Attached files

| file | filename |

|---|---|

| EX-10.5 - PROMISSORY NOTE BETWEEN CARBON ENERGY CORPORATION AND UMB BANK, DATED MAY 13, 20 - Carbon Energy Corp | f10q0620ex10-5_carbon.htm |

| EX-32.2 - CERTIFICATION - Carbon Energy Corp | f10q0620ex32-2_carbon.htm |

| EX-32.1 - CERTIFICATION - Carbon Energy Corp | f10q0620ex32-1_carbon.htm |

| EX-31.2 - CERTIFICATION - Carbon Energy Corp | f10q0620ex31-2_carbon.htm |

| EX-31.1 - CERTIFICATION - Carbon Energy Corp | f10q0620ex31-1_carbon.htm |

| EX-10.4 - CONSULTING AGREEMENT BETWEEN CARBON ENERGY CORPORATION AND MARK D. PIERCE, DATED - Carbon Energy Corp | f10q0620ex10-4_carbon.htm |

| EX-10.3 - CONSULTING AGREEMENT BETWEEN CARBON ENERGY CORPORATION AND KEVIN D. STRUZESKI, D - Carbon Energy Corp | f10q0620ex10-3_carbon.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2020

or

☐ Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________ to ____________

Commission File Number: 000-02040

| CARBON ENERGY CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Delaware | 26-0818050 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 1700 Broadway, Suite 1170, Denver, CO | 80290 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (720) 407-7030

| (Former name, address and fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name

of each exchange on which registered | ||

| None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Smaller reporting company | ☒ |

| Accelerated filer | ☐ | Emerging growth company | ☐ |

| Non-accelerated filer | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ☐ NO ☒

At August 7, 2020, there were 8,304,781 issued and outstanding shares of the Company’s common stock, $0.01 par value.

CARBON ENERGY CORPORATION

TABLE OF CONTENTS

i

Condensed Consolidated Balance Sheets

(in thousands, except share amounts)

| June 30, 2020 | December 31, 2019 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,311 | $ | 904 | ||||

| Restricted cash (Note 3) | 4,612 | - | ||||||

| Accounts receivable: | ||||||||

| Revenue | 1,846 | 12,886 | ||||||

| Joint interest billings and other | 415 | 1,552 | ||||||

| Commodity derivative asset (Note 13) | 6,129 | 5,915 | ||||||

| Prepaid expenses, deposits, and other current assets | 1,403 | 2,500 | ||||||

| Inventory | 491 | 2,512 | ||||||

| Total current assets | 16,207 | 26,269 | ||||||

| Non-current assets: | ||||||||

| Property and equipment (Note 4) | ||||||||

| Oil and gas properties, full cost method of accounting: | ||||||||

| Proved, net | 114,095 | 242,144 | ||||||

| Unproved | 1,616 | 4,872 | ||||||

| Other property and equipment, net | 1,189 | 15,984 | ||||||

| Total property and equipment, net | 116,900 | 263,000 | ||||||

| Investments in affiliates | 67 | 625 | ||||||

| Commodity derivative asset – non-current (Note 13) | 2,871 | 1,164 | ||||||

| Right-of-use assets | 1,949 | 6,104 | ||||||

| Other non-current assets | 2,276 | 1,092 | ||||||

| Total non-current assets | 124,063 | 271,985 | ||||||

| Total assets | $ | 140,270 | $ | 298,254 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities (Note 5) | $ | 12,500 | $ | 35,157 | ||||

| Firm transportation contract obligations (Note 14) | - | 5,679 | ||||||

| Lease liability – current | 696 | 1,625 | ||||||

| Commodity derivative liability (Note 13) | - | 469 | ||||||

| Credit facilities and notes payable (Note 7) | 1,339 | 5,788 | ||||||

| Total current liabilities | 14,535 | 48,718 | ||||||

| Non-current liabilities: | ||||||||

| Firm transportation contract obligations (Note 14) | - | 8,905 | ||||||

| Lease liability – non-current | 1,179 | 4,383 | ||||||

| Commodity derivative liability – non-current (Note 13) | - | 87 | ||||||

| Production and property taxes payable | - | 2,815 | ||||||

| Asset retirement obligations (Note 6) | 5,908 | 17,514 | ||||||

| Credit facilities and notes payable (Note 7) | 15,862 | 94,870 | ||||||

| Notes payable – related party (Note 7) | 49,484 | 44,741 | ||||||

| Total non-current liabilities | 72,433 | 173,315 | ||||||

| Commitments and contingencies (Note 14) | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $0.01 par value; liquidation preference of $674 and $524 at June 30, 2020 and December 31, 2019, respectively; authorized 1,000,000 shares, 50,000 shares issued and outstanding at June 30, 2020 and December 31, 2019 | 1 | 1 | ||||||

| Common stock, $0.01 par value; authorized 35,000,000 shares, 8,304,781 and 7,796,085 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively | 83 | 78 | ||||||

| Additional paid-in capital | 89,148 | 85,834 | ||||||

| Accumulated deficit | (63,559 | ) | (35,842 | ) | ||||

| Total Carbon stockholders’ equity | 25,673 | 50,071 | ||||||

| Non-controlling interests | 27,629 | 26,150 | ||||||

| Total stockholders’ equity | 53,302 | 76,221 | ||||||

| Total liabilities and stockholders’ equity | $ | 140,270 | $ | 298,254 | ||||

See accompanying notes to Condensed Consolidated Financial Statements.

1

Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (in thousands, except per share amounts) | 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Revenue: | ||||||||||||||||

| Natural gas sales | $ | 4,138 | $ | 14,216 | $ | 12,572 | $ | 33,532 | ||||||||

| Natural gas liquids | 49 | 195 | 201 | 441 | ||||||||||||

| Oil sales | 3,767 | 9,902 | 10,982 | 18,891 | ||||||||||||

| Transportation and handling | 274 | 322 | 908 | 1,056 | ||||||||||||

| Marketing gas sales | 2,380 | 3,221 | 8,698 | 8,165 | ||||||||||||

| Commodity derivative (loss) gain | (5,647 | ) | 8,680 | 14,067 | (627 | ) | ||||||||||

| Other income | 2 | 305 | - | 697 | ||||||||||||

| Total revenue | 4,963 | 36,841 | 47,428 | 62,155 | ||||||||||||

| Expenses: | ||||||||||||||||

| Lease operating expenses | 5,086 | 7,480 | 12,458 | 14,095 | ||||||||||||

| Pipeline operating expenses | 1,432 | 2,950 | 4,125 | 6,035 | ||||||||||||

| Transportation and gathering costs | 1,475 | 1,130 | 4,052 | 2,799 | ||||||||||||

| Production and property taxes | 1,136 | 1,666 | 1,146 | 3,676 | ||||||||||||

| Marketing gas purchases | 1,329 | 4,795 | 4,801 | 11,097 | ||||||||||||

| General and administrative | 5,402 | 3,947 | 8,702 | 8,636 | ||||||||||||

| Depreciation, depletion and amortization | 2,149 | 3,881 | 5,960 | 7,860 | ||||||||||||

| Accretion of asset retirement obligations | 299 | 405 | 777 | 799 | ||||||||||||

| Loss on Appalachia Divestiture | 34,463 | - | 34,463 | - | ||||||||||||

| Total expenses | 52,771 | 26,254 | 76,484 | 54,997 | ||||||||||||

| Operating (loss) income | (47,808 | ) | 10,587 | (29,056 | ) | 7,158 | ||||||||||

| Other income (expense): | ||||||||||||||||

| Interest expense, net | (2,774 | ) | (3,445 | ) | (5,647 | ) | (6,725 | ) | ||||||||

| Investments in affiliates | - | 21 | (421 | ) | 40 | |||||||||||

| Other income | 104 | - | 104 | - | ||||||||||||

| Total expense | (2,670 | ) | (3,424 | ) | (5,964 | ) | (6,685 | ) | ||||||||

| (Loss) income before income taxes | (50,478 | ) | 7,163 | (35,020 | ) | 473 | ||||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Net (loss) income before non-controlling interests and preferred shares | (50,478 | ) | 7,163 | (35,020 | ) | 473 | ||||||||||

| Net (loss) income attributable to non-controlling interests | (2,542 | ) | 934 | 3,117 | (1,656 | ) | ||||||||||

| Net (loss) income attributable to controlling interests before preferred shares | (47,936 | ) | 6,229 | (38,137 | ) | 2,129 | ||||||||||

| Net income attributable to preferred shares – preferred return | 75 | 75 | 150 | 150 | ||||||||||||

| Net (loss) income attributable to common shares | $ | (48,011 | ) | $ | 6,154 | $ | (38,287 | ) | $ | 1,979 | ||||||

| Net (loss) income per common share: | ||||||||||||||||

| Basic | $ | (5.91 | ) | $ | 0.79 | $ | (4.81 | ) | $ | 0.26 | ||||||

| Diluted | $ | (5.91 | ) | $ | 0.75 | $ | (4.81 | ) | $ | 0.24 | ||||||

| Weighted average common shares outstanding: | ||||||||||||||||

| Basic | 8,118 | 7,815 | 7,964 | 7,739 | ||||||||||||

| Diluted | 8,118 | 8,157 | 7,964 | 8,081 | ||||||||||||

See accompanying notes to Condensed Consolidated Financial Statements.

