Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION CHIEF FINANCIAL OFFICER PURSUANT TO 18 U.S.C. SECTION 1350, AS ADO - Carbon Energy Corp | ex32_2.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO 18 U.S.C. SECTION 1350, AS - Carbon Energy Corp | ex32_1.htm |

| EX-31.2 - RULE 13A-14(A)/15D-14(A) - CERTIFICATION OF CHIEF FINANCIAL OFFICER. - Carbon Energy Corp | ex31_2.htm |

| EX-31.1 - RULE 13A-14(A)/15D-14(A) - CERTIFICATION OF CHIEF EXECUTIVE OFFICER. - Carbon Energy Corp | ex31_1.htm |

| EX-2.4 - AMENDMENT NO. 3 PURCHASE AND SALE AGREEMENT - Carbon Energy Corp | f10q0318ex2-4_carbonnatural.htm |

| EX-2.3 - AMENDMENT NO. 2 PURCHASE AND SALE AGREEMENT - Carbon Energy Corp | f10q0318ex2-3_carbonnatural.htm |

| EX-2.2 - AMENDMENT NO. 1 PURCHASE AND SALE AGREEMENT - Carbon Energy Corp | f10q0318ex2-2_carbonnatural.htm |

| EX-2.1 - PURCHASE AND SALE AGREEMENT - Carbon Energy Corp | f10q0318ex2-1_carbonnatural.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarter ended March 31, 2018

or

☐ Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________ to ____________

Commission File Number: 000-02040

| CARBON NATURAL GAS COMPANY |

| (Exact name of registrant as specified in its charter) |

| Delaware | 26-0818050 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 1700 Broadway, Suite 1170, Denver, CO | 80290 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (720) 407-7043

| (Former name, address and fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Smaller reporting company | ☒ | ||

| Accelerated filer | ☐ | Emerging growth company | ☐ | ||

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ☐ NO ☒

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

At May 14, 2017, there were 7,700,619 issued and outstanding shares of the Company’s common stock, $0.01 par value.

Carbon Natural Gas Company

TABLE OF CONTENTS

| Part I – FINANCIAL INFORMATION | |

| Item 1. Consolidated Financial Statements | 1 |

| Consolidated Balance Sheets (unaudited) | 1 |

| Consolidated Statements of Operations (unaudited) | 2 |

| Consolidated Statements of Stockholders’ Equity (unaudited) | 3 |

| Consolidated Statements of Cash Flows (unaudited) | 4 |

| Notes to the Consolidated Financial Statements (unaudited) | 5 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 32 |

| Item 4. Controls and Procedures | 44 |

| Part II – OTHER INFORMATION | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 45 |

| Item 6. Exhibits | 45 |

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

CARBON NATURAL GAS COMPANY

Consolidated Balance Sheets

| March 31, | December 31, | |||||||

| (in thousands) | 2018 | 2017 | ||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 4,114 | $ | 1,650 | ||||

| Accounts receivable: | ||||||||

| Revenue | 3,522 | 2,206 | ||||||

| Joint interest billings and other | 2,137 | 349 | ||||||

| Insurance receivable (Note 2) | 2,834 | 802 | ||||||

| Due from related parties | 571 | 2,075 | ||||||

| Other | 280 | - | ||||||

| Commodity derivative asset | - | 215 | ||||||

| Prepaid expense, deposits and other current assets | 2,058 | 783 | ||||||

| Total current assets | 15,516 | 8,080 | ||||||

| Property and equipment (Note 4) | ||||||||

| Oil and gas properties, full cost method of accounting: | ||||||||

| Proved, net | 89,956 | 34,178 | ||||||

| Unproved | 3,505 | 1,947 | ||||||

| Other property and equipment, net | 1,631 | 737 | ||||||

| Total property and equipment, net | 95,092 | 36,862 | ||||||

| Investments in affiliates (Note 6) | 12,850 | 14,267 | ||||||

| Other long-term assets | 1,777 | 800 | ||||||

| Total assets | $ | 125,235 | $ | 60,009 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities (Note 11) | $ | 18,566 | $ | 11,218 | ||||

| Firm transportation contract obligations (Note 14) | 123 | 127 | ||||||

| Commodity derivative liability (Note 13) | 1,769 | - | ||||||

| Total current liabilities | 20,458 | 11,345 | ||||||

| Non-current liabilities: | ||||||||

| Firm transportation contract obligations (Note 14) | 107 | 134 | ||||||

| Production and property taxes payable | 550 | 520 | ||||||

| Warrant liability (Note 12) | - | 2,017 | ||||||

| Asset retirement obligations (Note 5) | 10,032 | 7,357 | ||||||

| Credit facility (Note 7) | 23,223 | 22,140 | ||||||

| Credit facility-related party (Note 7) | 21,922 | - | ||||||

| Commodity derivative non-current liability (Note 13) | 910 | - | ||||||

| Total non-current liabilities | 56,744 | 32,168 | ||||||

| Commitments (Note 14) | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $0.01 par value; authorized 1,000,000 shares, no shares issued and outstanding at March 31, 2018 and December 31, 2017 | - | - | ||||||

| Common stock, $0.01 par value; authorized 10,000,000 shares, 7,572,048 and 6,005,633 shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively | 76 | 60 | ||||||

| Additional paid-in capital | 69,208 | 58,813 | ||||||

| Accumulated deficit | (40,649 | ) | (44,218 | ) | ||||

| Total Carbon stockholders’ equity | 28,635 | 14,655 | ||||||

| Non-controlling interests | 19,398 | 1,841 | ||||||

| Total stockholders’ equity | 48,033 | 16,496 | ||||||

| Total liabilities and stockholders’ equity | $ | 125,235 | $ | 60,009 | ||||

See accompanying notes to Consolidated Financial Statements.

| 1 |

CARBON NATURAL GAS COMPANY

Consolidated Statements of Operations

(Unaudited)

| Three Months Ended March 31, | ||||||||

| (in thousands, except per share amounts) | 2018 | 2017 | ||||||

| Revenue: | ||||||||

| Natural gas sales | $ | 3,939 | $ | 3,994 | ||||

| Natural gas liquid sales | 163 | - | ||||||

| Oil sales | 2,983 | 1,046 | ||||||

| Commodity derivative (loss) gain | (626 | ) | 2,144 | |||||

| Other income | 14 | 9 | ||||||

| Total revenue | 6,473 | 7,193 | ||||||

| Expenses: | ||||||||

| Lease operating expenses | 2,087 | 1,205 | ||||||

| Transportation and gathering costs | 855 | 489 | ||||||

| Production and property taxes | 433 | 412 | ||||||

| General and administrative | 2,948 | 1,745 | ||||||

| General and administrative - related party reimbursement | (1,116 | ) | (75 | ) | ||||

| Depreciation, depletion and amortization | 1,492 | 573 | ||||||

| Accretion of asset retirement obligations | 141 | 78 | ||||||

| Total expenses | 6,840 | 4,427 | ||||||

| Operating (loss) income | (367 | ) | 2,766 | |||||

| Other income (expense): | ||||||||

| Interest expense | (1,002 | ) | (267 | ) | ||||

| Warrant derivative gain | 225 | 830 | ||||||

| Gain on derecognized equity investment in affiliate – Carbon California | 5,391 | - | ||||||

| Investment in affiliates | 437 | 7 | ||||||

| Total other income (expense) | 5,051 | 570 | ||||||

| Income before income taxes | 4,684 | 3,336 | ||||||

| Provision for income taxes | - | - | ||||||

| Net income before non-controlling interests | 4,684 | 3,336 | ||||||

| Net income attributable to non-controlling interests | 1,115 | 44 | ||||||

| Net income attributable to controlling interest | $ | 3,569 | $ | 3,292 | ||||

| Net income per common share: | ||||||||

| Basic | $ | 0.51 | $ | 0.60 | ||||

| Diluted | $ | 0.46 | $ | 0.40 | ||||

| Weighted average common shares outstanding: | ||||||||

| Basic | 6,996 | 5,487 | ||||||

| Diluted | 7,226 | 6,255 | ||||||

See accompanying notes to Consolidated Financial Statements.

