Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GRAHAM CORP | ghm-8k_20200325.htm |

Business Update James R. Lines President & Chief Executive Officer Jeffrey F. Glajch Vice President & Chief Financial Officer NYSE: GHM • March 25, 2020

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “estimates,” “confidence,” “projects,” “typically,” “outlook,” “anticipates,” “believes,” “appears,” “could,” “opportunities,” “seeking,” “plans,” “aim,” “pursuit,” “look towards” and other similar words. All statements addressing operating performance, events, or developments that Graham Corporation expects or anticipates will occur in the future, including but not limited to, expected expansion and growth opportunities within its domestic and international markets, anticipated revenue, the timing of conversion of backlog to sales, market presence, profit margins, tax rates, foreign sales operations, its ability to improve cost competitiveness and productivity, customer preferences, changes in market conditions in the industries in which it operates, the effect on its business of volatility in commodities prices, changes in general economic conditions and customer behavior, forecasts regarding the timing and scope of the economic recovery in its markets, its acquisition and growth strategy and its operations in China, India and other international locations, are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in Graham Corporation's most recent Annual Report filed with the Securities and Exchange Commission, included under the heading entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of Graham Corporation's underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on Graham Corporation's forward-looking statements. Except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this slide presentation. This presentation discusses some non-GAAP financial measures, which Graham Corporation believes are useful in evaluating its performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. Graham Corporation has provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation.

Agenda Jim Lines Core values End market dynamics Supply Chain Backlog Outlook Jeff Glajch Balance sheet strength Actions taken Next steps

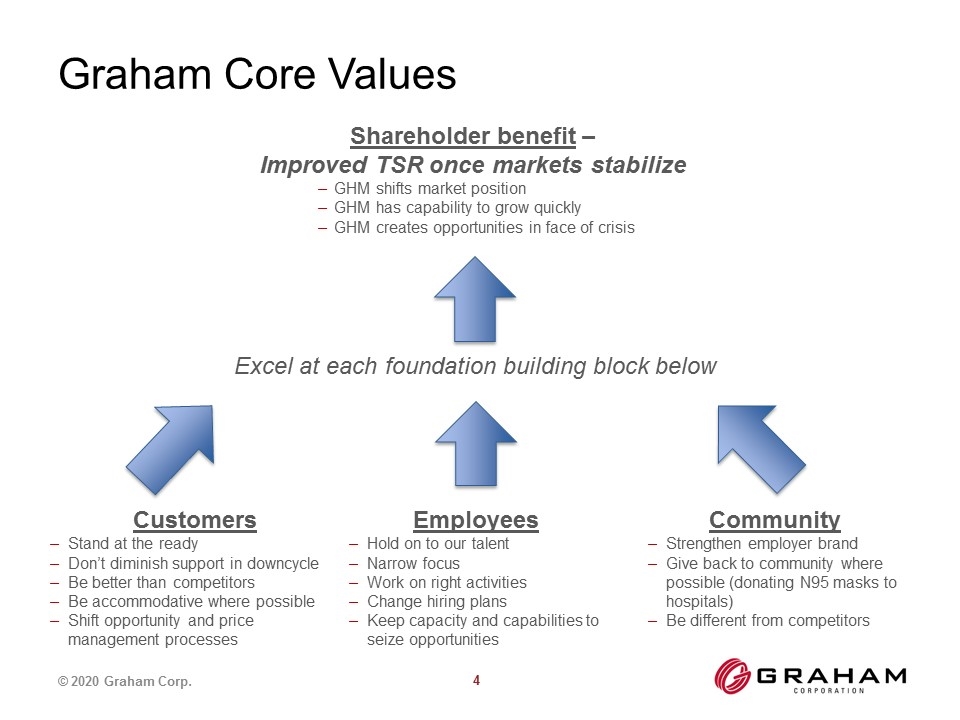

Graham Core Values Customers Stand at the ready Don’t diminish support in downcycle Be better than competitors Be accommodative where possible Shift opportunity and price management processes Employees Hold on to our talent Narrow focus Work on right activities Change hiring plans Keep capacity and capabilities to seize opportunities Community Strengthen employer brand Give back to community where possible (donating N95 masks to hospitals) Be different from competitors Excel at each foundation building block below Shareholder benefit – Improved TSR once markets stabilize GHM shifts market position GHM has capability to grow quickly GHM creates opportunities in face of crisis

Current Business Environment – End Markets Refining – varies by region and type of end user Bidding activity continues for several large projects in China, India, other areas in Asia Cash flow from upstream tied to oil price is weakening, integrated oil companies expected to slow order pace Too early to define approach of independent refiners whose decisions are tied to crack spreads rather than oil price Chemical/petrochemical – weakening U.S. investment trend Observing a measured, careful final investment decision Reduced fracking rig count, abundance of co-produced natural gas slowing order placement pattern U.S. Navy – opportunities remain robust Pipeline includes $40-$60 million of active bids, expected to close in next 12 months

