Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - WPX ENERGY, INC. | tm2031871d2_ex99-3.htm |

| 8-K - FORM 8-K - WPX ENERGY, INC. | tm2031871d2_8k.htm |

| EX-99.4 - EXHIBIT 99.4 - WPX ENERGY, INC. | tm2031871d2_ex99-4.htm |

| EX-99.1 - EXHIBIT 99.1 - WPX ENERGY, INC. | tm2031871d2_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - WPX ENERGY, INC. | tm2031871d2_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - WPX ENERGY, INC. | tm2031871d2_ex2-1.htm |

Exhibit 99.2

+ Devon and WPX Strategic Merger of Equals September 28, 2020 NYSE: DVNdevonenergy.com NYSE: WPXwpxenergy.com

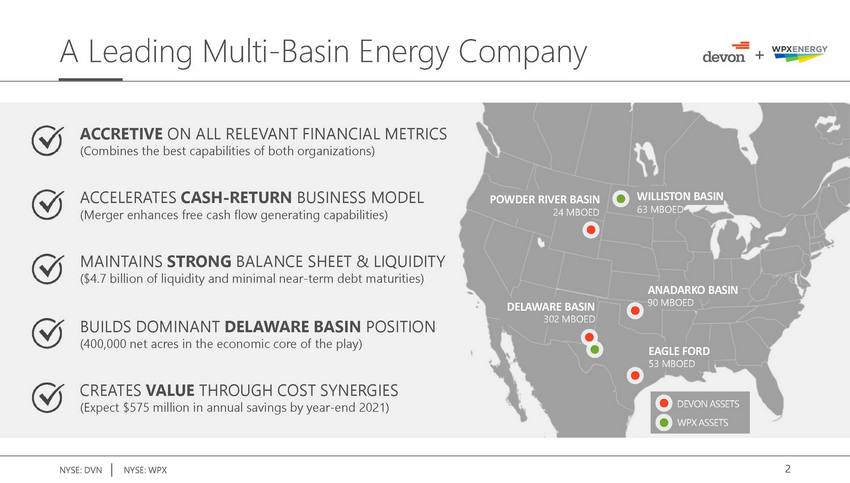

ACCRETIVE ON ALL RELEVANT FINANCIAL METRICS (Combines the best capabilities of both organizations) ACCELERATES CASH-RETURN BUSINESS MODEL (Merger enhances free cash flow generating capabilities) POWDER RIVER BASIN 24 MBOED WILLISTON BASIN 63 MBOED MAINTAINS STRONG BALANCE SHEET & LIQUIDITY ($4.7 billion of liquidity and minimal near-term debt maturities) BUILDS DOMINANT DELAWARE BASIN POSITION (400,000 net acres in the economic core of the play) DELAWARE BASIN 302 MBOED ANADARKO BASIN 90 MBOED EAGLE FORD 53 MBOED (Expect $575 million in annual savings by year-end 2021) DEVON ASSETS WPX ASSETS

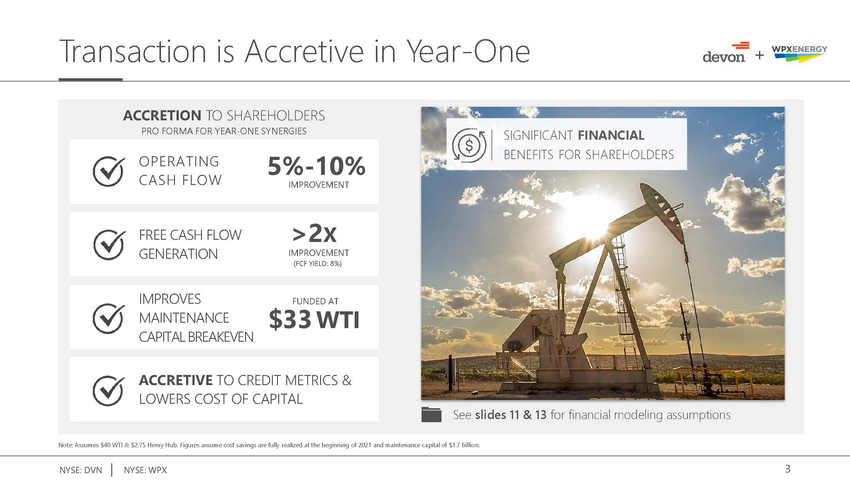

ACCRETION TO SHAREHOLDERS PRO FORMA FOR YEAR-ONE SYNERGIES SIGNIFICANT FINANCIAL BENEFITS FOR SHAREHOLDERS OPERATING CASH FLOW 5%-10% IMPROVEMENT FREE CASH FLOW GENERATION >2X IMPROVEMENT (FCF YIELD: 8%) IMPROVES MAINTENANCE CAPITAL BREAKEVEN FUNDED AT $33 WTI ACCRETIVE TO CREDIT METRICS & LOWERS COST OF CAPITAL See slides 11 & 13 for financial modeling assumptions Note: Assumes $40 WTI & $2.75 Henry Hub. Figures assume cost savings are fully realized at the beginning of 2021 and maintenance capital of $1.7 billion.

