Attached files

| file | filename |

|---|---|

| EX-3.3 - CERTIFICATE OF AMENDMENT OF CERTIFICATE OF INCORPORATION - Santa Fe Gold CORP | sfeg_ex3z3.htm |

| EX-32.1 - CERTIFICATION - Santa Fe Gold CORP | sfeg_ex32z1.htm |

| EX-31.1 - CERTIFICATION - Santa Fe Gold CORP | sfeg_ex31z1.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Santa Fe Gold CORP | sfeg_ex21z1.htm |

| EX-10.5 - VERBAL EMPLOYMENT AGREEMENT FOR FRANK MUELLER - Santa Fe Gold CORP | sfeg_ex10z5.htm |

| EX-10.4 - CHANGE OF CONTROL AGREEMENT FOR FRANK MUELLER - Santa Fe Gold CORP | sfeg_ex10z4.htm |

| EX-10.3 - DANIEL E. GORSKI CONSULTING AGREEMENT - Santa Fe Gold CORP | sfeg_ex10z3.htm |

| EX-10.2 - PURCHASE AGREEMENT BETWEEN SANTA FE ACQUISITION, LLC, BULLARD'S PEAK CORPORATION - Santa Fe Gold CORP | sfeg_ex10z2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal years ended June 30, 2019, 2018 and 2017 (As Restated)

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transaction period from ___________ to _________

Commission File No. 001-12974

SANTA FE GOLD CORPORATION |

(Exact name of registrant as specified in its charter) |

Delaware |

| 84-1094315 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

3544 Rio Grande Blvd., NW, Albuquerque, NM 87107

(Address of principal executive offices, Zip Code)

(505)255-4852

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

(Title of each class)

Securities registered pursuant to Section 12(g) of the Exchange Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.002 par value | SFEG | OTC PINK |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes x No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ¨ Yes x No

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) | Emerging growth company | ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

The aggregate market value of voting Common Stock held by non-affiliates of the registrant at the end of the second fiscal quarter ended December 31, 2018, was approximately $20,978,990 based on the last reported sale price of the registrant’s common stock as reported on the OTC Marketplace operated by OTB Market Group, Inc. on December 31, 2018.

As July 8, 2020, there were 415,957,718 shares of registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

2

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

|

| Page |

|

|

|

|

| |

|

|

|

ITEM 1: | 6 | |

ITEM 1A: | 12 | |

ITEM 1B: | 21 | |

ITEM 2: | 21 | |

ITEM 3: | 32 | |

ITEM 4: | 33 | |

|

|

|

|

| |

|

|

|

ITEM 5: | MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASES OF EQUITY SECURITIES | 34 |

ITEM 6: | 37 | |

ITEM 7: | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 37 |

ITEM 7A: | 41 | |

ITEM 8: | 42 | |

ITEM 9: | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 46 |

ITEM 9A: | 46 | |

ITEM 9B: | 47 | |

|

| |

|

|

|

ITEM 10: | 47 | |

ITEM 11: | 50 | |

ITEM 12: | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 52 |

ITEM 13: | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 54 |

ITEM 14: | 54 | |

|

|

|

|

| |

ITEM 15: | 55 | |

|

|

|

| 56 |

3

Unless the context requires otherwise, references to “Santa Fe Gold,” “Santa Fe,” “we,” “us,” our and the “Company” refer to Santa Fe Gold Corporation and its consolidated subsidiaries.

Financial Information Included in this 10-K

This is the first Annual Report filed by Santa Fe Gold after the original filed 10-K for fiscal year ended June 30, 2017, filed on July 5, 2018,with the Securities and Exchange Commission(“ the SEC or Commission”) Readers should be aware that several aspects of this report differ from previous Annual Reports on Form 10-K, as it covers three annual years of the Company. This Annual Report on Form 10-K for the year ended June 30, 2019, also contains our audited Consolidated Financial Statements for the years ended June 30, 2018 and 2017 (As Restated), which have not previously been filed (except for 2017 which are being restated hereby).

We have not filed and do not intend to file an amendment to any of our previously filed Annual Report on Form 10-K for the fiscal years ended prior to June 30, 2017. Prior to the filing of this Annual Report, the Company has filed amended Quarterly Reports on Form 10-Q for the quarters ended September 30, 2016 and December 30, 2016, and the quarter ended March 31, 2017. Concurrent with this filing, or as soon as practical, we are filing Quarterly Reports with the SEC on Form 10-Q for each of the quarters ended September 30,2017 and December 31, 2017; March 31, 2018, September 30, 2018 and December 31, 2018; March 31, 2019, September 30, 2019 and December 31, 2019 and March 31, 2020.

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report

On October 1, 2018, we disclosed in a Form 8-K that the board of directors formed a special committee in September 2018 to investigate and analyze certain financial transactions in the aggregate amount of approximately $1 million that occurred primarily between July 2016 and March 2018 involving Tom Laws (our former chief executive officer). The special committee investigation determined that Mr. Laws initially owes the Company $1,197,198 excluding penalty and accrued interest, of which $485,966 has been received by the Company to date and the Company has proceeded against Mr. Laws to collect the balance. The Company does not anticipate collection a material portion of the amount due us, See Item 3, “Legal Proceedings

The Company concluded that these financial transactions materially impacted the previously issued consolidated financial statements for, and financial information relating to, the fiscal year ended June 30, 2017. These financial statements for the fiscal year ended June 30, 2017 previously filed should not be relied upon. The Company’s financial statements for the fiscal year ended June 30, 2017, have been restated and are included herewith.

ADDITIONAL INFORMATION

Descriptions of agreements or other documents contained in this Annual Report filed on Form 10-K are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein and furnished herewith as exhibits for more complete descriptions of the terms and conditions set forth therein. Please see the exhibit index at the end of this report for a complete list of those exhibits.

We are required to comply with the United States Securities and Exchange Commission Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”), with respect to disclosures related to our mineral properties. The terms “mineralized material”, “mineralization” or similar terms as used in this Annual Report on Form 10-K does not indicate “reserves” by SEC Industry Guide 7 standards. We cannot be certain that any part of mineralized material or mineralization will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This Annual Report may contain certain “forward-looking” statements as such term is defined by the Commission in its rules, regulations and releases, which represent the Company’s expectations or beliefs, including but not limited to, statements concerning the registrant’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,” “might,” “plan,” “predict,” “strategy” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance, or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, many assuming that the Company secures adequate financing and is able to continue as a going concern, including statements regarding the following uncertainties, among other things:

4

·our ability to continue as a going concern;

·our ability to acquire financing to allow us to remain in business, engage in mining operations and/or develop any mines;

·projections regarding capital costs, expenditures, potential revenues, operating costs, production and economic returns may differ significantly from those that we have anticipated;

·exposure to all of the risks associated with mining operations, if any development of one or more of our projects is found to be economically feasible;

·title to some of our mineral properties may be uncertain or defective;

·land reclamation and mine closure may be burdensome and costly;

·significant risk and hazards associated with mining operations;

·the requirements that we obtain, maintain and renew environmental, construction and mining permits, which is often a costly and time-consuming process and may be opposed by local environmental group;

·our anticipated needs for working capital;

·claims , investigations, enforcement actions and other legal proceedings against us, and consequences therefrom;

·our lack of necessary financial resources to complete development of our projects and the uncertainty of our future best efforts financing plans,

·our exposure to material costs, liabilities and obligations as a result of environmental laws and regulations (including changes thereto) and permits;

·changes in the price of silver and gold;

·extensive regulation by the U.S. government as well as state and local governments;

·developments in the Department of Justice (“DOJ”) and SEC investigations;

·any projected revenues;

·our growth strategies,

·anticipated trends in our industry;

·unfavorable weather conditions;

·the commercial and economic viability of any mines;

·availability of materials and equipment;

·failure of equipment to process or operate in accordance with specifications, including expected throughput, which could prevent the production of commercially viable output; and

·our ability to seek out and acquire high quality gold, silver and/or copper properties.

