Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIAA REAL ESTATE ACCOUNT | tiaarealestatefactsheet123.htm |

Please refer to the next page for important disclosure information. TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2020 Portfolio Net Assets $23.2 Billion Inception Date 10/02/1995 Symbol QREARX Estimated Annual Expenses 1 2 0.78% Investment Description The Account seeks to generate favorable total returns primarily through rental income and appreciation of a diversified portfolio of directly held, private real estate investments and real estate-related investments and offers investors guaranteed, daily liquidity. The Account intends to invest between 75% and 85% of its net assets directly in real estate or real estate-related investments, which TIAA believes have the potential to generate rental income and appreciation. The remainder of its investments will be invested in liquid, fixed-income investments. Learn More For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), or visit TIAA.org Performance Total Return Average Annual Total Return QTD YTD 1 Year 3 Years 5 Years 10 Years Since Inception TIAA Real Estate Account 0.59% -0.84% -0.84% 3.11% 3.78% 7.14% 5.96% The returns quoted represent past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org, or call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. 1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. 2 The Account's total annual expense deduction appears in the Account's prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. Hypothetical Growth of $10,000 The chart illustrates the performance of a hypothetical $10,000 investment on December 31, 2010 and redeemed on December 31, 2020. — TIAA Real Estate Account $19,926 The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. Properties by Type (As of 12/31/2020) % of Real Estate Investments3 4 Office 38.1 Apartment 25.4 Retail 18.1 Industrial 16.7 Other 1.7 Properties by Region (As of 12/31/2020) % of Real Estate Investments3 West 40.2 East 30.4 South 26.9 Midwest 2.5 3 Wholly owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. 4 Other properties represents interests in Storage Portfolio investments, a hotel investment and land. 12/20 $1,500 $6,500 $11,500 $16,500 $21,500 12/10 6/12 12/13 6/15 12/16 6/18 12/19

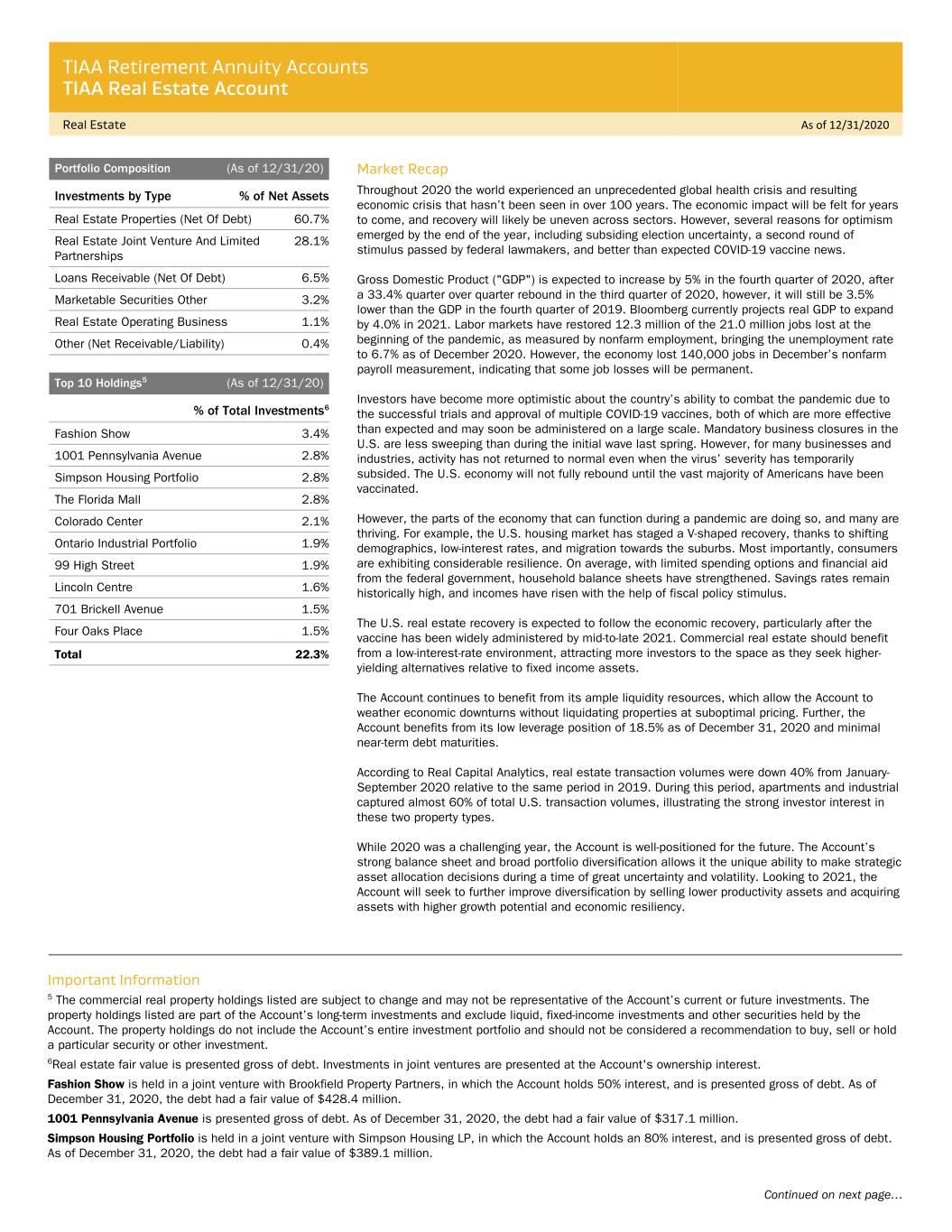

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2020 Continued on next page… Portfolio Composition (As of 12/31/20) Investments by Type % of Net Assets Real Estate Properties (Net Of Debt) 60.7% Real Estate Joint Venture And Limited Partnerships 28.1% Loans Receivable (Net Of Debt) 6.5% Marketable Securities Other 3.2% Real Estate Operating Business 1.1% Other (Net Receivable/Liability) 0.4% Top 10 Holdings 5 (As of 12/31/20) % of Total Investments 6 Fashion Show 3.4% 1001 Pennsylvania Avenue 2.8% Simpson Housing Portfolio 2.8% The Florida Mall 2.8% Colorado Center 2.1% Ontario Industrial Portfolio 1.9% 99 High Street 1.9% Lincoln Centre 1.6% 701 Brickell Avenue 1.5% Four Oaks Place 1.5% Total 22.3% Market Recap Throughout 2020 the world experienced an unprecedented global health crisis and resulting economic crisis that hasn’t been seen in over 100 years. The economic impact will be felt for years to come, and recovery will likely be uneven across sectors. However, several reasons for optimism emerged by the end of the year, including subsiding election uncertainty, a second round of stimulus passed by federal lawmakers, and better than expected COVID-19 vaccine news. Gross Domestic Product ("GDP") is expected to increase by 5% in the fourth quarter of 2020, after a 33.4% quarter over quarter rebound in the third quarter of 2020, however, it will still be 3.5% lower than the GDP in the fourth quarter of 2019. Bloomberg currently projects real GDP to