| 2 |

CARBON NATURAL GAS COMPANY

Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands)

| Additional | Non- | Total | ||||||||||||||||||||||

| Common Stock | Paid-in | Controlling | Accumulated | Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Interests | Deficit | Equity | |||||||||||||||||||

| Balances, December 31, 2017 | 6,006 | $ | 60 | $ | 58,813 | $ | 1,841 | $ | (44,218 | ) | $ | 16,496 | ||||||||||||

| Stock based compensation | 38 | 1 | 292 | - | - | 293 | ||||||||||||||||||

| CCC Warrant Exercise - Share Issuance | 1,528 | 15 | 8,311 | 16,466 | - | 24,792 | ||||||||||||||||||

| CCC Warrant Exercise - liability extinguishment | - | - | 1,792 | - | - | 1,792 | ||||||||||||||||||

| Non-controlling interest distributions, net | - | - | - | (24 | ) | - | (24 | ) | ||||||||||||||||

| Net income | - | - | - | 1,115 | 3,569 | 4,684 | ||||||||||||||||||

| Balances, March 31, 2018 | 7,572 | $ | 76 | $ | 69,208 | $ | 19,398 | $ | (40,649 | ) | $ | 48,033 | ||||||||||||

See accompanying notes to Consolidated Financial Statements.

| 3 |

CARBON NATURAL GAS COMPANY

Consolidated Statements of Cash Flows

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| (in thousands) | 2018 | 2017 | ||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 4,684 | $ | 3,336 | ||||

| Items not involving cash: | ||||||||

| Depreciation, depletion and amortization | 1,492 | 573 | ||||||

| Accretion of asset retirement obligations | 141 | 78 | ||||||

| Unrealized commodity derivative (gain) loss | 249 | (2,167 | ) | |||||

| Warrant derivative gain | (225 | ) | (830 | ) | ||||

| Stock-based compensation expense | 292 | 319 | ||||||

| Equity investment (income)loss | (437 | ) | (7 | ) | ||||

| Gain on derecognized equity investment in affiliate – Carbon California | (5,391 | ) | - | |||||

| Amortization of debt issuance costs | 89 | - | ||||||

| Other | - | (36 | ) | |||||

| Net change in: | ||||||||

| Accounts receivable | (1,611 | ) | 1,268 | |||||

| Prepaid expenses, deposits and other current assets | 448 | (67 | ) | |||||

| Accounts payable, accrued liabilities, firm transportation contract obligations, and other long-term obligations | 364 | (1,573 | ) | |||||

| Net cash provided by operating activities | 95 | 894 | ||||||

| Cash flows from investing activities: | ||||||||

| Development and acquisition of properties and equipment | (874 | ) | (396 | ) | ||||

| Cash received- Carbon California Acquisition | 275 | - | ||||||

| Other long-term assets | - | (3 | ) | |||||

| Net cash (used in) investing activities | (599 | ) | (399 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from credit facility | 3,000 | 300 | ||||||

| Payments on credit facility | (8 | ) | (1,000 | ) | ||||

| Distributions to non-controlling interests | (24 | ) | (23 | ) | ||||

| Net cash provided by (used in) financing activities | 2,968 | (723 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | 2,464 | (228 | ) | |||||

| Cash and cash equivalents, beginning of period | 1,650 | 858 | ||||||

| Cash and cash equivalents, end of period | $ | 4,114 | $ | 630 | ||||

See accompanying notes to Consolidated Financial Statements.

| 4 |

CARBON NATURAL GAS COMPANY

Notes to Consolidated Financial Statements

(Unaudited)

Note 1 – Organization

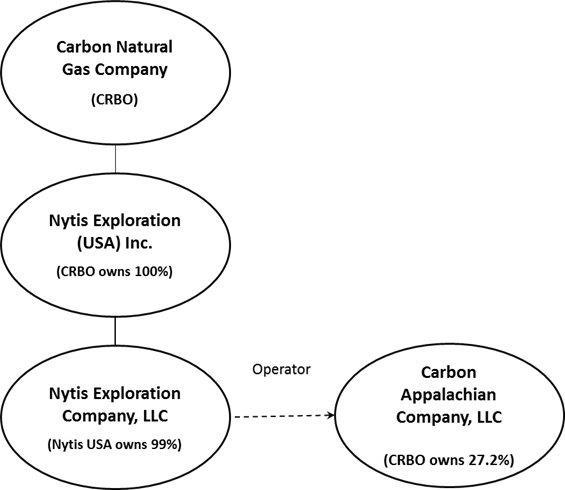

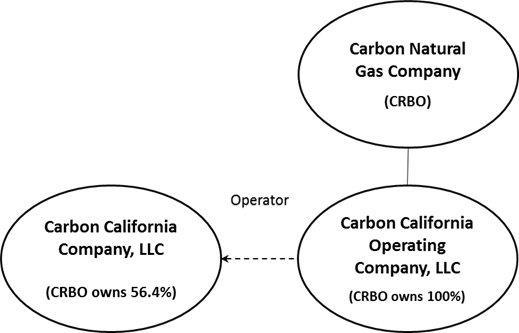

Carbon Natural Gas Company and its subsidiaries (referred to herein as “we”, “us”, or “Carbon” ) is an independent oil and gas company engaged in the exploration, development and production of oil and natural gas in the United States. The Company’s business is comprised of the assets and properties of Nytis Exploration (USA) Inc. (“Nytis USA”) and its subsidiary Nytis Exploration Company LLC (“Nytis LLC”) which conducts the Company’s operations in the Appalachian and Illinois Basins, in addition to its subsidiaries, Carbon California Operating Company, LLC and Carbon California Company, LLC which conducts the Company’s operations in California as well as our equity investment in Carbon Appalachian Company, LLC (“Carbon Appalachia”).

Appalachian and Illinois Basin Operations

In the Appalachian and Illinois Basins, Nytis LLC and Carbon Appalachia conducts our operations. The following illustrates this relationship as of March 31, 2018.

| 5 |

Ventura Basin Operations

In California, Carbon California Operating Company, LLC (“CCOC”) conducts Carbon California Company, LLC’s (“Carbon California”) operations. On February 1, 2018, an entity managed by Yorktown Partners, LLC (“Yorktown”) exercised a warrant it held to purchase shares of our common stock at an exercise price of $7.20 per share (the “California Warrant”), resulting in the issuance of 1,527,778 shares of our common stock. In exchange, we received Yorktown’s Class A Units of Carbon California representing approximately 46.96% of the then outstanding Class A Units of Carbon California (a profits interest of approximately 38.59%). After giving effect to the exercise on February 1, 2018, we own 56.4% of the voting and profits interests of Carbon California and Prudential Capital Energy Partners, L.P. (“Prudential”) owns 43.6%. Yorktown owns 68.6% of the outstanding shares of our common stock as of May 14, 2018, assuming the conversion of the preferred stock (described herein) to 625,000 shares of our common stock. As of February 1, 2018, we consolidate Carbon California for financial reporting purposes.

| 6 |

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information. Accordingly, they do not include all the information and footnotes required by GAAP for complete financial statements. In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments (consisting of normal and recurring accruals) considered necessary to present fairly our financial position as of March 31, 2018, and our results of operations and cash flows for the three months ended March 31, 2018 and 2017. Operating results for the three months ended March 31, 2018, are not necessarily indicative of the results that may be expected for the full year because of the impact of fluctuations in prices received for oil and natural gas, natural production declines, the uncertainty of exploration and development drilling results and other factors. The unaudited condensed consolidated financial statements and related notes included in this Quarterly Report on Form 10-Q should be read in conjunction with our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2017. Except as disclosed herein, there have been no material changes to the information disclosed in the notes to the consolidated financial statements included in our 2017 Annual Report on Form 10-K.

Principles of Consolidation

The unaudited condensed consolidated financial statements include the accounts of Carbon, CCOC, Carbon California and Nytis USA and its consolidated subsidiary, Nytis LLC. Carbon owns 100% of Nytis USA and CCOC. Nytis USA owns approximately 99% of Nytis LLC. Carbon owns 56.4% of Carbon California.