Actual events or results may differ materially from those discussed in forward-looking statements as as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described herein generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur. We caution you not to place undue reliance on these forward-looking statements. Do not invest in our common stock based on forward-looking statements. We do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

5

PART I

Overview of Events

We are a mining company engaged in the business acquiring and developing metal and mineral properties that may contain recoverable gold and/or silver deposits. Although management is optimistic about its plans for developing certain such properties, to date, minimal mining activities have commenced and there can be no assurance that they will or that if they do commence, that the Company’s mining activities will be profitable. After the dismissal from bankruptcy in June 2016, we had no assets and approximately $20 million of indebtedness was reinstated.

The properties we currently own were acquired subsequent to our dismissal from bankruptcy proceedings. We are in the process of raising capital that is required, in part, to begin development of our current mining properties and to help meet our working capital requirements. There can be no assurances that we will be successful in raising the capital necessary to implement our business plan or if we are successful, that there may not be additional or superseding demands on our capital resources. Although the Company has been successful in meeting its capital requirements in the past, since emerging from Bankruptcy and management is optimistic about being able to secure needed funding, any failure to do so or any unforeseen expenses or other demands on the Company’s capital could result in the need to curtail or cease operation, resulting in losses to investors.

We are an exploration company that owns certain mining leases and other mineral rights. None of our properties contain any proven and probable reserves under SEC Industry Guide 7, and all of our activities on all of our properties are exploratory in nature.

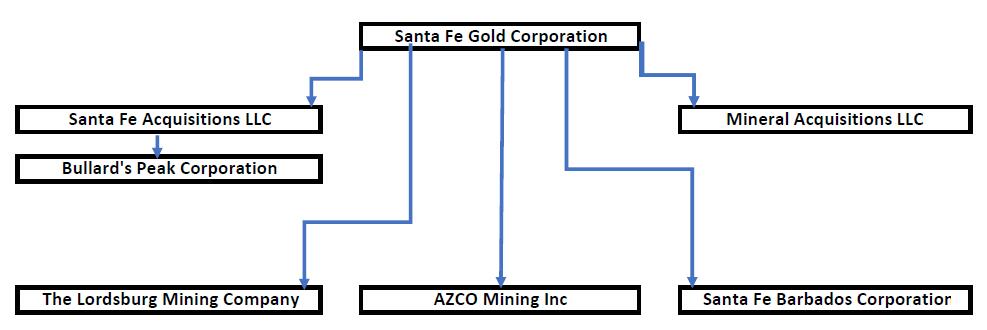

Company Organizational Chart

Overview of Recent Developments

Old New Mexico Properties Acquisitions

In August 2017, the Company acquired the Malone Mine claims, Playa Hidalgo Placer claims. On October 23, 2017, the Pinos Altos claims were purchased for an aggregate of $500. These mining claims are located in Grant County and Hidalgo County, New Mexico.

Alhambra Acquisition

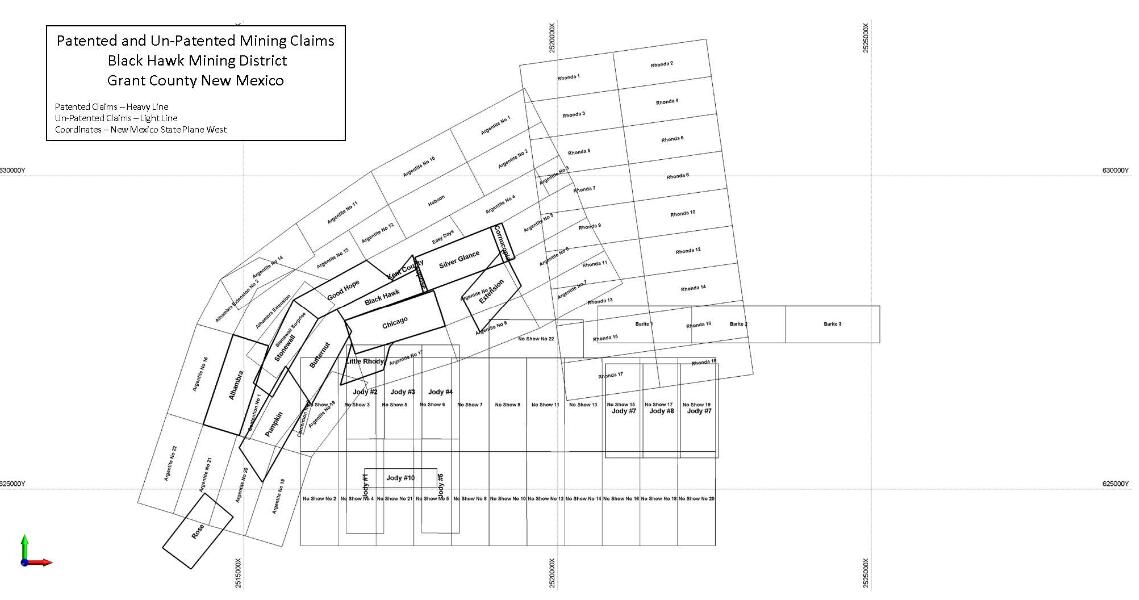

Pursuant to a stock purchase agreement dated August 2017, the Company acquired all the capital stock of Bullard’s Peak Corporation and the related patented unpatented claims in the Black Hawk district of New Mexico from Black Hawk Consolidated Mines Company for a purchase price of $3,115,365. The Company granted the seller a 2% net smelter return in perpetuity on all patented and unpatented claims. The net smelter return is the greater of (i) all monies the Company receives for or from any and all ore removed from the property comprising the mining claims whether for exploration, mining operations or any other reason, and (ii) the fair market value of removed ore from the property comprising the mining claims.

6

Based upon the Company’s review of FASB’s Business Combinations (Topic 805) Update amendment and the acquisition and outside independent documentation for this acquisition, it does not meet the requirements of acquiring a business or a business combination. All assets acquired are concentrated in a single identifiable asset, Land. The Company relies on Sections 805-10-55-5, 805-10-55-5A and 805-10-55-5B that identify the acquisition is not considered a business or business combination.

There were no mining operations being conducted on the property on the date of acquisition. Based on the Company’s analysis and understanding of documents obtained from outside sources and the sellers’ representations, no mining operations have been conducted on the property for the last five years. This is based on records from the New Mexico Department of Mines reflecting that they have no records of mining or exploration permits having ever been issued to any entity called Bullard’s Peak Corporation. A review of filed corporate tax returns also reflects no operational activities. To further assist the Company to determine if it acquired a business or a business combination, it looked to Accounting Standards Update 2017-01 Business Combinations (Topic 805).

