Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CION Investment Corp | tm2036542d1_ex99-1.htm |

| 8-K - FORM 8-K - CION Investment Corp | tm2036542d1_8k.htm |

Exhibit 99.2

|

CION Investment Corporation PORTFOLIO HOLDINGS Q3 2020 As of September 30, 2020 FOR EXISTING INVESTORS ONLY. |

|

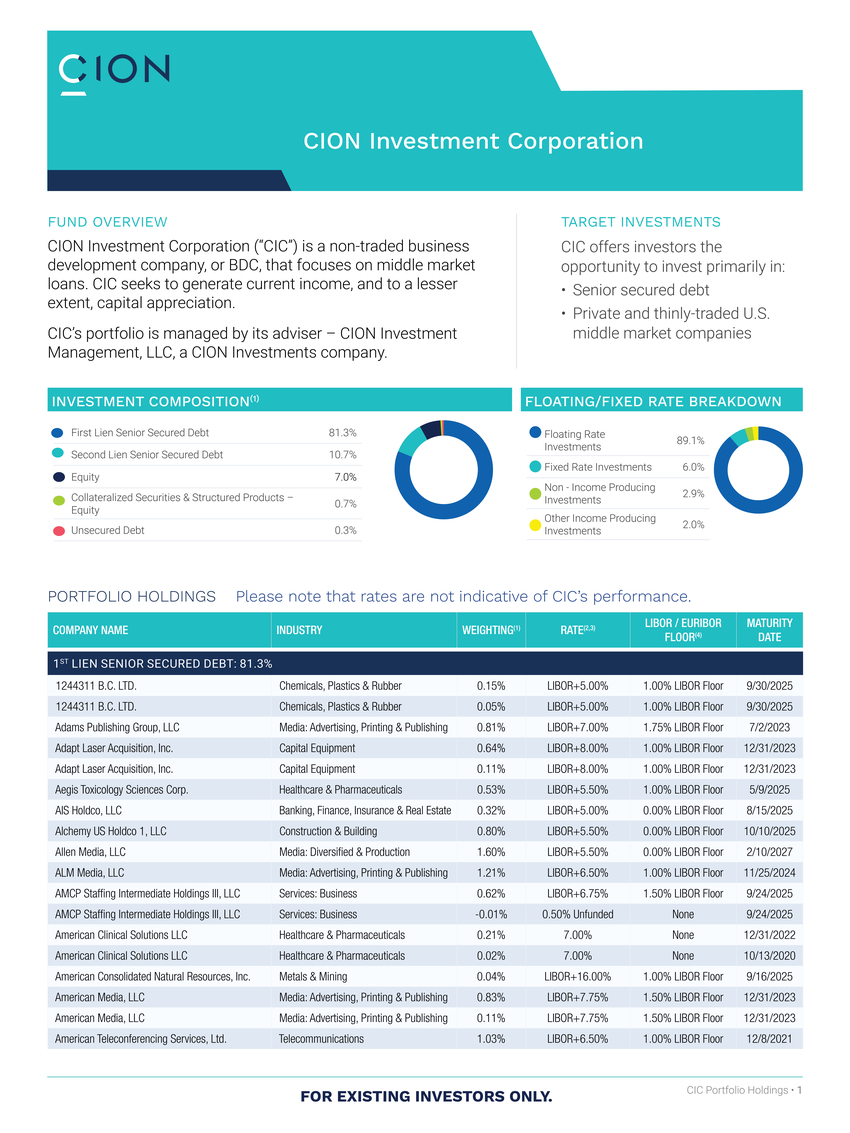

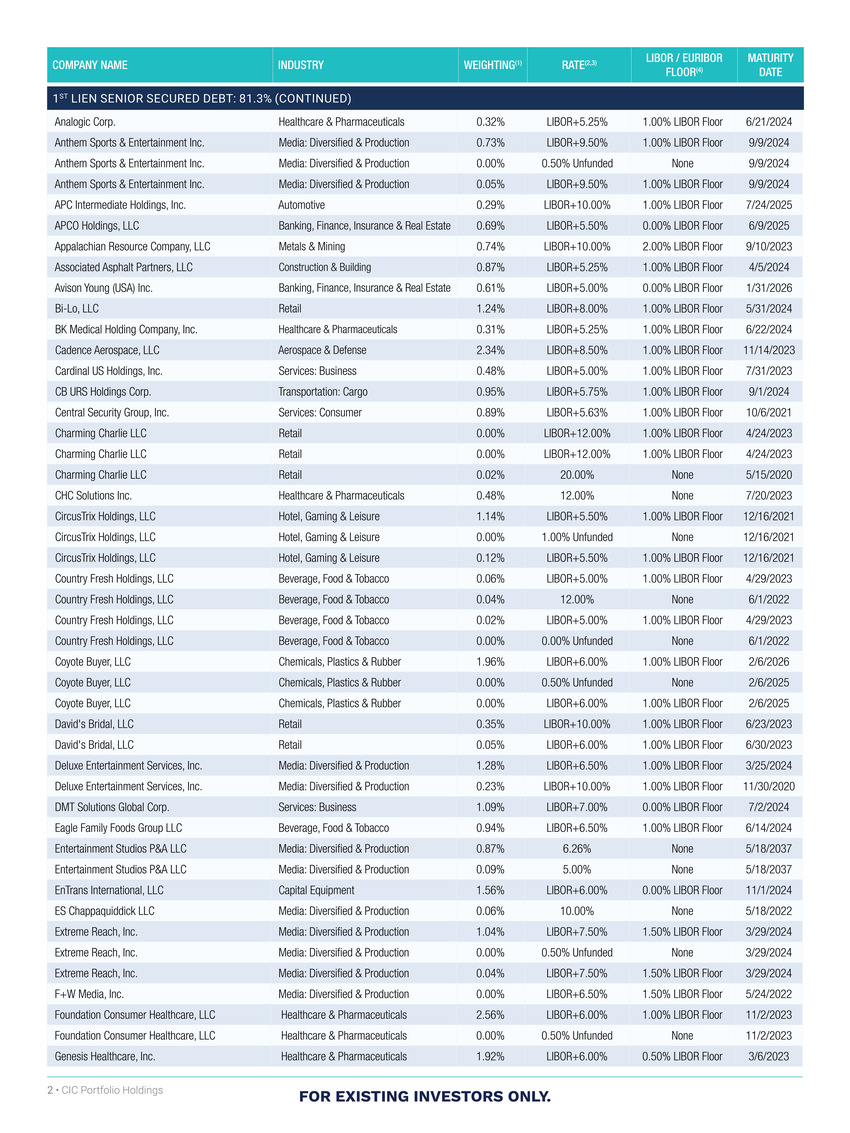

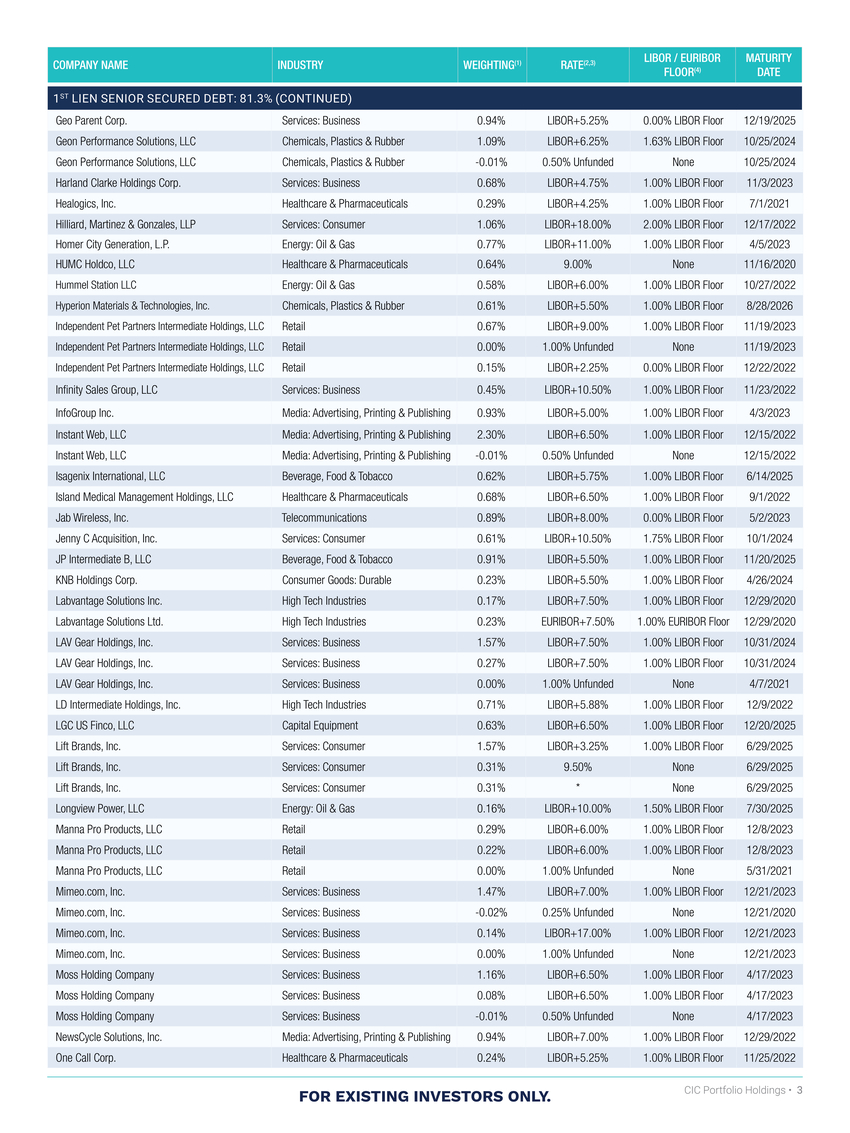

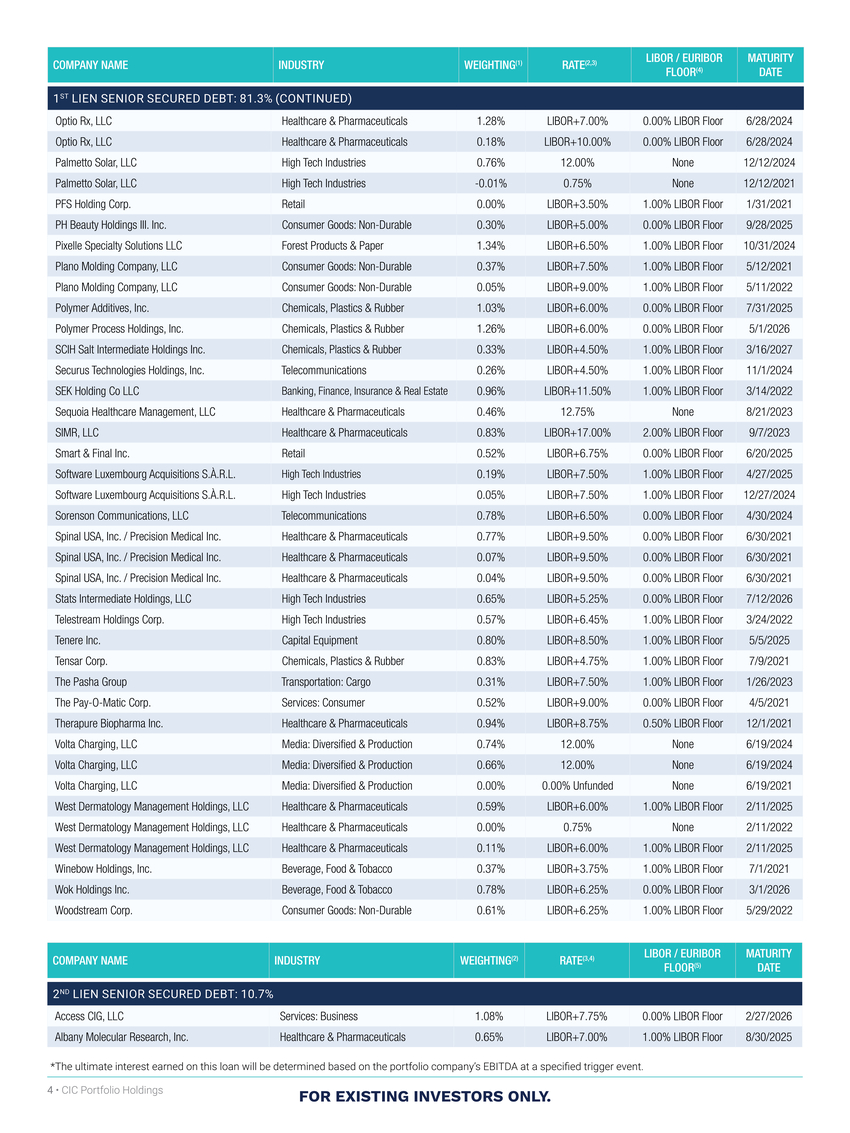

CION Investment Corporation CION Investment Corporation (“CIC”) is a non-traded business development company, or BDC, that