Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K |

(Mark One)

R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

£ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-35322

WPX Energy, Inc. |

(Exact Name of Registrant as Specified in Its Charter) |

Delaware | 45-1836028 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

3500 One Williams Center, Tulsa, Oklahoma | 74172-0172 | |

(Address of Principal Executive Offices) | (Zip Code) | |

855-979-2012

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: |

None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes R No £

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No R

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | R | Accelerated filer | £ | ||||

Non-accelerated filer | £ | (Do not check if a smaller reporting company) | Smaller reporting company | £ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No R

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second quarter was approximately $4,832,711,197.

The number of shares outstanding of the registrant’s common stock outstanding at February 25, 2015 was 203,877,415.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be delivered to stockholders in connection with its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III.

WPX ENERGY, INC.

FORM 10-K

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Business Overview and Properties | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

1

CERTAIN DEFINITIONS

The following oil and gas measurements and industry and other terms are used in this Form 10-K. As used herein, production volumes represent sales volumes, unless otherwise indicated.

Barrel—means one barrel of petroleum products that equals 42 U.S. gallons.

BBtu/d—means one billion BTUs per day.

Bcfe—means one billion cubic feet of gas equivalent determined using the ratio of one barrel of oil, condensate or NGLs to six thousand cubic feet of natural gas.

British Thermal Unit or BTU—means a unit of energy needed to raise the temperature of one pound of water by one degree Fahrenheit.

FERC—means the Federal Energy Regulatory Commission.

Fractionation—means the process by which a mixed stream of natural gas liquids is separated into its constituent products, such as ethane, propane and butane.

LOE—means lease and other operating expense excluding production taxes, ad valorem taxes and gathering, processing and transportation fees.

Mbbls—means one thousand barrels.

Mbbls/d—means one thousand barrels per day.

Mboe—means one thousand barrels of oil equivalent.

Mboe/d—means one thousand barrels of oil equivalent per day.

Mcf—means one thousand cubic feet.

Mcfe—means one thousand cubic feet of gas equivalent using the ratio of one barrel of oil, condensate or NGLs to six thousand cubic feet of natural gas.

MMbbls—means one million barrels.

MMBtu—means one million BTUs.

MMBtu/d—means one million BTUs per day.

MMcf—means one million cubic feet.

MMcf/d—means one million cubic feet per day.

MMcfe—means one million cubic feet of gas equivalent using the ratio of one barrel of oil, condensate or NGLs to six thousand cubic feet of natural gas.

MMcfe/d—means one million cubic feet of gas equivalent per day using the ratio of one barrel of oil, condensate or NGLs to six thousand cubic feet of natural gas.

NGLs—means natural gas liquids; natural gas liquids result from natural gas processing and crude oil refining and are used as petrochemical feedstocks, heating fuels and gasoline additives, among other applications.

2

PART I

In this report, WPX (which includes WPX Energy, Inc. and, unless the context otherwise requires, all of our subsidiaries) is at times referred to in the first person as “we,” “us” or “our.” We also sometimes refer to WPX as the “Company” or “WPX Energy.”

Throughout this report we “incorporate by reference” certain information in parts of other documents filed with the Securities and Exchange Commission (the “SEC”). The SEC allows us to disclose important information by referring to it in that manner. Please refer to such documents for information.

We are making forward-looking statements in this report. In “Item 1A: Risk Factors” we discuss some of the risk factors that could cause actual results to differ materially from those stated in the forward-looking statements.

Item 1. | Business |

WPX ENERGY, INC.

Incorporated in 2011, we are an independent natural gas and oil exploration and production company engaged in the exploitation and development of long-life unconventional properties. We are focused on profitably exploiting our significant natural gas reserves base and related NGLs in the Piceance Basin of the Rocky Mountain region, and on developing and growing our oil positions in the Williston Basin in North Dakota and the San Juan Basin in the southwestern United States.

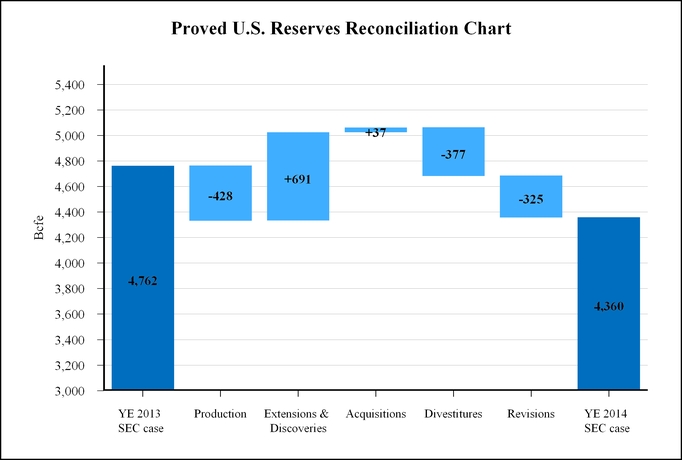

We have built a geographically diverse portfolio of natural gas and oil reserves through organic development and strategic acquisitions. Our domestic proved reserves at December 31, 2014 were 4,360 Bcfe. Our domestic reserves reflect a mix of 72 percent natural gas, 18 percent crude oil and 10 percent NGLs. During 2014, we replaced our domestic production for all commodities at a rate of 94 percent. For oil alone, we replaced 421 percent of our oil production. Our Piceance Basin operations form the majority of our proved reserves and current production, providing a low-cost, scalable asset base.

Our principal areas of operation are the Piceance Basin in Colorado, the Williston Basin in North Dakota, and the San Juan Basin in New Mexico and Colorado. Our principal executive office is located at 3500 One Williams Center, Tulsa, Oklahoma 74172. Our telephone number is 855-979-2012.

3

BUSINESS OVERVIEW AND PROPERTIES

Our Business Strategy

Our business strategy is to increase shareholder value by increasing production over time of oil, natural gas, and NGLs, expanding our margins, and finding and developing reserves.

• | Focused, Long-Term Portfolio Management. We are focused on long-term profitable growth. Our objective over time is to grow our production within our cash flow. With that in mind, we continuously evaluate the performance of our assets and, when appropriate, we consider divestitures of assets that are underperforming or which are no longer a part of our strategic focus. With regard to our core assets in the Piceance, Williston, and San Juan Basins, we expect to allocate capital to the most profitable opportunities based on commodity price cycles and other market conditions, enabling us to grow our reserves and production in a manner that maximizes our returns on investments. |

• | Build Asset Scale. We expect to opportunistically acquire acreage positions in areas where we feel we can establish significant scale and replicate cost-efficient development practices. We may also consider other “bolt-on” transactions that are directed at driving operational efficiencies through increased scale. We can manage costs by focusing on the establishment of large scale, contiguous acreage blocks where we can operate a majority of the properties. We believe this strategy allows us to better achieve economies of scale and apply continuous technological improvements in our operations. We have a history of acquiring undeveloped properties that meet our expected return requirements and other acquisition criteria to expand upon our existing positions as well as acquiring undeveloped acreage in new geographic areas that offer significant resource potential. |

• | Margin Expansion thru Focus on Costs. We believe we can expand our margins by focusing on opportunities to reduce our cost structure. As we rationalize our portfolio and reduce our areas of focus to core basins, we have the opportunity to improve our cost structure and ensure that our organization is in alignment with our margin growth objectives. |

• | Continue Oil Development and Increase Optionality. We believe that efforts to develop our oil properties will yield a more balanced commodity mix in our production, providing us with the option of focusing on the commodity with the best returns under different market conditions. This optionality, we believe, will place us in a position where we can better protect and grow our cash flows. We have engaged and will continue to engage in commodity derivative hedging activities to maintain a degree of cash flow stability. Typically, we target hedging approximately 50 percent of expected revenue from domestic production during a current calendar year in order to strike an appropriate balance of commodity price upside with cash flow protection, although we may vary from this level based on our perceptions of market risk. We have hedged approximately three-fourths of our anticipated 2015 natural gas production at a weighted average price of $4.10 per MMbtu, and approximately two-thirds of anticipated 2015 oil production at a weighted average price of $94.88 per barrel. |

Significant Properties

Our principal areas of operation are the Piceance Basin, Williston Basin and San Juan Basin.

