Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - WESTERN CAPITAL RESOURCES, INC. | g082108_ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - WESTERN CAPITAL RESOURCES, INC. | g082108_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - WESTERN CAPITAL RESOURCES, INC. | g082108_ex31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - WESTERN CAPITAL RESOURCES, INC. | g082108_ex21-1.htm |

| EX-4.1 - EXHIBIT 4.1 - WESTERN CAPITAL RESOURCES, INC. | g082108_ex4-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 |

or

| ☐ | TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______________________ to ___________________ |

Commission File Number 000-52015

WESTERN CAPITAL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 47-0848102 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

|

11550 “I” Street, Suite 150 Omaha, Nebraska |

68137 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (402) 551-8888

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☒ Emerging Growth Company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2020 was approximately $11,533,000 based on the closing sales price of $4.30 per share as reported on the OTCQB. As of March 29, 2021, there were 9,249,900 shares of our common stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

None.

Western

Capital Resources, Inc.

Form 10-K

Table of Contents

OVERVIEW

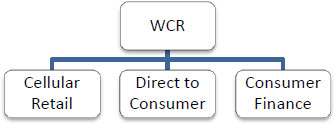

Western Capital Resources, Inc. (“WCR” or “Western Capital”), a Delaware corporation originally incorporated in Minnesota in 2001 and reincorporated in Delaware in 2016, is a holding company having a controlling interest in subsidiaries operating in the following industries and operating segments:

Our “Cellular Retail” segment is comprised of an authorized Cricket Wireless dealer and involves the retail sale of cellular phones and accessories to consumers through our wholly-owned subsidiary PQH Wireless, Inc. and its controlled but less than 100% owned subsidiaries. Our “Direct to Consumer” segment consists of a wholly-owned, branded online and direct marketing distribution retailer of live plants, seeds, holiday gifts and garden accessories selling its products under Park Seed, Jackson & Perkins and Wayside Gardens brand names and home improvement and restoration products operating as Van Dyke’s Restorers as well as a wholesaler under the Park Wholesale brand. Our “Consumer Finance” segment consists of retail financial services conducted through our wholly-owned subsidiaries Wyoming Financial Lenders, Inc. and Express Pawn, Inc. Our investment holdings are included with WCR. Throughout this report, we collectively refer to WCR and its consolidated subsidiaries as “we,” the “Company,” and “us.”

RECENT EVENTS

Consumer Finance Segment

On November 3, 2020, Nebraska voters passed a ballot initiative that limits all fees charged by payday lenders in Nebraska to an annual interest rate of 36%. In anticipation of such passage, we ceased writing new payday loans in Nebraska in late October 2020 and closed all Nebraska loan centers by year end. Payday operation in Nebraska generated approximately 19% of the segment’s revenue in 2020. The closure of Nebraska payday operations will have a significant and negative impact on this segment’s earnings and a negative impact on this segment’s contribution to shareholder earnings.

In November 2020, we sold five of our six loan centers in Iowa, leaving 19 loan centers in four states, Iowa (1), Kansas (2), North Dakota (10) and Wyoming (6), open as of December 31, 2020. Our three pawn store locations in Iowa (1) and Nebraska (2) also remained open.

In October 2017, the U.S. Consumer Financial Protection Bureau (“CFPB”) adopted a new rule for payday lending. In January 2018, the CFPB issued a statement that it intended to “reconsider” the regulation and delayed the August 19, 2019 compliance date for the other provisions to November 19, 2020. In July 2020, the CFPB issued a final rule applicable to the 2017 rule. The final rule rescinds the mandatory underwriting provisions of the 2017 rule but does not rescind or alter the payments provisions of the 2017 rule. The CFPB has stated that it will seek to have these rules go into effect with a reasonable period for entities to come into compliance. The implementation of the final rule is likely to result in a reduction of bad debt collections in-house and higher outside collection costs, and thus a negative impact on our Consumer Finance segment operating results and this segment’s contribution to shareholder earnings.

2

Common Stock Repurchases

Through open market purchases, in the fourth quarter of 2020 the Company repurchased and cancelled 11,916 shares of our common stock at an average price of $6.00 per share.

Acquisitions

On January 8, 2021, our newly-formed wholly-owned subsidiary completed a merger with Swisher Acquisition, Inc. (“Swisher”), a manufacturer of lawn and garden power equipment and emergency safety shelters, and provider of turn-key manufacturing services to third parties. Pursuant to the merger, the Company issued 408,000 shares of our common stock as consideration for the merger and Swisher became a wholly-owned subsidiary of the Company as the survivor of the merger.

We are actively searching for additional acquisition opportunities. We are industry agnostic and target leaders in niche industries or geographies as well as opportunistic purchases of businesses that we believe we can improve operationally. We have a particular interest in companies facing succession dilemmas, corporate divestitures and businesses in out-of-favor industries. In addition, we seek to grow our subsidiaries through add-on acquisitions in the e-commerce, cellular retail and manufacturing (added in 2021) segments. Our overall strategy continues to focus on building a diversified portfolio of strong cash flow generating businesses. Our financial strength, long-term view and operating expertise allow subsidiary companies to focus on growing and maximizing return on investment. We expect to be patient and move upon what we believe to be the right investment opportunities.

CELLULAR RETAIL SEGMENT

General Description

We operate cellular retail stores as an authorized Cricket Wireless retailer, selling cellular phones and accessories, activating Cricket Wireless customers on the Cricket network, providing ancillary services and accepting service payments from Cricket customers. As an authorized Cricket Wireless dealer, we are only permitted to sell the Cricket line of no-contract cellular phones and service at our Cricket retail stores.

We generate revenue in this business through retail sales of cellular phones, receipt of back-end compensation from Cricket, sales of phone accessories (e.g., cases, chargers and bluetooth devices), fees charged when a customer changes services (service activations and reactivations, adding lines, phone number changes, etc.), or whenever a customer whom we activated on the Cricket network pays his or her no-contract cellular bill.

A summary table of the number of cellular retail stores we operated during the periods ended December 31, 2020 and 2019 follows:

| 2020 | 2019 | |||||||

| Beginning | 222 | 205 | ||||||

| Acquired / Launched | 20 | 69 | ||||||

| Closed / Divested | (37 | ) | (52 | ) | ||||

| Ending | 205 | 222 | ||||||

Market Information and Marketing

Cricket Wireless provides nationwide 5G coverage and offers customers simple, no annual contract, no overages, predictable and affordable nationwide flat rate wireless plans. Cricket Wireless customers have the added advantage of unlimited talk, text and picture messages in the U.S. and high-speed data access which varies by plan (speeds are reduced after reaching high-speed data allowances on some plans) on the AT&T network.

3

No-contract cellular products and services were historically targeted primarily only to market segments that were underserved by traditional communications companies requiring credit approval, a contractual commitment from the subscriber for a period of at least one year, and often included overage charges for minute and data usage in excess of a specified limit. We believe that a large portion of the U.S. cellular market consists of customers who are price-sensitive and prefer not to enter into these fixed-term contracts. We believe that the Cricket Wireless cellular retail product and service offerings we offer appeal strongly to both the underserved markets and the greater U.S. cellular market and believe we are positioned to benefit as a Cricket Wireless dealer.

