Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TECH DATA CORP | earningsreleasefy21q1fin.htm |

| 8-K - 8-K - TECH DATA CORP | tecd-20200528.htm |

Q1 Fiscal Year 2021 Financial Highlights For the quarter ended April 30, 2020 May 28, 2020

Forward‐Looking Statements Certain statements in this communication may contain “forward‐looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, including statements regarding Tech Data’s plans, objectives, expectations and intentions, Tech Data’s financial results and estimates and/or business prospects, involve a number of risks and uncertainties and actual results could differ materially from those projected. These forward looking statements are based on current expectations, estimates, forecasts, and projections about the operating environment, economies and markets in which Tech Data operates and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward looking statements. In addition, any statements that refer to Tech Data’s future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances, are forward looking statements. These forward looking statements are only predictions and are subject to risks, uncertainties, and assumptions. Therefore, actual results may differ materially and adversely from those expressed in any forward looking statements. For additional information with respect to important risks and other factors that could cause actual results to differ materially from those in the forward‐looking statements, see Tech Data’s Annual Report on Form 10‐K for the year ended January 31, 2020, including Part I, Item 1A, “Risk Factors” therein, Quarterly Reports on Form 10‐Q, Current Reports on Form 8‐K and other securities filings with the Securities and Exchange Commission (the “SEC”) that are available at the SEC’s website at www.sec.gov and other securities regulators. Readers are cautioned not to place undue reliance upon any such forward‐looking statements, which speak only as of the date made. Many of these factors are beyond Tech Data’s control. Unless otherwise required by applicable securities laws, Tech Data disclaims any intention or obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise. Tech Data undertakes no duty to update any forward looking statements contained herein to reflect actual results or changes in Tech Data’s expectations. Use of Non‐GAAP Financial Information This document includes financial results prepared in accordance with generally accepted accounting principles (“GAAP”). In addition to GAAP results, Tech Data management believes that the presentation of non‐GAAP financial measures is useful to investors because it provides investors with a more complete understanding of our operational results and a meaningful comparison of our performance between periods. The non‐GAAP results and outlook should only be used in conjunction with results reported in accordance with GAAP and are not intended to be a substitute for results reported in accordance with GAAP. Non‐GAAP financial measures presented in this presentation or other presentations, press releases and similar documents issued by Tech Data, include but are not limited to sales, income or expense items as adjusted for the impact of changes in foreign currencies (referred to as “constant currency”) , non‐GAAP selling, general and administrative expenses (“SG&A”), non‐GAAP operating income, non‐GAAP operating margin, non‐GAAP net income, non‐GAAP earnings per diluted share, Adjusted non‐GAAP operating income growth, Adjusted non‐GAAP EPS growth and Adjusted Return on Invested Capital. These non‐GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by comparable companies. Management may also use these non‐ GAAP financial measures to establish operational goals and, in some cases, for measuring performance for compensation purposes. This presentation provides a detailed reconciliation between results reported in accordance with GAAP and non‐GAAP financial measures. 2

Worldwide Net Sales $ in Billions Q1 FY21: $10.4 • Worldwide net sales were $8.2 billion, a decrease of 3% $9.1 $9.1 3% compared to the prior-year quarter. $8.4 4% 3% $8.2 4% 3% 41% • Portfolio optimization actions reduced net sales by Asia Pacific 47% 46% approximately 3 percent. 45% 48% Americas Europe • On a constant currency basis, net sales decreased 56% 1% compared to the prior-year quarter. 51% 49% 51% 49% • Three vendors represented 10% or more of net sales: Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Apple Inc. 14%; Cisco Systems 12%; and HP Inc. Y/Y Growth ‐2% 2% ‐2% ‐1% ‐3% 11%. Y/Y CC Growth (1) 3% 5% 0% 0% ‐1% ⁽¹⁾ CC: constant currency 3

