Attached files

| file | filename |

|---|---|

| EX-4.2 - EXHIBIT 4.2 - Kaspien Holdings Inc. | ex4_2.htm |

| EX-32 - EXHIBIT 32 - Kaspien Holdings Inc. | ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - Kaspien Holdings Inc. | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Kaspien Holdings Inc. | ex31_1.htm |

| EX-23 - EXHIBIT 23 - Kaspien Holdings Inc. | ex23.htm |

| EX-21 - EXHIBIT 21 - Kaspien Holdings Inc. | ex21.htm |

| EX-10.17 - EXHIBIT 10.17 - Kaspien Holdings Inc. | ex10_17.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED FEBRUARY 1, 2020

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

FOR THE TRANSITION PERIOD FROM ………… TO …………

COMMISSION FILE NUMBER: 0-14818

TRANS WORLD ENTERTAINMENT CORPORATION

(Exact name of registrant as specified in its charter)

|

New York

|

14-1541629

|

|

|

State or Other Jurisdiction of Incorporation or Organization

|

I.R.S. Employer Identification No.

|

|

|

2818 N. Sullivan Rd. Ste 30

Spokane, WA 99216

|

12203

|

|

|

Address of Principal Executive Offices

|

Zip Code

|

(855) 300-2710

Registrant’s Telephone Number, Including Area Code

Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report

38 Corporate Circle

Albany, NY 12203

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value per share

|

TWMC

|

NASDAQ Stock Market

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of August 2, 2019, the last business day of the Company’s most recently completed second fiscal quarter, 1,816,061 shares of the Registrant’s Common Stock were issued and outstanding. The aggregate market value of

the voting stock held by non-affiliates of the Registrant, based upon the closing sale price of the Registrant’s Common Stock on August 2, 2019, was $10,569,475. As of May 29, 2020, there

were 1,825,198 shares of Common Stock issued and outstanding.

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934

subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

DOCUMENTS INCORPORATED BY REFERENCE:

None.

PART I

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to analyses and other information that are based on forecasts of future results and estimates of

amounts not yet determinable. These statements also relate to the Trans World Entertainment Corporation’s (“the Company’s”) future prospects, developments and business strategies. The statements contained in this document that are not statements of

historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, and similar terms and phrases, including references to assumptions, in this document to identify forward-looking

statements. These forward-looking statements are made based on management’s expectations and beliefs concerning future events and are subject to uncertainties and factors relating to our operations and business environment, all of which are

difficult to predict and many of which are beyond the Company’s control, that could cause actual results to differ materially from those matters expressed in or implied by these forward-looking statements. The following factors are among those that

may cause actual results to differ materially from the Company’s forward-looking statements.

|

• continued operating losses;

• impact of the novel coronavirus identified as “COVID-19” on our business and operating results;

• the ability of the Company to satisfy its liabilities and to continue as a going concern;

• our ability to realize the benefits of recent divestitures;

• maintaining etailz’s segment relationship with Amazon;

• decline in the Company’s stock price;

• the limited public float and trading volume for our Common Stock;

• new product introductions;

• advancements in technology;

• dependence on key employees, the ability to hire new employees and pay competitive wages;

|

• the Company’s level of debt and related restrictions and limitations;

• future cash flows;

• vendor terms;

• interest rate fluctuations;

• access to third party digital marketplaces;

• adverse publicity;

• product liability claims;

• changes in laws and regulations;

• breach of data security;

• increase in Amazon Marketplace fulfillment and storage fees;

• the other matters set forth under Item 1A “Risk Factors,” Item 7 “Management’s Discussion and Analysis of Financial

Condition and Results of Operations”, and other sections of this Annual Report on Form 10-K

|

The reader should keep in mind that any forward-looking statement made by us in this document, or elsewhere, pertains only as of the date on which we make it. New risks and uncertainties come up from time-to-time and it is impossible for us to

predict these events or how they may affect us. In light of these risks and uncertainties, you should keep in mind that any forward-looking statements made in this report or elsewhere might not occur.

1

In addition, the preparation of financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires us to make estimates and assumptions. These estimates and assumptions affect:

| • |

the reported amounts and timing of revenue and expenses,

|

| • |

the reported amounts and classification of assets and liabilities, and

|

| • |

the disclosure of contingent assets and liabilities.

|

Actual results may vary from our estimates and assumptions. These estimates and assumptions are based on historical results, assumptions that we make, as well as assumptions by third parties.

Reverse Stock Split

On August 15, 2019, we completed a 1-for-20 reverse stock split of our outstanding Common Stock. As a result of this stock split, our issued and outstanding Common Stock decreased from 36,291,620 to 1,814,581 shares.

Accordingly, all share and per share information contained in this report has been restated to retroactively show the effect of this stock split.

| Item 1. |

BUSINESS

|

Company Background

Trans World Entertainment Corporation, which, together with its consolidated subsidiaries, is referred to herein as the “Company”, “we”, “us” and “our”, was incorporated in New York in 1972. We own 100% of the outstanding Common Stock of Trans

World NY Sub, Inc. (f/k/a Record Town, Inc.) and etailz, Inc. See below for additional information.

Our Reportable Segments

During 2019, the Company operated our business in two segments:

etailz Segment (“etailz”)

etailz provides a platform of software and services to empower brands to grow their online distribution channels on digital marketplaces such as Amazon, Walmart, eBay, among others. The Company helps brands achieve their online retail goals

through its innovative and proprietary technology, tailored strategies and mutually beneficial partnerships.

For Your Entertainment Segment (“fye”)

The fye segment operates retail stores and two e-commerce sites selling entertainment products, including trend, video, music, electronics and related products in the United States.

As of February 1, 2020, the fye segment operated 200 stores primarily in malls totaling approximately 1.1 million square feet in the United States, the District of Columbia and the U.S. Virgin Islands predominantly

under the For Your Entertainment brand.

The fye segment operates two retail web sites, www.fye.com and www.secondspin.com. fye.com carries entertainment products, including trend, video, music,

electronics and related products. SecondSpin.com is a leading seller of used CDs, DVDs, and Blu-Ray online and carries one of the largest catalogs of used media available online.

On February 20, 2020, the Company consummated the sale of substantially all of the assets and certain of the liabilities relating to fye to a subsidiary of 2428391 Ontario Inc. o/a Sunrise Records (“Sunrise Records”) pursuant to an Asset Purchase

Agreement (as amended, the “Asset Purchase Agreement”) dated January 23, 2020, by and among the Company, Record Town, Inc., Record Town USA LLC, Record Town Utah LLC, Trans World FL LLC, Trans World New York, LLC, 2428392 Inc., and Sunrise Records.

(the “FYE Transaction”).

2

All of our financial information for fiscal 2019 includes the fye segment. For pro forma information, see Note 13 of the Notes to the Consolidated Financial Statements.

