Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LendingClub Corp | q220exhibit991er.htm |

| 8-K - 8-K - LendingClub Corp | q220form8-ker.htm |

EXHIBIT 99.2

Q2 2020 Quarterly Investor Update

As the macroeconomy continues to digest the impacts of the COVID-19 crisis, we are seeing signs of recovery balanced by uncertain action in Washington, the rate of infection and an unknown timeline for a vaccine.

We remain committed to helping both sides of our marketplace navigate the current environment and since March we have taken swift and sustained action across the platform in order to protect returns for investors. We tightened underwriting on new loans, increased interest rates on new loans, added capacity to help borrowers over the phone, and launched self-service options online for borrowers looking for help.

Because of these actions and more, we continue to observe resilience on the platform:

• | Total loan borrower performance is strong, with approximately 95% of such borrower loan balances not actively enrolled in hardship plans as of July 31, 2020. Repayment rates in the second quarter of 2020 also returned to pre-COVID-19 levels and roll rates (the percentage of borrowers who progress into later delinquency stages) have remained relatively low. Newer vintages are displaying better credit performance compared to pre-COVID-19 vintages and have low enrollment rates into our 2-month Skip-a-Pay program. |

• | The initial set of borrowers who enrolled in Skip-a-Pay are graduating (i.e. completing the 2-month deferral period). Of those who have graduated, nearly 66% are back on their regular payment schedule and approximately 28% have enrolled in another payment plan. Since the launch of the interest-only payment plan in early June, the majority of borrowers enrolling in a second payment plan are choosing to enroll in the interest-only plan and making partial payments, reflecting proactive steps to stay on track. |

Given how unique the current environment is, we’ll continue to watch performance closely in the next several months.

Looking across grade and term, we estimate approximately a 3% internal rate of return (IRR) for vintages most exposed to the impacts of COVID-19 (loans facilitated from Q1 2018 to Q1 2020). Our model continues to expect losses to peak in Q4 2020 and Q1 2021 based on the structure and timing of hardship plans (which enable some portion of borrowers to return to current status, but also moves the period when investors will observe peak losses into the future as borrowers have more time to digest the impact on their finances).