Piceance Basin

We entered the Piceance Basin in May 2001 with the acquisition of Barrett Resources and since that time have grown to become the largest natural gas producer in Colorado. Our Piceance Basin properties currently comprise our largest area of concentrated development drilling. We operate 4,742 wells in the Piceance Basin and also own interest in 318 wells operated by others. We hold 196,149 net acres in the Piceance Basin.

During 2014, we operated an average of 8.5 drilling rigs in the basin, including 6.2 in the Piceance Valley, 1.6 in the Piceance Highlands and 0.7 in the Piceance Niobrara. In response to lower commodity prices, we expect to operate 3.5 rigs in the Piceance Basin in 2015. In 2014, we had an average of 564 MMcf per day of net gas production from our Piceance Basin properties along with an average of 14.7 Mbbls per day of NGLs and 1.9 Mbbls per day of condensate recovered from our Piceance Basin properties. Capital expenditures were approximately $523 million which included the completion of 269 gross (252 net) wells in 2014. As of December 31, 2014, another 46 gross operated wells were awaiting completions. A large majority of our natural gas production in this basin currently is gathered through a system owned by Williams Partners L.P. and delivered to markets through a number of interstate pipelines.

The Piceance Basin is located in northwestern Colorado. Our operations in the basin are divided into two areas: the Piceance Valley and the Piceance Highlands. Our Piceance Valley area includes operations along the Colorado River valley and is the more developed area where we have produced consistent, repeatable results. The Piceance Highlands, which are those areas at higher elevations above the river valley, contain vast development opportunities that position us well for growth in the

4

future as infrastructure expands and efficiency improvements continue. Our development activities in the basin are primarily focused on the Williams Fork section within the Mesaverde formation. The Williams Fork can be over 2,000 feet in thickness and is comprised of multiple tight, interbedded, lenticular sandstone lenses encountered at depths ranging from 6,000 to 9,000 feet. In order to maximize producing rates and recovery of natural gas reserves we must hydraulically fracture the well using a fluid system comprised of 99 percent water and sand. Advancements in completion technology, including the use of microseismic data, have enabled us to more effectively stimulate the reservoir and recover a greater percentage of the natural gas in place.

In early 2013, we announced a successful discovery in the Niobrara Shale formation which has the potential to significantly increase our natural gas reserves and daily production in future years. The discovery well produced an initial high of 16 MMcf per day at a flowing pressure of 7,300 pounds per square inch. Additional drilling thus far has validated the existence of a highly pressured continuous gas accumulation capable of producing pipeline quality gas. Future drilling will focus on driving down costs while optimizing completion techniques. The Niobrara and Mancos Shales are generally located at depths of 10,000 to 13,000 feet. We have the lease rights to approximately 160,000 net acres of the Niobrara/Mancos Shale play that underlies our expansive leasehold position in the Piceance Basin. Substantial gathering and processing infrastructure is in place to accommodate additional gas volumes from the area, as is take-away capacity from the basin. Gas produced from the Niobrara and Mancos Shales can be processed without modification to existing gas treatment facilities.

Williston Basin

In December 2010, we acquired leasehold positions of approximately 85,800 net acres in the Williston Basin. All of these properties are on the Fort Berthold Indian Reservation in North Dakota and we are the primary operator. Based on our geologic interpretation of the Bakken formation, the evolution of completion techniques, our own drilling results as well as the publicly available drilling results for other operators in the basin, we believe that a substantial portion of our Williston Basin acreage is prospective in the Bakken and Three Forks formations, the primary targets for all of the well locations in our current drilling inventory. We operate 177 wells in the Williston Basin and also own interest in 19 wells operated by others. We hold 85,483 net acres in the Williston Basin.

During 2014, we operated an average of 4.8 rigs on our Williston Basin properties and we had an average of 22.3 Mboe per day of net production from our Williston Basin wells. In response to lower oil prices we expect to operate 1.4 rigs in the Williston Basin in 2015. Capital expenditures were approximately $632 million which included the completion of 55 gross (45 net) wells in 2014. As of December 31, 2014, another 25 gross operated wells were awaiting completion.

We are developing oil reserves through horizontal drilling in the Middle Bakken and the Upper Three Forks Shale oil formations. Based on our subsurface geological analysis, we believe that our position lies in an area of the basin with substantial potential recovery for Bakken and Three Forks formation oil.

Williston Basin is spread across North Dakota, South Dakota, Montana and parts of southern Canada, covering approximately 202,000 square miles, of which 143,000 square miles are in the United States. The basin produces oil and natural gas from numerous producing horizons including the Bakken, Three Forks, Madison and Red River formations.

The Devonian-age Bakken formation is found within the Williston Basin underlying portions of North Dakota and Montana and is comprised of three lithologic members referred to as the Upper, Middle and Lower Bakken Shales. The formation ranges up to 150 feet thick and is a continuous and structurally simple reservoir. The upper and lower shales are highly organic, thermally mature and over pressured and can act as both a source and reservoir for the oil. The Middle Bakken, which varies in composition from a silty dolomite to shaly limestone or sand, serves as the productive formation and is a critical reservoir for commercial production. Generally, the Bakken formation is found at vertical depths of 8,500 to 11,500 feet.

The Three Forks formation, generally found immediately under the Bakken formation, has also proven to contain productive reservoir rock. The Three Forks formation typically consists of interbedded dolomites and shale with local development of a discontinuous sandy member at the top, known as the Sanish Sand. The Three Forks formation is an unconventional carbonate play. Similar to the Bakken formation, the Three Forks formation is being exploited utilizing the same horizontal drilling and advanced completion techniques as the Bakken development. Drilling in the Three Forks formation began in mid-2008 and many operators are drilling wells targeting this formation.

Our acreage in the Williston Basin, as well as a portion of our acreage in the Piceance Basin, is leased to us by or with the approval of the federal government or its agencies, and is subject to federal authority, the National Environmental Policy Act (“NEPA”), the Bureau of Indian Affairs or other regulatory regimes that require governmental agencies to evaluate the potential environmental impacts of a proposed project on government owned lands. These regulatory regimes impose obligations on the

5

federal government and governmental agencies that may result in legal challenges and potentially lengthy delays in obtaining project permits or approvals and could result, in certain instances, in the cancellation of existing leases.

San Juan Basin

We first acquired properties in the San Juan Basin as part of The Williams Companies, Inc. (“Williams”) acquisition of Northwest Energy in 1983. Our San Juan Basin properties include holdings across the basin producing primarily from the Mesaverde, Fruitland Coal and Mancos Shale formations which are predominantly gas bearing. We operate four units in New Mexico (Rosa, Cox Canyon, Northwest Lybrook and South Chaco) and also operate the Northeast Chaco CA (Communitized Area), as well as a number of non-unit properties. We operate in three major areas of Colorado (Northwest Cedar Hills, Ignacio and Bondad). We operate 945 wells in the San Juan Basin and also own interest in 2,319 wells operated by other operators in New Mexico and Colorado. We hold approximately 134,000 net acres in the gas window of the basin.

In 2013, we announced a successful oil discovery in the Mancos Gallup Sandstone in the San Juan Basin that has the potential to significantly increase our oil production and reserves in future years. In 2014, we announced that we executed multiple transactions to own or control over 53,000 additional acres in the heart of the San Juan Basin’s Gallup oil window. At December 31, 2014, our leasehold position in the oil window of the San Juan Basin was approximately 85,000 net acres of which we own or control, and we are targeting additional acreage.

