Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIVE STAR SENIOR LIVING INC. | a6302020-exhibit991.htm |

| 8-K - 8-K - FIVE STAR SENIOR LIVING INC. | fve-20200806.htm |

Investor Presentation August 2020 “To honor and enrich the journey of life, one experience at a time.”

Warning Concerning Forward-Looking Statements This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and our actual results may diffe materially from those contained in, or implied by, our forward- looking statements. Forward-looking statements in this presentation relate to various aspects of our business, including our ability to operate our senior living communities profitably, our ability to grow revenues at the senior living communities we manage and to increase the fees we earn from managing senior living communities, our expectation to focus our expansion activities on internal growth from our existing senior living communities and the ancillary services that we may provide, our ability to increase the number of senior living communities we operate and residents we serve, and to grow our other sources of revenues, including rehabilitation and wellness services and other services we may provide, whether the aging U.S. population and increasing life spans of older adults will increase the demand for senior living communities, health and wellness centers and other healthcare related properties and services, our ability to comply and to remain in compliance with applicable Medicare, Medicaid and other federal and state regulatory, rulemaking and rate- setting requirements, our ability to access or raise debt or equity capital and our ability to sell communities we own and Diversified Healthcare Trust’s (DHC) ability to sell communities we manage, that we or DHC as applicable, may offer for sale. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, such as the impact of conditions in the economy and the capital markets on us and our residents and other customers, competition within the senior living and other health and wellness related services businesses, older adults delaying or forgoing moving into senior living communities or purchasing health and wellness services from us, increases in our labor costs or in costs we pay for goods and services, increases in tort and insurance liability costs, our operating and debt leverage, actual and potential conflicts of interest with our related parties, changes in Medicare or Medicaid policies and regulations, or the possible repeal, replacement or modification of Medicare, Medicaid or other existing or proposed legislation or regulations, which could result in reduced Medicare or Medicaid rates or a failure of such rates to cover our costs or limit the scope or funding of either or both programs, or reductions in private insurance utilization and coverage, delays or non-payments of government payments to us, compliance with, and changes to, federal, state and local laws and regulations that could affect our services or impose requirements, costs and administrative burdens that may reduce our ability to operate our business profitably, our exposure to litigation and regulatory and government proceedings, continued efforts by third party payers to reduce costs, and acts of terrorism, outbreaks of pandemics, including COVID-19, or other manmade or natural disasters. For example: (a) challenging conditions in the senior living industry continue to exist and our business and our operations remain subject to substantial risks, many of which are beyond our control; as a result, our operations may not be profitable in the future and we may realize losses; (b) we may not successfully execute our strategic growth initiatives, (c) we may not be able to successfully integrate, operate and profitably23,500 manage our senior living communities;268 (d) we cannot be sure that we will enter additional management arrangements with DHC; (e) our belief that the aging of the U.S. population and increasing life spans of older adults will increase demand for senior living communities and services may not be realized or may not result in increased demand for our services; (f) our investments in our workforce and continued focus on reducing our employee turnover level by enhancing our competitiveness in the marketplace with respect to cash compensation and other benefits may not be successful and may not result32 in the benefits we expect to achieveTEAM through such investments; (g) our marketing initiatives may not succeed inCMPANY increasing our occupancy and revenues, and they may cost moreTOTAL than any $ increasedRAISED revenues they may generate; (h) our strategic investments to enhance efficiencies in and benefits from our purchasing of services may not be successful or generate the returns or savings we expect; (i) circumstances that adversely affect the ability of older adults or theirMEMBERS families to pay for our services, such as economic downturns, weakeningBEGAN housing market conditions, higher levels of unemploymentFOR among WALK our residents’ TO or potential residents’ family members, lower levels of consumer confidence, stock market volatility and/or changes in demographics generally, could affect the revenues and profitability ofEND our seniorALZHEIMER’S living communities; (j) residents who pay for our services with their private resources may become unable to afford our services, resulting in decreased occupancy and decreased revenues at our senior living communities; (k) the various federal and state government agencies that pay us for the services we provide to some of our residents are experiencing budgetary constraints and may lower the Medicare, MedicaidSINCE and other 2017 rates they pay us; (l) we may be unable to repay or refinance our debt obligations when they become due; (m) certain aspects of our operations and futuregrowthwemaypursueinour business may require significant amounts of working capital and require us to make significant capital expenditures; accordingly, we may not have sufficient cash liquidity; (n) the amount of available borrowings under our credit facility is subject to our having qualified collateral, which is primarily based on the value of the assets securing our obligations under our credit facility; (o) the availability of borrowings under our credit facility is subject to our satisfying certain financial covenants and other conditions that we may be unable to satisfy; (p) our actions and approach4 to managing our insurance costs may not be successful and could result in our incurring significant costs and liabilities that we will be responsible for funding; (q) contingencies in any applicable acquisition or sale agreements we or DHC have entered into, or may enter into, may not be satisfied and our and DHC's applicable acquisitions or sales, and any related management arrangements we may expect to enter into,RANKING may not occur, ON may2019 be delayed orthetermsmaychange;(r)wemaynotbeabletosell communities that we may seek to sell on terms acceptable to us or otherwise; (s) the advantages we believe we may realizeLIST from ourOF relationships 50 LARGEST with related parties may not materialize; (t) operating deficiencies or a license revocation at one or more of our senior living communities may have an adverse impact on our ability to operate, obtain licenses for, or attract residents to, our3 other communities and (u) the COVID-19 pandemic may continue to adversely affect our business, operating results and financial condition236 for an indefinite period of time, including by decreasing the occupancy of our senior living communities, causing staffing and supply shortages and increasing the costs of operating our senior living facilities. U.S. SENIR HOUSING OPERATORS RANKING ON 2019 OurAnnualReportonForm10-KfortheyearendedDecember31,2019,ourQuar32 terly Report on Form 10-Q for the period ended March 31, 2020 and our other filings with the Securities and Exchange Commission (SEC) identify other important factors that could cause25,80 differences from our forward-lookingAGEILITY statements. The filings with theCOMPILED SEC of Five Star BY Senior Living Inc.J.D. (Five POWER Star) are available on the SEC’s website at www.sec.gov.STATES You should WHERE not place undue relianceRESIDENTS upon our forward-looking statements.PHYSICAL Except THERAPY as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. SOLUTIONS’ CLINICS AMERICAN SENIOR LIVING IN OUR CARE IN OUR CARE SENIORS HOUSING SATISFACTION STUDY Non-GAAP Financial Measures ASSOCIATION (ASHA) This presentation contains non-GAAP financial measures including earnings before interest, income tax, depreciation and amortization (EBITDA),AdjustedEBITDAandFreeCashFlow.Reconciliations for these metrics to the closest U.S. generally accepted accounting principles (GAAP) metrics are herein. We believe the non-GAAP financial measures presented herein are meaningful supplemental disclosures because they may help investors better understand changes in our operating results and ability to pay rent or service debt, make capital expenditures and expand our business. These non-GAAP financial measures may also help investors make comparisons between us and other companies on both a GAAP and non-GAAP basis. We believe that EBITDA and Adjusted EBITDA are meaningful financial measures that may help investors better understand our financial performance, including by allowing investors to compare our performance between periods and to the performance of other companies. We believe that Free Cash Flow is a meaningful financial measure that may help investors better understand the cash generated by our operations that can be used to service debt and expand our business. Note: Data throughout this presentation is based on June 30, 2020 results, unless otherwise noted. Also, statements about the industry and demographics relate to the United States. 2