Business Overview

etailz Segment

etailz provides a platform of software and services to empower brands to grow their online distribution channel on digital marketplaces such as Amazon, Walmart, and eBay, among others. etailz empowers brands to achieve their online retail goals

through its innovative, proprietary technology, tailored strategies and mutually beneficial partnerships.

etailz is positioning itself to be a brand’s ultimate online growth partner and are guided by six core principles:

| Partner Obsession |

Insights Driven

|

| Simplicity |

Innovation

|

| Results | Ownership |

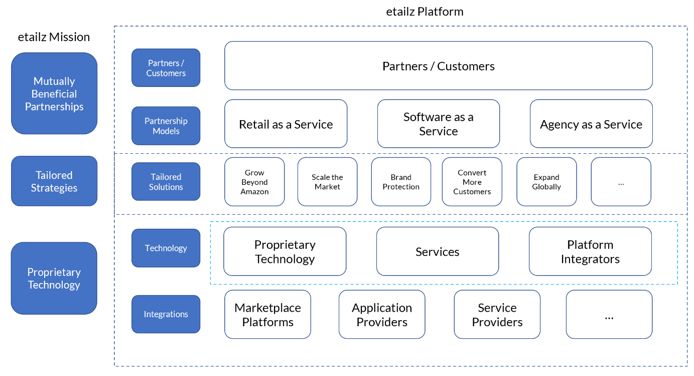

A high-level overview of the etailz platform is shown in Figure 1.

Figure 1: etailz platform of products and services

3

Partners

etailz’s partners include brands, suppliers, distributors, liquidators, and affiliates such as venture capital firms and marketing agencies. At the end of fiscal 2019 and following its vendor rationalization effort,

etailz had 1,039 partners.

Tailored Solutions

etailz’s customizable solutions for its partners include, but are not limited to, scaling the market, growing beyond Amazon, protecting a brand, expanding globally, converting more customers, and launching new products. etailz uses its platform to

customize solutions to cater to partner needs.

Partnership Models

etailz works with partners in three different partnership models:

Retail as a Service: In this model, etailz buys inventory and sells it on marketplaces such as Amazon, Walmart and eBay as a third-party seller. Additionally, etailz

supports dropship integrations with various suppliers and distributors and incubates its own brands. At the end of fiscal 2019, etailz had a total of 6 incubated brands – Jump Off Joe, Brilliant Bee, Big Betty, Domestic Corner, Coy Beauty and Keto.

In Retail as a Service, etailz’ business model is the same as that of a wholesale retailer.

Agency as a Service: In this model, etailz serves as an extension of a partner’s e-commerce team providing full service and managed services in the areas of inventory

management, marketing management, creative, brand control, tax, compliance and other marketplace growth services. etailz charges a subscription fee and receives a percentage of the revenue generated.

Software as a Service: In this model, etailz provides partners access to software through its platform of proprietary technology to empower partners to self-manage their

marketplace channel. etailz charges a subscription fee and receives a percentage of the transaction.

By offering a platform of software and services, etailz intends to diversify its risk and leverage its assets to capture more market share.

The “Agency as a Service” and “Software as a Service” models are collectively called “Subscriptions.”

Technology and Integrations

etailz’s marketplace growth platform of software and services is a one stop shop insights driven platform across the categories of brand protection, logistics, inventory management, pricing, digital marketing, creative, tax and compliance among

others, all accessible through a centralized portal. The platform has been developed over a period of 12 years and over $800 million in revenue has been processed through the platform.

The platform uses an insight driven approach to digital marketplace retailing using proprietary software. Using data collected from marketplaces, optimal inventory thresholds and purchasing trends are calculated within its advanced inventory

management software developed in-house. etailz also has proprietary software related to pricing, advertisement management, marketplace seller tracking and channel auditing.

Additionally, the platform can be extended to various software and service providers, thereby enabling a network of partner integrations. As of January 31, 2019, etailz had formed a strategic partnership with third party logistics provider,

Deliverr and tax provider – TaxCloud. In 2020, etailz intends to expand this to companies: MyFBAPrep and VantageBP among others.

The platform lends itself to network effects. The more partners etailz has on its platform, the more data and insights it can collect. The more insights it gets, more products and services it can serve its partners and more marketplace

integrations it can support. The more marketplace providers that can be integrated, the more partners etailz can acquire. This facilitates rapid scale.

4

Business Environment

Digital marketplaces allow consumers to shop from a variety of merchants in one place and have become an integral part of many brand manufacturers’ businesses.

In the US, total estimated e-commerce sales for 2020 are projected at $604 billion, an increase of 9% from 2019. e-commerce sales in 2019 accounted for 11% of total retail sales as compared to 10% of total retail sales for 2018. Top marketplaces

in the US include Amazon.com (2.3 billion visits per month), eBay.com (600 million visits per month) and Walmart.com (450 million visits per month). In 2019, Amazon represented 47% of U.S. retail e-commerce sales. Amazon’s third-party business is

growing faster than its first party business . As of 2019, the compound annual growth rate for Amazon’s third-party business was 52%, compared to 25% for its retail business.

There are several drivers of this growth including consumer preference for convenience, selection, personalization, opportunities, the ability to price compare, and delivery speed that are only found via e-commerce.

Globally, e-commerce sales are growing faster than physical store sales. According to global retail e-commerce statistics, e-commerce sales are projected to grow to $6.5 trillion, or 22% of total retail, by 2023 from $3.5 trillion in 2019, or 14.1

of total retail. At the end of 2019, China represented 54% of total global e-commerce sales, followed by the US at 16% and United Kingdom at 4%.

Globally, etailz sells on marketplaces in the United States (amazon.com, walmart.com, ebay.com, google.com, sears.com, jet.com, pricefalls.com, overstock.com, and wish.com ), the United Kingdom (amazon.uk), Germany (amazon.de) Canada (amazon.ca)

and India (amazon.in). In 2020, etailz intends to expand its selling to marketplaces in Japan and Mexico.

Competition and Strategic Positioning

etailz operates in a category within e-commerce called “Marketplace Growth Software and Services”. Businesses in this category provide services to brands and other sellers to facilitate growth on marketplaces. The market is very fragmented, and

most providers are focused on a few focus areas where sellers have support needs. Subcategories in this market include: Account and Marketing Services, Supply Chain and Logistics Providers, Manufacturers and Product Suppliers, Legal Services and

Accounting, Tax and Financial Services. In the Account and Marketing Services subcategory, services are further divided into retail services, agency services and software services. This is analogous to etailz’s business models – Retail as a Service,

Agency as a Service and Software as a Service.

etailz positions itself as a comprehensive and fully customizable platform of software and services tailored towards online marketplace growth. etailz’s core focus is on the Account and Marketing Services subcategory and competes in this

subcategory with Software Providers, Agencies and Retailers.

Revenue Distribution

etailz’s primary source of revenue is through its “Retail as a Service” business, specifically as a third-party seller on the Amazon US marketplace (96% of net revenue in fiscal 2019). The remaining revenue is generated from other marketplaces

including Amazon International, Walmart and eBay.

Approximately 66% of total etailz’s revenue in fiscal 2019 was generated by four major categories: health & personal care; home/kitchen/grocery; tools/office/outdoor; and pets & sporting goods.

