Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - LANNETT CO INC | lci-20200630xex32.htm |

| EX-31.2 - EX-31.2 - LANNETT CO INC | lci-20200630ex312aaf0ad.htm |

| EX-31.1 - EX-31.1 - LANNETT CO INC | lci-20200630ex3111d1d02.htm |

| EX-23.1 - EX-23.1 - LANNETT CO INC | lci-20200630ex23174efe0.htm |

| EX-21.1 - EX-21.1 - LANNETT CO INC | lci-20200630ex211a682b4.htm |

| EX-10.63 - EX-10.63 - LANNETT CO INC | lci-20200630ex1063a66fd.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

⌧ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2020

OR

◻ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-31298

LANNETT COMPANY, INC.

(Exact name of registrant as specified in its charter)

State of Delaware | 23-0787699 |

State of Incorporation | I.R.S. Employer I.D. No. |

9000 State Road

Philadelphia, Pennsylvania 19136

Registrant’s telephone number, including area code: (215) 333-9000

(Address of principal executive offices and telephone number)

Securities registered under Section 12(b) of the Exchange Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, $0.001 par value | | LCI | | New York Stock Exchange |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ◻ | Accelerated filer ⌧ |

| |

Non-accelerated filer ◻ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ⌧

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12B-12 of the Exchange Act). Yes ◻ No ⌧

Aggregate market value of common stock held by non-affiliates of the registrant, as of December 31, 2019 was $277,527,086 based on the closing price of the stock on the NYSE.

As of July 31, 2020, there were 40,220,659 shares of the registrant’s common stock, $.001 par value, outstanding.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. Any statements made in this Annual Report that are not statements of historical fact or that refer to estimated or anticipated future events are forward-looking statements. We have based our forward-looking statements on management’s beliefs and assumptions based on information available to them at this time. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “continue,” or “pursue,” or the negative other variations thereof or comparable terminology, are intended to identify forward-looking statements. Such forward-looking statements reflect our current perspective of our business, future performance, existing trends and information as of the date of this filing. These include, but are not limited to our beliefs about future revenue and expense levels, growth rates, prospects related to our strategic initiatives and business strategies, express or implied assumptions about government regulatory action or inaction, anticipated product approvals and launches, business initiatives and product development activities, assessments related to clinical trial results, product performance and competitive environment, anticipated financial performance, integration of acquisitions and the impact of the nonrenewal of the exclusive distribution agreement with Jerome Stevens Pharmaceuticals on our future business and prospects. The statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. We caution the reader that certain important factors may affect our actual operating results and could cause such results to differ materially from those expressed or implied by forward-looking statements. Lannett is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events or otherwise and other events or factors, many of which are beyond our control, including those resulting from such events, or the prospect of such events, such as public health issues including health epidemics or pandemics, such as the recent outbreak of the novel coronavirus (“COVID-19”), whether occurring in the United States or elsewhere, which could disrupt our operations, disrupt the operations of our suppliers and business development and other strategic partners, disrupt the global financial markets or result in political or economic instability. We believe the risks and uncertainties discussed under the “Item 1A - Risk Factors” and other risks and uncertainties detailed herein and from time to time in our SEC filings may affect our actual results.

We disclaim any obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. We also may make additional disclosures in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and in other filings that we may make from time to time with the SEC. Other factors besides those listed here could also adversely affect us.

3

ITEM 1. DESCRIPTION OF BUSINESS

Business Overview

Lannett Company, Inc. and subsidiaries (the “Company,” “Lannett,” “we,” or “us”) was incorporated in 1942 under the laws of the Commonwealth of Pennsylvania and reincorporated in 1991 as a Delaware corporation. We primarily develop, manufacture, market and distribute generic versions of brand pharmaceutical products. We report financial information on a quarterly and fiscal year basis with the most recent being the fiscal year ended June 30, 2020. All references herein to a “fiscal year” or “Fiscal” refer to the applicable fiscal year ended June 30.

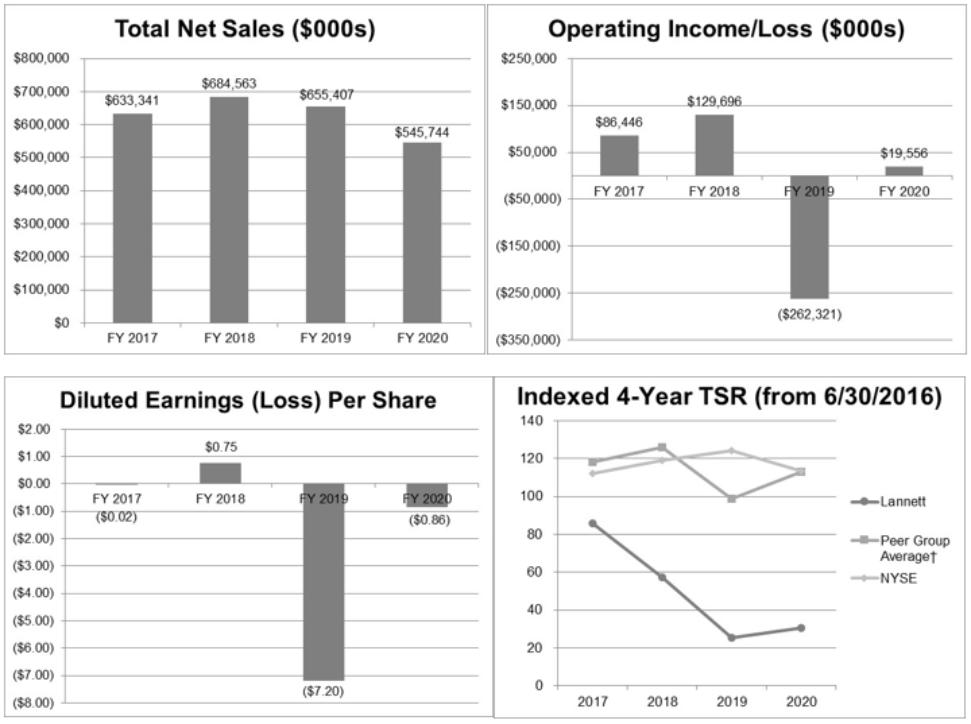

The Company has experienced total net sales growth at a compounded annual growth rate in excess of 22% over the past 18 years. In that time period, total net sales increased from $12.1 million in fiscal year 2001 to $545.7 million in fiscal year 2020. This growth has been achieved through filing and receiving approvals for abbreviated new drug applications (“ANDAs”), strategic partnerships and launches of additional manufactured drugs, opportunities resulting from our strong historical record of regulatory compliance, as well as the acquisitions of Silarx Pharmaceuticals, Inc. (“Silarx”) and Kremers Urban Pharmaceuticals Inc. (“KUPI”) in 2015.

Most products that we currently manufacture and/or distribute are prescription products. Our top five products in fiscal years 2020, 2019 and 2018 accounted for 45%, 52% and 58% of total net sales, respectively. On March 23, 2019, the Company’s distribution agreement with Jerome Stevens Pharmaceuticals (the “JSP Distribution Agreement”) expired and was not renewed. Accordingly, top product concentration rates declined in Fiscal 2020. Net sales of JSP products, primarily Levothyroxine Sodium Tablets USP, which was one of our top five products in fiscal 2019, totaled $202.5 million and $253.1 million in fiscal years 2019 and 2018, respectively, or 31% and 37% of total net sales, respectively.