Worldwide Gross Profit and Margin $ in Millions Q1 FY21: • Gross profit of $531.7 million increased 4% compared to the prior-year quarter and increased 7% on a constant currency basis. • Gross margin increased 44 basis points compared to the prior-year quarter. 4

Worldwide SG&A Expenses $ in Millions Q1 FY21: • Non-GAAP SG&A expenses of $402.8 million increased 5% compared to the prior-year quarter and increased 7% on a constant currency basis. • Non-GAAP SG&A as a percentage of net sales increased 35 basis points compared to the prior-year quarter. • GAAP depreciation and amortization expense was $42.0 million compared to $37.3 million in the prior- year quarter. (1) Non-GAAP SG&A excludes acquisition-related amortization of intangibles expenses, legal settlements and tax indemnifications. See GAAP to Non-GAAP reconciliation in the appendix. 5

Worldwide Operating Income $ in Millions Q1 FY21: • Worldwide non-GAAP operating income of $128.9 million increased 3% compared to the prior-year quarter, and increased 5% on a constant currency basis. • Worldwide non-GAAP operating margin increased 10 basis points from the prior-year quarter. (1) See the GAAP to Non-GAAP reconciliation in the appendix. . 6

Worldwide Net Income and EPS Q1 FY21: $ in Millions (except EPS) • The effective tax rate was 20%, compared to 23% in the prior-year quarter. The non-GAAP effective tax rate was 22%, compared to 23% in the prior-year quarter. • Non-GAAP net income of $80.1 million increased 5% compared to the prior-year quarter and increased 7% on a constant currency basis. • Non-GAAP EPS of $2.22 increased 9% compared to the prior-year quarter and increased 11% on a constant currency basis. (1) See the GAAP to non-GAAP reconciliation in the appendix. 7

Regional Results ‐ Americas Net Sales $ in Billions $4.3 $4.2 $4.3 Q1 FY21: $3.9 $3.8 • Americas’ reported net sales were $3.9 billion, an increase of 4% compared to the prior-year quarter • Portfolio optimization actions reduced net sales by approximately 2 percent. Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 • On a constant currency basis, net sales increased 5% compared to the prior-year quarter. Americas Y/Y Growth 5% 7% 2% 1% 4% Y/Y CC Growth (1) 6% 7% 2% 1% 5% (1) CC: constant currency 8

Regional Results ‐ Americas Operating Income (1) $ in Millions Q1 FY21: • Americas’ non-GAAP operating income of $83.7 million decreased 1% compared to the prior-year quarter, and decreased 1% on a constant currency basis. • Non-GAAP operating margin decreased 12 basis points compared to the prior-year quarter. (1) Before stock compensation expense. (2) See the GAAP to non-GAAP reconciliation in the appendix 9

Regional Results ‐ Europe Net Sales $ in Billions Q1 FY21: $5.8 • Europe’s reported net sales were $4.0 billion, $4.6 a decline of 8% compared to the prior-year $4.3 $4.4 $4.0 quarter. • Portfolio optimization actions reduced net sales by approximately 3 percent. • On a constant currency basis, net sales declined 5% compared to the prior-year Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 quarter. Europe Y/Y Growth ‐8% ‐2% ‐6% ‐2% ‐8% Y/Y CC Growth (1) 1% 2% ‐2% 0% ‐5% ⁽¹⁾ CC: constant currency 10

Regional Results ‐ Europe Operating Income (1) $ in Millions Q1 FY21: • Europe’s non-GAAP operating income of $52.0 million increased 14% compared to the prior-year quarter, and increased 19% on a constant currency basis. • Non-GAAP operating margin improved 25 basis points from the prior-year quarter. (1) Before stock compensation expense. (2) See the GAAP to non-GAAP reconciliation in the appendix. 11

