Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | br-20200827.htm |

EXHIBIT 99.1 Q1 FY21 Investor Presentation AS OF AUGUST 11, 2020

Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2021 Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the year ended June 30, 2020 (the “2020 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2020 Annual Report. These risks include: • the potential impact and effects of the Covid-19 pandemic (“Covid-19”) on the business of Broadridge, Broadridge’s results of operations and financial performance, any measures Broadridge has and may take in response to Covid-19 and any expectations Broadridge may have with respect thereto; • the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; • Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; • a material security breach or cybersecurity attack affecting the information of Broadridge's clients; • changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; • declines in participation and activity in the securities markets; • the failure of Broadridge's key service providers to provide the anticipated levels of service; • a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; • overall market and economic conditions and their impact on the securities markets; • Broadridge’s failure to keep pace with changes in technology and the demands of its clients; • Broadridge’s ability to attract and retain key personnel; • the impact of new acquisitions and divestitures; and • competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. | © 2020 1

Use of Non-GAAP Financial Measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, Adjusted EBITDA, EBITDAR and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, for internal planning, evaluating leverage, forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Key Performance Indicators Management focuses on a variety of key indicators to plan, measure and evaluate the Company’s business and financial performance. These performance indicators include Revenue and Recurring fee revenue, as well as Non-GAAP measures of Adjusted Operating income, Adjusted Net earnings, Adjusted Diluted earnings per share, Free Cash flow, and Closed sales. In addition, management focuses on select operating metrics specific to Broadridge of Record Growth and Internal Trade Growth. For more information on our key performance measures, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations--Key Performance Indicators” in our 2020 Annual Report. Please see slides 36-41 for further explanation of our Non-GAAP Measures, the reasons we believe these Non-GAAP measures are helpful to our investors, and reconciliations of these Non-GAAP measures to the most directly comparable GAAP measures. | © 2020 2

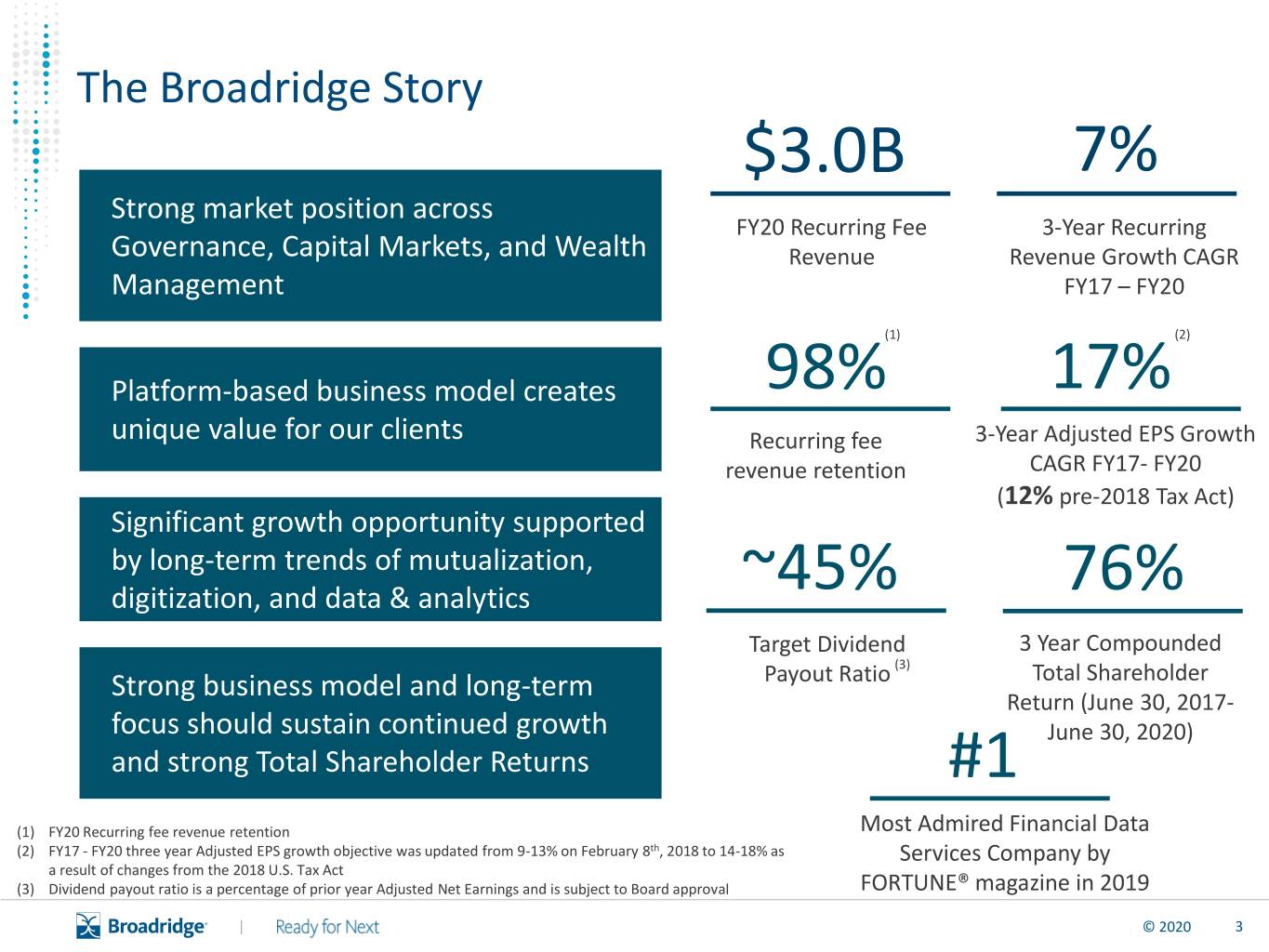

The Broadridge Story $3.0B 7% Strong market position across FY20 Recurring Fee 3-Year Recurring Governance, Capital Markets, and Wealth Revenue Revenue Growth CAGR Management FY17 – FY20 (1) (2) Platform-based business model creates 98% 17% unique value for our clients Recurring fee 3-Year Adjusted EPS Growth revenue retention CAGR FY17- FY20 (12% pre-2018 Tax Act) Significant growth opportunity supported by long-term trends of mutualization, digitization, and data & analytics ~45% 76% Target Dividend 3 Year Compounded Payout Ratio (3) Total Shareholder Strong business model and long-term Return (June 30, 2017- focus should sustain continued growth June 30, 2020) and strong Total Shareholder Returns #1 (1) FY20 Recurring fee revenue retention Most Admired Financial Data (2) FY17 - FY20 three year Adjusted EPS growth objective was updated from 9-13% on February 8th, 2018 to 14-18% as Services Company by a result of changes from the 2018 U.S. Tax Act (3) Dividend payout ratio is a percentage of prior year Adjusted Net Earnings and is subject to Board approval FORTUNE® magazine in 2019 | © 2020 3

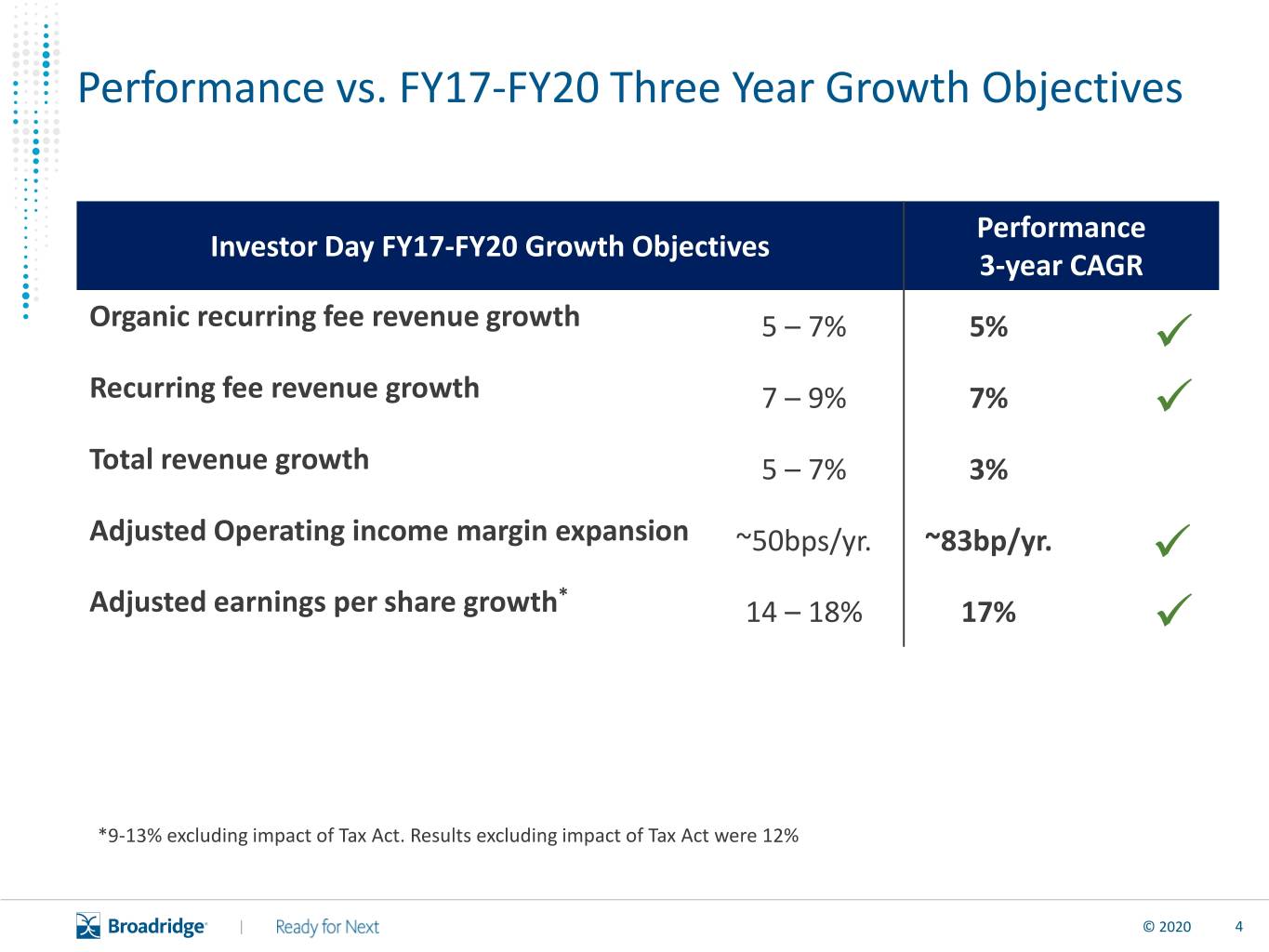

Performance vs. FY17-FY20 Three Year Growth Objectives Performance Investor Day FY17-FY20 Growth Objectives 3-year CAGR Organic recurring fee revenue growth 5 – 7% 5% Recurring fee revenue growth 7 – 9% 7% Total revenue growth 5 – 7% 3% Adjusted Operating income margin expansion ~50bps/yr. ~83bp/yr. * Adjusted earnings per share growth 14 – 18% 17% *9-13% excluding impact of Tax Act. Results excluding impact of Tax Act were 12% | © 2020 4

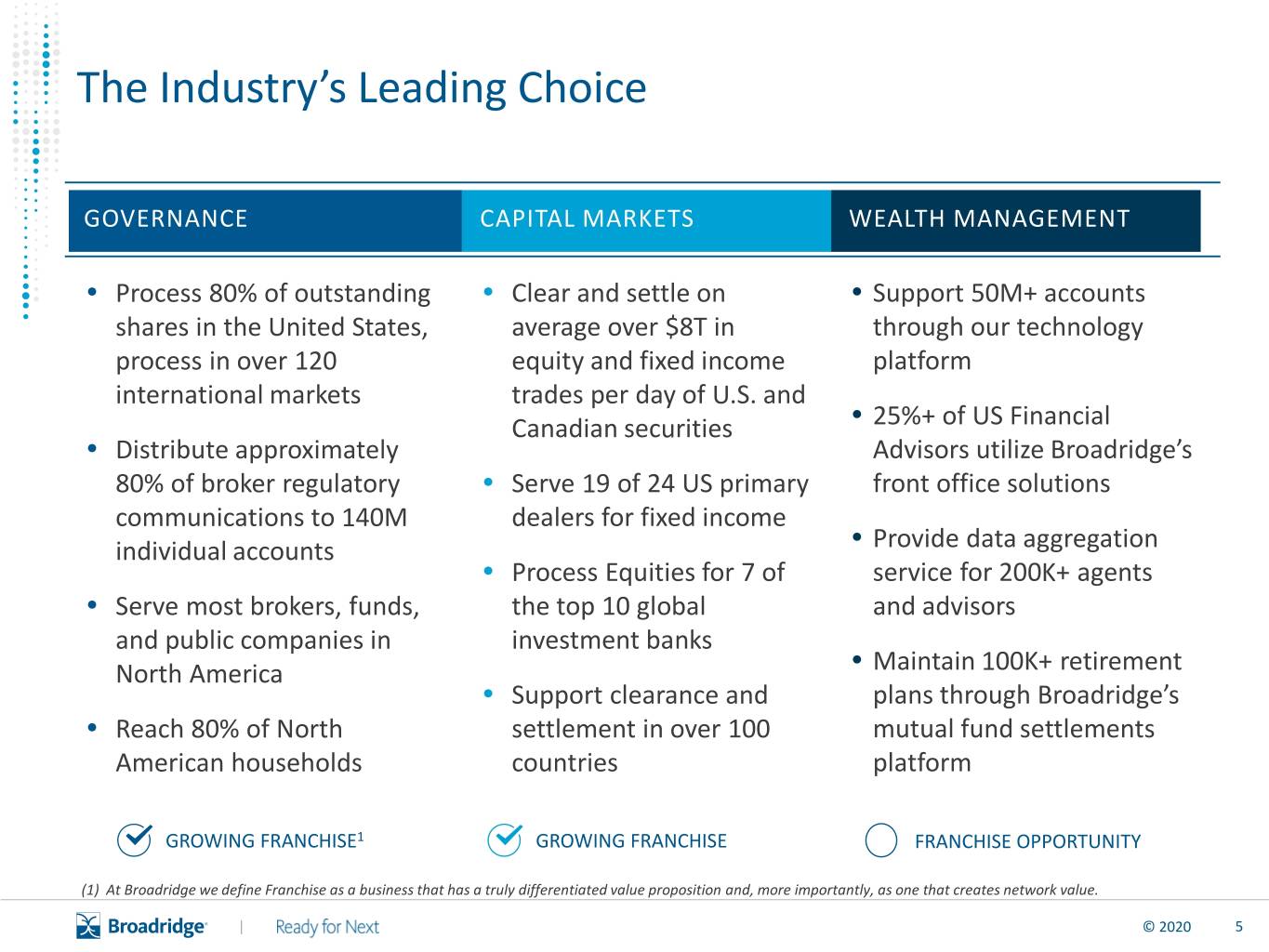

The Industry’s Leading Choice GOVERNANCE CAPITAL MARKETS WEALTH MANAGEMENT • Process 80% of outstanding • Clear and settle on • Support 50M+ accounts shares in the United States, average over $8T in through our technology process in over 120 equity and fixed income platform international markets trades per day of U.S. and Canadian securities • 25%+ of US Financial • Distribute approximately Advisors utilize Broadridge’s 80% of broker regulatory • Serve 19 of 24 US primary front office solutions communications to 140M dealers for fixed income individual accounts • Provide data aggregation • Process Equities for 7 of service for 200K+ agents • Serve most brokers, funds, the top 10 global and advisors and public companies in investment banks North America • Maintain 100K+ retirement • Support clearance and plans through Broadridge’s • Reach 80% of North settlement in over 100 mutual fund settlements American households countries platform GROWING FRANCHISE1 GROWING FRANCHISE FRANCHISE OPPORTUNITY (1) At Broadridge we define Franchise as a business that has a truly differentiated value proposition and, more importantly, as one that creates network value. | © 2020 5