Market Strategy

We believe that our business model is scalable and we can apply our operational protocols and administrative office functions to continue expanding our cellular retail business. We will continue to evaluate strategic and opportunistic acquisitions of existing Cricket dealerships and will actively close, dispose or consolidate locations that do not meet our operating criteria in order to streamline operations.

Products and Services

Our authorized Cricket retail stores offer the following products and services:

| ● | Cricket Wireless service plans, each designed to attract customers by offering simple, no annual contract, no overages, predictable and affordable talk, text, picture messaging and high-speed data services that are a competitive alternative to traditional wireless and wireline services (e.g., flat-rate and unlimited talk/text/picture messages plans, without fixed-term contracts, early termination fees or credit checks); |

| ● | Cricket Wireless plan upgrades, such as Cricket International, individual country add-ons, Cricket Protect and mobile hotspots; |

| ● | Cricket handsets: and |

| ● | A wide range of cellular accessories. |

When purchasing a phone, our customers have options among the latest in Apple, Samsung and other Android-based and Windows OS-based smartphones. Because there is no contract for the monthly service, customer phone purchases are paid in full at the time of purchase.

Seasonality

Our Cellular Retail segment operations are influenced by seasonal effects related to traditional retail selling periods and other factors affecting our customer base. In particular, we generally expect sales activity to be highest in the first and fourth quarters. Nevertheless, our revenues can be strongly affected by the launch of new markets, new or improved products such as the release of the latest smartphone edition, promotional activity, the timing of federal tax-refunds and stimulus programs and the actions of our competitors, any of which have the ability to offset or exacerbate the seasonality we normally experience.

Competition

There is substantial and ever-increasing competition in the wireless phone industry where customers can choose between many other postpaid and no-contract resellers, including AT&T, Verizon, T-Mobile/Sprint/Metro, Boost Mobile and a larger number of regional providers. We compete for customers based principally on Cricket’s service/device offerings, price, call quality and coverage area.

4

Competition for the no-contract customers is primarily among Metro, Virgin Mobile and Boost Mobile, but also includes the traditional postpaid carriers that have introduced no-contract products. There is also competition with other no-contract phone service providers such as Straight Talk by Wal-Mart or Wal-Mart’s Family Mobile powered by T-Mobile, an increase of national retailers offering similar or identical products and services that we provide, such as Cricket phones sold at Game Stop and Wal-Mart, and an increase in mobile virtual network operator (“MVNO”) offerings.

Our Cricket store business also competes with other current or potential authorized Cricket Wireless dealers and direct-to-consumer sales through the Cricket Wireless website. The authorization to sell Cricket products and services is granted by Cricket Wireless, LLC, a wholly-owned subsidiary of AT&T. Our ability to compete with other sellers of Cricket products and services will depend on the success with which we operate our stores and the attractiveness of their locations.

DIRECT TO CONSUMER SEGMENT

General Description

Our Direct to Consumer segment is a direct marketer of roses, plants, seeds, holiday gifts and home restoration products. The business is composed of: 1) a multi-channel retailer of seeds, garden and living gift products; 2) a wholesale seed business; and 3) a multi-channel retailer of home hardware and restoration products. Our garden products brands are highly recognizable in the rose and garden space as both the Jackson & Perkins and Park Seed brands were founded roughly 150 years ago.

During fiscal 2020, our Direct to Consumer segment benefitted from the industry-wide changes in consumer purchasing methods and increase in demand for products ordered online, and from increased consumer interest in gardening and seed-related products.

Products and Services

Our Direct to Consumer segment sells product through catalogs and online under the following brands:

| ● | Jackson & Perkins, founded in 1872, has approximately 150 years of history and is the most recognized brand of premium garden roses. Jackson and Perkins is one of the largest direct-to-consumer retailers of bare root roses in the United States, selling over 130 active varieties of bare root roses, of which 23 varieties are patented by Jackson and Perkins. In addition to bare root roses, we sell perennials, flower bulbs, outdoor living products as well as living holiday gifts plants. Holiday gifts include fresh evergreen wreaths, live decorative Christmas trees and holiday amaryllis. |

| ● | Park Seed, founded in 1868, over 150 years in the business and one of America’s oldest and largest direct-to-consumer seed retailers. As a leader within the Direct to Consumer seed business, Park Seed sells over 2,500 premium vegetable and flower seed options, as well as various gardening supplies. The wholesale seed business sells seeds, plants and other horticultural products in larger quantities to small-medium sized growers, nurseries and garden centers. Plants and seeds sales are concentrated during the spring months. |

| ● | Wayside Gardens, sells unique, hard to find high-end flowers, plants and gardening supplies to the master gardener. The Wayside Gardens customer is extremely selective, very knowledgeable, and seeks high quality plants. Approximately 70% of sales occur in the three months from March to May, during the spring planting season. |

| ● | Van Dyke’s, an online and catalog retailer with a vast assortment of vintage home restoration wood products, hardware and antique furniture, many of which are hard to find. Van Dyke’s focus is on hardware, decorative wood, home accents, knobs and pulls and kitchen, bath and other décor. |

5

Seasonality

Demand for live goods and holiday products is cyclical in nature, sensitive to seasonal growing patterns, general weather conditions, holiday sales patterns and competitive influences. As such, the Direct to Consumer segment’s results of operations, financial condition and cash flows could fluctuate significantly from period to period. The majority of segment revenue is derived in three selling periods, spring, fall, and the December holiday season, while the summer season accounts for a small portion of sales.

Market Strategy

As a direct-to-consumer retailer, we focus our marketing spending on internet advertising, mail order catalogs and traditional advertising mediums (i.e., public relations, magazines, social media, etc.). We are focused on niche markets and direct our advertising to repeat and new customers through internet marketing strategies.

Competition

In the retail garden business, within the bare root rose category, we compete against brick and mortar garden centers and nurseries (approximately 10,000 across the United States), as well as other online and mail-order retailers, including David Austin Roses and Regan Nursery. Across other plant categories, we compete against brick and mortar garden centers and big-box retailers, Gardens Alive and their portfolio of brands, as well as other direct-to-consumer competitors. Competitors for our seed and growing accessory category include brick and mortar retailers and other direct-to-consumers retailers like Burpee. Within the seed business, Burpee, in addition to having an online presence, supplies lower-end seed products to mass-market retailers, including Wal-Mart. Our biggest competitive advantages are our recognizable brand names and their affiliated product lines: Jackson & Perkins brand name and unique rose varieties and our Park Seed brand exclusive garden seeds and growing products. In addition, Jackson & Perkins’ successful online platform provides a competitive advantage over brick and mortar garden centers and nurseries with many consumers, particularly since the COVID-19 pandemic started. The most direct competitor for Wayside Gardens is White Flower Farms, which also focuses on high-end, premium plants.

Within the holiday gifting portion of this segment, we compete against larger competitors including Harry and David and 1-800 Flowers, among others.