expand by 4.0% in 2021. Labor markets have restored 12.3 million of the 21.0 million jobs lost at the beginning of the pandemic, as measured by nonfarm employment, bringing the unemployment rate to 6.7% as of December 2020. However, the economy lost 140,000 jobs in December’s nonfarm payroll measurement, indicating that some job losses will be permanent. Investors have become more optimistic about the country’s ability to combat the pandemic due to the successful trials and approval of multiple COVID-19 vaccines, both of which are more effective than expected and may soon be administered on a large scale. Mandatory business closures in the U.S. are less sweeping than during the initial wave last spring. However, for many businesses and industries, activity has not returned to normal even when the virus’ severity has temporarily subsided. The U.S. economy will not fully rebound until the vast majority of Americans have been vaccinated. However, the parts of the economy that can function during a pandemic are doing so, and many are thriving. For example, the U.S. housing market has staged a V-shaped recovery, thanks to shifting demographics, low-interest rates, and migration towards the suburbs. Most importantly, consumers are exhibiting considerable resilience. On average, with limited spending options and financial aid from the federal government, household balance sheets have strengthened. Savings rates remain historically high, and incomes have risen with the help of fiscal policy stimulus. The U.S. real estate recovery is expected to follow the economic recovery, particularly after the vaccine has been widely administered by mid-to-late 2021. Commercial real estate should benefit from a low-interest-rate environment, attracting more investors to the space as they seek higher- yielding alternatives relative to fixed income assets. The Account continues to benefit from its ample liquidity resources, which allow the Account to weather economic downturns without liquidating properties at suboptimal pricing. Further, the Account benefits from its low leverage position of 18.5% as of December 31, 2020 and minimal near-term debt maturities. According to Real Capital Analytics, real estate transaction volumes were down 40% from January- September 2020 relative to the same period in 2019. During this period, apartments and industrial captured almost 60% of total U.S. transaction volumes, illustrating the strong investor interest in these two property types. While 2020 was a challenging year, the Account is well-positioned for the future. The Account’s strong balance sheet and broad portfolio diversification allows it the unique ability to make strategic asset allocation decisions during a time of great uncertainty and volatility. Looking to 2021, the Account will seek to further improve diversification by selling lower productivity assets and acquiring assets with higher growth potential and economic resiliency. Important Information 5 The commercial real property holdings listed are subject to change and may not be representative of the Account’s current or future investments. The property holdings listed are part of the Account’s long-term investments and exclude liquid, fixed-income investments and other securities held by the Account. The property holdings do not include the Account’s entire investment portfolio and should not be considered a recommendation to buy, sell or hold a particular security or other investment. 6Real estate fair value is presented gross of debt. Investments in joint ventures are presented at the Account's ownership interest. Fashion Show is held in a joint venture with Brookfield Property Partners, in which the Account holds 50% interest, and is presented gross of debt. As of December 31, 2020, the debt had a fair value of $428.4 million. 1001 Pennsylvania Avenue is presented gross of debt. As of December 31, 2020, the debt had a fair value of $317.1 million. Simpson Housing Portfolio is held in a joint venture with Simpson Housing LP, in which the Account holds an 80% interest, and is presented gross of debt. As of December 31, 2020, the debt had a fair value of $389.1 million.