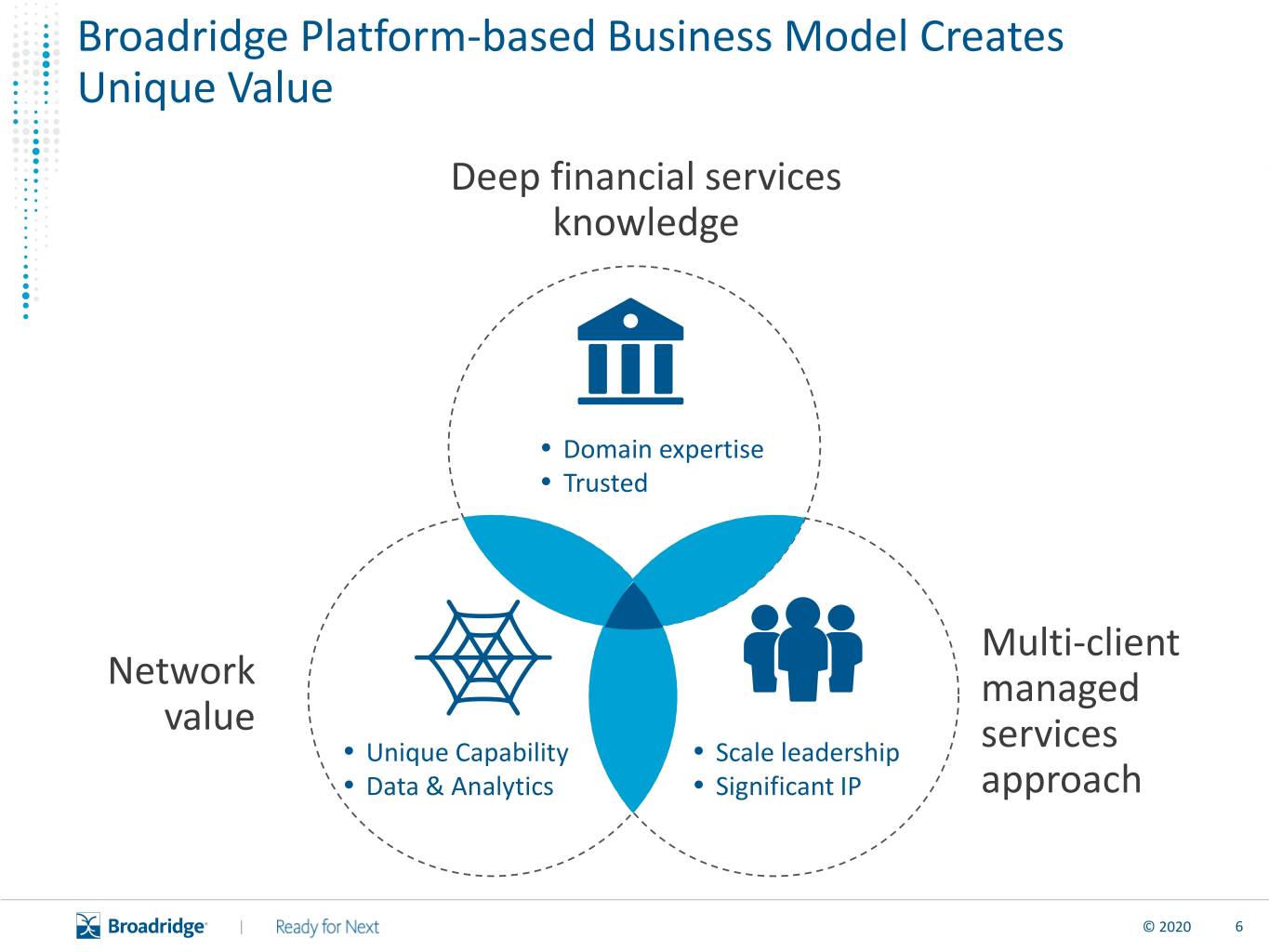

Broadridge Platform-based Business Model Creates Unique Value Deep financial services knowledge • Domain expertise • Trusted Multi-client Network managed value • Unique Capability • Scale leadership services • Data & Analytics • Significant IP approach | © 2020 6

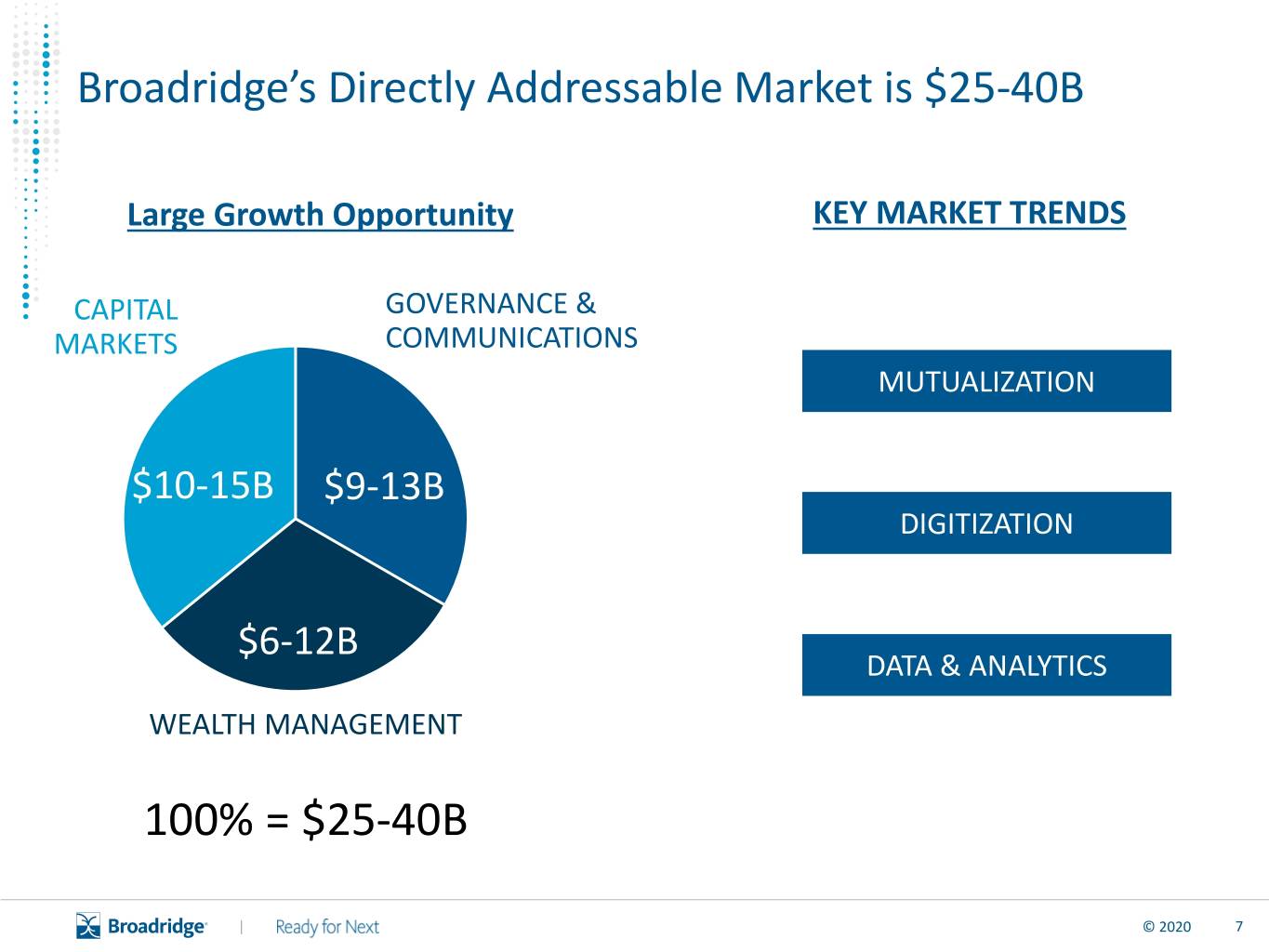

Broadridge’s Directly Addressable Market is $25-40B Large Growth Opportunity KEY MARKET TRENDS CAPITAL GOVERNANCE & MARKETS COMMUNICATIONS MUTUALIZATION $10-15B $9-13B DIGITIZATION $6-12B DATA & ANALYTICS WEALTH MANAGEMENT 100% = $25-40B | © 2020 7

Broadridge Business Model is Strong • Large, recurring revenue base with good visibility aided Sustainable Growth by $355 million revenue backlog • Organic strength driven by large addressable market Steady Margin • Continued scale and operational leverage Expansion • Focus on operational efficiencies • Capital light business model: average Capex is 2% of Strong Free Cash Flow total annual revenue1 • Largely predictable model Balanced Capital • Target ~45% dividend payout ratio2 Allocation • Balance of targeted M&A and share repurchase (1) Average Capex includes Software Purchases and capitalized internal use software, and is average from FY18 – FY20 (2) Dividend payout ratio is a percentage of prior year Adjusted Net Earnings and is subject to Board approval | © 2020 8

Executing Against Investor Day Themes Extend Governance Drive Capital Markets Build Wealth Management • Driving next-gen • Extending global post • On track to deliver front regulatory trade technology platform to back wealth communications Continued progress management platform for Strengthening digital onboarding major clients UBS in CY21 products to enhance New client wins further • Continued strong interest regulatory and other extend international from key clients in communications reach integrated Wealth Rule 30e-3 and • Developing new products platform Enhanced Content opportunities to drive network value in • RPM, Rockall, Shadow and fixed income market ClearStructure • Growing data & analytics • Developing blockchain- acquisitions accelerate suite enabled solution for repo growth and broaden • Broadening corporate market product suite issuer solution set • Continuing penetration of • Building omni-channel existing products communications | © 2020 9

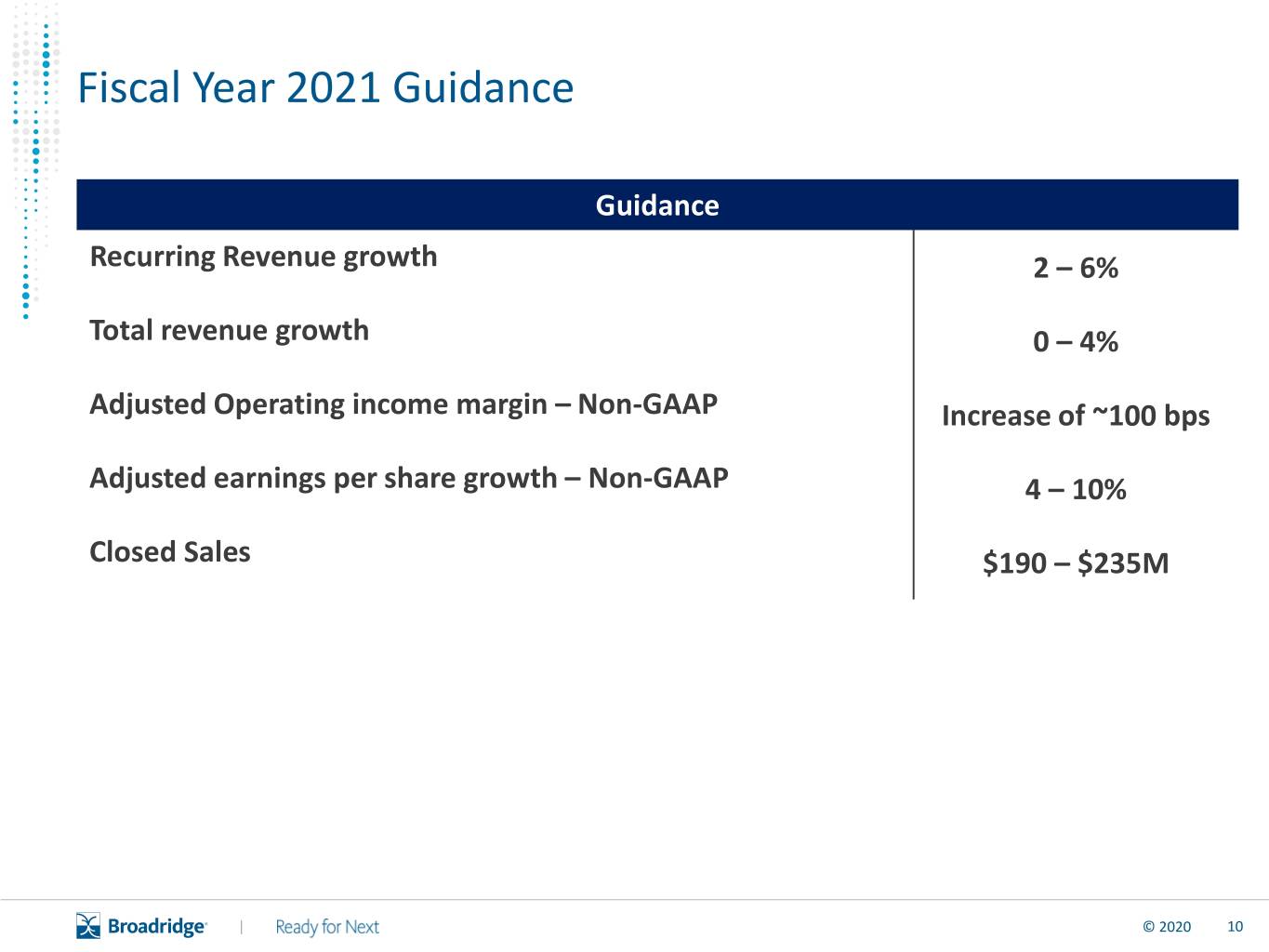

Fiscal Year 2021 Guidance Guidance Recurring Revenue growth 2 – 6% Total revenue growth 0 – 4% Adjusted Operating income margin – Non-GAAP Increase of ~100 bps Adjusted earnings per share growth – Non-GAAP 4 – 10% Closed Sales $190 – $235M | © 2020 10