Regional Results ‐ Asia Pacific Net Sales $ in Billions Q1 FY21: $0.34 $0.33 $0.31 $0.29 • Asia Pacific reported net sales were $0.26 billion, a decrease of 16% compared to the $0.26 prior-year quarter. • Portfolio optimization actions reduced net sales by approximately 12 percent. • On a constant currency basis, net sales decreased 12% compared to the prior-year Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 quarter. Asia Pacific Y/Y Growth 15% 14% 4% 0% ‐16% Y/Y CC Growth (1) 19% 17% 4% 0% ‐12% (1) CC: constant currency 12

Regional Results ‐ Asia Pacific Operating Income (1) $ in Millions Q1 FY21: • The Asia Pacific region’s non-GAAP operating loss was -$0.5 million. • Non-GAAP operating margin declined 110 basis points from the prior-year quarter. (1) Before stock compensation expense. (2) See the GAAP to non-GAAP reconciliation in the appendix. 13

Worldwide Cash Metrics Cash Flow from Operations Cash Conversion Cycle $ in Millions Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Days of Sales 59 54 58 54 60 Outstanding Days of Supply 38 33 33 29 36 Days of Purchases (78) (69) (74) (68) (76) Outstanding Cash Conversion 19 18 17 15 20 Cycle Q1 FY21: • Net cash used by operations was $8 million. • The cash balance at the end of the quarter was $829 million. 14

Worldwide Balance Sheet Highlights Q1 FY21: • Accumulated other comprehensive loss was $55.1 million. • Capital expenditures were $19.5 million. • At January 31, 2020, the company had $3.1 billion of equity, and 35.66 million shares outstanding resulting in book value of $87.12 per share. • At January 31, 2020, the company had approximately $1.9 billion of goodwill and acquired intangibles. 15

Worldwide Return on Invested Capital • Company’s Weighted Average Cost of Capital is approximately 9%. • Adjusted return on invested capital in Q1 FY21 TTM (trailing twelve months) was 15% compared to 14% in the prior-year quarter. (1) See reconciliation of ROIC to adjusted ROIC calculation in appendix. 16

APPENDIX GAAP to Non‐GAAP Reconciliations 17

SG&A $ in thousands Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Net Sales$ 8,406,424 $ 9,092,244 $ 9,118,944 $ 10,380,809 $ 8,175,174 SG&A Expenses (GAAP) $ 405,534 $ 431,694 $ 415,242 $ 438,208 $ 427,863 Acquisition-related intangible assets amortization expense (20,879) (21,182) (21,044) (23,812) (24,489) Legal settlements 282 - - 351 - Tax indemnifications (320) (265) (62) (545) (616) SG&A Expenses (non-GAAP)$ 384,617 $ 410,247 $ 394,136 $ 414,202 $ 402,758 SG&A Expenses (GAAP) % 4.82% 4.75% 4.55% 4.22% 5.23% SG&A Expenses (non-GAAP) % 4.58% 4.51% 4.32% 3.99% 4.93% 18

Operating Income Q1 FY21 (In thousands) Q1 FY21 Stock Ame r icas (1) Europe (1) Asia Pacific (1) Compensation Consolidated Expense Net Sales $ 3,944,760 $ 3,971,130 $ 259,284 $ 8,175,174 Operating income (loss) (GAAP) (1) $ 49,783 $ 45,884 $ (3,245) $ (6,307) $ 86,115 Acquisition, integration and restructuring 16,956 (178) 903 - 17,681 expenses Acquisition-related intangible assets 16,925 6,311 1,253 24,489 amortization expense Tax indemnifications - 7 609 616 Total non-GAAP operating income $ 33,881 $ 6,140 $ 2,765 $ - $ 42,786 adjustments Operating income (loss) (non-GAAP) $ 83,664 $ 52,024 $ (480) $ (6,307) $ 128,901 Operating margin (GAAP) 1.26% 1.16% -1.25% 1.05% Operating margin (non-GAAP) 2.12% 1.31% -0.19% 1.58% (1) GAAP operating income does not include stock compensation expense at the regional level. 19