Business at a Glance Operates and manages a total of 263 senior living communities with 30,544 units across 31 states in the U.S.(1)(2) Revenues By Contract Type (2) Senior Living Unit Mix (2) Payer Mix (2)(3) Rehabilitation IL Private Pay Owned and Leased and Wellness 36% 81% Senior Living Services 37% 34% ALZ 12% CCRC 7% Medicare 18% Management AL SNF 4% Fees 41% Medicaid 29% 1% National Senior Living Operator with Scale and Diversification • Operates 206 outpatient rehabilitation clinics, 45% more than a year ago. • 40 inpatient clinics within Five Star communities. • Expansion into non-traditional markets provides new opportunities for accelerated growth. Top 10 states All other states (1) Data is as of and for the quarter ended June 30, 2020. (2) Excludes two senior living communities we managed for DHC that DHC sold on August 1, 2020 and are no longer managed by us. (3) Represents our management and operating revenues. Excludes revenues from reimbursed community-level costs incurred on behalf of managed communities and other reimbursed expenses. 3

Senior Living Spectrum(1) Alzheimer’s (ALZ)/ Continued Care Retirement Stand-Alone Skilled Nursing Independent Living (IL) Assisted Living (AL) Memory Care(2) Community (CCRC) (SNF) . Residents have a high . One bedroom functional . A dedicated, secure unit in . Accommodations for . High level of medical care degree of independence in units with kitchenettes. assisted living or a stand independent living, assisted provided by licensed health large, private units. alone community. living and nursing care, professions. . Services include laundry, offering a continuum of medication management . Short term care for . Daily meals, housekeeping . Bridge to Rediscovery™ care. and assistance with rehabilitation from illness or and social activities are program. activities of daily living. injury, or long-term care for provided. . Healthcare units with chronic medical conditions. . Nursing care available. intensive rehabilitation capabilities. Managed(3)(4): 10,497 Managed(3)(5): 11,141 Managed(3)(5): 3,197 Managed(3)(6): 2,186 Managed(3): 1,211 Owned: 564 Owned: 1,274 Owned: 270 Owned: - Owned: - Leased: - Leased(7): 177 Leased(7): 27 Leased: - Leased: - Total Living Units: 11,061 Total Living Units: 12,592 Total Living Units: 3,494 Total Living Units: 2,186 Total Living Units: 1,211 (1) Data presented as of June 30, 2020. (2) ALZ/memory care is included within AL in our Q2 2020 Quarterly Report on Form 10-Q and our press release included in our Current Report on Form 8-K dated August 6, 2020. (3) Excludes data from two senior living communities we managed for DHC that DHC sold on August 1, 2020. (4) Includes one active adult community with 168 units. (5) Managed on behalf of DHC. (6) The unit count represents only the SNF units at our CCRCs. (7) Leased from Healthpeak Properties Inc. (NYSE: PEAK). 4