Competitive Strengths

Management. We have been focused on maintaining and augmenting the quality of our management team in anticipation of continuing growth. As part of our growth, we have established corporate and non-corporate officer positions. We have hired experienced personnel from large, established, brand pharmaceutical companies as well as competing generic companies to complement the skills and knowledge of the existing management team. As we continue to grow, additional personnel may need to be added to our management team. We intend to hire the best people available to expand the knowledge base and expertise within our team.

Market Orientation. We believe that our success depends on our ability to properly assess the competitive market for new products, including customer interest, the number of competitors, market share opportunity and the generic unit price erosion. We intend to reduce our exposure to competitive influences that may negatively affect our sales and profits, including the potential saturation of the market for certain products, by continuing to emphasize a strong product selection process with an orientation to internal development in which we have technological and manufacturing expertise and external development partnerships to access other technologies and associated manufacturing capacity as well as risk-sharing.

Dependable U.S. Based Supplier to our Customers. We believe we are viewed by our customers as a strong, dependable supplier due in part to our agile and reliable operations network, as well as having a less complex manufacturing/supply chain based mostly within the U.S. We have cultivated productive customer relationships by focusing on what is important to them and their patients, along with maintaining adequate inventory levels, employing a responsive order filling system and prioritizing timely fulfillment of those orders. A majority of our orders are filled and shipped on or the day after we receive the order.

Reputation for Regulatory Compliance. We have a strong track record of regulatory compliance. We believe that we have effective regulatory compliance capabilities and practices due to: (1) the hiring of qualified individuals, (2) the implementation of comprehensive Standard Operating Procedures (“SOP”) and (3) adherence to current Good

4

Manufacturing Practices (“cGMP”). Our agility in responding quickly to market events and a reputation for regulatory compliance positions us to avail ourselves of market opportunities as they materialize.

We continue to pursue “Quality by Design” for improving and maintaining product quality in our pharmaceutical development and manufacturing facilities, which is outlined in the Food and Drug Administration (the “FDA”) report entitled, “Pharmaceutical Quality for the 21st Century: A Risk-Based Approach.” The FDA periodically inspects our operations to determine our compliance with applicable laws and regulations. During an inspection, the FDA may issue an inspection report , entitled a “Form 483,” containing potentially objectionable observations arising from an inspection. Additionally, at the close of each inspection, FDA will issue an Establishment Inspection Report (EIR) that details the final classification for each site, either No Action Indicated (NAI), Voluntary Action Indicated (VAI), or Official Action Indicated (OAI). The FDA’s observations may be minor or severe in nature and the degree of severity is generally determined by potential consequences to the consumer. By strictly complying with cGMPs and the various FDA guidelines as well as adherence to our Standard Operating Procedures, we have never received a cGMP Warning Letter in more than 70 years of business.

Leverage our Flexibility and Speed. We believe flexibility and speed in decision-making are critical success factors in the generic industry. Our mid-sized scale and relatively less complex organizational structure as a U.S. based organization results in a nimbler response to securing market opportunities.

Extensive Experience with Productive Partnerships. We continue to grow, diversify and strengthen our business by entering into partnerships to distribute both externally developed products and authorized generic equivalents of brand products. In fiscal year 2020, we successfully launched 18 new products, several of which are sourced from external parties, including Posaconazole (Noxafil®) and Amphetamine Salts ER (Adderall ER®). We believe that our success with these products, along with existing alliances, has established us as a strong development and marketing partner creating the foundation for continued productive partnership alliances in the future.

Strong Track Record of Obtaining Regulatory Approvals for New Products. During the past three fiscal years, we have received 1 NDA approval and 15 ANDA approvals from the FDA. Although the timing of ANDA approvals by the FDA is uncertain, we currently expect to continue to receive more during Fiscal 2021. These regulatory approvals will enable us to manufacture and supply a broader portfolio of generic pharmaceutical products.

Efficient Development Systems and Manufacturing Expertise for New Products. We believe that our U.S.-based manufacturing expertise, low overhead expenses and skilled product development capabilities will help us remain competitive in the generic pharmaceutical market. We intend to dedicate significant resources toward developing new products because we believe our success is linked to our ability to continually introduce new generic products into the marketplace.

Business Strategies

Focus on the large US Generic Market

We believe generics are the foundation of efficient pharmaceutical care and are estimated to be approximately 90% of all US pharmaceutical prescription volume with an IQVIA value of approximately $56 billion for the 12-month period ending June 30, 2020. While that estimate likely well exceeds actual market size, Lannett’s opportunity is significant relative to Lannett’s size.

We are focused on increasing our market share in the generic pharmaceutical industry while directing additional resources on the development of new products. We continue to improve our financial performance by expanding our line of generic products, increasing unit sales to current customers, creating manufacturing efficiencies and managing our overhead and administrative costs.

5

Emphasis on In-Line Execution

We have a broad portfolio of existing generics and we continually look to optimize the share and value of our existing portfolio. We look to capitalize on competitor supply disruptions which occur frequently in the industry of both a shorter and longer duration. We seek to reduce the cost of our products through various life cycle management approaches including increasing the efficiency of our plant, and our product manufacturing yields, and lowering incipient and API costs from third-party suppliers.

Strategic Expansion of our Product Offering

We have three primary strategies for expanding our product offerings: (1) deploying our experienced Research and Development (“R&D”) staff to develop products in-house; (2) entering into product development agreements or strategic alliances with third-party product developers and formulators; and (3) purchasing ANDAs or New Drug Applications (“NDA”) from other manufacturers. We expect that each strategy will facilitate our identification, selection and development of additional pharmaceutical products that we may sell to our existing network of customers.

Between January 2018 and June 2020, the number of alliances that our business development efforts have secured increased significantly and we have acquired or in-licensed over 60 ANDA products as a result of these efforts.

Opportunistically, we may increase our focus on specialty markets within the pharmaceutical industry. As a result, in Fiscal 2018, the Company filed its first NDA for Numbrino (cocaine hydrochloride solution), which was approved by the FDA in January 2020.

Similarly, in 2016, the Company announced a strategic partnership with YiChang HEC ChangJiang Pharmaceutical Co., Ltd, an HEC Group company, to co-develop a biosimilar insulin glargine pharmaceutical product for the U.S. market. The product is currently in development, and a healthy human Pharmacokinetic/Pharmacodynamic modeling (“PK/PD”) clinical trial was conducted in South Africa. It compared the Lannett/HEC insulin glargine to U.S. Lantus® as part of the effort to file a biosimilar Biologics License Application (“BLA”) with the U.S. FDA. The study met all of its primary inputs. Subsequently, Lannett held a Biosimilar Biological Product Development Type II meeting with the FDA. The feedback was consistent with our expectation. The Company plans to manage the clinical and regulatory steps specific for an FDA approval to market and will have the exclusive U.S. marketing rights to the product. We currently expect to file the product during our Fiscal 2023. In addition, we will market other generic products developed by HEC with several launches expected over the next few years.

In July 2019, the Company entered into an agreement with Cediprof, Inc. (“Cediprof”) to distribute Levothyroxine Sodium Tablets USP beginning not later than August 1, 2022. Levothyroxine is one of the largest generics sold in the USA. The product has several technical attributes that make receiving an FDA approval and continuous manufacturing challenging. The Cediprof product is already approved and has been sold in the U.S. by its current partner for the past several years. In August 2020, the Company announced it had commenced distributing Cediprof’s Levothyroxine product under an interim exclusive supply and distribution agreement.