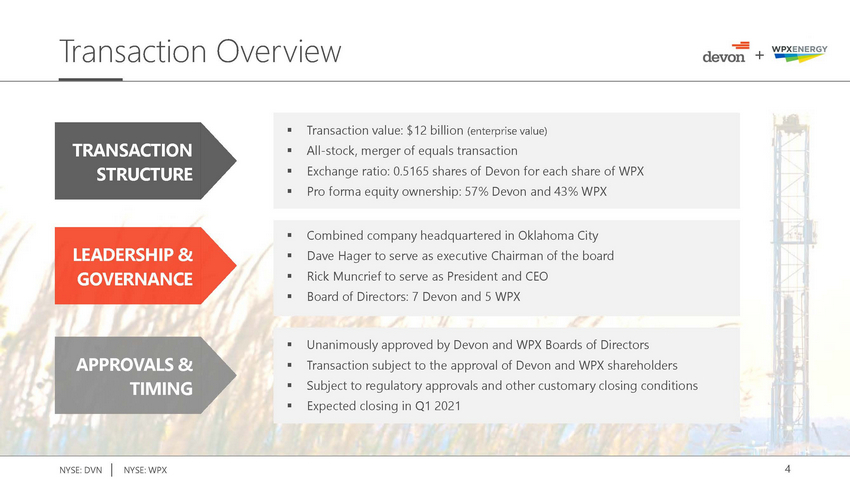

TRANSACTION STRUCTURE LEADERSHIP & GOVERNANCE APPROVALS & TIMING ▪Transaction value: $12 billion (enterprise value) ▪All-stock, merger of equals transaction ▪Exchange ratio: 0.5165 shares of Devon for each share of WPX ▪Pro forma equity ownership: 57% Devon and 43% WPX ▪Combined company headquartered in Oklahoma City ▪Dave Hager to serve as executive Chairman of the board ▪Rick Muncrief to serve as President and CEO ▪Board of Directors: 7 Devon and 5 WPX ▪Unanimously approved by Devon and WPX Boards of Directors ▪Transaction subject to the approval of Devon and WPX shareholders ▪Subject to regulatory approvals and other customary closing conditions ▪Expected closing in Q1 2021

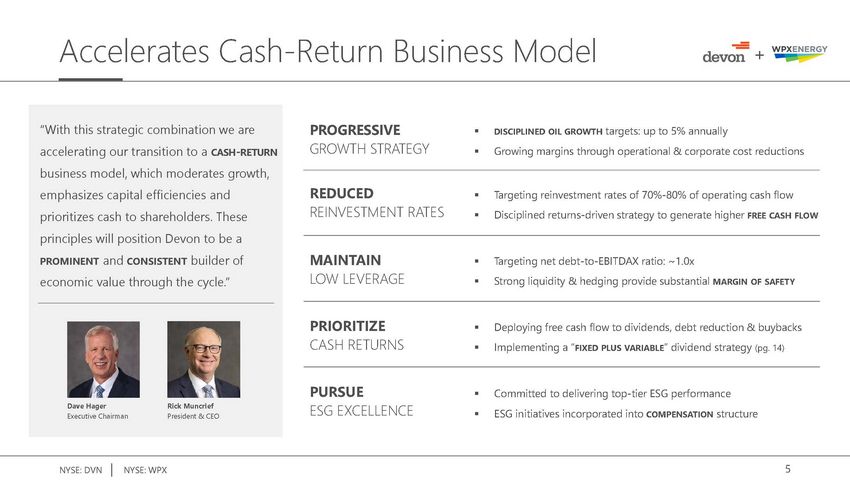

“With this strategic combination we are accelerating our transition to a CASH-RETURN business model, which moderates growth, emphasizes capital efficiencies and prioritizes cash to shareholders. These principles will position Devon to be a PROMINENT and CONSISTENT builder of economic value through the cycle.” PROGRESSIVE GROWTH STRATEGY REDUCED REINVESTMENT RATES MAINTAIN LOW LEVERAGE ▪DISCIPLINED OIL GROWTH targets: up to 5% annually ▪Growing margins through operational & corporate cost reductions ▪Targeting reinvestment rates of 70%-80% of operating cash flow ▪Disciplined returns-driven strategy to generate higher FREE CASH FLOW ▪Targeting net debt-to-EBITDAX ratio: ~1.0x ▪Strong liquidity & hedging provide substantial MARGIN OF SAFETY PRIORITIZE CASH RETURNS ▪Deploying free cash flow to dividends, debt reduction & buybacks ▪Implementing a “FIXED PLUS VARIABLE” dividend strategy (pg. 14) Dave Hager Executive Chairman Rick Muncrief President & CEO PURSUE ESG EXCELLENCE ▪Committed to delivering top-tier ESG performance ▪ESG initiatives incorporated into COMPENSATION structure