A New Transition Completed Transaction with DHC Completed the restructuring of Five Star’s business arrangements with DHC. On January 1, 2020, entered into new management agreements to operate all senior living communities we leased from and managed for the account of DHC as of December 31, 2019. Financial restructuring immediately improved Five Star’s financial position and liquidity. Highlights of New Management Agreements. A 15-year term commenced on January 1, 2020, with two, five-year extensions at Five Star’s option, subject to maintaining portfolio financial performance. A base management fee of 5% of community gross revenues and a 3% fee on capital projects managed by Five Star. An incentive fee of 15% of annual property level EBITDA on a combined basis for the total portfolio in excess of an EBITDA-based performance target, subject to a limit of up to 1.5% of portfolio gross annual revenues, beginning in 2021. Performance target increases annually based on the greater of the annual increase of the Consumer Price Index (CPI) or 2%, plus 6% of any capital investments funded at the managed senior living communities in excess of capital investment target. Unless otherwise agreed, capital investment target increases annually based on the greater of the annual increase of CPI or 2%. 5

The Five Star Value Our success is built on four foundational elements that drive performance, customer loyalty and competitiveness. Exceptional Resident Experience: . We take a holistic approach across all levels to elevate, enhance and enrich the lives of our residents. Team Member Engagement: . Achieve continual reduction in turnover rates. Exceptional Resident Team Member . Commitment to team members through recognition and learning Experience Engagement and development. Operational Efficiency: . Drive RevPAR(1) accretion. . Execute rate optimization as we navigate through COVID-19 impacts on census. . Improved operating cost structure for targeted savings of $8-$10 million annually in our senior living segment upon stabilization of implemented programs. Focus on Continued Growth: Operational Efficiency Continued Focus . Grow rehabilitation and wellness services segment through on Growth opening new Ageility clinics. In the second quarter of 2020, Ageility experienced revenue growth of 6% over the prior year quarter on a pro forma basis(2), and contributed 34% of our overall operating revenues. . Add fitness platform capabilities to expand beyond rehabilitation services. . Continue to expand into management of active adult communities. (1) RevPAR, or average monthly senior living revenue per available unit, is defined by us as resident fee revenues for the portfolio for the period divided by the average number of available units for the period, divided by the number of months in the period. Average number of available units for the period includes only living units categorized as in service. (2) Compared to Pro Forma Q2 2019. For a reconciliation of Pro Forma data, refer to the Pro Forma Condensed Consolidated Statement of Operations within our press release included in our Current Report on Form 8-K dated August 6, 2020. 6

Exceptional Resident Experience Our focus on the resident experience is grounded in market research and a deep understanding of our customer. Resident Engagement and Services: . We provide comprehensive resident programming, including Lifestyle 360, our signature resident enrichment program, and Bridge to Rediscovery™, our award-winning memory care program designed to provide our residents fulfilling and positive lives. . Our culinary experience offers exceptional and creative chef crafted meals, focusing on nutritional health, seasonal variety and social engagement. . Local excellence, design and flair is supported by a central facilities function and a robust capital management program. COVID-19 Resident Support (1): . We have implemented new group activities that allow for engagement while maintaining social distancing. . We continue to provide devices and connectivity options for interaction with family members, as well as virtual programming opportunities and distance (1) In response to a resident and family member survey conducted during the COVID-19 learning. lockdown, 95% of responders replied favorably or neutrally to feeling well supported or cared for during this time, 91% replied favorably or neutrally to the frequency and efficacy of communication in keeping resident and family members informed, and 83% replied favorably or . We offer complimentary counseling and neutrally that Five Star's in-room dining program continued to provide quality, flavor, and variety support services for residents. during this time. 7

Team Member Engagement Attracting, inspiring and retaining great talent remains the biggest challenge and opportunity in our industry. We are a service organization and our people are our most important asset. Investing in our people will drive an exceptional resident and client experience. Key initiatives: . Attract and select talented individuals uniquely suited to be successful at Five Star. . Build upon our new learning management platform to provide training and development opportunities for all team members. . Execute on recognition through rewards and career advancement. . Grow and foster a culture of accountability, transparency and innovation. . Average tenure of employee has increased from 4.7 years at December 31, 2019 to 4.9 years at June 30, 2020. . Employee turnover rates decreased from 61% at December 31, 2019 to 55% at June 30, 2020. 8

Operational Efficiency National company with the ability to support communities at scale. . Five Star's internal operational excellence framework is founded on the operational best practices outlined in the J.D. Power Senior Living Community Certification Program and is intended to drive consistently high performance and profitability across our portfolio. . Revenue management program to execute dynamic pricing by combining internal data points in conjunction with external market research to optimize profitability at each community. . Strategic sourcing designed to govern consistency in spend practices throughout the organization, leverage scale for better pricing and tighten controls to achieve maximum cost efficiencies. 9

