Attached files

| file | filename |

|---|---|

| EX-31.4 - EXHIBIT 31.4 - Spok Holdings, Inc | exhibit314.htm |

| EX-31.3 - EXHIBIT 31.3 - Spok Holdings, Inc | exhibit313.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2019

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-32358

SPOK HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE | 16-1694797 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

6850 Versar Center, Suite 420 Springfield, Virginia | 22151-4148 | |

(Address of principal executive offices) | (Zip Code) | |

(800) 611-8488

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | SPOK | NASDAQ National Market® |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | x | ||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | ||

Emerging growth company | ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the common stock held by non-affiliates of the registrant was $289 million based on the closing price of $15.04 per share on the NASDAQ National Market® on June 28, 2019.

The number of shares of registrant’s common stock outstanding on April 24, 2020 was 19,005,209.

Explanatory Note

Spok Holdings, Inc. and its subsidiaries (“Spok,” the “Company,” “we,” “our” or “us”) is filing this Amendment No. 1 (this “Amendment”) to our Annual Report on Form 10-K for the year ended December 31, 2019, originally filed with the Securities and Exchange Commission (“SEC”) on February 27, 2020 (the “Form 10-K”), to provide the information required by Part III that was intended to be incorporated by reference from the Company’s definitive proxy statement related to its 2020 Annual Meeting of Stockholders. This Amendment is required because such proxy statement will not be filed within the required time period for incorporation by reference.

Accordingly, Part III of the Form 10-K is hereby amended and restated as set forth in this Amendment. The reference on the cover page of the Form 10-K to the incorporation by reference of portions of the proxy statement is hereby deleted. As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with this Amendment, the Company's Chief Executive Officer and Chief Financial Officer have reissued applicable portions of their certifications required under Section 302 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). Accordingly, Part IV, Item 15 of this Amendment reflects the filing of such certifications herewith. This Amendment does not include certifications under Section 906 of Sarbanes-Oxley because no financial statements are being filed with this Amendment.

With the exception of the foregoing, no other information in the Form 10-K has been supplemented, updated or amended. This Amendment is not intended to amend or otherwise update other information in the Form 10-K. Among other things, forward-looking statements made in the Form 10-K have not been revised to reflect events, results or developments that have occurred or facts that have become known to us after the date of the Form 10-K, and such forward-looking statements should be read in their historical context. Accordingly, this Amendment should be read in conjunction with the Form 10-K and with our filings made with the SEC subsequent to the filing of the Form 10-K.

TABLE OF CONTENTS

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set forth below is certain information, as of April 29, 2020, for each member of our Board of Directors (the “Board”).

DIRECTORS

Royce Yudkoff, age 64, became a director and the Chair of the Board in November 2004. He is also a member of the Compensation Committee and Nominating and Governance Committee. Prior to the merger of Metrocall and Arch in November 2004, Mr. Yudkoff had been a director of Metrocall since April 1997, and had served as the Chair of its Board since February 2003. In 1989, Mr. Yudkoff co-founded ABRY Partners, LLC, a private equity investment firm, which focuses on the media, communications and business services sectors. Mr. Yudkoff currently serves on the Board of ABRY Partners, LLC, Stafford Insurance Company and America's Kitchen, Inc. Mr. Yudkoff served on the Board of Muzak Holdings LLC from 2002 to 2009, Talent Partners from 2000 to 2014, Media Ocean, LLC from 2014 to 2015 and Nexstar Broadcasting Group, Inc. from 1996 to 2014. Additionally, Mr. Yudkoff is a Professor of Management Practice at Harvard Business School.

• | Director Qualifications: Mr. Yudkoff has an understanding of our operations, strategies, financial outlook and ongoing challenges. In addition, Mr. Yudkoff has experience in the media and communication sectors that can be applied to our operations. Mr. Yudkoff has the requisite qualifications to continue as a director. |

N. Blair Butterfield, age 63, became a director of the Company in July 2013. He is a member of the Audit Committee and Cybersecurity Committee. Prior to 2016, Mr. Butterfield was the President of VitalHealth Software, North America which offers the industry’s leading cloud-based eHealth application development platform with solutions for collaborative care as well as the Office of the National Coordinator certified electronic health records for specialty practices. Mr. Butterfield is a senior health information technology (“IT”) executive and eHealth expert with thirty years of global experience in new market and business development, general management, government initiatives, sales management and strategic marketing. He is also the Chairman of Wind River Advisory Group, LLC, a strategic consulting firm in health IT and ehealth. He has also served as Vice President, International Development for eHealth at GE Healthcare from 2006 to 2011. Previously, Mr. Butterfield served on the Board of California Institute of Computer. Assisted Surgery (CICAS) from 2011 to 2013, All Clear Diagnostics, LLC from 2012 to 2014, the eHealth Initiative and Foundation from 2008 to 2010, and the VistA Software Alliance from 2006 to 2008.

• | Director Qualifications: Mr. Butterfield has extensive experience in the software industry that can be applied to our operations in such market segments as enterprise health information systems and platform software, health information exchange (HIE), electronic medical Records (EMR), medical imaging, standards-based interoperability and clinical informatics. Mr. Butterfield has the requisite qualifications to continue as a director. |

Stacia A. Hylton, age 59, became a director of the Company in 2015. Ms. Hylton is a member of the Audit Committee and Chair of the Cybersecurity Committee. Ms. Hylton currently serves as a Principal for LS Advisory, a New Jersey-based business solutions advisory consultancy. She also serves on the Board of Directors for Lexis-Nexis Special Services Inc., an information and data analytics solutions company, and Core-Civic, Inc., a publicly traded real estate solutions and corrections and residential reentry centers provider. In 2016, Ms. Hylton served as Senior Vice President for Cyber Security at MTM Technologies, Inc., a leading national provider of innovative IT solutions and services. In 2010, Ms. Hylton was nominated by the President of the United States and confirmed by the United States Senate as Director of the United States Marshals Service (“USMS”), a federal law enforcement agency. The USMS employs over 12,000 employees, task force officers and contractors with a budget in excess of $4.9 billion.Ms. Hylton retired as Director of USMS in 2015. In 2010, she was President of Hylton Kirk & Associates, a private consulting firm located in the Commonwealth of Virginia. From 2004 to 2010 Ms. Hylton served as the Federal Detention Trustee in the United States Department of Justice. From 1980 through 2004 she served in progressively responsible positions within USMS.

• | Director Qualifications: Ms. Hylton has extensive operational and executive management experience that includes security, alarm monitoring/call center technology, multi-year fiscal planning and execution, contracting, cyber security data-analytics and corporate strategy. Ms. Hylton provides unique insight, which assists the Company in developing and growing key market segments for our healthcare communication solutions. Ms. Hylton has the requisite qualifications to continue serving as a director. |

Vincent D. Kelly, age 60, became a director, President and Chief Executive Officer (“CEO”) of the Company in November 2004 when USA Mobility was formed through the merger of Metrocall and Arch. Prior to the merger of Metrocall and Arch Mr. Kelly was President and CEO of Metrocall since February 2003. Prior to this appointment, he had also served at various times as Chief Operating Officer, Chief Financial Officer and Executive Vice President of Metrocall. He served as the Treasurer of Metrocall from August 1995 to February 2003, and served as a director Metrocall from 1990 to 1996 and from May 2003 to November 2004. Mr. Kelly serves as CEO for all our subsidiaries as well as a Director. Mr. Kelly served on the Boards of Tellabs from 2012 to 2013 and Penton Media from 2003 to 2007.

