Attached files

| file | filename |

|---|---|

| EX-32.B - CERTIFICATION - TECH DATA CORP | exhibit32-bq1fy18.htm |

| EX-32.A - CERTIFICATION - TECH DATA CORP | exhibit32-aq1fy18.htm |

| EX-31.B - CERTIFICATION - TECH DATA CORP | exhibit31-bq1fy18.htm |

| EX-31.A - CERTIFICATION - TECH DATA CORP | exhibit31-aq1fy18.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended April 30, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 0-14625

TECH DATA CORPORATION

(Exact name of Registrant as specified in its charter)

Florida | No. 59-1578329 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

5350 Tech Data Drive Clearwater, Florida | 33760 |

(Address of principal executive offices) | (Zip Code) |

(Registrant’s Telephone Number, including Area Code): (727) 539-7429

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “accelerated filer”, “large accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated Filer | x | Accelerated Filer | ¨ |

Non-accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company Filer | ¨ |

Emerging Growth Company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Class | Outstanding at May 31, 2017 |

Common stock, par value $.0015 per share | 38,128,592 |

1

TECH DATA CORPORATION AND SUBSIDIARIES

Form 10-Q for the Three Months Ended April 30, 2017

INDEX

PAGE | ||

PART I. | ||

ITEM 1. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II. | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 2 | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

EXHIBITS | ||

CERTIFICATIONS | ||

2

PART I. FINANCIAL INFORMATION

ITEM 1. | Financial Statements |

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(In thousands, except par value and share amounts)

April 30, 2017 | January 31, 2017 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 861,541 | $ | 2,125,591 | |||

Accounts receivable, net | 4,538,603 | 3,047,927 | |||||

Inventories | 2,601,951 | 2,118,902 | |||||

Prepaid expenses and other assets | 253,453 | 119,906 | |||||

Total current assets | 8,255,548 | 7,412,326 | |||||

Property and equipment, net | 133,761 | 74,239 | |||||

Goodwill | 698,442 | 199,021 | |||||

Intangible assets, net | 1,263,467 | 130,676 | |||||

Other assets, net | 205,390 | 115,604 | |||||

Total assets | $ | 10,556,608 | $ | 7,931,866 | |||

LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 4,924,292 | $ | 3,844,532 | |||

Accrued expenses and other liabilities | 690,826 | 493,199 | |||||

Revolving credit loans and current maturities of long-term debt, net | 486,156 | 373,123 | |||||

Total current liabilities | 6,101,274 | 4,710,854 | |||||

Long-term debt, less current maturities | 1,799,646 | 989,924 | |||||

Other long-term liabilities | 174,444 | 61,200 | |||||

Total liabilities | 8,075,364 | 5,761,978 | |||||

Commitments and contingencies (Note 10) | |||||||

Shareholders’ equity: | |||||||

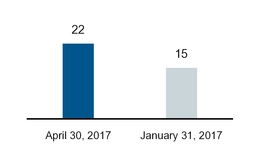

Common stock, par value $.0015; 200,000,000 shares authorized; 59,245,585 shares issued at April 30, 2017 and January 31, 2017 | 89 | 89 | |||||

Additional paid-in capital | 803,721 | 686,042 | |||||

Treasury stock, at cost (21,117,840 and 24,018,983 shares at April 30, 2017 and January 31, 2017) | (941,634 | ) | (1,070,994 | ) | |||

Retained earnings | 2,659,947 | 2,629,293 | |||||

Accumulated other comprehensive loss | (40,879 | ) | (74,542 | ) | |||

Total shareholders' equity | 2,481,244 | 2,169,888 | |||||

Total liabilities and shareholders' equity | $ | 10,556,608 | $ | 7,931,866 | |||

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

3

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME

(In thousands, except per share amounts)

(Unaudited)

Three months ended April 30, | |||||||

2017 | 2016 | ||||||

Net sales | $ | 7,664,063 | $ | 5,963,362 | |||

Cost of products sold | 7,206,975 | 5,664,751 | |||||

Gross profit | 457,088 | 298,611 | |||||

Operating expenses: | |||||||

Selling, general and administrative expenses | 352,632 | 246,496 | |||||

Acquisition and integration expenses | 42,066 | — | |||||

LCD settlements and other, net | (12,688 | ) | (443 | ) | |||

382,010 | 246,053 | ||||||

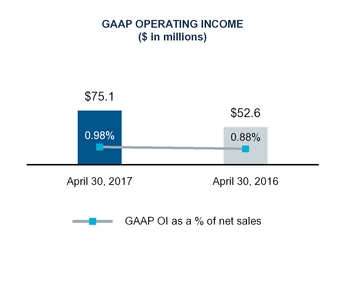

Operating income | 75,078 | 52,558 | |||||

Interest expense | 31,008 | 5,601 | |||||

Other income, net | (415 | ) | (1,034 | ) | |||

Income before income taxes | 44,485 | 47,991 | |||||

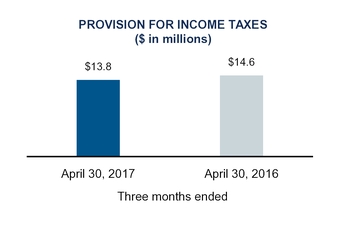

Provision for income taxes | 13,831 | 14,618 | |||||

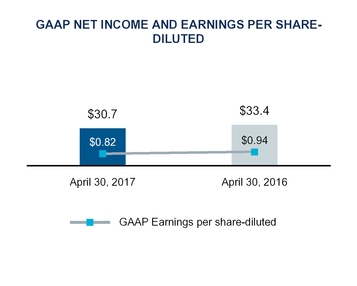

Net income | $ | 30,654 | $ | 33,373 | |||

Earnings per share: | |||||||

Basic | $ | 0.82 | $ | 0.95 | |||

Diluted | $ | 0.82 | $ | 0.94 | |||

Weighted average common shares outstanding: | |||||||

Basic | 37,251 | 35,127 | |||||

Diluted | 37,468 | 35,370 | |||||

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

4

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

Three months ended April 30, | |||||||

2017 | 2016 | ||||||

Net income | $ | 30,654 | $ | 33,373 | |||

Other comprehensive income: | |||||||

Foreign currency translation adjustment | 33,663 | 95,992 | |||||

Total comprehensive income | $ | 64,317 | $ | 129,365 | |||

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

5

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(In thousands)

(Unaudited)

Three months ended April 30, | |||||||

2017 | 2016 | ||||||

Cash flows from operating activities: | |||||||

Cash received from customers | $ | 9,501,659 | $ | 7,093,723 | |||

Cash paid to vendors and employees | (9,238,349 | ) | (6,793,778 | ) | |||

Interest paid, net | (19,456 | ) | (8,369 | ) | |||

Income taxes paid | (19,496 | ) | (15,821 | ) | |||

Net cash provided by operating activities | 224,358 | 275,755 | |||||

Cash flows from investing activities: | |||||||

Acquisition of business, net of cash acquired | (2,249,959 | ) | — | ||||

Expenditures for property and equipment | (4,373 | ) | (7,166 | ) | |||

Software and software development costs | (26,073 | ) | (4,397 | ) | |||

Net cash used in investing activities | (2,280,405 | ) | (11,563 | ) | |||

Cash flows from financing activities: | |||||||

Borrowings on long-term debt | 1,008,148 | — | |||||

Principal payments on long-term debt | (200,000 | ) | — | ||||

Cash paid for debt issuance costs | (5,121 | ) | — | ||||

Net repayments on revolving credit loans | (7,589 | ) | (1,187 | ) | |||

Payments for employee tax withholdings on equity awards | (5,500 | ) | (4,093 | ) | |||

Proceeds from the reissuance of treasury stock | 389 | 146 | |||||

Net cash provided by (used in) financing activities | 790,327 | (5,134 | ) | ||||

Effect of exchange rate changes on cash and cash equivalents | 1,670 | 35,507 | |||||

Net (decrease) increase in cash and cash equivalents | (1,264,050 | ) | 294,565 | ||||

Cash and cash equivalents at beginning of year | 2,125,591 | 531,169 | |||||

Cash and cash equivalents at end of period | $ | 861,541 | $ | 825,734 | |||

Reconciliation of net income to net cash provided by operating activities: | |||||||