Our Van Dyke’s Restorers brand competes primarily with other online retailers because brick and mortar stores cannot afford to carry Van Dyke’s breadth of SKUs. Our competitors are Signature Hardware, House of Antique Hardware, and Rejuvenation Hardware (part of Williams Sonoma). These competitors compete primarily in the hardware, lighting and kitchen and bath categories. The decorative wood portion of the Van Dyke’s business is in a very fragmented industry niche and there are no big decorative wood competitors. Van Dyke’s competes primarily through the breadth of its product variety as well as through its established brand name and customer list.

CONSUMER FINANCE SEGMENT

General Description

The majority of short-term consumer loans we provide are commonly referred to as “payday loans” or “cash advance” loans. Such loans are referred to as “payday loans” because they are typically made to borrowers who have no available cash and promise to repay the loan out of their next paycheck. We also provide pawn loans and provided short-term installment loans through October 2020 as part of this operating segment.

6

We provide short-term consumer loans in amounts that typically range from $100 to $500, with the average loan amount, including fee, being approximately $444. Cash advance loans provide customers with cash in exchange for a promissory note with a maturity of generally two to four weeks and the customer’s post-dated personal check for the aggregate amount of the cash advance, plus a fee. The fee varies from state to state based on applicable regulations and generally ranges from $15 to $22 for each whole or partial increment of $100 borrowed. To repay the cash advance loan, a customer may pay with cash, in which case their personal check is returned to them, or allow the check to be presented to the bank for collection. Approximately 92% and 91% of our lending revenue (comprised of payday loan fees and installment and pawn loan interest and fees) in the Consumer Finance segment was derived from payday lending in 2020 and 2019, respectively. Payday lending revenue made up approximately 71% and 76% of our total revenue (comprised of lending revenue, check cashing fees, pawn fees and miscellaneous other revenue) in the Consumer Finance segment in 2020 and 2019, respectively.

We offered short-term installment loans in Wisconsin until October 2020 and in Colorado until February 2019. Approximately 2% and 3% of our total revenue in the Consumer Finance segment was derived from installment lending in 2020 and 2019, respectively. We provided our installment loan customers with cash in exchange for a promissory note with a maturity of generally six months. The fee and interest rate on installment loans varied based on applicable state regulations. Like cash advance or payday loans, installment loans were unsecured.

We operate three pawn stores in our Consumer Finance segment. Our pawn stores provide collateralized non-recourse loans, commonly known as “pawn loans” with maturities of one to four months. Allowable service charges vary by state and loan size. The loan amount varies depending on our valuation of each item pawned. We generally lend from 30% to 55% of our estimate of the collateral’s resale value. Customers have the option to redeem the pawned merchandise during the term or at maturity, or else forfeit the merchandise to us on maturity. At our pawn stores, we sell merchandise acquired through either customer forfeiture of pawn collateral, second-hand merchandise purchased from customers or consigned to us, or new merchandise purchased from vendors. Pawn store revenues made up approximately 23% and 17% of our total revenue in the Consumer Finance segment in 2020 and 2019, respectively.

All of our Consumer Finance lending activities and other services are subject to state regulations (which vary from state to state), federal regulations and local regulations, where applicable.

As part of each payday loan transaction, we enter into a standardized written promissory note with the borrowing customer and obtain proof of income and identity, a personal post-dated check for the principal loan amount plus a specified fee, and other documentation. Our standardized contracts vary based on state laws, but all of our contracts plainly state in simple terms the annual percentage rate (assuming the fees we charge are computed as interest) in compliance with Regulation Z, the borrower’s right to rescind the transaction, a dispute-resolution clause, a notice of financial privacy rights, an affirmative representation about whether the borrower is a member of the U.S. military, and the consequences of defaulting on the loan. We retain copies of our written contracts and provide a signed copy to our customers.

In general, our lending process and standards are extraordinarily different from those used by banks. To our knowledge, banks typically order and carefully review credit reports on all loans, engage in extensive underwriting analysis, and will typically make independent verification of earnings history through phone calls, reviews of tax returns and other processes. As a result, we generally experience a higher default rate on our personal loans than banks do on their personal loans (see caption below, “Risks Associated with Our Loans—Default and Collection”). As of December 31, 2020, we had an aggregate (of all loan types) of approximately:

| ● | $1.84 million in current outstanding loan principal, fees and interest due to us; and |

| ● | $0.41 million of late loans (customers’ repayment checks deposited and returned as NSF within the last 180 days or installment loan balances not past the final installment due date with one or more payments delinquent). |

7

A summary table of the number of Consumer Finance locations operated during the periods ended December 31, 2020 and 2019 follows:

| 2020 | 2019 | |||||||

| Beginning | 39 | 41 | ||||||

| Acquired / Launched | — | — | ||||||

| Closed / Divested | (17 | ) | (2 | ) | ||||

| Ending | 22 | 39 | ||||||

The Fees We Charge

The fee we charge for a payday loan varies from state to state, based on applicable regulations, and generally ranges from $15 to $22 for each whole or partial increment of $100 borrowed. We do not charge interest in connection with our payday loans but did charge interest and fees where allowable on our short-term installment loans made in Wisconsin. If, however, we calculate the loan fees we charge as an annual percentage rate of interest (“APR”), such rate would range from 177% for a 31-day loan transacted in Kansas (on the low end) to approximately 536% for a 14-day loan in Wyoming (on the high end), with the actual average loan amount and average actual loan fees we charge involving an imputed annual percentage rate of approximately 439% and 198% for a 14-day and 31-day loan, respectively. The term of a loan significantly affects the imputed APR of the fees we charge for our loans. For instance, when a $15 fee is charged for a two-week loan of $100, the resulting APR is 391%. When the same fee on $100 is charged for a four-week loan, the resulting APR is 195%. Currently, we do not charge the maximum fee permitted in all of the states where we operate. We do, however, charge a uniform fee for all transactions processed in any particular state that involve the same range of payday loan amounts and the same term.

Of the four states in which we presently operate, each limits the loan fees we may charge and the term (i.e., the length) of the loan we may offer our customers.

We also offer pawn loans in Nebraska and Iowa. Allowable service charges for pawn loans vary by state and loan size. Our pawn loans earn 20% per month for loans under $1,000 and our average pawn loan amount typically ranges between $10 and $250, although it may range as high as $5,000. The loan amount varies depending on our estimated value of each item pawned.

Many states have laws limiting the amount of fees that may be charged in connection with any lending transaction (including payday and pawn lending transactions) when calculated as an APR, and some states expressly prohibit payday lending. These limitations, combined with other limitations and restrictions, effectively prohibit us from utilizing our present business model for cash advance or “payday” lending in those jurisdictions. In addition, the federal “2007 Military Authorization Act” prohibits lenders from offering or making payday loans (or similar lending transactions) to members of the U.S. military when the interest or fees exceed a 36% APR. Like the state limitations discussed above, this limitation effectively prohibits us from providing our cash advance or “payday” lending to members of the U.S. military. As a result of these restrictions, we do not conduct business with U.S. military personnel.

The above-described payday fees are the only fees we assess and collect from our customers for payday loans. Nevertheless, we also charge a flat fee that ranges from $15 to $40 (depending on the state) for returned checks in the event that a post-dated check we attempt to cash as repayment for our loan is returned.