During 2014, we operated an average of 2.3 rigs in the San Juan Basin on our oil properties and we expect to operate 2.3 rigs in the San Juan Basin in 2015. We had an average of 139 MMcfe per day of net production from our San Juan Basin properties which included 3.9 Mbbls per day of oil. Capital expenditures were approximately $568 million which included the completion of 47 gross (44 net) wells from our oil properties. As of December 31, 2014, another 10 gross operated wells were awaiting completion.

The San Juan Basin is one of the oldest and most prolific coal bed methane plays in the world. The Fruitland coal bed extends to depths of approximately 4,200 feet with net thickness ranging from zero to 100 feet. The Mesaverde play is the top producing tight gas play in the basin with total thickness ranging from 500 to 2,500 feet. The Mesaverde is underlain by the upper Mancos Shale and overlain by the Lewis Shale. The Mancos Shale, locally referred to as the Gallup Sandstone, is found at a depth of approximately 5,400 feet and is fine-grained sandstone interval of approximately 150 feet thick. The Mancos Shale includes both oil and natural gas.

Some of our acreage in the San Juan Basin is leased to us by or with the approval of the federal government or its agencies, including the United States Forest Service, Bureau of Land Management (“BLM”), the Bureau of Indian Affairs, and the Federal Indian Minerals Office. These particular leases are subject to federal authority, including the National Environmental Policy Act, and require governmental agencies to evaluate the potential environmental impacts of a proposed project on government owned lands. These regulatory regimes impose obligations on the federal government and governmental agencies that may result in legal challenges and potentially lengthy delays in obtaining both permits to drill and rights of way.

Other Properties

Our other holdings, amounting to approximately 3 percent of our assets, are primarily comprised of gas reserves in the Appalachian Basin in Pennsylvania. Approximately 95 percent of our Appalachian Basin assets were sold in January 2015.

Acquisitions and Divestitures

On June 4, 2014, we announced that we had completed the sale of working interests in some of our historical Piceance Basin wells to Legacy Reserves LP for a sales price of $355 million subject to customary post-closing adjustments. Our undeveloped locations in the Piceance Basin were not included in the transaction, which was limited to a graduated working interest in certain of our proved developed producing wells drilled prior to 2009. The working interests represented approximately 300 Bcfe of proved reserves, or approximately 6 percent of our year-end 2013 proved reserves.

On August 18, 2014, we announced that we have agreed to sell our remaining mature, coalbed methane holdings in the Powder River Basin for $155 million in cash. We continue to negotiate the divestiture. The original sales agreement was scheduled to terminate February 13, 2015, but both parties agreed to extend the time table. If the agreement does not successfully close in March, WPX has the option to terminate the transaction. Additionally, we have recorded an impairment of $45 million in December 2014 to reduce the net assets to the probability weighted average of estimated sales prices that may be achieved. Reserves in the basin are estimated to be 200 Bcfe and fourth-quarter production was 143 MMcf per day, which includes operated and non-operated working interests in approximately 5,000 wells. Since 2011, our drilling activities in the basin have been minimal therefore resulting in declining production and production in the basin has amounted to less than 13 percent of our total domestic annual production in 2014. In our financial statements, we have reclassified our Powder River

6

operations as discontinued operations in accordance with the provisions of “Presentation of Financial Statements” in the Accounting Standards Codification.

On August 26, 2014, we announced that we closed an agreement to jointly develop nearly 400 future wells in our Trail Ridge properties in the Piceance Basin with TRDC LLC, a subsidiary of Houston-based G2X Energy. As part of the joint agreement, we received $40 million in cash for 49 percent of our working interest in approximately 100 proved developed producing Trail Ridge wells in the Piceance Basin. During the carry period we will pay 28 percent of the Trail Ridge development and receive 51 percent of the production and reserves until TRDC has completed its $170 million funding commitment. The joint development agreement is for the Williams Forks and Iles formations and does not include deeper opportunities in the Mancos and Niobrara shales.

On January 29, 2015, we announced that we had completed the disposition of our international interests upon the successful merger of Apco Oil and Gas International Inc. (“Apco”) with a subsidiary of privately held Pluspetrol Resources Corporation. We received approximately $294 million for the disposition of our 69 percent controlling equity interest in Apco. In connection with the transaction, we also sold additional Argentina-related assets to Pluspetrol. Together, these non-operated international holdings comprised less than 5 percent of our 2014 year-end proved reserves. In our financial statements, we have reclassified our international operations to discontinued operations in accordance with the provision of “Presentation of Financial Statements” in the Accounting Standards Codification.

On February 2, 2015, we announced that we had completed the sale of our operations in northeast Pennsylvania, including the release of certain firm transportation capacity, to Southwestern Energy Company, for approximately $300 million. The transaction included physical operations covering approximately 46,700 acres, roughly 50 million cubic feet per day of net natural gas production, and 63 operated horizontal wells, primarily in Susquehanna County, Pennsylvania. The transfer in the firm transportation capacity in connection with the sale resulted in our release from approximately $24 million per year in annual demand obligations associated with the transport.

In 2014, we executed multiple transactions to control approximately 53,000 additional acres in the heart of the San Juan Basin’s Gallup oil window. These transactions included 28 Bcfe of proved reserves. We may from time to time dispose of producing properties and undeveloped acreage positions if we believe they no longer fit into our strategic plan.

Title to Properties

Our title to properties is subject to royalty, overriding royalty, carried, net profits, working and other similar interests and contractual arrangements customary in the natural gas and oil industry, to liens for current taxes not yet due and to other encumbrances. In addition, leases on Native American reservations are subject to Bureau of Indian Affairs and other approvals unique to those locations. As is customary in the industry in the case of undeveloped properties, a limited investigation of record title is made at the time of acquisition. Drilling title opinions are usually prepared before commencement of drilling operations. We believe we have satisfactory title to substantially all of our active properties in accordance with standards generally accepted in the natural gas and oil industry. Nevertheless, we are involved in title disputes from time to time which can result in litigation and delay or loss of our ability to realize the benefits of our leases.

Reserves and Production Information

We have significant oil and gas producing activities primarily in the Piceance, Williston and San Juan Basins located in the United States. Prior to the divestiture in January 2015, we had international oil and gas producing activities, primarily in Argentina. Proved reserves related to international activities were less than 5 percent of our total international and domestic proved reserves as of December 31, 2014. Accordingly, unless specifically stated otherwise, the information in the remainder of this Item 1 relates only to the oil and gas activities in the United States.

7

Oil and Gas Reserves

The following table sets forth our estimated domestic net proved developed and undeveloped reserves expressed by product and on a natural gas equivalent basis for the reporting periods December 31, 2014, 2013 and 2012.

As of December 31, 2014 | |||||||||||||

Gas (MMcf) | Oil (Mbbls) | NGL (Mbbls) | Equivalent (MMcfe) | % | |||||||||

Proved Developed | 2,089,974 | 60,012 | 43,955 | 2,713,770 | 62% | ||||||||

Proved Undeveloped | 1,059,617 | 70,817 | 26,885 | 1,645,831 | 38% | ||||||||

Total Proved-Domestic | 3,149,591 | 130,829 | 70,840 | 4,359,601 | |||||||||

As of December 31, 2013 | |||||||||||||

Gas (MMcf) | Oil (Mbbls) | NGL (Mbbls) | Equivalent (MMcfe) | % | |||||||||

Proved Developed | 2,265,204 | 36,828 | 48,587 | 2,777,695 | 58% | ||||||||

Proved Undeveloped | 1,364,552 | 66,102 | 37,128 | 1,983,930 | 42% | ||||||||

Total Proved-Domestic | 3,629,756 | 102,930 | 85,715 | 4,761,625 | |||||||||

As of December 31, 2012 | |||||||||||||

Gas (MMcf) | Oil (Mbbls) | NGL (Mbbls) | Equivalent (MMcfe) | % | |||||||||

Proved Developed | 2,170,681 | 23,740 | 64,910 | 2,702,579 | 60% | ||||||||

Proved Undeveloped | 1,198,392 | 52,807 | 45,449 | 1,787,928 | 40% | ||||||||

Total Proved-Domestic | 3,369,073 | 76,547 | 110,359 | 4,490,507 | |||||||||

The following table sets forth our estimated domestic net proved reserves for our largest areas of activity expressed by product and on a gas equivalent basis as of December 31, 2014.