• | Director Qualifications: Mr. Kelly has been involved with the wireless and telecommunications industry for over 25 years and the software industry for over four years. Mr. Kelly holds a BS in accounting from George Mason University. Mr. Kelly has the requisite qualifications to continue as a director. |

Brian O’Reilly, age 60, became a director of the Company in November 2004. He is a member of the Nominating and Governance Committee and is the Chair of the Compensation Committee. Prior to the merger of Metrocall and Arch, Mr. O’Reilly had been a director of Metrocall since October 2002. He was with Toronto-Dominion Bank for 16 years, from 1986 to 2002. From 1986 to 1996, Mr. O’Reilly served as the managing director of Toronto-Dominion Bank’s loan syndication group, focused on the underwriting of media and telecommunications loans. From 1996 to 2002, he served as the managing director of Toronto-Dominion Bank’s media, telecom and technology group with primary responsibility for investment banking in the wireless and emerging telecommunications sectors.

• | Director Qualifications: Mr. O’Reilly has been involved with the paging industry as a director since 2002 and a director of the Company since November 2004. Mr. O’Reilly has past experience in the underwriting of media and communication financing that can be applied to our operations. Mr. O'Reilly has the requisite qualifications to continue as a director. |

Matthew Oristano, age 63, became a director of the Company in November 2004. He is Chair of the Audit Committee. Prior to the merger of Metrocall and Arch, Mr. Oristano had been a director of Arch since 2002. Mr. Oristano has been the President, CEO and member of the Board of Alda Inc., an investment management company, since 1995. He has served as chair of the Board, President and CEO of Reaction Biology Corporation, a contract biomedical research firm, since March 2004. He was the Vice President, Treasurer and member of the Board of The Oristano Foundation from 1995 to November 2012.

• | Director Qualifications: Mr. Oristano has an understanding of our operations, strategies, financial outlook and ongoing challenges. In addition, Mr. Oristano has past experience in investment management and telecommunications company operations. As a CEO, Mr. Oristano has directly supervised CFOs and been involved in the annual audit process. Mr. Oristano is also considered an audit committee financial expert. Mr. Oristano has the requisite qualifications to continue as a director. |

Todd Stein, age 42, became a director of the Company in July 2018. He is a member of the Audit Committee. Mr. Stein is Co-Investment Manager of Dallas-based Braeside Investments, LLC, the investment manager of private investment partnerships focusing on global small and micro-cap equities. Mr. Stein’s core competency is applying fundamental analysis to purchase undervalued securities. Prior to co-founding Braeside in 2004, Mr. Stein was a portfolio manager at Q Investments, L.P. During his tenure at Q, Mr. Stein co-managed a merger arbitrage portfolio in addition to serving as the firm’s primary analyst on its short distressed/bankrupt equities portfolio. In 2002, Mr. Stein was appointed by the U.S. Trustee of the Northern District of Illinois to serve on the official creditors’ committee of United Airlines. Mr. Stein holds the Chartered Financial Analyst designation.

• | Director Qualifications: The funds managed by Braeside have been stockholders of the Company for more than six years. Thus, Mr. Stein has an understanding of our operations, strategies, financial outlook and ongoing challenges. In addition, Mr. Stein has nearly two decades of experience in global investment management. Mr. Stein provides insight into capital allocation, which assists the Company in evaluating strategic growth opportunities for our critical communication solutions. Mr. Stein has the requisite qualifications to continue as a director. |

Samme L. Thompson, age 74, became a director of the company in 2004. He is a member of the Compensation Committee and is Chairman of the Nominating and Governance Committee. Prior to the merger of Metrocall and Arch Wireless, Mr. Thompson had been a director of Arch. Mr. Thompson currently serves on the Board of Visitors at the Katz Graduate Business School, and College of Business Administration at the University of Pittsburgh. He previously served on the boards of the Knapp Entrepreneurial Development Center at the Illinois Institute of Technology, and Broadband Illinois, LLC. Mr. Thompson is the owner and president of Telit Associates, Inc., a strategic consulting and financial advisory firm that addresses telecom and information technology businesses. He was previously Senior Vice President, Global Corporate Strategy and Corporate Business Development at Motorola Corporation; Chief Strategy Officer at AT&T Information Systems; Senior Vice President in Kidder, Peabody’s investment banking group; and was a strategy consultant at McKinsey & Co. Since August 2005, he has been a member of the Board of American Tower Corporation (“ATC”), following their merger with with SpectraSite, Inc., a landlord of transmission tower sites used by our Company. Due to his relationship with ATC, Mr. Thompson has recused himself from all decisions by the Board on matters relating to ATC.

• | Director Qualifications: Mr. Thompson has been involved in the wireless communications and information technology industries for one 40 years. His in-depth knowledge of business strategy, business development and finance relating to communications and IT businesses is applicable to our Company's current strategic direction, financial outlook and associated challenges. |

Dr. Bobbie Byrne, age 52, became a director of the Company in January 2020. She is a member of the Cybersecurity Committee.

Dr. Byrne has served as Chief Information Officer at Advocate Aurora Health since 2017 and is responsible for all information technology applications, information security, infrastructure, clinical informatics, data warehousing and business intelligence across the entire healthcare system. In 2017 she served as CMO at Edward-Elmhurst Health where she was responsible for quality and safety, clinical research, information technology and patient experience and prior to that she was the CIO from 2009 to 2017 where she oversaw the Epic and Lawson implementations. Dr. Byrne was the Clinical Director at the Certification Commission for Healthcare Information Technology in 2009 and served as the SVP, Clinical Solutions for Eclipsys, Inc. (now Allscripts, Inc.) from 2005 to 2009.

• | Director Qualifications: Dr. Byrne has extensive operational and executive management experience with over 20 years of experience in the healthcare industry, which provides a unique insight to the Company as it transitions to a cloud-based software Company. She completed medical school at Northwestern University and pediatrics residency at Children’s Memorial Medical Center in Chicago. She also practiced at Northwestern Memorial Hospital and North Shore University Healthcare. She received her M.B.A. from the Kellogg Graduate School of Management and her B.A. from Northwestern University. She is active in the informatics work of the American Academy of Pediatrics, having served on the organization’s Physician Advisory Council for Informatics. She is board certified in both Pediatrics and Clinical Informatics. Dr. Byrne has the requisite qualifications to serve as a director. |

Christine M. Cournoyer, age 68, became a director of the Company in March 2020. She is a member of the Nominating and Governance Committee. Ms. Cournoyer currently serves as a strategic advisor to digital health companies and as a board member of CareDx, Inc., a leading precision medicine company providing solutions for transplant patients, since 2019. She served as CEO and Chairperson of N-of-One, Inc. from 2012 to 2019 until it was acquired by QIAGEN N.V., for whom she served as a strategic advisor for the remainder of 2019. In her time as CEO of N-of-One, Inc. Ms. Cournoyer led the transformation from a patient concierge business to a leading molecular decision support company selling to large health providers and leading molecular diagnostic commercial labs. She, along with the efforts of her team, created a HIPAA compliant platform running in the cloud that scaled to interpret hundreds of thousands of molecular diagnostics tests. From 2010 to 2011 Ms. Cournoyer served as the VP of Clinical Analytics for United-Health Group/Optum where she was responsible for clinical solutions and defining the clinical support strategy. Between 2006 and 2010 she was the President and COO for Picis, a global leader in healthcare IT. Ms. Cournoyer also served as a board member of Emerson Hospital from 2012 to 2018, BJ's Wholesale Club from 2008 to 2011, Stride Rite from 2001 to 2007 and GTech from 2003 to 2006 . Prior positions include Managing Director, Database Division, of Harte Hanks, and VP of Global Business Transformation and CIO of the IBM Software Group.

• | Director Qualifications: Ms. Cournoyer has over 30 years of management experience in the Software and Healthcare IT industry. Ms. Cournoyer has extensive public and private board experience, having served on the Board of Directors for three public companies: Stride Rite, GTECH, and BJ’s Wholesale Club. Ms. Cournoyer served as the Chairperson of the Board of Directors for N-of-One, a privately held venture backed company in molecular/genomics decision support. She is presently serving on the board of CareDx, a leader in the field of transplants. Ms. Cournoyer has experience serving on the Finance, Audit, and Compensation Committees, and has chaired a Technology Committee for two of the boards. Ms. Cournoyer has also served on a nonprofit board as a member of the Emerson Hospital Board of Trustees. She holds a B.S. degree in Business Administration from the University of Massachusetts, an M.A. in Economics from Northeastern University and is a graduate of the MIT Executive Education Program. Ms. Cournoyer has the requisite qualifications to serve as a director. |

EXECUTIVE OFFICERS

Our executive officers serve at the pleasure of the Board (only Mr. Kelly has an employment contract). Set forth below is biographical information for each of our executive officers who is not also a director as of April 29, 2020.