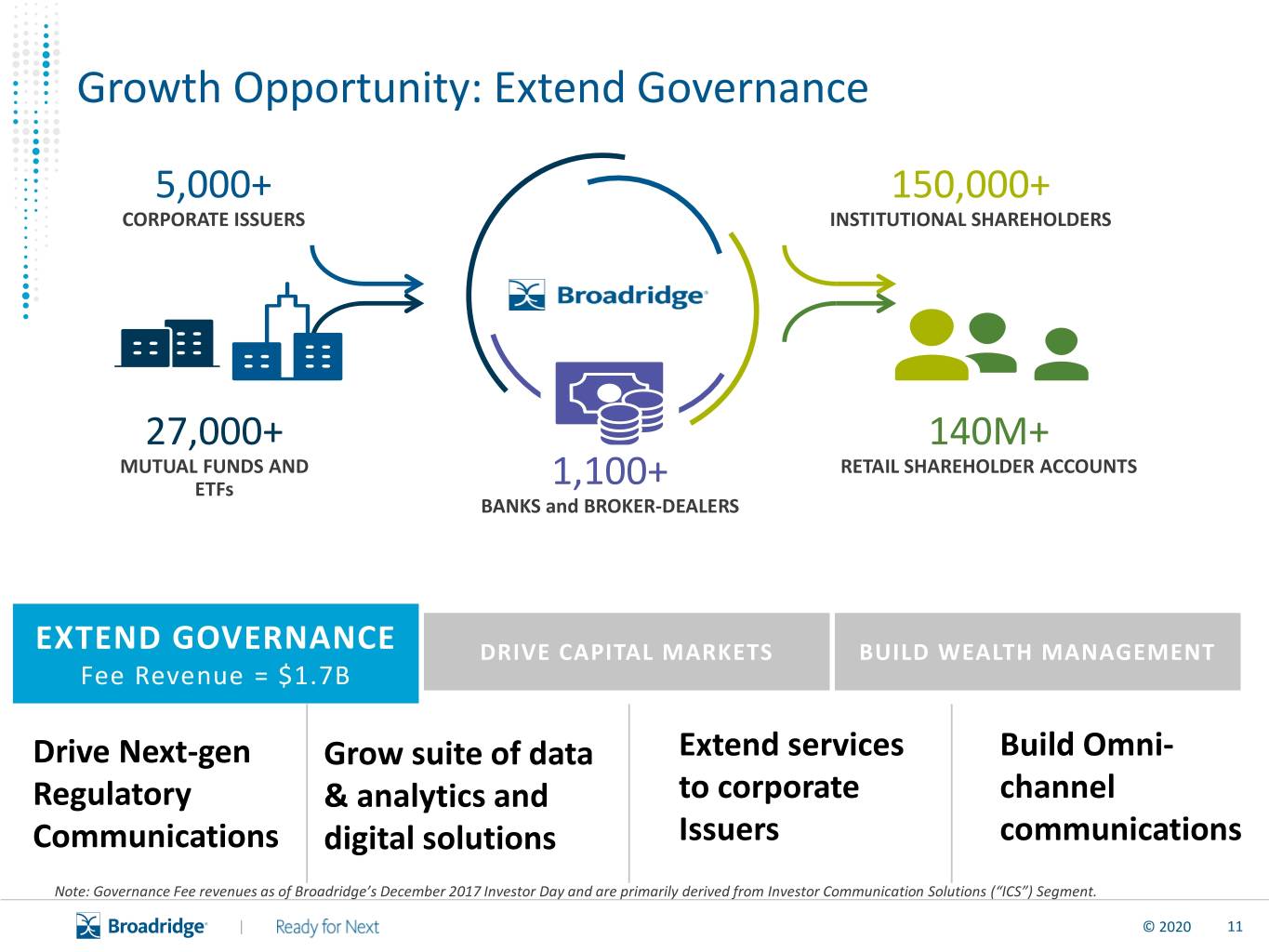

Growth Opportunity: Extend Governance 5,000+ 150,000+ CORPORATE ISSUERS INSTITUTIONAL SHAREHOLDERS 27,000+ 140M+ MUTUAL FUNDS AND RETAIL SHAREHOLDER ACCOUNTS ETFs 1,100+ BANKS and BROKER-DEALERS EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH MANAGEMENT Fee Revenue = $1.7B Drive Next-gen Grow suite of data Extend services Build Omni- Regulatory & analytics and to corporate channel Communications digital solutions Issuers communications Note: Governance Fee revenues as of Broadridge’s December 2017 Investor Day and are primarily derived from Investor Communication Solutions (“ICS”) Segment. | © 2020 11

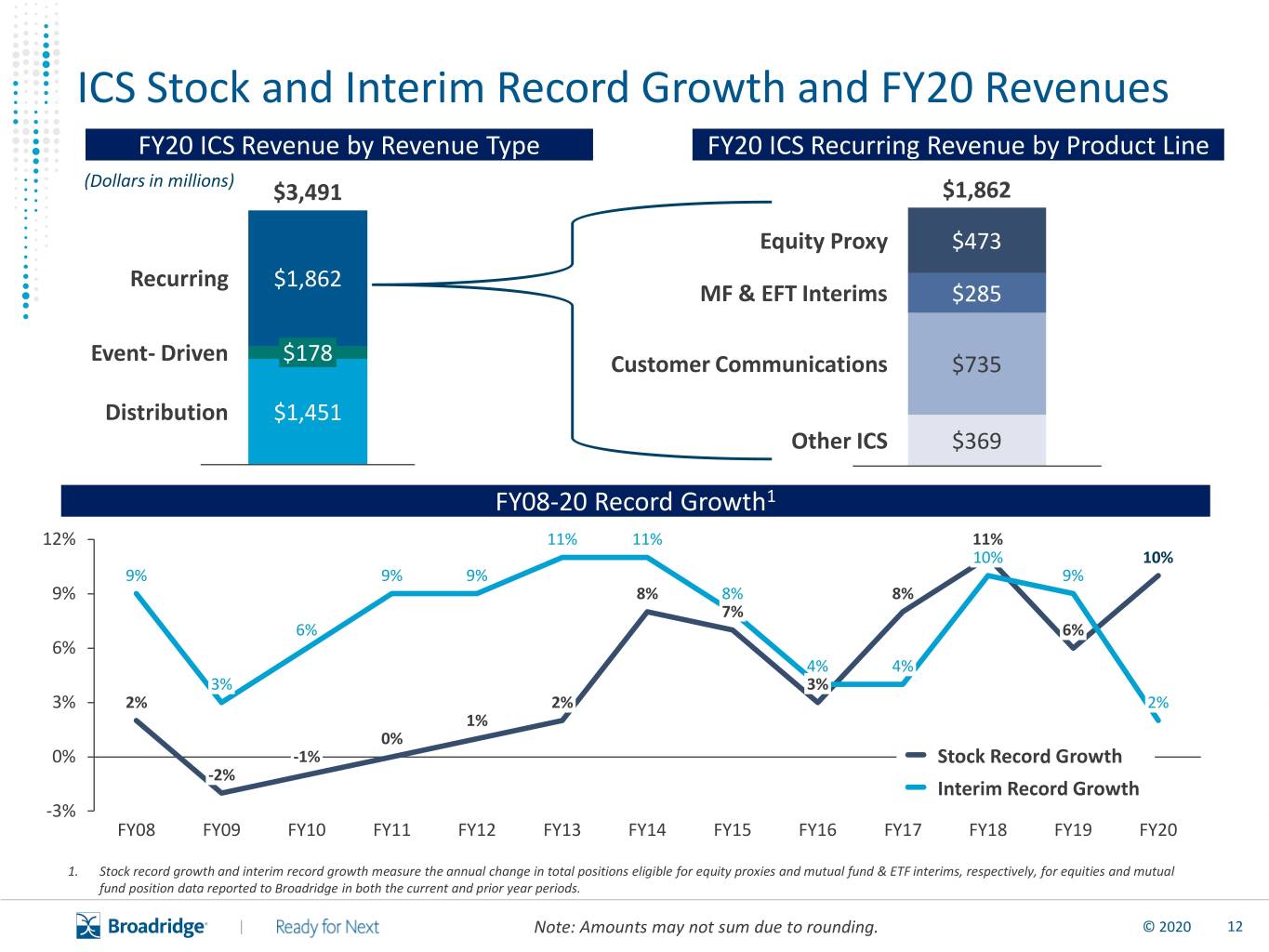

ICS Stock and Interim Record Growth and FY20 Revenues FY20 ICS Revenue by Revenue Type FY20 ICS Recurring Revenue by Product Line (Dollars in millions) $3,491 $1,862 Equity Proxy $473 Recurring $1,862 MF & EFT Interims $285 Event- Driven $178 Customer Communications $735 Distribution $1,451 Other ICS $369 FY08-20 Record Growth1 12% 11% 11% 11% 10% 10% 9% 9% 9% 9% 9% 8% 8% 8% 7% 6% 6% 6% 4% 4% 3% 3% 3% 2% 2% 2% 1% 0% 0% -1% Stock Record Growth -2% Interim Record Growth -3% FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 1. Stock record growth and interim record growth measure the annual change in total positions eligible for equity proxies and mutual fund & ETF interims, respectively, for equities and mutual fund position data reported to Broadridge in both the current and prior year periods. | Note: Amounts may not sum due to rounding. © 2020 12

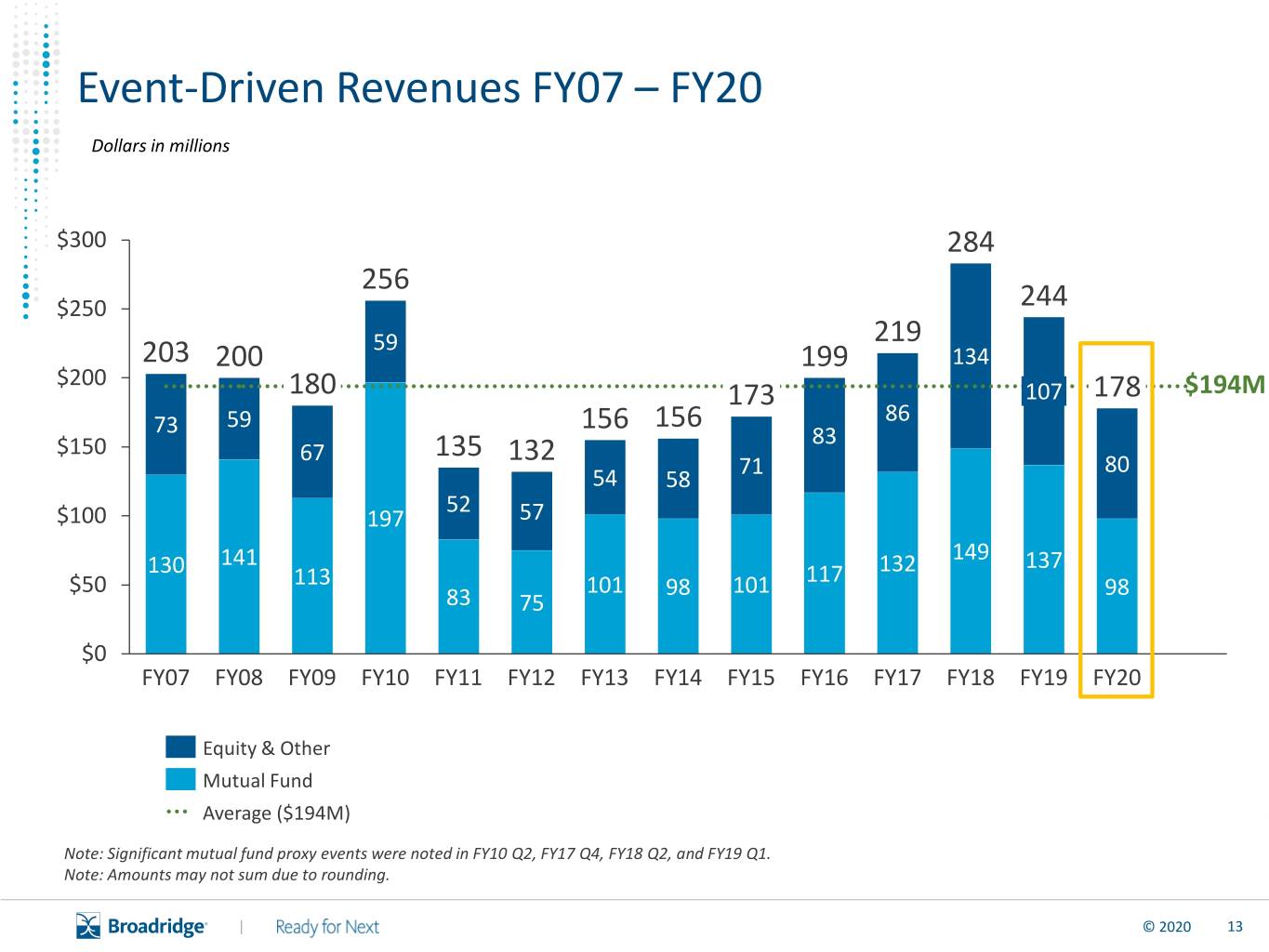

Event-Driven Revenues FY07 – FY20 Dollars in millions $300 284 256 $250 244 59 219 203 200 199 134 $200 180 173 107 178 $194M 59 156 156 86 73 83 $150 67 135 132 71 80 54 58 52 $100 197 57 141 149 137 130 117 132 $50 113 101 98 101 98 83 75 $0 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 Equity & Other Mutual Fund Average ($194M) Note: Significant mutual fund proxy events were noted in FY10 Q2, FY17 Q4, FY18 Q2, and FY19 Q1. Note: Amounts may not sum due to rounding. | © 2020 13