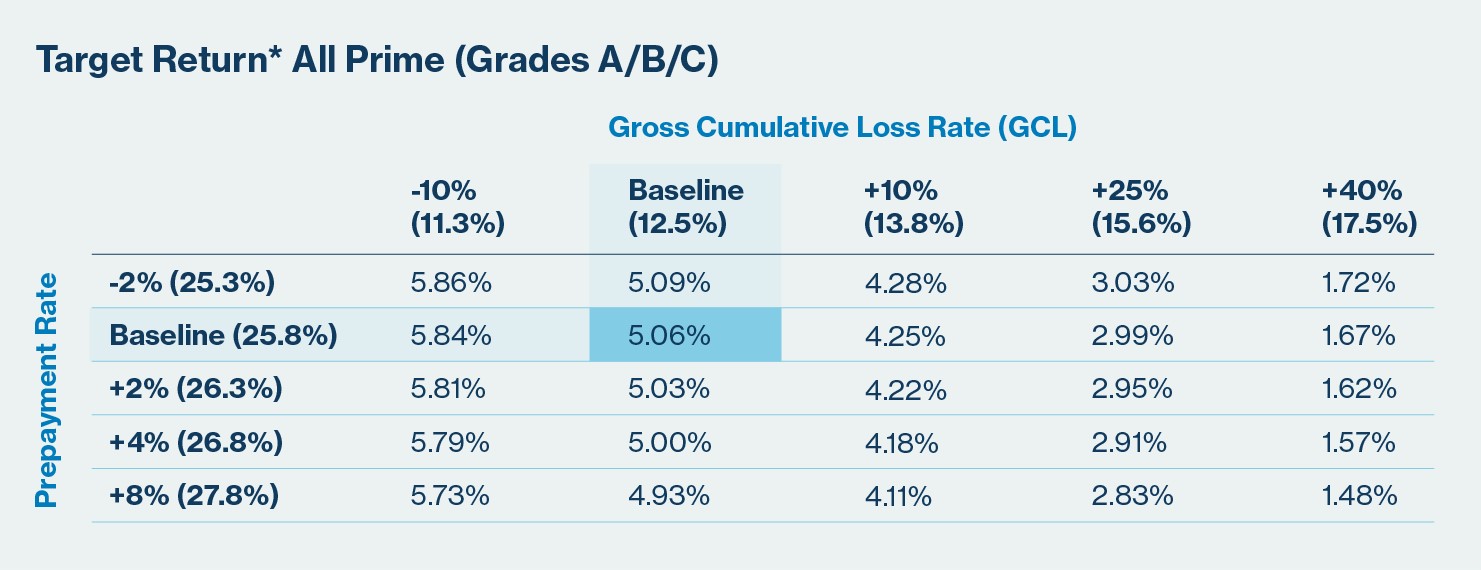

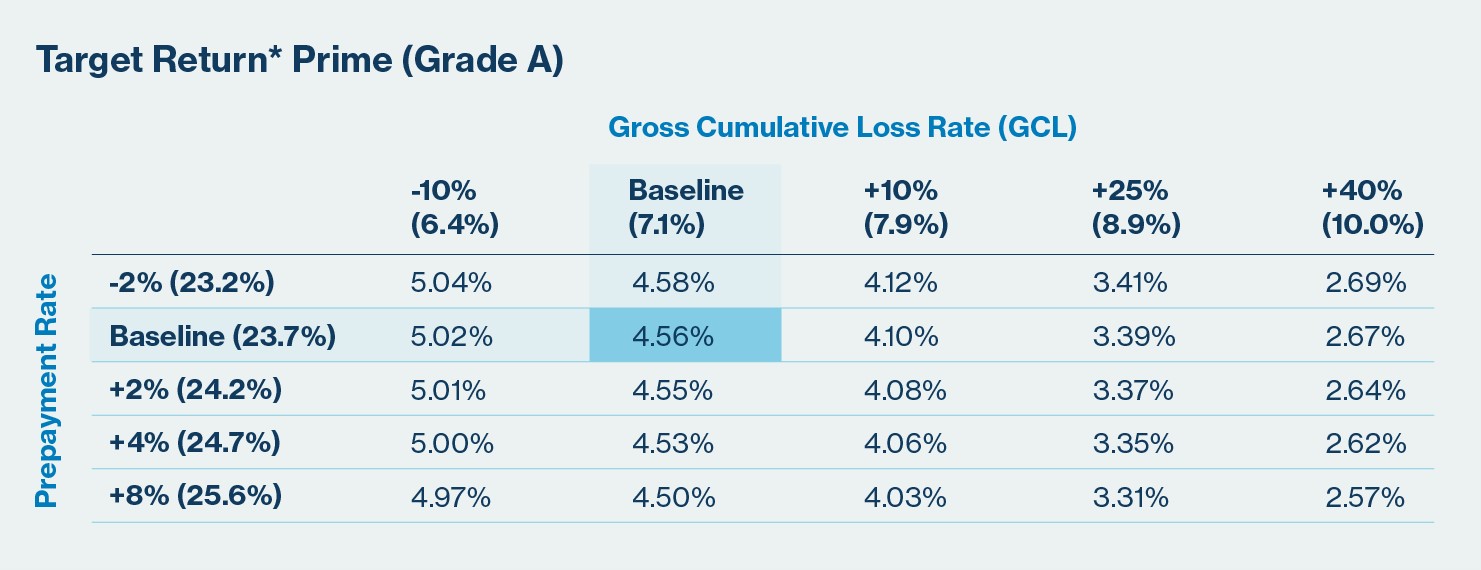

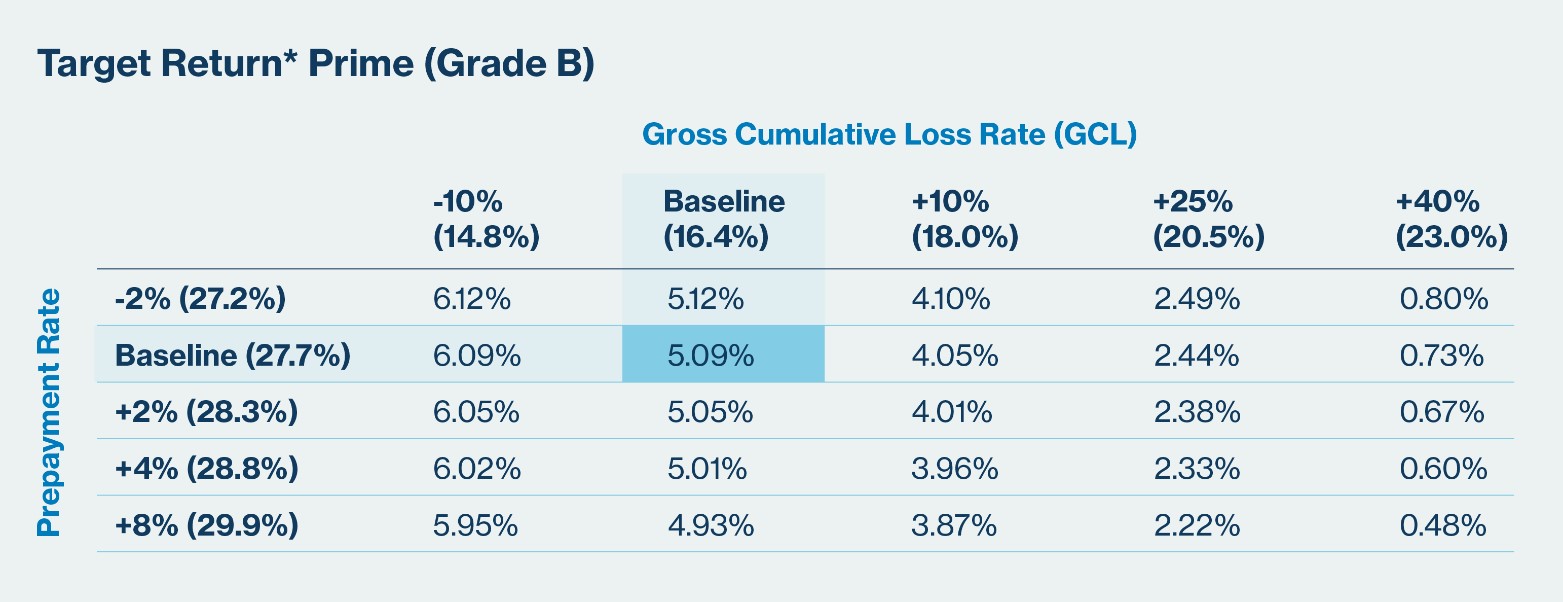

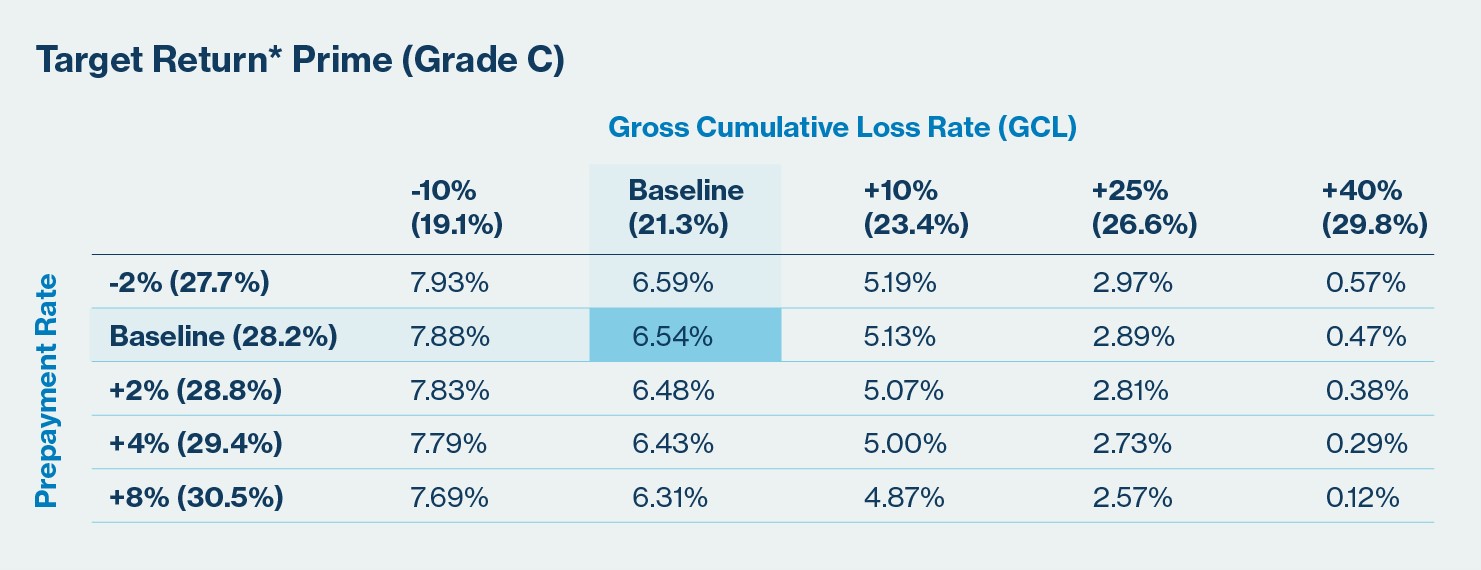

Looking ahead to potential performance on new loan issuance, we are continuing to target an approximately 5% return for the total Prime portfolio (no change since our previous update on June 25, 2020). We believe this positions the portfolio competitively in a historically low yield environment. In order to provide more detail to investors, we have provided performance targets at the grade level below. These targets continue to factor in the dramatic changes on the platform since the emergence of coronavirus (substantial credit cuts, interest rate increases, verification enhancements and more) as well as anticipated effects of the current macroeconomic outlook. It’s important to note that actual returns will be influenced by a variety of factors.

We are targeting currently approximately 5% for the total Prime portfolio; approximately 4.6% for A-grade loans, approximately 5.1% for B-grade loans, and approximately 6.5% for C-grade loans. As was the case in our last update, we have also provided insight