Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | br-20200225.htm |

EXHIBIT 99.1 INVESTOR PRESENTATION THIRD QUARTER FISCAL YEAR 2020

Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2020 Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2019 (the “2019 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2019 Annual Report. These risks include: • the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; • Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; • a material security breach or cybersecurity attack affecting the information of Broadridge's clients; • changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; • declines in participation and activity in the securities markets; • the failure of Broadridge's key service providers to provide the anticipated levels of service; • a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; • overall market and economic conditions and their impact on the securities markets; • Broadridge’s failure to keep pace with changes in technology and demands of its clients; • Broadridge’s ability to attract and retain key personnel; • the impact of new acquisitions and divestitures; and • competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. © 2020 | 2

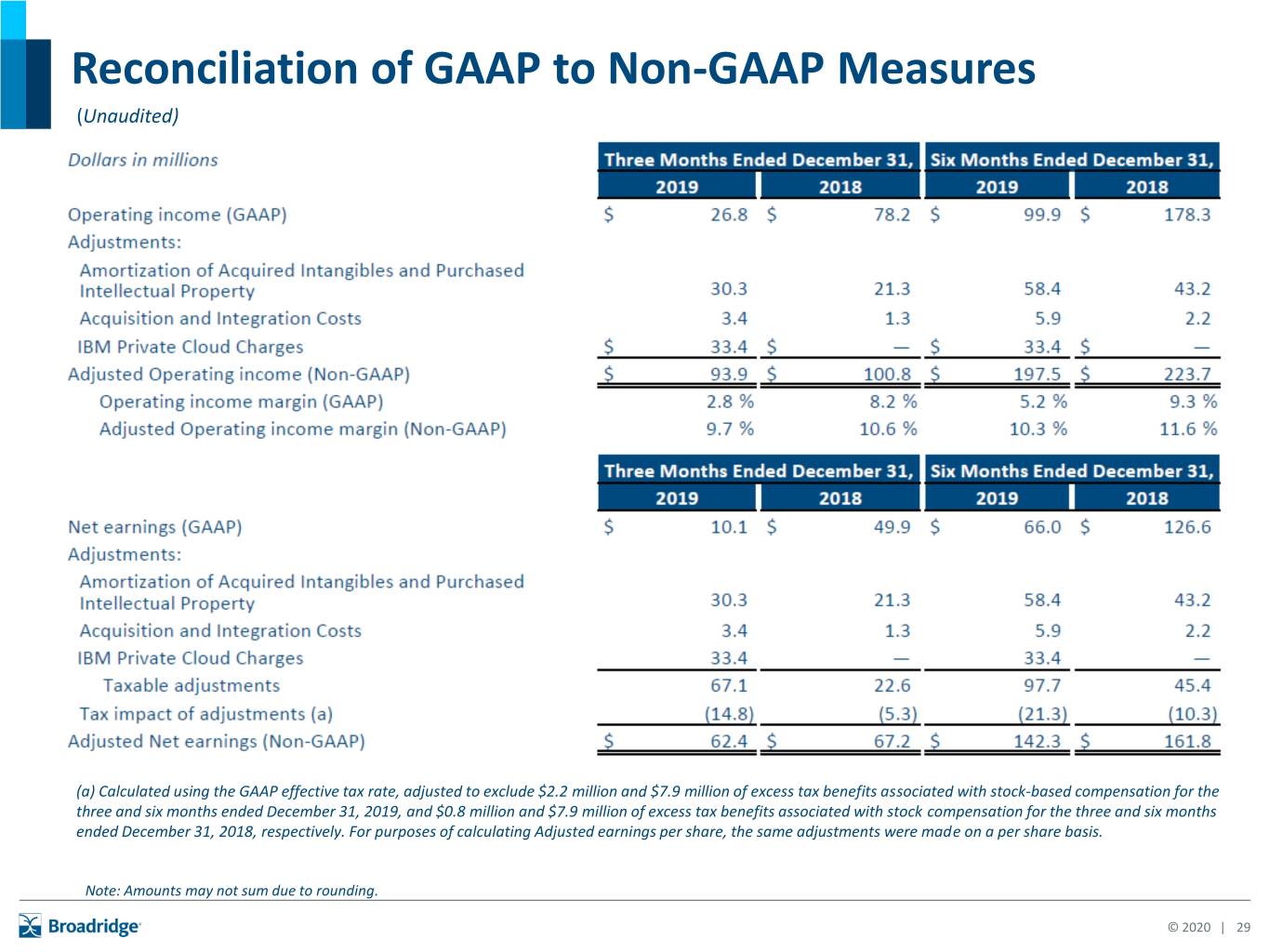

Use of Non-GAAP Financial Measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings Per Share These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, and (iii) IBM Private Cloud Charges. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. IBM Private Cloud Charges represent a charge on the hardware assets to be transferred to International Business Machines Corporation ("IBM") and other charges related to the information technology agreement for private cloud services the Company entered into with IBM. We exclude IBM Private Cloud Charges from our Adjusted Operating income and other earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and this item does not reflect ordinary operations or earnings. We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non-cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets. Free Cash Flow In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. © 2020 | 3

The Broadridge Story $2.8B 7-9% Strong market position across Governance, FY19 Recurring Fee 3-Year Total Capital Markets, and Wealth Management Revenue Recurring Revenue Growth Objective (1) (2) Platform-based business model creates 98% 8-12% unique value for our clients Recurring fee FY 20 Adjusted EPS revenue retention Growth Guidance Significant growth opportunity supported by long-term trends of mutualization, ~45% 27% digitization, and data & analytics Target Dividend Annualized 3 Year Total Payout Ratio (3) Shareholder Return Strong business model and long-term focus (June 30, 2017- June 30 2019) should sustain continued growth and strong Total Shareholder Returns #1 Most Admired Financial Data (1) As reported in Investor Day 2017 Services Company by (2) As noted during January 31, 2020 Q2 Earnings Call, Adjusted EPS growth of 8-12% is expected to be at low end of range (3) Dividend payout ratio is a percentage of prior year Adjusted Net Earnings and is subject to Board approval FORTUNE® magazine in 2019 © 2020 | 4