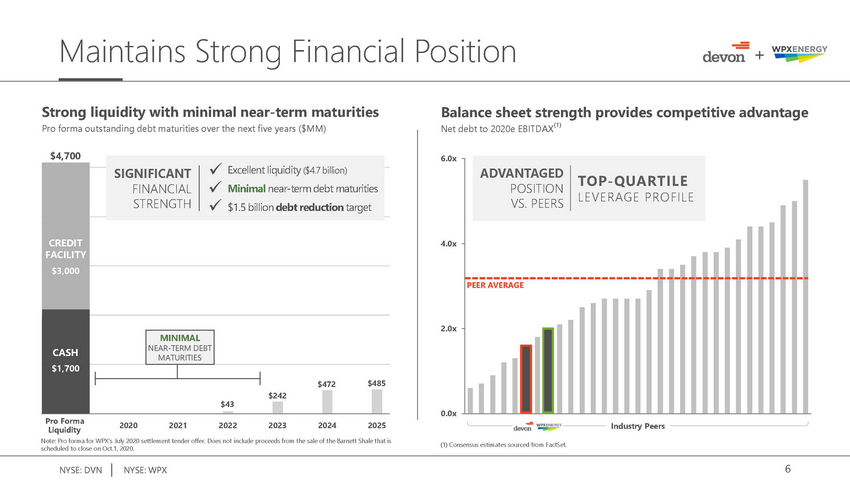

Strong liquidity with minimal near-term maturities Pro forma outstanding debt maturities over the next five years ($MM) Balance sheet strength provides competitive advantage Net debt to 2020e EBITDAX (1) $4,700 SIGNIFICANT FINANCIAL STRENGTH x Excellent liquidity ($4.7 billion) x Minimal near-term debt maturities x $1.5 billion debt reduction target 6.0x ADVANTAGED POSITION VS. PEERS TOP-QUARTILE LEV ERAGE P RO FI LE CREDIT FACILITY $3,000 4.0x PEER AVERAGE CASH $1,700 Pro Forma MINIMAL NEAR-TERM DEBT MATURITIES $43 $242 $472 $485 2.0x 0.0x Liquidity 202020212022202320242025 Industry Peers Note: Pro forma for WPX’s July 2020 settlement tender offer. Does not include proceeds from the sale of the Barnett Shale that is scheduled to close on Oct.1, 2020. (1) Consensus estimates sourced from FactSet.

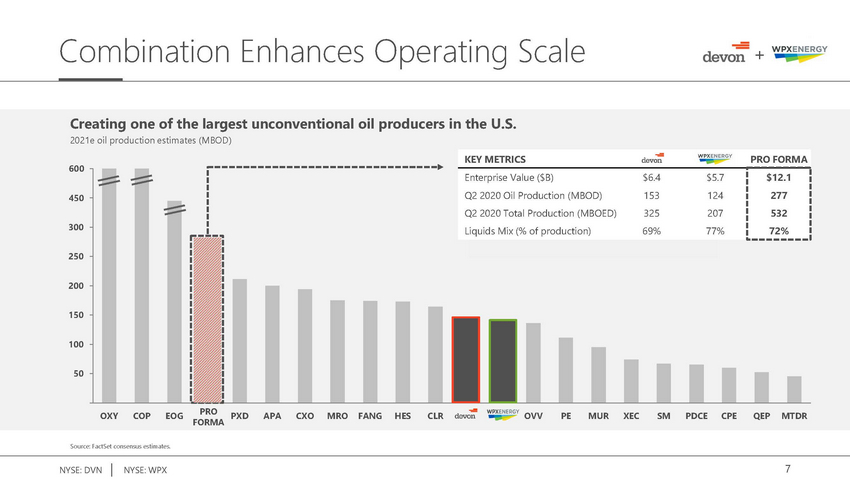

Creating one of the largest unconventional oil producers in the U.S. 400 E L nterprise Value ($B)$6.4$5 Q2 2020 Oil Production (MBOD)15312 Q2 2020 Total Production (MBOED) 325 20 iquids Mix (% of production)69%77 .7 4 7 % $12.1 277 532 72% 350 KEY METRICSPRO FORMA 450 300 250 200 150 100 0 OXYCOPEOG PRO FORMA PXDAPACXOMROFANGHESCLROVVPEMURXECSMPDCECPEQEPMTDR Source: FactSet consensus estimates.

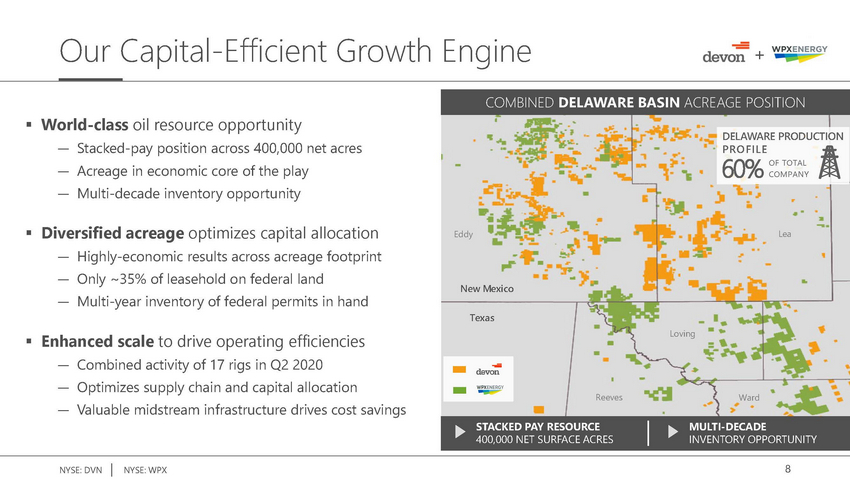

▪ World-class oil resource opportunity — Stacked-pay position across 400,000 net acres — Acreage in economic core of the play — Multi-decade inventory opportunity ▪ Diversified acreage optimizes capital allocation — Highly-economic results across acreage footprint — Only ~35% of leasehold on federal land — Multi-year inventory of federal permits in hand COMBINED DELAWARE BASIN ACREAGE POSITION DELAWARE PRODUCTION P RO F I L E 60% EddyLea New Mexico Texas ▪ Enhanced scale to drive operating efficiencies — Combined activity of 17 rigs in Q2 2020 — Optimizes supply chain and capital allocation — Valuable midstream infrastructure drives cost savings Reeves Loving Ward STACKED PAY RESOURCE 400,000 NET SURFACE ACRES MULTI-DECADE INVENTORY OPPORTUNITY