Extensions or “Rollovers” of Payday Loans

Most states prohibit payday lenders from extending or refinancing a payday loan. Nevertheless, one state in which we presently provide payday loans (North Dakota) permits a loan to be extended or “rolled over” once.

8

When a customer “rolls over” or extends the term of an outstanding loan, when permitted by state law, we treat that rollover or extension as a brand new loan and we again charge the above-described loan fee for that transaction. This rollover has no effect on the imputed APR of the loan in those cases where the extended term is equal to the initial term of the loan. For example, a $100 four-week loan that costs $20 to obtain is the APR equivalent of 261%. If a customer extends the term of that loan for an additional four-week period, the customer will have paid $40 total in fees to obtain the $100 eight-week loan—which is again the APR equivalent of 261%. In cases where a customer (1) extends or rolls over a loan for a length of time that is less than the original loan or (2) repays the extended loan prior to the expiration of the fully extended term, the imputed APR will increase. For example, if a customer who obtained an initial $100 four-week loan for $20 in loan fees (the APR equivalent of 261%) later extends the term of that loan for only two additional weeks and pays the additional $20 loan fee, that customer will have borrowed $100 for a six-week period at a total cost of $40—which is the APR equivalent of 347%. We do not charge any interest on the unpaid fee from the initial term of the loan because, as a condition to agreeing to a loan extension, we will only accept cash payment of the fee for extending the loan.

Risks Associated With Our Loans—Default and Collection

Ordinarily, our customers approach us for a loan because they currently have insufficient funds to meet their present obligations, and so rarely, if ever, do our customers have sufficient funds in their checking accounts to cover the personal post-dated checks they provide us at the time of the loan transaction. The nature of our payday loan transactions presents a number of risks, including the ultimate risk that the loan will not be paid back. In addition, we do not obtain security for our payday loans principally because, even assuming our customers would have potential collateral to offer as security for a payday loan, the small size of each particular lending transaction does not justify the time, effort and expense of identifying the collateral and properly obtaining a security interest in such collateral. As a consequence, all of our payday loans are unsecured. This means that, absent court or other legal action compelling a customer to repay our loans, we rely principally on the willingness and ability of our customers to repay amounts they owe us. In this regard, in many cases the costs of merely attempting to collect the amounts owed to us exceed the amounts we would seek to collect—making it impractical to take formal legal action against a defaulted borrower.

When a customer defaults on a loan, we engage in collection practices that include contacting the customer for repayment and the customer’s bank to determine whether funds are available to satisfy their personal post-dated check. If funds are available, we present the check to the bank for repayment and an official check from the bank is obtained to pay off the item. The costs involved in these initial collection efforts are minimal and involve some employee time and possibly a flat $15-30 bank fee to cover the cost of the cashier’s check. If funds are not available, we generally attempt to collect returned checks for up to 90 days (or up to 180 days in cases where a bank account is still active and the customer has not initiated a stop payment on the postdated check provided), principally through continued attempts to contact the customer. If our attempts remain unsuccessful after 90 (or 180) days, we generally assign the item to a collection agency. Assignment to a collection agency may cost us 30-40% of the amount eventually collected (if any) from the customer. Ordinarily, we do not recoup any costs of collection from our customers.

Historically, we collect approximately 60% - 63% of the amount of all returned checks, which results in approximately 2.38% of our total payday loan principal and fee volume being uncollectible. In 2020 and 2019, we generated approximately 84,000 and 126,000 payday loan transactions, respectively.

Industry Information

According to a December 2017 study by the Center for Financial Services Innovation (“2017 Financially Underserved Market Size Study”), consumers spent approximately $3.2 billion on fees for single payment loan products from storefront payday lenders in 2016, compared to $3.6 billion in 2015. This year-over-year decline continues a trend that is expected to continue going forward. According to the Community Financial Services Association of America (“CFSA”) website, industry analysts estimate that 12 million U.S. households use short-term payday advances each year in 35 states, and estimate that there are 20,600 payday advance locations across the United States, which extend approximately $38.5 billion in short-term credit to households experiencing cash-flow shortfalls. In addition to being a valuable source of credit for many consumers, the payday loan industry makes significant contributions to the U.S. and state economies, employing more than 50,000 Americans who earn $2 billion in wages and generating more than $2.6 billion in federal, state, and local taxes. Industry trends indicate that there will likely be a net decrease in total payday lending stores over the next few years due to store closings resulting from a combination of regulatory or legal changes, regulatory pressures, a slowdown in new store growth, and general economic conditions.

9

Predatory Lending and Regulatory Concerns

In general, the payday lending industry suffers from the perception and widespread belief that payday lenders are, by their nature, predatory lenders, offering loans to low-income and poorly educated consumers at costs that are too high to be good for consumers. This perception and belief results in frequent efforts in the U.S. Congress and various state legislatures, often proposed by consumer advocacy groups and lobbyists for traditional financial institutions such as banks, to further regulate and restrict or prohibit payday lending outright. See “Item 1A – Risk Factors” for further information regarding regulatory risks.

We do not believe payday lending is predatory, nor do we believe that our loans are too costly for consumers if they are judiciously obtained. In fact, we believe that bank overdraft fees by themselves are typically far more costly for consumers, and bouncing a check can often involve other negative consequences such as independent fees levied by the parties to whom a bad check is written, negative publicity, etc. In this regard, the FDIC released a November 2008 report called “Study of Bank Overdraft Programs.” The report indicates that the average amount obtained when bank customers overdraw their accounts is $60, and the average overdraft fee charged by the bank is $27. This equates to an APR of 1,173% and 587% for a two-week and four-week $60 bank “loan,” respectively. In sum, we believe that many of the bad perceptions about our industry are fueled primarily by:

| ● | the effects of our loans on consumers who do not judiciously obtain payday loans; |

| ● | a lack of genuine understanding about the choices faced by low and middle-income people facing a critical cash shortage; and |

| ● | anti-payday lending lobbying campaigns, often funded by traditional financial institutions such as banks and credit unions that would economically benefit from the elimination of payday lending. |

Seasonality

Our Consumer Finance segment results are subject to seasonality, with the first and fourth quarters typically being our strongest periods as a result of broader economic factors, such as holiday spending habits at the end of each year and income tax refunds during the first quarter.

Competition

Like most other payday lenders, we believe that the primary competitive factors in our business are location and customer service. We face intense competition in an industry with relatively low barriers to entry, and we believe that the payday lending markets are becoming more competitive as the industry matures and consolidates. We compete with other payday lending and check cashing stores, and with financial service entities and retail businesses that offer payday loans or similar financial services. For example, we consider credit card companies that offer payday features, credit unions, banks that offer small loans, and creditors and loan services that can extend payment terms on outstanding loans to be our competitors. In addition, we compete in part with services offered by traditional financial institutions, most notably with respect to the “overdraft protection” services those institutions may offer and the charges they levy for checks written with insufficient funds.

Additional areas of competition have arisen. Businesses offer loans over the Internet as well as “loans by phone,” and these services compete with the services we offer. There also has been increasing penetration of electronic banking and related services into the check cashing and money transfer industry, including direct deposit of payroll checks, payroll or debit cards, stored-value cards, prepaid credit and debit cards, and electronic transfer of government benefits.