Based upon the Company’s review of FASB’s Business Combinations (Topic 805) Update amendment and the acquisition and outside independent documentation for this acquisition, it does not meet the requirements of acquiring a business or a business combination. All assets acquired are concentrated in a single identifiable asset, Land. The Company relies on Sections 805-10-55-5, 805-10-55-5A and 805-10-55-5B that identify the acquisition is not considered a business or business combination.

To date, there have been no mining or exploration activities at this mine site. With limited information, the Company has done an initial economic feasibility study and will need to complete future exploration activity on the property prior to developing a proper mining plan for the site. The Company currently considers the location as an exploration property with required geological work yet to be performed.

British Columbia Properties

On November 30, 2017, the Company entered into substantially identical agreements with Fortune Graphite, Inc. and Worldwide Graphite Producers, Ltd. to acquire a total of four placer claims for aggregate consideration of Can$400,000 and the issuance of 10,000,000 shares of Company common stock. Title to these claims remains in trust with the sellers until payment in full. To date, the Company has paid Can$260,000. The Company owes the sellers Can$140,000 and 10,000,000 shares of Company common stock. Based upon our subsequent scrutiny and analysis of the transaction, the Company in February 2019 initiated an arbitration proceeding against the seller to void and rescind the purchase of these British Columbia properties. In addition to voiding and rescinding the transaction, the Company is seeking additional remedies. The Company cannot predict the outcome of this arbitration, and there is no assurance that the Company will not lose its interest in these claims, or owe seller the remaining outstanding amounts. In connection with this arbitration, the Company’s legal position is to void the transaction and, due to the uncertainty of the outcome, has provided an impairment of the amount at June 30, 2019, in the amount of $210,116.

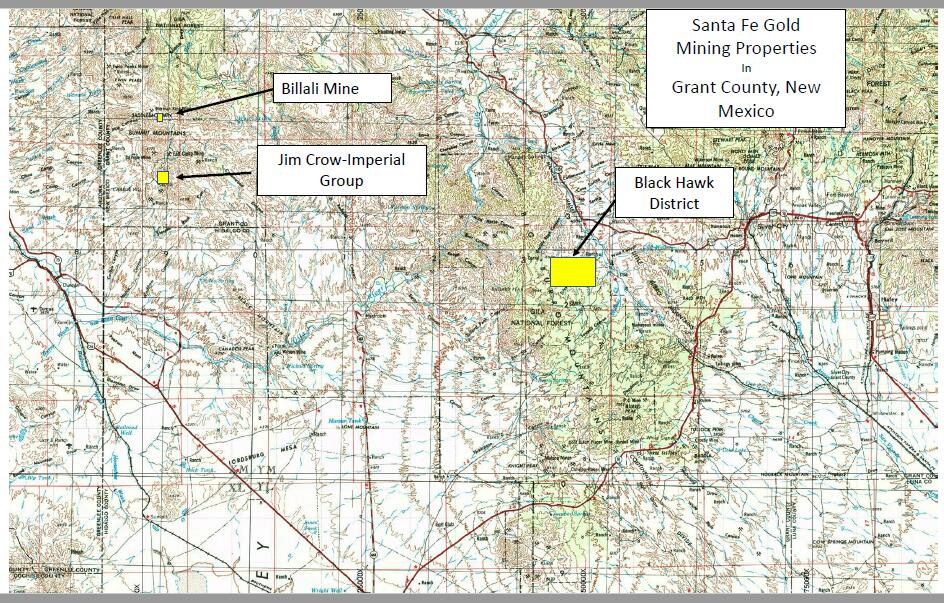

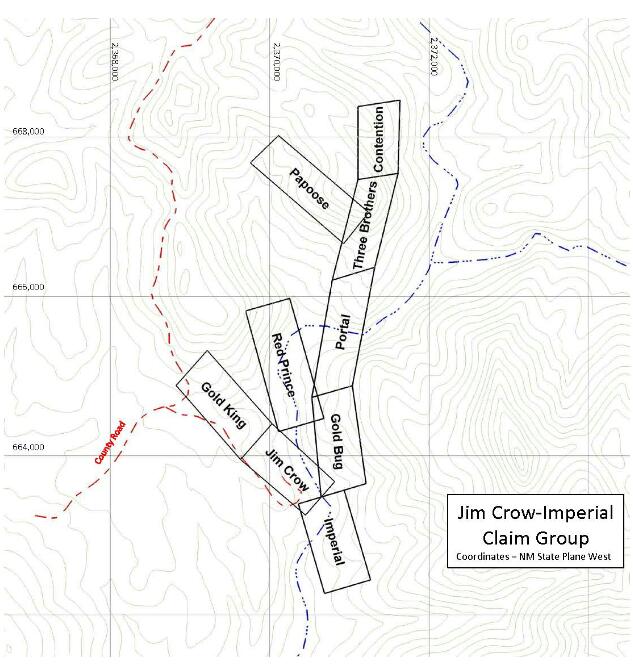

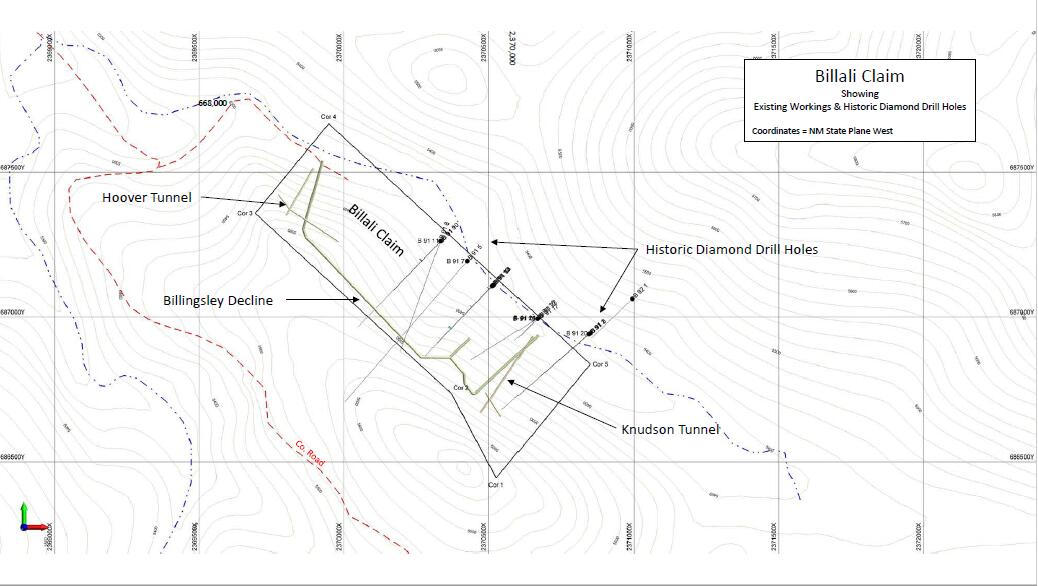

Agreement for Two New Mexico Mining Properties

The Company formed a wholly-owned subsidiary, Minerals Acquisitions, LLC, that entered into an Agreement with a mining operator in January 2019 to purchase two properties in western New Mexico, known as the Billali Mine and the Jim Crow Imperial Mine (the “Billali Agreement” and the “Jim Crow Agreement.”) The purchase price for all rights and interests to be conveyed is $2,500,000 for the Billali Mine and $7,500,000 for the Jim Crow Imperial Mine, each documented as separate definitive agreements, with aggregate consideration for both definitive agreements payable as follows pursuant to the third amendment to the aforementioned agreements dated effective May 1, 2020:

*$500,000 paid to date as of the filing date;

*buyer to pay $50,000 monthly commencing July 1, 2020 and continuing for the next subsequent 19 months;

*commencing 30 days after the last payment above, and continuing for the for an additional 48 subsequent payments, buyer to make each 30 days a payment in the amount of $175,000;

* after the final payment above and 30 days thereafter, the buyer will make the final payment of $100,000 completing the purchase.