In October 2019, the Company announced it had entered into an exclusive U.S. distribution agreement for the therapeutically equivalent generic of ADVAIR DISKUS® (Fluticasone Propionate – Salmeterol Xinafoate Powder Inhaler) of Respirent Pharmaceuticals Co. Ltd. ADVAIR DISKUS had U.S. sales of $3.6 billion for the 12 months ending July 2019, according to IQVIA, although actual generic market values are expected to be lower. The Company currently anticipates the product would be filed during Fiscal Year 2021. Under the agreement, the Company will commence U.S. distribution of the product after FDA approval. The Company will make an upfront payment, as well as future milestone payments, and receive a portion of the net profits once it commences distribution of the product. The term of the agreement is 12 years, which begins upon commencement of distribution. We have several other existing supply and development agreements with both international and domestic companies; in addition, we are currently in negotiations on similar agreements with other companies through which we can market and distribute future products. We intend to capitalize on our strong customer relationships to build our market share for such products.

6

Due to the expiration of the JSP Distribution Agreement in March 2019, management reassessed its overall business strategies to offset the impact of the loss on a short- and long-term basis. These plans currently include, among other things, an emphasis on reducing cost of sales, R&D and selling, general and administrative (“SG&A”) expenses; continuing to accelerate new product launches; increasing the level of strategic partnerships; and reducing capital expenditures. Management will also continue its emphasis on accelerating ANDA filings. In addition, management plans to attempt, at the appropriate time, to refinance all or a significant portion of its outstanding long-term debt to reduce principal repayment requirements and establish more flexibility around financial covenants. These actions may increase related interest expense, but are expected to positively impact cash flows.

Mergers and Acquisitions.

We evaluate potential mergers and acquisitions opportunities that are a strategic fit and accretive to our business. During Fiscal 2016, we completed the acquisition of KUPI, the former subsidiary of global biopharmaceuticals company UCB S.A. KUPI is a U.S. specialty pharmaceuticals manufacturer focused on the development of products that are difficult to formulate or utilize specialized delivery technologies. Strategic benefits of the acquisition include expanded manufacturing capacity, a diversified product portfolio and pipeline and complementary R&D expertise.

Key Products

Key products were selected based on current and future sales and profitability. In aggregate, the 11 products noted below accounts for approximately 57% of Lannett sales in Fiscal 2020. While these products are our top selling products, margins may vary well above or below average margins based on changing competitive circumstances as well as product partnership royalties, where applicable.

Fluphenazine Tablets

Fluphenazine tablets are used for the management of manifestations of psychotic disorders. Net sales of Fluphenazine tablets represented approximately 18% of total net sales in fiscal year 2020.

Posaconazole DR Tablets

Posaconazole DR tablets are used to prevent fungal infections in people who have a weak immune system resulting from certain treatments or conditions. The product is the generic version of Noxafil®. Net Sales of Posaconazole DR represented approximately 10% of total net sales in fiscal year 2020.

Verapamil SR Tablets

Verapamil SR tablets are a calcium channel blocker used in the treatment of high blood pressure, arrhythmia and angina. We market the authorized generic of Verelan PM.

Methylphenidate CD Capsules

Methylphenidate CD is a central nervous system (“CNS”) stimulant indicated for the treatment of Attention Deficit Hyperactivity Disorder (“ADHD”). This product is the authorized generic version of the brand Metadate CD®.

Omeprazole Capsules

Omeprazole is a proton pump inhibitor. The product is a generic version of the branded drug Prilosec®. It is indicated for the treatment of certain diseases of the esophagus and stomach ulcers as well as pathologic hypersecretory conditions. KUPI produces Omeprazole DR capsules in 10mg, 20mg and 40mg dosages.

7

Pantoprazole Sodium DR Tablets

Pantoprazole is a proton pump inhibitor. The product is a generic version of the branded drug Nexium®. It is indicated for the treatment of certain diseases of the esophagus and pathological hypersecretory conditions. KUPI produces Pantoprazole tablets in 20mg and 40mg dosages.

Sumatriptan Nasal Spray

Sumatriptan Nasal Spray is indicated for the acute treatment of migraine attacks. This product is a generic version of Imitrex® Nasal Spray. The Company distributes the 5mg and 20mg dosages.

Metolazone Tablets

Metolazone is a diuretic medication. It is indicated for the treatment of hypertension, alone or in combination with other anti-hypertensives. We market the authorized generic version of Zaroxolyn®.

Amphetamine IR Tablets

Amphetamine IR Tablets are used to treat attention deficit hyperactivity disorder (ADHD) and narcolepsy. It is the generic version of Adderall.

Methylphenidate Hydrochloride ER

Methylphenidate ER is a CNS stimulant indicated for the treatment of ADHD in children six years of age and older, adolescents and adults up to the age of 65. The product is a generic version of the branded drug Concerta®.

The Company markets one form of the product which was designated “BX.” Per a teleconference on November 2014, the FDA informed KUPI that it was changing the therapeutic equivalence rating of its product from “AB” (therapeutically equivalent) to “BX.” A BX-rated drug is a product for which data are insufficient to determine therapeutic equivalence; it is still approved and can be prescribed, but the FDA does not recommend it as automatically substitutable for the brand-name drug at the pharmacy.

The Company has been working with the FDA to regain the “AB” rating, and in the meantime, maintain the drug on the U.S. market with a BX rating. However, there can be no assurance as to when or if the Company will regain the “AB” rating or be permitted to remain on the market. The Company also agreed to potential acquisition-related contingent payments to UCB related to Methylphenidate ER if the FDA reinstates the AB-rating and certain sales thresholds are met. Such potential contingent payments are set to expire after December 31, 2020.

In August 2018, the Company entered into an exclusive perpetual licensing agreement with Andor Pharmaceuticals, LLC for Methylphenidate Hydrochloride Extended Release (ER) tablets USP (CII) in 18 mg, 27 mg, 36 mg and 54 mg strengths. Andor’s ANDA of Methylphenidate was approved by the FDA on April 24, 2019 as an AB-rated generic equivalent to the brand Concerta®. Lannett commenced marketing of this product on May 29, 2019.

Under the licensing agreement, Lannett is providing sales, marketing and distribution support of Andor’s Methylphenidate ER product, for which it will receive a percentage of the net profits.

Cocaine Hydrochloride Solution

In December 2017, a competitor received approval from the FDA to market and sell a Cocaine Hydrochloride topical product. This approval affects the Company’s right to market and sell its unapproved cocaine hydrochloride solution product. According to FDA guidance, the FDA typically allows the marketing of unapproved products for up to one year following the approval of an NDA for the product. Upon the recent request of the FDA to cease manufacturing and distributing our unapproved cocaine hydrochloride solution product as a result of an approved product on the market, the Company committed to not manufacture or distribute cocaine hydrochloride 10% solution, which has not been sold

8

during Fiscal 2019, as of April 15, 2019. The Company also ceased manufacturing its unapproved cocaine hydrochloride 4% solution on June 15, 2019 and ceased distributing the product on August 15, 2019.

We filed a NDA for Numbrino® Nasal Solution in Fiscal 2018. We received approval in January 2020 and launched the product in March 2020.

