Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Santa Fe Gold CORP | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - Santa Fe Gold CORP | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to_______

Commission file number 001-12974

SANTA FE GOLD CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 84-1094315 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 1128 Pennsylvania NE, Suite 200, Albuquerque, NM | 87110 |

| (Address of principal executive offices) | (Zip Code) |

(505) 255-4852

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, $.002 par value

(Title of

class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act.

Yes

[X] No [ ]

Indicate by check mark whether the issuer (1) filed all reports

required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of

1934 during the past 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes [X] No [

]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] |

| Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the Common Stock of Santa Fe Gold Corporation held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $84,745,941.

As of September 27, 2010, there were 93,062,510 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None.

1

TABLE OF CONTENTS

ADDITIONAL INFORMATION

Descriptions of agreements or other documents contained in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the exhibit index at the end of this report for a complete list of those exhibits.

2

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K or incorporated by reference may contain certain “forward-looking” statements as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent the registrant’s expectations or beliefs, including but not limited to, statements concerning the registrant’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,” “might,” “plan,” “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements.

This annual report contains forward-looking statements, many assuming that the Company secures adequate financing and is able to continue as a going concern, including statements regarding, among other things, (a) our projected sales and profitability, (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans, (e) our anticipated needs for working capital, (f) unfavorable weather conditions, (g) the lack of commercial acceptance of our product or by-products, (h) changes in environmental laws, (i) problems regarding availability of materials and equipment, (j) failure of equipment to process or operate in accordance with specifications, including expected throughput, which could prevent the production of commercially viable output, (k) our lack of necessary financial resources to complete development of our projects, successfully market our products and fund our other capital commitments and (l) our ability to seek out and acquire high quality gold, silver and/or copper properties. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Business,” as well as in this annual report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this annual report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this annual report will in fact occur. In addition to the information expressly required to be included in this annual report, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

These risks and uncertainties and other factors include, but are not limited to, those set forth under Item 1A. “Risk Factors”. All subsequent written and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

3

PART I

ITEM 1. BUSINESS

History and Organization

Santa Fe Gold Corporation (“the Company”, “our” or “we”) is a U.S. mining company, incorporated in 1991 in the state of Delaware. Our general business strategy is to acquire and develop mining properties amenable to low cost production. Presently, we have four projects: Our Summit silver-gold and Ortiz gold projects located in New Mexico; and our Black Canyon mica and Planet micaceous iron oxide projects located in Arizona. See “Item 2. Properties” for more information about our properties. We have constructed a mill and are developing an underground mine at our Summit silver-gold project, which successfully started up in 2010. We expect commercial production to be achieved in 2011. Information about the Company, including a link to our most recent financial reports filed with the Securities and Exchange Commission (“SEC”), can be viewed on our website at www.santafegoldcorp.com.

From July 1, 2006 through the current date, we completed private placements of our common stock, and notes convertible into our common stock, for amounts aggregating $2,856,757. Additionally, in December 2007, we raised capital pursuant to a private placement of convertible debentures aggregating $13,500,000. In September 2009, we entered into a gold sale agreement with an investor that included an upfront payment of $4,000,000. In January 2010, we raised $10,000,000 through a registered direct offering pursuant to an S-3 Registration Statement. We used the majority of the funds raised to acquire and construct the Summit mine and Banner mill and for working capital. We anticipate using the remainder of the $10 million raised in January 2010 to continue these efforts. See” Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operation” for more information.

Construction of the Summit mine and related Banner mill was the focus of our activities in 2010. In April 2007, we received results of a preliminary feasibility study carried out by an independent geological engineering firm that concluded that development of the Summit deposit would be economically viable. Capital cost was estimated as $13.4 million and the construction schedule was estimated to require 12 months. In December 2007, we arranged a financing of $13.5 million by way of a private placement of senior secured convertible debentures. We began construction activities during the first quarter of 2008, including development of the Summit mine and construction of the Banner mill. Underground mine development is on-going. Construction of the Banner mill was completed in Q2 2009 except for the tailings disposal impoundment, for which in October 2009 we received a conditional permit that allowed construction to proceed. Construction of the tailings disposal impoundment was completed in Q1 2010. Commencement of processing operations at the Banner mill began on March 25, 2010. Commissioning of the mill proceeded satisfactorily and in July 2010, we expanded mill operations to two shifts per day, five days a week. Sales of ore as silica flux commenced in Q2 2010 and sales of precious metals flotation concentrates began in Q3 2010. We plan to ramp up production from the Summit mine and increase throughput at the Banner mill, and expect the Summit project to achieve commercial production in 2011. As of June 30, 2010, we have approximately $48.4 million in federal tax loss carry-forwards to shelter federal income tax otherwise payable.

Our principal executive offices are located at 1128 Pennsylvania NE, Suite 200, Albuquerque, New Mexico 87110, and our telephone number is (505) 255-4852. Our Summit operations in southwestern New Mexico are conducted through our wholly-owned subsidiary, The Lordsburg Mining Company. Our mica operations in Arizona are conducted through our wholly- owned subsidiary, Azco Mica Inc. Our activity in Mexico is conducted through our wholly-owned subsidiary, Minera Sandia, S.A. de C.V. Administration of the September 2009 gold sale agreement is conducted through our wholly-owned Barbados subsidiary, Santa Fe Gold (Barbados) Corporation.

Please refer to page 30 of this report for a glossary of certain terms used herein.

Recent Developments

On September 24, 2010, we entered into a non-binding Memorandum of Understanding with Columbus Silver Corporation (TSXV: CSC) (“Columbus Silver”) pursuant to which we will acquire all of the outstanding shares of common stock of Columbus Silver in exchange for shares of our common stock. The contemplated exchange ratio is one share of our common stock for every 5.82515 shares of Columbus Silver’s common stock. It is contemplated that we will issue a total of 8,787,527 shares in the transaction, which is valued at approximately $9.93 million. Following completion of the transaction, it is estimated that we will be owned 91.37% by current Company shareholders and 8.63% by Columbus Silver shareholders. The combination with Columbus Silver is a notable step forward in our objective to become a significant North American precious metals producer.

The Memorandum of Understanding contemplates a business combination by way of a Plan of Arrangement, which is subject to Canadian court approval. In addition, the proposed transactions are subject to the final approval of the boards of directors of Santa Fe Gold and Columbus Silver, stock exchange and regulatory approvals, and Columbus Silver shareholder approval. On September 27, 2010, in relation to the transaction with Columbus Silver, we filed a Current Report on Form 8-K

4

On September 13, 2010, we announced the Company has shipped an initial 20 tons of precious metals concentrate to a European smelter. At current metal prices, the shipment contains approximately $425,000 in gold and silver. We will be paid for the gold and silver less customary smelter charges.

On September 1, 2010, we announced the Company will supply an additional 3,000 to 6,000 tons of trial siliceous flux material to a smelter in Arizona. We previously provided the smelter with 3,000 tons of similar material earlier in the year. The flux material will be processed for precious metals recovery. We will be paid for the contained silver and gold less customary charges. The siliceous flux constitutes ore from the Summit mine upgraded in silica and precious metals contents through crushing and screening.

On August 26, 2010, we announced the Company has contracted with another Arizona smelter to supply a trial shipment of 1,000 tons of siliceous flux material. The flux material will be processed for precious metals recovery. We will be paid for the contained silver and gold less customary charges. The siliceous flux constitutes a beneficiated product of ore from the Summit mine upgraded in silica and precious metals contents through crushing and screening.