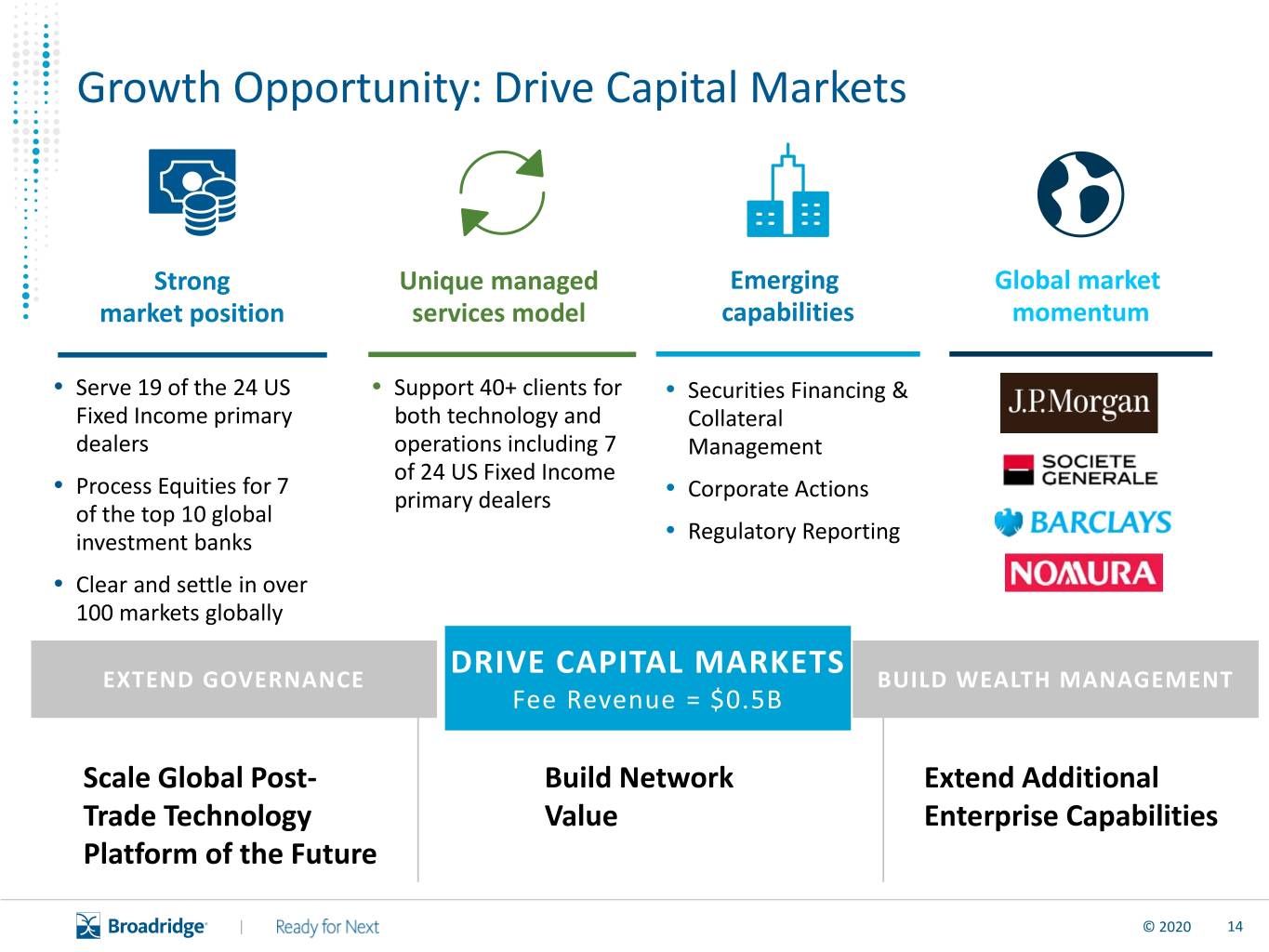

Growth Opportunity: Drive Capital Markets Strong Unique managed Emerging Global market market position services model capabilities momentum • Serve 19 of the 24 US • Support 40+ clients for • Securities Financing & Fixed Income primary both technology and Collateral dealers operations including 7 Management of 24 US Fixed Income • Process Equities for 7 primary dealers • Corporate Actions of the top 10 global investment banks • Regulatory Reporting • Clear and settle in over 100 markets globally EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH MANAGEMENT Fee Revenue = $0.5B Scale Global Post- Build Network Extend Additional Trade Technology Value Enterprise Capabilities Platform of the Future | © 2020 14

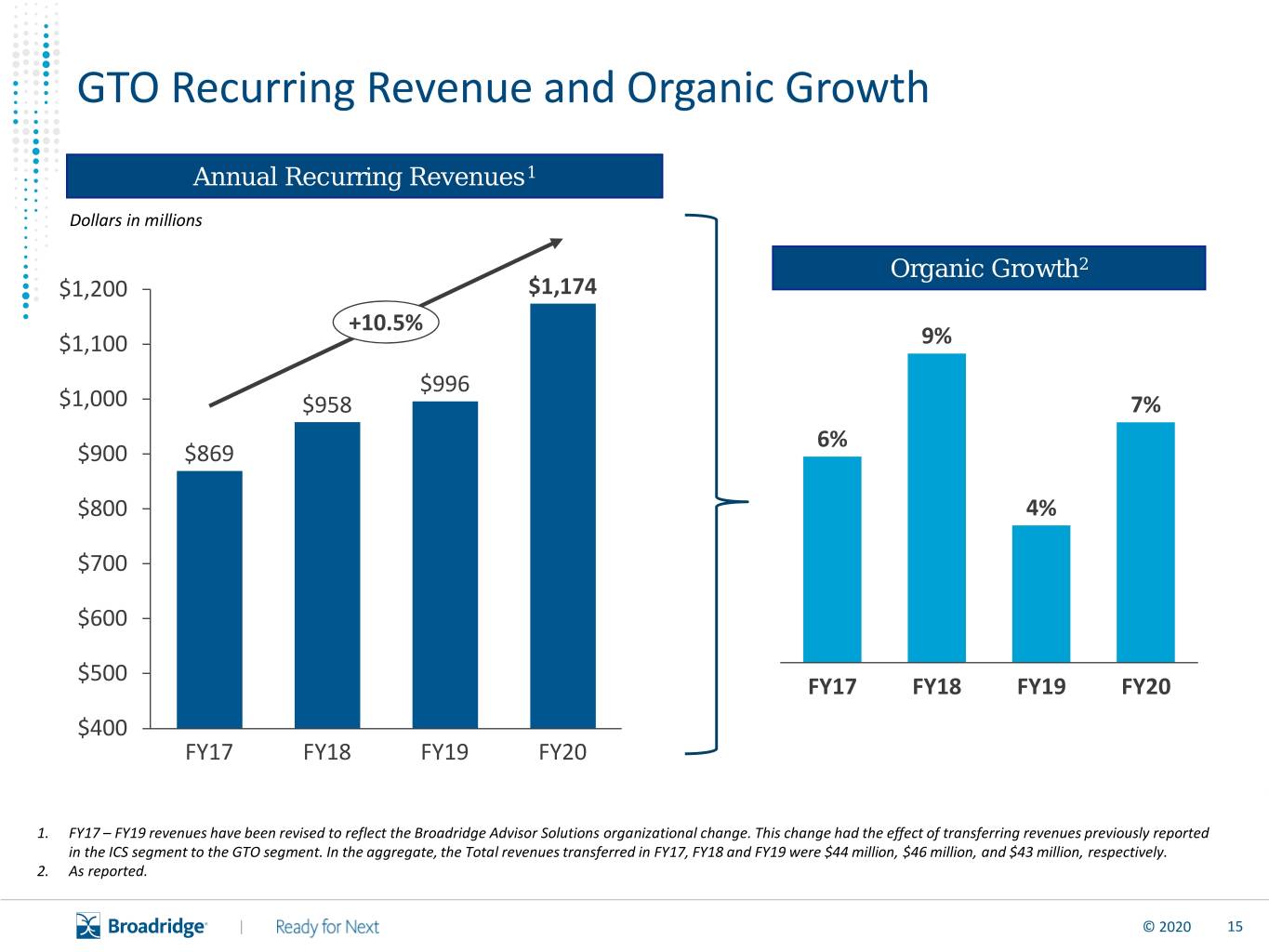

GTO Recurring Revenue and Organic Growth Annual Recurring Revenues1 Dollars in millions Organic Growth2 $1,200 $1,174 +10.5% $1,100 9% $996 $1,000 $958 7% 6% $900 $869 $800 4% $700 $600 $500 FY17 FY18 FY19 FY20 $400 FY17 FY18 FY19 FY20 1. FY17 – FY19 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In the aggregate, the Total revenues transferred in FY17, FY18 and FY19 were $44 million, $46 million, and $43 million, respectively. 2. As reported. | © 2020 15

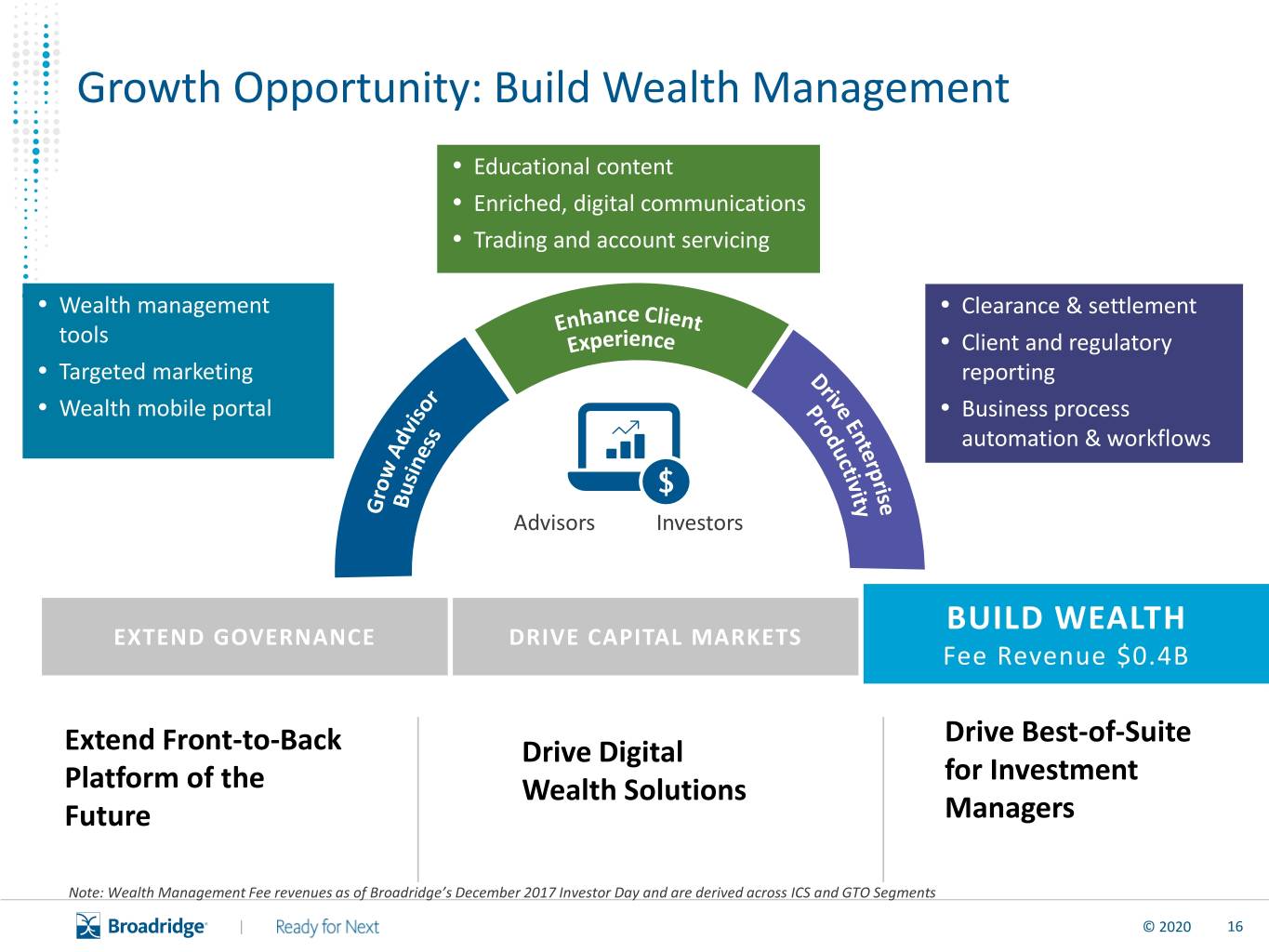

Growth Opportunity: Build Wealth Management • Educational content • Enriched, digital communications • Trading and account servicing • Wealth management • Clearance & settlement tools • Client and regulatory • Targeted marketing reporting • Wealth mobile portal • Business process automation & workflows Advisors Investors EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH Fee Revenue $0.4B Drive Best-of-Suite Extend Front-to-Back Drive Digital for Investment Platform of the Wealth Solutions Future Managers Note: Wealth Management Fee revenues as of Broadridge’s December 2017 Investor Day and are derived across ICS and GTO Segments | © 2020 16

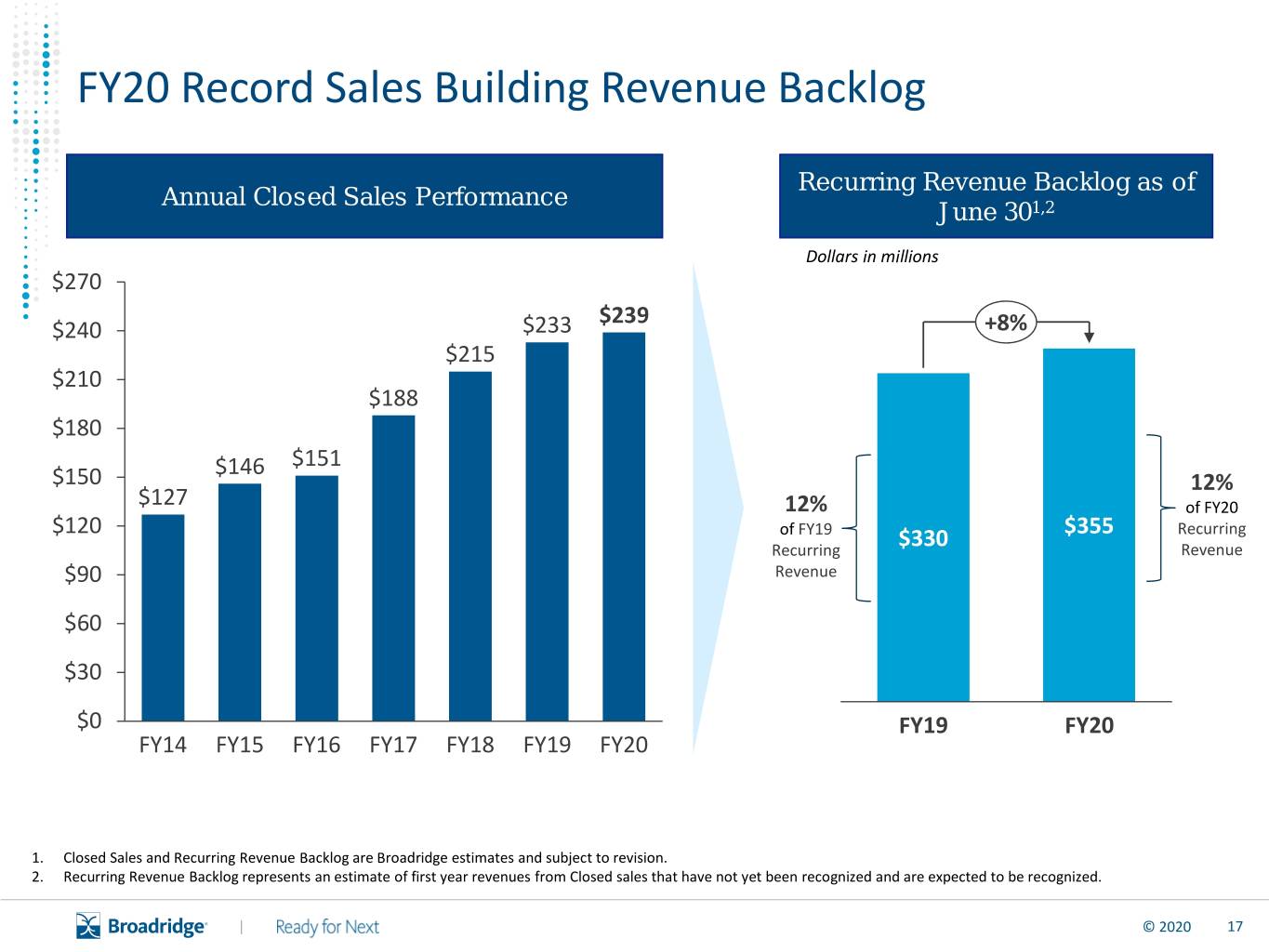

FY20 Record Sales Building Revenue Backlog Recurring Revenue Backlog as of Annual Closed Sales Performance June 301,2 Dollars in millions $270 $239 $240 $233 +8% $215 $210 $188 $180 $146 $151 $150 12% $127 12% of FY20 $120 of FY19 $355 Recurring Recurring $330 Revenue $90 Revenue $60 $30 $0 FY19 FY20 FY14 FY15 FY16 FY17 FY18 FY19 FY20 1. Closed Sales and Recurring Revenue Backlog are Broadridge estimates and subject to revision. 2. Recurring Revenue Backlog represents an estimate of first year revenues from Closed sales that have not yet been recognized and are expected to be recognized. | © 2020 17