As of December 31, 2014 | |||||||||||

Gas (MMcf) | Oil (MBbls) | NGL (MBbls) | Equivalent (MMcfe) | ||||||||

Piceance Basin | 2,162,071 | 7,649 | 54,430 | 2,534,548 | |||||||

Williston Basin | 50,297 | 101,324 | 9,542 | 715,495 | |||||||

San Juan Basin | 426,263 | 21,778 | 6,647 | 596,812 | |||||||

Appalachian Basin(a) | 297,801 | — | — | 297,801 | |||||||

Powder River Basin(a) | 200,089 | — | — | 200,089 | |||||||

Other | 13,070 | 78 | 221 | 14,856 | |||||||

Total Proved-Domestic | 3,149,591 | 130,829 | 70,840 | 4,359,601 | |||||||

(a) | Includes assets held for sale as of December 31, 2014 (see Note 2 and Note 4 of Notes to Consolidated Financial Statements). |

We prepare our own reserves estimates and approximately 88 percent of our reserves are audited by Netherland, Sewell & Associates, Inc. (“NSAI”).

We have not filed on a recurring basis estimates of our total proved net oil, NGL, and gas reserves with any U.S. regulatory authority or agency other than with the U.S. Department of Energy and the SEC. The estimates furnished to the Department of Energy have been consistent with those furnished to the SEC.

Our 2014 year-end estimated proved reserves reflect an average natural gas price of $4.01 per Mcf, an average oil price of $83.62 per barrel and average NGL price of $40.40 per barrel. These prices were calculated from the 12-month average, first-of-the-month price for the applicable indices for each basin as adjusted for respective location price differentials. During 2014, we added 691 Bcfe of extensions and discoveries to our proved reserves. During 2014, we participated in the drilling of 479 gross wells at a net capital cost of approximately $1,454 million, which includes costs associated with exploratory wells.

8

Proved reserves reconciliation

The 691 Bcfe of extensions and discoveries reflects 189 Bcfe added for drilled locations and 502 Bcfe added for new proved undeveloped locations. The extensions and discoveries were primarily in the Piceance, Williston and San Juan Basins. The acquisitions of 37 Bcfe were primarily in the San Juan Basin. The divestitures of 377 Bcfe were primarily in the Piceance Basin. The overall net negative revisions of 325 Bcfe reflects 97 Bcfe of net positive revisions made to developed reserves and 422 Bcfe of net negative revisions made to undeveloped reserves.

Reserves estimation process

Our reserves are estimated by deterministic methods using an appropriate combination of production performance analysis and volumetric techniques. The proved reserves for economic undrilled locations are estimated by analogy or volumetrically from offset developed locations. Reservoir continuity and lateral pervasiveness of our tight-sands, shale and coal bed methane reservoirs is established by combinations of subsurface analysis and analysis of 2D and 3D seismic data and pressure data. Understanding reservoir quality may be augmented by core samples analysis.

The engineering staff of each basin asset team provides the reserves modeling and forecasts for their respective areas. Various departments also participate in the preparation of the year-end reserves estimate by providing supporting information such as pricing, capital costs, expenses, ownership, gas gathering and gas quality. The departments and their roles in the year-end reserves process are coordinated by our reserves analysis department. The reserves analysis department’s responsibilities also include performing an internal review of reserves data for reasonableness and accuracy, working with NSAI and the asset teams to successfully complete the reserves audit, finalizing the year-end reserves report and reporting reserves data to accounting.

The preparation of our year-end reserves report is a formal process. Early in the year, we begin with a review of the existing internal processes and controls to identify where improvements can be made from the prior year’s reporting cycle. Later in the year, the reserves staffs from the asset teams submit their preliminary reserves data to the reserves analysis department. After review by the reserves analysis department, the data is submitted to NSAI to begin their audits. Reserves data analysis and further review are then conducted and iterated between the asset teams, reserves analysis department and NSAI. In

9

early December, reserves are reviewed with senior management. The process concludes upon receipt of the audit letter from NSAI.

The reserves estimates resulting from our process are subjected to both internal and external controls to promote transparency and accuracy of the year-end reserves estimates. Our internal reserves analysis team is independent and does not work within an asset team or report directly to anyone on an asset team. The reserves analysis department provides detailed independent review and extensive documentation of the year-end process. Our internal processes and controls, as they relate to the year-end reserves, are reviewed and updated as appropriate. The compensation of our reserves analysis team is not directly linked to reserves additions or revisions except to the extent that reserves additions are a component of our all-employee incentive plan.

Approximately 88 percent of our total year-end 2014 domestic proved reserves estimates were audited by NSAI. When compared on a well-by-well basis, some of our estimates are greater and some are less than the NSAI estimates. NSAI is satisfied with our methods and procedures used to prepare the December 31, 2014 reserves estimates and future revenue, and noted nothing of an unusual nature that would cause NSAI to take exception with the estimates, in the aggregate, prepared by us. NSAI was founded in 1961 and performs consulting petroleum engineering services under Texas Board of Professional Engineers Registration No. F-2699. Within NSAI, the technical persons primarily responsible for auditing the estimates meet or exceed the education, training, and experience requirements set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers; both are proficient in judiciously applying industry standard practices to engineering and geoscience evaluations as well as applying SEC and other industry reserves definitions and guidelines.

The technical person primarily responsible for overseeing preparation of the reserves estimates and the third party reserves audit is our Director of Reserves and Production Services. The Director’s qualifications include 32 years of reserves evaluation experience, a B.S. in geology from the University of Texas at Austin, an M.S. in Physical Sciences from the University of Houston and membership in the American Association of Petroleum Geologists and The Society of Petroleum Engineers.

Proved undeveloped reserves

The majority of our reserves is concentrated in unconventional tight-sands, shale and coal bed gas reservoirs. We use available geoscience and engineering data to establish drainage areas and reservoir continuity beyond one direct offset from a producing well, which provides additional proved undeveloped reserves. Inherent in the methodology is a requirement for significant well density of economically producing wells to establish reasonable certainty. In fields where producing wells are less concentrated, generally only direct offsets from proved producing wells were assigned the proved undeveloped reserves classification. No new technologies were used to assign proved undeveloped reserves.

At December 31, 2014, our proved undeveloped reserves were 1,646 Bcfe, a decrease of 338 Bcfe from our December 31, 2013 proved undeveloped reserves estimate of 1,984 Bcfe and represents 38 percent of our total proved reserves. During 2014, 394 Bcfe of our December 31, 2013 proved undeveloped reserves were converted to proved developed reserves at a cost of $592 million. This represents a proved undeveloped conversion rate of 19.9 percent. Of the converted reserves, 69 percent were in the Piceance Basin primarily in the Williams Fork formations, 25 percent were in the Bakken and Three Forks formations in the Williston Basin, and the other 6 percent were in all other production areas combined.

In 2014, net revisions for our proved undeveloped reserves were 422 Bcfe. Net negative revisions of 363 Bcfe were due to a reduction in near-term drilling capital estimates and the related limitations imposed by the SEC five year rules. Of the 363 Bcfe, 62 percent relates to the Piceance Basin, 17 percent relates to our San Juan Basin legacy assets, 11 percent in our Williston Basin assets and 10 percent for all other production areas. Net downward revision of 122 Bcfe is primarily due to re-spacing and field studies in the Piceance, Appalachian and Williston Basins. Revisions due to economics resulted in net upward revisions of 23 Bcfe. Revisions to proved undeveloped reserves that were on the books at December 31, 2013 and December 31, 2014 show an upward increase of 40 Bcfe.