On January 20, 2010 we entered into definitive agreements with 23 institutional investors to purchase $10 million of securities in a registered direct offering. We received net proceeds of $9,375,000 after deducting placement agent fees and other offering expenses. The securities were offered pursuant to an effective S-3 Registration Statement. The company sold to the investors an aggregate of 7,692,310 shares of its common stock, and warrants to purchase up to 3,846,155 additional shares of common stock. Each unit, consisting of one share of common stock and one-half of a warrant to purchase a share of common stock, was sold for a purchase price of $1.30. The warrants to purchase additional shares are exercisable at an exercise price of $1.70 per share and have a term of 5 years.

On September 11, 2009, we entered into a definitive gold sale agreement with Sandstorm Resources Ltd. (TSX-V: SSL) (“Sandstorm”) to sell a portion of the life-of-mine gold production (but not silver production) from our Summit silver-gold mine. Under the agreement we received an upfront cash deposit of $4.0 million, plus we will receive ongoing production payments equal to the lesser of $400 per ounce or the prevailing market price, for each ounce of gold delivered pursuant to the agreement for the life of the mine. Gold production subject to the agreement includes 50% of the first 10,000 ounces of gold produced, and 22% of the gold thereafter. The amount of payable gold can be reduced from 22% to 15% provided that within 36 months the Summit mine reaches certain performance levels in any consecutive 12 month period, in compliance with prefeasibility estimates, including 1) the rate of ore mined and processed must average 400 tons per day or more, and 2) payable gold production must exceed 11,500 ounces during such consecutive 12 month period. Sandstorm made an initial payment of $500,000 and on October 7, 2009 paid the remaining $3,500,000 balance of the upfront cash deposit. We will receive credit against the $4,000.000 upfront cash deposit for the difference between the market price and $400 per ounce for those gold deliveries where the prevailing market price exceeds $400 per ounce. These credits will be recognized as revenue, in addition to the ongoing production payments received for gold delivered pursuant to the agreement. In certain circumstances, including failure to meet minimum production rates, interruption in production due to permitting issues and customary events of default, the agreement may be terminated. In such event, we may be required to return to Sandstorm the upfront cash deposit of $4.0 million less a credit for gold delivered up to the date of that event, which is determined using the difference between the market price and $400 per ounce for gold deliveries where the prevailing market price exceeded $400 per ounce.

On December 21, 2007, we entered into a definitive agreement for the placement with a single investor of senior secured convertible debentures in the amount of $13,500,000. Proceeds from the debentures were used primarily for the development of the Summit project. The debentures were issued in accordance with a pre-determined funding schedule. The term of the debentures is 60 months. In fiscal 2008, we received advances aggregating $5,350,000 under the agreement, and in fiscal 2009 received advances aggregating $8,150,000, bringing the total received to $13,500,000.

Effective June 30, 2009, we agreed with the investor to convert the aggregate accrued interest of $974,360 due June 30, 2009 under the convertible debentures, into 974,360 shares of the Company’s common stock. We also agreed that aggregate accrued interest on the outstanding principal amounts of the debentures for the quarters ending September 30, 2009 and December 31, 2009, shall be paid in shares of the Company’s common stock, to be valued at one dollar ($1.00) per share at the time of payment and issuance. Beginning in 2010, we have paid accrued quarterly interest in cash.

On June 13, 2009, we entered into a purchase option contract on the Pilar gold property consisting of two mineral exploitation concessions covering 240 acres located 165 kilometers east-southeast of Hermosillo, State of Sonora, Mexico. In March 2010, we relinquished our interest in this property before the March 13, 2010 payments were due, after receiving disappointing results from an extensive program of trenching and surface sampling. Our wholly owned Mexican subsidiary, Minera Sandia S.A. de C.V., entered into the purchase option contract with Minera de Suaqui Grande, S. de R.L. de C.V.

5

The contract provided for option payments of $1,000 upon signing, $99,000 on March 13, 2010, and $125,000 on March 13, 2011. The last payment of $1,307,000 was due March 13, 2012, and would have completed the purchase. In connection with the acquisition, we agreed to issue 117,000 restricted shares of common stock to Minera de Suaqui Grande, S. de R.L. de C.V. under the terms of a consulting agreement, and agreed to pay creditors $11,150 in cash and 17,400 shares of restricted common stock valued at $19,836. We also agreed to pay finder’s fees of $15,000 in cash and 25,000 shares of restricted common stock valued at $28,500, and to match option and purchase payments when they became due by payments either in cash or in restricted common stock. We were not required to pay a production royalty under the agreements.

Competitive Business Conditions

Many companies are engaged in the exploration and development of mineral properties. We are at a disadvantage with respect to those competitors whose technical staff and financial resources exceed our own. Our lack of revenues and limited financial resources further hinder our ability to acquire and develop mineral interests.

Government Regulations and Permits

In connection with mining, milling and exploration activities, we are subject to extensive federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species.

At the Summit mine and Banner mill, we are continuing permitting activities as construction and development progress. On October 2, 2009 we received a Permit to Construct and Operate the Banner Mill Tailings Dam from the NM Office of the State Engineer (OSE). This permit allowed us to construct a tailings disposal impoundment and commence discharge of mill tailings.

Concurrent with the tailings disposal permit, New Mexico requires a Discharge Permit from the NM Environmental Department and a Reclamation Permit from Mining and Minerals Division under the NM Mining Act of 1993. Both of these permits have been issued, and financial assurance for future reclamation has been established.

Safety of our employees is regulated by the Mine Safety and Health Administration (MSHA), a federal agency, and by the NM Office of the State Mine Inspector. We are continuing development of the Summit underground mine, and regulation require secondary escape routes, exhaust ventilation, wireless communications, and underground refuge and emergency rescue capabilities. Work on these issues is underway and is being coordinated with the regulatory agencies.

With respect to the permits required for the Summit project mentioned above, as well as permits for the Ortiz project and for our other projects, we may be unable to obtain such permits in a timely manner, on reasonable terms, or at all. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving such permits, our timetable and business plan for development and mining of these properties could be adversely affected. See Item IA. “Risk Factors” for more information.

Employees

We currently have 36 full-time employees, including our executive officer, head office support staff and Lordsburg management and operating personnel. We also engage consultants and independent contractors in connection with financial accounting, construction, and exploration and development of our mining properties.

Office Facilities

Our corporate offices are located in Albuquerque, New Mexico. We lease offices at 1128 Pennsylvania NE, Suite 200, Albuquerque, New Mexico 87110, totaling approximately 2,300 square feet. We believe this space is adequate for our needs for the foreseeable future.

6

ITEM 1A. RISK FACTORS

This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operation, contains forward looking statements that may be materially affected by numerous risk factors, including those summarized below:

Risk Factors Related to Our Business and Operations

We are dependent upon production of precious metals and industrial minerals from a limited number of properties, have incurred substantial losses since our inception in 1991, and may never be profitable.

Since our inception in 1991, we have not been profitable. As of June 30, 2010, our total accumulated deficit was approximately $55.1 million. To become profitable, we must identify mineralization and establish reserves, and then either develop properties ourselves or locate and enter into agreements with third party operators. It could be years before we receive significant revenues from industrial mineral or precious metals production. We may suffer significant additional losses in the future and may never be profitable. There can be no assurance we will receive significant revenue from operations in the foreseeable future, if at all. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We ceased mining operations at our Black Canyon mica property in 2002 after unsuccessful attempts to begin profitable operations. We have established only limited probable reserves at our Summit silver-gold property, and have not established proven or probable reserves at our Ortiz gold property or at our Planet micaceous iron property. If we are unable to economically produce silver or gold from our Summit or Ortiz properties, we will be forced to identify and invest substantial sums in one or more additional properties. Such properties may not be available to us on favorable terms or at all. Because of the numerous risks and uncertainties associated with exploration and development of mining properties, we are unable to predict the extent of any future losses or when we will become profitable, if at all.