Revenue Management Optimization Program. . Refined, systematic and centralized pricing, by combining internal sales and financial data with external market research. . Synthesizing occupancy with rate optimization combined with cost structure to achieve maximum profitability output. . All Five Star communities are now enrolled in our proprietary revenue management program. . The RevPAR Penetration Index (comparing Five Star’s RevPAR to that of the competition) is an indication of whether or not an advantage is achieved in a particular market faster than competition. . Continually refine the program to respond to changes in the market. Comparable Community Occupancy (1)(2) Comparable Community RevPAR (1)(2) 88.0% $4,000 $3,398 86.0% $3,500 $2,813 84.0% $3,000 $2,500 82.0% 80.1% $2,000 80.0% $1,500 78.0% 78.3% $1,000 76.0% $500 74.0% $- Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Owned/Leased Managed Owned/Leased Managed (1) Comparable community data represents financial data of the 24 communities that we continuously owned or leased and the 75 communities that we continuously managed since April 1, 2019. (2) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020 and Q2 2020 metrics reflect the impact COVID-19 has had on the operations of comparable communities. Operational Efficiency 10

Strategic Sourcing Initiatives to manage costs. . Evaluate spend governance practices Senior Living and Rehabilitation and Wellness Services throughout the organization. Operating Expenses as a % of Revenues (1)(2)(3)(4) . Leverage scale for efficient pricing. 90.0% . Streamline sourcing opportunities within 88.0% senior living operating costs. 86.0% 84.0% . Benefits include enhanced governance, 82.0% 80.0% tightened controls and improved vendor 80% relationships. 78.0% 76.0% Focus on improved outcomes. 74.0% 72.0% . Plan to achieve $8 - $10 million annually in 70.0% cost-efficiency savings in senior living 68.0% segment, including costs incurred by the 66.0% communities we manage for DHC, upon 64.0% completion of roll-out of initiatives in 9 to Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 12 months and is expected to stabilize in 2021. (1) On January 1, 2020, Five Star entered into new management agreements to operate 166 senior living communities we leased from, and managed for the account of, DHC, as of December 31, 2019. Prior to January 1, 2020, senior living operating expenses and revenues reflect those associated with the communities leased from DHC; subsequent to December 31, 2019, senior living operating expenses and revenues reflect those associated with our owned and leased communities and rehabilitation and wellness services clinics. (2) Reflects adjustments to arrive at Adjusted EBITDA that impact senior living and rehabilitation and wellness services revenues and operating expense. As a result, Q4 2019 revenues do not include $4.2 million related to deferred resident fees and deposits and Q2 2020 expenses do not include $2.5 million in costs associated with the agreed upon settlement of a lawsuit. (3) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020 and Q2 2020 metrics reflect the impact COVID-19 has had on the operations of comparable communities. (4) Senior living and rehabilitation and wellness operating expenses includes senior living wages and benefits and other senior living operating expenses. Revenues includes senior living revenues and rehabilitation and wellness services revenues and excludes revenues from management fees, reimbursed community-level costs incurred on behalf of managed communities and other reimbursed expenses. Operational Efficiency 11

Continued Growth Five Star continues to diversify its revenue stream by investing in ancillary businesses to deliver innovative and differentiated offerings to older adults and caregivers. The company continues to explore and evaluate ancillary services that complement our existing lines of business within the traditional senior living market, leading with our rehabilitation and wellness services segment, primarily consisting of Ageility rehabilitation and fitness. As the Five Star vision evolves to include a broader range of service offerings for older adults, we are focused on exploring next generation market opportunities. 12