All proved undeveloped locations are scheduled to be drilled within the next five years based on current expectations. Development drilling schedules are subject to revision and reprioritization throughout the year resulting from unknown factors such as the relative success of individual developmental drilling prospects, rig availability, title issues or delays and the effect that acquisitions or dispositions may have on prioritizing developmental drilling plans for maximizing returns of capital spent.

10

Oil and Gas Production, Production Prices and Production Costs

Production Sales Data

The following table summarizes our net production sales volumes, including those in the Appalachian Basin, for the years indicated, but excludes our Powder River Basin and international operations which are classified as discontinued operations.

Year Ended December 31, | ||||||||

2014 | 2013 | 2012 | ||||||

Natural Gas (MMcf) | ||||||||

U.S. | ||||||||

Piceance Basin | 205,853 | 219,317 | 246,179 | |||||

Other | 74,533 | 76,617 | 74,983 | |||||

Total | 280,386 | 295,934 | 321,162 | |||||

Oil (Mbbls) | ||||||||

U.S. | ||||||||

Williston Basin | 7,123 | 4,828 | 3,487 | |||||

Other | 2,121 | 1,091 | 907 | |||||

Total | 9,244 | 5,919 | 4,394 | |||||

NGLs (Mbbls) | ||||||||

U.S. | ||||||||

Piceance Basin | 5,352 | 6,963 | 10,075 | |||||

Other | 898 | 452 | 317 | |||||

Total | 6,250 | 7,415 | 10,392 | |||||

Combined Equivalent Volumes (MMcfe) | 373,352 | 375,940 | 409,877 | |||||

Combined Equivalent Volumes (Mboe) | 62,225 | 62,657 | 68,313 | |||||

Average Daily Combined Equivalent Volumes (MMcfe/d) | ||||||||

U.S. | ||||||||

Piceance Basin | 663 | 727 | 852 | |||||

Other | 360 | 303 | 268 | |||||

Total | 1,023 | 1,030 | 1,120 | |||||

Net production sales data for our Powder River Basin and international operations are presented in the table below.

Year Ended December 31, | ||||||||

2014 | 2013 | 2012 | ||||||

Natural Gas (MMcf) | ||||||||

Powder River Basin | 55,042 | 63,529 | 76,321 | |||||

International | 7,423 | 6,534 | 7,061 | |||||

Total | 62,465 | 70,063 | 83,382 | |||||

Oil (Mbbls) | ||||||||

Powder River Basin | 1 | 8 | — | |||||

International | 2,142 | 2,032 | 2,178 | |||||

Total | 2,143 | 2,040 | 2,178 | |||||

NGLs (Mbbls) | ||||||||

Powder River Basin | — | 6 | — | |||||

International | 160 | 167 | 181 | |||||

Total | 160 | 173 | 181 | |||||

Combined Equivalent Volumes (MMcfe) | 76,286 | 83,347 | 97,539 | |||||

Combined Equivalent Volumes (Mboe) | 12,714 | 13,891 | 16,257 | |||||

11

Domestic realized average price per unit

The following table summarizes our domestic sales prices, including the Appalachian Basin, for the years indicated, but excludes our Powder River Basin operations which are classified as discontinued operations.

Year Ended December 31, | |||||||||||

2014 | 2013 | 2012 | |||||||||

Natural gas(a): | |||||||||||

Natural gas excluding all derivative settlements (per Mcf) | $ | 3.57 | $ | 3.01 | $ | 2.40 | |||||

Impact of hedges (per Mcf) | — | 0.02 | 1.32 | ||||||||

Natural gas including hedges (per Mcf) | 3.57 | 3.03 | 3.72 | ||||||||

Impact of net cash received (paid) related to settlement of derivatives not designated as hedges (per Mcf) | (0.10 | ) | (0.07 | ) | 0.04 | ||||||

Natural gas net price including all derivative settlements (per Mcf) | $ | 3.47 | $ | 2.96 | $ | 3.76 | |||||

Oil(a): | |||||||||||

Oil excluding all derivative settlements (per barrel) | $ | 78.32 | $ | 90.21 | $ | 83.34 | |||||

Impact of hedges (per barrel) | — | — | 2.23 | ||||||||

Oil including hedges (per barrel) | 78.32 | 90.21 | 85.57 | ||||||||

Impact of net cash received (paid) related to settlement of derivatives not designated as hedges (per barrel) | 2.01 | 1.52 | 0.35 | ||||||||

Oil net price including all derivative settlements (per barrel) | $ | 80.33 | $ | 91.73 | $ | 85.92 | |||||

NGL(a): | |||||||||||

NGL excluding all derivative settlements (per barrel) | $ | 32.79 | $ | 30.72 | $ | 28.56 | |||||

Impact of net cash received (paid) related to settlement of derivatives not designated as hedges (per barrel) | 1.12 | 0.08 | 1.56 | ||||||||

NGL net price including all derivative settlements (per barrel) | $ | 33.91 | $ | 30.80 | $ | 30.12 | |||||

Combined commodity price per Mcfe, including all derivative settlements | $ | 5.17 | $ | 4.41 | $ | 4.55 | |||||

__________

(a) Realized average prices reflect market prices, net of fuel, shrink, transportation and fractionation, and processing.

Domestic expenses per Mcfe

The following table summarizes our domestic costs, including costs in the Appalachian Basin, for the years indicated and excludes our Powder River Basin operations which are classified as discontinued operations.

Year Ended December 31, | |||||||||||

2014 | 2013 | 2012 | |||||||||

Production costs: | |||||||||||

Lifting costs and workovers | $ | 0.53 | $ | 0.47 | $ | 0.40 | |||||

Facilities operating expense | 0.06 | 0.07 | 0.04 | ||||||||

Other operating and maintenance | 0.06 | 0.06 | 0.05 | ||||||||

Total LOE | $ | 0.65 | $ | 0.60 | $ | 0.49 | |||||

Gathering, processing and transportation charges | 0.88 | 0.93 | 1.06 | ||||||||

Taxes other than income | 0.34 | 0.27 | 0.17 | ||||||||

Total production cost | $ | 1.87 | $ | 1.80 | $ | 1.72 | |||||

General and administrative | $ | 0.73 | $ | 0.71 | $ | 0.65 | |||||

Depreciation, depletion and amortization | $ | 2.17 | $ | 2.28 | $ | 2.16 | |||||

12

Productive Oil and Gas Wells

The table below summarizes 2014 productive gross and net wells by area. We use the term “gross” to refer to all wells or acreage in which we have at least a partial working interest and “net” to refer to our ownership represented by that working interest.

Gas Wells (Gross) | Gas Wells (Net) | Oil Wells (Gross) | Oil Wells (Net) | ||||||||

Piceance Basin | 5,060 | 3,502 | — | — | |||||||

Williston Basin | — | — | 196 | 138 | |||||||

San Juan Basin | 3,174 | 875 | 90 | 82 | |||||||

Appalachian Basin(a) | 168 | 87 | — | — | |||||||

Powder River Basin(a) | 5,124 | 2,189 | — | — | |||||||

Other (b) | 1,138 | 22 | 7 | — | |||||||

Total | 14,664 | 6,675 | 293 | 220 | |||||||

(a) | Includes assets held for sale as of December 31, 2014 (see Note 2 and Note 4 of Notes to Consolidated Financial Statements). |

(b) | Includes Green River Basin and other miscellaneous properties. |

At December 31, 2014, there were 228 gross and 103 net producing wells with multiple completions.

Developed and Undeveloped Acreage

The following table summarizes our leased acreage as of December 31, 2014.