*each payment made hereunder will be allocated twenty-five per cent (25%) to the Billali and seventy-five percent (75%) to the Jim Crow, Imperial.

The Agreement has a 5% net smelter return (NSR) royalty on the nine patented Lode Claims up $650,000, and a 3% NSR royalty thereafter.

Title and all rights and interest in the properties will be conveyed under the agreements upon completion of the payments of the purchase prices of the properties. The Company has the right to cancel the Agreement at any time.

7

Minerals Acquisitions, LLC was transferred the Jim Crow mine permit on August 20, 2019, from the selling party. The Company leases water rights for the mine site. The Company began initial site mining preparations at the Jim Crow mine during the last calendar quarter of 2019 and anticipates the first shipment of processed mineralized ore in the third calendar quarter of 2020 to our smelter. There can be no assurance of continued shipments of our processed mineralized ore until the Company enters into a long-term contract with the smelter, upon acceptance of our mineralized ore.

Due to Covid-19 the smelter and all laboratories are on a very slow pace. We sent a sample to a laboratory, designated by our potential smelter, was taking four to six weeks to provide an analysis of the ore sample submitted. Upon receipt of successful laboratory results, the smelter will discuss an initial contract for our material.

There were no mining operations being conducted on the property on the date of purchase. Based on the Company’s analysis and understanding of annual filed reports filed by the sellers, no mining operations have been conducted on the properties in the last four or five years. A review of the tax returns for the calendar years ended 2016-2018 support this position. The Company has inquired with the New Mexico Mining and Minerals Division to obtain the last few years of filings on Form 7, Annual Report Metal and Mill Concentrate Operations. The current reports obtained from the Division, reflect no mining operations have occurred in the years 2014 to 2018. Accordingly, (i) there were no revenue-producing activities and (ii) in connection with the acquisition, no employee base was associated with the acquisition, no market distribution system was associated with the acquisition, no sales force or customer base was associated with the acquisition, and no production techniques or actual production was associated with the acquisition of the properties. The Company believes that the physical facilities need various improvements prior to beginning mining operations.

To further assist the Company to determine if it acquired a business or a business combination, it looked to Accounting Standards Update 2017-01 Business Combinations (Topic 805). Based upon the Company’s review of the purchase agreement that provides for only the purchase of patented and unpatented mining claims as detailed in the agreement. Ownership transfers of these claims are not to transferred until the full amount specified in the agreement is paid in full. The Company has reviewed the tax returns of the sellers for their calendar tax years 2016-2018, which indicate no operations have occurred in those years. Based upon the Company’s review of FASB’s Business Combinations (Topic 805) Update amendment and the review of the acquisition documentation, this acquisition does not meet the requirements of acquiring a business. All assets to be acquired are concentrated in a single identifiable asset or group of similar identifiable assets, patented mining leases, as descripted in the Agreement. The Company relies on Sections 805-10-55-5, 805-10-55A and 805-10-55-5B that identify the acquisition is not considered a business or a business combination.

The Company considers this property to be an exploration property. The Company will capitalize the payments under the Agreement as made to the sellers for the mineral interest. Initial activities on the sites will be to complete limited exploration activities and required mine development projects with the intent to start limited mining activities in the first half of calendar 2020. These activities may be delayed based on the current outbreak of Covid-19 situation and current unknown factors at this time.

When the Company begins receiving revenue stream from these projects, the Company will amortize the capitalized payment balance each quarter thereafter. Companies that have reserves under Guide 7 typically capitalize these costs, and subsequently depreciate or amortize them on a units-of-production basis as reserves are mined. Unlike these other companies, on properties that have no reserves we will depreciate or amortize any capitalized costs based on the most appropriate amortization method, which includes straight-line or units-of-production method over the estimated life of the mine, as determined by our geologist. As we have no reliable information to compute a units of production methodology, we will amortize our capitalized costs on a straight-line basis. Because of these and other differences, our financial statements may not be comparable to the financial statements of mining companies that have established reserves on their properties.

Competition

The mining industry is highly competitive. We will be competing with numerous companies, substantially all of which have far greater resources available to them that we are likely to when we commence operations. We therefore may be at a significant disadvantage in the course of obtaining materials, supplies, labor, and equipment from time to time. Additionally, we are and will continue to be an insignificant participant in the business of mining exploration and development.

Compliance with Government Regulations

Overview

Continuing to acquire and explore mineral properties in the State of New Mexico will require the Company to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the State of New Mexico and the United States.

The mining industry, (specifically the activities of exploration, drilling) operate in a legal environment that requires permits to conduct virtually all operations. Thus, permits are required by local, state and federal government agencies. Local authorities, usually counties,

8

also have control over mining activity. The various permits address such issues as prospecting, development, production, labor standards, taxes, occupational health and safety, toxic substances, air quality, water use, water discharge, water quality, noise, dust, wildlife impacts, as well as other environmental and socioeconomic issues.

Like all other mining companies doing business in the United States, we are subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and to protect threatened or endangered species, in the vicinity of our mining operations. These include “permitting” or “pre-operating approval” requirements that are designed: (i) to ensure the environmental integrity of a proposed mining facility, (ii) to ensure operating plans are designed to mitigate the effects of discharges into the environment during exploration, mining operations, and reclamation and (iii) that post-operation plans are designed to remediate the lands affected by a mining facility once commercial mining operations have ceased.

United States. Mining in the State of New Mexico is subject to federal, state and local law. Three types of laws are of particular importance to the Company’s U.S. mineral properties: those affecting land ownership and mining rights; those regulating mining operations; and those dealing with the environment.

Land Ownership. On Federal Lands, mining rights are governed by the General Mining Law of 1872 (General Mining Law) as amended, 30 U.S.C. §§ 21-161 (various sections), which allows the location of mining claims on certain Federal Lands upon the discovery of a valuable mineral deposit and proper compliance with claim location requirements. A valid mining claim provides the holder with the right to conduct mining operations for the removal of locatable minerals, subject to compliance with the General Mining Law and Nevada state law governing the staking and registration of mining claims, as well as compliance with various federal, state and local operating and environmental laws, regulations and ordinances. As the owner or lessee of the unpatented mining claims, the Company has the right to conduct mining operations on the lands subject to the prior procurement of required operating permits and approvals, compliance with the terms and conditions of any applicable mining lease, and compliance with applicable federal, state, and local laws, regulations and ordinances.

