Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Pattern Energy Group Inc. | d802941dex993.htm |

| EX-99.2 - EX-99.2 - Pattern Energy Group Inc. | d802941dex992.htm |

| 8-K - 8-K - Pattern Energy Group Inc. | d802941d8k.htm |

Exhibit 99.1 Pattern Energy Sale to CPP Investments A Compelling Value Proposition for Stockholders February 2020Exhibit 99.1 Pattern Energy Sale to CPP Investments A Compelling Value Proposition for Stockholders February 2020

Cautionary Statement Regarding Forward-Looking Statements Certain statements contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws. Such statements include statements concerning anticipated future events and expectations that are not historical facts. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, target, estimate, continue, positions, plan, predict, project, forecast, guidance, goal, objective, prospects, possible or potential, by future conditional verbs such as assume, will, would, should, could or may, or by variations of such words or by similar expressions or the negative thereof. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors related to the pending acquisition of the Company, including, without limitation, (1) risks related to the consummation of the Merger, including the risks that (a) the Merger may not be consummated within the anticipated time period, or at all, (b) the parties may fail to obtain shareholder approval of the Merger Agreement, (c) the parties may fail to secure other applicable regulatory approvals, including from the Federal Energy Regulatory Commission, and (d) other conditions to the consummation of the Merger under the Merger Agreement may not be satisfied; (2) the effects that any termination of the Merger Agreement may have on the Company or its business, including the risks that (a) the price of the Company's common stock may decline significantly if the Merger is not completed, (b) the Merger Agreement may be terminated in circumstances requiring the Company to pay Parent a termination fee, or (c) the circumstances of the termination, including the possible imposition of a 12-month tail period during which the termination fee could be payable upon certain subsequent transactions, may have a chilling effect on alternatives to the Merger; (3) the effects that the announcement or pendency of the Merger may have on the Company and its business, including the risks that as a result (a) the Company's business, operating results or stock price may suffer, (b) the Company's current plans and operations may be disrupted, (c) the Company's ability to retain or recruit key employees may be adversely affected, (d) the Company's business relationships (including with suppliers, off- takers, and business partners) may be adversely affected, (e) the Company is not able to access the debt or equity markets on favorable terms, or at all, or (f) the Company's management's or employees' attention may be diverted from other important matters; (4) the effect of limitations that the Merger Agreement places on the Company's ability to operate its business or engage in alternative transactions; (5) the nature, cost and outcome of pending and future litigation and other legal proceedings, including any such proceedings related to the Merger and instituted against the Company and others; (6) the risk that the Merger and related transactions may involve unexpected costs, liabilities or delays; (7) the Company's ability to continue paying a quarterly dividend; and (8) other economic, business, competitive, legal, regulatory, and/or tax factors under the heading Risk Factors in Part I, Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as updated or supplemented by subsequent reports that the Company has filed or files with the U.S. Securities and Exchange Commission ( SEC ) and Canadian securities regulatory authorities. Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company does not assume any obligation to publicly update any forward-looking statement after it is made, whether as a result of new information, future events or otherwise, except as required by law. Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This presentation may be deemed to be solicitation material in respect of the Merger. In connection with the proposed transaction, the Company has filed a definitive proxy statement with the SEC and Canadian securities regulatory authorities and mailed the definitive proxy statement and proxy card to each stockholder entitled to vote at the special meeting relating to the proposed Merger. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED TRANSACTION THAT THE COMPANY HAS FILED AND MAY FILE WITH THE SEC AND CANADIAN SECURITIES REG`ULATORY AUTHORITIES WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Stockholders and investors are able to obtain free copies of the proxy statement and other relevant materials (when they become available) and other documents filed by the Company at the SEC's website at www.sec.gov and the website of the Canadian securities regulatory authorities at www.sedar.com. Copies of the proxy statement and the filings incorporated by reference therein may also be obtained, without charge, by contacting the Company's Investor Relations department at ir@patternenergy.com or (416) 526-1563. Participants in Solicitation The Company and its directors, executive officers and certain employees, may be deemed, under SEC rules and applicable rules in Canada, to be participants in the solicitation of proxies in respect of the Merger. Information regarding the Company's directors and executive officers is available in its annual proxy statement and definitive proxy statement related to the proposed transaction filed with the SEC and Canadian securities regulatory authorities on April 23, 2019 and February 4, 2020, respectively. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is also contained in the definitive proxy statement and other relevant materials filed with the SEC and Canadian securities regulatory authorities. These documents can be obtained free of charge from the Company from the sources indicated above. PATTERN ENERGY GROUP INC. PAGE 2Cautionary Statement Regarding Forward-Looking Statements Certain statements contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws. Such statements include statements concerning anticipated future events and expectations that are not historical facts. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, target, estimate, continue, positions, plan, predict, project, forecast, guidance, goal, objective, prospects, possible or potential, by future conditional verbs such as assume, will, would, should, could or may, or by variations of such words or by similar expressions or the negative thereof. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors related to the pending acquisition of the Company, including, without limitation, (1) risks related to the consummation of the Merger, including the risks that (a) the Merger may not be consummated within the anticipated time period, or at all, (b) the parties may fail to obtain shareholder approval of the Merger Agreement, (c) the parties may fail to secure other applicable regulatory approvals, including from the Federal Energy Regulatory Commission, and (d) other conditions to the consummation of the Merger under the Merger Agreement may not be satisfied; (2) the effects that any termination of the Merger Agreement may have on the Company or its business, including the risks that (a) the price of the Company's common stock may decline significantly if the Merger is not completed, (b) the Merger Agreement may be terminated in circumstances requiring the Company to pay Parent a termination fee, or (c) the circumstances of the termination, including the possible imposition of a 12-month tail period during which the termination fee could be payable upon certain subsequent transactions, may have a chilling effect on alternatives to the Merger; (3) the effects that the announcement or pendency of the Merger may have on the Company and its business, including the risks that as a result (a) the Company's business, operating results or stock price may suffer, (b) the Company's current plans and operations may be disrupted, (c) the Company's ability to retain or recruit key employees may be adversely affected, (d) the Company's business relationships (including with suppliers, off- takers, and business partners) may be adversely affected, (e) the Company is not able to access the debt or equity markets on favorable terms, or at all, or (f) the Company's management's or employees' attention may be diverted from other important matters; (4) the effect of limitations that the Merger Agreement places on the Company's ability to operate its business or engage in alternative transactions; (5) the nature, cost and outcome of pending and future litigation and other legal proceedings, including any such proceedings related to the Merger and instituted against the Company and others; (6) the risk that the Merger and related transactions may involve unexpected costs, liabilities or delays; (7) the Company's ability to continue paying a quarterly dividend; and (8) other economic, business, competitive, legal, regulatory, and/or tax factors under the heading Risk Factors in Part I, Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as updated or supplemented by subsequent reports that the Company has filed or files with the U.S. Securities and Exchange Commission ( SEC ) and Canadian securities regulatory authorities. Potential investors, stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company does not assume any obligation to publicly update any forward-looking statement after it is made, whether as a result of new information, future events or otherwise, except as required by law. Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This presentation may be deemed to be solicitation material in respect of the Merger. In connection with the proposed transaction, the Company has filed a definitive proxy statement with the SEC and Canadian securities regulatory authorities and mailed the definitive proxy statement and proxy card to each stockholder entitled to vote at the special meeting relating to the proposed Merger. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED TRANSACTION THAT THE COMPANY HAS FILED AND MAY FILE WITH THE SEC AND CANADIAN SECURITIES REG`ULATORY AUTHORITIES WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Stockholders and investors are able to obtain free copies of the proxy statement and other relevant materials (when they become available) and other documents filed by the Company at the SEC's website at www.sec.gov and the website of the Canadian securities regulatory authorities at www.sedar.com. Copies of the proxy statement and the filings incorporated by reference therein may also be obtained, without charge, by contacting the Company's Investor Relations department at ir@patternenergy.com or (416) 526-1563. Participants in Solicitation The Company and its directors, executive officers and certain employees, may be deemed, under SEC rules and applicable rules in Canada, to be participants in the solicitation of proxies in respect of the Merger. Information regarding the Company's directors and executive officers is available in its annual proxy statement and definitive proxy statement related to the proposed transaction filed with the SEC and Canadian securities regulatory authorities on April 23, 2019 and February 4, 2020, respectively. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is also contained in the definitive proxy statement and other relevant materials filed with the SEC and Canadian securities regulatory authorities. These documents can be obtained free of charge from the Company from the sources indicated above. PATTERN ENERGY GROUP INC. PAGE 2