5

In October 2019, etailz put increased focus on its subscription business (“Agency as a Service” and “Software as a Service”). As of January 31, 2020, the total number of subscription partners was 31 generating less

than 1% of net revenue in fiscal 2019. etailz expects continued growth in the subscription business in fiscal 2020.

Employees

As of February 1, 2020, etailz employed approximately 155 people, of whom approximately 148 were employed on a full-time basis. At the end of fiscal 2019, etailz had department heads in the areas of marketing, operations, sales, account

management, human resources, accounting, FP&A, warehouse operations, compliance, and engineering.

Customer Acquisition

etailz acquires its partners through a combination of brand building, inbound digital marketing, and outbound sales, as well as using its proprietary data platform to identify brands that would be good strategic fits for its services. etailz

utilizes content marketing to strengthen its visibility within the industry. etailz’s public relations efforts consist of press releases, articles in industry publications, and articles on its website to build its brand.

In addition, etailz regularly runs advertisements on popular ad platforms such as Google, Facebook, Twitter and LinkedIn to bring leads into its sales funnels.

Trademarks

The trademark etailz is registered with the U.S. Patent and Trademark Office and is owned by etailz. We believe that our rights to this trademark is adequately protected. We hold no material patents, licenses, franchises, or concessions; however,

our established trademark is essential to maintaining our competitive position.

Available Information

The Company’s headquarters are located at 2818 N. Sullivan Road, Suite 130, Spokane Valley, WA 99216, and its telephone number is (855)-300-2710. The Company’s corporate website address is www.twec.com. The Company

makes available, free of charge, its Exchange Act Reports (Forms 10-K, 10-Q, 8-K and any amendments thereto) on its web site as soon as practical after the reports are filed with the Securities and Exchange Commission (“SEC”). The public may read and

copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The

SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. This information can be obtained from the site http://www.sec.gov. The Company’s

Common Stock, $0.01 par value, is listed on the NASDAQ Capital Market under the trading symbol “TWMC”.

| Item 1A. |

RISK FACTORS

|

The following is a discussion of certain factors, which could affect the financial results of the Company.

Risks Related to Our Business and Industry

If we cannot successfully implement our business strategy our growth and profitability could be adversely impacted.

6

Our future results will depend, among other things, on our success in implementing our business strategy.

During the third quarter of 2019, based on recurring losses from operations, the expectation of continuing operating losses for the foreseeable future, and uncertainty with respect to any available future funding, the

Company concluded that there was substantial doubt about the Company’s ability to continue as a going concern. As a response, the Company pursued several strategic initiatives towards its strategy of shifting its focus solely to the operation of

etailz, improving profitability and meeting future liquidity needs and capital requirements. The following initiatives were completed during the first quarter of 2020:

| • |

The sale of the For Your Entertainment (fye) business;

|

| • |

The establishment of a new secured $25 million revolving credit facility (the “New Credit Facility”) with Encina Business Credit, LLC (“Encina”);

|

| • |

The execution of a separate subordinated loan agreement for etailz, Inc. (the “Subordinated Loan”); and

|

| • |

The receipt by etailz, Inc. of loan proceeds pursuant to the Paycheck Protection Plan (the “PPP Loan”) under the Coronavirus Aid, Relief, and Economic Security Act.

|

Notwithstanding the foregoing, the ability of the Company to meet its liabilities and to continue as a going concern is dependent on improved profitability, the continued implementation of the strategic initiative to

reposition etailz as a platform of software and services, the availability of future funding, implementation of one or more corporate initiatives to reduce costs at the parent company level (which could include a voluntary delisting from NASDAQ and

deregistering of our Common Stock in order to substantially eliminate the costs associated with being a public company), satisfying all unassumed liabilities of the fye segment and other strategic alternatives, including selling all or part of the

remaining business or assets of the Company, and overcoming the impact of the COVID-19 pandemic.

There can be no assurance that we will be successful in further implementing our business strategy or that the strategy, including the completed initiatives, will be successful in sustaining acceptable levels of

sales growth and profitability. As a result, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern for a period of one year after the date of filing of this Annual Report on

Form 10-K. In addition, the proceeds from the PPP Loan are subject to audit and there is a risk of repayment.

A pandemic, epidemic or outbreak of an infectious disease, such as COVID-19, may materially and adversely affect our business.

Our business, results of operations, and financial condition may be materially adversely impacted if a public health outbreak, including the recent COVID-19 pandemic, interferes with our ability,

or the ability of our employees, contractors, suppliers, and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business.

7

The COVID-19 pandemic has adversely affected and may continue to adversely affect the economies and financial markets worldwide, resulting in an economic downturn that could impact

our business, financial condition and results of operations. As a result, our ability to fund through public or private equity offerings, debt financings, and through other means at acceptable terms, if at

all, may be disrupted, in the event our financing needs for the foreseeable future are not able to be met by our New Credit Facility, balances of cash, cash equivalents and cash generated from operations.

In addition, the continuation of the COVID-19 pandemic and various governmental responses in the United States has adversely affected and may continue to adversely affect our business operations,

including our ability to carry on business development activities, restrictions in business-related travel, delays or disruptions in our on-going projects, and unavailability of the employees of the Company or third-parties with whom we conduct

business, due to illness or quarantines, among others. Our business was negatively impacted by disruptions in our supply chain, which limited our ability to source merchandise, and limits on products fulfillment placed by Amazon. The extent to which

COVID-19 could impact our business will depend on future developments, which are highly uncertain and cannot be predicted with confidence, and will depend on many factors, including the duration of the outbreak, the effect of travel restrictions and

social distancing efforts in the United States and other countries, the scope and length of business closures or business disruptions, and the actions taken by governments to contain and treat the disease. As such, we cannot presently predict the

scope and extent of any potential business shutdowns or disruptions. Possible effects may include, but are not limited to, disruption to our customers and revenue, absenteeism in our labor workforce, unavailability of products and supplies used in

our operations, shutdowns that may be mandated or requested by governmental authorities, and a decline in the value of our assets, including various long-lived assets.

Continued increases in Amazon Marketplace fulfillment and storage fees could have an adverse impact on our profit margin and results of operations.

etailz utilizes Amazon’s Freight by Amazon (“FBA”) platform to store their products at the Amazon fulfillment center and to pack and distribute these products to customers. If Amazon continues to increase its FBA fees,

our profit margin for the etailz segment could be adversely affected.

The Company’s business is influenced by general economic conditions.

The Company’s performance is subject to general economic conditions and their impact on levels of discretionary consumer spending. General economic conditions impacting discretionary consumer spending include, among

others, wages and employment, consumer debt, reductions in net worth, residential real estate and mortgage markets, taxation, fuel and energy prices, interest rates, consumer confidence and other macroeconomic factors.

Consumer purchases of discretionary items generally decline during recessionary periods and other periods where disposable income is adversely affected. A downturn in the economy affects retailers disproportionately,

as consumers may prioritize reductions in discretionary spending, which could have a direct impact on purchases of our products and services and adversely impact our results of operations. In addition, reduced consumer spending may drive us and our

competitors to offer additional products at promotional prices, which would have a negative impact on gross profit.