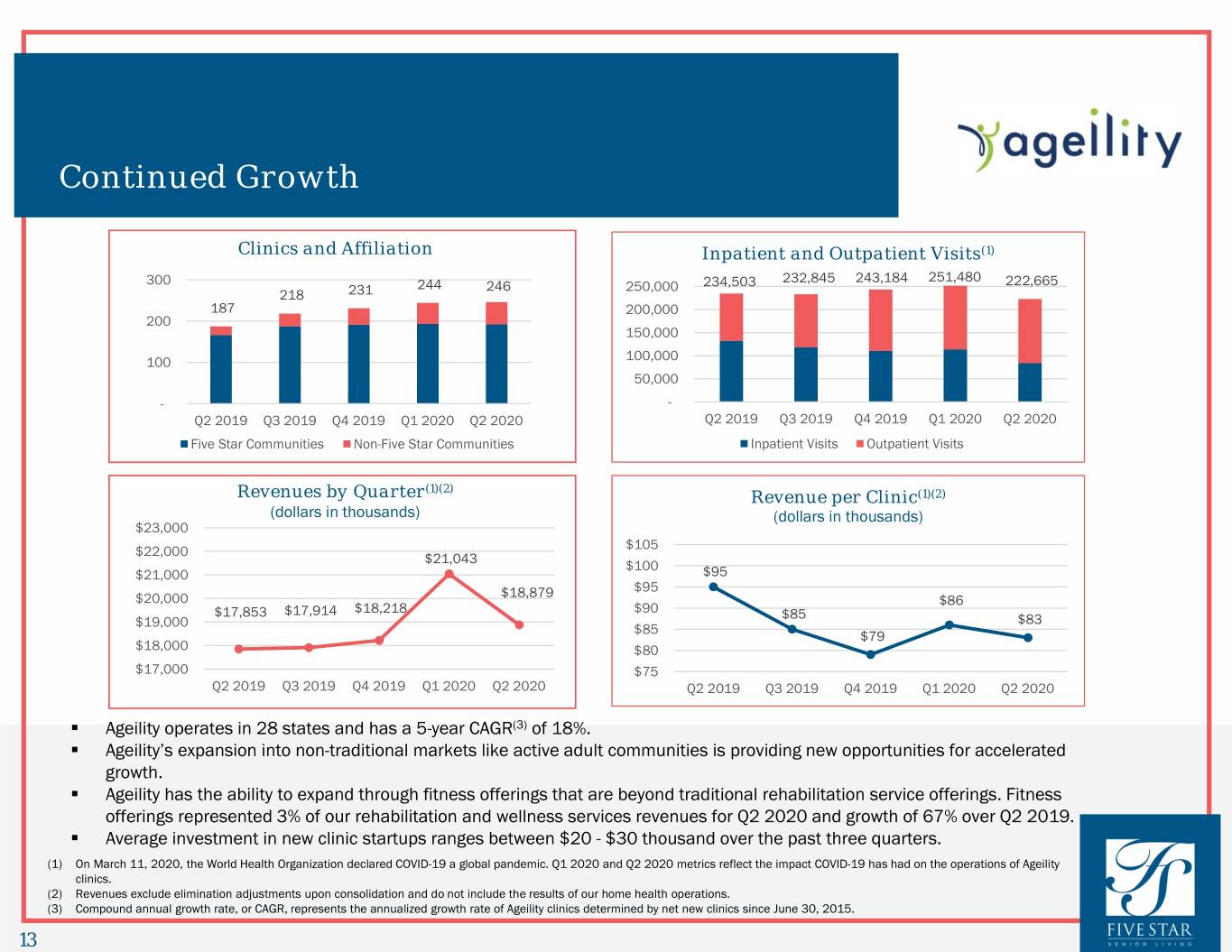

Continued Growth Clinics and Affiliation Inpatient and Outpatient Visits(1) 232,845 243,184 251,480 300 244 246 250,000 234,503 222,665 218 231 187 200,000 200 150,000 100 100,000 50,000 - - Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Five Star Communities Non-Five Star Communities Inpatient Visits Outpatient Visits (1)(2) Revenues by Quarter Revenue per Clinic(1)(2) (dollars in thousands) (dollars in thousands) $23,000 $22,000 $105 $21,043 $100 $21,000 $95 $18,879 $95 $20,000 $86 $17,853 $17,914 $18,218 $90 $85 $19,000 $83 $85 $79 $18,000 $80 $17,000 $75 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 . Ageility operates in 28 states and has a 5-year CAGR(3) of 18%. . Ageility’s expansion into non-traditional markets like active adult communities is providing new opportunities for accelerated growth. . Ageility has the ability to expand through fitness offerings that are beyond traditional rehabilitation service offerings. Fitness offerings represented 3% of our rehabilitation and wellness services revenues for Q2 2020 and growth of 67% over Q2 2019. . Average investment in new clinic startups ranges between $20 - $30 thousand over the past three quarters. (1) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020 and Q2 2020 metrics reflect the impact COVID-19 has had on the operations of Ageility clinics. (2) Revenues exclude elimination adjustments upon consolidation and do not include the results of our home health operations. (3) Compound annual growth rate, or CAGR, represents the annualized growth rate of Ageility clinics determined by net new clinics since June 30, 2015. 13

Comparable Clinics Revenue Per Comparable Clinic(1)(2)(3) Operating Margin Per Comparable Clinic(1)(2)(3) (dollars in thousands) 25.0% $104 $101 $102 19.8% $99 20.0% $100 16.4% $98 $94 $96 15.0% $94 11.5% 10.9% 11.2% $92 $91 $88 10.0% $90 $88 5.0% $86 $84 $82 0.0% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 (1) Comparable clinic data represents financial data of the 173 clinics that we have continuously operated since April 1, 2019. (2) Revenues exclude elimination adjustments upon consolidation and do not include the results of our home health operations. (3) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2020 and Q2 2020 metrics reflect the impact COVID-19 has had on the operations of comparable clinics. 14