The competitor filed a Citizen Petition with the FDA in February 2019, claiming that the grant of the NCE exclusivity blocks the approval of the Company’s application for five years and requesting that the FDA refuse to accept any further submissions in furtherance of the Company’s Section 505(b)(2) NDA application, treat as withdrawn any submissions made by the Company after December 2017 and withdraw the Company’s Section 505(b)(2) application. On April 24, 2019, the Company filed an opposition to the Citizen Petition requesting that it be denied. On July 3, 2019, the FDA denied the competitor’s Citizen Petition. Thereafter, the competitor filed a second Citizen Petition claiming that the FDA should rescind the acceptance of the Company’s Section 505(b)(2) application and only permit the Company to re-submit the application as an ANDA after the expiration of the competitor’s five-year exclusivity. The Company filed an opposition to the second Citizen Petition asserting, among other things, that the FDA should summarily deny the second Citizen Petition as an improper attempt to delay competition. On January 10, 2020, the FDA denied the second Citizen Petition and the FDA approved the Company’s Section 505(b)(2) NDA application. On January 27, 2020, the competitor filed a complaint against the FDA seeking an order invalidating the approval of the Company’s 505(b)(2) NDA, claiming the approval violates the competitor’s five-year exclusivity. On February 14, 2020, the Company filed a motion to intervene in the competitor’s lawsuit in order to argue that the request for relief be denied. On April 15, 2020, the competitor filed a motion for summary judgment. The Company and FDA filed responses in opposition and cross motions for summary judgment requesting dismissal of the complaint. The parties submitted further reply briefs and are awaiting a decision by the Court.

On June 6, 2020, the competitor filed a patent infringement complaint in the United States District Court for the District of Delaware, asserting that the Company’s approved cocaine hydrochloride product infringes three patents issued to the competitor. On June 19, 2020, the Company filed an answer and counterclaim, alleging that the Company either does not infringe or the three asserted patents are invalid. In addition, the Company sought a declaration that, as to the competitor’s three additional patents not asserted against the Company, they are either not infringed or invalid.

Sales & Marketing and Customers

We enter into contracts with Group Purchasing Organizations (“GPOs”) to sell our products to their members who are our direct and indirect customers. The largest GPOs are ClarusOne, Red Oak Sourcing and Walgreens Boots Alliance Development. Net sales to these GPOs accounted for 74% of total net sales in fiscal year 2020 and 63% in fiscal year 2019.

We sell our pharmaceutical products to generic pharmaceutical distributors, drug wholesalers, chain drug retailers, private label distributors, mail-order pharmacies, other pharmaceutical companies, managed care organizations, hospital buying groups, governmental entities and health maintenance organizations. The pharmaceutical industry’s largest wholesale distributors, Amerisource Bergen, McKesson and Cardinal Health, each associated with one of the GPOs mentioned above, accounted for 25%, 23% and 11%, respectively, of our total net sales in fiscal year 2020, 21%, 18% and 10%, respectively, of our total net sales in fiscal year 2019 and 29%, 17% and 6%, respectively, of our total net sales in fiscal year 2018.

Sales to wholesale customers include “indirect sales,” which represent sales to third-party entities, such as independent pharmacies, managed care organizations, hospitals, nursing homes and group purchasing organizations, collectively referred to as “indirect customers.”

We enter into definitive agreements with our indirect customers to establish pricing for certain covered products. Under such agreements, the indirect customers independently select a wholesaler from which to purchase the products at these agreed-upon prices. We will provide credit to the wholesaler for the difference between the agreed-upon price with the indirect customer and the wholesaler’s invoice price. This credit is called a “chargeback.” For more information on chargebacks, see the section entitled “Critical Accounting Policies” in Item 7, “Management’s Discussion and Analysis

9

of Financial Condition and Results of Operations” of this Form 10-K. These indirect sale transactions are recorded on our books as sales to wholesale customers.

We promote our products through direct sales, trade shows and group purchasing organizations’ bidding processes. We also have a limited number of products that are marketed as part of our customers’ “private label” programs. Private label products are manufactured by Lannett but distributed to the customer with a label typically containing the name and logo of the customer. Private label allows us to leverage our internal sales efforts by using the sales and marketing efforts of those customers.

Strong and dependable customer relationships have created a positive platform for us to increase our sales volumes. Historically and in fiscal years 2020, 2019 and 2018, our advertising expenses have been immaterial. When our sales representatives make contact with a customer, we will generally offer to supply the customer our products at fixed prices. If accepted, the customer’s purchasing department will coordinate the purchase, receipt and distribution of the products throughout its distribution centers and retail outlets. Once a customer accepts our supply of a product, the customer typically expects a high standard of service, including timely receipt of products ordered, availability of convenient, user-friendly and effective customer service functions and maintaining open lines of communication.

We believe that retail-level consumer demand dictates the total volume of sales for most of our various products. In the event that wholesale and retail customers adjust their purchasing volumes, we believe that consumer demand will be fulfilled by other wholesale or retail sources of supply. As a result, we attempt to develop and maintain strong relationships with most of the major retail chains, wholesale distributors and mail-order pharmacies in order to facilitate the supply of our products through whatever channel the consumer prefers. Although we have agreements with customers governing the transaction terms of our sales, generally there are no minimum purchase quantities applicable to these agreements. Our practice of maintaining adequate inventory levels, employing a responsive order filling system and prioritizing timely fulfillment of those orders have contributed to a strong reputation among our customers as a dependable supplier of high-quality generic pharmaceuticals.

Competition

The manufacturing and distribution of generic pharmaceutical products is a highly competitive industry. Competition is based primarily on a reliable supply and price. In addition to competitive pricing, our competitive advantages are our ability to provide strong and dependable customer service by maintaining adequate inventory levels, employing a responsive order filling system and prioritizing timely fulfillment of orders. We ensure that our products are available from national wholesale, chain drug and mail-order suppliers as well as our own warehouse. The modernization of our facilities, hiring of experienced staff and implementation of inventory and quality control programs have improved our competitive cost position. Our primary competitors across our product portfolio are Teva Pharmaceutical Industries Ltd., Mylan N.V., and Amneal Pharmaceuticals Inc.

Validated Pharmaceutical Capabilities

The Company’s 432,000 square foot Seymour, Indiana facility contains approximately 107,000 square feet of manufacturing space as well as a leased 116,000 square foot temperature/humidity-controlled storage warehouse. The Seymour facility has had satisfactory inspections conducted by the FDA and EMA and similar regulatory authorities of Japan, Taiwan, Brazil, China, Korea and Turkey. As of June 30, 2020, the facility has a production capacity of approximately 4.0 billion doses based on our current product mix and plant configuration.

The Company has an 110,000 square foot manufacturing facility located in Carmel, New York, which sits on 25.8 acres of land. The facility specializes in liquid products and currently houses manufacturing, packaging, quality and research and development and has capacity for additional manufacturing space, if needed.

Lannett owns two facilities in Philadelphia, Pennsylvania. The research and development facilities are located in a 31,000 square foot facility at 9000 State Road and a second, 63,000 square foot facility that is located within one mile of the State Road facility at 9001 Torresdale Avenue, Philadelphia, PA. The latter facility contains our analytical research and development and quality control laboratories. We have adopted many systems and processes to ensure adherence to

10

FDA requirements and we believe we are operating our facilities in substantial compliance with the FDA’s cGMP regulations.

Raw Materials and Finished Goods Suppliers

Our use of raw materials in the production process consists of pharmaceutical chemicals in various forms that are often available from several sources. In addition to the raw materials we purchase for the production process, we purchase certain finished dosage inventories. We sell these finished dosage form products directly to our customers along with the finished dosage form products manufactured in-house. We generally take precautionary measures to avoid a disruption in raw materials and finished goods, such as finding secondary suppliers for certain raw materials or finished goods when available and maintaining adequate inventory levels.

Over time, we have entered into supply and development agreements with Summit Bioscience LLC, HEC Pharm Group, Dexcel Pharma, Elite Pharmaceuticals, RivoPharm and various other international and domestic companies. The Company is currently in negotiations on similar agreements with other companies and is actively seeking additional strategic partnerships, through which it will market and distribute products manufactured in-house or by third parties. The Company plans to continue evaluating ways to improve its capital structure and consider potential merger and acquisition opportunities. The Company also continues to assess product acquisitions that are a strategic fit and accretive to the business.