8

Disruption of global capital and credit markets may have a material adverse effect on the Company’s liquidity and capital resources.

Distress in the financial markets has in the past and can in the future result in extreme volatility in security prices, diminished liquidity and credit availability. There can be no assurance that our liquidity will

not be affected by changes in the financial markets and the global economy or that our capital resources will at all times be sufficient to satisfy our liquidity needs.

Because of our floating rate credit facility, we may be adversely affected by interest rate changes.

Our financial position may be affected by fluctuations in interest rates, as the New Credit Facility is subject to floating interest rates. Interest rates are highly sensitive to many factors, including governmental

monetary policies, domestic and international economic and political conditions and other factors beyond our control. As we borrow against our credit facility, a significant increase in interest rates could have an adverse effect on our financial

position and results of operations.

The Company is dependent upon access to capital, including bank credit facilities and short-term vendor financing, for its liquidity needs.

The Company must have sufficient sources of liquidity to fund its working capital requirements and indebtedness. Based on its recurring losses from operations, expectation of

continuing operating losses, and uncertainty with respect to any available future funding, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern for a period of one year after the date of

filing of this Annual Report on Form 10-K.

The future availability of financing will depend on a variety of factors, such as economic and market conditions, the availability of credit and the Company’s credit rating, as well as the Company’s reputation with

potential lenders. These factors could materially adversely affect the Company’s ability to fund its working capital requirements, costs of borrowing, and the Company’s financial position and results of operations would be adversely impacted.

Historically, we have experienced declines and we may continue to experience fluctuation in our level of sales and results from operations.

A variety of factors has historically affected, and will continue to affect, our sales results and profit margins. These factors include general economic conditions; competition; actions taken by our competitors;

consumer trends and preferences; access to third party marketplaces; and new product introductions and changes in our product mix.

There is no assurance that we will achieve positive levels of sales and earnings growth, and any decline in our future growth or performance could have a material adverse effect on our business and results of

operations.

The ability of the Company to satisfy its liabilities and to continue as a going concern will continue to be dependent on the implementation of several items, the success of which is not certain.

The Company has suffered recurring losses from operations and the Company’s primary sources of liquidity are borrowing capacity under its revolving credit facility, available cash and cash equivalents, all of which are

limited. Therefore, the ability of the Company to meet its liabilities and to continue as a going concern is dependent on, among other things, improved profitability, the continued implementation of the strategic initiative to reposition etailz as a

platform of software and services, the availability of future funding, implementation of one or more corporate initiatives to reduce costs at the parent company level (which could include a voluntary delisting from NASDAQ and deregistering of our

Common Stock in order to substantially eliminate the costs associated with being a public company), satisfying all unassumed liabilities of the fye segment and other strategic alternatives, including selling all or part of the remaining business or

assets of the Company, and overcoming the impact of the COVID-19 pandemic.

There can be no assurance that we will be successful in further implementing our business strategy or that the strategy, including the completed initiatives, will be successful in sustaining acceptable levels of sales growth and profitability.

As a result, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern for a period of one year after the date of filing of this Annual Report on Form 10-K.

9

A change in one or more of the Company’s partners’ policies or the Company’s relationship with those partners could adversely affect the Company’s results of operations.

The Company is dependent on its partners to supply merchandise in a timely and efficient manner. If a partner fails to deliver on its commitments, whether due to financial difficulties or other reasons, the Company

could experience merchandise shortages that could lead to lost sales.

Historically, the etailz segment has not experienced difficulty in obtaining satisfactory sources of supply and management believes that it will continue to have access to adequate sources of supply. No individual

partner exceeded 10% of etailz purchases in fiscal 2019.

etailz revenue is dependent upon maintaining etailz’s relationship with Amazon and failure to do so, or any restrictions on our ability to offer products on the Amazon Marketplace, could have an

adverse impact on our business, financial condition and results of operations.

etailz generates substantially all of its revenue through the Amazon Marketplace. Therefore, we depend in large part on our relationship with Amazon for the growth of the etailz segment. In particular, we depend on our

ability to offer products on the Amazon Marketplace. We also depend on Amazon for the timely delivery of products to customers. Any adverse change in our relationship with Amazon, including restrictions on the ability to offer products or termination

of the relationship, could adversely affect the continued growth of our etailz segment and our financial condition and results of operations.

Parties with whom the Company does business may be subject to insolvency risks or may otherwise become unable or unwilling to perform their obligations to the Company.

The Company is a party to contracts, transactions and business relationships with various third parties, including partners, vendors, suppliers, service providers and lenders, pursuant to which such third parties have

performance, payment and other obligations to the Company. In some cases, the Company depends upon such third parties to provide essential products, services or other benefits, including with respect to merchandise, advertising, software development

and support, logistics, other agreements for goods and services in order to operate the Company’s business in the ordinary course, extensions of credit, credit card accounts and related receivables, and other vital matters. Economic, industry and

market conditions, including as a result of the COVID-19 pandemic, could result in increased risks to the Company associated with the potential financial distress or insolvency of such third parties. The Company is not currently able to accurately

determine the extent and scope of the impact of the COVID-19 pandemic on such third parties. If any of these third parties were to become subject to bankruptcy, receivership or similar proceedings, the rights and benefits of the Company in relation

to its contracts, transactions and business relationships with such third parties could be terminated, modified in a manner adverse to the Company, or otherwise impaired. The Company cannot make any assurances that it would be able to arrange for

alternate or replacement contracts, transactions or business relationships on terms as favorable as the Company’s existing contracts, transactions or business relationships, if at all. Any inability on the part of the Company to do so could

negatively affect the Company’s cash flows, financial condition and results of operations.

10

Breach of data security could harm our business and standing with our customers.

The protection of our partner, employee and business data is critical to us. Our business, like that of most companies, involves confidential information about our employees, our suppliers and our Company. We rely on

commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of all such data, including confidential information. Despite the security measures we have in place, our facilities and

systems, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors, or other similar events. Unauthorized parties may attempt to

gain access to our systems or information through fraud or other means, including deceiving our employees or third-party service providers. The methods used to obtain unauthorized access, disable or degrade service, or sabotage systems are also

constantly changing and evolving, and may be difficult to anticipate or detect. We have implemented and regularly review and update our control systems, processes and procedures to protect against unauthorized access to or use of secured data and to

prevent data loss. However, the ever-evolving threats mean we must continually evaluate and adapt our systems and processes, and there is no guarantee that they will be adequate to safeguard against all data security breaches or misuses of data. Any

security breach involving the misappropriation, loss or other unauthorized disclosure of customer payment card or personal information or employee personal or confidential information, whether by us or our vendors, could damage our reputation, expose

us to risk of litigation and liability, disrupt our operations, harm our business and have an adverse impact upon our net sales and profitability. As the regulatory environment related to information security, data collection and use, and privacy

becomes increasingly rigorous, with new and changing requirements applicable to our business, compliance with those requirements could also result in additional costs. Further, if we are unable to comply with the security standards established by

banks and the credit card industry, we may be subject to fines, restrictions and expulsion from card acceptance programs, which could adversely affect our retail operations.