Nytis LLC also holds an interest in 64 oil and gas partnerships. For partnerships where we have a controlling interest, the partnerships are consolidated. We are currently consolidating, on a pro-rata basis, 47 partnerships. In these instances, we reflect the non-controlling ownership interest in partnerships and subsidiaries as non-controlling interests on our unaudited consolidated statements of operations and reflect the non-controlling ownership interests in the net assets of the partnerships as non-controlling interests within stockholders’ equity on our unaudited consolidated balance sheet. All significant intercompany accounts and transactions have been eliminated.

In accordance with established practice in the oil and gas industry our unaudited condensed consolidated financial statements also include our pro-rata share of assets, liabilities, income, lease operating costs and general and administrative expenses of the oil and gas partnerships in which we have a non-controlling interest.

Non-majority owned investments that do not meet the criteria for pro-rata consolidation are accounted for using the equity method when we have the ability to significantly influence the operating decisions of the investee. When we do not have the ability to significantly influence the operating decisions of an investee, the cost method is used. All transactions, if any, with investees have been eliminated in the accompanying unaudited condensed consolidated financial statements.

Effective February 1, 2018, Yorktown exercised the California Warrant, which resulted in us acquiring Yorktown’s ownership interest in Carbon California in exchange for shares of our common stock. Following the closing of the Seneca Acquisition on May 1, 2018 (see note 16), our ownership decreased to 53.92% of the voting and profits interests of Carbon California, and Prudential owns the remainder.

Insurance Receivable

Insurance receivable is comprised of an insurance receivable for the loss of property as a result of wildfires that impacted Carbon California in December 2017. The Company filed claims with its insurance provider and is in receipt of partial funds associated with the claims as of March 31, 2018. Therefore, the Company has determined the receivable is collectible and is included in insurance receivable on the unaudited consolidated balance sheets.

| 7 |

Investments in Affiliates

Investments in non-consolidated affiliates are accounted for under either the cost or equity method of accounting, as appropriate. The cost method of accounting is generally used for investments in affiliates in which we have has less than 20% of the voting interests of a corporate affiliate or less than a 3% to 5% interest of a partnership or limited liability company and do not have significant influence. Investments in non-consolidated affiliates, accounted for using the cost method of accounting, are recorded at cost and impairment assessments for each investment are made annually to determine if a decline in the fair value of the investment, other than temporary, has occurred. A permanent impairment is recognized if a decline in the fair value occurs.

If we hold between 20% and 50% of the voting interest in non-consolidated corporate affiliates or generally greater than a 3% to 5% interest of a partnership or limited liability company and can exert significant influence or control (e.g., through our influence with a seat on the board of directors or management of operations), the equity method of accounting is generally used to account for the investment. Equity method investments will increase or decrease by our share of the affiliate’s profits or losses and such profits or losses are recognized in our unaudited consolidated statements of operations. For our equity method investment in Carbon Appalachia, we use the hypothetical liquidation at book value method to recognize our share of the affiliate’s profits or losses. We review equity method investments for impairment whenever events or changes in circumstances indicate that an other than temporary decline in value has occurred.

Related Party Transactions

Management Reimbursements

In our role as manager of Carbon California and Carbon Appalachia, we receive management reimbursements. We received approximately $753,000 and $50,000 for the three months ended March 31, 2018, and for the one month ended January 31, 2018, from Carbon Appalachia and Carbon California, respectively. These reimbursements are included in general and administrative – related party reimbursement on our unaudited consolidated statements of operations. Effective February 1, 2018, the management reimbursements received from Carbon California are eliminated at consolidation. This elimination includes $100,000 for the period February 1, 2018, through March 31, 2018.

In addition to the management reimbursements, approximately $299,000 and $14,000 in general and administrative expenses were reimbursed for the three months ended March 31, 2018, and for the one month ended January 31, 2018, by Carbon Appalachia and Carbon California, respectively. The elimination of Carbon California in consolidation includes approximately $28,000 for the period February 1, 2018, through March 31, 2018.

Operating Reimbursements

In our role as operator of Carbon California and Carbon Appalachia, we receive reimbursements of operating expenses. These expenses are recorded directly to receivable – related party on our unaudited consolidated balance sheets and are therefore not included in our operating expenses on our unaudited consolidated statements of operations.

| 8 |

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to makes estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. There have been no changes in our critical accounting estimates from those that were disclosed in the 2017 Annual Report on Form 10-K. Actual results could differ from these estimates.

Earnings (Loss) Per Common Share

Basic earnings per common share is computed by dividing the net income (loss) attributable to common stockholders for the period by the weighted average number of common shares outstanding during the period. The shares of restricted common stock granted to our officers, directors and employees are included in the computation of basic net income per share only after the shares become fully vested. Diluted earnings per common share includes both the vested and unvested shares of restricted stock and the potential dilution that could occur upon exercise of warrants to acquire common stock computed using the treasury stock method, which assumes that the increase in the number of shares is reduced by the number of shares which could have been repurchased by us with the proceeds from the exercise of warrants (which were assumed to have been made at the average market price of the common shares during the reporting period).

The following table sets forth the calculation of basic and diluted income per share:

| Three months ended March 31, | ||||||||

| (in thousands except per share amounts) | 2018 | 2017 | ||||||

| Net income | $ | 3,569 | $ | 3,292 | ||||

| Less: warrant derivative gain | (225 | ) | (830 | ) | ||||

| Diluted net income | 3,344 | 2,462 | ||||||

| Basic weighted-average common shares outstanding during the period | 6,996 | 5,487 | ||||||

| Add dilutive effects of warrants and non-vested shares of restricted stock | 230 | 738 | ||||||

| Diluted weighted-average common shares outstanding during the period | 7,226 | 6,225 | ||||||

| Basic net income per common share | $ | 0.51 | $ | 0.60 | ||||

| Diluted net income per common share | $ | 0.46 | $ | 0.40 | ||||

| 9 |

Recently Adopted Accounting Pronouncement

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standard Update ("ASU") 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”), which establishes a comprehensive new revenue recognition standard designed to depict the transfer of goods or services to a customer in an amount that reflects the consideration the entity expects to receive in exchange for those goods or services. In March 2016, the FASB released certain implementation guidance through ASU 2016-08 (collectively with ASU 2014-09, the "Revenue ASUs") to clarify principal versus agent considerations. The Revenue ASUs allow for the use of either the full or modified retrospective transition method, and the standard will be effective for annual reporting periods beginning after December 15, 2017 including interim periods within that period, with early adoption permitted for annual reporting periods beginning after December 15, 2016. We adopted the guidance using the modified retrospective method with the effective date of January 1, 2018. We did not record a cumulative-effect adjustment to the opening balance of retained earnings as no adjustment was necessary. The adoption of the Revenue ASUs did not impact net income or cash flows. See note 10 for the new disclosures required by the Revenue ASUs.

Recently Issued Accounting Pronouncements

In February 2016, the FASB issued ASU No. 2016-02, Leases (“ASU 2016-02”). The objective of this ASU is to increase transparency and comparability among organizations by recognizing lease assets and liabilities on the balance sheet and disclosing key information about leasing arrangements. ASU 2016-02 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018 and should be applied using a modified retrospective approach. Early adoption is permitted. The Company is currently evaluating the impact on its financial statements of adopting ASU 2016-02.

In March 2018, the FASB issued ASU No. 2018-05, Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118 (“ASU 2018-05”). The objective of this ASU is to codify the guidance provided by Staff Accounting Bulletin No. 118 regarding the accounting for the income tax effects of the Tax Cuts and Jobs Act (the “TCJA”) passed by Congress in December 2017 if such accounting is not complete by the time a company issues its financial statements that include the reporting period in which the TCJA was enacted. ASU 2018-05 was effective upon addition to the FASB Codification in March 2018.

Note 3 – Acquisitions and Divestitures

Acquisition of Majority Control of Carbon California

Carbon California was formed in 2016 by us and entities managed by Yorktown and Prudential to acquire producing assets in the Ventura Basin of California.

In connection with the entry into the limited liability company agreement of Carbon California, we received Class B Units and issued to Yorktown a warrant (“the California Warrant”). The exercise price for the California Warrant was payable exclusively with Class A Units of Carbon California held by Yorktown and the number of shares of our common stock for which the California Warrant was exercisable was determined, as of the time of exercise, by dividing (a) the aggregate unreturned capital of Yorktown’s Class A Units of Carbon California by (b) the exercise price. The California Warrant had a term of seven years and included certain standard registration rights with respect to the shares of our common stock issuable upon exercise of the California Warrant.