Net income | $ | 30,654 | $ | 33,373 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 31,683 | 14,047 | |||||

Provision for losses on accounts receivable | 3,910 | (1,305 | ) | ||||

Stock-based compensation expense | 4,918 | 3,657 | |||||

Accretion of debt discount and debt issuance costs | 587 | 208 | |||||

Changes in operating assets and liabilities, net of acquisition: | |||||||

Accounts receivable | 374,857 | 519,337 | |||||

Inventories | (232,153 | ) | 93,260 | ||||

Prepaid expenses and other assets | (58,892 | ) | 50,479 | ||||

Accounts payable | 71,321 | (381,928 | ) | ||||

Accrued expenses and other liabilities | (2,527 | ) | (55,373 | ) | |||

Total adjustments | 193,704 | 242,382 | |||||

Net cash provided by operating activities | $ | 224,358 | $ | 275,755 | |||

Supplemental schedule of non-cash investing activities: | |||||||

Issuance of stock to acquire business | $ | 247,232 | $ | — | |||

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

6

TECH DATA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 — BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business

Tech Data Corporation (“Tech Data” or the “Company”) is one of the world’s largest wholesale distributors of technology products. The Company serves as an indispensable link in the technology supply chain by bringing products from the world’s leading technology vendors to market, as well as providing customers with advanced logistics capabilities and value-added services. Tech Data’s customers include value-added resellers, direct marketers, retailers and corporate resellers who support the diverse technology needs of end users. On February 27, 2017, the Company purchased all of the outstanding shares of Avnet Inc.'s ("Avnet") Technology Solutions ("TS") business (see Note 3 - Acquisitions for further discussion). Prior to the acquisition of TS, the Company managed its operations in two geographic segments: the Americas and Europe. As a result of the acquisition of TS, the Company now manages its operations in three geographic segments: the Americas, Europe and Asia-Pacific. There were no Tech Data operations in the Asia-Pacific region prior to the acquisition of TS.

Principles of Consolidation

The consolidated financial statements include the accounts of Tech Data and its subsidiaries, including the results of TS from the date of acquisition of February 27, 2017. All significant intercompany accounts and transactions have been eliminated in consolidation. The Company operates on a fiscal year that ends on January 31.

Basis of Presentation

The consolidated financial statements have been prepared by the Company, without audit, pursuant to the rules and regulations of the United States Securities and Exchange Commission (“SEC”). The Company prepares its financial statements in conformity with generally accepted accounting principles in the United States (“GAAP”). These principles require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the opinion of management, the accompanying unaudited consolidated financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the consolidated financial position of the Company as of April 30, 2017, and its consolidated statements of income, comprehensive income and cash flows for the three months ended April 30, 2017 and 2016.

Seasonality

The Company’s quarterly operating results have fluctuated significantly in the past and will likely continue to do so in the future as a result of currency fluctuations and seasonal variations in the demand for the products and services offered. Narrow operating margins may magnify the impact of these factors on the Company's operating results. Recent historical seasonal variations have included an increase in European demand during the Company’s fiscal fourth quarter and decreased demand in other fiscal quarters. Given that the majority of the Company’s revenues are derived from Europe, the worldwide results closely follow the seasonality trends in Europe. The seasonal trend in Europe typically results in greater operating leverage, and therefore, lower selling, general and administrative expenses as a percentage of net sales in the region and on a consolidated basis during the second semester of the Company's fiscal year, particularly in the Company's fourth quarter. Therefore, the results of operations for the three months ended April 30, 2017 and 2016 are not necessarily indicative of the results that can be expected for the entire fiscal year ended January 31, 2018.

Acquisition and integration expenses

Acquisition and integration expenses are primarily comprised of transaction related costs, professional services, restructuring costs and other costs related to the acquisition of TS (see Note 3 – Acquisitions for further discussion).

LCD settlements and other, net

The Company has been a claimant in proceedings seeking damages from certain manufacturers of LCD flat panel and cathode ray tube displays. The Company reached settlement agreements with certain manufacturers during the three months ended April 30, 2017 and 2016 and has recorded these amounts, net of attorney fees and expenses, in "LCD settlements and other, net" in the Consolidated Statement of Income.

7

Accounts Receivable Purchase Agreements

The Company has uncommitted accounts receivable purchase agreements under which certain accounts receivable may be sold, without recourse, to third-party financial institutions. Under these programs, the Company may sell certain accounts receivable in exchange for cash less a discount, as defined in the agreements. Available capacity under these programs, which the Company uses as a source of working capital funding, is dependent on the level of accounts receivable eligible to be sold into these programs and the financial institutions' willingness to purchase such receivables. In addition, certain of these agreements also require that the Company continue to service, administer and collect the sold accounts receivable. At April 30, 2017 and January 31, 2017, the Company had a total of $516.0 million and $506.7 million, respectively, of accounts receivable sold to and held by financial institutions under these agreements. During the three months ended April 30, 2017 and 2016, discount fees recorded under these facilities were $1.7 million and $1.2 million, respectively. These discount fees are included as a component of "other income, net" in the Consolidated Statement of Income.

Recently Adopted Accounting Standards

In July 2015, the FASB issued a new accounting standard that simplifies the subsequent measurement of inventory. Under the new standard, the cost of inventory will be compared to the net realizable value (NRV). Net realizable value is defined as the estimated selling prices in the ordinary course of business less reasonably predictable costs of completion, disposal and transportation. The standard should be applied prospectively and was effective for the Company beginning with the current quarter ended April 30, 2017. The adoption of this standard had no material impact on the Company's consolidated financial statements.

In January 2017, the FASB issued a new standard that simplifies the subsequent measurement of goodwill by eliminating Step 2 from the annual goodwill impairment test. With the elimination of Step 2, entities will measure goodwill for impairment by comparing the fair value of the reporting unit with its carrying amount. An impairment charge should be recognized for the amount by which the carrying amount exceeds the reporting unit's fair value, only to the extent of the carrying value of goodwill allocated to that reporting unit. The accounting standard should be applied prospectively. The Company early adopted the guidance during the current quarter ended April 30, 2017. The adoption of this standard had no material impact on the Company's consolidated financial statements.

Recently Issued Accounting Standards

In May 2014, the FASB issued an accounting standard which will supersede all existing revenue recognition guidance under current GAAP. In March, April, May and December 2016, the FASB issued additional updates to the new accounting standard which provide supplemental adoption guidance and clarifications. The new standard requires the recognition of revenue to depict the transfer of promised goods or services in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods and services. The accounting standard is effective for the Company beginning with the quarter ending April 30, 2018, with early adoption permitted in the quarter ended April 30, 2017. The standard may be adopted using either a full retrospective or a modified retrospective approach. The Company has established a project implementation team and developed a multi-phase plan to assess the Company’s business, as well as any changes to processes or systems to adopt the requirements of the new standard. The Company is in the process of developing its conclusions on several aspects of the standard, including principal versus agent considerations, which would impact reporting certain revenues on a gross or net basis, as well as assessing the impact of the new standard on the accounting for revenue earned by TS, which was acquired in February 2017.

In February 2016, the FASB issued an accounting standard which requires the recognition of assets and liabilities arising from lease transactions on the balance sheet and the disclosure of additional information about leasing arrangements. Under the new guidance, for all leases, interest expense and amortization of the right to use asset will be recorded for leases determined to be financing leases and straight-line lease expense will be recorded for leases determined to be operating leases. Lessees will initially recognize assets for the right to use the leased assets and liabilities for the obligations created by those leases. The new accounting standard must be adopted using a modified retrospective approach for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements. The accounting standard is effective for the Company beginning with the quarter ending April 30, 2019, with early adoption permitted. The Company is currently in the process of assessing what impact this new standard may have on its consolidated financial statements.

In June 2016, the FASB issued an accounting standard which revises the methodology for measuring credit losses on financial instruments and the timing of the recognition of those losses. Under the new standard, financial assets measured at an amortized cost basis are to be presented net of the amount not expected to be collected via an allowance for credit losses. Estimated credit losses are to be based on historical information adjusted for management's expectation that current conditions and supportable forecasts differ from historical experience. The accounting standard is effective for the Company beginning with the quarter ending April 30, 2020, with early adoption permitted. The Company is currently in the process of assessing what impact this new standard may have on its consolidated financial statements.