Current Business Environment – Supply Chain Largely regional for Graham Most suppliers are domestic, to support Batavia operations Global subcontractors are regional, in support of regional projects China supply chain primarily used for China end market Diversified, several sources for key components Maintaining ongoing communications to monitor status of suppliers and subcontractors

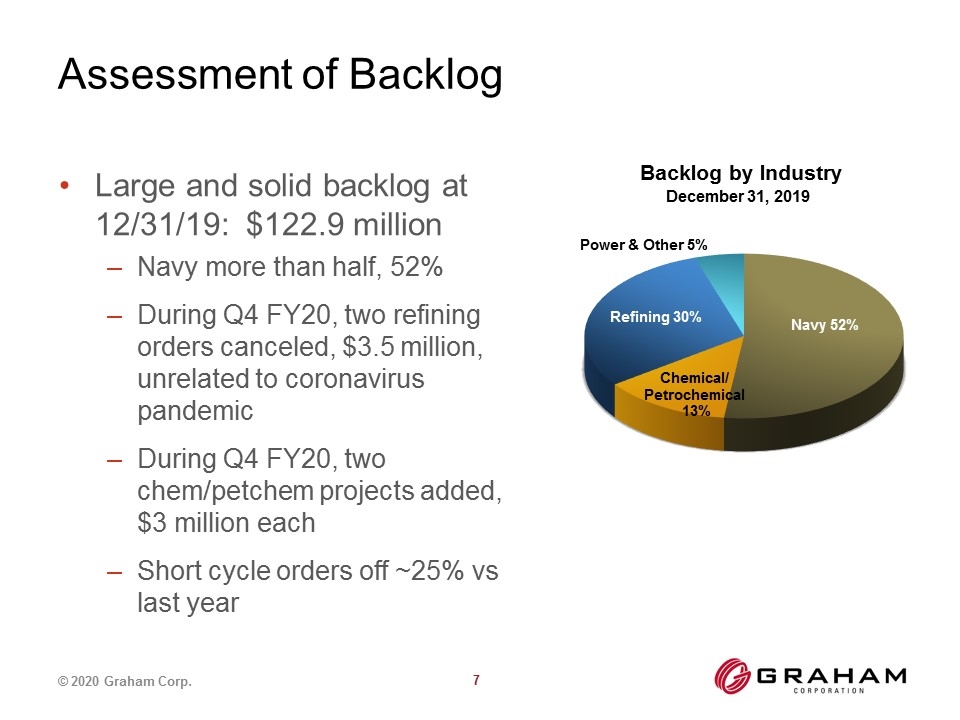

Assessment of Backlog Large and solid backlog at 12/31/19: $122.9 million Navy more than half, 52% During Q4 FY20, two refining orders canceled, $3.5 million, unrelated to coronavirus pandemic During Q4 FY20, two chem/petchem projects added, $3 million each Short cycle orders off ~25% vs last year Backlog by Industry December 31, 2019

Outlook – Uncertain Fiscal 2020 Rescinding guidance announced on January 29, 2020 Fiscal 2021 Extent of remobilization following shutdown may be impacted if shutdown gets extended Delaying finalization of budget due to significant uncertainty Once business is back up and running, anticipate subsequent 12 months revenue flat with fiscal 2020 Scenario assessment China coronavirus recovery situation may replicate in U.S. Graham management currently developing various contingency plans dependent on severity and duration of situation

Significant Liquidity Provides Strength During Unprecedented Times $72 million of cash at 12/31/19 $25 million of borrowing capacity, plus additional $25 million accordion in debt agreement Virtually no bank debt outstanding Board of Directors plans to maintain quarterly cash dividend Retain current workforce to be ready when market recovers M&A opportunities may become more readily available Cash burn rate is ~ $3 million / month, long runway

Graham’s Temporary Actions Taken to Adapt and Thrive Protecting our workforce Two-week facility shutdown through April 5, 2020 In advance of shutdown: Business travel stopped Requiring self-isolation following certain personal travel Restricting visitors Office employees work remotely Social distancing by limiting number of employees at work Deep cleaning of facilities Prohibiting group gatherings Encouraging hygiene practices advised by health authorities Wage continuity to support our workforce

Next Steps Plan to provide another interim investor update if situation changes Continue to maintain contact with customers, EPCs, suppliers Office staff working remotely Keep employees informed of changes Board intends to maintain quarterly cash dividend Current timing for Q4 FY20 is May 29, 2020

Business Update NYSE: GHM • March 25, 2020