The issuance of the Class B Units and the California Warrant were in contemplation of each other, and under non-monetary related party guidance, we accounted for the California Warrant, at issuance, based on the fair value of the California Warrant as of the date of grant (February 15, 2017) and recorded a long-term warrant liability with an associated offset to Additional Paid in Capital (“APIC”). Future changes to the fair value of the California Warrant are recognized in earnings. We accounted for the fair value of the Class B Units at their estimated fair value at the date of grant, which became our investment in Carbon California with an offsetting entry to APIC. Additionally, we accounted for our 17.81% profits interest in Carbon California as an equity method investment until January 31, 2018.

| 10 |

On February 1, 2018, Yorktown exercised the California Warrant resulting in the issuance of 1,527,778 shares of our common stock in exchange for Yorktown’s Class A Units of Carbon California representing approximately 46.96% of the outstanding Class A Units of Carbon California (a profits interest of approximately 38.59%). After giving effect to the exercise on February 1, 2018, we owned 56.4% of the voting and profits interests of Carbon California.

The exercise of the California Warrant and the acquisition of the additional ownership interest is accounted for as a step acquisition in which we obtained control in accordance with ASC 805, Business Combinations (“ASC 805”) (referred to herein as the “Carbon California Acquisition”). We recognized 100% of the identifiable assets acquired, liabilities assumed and the non-controlling interest at their respective fair value as of the date of the acquisition. We exchanged 1,527,778 common shares at a fair value of approximately $8.3 million ($5.45 per share), for 11,000 Class A Units of Carbon California, representing a 38.59% ownership interest in Carbon California. We followed the fair value method to allocate the consideration transferred to the identifiable net assets acquired and non-controlling interest (“NCI”) on a preliminary basis as follows:

| Amount (in thousands) |

||||

| Fair value of Carbon common shares transferred as consideration | $ | 8,326 | ||

| Fair value of NCI | 16,466 | |||

| Fair value of previously held interest | 7,244 | |||

| Fair value of business acquired | $ | 32,036 | ||

| Assets acquired and liabilities assumed | ||||

|

Amount (in thousands) |

||||

| Cash | $ | 275 | ||

| Accounts receivable: | ||||

| Joint interest billings and other | 690 | |||

| Receivable - related party | 1,610 | |||

| Prepaid expense, deposits, and other current assets | 1,723 | |||

| Oil and gas properties: | ||||

| Proved | 56,477 | |||

| Unproved | 1,495 | |||

| Other property and equipment, net | 877 | |||

| Other long-term assets | 475 | |||

| Accounts payable and accrued liabilities | (6,054 | ) | ||

| Commodity derivative liability – short-term | (916 | ) | ||

| Commodity derivative liability – long-term | (1,729 | ) | ||

| Asset retirement obligations – short-term | (384 | ) | ||

| Asset retirement obligations – long-term | (2,537 | ) | ||

| Notes, related party, net | (8,874 | ) | ||

| Revolver, related party | (11,000 | ) | ||

| Notes payable | (92 | ) | ||

| Total net assets acquired | $ | 32,036 | ||

The preliminary fair value of the assets acquired and liabilities assumed were determined using various valuation techniques, including an income approach. The fair value measurements were primarily based on significant inputs that are not directly observable in the market and are considered Level 3 under the fair value measurements and disclosure framework.

On the date of the acquisition, we derecognized our equity investment in Carbon California and recognized a gain of approximately $5.4 million based on the fair value of our previously held interest compared to its carrying value.

For assets and liabilities accounted for as business combinations, including the Carbon California Acquisition, to determine the fair value of the assets acquired, the Company primarily used the income approach and made market assumptions as to projections of estimated quantities of oil and natural gas reserves, future production rates, future commodity prices including price differentials as of the date of closing, future operating and development costs, a market participant weighted average cost of capital, and the condition of vehicles and equipment. The determination of the fair value of the accounts payable and accrued liabilities assumed required significant judgement, including estimates relating to production assets.

| 11 |

Consolidation of Carbon California Unaudited Pro Forma Results of Operations

Below are unaudited consolidated results of operations for the quarters ended March 31, 2018 and 2017 as though the Carbon California Acquisition had been completed as of January 1, 2017. The Carbon California Acquisition closed February 1, 2018, and accordingly, the Company’s unaudited consolidated statements of operations for the quarter ended March 31, 2018, includes the results of operations for the period February 1, 2018, through March 31, 2018.

| Unaudited Pro Forma Consolidated Results | ||||||||

| For Three Months Ended March 31, | ||||||||

| (in thousands, except per share amounts) | 2018 | 2017 | ||||||

| Revenue | $ | 6,672 | $ | 8,232 | ||||

| Net income before non-controlling interests | 3,543 | 444 | ||||||

| Net income attributable to non-controlling interests | 1,115 | 44 | ||||||

| Net income attributable to controlling interests | $ | 2,428 | $ | 400 | ||||

| Net income per share (basic) | $ | 0.35 | $ | 0.07 | ||||

| Net income (loss) per share (diluted) | $ | 0.30 | $ | (0.07 | ) | |||

Note 4 – Property and Equipment

Net property and equipment as of March 31, 2018 and December 31, 2017, consists of the following:

| (in thousands) | March 31, 2018 | December 31, 2017 | ||||||

| Oil and gas properties: | ||||||||

| Proved oil and gas properties | $ | 173,242 | $ | 114,893 | ||||

| Unproved properties not subject to depletion | 3,505 | 1,947 | ||||||

| Accumulated depreciation, depletion, amortization and impairment | (83,286 | ) | (80,715 | ) | ||||

| Net oil and gas properties | 93,461 | 36,125 | ||||||

| Furniture and fixtures, computer hardware and software, and other equipment | 2,955 | 1,758 | ||||||

| Accumulated depreciation and amortization | (1,324 | ) | (1,021 | ) | ||||

| Net other property and equipment | 1,631 | 737 | ||||||

| Total net property and equipment | $ | 95,092 | $ | 36,862 | ||||

| 12 |

We had approximately $3.5 million and $1.9 million, at March 31, 2018 and December 31, 2017, respectively, of unproved oil and gas properties not subject to depletion. At March 31, 2018 and December 31, 2017, our unproved properties consist principally of leasehold acquisition costs in the following areas:

| (in thousands) | March 31, 2018 | December 31, 2017 | ||||||

| Ventura Basin | $ | 1,495 | $ | - | ||||

| Illinois Basin: | ||||||||

| Indiana | 430 | 432 | ||||||

| Illinois | 151 | 136 | ||||||

| Appalachian Basin: | ||||||||

| Kentucky | 918 | 915 | ||||||

| Ohio | 65 | 66 | ||||||

| West Virginia | 446 | 398 | ||||||

| Total unproved properties not subject to depletion | $ | 3,505 | $ | 1,947 | ||||

During the three months ended March 31, 2018 and 2017, there were no expiring leasehold costs that were reclassified into proved property. The excluded properties are assessed for impairment at least annually. Subject to industry conditions, evaluations of most of these properties and the inclusion of their costs in amortized capital costs is expected to be completed within five years.

We capitalized overhead applicable to acquisition, development and exploration activities of approximately $71,000 and $75,000 for the three months ended March 31, 2018 and 2017, respectively.

Depletion expense related to oil and gas properties for the three months ended March 31, 2018 and 2017, was approximately $1.3 million and $533,000, or $0.76 and $0.41 per Mcfe, respectively. Depreciation expense related to furniture and fixtures, computer hardware and software, and other equipment for the three months ended March 31, 2018 and 2017, was approximately $149,000 and $40,000, respectively.

Note 5 – Asset Retirement Obligation

Our asset retirement obligations (“ARO”) relate to future costs associated with the plugging and abandonment of oil and gas wells, removal of equipment and facilities from leased acreage and returning such land to its original condition. The fair value of a liability for an ARO is recorded in the period in which it is incurred or acquired, and the cost of such liability is recorded as an increase in the carrying amount of the related long-lived asset by the same amount. The liability is accreted each period and the capitalized cost is depleted on a units-of-production basis as part of the full cost pool. Revisions to estimated AROs result in adjustments to the related capitalized asset and corresponding liability.