2

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands)

| Additional | Non- | Total | ||||||||||||||||||||||||||||||

| Common Stock | Preferred Stock | Paid-in | Controlling | Accumulated | Stockholders’ | |||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Interests | Deficit | Equity | |||||||||||||||||||||||||

| Balance as of December 31, 2019 | 7,796 | $ | 78 | 50 | $ | 1 | $ | 85,834 | $ | 26,150 | $ | (35,842 | ) | $ | 76,221 | |||||||||||||||||

| Stock-based compensation | - | - | - | - | 204 | - | - | 204 | ||||||||||||||||||||||||

| Restricted stock vested | 20 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Performance units vested | 83 | 1 | - | - | (1 | ) | - | - | - | |||||||||||||||||||||||

| Non-controlling interests’ distributions, net | - | - | - | - | - | (3 | ) | - | (3 | ) | ||||||||||||||||||||||

| Net income | - | - | - | - | - | 5,659 | 9,799 | 15,458 | ||||||||||||||||||||||||

| Balance as of March 31, 2020 | 7,899 | $ | 79 | 50 | $ | 1 | $ | 86,037 | $ | 31,806 | $ | (26,043 | ) | $ | 91,880 | |||||||||||||||||

| Stock-based compensation | - | - | - | - | 3,151 | - | - | 3,151 | ||||||||||||||||||||||||

| Restricted stock vested | 380 | 4 | - | - | (4 | ) | - | - | - | |||||||||||||||||||||||

| Performance units vested | 169 | 2 | - | - | (2 | ) | - | - | - | |||||||||||||||||||||||

| Restricted stock and performance units exchanged for tax withholding | (143 | ) | (2 | ) | - | - | (34 | ) | - | - | (36 | ) | ||||||||||||||||||||

| Impact of Appalachia Divestiture | - | - | - | - | - | (1,635 | ) | 10,420 | 8,785 | |||||||||||||||||||||||

| Net loss | - | - | - | - | - | (2,542 | ) | (47,936 | ) | (50,478 | ) | |||||||||||||||||||||

| Balance as of June 30, 2020 | 8,305 | $ | 83 | 50 | $ | 1 | $ | 89,148 | $ | 27,629 | $ | (63,559 | ) | $ | 53,302 | |||||||||||||||||

| Additional | Non- | Total | ||||||||||||||||||||||||||||||

| Common Stock | Preferred Stock | Paid-in | Controlling | Accumulated | Stockholders’ | |||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Interests | Deficit | Equity | |||||||||||||||||||||||||

| Balance as of December 31, 2018 | 7,656 | $ | 77 | 50 | $ | 1 | $ | 84,612 | $ | 28,284 | $ | (36,939 | ) | $ | 76,035 | |||||||||||||||||

| Stock-based compensation | - | - | - | - | 222 | - | - | 222 | ||||||||||||||||||||||||

| Restricted stock vested | 40 | 1 | - | - | - | - | - | 1 | ||||||||||||||||||||||||

| Performance units vested | 95 | 1 | - | - | (1 | ) | - | - | - | |||||||||||||||||||||||

| Non-controlling interests’ contributions, net | - | - | - | - | - | 22 | - | 22 | ||||||||||||||||||||||||

| Net loss | - | - | - | - | - | (2,590 | ) | (4,100 | ) | (6,690 | ) | |||||||||||||||||||||

| Balance as of March 31, 2019 | 7,791 | $ | 79 | 50 | $ | 1 | $ | 84,833 | $ | 25,716 | $ | (41,039 | ) | $ | 69,590 | |||||||||||||||||

| Stock-based compensation | - | - | - | - | 224 | - | - | 224 | ||||||||||||||||||||||||

| Restricted stock vested | 25 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Non-controlling interests’ distributions, net | - | - | - | - | - | (16 | ) | - | (16 | ) | ||||||||||||||||||||||

| Net income | - | - | - | - | - | 934 | 6,229 | 7,163 | ||||||||||||||||||||||||

| Balance as of June 30, 2019 | 7,816 | $ | 79 | 50 | $ | 1 | $ | 85,057 | $ | 26,634 | $ | (34,810 | ) | $ | 76,961 | |||||||||||||||||

See accompanying notes to Condensed Consolidated Financial Statements.

3

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| (in thousands) | 2020 | 2019 | ||||||

| Cash flows from operating activities: | ||||||||

| Net (loss) income | $ | (35,020 | ) | $ | 473 | |||

| Items not involving cash: | ||||||||

| Depreciation, depletion and amortization | 5,960 | 7,860 | ||||||

| Accretion of asset retirement obligations | 777 | 799 | ||||||

| Unrealized commodity derivative (gain) loss | (5,626 | ) | 396 | |||||

| Stock-based compensation expense | 3,355 | 446 | ||||||

| Net loss on Appalachia Divestiture | 25,527 | - | ||||||

| Loss on sale of affiliate investment | 419 | - | ||||||

| Investments in affiliates | 9 | (40 | ) | |||||

| Amortization of debt costs | 857 | 405 | ||||||

| Interest expense paid-in-kind | 1,052 | 1,244 | ||||||

| Other | (74 | ) | - | |||||

| Net change in: | ||||||||

| Accounts receivable | 2,525 | 7,525 | ||||||

| Prepaid expenses, deposits and other current assets | 204 | (375 | ) | |||||

| Accounts payable, accrued liabilities and firm transportation contract obligations | (9,009 | ) | (8,611 | ) | ||||

| Inventory and other non-current items | 452 | (327 | ) | |||||

| Net cash (used in) provided by operating activities | (8,592 | ) | 9,795 | |||||

| Cash flows from investing activities: | ||||||||

| Development and acquisition of properties and equipment | (3,460 | ) | (1,863 | ) | ||||

| Distribution from affiliate | - | 50 | ||||||

| Proceeds from Appalachia Divestiture | 98,121 | - | ||||||

| Proceeds from disposition of oil and gas properties and other property and equipment | 922 | 176 | ||||||

| Proceeds from sale of affiliate investment | 131 | - | ||||||

| Net cash provided by (used in) investing activities | 95,714 | (1,637 | ) | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from credit facilities and notes payable | 8,839 | 4,029 | ||||||

| Payments on credit facilities and notes payable | (88,803 | ) | (13,185 | ) | ||||

| Payments of debt issuance costs | - | (93 | ) | |||||

| Vested restricted stock and performance units exchanged for tax withholding | (36 | ) | - | |||||

| (Distributions to) contributions from non-controlling interests, net | (3 | ) | 6 | |||||

| Net cash used in financing activities | (80,003 | ) | (9,243 | ) | ||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 7,119 | (1,085 | ) | |||||

| Cash, cash equivalents and restricted cash, beginning of period | 904 | 5,736 | ||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 8,023 | $ | 4,651 | ||||

See accompanying notes to Condensed Consolidated Financial Statements.

4

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1 – ORGANIZATION

Carbon Energy Corporation is an independent oil and natural gas company engaged in the acquisition, exploration, development and production of oil, natural gas and natural gas liquids properties. The terms “we”, “us”, “our”, the “Company” or “Carbon” refer to Carbon Energy Corporation and our consolidated subsidiaries.

On May 26, 2020 Carbon Energy Corporation completed its sale of all of the issued and outstanding membership interests of Carbon Appalachia Company, LLC and Nytis Exploration Company LLC. See Note 3 – Divestiture for more information. Following the sale, Carbon’s operations are substantially limited to those in the Ventura Basin through Carbon California Company, LLC, a Delaware limited liability company (“Carbon California”), its majority-owned subsidiary.