In August 2016, the FASB issued a new accounting standard that addresses how certain cash receipts and cash payments are presented and classified on the statement of cash flows. The accounting standard is effective for the Company beginning with the quarter ending April 30, 2018, with early adoption permitted. The Company does not expect the adoption of this standard to have a material impact on its consolidated financial statements.

8

In October 2016, the FASB issued a new accounting standard that revises the accounting for the income tax consequences of intra-entity transfers of assets other than inventory. The accounting standard is effective for the Company beginning with the quarter ending April 30, 2018, with early adoption permitted. The Company does not expect the adoption of this standard to have a material impact on its consolidated financial statements.

9

NOTE 2 — EARNINGS PER SHARE ("EPS")

The Company presents the computation of earnings per share on a basic and diluted basis. Basic EPS is computed by dividing net income by the weighted average number of shares outstanding during the reported period. Diluted EPS reflects the potential dilution related to equity-based incentives (further discussed in Note 6 – Stock-Based Compensation) using the treasury stock method. The composition of basic and diluted EPS is as follows:

Three months ended April 30, | |||||||

2017 | 2016 | ||||||

(in thousands, except per share data) | |||||||

Net income | $ | 30,654 | $ | 33,373 | |||

Weighted average common shares - basic | 37,251 | 35,127 | |||||

Effect of dilutive securities: | |||||||

Equity based awards | 217 | 243 | |||||

Weighted average common shares - diluted | 37,468 | 35,370 | |||||

Earnings per share: | |||||||

Basic | $ | 0.82 | $ | 0.95 | |||

Diluted | $ | 0.82 | $ | 0.94 | |||

For the three months ended April 30, 2017 and 2016, there were zero and 200,383 shares, respectively, excluded from the computation of diluted earnings per share because their effect would have been antidilutive.

NOTE 3 - ACQUISITIONS

Acquisition of TS

On September 19, 2016, Tech Data entered into an interest purchase agreement, as subsequently amended, with Avnet to acquire all the shares of TS. Pursuant to the interest purchase agreement, and subject to the terms and conditions contained therein, at the closing of the acquisition on February 27, 2017, Tech Data acquired all of the outstanding shares of TS for an aggregate estimated purchase price of approximately $2.7 billion, including approximately $2.5 billion paid to Avnet in cash including estimated closing adjustments, and 2,785,402 shares of the Company's common stock, valued at approximately $247 million based on the closing price of the Company's common stock on February 27, 2017. The final cash consideration is subject to certain working capital and other adjustments and therefore the final purchase price may vary significantly from these estimates. TS delivers technology services, software, hardware and solutions across the data center. The TS acquisition diversifies the Company's end-to-end solutions, deepens its value added capabilities and balances its solutions portfolio. The addition of TS also extends the Company's geographic reach into the Asia-Pacific region while broadening its capabilities in Europe and the Americas, including re-entering Latin America with a focus on the delivery of new technologies that drive and complement the data center in this market.

The Company has accounted for the TS acquisition as a business combination and allocated the preliminary estimated purchase price to the estimated fair values of assets acquired and liabilities assumed. The Company has not yet completed its evaluation and determination of certain assets acquired and liabilities assumed, primarily (i) the final valuation of intangible assets related to customer relationships and trade names, (ii) the final assessment and valuation of certain other assets acquired and liabilities assumed, including accounts receivable, inventory, property and equipment, capitalized software, accrued expenses and other liabilities and (iii) the final assessment and valuation of certain income tax amounts. Therefore, the final fair values of the assets acquired and liabilities assumed may vary significantly from the Company's preliminary estimates.

10

The preliminary allocation of the estimated purchase price to assets acquired and liabilities assumed is as follows:

(in millions) | |||

Current assets | $ | 2,363 | |

Property and equipment, net | 61 | ||

Goodwill | 493 | ||

Intangible assets | 1,035 | ||

Other assets, net | 180 | ||

Total assets | 4,132 | ||

Other current liabilities | 1,178 | ||

Revolving credit loans and long-term debt | 119 | ||

Other long-term liabilities | 118 | ||

Total liabilities | 1,415 | ||

Estimated purchase price | $ | 2,717 | |

The allocation of the preliminary value of identifiable intangible assets is comprised of approximately $991 million of customer relationships with a weighted-average amortization period of 14 years and $44 million of trade names with an amortization period of 5 years. Goodwill is the excess of the consideration transferred over the net assets recognized and primarily represents the expected revenue and cost synergies of the combined company and assembled workforce. Approximately $1.1 billion of the goodwill and identifiable intangible assets are expected to be deductible for tax purposes.

Included within the Company’s Consolidated Statement of Income are estimated net sales of approximately $1.6 billion from TS from the acquisition date of February 27, 2017 through the Company’s quarter ended April 30, 2017. As the Company began integrating certain sales and other functions after the closing of the acquisition, these amounts represent an estimate of the TS net sales for the two months ended April 30, 2017 and are not necessarily indicative of how the TS operations would have performed on a stand-alone basis.

The following table presents unaudited supplemental pro forma information as if the TS acquisition had occurred at the beginning of fiscal 2017. The pro forma results presented are based on combining the stand-alone operating results of the Company and TS for the periods prior to the acquisition date after giving effect to certain adjustments related to the transaction. The pro forma results exclude any benefits that may result from potential cost synergies of the combined company and certain non-recurring costs. As a result, the pro forma information below is presented for informational purposes only and does not purport to present what actual results would have been had the acquisition actually been consummated on the date indicated and it is not necessarily indicative of the results of operations that may result in the future.

Three months ended April 30: | 2017 | 2016 | ||||||

(in millions) | ||||||||

Pro forma net sales | $ | 8,397 | $ | 8,177 | ||||

Pro forma net income | $ | 35 | $ | 31 | ||||

Adjustments reflected in the pro forma results include the following:

• | Amortization of acquired intangible assets based on the preliminary valuation and estimated purchase price |

• | Interest costs associated with the transaction |

• | Certain non-recurring transaction costs |

• | Tax effects of adjustments based on an estimated statutory tax rate |

11

Acquisition and integration expenses

Acquisition and integration expenses are comprised of transaction related costs, professional services, restructuring costs and other costs related to the acquisition of TS. Transaction related costs primarily include investment banking fees incurred in connection with the completion of the transaction. Professional services are primarily comprised of integration related activities, including professional fees for project management, accounting and tax consulting services. Restructuring costs are comprised of severance and facility exit costs.

Acquisition and integration expenses for the three months ended April 30, 2017 are comprised of the following:

Three months ended: | April 30, 2017 | |||

(in thousands) | ||||

Transaction related costs | $ | 15,179 | ||

Professional services | 11,907 | |||

Restructuring costs | 10,345 | |||

Other | 4,635 | |||

Total | $ | 42,066 | ||

During the three months ended April 30, 2017, the Company recorded restructuring costs, primarily in the Americas segment, including severance costs related to headcount reductions and facility exit costs. The accrued restructuring charges are included in “accrued expenses and other liabilities” in the Consolidated Balance Sheet.

Information related to restructuring program activity during the three months ended April 30, 2017 is outlined below:

Severance | Facility Exit Costs | Total | ||||||||||

(in thousands) | ||||||||||||

Fiscal 2018 restructuring expenses | $ | 10,059 | $ | 286 | $ | 10,345 | ||||||

Cash payments | (4,127 | ) | (286 | ) | (4,413 | ) | ||||||

Foreign currency translation | 26 | — | 26 | |||||||||

Balance at April 30, 2017 | $ | 5,958 | $ | — | $ | 5,958 | ||||||

NOTE 4 — GOODWILL

The changes in the carrying amount of goodwill, by geographic segment, for the three months ended April 30, 2017, are as follows (in thousands):

Americas | Europe | Asia-Pacific | Total | ||||||||||||

Balance as of January 31, 2017 | $ | 19,559 | $ | 179,462 | $ | — | $ | 199,021 | |||||||

Goodwill acquired during the year (1) | 362,751 | 122,503 | 7,352 | 492,606 | |||||||||||

Foreign currency translation adjustment | (67 | ) | 6,219 | 663 | 6,815 | ||||||||||

Balance as of April 30, 2017 | $ | 382,243 | $ | 308,184 | $ | 8,015 | $ | 698,442 | |||||||

(1) Amounts based on preliminary purchase price allocation related to the acquisition of TS.