The estimated ARO liability is based on estimated economic lives, estimates as to the cost to abandon the wells in the future, and federal and state regulatory requirements. The liability is discounted using a credit-adjusted risk-free rate estimated at the time the liability is incurred or acquired or increased as a result of a reassessment of expected cash flows and assumptions inherent in the estimation of the liability. Upward revisions to the liability could occur due to changes in estimated abandonment costs or well economic lives, or if federal or state regulators enact new requirements regarding the abandonment of wells. AROs are valued utilizing Level 3 fair value measurement inputs (see note 12).

| 13 |

The following table is a reconciliation of the ARO:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2018 | 2017 | ||||||

| Balance at beginning of period | $ | 7,737 | $ | 5,120 | ||||

| Accretion expense | 141 | 78 | ||||||

| Additions from Carbon California Company, LLC | 2,921 | - | ||||||

| Additions during period | - | 3 | ||||||

| 10,799 | 5,201 | |||||||

| Less: ARO recognized as a current liability | (767 | ) | (124 | ) | ||||

| Balance at end of period | $ | 10,032 | $ | 5,077 | ||||

Note 6 – Investments in Affiliates

Carbon California

Carbon California was formed in 2016 by us and entities managed by Yorktown and Prudential to acquire producing assets in the Ventura Basin in California. On February 15, 2017, we, Yorktown and Prudential entered into a limited liability company agreement (the “Carbon California LLC Agreement”) of Carbon California, a Delaware limited liability company.

Prior to February 1, 2018, we held 17.81% of the voting and profits interests, Yorktown held 38.59% of the voting and profits interests and Prudential held 43.59% of the voting and profits interests in Carbon California. On February 1, 2018, Yorktown exercised the California Warrant, pursuant to which Yorktown obtained additional shares of common stock in us in exchange for the transfer and assignment by Yorktown of all its rights in Carbon California. Following the exercise of the California Warrant by Yorktown, we owned 56.4% of the voting and profits interests, and Prudential held the remainder of the interests, in Carbon California. We consolidate Carbon California for financial reporting purposes.

On February 15, 2017, Carbon California (i) issued and sold Class A Units to Yorktown and Prudential for an aggregate cash consideration of $22.0 million, (ii) entered into a Note Purchase Agreement (the “Note Purchase Agreement”) with Prudential Legacy Insurance Company of New Jersey and Prudential Insurance Company of America for the issuance and sale of up to $25.0 million of Senior Secured Revolving Notes (the “Senior Revolving Notes”) due February 15, 2022 and (iii) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Prudential for the issuance and sale of $10.0 million of Senior Subordinated Notes (the “Subordinated Notes”) due February 15, 2024. We are not a guarantor of the Senior Revolving Notes or the Subordinate Notes which are held by Carbon California.

The closing of the Note Purchase Agreement and the Securities Purchase Agreement on February 15, 2017, resulted in the sale and issuance by Carbon California of (i) Senior Revolving Notes in the principal amount of $10.0 million and (ii) Subordinated Notes in the original principal amount of $10.0 million. The maximum principal amount available under the Senior Revolving Notes is based upon the borrowing base attributable to Carbon California’s proved oil and gas reserves which is to be determined at least semi-annually. As of March 31, 2018, the borrowing base was $15.0 million, of which $13.0 million was outstanding. On May 1, 2018, the borrowing base increased to $41.0 million (see note 16).

Net proceeds from the offering transaction were used by Carbon California to complete the acquisitions of oil and gas assets in the Ventura Basin of California, which acquisitions also closed on February 15, 2017. The remainder of the net proceeds were used to fund field development projects, to fund a future complementary acquisition and for general working capital purposes of Carbon California.

| 14 |

For the period February 15, 2017 (inception) through January 31, 2018, based on our 17.8% interest in Carbon California, our ability to appoint a member to the board of directors and our role of manager of Carbon California, we accounted for our investment in Carbon California under the equity method of accounting as we believed we exerted significant influence. We used the Hypothetical Liquidation at Book Value (“HLBV”) to determine our share of profits or losses in Carbon California and adjusted the carrying value of our investment accordingly. The HLBV is a balance-sheet approach that calculates the amount each member of Carbon California would have received if Carbon California were liquidated at book value at the end of each measurement period. The change in the allocated amount to each member during the period represents the income or loss allocated to that member. In the event of liquidation of Carbon California, to the extent that Carbon California has net income, available proceeds are first distributed to members holding Class A and Class B units and any remaining proceeds are then distributed to members holding Class A units. For the period February 15, 2017 (inception) through January 31, 2018, Carbon California incurred a net loss of which our share (as a holder of Class B Units for that period) was zero.

In connection with our entry into the Carbon California LLC Agreement, we received the aforementioned Class B Units and issued to Yorktown the California Warrant. The exercise price for the California Warrant was payable exclusively with Class A Units of Carbon California held by Yorktown and the number of shares of our common stock for which the California Warrant was exercisable was determined, as of the time of exercise, by dividing (a) the aggregate unreturned capital of Yorktown’s Class A Units of Carbon California by (b) the exercise price. The California Warrant had a term of seven years and included certain standard registration rights with respect to the shares of our common stock issuable upon exercise of the California Warrant. On February 1, 2018, Yorktown exercised the California Warrant. As a result of the warrant exercise, Carbon holds 11,000 Class A Units of Carbon California and all of the Class B units, resulting in an aggregate Sharing Percentage of 56.4%. Effective February 1, 2018, the Company consolidates Carbon California in its unaudited condensed consolidated financial statements.

Carbon Appalachia

Carbon Appalachia was formed in 2016 by us, Yorktown and entities managed by Old Ironsides Energy LLC (“Old Ironsides”) to acquire producing assets in the Appalachian Basin in Kentucky, Tennessee, Virginia and West Virginia.

Outlined below is a summary of i) our contributions, ii) our resulting percentage of Class A unit ownership and iii) our overall resulting Sharing Percentage of Carbon Appalachia after giving effect to the Class C Unit ownership. Holders of units within each class of units participate in profit or losses and distributions according to their proportionate share of each class of units (“Sharing Percentage”). Each contribution and its use are described in detail following the table.

| Timing | Capital Contribution | Resulting Class A Units (%) | Resulting Sharing % | |||||||

| April 2017 | $0.24 million | 2.00 | % | 2.98 | % | |||||

| August 2017 | $3.71 million | 15.20 | % | 16.04 | % | |||||

| September 2017 | $2.92 million | 18.55 | % | 19.37 | % | |||||

| November 2017 | Warrant exercise | 26.50 | % | 27.24 | % | |||||

On April 3, 2017, we, Yorktown and Old Ironsides, entered in to a limited liability company agreement (the “Carbon Appalachia LLC Agreement”), with an initial equity commitment of $100.0 million, of which $37.0 million has been contributed as of March 31, 2018.

Pursuant to the Carbon Appalachia LLC Agreement, we acquired a 2.0% interest in Carbon Appalachia for $240,000 of Class A Units associated with our initial equity commitment of $2.0 million. We also have the ability to earn up to an additional 14.7% of Carbon Appalachia distributions (represented by Class B Units) after certain return thresholds to the holders of Class A Units are met. The Class B Units were acquired for no cash consideration.

| 15 |

In addition, we acquired a 1.0% interest represented by Class C Units which were obtained in connection with the contribution to Carbon Appalachia of a portion of our working interest in undeveloped properties in Tennessee. If Carbon Appalachia agrees to drill horizontal Chattanooga Shale wells on these properties, it will pay 100% of the cost of drilling and completion of the first 20 wells to earn a 75% working interest in such properties. We, through our subsidiary, Nytis LLC, will retain a 25% working interest in the properties. There was no activity associated with these properties in 2017 nor in the first quarter of 2018.

In 2017, Carbon Appalachia Enterprises, LLC, formerly known as Carbon Tennessee Company, LLC (“CAE”), a subsidiary of Carbon Appalachia, entered into a 4-year $100.0 million (with $1.5 million sublimit for letters of credit) senior secured asset-based revolving credit facility with LegacyTexas Bank with an initial borrowing base of $10.0 million (the “CAE Credit Facility”).