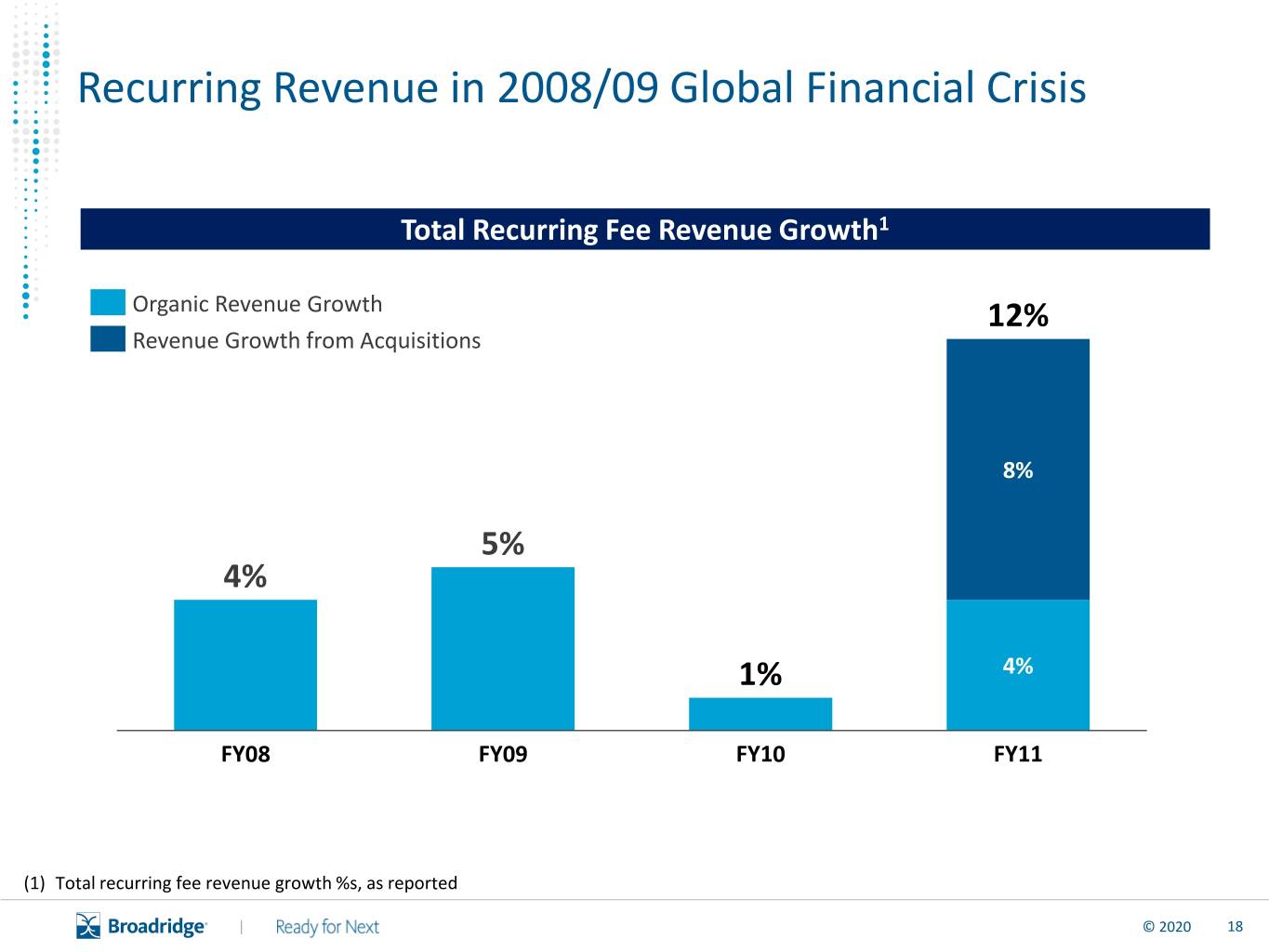

Recurring Revenue in 2008/09 Global Financial Crisis Total Recurring Fee Revenue Growth1 Organic Revenue Growth 12% Revenue Growth from Acquisitions 8% 5% 4% 1% 4% FY08 FY09 FY10 FY11 (1) Total recurring fee revenue growth %s, as reported | © 2020 18

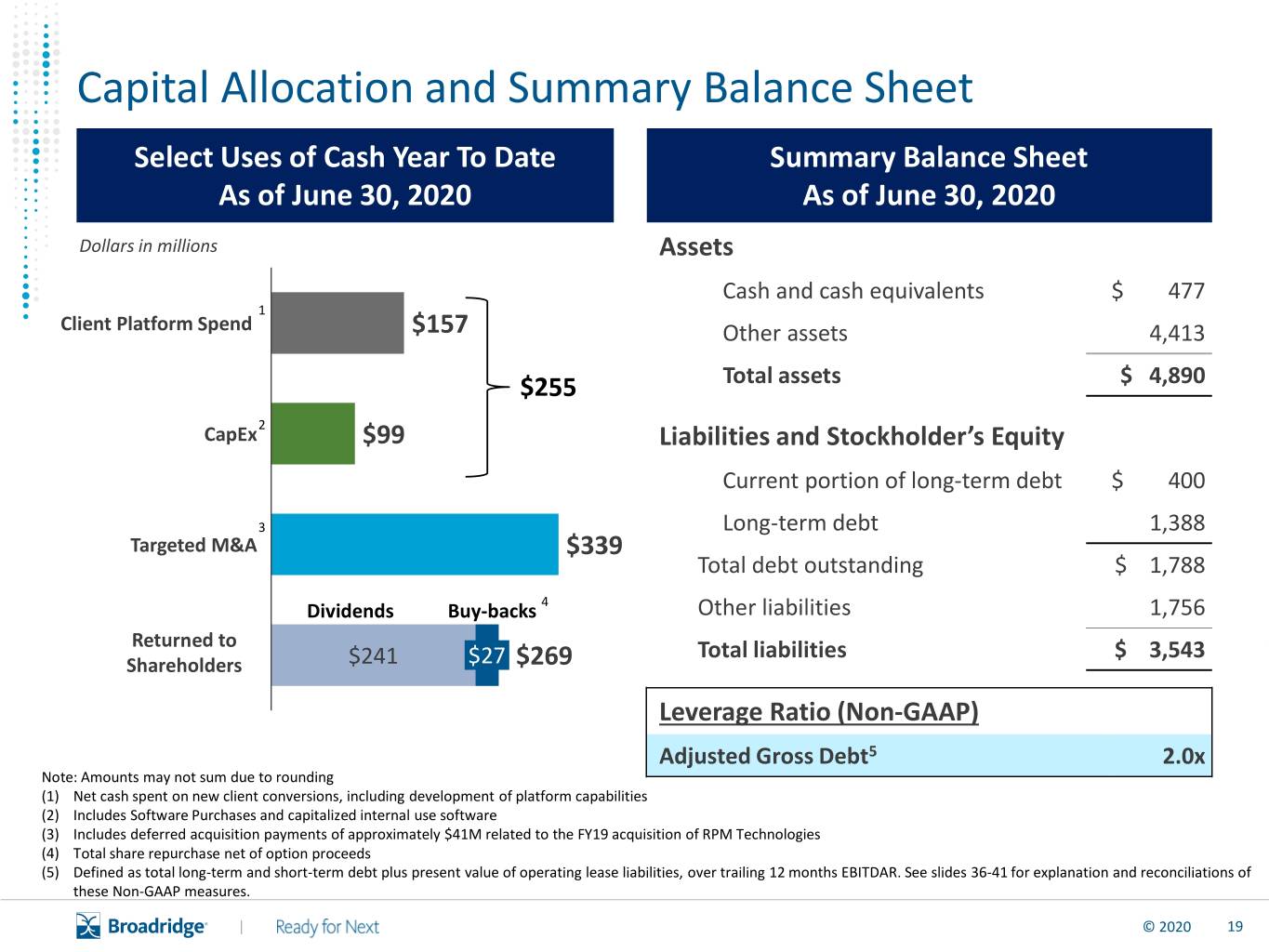

Capital Allocation and Summary Balance Sheet Select Uses of Cash Year To Date Summary Balance Sheet As of June 30, 2020 As of June 30, 2020 Dollars in millions Assets Cash and cash equivalents $ 477 1 Client Platform Spend $157 Other assets 4,413 $255 Total assets $ 4,890 2 CapEx $99 Liabilities and Stockholder’s Equity Current portion of long-term debt $ 400 3 Long-term debt 1,388 Targeted M&A $339 Total debt outstanding $ 1,788 4 Dividends Buy-backs Other liabilities 1,756 Returned to Total liabilities $ 3,543 Shareholders $241 $27 $269 LeverageTotal stockholders’ Ratio (Non equity-GAAP) $ 1,346.5 Adjusted Gross Debt5 2.0x Note: Amounts may not sum due to rounding (1) Net cash spent on new client conversions, including development of platform capabilities (2) Includes Software Purchases and capitalized internal use software (3) Includes deferred acquisition payments of approximately $41M related to the FY19 acquisition of RPM Technologies (4) Total share repurchase net of option proceeds (5) Defined as total long-term and short-term debt plus present value of operating lease liabilities, over trailing 12 months EBITDAR. See slides 36-41 for explanation and reconciliations of these Non-GAAP measures. | © 2020 19

Regulatory Update Modernization • Proposes summary annual, semi-annual reports to replace current long-form reports of mutual fund and eliminates overlapping annual prospectus as part of layered approach Positive direction for fund industry, individual investors, and Broadridge communications • • Reinforces importance of communications to individual investors, creates simpler and “Rule 498B” more engaging content, and strong path to digital • Likely neutral to BR. Impacts annual prospectus revenue (~$60M) while creating Proposed on opportunity to drive more engaging and lower-cost content for funds 8/5/20 • Timing and implementation of final rules uncertain but likely 2-3 years Rule 30e-3 • Mutual funds to opt-in shareholders to receive “Notice-and-Access” beginning Jan ‘21 “Notice-and- • Modestly net positive (higher recurring revenue, lower distribution revenues) • Will be superseded by 498B upon implementation of streamlined reports Mutualfunds Access” • Broadridge comment letter in October 2018 laid out the Company’s strong track Mutual fund record of value ($400M+ annually) delivered to the mutual fund industry and identified future savings interim fees • Since Broadridge’s comment letter, fees discussion rolled into proxy working groups (no timeline for issuing a recommendation to the SEC) Proxy • Currently implementing end-to-end vote confirmation for institutional clients Roundtable • Little economic impact to Broadridge Equity Equity proxy | © 2020 20

Fourth Quarter Fiscal 2020 Results | © 2020 21

Highlights . Broadridge is executing well in this new and challenging environment • Health and safety of our associates remains our top priority • Our associates and technology are processing record investor communication levels and heavy trading volumes . Exceptional Fourth Quarter results highlight strength of our value proposition and resilience of our business model • Recurring revenue growth of 14% and Total revenue growth of 12% • Event-driven revenues rose $17 million • Diluted EPS rose 27% and Adjusted EPS rose 25% • Second strongest Closed Sales quarter on record . Strong Fiscal Year 2020 results despite decline in full year event-driven revenues and backdrop of the Covid-19 pandemic across the globe • FY20 Recurring revenue growth of 10% • Diluted EPS decline of (3)% and Adjusted EPS growth of 8% • FY20 Results and FY21 outlook support 6% annual dividend increase | © 2020 22

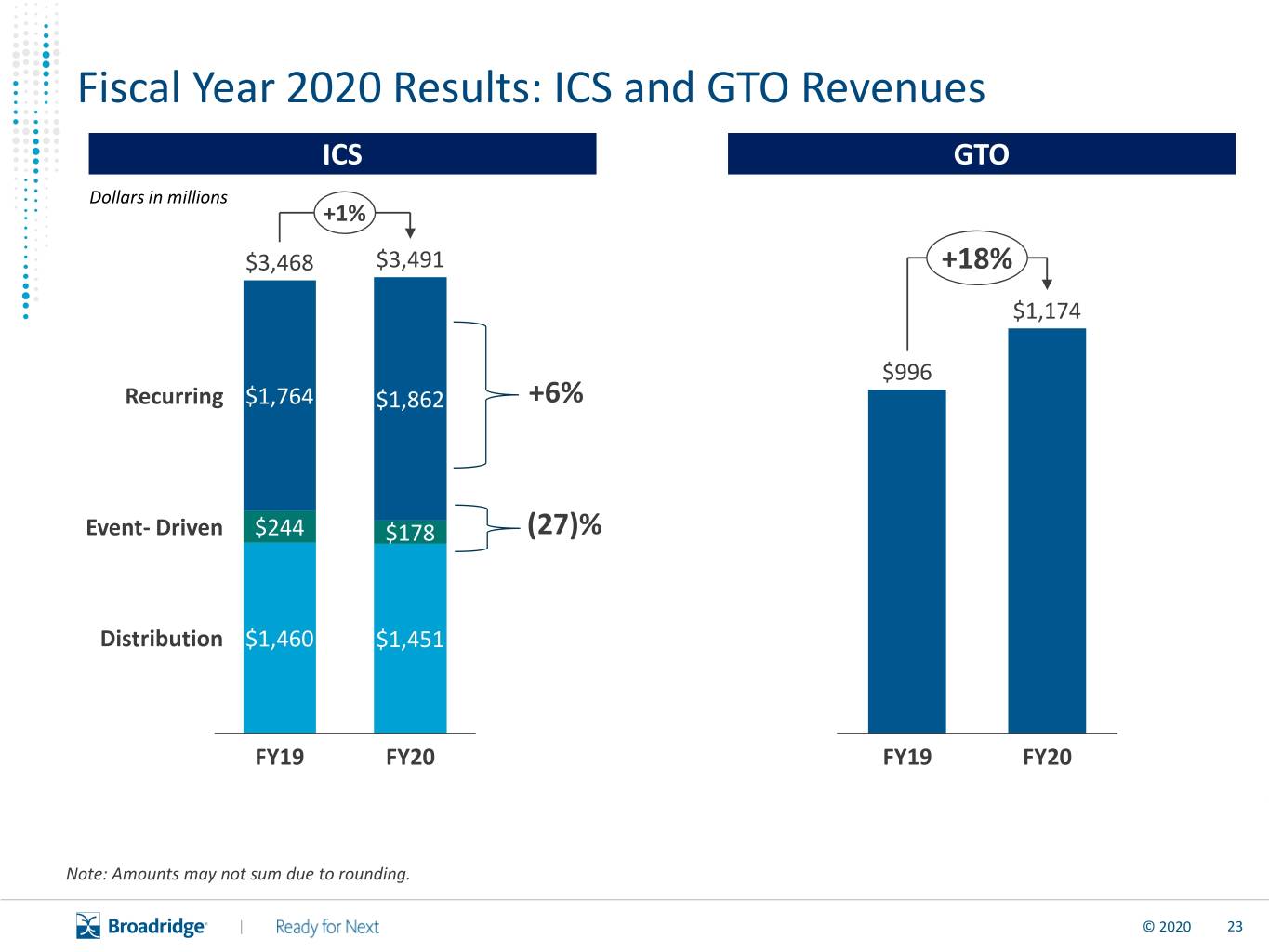

Fiscal Year 2020 Results: ICS and GTO Revenues ICS GTO Dollars in millions +1% $3,468 $3,491 +18% $1,174 $996 Recurring $1,764 $1,862 +6% Event- Driven $244 $178 (27)% Distribution $1,460 $1,451 FY19 FY20 FY19 FY20 Note: Amounts may not sum due to rounding. | © 2020 23