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 12/31/2020 Continued on next page… The Florida Mall is held in a joint venture with Simon Property Group, LP, in which the Account holds a 50% interest, and is presented gross of debt. As of December 31, 2020, the debt had a fair value of $153.3 million. Colorado Center is held in a joint venture with Boston Properties Inc., in which the Account holds a 50% interest, and is presented gross of debt. As of December 31, 2020, the debt had a fair value of $280.2 million. 99 High Street is presented gross of debt. As of December 31, 2020, the debt had a fair value of $285.0 million. 701 Brickell Avenue is presented gross of debt. As of December 31, 2020, the debt had a fair value of $185.5 million. Four Oaks Place is held in a joint venture with Allianz US Private REIT LP, in which the Account holds a 51% interest, and is presented gross of debt. As of December 31, 2020, the debt had a fair value of $83.9 million. Real estate investment portfolio turnover rate for the Account was 7.1% for the year ended 12/31/2020. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. Marketable securities portfolio turnover rate for the Account was 113.4% for the year ended 12/31/2020. Marketable securities portfolio turnover rate is calculated by dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. This material is for informational or educational purposes only and does not constitute investment advice under ERISA, a securities recommendation under federal securities laws, or an insurance product recommendation under state insurance laws or regulations. This material is intended to provide you with information to help you make informed decisions. You should not view or construe the availability of this information as a suggestion that you take or refrain from taking a particular course of action, as the advice of an impartial fiduciary, as an offer to sell or a solicitation to buy or hold any securities, as a recommendation of any securities transactions or investment strategy involving securities (including account recommendations), a recommendation to rollover or transfer assets to TIAA or a recommendation to purchase an insurance product. In making this information available to you, TIAA assumes that you are capable of evaluating the information and exercising independent judgment. As such, you should consider your other assets, income and investments and you should not rely on the information as the primary basis for making investment or insurance product purchase or contribution decisions. The information that you may derive from this material is for illustrative purposes only and is not individualized or based on your particular needs. This material does not take into account your specific objectives or circumstances, or suggest any specific course of action. Investment, insurance product purchase or contribution decisions should be made based on your own objectives and circumstances. The purpose of this material is not to predict future returns, but to be used as education only. Contact your tax advisor regarding the tax implications. You should read all associated disclosures. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC, distributes securities products. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161. A Note About Risks In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. ©2021 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 1477917