Our hardware and software systems are vulnerable to damage, theft or intrusion that could harm our business.

Any failure of our computer hardware or software systems that causes an interruption in our operations or a decrease in inventory tracking could result in reduced net sales and profitability. Additionally, if any data

intrusion, security breach, misappropriation or theft were to occur, we could incur significant costs in responding to such event, including responding to any resulting claims, litigation or investigations, which could harm our operating results.

Our inability or failure to protect our intellectual property rights, or any claimed infringement by us of third-party intellectual rights, could have a negative impact on our operating results.

Our trademark, trade secrets and other intellectual property, including proprietary software, are valuable assets that are critical to our success. The unauthorized reproduction or other misappropriation of our

intellectual property could cause a decline in our revenue. In addition, any infringement or other intellectual property claim made against us could be time-consuming to address, result in costly litigation, cause product delays, require us to enter

into royalty or licensing agreements or result in our loss of ownership or use of the intellectual property.

Loss of key personnel or the inability to attract, train and retain qualified employees could adversely affect the Company’s results of operations.

The Company believes that its future prospects depend, to a significant extent, on the services of its executive officers. Our future success will also depend on our ability to attract and retain qualified key

personnel. The loss of the services of certain of the Company’s executive officers and other key management personnel could adversely affect the Company’s results of operations.

11

In addition to our executive officers, the Company’s business is dependent on our ability to attract, train and retain qualified team members. Our ability to meet our labor needs while controlling our costs is subject

to external factors such as unemployment levels, health care costs and changing demographics. If we are unable to attract and retain adequate numbers of qualified team members, our operations and support functions could suffer. Those factors,

together with increased wage and benefit costs, could adversely affect our results of operations.

Failure to comply with legal and regulatory requirements could adversely affect the Company’s results of operations.

The Company’s business is subject to a wide array of laws and regulations. Significant legislative changes that impact our relationship with our workforce (none of which is represented by unions) could increase our

expenses and adversely affect our operations. Examples of possible legislative changes impacting our relationship with our workforce include changes to an employer’s obligation to recognize collective bargaining units, the process by which collective

bargaining units are negotiated or imposed, minimum wage requirements, health care mandates, and changes in overtime regulations.

Our policies, procedures and internal controls are designed to comply with all applicable laws and regulations, including those imposed by the Securities and Exchange Commission and the NASDAQ Capital Market, as well

as applicable employment laws. Additional legal and regulatory requirements increase the complexity of the regulatory environment in which we operate and the related cost of compliance. Failure to comply with such laws and regulations may result in

damage to our reputation, financial condition and market price of our stock.

We may face difficulties in meeting our labor needs to effectively operate our business.

We are heavily dependent upon our labor workforce. Our compensation packages are designed to provide benefits commensurate with our level of expected service. However, we face the challenge of filling many positions at

wage scales that are appropriate to the industry and competitive factors. We also face other risks in meeting our labor needs, including competition for qualified personnel, overall unemployment levels, and increased costs associated with complying

with regulations relating to COVID-19. Changes in any of these factors, including a shortage of available workforce, could interfere with our ability to adequately service our customers and could result in increasing labor costs.

Our business could be adversely affected by increased labor costs, including costs related to an increase in minimum wage and health care.

Labor is one of the primary components in the cost of operating our business. Increased labor costs, whether due to competition, unionization, increased minimum wage, state unemployment rates, health care, or other

employee benefits costs may adversely impact our operating expenses. Additionally, there is no assurance that future health care legislation will not adversely impact our results or operations.

Litigation may adversely affect our business, financial condition and results of operations.

Our business is subject to the risk of litigation by employees, consumers, partners, suppliers, competitors, stockholders, government agencies or others through private actions, class actions, administrative

proceedings, regulatory actions or other litigation. The outcome of litigation, particularly class action lawsuits and regulatory actions, is difficult to assess or quantify. We may incur losses relating to these claims, and in addition, these

proceedings could cause us to incur costs and may require us to devote resources to defend against these claims that could adversely affect our results of operations. For a description of current legal proceedings, see “Part I, Item 3, Legal

Proceedings.”

12

An impairment of the carrying value of fixed assets, intangible assets and goodwill has negatively affected and may in the future negatively affect our financial results.

Because we have grown in part through acquisitions, goodwill and other acquired intangible assets have represented a substantial portion of our total assets.

Under generally accepted accounting principles, we assess our long-lived assets for impairment whenever economic events or changes in circumstances indicate that the carrying value of an asset may not be recoverable.

During fiscal 2019, as a result of triggering events, the Company performed impairment tests on the fixed assets and operating lease right-of-use assets of the fye segment and concluded that both were fully impaired.

The Company recorded impairment losses of approximately $23.2 million for fixed assets and operating lease right-of-use assets of the fye segment.

During fiscal 2019, the Company fully impaired its vendor relationships and the Company recognized an impairment loss of $0.8 million.

In the future, significant negative industry or general economic trends, disruptions to our business and unexpected significant changes or planned changes in our use of our long-lived assets may result in additional

impairments to our fixed assets and intangible assets. Any reduction in or impairment of the value of fixed assets or intangible assets will result in a charge against earnings, which could have an adverse impact on our reported results of operations

and financial condition.

The effects of natural disasters, terrorism, acts of war, and public health issues may adversely affect our business.

Natural disasters, including earthquakes, hurricanes, floods, and tornadoes may affect store and distribution center operations. In addition, acts of terrorism, acts of war, and military action both in the United

States and abroad can have a significant effect on economic conditions and may negatively affect our ability to purchase merchandise from suppliers for sale to our customers. Public health issues, such as flu or other pandemics, whether occurring in

the United States or abroad, could disrupt our operations and result in a significant part of our workforce being unable to operate or maintain our infrastructure or perform other tasks necessary to conduct our business. Additionally, public health

issues may disrupt, or have an adverse effect on, our suppliers’ operations, our operations, our customers, or customer demand. Our ability to mitigate the adverse effect of these events depends, in part, upon the effectiveness of our disaster

preparedness and response planning as well as business continuity planning. However, we cannot be certain that our plans will be adequate or implemented properly in the event of an actual disaster. We may be required to suspend operations in some or

all our locations, which could have a material adverse effect on our business, financial condition, and results of operations. Any significant declines in public safety or uncertainties regarding future economic prospects that affect customer

spending habits could have a material adverse effect on customer purchases of our products.

The terms of our asset-based revolving credit agreement impose certain restrictions on us that may impair our ability to respond to changing business and economic conditions, which could have a

significant adverse impact on our business. Additionally, our business could suffer if our ability to acquire financing is reduced or eliminated.

On February 20, 2020, etailz entered into a Loan and Security Agreement (the “Loan Agreement”) with Encina, as administrative agent, under which the lenders committed to provide up to $25 million in loans under a

three-year, secured revolving credit facility (the “New Credit Facility”).

13

Among other things, the Loan Agreement limits etailz’s ability to incur additional indebtedness, create liens, make investments, make restricted payments or specified payments and merge or acquire assets. The Loan

Agreement also requires etailz to comply with a financial maintenance covenant.