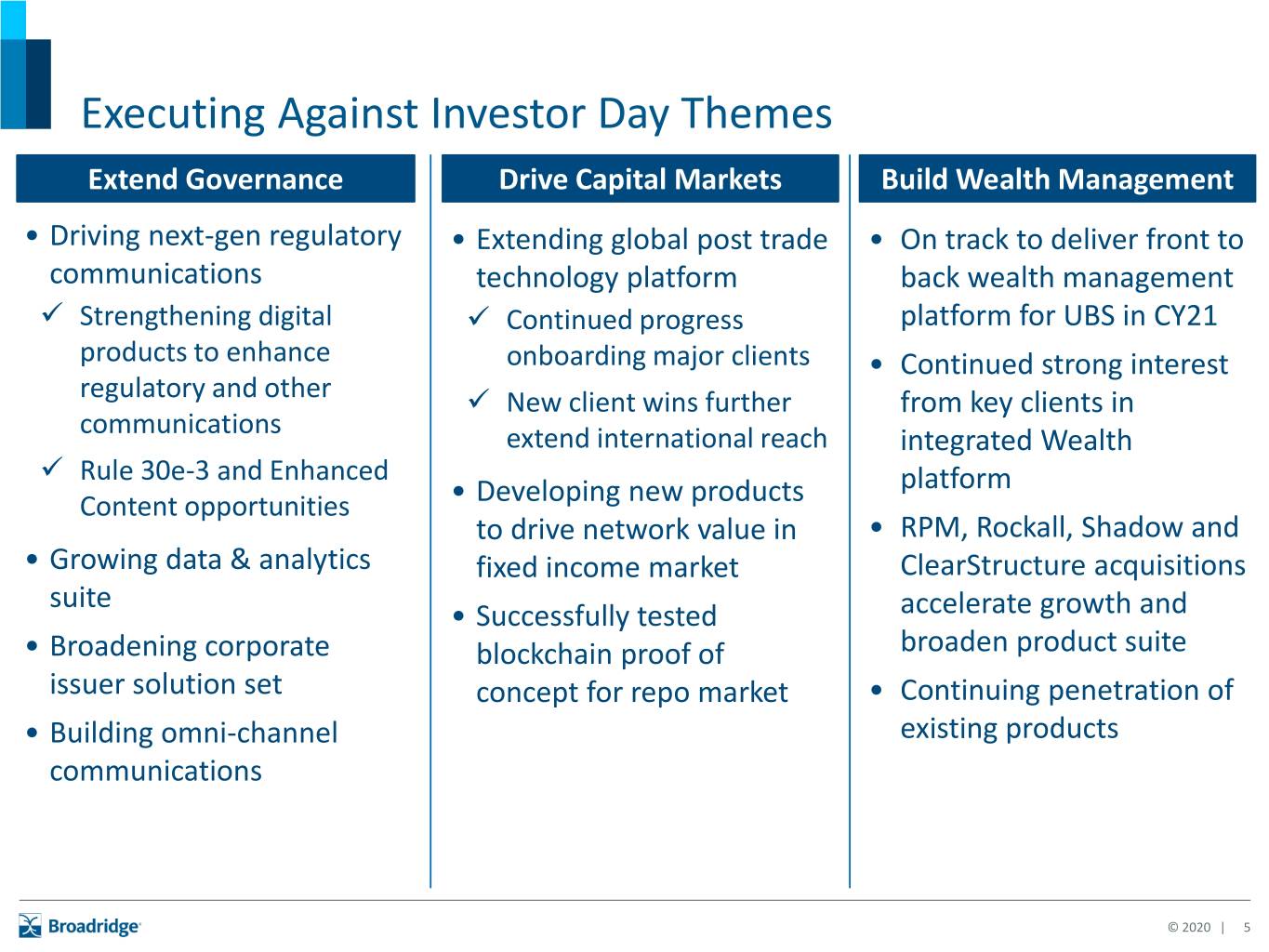

Executing Against Investor Day Themes Extend Governance Drive Capital Markets Build Wealth Management • Driving next-gen regulatory • Extending global post trade • On track to deliver front to communications technology platform back wealth management ✓ Strengthening digital ✓ Continued progress platform for UBS in CY21 products to enhance onboarding major clients • Continued strong interest regulatory and other ✓ New client wins further from key clients in communications extend international reach integrated Wealth ✓ Rule 30e-3 and Enhanced platform Content opportunities • Developing new products to drive network value in • RPM, Rockall, Shadow and • Growing data & analytics fixed income market ClearStructure acquisitions suite • Successfully tested accelerate growth and • Broadening corporate blockchain proof of broaden product suite issuer solution set concept for repo market • Continuing penetration of • Building omni-channel existing products communications © 2020 | 5

The Industry’s Leading Choice GOVERNANCE CAPITAL MARKETS WEALTH MANAGEMENT • Process 80% of outstanding • Clear and settle over $7T • Support 50M+ accounts shares in the United States, per day through our technology process in over 120 platform international markets • Serve 19 of 24 US primary dealers for fixed income • 25%+ of US Financial • Distribute approximately Advisors utilize Broadridge’s 80% of broker regulatory • Process Equities for 7 of front office solutions communications to 140M the top 10 global individual accounts investment banks • Provide data aggregation service for 200K+ agents • Serve most brokers, funds, • Support clearance and and advisors and public companies in settlement in over 90 North America countries • Maintain 100K+ retirement plans through Broadridge’s • Reach 80% of North mutual fund settlements American households platform GROWING FRANCHISE1 GROWING FRANCHISE FRANCHISE OPPORTUNITY (1) At Broadridge we define Franchise as a business that has a truly differentiated value proposition and, more importantly, as one that creates network value. © 2020 | 6

Broadridge Platform-based Business Model Creates Unique Value Deep financial services knowledge • Domain expertise • Trusted Multi-client Network managed value • Unique Capability • Scale leadership services • Data & Analytics • Significant IP approach © 2020 | 7