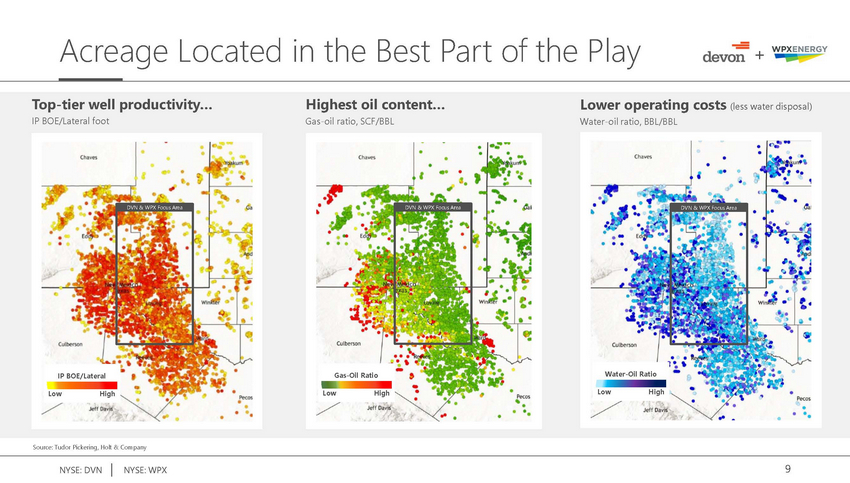

Top-tier well productivity… IP BOE/Lateral foot Highest oil content… Gas-oil ratio, SCF/BBL Lower operating costs (less water disposal) Water-oil ratio, BBL/BBL DVN & WPX Focus Area DVN & WPX Focus Area DVN & WPX Focus Area IP BOE/Lateral LowHigh Gas-Oil Ratio LowHigh Water-Oil Ratio LowHigh Source: Tudor Pickering, Holt & Company

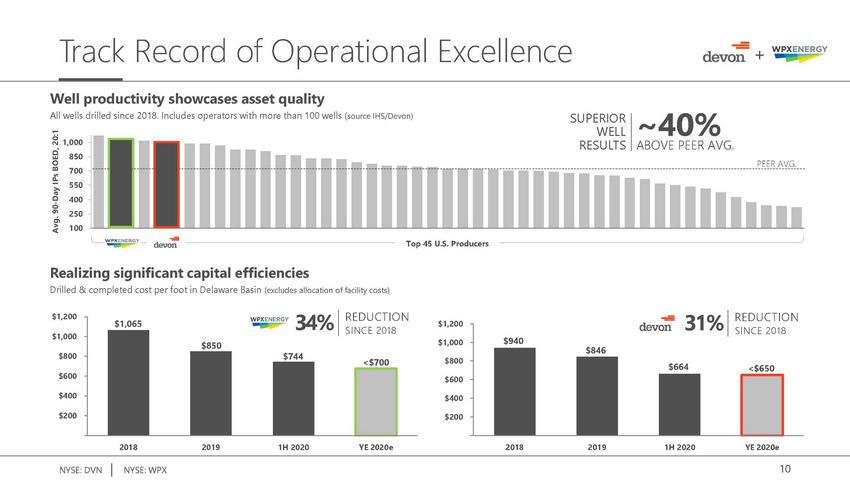

Well productivity showcases asset quality All wells drilled since 2018. Includes operators with more than 100 wells (source IHS/Devon) SUPERIOR WELL ~40% Avg. 90-Day IPs BOED, 20:1 850 700 550 400 250 100 Top 45 U.S. Producers RESULTS ABOVE PEER AVG. PEER AVG. Realizing significant capital efficiencies Drilled & completed cost per foot in Delaware Basin (excludes allocation of facility costs) $1,200 $1,000 $800 $1,065 $850 REDUCTION 34% $744 $1,200 $1,000 $800 $940 $846 REDUCTION 31% $600 $400 <$700 $600 $400 $664 <$650 $-$200 $-201820191H 2020YE 2020e