12

NOTE 5 — DEBT

The carrying value of the Company's outstanding debt consists of the following (in thousands):

As of: | April 30, 2017 | January 31, 2017 | |||||

Senior Notes, interest at 3.70% payable semi-annually, due February 15, 2022 | $ | 500,000 | $ | 500,000 | |||

Senior Notes, interest at 4.95% payable semi-annually, due February 15, 2027 | 500,000 | 500,000 | |||||

Senior Notes, interest at 3.75% payable semi-annually, due September 21, 2017 | 350,000 | 350,000 | |||||

Less—unamortized debt discount and debt issuance costs | (10,161 | ) | (10,633 | ) | |||

Senior Notes, net | 1,339,839 | 1,339,367 | |||||

Term Loans | 800,000 | — | |||||

Other committed and uncommitted revolving credit facilities, average interest rate of 6.40% and 8.35% at April 30, 2017 and January 31, 2017, respectively | 125,349 | 23,680 | |||||

Other long-term debt | 20,614 | — | |||||

2,285,802 | 1,363,047 | ||||||

Less—current maturities (included as “revolving credit loans and current maturities of long-term debt, net”) | (486,156 | ) | (373,123 | ) | |||

Total long-term debt | $ | 1,799,646 | $ | 989,924 | |||

Senior Notes

In January 2017, the Company issued $500.0 million aggregate principal amount of 3.70% Senior Notes due 2022 (the "3.70% Senior Notes") and $500.0 million aggregate principal amount of 4.95% Senior Notes due 2027 (the "4.95% Senior Notes") (collectively the "2017 Senior Notes"), resulting in proceeds of approximately $989.8 million, net of debt discount and debt issuance costs of approximately $1.6 million and $8.6 million, respectively. The net proceeds from the issuance of the 2017 Senior Notes were used to fund a portion of the purchase price of the acquisition of TS. The debt discount and debt issuance costs incurred in connection with the public offering are amortized over the life of the 2017 Senior Notes as additional interest expense using the effective interest method. The Company pays interest on the 2017 Senior Notes semi-annually in arrears on February 15 and August 15 of each year, beginning on August 15, 2017. The interest rate payable on the 2017 Senior Notes will be subject to adjustment from time to time if the credit rating assigned to such series of notes is downgraded. At no point will the interest rate be reduced below the interest rate payable on the notes on the date of the initial issuance or the total increase in the interest rate on the notes exceed 2.00% above the interest rate payable on the notes of the series on the date of their initial issuance. The 2017 Senior Notes are senior unsecured obligations of the Company and will rank equally with all other unsecured and unsubordinated indebtedness of the Company from time to time outstanding.

The Company, at its option, may redeem the 3.70% Senior Notes at any time prior to January 15, 2022 and the 4.95% Senior Notes at any time prior to November 15, 2026, in each case in whole or in part, at a redemption price equal to the greater of (i) 100% of the principal amount of the 2017 Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2017 Senior Notes to be redeemed, discounted to the date of redemption on a semi-annual basis at a rate equal to the sum of the applicable Treasury Rate plus 30 basis points for the 3.70% Senior Notes and 40 basis points for the 4.95% Senior Notes, plus the accrued and unpaid interest on the principal amount being redeemed up to the date of redemption. The Company may also redeem the 2017 Senior Notes, at any time in whole or from time to time in part, on or after January 15, 2022 for the 3.70% Senior Notes and November 15, 2026 for the 4.95% Senior Notes, in each case, at a redemption price equal to 100% of the principal amount of the 2017 Senior Notes to be redeemed.

In September 2012, the Company issued $350.0 million aggregate principal amount of 3.75% Senior Notes in a public offering (the “3.75% Senior Notes”), resulting in cash proceeds of approximately $345.8 million, net of debt discount and debt issuance costs of approximately $1.3 million and $2.9 million, respectively. The debt discount and debt issuance costs incurred in connection with the public offering are amortized over the life of the 3.75% Senior Notes as additional interest expense using the effective interest method. The Company pays interest on the 3.75% Senior Notes semi-annually in arrears on March 21 and September 21 of each year, ending on the maturity date of September 21, 2017. The Company, at its option, may redeem the 3.75% Senior Notes at any time in whole or in part, at a redemption price equal to the greater of (i) 100% of the principal amount of the 3.75% Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 3.75% Senior Notes being redeemed, discounted at a rate equal to the sum of the applicable Treasury Rate plus 50 basis points, plus accrued and unpaid interest up to the date of redemption. The 3.75% Senior Notes are senior unsecured obligations of the Company and will rank equally with all other unsecured and unsubordinated indebtedness of the Company from time to time outstanding.

Other Credit Facilities

The Company has a $1.0 billion revolving credit facility with a syndicate of banks (the “Credit Agreement”), which among other things, provides for (i) a maturity date of November 2, 2021, (ii) an interest rate on borrowings, facility fees and letter of credit fees based on the Company’s non-credit enhanced senior unsecured debt rating as determined by Standard & Poor’s Rating Service and Moody’s Investor Service, and (iii) the ability to increase the facility to a maximum of $1.25 billion, subject to certain conditions. The Company pays interest on advances under the Credit Agreement at LIBOR (or similar interbank offered rates depending on currency draw) plus a

13

predetermined margin that is based on the Company’s debt rating. There were no amounts outstanding under the Credit Agreement at April 30, 2017 and January 31, 2017.

The Company entered into a term loan credit agreement on November 2, 2016 with a syndicate of banks (the "Term Loan Credit Agreement") which provides for the borrowing of (i) a tranche of senior unsecured term loans in an original aggregate principal amount of $250 million and maturing three years after the funding date and (ii) a tranche of senior unsecured term loans in an original aggregate principal amount of $750 million and maturing five years after the funding date. The Company pays interest on advances under the Term Loan Credit Agreement at a variable rate based on LIBOR (or similar interbank offered rates depending on currency draw) plus a predetermined margin that is based on the Company's debt rating. In connection with the acquisition of TS on February 27, 2017, the Company borrowed $1.0 billion under its Term Loan Credit Agreement in order to fund a portion of the cash consideration paid to Avnet. The borrowings are comprised of a $250.0 million tranche of three-year senior unsecured term loans (the “2020 Term Loans”) and a $750.0 million tranche of five-year senior unsecured term loans (the “2022 Term Loans”). The outstanding principal amount of the 2020 Term Loans is payable on February 27, 2020. The outstanding principal amount of the 2022 Term Loans is payable in equal quarterly installments of i) for the first three years after the funding date, 5.0% per annum of the initial principal amount and ii) for the fourth and fifth years after the funding date, 10.0% per annum of the initial principal amount, with the remaining balance payable on February 27, 2022.

The Company may repay the 2020 Term Loans and 2022 Term Loans, at any time in whole or in part, without penalty or premium prior to the respective maturity dates. Quarterly installment payments due under the 2022 Term Loans are reduced by the amount of any prepayments made by the Company. During the first quarter of fiscal 2018, the Company made principal payments of $150 million and $50 million, respectively, on the 2020 Term Loans and 2022 Term Loans. At April 30, 2017, there was $100 million outstanding on the 2020 Term Loans and $700 million outstanding on the 2022 Term Loans.

The Company also has an agreement with a syndicate of banks (the “Receivables Securitization Program”) that allows the Company to transfer an undivided interest in a designated pool of U.S. accounts receivable, on an ongoing basis, to provide collateral for borrowings up to a maximum of $400.0 million. Under this program, the Company transfers certain U.S. trade receivables into a wholly-owned bankruptcy remote special purpose entity. Such receivables, which are recorded in the Consolidated Balance Sheet, totaled $712.1 million and $748.6 million at April 30, 2017 and January 31, 2017, respectively. As collections reduce accounts receivable balances included in the collateral pool, the Company may transfer interests in new receivables to bring the amount available to be borrowed up to the maximum. This program has a maturity date of November 16, 2017, and interest is to be paid on advances under the Receivables Securitization Program at the applicable commercial paper or LIBOR rate plus an agreed-upon margin. There were no amounts outstanding under the Receivables Securitization Program at April 30, 2017 and January 31, 2017.