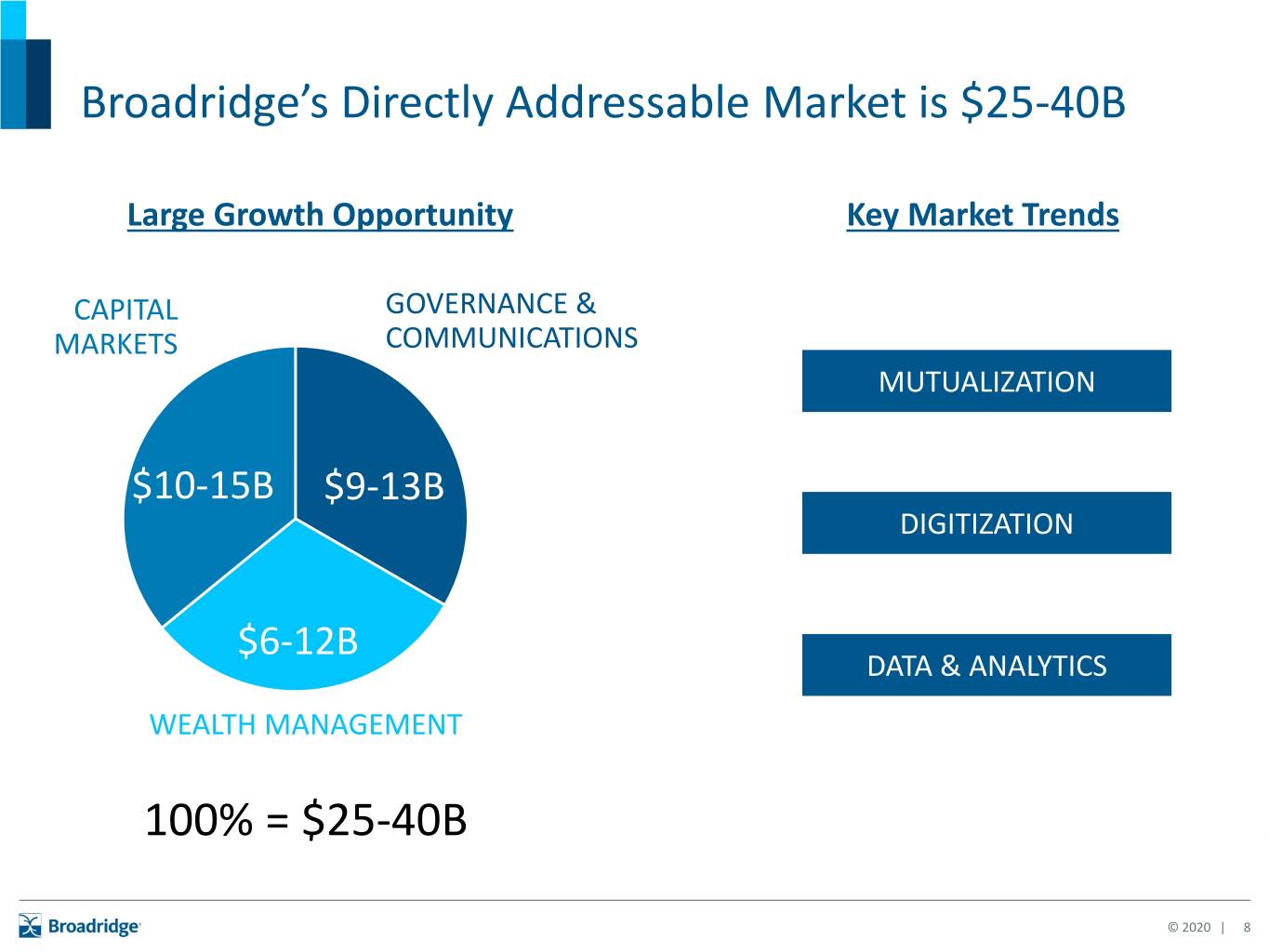

Broadridge’s Directly Addressable Market is $25-40B Large Growth Opportunity Key Market Trends CAPITAL GOVERNANCE & MARKETS COMMUNICATIONS MUTUALIZATION $10-15B $9-13B DIGITIZATION $6-12B DATA & ANALYTICS WEALTH MANAGEMENT 100% = $25-40B © 2020 | 8