Research and Development Process

Over the past several years, we have invested in R&D projects. The costs of these R&D efforts are expensed during the periods incurred. We believe that such costs may be recovered in future years when we receive approval from the FDA to manufacture and distribute such products. We have embarked on a plan to grow in future years, which includes organic growth to be achieved through our R&D efforts. We expect that our growing list of generic products under development will drive future growth. The following steps outline the numerous stages in the generic drug development process:

| 1.) | Formulation and Analytical Method Development. After a drug candidate is selected for future sale, product development scientists perform various experiments to incorporate excipients with the APIs to produce a robust, stable and bioequivalent dosage form that will be therapeutically equivalent to the brand name drug, and meet all FDA requirements for approval. These experiments will result in the creation of a number of product formulations to determine which formula will be most suitable for our subsequent development process. Various formulations are tested in the laboratory to measure results against the innovator brand drug. During this time, we may use reverse engineering methods on samples of the innovator drug to determine the type and quantity of inactive ingredients. During the formulation phase, our R&D chemists begin to develop an analytical, laboratory testing method. The successful development of this test method will allow us to test developmental and commercial batches of the product in the future. All of the information used in the final formulation, including the analytical test methods adopted for the generic drug candidate, will be included as part of the Chemistry, Manufacturing and Controls (“CMC”) section of the ANDA submitted to the FDA. |

| 2.) | Scale-up and Tech Transfer. After product development, our R&D formulators and our R&D chemists agree on a final formulation for use in moving the drug candidate forward in the developmental process, we then attempt to increase the batch size of the product. The batch size represents the standard magnitude to be used in manufacturing a batch of the product. The determination of batch size affects the amount of raw material that is used in the manufacturing process and the number of expected dosages to be created during the production cycle. We attempt to determine batch size based on the amount of active ingredient in each dosage, the available production equipment and unit sales projections. The scaled-up batch is then generally produced in our commercial manufacturing facilities. During this manufacturing process, we document the equipment used, the amount of time in each major processing step and any other steps needed to consistently produce a batch of that product. |

11

| 3.) | Bio equivalency and Clinical Testing. After a successful scale-up of the generic drug batch, we schedule and perform generally required bio equivalency testing on the product and in some cases, clinical testing, if required by the FDA. These procedures, which are generally outsourced to third parties, include testing the absorption rate and extent of the generic product in the human bloodstream compared to the absorption of the innovator drug. The results of this testing are then documented and reported to us to determine the “success” of the generic drug product. Success, in this context, means that we are able to demonstrate that our product is comparable to the innovator product in dosage form, strength, route of administration, quality, performance characteristics and intended use. |

Bioequivalence (meaning that the product has the same blood levels and dosage form as the innovator drug) and a stable formula are the primary requirements for a generic drug approval (assuming the manufacturing plant is in compliance with the FDA’s cGMP regulations). Lengthy and costly clinical trials proving safety and efficacy, which are required by the FDA for NDAs (and may include 505(b)(2)NDAs), are typically unnecessary for generic companies. If the results are successful, we will continue the collection of information and documentation for assembly of the drug application.

| 4.) | Submission of the ANDA for FDA Review and Approval. An ANDA is a comprehensive submission that contains, among other things, data and information pertaining to the proposed labeling, active pharmaceutical ingredient, excipients, container/closure, drug product formulation, drug product testing specification, methodology and results. Bioequivalence study reports are also included in the ANDA submission. |

Our ANDAs and NDAs are submitted to the FDA electronically using the most current Electronic Common Technical Document standards. Lannett strives to achieve a first cycle approval for each ANDA under the Generic Drug User Fee Amendments of 2012 (“GDUFA”) review metrics.

In fiscal year 2020, we launched several products from internal and external sources. The following summary contains more specific details regarding our latest product launches. Market data was obtained from IQVIA although actual generic market sizes are expected to be smaller.

| | |

| |

| | Total Market Size as of | |

Product Launch |

| Month of Launch |

| Equivalent Brand |

| May 2020 ($ in millions) | ||

1 | Posaconazole DR Tablets |

| September, 2019 |

| Noxafil® | | $ | 259.8 |

2 | Cyproheptadine Oral Solution |

| October, 2019 |

| Periactin® | | $ | 5.5 |

3 | Prednisone Tablets |

| October, 2019 |

| Deltasone® | | $ | 125.5 |

4 | Venlafaxine HCL ER Tablets |

| December, 2019 |

| Effexor® | | $ | 133.6 |

5 | Lidocaine HCl Topical Solution |

| December, 2019 |

| Lidocaine | | $ | 17.9 |

6 | Butalbital w/ Acetaminophen & Caffeine Caps - 300 mg |

| December, 2019 |

| Nexgen Generic | | $ | 20.1 |

7 | Butalbital w/ Acetaminophen & Caffeine Caps - 325 mg |

| December, 2019 |

| Mayne Generic | | $ | 54.5 |

8 | Propranolol HCL ER Capsules |

| February, 2020 |

| Inderal LA® | | $ | 120.7 |

9 | Numbrino (Cocaine Hydrochloride) Nasal Solution (CII) |

| March, 2020 |

| Numbrino® | | $ | 12.0 |

10 | Nystatin Oral Suspension |

| March, 2020 |

| Mycostatin® | | $ | 32.0 |

11 | Valproic Acid Oral Solution |

| March, 2020 |

| Depakene® | | $ | 9.5 |

12 | Dextroamphetamine-Amphetamine ER Capsule (CII) |

| April, 2020 |

| Adderall XR® | | $ | 1,488.1 |

13 | Lactulose Solution |

| April, 2020 |

| Chronulac® | | $ | 17.4 |

14 | Clobazam Tablets (CIV) |

| May, 2020 |

| Onfi® | | $ | 152.1 |

15 | Sulfamethoxazole + Trimethoprim Suspension |

| May, 2020 |

| Septra® | | $ | 23.6 |

16 | Clobazam Oral Suspension | | May, 2020 | | Onfi® | | $ | 90.0 |

17 | Amphetamine Sulfate IR Tablets (CII) | | June, 2020 | | Evekeo® | | $ | 31.4 |

18 | Brompheniramine-Pseudoephedrine-DM Syrup |

| June, 2020 |

| Bromfed DM® | | $ | 37.4 |

We have additional products of various dosage forms currently under development. Our developmental drug products are intended to treat a diverse range of indications. The products under development are at various stages in the development cycle—formulation, scale-up, clinical testing and/or FDA review.

12

The cost associated with each product that we are currently developing is dependent on numerous factors, including but not limited to, the complexity of the active ingredient’s chemical characteristics, the price of the raw materials and the FDA-mandated requirement of bioequivalence studies (depending on the FDA’s Product Specific Guidance). With the introduction of GDUFA and additional guidance issued by the FDA, the cost to develop a new generic product varies but can total several million dollars.

In addition, we currently own several ANDAs for products that are not currently marketed and noted as Discontinued in FDA’s Orange Book. Occasionally, we review such discontinued products to determine if the market potential for any of these products has recently changed to make it attractive for us to reconsider manufacturing and selling. If we decide to commercially market one of these products, we evaluate the requirements necessary for commercial launch, including a filing strategy to properly report the relaunch to the FDA so that the product is moved to the Active section of the Orange Book.