Bonnie K. Culp-Fingerhut, age 68, was appointed Executive Vice President ("EVP") of Human Resources and Administration (“HR”) in October 2007. Ms. Culp-Fingerhut has been responsible for strategic human resource planning and human resource policy development at USA Mobility (now operating as Spok, Inc.) and its predecessor company, Metrocall, Inc., since 1997. She oversees corporate and international human resource and payroll operations. In addition, Ms. Culp-Fingerhut assumed the role of Executive Vice President of Human Resources and Administration in October of 2007 and oversees the Ethics Program and related compliance activities. Prior to joining the Company, Ms. Culp-Fingerhut was a consultant with Hay Group, a global Human Resources management-consulting firm where she provided advice and services primarily to organizations undergoing large-scale organizational change. She has expertise in designing and implementing cost-effective human resource systems that align with and support the business strategies of the organization. This includes planning and implementing transition, integration and downsizing strategies, and creating reward and performance management systems. Ms. Culp-Fingerhut has over 30 years of experience in human resource management and operations including more than 12 years of senior management positions. Ms. Culp-Fingerhut holds a Masters of Arts in Industrial Relations from Saint Frances College. Ms. Culp-Fingerhut is an NEO.

Michael W. Wallace, age 51, was appointed Chief Financial Officer on March 27, 2017 and Chief Operating Officer on January 2, 2020. Before his appointment as CFO, Mr. Wallace spent more than 25 years as a financial executive at both public and private companies, most recently as Executive Vice President and CFO at Intermedix Corporation, a healthcare revenue cycle/practice management and data analytics solution provider since August 2013. Prior to joining Intermedix, he was the Executive Vice President and CFO of The Elephant Group (d.b.a. Saveology.com), a leading Internet-based, direct-to-consumer marketing platform. Prior to that, he served as Senior Vice President and CFO of Radiology Corporation of America, a national provider of mobile and fixed-site positron emission tomography (PET) imaging services. Mr. Wallace has also served as an Assistant Chief Accountant in the Securities and Exchange Commission’s (SEC) Division of Enforcement and was a member of the Commission’s Financial Fraud Task Force in Washington, D.C. Prior to being at the SEC, Mr. Wallace served as CFO at Inktel Direct Corporation, a direct marketing service firm, CELLIT Technologies, Inc., a software company serving the contact center marketplace, and Kellstrom Industries, Inc., a publicly held global aerospace company. Before joining Kellstrom, Mr. Wallace worked at KPMG Peat Marwick, LLP in Miami for more than seven years. He received his bachelor’s degree in business administration from the University of Notre Dame and is a licensed Certified Public Accountant. Mr. Wallace became an NEO upon his appointment as CFO on March 27, 2017.

Sharon Woods Keisling, age 51, was appointed Corporate Secretary of USA Mobility, Inc. (now operating as Spok, Inc.) in July 2007 and Treasurer in October 2008. Ms. Woods Keisling joined Metrocall, Inc. in August 1989. Ms. Woods Keisling was named Vice President of Treasury Operations with the merger of Arch and Metrocall in 2004. Prior to this appointment, she held positions in Accounts Receivable and IT. Ms. Woods Keisling currently serves as a Director of Spok, Inc., Arch Wireless, Spok AUS Pty Ltd, Spok Middle East, Inc., and Spok UK Ltd, all wholly owned subsidiaries of the Company. Ms. Woods Keisling holds a Bachelor of Arts in Accounting from Kings College and has over 30 years of cash operation experience.

CORPORATE GOVERNANCE

In recognition of our governance practices, Institutional Shareholder Services (ISS) has consistently given us its highest ranking of “1” under its Governance QualityScore rating system, and a “1” for Spok’s “Shareholder Rights,” which indicates the lowest governance risk as compared to our industry.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has established various separately designated standing committees to assist it with performance of its responsibilities. The Board designates the members of these committees and the committee chairs annually at its organizational meeting, which typically follows the annual meeting of stockholders, based on the recommendations of the Nominating and Governance Committee. The Chair of each committee works with Company management to develop the agenda for that committee and determine the frequency and length of committee meetings. After each meeting, each committee provides a full report to the Board.

The Board has adopted written charters for each of these committees. These charters are available on the Company’s website at http://www.spok.com/meet-spok/investor-relations. The following table summarizes the primary responsibilities of the committees:

Committee Audit Compensation Nominating and Governance Cybersecurity | Primary Responsibilities The Audit Committee assists the Board in its oversight of the integrity of the Company’s financial statements and financial reporting processes and systems of internal control; the qualifications, independence and performance of the Company’s independent registered public accounting firm, the internal auditors and the internal audit function and the Company’s compliance with legal and regulatory requirements. The Audit Committee also prepares the Audit Committee Report required by SEC rules. The Compensation Committee determines, reviews and approves the compensation of the named executive officers ("NEOs"), including salary, annual short-term incentive awards and long-term incentive awards. The Compensation Committee reviews director compensation and recommends changes in compensation to the Board. In addition, the Compensation Committee evaluates the design and effectiveness of the Company’s incentive programs. The Compensation Committee also prepares the Compensation Committee Report required by SEC rules The Nominating and Governance Committee identifies individuals qualified to become Board members consistent with the criteria established by the Board, which are described in the Company’s Corporate Governance Guidelines, and recommends a slate of nominees for election at each annual meeting of stockholders; makes recommendations to the Board concerning the appropriate size, function, needs and composition of the Board and its committees; advises the Board on corporate governance matters, including the development of recommendations to the Board on the Company’s Corporate Governance Guidelines; and oversees the self-evaluation process of the Board and its committees. Added in 2020, the Cybersecurity committee enhances the Board’s understanding and oversight of the policies, controls and procedures that Spok management has put in place to identify, manage and mitigate risks related to cybersecurity, privacy and disaster recovery. |

The following table sets forth the current members of each committee:

Name | Audit(1) | Compensation(2) | Nominating and Governance(3) | Cybersecurity(4) |

N. Blair Butterfield* | √ | √ | ||

Stacia A. Hylton* | √ | Chair | ||

Vincent D. Kelly | ||||

Brian O’Reilly* | Chair | √ | ||

Matthew Oristano* | Chair | |||

Samme L. Thompson* | √ | Chair | ||

Royce Yudkoff*(4) | √ | √ | ||

Todd Stein* | √ | |||

Bobbie Byrne* | √ | |||

Christine M. Cournoyer* | √ | |||

* Independent Director

(1) The Audit Committee consists entirely of non-management directors, all of whom the Board has determined are independent within the meaning of the listing standards of NASDAQ and Rule 10A-3 of the Exchange Act. The Board has determined that all members of the Audit Committee are financially literate and that Matthew Oristano is an “audit committee financial expert” within the meaning set forth in SEC regulations.

(2)The Compensation Committee consists entirely of non-management directors, all of whom the Board has determined are independent within the meaning of the listing standards of NASDAQ, are non-employee directors for the purposes of Rule 16b-3 of the Exchange Act, and satisfy the requirements of Internal Revenue Code Section 162(m) for outside directors.

(3)The Nominating and Governance Committee consists entirely of non-management directors, all of whom the Board has determined are independent within the meaning of the listing standards of NASDAQ.

(4) The Cybersecurity Committee was established in 2020 and consists entirely of non-management directors, all of whom the Board has determined are independent within the meaning of the listing standards of NASDAQ.

(5)Chair of the Board of Directors.