Developed | Undeveloped | Total | |||||||||||||||

Gross Acres | Net Acres | Gross Acres | Net Acres | Gross Acres | Net Acres | ||||||||||||

Piceance Basin | 157,973 | 121,959 | 103,014 | 74,190 | 260,988 | 196,149 | |||||||||||

Williston Basin | 64,419 | 56,760 | 68,199 | 28,723 | 132,618 | 85,483 | |||||||||||

San Juan Basin | 239,404 | 130,485 | 94,587 | 80,656 | 333,991 | 211,141 | |||||||||||

Appalachian Basin(a) | 37,970 | 27,995 | 65,069 | 51,547 | 103,038 | 79,541 | |||||||||||

Powder River Basin(a) | 595,822 | 268,567 | 166,216 | 72,431 | 762,038 | 340,998 | |||||||||||

Other (b) | 31,105 | 6,215 | 377,719 | 275,189 | 408,824 | 281,404 | |||||||||||

Total | 1,126,693 | 611,981 | 874,804 | 582,736 | 2,001,497 | 1,194,716 | |||||||||||

__________

(a) | Includes assets held for sale as of December 31, 2014 (see Note 2 and Note 4 of Notes to Consolidated Financial Statements). |

(b) | Includes exploratory acreage in Montana, Wyoming, Kansas and other miscellaneous smaller properties. |

Drilling and Exploratory Activities

We focus on lower-risk development drilling. Our development drilling success rate was 100 percent in 2014, 2013 and 2012. Our combined development and exploration success rate was 99 percent in 2014, and 100 percent in 2013 and 2012.

13

The following table summarizes the number of domestic wells drilled for the periods indicated.

2014 | 2013 | 2012 | |||||||||||||||

Gross Wells | Net Wells | Gross Wells | Net Wells | Gross Wells | Net Wells | ||||||||||||

Development wells: | |||||||||||||||||

Piceance Basin | 267 | 250 | 249 | 236 | 239 | 208 | |||||||||||

Williston Basin | 55 | 45 | 51 | 36 | 41 | 27 | |||||||||||

San Juan Basin | 47 | 44 | 9 | 9 | 11 | 6 | |||||||||||

Appalachian Basin(a) | 25 | 7 | 37 | 24 | 54 | 33 | |||||||||||

Powder River Basin(a) | 61 | 22 | 37 | 16 | 150 | 92 | |||||||||||

Other(b) | 17 | — | 24 | — | 52 | — | |||||||||||

Productive | 472 | 368 | 407 | 321 | 547 | 366 | |||||||||||

Nonproductive | — | — | — | — | — | — | |||||||||||

Development well total | 472 | 368 | 407 | 321 | 547 | 366 | |||||||||||

Exploration wells: | |||||||||||||||||

Productive | 2 | 2 | 9 | 9 | 1 | 1 | |||||||||||

Nonproductive(c) | 5 | 5 | — | — | — | — | |||||||||||

Exploration well total | 7 | 7 | 9 | 9 | 1 | 1 | |||||||||||

Total Drilled | 479 | 375 | 416 | 330 | 548 | 367 | |||||||||||

__________

(a) | Includes assets held for sale as of December 31, 2014 (see Note 2 and Note 4 of Notes to Consolidated Financial Statements). |

(b) | Includes Green River Basin and other miscellaneous properties. |

(c) | Reflects exploration wells which were drilled and not completed. |

Total gross operated wells drilled were 369, 361 and 423 in 2014, 2013 and 2012, respectively.

Present Activities

At December 31, 2014, we had 12 gross (11 net) wells in the process of being drilled. As previously noted in Significant Properties, we also have a large number of wells that are awaiting completion.

14

Scheduled Lease Expirations

The table below sets forth, as of December 31, 2014, the gross and net acres scheduled to expire over the next several years. The acreage will not expire if we are able to establish production by drilling wells on the lease prior to the expiration date.

2015 | 2016 | 2017 | 2018+ | Total | ||||||||||

Piceance Basin | 777 | 5,782 | 14 | 11,746 | 18,319 | |||||||||

Williston Basin | 146 | 160 | 280 | 1,587 | 2,173 | |||||||||

San Juan Basin | 160 | 1,122 | 5,603 | 35,809 | 42,694 | |||||||||

Appalachian Basin(a) | 23,020 | 16,944 | 4,925 | 9,297 | 54,186 | |||||||||

Powder River Basin(a) | 660 | 39 | 1,640 | 27 | 2,366 | |||||||||

Other(b) | 54,135 | 62,131 | 132,469 | 93,085 | 341,820 | |||||||||

Total (Gross Acres) | 78,898 | 86,178 | 144,931 | 151,551 | 461,558 | |||||||||

2015 | 2016 | 2017 | 2018+ | Total | ||||||||||

Piceance Basin | 396 | 4,966 | 14 | 10,865 | 16,241 | |||||||||

Williston Basin | 86 | 160 | 200 | 1,583 | 2,029 | |||||||||

San Juan Basin | 144 | 1,122 | 5,603 | 35,359 | 42,228 | |||||||||

Appalachian Basin(a) | 20,153 | 13,984 | 4,209 | 5,086 | 43,432 | |||||||||

Powder River Basin(a) | 342 | 19 | 820 | 14 | 1,195 | |||||||||

Other(b) | 43,987 | 46,363 | 89,103 | 83,583 | 263,036 | |||||||||

Total (Net Acres) | 65,108 | 66,614 | 99,949 | 136,490 | 368,161 | |||||||||

__________

(a) | Includes assets held for sale as of December 31, 2014 (see Note 2 and Note 4 of Notes to Consolidated Financial Statements). |

(b) | Includes Green River Basin and other miscellaneous properties. |

Gas Management

Our sales and marketing activities include the sale of our natural gas, oil and NGL production along with third-party purchases and sales of natural gas, which includes natural gas purchased from working interest owners in operated wells and other area third-party producers. Our sales and marketing activities also include the management of various natural gas related contracts such as transportation, storage and related price risk management activity. We primarily engage in these activities to enhance the value received from the sale of our natural gas and oil production. Revenues associated with the sale of our production are recorded in product revenues. The revenues and expenses related to other marketing activities are reported on a gross basis as part of gas management revenues and costs and expenses. Transportation capacity demand payments associated with contracts that are currently not utilized to support our development activities are captured as an expense item in gas management.

Purchase Commitments

In December 2010, we entered a long-term obligation to purchase 200,000 MMBtu per day of natural gas at Transco Station 515 (Marcellus Shale) priced at market prices from a third party. Purchases under the 12-year contract began in January 2012. We expect to sell this natural gas in the open market and may utilize available transportation capacity to facilitate the sales.

Seasonality

Generally, the demand for natural gas decreases during the spring and fall months and increases during the winter months and in some areas during the summer months. Seasonal anomalies such as mild winters or hot summers can lessen or intensify this fluctuation. Conversely, during extreme weather events such as blizzards, hurricanes, or heat waves, pipeline systems can become temporarily constrained thus amplifying localized price volatility. In addition, pipelines, utilities, local distribution companies and industrial users utilize natural gas storage facilities and purchase some of their anticipated winter requirements during the summer months. This can lessen seasonal demand fluctuations. World weather and resultant prices for liquefied natural gas can also affect deliveries of competing liquefied natural gas into this country from abroad, affecting the price of

15

domestically produced natural gas. In addition, adverse weather conditions can also affect our production rates or otherwise disrupt our operations.

Hedging Activity

To manage the commodity price risk and volatility associated with owning producing natural gas, crude oil and NGL properties, we enter into derivative contracts for a portion of our expected future production. See further discussion in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Customers

Natural gas, oil and NGL production is sold through our sales and marketing activities to a variety of purchasers under various length contracts ranging from one day to multi-year under various pricing structures. Our third-party customers include other producers, utility companies, power generators, banks, marketing and trading companies and midstream service providers. In 2014, natural gas sales to BP Energy Company accounted for approximately 13 percent of our consolidated revenues. We believe that the loss of one or more of our current natural gas, oil or NGLs purchasers would not have a material adverse effect on our ability to sell our production, because any individual purchaser could be readily replaced by other purchasers, absent a broad market disruption.