Ventura Basin Operations

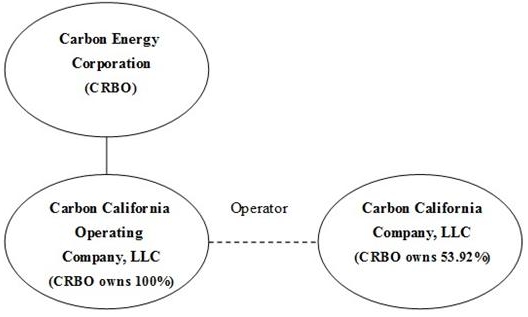

In California, Carbon California Operating Company, LLC conducts operations on behalf of Carbon California. We own 53.92% of the voting and profits interests and Prudential Legacy Insurance Company of New Jersey and Prudential Insurance Company of America or its affiliates (collectively, “Prudential”) owns 46.08% of the voting and profits interest in Carbon California. The following organizational chart illustrates this relationship as of June 30, 2020:

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and in accordance with U.S. generally accepted accounting principles (“GAAP”) applicable to interim financial statements. These unaudited condensed consolidated financial statements reflect all normal recurring adjustments that are, in the opinion of management, necessary for a fair presentation of the results of the interim period. Operating results for the interim periods presented require management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes and are not necessarily indicative of the results that may be expected for the full year. The condensed consolidated balance sheet data as of December 31, 2019 was derived from audited financial statements but does not include all disclosures required by GAAP. These unaudited condensed consolidated financial statements should be read in conjunction with our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2019. The Company follows the same accounting policies for preparing quarterly and annual reports.

Principles of Consolidation

The unaudited condensed consolidated financial statements include the accounts of the Company and its consolidated subsidiaries. Partnerships and subsidiaries in which we have a controlling interest are consolidated. We reflect the non-controlling ownership interest in partnerships and subsidiaries as non-controlling interests on our unaudited condensed consolidated statements of operations and also reflect the non-controlling ownership interest in the net assets of the partnerships as non-controlling interests within stockholders’ equity on our unaudited condensed consolidated balance sheets. All significant intercompany accounts and transactions have been eliminated.

In accordance with established practice in the oil and gas industry, our unaudited condensed consolidated financial statements also include our pro-rata share of assets, liabilities, income, lease operating costs and general and administrative expenses of the oil and gas partnerships in which we have a non-controlling interest.

Non-majority owned investments that do not meet the criteria for pro-rata consolidation are accounted for using the equity method when we have the ability to significantly influence the operating decisions of the investee. When we do not have the ability to significantly influence the operating decisions of an investee, the cost method is used. All transactions, if any, with investees have been eliminated in the accompanying unaudited condensed consolidated financial statements.

5

Cash and Cash Equivalents and Restricted Cash

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported in the unaudited condensed consolidated balance sheet to amounts shown in the unaudited condensed consolidated statement of cash flows in thousands:

| June 30, 2020 | ||||

| Cash and cash equivalents | $ | 1,311 | ||

| Restricted cash | 4,612 | |||

| Other non-current assets | 2,100 | |||

| Total cash, cash equivalents and restricted cash | $ | 8,023 | ||

NOTE 3 – DIVESTITURE

On April 7, 2020, Carbon Energy Corporation, together with Nytis Exploration (USA) Inc. (the “Sellers”), and certain of the Company’s other direct and indirect wholly owned subsidiaries, entered into a Membership Interest Purchase Agreement (“MIPA”) to sell all of the issued and outstanding membership interests of Carbon Appalachia Company, LLC (“Carbon Appalachia”) and Nytis Exploration Company LLC (“Nytis LLC”) to Diversified Gas & Oil Corporation (“DGOC”) for $110.0 million, subject to customary purchase price adjustments, and a contingent payment of up to $15.0 million (the “Appalachia Divestiture”). The assets sold in the Appalachia Divestiture comprised substantially all of the Company’s assets in the Appalachian and Illinois basin. The transaction closed on May 26, 2020 for net proceeds of $98.1 million based on preliminary estimates of closing adjustments, resulting in a loss of approximately $34.5 million. The contingent payment of up to $15.0 million in the aggregate represents a contingent receivable that is not recorded in our unaudited condensed consolidated balance sheet. The contingent payment will be calculated based on fixed volumes and the average settled natural gas pricing for 2020, 2021, and 2022 as compared to established benchmark pricing. Any payments due will be paid yearly by January 5 of each of 2021, 2022 and 2023 based on the contingent payment calculation for the respective calendar years.

Proceeds from the closing were used to settle all outstanding amounts associated with the 2018 Credit Facility (as defined below) and repay a portion of the Old Ironsides Notes. See Note 7 – Credit Facilities and Notes Payable for more information. We incurred exit costs in conjunction with the divestiture of one-time severance and termination benefits for the affected employees.

The assets, liabilities and equity disposed of are set out in the table below:

| Amount

(in thousands) | ||||

| Assets: | ||||

| Accounts receivable | $ | 9,651 | ||

| Prepaid expenses | 892 | |||

| Derivative assets | 3,159 | |||

| Inventory | 1,409 | |||

| Oil and gas properties | 128,993 | |||

| Other property and equipment | 14,035 | |||

| Right-of-use assets | 3,406 | |||

| Other non-current assets | 436 | |||

| Liabilities and Equity: | ||||

| Accounts payable and accrued liabilities | (13,355 | ) | ||

| Firm transportation contract obligations | (12,981 | ) | ||

| Lease liabilities | (3,406 | ) | ||

| Derivative liabilities | (11 | ) | ||

| Production and property taxes payable | (3,342 | ) | ||

| Asset retirement obligations | (14,027 | ) | ||

| Equity in subsidiaries | 8,785 | |||

| Net assets disposed | 123,644 | |||

| Cash received | 98,121 | |||

| Transaction costs | (8,940 | ) | ||

| Loss on Appalachia Divestiture | $ | 34,463 | ||

At June 30, 2020, restricted cash on the condensed consolidated balance sheet of approximately $6.7 million represents amounts held in escrow from the purchase price. The escrow amount will be released to the Company upon satisfaction of certain indemnification obligations and will be released upon the fulfillment of associated release requirements over the 36 months following the closing of the Appalachia Divestiture.

Carbon and DGOC entered into a transition services agreement to provide, on an interim basis, certain services associated with the sold assets. The services commenced on May 26, 2020 and are expected to terminate in November 2020. Billings of approximately $269,000 are recorded as a reduction of general and administrative expenses during the three months ended June 30, 2020.

The following table presents net income before non-controlling interests and net income attributable to controlling interests for the subsidiaries sold for the three and six months ended June 30, 2020 and 2019:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| (in thousands) | 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Net (loss) income before non-controlling interests | $ | (3,000) | $ | 5,003 | $ | 1,645 | $ | 3,923 | ||||||||

| Net (loss) income attributable to controlling interests | $ | (2,737) | $ | 5,309 | $ | 1,541 | $ | 3,719 | ||||||||

6

NOTE 4 – PROPERTY AND EQUIPMENT

Property and equipment, net consists of the following:

| (in thousands) | June 30, 2020 | December 31, 2019 | ||||||

| Oil and gas properties: | ||||||||

| Proved oil and gas properties | $ | 125,006 | $ | 351,488 | ||||

| Unproved properties | 1,616 | 4,872 | ||||||

| Accumulated depreciation, depletion, amortization and impairment | (10,911 | ) | (109,344 | ) | ||||

| Oil and gas properties, net | 115,711 | 247,016 | ||||||

| Pipeline facilities and equipment | - | 12,814 | ||||||

| Base gas | - | 1,937 | ||||||

| Furniture and fixtures, computer hardware and software, and other equipment | 2,614 | 6,762 | ||||||

| Accumulated depreciation and amortization | (1,425 | ) | (5,529 | ) | ||||

| Other property and equipment, net | 1,189 | 15,984 | ||||||

| Total property and equipment, net | $ | 116,900 | $ | 263,000 | ||||

Unproved oil and gas properties not subject to depletion are excluded from the full cost pool until it is determined if reserves can be assigned to the related properties. Subject to industry conditions, evaluation of most of these properties and the inclusion of their costs in the full cost pool is expected to be completed within five years. Unproved properties are assessed for impairment at least annually. During the three and six months ended June 30, 2020 and 2019, there were no expiring or impaired leasehold costs that were reclassified into proved property.

We capitalized overhead applicable to acquisition, development and exploration activities of approximately $134,000 and $372,000 for the three and six months ended June 30, 2020, respectively. For the three and six months ended June 30, 2019, we capitalized overhead applicable to acquisition, development and exploration activities of approximately $305,000 and $373,000, respectively.