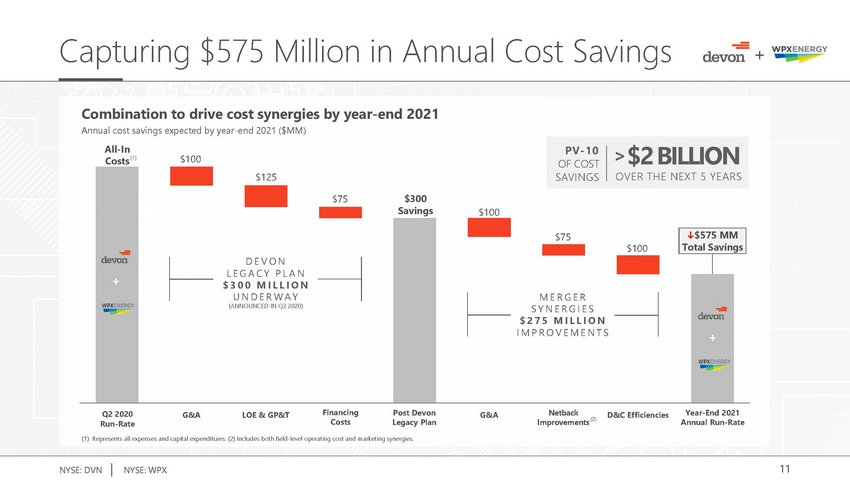

Combination to drive cost synergies by year-end 2021 Annual cost savings expected by year-end 2021 ($MM) All-In Costs (1) $100 $125 PV - 10 OF COST SAVINGS >$2 BILLION OVER THE NEXT 5 YEARS $75 $300 Savings $100 DEV O N LE G AC Y P LAN +$300 M I L L I O N U N DER W A Y (ANNOUNCED IN Q2 2020) $75 M ER G ER SYN E R G I E S $275 M I L L I O N I M P R O VE M E N T S $100 ↆ$575 MM Total Savings + Q2 2020 Run-Rate G&ALOE & GP&T Financing Costs Post Devon Legacy Plan G&A Netback Improvements (2) D&C Efficiencies Year-End 2021 Annual Run-Rate (1) Represents all expenses and capital expenditures. (2) Includes both field-level operating cost and marketing synergies.

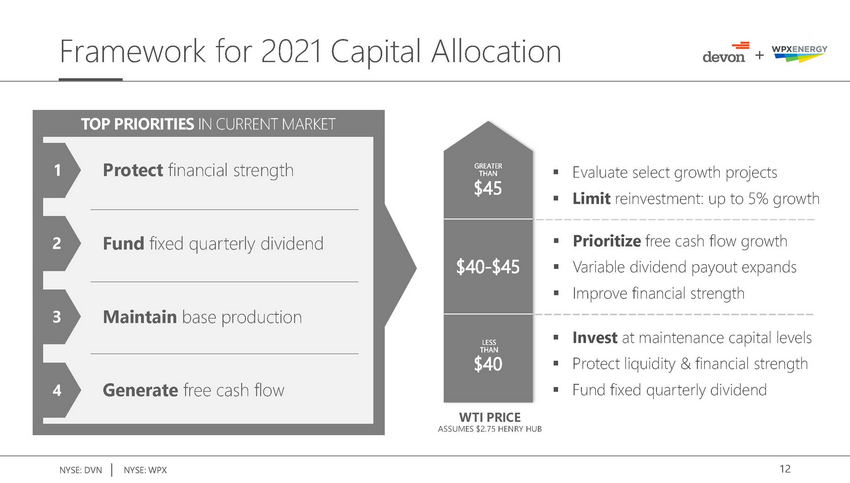

1 2 3 4 1Protect financial strength 2Fund fixed quarterly dividend 3Maintain base production 4Generate free cash flow GREATER THAN $45 $40-$45 LESS THAN $40 WTI PRICE ASSUMES $2.75 HENRY HUB ▪Evaluate select growth projects ▪Limit reinvestment: up to 5% growth ▪Prioritize free cash flow growth ▪Variable dividend payout expands ▪Improve financial strength ▪Invest at maintenance capital levels ▪Protect liquidity & financial strength ▪Fund fixed quarterly dividend