CODE OF BUSINESS CONDUCT AND ETHICS

Spok has adopted a Code of Business Conduct and Ethics that applies to all employees, including the CEO, CFO and CAO and all directors. This Code of Business Conduct and Ethics may be found on our website at http://www.spok.com/meet-spok/investor-relations. During the period covered by this report, we did not request a waiver of our Code of Business Conduct and Ethics and did not grant any such waivers. Spok intends to post amendments to or waivers from its Code of Business Conduct and Ethics (to the extent applicable to the Company’s directors, executive officers or principal financial officers) on its website.

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION OF DIRECTORS

2019 Non-Executive Director Compensation

The Company’s philosophy is to provide competitive compensation necessary to attract and retain high-quality non-executive directors, while also ensuring that non-executive directors interests are strongly aligned with our stockholders. Directors who are full-time employees of the Company (currently, only Mr. Kelly) receive no additional compensation for service as a director.

The Compensation Committee periodically reviews the competitiveness of director compensation, considers the appropriateness of the form and amount of director compensation and makes recommendations to the Board concerning such compensation with a view toward attracting and retaining qualified directors. There were no changes made to director compensation in 2019.

For 2019, our director compensation program provided for each non-executive director to receive an award of restricted shares of common stock (“restricted stock”) quarterly based upon the closing price per share of our common stock at the end of each quarter, such that each non-executive director will receive $60,000 per year of restricted stock ($70,000 for the Chair of the Audit Committee). The restricted stock vests on the earlier of a change in control of the Company or one year from the date of grant. In addition, for 2019, the non-executive directors received cash compensation of $45,000 per year ($55,000 for the Chair of the Audit Committee), also payable quarterly.

The following table presents the cash and equity compensation elements in place during 2019 for our non-executive directors:

Type of Compensation | Non-Executive Director (excluding Chair of Audit Committee) | Chair of Audit Committee | ||||

Annual Cash Fee(1) | $ | 45,000 | $ | 55,000 | ||

Annual Restricted Stock Award Value(1)(2) | 60,000 | 70,000 | ||||

(1)Both the cash fee and restricted stock award value are paid in quarterly installments.

(2) Restricted stock vests one year following the grant date, subject to earlier vesting upon a change in control.

The non-executive directors are reimbursed for any reasonable out-of-pocket Board related expenses incurred. There are no other annual fees paid to these non-executive directors.

The following table sets forth the compensation earned by the non-executive directors for the year ended December 31, 2019:

Director Compensation Table for 2019

Director Name | Fees Earned or Paid in Cash ($) | Restricted Stock Awards ($) (1)(2) | Total ($) | |||

Royce Yudkoff | 45,000 | 60,000 | 105,000 | |||

N. Blair Butterfield | 45,000 | 60,000 | 105,000 | |||

Stacia A. Hylton | 45,000 | 60,000 | 105,000 | |||

Brian O'Reilly | 45,000 | 60,000 | 105,000 | |||

Matthew Oristano | 55,000 | 70,000 | 125,000 | |||

Samme L. Thompson | 45,000 | 60,000 | 105,000 | |||

Todd Stein | 45,000 | 60,000 | 105,000 | |||

(1) Each non-executive director was awarded 4,485 shares of restricted stock during 2019, except that Mr. Oristano, the Chair of the Audit Committee had 5,235 shares of restricted stock awarded to him during 2019 None of our non-executive directors held any other stock awards or any outstanding options as of December 31, 2019.

(2) Amounts shown reflect the grant date fair value of the restricted stock awards as determined under FASB ASC Topic 718.

Non-Executive Director Compensation Actions for 2020.

In connection with compensation decisions for 2020, the Board’s independent compensation consultant, Korn Ferry, conducted a review of our non-executive director compensation program relative to the board compensation paid by our peer group of companies. Our peer group of companies is discussed and identified below under “Compensation Discussion and Analysis-Relationship With Compensation Consultants and Use of Peer Groups.” Although Korn Ferry’s review indicated that our total non-executive director compensation was below the median compensation level paid by our peer group, the Board determined to leave non-executive director compensation levels unchanged for 2020. Further, in order to provide for even closer alignment of our non-executive directors’ interests with those of our stockholders and to demonstrate leadership in connection with the economic effects of the coronavirus disease 2019 (COVID-19) pandemic, the Board unanimously approved converting the cash fee portion of our non-executive director compensation to stock awards. The stock awards will be granted quarterly based on our stock price at the time of grant and will be fully vested upon issuance. In connection with this change, we adopted a deferred compensation plan for non-executive directors, pursuant to which the non-executive directors may defer settlement of these stock awards until a future date or their departure from the Board.

Stock Ownership Guidelines for Non-Executive Directors and Prohibitions on Pledging and Hedging

The Board believes that stock ownership guidelines further align the interest of directors with those of the Company’s stockholders. The non-executive directors are required to hold shares of common stock and/or restricted stock equal to three times their annual cash compensation ($135,000 for each non-executive director and $165,000 for the Chair of the Audit Committee) as measured on June 30th of each year. All non-executive directors will have a three-year grace period to reach the ownership threshold. All non-executive directors have met the stock ownership guidelines as of April 1, 2020, except for Mr. Stein who has until July 2021, Dr. Byrne who has until January 2023 and Ms. Cournoyer who has until March 2023 to reach the ownership threshold for non-executive directors.

Our non-executive directors remained committed to each holding a meaningful ownership interest in our Company as we continue our transition from a wireless centric customer base to a growing software centric healthcare communications customer base. In particular, none of our non-executive directors have sold shares of our common stock held by them directly since May 2013 and some non-executive directors were active purchasers of our common stock during 2019. Further, in order to provide for even closer alignment of our non-executive directors’ interests with those of our stockholders and to demonstrate leadership in connection with the economic effects of the COVID-19 pandemic, the Board unanimously approved converting the cash fee portion of our non-executive director compensation to stock awards. The Company’s non-executive directors are not permitted to engage in hedging activities with respect to our stock and are not permitted to pledge their shares of our stock.

COMPENSATION DISCUSSION AND ANALYSIS

Say on Pay Results in 2019 and Stockholder Outreach

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 provides stockholders with a non-binding advisory vote (“Say-on-Pay”) on the compensation of our NEOs as such compensation is disclosed in our annual proxy statement. We hold these votes annually. At our 2019 Annual Meeting, the 2018 NEO compensation program was approved by 94% of the shares voting (excluding abstentions and broker non-votes). Through our stockholder outreach in 2019 and through April 2020 we obtained feedback from our stockholders on our operational and financial performance as well as our NEO pay practices. This 2019 and 2020 stockholder outreach consisted of:

1. | Conducting quarterly reviews of our financial and operating results. For those stockholders who cannot attend the live meetings, we provide a recording of the reviews that can be accessed for 14 days subsequent to the live meeting; |

2. | Meeting individually with investors or interested parties who request meetings with management to discuss our financial or operating results; |

3. | Speaking with stockholders representing approximately 80.0% of our outstanding shares throughout the year; and |

4. | Hosting an Investor Day that included management presentations and product demonstrations. |

Based on the past feedback from our stockholders, the Compensation Committee retained the following elements previously established for our executive (including the NEOs) compensation program:

1. | Awarded an annual LTIP award, which for 2019, 50% was performance based over a multi-year performance period and 50% was time based over a multi-year vesting period; |

2. | Retained the CEO's minimum stock ownership guideline at three times the CEO's annual salary; |

3. | Retained minimum stock ownership guidelines for all other executive officers (including the NEOs) at one times the executive officer's annual salary; |

4. | Retained the prohibition for hedging or pledging the shares of the Company's common stock by executive officers (including the NEOs); and |

5. | Retained the clawback policy regarding adjustment or recovery of compensation. |

Compensation Philosophy

The compensation philosophy of our Company is intended to motivate executives to achieve Spok’s strategic goals and operational plans and attract and retain high quality talent while the Company transitions from a wireless centric customer base to a growing software centric healthcare communications customer base. While our increase in research and development costs are indicative of our transition efforts, we are still several years from completing this transition. Our Company believes that attracting and retaining key personnel is always critical. However, during this transition it is even more imperative that key personnel remain with the Company as we build the foundation for our future success. This philosophy is supported by an executive compensation program including a pay-for-performance objective that aligns executive compensation with stockholder value as well as an equity interest in the Company which we believe aligns executive financial interests with those of our stockholders. That philosophy is translated into the executive compensation program design based on the following principles.