Operating Income Q4 FY20 (In thousands) Q4 FY20 Stock Ame r icas (1) Europe (1) Asia Pacific (1) Compensation Consolidated Expense Net Sales $ 4,291,774 $ 5,760,643 $ 328,392 $ 10,380,809 Operating income (GAAP) (1) $ 89,095 $ 131,893 $ 5,562 $ (8,480) $ 218,070 Acquisition, integration and restructuring 8,275 1,196 19 463 9,953 expenses Legal settlements and other, net (351) - - (351) Acquisition-related intangible assets 16,058 6,448 1,306 23,812 amortization expense Tax indemnifications - 1,295 (750) 545 Total non-GAAP operating income $ 23,982 $ 8,939 $ 575 $ 463 $ 33,959 adjustments Operating income (non-GAAP) $ 113,077 $ 140,832 $ 6,137 $ (8,017) $ 252,029 Operating margin (GAAP) 2.08% 2.29% 1.69% 2.10% Operating margin (non-GAAP) 2.63% 2.44% 1.87% 2.43% (1) GAAP operating income does not include stock compensation expense at the regional level. 20

Operating Income Q3 FY20 (In thousands) Q3 FY20 Stock Ame r icas (1) Europe (1) Asia Pacific (1) Compensation Consolidated Expense Net Sales $ 4,202,320 $ 4,622,270 $ 294,354 $ 9,118,944 Operating income (GAAP) (1) $ 82,420 $ 66,536 $ 279 $ (7,347) $ 141,888 Acquisition, integration and restructuring 3,551 975 121 - 4,647 expenses Gain on disposal of subsidiary - (1,390) - (1,390) Acquisition-related intangible assets 13,438 6,312 1,294 21,044 amortization expense Tax indemnifications - - 62 62 Total non-GAAP operating income $ 16,989 $ 5,897 $ 1,477 $ - $ 24,363 adjustments Operating income (non-GAAP) $ 99,409 $ 72,433 $ 1,756 $ (7,347) $ 166,251 Operating margin (GAAP) 1.96% 1.44% 0.09% 1.56% Operating margin (non-GAAP) 2.37% 1.57% 0.60% 1.82% (1) GAAP operating income does not include stock compensation expense at the regional level. 21

Operating Income Q2 FY20 (In thousands) Q2 FY20 Stock Ame r icas (1) Europe (1) Asia Pacific (1) Compensation Consolidated Expense Net Sales $ 4,316,731 $ 4,439,627 $ 335,886 $ 9,092,244 Operating income (GAAP) (1) $ 93,085 $ 37,649 $ 2,068 $ (8,055) $ 124,747 Acquisition, integration and restructuring 1,341 3,229 639 - 5,209 expenses Acquisition-related intangible assets 13,440 6,430 1,312 21,182 amortization expense Tax indemnifications - - 265 265 Total non-GAAP operating income $ 14,781 $ 9,659 $ 2,216 $ - $ 26,656 adjustments Operating income (non-GAAP) $ 107,866 $ 47,308 $ 4,284 $ (8,055) $ 151,403 Operating margin (GAAP) 2.16% 0.85% 0.62% 1.37% Operating margin (non-GAAP) 2.50% 1.07% 1.28% 1.67% (1) GAAP operating income does not include stock compensation expense at the regional level. 22

Operating Income Q1 FY20 (In thousands) Q1 FY20 Stock Ame r icas (1) Europe (1) Asia Pacific (1) Compensation Consolidated Expense Net Sales $ 3,789,198 $ 4,309,500 $ 307,726 $ 8,406,424 Operating income (GAAP) (1) $ 68,633 $ 36,420 $ 876 $ (8,305) $ 97,624 Acquisition, integration and restructuring 2,911 3,024 286 - 6,221 expenses Legal settlements and other, net (282) - - (282) Acquisition-related intangible assets 13,440 6,115 1,324 20,879 amortization expense Tax indemnifications - - 320 320 Total non-GAAP operating income $ 16,069 $ 9,139 $ 1,930 $ - $ 27,138 adjustments Operating income (non-GAAP) $ 84,702 $ 45,559 $ 2,806 $ (8,305) $ 124,762 Operating margin (GAAP) 1.81% 0.85% 0.28% 1.16% Operating margin (non-GAAP) 2.24% 1.06% 0.91% 1.48% (1) GAAP operating income does not include stock compensation expense at the regional level. 23