In addition to the efforts of our internal product development group, we have contracted with numerous outside firms for the formulation and development of several new generic drug products. These outsourced R&D products are at various stages in the development cycle—formulation, analytical method development and testing and manufacturing scale-up. These products include orally administered solid dosage products, injectables and nasal delivery products that are intended to treat a diverse range of medical indications.

We intend to ultimately transfer the formulation technology and manufacturing process for some of these R&D products to our own commercial manufacturing sites. We initiated these outsourced R&D efforts to complement the progress of our own internal R&D efforts.

We recorded R&D expenses of $30.0 million in fiscal year 2020, $38.3 million in fiscal year 2019 and $29.2 million in fiscal year 2018. These amounts included expenses associated with bioequivalence studies, internal development resources as well as outsourced development. While we manage all R&D from our principal executive office in Philadelphia, Pennsylvania, we have also been taking steps to capitalize on favorable development costs in other countries. We have strategic relationships with various companies that either act as contract research organizations or API suppliers as well as dosage form manufacturers. In addition, U.S.-based research organizations have been engaged for product development to enhance our internal development. Fixed payment arrangements are established between Lannett and these research organizations and in some cases include a royalty provision. Development payments are normally scheduled in advance, based on attaining development milestones.

Government Regulation

Pharmaceutical manufacturers are subject to extensive regulation by the federal government, including the FDA and, in cases of controlled substance products the DEA, as well as other federal regulatory bodies and state governments. The Federal Food, Drug and Cosmetic Act (the “FDCA”), the Controlled Substance Act (the “CSA”) and other federal statutes and regulations govern or influence the testing, manufacture, safety, labeling, storage, record keeping, approval, advertising and promotion of our generic drug products. Non-compliance with applicable regulations can result in fines, product recalls and seizure of products, total or partial suspension of production, personal and/or corporate prosecution and debarment and refusal of the government to approve applications. The FDA also has the authority to revoke previously approved drug applications.

Generally, FDA approval is required before a drug can be marketed. A new drug is one not generally recognized by qualified experts as safe and effective for its intended use and is submitted to the FDA as a NDA. The FDA review process for new drugs is very extensive and requires a substantial investment to research and test the drug candidate. A less burdensome approval pathway, the ANDA, is used for generic drug products. Typically, the investment required to develop a generic drug is less costly than the new drug. Some drug products may be submitted as a 505(b)(2) NDA, allowing some of the required research and testing to be waived by relying on FDA’s previous findings of safety and efficacy and literature. For additional information on the FDA approval pathways, refer to section 505(b)(1) and 505(b)(2) of the FD&C Act for NDAs, section 505(j) for ANDAs and resources available on the FDA website, www.fda.gov.

13

Manufacturing cGMP Requirements

Among the requirements for a new drug approval, facilities identified in each application that perform operations related to the drug product, including drug substance manufacturers and outside contract facilities, must conform to FDA cGMP regulations. The FDA may perform general GMP and/or pre-approval inspections to assess a company’s compliance with cGMP regulations. These inspections include reviews of procedures, operations, and data used to support the application and ongoing drug product manufacturing and testing. FDA’s cGMP regulations require, among other things, quality control and quality assurance systems as well as the corresponding records and documentation. In complying with the evolving standards set forth in the cGMP regulations, we must continue to expend time, money and effort in many areas to ensure compliance.

Failure to comply with statutory and regulatory requirements subject a manufacturer to possible legal or regulatory action, including but not limited to, warning letters, consent decrees placing significant restrictions on or suspending manufacturing operations, injunctions, the seizure of non-complying drug products and/or civil and criminal penalties.

Adverse experiences with the product and certain non-compliance events may need to be reported to the FDA and could result in regulatory actions such as labeling changes or FDA request for application withdrawal or product removal.

Other Regulatory Requirements

With respect to post-market product advertising and promotion, the FDA imposes a number of complex regulations on entities that advertise and promote pharmaceuticals, which include, among others, standards for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet. The FDA has very broad enforcement authority under the FDCA and failure to abide by these regulations can result in penalties, including the issuance of a warning letter directing entities to correct deviations from FDA standards, a requirement that future advertising and promotional materials be pre-cleared by the FDA and state and/or federal civil and criminal investigations and prosecutions. Some of our products require participation in Risk Evaluation and Mitigation Strategies (“REMS”) programs. A shared system REMS encompasses multiple prescription drug products and is developed and implemented jointly by two or more companies marketing the same products. These programs can add significant costs for the Company, depending on market share and complexity of the program.

Any one or a combination of FDA regulatory or enforcement actions against the Company could have a material adverse effect on our financial results.

DEA Regulation

We maintain registrations and quota (limitations on purchases of controlled substances) with the DEA that enable us to receive, manufacture, store, develop, test and distribute controlled substances in connection with our operations. Controlled substances are those drugs that appear on one of five schedules promulgated and administered by the DEA under the CSA. The CSA governs, among other things, the distribution, recordkeeping, quota, handling, security and disposal of controlled substances. We are subject to periodic and ongoing inspections by the DEA and similar state drug enforcement authorities to assess our ongoing compliance with the DEA’s regulations. Any failure to comply with these regulations could lead to a variety of sanctions, including the revocation or a denial of renewal of our DEA registration or quota, injunctions, or civil or criminal penalties. We are subject to an allocation of national (aggregate) quota for several products in our portfolio. Our quota requests require DEA approval in full for us to meet our forecasted customer demands. The DEA may or may not approve our quota requests in full based on factors that we do not control.

Fraud and Abuse Laws

Because of the significant federal and state funding involved in the provision of health care services, including Medicare and Medicaid funding, Congress and state legislatures have enacted and federal and state governments actively enforce, a number of laws whose purpose is to eliminate fraud and abuse in federal health care programs. Our business is subject to compliance with these laws, including both federal and state level Anti-Kickback Statutes, as well as other laws aimed at eliminating fraud and abuse such as the False Claims Act and the Foreign Corrupt Practices Act (“FCPA”).

14

Anti-Kickback Statutes and Federal False Claims Act

One of the primary federal laws aimed at curbing fraud and abuse in the federal health care programs is the federal Anti-Kickback Statute, 42 U.S.C. § 1320a–7b(b), which prohibits persons from knowingly and willfully soliciting, offering, receiving, or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a federal health care program such as Medicare, Medicaid or TRICARE. The definition of “remuneration” has been broadly interpreted to include anything of value, including for example gifts, certain discounts, the furnishing of free supplies, equipment or services, credit arrangements, payment of cash and waivers of payments, including copayments. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal health care covered business, the statute has been violated. Penalties for violations include criminal penalties and civil sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal health care programs. In addition, violations of the Anti-Kickback Statute can be considered violations of the Federal False Claims Act, discussed in more detail below.

The federal Anti-Kickback Statute is broad and prohibits many arrangements and practices that are lawful in businesses outside of the health care industry. Recognizing that the Anti-Kickback Statute is broad and may technically prohibit many innocuous or beneficial arrangements, Congress incorporated several statutory exceptions into the federal Anti-Kickback Statute’s framework, which protect certain types of business arrangements. Congress also authorized the Office of Inspector General of the U.S. Department of Health and Human Services (“OIG”) to issue a series of “regulatory safe harbors.” Both the statutory exceptions and regulatory safe harbors set forth provisions that, if all of their applicable requirements are met, will assure health care providers and other parties to the arrangement that the federal Anti-Kickback Statute has not been violated and that that they will not be prosecuted under the Anti-Kickback Statute. The failure of a transaction or arrangement to fit precisely within one or more safe harbors does not necessarily mean that it is illegal or that prosecution will be pursued. However, conduct and business arrangements that do not fully satisfy each applicable safe harbor may result in increased scrutiny by government enforcement authorities such as OIG.