Broadridge Remains Well-Positioned for Growth . Covid-19 pandemic is accelerating long-term trends driving our growth • Need for resiliency is adding urgency to mutualization discussions • Digitization is likely to accelerate • Ability to adapt data and new technologies critical to driving differentiation . We are increasing investment in our people, platforms, and products to meet that challenge • Strong cost measures to protect against uncertainty • Continuing to invest in talent and technology • Increasing investment in next-generation resiliency and digitization . Broadridge on track for continued growth in FY21, despite macroeconomic uncertainty • 2 - 6% Recurring revenue growth • 4 - 10% Adjusted EPS growth . Focus on long-term and continued investment leaves Broadridge better positioned than ever for growth | © 2020 24

Financial Highlights .1 Strong finish to the fiscal year .2 Event-Driven activity at highest point this year in Q4, but an overall modest year .3 Record full year Closed Sales demonstrate the strength and resilience of the Broadridge model .4 We have good visibility into our Recurring revenue backlog, which grew to $355M this year – an indicator of our ability to generate ongoing revenue growth .5 Our balance sheet is strong and healthy .6 FY21 guidance calls for continued top and bottom-line growth, and increased investment | © 2020 25

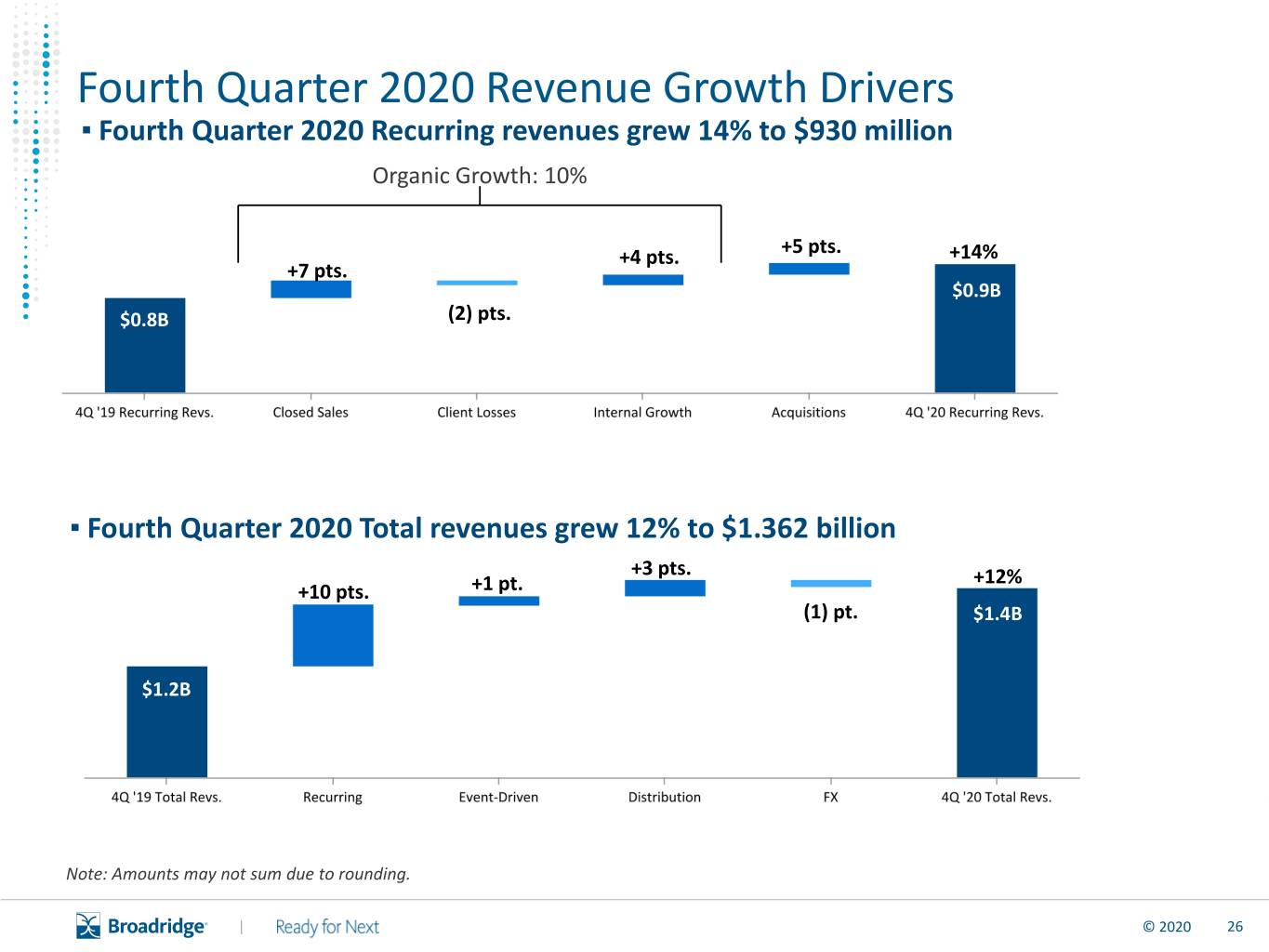

Fourth Quarter 2020 Revenue Growth Drivers ▪ Fourth Quarter 2020 Recurring revenues grew 14% to $930 million Organic Growth: 10% $623M $576M +4 pts. +5 pts. +14% +7 pts. $0.9B $0.8B (2) pts. ▪ Fourth Quarter 2020 Total revenues grew 12% to $1.362 billion +3 pts. +12% +10 pts. +1 pt. (1) pt. $1,362M$1.4B $1.2B $1,211M Note: Amounts may not sum due to rounding. | © 2020 26

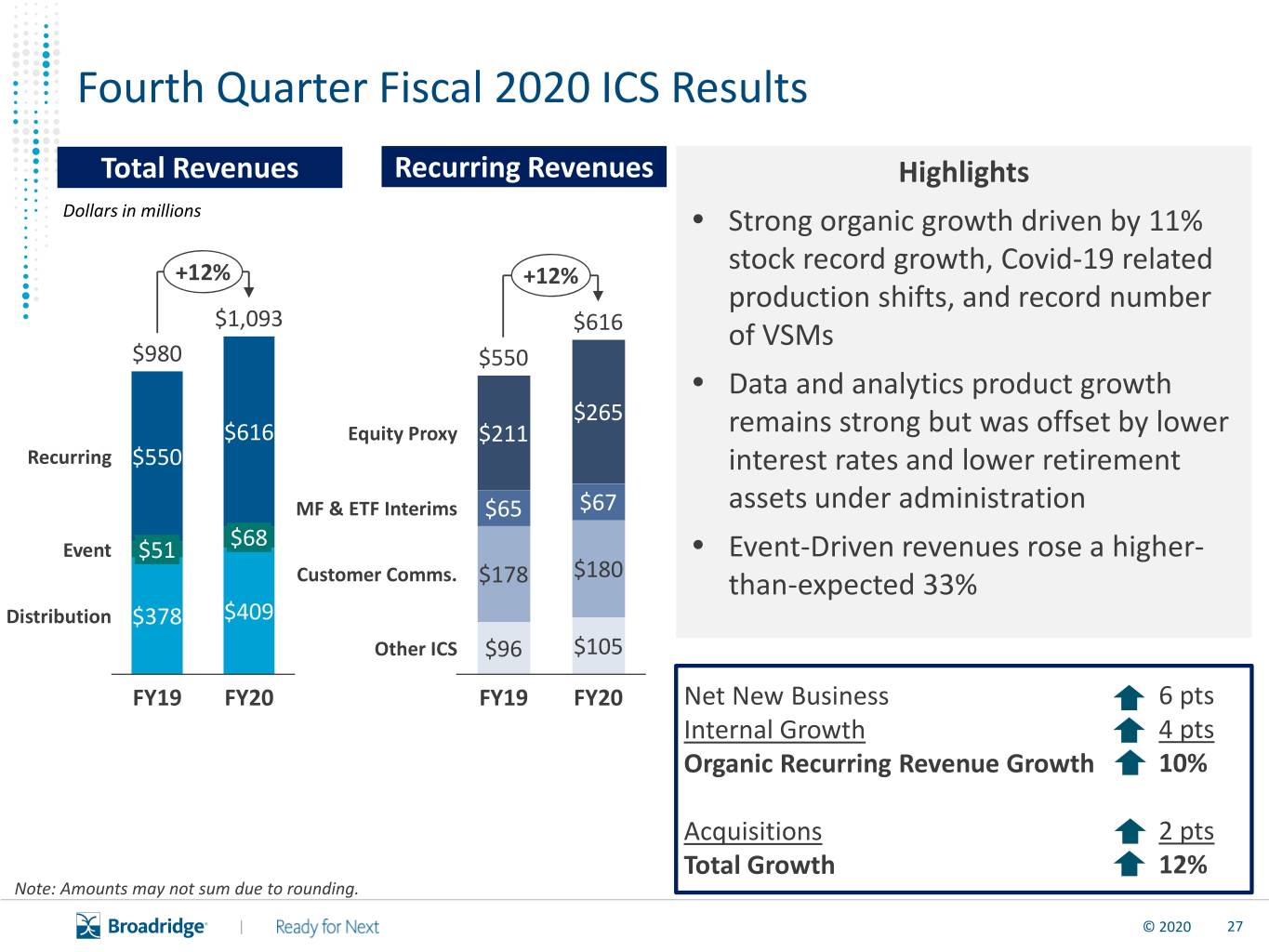

Fourth Quarter Fiscal 2020 ICS Results Total Revenues Recurring Revenues Highlights Dollars in millions • Strong organic growth driven by 11% stock record growth, Covid-19 related +12% +12% production shifts, and record number $1,093 $616 of VSMs $980 $550 • Data and analytics product growth $265 $616 Equity Proxy $211 remains strong but was offset by lower Recurring $550 interest rates and lower retirement MF & ETF Interims $65 $67 assets under administration $68 Event $51 • Event-Driven revenues rose a higher- $180 Customer Comms. $178 than-expected 33% Distribution $378 $409 Other ICS $96 $105 FY19 FY20 FY19 FY20 Net New Business 6 pts Internal Growth 4 pts Organic Recurring Revenue Growth 10% Acquisitions 2 pts Total Growth 12% Note: Amounts may not sum due to rounding. | © 2020 27

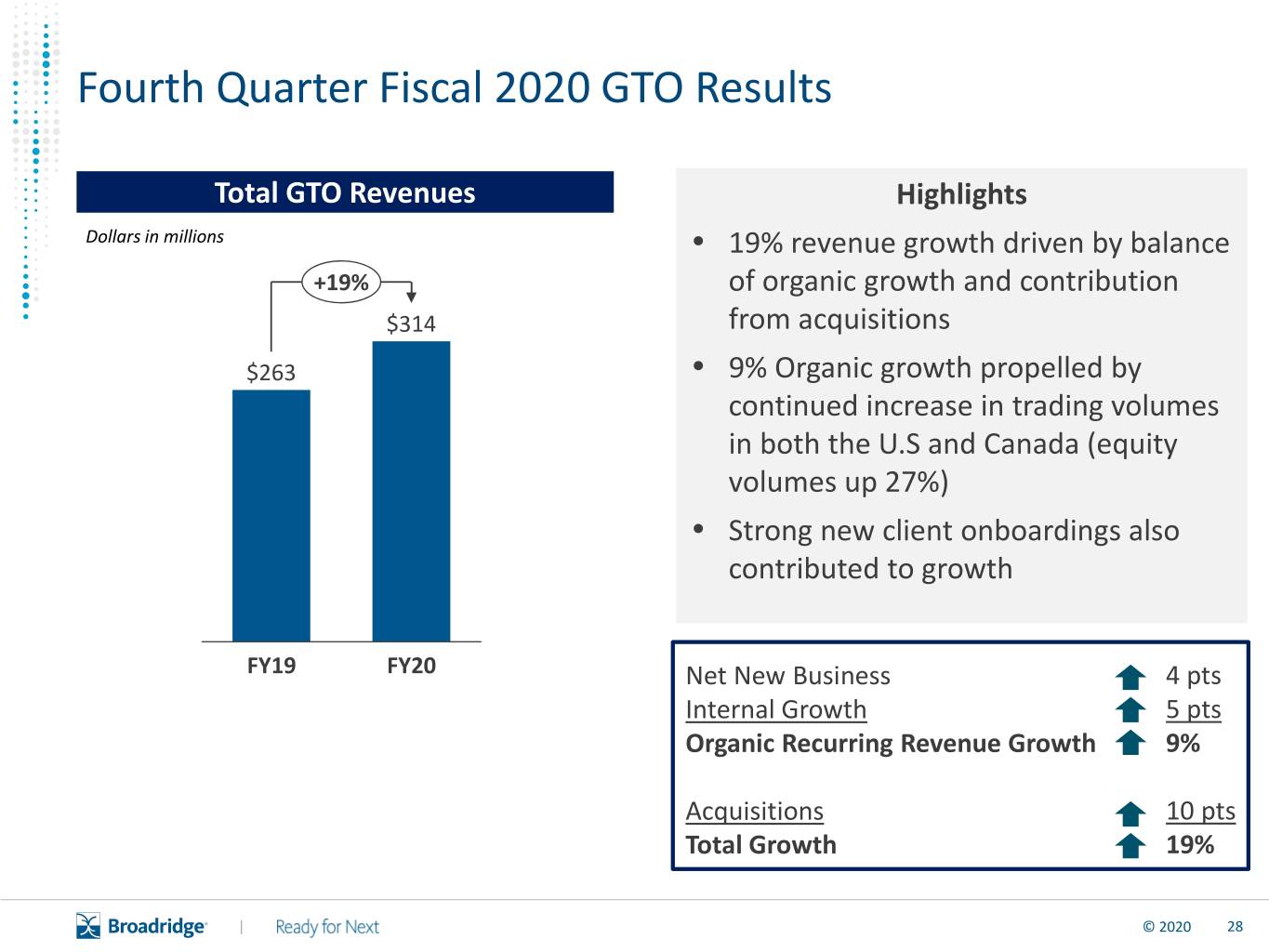

Fourth Quarter Fiscal 2020 GTO Results Total GTO Revenues Highlights Dollars in millions • 19% revenue growth driven by balance +19% of organic growth and contribution $314 from acquisitions $263 • 9% Organic growth propelled by continued increase in trading volumes in both the U.S and Canada (equity volumes up 27%) • Strong new client onboardings also contributed to growth FY19 FY20 Net New Business 4 pts Internal Growth 5 pts Organic Recurring Revenue Growth 9% Acquisitions 10 pts Total Growth 19% | © 2020 28