We also believe that customer service is critical to developing loyalty. In our industry, we believe that quality customer service means:

| ● | assisting with the loan application process and helping our customers understand the loan terms; |

| ● | treating customers respectfully; and |

| ● | processing transactions with accuracy, efficiency and speed. |

10

Our competitors for pawn store merchandise sales include numerous retail and wholesale stores, including jewelry stores, discount retail stores, consumer electronics stores, other pawn stores, other resale stores, electronic commerce retailers and auction sites.

The pawn industry in the United States is large and highly fragmented. The industry consists of approximately 13,000 pawn stores owned primarily by independent operators who own one to three locations. We consider the industry relatively mature. The three largest pawn store operators account for approximately 10% of the total estimated pawn stores in the United States.

Effect of General Economic Conditions on our Consumer Finance Segment

Our business has experienced fluctuating changes in our provision for loan losses in recent years, significantly impacted by the amount loaned by loan types where installment lending carried a higher forfeiture rate. For example, our provision for loan losses as a percentage of payday, installment and pawn loan revenue was 4.60%, 11.5% and 13.9% in 2020, 2019 and 2018, respectively. We are uncertain how the current economic conditions will affect demand for our services or our loan losses after 2020.

Credit and financing available to us and our industry have been negatively impacted by recent federal and state legislation and regulation, including the overall negative perception associated with payday lending. For example, we are aware of federal and state regulatory pressures being exerted on our banking relationships due to the negative perception about payday lending. For more information, see “Regulation - Regulation of Consumer Financing Activities” below.

REGULATION

We are subject to regulations by federal, state and local governments that affect the products and services we provide. Generally, these regulations are designed to protect consumers who use our services and are not designed to protect our shareholders.

Regulation of Consumer Financing Activities

In those states where we currently operate consumer finance activities, we are licensed as a payday lender or pawn broker where required and are subject to various state regulations regarding the terms and conditions of our payday and pawn loans and our lending policies, procedures and operations. In some states, payday lending is referred to as “deferred presentment,” “cash advance loans,” “deferred deposit loans,” or “consumer installment loans.” State regulations normally limit the amount that we may lend to any single consumer and may limit the number of loans that we may make to any consumer at one time or in the course of a single year. State regulations also limit the amount of fees that we may assess in connection with any loan transaction and may limit a customer’s ability to extend or “rollover” a loan with us. State regulations often specify minimum and maximum maturity dates for payday loans and, in some cases, specify mandatory cooling-off periods between transactions.

Our payday lending practices must also comply with the disclosure requirements of the Federal Truth-In-Lending Act and Regulation Z under that Act. Our collection activities for delinquent loans are generally subject to consumer protection laws regulating debt-collection practices. Finally, our payday lending business subjects us to the Equal Credit Opportunity Act and the Gramm-Leach-Bliley Act.

11

During the last several years, legislation has been introduced and passed in the U.S. Congress and in certain state legislatures proposing or effecting various restrictions or an outright prohibition on payday or certain installment lending and consumer advocacy groups in many states are actively seeking state law changes which would effectively end the viability of a payday loan business. Currently, state laws in Arizona, Colorado, Georgia, Montana, Nebraska, Oregon, and South Dakota have effectively eliminated the ability to conduct payday and certain installment lending in those states. In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which consolidated most federal regulation of financial services offered to consumers, and replaced the Office of Thrift Supervision’s seat on the FDIC Board. Almost all credit providers, including mortgage lenders, providers of payday loans, other nonbank financial companies, and banks and credit unions with assets over $10 billion, are subject to regulations and oversight by the Consumer Financial Protection Bureau (“CFPB”). While the CFPB does not have authority to make rules limiting interest rates or fees charged, the scope and extent of its authority are broad enough to impose limits on rollovers and extensions of payday loans, as well as compliance with federal rules and regulations.

After several years of research, debate, and public hearings, in October 2017, the CFPB adopted a new rule for payday lending. The 2017 rule, originally scheduled to go into effect in August 2019, would have imposed significant restrictions on the industry, and at the time it was expected that a large number of lenders would be forced to close their stores. The CFPB’s studies projected a reduction in the number of lenders by 50%, while industry studies forecasted a much higher attrition rate if the rule were to be implemented as originally adopted. Included in the new rule were requirements for vetting borrowers (i.e., obtaining a credit report and performing basic underwriting procedures), limits on the number of loans a consumer could obtain in a 12-month period, limiting to two the number of times a consumer’s check may be presented to the consumer’s bank for payment, and provisions requiring paydowns by the consumer on successive loans. However, in January 2018, the CFPB issued a statement that it intends to “reconsider” the regulation and delayed the August 19, 2019 compliance date for the other provisions to November 19, 2020. In July 2020, the CFPB issued a final rule applicable to the 2017 rule. The final rule rescinds the mandatory underwriting provisions of the 2017 rule but does not rescind or alter the payments provisions of the 2017 rule. The CFPB will seek to have these rules go into effect with a reasonable period for lenders to come into compliance.

In addition, our Consumer Finance segment activities are subject to the following federal consumer laws, regulations and CFPB guidance:

| ● | Unfair, Deceptive or Abusive Acts or Practices (“UDAAP”) |

| ● | Fair Debt Collections Practice Act (“FDCPA”) |

| ● | Consumer Complaint Management |

| ● | Electronic Fund Transfer Act (“EFTA”) (Reg. E) |

| ● | Fair Credit Reporting Act (“FCRA”) |

| ● | Service Members Civil Relief Act |

For more information, see “CONSUMER FINANCE SEGMENT—Predatory Lending and Regulatory Concerns” above.

Financial Reporting Regulation

Regulations promulgated by the United States Department of the Treasury under the Bank Secrecy Act require us to report all transactions involving currency in an amount greater than $10,000. Generally, every financial institution must report each deposit, withdrawal, exchange of currency, or other payment or transfer that involves an amount greater than $10,000. In addition, multiple currency transactions must be treated as a single transaction if we have knowledge that the transactions are by or on behalf of any one person and result, in a single business day, in the transfer of cash in or out totaling more than $10,000. In addition, the regulations require us to maintain information concerning sales of monetary instruments for cash in amounts from $3,000 to $10,000. The Bank Secrecy Act requires us, under certain circumstances, to file a suspicious activity report.

12

The Money Laundering Suppression Act of 1994 requires us to register with the United States Department of the Treasury as a money service business (“MSB”). MSBs include check cashers and sellers of money orders. MSBs must renew their registrations every two years, maintain a list of their agents, update the agent list annually, and make the agent list available for examination.

Finally, we have established various procedures designed to comply, and we continue to monitor and evaluate our business methods and procedures to ensure compliance with the USA PATRIOT Act.

Privacy Regulation

We are subject to a variety of federal and state laws and regulations restricting the use and seeking to protect the confidentiality of customer identity and other personal nonpublic customer information. We have identified our systems that capture and maintain nonpublic personal information, as that term is understood under the Gramm-Leach-Bliley Act and associated regulations. We disclose our public information policies to our customers as required by that law. We also have systems in place intended to safeguard this information as required by the Gramm-Leach-Bliley Act, which specifically governs certain aspects of our payday lending business.