Mining Operations

The exploration of mining properties and development and operation of mines is governed by both federal and state laws. The State of New Mexico likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. The State of New Mexico Mining and Minerals Division requires mine permits for each mining location. The permit has an Annual Permit Fee that is due by April 30 of each year. The Annual Permit Fee for minimal impact mines is currently $250.

Prior to receiving the necessary permits to explore or mine, the operator must comply with all regulatory requirements imposed by all governmental authorities having jurisdiction over the project. Generally, in order to obtain the requisite permits, the operator must have its land reclamation, restoration or replacement plans pre-approved. Specifically, the operator must present its plan to restore or replace the affected area. Often these requirements result in delays and/or costly studies or changes in the proposed activities; which may extend the time to completion. Although this may be necessary in order to mitigate the negative impact of certain aspects of an initial plan. All of these factors make it more difficult and costly to operate; and have a negative, and sometimes fatal, impact on the economic viability of the exploration or mining operation at issue. Finally, it is possible that future changes in laws or regulations could have a significant impact on our business, requiring the planned activities to be economically reevaluated at that time.

Environmental Law

Federal legislation in the United States and implementing regulations adopted and administered by the Environmental Protection Agency, the Forest Service, the Bureau of Land Management, the Fish and Wildlife Service, the Army Corps of Engineers and other agencies—in particular, legislation such as the federal Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, the National Forest Management Act, the Wilderness Act, and the Comprehensive Environmental Response, Compensation and Liability Act—have a direct bearing on domestic mining operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

The Clean Water Act. The Federal Clean Water Act is the principal Federal environmental protection law regulating mining operations in the United States as it pertains to water quality.

At the state level, water quality is regulated by the New Mexico Environment Department. If our exploration or any future development activities could affect a ground water aquifer, we are required to apply for a ground water discharge permit in compliance with the groundwater regulations. If exploration affects surface water, then compliance with surface water regulations is required.

The Clean Air Act. The Federal Clean Air Act establishes ambient air quality standards, limits the discharges of new sources and hazardous air pollutants and establishes a Federal air quality permitting program for such discharges. Hazardous materials are defined

9

in the Federal Clean Air Act and enabling regulations adopted under the Federal Clean Air Act to include various metals. The Federal Clean Air Act also imposes limitations on the level of particulate matter generated from mining operations.

National Environmental Policy Act (“NEPA”). NEPA requires all governmental agencies to consider the impact on the human environment of major federal actions as therein defined.

Endangered Species Act (“ESA”). The ESA requires federal agencies to ensure that any action authorized, funded or carried out by such agency is not likely to jeopardize the continued existence of any endangered or threatened species or result in the destruction or adverse modification of their critical habitat. In order to facilitate the conservation of imperiled species, the ESA establishes an interagency consultation process. When a federal agency proposes an action that “may affect” a listed species, it must consult with the USFWS and must prepare a “biological assessment” of the effects of a major construction activity if the USFWS advises that a threatened species may be present in the area of the activity.

National Forest Management Act. The National Forest Management Act, as implemented through Title 36 of the Code of Federal Regulations, provides a planning framework for lands and resource management of the National Forests. The planning framework seeks to manage the National Forest System resources in a combination that best serves the public interest without impairment of the productivity of the land, consistent with the Multiple Use Sustained Yield Act of 1960.

Wilderness Act. The Wilderness Act of 1964 created a National Wilderness Preservation System composed of Federally owned areas designated by Congress as “wilderness areas” to be preserved for future use and enjoyment.

The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”). CERCLA generally imposes joint and several liabilities, without regard to fault or legality of conduct, on classes of persons who are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the current owner or operator of a contaminated facility, a former owner or operator of the facility at the time of contamination and those persons that disposed or arranged for the disposal of the hazardous substance. Under CERCLA and comparable state statutes, such persons may be subject to strict joint and several liabilities for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. Governmental agencies or third parties may seek to hold the Company responsible under CERCLA and comparable state statutes for all or part of the costs to clean up sites at which such “hazardous substances” have been released.

The Resource Conservation and Recovery Act (“RCRA”). RCRA was designed and implemented to regulate the disposal of solid and hazardous wastes. It restricts solid waste disposal practices and the management, reuse or recovery of solid wastes and imposes substantial additional requirements on the subcategory of solid wastes that are determined to be hazardous. Like the Clean Water Act, RCRA provides for citizens’ suits to enforce the provisions of the law.

National Historic Preservation Act. The National Historic Preservation Act was designed and implemented to protect historic and cultural properties. Compliance with the Act is necessary where federal properties or federal actions are undertaken, such as mineral exploration on federal land, which may impact historic or traditional cultural properties, including native or Indian cultural sites.

Effect of Existing or Potential Government Regulations

Mineral exploration, including mining operations are subject to governmental regulation. Our operations may be affected in varying degrees by government regulation such as restrictions on production, price controls, tax increases, expropriation of property, environmental and pollution controls or changes in conditions under which minerals may be marketed. An excess supply of certain minerals may exist from time to time due to lack of markets, restrictions on exports, and numerous factors beyond our control. These factors include market fluctuations and government regulations relating to prices, taxes, royalties, allowable production and importing and exporting minerals. The effect of these factors cannot be accurately determined, and we are not aware of any probable government regulations that would impact the Company at this time, although there can be no assurances that regulations may not arise in the future. To the extent that government regulations do arise in the future, they may have a negative effect on our operations, which may in turn, result in losses to investors. This section is intended as a brief overview of the laws and regulations described herein and is not intended to be a comprehensive treatment of the subject matter.

We generally will be required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and revegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts would be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies. As soon as we have a mining operation, we will be required to arrange and pledge certificates of deposits for reclamation with the state regulatory agencies. At this time no reclamation cost is calculated or carried forward.

10

Employees

We currently have two full time employees as of our current fiscal year end. In order to implement our business plan, we will be required to employ or retain qualified consultants with the technical expertise to evaluate and mine our mineral properties and for administrative duties as required. We initially planned to employ approximately ten to twelve miners upon commencing our initial mining operations in New Mexico in late 2019. Thereafter, we hired approximately thirteen and as of the most recent date hereof, we have eight employees working on our mining operations in New Mexico in June 2020. The reduction in employees is due to the continuing effects of Covid-19.

Insurance

We currently maintain liability and workmen’s compensation insurance coverage to cover losses or risks incurred in the ordinary course of business.

Exploration

The Company has spent only nominal amounts during each of the last three fiscal years on exploration and mine development.

Seasonality

We have no properties at this time that are subject to material restrictions on our operations due to seasonality.

Office Facilities

Our principal executive offices are located at 3544 Rio Grande Blvd. NW, Albuquerque, NM 87107. Our telephone number is (505) 255-4852.