The Loan Agreement contains customary events (including our Subordinated Debt) of default, including, but not limited to, payment defaults, breaches of representations and warranties, covenant defaults,

cross-defaults to other obligations, customary ERISA defaults, certain events of bankruptcy and insolvency, judgment defaults, the invalidity of liens on collateral, change in control, cessation of business or the liquidation of material assets of

the borrowers and guarantors under the New Credit Facility taken as a whole, the occurrence of an uninsured loss to a material portion of collateral and failure of the obligations under the New Credit

Facility to constitute senior indebtedness under any applicable subordination or intercreditor agreements, including our Subordinated Debt.

As of February 1, 2020, the Company had borrowings of $13.1 million under its previous credit facility with Wells Fargo. On February 20, 2020, in conjunction with the FYE Transaction, the Company fully satisfied its obligations under the Credit

Facility.

Risks Related to Ownership of Our Common Stock.

The ownership of our Common Stock is extremely concentrated, and entities affiliated with members of our Board of Directors have significant influence and control over the outcome of any vote of the

Company’s Shareholders and may have competing interests.

The Robert J. Higgins TWMC Trust (the “Trust”) owns approximately 39.1 % of the outstanding Common Stock and

Neil Subin owns approximately 16.5% of the outstanding Common Stock, and as a result can control the outcome of most actions requiring shareholder approval. In addition, entities affiliated with each of the Trust and Mr. Subin, as well as one of

our directors, Mr. Simpson, and certain of his affiliated entities, entered into a voting agreement (as described in “Related Party Transactions”) and agreed to how their respective shares of the Company’s Common Stock held by the parties (which

total approximately 60% ) will be voted with respect to (i) amending the Articles of Incorporation of the Company to set the size of the Board of Directors of the Company at three directors, (ii) the designation, election, removal, and replacement

of members of the Board and (iii) how shares of the Company’s capital stock held by the parties to the voting agreement will be voted on a Sale of the Company (as defined in the voting agreement) with respect to which there is a shareholder vote or

some other action to take place during the ninety (90) days immediately following the date of the voting agreement. Pursuant to the voting agreement, Messrs. Marcus and Simpson were appointed as directors of the Company, and Mr. Reickert, a

trustee of the Trust, remained as a director of the Company. Mr. Subin was also granted board observer rights. Entities affiliated with the Trust and Messrs. Marcus and Simpson are also lenders under our subordinated loan and security agreement,

have received warrants to purchase shares of the Company’s Common Stock and received contingent value rights (“CVRs”) representing the contractual right to receive cash payments from the Company in an amount equal, in the aggregate, to

19.9% of the proceeds received by the Company in respect of certain intercompany indebtedness owing to it by etailz and/or its equity interest in etailz, each as described in “Related Party Transactions”. As a

result, there may be instances in which the interest of Mr. Reickert, the Trust and its affiliated entities, Messrs. Marcus and Subin and their respective affiliated entities, and Mr. Simpson and his affiliated entities may conflict or be perceived

as being in conflict with the interest of a holder of our securities or the interest of the Company.

14

The Company’s stock price has experienced and could continue to experience volatility and could decline, resulting in a substantial loss on your investment.

Our stock price has experienced, and could continue to experience in the future, substantial volatility as a result of many factors, including global economic conditions, broad market fluctuations and public perception

of the prospects for the industries in which we operate and the value of our assets. As a result of the FYE Transaction, we are reliant on the performance of etailz, and a failure to meet market expectations, particularly with respect to net

revenues, operating margins and earnings per share, would likely result in a further decline in the market price of our stock.

If we do not meet the continued listing standards of the NASDAQ, our Common Stock could be delisted from trading, which could limit investors’ ability to make transactions in our Common Stock and

subject us to additional trading restrictions.

Our common stock is listed on NASDAQ, which imposes continued listing requirements with respect to listed shares. On August 15, 2019, the Company effected a reverse stock split of its outstanding shares of Common Stock

at a ratio of one-for-twenty pursuant to a Certificate of Amendment to the Company’s Certificate of Incorporation filed with the Secretary of State of the State of New York. The reverse stock split was reflected on NASDAQ beginning with the opening

of trading on August 15, 2019. The primary purpose of the reverse stock split, which was approved by the Company’s shareholders at the Company’s Annual Stockholders Meeting on June 27, 2019, was to enable the Company to comply with the $1.00 minimum

bid price requirement for continued listing on NASDAQ. There can be no assurance that we will be able to maintain compliance with the minimum bid price requirement or that we will otherwise be in compliance with other NASDAQ listing criteria. If we

fail to maintain compliance with the minimum bid requirement or to meet the other applicable continued listing requirements in the future and NASDAQ determines to delist our Common Stock, the delisting could adversely affect the market price and

liquidity of our Common Stock and reduce our ability to raise additional capital.

The limited public float and trading volume for our Common Stock may have an adverse impact and cause significant fluctuation of market price.

Historically, ownership of a significant portion of our outstanding shares of Common Stock has been concentrated in a small number of stockholders. Consequently, our Common Stock has a relatively small float and low

average daily trading volume, which could affect a shareholder’s ability to sell our stock or the price at which it can be sold. In addition, future sales of substantial amounts of our Common Stock in the public market by those larger stockholders,

or the perception that these sales could occur, may adversely impact the market price of the stock and our stock could be difficult for a shareholder to liquidate.

The Company intends to continue to undertake one or more corporate initiatives to reduce costs which may include deregistering the Company’s Common Stock under the Exchange Act.

Given the Company’s liquidity position, the Company intends to continue to undertake one or more corporate initiatives to reduce costs going forward. We currently incur significant expenses in connection with complying

with public company reporting requirements and, as a listed company, we have an obligation to continue to comply with the applicable reporting requirements. As part of its consideration of all available strategic alternatives for the Company, the

Board will consider whether, and may conclude that, deregistering our Common Stock, and therefore eliminating the significant expenses associated with complying with public company reporting requirements, is in the best interests of our shareholders.

If the Company determines to deregister its Common Stock, following such deregistration, we would no longer be a reporting company and we would cease to file annual, quarterly, current, and other reports and documents with the Securities and Exchange

Commission as soon as we are permitted to do so under applicable laws, rules and regulations. In such event, our shareholders would have significantly less information about the Company and our business, operations, and financial performance than

they have currently. Additionally, termination of our obligation to publicly disclose financial and other information about the Company following the deregistration of our Common Stock under the Exchange Act would make it more difficult (or even

impossible) for shareholders to sell shares of Common Stock held by them. Trading in our Common Stock would only occur, if at all, in privately negotiated sales and potentially on an OTC market, if one or more brokers chooses to make a market for our

Common Stock on any such market and complies with applicable regulatory requirements. There could be no assurances regarding any such private trading or OTC market trading.