Growth Opportunity: Extend Governance 5,000+ 150,000+ CORPORATE ISSUERS INSTITUTIONAL SHAREHOLDERS 27,000+ 140M+ MUTUAL FUNDS AND RETAIL SHAREHOLDER ACCOUNTS ETFs 1,100+ BANKS and BROKER-DEALERS EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH MANAGEMENT Fee Revenue = $1.7B Drive Next-gen Grow suite of data Extend services Build Omni- Regulatory & analytics and to corporate channel Communications digital solutions Issuers communications Note: Governance Fee revenues as of Broadridge’s December 2017 Investor Day and are primarily derived from Investor Communication Solutions (“ICS”) Segment. © 2020 | 9

ICS Record Growth and FY19 Revenues FY19 ICS Total Revenues2 (Dollars in millions) FY08-19 Record Growth1 $1,460 ICS Recurring fee revenues 42% $1,764 Event-driven fee Revenue 51% 12% 11% 11% 11% $244 Distribution revenues 10% 7% 10% 9% 9% 9% 9% 8% 8% 8% 8% 7% 6% 6% 6% 2 4% 4% FY19 ICS Recurring Revenue by Product Line 4% 3% 3% (Dollars in millions) 2% 2% 2% 1% 0% $325 $437 Equity Proxy 0% -1% 18% -2% 25% -2% Mutual fund and ETF -4% interims FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 $266 Customer comms. and Stock Record Growth Interim Record Growth $736 15% fulfillment 42% Other ICS 1 Stock record growth and interim record growth measure the annual change in total positions eligible for equity proxies and mutual fund & ETF interims, respectively, for equities and mutual fund position data reported to Broadridge in both the current and prior year periods. 2FY2019 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In the aggregate, the Total revenues transferred in FY2019 were $42.8 million. © 2020 | 10

Event-Driven Revenue: Near Historic Low Q2 Dollars in millions Note: Significant mutual fund proxy events were noted in FY17 Q4, FY18 Q2, and FY19 Q1. Note: Amounts may not sum due to rounding. © 2020 | 11

Regulatory Update • The SEC continues to look into a range of Governance issues that touch on our business. • Thematically, the SEC is clearly engaged and trying to understand how it can (1) strengthen our corporate governance system, and (2) utilize technology to (a) help drive down costs and (b) increase shareholder engagement. • Allows mutual funds to opt-in shareholders to receive “notice-and-access” beginning 2021. June 2018 • We are working with hundreds of fund families to prepare for 30e-3. SEC Approves Rule 30e-3 • Financial impact to BR: modestly net positive impact on gross profit (higher recurring fee “Notice-and-access” revenues with lower distribution revenues). October 2018 • BR comment letter a year ago laid out our strong track record of value ($400M+ annually) delivered to the mutual fund industry, and identified future savings. Comments on mutual • Since then, interim fees was rolled into discussions for the proxy distribution working groups, fund interim fees which meet periodically and have no timeline for issuing a recommendation to the SEC. Mutual funds Mutual October 2018 • We see the most momentum here. SEC staff said in public forums they are considering options for shorter/more streamlined regulatory communications, and in November 2019, this issue Comments on was moved to the SEC’s short-term agenda. modernization of mutual • We are in favor of any step to ensure main street investors have easy and actionable access to fund communications the information they need to invest with confidence. • We are working closely with SIFMA and other stakeholders to develop an industry consensus November 2018 around end-to-end vote confirmation, which is a key priority for the SEC. Proxy Roundtable • Little economic impact to BR, but we believe that any step that increases vote accuracy and confidence in the proxy voting process is a positive. Equity proxy Equity © 2020 | 12

Growth Opportunity: Drive Capital Markets Strong Unique managed Emerging Global market market position services model capabilities momentum • Serve 19 of the 24 US • Support 40+ clients for • Securities Financing & Fixed Income primary both technology and Collateral dealers operations including 7 Management of 24 US Fixed Income • Process Equities for 7 primary dealers • Corporate Actions of the top 10 global investment banks • Regulatory Reporting • Clear and settle in over 90 markets globally EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH MANAGEMENT Fee Revenue = $0.5B Scale Global Post- Build Network Extend Additional Trade Technology Value Enterprise Capabilities Platform of the Future Note: Capital Markets Fee revenues as of Broadridge’s December 2017 Investor Day and are primarily derived from Global Technology and Operations (“GTO”) Segment © 2020 | 13