REGULATORY MATTERS

The oil and natural gas industry is extensively regulated by numerous federal, state, local and foreign authorities, including Native American tribes in the United States. Legislation affecting the oil and natural gas industry is under constant review for amendment or expansion, frequently increasing the regulatory burden. Also, numerous departments and agencies, both federal and state, and Native American tribes are authorized by statute to issue rules and regulations binding on the oil and natural gas industry and its individual members, some of which carry substantial penalties for noncompliance. Although the regulatory burden on the oil and natural gas industry increases our cost of doing business and, consequently, affects our profitability, these burdens generally do not affect us any differently or to any greater or lesser extent than they affect other companies in the industry with similar types, quantities and locations of production.

The availability, terms and cost of transportation significantly affect sales of oil and natural gas. The interstate transportation and sale for resale of oil and natural gas is subject to federal regulation, including regulation of the terms, conditions and rates for interstate transportation, storage and various other matters, primarily by the FERC. Federal and state regulations govern the price and terms for access to oil and natural gas pipeline transportation. The FERC’s regulations for interstate oil and natural gas transmission in some circumstances may also affect the intrastate transportation of oil and natural gas.

Although oil and natural gas prices are currently unregulated, Congress historically has been active in the area of oil and natural gas regulation. We cannot predict whether new legislation to regulate oil and natural gas might be proposed, what proposals, if any, might actually be enacted by Congress or the various state legislatures, and what effect, if any, the proposals might have on our operations. Sales of natural gas, oil, condensate and NGLs are not currently regulated and are made at market prices.

Drilling and Production

Our operations are subject to various types of regulation at federal, state, local and Native American tribal levels. These types of regulation include requiring permits for the drilling of wells, drilling bonds and reports concerning operations. Most states, and some counties, municipalities and Native American tribal areas where we operate also regulate one or more of the following activities:

• | the location of wells; |

• | the method of drilling and casing wells; |

• | the timing of construction or drilling activities including seasonal wildlife closures; |

• | the employment of tribal members or use of tribal owned service businesses; |

• | the rates of production or “allowables”; |

• | the surface use and restoration of properties upon which wells are drilled; |

• | the plugging and abandoning of wells; |

• | the notice to surface owners and other third parties; and |

• | the use, maintenance and restoration of roads and bridges used during all phases of drilling and production. |

16

State laws regulate the size and shape of drilling and spacing units or proration units governing the pooling of oil and natural gas properties. Some states allow forced pooling or integration of tracts to facilitate exploration while other states rely on voluntary pooling of lands and leases. In some instances, forced pooling or unitization may be implemented by third parties and may reduce our interest in the unitized properties. In addition, state conservation laws establish maximum rates of production from oil and natural gas wells, generally prohibit the venting or flaring of natural gas and impose requirements regarding the ratability of production. These laws and regulations may limit the amount of oil and natural gas we can produce from our wells or limit the number of wells or the locations at which we can drill. Moreover, each state generally imposes a production or severance tax with respect to the production and sale of natural gas, oil and NGLs within its jurisdiction. States do not regulate wellhead prices or engage in other similar direct regulation, but there can be no assurance that they will not do so in the future. The effect of such future regulations may be to limit the amounts of oil and natural gas that may be produced from our wells, negatively affect the economics of production from these wells, or to limit the number of locations we can drill.

Federal, state and local regulations provide detailed requirements in areas where we operate for the abandonment of wells, closure or decommissioning of production facilities and pipelines, and site restoration. Most states have an administrative agency that requires the posting of performance bonds to fulfill financial requirements for owners and operators on state land. The Army Corps of Engineers and many other state and local authorities also have regulations for plugging and abandonment, decommissioning and site restoration. Although the Army Corps of Engineers does not require bonds or other financial assurances, some state agencies and municipalities do have such requirements.

Natural Gas Sales and Transportation

Historically, federal legislation and regulatory controls have affected the price of the natural gas we produce and the manner in which we market our production. The FERC has jurisdiction over the transportation and sale for resale of natural gas in interstate commerce by natural gas companies under the Natural Gas Act of 1938 and the Natural Gas Policy Act of 1978. Various federal laws enacted since 1978 have resulted in the complete removal of all price and non-price controls for sales of domestic natural gas sold in first sales, which include all of our own production. Under the Energy Policy Act of 2005, the FERC has substantial enforcement authority to prohibit the manipulation of natural gas markets and enforce its rules and orders, including the ability to assess substantial civil penalties.

The FERC also regulates interstate natural gas transportation rates and service conditions and establishes the terms under which we may use interstate natural gas pipeline capacity, which affects the marketing of natural gas that we produce, as well as the revenues we receive for sales of our natural gas and release of our natural gas pipeline capacity. Commencing in 1985, the FERC promulgated a series of orders, regulations and rule makings that significantly fostered competition in the business of transporting and marketing natural gas. Today, interstate pipeline companies are required to provide nondiscriminatory transportation services to producers, marketers and other shippers, regardless of whether such shippers are affiliated with them. The FERC’s initiatives have led to the development of a competitive, open access market for natural gas purchases and sales that permits all purchasers of natural gas to buy directly from third-party sellers other than pipelines. However, the natural gas industry historically has been very heavily regulated; therefore, we cannot guarantee that the less stringent regulatory approach currently pursued by the FERC and Congress will continue indefinitely into the future nor can we determine what effect, if any, future regulatory changes might have on our natural gas related activities.

Under the FERC’s current regulatory regime, transmission services must be provided on an open-access, nondiscriminatory basis at cost-based rates or at market-based rates if the transportation market at issue is sufficiently competitive. Gathering service, which occurs upstream of jurisdictional transmission services, is regulated by the states onshore and in state waters. Although its policy is still in flux, the FERC has in the past reclassified certain jurisdictional transmission facilities as non-jurisdictional gathering facilities, which has the tendency to increase our costs of transporting natural gas to point-of-sale locations.

Oil Sales and Transportation

Sales of crude oil, condensate and NGLs are not currently regulated and are made at negotiated prices. Nevertheless, Congress could reenact price controls in the future.

Our crude oil sales are affected by the availability, terms and cost of transportation. The transportation of oil in common carrier pipelines is also subject to rate regulation. The FERC regulates interstate oil pipeline transportation rates under the Interstate Commerce Act and intrastate oil pipeline transportation rates are subject to regulation by state regulatory commissions. The basis for intrastate oil pipeline regulation, and the degree of regulatory oversight and scrutiny given to intrastate oil pipeline rates, varies from state to state. Insofar as effective interstate and intrastate rates are equally applicable to all comparable shippers, we believe that the regulation of oil transportation rates will not affect our operations in any way that is of material difference from those of our competitors.

17

Further, interstate and intrastate common carrier oil pipelines must provide service on a non-discriminatory basis. Under this open access standard, common carriers must offer service to all shippers requesting service on the same terms and under the same rates. When oil pipelines operate at full capacity, access is governed by prorating provisions set forth in the pipelines’ published tariffs. Accordingly, we believe that access to oil pipeline transportation services generally will be available to us to the same extent as to our competitors.

Operation on Native American Reservations

A portion of our leases are, and some of our future leases may be, regulated by Native American tribes. In addition to regulation by various federal, state, and local agencies and authorities, an entirely separate and distinct set of laws and regulations applies to lessees, operators and other parties within the boundaries of Native American reservations in the United States. Various federal agencies within the U.S. Department of the Interior, particularly the Bureau of Indian Affairs, the Office of Natural Resources Revenue and BLM, and the Environmental Protection Agency (“EPA”), together with each Native American tribe, promulgate and enforce regulations pertaining to oil and gas operations on Native American reservations. These regulations include lease provisions, royalty matters, drilling and production requirements, environmental standards, tribal employment contractor preferences and numerous other matters.