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations.

We will require significant additional funding for geological and geochemical analysis, metallurgical testing, and, if warranted, feasibility studies with regard to the results of our exploration. We may not benefit from such investments if we are unable to identify a commercial ore deposit. If we are successful in identifying reserves, we will require significant additional capital to establish a mine and construct a mill and other facilities necessary to mine those reserves. That funding, in turn, will depend upon a number of factors, including the state of the national and worldwide economy and the price of gold and other metals. We may not be successful in obtaining the required financing for these or other purposes, which would adversely affect our ability to continue operating. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and the possible, partial or total loss of our potential interest in certain properties.

Our industry is highly competitive, attractive mineral lands are scarce, and we may not be able to obtain quality properties.

We compete with many companies in the mining business, including large, established mining companies with substantial capabilities, personnel and financial resources far greater than our own. In addition, there is a limited supply of desirable mineral properties available for acquisition in the United States and in other areas where we may conduct exploration activities. For these reasons, we may be at a competitive disadvantage in acquiring mineral properties. Competition in the industry is not limited to the acquisition of mineral properties but also extends to the technical expertise to operate such properties and the financial ability to fund such properties. Our inability to compete with other companies in these areas could have a material adverse effect on our results of operation and business.

7

The feasibility of mining our Summit silver-gold property or our Ortiz gold property has not been established, meaning that we have not completed engineering, permitting or other work necessary to determine if it is commercially feasible to develop these properties.

We currently have established only limited probable reserves on the Summit silver-gold property and have not established proven or probable reserves on the Ortiz gold property. A “reserve,” as defined by regulation of the SEC, is that part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not received feasibility studies nor obtained necessary operating permits with regard to the Ortiz gold property. As a result, we have no reserves at the Ortiz gold property.

At the Summit silver-gold property, a qualified independent engineering firm has completed a pre-feasibility study that concluded there would be minimal risk in proceeding to development and mining on the basis of estimates of mineralized material. Subsequently, we have established probable reserves. However, the pre-feasibility stage estimate carries significant risks associated with factors including but not limited to the following:

-

The limited amount of drilling completed to date. The Summit deposit is defined by only 78,000 feet of drilling in 88 drill holes. These holes are spaced to intersect the mineralized zone up to 200 feet apart, a drilling density insufficient for detailed mine planning in this style of epithermal precious metals deposit. As a result, mine plans are preliminary in nature and details must be developed in conjunction with underground development.

-

Process and metallurgical testing has been limited to small pilot plant and bench scale testing. This causes uncertainty in metallurgical recovery and operating factors when scaling up to the full sized commercial plant. Although operating results to date at the Banner mill indicate that the mill will perform satisfactorily, additional fine tuning is necessary in order to optimize recovery of precious metals.

-

Samples collected for metallurgical testing were selected from drill core from various parts of the Summit deposit and from samples taken from old underground workings located in the upper part of the deposit. Because of the small number and size of samples available for metallurgical testing, metallurgical results may not accurately characterize the deposit as a whole.

-

The project has no significant operating history upon which to base estimates of operating costs and capital requirements. As a result, estimations of mineralized material, mining and process recoveries and operating costs have been based to a large extent upon the interpretation of geologic data from drill holes, and upon pre-feasibility estimates that derive forecasts of operating costs from anticipated tonnages and grades of mineralized material to be mined and processed, the configuration of the deposit, expected recovery rates of gold and silver from the mineralized material, comparable facility and equipment costs, and climatic conditions and other factors. Estimates of operating costs and capital requirements are preliminary estimates only.

-

Commonly in new projects, actual construction costs, operating costs and economic returns differ materially from those initially estimated. Accordingly, there can be no assurance that the Summit mine or Banner mill can be brought into operation within the time frame or at the cost anticipated by the Company, or that the forecasted operating results can be achieved.

Although preliminary feasibility studies carried out on the Summit silver-gold and Ortiz gold properties have yielded promising results with respect to potential economic viability, substantial additional feasibility work and expenditures are required to demonstrate economic viability. The mineralized materials identified to date on these properties have not and may never demonstrate economic viability. The feasibility of mining has not been, and may never be, established. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade and proximity to infrastructure; metal prices, which can be highly variable; and government regulations, including environmental and reclamation obligations. If we are unable to establish some or all of our mineralized material as proven or probable reserves in sufficient quantities to justify commercial operations, we may not be able to raise sufficient capital to develop a mine. If we are unable to establish such reserves, the market value of our securities may decline.

8

Fluctuating gold and silver prices could negatively impact our business plan.

The potential for profitability of gold and silver mining operations at our Summit silver-gold property and at our Ortiz gold property and the values of these properties are directly related to the market prices of gold and silver. The prices of gold and silver may also have a significant influence on the market price of our common stock. In the event that we obtain positive feasibility results and progress to a point where a commercial production decision can be made, our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before any revenue from production would be received. A decrease in the price of gold or silver at any time during future development or mining may prevent our properties from being economically mined or result in the impairment of assets as a result of lower gold or silver prices. The prices of gold and silver are affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the purchase or sale of gold by central banks, and the political and economic conditions of major gold producing countries throughout the world. During the last five years, the average annual market price of gold has progressively increased from $445 per ounce to $972 per ounce, as shown in the table below:

| Average Annual Market Price of Gold, 2005-2009 | ||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | ||||

| $ 445 | $603 | $695 | $872 | $972 | ||||

Although it may be possible for us to protect against future gold and silver price fluctuations through hedging programs, the volatility of metal prices represents a substantial risk that is impossible to completely eliminate by planning or technical expertise. In the event gold or silver prices decline and remain low for prolonged periods of time, we might be unable to continue with development of our Summit silver-gold property or to develop our Ortiz gold property or produce any significant revenue.

Any proposal for commercial mining operations at our Summit silver-gold property or at our Ortiz gold property would be subject to permitting requirements that could cause us to delay, suspend or terminate our development plans.

Mining and processing operations at the Summit silver-gold property or at the Ortiz gold property would require permits from the state and federal governments. We may be unable to obtain such permits in a timely manner, on reasonable terms, or at all. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving such permits, our timetable and business plan for development and mining of one or both of these properties could be adversely affected.

We may not be able to obtain an adequate supply of water to complete desired development and mining of our Summit silver-gold property or of our Ortiz gold property.

For successful development, we will need to obtain the rights for a sufficient amount of water to service the mining and processing operation. Our lease with Ortiz Mines, Inc. gives us all rights that Ortiz Mines, Inc. may have to initiate and use water and water rights in connection with the property, including among others the right to drill, pump, divert, transport and use water from wells, containment areas and drainages. However there can be no assurance we will be able to exercise our rights under the lease agreement or obtain access to the amount of water needed to operate a mine at the property. For our Summit silver-gold property, this risk is mitigated in that sufficient water for mining purposes can be purchased and trucked to the Summit property; and sufficient water is available for processing purposes on our Lordsburg mill site property, for which water we have usage rights.

We may be at risk of losing title to our Ortiz gold property lease if we fail to perform our obligations.

Under the terms of our lease with Ortiz Mines, Inc., we are required to meet certain obligations as is common in a mineral lease of this type. Among other requirements, we must begin mineral production by February 2015 (February 2022 in certain circumstances), make annual payments, pay a sliding-scale production royalty based on the price of gold and comply with all governmental permitting and other regulations. If we fail to make payments in a timely manner or to perform our other obligations as required under the lease, we are at risk that the lease could be cancelled.