n $26.75 per share all-cash consideration provides significant, immediate and certain value CPP n Standalone company has faced significant headwinds that led to it consistently Investments trading at a discount to peers who all have financial sponsors Transaction: Best Option n Recent movements at peer companies, driven by M&A speculation, should not be simply extrapolated to Pattern Energy’s stock price for Pattern Energy n The fundamentals have not changed. Absent this transaction, the Company will Stockholders continue facing headwinds, which will require raising equity and possibly cutting the dividend n Robust process led by Special Committee of the Board confirms this transaction provides the most value for Pattern Energy stockholders The Board of Directors continues to recommend that Pattern Energy stockholders vote “FOR” the CPP Investments transaction PATTERN ENERGY GROUP INC. PAGE 3n $26.75 per share all-cash consideration provides significant, immediate and certain value CPP n Standalone company has faced significant headwinds that led to it consistently Investments trading at a discount to peers who all have financial sponsors Transaction: Best Option n Recent movements at peer companies, driven by M&A speculation, should not be simply extrapolated to Pattern Energy’s stock price for Pattern Energy n The fundamentals have not changed. Absent this transaction, the Company will Stockholders continue facing headwinds, which will require raising equity and possibly cutting the dividend n Robust process led by Special Committee of the Board confirms this transaction provides the most value for Pattern Energy stockholders The Board of Directors continues to recommend that Pattern Energy stockholders vote “FOR” the CPP Investments transaction PATTERN ENERGY GROUP INC. PAGE 3

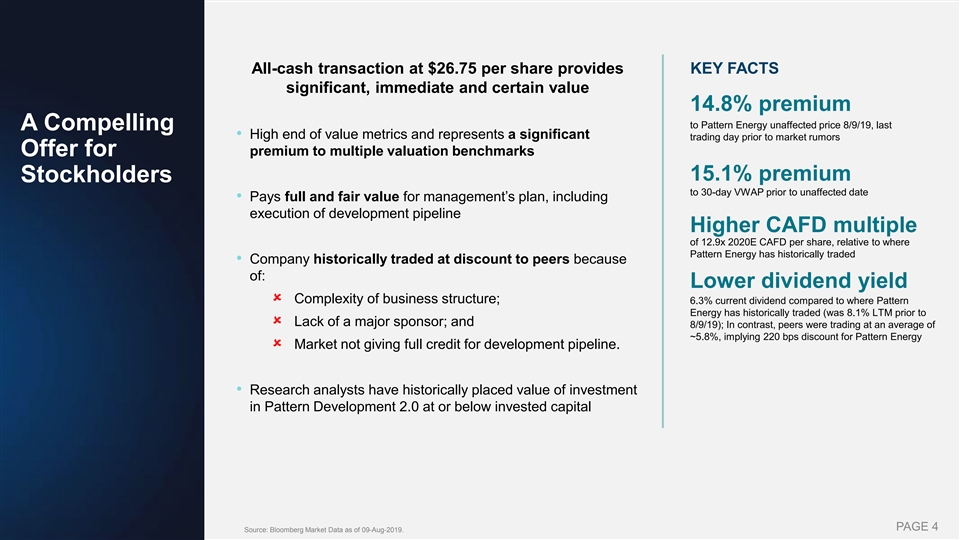

All-cash transaction at $26.75 per share provides KEY FACTS significant, immediate and certain value 14.8% premium to Pattern Energy unaffected price 8/9/19, last A Compelling • High end of value metrics and represents a significant trading day prior to market rumors Offer for premium to multiple valuation benchmarks 15.1% premium Stockholders to 30-day VWAP prior to unaffected date • Pays full and fair value for management’s plan, including execution of development pipeline Higher CAFD multiple of 12.9x 2020E CAFD per share, relative to where Pattern Energy has historically traded • Company historically traded at discount to peers because of: Lower dividend yield û Complexity of business structure; 6.3% current dividend compared to where Pattern Energy has historically traded (was 8.1% LTM prior to û Lack of a major sponsor; and 8/9/19); In contrast, peers were trading at an average of ~5.8%, implying 220 bps discount for Pattern Energy û Market not giving full credit for development pipeline. • Research analysts have historically placed value of investment in Pattern Development 2.0 at or below invested capital PAGE 4 Source: Bloomberg Market Data as of 09-Aug-2019.All-cash transaction at $26.75 per share provides KEY FACTS significant, immediate and certain value 14.8% premium to Pattern Energy unaffected price 8/9/19, last A Compelling • High end of value metrics and represents a significant trading day prior to market rumors Offer for premium to multiple valuation benchmarks 15.1% premium Stockholders to 30-day VWAP prior to unaffected date • Pays full and fair value for management’s plan, including execution of development pipeline Higher CAFD multiple of 12.9x 2020E CAFD per share, relative to where Pattern Energy has historically traded • Company historically traded at discount to peers because of: Lower dividend yield û Complexity of business structure; 6.3% current dividend compared to where Pattern Energy has historically traded (was 8.1% LTM prior to û Lack of a major sponsor; and 8/9/19); In contrast, peers were trading at an average of ~5.8%, implying 220 bps discount for Pattern Energy û Market not giving full credit for development pipeline. • Research analysts have historically placed value of investment in Pattern Development 2.0 at or below invested capital PAGE 4 Source: Bloomberg Market Data as of 09-Aug-2019.