Depletion expense related to oil and gas properties for the three and six months ended June 30, 2020 was approximately $1.9 million and $5.3 million, respectively. Depletion expense related to oil and gas properties for the three and six months ended June 30, 2019 was approximately $3.5 million and $7.0 million, respectively.

For the three and six months ended June 30, 2020 and 2019, we did not recognize any ceiling test impairments as our full cost pool did not exceed the ceiling limitations. Future declines in oil and natural gas prices, increases in future operating expenses and future development costs could result in impairments of our oil and gas properties in future periods. Impairment changes are a non-cash charge and accordingly would not affect cash flows but would adversely affect our net income and stockholders’ equity.

NOTE 5 – ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

Accounts payable and accrued liabilities consist of the following:

| (in thousands) | June 30, 2020 | December 31, 2019 | ||||||

| Accounts payable | $ | 3,717 | $ | 9,875 | ||||

| Oil and gas revenue suspense | 135 | 3,620 | ||||||

| Gathering and transportation payables | 906 | 1,877 | ||||||

| Production taxes payable | 31 | 3,212 | ||||||

| Accrued lease operating costs | - | 664 | ||||||

| Accrued ad valorem taxes-current | 562 | 4,407 | ||||||

| Accrued general and administrative expenses | 2,521 | 3,260 | ||||||

| Asset retirement obligations-current | 3,384 | 5,021 | ||||||

| Accrued interest | 791 | 1,335 | ||||||

| Accrued gas purchases | - | 1,392 | ||||||

| Other liabilities | 453 | 494 | ||||||

| Total accounts payable and accrued liabilities | $ | 12,500 | $ | 35,157 | ||||

NOTE 6 – ASSET RETIREMENT OBLIGATIONS

The Company’s asset retirement obligations (“ARO”) relate to future costs associated with the plugging and abandonment of oil and gas wells, removal of equipment and facilities from leased acreage and returning such land to its original condition. The fair value of a liability for an ARO is recorded in the period in which it is incurred, and the cost of such liability is recorded as an increase in the carrying amount of the related long-lived asset by the same amount. The liability is accreted each period and the capitalized cost is depleted on a units-of-production basis as part of the full cost pool. Revisions to the estimated ARO liability result in adjustments to the related capitalized asset and corresponding liability.

7

The ARO liability is based on estimated economic lives, estimates of the cost to abandon the wells in the future, and federal and state regulatory requirements. The liability is discounted using a credit-adjusted risk-free rate estimated at the time the liability is incurred or adjusted as a result of a reassessment of expected cash flows and assumptions inherent in the estimation of the liability. Revisions to the liability could occur due to changes in estimated abandonment costs or well economic lives, or if federal or state regulators enact new requirements regarding the abandonment of wells.

The following table is a reconciliation of ARO:

| Six Months Ended June 30, | ||||||||

| (in thousands) | 2020 | 2019 | ||||||

| Balance at beginning of period | $ | 22,535 | $ | 22,310 | ||||

| Accretion expense | 777 | 799 | ||||||

| Obligations discharged with Appalachia Divestiture | (14,027 | ) | - | |||||

| Additions | 7 | - | ||||||

| Balance at end of period | $ | 9,292 | $ | 23,109 | ||||

| Less: Current portion | (3,384 | ) | (3,708 | ) | ||||

| Non-current portion | $ | 5,908 | $ | 19,401 | ||||

NOTE 7 – CREDIT FACILITIES AND NOTES PAYABLE

The table below summarizes the outstanding credit facilities and notes payable:

| (in thousands) | June 30, 2020 | December 31, 2019 | ||||||

| 2018 Credit Facility – revolver | $ | - | $ | 69,150 | ||||

| 2018 Credit Facility – term note | - | 5,833 | ||||||

| Old Ironsides Notes | 15,836 | 25,675 | ||||||

| Paycheck Protection Program Loan | 1,339 | - | ||||||

| Other debt | 26 | 45 | ||||||

| Total debt | 17,201 | 100,703 | ||||||

| Less: unamortized debt discount | - | (45 | ) | |||||

| Total credit facilities and notes payable | 17,201 | 100,658 | ||||||

| Current portion of credit facilities and notes payable | (1,339 | ) | (5,788 | ) | ||||

| Non-current debt, net of current portion and unamortized debt discount | $ | 15,862 | $ | 94,870 | ||||

Paycheck Protection Program Loan

Reclass of non-current portion is open.

In May 2020, the Company received loan proceeds of approximately $1.3 million (“PPP Loan”) under the Paycheck Protection Program (“PPP”). The PPP, established as part of the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”), provides for loans to qualifying businesses for amounts up to 2.5 times the average monthly payroll expenses of the qualifying business. The PPP Loan and accrued interest are forgivable after 24 weeks as long as the borrower uses the loan proceeds for eligible purposes, including payroll, benefits, rent and utilities, and maintains its payroll levels. For purposes of the PPP Loan, payroll costs exclude cash compensation of an individual employee in excess of $100,000, prorated annually. Not more than 40% of the forgiven amount may be for non-payroll costs. The amount of loan forgiveness will be reduced if the borrower terminates full-time employees or reduces salaries and wages for employees with salaries of $100,000 or less annually by more than 25% during the 24-week period.

The PPP Loan is evidenced by a promissory note, dated as of May 13, 2020 (the “PPP Note”), which contains customary events of default relating to, among other things, payment defaults and breaches of representations and warranties, and bears interest at 1.0% per annum. No payments of principal or interest are due during the six-month period beginning on the date of the PPP Note (the “Deferral Period”).

The Company intends to use the proceeds for purposes consistent with the PPP. In order to obtain full or partial forgiveness of the PPP Loan, the Company must request forgiveness and must provide satisfactory documentation in accordance with applicable Small Business Administration (“SBA”) guidelines. Interest payable on the PPP Note may be forgiven only if the SBA agrees to pay such interest on the forgiven principal amount of the PPP Note. The Company will be obligated to repay any portion of the principal amount of the PPP Note that is not forgiven, together with interest accrued and accruing thereon at the rate set forth above, until such unforgiven portion is paid in full. We intend to apply for forgiveness of the PPP Note as soon as we are eligible.

Beginning one month following expiration of the Deferral Period, and continuing monthly until 24 months from the date of the PPP Note (the “Maturity Date”), the Company is obligated to make monthly payments of principal and interest to the Lender with respect to any unforgiven portion of the PPP Note, in such equal amounts required to fully amortize the principal amount outstanding on the PPP Note as of the last day of the Deferral Period by the Maturity Date. The Company is permitted to prepay the PPP Note at any time without payment of any prepayment premium or penalty.

8

Carbon Appalachia

2018 Credit Facility

In 2018, the Company and its subsidiaries amended and restated its prior credit facilities and entered into a $500.0 million senior secured asset-based revolving credit facility maturing December 31, 2022 and a $15.0 million term loan maturing in 2020 (the “2018 Credit Facility”). The borrowers under the 2018 Credit Facility were Carbon Appalachia Enterprises, LLC (“CAE”) and various other subsidiaries of the Company (including Nytis Exploration (USA) Inc., a direct wholly owned subsidiary of the Company (“Nytis USA”), together with CAE, the “Borrowers”). Under the 2018 Credit Facility, the Company was neither a borrower nor a guarantor. The initial borrowing base under the 2018 Credit Facility was $75.0 million. Loans under the 2018 Credit Facility may be prepaid without premium or penalty.

Using proceeds from the Appalachia Divestiture, we repaid the outstanding principal balance and accrued interest under the 2018 Credit Facility, including the term loan, of $72.3 million, and terminated the 2018 Credit Facility on May 26, 2020.

Old Ironsides Notes

On December 31, 2018, in connection with our acquisition (the “OIE Membership Acquisition”) of all of the Class A Units of Carbon Appalachia from Old Ironside Fund II-A Portfolio Holding Company, LLC, a Delaware limited liability company, and Old Ironside Fund II-B Portfolio Holding Company, LLC, a Delaware limited liability company (collectively, “Old Ironsides”), we delivered unsecured, promissory notes in the aggregate original principal amount of approximately $25.1 million to Old Ironsides (the “Old Ironsides Notes”). The Old Ironsides Notes bear interest at 10.0% per annum and have a term of five years, the first three of which require interest-only payments at the end of each calendar quarter beginning with the quarter ending March 31, 2019. At the end of the three-year interest-only period, the then current outstanding principal balance and interest is to be paid in 24 equal monthly payments. The Old Ironsides Notes also require mandatory prepayments upon the occurrence of certain subsequent liquidity events. A mandatory, one-time principal reduction payment in the aggregate amount of $2.0 million was made to Old Ironsides on February 1, 2019.