Many states have adopted laws similar to the federal Anti-Kickback Statute. Some of these state prohibitions apply to referrals of patients for health care items or services reimbursed by any source, including commercial payers and private pay patients.

Government officials have focused their Anti-Kickback Statute enforcement efforts on marketing of health care services and products, among other activities and recently have brought cases against companies and certain sales, marketing and executive personnel, for allegedly offering unlawful inducements to potential or existing customers in an attempt to procure their business. Additionally, a number of courts have ruled that a transaction that violates the Anti-Kickback Statute is unenforceable as against public policy.

In addition to applying federal and state Anti-Kickback Statutes in enforcement actions involving the marketing of healthcare services and products, the federal government and various states also have enacted laws specifically regulating the sales and marketing practices of pharmaceutical companies. These laws and regulations may limit financial interactions between manufacturers and health care providers, require disclosure to the federal or state government and the public of such interactions (e.g. federal and state “Sunshine” laws), or require the adoption of compliance standards or programs. Many of these laws and regulations contain ambiguous requirements or require administrative guidance for implementation and, given the lack of clarity, our activities could be subject to the penalties under the pertinent laws and regulations.

Another development affecting the health care industry is the increased use of the Federal False Claims Act (“FFCA”) and in particular, action brought pursuant to the FFCA’s “Whistleblower” or “Qui Tam” provisions. The FFCA imposes liability on any person or entity who, among other things, knowingly presents, or causes to be presented, a false or fraudulent claim for payment by a federal health care program. The Qui Tam provisions of the FFCA allow a private individual to bring actions on behalf of the federal government alleging that the defendant has submitted a false claim to the federal government and to share in any monetary recovery. In recent years, the number of suits brought against health care providers by private individuals has increased dramatically, and in Fiscal 2019, the federal government recovered more than $3 billion in judgements and settlements related to FFCA violations in the health care industry. In

15

addition to the FFCA, various states have enacted false claims laws analogous to the FFCA, and many of these state laws apply where a claim is submitted to any third-party payer and not merely a federal health care program.

When an entity is determined to have violated the FFCA, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties in excess of $23,000 per claim, as adjusted annually. Liability arises, primarily, when an entity knowingly submits or causes another to submit a false claim for reimbursement to the federal government. The federal government has used the FFCA to assert liability on the basis of inadequate care, kickbacks and other improper referrals; improper use of Medicare numbers by the provider of services; as well as allegations regarding misrepresentations with respect to the services rendered. In addition, the federal government has prosecuted companies under the FFCA in connection with off-label promotion of products. Our future activities relating to the reporting of wholesale or estimated retail prices of our products, the reporting of discount and rebate information and other information affecting federal, state and third-party reimbursement of our products and the sale and marketing of our products may be subject to scrutiny under these laws. We are unable to predict whether we will be subject to actions under the FFCA or a similar state law, or the impact of such actions. However, the costs of defending such claims, as well as any sanctions imposed, could significantly affect our financial performance.

Travel Act

Recently, the Department of Justice has begun to use the 1961 federal Travel Act as a tool to pursue criminal charges in the case of health care kickback and commercial bribery allegations. This law was enacted as part of the Kennedy Administration’s war on organized crime. It formed the basis for a federal enforcement action against the Forest Park Medical Center, a Texas physician-owned specialty hospital, and a number of surgeons and administrators, who were convicted of conspiring to pay or receive bribes in exchange for referrals of patients in violation of a state commercial bribery law. Importantly, this case was not limited to claims covered under federal programs, and the failure of the state to bring charges under its own statute did not prevent the federal case from proceeding. The Travel Act may be used by the Justice Department as a way to expand its reach to penalize kickbacks and similar arrangements even when the Anti-Kickback Statute and FFCA would not apply. These efforts could increase our vulnerability to litigation and penalties if our past or present operations are found to be in violation of such act.

Foreign Corrupt Practices Act

The U.S. Foreign Corrupt Practices Act of 1977, as amended, and similar anti-bribery laws in other jurisdictions generally prohibit certain classes of persons and entities, and their intermediaries, from making payments to foreign government officials to assist in obtaining or retaining business. Specifically, the anti-bribery provisions of the FCPA prohibit the bribery of government officials. If we are found to be liable for FCPA or other violations, we could suffer from civil and criminal penalties or other sanctions, including contract cancellations or debarment, and loss of our reputation, any of which could have a significant impact on our business, financial condition and operations.

HIPAA and Other Fraud and Privacy Regulations

The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) created two new federal crimes: health care fraud and false statements relating to health care matters. The HIPAA health care fraud statute prohibits, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any health care benefit program, including private payment programs. HIPAA’s extensive privacy and security regulations impose significant regulatory requirements on covered entities to acquire and implement information systems and to adopt business procedures and security measures designed to protect the privacy and security of patients’ protected health information. These particular HIPAA requirements have had a significant financial impact on many sectors of the health care industry because they impose extensive new requirements and restrictions on the use and disclosure of identifiable patient information, and the financial consequences of a data breach or unauthorized disclosure of patients’ protected health information, including data breaches caused by malicious third parties and inadvertent disclosures, can result in substantial civil fines, penalties and lawsuits, negative publicity, and costly remediation efforts imposed by the Office for Civil Rights of the U.S. Department of Health and Human Services. The HIPAA false statements statute prohibits knowingly and willfully falsifying, concealing, or covering up a material fact or making any materially false, fictitious,

16

or fraudulent statement or representation in connection with the delivery of or payment for health care benefits, items, or services. A violation of this statute is a felony and may result in fines, imprisonment and/or exclusion from government-sponsored programs.

Pricing

In the United States, our sales are dependent upon the availability of coverage and reimbursement for our products from third-party payors, including federal and state programs such as Medicare and Medicaid and private organizations such as commercial health insurance and managed care companies. Such third-party payors challenge the price of medical products and services and continue to institute cost containment measures to control or significantly influence the purchase of medical products and services.

Over the past several years, the rising costs of providing health care services has triggered legislation to make certain changes to the way in which pharmaceuticals are covered and reimbursed, particularly by government programs. For instance, federal legislation and regulations have created a voluntary prescription drug benefit, Medicare Part D, which revised the formula used to reimburse health care providers and physicians under Medicare Part B and imposed significant revisions to the Medicaid Drug Rebate Program. These changes have resulted in and may continue to result in, coverage and reimbursement restrictions and increased rebate obligations by manufacturers.

In addition, there continues to be legislative and regulatory proposals at the federal and state levels directed at containing or lowering the cost of health care. Examples of how limits on drug coverage and reimbursement in the United States may cause reduced payments for drugs in the future include:

| ● | changing Medicare reimbursement methodologies; |

| ● | revising drug rebate calculations under the Medicaid program; |

| ● | reforming drug importation laws; |

| ● | fluctuating decisions on which drugs to include in formularies; and |

| ● | requiring pre-approval of coverage for new or innovative drug therapies. |

Also, over the last few years, several states have passed legislation or have proposed legislation that have imposed price reporting requirements for both generic and brand pharmaceutical products and that include price transparency, price increase notification and supplement rebate requirements.

We cannot predict the likelihood or pace of such additional changes or whether there will be significant legislative or regulatory reform impacting our products, nor can we predict with precision what effect such governmental measures would have if they were ultimately enacted into law. However, in general, we believe that legislative and regulatory reform activity likely will continue.