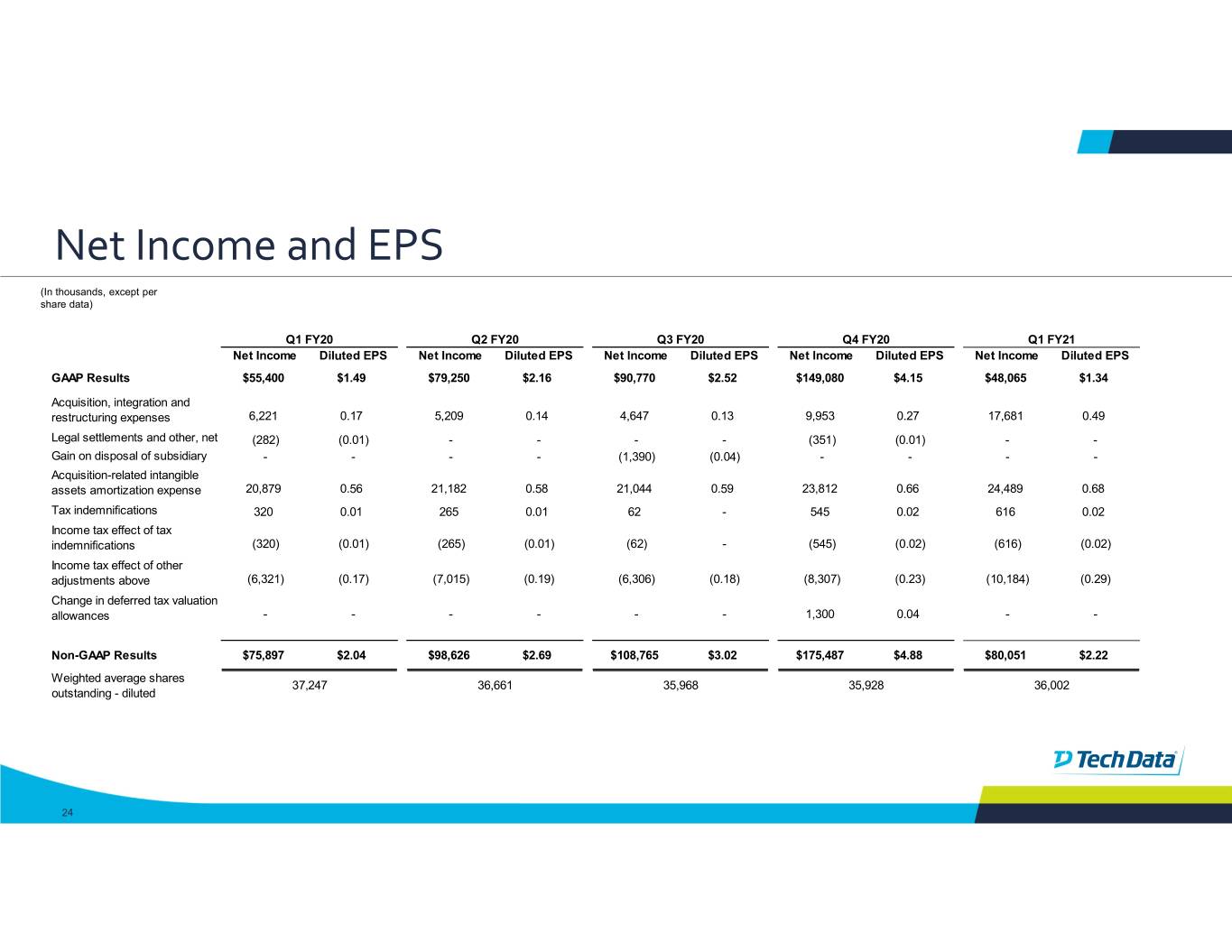

Net Income and EPS (In thousands, except per share data) Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Net Income Diluted EPS Net Income Diluted EPS Net Income Diluted EPS Net Income Diluted EPS Net Income Diluted EPS GAAP Results $55,400 $1.49 $79,250 $2.16 $90,770 $2.52 $149,080 $4.15 $48,065 $1.34 Acquisition, integration and restructuring expenses 6,221 0.17 5,209 0.14 4,647 0.13 9,953 0.27 17,681 0.49 Legal settlements and other, net (282) (0.01) - - - - (351) (0.01) - - Gain on disposal of subsidiary -- --(1,390)(0.04)-- -- Acquisition-related intangible assets amortization expense 20,879 0.56 21,182 0.58 21,044 0.59 23,812 0.66 24,489 0.68 Tax indemnifications 320 0.01 265 0.01 62 - 545 0.02 616 0.02 Income tax effect of tax indemnifications (320) (0.01) (265) (0.01) (62) - (545) (0.02) (616) (0.02) Income tax effect of other adjustments above (6,321) (0.17) (7,015) (0.19) (6,306) (0.18) (8,307) (0.23) (10,184) (0.29) Change in deferred tax valuation allowances -- -- --1,3000.04-- Non-GAAP Results $75,897 $2.04 $98,626 $2.69 $108,765 $3.02 $175,487 $4.88 $80,051 $2.22 Weighted average shares 37,247 36,661 35,968 35,928 36,002 outstanding - diluted 24

Return on Invested Capital $ in thousands Twelve months ended April 30, TTM Net Operating Profit After Tax (NOPAT)*: 2019 2020 Operating income$ 520,930 $ 570,820 Income taxes on operating income (1) (52,272) (127,358) NOPAT $ 468,658 $ 443,462 Average Invested Capital: Short-term debt (5-qtr end average)$ 115,018 $ 119,171 Long-term debt (5-qtr end average) 1,361,506 1,313,004 Shareholders' Equity (5-qtr end average) 2,881,968 2,999,952 Total average capital 