CPP Investments Transaction Fully Values Growth Prospects that the Market has Historically Discounted • Analysts ascribe minimal growth to the Company’s standalone plan • The market historically has not recognized Pattern Development 2.0 expected contributions • Low growth outlook will result in higher dividend yield Delivering the CAFD Forecast EBITDA Most Value 1 1 (Analyst Consensus vs Management Plan ) (Analyst Consensus vs. Management Plan ) '20-'23 CAGR: 2.5% '19-'23 CAGR: 7.2% '20-'23 CAGR: 6.3% '19-'23 CAGR: 12.0% $547 $552 $508 $459 $470 $275 $463 $437 $436 $248 $226 $227 $215 $204 $201 $195 $175 $172 2020E 2021E 2022E 2023E 2019E 2020E 2021E 2022E 2023E % Δ 5.2% 16.5% 18.1% 17.6% % Δ 1.7% 1.5% 15.9% 15.3% 21.1% Analyst Consensus Management Plan Analyst Consensus Management Plan P2 Contribution to CAFD Analyst Consensus DPS (as of 09-Aug-2019) 1 (Available Analyst Estimates vs. Management Plan ) '19-'23 CAGR: 0.9% $117 P2 Contributions Not Transparent to Analysts $73 $1.75 $1.75 $1.73 $48 $1.69 $1.69 $17 $17 $17 $16 $13 2020E 2021E 2022E 2023E Analyst Estimates Management Plan 2019E 2020E 2021E 2022E 2023E No. Analysts 4 2 1 1 % Analysts 50% 25% 13% 13% Source: CapIQ, Bloomberg market data. 1 Reflects midpoint of 2019 and management guided CAFD per merger proxy. Adjusted EBITDA and P2 Distributions per merger proxy. Analyst consensus as of deal announcement on 04-Nov-2019. PAGE 5CPP Investments Transaction Fully Values Growth Prospects that the Market has Historically Discounted • Analysts ascribe minimal growth to the Company’s standalone plan • The market historically has not recognized Pattern Development 2.0 expected contributions • Low growth outlook will result in higher dividend yield Delivering the CAFD Forecast EBITDA Most Value 1 1 (Analyst Consensus vs Management Plan ) (Analyst Consensus vs. Management Plan ) '20-'23 CAGR: 2.5% '19-'23 CAGR: 7.2% '20-'23 CAGR: 6.3% '19-'23 CAGR: 12.0% $547 $552 $508 $459 $470 $275 $463 $437 $436 $248 $226 $227 $215 $204 $201 $195 $175 $172 2020E 2021E 2022E 2023E 2019E 2020E 2021E 2022E 2023E % Δ 5.2% 16.5% 18.1% 17.6% % Δ 1.7% 1.5% 15.9% 15.3% 21.1% Analyst Consensus Management Plan Analyst Consensus Management Plan P2 Contribution to CAFD Analyst Consensus DPS (as of 09-Aug-2019) 1 (Available Analyst Estimates vs. Management Plan ) '19-'23 CAGR: 0.9% $117 P2 Contributions Not Transparent to Analysts $73 $1.75 $1.75 $1.73 $48 $1.69 $1.69 $17 $17 $17 $16 $13 2020E 2021E 2022E 2023E Analyst Estimates Management Plan 2019E 2020E 2021E 2022E 2023E No. Analysts 4 2 1 1 % Analysts 50% 25% 13% 13% Source: CapIQ, Bloomberg market data. 1 Reflects midpoint of 2019 and management guided CAFD per merger proxy. Adjusted EBITDA and P2 Distributions per merger proxy. Analyst consensus as of deal announcement on 04-Nov-2019. PAGE 5