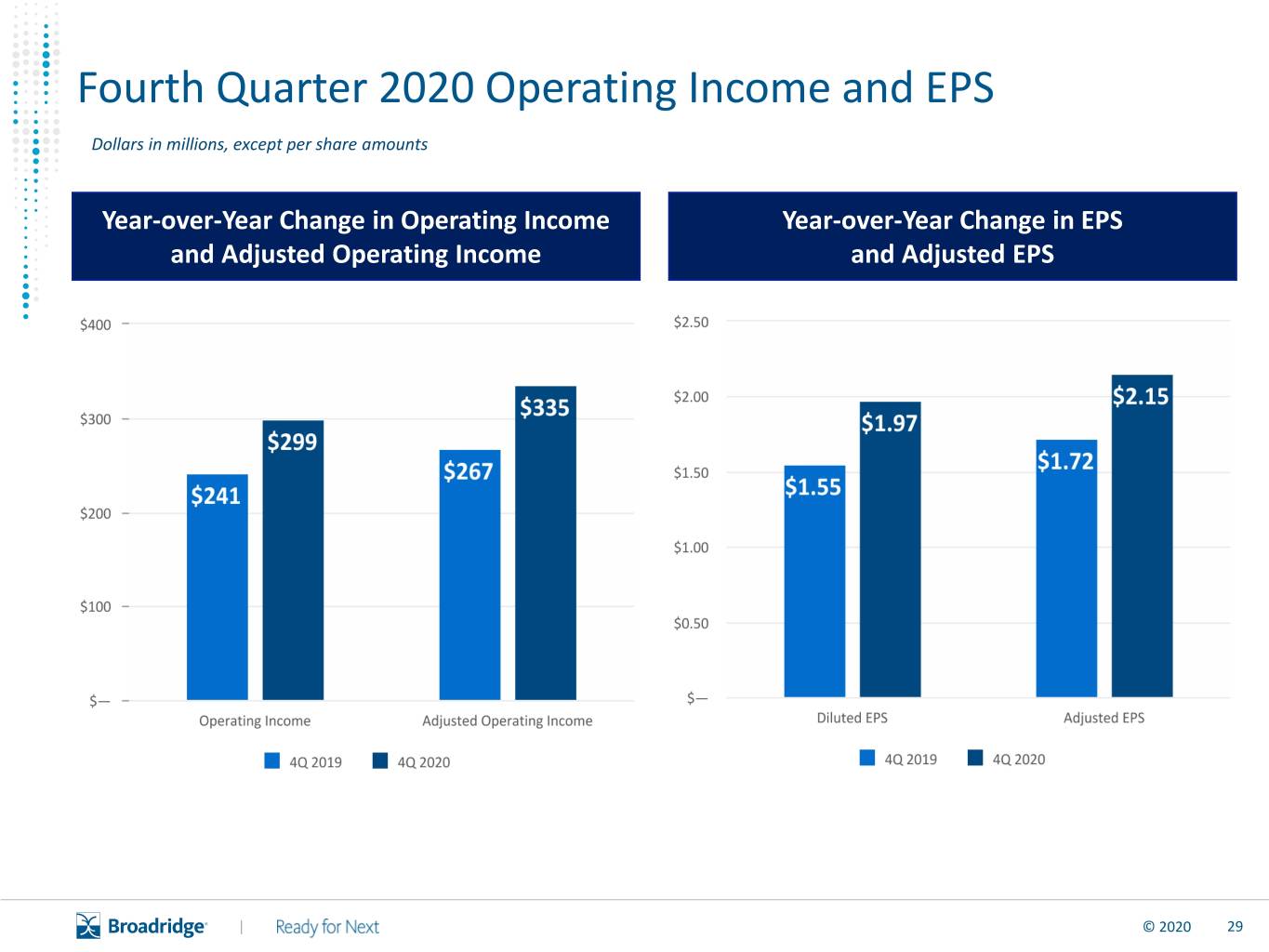

Fourth Quarter 2020 Operating Income and EPS Dollars in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in EPS and Adjusted Operating Income and Adjusted EPS | © 2020 29

Fiscal Year 2020 vs. Fiscal Year 2019 | © 2020 30

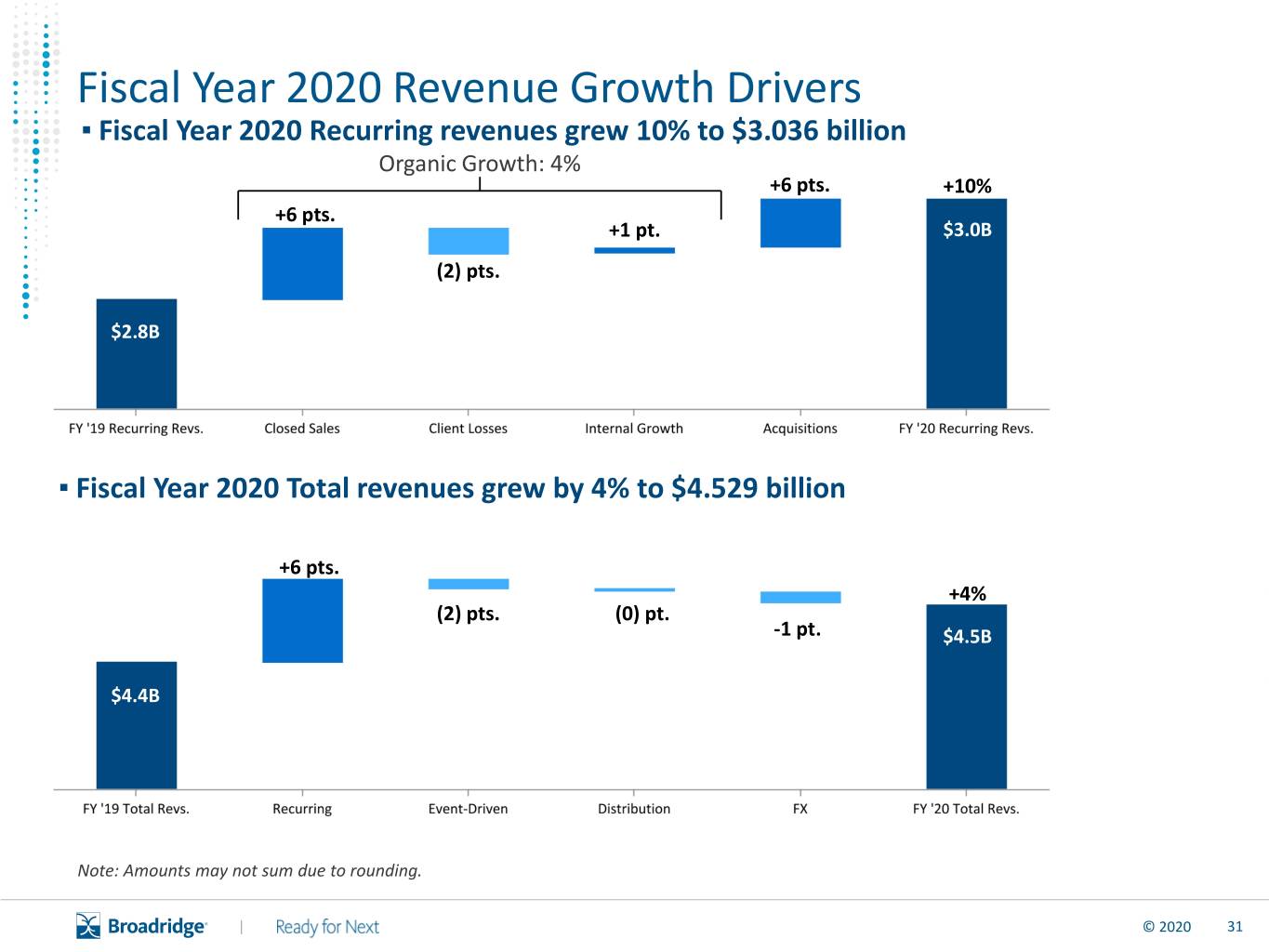

Fiscal Year 2020 Revenue Growth Drivers ▪ Fiscal Year 2020 Recurring revenues grew 10% to $3.036 billion Organic Growth: 4% +6 pts. +10%$623M +6 pts. +1 pt. $3.0B $576M (2) pts. $2.8B ▪ Fiscal Year 2020 Total revenues grew by 4% to $4.529 billion +6 pts. $3,151M +4% (2) pts. (0) pt. -1 pt. $4.5B $4.4B Note: Amounts may not sum due to rounding. | © 2020 31

Full Year Fiscal 2020 Results ICS GTO Dollars in millions Total Revenues Recurring Revenues +18% +1% +6% $3,468 $3,491 $1,862 $1,174 $1,764 $473 $996 Equity Proxy $437 Recurring $1,764 $1,862 $285 MF & ETF Interims $266 Event Driven $244 $178 Customer Comms. $736 $735 Distribution $1,460 $1,451 Other ICS $325 $369 FY19 FY20 FY19 FY20 FY19 FY20 Note: Amounts may not sum due to rounding. | © 2020 32

Fiscal Year 2020 Operating Income and EPS Dollars in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in EPS and Adjusted Operating Income and Adjusted EPS | © 2020 33

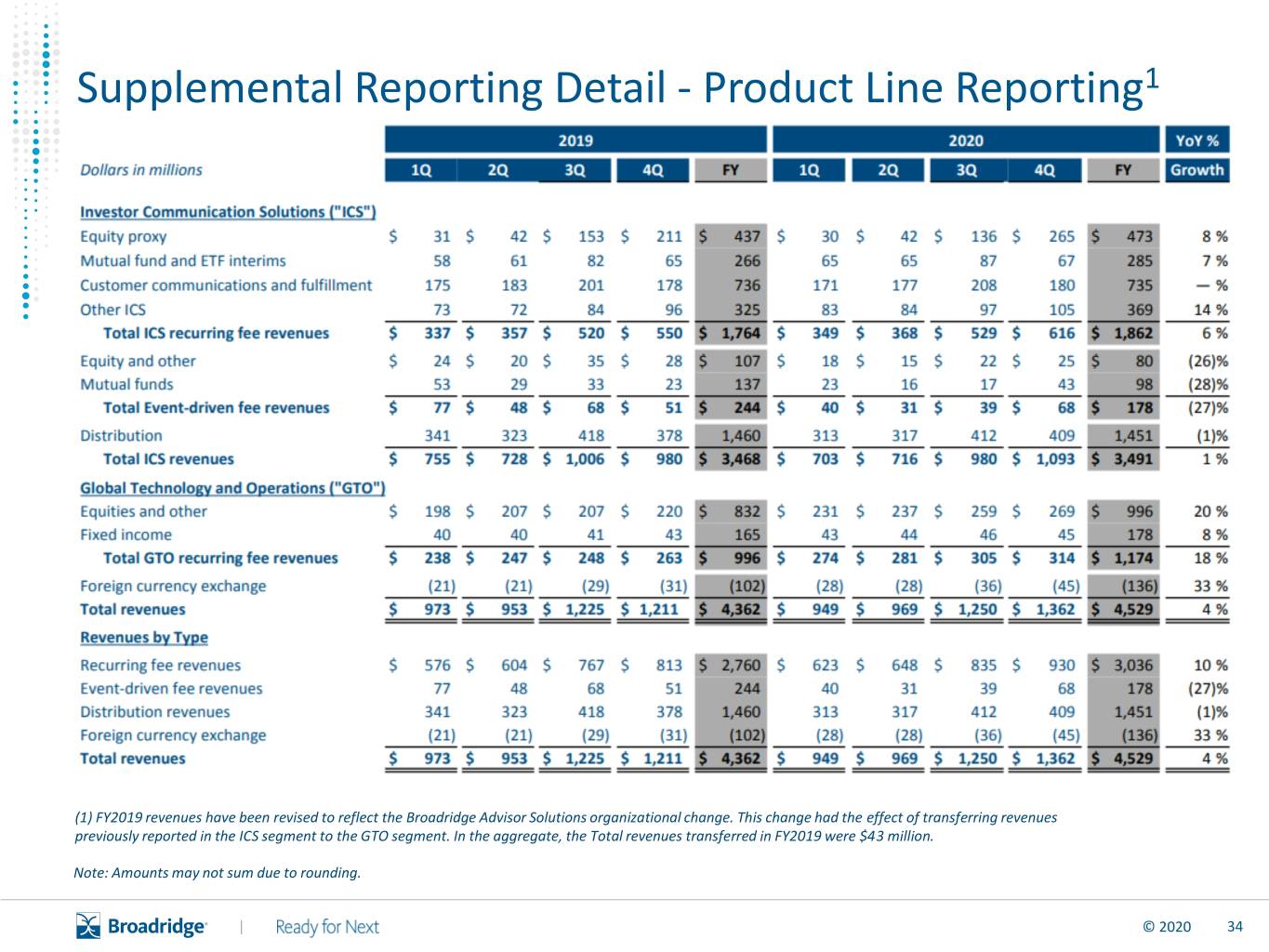

Supplemental Reporting Detail - Product Line Reporting1 (1) FY2019 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In the aggregate, the Total revenues transferred in FY2019 were $43 million. Note: Amounts may not sum due to rounding. | © 2020 34

Explanation of Non-GAAP Measures and Reconciliation of GAAP to Non-GAAP Measures | © 2020 35

Non-GAAP Measures Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings Per Share, Adjusted EBITDA and EBITDAR Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings and Adjusted earnings per share reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, (iii) IBM Private Cloud Charges, (iv) the Gain on Sale of a Joint Venture Investment, and (v) Covid-19 Related Expenses. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. IBM Private Cloud Charges represent a charge on the hardware assets to be transferred to International Business Machines Corporation ("IBM") and other charges related to the information technology agreement for private cloud services the Company entered into with IBM. The Gain on Sale of a Joint Venture Investment represents a non-operating, cash gain on the sale of one of the Company’s joint venture investments. Covid-19 Related Expenses represents certain non-recurring expenses associated with the Covid-19 pandemic. Adjusted EBITDA reflects Net earnings before interest, taxes, other non-operating (income)/expenses net, depreciation, amortization, IBM Private Cloud Charges, Acquisition and Integration Costs, and Covid-19 Related Expenses. EBITDAR reflects Adjusted EBITDA before facilities and equipment lease expenses, and software license agreement expenses. Our management uses Adjusted EBITDA and EBITDAR to better understand the Company’s pre-tax cash flow, adjusted for the impact of leverage. We exclude IBM Private Cloud Charges, Gain on Sale of a Joint Venture Investment, and Covid-19 Related Expenses from our Adjusted Operating income and other earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and these items do not reflect ordinary operations or earnings. We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non-cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets. Free Cash Flow In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. | © 2020 36