The interest payable under the Old Ironsides Notes can be paid-in-kind at the election of the Company. This provision allows the Company to increase the principal balance associated with the Old Ironsides Notes. This election creates a second tranche of principal, which bears interest at 12.0% per annum. For the six months ended June 30, 2020, the Company elected payment-in-kind interest of approximately $662,000.

On May 25, 2020, Carbon entered into an Agreement Regarding Payoff and Release or Amendment of Notes (the “Payoff Agreement”) with Old Ironsides. Pursuant to the terms of the Payoff Agreement, Carbon is required to apply certain net proceeds from the Appalachia Divestiture in repayment of the Old Ironsides Notes on specified repayment dates tied to milestones under the MIPA. The initial payment of $10.5 million was paid within three business days after the closing date of the Appalachia Divestiture. The second payment is due within three business days after the settlement and payment of the Final Base Purchase Price (as defined in the MIPA). If the sum of the initial payment and the second payment is at least $20.0 million, the Old Ironsides Notes will be deemed paid in full. If the sum of the initial payment and the second payment is at least $18.0 million but less than $20.0 million, the Old Ironsides Notes will be amended such that the outstanding principal balance plus all accrued and unpaid interest is equal to $21.5 million (less the amount of the initial and second payments) and the Old Ironsides Notes will remain outstanding with no other change to the existing terms. If the sum of the initial payment and the second payment is less than $18.0 million, then Carbon will have the opportunity to make a third payment.

The third payment would be due within three business days after the first Contingent Payment (as defined in the MIPA). If the sum of the initial payment, the second payment and the third payment is at least $18.0 million, the Old Ironsides Notes will be amended such that the outstanding principal balance plus all accrued and unpaid interest is equal to $23.0 million (less the amount of the initial, second and third payments) and the Old Ironsides Notes will remain outstanding with no other change to the existing terms. If the sum of the initial payment, the second payment and the third payment is less than $18.0 million, the payments made by Carbon as of such date will be considered mandatory prepayments and the Old Ironsides Notes will remain outstanding with a maturity date of December 31, 2023 and no change to the existing terms.

Carbon California

The table below summarizes the outstanding notes payable – related party:

| (in thousands) | June 30, 2020 | December 31, 2019 | ||||||

| Senior Revolving Notes, related party, due February 15, 2022 | $ | 37,200 | $ | 33,000 | ||||

| Subordinated Notes, related party, due February 15, 2024 | 13,390 | 13,000 | ||||||

| Total principal | 50,590 | 46,000 | ||||||

| Less: Deferred notes costs | (154 | ) | (175 | ) | ||||

| Less: unamortized debt discount | (952 | ) | (1,084 | ) | ||||

| Total notes payable – related party | $ | 49,484 | $ | 44,741 | ||||

9

Senior Revolving Notes, Related Party

On February 15, 2017, Carbon California entered into a Note Purchase Agreement (the “Note Purchase Agreement”) for the issuance and sale of Senior Secured Revolving Notes to Prudential with an initial revolving borrowing capacity of $25.0 million which mature on February 15, 2022 (the “Senior Revolving Notes”). The Company is not a guarantor of the Senior Revolving Notes. The closing of the Note Purchase Agreement on February 15, 2017 resulted in the sale and issuance by Carbon California of Senior Revolving Notes in the principal amount of $10.0 million. The maximum principal amount available under the Senior Revolving Notes is based upon the borrowing base attributable to Carbon California’s proved oil and gas reserves which is to be determined at least semi-annually. On April 1, 2020, the borrowing base was redetermined and reduced to $40.0 million. Effective June 30, 2020, and through December 31, 2020, Prudential is no longer obligated to make advances under the Senior Revolving Notes.

Carbon California may elect to incur interest at either (i) 5.50% plus LIBOR or (ii) 4.50% plus the Prime Rate (which is defined as the interest rate published daily by JPMorgan Chase Bank, N.A.). As of December 31, 2019, the effective borrowing rate for the Senior Revolving Notes was 7.10%. In addition, the Senior Revolving Notes include a commitment fee for any unused amounts at 0.50% as well as an annual administrative fee of $75,000, payable on February 15 each year.

The Senior Revolving Notes are secured by all the assets of Carbon California. The Senior Revolving Notes require Carbon California, as of January 1 and July 1 of each year, to hedge its anticipated proved developed production at such time for year one, two and three at a rate of 75%, 65% and 50%, respectively. Carbon California may make principal payments in minimum installments of $500,000. Distributions to equity members are generally restricted.

Carbon California incurred fees directly associated with the issuance of the Senior Revolving Notes and amortizes these fees over the life of the Senior Revolving Notes. The current portion of these fees are included in prepaid expenses and deposits and the long-term portion is included in other non-current assets for a combined value of approximately $458,000. For the three and six months ended June 30, 2020, Carbon California amortized fees of $70,000 and $141,000, respectively.

Carbon California may at any time repay the Senior Revolving Notes, in whole or in part, without penalty. Carbon California must pay down Senior Revolving Notes or provide mortgages of additional oil and natural gas properties to the extent that outstanding loans and letters of credit exceed the borrowing base.

Subordinated Notes, Related Party

On February 15, 2017, Carbon California entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Prudential Capital Energy Partners, L.P. for the issuance and sale of Subordinated Notes due February 15, 2024, bearing interest of 12.0% per annum (the “Subordinated Notes”). The Company is not a guarantor of the Subordinated Notes. The closing of the Securities Purchase Agreement on February 15, 2017 resulted in the sale and issuance by Carbon California of Subordinated Notes in the original principal amount of $10.0 million, all of which remains outstanding as of June 30, 2020.

Prudential received an additional 1,425 Class A Units, representing 5.0% of the total sharing percentage, for the issuance of the Subordinated Notes. Carbon California valued this unit issuance based on the relative fair value by valuing the units at $1,000 per unit and aggregating the amount with the outstanding Subordinated Notes of $10.0 million. The Company then allocated the non-cash value of the units of approximately $1.3 million, which was recorded as a discount to the Subordinated Notes. As of June 30, 2020, Carbon California had an outstanding discount of approximately $646,000, which is presented net of the Subordinated Notes within Notes payable-related party on the unaudited condensed consolidated balance sheets. During the three and six months ended June 30, 2020, Carbon California amortized $45,000 and $89,000, respectively, associated with the Subordinated Notes.

The Subordinated Notes require Carbon California, as of January 1 and July 1 of each year, to hedge its anticipated production at such time for year one, two and three at a rate of 67.5%, 58.5% and 45.0%, respectively.

Prepayment of the Subordinated Notes is allowed at 100%, subject to a 3.0% fee of outstanding principal. Prepayment is not subject to a prepayment fee after February 17, 2020. Distributions to equity members are generally restricted.

2018 Subordinated Notes, Related Party

On May 1, 2018, Carbon California entered into an agreement with Prudential for the issuance and sale of $3.0 million in subordinated notes due February 15, 2024, bearing interest of 12.0% per annum (the “2018 Subordinated Notes”), of which $3.0 million remains outstanding as of June 30, 2020.

Prudential received 585 Class A Units, representing an approximate 2.0% additional sharing percentage, for the issuance of the 2018 Subordinated Notes. Carbon California valued this unit issuance based on the relative fair value by valuing the units at $1,000 per unit and aggregating the amount with the outstanding 2018 Subordinated Notes of $3.0 million. The Company then allocated the non-cash value of the units of approximately $490,000, which was recorded as a discount to the 2018 Subordinated Notes. As of June 30, 2020, Carbon California had an outstanding discount of $307,000 associated with these notes, which is presented net of the 2018 Subordinated Notes within Notes payable - related party on the unaudited condensed consolidated balance sheets. During the three and six months ended June 30, 2020, Carbon California amortized $42,000 and $21,000, respectively, associated with the 2018 Subordinated Notes.

The 2018 Subordinated Notes require Carbon California, as of January 1 and July 1 of each year, to hedge its anticipated production at such time for year one, two and three at a rate of 67.5%, 58.5% and 45.0%, respectively.

Prepayment of the 2018 Subordinated Notes is allowed at 100%, subject to a 3.0% fee of outstanding principal. Prepayment is not subject to a prepayment fee after February 17, 2020. Distributions to equity members are generally restricted.