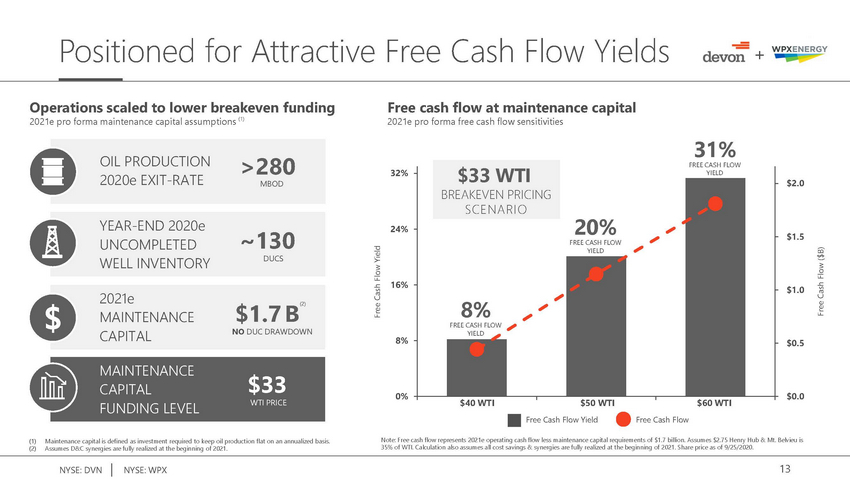

Operations scaled to lower breakeven funding 2021e pro forma maintenance capital assumptions (1) Free cash flow at maintenance capital 2021e pro forma free cash flow sensitivities 31% OIL PRODUCTION 2020e EXIT-RATE YEAR-END 2020e UNCOMPLETED WELL INVENTORY 2021e $MAINTENANCE >280 MBOD ~130 DUCS $1.7 B (2) 32% 24% 16% $33 WTI BREAKEVEN PRICING SC E NA RI O Free Cash Flow Yield 20% FREE CASH FLOW YIELD FREE CASH FLOW YIELD $2.0 Free Cash Flow ($B) $1.0 CAPITAL NO DUC DRAWDOWN FREE CASH FLOW YIELD 8% $0.5 MAINTENANCE CAPITAL FUNDING LEVEL $33 WTI PRICE 0% $40 WTI$50 WTI Free Cash Flow Yield Free Cash Flow $60 WTI $0.0 (1)Maintenance capital is defined as investment required to keep oil production flat on an annualized basis. (2)Assumes D&C synergies are fully realized at the beginning of 2021. Note: Free cash flow represents 2021e operating cash flow less maintenance capital requirements of $1.7 billion. Assumes $2.75 Henry Hub & Mt. Belvieu is 35% of WTI. Calculation also assumes all cost savings & synergies are fully realized at the beginning of 2021. Share price as of 9/25/2020.

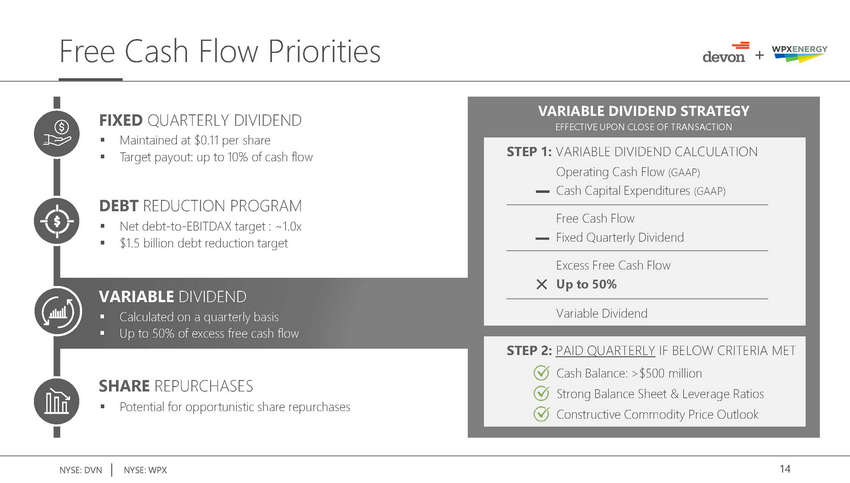

FIXED QUARTERLY DIVIDEND ▪Maintained at $0.11 per share ▪Target payout: up to 10% of cash flow DEBT REDUCTION PROGRAM ▪Net debt-to-EBITDAX target : ~1.0x ▪$1.5 billion debt reduction target VARIABLE DIVIDEND ▪Calculated on a quarterly basis ▪Up to 50% of excess free cash flow SHARE REPURCHASES ▪Potential for opportunistic share repurchases VARIABLE DIVIDEND STRATEGY EFFECTIVE UPON CLOSE OF TRANSACTION STEP 1: VARIABLE DIVIDEND CALCULATION Operating Cash Flow (GAAP) − Cash Capital Expenditures (GAAP) Free Cash Flow − Fixed Quarterly Dividend Excess Free Cash Flow × Up to 50% Variable Dividend STEP 2: PAID QUARTERLY IF BELOW CRITERIA MET Cash Balance: >$500 million Strong Balance Sheet & Leverage Ratios Constructive Commodity Price Outlook

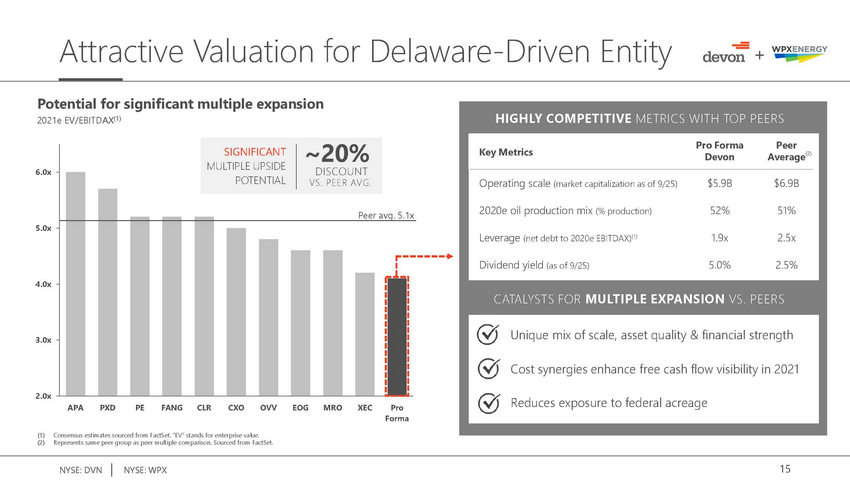

Potential for significant multiple expansion 2021e EV/EBITDAX(1) HIGHLY COMPETITIVE METRICS WITH TOP PEERS 6.0x SIGNIFICANT MULTIPLE UPSIDE ~20% DISCOUNT Key Metrics Pro Forma Devon Peer Average(2) 5.0x POTENTIAL VS. PEER AVG. Peer avg. 5.1x Operating scale (market capitalization as of 9/25) $5.9B $6.9B 2020e oil production mix (% production) 52% 51% Leverage (net debt to 2020e EBITDAX)(1) 1.9x 2.5x Dividend yield (as of 9/25) 5.0% 2.5% 4.0x CATALYSTS FOR MULTIPLE EXPANSION VS. PEERS 3.0x Unique mix of scale, asset quality & financial strength Cost synergies enhance free cash flow visibility in 2021 2.0x APAPXDPEFANGCLRCXOOVVEOGMROXECPro Forma Reduces exposure to federal acreage (1)Consensus estimates sourced from FactSet. “EV” stands for enterprise value. (2)Represents same peer group as peer multiple comparison. Sourced from FactSet.