Growth Opportunity: Build Wealth Management • Educational content • Enriched, digital communications • Trading and account servicing • Wealth management • Clearance & settlement tools • Client and regulatory • Targeted marketing reporting • Wealth mobile portal • Business process automation & workflows Advisors Investors BUILD WEALTH EXTEND GOVERNANCE DRIVE CAPITAL MARKETS Fee Revenue $0.4B Drive Best-of-Suite Extend Front-to-Back Drive Digital for Investment Platform of the Wealth Solutions Future Managers Note: Wealth Management Fee revenues as of Broadridge’s December 2017 Investor Day and are derived across ICS and GTO Segments © 2020 | 14

Record Sales Building Revenue Backlog Dollars in millions Recurring Revenue Backlog as of Annual Closed Sales Performance June 30 3,4 $250 FY’14 – 19 $230 CAGR – 13% $200 $190 $150 $233 $215 $100 $188 $146 $151 $127 $50 (2) $83 $0 FY14 FY15 FY16 FY17 FY18 FY19 FY20 (1) Closed Sales FY 20 Closed Sales Guidance (1) FY20 Closed sales Guidance Range as of August 1, 2019 Earnings Call. (2) Year to Date actuals, as reported on January 31, 2020 Earnings Call. (3) Recurring Revenue Backlog as of August 1, 2019 Earnings Call and are Broadridge estimates and subject to revision. (4) Recurring Revenue Backlog represents an estimate of first year revenues from Closed sales that have not yet been recognized and are expected to be recognized. Not Yet Live represents the subset of the Backlog where none of the first year revenues from Closed sales have been recognized but are expected to be recognized. Live represents the subset of the Backlog where a portion of the first year revenues from Closed sales have been recognized in previous periods. © 2020 | 15

Broadridge Business Model is Strong • Large, recurring revenue base with good visibility aided Sustainable Growth by $330 million revenue backlog • Organic strength driven by large addressable market Steady Margin • Continued scale and operational leverage Expansion • Focus on operational efficiencies • 100+% average free cash flow conversion Strong Free Cash Flow • Largely predictable model Balanced Capital • Target ~45% dividend payout ratio1 Allocation • Balance of targeted M&A and share repurchase (1) Dividend payout ratio is a percentage of prior year Adjusted Net Earnings and is subject to Board approval. © 2020 | 16

FY17 - FY20 Three Year Growth Objectives Winning formula for top quartile TSR Organic Recurring Fee Revenue Growth1 5-7% Recurring Fee Revenue Growth1 7-9% Adjusted Op Income Margin Expansion ~50bps/yr Adjusted EPS Growth2 14-18% 1) Three Year objectives presented at 2017 Investor Day. Revenue growth rates represent compound annual growth rates (CAGRs). 2) FY17 - FY20 three year Adjusted EPS growth objective updated February 8, 2018 to 14-18% from 9-13% as a result of change in U.S. Tax Law. © 2020 | 17

Second Quarter Fiscal Year 2020 Financial Summary © 2020 | 18

Fiscal Year 2020 Guidance – As of January 31, 2020 Recurring fee revenue growth 8-10% Total revenue growth 3-6% Operating income margin – GAAP ~14% Adjusted Operating income margin – Non-GAAP ~18% Diluted earnings per share growth (4) – 0% Adjusted earnings per share growth – Non-GAAP 8-12%(1) Closed sales $190 - $230M (1) Expected to be at low end of range. © 2020 | 19

Second Quarter Highlights ▪ 7% Recurring fee revenue growth driven by strong contribution from recent acquisitions ▪ Event-Driven Revenue down 36% to near historic low drove lower EPS • Adjusted EPS down 5% to $0.53 in seasonally small quarter • GAAP EPS down 79% to $0.09 driven by charges associated with the IBM Private Cloud Agreement and increased acquisition amortization ▪ Recent M&A performing well ▪ Strong year-to-date Sales of $83M, up double digits excluding FY19 UBS deal ▪ FY20 Guidance on-track despite significant drop in event-driven revenue • Recurring fee revenue growth of 8-10% driven by pick-up in organic growth in seasonally more important second half • Adjusted EPS growth of 8-12%, expected to be at low end of range ▪ Broadridge remains on track for longer-term opportunity and continues to invest in new product with exciting milestones later this year © 2020 | 20