In addition to the facilities described above, the Company has various other committed and uncommitted lines of credit and overdraft facilities totaling approximately $348.4 million at April 30, 2017 to support its operations. Most of these facilities are provided on an unsecured, short-term basis and are reviewed periodically for renewal. There was $125.3 million outstanding on these facilities at April 30, 2017, at a weighted average interest rate of 6.40%, and there was $23.7 million outstanding at January 31, 2017, at a weighted average interest rate of 8.35%.

At April 30, 2017, the Company had also issued standby letters of credit of $29.5 million. These letters of credit typically act as a guarantee of payment to certain third parties in accordance with specified terms and conditions. The issuance of these letters of credit reduces the Company's borrowing availability under certain of the above-mentioned credit facilities.

Certain of the Company’s credit facilities contain limitations on the amounts of annual dividends and repurchases of common stock and require compliance with other obligations, warranties and covenants. The financial ratio covenants under these credit facilities include a maximum total leverage ratio and a minimum interest coverage ratio. At April 30, 2017, the Company was in compliance with all such financial covenants.

Future payments of debt at April 30, 2017 and for succeeding fiscal years are as follows (in thousands):

Fiscal Year: | |||

2018 (remaining 9 months) | $ | 486,504 | |

2019 | 21,105 | ||

2020 | 40,228 | ||

2021 | 176,251 | ||

2022 | 75,000 | ||

Thereafter | 1,496,875 | ||

Total principal payments | $ | 2,295,963 | |

14

NOTE 6 — STOCK-BASED COMPENSATION

For the three months ended April 30, 2017 and 2016, the Company recorded $4.9 million and $3.7 million, respectively, of stock-based compensation expense.

At April 30, 2017, the Company had awards outstanding from two equity-based compensation plans, only one of which is currently active. The active plan was initially approved by the Company’s shareholders in June 2009 and includes 4.0 million shares available for grant of which approximately 1.7 million shares remain available for future grant at April 30, 2017. Under the active plan, the Company is authorized to award officers, employees, and non-employee members of the Board of Directors restricted stock, options to purchase common stock, maximum value stock-settled stock appreciation rights, maximum value options, and performance awards that are dependent upon achievement of specified performance goals. Equity-based compensation awards have a maximum term of 10 years, unless a shorter period is specified by the Compensation Committee of the Board of Directors ("Compensation Committee") or is required under local law. Awards under the plans are priced as determined by the Compensation Committee, and under the terms of the Company’s active equity-based compensation plan, are required to be priced at, or above, the fair market value of the Company’s common stock on the date of grant. Awards generally vest between one and three years from the date of grant. The Company’s policy is to utilize shares of its treasury stock, to the extent available, to satisfy its obligation to issue shares upon the exercise of awards.

Restricted stock units

A summary of the Company’s restricted stock activity for the three months ended April 30, 2017 is as follows:

Shares | ||

Nonvested at January 31, 2017 | 487,596 | |

Granted | 390,365 | |

Vested | (170,855 | ) |

Canceled | (6,014 | ) |

Nonvested at April 30, 2017 | 701,092 | |

Performance based restricted stock units

The Company's performance based restricted stock unit awards are subject to vesting conditions, including meeting specified cumulative performance objectives over a period of three years. Each performance based award recipient could vest in 0% to 150% of the target shares granted contingent on the achievement of the Company's financial performance metrics. A summary of the Company’s performance based restricted stock activity, assuming maximum achievement, for the three months ended April 30, 2017 is as follows:

Shares | ||

Nonvested at January 31, 2017 | 17,486 | |

Granted | 159,102 | |

Nonvested at April 30, 2017 | 176,588 | |

NOTE 7 — SHAREHOLDERS' EQUITY

The Company’s common share issuance activity for the three months ended April 30, 2017 is summarized as follows:

Shares | Weighted-average price per share | |||||

Treasury stock balance at January 31, 2017 | 24,018,983 | $ | 44.59 | |||

Shares of treasury stock reissued for equity incentive plans | (115,741 | ) | ||||

Shares of treasury stock reissued for acquisition of TS | (2,785,402 | ) | ||||

Treasury stock balance at April 30, 2017 | 21,117,840 | $ | 44.59 | |||

As part of the acquisition of TS, the Company reissued 2,785,402 shares of Tech Data's common stock out of treasury stock (see further discussion in Note 3 - Acquisitions). There were no common shares repurchased by the Company during the three months ended April 30, 2017. The reissuance of shares from treasury stock is based on the weighted average purchase price of the shares.

15

NOTE 8 — FAIR VALUE MEASUREMENTS

The Company’s assets and liabilities carried or disclosed at fair value are classified in one of the following three categories: Level 1 – quoted market prices in active markets for identical assets and liabilities; Level 2 – inputs other than quoted market prices included in Level 1 above that are observable for the asset or liability, either directly or indirectly; and Level 3 – unobservable inputs for the asset or liability. The classification of an asset or liability within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The following table summarizes the valuation of the Company's assets and liabilities that are measured at fair value on a recurring basis:

April 30, 2017 | January 31, 2017 | ||||||||||||||||||

Fair value measurement category | Fair value measurement category | ||||||||||||||||||

Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | ||||||||||||||

(in thousands) | |||||||||||||||||||

ASSETS | |||||||||||||||||||

Cash equivalents | $ | — | $ | 1,000,010 | |||||||||||||||

Foreign currency forward contracts | $ | 7,948 | $ | 2,264 | |||||||||||||||

LIABILITIES | |||||||||||||||||||

Foreign currency forward contracts | $ | 9,922 | $ | 9,711 | |||||||||||||||

The Company’s cash equivalents at January 31, 2017 consisted primarily of highly liquid investments in money market funds with maturity periods of three months or less.

The Company's foreign currency forward contracts are measured on a recurring basis based on foreign currency spot rates and forward rates quoted by banks or foreign currency dealers (Level 2 criteria) and are marked-to-market each period with gains and losses on these contracts recorded in the Consolidated Statement of Income on a basis consistent with the classification of the change in the fair value of the underlying transactions giving rise to these foreign currency exchange gains and losses in the period in which their value changes, with the offsetting amount for unsettled positions being included in either "prepaid expenses and other assets" or "accrued expenses and other liabilities" in the Consolidated Balance Sheet. See further discussion below in Note 9 – Derivative Instruments.

The Company utilizes life insurance policies to fund the Company’s nonqualified deferred compensation plan. The life insurance asset recorded by the Company is the amount that would be realized upon the assumed surrender of the policy. This amount is based on the underlying fair value of the invested assets contained within the life insurance policies. The gains and losses are recorded in the Company’s Consolidated Statement of Income within "other income, net." The related deferred compensation liability is also marked-to-market each period based upon the returns of the various investments selected by the plan participants and the gains and losses are recorded in the Company’s Consolidated Statement of Income within "selling, general and administrative expenses." The net realizable value of the Company's life insurance investments and related deferred compensation liability is $41.7 million and $41.7 million, respectively, at April 30, 2017 and $35.2 million and $35.3 million, respectively, at January 31, 2017.

The carrying value of the 3.70% Senior Notes, 4.95% Senior Notes and 3.75% Senior Notes (collectively the "Senior Notes") discussed in Note 5 - Debt represents cost less unamortized debt discount and debt issuance costs. The estimated fair value of the Senior Notes is based upon quoted market information (Level 1). The estimated fair value of the Senior Notes was $1.376 billion and $1.354 billion, respectively, at April 30, 2017 and January 31, 2017. The estimated fair value of the $800 million outstanding under the Term Loan Credit Agreement at April 30, 2017 approximates its carrying value.

NOTE 9 — DERIVATIVE INSTRUMENTS

In the ordinary course of business, the Company is exposed to movements in foreign currency exchange rates. The Company’s foreign currency risk management objective is to protect earnings and cash flows from the impact of exchange rate changes primarily through the use of foreign currency forward contracts to hedge both intercompany and third party loans, accounts receivable and accounts payable. These derivatives are not designated as hedging instruments.

The Company’s foreign currency exposure relates primarily to international transactions where the currency collected from customers can be different from the currency used to purchase the product. The Company’s transactions in its foreign operations are denominated primarily in the following currencies: Australian dollar, British pound, Canadian dollar, Czech koruna, Danish krone, euro, Indian rupee, Indonesian rupiah, Mexican peso, Norwegian krone, Polish zloty, Singapore dollar, Swedish krona, Swiss franc and U.S. dollar.