Strong Management Team Katherine Potter President and Chief Executive Officer Katherine is President and Chief Executive Officer of Five Star. Katherine previously served as Executive Vice President and General Counsel since 2018, Senior Vice President and General Counsel since 2016, and Vice President and General Counsel since 2012. Prior to joining Five Star, Katherine practiced law at Sullivan & Worcester LLP and Burns & Levinson LLP, where she focused on corporate law matters, including securities, mergers and acquisitions, corporate governance and other transactional matters. Jeff Leer Executive Vice President, Chief Financial Officer and Treasurer Jeff is Executive Vice President, Chief Financial Officer and Treasurer of Five Star. Prior to joining Five Star, Jeff served as Chief Financial Officer and Treasurer of Office Properties Income Trust and he has been serving as Senior Vice President of The RMR Group LLC, where he has been responsible for the day to day oversight of the accounting and finance support functions of The RMR Group and its various affiliates. Prior to joining The RMR Group LLC, Jeff held various accounting and finance positions at several multi-national Fortune 500 companies as well as the public accounting firm, Vitale, Caturano PC (predecessor to RSM US LLP). Jeff is also a certified public accountant. Margaret Wigglesworth Senior Vice President and Chief Operating Officer Margaret is Senior Vice President and Chief Operating Officer of Five Star. Margaret has held various executive roles at large organizations over the past three decades where she was responsible for operations and change management. Prior to joining Five Star, Margaret held positions at International Council of Shopping Centers, Cresa and Colliers International USA. 15

Industry Trends Life is a Journey. Who you travel with matters.

Favorable long-term industry demographics coupled with Five Star’s understanding of changing consumer preferences indicate a positive outlook. Age 85+ Population Growth(1) Senior Living Supply-Demand Trends(2) 16 9% NIC 2020E – 2035E NIC Actuals Forecast 8% 4.0% 320 7% 12 3.5% 270 6% 3.0% 220 5% 2.5% 8 170 4% 2.0% 1.5% 120 3% Bps 1.0% Millions 4 2% 70 0.5% 1% 20 0.0% 0 0% (30) 2015 2020 2025 2030 2035 -0.5% -1.0% (80) 2017Q4 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 2019Q4 2020Q1 2020Q2 85+ Population Growth Rate (%) Net Supply Growth (bps, Right Axis) Supply Growth (%, Left Axis) Absorption (%, Left Axis) Compelling Long-Term Demographics Supply and Absorption Trends Uncertain Amidst COVID-19 . Senior living targeted demographic of 85+ population is projected to grow over 30% in the next five years. . Supply was down in the second quarter of 2020 and at its lowest level of growth since the third quarter of 2016. However, absorption was . National healthcare spending is projected to grow at an average rate of materially down as a result of the pandemic, resulting in substantial net (3) 5.7% per year and reach $6.0 trillion by 2027. supply growth in the quarter. . We expect the dynamics of this imbalance to persist while the COVID-19 pandemic remains prevalent. (1) Source: U.S. Census Bureau, “2014 National Population Projections”. (2) Source: NIC Map © Data Service, as of Q2 2020. For more information on the NIC MAP © Data Service, please visit www.nic.org/NIC-map. (3) Source: Centers for Medicare & Medicaid Services, www.cms.gov. 17

Strategic Partnerships Five Star is focused on collaborating with like-minded organizations that have shared values and a common goal of honoring and enriching the lives of older adults. MIT Agelab™ National Senior Games™ . Access to insightful research. . Demonstrated affinity with wellness of older adults. . Network of potential strategic partners. . Strategic positioning opportunities for both Five Star . Branding and differentiation and Ageility. opportunities. . Hosted MIT AgeLab’s first Aging2.0™ national OMEGA Summit . Platform for Five Star to (Opportunities for collaborate with other industry Multigenerational Exchange, leaders in aging services and Growth and Action) to inspire related fields to address innovative and differentiated biggest challenges and programming for our opportunities focused on older communities and career adult demographic. opportunities in the senior living industry for the students . Strategic alignment across involved. industries and related fields will create an interdisciplinary, intergenerational and interactive ecosystem of innovative products and services for older adults. 18

COVID-19 Re-opening Life is a Journey. Who you travel with matters.

COVID-19 Re-opening Phases Phase 1 Phase 2 Phase 3 Ease Internal Ease External “New Normal” Restrictions Restrictions •Slowly ease internal •Expand internal •Focus on stable, longer restrictions. activities. term adaptation to the •Educate and reinforce •Slowly allow visitors “new normal.” wearing of masks, into community with •Maintain and reinforce social distancing, significant restrictions. all infection control disinfection and •Ongoing reinforcement measures. hygiene. of infection control •Reconfigured common •Scheduled and measures. and dining spaces. regulated internal •As of August 1, 2020, •Tracking and restricting activities. five communities have movement of visitors in •Limited dining progressed to Phase 2. communities. activities. •Scheduled family visits in outdoor areas. •As of August 1, 2020, 30 communities have progressed to Phase 1. Criteria based on COVID-19 case trends, test availability and workforce stability determine community readiness to move to next level. 20

Committed to Protecting our Residents, Patients and Team Members Five Star is implementing a three-pronged approach to re-opening. Criteria Guidelines Planning •Criteria based on key metrics is •Guidelines created by cross- •Tools and process for used to determine community functional teams ensure communities to develop and readiness to move through compliance with best practices, implement a reopening plan levels to the “New Normal.” safety standards and based on the Five Star •% decline in resident/team government recommendations guidelines and the unique needs member COVID-19 positive and regulations. of their communities. cases over 14 days. •Responsibilities of community •Coordination and staffing needs •Local lab/testing readily stakeholders (residents, team include: available. members, family members and •multiple seatings for dining •COVID-19 positive cases in visitors) including: and meal service, county below certain •use of masks at all times, •limiting traffic in hallways and thresholds. •physical distancing, use of elevators, •Workforce stability to support •disinfection and personal •Monitored, socially-distant safe and sustainable re- hygiene, and activities options, and opening. •limiting group size and •enhanced infection control congregating. protocols. COVID-19 Re-opening 21