Technology and Information

We maintain integrated systems of retail points of sale and management software applications and platforms for processing the various types of financial transactions we offer. These systems provide us with customer service, internal control mechanisms, record-keeping and reporting information. These systems are designed to provide summary, detailed and exception information to various levels of management.

Security

We believe the principal security risks to our Consumer Finance and Cellular Retail segments are robbery and employee theft. We have established extensive security and management information systems to address both areas of potential loss. To protect against robbery, most payday lending store employees work behind bullet-resistant glass, and the back office, safe and computer areas are locked and closed to customers. Security measures utilized in our retail locations include mechanical safes, electronic alarm systems monitored by third parties or remote-controlled systems, control over entry to customer service representative, motion detection devices, locked cases, and, at times, the use of professional security services. Consumer Finance segment employees also use cellular phones to ensure safety and security whenever they are outside secured areas.

We implemented critical safeguarding controls, including daily cash and deposit monitoring, unannounced audits of cash and inventory items, and requiring immediate responses from our staff when irregularities in cash balances are discovered. We primarily self-insure for employee theft and dishonesty at the store level.

We regularly receive and store information about our customers, vendors and other third parties. We have programs in place to detect, contain, and respond to data security incidents. However, because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be difficult to detect for long periods of time, we may be unable to anticipate these techniques or implement adequate preventive measures. In addition, hardware, software, or applications we develop or procure from third parties or through open-source solutions may contain defects in design or manufacture or other problems that could unexpectedly compromise information security. Unauthorized parties may also attempt to gain access to our systems or facilities, or those of third parties with whom we do business, through fraud, trickery, or other forms of deceiving our team members, contractors, and vendors.

13

EMPLOYEES

As of December 31, 2020, we had approximately 840 employees. We believe our relationship with our employees is good, and we have not suffered any work stoppages or labor disputes. We do not have any employees that operate under collective-bargaining agreements.

CORPORATE INFORMATION

Our principal offices are located at 11550 “I” Street, Suite 150, Omaha, Nebraska 68137, our telephone number at that office is (402) 551-8888, and our internet website is https://www.westerncapitalresources.com.

Our fiscal year ends December 31. Neither we nor any of our predecessors have been in bankruptcy, receivership or any similar proceeding.

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and your investment in us.

Investment Risks

Acquisitions and strategic investments may fail to meet our expectations, and any such failure could have a negative impact on our results of operation or financial condition, and could ultimately result in dilution to our shareholders.

Our long-term growth strategy includes acquisitions. We may not successfully execute this strategy. An acquisition strategy includes numerous risks, including, among others, the risk that our financial projections relating to our acquisitions may turn out to be incorrect and our investment may fail to positively impact our results and growth as anticipated (and may in fact negatively impact our results), the risk of unexpected or unidentified issues not discovered in the due diligence process which could harm our financial condition, risks related to our ability to successfully integrate an acquisition target into the Company, and the need for substantial additional capital which may result in dilution to our shareholders.

Acquisitions and strategic investments made wholly or partly on the basis of our issuance of securities to the target companies, or acquisitions made with cash that is obtained from outside investors or lenders, will result in dilution to our shareholders.

The structuring of future acquisitions, whether through share exchanges, merger acquisitions or otherwise, may result in dilution to existing shareholders. In addition, cash-based transactions may not be financed from corporate cash flows and reserves, and may themselves be financed through borrowing arrangements or the sale of equity or equity-linked securities, the latter of which would be dilutive to our shareholders.

Acquisitions and strategic investments may be disruptive to our business.

The time and expense associated with finding suitable acquisitions or with integrating acquired entities and operations with our Company can be disruptive to our ongoing business and divert our management’s attention. In addition, the financing of acquisitions may impact our ability to obtain or renew financing for existing operations, or subject us to covenants restricting certain activities. Any of these outcomes could have a short- or long-term adverse effect on our results of operation and our ability to further execute our acquisition strategy.

14

Unpredictability in financing and other markets could impair our ability to grow our business through acquisitions

We anticipate that opportunities to acquire businesses will materially depend on the availability of financing alternatives with acceptable terms as well as acceptable market valuations of prospective acquisitions. As a result, poor credit and other market conditions, mergers and acquisitions market valuations, any uncertainty in the financing markets, or the adverse regulatory pressures of being involved in the payday lending business in particular, could materially limit our ability to grow through acquisitions since such conditions and uncertainty make obtaining financing and finding attractive opportunities more difficult and more expensive.

Our controlling shareholder possesses controlling voting power with respect to our common stock, which will limit other shareholders’ influence on corporate matters.

Our controlling shareholders, WCR, LLC, BC Alpha Holdings I, LLC and their affiliates that are under common control (see Item 12), had beneficial ownership of approximately 74% of our common stock as of March 29, 2021. As a result, the controlling shareholders have the ability to outright control our affairs through the election and removal of our entire Board of Directors and all other matters requiring shareholder approval, including a future merger or consolidation of the Company, or a sale of all or substantially all of our assets. This concentrated control limits the Company’s public float and could discourage others from initiating any such potential merger, consolidation or sale or other change-of-control transaction that may otherwise be beneficial to our shareholders. Furthermore, this concentrated control will limit the practical effect of your participation in Company matters, through shareholder votes and otherwise.

Our certificate of incorporation grants our Board of Directors the power to issue additional shares of common and preferred stock and to designate other classes of preferred stock, all without shareholder approval.

Our authorized capital consists of 12.5 million shares of capital stock. Pursuant to authority granted by our certificate of incorporation, our Board of Directors, without any action by our shareholders, may designate and issue shares in such classes or series (including other classes or series of preferred stock) as it deems appropriate and establish the rights, preferences and privileges of such shares, including dividends, liquidation and voting rights, provided they are consistent with Delaware law. The rights of holders of other classes or series of stock that may be issued could be superior to the rights of holders of our common shares. The designation and issuance of shares of capital stock having preferential rights could adversely affect other rights appurtenant to shares of our common stock. Furthermore, any issuances of additional stock (common or preferred) will dilute the percentage of ownership interest of then-current holders of our capital stock and may dilute our book value per share.

Our common stock trades only in an illiquid trading market.

Trading of our common stock is conducted on the OTCQB, a tier of the OTC Markets (symbol: WCRS). This has an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us and our common stock. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock.

There is not now and there may not ever be an active market for shares of our common stock.

In general, there has been minimal trading volume in our common stock. During 2020, the average daily trading volume was under 2,000 shares. The small trading volume will likely make it difficult for our shareholders to sell their shares as and when they choose. Furthermore, small trading volumes are generally understood to depress market prices. As a result, you may not always be able to resell shares of our common stock publicly at the time and prices that you feel are fair or appropriate.

15

A significant portion of our assets consists of goodwill and other intangible assets.

As of December 31, 2020, 10.0% of our assets consisted of goodwill and other intangible assets. Under generally accepted accounting principles, the carrying value of goodwill is subject to periodic review and testing to determine if it is impaired. The value of our assets will depend on market conditions, regulatory environment, the availability of buyers and similar factors. While the value of these assets is based on management projections and assumptions and is determined by using the discounted cash flow method for purposes of our impairment testing, those values may differ from what could ultimately be realized by us in a sales transaction or otherwise and that difference, while not affecting cash flow, could have a material adverse impact on our operating results and financial position.