10

Restrictions and Covenants

The Senior Revolving Notes, Subordinated Notes and 2018 Subordinated Notes contain affirmative and negative covenants that, among other things, limit Carbon California’s ability to (i) incur additional debt; (ii) incur additional liens; (iii) sell, transfer or dispose of assets; (iv) merge or consolidate, wind-up, dissolve or liquidate; (v) make dividends and distributions on, or repurchases of, equity; (vi) make certain investments; (vii) enter into certain transactions with our affiliates; (viii) enter into sales-leaseback transactions; (ix) make optional or voluntary payments of debt; (x) change the nature of our business; (xi) change our fiscal year to make changes to the accounting treatment or reporting practices; (xii) amend constituent documents; and (xiii) enter into certain hedging transactions.

In December 2019, Carbon California amended the Senior Revolving Notes, the Subordinated Notes and the 2018 Subordinated Notes to amend the total leverage ratio and senior leverage ratio, effective September 30, 2019. The Senior Revolving Notes were also amended to provide a mechanism to determine a successor reference rate to LIBOR.

In July 2020, Carbon California amended the Senior Revolving Notes, the Subordinated Notes and the 2018 Subordinated Notes to restrict additional withdrawals under the Senior Revolving Notes through December 31, 2020, amend the total leverage ratio, senior leverage ratio and interest coverage ratio and provide a waiver for non-compliance with its Senior Revolving Notes/EBITDA ratio at March 31, 2020. Also, the interest payable under the Subordinated Notes and the 2018 Subordinated Notes beginning May 15, 2020 would be paid in kind and added to the outstanding principal amount of each note. For the three months ended June 30, 2020, paid in kind interest was approximately $390,000.

The affirmative and negative covenants are subject to various exceptions, including basket amounts and acceptable transaction levels. In addition, (i) the Senior Revolving Notes require at June 30, 2020 Carbon California’s compliance with (A) a maximum Debt/EBITDA ratio of 6.0 to 1.0 (B) a maximum Senior Revolving Notes/EBITDA ratio of 4.5 to 1.0 and (C) a minimum interest coverage ratio of 1.65 to 1 and (ii) the Subordinated Notes require at June 30, 2020 Carbon California’s compliance with (A) a maximum Debt/EBITDA ratio of 6.90 to 1.0, (B) a maximum Senior Revolving Notes/EBITDA ratio of 5.18 to 1.0, (C) a minimum interest coverage ratio of 1.4 to 1.0, (D) an asset coverage test whereby indebtedness may not exceed the product of 0.65 times Adjusted PV-10 of proved developed reserves set forth in the most recent reserve report, (E) maintenance of a minimum borrowing base of $30.0 million under the Senior Revolving Notes and (F) a minimum current ratio of 0.85 to 1.00.

As of June 30, 2020, Carbon California was in compliance with its financial covenants.

NOTE 8 – REVENUE

The following tables present our disaggregated revenue by primary region within the United States and major product line:

For the three months ended June 30, 2020 and 2019 (in thousands):

| Appalachian and Illinois Basins | Ventura Basin | Total | ||||||||||||||||||||||

| Three Months Ended June 30, | Three Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Natural gas sales | $ | 4,011 | $ | 13,879 | $ | 127 | $ | 337 | $ | 4,138 | $ | 14,216 | ||||||||||||

| Natural gas liquids sales | - | - | 49 | 195 | 49 | 195 | ||||||||||||||||||

| Oil sales | 194 | 1,558 | 3,573 | 8,344 | 3,767 | 9,902 | ||||||||||||||||||

| Transportation and handling | 274 | 322 | - | - | 274 | 322 | ||||||||||||||||||

| Marketing gas sales | 2,380 | 3,221 | - | - | 2,380 | 3,221 | ||||||||||||||||||

| Total | $ | 6,859 | $ | 18,980 | $ | 3,749 | $ | 8,876 | $ | 10,608 | $ | 27,856 | ||||||||||||

For the six months ended June 30, 2020 and 2019 (in thousands):

| Appalachian and Illinois Basins | Ventura Basin | Total | ||||||||||||||||||||||

| Six Months Ended June 30, | Six Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Natural gas sales | $ | 12,030 | $ | 32,671 | $ | 542 | $ | 861 | $ | 12,572 | $ | 33,532 | ||||||||||||

| Natural gas liquids sales | - | - | 201 | 441 | 201 | 441 | ||||||||||||||||||

| Oil sales | 1,339 | 3,095 | 9,643 | 15,796 | 10,982 | 18,891 | ||||||||||||||||||

| Transportation and handling | 908 | 1,056 | - | - | 908 | 1,056 | ||||||||||||||||||

| Marketing gas sales | 8,698 | 8,165 | - | - | 8,698 | 8,165 | ||||||||||||||||||

| Total | $ | 22,975 | $ | 44,987 | $ | 10,386 | $ | 17,098 | $ | 33,361 | $ | 62,085 | ||||||||||||

We record revenue in the month production is delivered to the purchaser, but settlement statements may not be received until 30 to 90 days after the month of production. As such, we estimate the production delivered and the related pricing. The estimated revenue is recorded within Accounts receivable – Revenue on the consolidated balance sheets. Any differences between our initial estimates and actuals are recorded in the month payment is received from the customer. These differences have not historically been material.

11

NOTE 9 – STOCK-BASED COMPENSATION PLANS

We have three stock plans, the Carbon 2011 Stock Incentive Plan, the Carbon 2015 Stock Incentive Plan and the Carbon 2019 Long Term Incentive Plan (collectively the “Carbon Plans”). The Carbon 2019 Long Term Incentive Plan was approved by the Company’s stockholders in May 2019. The Carbon Plans provide for the issuance of approximately 1.6 million shares of common stock to our officers, directors, employees or consultants eligible to receive the awards under the Carbon Plans. As of June 30, 2020, there were approximately 254,000 shares of common stock available to be granted under the Carbon Plans.

The Carbon Plans provide for the granting of incentive stock options, non-qualified stock options, restricted stock awards, performance awards and phantom stock awards, or a combination of the foregoing, to employees, officers, directors or consultants, provided that only employees may be granted incentive stock options and directors may only be granted restricted stock awards and phantom stock awards.

The Appalachia Divestiture was a change in control event; therefore, we accelerated the vesting of substantially all outstanding unvested restricted stock and unvested restricted performance units. Any remaining unvested restricted performance units were forfeited due to certain performance measures not achieved.

Restricted Stock

As of June 30, 2020, approximately 847,000 shares of restricted stock have been granted under the terms of the Carbon Plans. Restricted stock awards for employees vest ratably over a three-year service period or cliff vest at the end of a three-year service period. For non-employee directors, the awards vest upon the earlier of a change in control of us or the date their membership on the Board of Directors is terminated other than for cause as defined in the agreement. During the six months ended June 30, 2020, approximately 400,000 restricted stock units vested.

Compensation costs recognized for restricted stock grants were approximately $1.7 million and $1.9 million for the three and six months ended June 30, 2020, respectively, and approximately $224,000 and $403,000 for the three and six months ended June 30, 2019, respectively.

Restricted Performance Units

As of June 30, 2020, approximately 804,000 shares of performance units have been granted under the terms of the Carbon Plans. Performance units represent a contractual right to receive one share of our common stock subject to the terms and conditions of the agreements, including the achievement of certain performance measures relative to a defined peer group or the growth of certain performance measures over a defined period of time as well as, in some cases, continued service requirements.

We account for the performance units granted during 2018 and 2019 at their fair value determined at the date of grant, which were $9.80 and $10.00 per share, respectively. The final measurement of compensation cost will be based on the number of performance units that ultimately vest. During the six months ended June 30, 2020, approximately 251,000 performance units vested and we recognized $1.4 million of compensation costs.

NOTE 10 – EARNINGS (LOSS) PER COMMON SHARE

Basic earnings (loss) per common share is computed by dividing the net income (loss) attributable to common stockholders for the period by the basic weighted average number of common shares outstanding during the period. Diluted earnings (loss) per common share includes potentially issuable shares consisting primarily of non-vested restricted stock and contingent restricted performance units, using the treasury stock method. In periods when we report a net loss, all common stock equivalents are excluded from the calculation of diluted weighted average shares outstanding because they would have an anti-dilutive effect, meaning the loss per share would be reduced.

For the three and six months ended June 30, 2019, approximately 276,000 shares of restricted performance units subject to future contingencies were excluded from the computation of basic and diluted earnings per share.