COMPENSATION PRINCIPLES Link compensation to performance. We believe that compensation levels should reflect performance. This is accomplished by: • Motivating, recognizing, and rewarding individual excellence; • Paying short-term cash bonuses based upon Company financial performance; we set rigorous annual financial performance targets and have, in 2019 and prior years, strictly adhered to the pre-set targets when determining award payouts; and • Linking elements of long-term compensation to our Company’s financial performance coupled with preserving value through continued stewardship over time. Maintain competitive but reasonable compensation levels. We strive to balance programs and levels of compensation that are competitive with those offered by companies of similar size, including our peer group, with compensation levels and incentives that appropriate for our Company. For 2019, based on data provided by our independent compensation consultant, Korn Ferry, total compensation for our CEO was below the median compensation level of our peer group. Align management’s interests with those of stockholders. We seek to implement programs that will retain the executives while increasing long-term stockholder value by providing competitive compensation and granting long-term equity-based incentives. |

CEO Pay Ratio

The 2019 compensation disclosure ratio of the median annual total compensation of all Company employees to the annual total compensation of the Company’s chief executive officer is as follows:

Category | 2019 Total Compensation and Ratio | |||

Annual total compensation of Vincent D. Kelly, Chief Executive Officer | $ | 2,223,303 | ||

Annual total compensation of our median employee | 101,869 | |||

Ratio of the annual total compensation of Vincent D. Kelly, Chief Executive Officer as compared to the annual total compensation of our median employee | 22:1 | |||

The calculation of annual total compensation of our median employee was determined in the same manner as the Total Compensation shown for our CEO in the Summary Compensation Table. We identified the median employee by examining the 2019 total compensation for all individuals, excluding our CEO, who were employed by us on December 31, 2019. We included all employees, whether employed on a full-time, part-time, or seasonal basis; we did not make any assumptions, adjustments, or estimates with respect to total compensation, with the exception of annualizing the salary compensation for any full-time employees that were not employed by us for all of 2019.

EXECUTIVE COMPENSATION DESIGN

Objectives

The design of our executive compensation program reflects the unique strategic situation of the Company using the compensation principles of our Compensation Philosophy. Our Company has been a public company since we were founded in November 2004 resulting from the merger of Metrocall Holdings, Inc. and Arch Wireless, Inc., the two largest remaining independent paging companies in the United States. The merger allowed us to consolidate operations, reduce costs and create stockholder value including the return of $111.0 million between January 1, 2015 and December 31, 2019 in the form of cash distributions (including dividends) and common stock repurchases. This merger also allowed for management of the declining wireless customer base to focus on the most profitable industry segments, primarily healthcare.

In an effort to capitalize on the valuable customer franchise from our wireless customer base in the healthcare industry segment, we acquired Amcom Software, Inc. (“Amcom”) in 2011. Amcom provided healthcare communication software solutions to customers in a variety of industries with a particular emphasis on healthcare. This common focus on the healthcare segment provided our Company with a unique opportunity. This unique opportunity allowed for transition from a declining wireless revenue stream to a growing healthcare communications software business while creating significant stockholder value during the transition. In essence, the Company must profitably manage two revenue lines: 1) a declining wireless revenue stream and related subscribers and 2) a growing healthcare communications software business. We are engaged in a multi-year transition from a declining hardware-based wireless company to a growing healthcare communications software company. Becoming the leader in healthcare communication and collaboration requires us to continue development of our integrated platform and invest in the key areas of customer need including: 1) mobility, 2) alerting, 3) contact center and 4) multiple workflows in the clinical healthcare context. We will continue to increase our spending on product development and strategy in 2020 and beyond to develop these solutions and compete in the changing marketplace. These strategic considerations are important operational elements considered by the Compensation Committee in determining 2019 compensation for our executives, including our NEOs. The Compensation Committee actively considers the implications of this business transition and the evolving size and nature of the overall business when developing the target pay opportunities as part of the executive compensation program design.

For all of our executives, which include the NEOs, incentive compensation in 2019 is determined by the Compensation Committee and ratified by the Board. The Compensation Committee believes that elements of incentive compensation paid to executives should be closely aligned with the Company’s short-term and long-term performance; linked to specific, measurable results which create value for stockholders; and assist the Company in attracting and retaining key executives critical to long-term success.

In establishing compensation for executives, the Compensation Committee has the following objectives:

• | Attract and retain individuals of superior ability and managerial talent; |

• | Ensure compensation performance criteria are aligned with our corporate strategies, business objectives and the long-term interests of our stockholders through profitable management of our transition; |

• | Achieve key strategic and financial performance measures by linking incentive award opportunities to attainment of performance criteria in these areas; and |

• | Focus executive performance on long-term stockholder value, as well as promoting retention of key staff, by providing a portion of total compensation opportunities in the form of direct ownership in our Company through performance, and time-based, RSUs which are payable in our common stock when such RSUs vest. |

Prior to establishing the compensation plans, the Board and the Compensation Committee reviews with management the Company’s long range plan (“LRP”). The LRP is a five-year projection of the Company's operations. This LRP was reviewed with the full Board at two meetings during the year. The Board discusses with management the Company’s operational priorities, strategic direction, budget assumptions including headcount, sales, research and development spending, capital expenditures, revenue growth, subscriber churn, maintenance retention and other elements supporting the LRP. The Board also reviews a detailed narrative which encapsulates this process. The Board takes great care in setting compensation plans, including determination of performance criteria, to ensure plans are robust and compensation is adequately proportioned between cash and equity in order to create both short-term stability and long-term focus. The Board and Compensation Committee actively and independently considers the performance criteria and management projections when determining the appropriate performance criteria for use in Short-Term Incentive Compensation ("STIP") and Long-Term Incentive Compensation ("LTIP") as the basis for motivating executive performance.

Based on this understanding of the Company’s operations and plans, as detailed in the LRP, the Compensation Committee identified all key performance criteria, as further outlined under the Short-Term and Long-Term Incentive Compensation sections, that, in the judgment of the Compensation Committee, would support the Company’s capital allocation and long-term stockholder value creation plans. The Compensation Committee believes that the selected performance criteria for both the STIP and LTIP incentivize management to weigh its operational decisions in a manner that best supports the interests of stockholders.