Industry Risks

We face significant cellular retail competition that may reduce our market share and lower our profits.

We face significant competition in our Cellular Retail segment. We compete with the three national wireless service providers (AT&T, T-Mobile/Sprint and Verizon Wireless) as well as other smaller brands or carriers such as U.S. Cellular, Boost Mobile and Metro by T-Mobile and with many mobile virtual network operators (“MVNOs”) such as Walmart’s Straight Talk and Family Mobile plans. We also compete with government-financed “lifeline assurance” programs that offer free or reduced-cost cellular services to individuals and families receiving many types of public assistance. Our ability to compete effectively will depend on, among other things, the pricing of cellular services and equipment, the quality of our customer service, the reach and quality of our sales and distribution channels and our capital resources. It will also depend on how successfully we anticipate and respond to various factors affecting our industry, including new technologies and business models, changes in consumer preferences, demographic trends and economic conditions.

The cellular retail industry also faces competition from other communications and technology companies seeking to capture customer revenue and brand dominance with respect to the provision of cellular accessories and services. For example, Apple Inc. packages software applications and content with its handsets, and Google Inc. has developed and deployed an operating system and related applications for mobile devices.

A sustained deterioration in the economy could reduce demand for our Direct to Consumer segment products and services and result in reduced earnings.

A sudden or sustained deterioration in the economy could result in decreased demand for our seed, live plant, holiday gifts, lawn and garden power equipment, emergency safety shelters and home restoration products. This could result in decreased revenue and, because a significant portion of our sales in the Direct to Consumer segment are of live goods, inventory losses on live product acquired prior to a seasonal selling period could be significant.

Our success depends, in substantial part, on our continued ability to market our products through search engines and social media platforms.

The marketing of our products in the Direct to Consumer segment depends on our ability to cultivate and maintain cost-effective and otherwise satisfactory relationships with search engines and social media platforms, including those operated by Google, Facebook, Bing and Yahoo! These platforms could decide to change their terms and conditions of use at any time (and without notice) and/or significantly increase their fees. No assurances can be provided that we will be able to maintain cost-effective and otherwise satisfactory relationships with these platforms and our inability to do so in the case of one or more of these platforms could have a material adverse effect on our business, financial condition and results of operations.

We obtain a significant number of visits via search engines such as Google, Bing and Yahoo! Search engines frequently change the algorithms that determine the ranking and display of results of a user’s search and may make other changes to the way results are displayed, which can negatively affect the placement of links and, therefore, reduce the number of visits to our website. The growing use of online ad-blocking software may also impact the success of our marketing efforts because we may reach a smaller audience and fail to bring more customers to our websites, which could have a material adverse effect on our business, financial condition and results of operations.

16

Our reliance on information management and transaction systems to operate our business exposes us to potential security breaches of our sensitive information from cyber incidents and hacking.

Effective information security internal controls are necessary for us to protect our sensitive information from illegal activities and unauthorized disclosure. Despite our efforts to maintain the highest level of security around our information systems, the sophistication of hackers continues to increase. Our inability to maintain effective controls or utilization of information technology providers that also maintain effective controls may increase our vulnerability to cyber-attacks. Breaches of our information management systems could adversely affect our business reputation. We could also be subject to lawsuits or fines relating to the unauthorized disclosure of information. Any of these outcomes could negatively affect our results of operations and the price of our common stock.

Free shipping pressure in the e-commerce industry could decrease our Direct to Consumer segment’s revenues and profitability.

The abundance of free shipping offers from Amazon.com and other online retailers has put pressure on our Direct to Consumer segment shipping revenues, currently representing 16% of Direct to Consumer revenues. If market forces lead to the elimination of this revenue stream, it may be difficult for the Direct to Consumer segment to make up that lost revenue.

The payday loan industry is highly regulated under federal, state and local laws and regulations. Changes in federal, state or local laws and regulations governing lending practices, or changes in the interpretation of such laws and regulations, could negatively affect our business.

Our Consumer Finance segment activities are highly regulated under numerous federal, state and local laws, regulations and rules, which are subject to change. New laws, regulations or rules could be enacted or issued, interpretations of existing laws, regulations or rules may change and enforcement action by regulatory agencies may intensify.

Although states provide the primary regulatory framework under which we offer payday loans, certain federal laws also affect our business. For example, because payday loans are viewed as extensions of credit, we must comply with the federal Truth-in-Lending Act and Regulation Z under that Act. Additionally, we are subject to the Equal Credit Opportunity Act, the Gramm-Leach-Bliley Act and certain other federal laws.

From a federal standpoint, anti-payday loan legislation has occasionally been introduced in the U.S. Congress. Over the past several years, consumer advocacy groups and certain media reports have advocated governmental and regulatory action to prohibit or severely restrict sub-prime lending activities such as those we conduct. As outlined under “BUSINESS – REGULATION – Regulation of Consumer Financing Activities,” the CFPB released their final rule in October 2017, announced in January 2018 that it was reconsidering the rule and in July 2020 issued a final rule applicable to the 2017 rule.

In the states, there are nearly always bills pending to alter the current laws governing payday lending. There is also a current trend for consumer activist groups to seek law changes through a ballot initiative. Any of these bills or ballot initiatives, or future proposed legislation or regulations prohibiting payday loans or making them less profitable, could be passed in any state at any time, or existing laws permitting payday lending could expire.

Statutes authorizing payday loans typically provide state agencies that regulate banks and financial institutions with significant regulatory powers to administer and enforce the laws relating to payday lending. Under statutory authority, state regulators have broad discretionary power and may impose new licensing requirements, interpret or enforce existing regulatory requirements in different ways or issue new administrative rules, even if not contained in state statutes, that affect the way we do business and may force us to terminate or modify our operations in those jurisdictions. They may also impose rules that are generally adverse to our industry. Finally, in many states, the attorney general has scrutinized or continues to scrutinize the payday loan statutes and the interpretations of those statutes.

17

In sum, the passage of federal or state laws and regulations that govern or otherwise affect lending, or changes in interpretations of them, could, at any point, result in our curtailment or cessation of operations in certain or all jurisdictions or locations essentially prohibiting us from conducting our lending business in its current form. Any such legal or regulatory change would certainly have a material and adverse effect on us, our operating results, financial condition and prospects, and perhaps even our viability. Furthermore, any failure to comply with any applicable federal, state or local laws or regulations could result in fines, litigation, closure of one or more store locations and negative publicity.

Litigation and regulatory actions directed toward the consumer finance industry or our Company could adversely affect our operating results, particularly in certain key states.

During the last few years, the consumer finance industry has been subject to regulatory proceedings, class action lawsuits and other litigation regarding the offering of payday loans, and we could suffer losses resulting from interpretations of state laws in those lawsuits or regulatory proceedings, even if we are not a party to those proceedings. The losses we could suffer could be directly incurred through our involvement in litigation or regulatory proceedings, or could be indirectly incurred through negative publicity regarding the industry in general that is generated by litigation on regulatory proceedings involving third parties.