The CAE Credit Facility borrowing base was adjusted for acquisitions completed in 2017. Most recently, on April 30, 2018, CAE Credit Facility was amended, which increased the borrowing base to $70.0 million with redeterminations as of April 1 and October 1 each year. As of March 31, 2018, there was approximately $38.0 million outstanding under the CAE Credit Facility.

The CAE Credit Facility is guaranteed by each of CAE’s existing and future direct or indirect subsidiaries (subject to certain exceptions). CAE’s obligations and those of CAE’s subsidiary guarantors under the CAE Credit Facility are secured by essentially all of CAE’s tangible and intangible personal and real property (subject to certain exclusions).

Interest is payable quarterly and accrues on borrowings under the CAE Credit Facility at a rate per annum equal to either (i) the base rate plus an applicable margin between 0.00% and 1.00% or (ii) the Adjusted LIBOR rate plus an applicable margin between 3.00% and 4.00% at our option. The actual margin percentage is dependent on the CAE Credit Facility utilization percentage. CAE is obligated to pay certain fees and expenses in connection with the CAE Credit Facility, including a commitment fee for any unused amounts of 0.50%.

The CAE Credit Facility contains affirmative and negative covenants that, among other things, limit CAE’s ability to (i) incur additional debt; (ii) incur additional liens; (iii) sell, transfer or dispose of assets; (iv) merge or consolidate, wind-up, dissolve or liquidate; (v) make dividends and distributions on, or repurchases of, equity; (vi) make certain investments; (vii) enter into certain transactions with our affiliates; (viii) enter into sales-leaseback transactions; (ix) make optional or voluntary payments of debt; (x) change the nature of our business; (xi) change our fiscal year to make changes to the accounting treatment or reporting practices; (xii) amend constituent documents; and (xiii) enter into certain hedging transactions.

The affirmative and negative covenants are subject to various exceptions, including basket amounts and acceptable transaction levels. In addition, the CAE Credit Facility requires CAE’s compliance, on a consolidated basis, with (i) a maximum Debt/EBITDA ratio of 3.5 to 1.0 and (ii) a minimum current ratio of 1.0 to 1.0.

CAE may at any time repay the loans under the CAE Credit Facility, in whole or in part, without penalty. CAE must pay down borrowings under the CAE Credit Facility or provide mortgages of additional oil and natural gas properties to the extent that outstanding loans and letters of credit exceed the borrowing base.

In connection with our entry into the Carbon Appalachia LLC Agreement, and Carbon Appalachia engaging in certain transactions during 2017, we received the aforementioned Class B Units and issued to Yorktown awarrant to purchase approximately 408,000 shares of our common stock at an exercise price of $7.20 per share (the “Appalachia Warrant”). The Appalachia Warrant was payable exclusively with Class A Units of Carbon Appalachia held by Yorktown and the number of shares of our common stock for which the Appalachia Warrant was exercisable was determined, as of the time of exercise, by dividing (a) the aggregate unreturned capital of Yorktown’s Class A Units of Carbon Appalachia plus a required 10% internal rate of return by (b) the exercise price.

| 16 |

On November 1, 2017, Yorktown exercised the Appalachia Warrant, resulting in the issuance of approximately 432,000 shares of our common stock in exchange for Class A Units representing approximately 7.95% of then outstanding Class A Units of Carbon Appalachia. We accounted for the exercise through extinguishment of the warrant liability associated with the Appalachia Warrant of approximately $1.9 million and the receipt of Yorktown’s Class A Units as an increase to investment in affiliates in the amount of approximately $2.9 million. After giving effect to the exercise, we own 26.5% of Carbon Appalachia’s outstanding Class A Units along with 100% of its Class C Units.

The issuance of the Class B Units and the Appalachia Warrant were in contemplation of each other, and under non-monetary related party guidance, we accounted for the Appalachia Warrant, at issuance, based on the fair value of the Appalachia Warrant as of the date of grant (April 3, 2017) and recorded a warrant liability with an associated offset to APIC. Future changes to the fair value of the Appalachia Warrant are recognized in earnings. We accounted for the fair value of the Class B Units at their estimated fair value at the date of grant, which became our investment in Carbon Appalachia with an offsetting entry to APIC.

As of the grant date of the Appalachia Warrant, we estimated that the fair market value of the Appalachia Warrant was approximately $1.3 million, and the fair value of the Class B Units was approximately $924,000. The difference in the fair value of the Appalachia Warrant from the grant date though its exercise on November 1, 2017, was approximately $619,000 and was recognized in warrant derivative gain in our consolidated statements of operations for the year ended December 31, 2017.

Based on our 27.24% combined Class A and Class C interest (and our ability as of March 31, 2018 to earn up to an additional 14.7%) in Carbon Appalachia, our ability to appoint a member to the board of directors and our role of manager of Carbon Appalachia, we are accounting for our investment in Carbon Appalachia under the equity method of accounting as we believe we exert significant influence. We use the HLBV to determine our share of profits or losses in Carbon Appalachia and adjust the carrying value of our investment accordingly. Our investment in Carbon Appalachia is represented by our Class A and C interests, which we acquired by contributing approximately $6.9 million in cash and unevaluated property. In the event of liquidation of Carbon Appalachia, available proceeds are first distributed to members holding Class C Units then to holders of Class A Units until their contributed capital is recovered with an internal rate of return of 10%. Any additional distributions would then be shared between holders of Class A, Class B and Class C Units. For the three months ended March 31, 2018, Carbon Appalachia earned net income, of which our share is approximately $413,000. The ability of Carbon Appalachia to make distributions to its owners, including us, is dependent upon the terms of its credit facilities, which currently prohibit distributions unless agreed to by the lender.

As of March 31, 2018, Carbon Appalachia is in compliance with all CAE Credit Facility covenants.

The following table sets forth, selected historical unaudited financial data for Carbon Appalachia.

| (in thousands) | As of March 31, 2018 | |||

| Current assets | $ | 21,452 | ||

| Total oil and gas properties, net | $ | 83,404 | ||

| Current liabilities | $ | 17,086 | ||

| Non-current liabilities | $ | 58,730 | ||

| Total members’ equity | $ | 42,506 | ||

| (in thousands) | Three months ended March 31, 2018 | |||

| Revenues | $ | 25,743 | ||

| Operating expenses | 23,534 | |||

| Income from operations | 2,208 | |||

| Net income | 1,526 | |||

Investments in Affiliates

During the three months ended March 31, 2018 and 2017, we recorded total equity method income of approximately $437,000 and $7,000, respectively. Additionally, on February 1, 2018, as a result of the Carbon California Acquisition, we derecognized our equity investment in Carbon California and recognized a gain of approximately $5.4 million based on the fair value of our previously held interest compared to its carrying value.

| 17 |

Note 7 – Credit Facilities

Our Credit Facility

In 2016, we entered into a 4-year $100.0 million senior secured asset-based revolving credit facility with LegacyTexas Bank. LegacyTexas Bank is the initial lender and acts as administrative agent.

The credit facility has a maximum availability of $100.0 million (with a $500,000 sublimit for letters of credit), which availability is subject to the amount of the borrowing base. The initial borrowing base established under the credit facility was $17.0 million. The borrowing base is subject to semi-annual redeterminations in March and September. On March 30, 2018, the borrowing base was increased from $23.0 to $25.0 million, of which approximately $23.2 million was outstanding as of March 31, 2018. Our effective interest rate as of March 31, 2018 was 7.59%.

The credit facility is guaranteed by each of our existing and future subsidiaries (subject to certain exceptions). Our obligations and those of our subsidiary guarantors under the credit facility are secured by essentially all of our tangible and intangible personal and real property (subject to certain exclusions).

Interest is payable quarterly and accrues on borrowings under the credit facility at a rate per annum equal to either (i) the base rate plus an applicable margin between 0.50% and 1.50% or (ii) the Adjusted LIBOR rate plus an applicable margin between 3.50% and 4.50% at our option. The actual margin percentage is dependent on the credit facility utilization percentage. We are obligated to pay certain fees and expenses in connection with the credit facility, including a commitment fee for any unused amounts of 0.50%.