9

The reserve estimations at our Summit property are imprecise.

Although we have relied on expert independent consultants to calculate the reserve estimations disclosed in our reports, such estimations are necessarily imprecise because they depend upon the judgment of the individuals who review the geological and engineering information and upon statistical inferences drawn from only limited drilling and sampling. If the Summit mining operation were to encounter mineralization or geologic conditions different from those predicted, reserve estimations might have to be adjusted and mining plans altered. Changes to the planned operations could adversely affect forecast costs and profitability.

The future prices of mica and feldspathic sand are uncertain.

According to published information, mica prices have varied over the past several years, and the outlook for future mica prices is unclear. Manufactured sand prices in the Phoenix area generally have fluctuated over the past several years, with demand driven by the state of the housing, construction, and recreational markets, which in recent years has undergone a dramatic decline. There are numerous factors beyond our control that could affect markets for both mica and feldspathic sand. No assurance can be given as to future prices or demand for products, if any, that could be produced from our Black Canyon mica project. Any decline in prices could have a material adverse effect on project economics.

Titles to unpatented claims can be uncertain, and we are at risk of loss of ownership of our Black Canyon mica property and a portion of our Summit and Lordsburg properties.

Our property holdings at the Black Canyon mica property and a portion of our holdings at our Summit and Lordsburg properties consist of unpatented mining claims and unpatented mill site claims located on public land and held pursuant to the General Mining Law of 1872. The validity of such unpatented mining claims may be subject to title defects and may be contested. Because a substantial portion of all mineral exploration, development and mining in the United States occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained a title opinion on our entire property, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. Although we believe that our claims are in good standing and held according to industry practice, we remain at risk that the mining claims may be forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges as to whether a discovery of a valuable mineral exists on every claim.

In recent years the United States Congress has considered amendments to the General Mining Law of 1872, some of which would lower the value of unpatented mining claims by restricting activities and imposing additional user fees or production royalties. If enacted, these legislative changes could have an adverse impact on our operations.

The development and completion of our properties entail significant risks.

The development of mineral deposits involves significant risks that even the best evaluation, experience and knowledge cannot eliminate. The economic feasibility of our mining properties is based upon a number of factors, including estimations of reserves and mineralized material, extraction and process recoveries, engineering, capital and operating costs, future production rates and future prices of gold, silver, copper, mica, feldspathic sand and micaceous iron oxide.

Our properties have no significant operating history upon which to base estimates of operating costs and capital requirements.

As a result, estimations of mineralized material and reserves, mining and process recoveries and operating costs must be based to a large extent upon the interpretation of geologic data obtained from drill holes, and upon scoping and feasibility estimates that derive forecasts of operating costs from anticipated tonnages and grades of mineralized material and reserves to be mined and processed, the configuration of the mineralized deposits, expected recovery rates of minerals, comparable facility and equipment costs, and climatic conditions and other factors. Commonly in new projects, actual construction costs, operating costs and economic returns differ materially from those initially estimated. Accordingly, there can be no assurance that our properties can be developed within the time frames or at the costs anticipated, or that any forecasted operating results can be achieved.

10

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for minerals is highly speculative and involves greater risk than many other businesses. Most exploration programs fail to result in the discovery of economic mineralization. Our exploration and mining efforts are subject to the operating hazards and risks common to the industry, such as:

- economically insufficient mineralized materials;

- decrease in reserves due to lower metal prices;

- fluctuations in production cost that may make mining uneconomical;

- unanticipated variations in grade and other geologic problems;

- unusual or unexpected formations;

- difficult surface or underground conditions;

- failure of pit walls or dams;

- metallurgical and other processing problems;

- environmental hazards;

- water conditions;

- mechanical and equipment performance problems;

- industrial accidents;

- personal injury, fire, flooding, cave-ins and landslides;

- labor disputes; and

- governmental regulations.

Any of these risks can adversely affect the feasibility of development of our properties, production quantities and rates, and costs and expenditures. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral properties are likely not to be recovered, a write-down of our investment would be necessary. All of these factors may result in unrecoverable losses or cause us to incur potential liabilities, which could have a material adverse effect on our financial position.

Our ongoing operations, including past mining activities, are subject to environmental risks that could expose us to significant liability and delay, suspension or termination of our operations.

All phases of our operations will be subject to federal, state and local environmental regulations. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulation, if any, may adversely affect our operations, make our operations prohibitively expensive, or prohibit them altogether. Environmental hazards may exist on the Black Canyon mica property, the Summit silver-gold property, the Lordsburg property, the Ortiz gold property, and the Planet micaceous iron oxide property and on properties in which we may hold interests in the future that are unknown to us at the present. Failure to comply with applicable environmental laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities, causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions.

Production, if any, at our projects may involve the use of hazardous materials.

Should these materials leak or otherwise be discharged from their containment systems, then we may become subject to liability for hazards. We have not purchased insurance for environmental risks including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production, as it is not generally available at a reasonable price.

11

In addition to environmental regulations, we are subject to a wide variety of laws and regulations directly and indirectly relating to mining that often change and could adversely affect our business.

We are subject to extensive United States federal, state and local laws and regulations related to mine prospecting, development, transportation, production, exports, taxes, labor standards, occupational health and safety, waste disposal, protection and remediation of the environment, mine safety, hazardous materials, toxic substances and other matters. These laws and regulation frequently change. New laws and regulations or more stringent enforcement of existing ones could have a material adverse impact on us, causing a delay or reduction in production, increasing costs and preventing an expansion of mining activities.

We depend on a limited number of personnel and the loss of any of these individuals could adversely affect our business.

We are highly dependent on seven persons, namely Mr. Olson, our chairman; Mr. Pierce Carson, our president and chief executive officer and principal financial officer; Mr. Martinez, our controller; Mr. Ryan Carson, manager of legal affairs; Mr. Moore, general manager of our Summit project; Mr. Freeman, senior consultant; and Mr. Floyd, mill superintendent. We rely heavily on these seven individuals for the conduct of our business, and the loss of any of them could significantly and adversely affect our business. In that event, we would be forced to identify and retain a suitable replacement, which we may not be able to accomplish on terms acceptable to us. We have no life insurance on the life of any officer.

Our Chief Executive Officer may face a conflict of interest relating to the acquisition of mineral properties by the Company.

We have an agreement with Mr. Carson, which pre-dates his joining the Company as an officer and director, under which he identified properties that constitute potential acquisition targets. Although Mr. Carson has no pre-existing interest in the targeted properties, under the agreement he stands to gain if we acquire an identified property and either place it into production or sell it. This arrangement gives rise to potential conflicts of interest with regard to whether or not we should acquire a targeted property and the price we agree to pay for the property. While we have sought to mitigate the risk inherent in the arrangement with Mr. Carson by careful evaluation by the Board of Directors of any proposed transaction, this step may not be sufficient to eliminate the risk entirely. Acquisitions of the Summit silver-gold property and Ortiz gold property are subject to the property identification agreement with Mr. Carson.

Delaware law and our Articles of Incorporation may protect our directors from certain types of lawsuits. Delaware law provides that our directors will not be liable to our stockholders or to us for monetary damages for all but certain types of conduct as directors of the Company.

Our Articles of Incorporation permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Risks Related to our Common Stock

The sale of our common stock by selling stockholders may depress the price of our common stock due to the limited trading market that exists.

Due to a number of factors, including the lack of listing of our common stock on a national securities exchange, the trading volume in our common stock has historically been limited. Trading volume over the last 3 months has averaged approximately 55,000 shares per day. As a result, the sale of a significant amount of common stock by selling shareholders may depress the price of our common stock and the price of our common stock may decline.