Financial Overview

Key Financial Metrics Strong Balance Sheet as of June 30, 2020. . Liquidity. . $76.1 million of unrestricted cash and cash equivalents on hand(1). . Zero amounts outstanding under $65.0 million(2) revolving credit facility. . Own eight unencumbered AL/IL communities with 742 living units. Financial Performance. . Generated Adjusted EBITDA of $7.1 million (Q2 2020). . Achieved $1.0 million, or 6%(3), growth in Ageility due to the stabilization of 2019 opened clinics offset by a reduction of in-person visits due to the COVID-19 pandemic. COVID-19 Expected Impact in Q3 2020. . Declines in census. . Increased costs related to personal protective equipment, labor, insurance and other operating costs. . Delayed construction management projects, including planned openings of new Ageility clinics. (1) Unrestricted cash and cash equivalents on hand includes $4.7 million of funds received under the Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act Provider Relief Funds. We are evaluating whether we are eligible to retain these funds. (2) The amount of available borrowings under our revolving credit facility is subject to qualifying collateral and reduced by issued letters of credit. At June 30, 2020, we had letters of credit issued of $2.4 million and $51.8 million available for borrowings under our revolving credit facility. (3) Compared to Pro Forma Q2 2019. For a reconciliation of Pro Forma data, refer to the Pro Forma Condensed Consolidated Statement of Operations within our press release included in our Current Report on Form 8-K dated August 6, 2020. Financial Overview 23

Condensed Consolidated Statement of Operations Compared to Q2 2019 Pro Forma Results (in thousands) (unaudited) Three Months Ended Actual Pro Forma June 30, 2020 June 30, 2019 Revenues Senior living $ 19,979 $ 20,767 Management fees 15,705 18,044 Rehabilitation and wellness services 18,879 18,239 Total management and operating revenues 54,563 57,050 Reimbursed community-level costs incurred on behalf of managed communities 224,104 253,836 Other reimbursed expenses 6,417 - Total revenues 285,084 310,886 Other operating income(1) 1,499 - Total revenues and other operating income 286,583 310,886 Operating expenses Senior living wages and benefits 10,097 9,504 Other senior living operating expenses 8,341 5,228 Rehabilitation and wellness services expenses 15,049 16,016 Community-level costs incurred on behalf of managed communities 224,104 253,836 General and administrative 23,567 16,204 Rent 1,378 989 Depreciation and amortization 2,703 2,749 Toal operating expenses 285,239 304,526 Other income (756) (402) (Benefit) provision for income taxes (902) 1,766 Net income $ 3,002 $ 4,996 (1) Other operating income includes income recognized for funds received under the CARES Act Provider Relief Fund for which we have determined we have complied with the terms and conditions for retaining these funds. Financial Overview 24

EBITDA and Adjusted EBITDA (in thousands) (unaudited) (1) Represents the excess of the fair value of the Share Issuances of $97,899 compared to the consideration of $75,000 paid by DHC. (2) Lease inducement recognized for Q4 2019 as a result of the completion of the Restructuring Transactions. (3) Deferred resident fees and deposits related to senior living communities Five Star previously leased from, and now manages for the account of, DHC, as a result of the completion of the Restructuring Transactions. (4) Costs incurred related to the Restructuring Transactions. Financial Overview 25

Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Six Months Ended Three Months Ended June 30, June 30, March 31, 2020 2020 2020 CASH FLOW FROM OPERATING ACTIVITIES: Net loss $ (14,207) $ 3,002 $ (17,209) Adjustments to reconcile net loss to cash provided by operating activities Non-cash income and expense adjustments, net 30,412 2,670 27,742 Changes in assets and liabilities(1)(2) 23,953 29,019 (5,066) Net cash provided by investing activities 40,158 34,691 5,467 CASH FLOW FROM INVESTING ACTIVITIES: Acquisition of property and equipment(2) (3,121) (1,108) (2,013) Purchases of debt and equity investments (5,092) (3,504) (1,588) Proceeds from sale of property and equipment 2,725 - 2,725 Distributions in excess of earnings from Affiliates Insurance Company 287 287 - Proceeds from sale of debt and equity investments 4,851 3,398 1,453 Net cash (used in) provided by investing activities (350) (927) 577 CASH FLOW FROM FINANCING ACTIVITIES: Costs related to issuance of common stock (559) - (559) Repayments of mortgage note payable (190) (95) (95) Targeted SNF distribution funds received on behalf of others 4,715 4,715 - Net cash provided by (used in) financing activities 3,966 4,620 (654) Change in cash and cash equivalents and restricted cash and restricted cash equivalents 43,774 38,384 5,390 Cash and cash equivalents and restricted cash and restricted cash equivalents at beginning of period 56,979 62,369 56,979 Cash and cash equivalents and restricted cash and restricted cash equivalents at end of period $ 100,753 $ 100,753 $ 62,369 Reconciliation of cash and cash equivalents and restricted cash and cash equivalents: Cash and cash equivalents(3) $ 76,114 $ 76,114 $ 36,641 Current restricted cash and cash equivalents 23,858 23,858 24,290 Other restricted cash and cash equivalents 781 781 1,438 Cash and cash equivalents and restricted cash and cash equivalents at end of period $ 100,753 $ 100,753 $ 62,369 (1) Changes in assets and liabilities includes the receipt of $23.5 million of cash from DHC related to the Restructuring Transactions. (2) Net cash provided by operating activities, net cash provided by investing activities and CapEx spend for the three months ended March 31, 2020 reflect reclassification adjustments of certain DHC reimbursements from the prior period to conform to the current period presentation. (3) Unrestricted cash and cash equivalents on hand includes $4.7 million of funds received under the CARES Act Provider Relief Funds. We are evaluating whether we are eligible to retain these funds. Financial Overview 26