The credit facility contains affirmative and negative covenants that, among other things, limit our ability to (i) incur additional debt; (ii) incur additional liens; (iii) sell, transfer or dispose of assets; (iv) merge or consolidate, wind-up, dissolve or liquidate; (v) make dividends and distributions on, or repurchases of, equity; (vi) make certain investments; (vii) enter into certain transactions with our affiliates; (viii) enter into sales-leaseback transactions; (ix) make optional or voluntary payments of debt; (x) change the nature of our business; (xi) change our fiscal year to make changes to the accounting treatment or reporting practices; (xii) amend constituent documents; and (xiii) enter into certain hedging transactions.

The affirmative and negative covenants are subject to various exceptions, including basket amounts and acceptable transaction levels. In addition, the credit facility requires our compliance, on a consolidated basis, with (i) a maximum Debt/EBITDA ratio of 3.5 to 1.0 and (ii) a minimum current ratio of 1.0 to 1.0.

On March 27, 2018, the credit facility was amended to revise the calculation of the Leverage Ratio from a Debt/EBITDA ratio to a Net Debt/Adjusted EBITDA ratio, reset the testing period used in the determination of Adjusted EBITDA, eliminated the minimum current ratio and substituted alternative liquidity requirements, including maximum allowed current liabilities in relation to current assets, a minimum cash balance requirement of $750,000 and maximum aged trade payable requirements. As of March 31, 2018, we were in compliance with our financial covenants.

We may at any time repay the loans under the credit facility, in whole or in part, without penalty. We must pay down borrowings under the credit facility or provide mortgages of additional oil and natural gas properties to the extent that outstanding loan and letters of credit exceed the borrowing base.

As required under the terms of the credit facility, we entered into derivative contracts with fixed pricing for a certain percentage of our production. We are a party to an ISDA Master Agreement with BP Energy Company that established standard terms for the derivative contracts and an inter-creditor agreement with LegacyTexas Bank and BP Energy Company whereby any credit exposure related to the derivative contracts entered into by the Company and BP Energy Company is secured by the collateral and backed by the guarantees supporting the credit facility.

| 18 |

Carbon California – Credit Facilities

Effective as of February 1, 2018, our ownership in Carbon California increased to 56.4% due to the exercise of the California Warrant. As a result, we consolidate Carbon California for financial reporting purposes.

The table below details the notes payable outstanding for Carbon California as of March 31, 2018 (in thousands):

| Revolver, related party, due February 15, 2022 | $ | 13,000 | ||

| Notes, related party, due February 15, 2024 | $ | 10,000 | ||

| Total gross notes payable | 23,000 | |||

| Less: Deferred notes costs | (154 | ) | ||

| Less: Notes discount | (924 | ) | ||

| Total net notes payable | $ | 21,922 |

Carbon California- Revolver, Related Party

On February 15, 2017, Carbon California entered into a revolver agreement with Prudential Legacy Insurance Company of New Jersey and Prudential Insurance Company of America for the issuance and sale of up to $25.0 million due February 15, 2022 (the “Revolver”). Carbon California may elect to incur interest at either (i) 5.0% plus the London interbank offered rate (“LIBOR”) or (ii) 4.00% plus Prime Rate (which is defined as the interest rate published daily by JPMorgan Chase Bank, N.A.). As of March 31, 2018, the Revolver’s effective borrowing rate was 8.29%. In addition, the Revolver includes a commitment fee for any unused amounts at 0.50% as well as an annual administrative fee of $75,000, payable on February 15 each year.

The maximum principal amount available under the Revolver is based upon the borrowing base attributable to Carbon California’s proved oil and gas reserves, which is to be determined at least semi-annually. As of March 31, 2018, the Revolver has a borrowing base of $15.0 million, of which $13.0 million is outstanding. On May 1, 2018, the borrowing base increased to $41.0 million (see note 16).

The Revolver is secured by all the assets of Carbon California. The Revolver requires Carbon California, as of January 1 and July of each year, to hedge its anticipate proved developed products production at such time for year one, two and three at a rate of 75%, 65% and 50%, respectively. Carbon California may make principal payments in minimum installments of $500,000. Distributions to equity members are generally restricted.

Carbon California incurred fees directly associated with the issuance of the Revolver and amortizes these fees over the life of the Revolver. The current portion of these fees are included in prepaid expense and deposits and the long-term portion is included in other long-term assets for a combined value of $706,000. During the three months ended March 31, 2018 and 2017, Carbon California amortized fees of $29,000 and $14,000, respectively.

The Revolver agreement requires Carbon California to maintain certain financial and non-financial covenants which include the following ratios: total leverage ratio, senior leverage ratio, interest coverage ratio, current ratio, and other qualitative covenants as defined in the Revolver agreement. As of March 31, 2018, Carbon California was in breach of its covenants; however, Carbon California obtained a waiver for the March 31, 2018 measurement period.

Carbon California Notes

On February 15, 2017, Carbon California entered into an agreement with Prudential Capital Energy Partners, L.P. for the issuance and sale of $10.0 million of unsecured notes (the “Carbon California Notes”) due February 15, 2024, bearing interest of 12% per annum.

| 19 |

Prudential received an additional 1,425 Class A units, representing 5% of total sharing percentage, for the issuance of the Carbon California Notes. Carbon California valued this unit issuance based on the relative fair value by valuing the units at $1,000 per unit and aggregating the amount with the outstanding Carbon California Notes of $10.0 million. The Company then allocated the non-cash value of the units of approximately $1.25 million, which was recorded as a discount to the Carbon California Notes. As of March 31, 2018, Carbon California had an outstanding discount of $923,000, which is presented net of the Carbon California Notes within Credit facility-related party on the unaudited consolidated balance sheets.

The Carbon California Notes require Carbon California, as of January 1 and July 1 of each year, to hedge its anticipated production at such time for year one, two and three at a rate of 67.5%, 58.5% and 45%, respectively.

Prepayment of the Carbon California Notes is currently not available. After February 15, 2019, prepayment is allowed at 100%, subject to a 3.0% fee of outstanding principal. Prepayment is not subject to such fee after February 17, 2020. Distributions to equity members are generally restricted.

The Carbon California Notes agreement requires Carbon California to maintain certain financial and non-financial covenants, which include the following ratios: total leverage ratio, senior leverage ratio, interest coverage ratio, asset coverage ratio, current ratio, and other qualitative covenants as defined in the Revolver agreement. As of March 31, 2018, Carbon California was in breach of financial covenants; however, Carbon California obtained a waiver for March 31, 2018 measurement period.

On May 1, 2018, in connection with the Seneca acquisition, the Revolver and Carbon California Notes Agreement were amended. See note 16.

| 20 |

Note 8 – Income Taxes

We recognize deferred income tax assets and liabilities for the estimated future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. We have net operating loss carryforwards available in certain jurisdictions to reduce future taxable income. Future tax benefits for net operating loss carryforwards are recognized to the extent that realization of these benefits is considered more likely than not. To the extent that available evidence raises doubt about the realization of a deferred income tax asset, a valuation allowance is established.

At March 31, 2018, we have established a full valuation allowance against the balance of net deferred tax assets.

Note 9 – Stockholders’ Equity

Authorized and Issued Capital Stock

Effective March 15, 2017, and pursuant to a reverse stock split approved by the stockholders and Board of Directors, each 20 shares of issued and outstanding common stock became one share of common stock and no fractional shares were issued. References to the number of shares and price per share give retroactive effect to the reverse stock split for all periods presented.

As of March 31, 2018, we had 10.0 million shares of common stock authorized with a par value of $0.01 per share, of which approximately 7.6 million were issued and outstanding, and 1.0 million shares of preferred stock authorized with a par value of $0.01 per share. On April 6, 2018, the Company entered into a preferred stock purchase agreement with Yorktown for a private placement of 50,000 shares of the Company’s Series B Convertible Preferred Stock for $5.0 million. During the three months ended March 31, 2018, the increase in our issued and outstanding common stock is primarily due to a) Yorktown’s exercise of the California Warrant (see note 3), resulting in the issuance of approximately 1.5 million shares of our common stock in exchange for Class A Units in Carbon California representing approximately 46.96% of the then outstanding Class A Units, in addition to b) restricted stock that vested during the quarter.