The Company considers inventory as an economic hedge against foreign currency exposure in accounts payable in certain circumstances. This practice offsets such inventory against corresponding accounts payable denominated in currencies other than the

16

functional currency of the subsidiary buying the inventory when determining the net exposure to be hedged using traditional forward contracts. Under this strategy, the Company would expect to increase or decrease selling prices for products purchased in foreign currencies based on fluctuations in foreign currency exchange rates affecting the underlying accounts payable. To the extent the Company incurs a foreign currency exchange loss (gain) on the underlying accounts payable denominated in the foreign currency, a corresponding increase (decrease) in gross profit would be expected as the related inventory is sold. This strategy can result in a certain degree of quarterly earnings volatility as the underlying accounts payable is remeasured using the foreign currency exchange rate prevailing at the end of each period, or settlement date if earlier, whereas the corresponding increase (decrease) in gross profit is not realized until the related inventory is sold.

The Company recognizes foreign currency exchange gains and losses on its derivative instruments used to manage its exposures to foreign currency denominated accounts receivable and accounts payable as a component of “cost of products sold” which is consistent with the classification of the change in fair value upon remeasurement of the underlying hedged accounts receivable or accounts payable. The Company recognizes foreign currency exchange gains and losses on its derivative instruments used to manage its exposures to foreign currency denominated financing transactions as a component of “other income, net” which is consistent with the classification of the change in fair value upon remeasurement of the underlying hedged loans. The total amount recognized in earnings on the Company's foreign currency forward contracts, which depending upon the nature of the underlying hedged asset or liability is included as a component of either “cost of products sold” or “other income, net”, was a net foreign currency exchange gain of $0.9 million and a loss of $7.4 million, respectively, for the three months ended April 30, 2017 and 2016. The gains and losses on the Company’s foreign currency forward contracts are largely offset by the change in the fair value of the underlying hedged assets or liabilities.

The notional amount of forward exchange contracts is the amount of foreign currency to be bought or sold at maturity. Notional amounts are indicative of the extent of the Company’s involvement in the various types and uses of derivative financial instruments and are not a measure of the Company’s exposure to credit or market risks through its use of derivatives. The estimated fair value of derivative financial instruments represents the amount required to enter into similar offsetting contracts with similar remaining maturities based on quoted market prices.

The Company's average notional amounts of derivative financial instruments outstanding during the three months ended April 30, 2017 and 2016 were approximately $0.8 billion and $0.5 billion, respectively, with average maturities of 36 days and 30 days, respectively. As discussed above, under the Company's hedging policies, gains and losses on the derivative financial instruments are largely offset by the gains and losses on the underlying assets or liabilities being hedged.

The Company’s foreign currency forward contracts are also discussed in Note 8 – Fair Value Measurements.

17

NOTE 10 — COMMITMENTS & CONTINGENCIES

Operating Leases

The Company leases logistics centers, office facilities and certain equipment under non-cancelable operating leases. Future minimum lease payments at April 30, 2017, under all such leases, including minimum commitments under an agreement for data center services, for succeeding fiscal years and thereafter are as follows (in thousands):

Fiscal year: | |||

2018 (remaining 9 months) | $ | 53,900 | |

2019 | 57,500 | ||

2020 | 50,000 | ||

2021 | 44,100 | ||

2022 | 27,400 | ||

Thereafter | 48,000 | ||

Total payments | $ | 280,900 | |

Synthetic Lease Facility

The Company has a synthetic lease facility with a group of financial institutions (the “Synthetic Lease”) under which the Company leases certain logistics centers and office facilities from a third-party lessor, that expires in June 2018. Properties leased under the Synthetic Lease are located in Clearwater and Miami, Florida; Fort Worth, Texas; Fontana, California; Suwanee, Georgia; Swedesboro, New Jersey; and South Bend, Indiana. The Synthetic Lease is accounted for as an operating lease and rental payments are calculated at the applicable LIBOR rate plus a margin based on the Company's credit ratings.

Upon not less than 30 days notice, the Company, at its option, may purchase one or any combination of the properties, at an amount equal to each of the property's cost, as long as the lease balance does not decrease below a defined amount. Upon not less than 270 days, nor more than 360 days, prior to the lease expiration, the Company may, at its option, (i) purchase a minimum of two of the properties, at an amount equal to each of the property's cost, (ii) exercise the option to renew the lease for a minimum of two of the properties or (iii) exercise the option to remarket a minimum of two of the properties and cause a sale of the properties. If the Company elects to remarket the properties, the Company has guaranteed the lessor a percentage of the cost of each property, in the aggregate amount of approximately $133.8 million. Future annual lease payments under the Synthetic Lease are approximately $3.5 million per year.

Guarantees

The Company has arrangements with certain finance companies that provide inventory financing facilities to the Company’s customers. In conjunction with certain of these arrangements, the Company would be required to purchase certain inventory in the event the inventory is repossessed from the customers by the finance companies. As the Company does not have access to information regarding the amount of inventory purchased from the Company still on hand with the customer at any point in time, the Company’s repurchase obligations relating to inventory cannot be reasonably estimated. Repurchases of inventory by the Company under these arrangements have been insignificant to date. The Company believes that, based on historical experience, the likelihood of a material loss pursuant to these inventory repurchase obligations is remote.

The Company provides additional financial guarantees to finance companies on behalf of certain customers. The majority of these guarantees are for an indefinite period of time, where the Company would be required to perform if the customer is in default with the finance company related to purchases made from the Company. The Company reviews the underlying credit for these guarantees on at least an annual basis. As of April 30, 2017 and January 31, 2017, the outstanding amount of guarantees under these arrangements totaled $3.9 million and $3.7 million, respectively. The Company believes that, based on historical experience, the likelihood of a material loss pursuant to the above guarantees is remote.

18

Contingencies

Prior to fiscal 2004, one of the Company’s subsidiaries, located in Spain, was audited in relation to various value added tax (“VAT”) matters. As a result of those audits, the Spanish subsidiary received notices of assessment from the Regional Inspection Unit of Spain’s taxing authority that allege the subsidiary did not properly collect and remit VAT. The Spanish subsidiary appealed these assessments to the Madrid Central Economic Administrative Courts beginning in March 2010. The Company estimates the probable liability for these assessments, including various penalties and interest, was approximately $7.3 million at April 30, 2017, which is included in "accrued expenses and other liabilities" in the Consolidated Balance Sheet.

In December 2010, in a non-unanimous decision, a Brazilian appellate court overturned a 2003 trial court which had previously ruled in favor of the Company’s Brazilian subsidiary related to the imposition of certain taxes on payments abroad related to the licensing of commercial software products, commonly referred to as “CIDE tax.” The Company estimates the total exposure related to the CIDE tax, including interest, was approximately $23.1 million at April 30, 2017. The Brazilian subsidiary has appealed the unfavorable ruling to the Supreme Court and Superior Court, Brazil's two highest appellate courts. Based on the legal opinion of outside counsel, the Company believes that the chances of success on appeal of this matter are favorable and the Brazilian subsidiary intends to vigorously defend its position that the CIDE tax is not due. However, due to the lack of predictability of the Brazilian court system, the Company has concluded that it is reasonably possible that the Brazilian subsidiary may incur a loss up to the total exposure described above. The Company believes the resolution of this litigation will not be material to the Company’s consolidated net assets or liquidity.

The Company is subject to various other legal proceedings and claims arising in the ordinary course of business. The Company’s management does not expect that the outcome in any of these other legal proceedings, individually or collectively, will have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

NOTE 11 — SEGMENT INFORMATION

The Company operates predominantly in a single industry segment as a distributor of technology products, logistics management, and other value-added services. While the Company operates primarily in one industry, it is managed based on geographic segments. Prior to the acquisition of TS, the Company managed its operations in two geographic segments: the Americas and Europe. As a result of the acquisition of TS, the Company now manages its operations in three geographic segments: the Americas, Europe and Asia-Pacific. There were no Tech Data operations in the Asia-Pacific region prior to the acquisition of TS. Therefore, the recasting of our segment disclosure for all periods presented did not have an impact on the prior presentation. The Company does not consider stock-based compensation expense in assessing the performance of its operating segments, and therefore the Company excludes stock-based compensation expense from segment information. The accounting policies of the segments are the same as those described in Note 1 – Business and Summary of Significant Accounting Policies.