15

| Item 1B. |

UNRESOLVED SEC COMMENTS

|

None.

| Item 2. |

PROPERTIES

|

Retail Stores

As of February 1, 2020, the fye segment leased and operated 200 stores. The majority of the leases provide for the payment of fixed monthly rent and expenses for maintenance, property taxes and insurance, while others provide for the payment of

monthly rent based on a percentage of sales. Certain leases provide for additional rent based on store sales in excess of specified levels. The following table lists the leases due to expire in each of the fiscal years shown as of the fiscal

year-end, assuming any renewal options are not exercised:

|

Year

|

No. of

Leases

|

Year

|

No. of

Leases

|

|||

|

2020

|

164

|

2023

|

3

|

|||

|

2021

|

27

|

2024

|

2

|

|||

|

2022

|

3

|

2025 and beyond

|

1

|

On February 20, 2020, as part of the FYE Transaction, Sunrise Records assumed the obligation under the leases for all stores, Albany, NY offices and distribution center.

16

Corporate Offices and Distribution Center Facilities

As of February 1, 2020, we leased the following office and distribution facilities:

|

Location

|

Square

Footage |

Owned or

Leased |

Use

|

|||

|

fye

|

||||||

|

Albany, NY

|

39,800

|

Leased

|

Office administration

|

|||

|

Albany, NY

|

141,500

|

Leased

|

Distribution center

|

|||

|

etailz

|

||||||

|

Spokane, WA

|

30,700

|

Leased

|

Office administration

|

|||

|

Spokane, WA

|

32,000

|

Leased

|

Distribution center

|

On February 20, 2020, as part of the FYE Transaction, Sunrise Records assumed the obligation under the leases for all stores, Albany, NY offices and distribution center.

The Spokane, WA distribution center supports the distribution to outside distribution facilities for sale on third-party marketplaces for etailz.

| Item 3. |

LEGAL PROCEEDINGS

|

The Company is subject to legal proceedings and claims that have arisen in the ordinary course of its business and have not been finally adjudicated. Although there can be no assurance as to the ultimate disposition of these matters, it is

management’s opinion, based upon the information available at this time, that the expected outcome of these matters, individually and in the aggregate, will not have a material adverse effect on the results of operations and financial condition of

the Company.

Store Manager Class Actions

There are two pending class actions. The first, Spack v. Trans World Entertainment Corp. was originally filed in the District of New Jersey, April 2017 (the “Spack Action”). The Spack Action alleges that the

Company misclassified Store Managers (“SMs”) as exempt nationwide. It also alleges that Trans World improperly calculated overtime for Senior Assistant Managers (“SAMs”) nationwide, and that both SMs and SAMs worked “off-the-clock.” It also alleges

violations of New Jersey and Pennsylvania State Law with respect to calculating overtime for SAMs. The second, Roper v. Trans World Entertainment Corp., was filed in the Northern District of New York, May 2017 (the “Roper Action”). The Roper Action

also asserts a nationwide misclassification claim on behalf of SMs. Both actions were consolidated into the Northern District of New York, with the Spack Action being the lead case.

The Company has reached a preliminary settlement with the plaintiffs for both store manager class actions. The Company reserved $425,000 for the settlement as of February 2, 2020.

| Item 4. |

MINE SAFETY DISCLOSURES

|

Not applicable.

17

PART II

| Item 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information: The Company’s Common Stock trades on the NASDAQ Capital Market under the symbol “TWMC.” As of May 29, 2020, there were 225 shareholders of record. The following table sets forth high

and low last reported sale prices for each fiscal quarter during the period from February 4, 2018 through May 29, 2020.

|

Closing Sales Prices |

||||||||

|

High |

Low |

|||||||

|

2018 |

||||||||

|

1st Quarter |

$ |

36.00 |

$ |

20.00 |

||||

|

2nd Quarter |

$ |

27.00 |

$ |

17.00 |

||||

|

3rd Quarter |

$ |

22.80 |

$ |

13.00 |

||||

|

4th Quarter |

$ |

25.80 |

$ |

11.40 |

||||

|

2019 |

||||||||

|

1st Quarter |

$ |

12.48 |

$ |

5.77 |

||||

|

2nd Quarter |

$ |

8.01 |

$ |

5.00 |

||||

|

3d Quarter |

$ |

6.08 |

$ |

2.74 |

||||

|

4th Quarter |

$ |

6.98 |

$ |

1.92 |

||||

|

2020 |

||||||||

|

1st Quarter |

$ |

5.35 |

$ |

2.39 |

||||

|

2nd Quarter (through May 29, 2020) |

$ |

5.14 |

$ |

3.62 |

||||

On May 29, 2020, the last trading date in May the reported sale price on the Common Stock on the NASDAQ Capital Market was $4.80. On August 15, 2019, the Company completed a 1-for-20 reverse stock split of outstanding Common Stock. All closing

prices have been adjusted to reflect the reverse stock split.

Dividend Policy: The Company did not pay cash dividends in fiscal 2019 and fiscal 2018. The declaration and payment of any dividends is at the sole discretion of

the board of directors and is not guaranteed.

Issuer Purchases of Equity Securities during the Quarter Ended February 1, 2020

During the three-month period ended February 1, 2020, the Company did not repurchase any shares under the share repurchase program.

| Item 6. |

SELECTED CONSOLIDATED FINANCIAL DATA

|

Not required under the requirements of a Smaller Reporting Company.

18

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Overview

Management’s Discussion and Analysis of Financial Condition and Results of Operations provide information that the Company’s management believes necessary to achieve an understanding of its financial condition and results of operations. To the

extent that such analysis contains statements which are not of a historical nature, such statements are forward-looking statements, which involve risks and uncertainties. These risks include, but are not limited to, changes in the competitive

environment for the Company’s products and services; general economic factors in markets where the Company’s products and services are sold; and other factors including, but not limited to: cost of goods, consumer disposable income, consumer debt

levels and buying patterns, consumer credit availability, interest rates, customer preferences, unemployment, labor costs, inflation, fuel and energy prices, weather patterns, climate change, catastrophic events, competitive pressures and insurance

costs discussed in the Company’s filings with the Securities and Exchange Commission.

FYE Transaction

On February 20, 2020, the Company consummated the sale of substantially all of the assets and certain of the liabilities relating to fye to a subsidiary of Sunrise Records pursuant to an Asset Purchase Agreement dated

January 23, 2020, by and among the Company, Record Town, Inc., Record Town USA LLC, Record Town Utah LLC, Trans World FL LLC, Trans World New York, LLC, 2428392 Inc., and Sunrise Records.

Following the FYE Transaction, etailz is the Company’s only operating segment. However, all of our financial information for fiscal 2019 includes the fye segment. For pro forma information, see Note 13 of the Notes to the Consolidated Financial

Statements.

Impact of COVID-19

To date, as a direct result of COVID-19, most of our employees are working remotely. The full extent to which the COVID-19 pandemic will directly or indirectly impact our business, results of operations and financial

condition, including expenses, reserves and allowances, and employee-related amounts, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to

contain or treat it, as well as the economic impact on local, regional, national and international customers and markets, which are highly uncertain and cannot be predicted at this time. Management is actively monitoring this situation and the

possible effects on its financial condition, liquidity, operations, industry, and workforce. Given the daily evolution of the COVID-19 outbreak and the response to curb its spread, currently we are not able to estimate the effects of the COVID-19

outbreak to our results of operations, financial condition, or liquidity.