Native American tribes are subject to various federal statutes and oversight by the Bureau of Indian Affairs and BLM. However, each Native American tribe is a sovereign nation and has the right to enact and enforce certain other laws and regulations entirely independent from federal, state and local statutes and regulations, as long as they do not supersede or conflict with such federal statutes. These tribal laws and regulations include various fees, taxes, requirements to employ Native American tribal members or use tribal owned service businesses and numerous other conditions that apply to lessees, operators and contractors conducting operations within the boundaries of a Native American reservation. Further, lessees and operators within a Native American reservation are often subject to the Native American tribal court system, unless there is a specific waiver of sovereign immunity by the Native American tribe allowing resolution of disputes between the Native American tribe and those lessees or operators to occur in federal or state court.

Therefore, we are subject to various laws and regulations pertaining to Native American tribal surface ownership, Native American oil and gas leases, fees, taxes and other burdens, obligations and issues unique to oil and gas ownership and operations within Native American reservations. One or more of these requirements, or delays in obtaining necessary approvals or permits pursuant to these regulations, may increase our costs of doing business on Native American tribal lands and have an impact on the economic viability of any well or project on those lands.

ENVIRONMENTAL MATTERS

Our operations are subject to numerous federal, state, local, Native American tribal and foreign laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. Applicable U.S. federal environmental laws include, but are not limited to, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), the Clean Water Act (“CWA”) and the Clean Air Act (“CAA”). These laws and regulations govern environmental cleanup standards, require permits for air, water, underground injection, solid and hazardous waste disposal and set environmental compliance criteria. In addition, state and local laws and regulations set forth specific standards for drilling wells, the maintenance of bonding requirements in order to drill or operate wells, the spacing and location of wells, the method of drilling and casing wells, the surface use and restoration of properties upon which wells are drilled, the plugging and abandoning of wells, and the prevention and cleanup of pollutants and other matters. We maintain insurance against costs of clean-up operations, but we are not fully insured against all such risks. Additionally, Congress and federal and state agencies frequently revise the environmental laws and regulations, and any changes that result in delay or more stringent and costly permitting, waste handling, disposal and clean-up requirements for the oil and gas industry could have a significant impact on our operating costs. Although future environmental obligations are not expected to have a material impact on the results of our operations or financial condition, there can be no assurance that future developments, such as increasingly stringent environmental laws or enforcement thereof, will not cause us to incur material environmental liabilities or costs.

Public and regulatory scrutiny of the energy industry has resulted in increased environmental regulation and enforcement being either proposed or implemented. For example, EPA’s 2011 – 2013 and 2014 – 2016 National Enforcement Initiatives include Energy Extraction and “Assuring Energy Extraction Activities Comply with Environmental Laws.” According to the EPA’s website, “some techniques for natural gas extraction pose a significant risk to public health and the environment.” To address these concerns, the EPA’s goal is to “address incidences of noncompliance from natural gas extraction and production activities that may cause or contribute to significant harm to public health and/or the environment.” The EPA has emphasized that this initiative will be focused on those areas of the country where energy extraction activities are concentrated, and the focus and nature of the enforcement activities will vary with the type of activity and the related pollution problem presented.

18

This initiative could involve a large scale investigation of our facilities and processes, and could lead to potential enforcement actions, penalties or injunctive relief against us.

Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal fines and penalties and the imposition of injunctive relief. Accidental releases or spills may occur in the course of our operations, and we cannot assure you that we will not incur significant costs and liabilities as a result of such releases or spills, including any third-party claims for damage to property, natural resources or persons. Although we believe that we are in substantial compliance with applicable environmental laws and regulations and that continued compliance with existing requirements will not have a material adverse impact on us, there can be no assurance that this will continue in the future.

The environmental laws and regulations that could have a material impact on the oil and natural gas exploration and production industry and our business are as follows:

Hazardous Substances and Wastes. CERCLA, also known as the “Superfund law,” imposes liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the owner or operator of the disposal site or sites where the release occurred and companies that transported or disposed or arranged for the transport or disposal of the hazardous substances found at the site. Persons who are or were responsible for releases of hazardous substances under CERCLA may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment and for damages to natural resources, and it is not uncommon for neighboring landowners and other third parties to file corresponding common law claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment.

The Resource Conservation and Recovery Act (“RCRA”) generally does not regulate wastes generated by the exploration and production of natural gas and oil. RCRA specifically excludes from the definition of hazardous waste “drilling fluids, produced waters and other wastes associated with the exploration, development or production of crude oil, natural gas or geothermal energy.” However, legislation has been proposed in Congress from time to time that would reclassify certain natural gas and oil exploration and production wastes as “hazardous wastes,” which would make the reclassified wastes subject to much more stringent handling, disposal and clean-up requirements. If such legislation were to be enacted, it could have a significant impact on our operating costs, as well as the natural gas and oil industry in general. Moreover, ordinary industrial wastes, such as paint wastes, waste solvents, laboratory wastes and waste oils, may be regulated as hazardous waste.

We own or lease, and have in the past owned or leased, onshore properties that for many years have been used for or associated with the exploration and production of natural gas and oil. Although we have utilized operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed of or released on or under the properties owned or leased by us on or under other locations where such wastes have been taken for disposal. In addition, a portion of these properties have been operated by third parties whose treatment and disposal or release of wastes was not under our control. These properties and the wastes disposed thereon may be subject to CERCLA, the CWA, RCRA and analogous state laws. Under such laws, we could be required to remove or remediate previously disposed wastes (including waste disposed of or released by prior owners or operators) or property contamination (including groundwater contamination by prior owners or operators), or to perform remedial plugging or closure operations to prevent future contamination.

Waste Discharges. The CWA and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA and regulations implemented thereunder also prohibit the discharge of dredge and fill material into regulated waters, including jurisdictional wetlands, unless authorized by an appropriately issued permit. Spill prevention, control and countermeasure requirements of federal laws require appropriate containment berms and similar structures to help prevent the contamination of navigable waters by a petroleum hydrocarbon tank spill, rupture or leak. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Federal and state regulatory agencies can impose administrative, civil and criminal penalties as well as other enforcement mechanisms for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations. On February 16, 2012, the EPA issued the final 2012 construction general permit (“CGP”) for stormwater discharges from construction activities involving more than one acre, which will provide coverage for a five-year period. The 2012 CGP modifies the prior CGP to implement the new Effluent Limitations Guidelines and New Source Performance Standards for the Construction and Development Industry. The new rule includes new and more stringent restrictions on erosion and sediment control, pollution prevention and stabilization, although a numeric turbidity limit for certain larger construction sites has been stayed as of January 4, 2011.

19

Air Emissions. The CAA and associated state laws and regulations restrict the emission of air pollutants from many sources, including oil and gas operations. New facilities may be required to obtain permits before construction can begin, and existing facilities may be required to obtain additional permits and incur capital costs in order to remain in compliance. More stringent regulations governing emissions of toxic air pollutants and greenhouse gases (“GHGs”) have been developed by the EPA and may increase the costs of compliance for some facilities. In 2012, the EPA issued federal regulations affecting our operations under the New Source Performance Standards provisions (new Subpart OOOO) and expanded regulations under national emission standards for hazardous air pollutants, although implementation of some of the more rigorous requirements is not required until 2015.

Oil Pollution Act. The Oil Pollution Act of 1990, as amended (“OPA”), and regulations thereunder impose a variety of requirements on “responsible parties” related to the prevention of oil spills and liability for damages resulting from such spills in United States waters. A “responsible party” includes the owner or operator of an onshore facility, pipeline or vessel, or the lessee or permittee of the area in which an offshore facility is located. OPA assigns liability to each responsible party for oil cleanup costs and a variety of public and private damages. While liability limits apply in some circumstances, a party cannot take advantage of liability limits if the spill was caused by gross negligence or willful misconduct or resulted from violation of a federal safety, construction or operating regulation. If the party fails to report a spill or to cooperate fully in the cleanup, liability limits likewise do not apply. Few defenses exist to the liability imposed by OPA. OPA imposes ongoing requirements on a responsible party, including the preparation of oil spill response plans and proof of financial responsibility to cover environmental cleanup and restoration costs that could be incurred in connection with an oil spill.