changes in its expectations. Summary InformationThe information in this commentary is summary information only and should be read in conjunction with CIC’s Annual Report on Form 10-K for the period ended December 31, 2020, which CIC filed with the Securities and Exchange Commission (“SEC”) on March 16, 2021, as well as CIC’s other reports filed with the SEC. A copy of CIC’s Annual Report on Form 10-K for the period ended December 31, 2020 and CIC’s other reports filed with the SEC can be found on CIC’s website at www.cioninvestments.com and the SEC’s website at www.sec.gov.