focuses on middle market loans. CIC seeks to generate current income, and to a lesser extent, capital appreciation. CIC’s portfolio is managed by its adviser – CION Investment Management, LLC, a CION Investments company. TARGET INVESTMENTS CIC offers investors the opportunity to invest primarily in: Senior secured debt Private and thinly-traded U.S. middle market companies INVESTMENT COMPOSITION(1) FLOATING/FIXED RATE BREAKDOWN First Lien Senior Secured Debt 81.3% Second Lien Senior Secured Debt 10.7% Equity 7.0% 89.1% Fixed Rate Investments6.0% Collateralized Securities & Structured Products –0.7% Equity Unsecured Debt0.3% Non - Income Producing Investments Other Income Producing Investments 2.9% 2.0% PORTFOLIO HOLDINGSPlease note that rates are not indicative of CIC’s performance. FOR EXISTING INVESTORS ONLY. CIC Portfolio Holdings • 1 |

|

2 • CIC Portfolio Holdings FOR EXISTING INVESTORS ONLY. |

|

FOR EXISTING INVESTORS ONLY. CIC Portfolio Holdings • 3 |

|

*The ultimate interest earned on this loan will be determined based on the portfolio company’s EBITDA at a specified trigger event. 4 • CIC Portfolio Holdings FOR EXISTING INVESTORS ONLY. |