Dismissal of Bankruptcy Proceeding and Emergence from Voluntary Reorganization

In August 2015, the Company filed for Chapter 11 bankruptcy protection in Delaware in order to secure the existing assets from creditor actions, Case No. 15-11761 (MFW). Jakes Jordaan, our former chief executive officer, filed an affidavit in support of the first day motion that we had only one remaining option (plan) to have an orderly sale of all assets to satisfying qualified debt without any plan thereafter and he began working with an investment banker to assist with these efforts. The “asset sale” took place in February 2016 and left Santa Fe and its subsidiaries without any assets but with the remaining debt.

After the dismissal of the bankruptcy case, the Company had limited assets, but remained liable for all commitments and debts that then were outstanding. Santa Fe Gold Barbados, The Lordsburg Mining Company and AZCO are subsidiaries of the Company with nominal assets and all of their commitments and debts remain. The bankruptcy court set up a trust fund funded by the activities of the Summit mine (main asset sold in bankruptcy proceedings) for five years from the inception of mine production at the Summit mine, with the funds held in trust distributed by an independent trustee to certain unsecured creditors.

Santa Fe failed to provide a plan of reorganization in connection with its petition under Chapter 11of the United States Bankruptcy Code. The significant transactions that occurred upon emergence from bankruptcy were as follows:

·The approximately $20 million of indebtedness outstanding on account of the Company’s senior notes and unsecured claims were reinstated; and

·The courts established a trust in April 2016 for the benefit of certain creditors. A profit interest was attached to the Summit mine for the benefit of certain creditors holding unsecured claims filed by each creditor.

The Company received Bankruptcy Court confirmation of the dismissal in June 2016, and subsequently emerged from bankruptcy. The only funds available for the future administrative costs were prepaid insurance funds of approximately $49,000. The Company subsequently began selling on a best-efforts basis equity for the cash needed for working capital purposes. Currently we have no continuing commitment from any party to provide working capital, and there is no certainty that the Company will be able to continue its current business plan.

At the end of the Company’s fiscal year ended June 30, 2019, the Company wrote off debt and related, accrued interest in the aggregate amount of $12,506,540. The write off of debt was related to two finance facilities that were outside of the British Columbia statutes of limitations. The Company retained legal services in British Columbia to research the British Columbia statutes of limitations on the collectability of the finance facilities. Legal counsel reviewed all related documents, records of proceedings and all records and

11

documents deemed relevant to the two finance facilities. It was determined that the finance facilities were subject to the laws of the Providence of British Columbia and the federal laws of Canada. The Company received a written legal opinion from legal counsel, with respect to the two finance facilities and any sums due there under. Our counsel determined, after researching the Limitations Act (British Columbia) and relevant case law in the Provence of British Columbia, that the sums the Company had been carrying on its books and records related to those two finance facilities were time barred from any collection efforts because they are outside of statute of limitations period allowed under British Columbia law. Stated differently, the statutes of limitations has run for the two finance facility liabilities pursuant to the Limitations Act (British Columbia) and no future claims can be commenced in the Providence of British Columbia for collection thereunder. Therefore, the Company has no outstanding legal obligation on the two finance facilities.

Available Information

We make available, free of charge, on or through our Internet website, at www.santafegoldcorp.com, our annual report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not, incorporated into this report on Form 10-K.

You can read our SEC filings, including this annual report as well as our other periodic and current reports, on the SEC’s website at www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

The Company operates in a rapidly changing environment that involves numerous risks and uncertainties involving precious metal prices, explorations costs and government oversight. Investors should carefully consider the risks described below before purchasing the Company’s common shares. The occurrence of any of the following events could negatively affect our business operations and our results of operations. If these events occur, the trading price of the Company’s common shares could decline, and shareholders may lose part or even all of their investment.

Risk Associated with Our Business

All of our properties are in the exploration stage. There can be no assurance that we will establish the existence of any metal or mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we are not likely to earn any revenues from these properties, and our business could fail.

We have not established that any of our mining properties contain commercially viable mineral or metal reserves. Our ability to conclude that an individual prospect has any viable mineral or metal reserves requires further efforts and any funds that we spend on exploration may be lost. Even if we do eventually discover commercially viable mineral or metal reserves on one or more of our properties, there can be no assurances that we will develop producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties, which are explored and mined, are ultimately developed into commercially viable producing mines.

The commercial viability of an established mineral deposit will depend on a large number of factors including, by way of example, the size, grade and other attributes of the mineral or metal deposit, the proximity of the resource to infrastructure, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified metal or mineral resource unprofitable.

Even if commercial viability of a mineral or metal deposit is established, we may be required to expend significant resources until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to both establish proven and probable reserves as well as those required to implement permitting and drilling operations. Because of these uncertainties, investors have no assurances that our drilling programs will result in commercially viable operations nor that we will be successful in the establishment or expansion of any resources or reserves. Any failure in our ability to successfully execute on the forgoing will adversely impact our business results of operations, in turn leading to losses for investors.

Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are not defined terms under SEC Industry Guide 7 and are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of potential mineral deposits that may be considered mineral resources will ever be converted into reserves. Our mineral resources have a great amount of

12

uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Our properties currently do not contain any known proven or probable ore reserves under SEC Industry Guide 7 reporting standards. Investors are cautioned not to assume that any mineral resources will ever be converted into SEC Guide 7 compliant reserves.

If we establish the existence of commercially viable mineral or metal resources on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could suffer.

If we do discover mineral and metal resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, engage in drilling operations and develop extraction and processing facilities (or effect acceptable shipping arrangements therefor) and infrastructure. We do not have adequate capital to develop necessary facilities and infrastructure and will need to raise additional funds. Although we may derive substantial benefits from the discovery of commercially exploitable deposits, there can be no assurance that such a resource will be large enough to justify commercial operations or that we will be able to raise the funds required for development and/or processing on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities, infrastructure, development, processing or related activities, our business may fail and we may be forced to curtail or cease operations.

Our exploration and extraction activities may not be commercially successful.

While we believe there are positive indicators that our properties contain commercially exploitable minerals and metals, such belief has been based solely on preliminary tests that we have conducted and data provided by third parties. There can be no assurance that the tests and data upon which we have relied are correct or accurate. Moreover, mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of most exploration programs. The success of mineral exploration and development is determined in part by the following factors:

·the identification of potential mineralization based on analysis;

·the availability of permits;

·the quality of our management and our geological and technical expertise; and

·the capital available for mining operations.

Substantial expenditures and time are required to establish existing proven and probable reserves through drilling and analysis, and to develop the mines and facilities and infrastructure at any site chosen for mining. Whether a mineral or metal deposit will be commercially viable depends on a number of factors, which include, without limitation: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection; and general economic factors, which include, without limitation, market prices for certain minerals or metals, labor costs, the impact of technological innovations on the supply and demand for the commodities we mine. If our exploration and extraction activities are not successful, our business will likely fail.

There may be challenges to the title of our mineral properties.

The Company has acquired certain rights to its properties by unpatented claims, ownership of land or by lease from those owning the property and its patented claims are limited. The validity of title to many types of natural resource property depends upon numerous circumstances and factual matters (many of which are not discoverable of record or by other readily available means) and is subject to many uncertainties of existing law and its application. There can be no assurance that the validity of our titles to our properties will be upheld or that third parties will not otherwise seek to invalidate those rights. In the event the validity of our title to any of these properties are not upheld, such events would have a material adverse effect on us.