Elements of Compensation

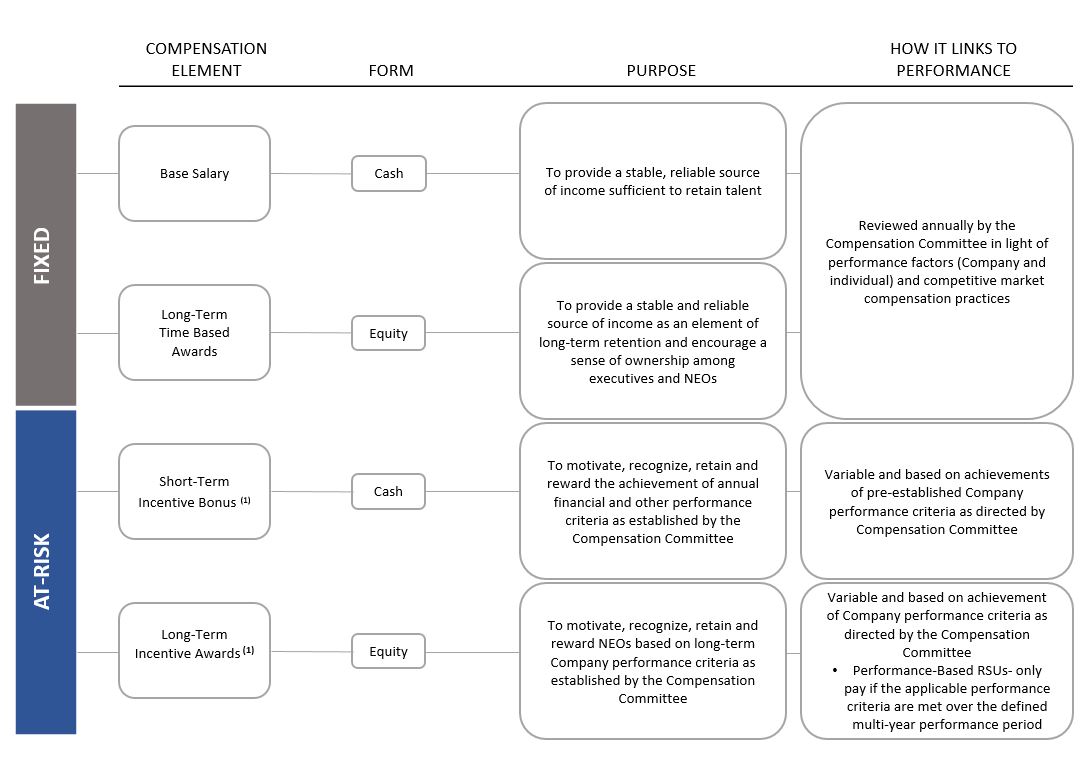

The following chart summarizes the key pay elements during 2019 for our executives including the NEOs.

(1)The “At-Risk” compensation elements are based on incentive plans approved in advance by the Compensation Committee. The 2019 STIP was 100% performance based while the LTIP was 50% performance based and 50% time based. Both the performance based STIP and LTIP awards provided for non-payment or caps on potential payment of the awards if the pre-established performance criteria are not met or exceeded. Both the performance based STIP and LTIP awards provided that if certain pre-established performance minimums are not met, no payment is made on the performance based components. In 2019, as we have done in prior years, we set rigorous financial performance metrics and strictly adhered to the pre-established metrics when determining STIP payouts to our NEOs.

We believe, given the industry in which we operate, that we have established base compensation, cash bonuses and equity incentives at levels consistent with those for executives, including NEOs, of comparable companies and that they are generally sufficient to retain our existing executive officers and to hire new executive officers when and as required. Our Compensation Committee believes a significant portion of our executives', including NEOs', compensation should be tied to our performance.

We believe, as is common in the technology sector and with our industrial peers, equity awards are a key compensation-related motivator in attracting and retaining executive officers in addition to base salary and cash bonuses. Each of these components are discussed in further detail in later sections.

The Compensation Committee also established policies which prohibit executives, including the NEOs, from hedging or pledging their shares of the Company’s common stock. In addition, our Compensation Committee has instituted a clawback policy regarding adjustment or recovery of compensation. Such policies also reduce risks associated with the Company’s compensation policies. We believe our compensation policies and practices are not likely to have a material adverse impact on the Company.

Relationship with Compensation Consultants and Use of Peer Groups

Given the high level of approval by stockholders of our 2018 Executive Compensation Program, the Compensation Committee determined that minimal changes would be made to the form, amounts and structure of the 2019 Executive Compensation Program, and our 2018 peer group, as set forth in the following table, was again utilized for 2019 compensation decisions.

l 8x8 Inc.; | l Iridium Communications Inc.; |

l Alaska Communications Systems Group, Inc.;(1) | l Liveperson Inc.;(1) |

l Boingo Wireless, Inc.;(1) | l Lumos Networks Corp.; |

l Calamp Corp.; | l MagicJack VocalTec Ltd.; |

l Cogent Communications Group, Inc.; | l Medidata Solutions, Inc.; |

l Computer Programs & Systems Inc.;(1) | l Meru Networks, Inc.; |

l Consolidated Communications Holdings, Inc.; | l Ntelos Holdings Corp.; |

l inContact, Inc.; | l Shenandoah Telecommunications Co.; and |

l Inteliquent, Inc.; | l Vocera Communications, Inc.(1) |

(1) Included in Korn Kerry's proposed peer group described below.

In order to ensure proper compensation alignment as we continue our transition into a software company, the Compensation Committee engaged Korn Ferry, an independent consulting firm, at the beginning of 2019, to review the Company's peer group and NEO compensation. Korn Ferry held discussions with management and the chair of the Compensation Committee, and based on their respective input, proposed changes to the peer group for the Compensation Committee’s consideration. In developing the peer group, Korn Ferry and the Compensation Committee considered Spok’s current and go-forward revenue mix between paging services and software solutions, with an emphasis on the software business which is expected to generate more of the Company’s revenues over time, and selected a blend of companies that operate within these discrete businesses. Based on Korn Ferry's review, the peer group was updated by the Compensation Committee in 2019 to be used for future compensation decisions and consists of the following companies:

l Alaska Communications Systems Group, Inc.; | l Globalstar, Inc.; |

l Appfolio, Inc.; | l HealthStream, Inc.; |

l Boingo Wireless, Inc.; | l LivePerson,Inc.; |

l Castlight Health, Inc; | l MobileIron, Inc.; |

l Computer Programs and Systems, Inc.; | l Model N, Inc.; |

l Everbridge, Inc.; | l NextGen Healthcare, Inc.; |

l Evolent Health, Inc.; | l ORBCOMM Inc.; and |

l Five9, Inc.; | l Vocera Communications, Inc. |

In addition to reviewing the peer group with the Compensation Committee, Korn Ferry reviewed the Company’s executive compensation program to assess its competitiveness, pay mix and long-term incentive design with respect to the updated peer group. This review indicated that compensation was generally in-line with or, in the case of our CEO, below the median compensation level for, the peer group assessed and as previously noted, no significant changes were made to the executive compensation program for 2019.

2019 EXECUTIVE COMPENSATION PROGRAM DECISIONS

The elements of compensation, all of which are discussed in greater detail below, include:

• | Base Salary; |

• | All Other Compensation; (consisting of employee benefits and limited perquisites); |

• | Short-Term Incentive Compensation; |

• | Long-Term Incentive Compensation; and |

• | Termination and Change-in-Control Arrangements. |

Base Salary

Base salaries are intended to provide our NEOs with a degree of financial certainty and stability that does not depend on our performance, and are part of the total compensation package that the Compensation Committee believes is necessary to help ensure the retention of our NEOs. The base salary element of our compensation program is designed to be competitive with compensation paid to similarly situated, competent and skilled executives. Based on the Company’s planned operations for 2019, the Compensation Committee's review of the executive compensation program and the overwhelming approval by stockholders of the 2018 Executive Compensation Program, the Compensation Committee generally did not make changes to the NEO base salaries for 2019.

In October 2018, Company Management presented to the Compensation Committee an adjustment to decrease STIP and LTIP compensation for the CEO and CFO. This adjustment was effective for 2019 and allowed for alignment with corporate goals while the Company continues its transition. The purpose of these changes was to free up additional resources for the Company's research and development efforts. In addition, in early 2020, to demonstrate leadership in connection with the economic effects of the COVID-19 pandemic, our CEO voluntarily agreed to continue his 37.5% reduction in LTIP target award levels consistent with 2019 compensation.

All Other Compensation

We provide certain employee benefits and limited perquisites to our NEOs. In general, except as noted below, the other elements of compensation are the same as offered to all other employees of the Company.

Perquisites – We provide a car to the CEO pursuant to his employment agreement.

Insurance Premiums – We paid for basic life insurance at the value of the NEO’s annual salary to a maximum of $250,000. This is available to all employees of the Company.

Company Contribution to Defined Contribution Plan – All Company employees are eligible to receive a Company contribution.