In response to the rapidly evolving COVID-19 pandemic, we activated our business continuity program, led by our Executive Team in conjunction with Human Resources, to help us manage the situation. In mid-March, we transitioned our corporate office

staff to work 100% remotely. This process was aided through the implementation of a flexible work from home policy rolled out to the organization in fiscal 2019, having a companywide communication platform for instant messaging and video

conferencing, and cloud-based critical business applications. However, while our business is not dependent on physical office locations nor travel, having a 100% remote workforce does present increased operational risk. Our leadership team believes

we have the necessary controls in place to mitigate these impacts and allow the team to continue to operate effectively remotely as long as required by State guidelines.

19

While e-commerce has largely benefited from the closure of brick-and-mortar locations as consumer spending has been pushed online to marketplaces such as Amazon and Walmart, the industry nor our organization has been immune to the impact to our

supply chains. For instance, in March, Amazon reduced replenishment in their fulfillment centers to essential items which limited a significant percentage of SKUs carried by etailz and a number of etailz’ partners shut their warehouses or suffered

limited processing capacity due to COVID-19. While Amazon has since lifted restrictions and the leadership team executed contingency plans to mitigate the adverse impact from these restrictions, this highlights the fluid nature of COVID-19 across

supply chains.

Additionally, since the beginning of the pandemic, tens of millions of Americans have lost their jobs, significantly increasing the risk of near-term economic contraction in the United States that may affect e-commerce sales. The risk of a second

wave or increased numbers of positive COVID-19 cases also presents further risk to supply chains. Leadership is actively monitoring the situation and potential impacts on its financial condition, liquidity, operations and workforce but the full

extent of the impact is still highly uncertain.

Key Performance Indicators

Management monitors a number of key performance indicators to evaluate its performance, including:

Net Sales and Comparable Store Net Sales: The etailz segment measures total year over year sales growth. etailz measures its sales performance through several key performance indicators including: number of

partners and active product listings and sales per listing.

The fye segment measures the rate of comparable store net sales change. A store is included in comparable store net sales calculations at the beginning of its thirteenth full month of operation. Stores relocated, expanded or downsized are

excluded from comparable store sales if the change in square footage is greater than 20% until the thirteenth full month following relocation, expansion or downsizing. Closed stores that were open for at

least thirteen months are included in comparable store sales through the month immediately preceding the month of closing. The fye segment further analyzes net sales by product category

Cost of Sales and Gross Profit: Gross profit is calculated based on the cost of product in relation to its retail selling value. Changes in gross profit are impacted primarily by net sales levels, mix of

products sold, vendor discounts and allowances, shrinkage, obsolescence and distribution costs. Distribution expenses include those costs associated with receiving, inspecting & warehousing merchandise, Amazon fulfillment fees, and costs

associated with product returns to vendors.

Selling, General and Administrative (“SG&A”) Expenses: Included in SG&A expenses are payroll and related costs, occupancy charges, general operating and overhead expenses and depreciation charges.

SG&A expenses also include fixed assets write-offs associated with store closures, if any, and miscellaneous income and expense items, other than interest.

Balance Sheet and Ratios: The Company views cash, merchandise inventory, accounts payable leverage, and working capital as key indicators of its financial position. See “Liquidity and Capital Resources”

for further discussion of these items.

20

Fiscal Year Ended February 1, 2020 (“fiscal 2019”)

Compared to Fiscal Year Ended February 2, 2019 (“fiscal 2018”)

The Company’s fiscal year is a 52 or 53-week period ending the Saturday nearest to January 31. Fiscal 2019 and fiscal 2018 ended February 1, 2020 and February 2, 2019, respectively. Both fiscal 2019 and fiscal 2018

had 52 weeks.

Segment Highlights:

|

(amounts in thousands)

|

Fiscal Year

Ended

February 1,

2020

|

Fiscal Year

Ended

February 2,

2019

|

||||||

|

Total Revenue

|

||||||||

|

etailz

|

$

|

133,216

|

$

|

186,900

|

||||

|

fye

|

192,719

|

231,290

|

||||||

|

Total Company

|

$

|

325,935

|

$

|

418,190

|

||||

|

Gross Profit

|

||||||||

|

etailz

|

$

|

30,393

|

$

|

38,815

|

||||

|

fye

|

65,706

|

89,259

|

||||||

|

Total Company

|

$

|

96,099

|

$

|

128,074

|

||||

|

Loss From Operations

|

||||||||

|

etailz

|

$

|

(6,405

|

)

|

$

|

(72,351

|

)

|

||

|

fye

|

(50,770

|

)

|

(24,455

|

)

|

||||

|

Total Company

|

$

|

(57,175

|

)

|

$

|

(96,806

|

)

|

||

|

Reconciliation of etailz Loss From Operations to etailz Adjusted Loss From Operations

|

||||||||

|

etailz Loss From Operations

|

$

|

(6,405

|

)

|

$

|

(72,351

|

)

|

||

|

Acquisition related intangible amortization expenses

|

1,143

|

3,890

|

||||||

|

Acquisition related compensation expenses

|

66

|

3,821

|

||||||

|

Asset impairment charges

|

765

|

57,712

|

||||||

|

etailz Adjusted Loss From Operations (1)

|

$

|

(4,431

|

)

|

$

|

(6,928

|

)

|

||

|

(1)

|

In addition to the results of operations determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we reported non-GAAP etailz

adjusted operating loss as shown above. The Company believes that adjusted loss from operations as per the segment disclosure, when considered together with its GAAP financial results, provides management and investors with a more

complete understanding of its business operating results, including underlying trends, by excluding the effects of certain charges. This measure is not a recognized measure of financial performance under GAAP, and should not be considered

as a substitute for operating earnings (losses), net earnings (loss) from continuing operations or cash flows from operating activities, as determined in accordance with GAAP.

|

Total Revenue. The following table sets forth a year-over-year comparison of the Company’s total revenue:

|

2019 vs. 2018

|

|||||||||||||||||

|

2019

|

2018

|

$ |

|

%

|

|||||||||||||

|

(amounts in thousands)

|

|||||||||||||||||

|

etailz net sales

|

$

|

133,216

|

$

|

186,900

|

$

|

(53,684

|

)

|

(28.7

|

%)

|

||||||||

|

fye net sales

|

188,777

|

226,097

|

(37,320

|

)

|

(16.5

|

%)

|

|||||||||||

|

Other revenue (1)

|

3,942

|

5,193

|

(1,251

|

)

|

(24.1

|

%)

|

|||||||||||

|

Total revenue

|

$

|

325,935

|

$

|

418,190

|

$

|

(92,255

|

)

|

(22.1

|

%)

|

||||||||

|

1.

|

Other revenue is comprised of third-party commission income and management fees related to the fye segment.

|

21

Total revenue decreased 22.1% to $325.9 million compared to $418.2 million in fiscal 2018.

etailz Segment