Completion of one or more new acquisitions could result in the issuance of a significant amount of additional common stock, which may depress the trading price of our common stock.

Acquisition of one or more additional mineral properties, conceptually, could result in the issuance of a significant amount of common stock. Such issuance could depress the trading price of our common stock.

12

Our stock price may be volatile and as a result you could lose all or part of your investment.

In addition to volatility associated with OTC securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- changes in the worldwide prices for gold or silver;

- disappointing results from our exploration or development efforts;

- failure to meet our revenue or profit goals or operating budget;

- decline in demand for our common stock;

- downward revisions in securities analysts’ estimates or changes in general market conditions;

- technological innovations by competitors or in competing technologies;

- investor perception of our industry or our prospects; and

- general economic trends.

In addition, stock markets have experienced extreme price and volume fluctuations and the market prices of securities generally have been highly volatile. These fluctuations commonly are unrelated to operating performance of a company and may adversely affect the market price of our common stock. As a result, investors may be unable to resell their shares at a fair price.

A small number of existing shareholders own a significant portion of our common stock, which could limit your ability to influence the outcome of any shareholder vote.

Our executive officers and directors, together with our two largest shareholders, beneficially own approximately 40% of our common stock as of the date of this report. Under our Articles of Incorporation and Delaware law, the vote of a majority of the shares outstanding is generally required to approve most shareholder action. As a result, these individuals and entities will be able to influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our Articles of Incorporation or proposed mergers or other significant corporate transactions.

We have never paid dividends on our common stock and we do not anticipate paying any in the foreseeable future.

We have not paid dividends on our common stock to date, and we may not be in a position to pay dividends in the foreseeable future. Our ability to pay dividends will depend on our ability to successfully develop one or more properties and generate revenue from operations. Further, our initial earnings, if any, will likely be retained to finance our growth. Any future dividends will depend upon our earnings, our then-existing financial requirements and other factors and will be at the discretion of our Board of Directors.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Summit Silver-Gold Project

Overview

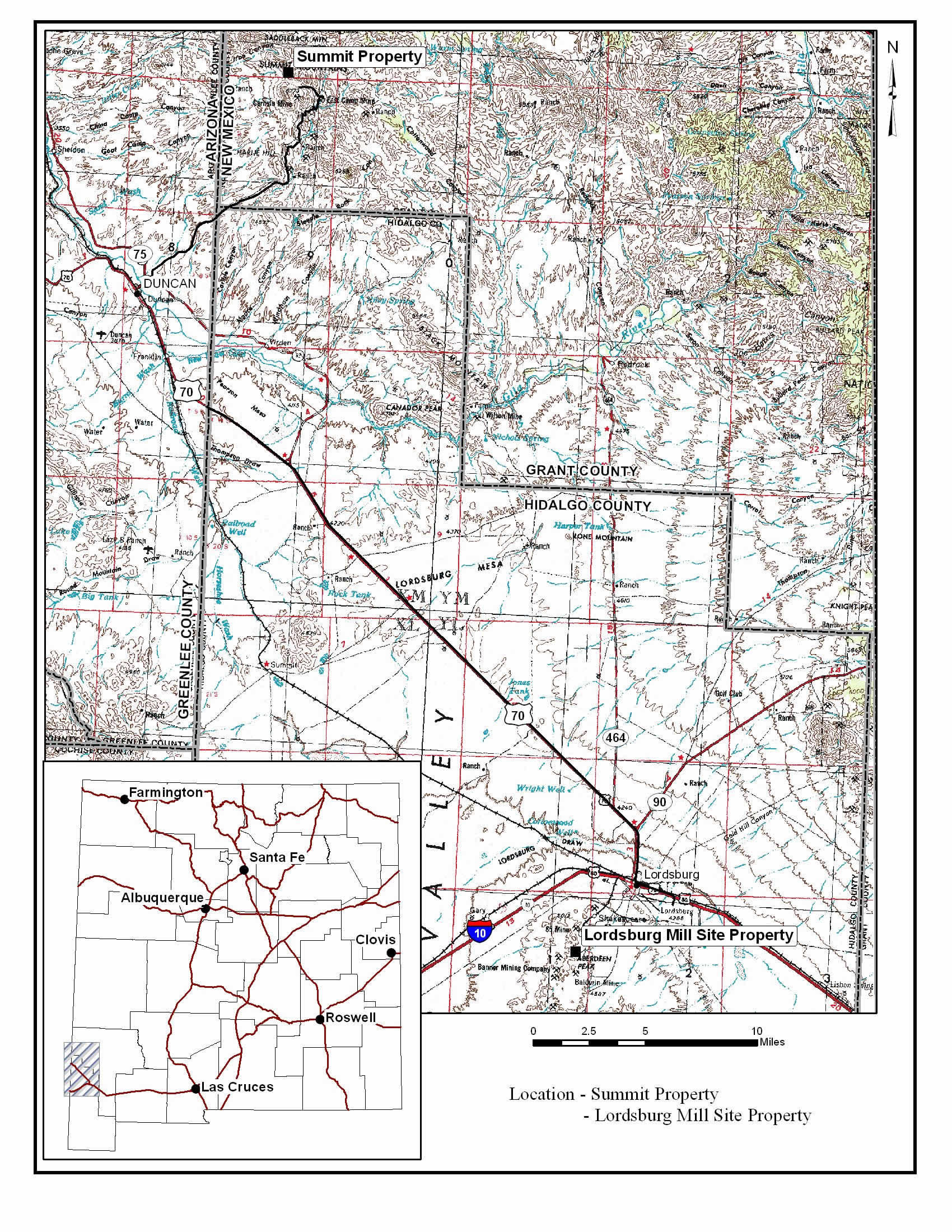

In May 2006, for cash consideration of $1,300,000, we acquired all of the outstanding shares of the Lordsburg Mining Company (“Lordsburg Mining”), a New Mexico corporation, from Imagin Minerals Inc., a privately-held industrial minerals company. We own and operate Lordsburg Mining as a wholly-owned subsidiary. Lordsburg Mining’s primary assets are the underground Summit silver-gold mine and related property consisting of 117 acres of patented mining claims and 740 acres of unpatented mining claims in Grant County, southwestern New Mexico; and the Banner mill, including mineral processing equipment consisting of a crushing and screening plant, a ball mill and a 400 ton-per-day flotation plant, and related property consisting of approximately 1,500 acres of wholly owned and leased patented and unpatented mining claims, located approximately 57 miles south of the Summit mine near Lordsburg, Hidalgo County, New Mexico;

13

Our strategic objective is to develop the Summit project. In April 2007, we received results of an engineering study that concluded the Summit deposit would form the basis of an economically viable underground mining operation. On the basis of the results of the study, we determined to proceed to secure the capital necessary for development, and in December 2007 arranged for financing of $13.5 million by way of a private placement of senior secured convertible debentures. In September 2009, we entered into a gold sale agreement with an investor that included an upfront payment of $4,000,000 in return for sale of a portion of future gold production at a preferential price. In January 2010, we raised $10 million through a registered direct offering pursuant to an S-3 Registration Statement. We used the majority of the funds raised to acquire and construct the Summit mine and Banner mill and for working capital.

Construction of the Banner mill and development of the Summit mine were initiated in Q1 2008, with an anticipated construction period of a minimum of twelve months. The Summit mine development is on-going. Construction of the Banner mill was completed in Q2 2009, except for the tailings dam and impoundment, for which in October 2009 we received a conditional permit allowing construction to proceed. Construction of the tailings disposal impoundment was completed in Q1 2010. We commenced processing operations at the Banner mill on March 25, 2010, and in July 2010 expanded milling operations to two shifts per day, five days per week. Sales of ore as silica flux commenced in Q2 2010 and sales of precious metals flotation concentrates began in Q3 2010. We plan to ramp up production from the Summit mine during the remainder of 2010 and expect to achieve commercial production in 2011.