CapEx Spend by Segment(1) (dollars in thousands, except per unit and clinic data) (unaudited) Three Months Ended June 30, March 31, 2020 2020 Senior living: Development, redevelopment and other non-recurring activities$ 67 $ 136 Improvements and other recurring activities 523 1,449 Total senior living 590 1,585 Rehabilitation and wellness services: Development, redevelopment and other non-recurring activities 35 169 Improvements and other recurring activities - 43 Total rehabilitation and wellness services 35 212 Corporate and other 483 216 Total CapEx spend $ 1,108 $ 2,013 Senior living: Number of units 2,312 2,312 Development, redevelopment and other non-recurring activities per unit$ 29 $ 59 Improvements and other recurring activities per unit$ 226 $ 627 Rehabilitation and wellness services: Number of clinics 246 244 Number of net new clinics 2 13 Development, redevelopment and other non-recurring activities per net new clinic$ 17,500 $ 13,000 Improvements and other recurring activities per clinic$ - $ 176 (1) CapEx spend by segment represents amounts paid related to the acquisition of property and equipment of Five Star and does not reflect amounts paid for the acquisition of property and equipment on behalf of and reimbursed by DHC. Financial Overview 27

Owned Senior Living Communities (as of and for the three months ended June 30, 2020) (dollars in thousands) (unaudited) Year Built or Property Living Senior Living Gross Net Carrying Date Most Recent No. Community Name State Type(1) Units Revenue Carrying Value Value Acquired Renovation (2) 1. Morningside of Decatur Alabama AL 49 $ 337 $ 3,629 $ 2,169 11/19/2004 1999 2. Morningside of Auburn Alabama AL 42 404 2,289 1,566 11/19/2004 1997 (2) 3. The Palms of Fort Myers Florida IL 218 1,864 30,658 15,369 4/1/2002 1988 (3) 4. Five Star Residences of Banta Pointe Indiana AL 121 819 18,234 12,837 9/29/2011 2006 (2) 5. Five Star Residences of Fort Wayne Indiana AL 154 1,185 25,644 17,898 9/29/2011 1998 6. Five Star Residences of Clearwater Indiana AL 88 371 9,747 5,593 6/1/2011 1999 (2) 7. Five Star Residences of Lafayette Indiana AL 109 577 15,531 10,704 6/1/2011 2000 (2) 8. Five Star Residences of Noblesville Indiana AL 151 1,332 25,142 17,850 7/1/2011 2005 (2) 9. The Villa at Riverwood Missouri IL 110 646 6,865 3,246 4/1/2002 1986 10. Carriage House Senior Living North Carolina AL 98 1,078 8,401 5,429 12/1/2008 1997 11. Forest Heights Senior Living North Carolina AL 111 921 13,567 8,986 12/1/2008 1998 (2) 12. Fox Hollow Senior Living North Carolina AL 77 941 11,029 7,323 7/1/2000 1999 (2) 13. Legacy Heights Senior Living North Carolina AL 116 1,536 12,631 8,221 12/1/2008 1997 14. Morningside at Irving Park North Carolina AL 91 789 6,813 3,796 11/19/2004 1997 (2) 15. Voorhees Senior Living New Jersey AL 104 1,058 10,242 6,175 7/1/2008 1999 (2) 16. Washington Township Senior Living New Jersey AL 103 920 10,168 6,169 7/1/2008 1998 17. The Devon Senior Living Pennsylvania AL 84 722 6,828 3,865 7/1/2008 1985 18. The Legacy of Anderson South Carolina IL 101 574 1,354 477 12/1/2008 2003 (2) 19. Morningside of Springfield Tennessee AL 54 427 3,654 1,785 11/19/2004 1984 20. Huntington Place Wisconsin AL 127 774 17,461 11,415 7/15/2010 1999 Total 2,108 $ 17,275 $ 239,887 $ 150,873 (1) AL is primarily an assisted living community and IL is primarily an independent living community. (2) Encumbered property under our $65,000 revolving credit facility. (3) Encumbered property under our $7,355 mortgage note. 28