19

The net sales, operating income and depreciation and amortization amounts presented below include the operations of TS for the period from February 27, 2017 to April 30, 2017. Financial information by geographic segment is as follows (in thousands):

Three months ended April 30, | |||||||

2017 | 2016 | ||||||

Net sales: | |||||||

Americas (1) | $ | 3,468,837 | $ | 2,388,004 | |||

Europe | 4,006,920 | 3,575,358 | |||||

Asia-Pacific | 188,306 | — | |||||

Total | $ | 7,664,063 | $ | 5,963,362 | |||

Operating income: | |||||||

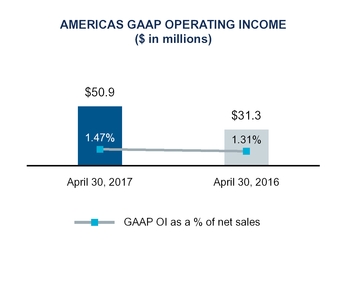

Americas (2) | $ | 50,900 | $ | 31,275 | |||

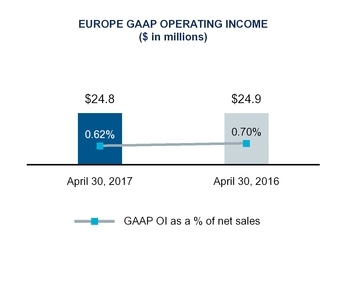

Europe (3) | 24,799 | 24,940 | |||||

Asia-Pacific | 4,297 | — | |||||

Stock-based compensation expense | (4,918 | ) | (3,657 | ) | |||

Total | $ | 75,078 | $ | 52,558 | |||

Depreciation and amortization: | |||||||

Americas | $ | 16,692 | $ | 4,890 | |||

Europe | 13,533 | 9,157 | |||||

Asia-Pacific | 1,458 | — | |||||

Total | $ | 31,683 | $ | 14,047 | |||

Capital expenditures: | |||||||

Americas | $ | 20,872 | $ | 6,097 | |||

Europe | 9,394 | 5,466 | |||||

Asia-Pacific | 180 | — | |||||

Total | $ | 30,446 | $ | 11,563 | |||

As of: | April 30, 2017 | January 31, 2017 | |||||

Identifiable assets: | |||||||

Americas | $ | 4,812,431 | $ | 3,238,162 | |||

Europe | 5,263,064 | 4,693,704 | |||||

Asia-Pacific | 481,113 | — | |||||

Total | $ | 10,556,608 | $ | 7,931,866 | |||

Long-lived assets: | |||||||

Americas (1) | $ | 71,539 | $ | 35,581 | |||

Europe | 56,803 | 38,658 | |||||

Asia-Pacific | 5,419 | — | |||||

Total | $ | 133,761 | $ | 74,239 | |||

Goodwill & acquisition-related intangible assets, net: | |||||||

Americas | $ | 1,138,400 | $ | 33,296 | |||

Europe | 608,635 | 246,002 | |||||

Asia-Pacific | 55,115 | — | |||||

Total | $ | 1,802,150 | $ | 279,298 | |||

(1) | Net sales in the United States represented 86% and 88%, respectively, of the total Americas' net sales for the three months ended April 30, 2017 and 2016. Total long-lived assets in the United States represented 92% and 94%, respectively, of the Americas' total long-lived assets at April 30, 2017 and January 31, 2017. |

(2) | Operating income in the Americas for the three months ended April 30, 2017 includes a gain related to LCD settlements and other, net, of $12.7 million and acquisition and integration related expenses of $30.2 million (see further discussion in Note 3 - Acquisitions). Operating income in the Americas for the three months ended April 30, 2016 includes $0.4 million of a gain related to LCD settlements and other, net (see further discussion in Note 1 – Business and Summary of Significant Accounting Policies). |

(3) | Operating income in Europe for the three months ended April 30, 2017 includes acquisition and integration related expenses of $11.5 million. |

20

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, including this Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), contains forward-looking statements, as described in the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks and uncertainties and actual results could differ materially from those projected. These forward-looking statements regarding future events and the future results of Tech Data Corporation (“Tech Data”, “we”, “our”, “us” or the “Company”) are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Readers are referred to the cautionary statements and important factors discussed in Part I, Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended January 31, 2017 for further information. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

OVERVIEW

Tech Data is one of the world’s largest wholesale distributors of technology products. We serve as an indispensable link in the technology supply chain by bringing products from the world’s leading technology vendors to market, as well as providing our customers with advanced logistics capabilities and value-added services.

Some of our key financial objectives are to gain share in select product areas in the geographies in which we operate and to improve operating income by growing gross profit faster than operating costs. In addition, we focus on deploying the right level of capital that yields solid operating cash flow generation and a return on invested capital that is above our weighted average cost of capital. To achieve this, we are focused on a strategy of execution, diversification and innovation that we believe differentiates our business in the marketplace. We also continually evaluate targeted strategic investments across our operations and new business opportunities and invest in those markets and product segments we believe provide us with the greatest opportunities for profitable growth.

On September 19, 2016, we entered into an interest purchase agreement with Avnet Inc. (“Avnet”) to acquire Avnet’s Technology Solutions business ("TS"). The acquisition of TS was completed on February 27, 2017. We acquired TS for an aggregate estimated purchase price of approximately $2.7 billion, including approximately $2.5 billion paid to Avnet in cash including estimated closing adjustments, and 2,785,402 shares of the Company's common stock. The final cash consideration is subject to certain working capital and other adjustments and therefore the final purchase price may vary significantly from these estimates.

TS delivers technology services, software, hardware and solutions across the data center. We believe that through the TS acquisition we will diversify our end-to-end solutions, deepen our value added capabilities and balance our solutions portfolio. The addition of TS also extends our geographic reach into the Asia-Pacific region while broadening our capabilities in Europe and the Americas, including re-entering Latin America with a focus on the delivery of new technologies that drive and complement the data center in this market. We now manage our business in three geographic segments: the Americas, Europe and Asia-Pacific. The combined business extends our operations into forty countries spread across five continents with approximately 14,000 employees.

In connection with the acquisition of TS, on January 31, 2017, the Company issued $500.0 million aggregate principal amount of 3.70% Senior Notes due 2022 and $500.0 million aggregate principal amount of 4.95% Senior Notes due 2027. Additionally, at the consummation of the acquisition on February 27, 2017, the Company borrowed $1.0 billion under its Term Loan Credit Agreement (as defined herein), comprised of $250.0 million aggregate principal amount of three-year term loans and $750.0 million aggregate principal amount of five-year term loans.

21

RESULTS OF OPERATIONS

The following table sets forth our Consolidated Statement of Income as a percentage of net sales:

Three months ended April 30, | |||||||

2017 | 2016 | ||||||

Net sales | 100.00 | % | 100.00 | % | |||

Cost of products sold | 94.04 | 94.99 | |||||

Gross profit | 5.96 | 5.01 | |||||

Operating expenses: | |||||||

Selling, general and administrative expenses | 4.60 | 4.13 | |||||

Acquisition and integration expenses | 0.55 | 0.00 | |||||

LCD settlements and other, net | (0.17 | ) | 0.00 | ||||

4.98 | 4.13 | ||||||

Operating income | 0.98 | 0.88 | |||||

Interest expense | 0.40 | 0.09 | |||||

Other income, net | 0.00 | (0.01 | ) | ||||

Income before income taxes | 0.58 | 0.80 | |||||

Provision for income taxes | 0.18 | 0.24 | |||||

Net income | 0.40 | % | 0.56 | % | |||

22

NON-GAAP FINANCIAL INFORMATION

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also discloses certain non-GAAP financial information. Certain of these measures are presented as adjusted for the impact of changes in foreign currencies (referred to as “impact of changes in foreign currencies”). Removing the impact of the changes in foreign currencies provides a framework for assessing our financial performance as compared to prior periods. The impact of changes in foreign currencies is calculated by using the exchange rates from the prior year comparable period applied to the results of operations for the current period. The non-GAAP financial measures presented in this document include:

• | Net sales, as adjusted, which is defined as net sales adjusted for the impact of changes in foreign currencies; |

• | Gross profit, as adjusted, which is defined as gross profit as adjusted for the impact of changes in foreign currencies; |

• | Selling, general and administrative expenses (“SG&A”), as adjusted, which is defined as SG&A as adjusted for the impact of changes in foreign currencies; |

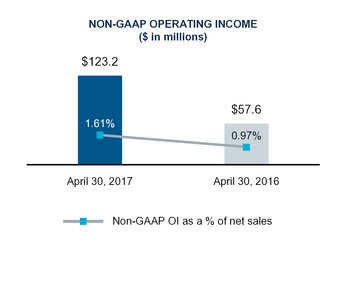

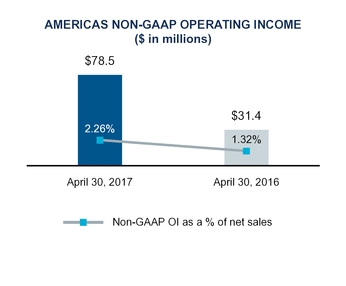

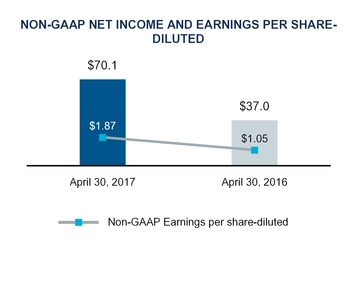

• | Non-GAAP operating income, which is defined as operating income as adjusted to exclude acquisition and integration expenses, LCD settlements and other, net and acquisition-related intangible asset amortization; |

• | Non-GAAP net income, which is defined as net income as adjusted to exclude acquisition and integration expenses, LCD settlements and other, net, acquisition-related intangible asset amortization, acquisition-related financing expenses, and the income tax effects of these adjustments; |

• | Non-GAAP earnings per share-diluted, which is defined as earnings per share-diluted as adjusted to exclude the per share impact of acquisition and integration expenses, LCD settlements and other, net, acquisition-related intangible asset amortization, acquisition-related financing expenses, and the income tax effects of these adjustments. |

Management believes that providing this additional information is useful to the reader to assess and understand our financial performance as compared with results from previous periods. Management also uses these non-GAAP measures to evaluate performance against certain operational goals. However, analysis of results on a non-GAAP basis should be used as a complement to, and in conjunction with, data presented in accordance with GAAP. Additionally, because these non-GAAP measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures reported by other companies.

23

NET SALES COMMENTARY | |

The following tables summarize our net sales and change in net sales by geographic region for the three months ended April 30, 2017 and 2016:

Three months ended April 30 | Change | |||||||||||||

2017 | 2016 | $ | % | |||||||||||

(in millions) | ||||||||||||||

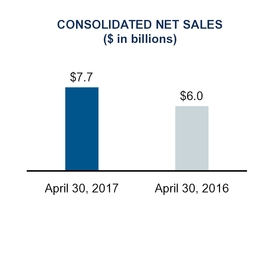

Consolidated net sales, as reported | $ | 7,664 | $ | 5,963 | $ | 1,701 | 28.5 | % | ||||||

Impact of changes in foreign currencies | 266 | — | ||||||||||||

Consolidated net sales, as adjusted | $ | 7,930 | $ | 5,963 | $ | 1,967 | 33.0 | % | ||||||

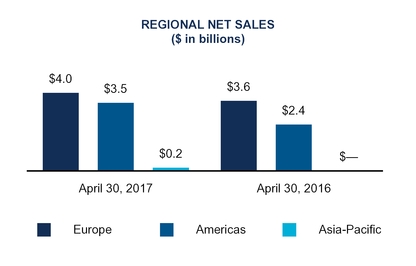

Americas net sales, as reported | $ | 3,469 | $ | 2,388 | $ | 1,081 | 45.3 | % | ||||||

Impact of changes in foreign currencies | 1 | — | ||||||||||||

Americas net sales, as adjusted | $ | 3,470 | $ | 2,388 | $ | 1,082 | 45.3 | % | ||||||

Europe net sales, as reported | $ | 4,007 | $ | 3,575 | $ | 432 | 12.1 | % | ||||||

Impact of changes in foreign currencies | 263 | — | ||||||||||||

Europe net sales, as adjusted | $ | 4,270 | $ | 3,575 | $ | 695 | 19.4 | % | ||||||

Asia-Pacific net sales, as reported | $ | 188 | $ | — | $ | 188 | N/A | |||||||

Impact of changes in foreign currencies | 2 | — | ||||||||||||

Asia-Pacific net sales, as adjusted | $ | 190 | $ | — | $ | 190 | N/A | |||||||

NET SALES COMMENTARY | |

AMERICAS

• | The increase in Americas net sales, as adjusted, of approximately $1.1 billion is primarily due to our further expansion into the Americas market through the acquisition of TS. TS net sales were concentrated in the data center and software product categories. The Americas also had growth in broadline products, which was partially offset by lower sales of consumer electronic products. |

EUROPE

• | The increase in Europe net sales, as adjusted, of $695 million is primarily due to the impact of the acquisition of TS with growth in the data center and software product categories, as well as growth in mobility products. |

ASIA-PACIFIC

• | The increase in Asia-Pacific net sales, as adjusted, of $190 million is due to the acquisition of TS, with net sales primarily in the data center and software product categories. |

24

MAJOR VENDORS

The following table provides a comparison of net sales generated from products purchased from vendors that exceeded 10% of our consolidated net sales for the three months ended April 30, 2017 and 2016 (as a percent of consolidated net sales):

Three months ended April 30: | 2017 | 2016 |

Apple, Inc. | 15% | 17% |

HP Inc. | 11% | 14% |

Cisco Systems, Inc. | 10% | 10% |

There were no customers that exceeded 10% of our consolidated net sales for the three months ended April 30, 2017 and 2016.

GROSS PROFIT | |

The following tables provide a comparison of our gross profit and gross profit as a percentage of net sales for the three months ended April 30, 2017 and 2016:

Three months ended April 30 | Change | |||||||||||||

2017 | 2016 | $ | % | |||||||||||

(in millions) | ||||||||||||||

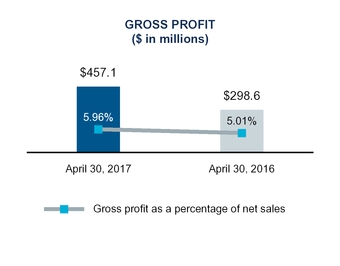

Gross profit, as reported | $ | 457.1 | $ | 298.6 | $ | 158.5 | 53.1 | % | ||||||

Impact of changes in foreign currencies | 14.5 | — | ||||||||||||

Gross profit, as adjusted | $ | 471.6 | $ | 298.6 | $ | 173.0 | 57.9 | % | ||||||

The increase in gross profit, as adjusted, of $173.0 million is primarily due to increased sales volume and changes in product mix, both of which were significantly impacted by the acquisition of TS. TS expanded our capabilities in providing end to end solutions and enabled us to shift our sales mix toward higher margin products such as those in the data center product category.

25

OPERATING EXPENSES | |

SELLING GENERAL AND ADMINISTRATIVE EXPENSES

The following tables provide a comparison of our selling, general and administrative expenses:

Three months ended April 30 | Change | |||||||||||||

2017 | 2016 | $ | % | |||||||||||

(in millions) | ||||||||||||||

SG&A, as reported | $ | 352.6 | $ | 246.5 | $ | 106.1 | 43.0 | % | ||||||

Impact of changes in foreign currencies | 11.8 | — | ||||||||||||

SG&A, as adjusted | $ | 364.4 | $ | 246.5 | $ | 117.9 | 47.8 | % | ||||||

SG&A as a percentage of net sales, as reported | 4.60 | % | 4.13 | % | 47 bps | |||||||||

The year over year increase in SG&A, as adjusted, of $117.9 million is primarily due to increased costs as a result of the acquisition of TS. The year over year increase in SG&A as a percentage of net sales is also primarily due to the acquisition of TS including higher costs incurred to support the increase in the more complex, higher margin data center business.

ACQUISITION AND INTEGRATION EXPENSES