The following table sets forth the calculation of basic and diluted income (loss) per share:

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (in thousands, except per share amounts) | 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Net (loss) income attributable to common stockholders, basic and diluted | (48,011 | ) | 6,154 | (38,287 | ) | 1,979 | ||||||||||

| Weighted-average number of common shares outstanding, basic | 8,118 | 7,815 | 7,964 | 7,739 | ||||||||||||

| Add dilutive effects of non-vested shares of restricted stock and restricted performance units | - | 342 | - | 342 | ||||||||||||

| Weighted-average number of common shares outstanding, diluted | 8,118 | 8,157 | 7,964 | 8,081 | ||||||||||||

| Net (loss) income per common share, basic | $ | (5.91 | ) | $ | 0.79 | $ | (4.81 | ) | $ | 0.26 | ||||||

| Net (loss) income per common share, diluted | $ | (5.91 | ) | $ | 0.75 | $ | (4.81 | ) | $ | 0.24 | ||||||

12

Series B Convertible Preferred Stock - Related Party

In May 2018, we raised $5.0 million through the issuance of 50,000 shares of Series B Convertible Preferred Stock, par value $0.01 per share (“Preferred Stock”) to Yorktown. The Preferred Stock converts into common stock at the election of the holder or will automatically convert into shares of our common stock upon completion of a qualifying equity financing event. The number of shares of common stock issuable upon conversion is dependent upon the price per share of common stock issued in connection with any such qualifying equity financing but has a floor conversion price equal to $8.00 per share. The conversion ratio at which the Preferred Stock will convert into common stock is equal to an amount per share of $100 plus all accrued but unpaid dividends payable in respect thereof divided by the greater of (i) $8.00 per share or (ii) the price that is 15.0% less than the lowest price per share of shares sold to the public in the next equity financing. Using the floor of $8.00 per share would yield 12.5 shares of common stock for every unit of Preferred Stock. The conversion price will be proportionately increased or decreased to reflect changes to the outstanding shares of common stock, such as the result of a combination, reclassification, subdivision, stock split, stock dividend or other similar transaction involving the common stock. Additionally, after the third anniversary of the issuance of the Preferred Stock, we have the option to redeem the shares for cash.

The Preferred Stock accrues cash dividends at a rate of 6.0% of the initial issue price of $100 per share per annum. The holders of the Preferred Stock are entitled to the same number of votes of common stock that such share of Preferred Stock would represent on an as converted basis. The holders of the Preferred Stock receive liquidation preference based on the initial issue price of $100 per share plus a preferred return over common stockholders and the holders of any junior ranking stock. The preferred return was approximately $674,000 as of June 30, 2020 and increased by $150,000 during the six months ended June 30, 2020.

Yorktown waived its right to be paid a liquidating distribution of approximately $5.6 million in connection with the Appalachia Divestiture until the restricted payment covenant in the Old Ironsides Notes is waived by Old Ironsides or until the payment in full of the Old Ironsides Notes or the earlier termination or cancellation of the Old Ironsides Notes, at which point the liquidating distribution will become immediately due and payable by Carbon out of Carbon’s assets legally available for distribution to its stockholders.

NOTE 11 – INCOME TAXES

We recognize deferred income tax assets and liabilities for the estimated future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. We have net operating loss carryforwards available in certain jurisdictions to reduce future taxable income. Future tax benefits from net operating loss carryforwards are recognized to the extent that realization of these benefits is considered more likely than not. To the extent that available evidence raises doubt about the realization of a deferred income tax asset, a valuation allowance is established.

At June 30, 2020, the Company has established a full valuation allowance against the balance of net deferred tax assets.

NOTE 12 – FAIR VALUE MEASUREMENTS

The following table presents our financial assets and liabilities that were accounted for at fair value on a recurring basis by level:

| (in thousands) | Fair Value Measurements Using | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| June 30, 2020 | ||||||||||||||||

| Assets: | ||||||||||||||||

| Commodity derivatives | $ | - | $ | 9,000 | $ | - | $ | 9,000 | ||||||||

| December 31, 2019 | ||||||||||||||||

| Assets: | ||||||||||||||||

| Commodity derivatives | $ | - | $ | 7,079 | $ | - | $ | 7,079 | ||||||||

| Liabilities: | ||||||||||||||||

| Commodity derivatives | $ | - | $ | 556 | $ | - | $ | 556 | ||||||||

Commodity Derivative

As of June 30, 2020, our commodity derivative financial instruments are comprised of oil swaps and costless collars. The fair values of these agreements are determined under an income valuation technique. The valuation model requires a variety of inputs, including contractual terms, published forward prices, volatilities for options and discount rates, as appropriate. Our estimates of fair value of derivatives include consideration of the counterparty’s credit worthiness, our credit worthiness and the time value of money. The consideration of these factors results in an estimated exit-price for each derivative asset or liability under a marketplace participant’s view. All significant inputs are observable, either directly or indirectly; therefore, our derivative instruments are included within the Level 2 fair value hierarchy.

Assets and Liabilities Measured and Recorded at Fair Value on a Non-Recurring Basis

Certain assets and liabilities are measured at fair value on a non-recurring basis. These assets and liabilities are not measured at fair value on an ongoing basis; however, they are subject to fair value adjustments in certain circumstances. The fair value of the following assets and liabilities are based on unobservable pricing inputs and therefore, are included within the Level 3 fair value hierarchy.

13

Firm transportation contracts. We assume, at times, certain firm transportation contracts as part of our acquisitions of oil and natural gas properties. The fair value of the firm transportation contract obligations was determined based upon the contractual obligations assumed by us and discounted based upon our effective borrowing rate. Subsequent to the Appalachia Divestiture, we no longer have any firm transportation contracts.

Debt Discount. The fair value of the debt discount from the 1,425 and 585 additional Class A Units issued in connection with the Subordinated Notes and 2018 Subordinated Notes was $1.3 million and $490,000, respectively. The debt discount was based on the relative fair value of Class A Units. Class A Units were issued contemporaneously at $1,000 per Class A Unit.

Asset Retirement Obligations. The fair value of our asset retirement obligation liability is recorded in the period in which it is incurred or assumed by taking into account the cost of abandoning oil and gas wells ranging from $20,000 to $45,000, which is based on our historical experience and industry expectations for similar work; the estimated timing of reclamation ranging from one to 75 years based on estimates from reserve engineers; an inflation rate between 1.52% to 2.79%; and a credit adjusted risk-free rate between 3.28% to 8.27%, which takes into account our credit risk and the time value of money.

NOTE 13 – COMMODITY DERIVATIVES

We historically use commodity-based derivative contracts to manage exposures to commodity price on a portion of our oil and natural gas production. We do not hold or issue derivative financial instruments for speculative or trading purposes. We also have entered into, on occasion, oil and natural gas physical delivery contracts to effectively provide commodity price hedges. Because these contracts are not expected to be net cash settled, they are considered to be normal sales contracts and not derivatives. These contracts are not recorded at fair value in the unaudited condensed consolidated financial statements.

We have entered into swap and costless collar derivative agreements to hedge a portion of our oil production through December 2022. Subsequent to the Appalachia Divestiture, our remaining derivative contracts relate to Carbon California production. As of June 30, 2020, these derivative agreements consisted of the following:

| Oil Swaps* | Oil Collars* | |||||||||||||||||||||

| Year | WTI Bbl | Weighted Average Price (a) | Brent Bbl | Weighted Average Price (b) | Brent Bbl | Weighted Average Price (b) | ||||||||||||||||

| 2020 | 41,867 | $ | 50.12 | 123,630 | $ | 64.22 | 30,400 | $ 47.00 - $75.00 | ||||||||||||||

| 2021 | - | $ | - | 86,341 | $ | 67.12 | 190,000 | $ 47.00 - $75.00 | ||||||||||||||

| 2022 | - | $ | - | - | $ | - | 199,900 | $ 50.00 - $61.00 | ||||||||||||||

| * | Includes 100% of Carbon California’s outstanding derivative hedges at June 30, 2020, and not our proportionate share. |

| (a) | NYMEX Light Sweet Crude West Texas Intermediate futures contracts for the respective period. |

| (b) | Brent future contracts for the respective period. |

For our swap instruments, we receive a fixed price for the hedged commodity and pay a floating price to the counterparty. The fixed-price payment and the floating-price payment are netted, resulting in a net amount due to or from the counterparty. Costless collars are designed to establish floor and ceiling prices on anticipated future oil and gas production. The ceiling establishes a maximum price that the Company will receive for the volumes under contract, while the floor establishes a minimum price.