Mineral operations are subject to applicable law and government regulations. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of them. If we cannot exploit any mineral resources that we discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters.

13

Companies, such as ours that plan to engage in exploration and extraction activities, often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Issuance of permits for our activities is subject to the discretion of government authorities, and we may be unable to obtain or maintain such permits. Permits required for future exploration or development may not be obtainable on reasonable terms, on a timely basis or at all. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration or development of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could face difficulty and/or fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the properties, may exist on the properties in which we hold an interest. It is possible that our properties could be located on or near the site of a Federal Superfund cleanup project. Although we endeavor to avoid such sites, it is possible that environmental cleanup or other environmental restoration procedures could remain to be completed or mandated by law, causing unpredictable and unexpected liabilities to arise. We are not currently aware of any environmental issues or litigation relating to any of our current or former properties but if they were to arise, we could face significant liability that would negatively impact our operations that would cause our business to fail.

Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete.

Competition in the mining industry for desirable properties, investment capital, equipment and personnel are intense. Numerous companies headquartered in the United States, Canada and elsewhere throughout the world compete for properties on a global basis. We are currently an insignificant participant in the mining industry due, in part, to our limited financial and personnel resources. We may be unable to: i) attract the necessary investment capital or a joint venture partner to fully develop our mineral properties, ii) acquire other desirable properties, iii) attract and hire necessary personnel, or iv) purchase necessary equipment.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

The business of exploring for and extracting minerals and metals involves a high degree of risk. Few properties are ultimately developed into producing mines. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade and proximity to infrastructure, metal prices, which can be highly variable, and government regulation, including environmental and reclamation obligations. These factors are not within our control. Uncertainties as to the metallurgical amenability of any minerals discovered may not warrant the mining of these metals or minerals on the basis of available technology. Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral or metal properties, such as, but not limited to:

·encountering unusual or unexpected formations;

·environmental pollution;

·personal injury, flooding and landslides;

·variations in grades of minerals or metals;

·labor disputes; and

·a decline in the price of gold, silver or copper.

We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down on our investment in such property interests. All of these factors may result in losses in relation to amounts spent which are not recoverable. The payment of any liabilities that arise from any such occurrence would have a material, adverse impact on our Company.

14

Our exploration and development activities are subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations.

The exploration, possible future development and production phases of our business will be subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set out limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulations, if any, may adversely affect our operations. If we fail to comply with any of the applicable environmental laws, regulations or permit requirements, we could face regulatory or judicial sanctions. Penalties imposed by either the courts or administrative bodies could delay or stop our operations or require a considerable capital expenditure. Although we intend to comply with all environmental laws and permitting obligations in conducting our business, there is always a possibility that those opposed to exploration and mining may attempt to interfere with our operations, whether by legal process, regulatory process or otherwise.

We could be subject to environmental lawsuits.

Neighboring landowners, other third parties and governmental entities could file claims based on environmental statutes and common law for personal injury and property damage allegedly caused by the release of hazardous substances or other waste material into the environment on or around our properties. There can be no assurance that our defense of such claims will be successful. A successful claim against us could have an adverse effect on our business prospects, financial condition and results of operation.

Risks Associated with our Company

Litigation with respect to Mr. Laws may not result in additional funds being obtained to reduce his indebtedness owed to the Company.

The Company has determined by its records that Mr. Laws initially owes us $1,197,198 ; after deducting the sum of $485,966 collected from him, the total amount Laws owed prior to collection of the Company is $711,232 (the “Missing Funds”) plus penalties, professional fees and accrued interest. The Company has commenced litigation and collection efforts, including foreclosure on pledged assets to collect these funds. Mr. Laws filed a petition for protection under the U.S. Bankruptcy Code and has sought to use that proceeding to challenge the Company’s rights to foreclose on certain property that was pledged as security in connection with a promissory note he provided to the Company. That promissory note was issued by Mr. Laws when it was discovered that he owed the Company and payment of the amount he owed the Company was demanded. Based on the position our legal counsel has taken, we believe that Mr. Laws’ challenge to the Company’s security interest will not be supported, nevertheless there can be no assurances that the Company will be able to collect the balance of the Missing Funds from Mr. Laws. Failure to collect the balance of funds from Mr. Laws will adversely impact the Company’s financial condition, including the impact from loss of the funds themselves, although that adverse effect has already been realized and the Company has been operating without the balance of the Missing Funds since they were absent in 2017. As a result of Mr. Laws’ actions, the Company will have the additional expenses associated with the restating of its financial statements, which is included in this filing made on Form 10-K. There were also expenses associated with engaging the special committee to conduct a forensic review of the Company’s books and records in connection with the transactions giving rise to the Missing Funds. Additionally, the Company incurred and may continue to incur the costs associated with engaging counsel to represent the Company in this matter and in the investigations. That is, the investigation(s) or “pre-investigation(s)” that have been conducted or may be conducted by the SEC and DOJ; as well as the costs to settle any matters related thereto, may be significant. The Missing Funds together with the additional expenses that may arise as a result of Mr. Laws’ actions in the aggregate are likely to be substantial. To the extent that they are substantial and that the Company is unable to collect any further sums from Mr. Laws, the Company’s business and results of operations will be adversely affected.

The DOJ and the SEC investigated or are currently investigating the Company, including financial transactions involving Thomas Laws.

The U.S. Department of Justice (“DOJ”) and the Securities and Exchange Commission (“SEC”) have, or may have, each initiated investigation into the Company, its officers, directors, and potentially others, resulting from the Laws transactions. The SEC has obtained a formal order to investigate the Company with respect to Laws, and while we understand that the DOJ investigation lead to Mr. Laws plea of guilty to various charges, including charges based on his actions alleged by the Company, we also understand that Mr. Laws is currently awaiting sentencing in connection with his plea(s) of guilty. The Company does not anticipate collecting a material amount due from Mr. Laws in his criminal proceedings. However, it believes that if it is ultimately successfully in recovering any further sums from Mr. Laws, beyond what it has already recovered, that any additional recovery will be determined by the U.S. Bankruptcy Court.

15

The SEC investigation surrounding the financial transactions involving Thomas Laws may result in other officers, directors or third-parties or the Company being subject to related or different enforcement actions.

None of funds that Mr. Laws owes the Company were ever received by anyone other than Mr. Laws, nor was there ever any evidence found (after a forensic review of the Company’s books and records by an independent special committee) that anyone else benefited in any way from the Laws transaction(s). However, notwithstanding the forgoing, the SEC continues to investigate this matter, and the Company is aware that one of our officers is the subject of the investigation and that officer is in settlement discussions with the Commission to bring closure to the investigation. If settlement terms are not reached by the parties, there would likely be an adversarial proceeding commenced by the Commission. Balanced against the certainty that defending would be time consuming and costly, settlement (under reasonable terms) is seen as preferable. There is no assurance that this investigation will not include other affiliates of the Company or the Company itself, and it can’t be predicted as to where this investigation may lead or what the Commission might ultimately decide to seek in terms of judicial relief. If the Commission brings an enforcement action against any of the forgoing, it would likely have a material adverse effect on the Company and its operations.

The SEC could take the position that we have paid impermissible finders’ fees or that we aided and abetted a violation of the registration requirements by paying compensation to an individual acting as an unregistered broker dealer.