The Spok Holdings, Inc. Savings and Retirement Plan (the “Plan”) is open to all Company employees working a minimum of twenty hours per week with at least thirty days of service. The Plan qualifies under Section 401(k) of the Internal Revenue Code (the “Code”). Under the Plan, participating employees may elect to voluntarily contribute a percentage of their qualifying compensation on a pretax or after-tax basis up to the annual maximum amounts established by the Code. The Company matches 50% of the employee’s contribution, up to 6% of each participant’s gross salary per pay period, or 50% of the employee’s annualized contribution up to $2,500, whichever is greater. There is a per-pay-period match on the 6% component and an end-of-year true up on the $2,500 component. Contributions made by the Company become fully vested three years from the date of the participant’s commencement of employment. Profit sharing contributions are discretionary. In 2019, 2018 and 2017, we made matching contributions in amounts equal to $40,250, $35,841, and $29,229, respectively, for the NEOs participating in the Plan.

Dividend Equivalent Rights (“DERs”) – Participants in the 2015 and 2018 LTIPs, including the NEOs, are entitled to accrue DERs on each RSU granted to the participant. Each DER represents the value of dividends paid on the Company’s common stock during the 2015 and 2018 LTIP performance cycles. Each participant, including the NEOs, is entitled to receive in cash the DERs accrued on the underlying RSUs if the pre-established performance criteria are met. If a participant voluntarily leaves the employ of the Company, the underlying DERs are forfeited along with forfeiture of the unvested RSUs.

Other Employee Benefits – We maintain broad-based benefits for all employees, including health, vision and dental insurance, disability insurance, paid time off and paid holidays. Executives (including NEOs) are eligible to participate in all of the employee benefit plans on the same basis as other employees with the exception of increased vacation accrual and eligibility for payout of that vacation accrual at time of termination.

Short-Term Incentive Compensation

Our STIP is designed to motivate our executives and key employees (including the NEOs) and reward them with cash payments for achieving quantifiable, pre-established Company performance criteria.

Description of the STIP Performance Criteria – Based on the information from the LRP for 2019, the Compensation Committee approved the performance criteria of the 2019 STIP to be effective January 1, 2019. The 2019 STIP was payable in cash, based upon separate pre-established performance criteria which included adjusted operating and capital expenses, wireless revenue, software revenue, software operations bookings, and development milestones, each of which is measurable and readily reportable and requires the coordination and cooperation of all of management for achievement.

The Compensation Committee selected the 2019 performance criteria, all of which are key elements leading to long-term stockholder value creation, for the STIP based on the following rationale:

Adjusted Operating and Capital Expenses – Adjusted Operating and Capital Expenses is defined as operating expenses less depreciation, amortization and accretion expense, less severance, less stock-based compensation, less goodwill impairment, plus capital expense (all calculated in accordance with U.S. GAAP). This performance criteria is a non-GAAP measure of the Company's operating expenses. This performance criteria measures the Company’s ability to manage its operations expenses based on parameters established by the Board.

Wireless Revenue – As noted earlier, the Company continues to transition from a declining wireless centric revenue base to a growing software centric base as represented by software revenue. As the Company transitions to a software centric base, the Compensation Committee believes it is important to focus on the retention of wireless revenues to continue internal funding of research and development projects which it anticipates will fuel long-term growth. A short-term focus on retention of the wireless revenue stream will in turn provide for the present endeavors within our research and development function and our continued transition into a software centric business. This performance criteria will reflect a reduction in revenue in comparison to actual results from the prior year given the declining nature of revenues related to those products and services.

Software Revenue – Software revenue is the basis for future growth. The Compensation Committee believes that the use of this metric will focus management on the growth of a software centric business.

Software Operations Bookings – Software operations bookings represent contractual arrangements to provide software licenses, professional services and equipment sales. These contractual arrangements (bookings) represent future revenue. This performance criteria focuses management on supporting the critical drivers for future growth and implementation of the transition to growth. As the Company accomplishes its transition to overall growth, this performance criteria will generally reflect an increase from the prior year based on the Compensation Committee's understanding of the Company's operations. In establishing the software operations booking target level for 2019 the Compensation Committee reviewed the actual performance level for software operations bookings in 2018 and set the 2019 target performance level higher than actual performance in 2018.

Development Milestones - As noted earlier, one of our Operating Objectives is to invest in our future solutions. This has resulted in additional development efforts which are designed to integrate our existing solutions, together with physician and nursing workflows, into a seamless platform of healthcare communication and collaboration. It was important for us to establish specific milestones to measure progress on the development of Spok Go given how critical these developments efforts are to our future.

The Compensation Committee believes these five 2019 STIP performance criteria are the key elements supporting stockholder value creation and appropriately focus management on successfully transitioning the Company to growth.

Performance Criteria levels are based on the Company's transition - During the transition period, the Compensation Committee understands that the outcomes of certain of the Company's key performance criteria, such as wireless revenue, will be lower than the prior year reflecting the strategic nature of the Company's business. The Compensation Committee has established higher target performance levels in 2019 for software operations bookings and software revenue as compared to actual 2018 results (see "Description of the STIP Performance Criteria" above) as this performance criterion is focused on transitioning to the software centric portion of the customer base.

Payouts are determined by interpolation of performance goals –Straight-line interpolation is used to determine payouts for STIP awards when 1) the actual performance is between the threshold performance level and target performance level or 2) the actual performance is between the target performance level and the maximum performance level. There is no STIP payout if achievement is below the threshold performance level. Payments under the STIP are contingent upon continued employment through the date of payment, though pro rata payments will be made in the event of death or disability based on actual performance at the triggering event date relative to targeted performance measures for each program. Further, if an executive’s employment is involuntarily terminated (other than for cause), the executive will be eligible to receive a pro rata payment of the STIP for the year of termination, subject to the execution of an appropriate release and other applicable and customary termination procedures.

The threshold, target and maximum performance goals for each component of the performance criteria and the payouts that would have been provided under the 2019 STIP in the event of performance at each applicable level are set forth in the following tables.

Performance Criteria(1) | Relative Weight | Threshold Payout Against Target | Threshold Performance Level (In 000s) | Target Payout | Target Performance Level (In 000s) | Maximum Payout Against Target | Maximum Performance Level (In 000s) |

Adjusted Operating and Capital Expenses(2) | 15% | 80% | $191,756 | 100% | $159,797 | 125% | $127,837 |

Wireless Revenue | 20% | 80% | $67,932 | 100% | $84,915 | 130% | $93,406 |

Software Revenue | 20% | 80% | $64,263 | 100% | $80,329 | 130% | $88,362 |

Software Operations Bookings(3) | 25% | 80% | $33,600 | 100% | $42,000 | 150% | $46,200 |

Development Milestones(4) | 20% | —% | — | 100% | 12/31/2019 | 100% | 12/31/2019 |

Total | 100% | 64% | 100% | 128.25% | |||

(1) The Compensation Committee selected the performance criteria as key measures in determining stockholder value. The relative weight assigned to each performance measure reflects the judgment of the Compensation Committee as to the importance each measure has to stockholder value.

(2) Operating expenses less depreciation, amortization and accretion expense, less severance, less stock-based compensation, less goodwill impairment plus capital expense (all calculated in accordance with U.S. GAAP).

(3) Software operations bookings represent contractual arrangements to provide software licenses, professional services and equipment sales. These contractual arrangements (bookings) represent future revenue.

(4) Target dates are an all or nothing performance objective. Failure to complete the required research and development tasks prior to the established deadline results in no payout on the related criterion.

The Compensation Committee actively considers the appropriate size of the pay opportunity each year in light of the evolving nature and size of the business. The Compensation Committee determines the threshold, target and maximum payouts for each performance criterion based on the Compensation Committee's understanding of the Company's LRP and the expectations for 2019. Based on this understanding, the Compensation Committee also establishes the relative weighting for each performance criterion with Software Operations Bookings afforded the most significant weighting (see "Description of the STIP Performance Criteria").

In establishing the software revenue and software operations booking target levels for 2019, the Compensation Committee reviewed the actual performance levels for these metrics in 2018 and set the target performance levels higher than actual performance for 2018.