The following table summarizes the fair value of the derivatives recorded in the unaudited condensed consolidated balance sheets. These derivative instruments are not designated as cash flow hedging instruments for accounting purposes:

| (in thousands) | June 30, 2020 | December 31, 2019 | ||||||

| Commodity derivative contracts: | ||||||||

| Commodity derivative asset | $ | 6,129 | $ | 5,915 | ||||

| Commodity derivative asset – non-current | $ | 2,871 | $ | 1,164 | ||||

| Commodity derivative liability | $ | - | $ | 469 | ||||

| Commodity derivative liability – non-current | $ | - | $ | 87 | ||||

14

The table below summarizes the commodity settlements and unrealized gains and losses related to the Company’s derivative instruments for the three and six months ended June 30, 2020 and 2019. Changes in the fair value of commodity derivative contracts are recognized in revenues in the unaudited condensed consolidated statements of operations and gains and losses are included within the cash flows from operating activities in the unaudited condensed consolidated statements of cash flows.

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| (in thousands) | 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Commodity derivative contracts: | ||||||||||||||||

| Settlement gain (loss) | $ | 5,363 | $ | 225 | $ | 8,441 | $ | (231 | ) | |||||||

| Unrealized gain (loss) | (11,010 | ) | 8,455 | 5,626 | (396 | ) | ||||||||||

| Total commodity derivative gain (loss) | $ | (5,647 | ) | $ | 8,680 | $ | 14,067 | $ | (627 | ) | ||||||

Commodity derivative settlement gains and losses are included within the cash flows from operating activities in the unaudited condensed consolidated statements of cash flows.

We net our derivative instrument fair value amounts pursuant to ISDA Master Agreements, which provide for the net settlement over the term of the contracts and in the event of default or termination of the contracts. The following table summarizes the effect of netting arrangements for recognized derivative assets and liabilities that are subject to master netting arrangements or similar arrangements in the unaudited condensed consolidated balance sheet as of June 30, 2020:

| Net | ||||||||||||

| Gross | Recognized | |||||||||||

| Recognized | Gross | Fair Value | ||||||||||

| Assets/ | Amounts | Assets/ | ||||||||||

| Balance Sheet Classification (in thousands) | Liabilities | Offset | Liabilities | |||||||||

| Commodity derivative assets: | ||||||||||||

| Commodity derivative asset | $ | 6,196 | $ | (67 | ) | $ | 6,129 | |||||

| Commodity derivative asset – non-current | 3,674 | (803 | ) | 2,871 | ||||||||

| Total derivative assets | $ | 9,870 | $ | (870 | ) | $ | 9,000 | |||||

| Commodity derivative liabilities: | ||||||||||||

| Commodity derivative liability | $ | (67 | ) | $ | 67 | $ | - | |||||

| Commodity derivative liability – non-current | (803 | ) | 803 | - | ||||||||

| Total derivative liabilities | $ | (870 | ) | $ | 870 | $ | - | |||||

Due to the volatility of oil and natural gas prices, the estimated fair value of our derivatives is subject to fluctuations from period to period.

NOTE 14 – COMMITMENTS AND CONTINGENCIES

Delivery Commitments

We had firm transportation contracts to ensure the transport for certain of our gas production to purchasers. These contracts were assumed in the EXCO Acquisition in October 2016 and the OIE Membership Acquisition in December 2018 and were reflected in the Company’s unaudited condensed consolidated balance sheet. The remaining volumes and related demand charges for the remaining term of these contracts were assumed by DGOC as of the closing of the Appalachia Divestiture.

15

Natural gas processing agreement

We entered into an initial five-year gas processing agreement expiring in 2022 with an option to extend the term of the agreement by another five years. The related demand charges for volume commitments over the remaining term of the agreement were approximately $1.8 million per year. We paid a processing fee of $2.50 per Mcf for the term of the agreement, with a minimum annual volume commitment of 720,000 Mcf.

Effective June 1, 2020 we entered into a revised gas processing agreement expiring July 31, 2022. We will pay a processing fee based on actual midstream expenditures and processed gas volumes for the prior calendar year. The base fee for calendar year 2020 is $3.50 per Mcf delivered to the processor. An additional fee, ranging from 5% to 15% of the processing fee, is attributable to the price of the residue gas sold by the processor. We will receive 100% of the allocated proceeds for the processor’s sale of our residue gas and natural gas liquids.

Capital Commitments

As of June 30, 2020, we had no capital commitments.

Litigation

The Company is subject to litigation and claims arising in the ordinary course of business. The Company accrues for such items when a liability is both probable and the amount can be reasonably estimated. In the opinion of management, the anticipated results of any pending litigation and claims are not expected to have a material effect on the results of operations, the financial position, or the cash flows of the Company.

NOTE 15 – SUPPLEMENTAL CASH FLOW DISCLOSURE

Supplemental cash flow disclosures for the six months ended June 30, 2020 and 2019 are presented below:

| Six Months Ended June 30, | ||||||||

| (in thousands) | 2020 | 2019 | ||||||

| Cash paid for interest | $ | 3,445 | $ | 4,536 | ||||

| Non-cash transactions: | ||||||||

| Capital expenditures included in accounts payable and accrued liabilities | $ | (269 | ) | $ | (39 | ) | ||

| Increase in asset retirement obligations | $ | 7 | $ | - | ||||

| Adjustments to OIE Membership Acquisition purchase price | $ | - | $ | 1,317 | ||||

NOTE 16 – SUBSEQUENT EVENTS

On August 7, 2020, we obtained the necessary consent that allowed for the conveyance of certain assets associated with the Appalachia Divestiture that were initially excluded pending receipt of such consent. As a result, approximately $400,000 in escrowed funds were released to Carbon, and pursuant to the MIPA, within 10 business days DGOC is to deliver to Carbon approximately $1.6 million in additional funds that were allocated to the properties as part of the MIPA.

16

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion includes forward-looking statements about our business, financial condition and results of operations, including discussions about management’s expectations for our business. These statements represent projections, beliefs and expectations based on current circumstances and conditions, and you should not construe these statements either as assurances of performance or as promises of a given course of action. Instead, various known and unknown factors may cause our actual performance and management’s actions to vary, and the results of these variances may be both material and adverse. A description of material factors known to us that may cause our results to vary or may cause management to deviate from its current plans and expectations, is set forth under “Risk Factors.” The following discussion should be read in conjunction with “Forward-Looking Statements,” “Risk Factors” and our unaudited condensed consolidated financial statements, including the notes thereto appearing elsewhere in this Quarterly Report on Form 10-Q and the information included or incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019 Annual Report on Form 10-K”).

General Overview

Carbon Energy Corporation, a Delaware corporation formed in 2007, is an independent oil and natural gas company engaged in the acquisition, exploration, development and production of oil, natural gas and natural gas liquids (“NGLs”) properties. We currently develop and operate oil and gas properties in the Ventura Basin in California through our majority-owned subsidiary, Carbon California. We own 53.92% of Carbon California which we consolidate for financial reporting purposes as a majority-owned subsidiary.

At June 30, 2020, our proved developed reserves were comprised of 84% oil and NGLs and 16% natural gas. Our current capital expenditure program is focused on the acquisition and development of oil and natural gas properties in areas where we currently operate. We believe that our asset and lease position, combined with our low operating expense structure and technical expertise, provides us with a portfolio of opportunities for the development of our oil and natural gas properties. Our growth plan is centered on the following activities:

| ● | Acquire and develop oil and gas producing properties that deliver attractive risk adjusted rates of return, provide for field development projects, and complement our existing asset base; and | |

| ● | Develop, optimize and maintain a portfolio of low risk, long-lived oil and natural gas properties that provide stable cash flows and attractive risk adjusted rates of return. |

Reverse Stock Split

As more fully described in proxy materials filed with the SEC, the Board of Directors is proposing to amend the Company’s amended and restated certificate of incorporation to effect a reverse stock split at a ratio of 4-for-1 (the “Reverse Stock Split”). If the Reverse Stock Split is approved, the Company will file with the Delaware Secretary of State a certificate of amendment to its Amended and Restated Certificate of Incorporation, at which date (the “effective time”) a stockholder owning fewer than four shares immediately prior to the effective time would only be entitled to a fraction of a share of common stock and will be paid cash in lieu of such fraction of a share, on the basis of $1.00 (the “Cash Payment”), for each share of common stock held by the stockholder (the “Cashed Out Stockholder”) immediately prior to effective time and the Cashed Out Stockholders will no longer be a stockholder of the Company. As of July 16, 2020, 90 shareholders that collectively owned 191 shares of the Company’s common stock owned less than four shares of common stock. If the Reverse Stock Split is approved, the Company would pay $191.00 to these Cashed Out Shareholders. The Company will use its own funds to pay the Cashed Out Stockholders.

17