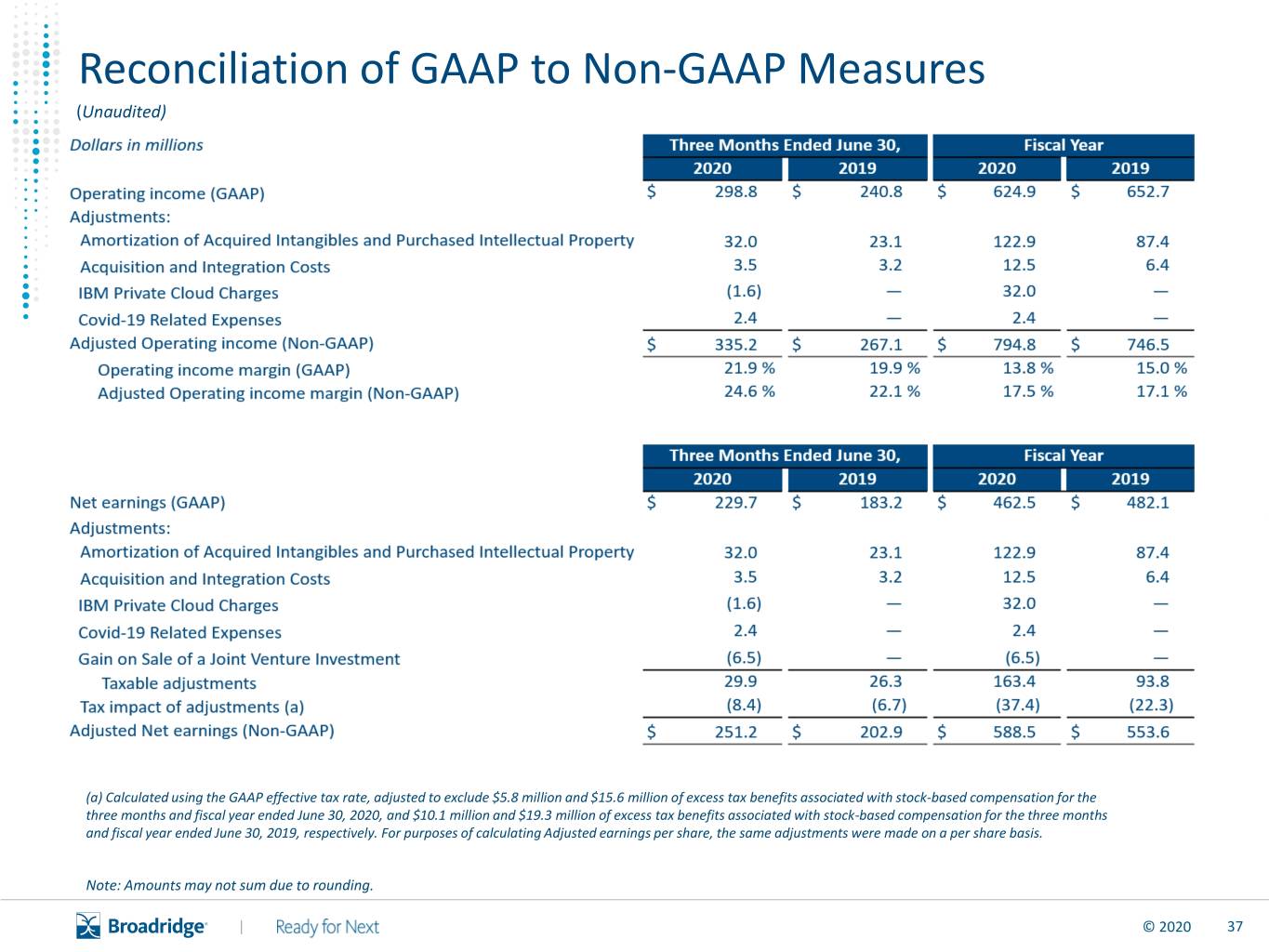

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (a) Calculated using the GAAP effective tax rate, adjusted to exclude $5.8 million and $15.6 million of excess tax benefits associated with stock-based compensation for the three months and fiscal year ended June 30, 2020, and $10.1 million and $19.3 million of excess tax benefits associated with stock-based compensation for the three months and fiscal year ended June 30, 2019, respectively. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. | © 2020 37

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) Dollars in millions, except per share amounts Three Months Ended June 30, Fiscal Year 2020 2019 2020 2019 Diluted earnings per share (GAAP) $ 1.97 $ 1.55 $ 3.95 $ 4.06 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.27 0.20 1.05 0.74 Acquisition and Integration Costs 0.03 0.03 0.11 0.05 IBM Private Cloud Charges (0.01) — 0.27 — Covid-19 Related Expenses 0.02 — 0.02 — Gain on Sale of a Joint Venture Investment (0.06) — (0.06) — Taxable adjustments 0.26 0.22 1.40 0.79 Tax impact of adjustments (a) (0.07) (0.06) (0.32) (0.19) Adjusted earnings per share (Non-GAAP) $ 2.15 $ 1.72 $ 5.03 $ 4.66 Fiscal Year 2020 2019 Net cash flows provided by operating activities (GAAP) $ 598.2 $ 617.0 Capital expenditures and Software purchases and capitalized internal use software (98.7) (72.6) Free cash flow (Non-GAAP) $ 499.5 $ 544.4 (a) Calculated using the GAAP effective tax rate, adjusted to exclude $5.8 million and $15.6 million of excess tax benefits associated with stock-based compensation for the three months and fiscal year ended June 30, 2020, and $10.1 million and $19.3 million of excess tax benefits associated with stock-based compensation for the three months and fiscal year ended June 30, 2019, respectively. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. | © 2020 38

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) Note: Amounts may not sum due to rounding. | © 2020 39

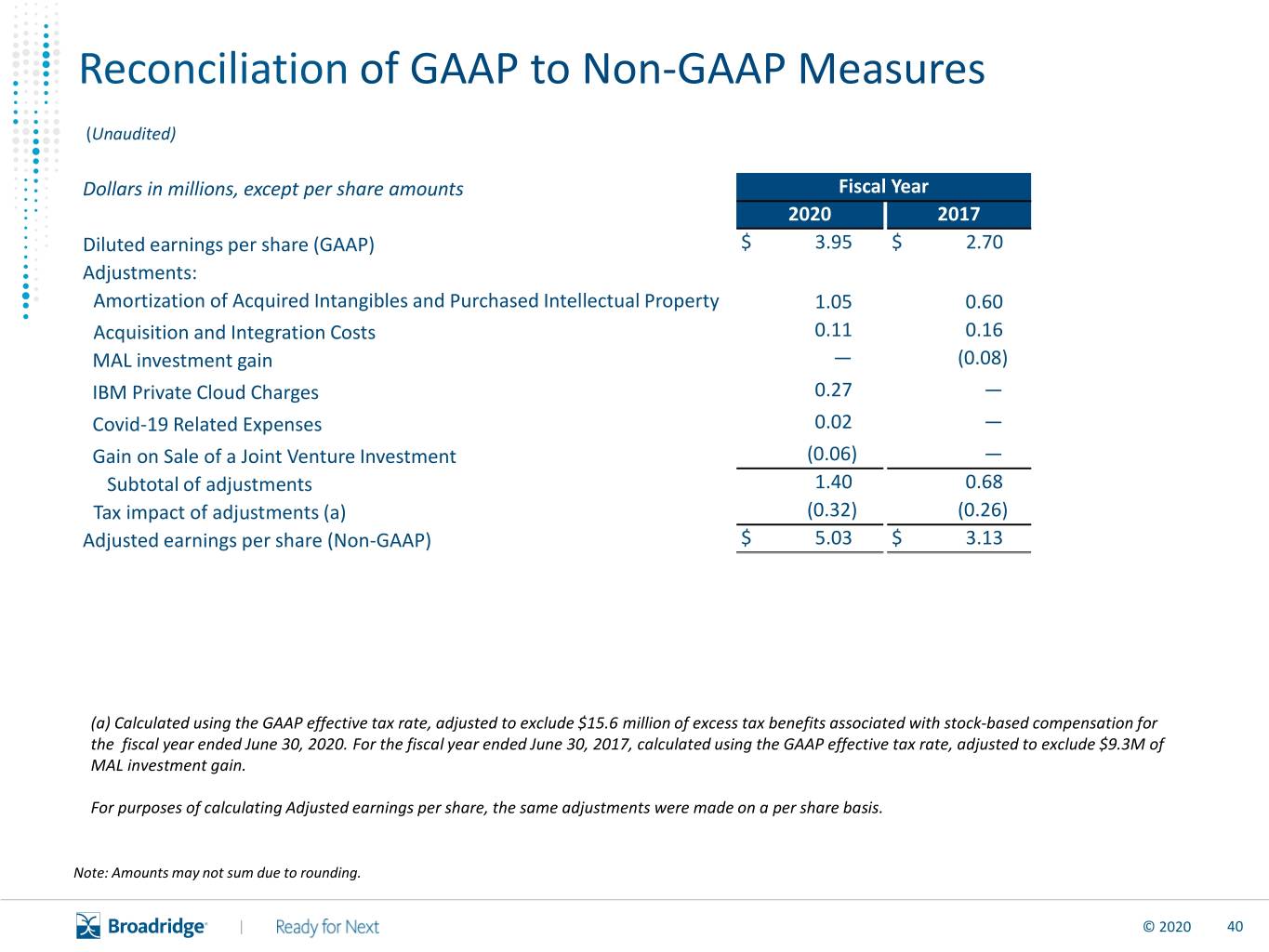

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) Dollars in millions, except per share amounts Fiscal Year 2020 2017 Diluted earnings per share (GAAP) $ 3.95 $ 2.70 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 1.05 0.60 Acquisition and Integration Costs 0.11 0.16 MAL investment gain — (0.08) IBM Private Cloud Charges 0.27 — Covid-19 Related Expenses 0.02 — Gain on Sale of a Joint Venture Investment (0.06) — Subtotal of adjustments 1.40 0.68 Tax impact of adjustments (a) (0.32) (0.26) Adjusted earnings per share (Non-GAAP) $ 5.03 $ 3.13 (a) Calculated using the GAAP effective tax rate, adjusted to exclude $15.6 million of excess tax benefits associated with stock-based compensation for the fiscal year ended June 30, 2020. For the fiscal year ended June 30, 2017, calculated using the GAAP effective tax rate, adjusted to exclude $9.3M of MAL investment gain. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. | © 2020 40

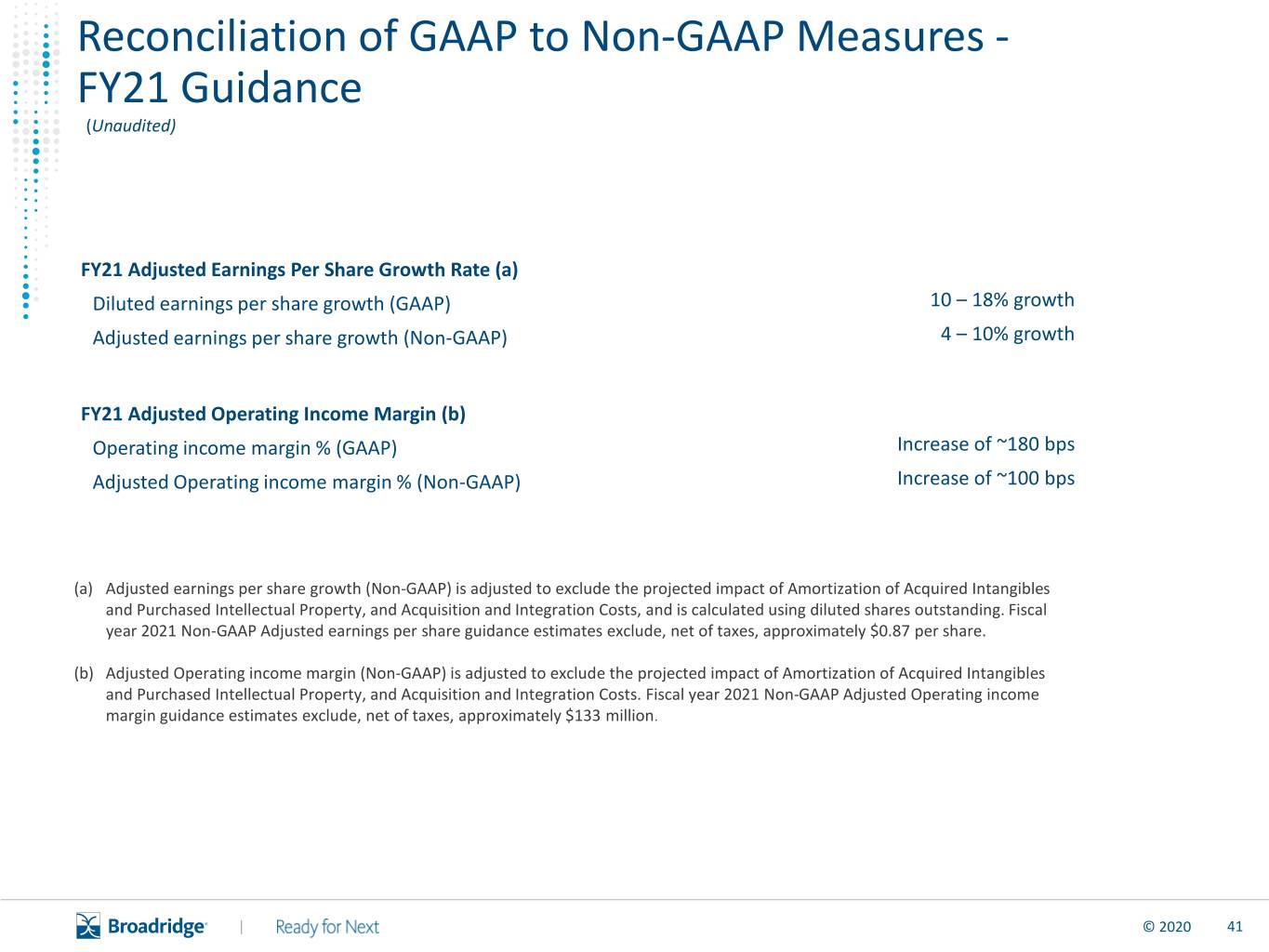

Reconciliation of GAAP to Non-GAAP Measures - FY21 Guidance (Unaudited) FY21 Adjusted Earnings Per Share Growth Rate (a) Diluted earnings per share growth (GAAP) 10 – 18% growth Adjusted earnings per share growth (Non-GAAP) 4 – 10% growth FY21 Adjusted Operating Income Margin (b) Operating income margin % (GAAP) Increase of ~180 bps Adjusted Operating income margin % (Non-GAAP) Increase of ~100 bps (a) Adjusted earnings per share growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, and is calculated using diluted shares outstanding. Fiscal year 2021 Non-GAAP Adjusted earnings per share guidance estimates exclude, net of taxes, approximately $0.87 per share. (b) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs. Fiscal year 2021 Non-GAAP Adjusted Operating income margin guidance estimates exclude, net of taxes, approximately $133 million. | © 2020 41

Broadridge Investor Relations Contacts W. Edings Thibault Tel: 516-472-5129 Email: edings.thibault@broadridge.com Elsa Ballard Tel: 212-973-6197 Email: elsa.ballard@broadridge.com | © 2020 42