Then the Compensation Committee established the threshold and maximum payout levels based on the Compensation Committee's judgment as to the impact on stockholder value.

The amounts paid under the 2019 STIP were based on the following achievement against the pre-established performance criteria.

Performance Criteria | Relative Weight | Actual Performance (in 000s) | Actual Payout | Weighted Actual Payout |

Adjusted Operating and Capital Expenses | 15% | $158,833 | 100.9% | 15.1% |

Wireless Revenue | 20% | $88,167 | 115.3% | 23.1% |

Software Revenue | 20% | $72,122 | 89.8% | 18.0% |

Software Operations Bookings | 25% | $36,475 | 86.8% | 21.7% |

Development Milestones | 20% | Completed | 100% | 20.0% |

Total | 100% | 97.9% | ||

The STIP opportunity for each NEO is based on a percentage of the NEO’s base salary. For the NEOs' 2019 STIP, the percentage of base salary, the targeted payout and the actual payout were as follows:

NEO | STIP Target Opportunity - Percentage of Base Salary | Targeted Payout ($) | Actual Payout ($) |

Vincent D. Kelly | 83% | 500,000 | 489,500 |

Michael W. Wallace | 71% | 250,000 | 244,750 |

Bonnie K. Culp-Fingerhut | 75% | 168,750 | 165,206 |

Sharon Woods Keisling | 75% | 131,250 | 128,494 |

Long-Term Incentive Compensation

Our 2019 LTIP rewards eligible executives, including the NEOs, through a combination of equity awards that contained time-based vesting and vesting based on the future financial performance of our Company. The goals of our long-term incentive program are to:

• | Reinforce a sense of ownership and to align the financial interests of eligible executives, including the NEOs, with those of our stockholders; |

• | Motivate decision-making which improves financial performance of our healthcare communications business over the long-term, particularly during the Company's transition; |

• | Recognize and reward superior financial performance of the Company; and |

• | Provide a retention element to our compensation program. |

These goals were used in establishing the LTIP performance criteria for the 2019 grant outlined below.

2019 LTIP AWARD – The Compensation Committee approved the 2019 LTIP which was granted to eligible employees, including NEOs, in January 2019. The 2019 LTIP grants provide eligible employees the opportunity to earn long-term incentive compensation based on continued employment with the Company and the Company’s attainment of certain financial goals as determined by the Compensation Committee for the period from January 1, 2019 through December 31, 2021 (the “2019-2021 performance period”).

Time-Based Vesting Awards - The Compensation Committee determined it would be appropriate and in the best interest of the Company and its stockholders to award a portion of its equity awards as time-based vesting to encourage, retain, and reinforce a sense of ownership among executives, including NEOs. The Company anticipates future equity incentive awards will continue to be awarded as a combination of both time and performance-based awards, however, the Compensation Committee may also consider other alternative forms of equity-based awards in the future.

In January 2019, as described above, the Compensation Committee awarded time-based RSUs to eligible employees, including NEOs, under our 2012 Equity Plan, subject to vesting as described below. Additionally, participants are entitled to DERs with respect to the RSUs to the extent that any cash dividends or cash distributions (regular or otherwise) are paid with respect to our common stock during the vesting period. Vested RSUs will be settled in the Company's common stock and vested DERs will be paid in a lump sum cash payment with accrued interest, in each case, subject to income and employment tax withholding. These grants are included in the 2019 Grants of Plan-Based Awards table and the grant date fair value of the awards is included with the NEOs 2019 compensation in the Summary Compensation Table.

The table below details the time-based RSUs awarded to the NEOs during 2019:

NEO | RSUs Awarded (Time-Based) (#) | Value at Grant Date ($)(1) | Market Value at Year-End ($)(2) | |||

Vincent D. Kelly | 37,707 | 499,995 | 461,157 | |||

Michael W. Wallace | 11,312 | 149,997 | 138,346 | |||

Bonnie K. Culp-Fingerhut | 6,363 | 84,373 | 77,819 | |||

Sharon Woods Keisling | 4,949 | 65,624 | 60,526 | |||

(1) The fair values of the RSUs awarded were calculated at $13.26, the closing price of the Company's common stock on December 31, 2018, the last trading day prior to the date of grant

(2) Market or payout values of the unvested RSUs were based on the number of RSUs granted and our closing stock price at December 31, 2019 of $12.23. The RSUs are convertible into shares of the Company’s common stock following vesting.

The time-based grants noted in the table above will vest in 3 equal installments on December 31, 2019, 2020 and 2021 based on continued employment with the Company.

Performance-based Vesting Awards - Based on the information from the LRP, the Compensation Committee approved the performance criteria for the 2019 LTIP grant for the 2019-2021 performance period, which performance criteria is measurable, readily reported and requires the coordination and cooperation of all management.

The Compensation Committee selected the performance criteria for the 2019 LTIP grant based on the following rationale:

Wireless Revenue – As noted earlier, the Company is in transition from a declining wireless centric revenue base to a growing software centric base as represented by software revenue. As the Company transitions to a software centric base, the Compensation Committee believes it is important to focus on the retention of wireless revenues to continue internal funding of research and development projects that it anticipates will fuel long-term growth. This performance criteria will reflect a reduction in revenue in comparison to actual results from the prior year given the declining nature of revenues related to those products and services. The Compensation Committee believes that maintaining this revenue stream is a key area of focus as the Company continues its transition into a software centric business. A long-term focus on the maintenance of this revenue stream will continue to benefit investors through both capital reallocation opportunities as well as the continued funding of current and future software development efforts.

Software Revenue – Software revenue is the basis for future growth. The Compensation Committee believes that the use of this metric will focus management on the growth of a software centric business.

Adjusted Operating and Capital Expenses – Adjusted Operating and Capital Expenses is defined as operating expenses less depreciation, amortization and accretion expense, less severance, less stock-based compensation, less goodwill impairment, plus capital expense (all calculated in accordance with U.S. GAAP). This performance criteria is a non-GAAP measure of the Company's operating expenses. This performance criteria measures the Company’s ability to manage its operations expenses based on parameters established by the Board.

Software Operations Bookings – Software operations bookings represent contractual arrangements to provide software licenses, professional services and equipment sales. These contractual arrangements (bookings) represent future revenue. This performance criteria focuses management on supporting the critical drivers for future growth and implementation of the transition to growth. As the Company accomplishes its transition to overall growth, this performance criteria will generally reflect an increase from the prior year based on the Compensation Committee's understanding of the Company's operations.

The Compensation Committee has determined that wireless revenue, software revenue, adjusted operating and capital expenses (as defined), and software operations bookings are key elements impacting stockholder value. The Compensation Committee believes that the use of wireless revenue, software revenue, adjusted operating and capital expenses (as defined), and software operations bookings in both the STIP and LTIP are warranted to motivate management to successfully implement the transition to growth and are aligned with our stockholders interests as follows:

• | Wireless revenue is the basis for future software growth. The Compensation Committee believes that the use of this metric will focus management on the responsible growth and transition of the Company into a software centric business with a continued focus on remaining debt free and providing itself with internal funding of current and future research and development efforts. |

• | Adjusted operating and capital expenses (as defined) is the non-GAAP measure for the Company's operating expenses. The Compensation Committee believes that the use of this metric will focus management on not only the long-term growth of revenues but on the responsible growth of profitable revenue streams which will continue to generate and provide long-term cash flows and the Company's long-term allocation strategy for stockholder dividends and/or common stock repurchases. |

• | Software operations bookings is the basis for achieving growth. The Compensation Committee's objective is to motivate management to achieve sustainable growth, which would require implementation of the strategies reviewed and approved by the Board (and Compensation Committee) during the review of the LRP. |

• | Software revenue is the basis for future growth. The Compensation Committee believes that the use of this metric will focus management on the growth of a software centric business. |

Payouts are determined based on long-term performance - Management recommended and the Compensation Committee, in its sole discretion, selected employees to be participants in the 2019 LTIP.