|

FOR EXISTING INVESTORS ONLY. CIC Portfolio Holdings • 5 |

|

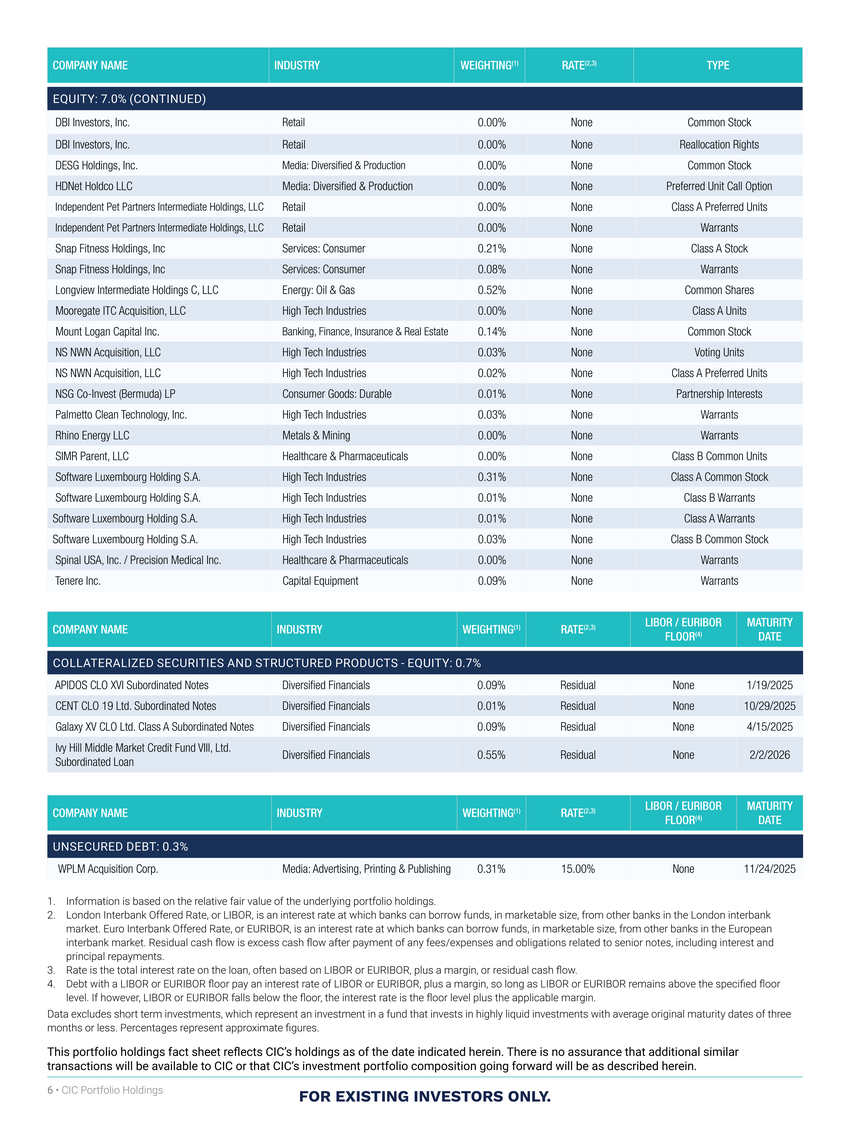

Information is based on the relative fair value of the underlying portfolio holdings. London Interbank Offered Rate, or LIBOR, is an interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. Euro Interbank Offered Rate, or EURIBOR, is an interest rate at which banks can borrow funds, in marketable size, from other banks in the European interbank market. Residual cash flow is excess cash flow after payment of any fees/expenses and obligations related to senior notes, including interest and principal repayments. Rate is the total interest rate on the loan, often based on LIBOR or EURIBOR, plus a margin, or residual cash flow. Debt with a LIBOR or EURIBOR floor pay an interest rate of LIBOR or EURIBOR, plus a margin, so long as LIBOR or EURIBOR remains above the specified floor level. If however, LIBOR or EURIBOR falls below the floor, the interest rate is the floor level plus the applicable margin. Data excludes short term investments, which represent an investment in a fund that invests in highly liquid investments with average original maturity dates of three months or less. Percentages represent approximate figures. This portfolio holdings fact sheet reflects CIC’s holdings as of the date indicated herein. There is no assurance that additional similar transactions will be available to CIC or that CIC’s investment portfolio composition going forward will be as described herein. 6 • CIC Portfolio Holdings FOR EXISTING INVESTORS ONLY. |

|

CION Investments 3 Park Avenue, 36th Floor New York, NY 10016 cioninvestments.com CIC-PH-1120 FOR EXISTING INVESTORS ONLY. |