The Summit mining and processing operation involves underground mining of silver and gold ore from the Summit mine and trucking of the ore 57 miles to the Banner mill site where metallurgical processing takes place. At full production, mining is planned to be carried out at a rate of 400 tons per day (120,000 tons per year). At the Banner site, processing is accomplished through conventional crushing, grinding and selective flotation to yield a bulk sulfide concentrate containing the recoverable precious metals. This concentrate is planned to be marketed to a smelter or to a third-party precious metals processing plant.

Since start-up in March 2010, the mill has demonstrated the ability to produce a high value silver-gold concentrate that averages around 600 ounces per ton silver and 10 ounces per ton gold. We have established trial sales of the concentrate to one smelter and plan to sell concentrate to other smelters as well. We also have shipped trial quantities of beneficiated Summit ore to two Arizona smelters as siliceous flux material, with the objective of reaching agreements on long term contracts. Any sales of siliceous flux material will be in addition to sales of concentrate produced at the Banner mill.

Location and Access

The Summit silver-gold property is located in a rugged and isolated setting in Grant County, southwestern New Mexico, near the Arizona state line. The property lies within the Steeple Rock Mining District, which has recorded notable historic production of gold, silver, base metals and fluorspar from several mines, currently inoperative, including Carlisle, East Camp and Norman King.

The property is accessible by paved and gravel road approximately 15 miles northeast from Arizona State Highway 75 N and the town of Duncan, Arizona. Electric power is not available on or near the property and is generated on-site in connection with the Summit mining operation. Water for limited usage is available on and near the property.

The terrain of the property is rugged, with steep canyons and ridges. Elevations range from 4,500 feet to 6,200 feet above sea level. The Summit siliceous mineralized structure forms a prominent northwesterly trending ridge.

The Banner mill site lies 57 miles to the south of the Summit property near the town of Lordsburg, Hidalgo County, New Mexico. Lordsburg is connected to Duncan, Arizona via US Highway 70. The Banner mill site is accessible from Lordsburg by a 4-mile paved road. Utilities on site include water and electric power. The Lordsburg area is well supported by transportation services including trucking and rail services, and by a wide range of fabrication, construction and other support services. The labor force required for the plant operation can be sourced locally.

14

Figure X.1

Claim Boundary Map

[click for larger version]

15

Mineral Title

Our holdings at the Summit silver-gold property in Grant County, New Mexico consist of 10 patented federal mining claims totaling approximately 117 acres and 62 unpatented federal mining claims totaling approximately 740 acres. Our holdings at and adjacent to the Banner mill site in Hidalgo County, New Mexico consist of 86 wholly-owned patented federal mining claims, 5 wholly-owned unpatented mining claims, 17 leased patented mining claims and 6 leased unpatented mining claims, aggregating approximately 1,500 acres. All wholly-owned claims are held in the name of Lordsburg Mining. The unpatented mining claims are located on public land and held pursuant to the General Mining Law of 1872. We fully own the mining rights and believe the claims are in good standing in accordance with the mining laws of the United States.

In order to maintain our claims in good standing, for our patented mining claims we must pay annual property taxes to Grant and Hidalgo Counties, and for our unpatented mining claims we must pay annual assessment fees to the Bureau of Land Management and record the payment of rental fees with Grant and Hidalgo Counties. We are current on property taxes related to our patented claims. Annual assessment and recording costs for our unpatented claims total approximately $10,500. We have paid the required fees for the 2010 and 2011 assessment years (September 1, 2009 through August 31, 2011).

The Summit property is subject to underlying net smelter return royalties capped at $4,000,000 and to a net-proceeds interest on sales of unbeneficiated mineralized rock with an end price of $2,400,000. The Summit acquisition is subject to a property identification agreement between us and our President and Chief Executive Officer. See Item 13. “Certain Relationships and Related Transactions”.

History

of Mining and Exploration

The Summit silver-gold property lies within the Steeple Rock district, which is one of the historic mining areas in the southwest United States. The former mines produced gold, silver and base metals from underground mining of epithermal vein systems. Prospecting activity dates back to before 1860. The first recorded production was from the Carlisle property, which operated from 1880-1897. A number of other mines including the Norman King and Billali also opened up during the 1880’s but ceased operation by the turn of the century. Following this early production, the district was largely dormant until the 1930’s-mid 1940’s when several mines operated. Subsequently sporadic small-scale operations continued until the 1990’s on various deposits including the Summit, Center, Mount Royal and Carlisle deposits.

The US Bureau of Mines estimated that between 1880 and 1986 the Steeple Rock district produced at least 148,000 ounces of gold, 3.3 million ounces of silver, 1.2 million pounds of copper, and 5 million pounds of lead and 4 million pounds of zinc. In addition, there was unrecorded precious and base metal production as part of silica flux shipments. Some 6,500 tons of fluorspar also were produced.

In the late 1970’s, Summit Minerals Inc. is reported to have shipped about 30,000 tons of mineralized material from the Summit property to ASARCO’s El Paso smelter as direct shipping silica flux grading 0.102 ounces per ton gold and 4.95 ounces per ton silver.

Exploration work estimated to have cost in excess of $8.0 million was carried out on the Summit silver-gold property from 1984-1992. This work included drilling totaling 104,700 feet on the Summit and adjacent structures, of which 78,000 feet was directed to the Summit structure. In 1984-85, Inspiration Mines Inc. reportedly spent about $1.5 million conducting underground development, shallow core drilling and sampling and mapping. In 1988-89, Novagold Resources Inc. reportedly expended approximately $2 million in surface and airborne geophysical surveys, underground mapping and sampling, and core drilling. Novagold’s drilling identified a significant block of mineralized material in the Summit vein. From 1989-1992, Biron Bay Resources Ltd., in joint venture with Novagold, conducted extensive exploration, drilled 88 core holes, and reportedly spent over $5.0 million extending and improving the level of confidence in the mineralized material at the Summit vein and in defining exploration potential in adjacent and outlying vein structures.

16

Geology and Mineralization

The Steeple Rock district contains numerous structurally controlled epithermal vein systems. The veins are controlled by conjugate fault systems that cut a thick pile of Tertiary volcanic rocks of intermediate composition. The deposits are localized along structurally controlled, hydrothermally altered zones cutting the volcanic host rocks. The dominant structures trend northwesterly and dip steeply. Secondary veins trend easterly and north-northwesterly. The veins can be traced for distances of up to several miles along strike and have widths that range up to 100 feet or more.

The epithermal veins have formed as open-space filling by a mixture of quartz, carbonate minerals and wallrock fragments and show evidence of multiple episodes of brecciation and re-cementation. Gold occurs as fine free grains or as electrum. Silver is found as argentite or in sulfosalts. Base metal sulfides including chalcopyrite, sphalerite and galena are common in certain deposits but rare in others. Gangue minerals usually consist of quartz, pyrite, calcite, barite and fluorite. Alteration of the volcanic country rocks adjacent to the veins commonly consists of sericitization, argillization and silicification.

The principal vein structure on the Summit silver-gold property is the Summit structure, which can be traced for 3,000 feet from southeast to northwest. The Billali structure forms a farther 2,000 foot continuation of the Summit structure in a northwesterly direction across an east-west fault. The Summit and Billali structures dip steeply to the northeast. These structures form segments of the East Camp Fault, which constitutes the main ore control in this part of the Steeple Rock district. The core drilling carried out from 1984-1992 tested both the Summit and Billali vein structures. Of the two, results from the Summit structure were the more promising with respect to vein continuity and economic potential.