Second Quarter 2020 Operating Review ▪ ICS Recurring revenues: continued growth • Recurring fee revenue growth of 9% (organic growth of 4%) excluding Customer Communications in quarter • Customer Communications revenues declined 3% driven by lower mutual funds communications in quarter ▪ Event-driven activity at decade lows ▪ GTO: on track for stronger growth • Recurring fee revenue growth of 14% (organic growth of 4%) • Strong growth from new sales offset by lower equity trading volumes in 2Q, but set the stage for organic growth acceleration over balance of FY20 • FY19 acquisitions performing well out of the gate ▪ Closed sales remained strong • Double digit increase on a year-to-date basis excluding FY19 UBS sale © 2020 | 21

Business Update: Focused on Long-term Growth ▪ Regulatory update ▪ Recent acquisitions strengthen core businesses • Wealth: ClearStructure • Governance: FundsLibrary ▪ Broadridge Private Cloud an important step forward in our cloud strategy enabling improved time-to-market, increased resilience, and enhanced focus on differentiated solutions ▪ Remain on track to deliver long-term growth • Targeted M&A investment broadens product lineup • Continued reinvestment despite event-driven pressures • Strong pipeline of innovative new products © 2020 | 22

Second Quarter 2020 Revenue Growth Drivers ▪ Second Quarter 2020 Recurring fee revenues grew 7% to $648 million Organic Growth: 1.5% $623M +6 pts. +6 pts. +7% $576M $648M (2) pts. (3) pts. $604M ▪ Second Quarter 2020 Total revenues grew 2% to $969 million +5 pts. +2% (2) pts. (1) pt. (1) pt. $969M $953M Note: Amounts may not sum due to rounding. © 2020 | 23

Second Quarter 2020 Segment Revenue Growth and Drivers (1) FY2019 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In aggregate, the Total revenues transferred in 2Q FY2019 were $10.4 million. Note: Amounts may not sum due to rounding. © 2020 | 24

Second Quarter 2020 Operating Income and EPS Dollars in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in Diluted EPS and and Adjusted Operating Income Adjusted EPS (5)% (7)% (66)% (79)% © 2020 | 25

Capital Allocation and Summary Balance Sheet Dollars in millions Notes: (a) Includes deferred acquisition payments of $41M related to Q4 2019 acquisitions. Note: Amounts may not sum due to rounding. © 2020 | 26

Supplemental Reporting Detail - Product Line Reporting1 © 2020 | 27

Reconciliation of GAAP to Non- GAAP Measures © 2020 | 28

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (a) Calculated using the GAAP effective tax rate, adjusted to exclude $2.2 million and $7.9 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2019, and $0.8 million and $7.9 million of excess tax benefits associated with stock compensation for the three and six months ended December 31, 2018, respectively. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. © 2020 | 29

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (a) Calculated using the GAAP effective tax rate, adjusted to exclude $2.2 million and $7.9 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2019, and $0.8 million and $7.9 million of excess tax benefits associated with stock-based compensation, for the three and six months ended December 31, 2018. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. © 2020 | 30