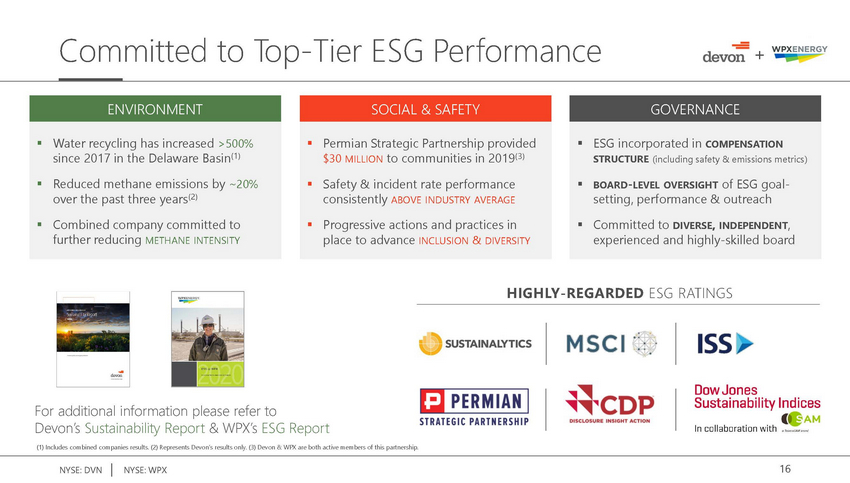

ENVIRONMENTSOCIAL & SAFETYGOVERNANCE ▪Water recycling has increased >500% since 2017 in the Delaware Basin(1) ▪Reduced methane emissions by ~20% over the past three years(2) ▪Combined company committed to further reducing METHANE INTENSITY ▪Permian Strategic Partnership provided $30 MILLION to communities in 2019(3) ▪Safety & incident rate performance consistently ABOVE INDUSTRY AVERAGE ▪Progressive actions and practices in place to advance INCLUSION & DIVERSITY ▪ESG incorporated in COMPENSATION STRUCTURE (including safety & emissions metrics) ▪BOARD-LEVEL OVERSIGHT of ESG goal-setting, performance & outreach ▪Committed to DIVERSE, INDEPENDENT, experienced and highly-skilled board HIGHLY-REGARDED ESG RATINGS For additional information please refer to Devon’s Sustainability Report & WPX’s ESG Report (1) Includes combined companies results. (2) Represents Devon’s results only. (3) Devon & WPX are both active members of this partnership.

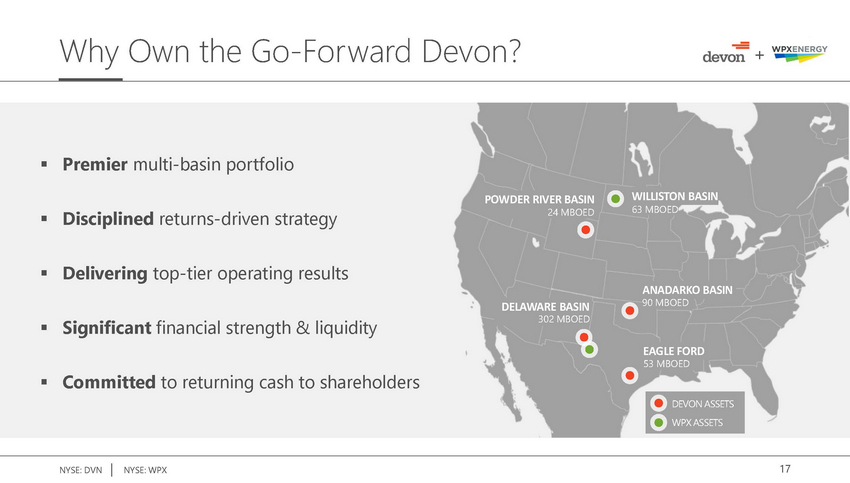

▪Premier multi-basin portfolio ▪Disciplined returns-driven strategy ▪Delivering top-tier operating results ▪Significant financial strength & liquidity ▪Committed to returning cash to shareholders POWDER RIVER BASIN 24 MBOED DELAWARE BASIN 302 MBOED WILLISTON BASIN 63 MBOED ANADARKO BASIN 90 MBOED DEVON ASSETS WPX ASSETS