4,358,492 4,432,127 Less: Cash (5-qtr end average) (676,308) (834,044) Average invested capital less average cash $ 3,682,184 $ 3,598,083 ROIC 13% 12% * Trailing Twelve Months is abbreviated as TTM. (1) Income taxes on operating income was calculated using the trailing twelve months effective tax rate. 25

Adjusted Return on Invested Capital $ in thousands Twelve months ended April 30, TTM Net Operating Profit After Tax (NOPAT), as adjusted*: 2019 2020 Non-GAAP operating income (1) $ 708,588 $ 698,584 Income taxes on non-GAAP operating income (2) (179,283) (159,929) NOPAT, as adjusted $ 529,305 $ 538,655 Average Invested Capital, as adjusted: Short-term debt (5-qtr end average)$ 115,018 $ 119,171 Long-term debt (5-qtr end average) 1,361,506 1,313,004 Shareholders' Equity (5-qtr end average) 2,881,968 2,999,952 Tax effected impact of non-GAAP adjustments (3) 44,860 45,368 Total average capital, as adjusted 4,403,352 4,477,495 Less: Cash (5-qtr end average) (676,308) (834,044) Average invested capital less average cash $ 3,727,044 $ 3,643,451 Adjusted ROIC 14% 15% * Trailing Twelve Months is abbreviated as TTM. (1) Represents operating income as adjusted to exclude acquisition, integration and restructuring expenses, legal settlements and other, net, gain on disposal of subsidiary, acquisition-related intangible assets amortization expense, goodwill impairment and tax indemnifications. (2) Income taxes on non-GAAP operating income was calculated using the trailing twelve months effective tax rate adjusted for the impact of non-GAAP adjustments during the respective periods. (3) Represents the 5 quarter average of the year-to-date impact of non-GAAP adjustments. 26