The Summit mineralized vein occurs within a wide, structurally controlled zone of hydrothermally altered volcanic rocks. Silver and gold mineralization is epithermal in style and consists of silver sulfides and electrum or native gold along with lesser pyrite, sphalerite and chalcopyrite. Precious metals contents, which are relatively low at the surface, increase significantly with depth for several hundred feet, apparently a reflection of vertical mineral zoning within the deposit. Below 1,000-1,500 feet, the precious metals contents appear to decrease although little deeper drilling was carried out. The main block of mineralized material, which occurs along the footwall of the structure, has been shown by extensive drilling to trend northwesterly about 1,500 feet in strike length and to extend 1,000 feet down dip. The true width of mineralization across the footwall mineralized zone ranges from 6 feet to over 50 feet and averages 10-15 feet.

Ore Reserve

In October 2009, Chapman, Wood and Griswold, Inc. (“CWG”), an independent geological engineering firm, completed a Technical Report on the Summit project compliant with Canada’s National Instrument 43-101 Standards of Disclosure for Mineral Projects. Based on the work carried out for that report, in February 2010, CWG concluded that a portion of the mineralization in the footwall zone could be classified as a Probable Reserve under the SEC’s Industry Guide 7, as follows:

| Probable Reserve (Footwall Zone) | |||||||||||||||

| Tons | Grade (oz/ton)(1) | Contained ounces | |||||||||||||

| Au | Ag | Au | Ag | ||||||||||||

| Inplace, diluted(2)(3) | 686,750 | 0.143 | 10.78 | 98,205 | 7,403,165 | ||||||||||

| Minable @ 90% extraction | 618,075 | 0.143 | 10.78 | 88,385 | 6,662,848 | ||||||||||

| Ounces in conc. at 80% rec. | 70,708 | 5,330,279 | |||||||||||||

| (1) |

Assays cut to 0.45 oz Au/t and 45.0 oz Ag/ton |

| (2) |

Diluted with 1.0 foot at grade on each wall. Minimum 6.0-foot horizontal width. |

| (3) |

Cutoff grade 0.16 oz Au equivalent per ton, using a 60:1 gold-silver price ratio and equivalent recoveries for gold and silver. |

17

Mineralized Material

During the evaluation of the Summit Mine mineral resource base, CWG noted significant quantities of mineralized material that cannot be classified as Reserves, as follows:

| Tons | Grade (oz/ton) | ||||||||||

| Au | Ag | ||||||||||

| 1. | Single-hole, isolated blocks within the footwall zone; inplace, diluted. | 71,380 | 0.144 | 5.44 | |||||||

| 2. | Mineralization peripheral to the Probable Reserve in the footwall zone; inplace, diluted. | 370,000 | 0.067 | 4.19 | |||||||

| 3. | Mineralization in a hangingwall section of the structure; inplace, undiluted at a 5-foot minimum horizontal width. | 196,000 | 0.092 | 3.80 | |||||||

CWG stated this mineralized material has the potential to be upgraded to Reserve status at current metal prices (approximately $1000 and $16 per ounce for gold and silver, respectively) following further definition by drilling and/or underground development.

Project Economic Estimate

Using capital and operating costs from CWG’s October 2009 Technical Report, and based on the Probable Reserves stated above, three-year (2007-2009) historic average gold and silver prices respectively of $846.57 and $14.34 per ounce, metallurgical recovery of 85 percent, and after payment of royalties and allowing for payments under a gold sale agreement, estimated Summit revenues over a six year mine life would total approximately $146 million and pre-tax net income would total approximately $77 million. Payback of capital would be achieved in 19 months after the commencement of production. The Company has approximately $48.4 million in federal tax loss carry-forwards to shelter federal income tax otherwise payable. Direct operating costs were estimated as $84.50 per ton of ore milled. The capital cost to bring the mine into production was estimated as $15.1 million, inclusive of mine development, mill construction, bonding requirements, and project management and working capital.

Metallurgical Testing

Conventional processing including crushing, grinding and milling of Summit mineralized material to produce a bulk sulfide flotation concentrate containing the recoverable precious metals has been evaluated and tested at bench scale. Based upon preliminary bench scale flotation tests, we believe that a precious metals recovery of approximately 80-86% with a concentration ratio of 70 to 1 is reasonably achievable. We believe that the concentrate could be treated to produce a dore product or alternatively, it could be marketed to a smelter or to a third-party precious metals processing operation for final extraction of gold and silver.

Mineral Processing Equipment

With the purchase of Lordsburg Mining in May 2006, we acquired an inactive 400 ton-per-day flotation plant, including ball mill and ancillary equipment. Subsequently, in June 2008, we purchased crushing, screening and conveying equipment. In order to utilize the flotation plant for mineral processing, we transported it from its previous location near Winston, Sierra County, New Mexico, refurbished it as necessary and erected it at the Banner mill site in Hidalgo County. In addition to the processing equipment acquired in 2006, we also acquired and installed other necessary equipment.

Permits

With the purchase of Lordsburg Mining in 2006, we acquired existing operating permits for the Summit property and the Banner mill site. The New Mexico Mining and Minerals Division issued these permits to Lordsburg Mining pursuant to the New Mexico Mining Act. We have modified and revised these permits as necessary to begin operations as necessary to facilitate the commencement of mining at the Summit property and resumption of mineral processing operations at the Banner mill site.

18

Permit No. GR001ME at the Summit mine allows operation of a “minimal impact mine”. As surface disturbance expands, it will be necessary to modify the permit and to post financial assurance for reclamation. Pursuant to the current permit, we have begun underground mining operations.

Permit No. H1001RE at the Banner mill site is for an “existing mining operation” and authorizes us to conduct mining and reclamation operations according to the conditions stipulated in the permit. All proposed mining disturbances are required to be addressed under a closeout plan and to be secured by financial assurance. Our modification and revision of the permit allows resumption of flotation milling, construction of a tailings impoundment and discharge of tailings. We also have obtained or will apply for other necessary permits, including air quality permits for the Banner mill and Summit mine. The major permits required to begin operations have been granted, however we anticipate that other permits for which we may apply will require a minimum of several months to obtain, and there can be no assurance that approval will be obtained in a timely manner, if at all.

Preliminary Feasibility Study

In April 2007, we received results of an engineering study carried out by the independent geological engineering firm of Chapman, Wood and Griswold, Inc., of Albuquerque, New Mexico. CWG concluded that the Summit deposit would form the basis of an economically viable underground mining operation.

CWG used an estimation of minable mineralized material for their study of 758,000 tons grading 10.28 ounces of silver per ton and 0.143 ounces of gold per ton in the main footwall zone. This estimation was adopted from a previous estimation carried out by St. Cloud Mining Co., and represents in-place, diluted, minable mineralization with a minimum six-foot horizontal width, based on results of assays from core holes and samples of underground workings. All high assay values were cut to 45.0 ounces of silver and 0.45 ounces of gold per ton. The CWG 2007 report was prepared in accordance with standards different than those prescribed by rules of the SEC. The SEC only permits the disclosure of proven or probable reserves.

The Summit mining and processing operation is planned to involve underground mining of mineralized material from the Summit property at a rate of 400 tons per day (120,000 tons per year) and trucking of the mined material 57 miles to the Banner mill site where metallurgical processing will take place. At the Banner site processing will be accomplished through conventional crushing, grinding and selective flotation to yield a high-grade bulk sulfide concentrate containing the recoverable precious metals. The concentrate will be marketed to one of the area’s copper smelters or to a third-party precious metals processing plant.