In addition, regulatory actions or enforcement efforts taken with respect to money services businesses could negatively affect our ability to operate our consumer finance segment in our current form. For example, federal bank regulators are imposing significant costs and regulatory pressure on banks that do business with money services businesses, even though our business is conducted in a manner compliant with applicable law. As a result, fewer and fewer banks are willing to accept or even retain customers in the MSB industry. We may be forced to change long-standing banking relationships and change the way we operate our consumer finance operations, incurring additional capital expenditures and paying higher banking fees.

Public perception of payday lending as being predatory or abusive could adversely affect our business.

In recent years, consumer advocacy groups and media reports have advocated governmental action to prohibit or severely restrict payday loans. The consumer groups and media reports typically focus on the cost to a consumer for this type of loan, which is higher than the interest typically charged by credit card issuers. The consumer groups and media reports typically characterize these transactions as predatory or abusive toward consumers. If this negative characterization of payday lending becomes widely accepted by consumers, demand for our payday loans could significantly decrease, which could adversely affect our results of operations primarily by decreasing our revenues. Negative perception of payday lending activities could also result in our industry being subject to more restrictive laws and regulations and greater exposure to litigation.

General economic conditions affect our Consumer Finance segment, and accordingly, our results of operations could be adversely affected by a general economic slowdown or other negative economic conditions such as high unemployment.

Provision for loan losses, net of recoveries, is one of our largest Consumer Finance segment operating expenses, constituting approximately 4.6% of our loan fee revenues for the year ended December 31, 2020. Any changes in economic factors that adversely affect our customers, such as an economic downturn or high unemployment, could result in higher loan loss experiences than anticipated, which could in turn adversely affect our loan charge-offs and operating results.

In addition, changes in economic factors could cause worsening performance of our pawn loans and in consumer demand for and resale value of pre-owned merchandise that we sell in our stores. This, in turn, could reduce the amount that we could effectively lend on an item of collateral. Such reductions could adversely affect pawn loan balances, pawn loan redemption rates, inventory balances, revenues and gross profit margins.

18

Company Risks

We are subject to risks associated with public health crises and epidemics/pandemics, such as COVID-19.

We are exposed to risks associated with public health crises and epidemics/pandemics, such as COVID-19, including its variants. COVID-19 or other epidemics/pandemics may have an adverse impact on our operations, supply chains and distribution systems and increase our expenses, including as a result of impacts associated with preventive and precautionary measures that we, other businesses and governments have taken, are taking or that may occur or recur in the future, including travel bans and restrictions, quarantines, shelter in place orders, and shutdowns. Due to these impacts and measures, we may experience significant and unpredictable reductions or increases in demand for certain of our products and services. In addition, prolonged quarantines or travel restrictions may significantly impact the ability of our employees to get to their places of work or may significantly hamper our products from moving through the supply and distribution chains. As a result, COVID-19 or other epidemics/pandemics could negatively affect our sales, and it is uncertain how they will affect our operations generally if these impacts persist or exacerbate over an extended period of time. In addition, some of our businesses, particularly our Direct to Consumer segment with its focus on online sales to consumers, enjoyed increased demand as a result of the COVID-19-related restrictions and resulting changes in consumer behavior, some of which demand may not continue if consumer behaviors again change as such restrictions lapse. Any of these impacts could have a material adverse effect on our business, financial condition and results of operations.

We face substantial risk through reliance on a single wireless retail carrier.

We operate our Cellular Retail segment exclusively as an authorized dealer for Cricket, which means that this segment of our operations is entirely dependent upon continued operations as a Cricket dealer under our dealer agreement with Cricket Wireless, the commitment of Cricket Wireless to advertise and offer competitive product and service offerings in our markets, and the health of our relationship with Cricket Wireless. If Cricket Wireless were to change certain aspects of its dealer arrangements, including items such as pricing, product supply, credit terms and dealer compensation structure (all of which are primarily determined by Cricket Wireless) in a manner that is adverse to us, our margins and results of operations would likely suffer. In addition, if Cricket Wireless were to begin growing its relationship with other operators, or were to embark upon an effort to significantly grow corporate-owned locations, our prospects for growth in this segment would suffer.

Managing our inventory is complex and may include write-downs of excess or obsolete inventory.

Managing our inventory, across our segments, is complicated by a number of factors, including the need to maintain a significant inventory of finished goods to support our cellular retail locations and online orders for our products that we anticipate but may not be received. These issues may cause us to purchase and maintain significant amounts of inventory. If this inventory is not used as expected based on anticipated requirements, it may become excess or obsolete. The existence of excess or obsolete inventory can result in sales price reductions or inventory write-downs, which could adversely affect our business and results of operations.

Outside factors may affect our ability to obtain product and fulfill orders in our Direct to Consumer segment.

In our Direct to Consumer segment we have year-to-year agreements with third party wholesale growers that could be impacted by changes in their business operations, including, but not limited to plant disease, financial difficulties, labor disruptions, land lease issues and water supplies. Although J&P Park Acquisitions, Inc. (“JPPA”) has taken steps to purchase from multiple vendors and identify alternate sources of supply, the long lead time involved in growing operations could mean the Company might not be able to obtain certain crops at certain times. Certain of the Company’s growers also compete with the Company through their own direct-to-consumer selling operations. Additionally, the recent COVID-19 virus has caused some imported products to be delayed. There could be further disruptions, whether caused by the third-party wholesaler, pandemic, weather or other environmental or climate influences that could limit the supply of product we rely upon to fulfill orders.

19

Large or rapid increases in the cost of raw materials or components parts or substantial decreases in their availability could materially and adversely affect the operating results of the Swisher business we acquired on January 8, 2021.

On January 8, 2021, we acquired Swisher, as described in Part I, Item 1, “Business-Recent Events-Acquisitions.” Swisher uses large amounts of steel, among other items, in the manufacture of its products. Occasionally, market prices of some of the steel or other key raw materials may increase significantly, including as a result of tariffs or other trade barriers. If in the future Swisher is not able to reduce product costs in other areas or pass raw material and related component price increases on to its customers, its margins could be adversely affected. In addition, because Swisher maintains limited raw material and component inventories, even brief unanticipated delays in delivery by suppliers - including those due to capacity constraints, labor disputes, impaired financial condition of suppliers, epidemics, pandemics like COVID-19, other infectious diseases, weather emergencies or other natural disasters - may impair Swisher’s ability to satisfy its customers and could adversely affect its financial performance.

We may be subject to product liability and other similar claims if people or property are harmed by the products we sell.

Some of the products we sell, including those sold in the recently acquired Swisher business, may expose us to product liability and other claims and litigation (including class actions) or regulatory action relating to safety, personal injury, death or environmental or property damage. Some of our agreements with members of our supply chain may not indemnify us from product liability for a particular product, and some members of our supply chain may not have sufficient resources or insurance to satisfy their indemnity and defense obligations. Although we maintain liability insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all.

A significant disruption in our information systems and our inability to adequately maintain and update those systems could adversely affect our operations and our ability to maintain the confidence of our customers and business partners.