Investor Relations Contacts Scott CoodyChris Carr VP, Investor RelationsManager, Investor Relations 405-552-4735405-228-2496 Email: investor.relations@dvn.com David Sullivan VP, Investor Relations 539-573-9360 Email: WPXInvestorRelations@WPXEnergy.com Investor Notices Additional Information and Where To Find It In connection with the proposed merger (the “Proposed Transaction”) of Devon Energy Corporation (“Devon”) and WPX Energy, Inc. (“WPX”), Devon will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 to register the shares of Devon’s common stock to be issued in connection with the Proposed Transaction. The registration statement will include a document that serves as a prospectus of Devon and a proxy statement of each of Devon and WPX (the “joint proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF DEVON AND WPX ARE ADVISED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DEVON, WPX, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive joint proxy statement/prospectus will be sent to the stockholders of each of Devon and WPX when it becomes available. Investors and security holders will be able to obtain copies of the registration statement and the joint proxy statement/prospectus and other documents containing important information about Devon and WPX free of charge from the SEC’s website when it becomes available. The documents filed by Devon with the SEC may be obtained free of charge at Devon’s website at www.devonenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Devon by requesting them by mail at Devon, Attn: Investor Relations, 333 West Sheridan Ave, Oklahoma City, OK 73102. The documents filed by WPX with the SEC may be obtained free of charge at WPX’s website at www.wpxenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from WPX by requesting them by mail at WPX, Attn: Investor Relations, P.O. Box 21810, Tulsa, OK 74102. Participants in the Solicitation Devon, WPX and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Devon’s and WPX’s stockholders with respect to the Proposed Transaction. Information about Devon’s directors and executive officers is available in Devon’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 19, 2020, and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 22, 2020. Information about WPX’s directors and executive officers is available in WPX’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 28, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on March 31, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Stockholders, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements This communication includes “forward-looking statements” as defined by the SEC. Such statements include those concerning strategic plans, Devon’s and WPX’s expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases such as “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this communication that address activities, events or developments that Devon or WPX expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond Devon’s and WPX’s control. Consequently, actual future results could differ materially from Devon’s and WPX’s expectations due to a number of factors, including, but not limited to: the risk that Devon’s and WPX’s businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate, including the risk of new restrictions with respect to hydraulic fracturing or other development activities on Devon’s or WPX’s federal acreage or their other assets; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the risk that Devon or WPX may be unable to obtain governmental and regulatory approvals required for the Proposed Transaction, or that required governmental and regulatory approvals may delay the Proposed Transaction or result in the imposition of conditions that could reduce the anticipated benefits from the Proposed Transaction or cause the parties to abandon the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied; the length of time necessary to consummate the Proposed Transaction, which may be longer than anticipated for various reasons; potential liability resulting from pending or future litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the Proposed Transaction on relationships with customers, suppliers, competitors, management and other employees; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; the volatility of oil, gas and natural gas liquids (NGL) prices; uncertainties inherent in estimating oil, gas and NGL reserves; the impact of reduced demand for our products and products made from them due to governmental and societal actions taken in response to the COVID-19 pandemic; the uncertainties, costs and risks involved in Devon’s and WPX’s operations, including as a result of employee misconduct; natural disasters, pandemics, epidemics (including COVID-19 and any escalation or worsening thereof) or other public health conditions; counterparty credit risks; risks relating to Devon’s and WPX’s indebtedness; risks related to Devon’s and WPX’s hedging activities; competition for assets, materials, people and capital; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; cyberattack risks; Devon’s and WPX’s limited control over third parties who operate some of their respective oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses Devon or WPX may experience; risks related to investors attempting to effect change; general domestic and international economic and political conditions, including the impact of COVID-19; and changes in tax, environmental and other laws, including court rulings, applicable to Devon’s and WPX’s business. In addition to the foregoing, the COVID-19 pandemic and its related repercussions have created significant volatility, uncertainty and turmoil in the global economy and Devon’s and WPX’s industry. This turmoil has included an unprecedented supply-and-demand imbalance for oil and other commodities, resulting in a swift and material decline in commodity prices in early 2020. Devon’s and WPX’s future actual results could differ materially from the forward-looking statements in this communication due to the COVID-19 pandemic and related impacts, including, by, among other things: contributing to a sustained or further deterioration in commodity prices; causing takeaway capacity constraints for production, resulting in further production shut-ins and additional downward pressure on impacted regional pricing differentials; limiting Devon’s and WPX’s ability to access sources of capital due to disruptions in financial markets; increasing the risk of a downgrade from credit rating agencies; exacerbating counterparty credit risks and the risk of supply chain interruptions; and increasing the risk of operational disruptions due to social distancing measures and other changes to business practices. Additional information concerning other risk factors is also contained in Devon’s and WPX’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other SEC filings. Many of these risks, uncertainties and assumptions are beyond Devon’s or WPX’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per share of Devon or WPX for the current or any future financial years or those of the combined company will necessarily match or exceed the historical published earnings per share of Devon or WPX, as applicable. Neither Devon nor WPX gives any assurance (1) that either Devon or WPX will achieve their expectations, or (2) concerning any result or the timing thereof, in each case, with respect to the Proposed Transaction or any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decree, cost reductions, business strategies, earnings or revenue trends or future financial results. All subsequent written and oral forward-looking statements concerning Devon, WPX, the Proposed Transaction, the combined company or other matters and attributable to Devon or WPX or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Devon and WPX assume no duty to update or revise their respective forward-looking statements based on new information, future events or otherwise.

Appendix

Dave Hager Executive Chairman Rick Muncrief President & CEO Jeff Ritenour EVP & Chief Financial Officer Clay Gaspar EVP & Chief Operating Officer David Harris EVP & Chief Corporate Development Officer Dennis Cameron EVP & General Counsel Tana Cashion SVP of Human Resources