CWG prepared a mine design that employs rubber-tired equipment to gain access to the minable mineralization through two declines, one on each end of the deposit, which would be driven from existing headings to and along the mineralized structure to a connecting point in the central part of the deposit. Further development of the deposit would continue by extending a decline to the lower limits of mineralization. Sufficient longhole drilling and trial extraction methods would be done to further plan the operation.

Potential Expansion of Proposed Initial Operation

Establishment of the proposed mining operation at Summit potentially would allow the Company to further expand the current base of mineralized material at the Summit deposit and to develop other properties in the Steeple Rock mining district. The Banner flotation mill at Lordsburg also might generate mining and processing opportunities from our ground holdings adjacent to the Banner mill site in the Virginia mining district and/or from surrounding mining districts, several of which historically have yielded substantial production of base and precious metals.

Development Activities

In December 2007 we arranged for the $13.5 million in capital necessary for project development. We began construction activities in Q1 2008 and estimated a minimum of 12 months would be required for construction and execution of the major elements of the mining and processing plan described above.

19

At the Summit mine, a seven hundred foot long 12’ x 12’ decline ramp intersected the predicted mineralized body in February 2009. Since then, we have proceeded to drive two development headings in the main mineralized structure, one an incline to the southeast planned to intersect old workings and to serve as a secondary escape and a source of additional ventilation, and the other a decline to the northwest toward additional mineralized bodies identified in previous drilling. The southeastern heading achieved its objectives in October 2009. The northwestern heading encountered the southern extensions of the predicted mineralized bodies in August 2009. Several thousand feet of underground development has been accomplished and work is proceeding on several headings. Stope development and test mining of ore bodies is underway, with the objective of ramping up production to the full production rate of 400 tons per day during 2011. Assays of mineralized bodies encountered to date show variable silver and gold values, with occasional very high grades encountered, as is to be expected from this style of epithermal mineralization. Assay results when averaged are consistent with the grades expected from previous estimates. The better grade material encountered in mine development activities is segregated at the mine and trucked to the Lordsburg mill site. Development operations are proceeding on the basis of two 10-hour shifts five days a week.

At the Banner mill, construction was essentially completed in Q2 2009, except for the tailings disposal impoundment. We experienced a delay in obtaining a permit necessary for construction of the tailings disposal impoundment. In October 2009 we obtained a conditional permit allowing us to begin construction of the tailings disposal impoundment. Construction of the impoundment was completed in Q1 2010. Processing operations at the Banner mill commenced on March 25, 2010. Commissioning of the mill proceeded satisfactorily and operations were expanded to two shifts per day, five days per week beginning in July 2010. Sales of ore as silica flux commenced in Q2 2010 and sales of precious metals flotation concentrates began in Q3 2010. Ramp-up of mill throughput is planned to occur over a period of the next several months in conjunction with increased output from the Summit mine. We expect that the Summit project will achieve commercial production in 2011.

Ortiz Gold Project

Overview

In August 2004, we acquired exclusive rights for exploration, development and mining of gold and other minerals on 57,267 acres (approximately 90 square miles) of the Ortiz Mine Grant in Santa Fe County, New Mexico. In November 2007, we relinquished 14,970 acres and retained under lease 42,297 acres (66 square miles). In December 2005, we received the results of an independent scoping study of the Carache and Lucas gold deposits. The study assessed various processing options for development and provided estimations of capital and operating costs for each option. The report concluded that the financial results indicate a favorable gold project employing high pressure grinding rolls with gravity recovery and contract mining. The report also stated that considerable upside exists in estimations of mineralized material in both contained ounces and grade.

Based on these results, we are proceeding to further examine mining and processing options and plan to continue this work over the next 12 months. We also intend to conduct an assessment of permitting and environmental issues. We have budgeted $500,000 for the planned work. We currently have not established proven or probable reserves on the Ortiz gold property.

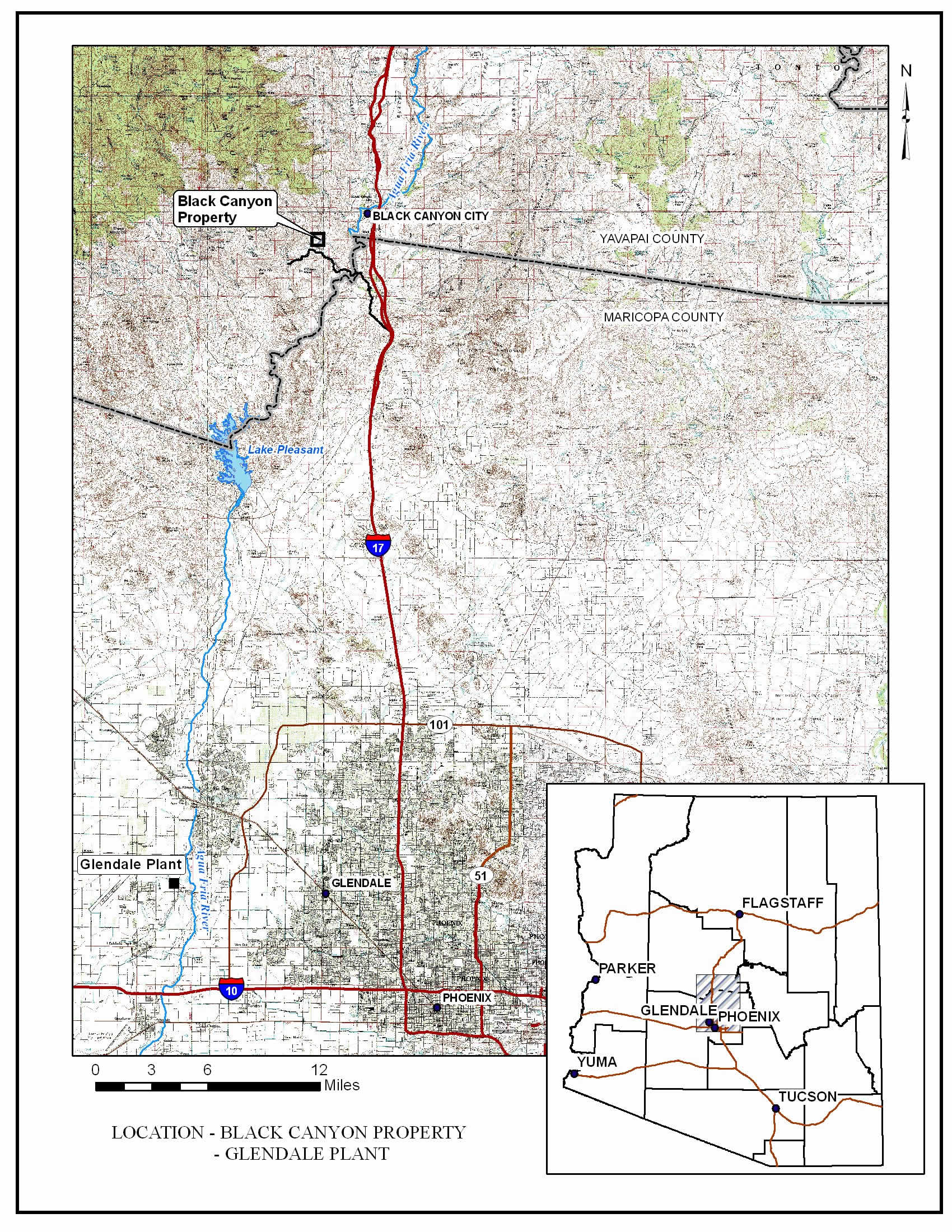

Location and Access