In the past, we paid finders’ fees in connection with the placement of certain shares of our common stock to an individual who is a non-U.S. resident. While the Company is confident that it met the factors set forth in the SEC Paul Anka No Action Letter (Issued July 24, 1991) (the seminal No Action Letter where transaction based compensation for finders has been approved by the Commission), by definition, the facts set forth in the aforementioned No Action Letter vary from those facts in all other situations including those that were present when finder’s fees were paid by the Company. As such, the SEC is not compelled to find the letter applicable in other situations and with other fact patterns. Nevertheless, we believe that the facts in the Company’s case are more compelling that those set forth in the Anka letter. The issuer in the Anka Letter did not have a pre-existing relationship with investors, whereas the Company not only had a pre-existing relationship with investors, the investors were almost entirely existing shareholders of the Company. Although, (a) the finder did not have involvement in negotiating or structuring transactions with investors (the Company’s investors had already determined to purchase, no sales material was provided by the finder with the sole exception of a blank subscription agreement that the finder was provided by the Company and that was provided along with the per share price to the investor as a courtesy); (b) the finder did not value or opine as to the Company’s common stock’s value and did not participate in negotiating on behalf of the investor or the Company; (c) the finder was not in the business of brokering transactions and its activity, as a finder, was isolated to helping the Company and again, (d) although fees were paid in connection with the sales of the Company’s common stock, this was disclosed on the subscription agreements and the other items were as limited or more limited than those that were present that gave rise to the SEC’s Paul Anka No-Action Letter. Further out of an abundance of caution, no commissions or finder’s fees have been paid in connection with the placement of common stock subsequent to August 2018. Nevertheless, if the SEC were to disagree with the Company’s analysis, the Company would be in a position to where it would be required to defend its position or to reach a settlement with the Commission, either of which could be costly and have a negative impact on the Company and its results of operations.

There can be no assurance the Company will successfully implement its plans.

We have historically incurred net losses from operations and we expect losses in the future periods. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the formation of a new business which seeks to obtain funds to finance its operations in a highly competitive environment. There can be no assurance that we will successfully implement any of our plans (including without limitation production of any mine, shipping ore to a smelter or otherwise commercially exploit our properties) in a timely or effective manner or that we will ever be profitable. In addition, there can be no assurances that we will choose to continue to develop any of our current properties because we intend to consider and, as appropriate, to divest ourselves of properties that may no longer be a strategic fit to our business strategy or that we lack the necessary capital to develop. If we lack the capital to implement our plans, we will be forced to curtail or cease operations.

Mineral exploration and development inherently involves significant and irreducible financial risks. We may suffer from the failure to find and develop profitable mineral deposits.

The exploration for and development of mineral deposits involves significant financial risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. Unprofitable efforts may result from the failure to discover mineral deposits. Even if mineral deposits are found, such deposits may be insufficient in quantity and quality to return a profit from production, or it may take a number of years until production is possible, during which time the economic viability of the project may change. Few properties which are explored are ultimately developed into producing mines. Mining companies rely on consultants and others for exploration, development, construction and operating expertise.

16

Substantial expenditures are required to establish ore reserves, extract metals from ores and, in the case of new properties, to construct mining and processing facilities. The economic feasibility of any development project is based upon, among other things, estimates of the size and grade of ore reserves, proximity to infrastructures and other resources (such as water and power), metallurgical recoveries, production rates and capital and operating costs of such development projects, and metals prices. Development projects are also subject to the completion of favorable feasibility studies, issuance and maintenance of necessary permits and receipt of adequate financing.

Once a mineral deposit is developed, whether it will be commercially viable depends on a number of factors, including: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; government regulations including taxes, royalties and land tenure; land use, importing and exporting of minerals and environmental protection; and mineral prices. Factors that affect adequacy of infrastructure include: reliability of roads, bridges, power sources and water supply; unusual or infrequent weather phenomena; sabotage; and government or other interference in the maintenance or provision of such infrastructure. All of these factors are highly cyclical. The exact effect of these factors cannot be accurately predicted, but the combination may result in not receiving an adequate return on invested capital.

Significant investment risks and operational costs are associated with our exploration activities. These risks and costs may result in lower economic returns and may adversely affect our business.

Mineral exploration, particularly for gold, involves many risks and is frequently unproductive. If mineralization is discovered, it may take a number of years until production is possible, during which time the economic viability of the project may change. Development projects may have no operating history upon which to base estimates of future operating costs and capital requirements. Development project items such as estimates of reserves, metal recoveries and cash operating costs are to a large extent based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, and feasibility studies. Estimates of cash operating costs are then derived based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of metals from the ore, comparable facility and equipment costs, anticipated climate conditions and other factors. As a result, actual cash operating costs and economic returns of any and all development projects may materially differ from the costs and returns estimated, and accordingly, our financial condition and results of operations may be negatively affected.

Any of our future acquisitions may result in significant risks, which may adversely affect our business.

An important element of our business strategy is the opportunistic acquisition of operating mines, properties and businesses or interests therein within our geographical area of interest. While it is our practice to engage independent mining consultants to assist in evaluating and making acquisitions, any mining properties or interests therein we may acquire may not be developed profitably or, if profitable when acquired, that profitability might not be sustained. In connection with any future acquisitions, we may incur indebtedness or issue equity securities, resulting in increased interest expense, or dilution of the percentage ownership of existing shareholders. We cannot predict the impact of future acquisitions on the price of our business or our common stock. Unprofitable acquisitions, or additional indebtedness or issuances of securities in connection with such acquisitions, may impact the price of our common stock and negatively affect our results of operations.

Our ability to find and acquire new mineral properties is uncertain. Accordingly, our prospects are uncertain for the future growth of our business.

Because mines have limited lives based on proven and probable ore reserves, we may seek to replace and expand our future ore reserves, if any. Identifying promising mining properties is difficult and speculative. Furthermore, we encounter strong competition from other mining companies in connection with the acquisition of properties producing or capable of producing gold. Many of these companies have greater financial resources than we do. Consequently, we may be unable to replace and expand future ore reserves through the acquisition of new mining properties or interests therein on terms we consider acceptable. As a result, our future revenues from the sale of gold or other precious metals, if any, may decline, resulting in lower income and reduced growth.

Delaware law and our by-laws protect our directors from certain types of lawsuits.

Delaware law provides that our directors will not be liable to us or our stockholders for monetary damages except for certain types of conduct as directors. Our by-laws require us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our directors caused by their negligence, poor judgment, or other circumstances. The indemnification provisions may require us to use our assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

17

We are in the preliminary stages of mining the Jim Crow Mine.

The Company is in the preliminary stages of mining operations in the Jim Crow Mine and anticipates the first shipment of ore during the second or third quarter of calendar 2020. The Company currently does not have a long-term shipping contract and there can be no assurances that shipping to this smelter will continue in future periods or that the Company will receive revenue therefrom. There can be no assurances of continued mining operations at the Jim Crow Mine or the shipment of ore to the smelter, any of which would adversely impact investors.

Dismissal of Bankruptcy Proceeding and Emergence from Voluntary Reorganization did not result in the elimination of Company liabilities.