Carbon Stock Incentive Plans

We have two stock plans, the Carbon 2011 Stock Incentive Plan and the Carbon 2015 Stock Incentive Plan (collectively the “Carbon Plans”). The Carbon Plans were approved by our shareholders and in the aggregate provide for the issuance of approximately 1.1 million shares of common stock to our officers, directors, employees or consultants eligible to receive the awards under the Carbon Plans.

The Carbon Plans provide for the granting of incentive stock options, non-qualified stock options, restricted stock awards, performance awards and phantom stock awards, or a combination of the foregoing, as to employees, officers, directors or consultants, provided that only employees may be granted incentive stock options and directors may only be granted restricted stock awards and phantom stock awards.

Restricted Stock

As of March 31, 2018, approximately 548,000 shares of restricted stock have been granted under the terms of the Carbon Plans. Restricted stock awards for employees vest ratably over a three-year service period or cliff vest at the end of a three-year service period. For non-employee directors, the awards vest upon the earlier of a change in control of us or the date their membership on the Board of Directors is terminated other than for cause. We recognize compensation expense for these restricted stock grants based on the grant date fair value of the shares, amortized ratably over three years for employee awards (based on the required service period for vesting) and seven years for non-employee director awards (based on a market survey of the average tenure of directors among U.S. public companies). For restricted stock granted between 2014 and 2017, we recognized compensation expense based on the grant date fair value of the shares, utilizing an enterprise value approach, using valuation metrics primarily based on multiples of cash flow from operations, production and reserves. For restricted stock and performance units granted in 2013, we utilized the closing price of our stock on the date of grant to recognize compensation expense. During the three months ended March 31, 2018, 38,637 restricted stock units vested.

| 21 |

Compensation costs recognized for these restricted stock grants were approximately $158,000 and $188,000 for the three months ended March 31, 2018 and 2017, respectively. As of March 31, 2018, there was approximately $957,000 of unrecognized compensation costs related to these restricted stock grants which we expect to be recognized over the next six years.

Restricted Performance Units

As of March 31, 2018, approximately 461,000 shares of performance units have been granted under the terms of the Carbon Plans. Performance units represent a contractual right to receive one share of our common stock subject to the terms and conditions of the agreements, including the achievement of certain performance measures relative to a defined peer group or the growth of certain performance measures over a defined period of time as well as, in some cases, continued service requirements.

We account for the performance units granted during 2014 through 2017 at their fair value determined at the date of grant, which were $11.80, $8.00, $5.40 and $7.20 per share, respectively. The final measurement of compensation cost will be based on the number of performance units that ultimately vest. At March 31, 2018, we estimated that none of the performance units granted in 2016 and 2017 would vest, and, accordingly, no compensation cost has been recorded for these performance units. During 2016, we estimated that it was probable that the performance units granted in 2014 and 2015 would vest and therefore compensation costs of approximately $135,000 and $132,000 related to these performance units were recognized for the three months ended March 31, 2018 and 2017, respectively. As of March 31, 2018, compensation costs related to the performance units granted in 2014 and 2015 have been fully recognized. As of March 31, 2018, if change in control and other performance provisions pursuant to the terms and conditions of these award agreements are met in full, the estimated unrecognized compensation cost related to the performance units granted in 2012, 2016 and 2017 would be approximately $1.9 million.

Note 10 – Revenue Recognition

Revenue from Contracts with Customers

We recognize revenue when it satisfies a performance obligation by transferring control over a product to a customer. Revenue is measured based on the consideration we expect to receive in exchange for those products. Revenues from contracts with customers are recorded on the unaudited consolidated statements of operations based on the type of product being sold.

Performance Obligations and Significant Judgments

We sell oil and natural gas products in the United States through a single reportable segment. We primarily sell products within two regions of the United States: Appalachia and Illinois Basins and the Ventura Basin. We enter into contracts that generally include one type of distinct product in variable quantities and priced based on a specific index related to the type of product. Most of our contract pricing provisions are tied to a market index, with certain adjustments based on, among other factors, whether a well delivers to a gathering or transmission line, quality of the oil or natural gas, and prevailing supply and demand conditions.

The oil and natural gas is typically sold in an unprocessed state to processors and other third parties for processing and sale to customers. We recognize revenue at a point in time when control of the oil or natural gas passes to the customer. For oil sales, control is typically transferred to the customer upon receipt at the wellhead or a contractually agreed upon delivery point. Under our natural gas contracts with processors, control transfers upon delivery at the wellhead or the inlet of the processing entity’s system. For our other natural gas contracts, control transfers upon delivery to the inlet or to a contractually agreed upon delivery point. In the cases where we sell to a processor, we have determined that we are the principal in the arrangement and the processors are our customers. We recognize the revenue in these contracts based on the net proceeds received from the processor.

| 22 |

Transfer of control drives the presentation of transportation and gathering costs within the accompanying unaudited consolidated statements of operations. Transportation and gathering costs incurred prior to control transfer are recorded within the transportation and gathering expense line item on the accompanying unaudited consolidated statements of operations, while transportation and gathering costs incurred subsequent to control transfer are recorded as a reduction to the related revenue.

A portion of our product sales are short-term in nature. For those contracts, we use the practical expedient in ASC 606-10-50-14 exempting us from disclosure of the transaction price allocated to remaining performance obligations if the performance obligation is part of a contract that has an original expected duration of one year or less.

For our product sales that have a contract term greater than one year, we have utilized the practical expedient in ASC 606-10-50-14(a) which states we are not required to disclose the transaction price allocated to remaining performance obligations if the variable consideration is allocated entirely to an unsatisfied performance obligation. Under these sales contracts, each unit of product represents a separate performance obligation; therefore, future volumes are unsatisfied and disclosure of the transaction price allocated to remaining performance obligations is not required. We have no unsatisfied performance obligations at the end of each reporting period.

We do not believe that significant judgments are required with respect to the determination of the transaction price, including any variable consideration identified. There is a low level of uncertainty due to the precision of measurement and use of index-based pricing with predictable differentials. Additionally, any variable consideration identified is not constrained.

Disaggregation of Revenues

In the following table, revenue for the three months ended March 31, 2018, is disaggregated by primary region within the United States and major product line. As noted above, we operate as one reportable segment.

| (in thousands) | ||||||||||||

| Type | Appalachia and Illinois Basin | Ventura Basin | Total | |||||||||

| Natural gas sales | $ | 3,805 | $ | 134 | $ | 3,939 | ||||||

| Natural gas liquids sales | - | 163 | 163 | |||||||||

| Oil sales | 247 | 2,736 | 2,983 | |||||||||

| Total revenue | $ | 4,052 | $ | 3,033 | $ | 7,085 | ||||||

Contract Balances

Under our product sales contracts, we invoice customers once our performance obligations have been satisfied, at which point payment is unconditional. Accordingly, our product sales contracts do not typically give rise to contract assets or liabilities under ASC 606.

Prior Period Performance Obligations

We record revenue in the month production is delivered to the purchaser, but settlement statements may not be received until 30 to 90 days after the month of production. As such, we estimate the production delivered and the related pricing. Any differences between our initial estimates and actuals are recorded in the month payment is received from the customer. These differences have not historically been material. For the three months ended March 31, 2018, revenue recognized in the reporting period related to prior period performance obligations is immaterial.

The estimated revenue is recorded within Accounts receivable - Revenue on the unaudited consolidated balance sheets.

| 23 |

Note 11 – Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities consist of the following:

| March 31, 2018 | December 31, 2017 | |||||||

| Accounts payable | $ | 5,374 | $ | 3,274 | ||||

| Oil and gas revenue suspense | 2,032 | 1,776 | ||||||

| Gathering and transportation payables | 807 | 497 | ||||||

| Production taxes payable | 654 | 214 | ||||||

| Drilling advances received from joint venture partner | 1,359 | 245 | ||||||

| Accrued lease operating expenses | 1,650 | 684 | ||||||

| Accrued ad valorem taxes-current | 1,099 | 1,054 | ||||||

| Accrued general and administrative expenses | 2,794 | 2,473 | ||||||

| Accrued asset retirement obligation-current | 767 | 380 | ||||||

| Accrued interest | 663 | 247 | ||||||

| Other liabilities | 1,367 | 374 | ||||||

| Total accounts payable and accrued liabilities | $ | 18,566 | $ | 11,218 | ||||

Note 12 – Fair Value Measurements