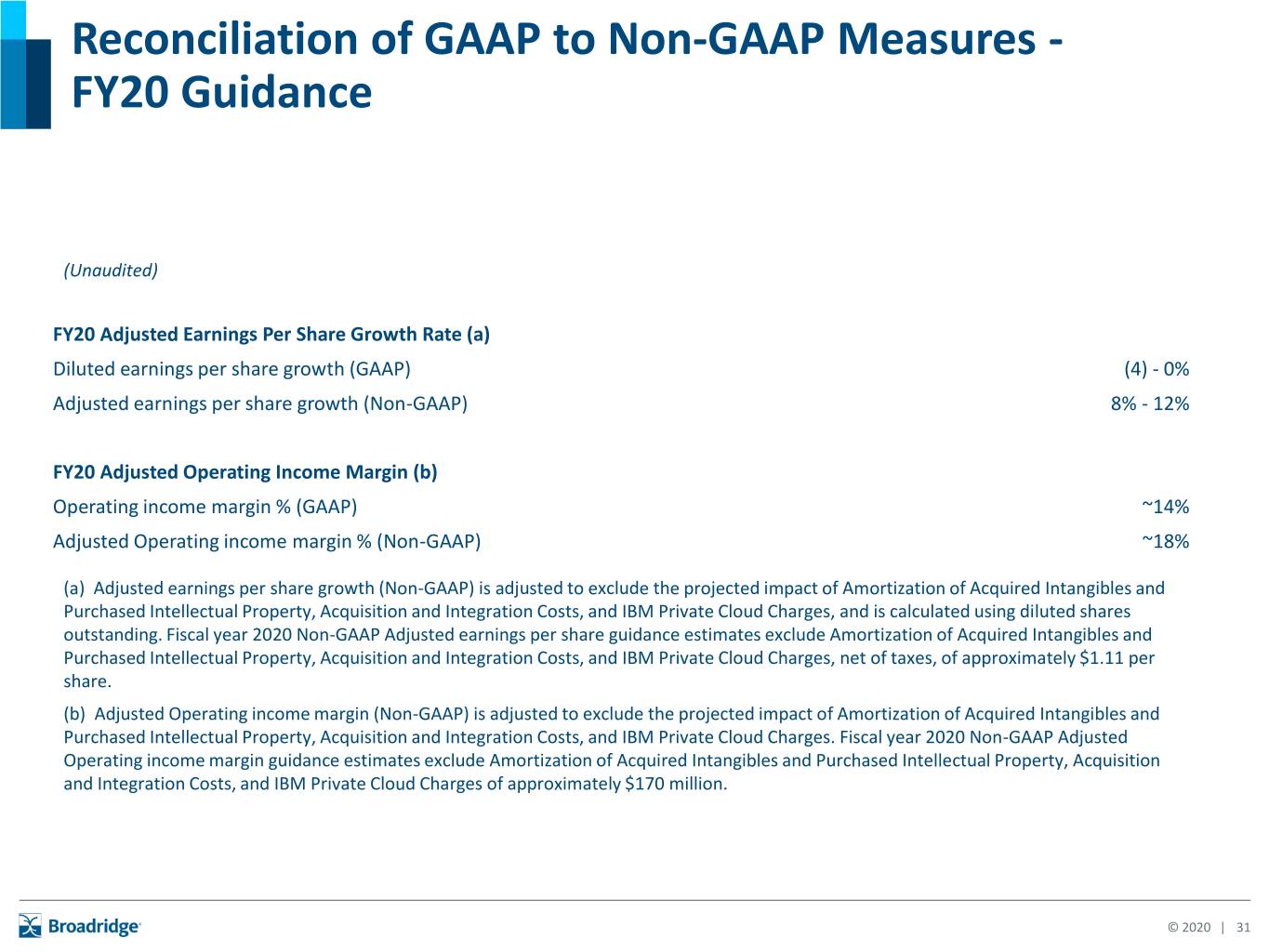

Reconciliation of GAAP to Non-GAAP Measures - FY20 Guidance (Unaudited) FY20 Adjusted Earnings Per Share Growth Rate (a) Diluted earnings per share growth (GAAP) (4) - 0% Adjusted earnings per share growth (Non-GAAP) 8% - 12% FY20 Adjusted Operating Income Margin (b) Operating income margin % (GAAP) ~14% Adjusted Operating income margin % (Non-GAAP) ~18% (a) Adjusted earnings per share growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges, and is calculated using diluted shares outstanding. Fiscal year 2020 Non-GAAP Adjusted earnings per share guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges, net of taxes, of approximately $1.11 per share. (b) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges. Fiscal year 2020 Non-GAAP Adjusted Operating income margin guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges of approximately $170 million. © 2020 | 31

Broadridge Investor Relations Contact W. Edings Thibault Tel: 516-472-5129 Email: edings.thibault@broadridge.com © 2020 | 32