into two factors that could impact returns (prepayments and losses) to illustrate the sensitivities of returns to these key variables and provide an illustration of potential adverse impacts on returns.

EXHIBIT 99.2

EXHIBIT 99.2

*Target return is the return that LendingClub takes reasonable steps to achieve. Target return is not a promise of future results and may not accurately reflect actual returns. Target returns shown are generated utilizing an internal rate of return (IRR) methodology and reflect a number of assumptions. Actual returns experienced by any individual portfolio may be impacted by, among other things, the size and diversity of the portfolio, the exposure to any single Member Payment Dependent Note (Note) or loan, borrower or group of Notes, loans or borrowers, as well as macroeconomic conditions. Individual results may vary, and targets are subject to change. Target returns are based primarily on historical variance of previous targets to loss and prepayment rates in place at the time of facilitation since Q1 2015.

Conclusion

The environment is unprecedented and changes daily. Given the pace of change, we encourage all of our investors to reach out to us with any questions; we’re here to help and will navigate this together.

Safe Harbor Statement

Some of the statements above, including statements regarding the impact of credit and underwriting initiatives, loan performance, platform returns, borrower attributes (including the number and behavior of those enrolled in hardship plans), our ability to successfully navigate the current economic climate the performance of the company and the impact of the coronavirus are “forward-looking statements.” The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “will,” “would” and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include the impact of global economic, political, market, health and social events or conditions, including the impact of the coronavirus, and those factors set forth in the section titled “Risk Factors” in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, as well as our subsequent reports on Form 10-Q each as filed with the Securities and Exchange Commission. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Information in this blog post is not an offer to sell securities or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.