Current or future federal or state laws and regulations may influence the prices of drugs and, therefore, could adversely affect the prices that we receive for our products. Programs in existence in certain states seek to set prices of all drugs sold within those states through the regulation and administration of the sale of prescription drugs. Expansion of these programs, in particular, state Medicaid programs, or changes required in the way in which Medicaid rebates are calculated under such programs, could adversely affect the price we receive for our products and could have a material adverse effect on our business, results of operations and financial condition. Further, generic pharmaceutical drug prices have been the focus of increased scrutiny by certain states’ attorney generals, the U.S. Department of Justice and Congress. Decreases in health care reimbursements or prices of our prescription drugs could limit our ability to sell our products or could decrease our revenues, which could have a material adverse effect on our business, results of operations and financial condition.

17

The Company believes that under the current regulatory environment, the generic pharmaceutical industry as a whole will be the target of increased governmental scrutiny, especially with respect to state and federal anti-trust and price-fixing claims.

See Note 10 “Legal, Regulatory Matters and Contingencies” for a description of current state and federal anti-trust and price-fixing claims.

Other Applicable Laws

We are also subject to federal, state and local laws of general applicability, including laws regulating working conditions and the storage, transportation, or discharge of items that may be considered hazardous substances, hazardous waste, or environmental contaminants. We monitor our compliance with laws and we believe we are in substantial compliance with all regulatory bodies.

As a publicly-traded company, we are also subject to significant regulations and laws, including the Sarbanes-Oxley Act of 2002. Since its enactment, we have developed and instituted a corporate compliance program based on what we believe are the current best practices and we continue to update the program in response to newly implemented or changing regulatory requirements.

Employees

As of June 30, 2020, we had 954 full-time employees.

Securities and Exchange Act Reports

We maintain a website at www.lannett.com. We make available on or through our website our current and periodic reports, including any amendments to those reports, that are filed with the Securities and Exchange Commission (the “SEC”) in accordance with the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These reports include Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. This information is available on our website free of charge as soon as reasonably practicable after we electronically file the information with, or furnish it to, the SEC.

The contents of our website are not incorporated by reference in this Form 10-K and shall not be deemed “filed” under the Exchange Act.

18

A relatively small group of products may represent a significant portion of our revenues, gross profit, or net earnings from time to time.

Sales of a limited number of our products from time to time represent a significant portion of our revenues, gross profit and net earnings. For Fiscal 2020, 2019 and 2018, our top five products in terms of sales, in the aggregate, represented approximately 45%, 52% and 58%, respectively, of our total net sales. If the volume or pricing of our largest selling products decline in the future, our business, financial condition, results of operations, cash flows and/or share price could be materially adversely affected. See Item 1. Description of Business for more information on our top products.

The generic pharmaceutical industry is highly competitive.

We face strong competition in our generic product business. Revenues and gross profit derived from the sales of generic pharmaceutical products tend to follow a pattern based on certain regulatory and competitive factors. Typically, as patents for brand-name products and related exclusivity periods expire or fall under patent challenges, the first generic manufacturer to receive regulatory approval for generic equivalents of such products is generally able to achieve significant market penetration. As competing off-patent manufacturers receive regulatory approvals on similar products or as brand manufacturers launch generic versions of such products (for which no separate regulatory approval is required), market share, revenues and gross profit typically decline, in some cases dramatically. Accordingly, the level of market share, revenue and gross profit attributable to a particular generic product is normally related to the number of competitors in that product’s market and the timing of that product’s regulatory approval and launch, in relation to competing approvals and launches. Consequently, we must continue to develop and introduce new products in a timely and cost-effective manner to maintain our revenues and gross margins.

If we are unable to successfully develop or commercialize new products, our operating results will suffer.

Our future results of operations will depend to a significant extent upon our ability to successfully commercialize new generic products in a timely manner. There are numerous difficulties in developing and commercializing new products, including:

| ● | developing, testing and manufacturing products in compliance with regulatory standards in a timely manner; |

| ● | receiving requisite regulatory approvals for such products in a timely manner; |

| ● | the availability, on commercially reasonable terms, of raw materials, including APIs and other key ingredients; |

| ● | developing and commercializing a new product is time consuming, costly and subject to numerous factors that may delay or prevent the successful commercialization of new products; and |

| ● | commercializing generic products may be substantially delayed by unexpired patents covering the brand drug. |

As a result of these and other difficulties, products currently in development by Lannett may or may not receive the regulatory approvals necessary for marketing. If any of our products, when developed and approved, cannot be successfully or timely commercialized, our operating results could be adversely affected. We cannot guarantee that any investment we make in developing products will be recouped, even if we are successful in commercializing those products.

Refer to the risk factor below related to the COVID-19 pandemic for further discussion of risks identified by the Company relating to the development and commercialization of new products.

19

Our gross profit may fluctuate from period to period depending upon our product sales mix, our product pricing and our costs to manufacture or purchase products.

Our future results of operations, financial condition and cash flows depend to a significant extent upon our product sales mix. Sales of certain products that we manufacture tend to create higher gross margins than the products we purchase and resell. As a result, our sales mix will significantly impact our gross profit from period to period.

Factors that may cause our sales mix to vary include:

| ● | the number of new product introductions; |

| ● | marketing exclusivity, if any, which may be obtained on certain new products; |

| ● | the level of competition in the marketplace for certain products; |

| ● | the availability of raw materials and finished products from our suppliers; and |

| ● | the scope and outcome of governmental regulatory action that may involve us. |

The Company is continuously seeking to keep product costs low, however there can be no guarantee that gross profit percentages will stay consistent in future periods. Pricing pressure from competitors, changes in product mix and the costs of producing or purchasing new drugs may also fluctuate in future periods.

Our substantial indebtedness may adversely affect our financial health.

We currently have substantial indebtedness. As of June 30, 2020, we had total outstanding debt of $708.0 million, of which $88.2 million is due within 12 months. The term loan A matures in November 2020 with $48.8 million outstanding as of June 30, 2020. As of June 30, 2020, we also have an undrawn $125.0 million revolving credit facility (the “Revolving Credit Facility”), which expires in November 2020. The Amended Term Loan Facility consists of an initial $910.0 million senior secured term loan facility (the “Senior Secured Term Loan Facility”), which was amended in June 2016 to include an additional $150.0 million incremental term loan (the “Incremental Term Loan”). The Amended Term Loan Facility, together with the Revolving Credit Facility comprises the amended senior secured credit facility (the “Amended Senior Secured Credit Facility”).

Our substantial indebtedness may have important consequences for us. For example, it may:

| ● | increase our vulnerability to general economic and industry conditions, including recessions and periods of significant inflation and financial market volatility; |

| ● | expose us to the risk of increased interest rates, because any borrowings we make under the Revolving Facility and other borrowings under the Term Loan Facility under certain circumstances, will bear interest at variable rates; |

| ● | require us to use a substantial portion of cash flow from operations to service our indebtedness, thereby reducing our ability to fund working capital, capital expenditures and other expenses; |

| ● | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| ● | place us at a competitive disadvantage compared to competitors that have less indebtedness; and |

| ● | limit our ability to borrow additional funds that may be needed to operate and expand our business. |

20

Due to many factors beyond our control, we may not be able to generate sufficient cash to service all of our indebtedness and meet our other ongoing liquidity needs and we may be forced to take other actions to satisfy our obligations under our debt agreements, which may not be successful.

Our ability to make payments on and to refinance, our indebtedness and to fund planned capital expenditures will depend on our ability to generate cash in the future. This is subject to general economic, financial, competitive, legislative, regulatory and other factors, many of which are beyond our control.