The YieldCo landscape changed in 2015, when KEY FACTS access to accretive equity capital became Peers Adopted Alternative Strategies Not Available to Pattern Energy That Does Not Have challenged A Financial Sponsor YieldCo NEP: Strong support from parent NEE • YieldCo business model is based on a simple equation: TERP: Brookfield participated in recent equity Landscape issuance and back-stopped deal; recent take private • Dividend + Growth offer by Brookfield Renewable Has Changed CWEN: GIP enhanced ROFO portfolio and committed financing to support drop downs • Pattern Energy has a high dividend payout ratio compared to peers AY: Strategic partnership with Algonquin CAFD: Taken private by Capital Dynamics • YieldCos require access to accretive equity to support growth and the PEGI: Revised plan: less M&A, more development, dividends minimize equity. 1 YieldCo Equity Issuances Over Time ($mm) 2-Year Forward DPS Growth 2 3 As of June 2015 As of Feb 2020 $4,712 $792 AY 23 % 7 % $3,849 IPO Follow-On PIPE Converts $345 $779 NEP 19 % 15 % $415 $1,216 TERP 19 % 6 % $1,475 $2,721 NYLD $1,073 18 % NM 4 (CWEN) $1,873 $515 $1,400 $402 $1,073 $50 PEGI 14 % 1 % $300 - $420 $75 $352 $215 2014 2015 2016 2017 2018 2019 2020 YTD 5 CAFD 14 % - Source: CapIQ, Bloomberg market data as of 21-Feb-2020. 1 Peer set shown for equity capital raises includes AY, CAFD, PEGI, NEP, NYLD and TERP. 2018 PIPE includes $650mm TERP shares issued to its sponsor Brookfield. 2 Two year forward dividend per share cumulative growth rate (CAGR) based on IBES consensus estimates as of 01-Jun-2015. 3 Two year forward dividend per share cumulative growth rate (CAGR) based on IBES consensus estimates as of 21-Feb-2020. 4 Not meaningful as CWEN cut dividend due to uncertainty related to PG&E situation. PAGE 6 5 Reflects midpoint of management guidance as of Q2 2016, given Jun-2015 IPO. The YieldCo landscape changed in 2015, when KEY FACTS access to accretive equity capital became Peers Adopted Alternative Strategies Not Available to Pattern Energy That Does Not Have challenged A Financial Sponsor YieldCo NEP: Strong support from parent NEE • YieldCo business model is based on a simple equation: TERP: Brookfield participated in recent equity Landscape issuance and back-stopped deal; recent take private • Dividend + Growth offer by Brookfield Renewable Has Changed CWEN: GIP enhanced ROFO portfolio and committed financing to support drop downs • Pattern Energy has a high dividend payout ratio compared to peers AY: Strategic partnership with Algonquin CAFD: Taken private by Capital Dynamics • YieldCos require access to accretive equity to support growth and the PEGI: Revised plan: less M&A, more development, dividends minimize equity. 1 YieldCo Equity Issuances Over Time ($mm) 2-Year Forward DPS Growth 2 3 As of June 2015 As of Feb 2020 $4,712 $792 AY 23 % 7 % $3,849 IPO Follow-On PIPE Converts $345 $779 NEP 19 % 15 % $415 $1,216 TERP 19 % 6 % $1,475 $2,721 NYLD $1,073 18 % NM 4 (CWEN) $1,873 $515 $1,400 $402 $1,073 $50 PEGI 14 % 1 % $300 - $420 $75 $352 $215 2014 2015 2016 2017 2018 2019 2020 YTD 5 CAFD 14 % - Source: CapIQ, Bloomberg market data as of 21-Feb-2020. 1 Peer set shown for equity capital raises includes AY, CAFD, PEGI, NEP, NYLD and TERP. 2018 PIPE includes $650mm TERP shares issued to its sponsor Brookfield. 2 Two year forward dividend per share cumulative growth rate (CAGR) based on IBES consensus estimates as of 01-Jun-2015. 3 Two year forward dividend per share cumulative growth rate (CAGR) based on IBES consensus estimates as of 21-Feb-2020. 4 Not meaningful as CWEN cut dividend due to uncertainty related to PG&E situation. PAGE 6 5 Reflects midpoint of management guidance as of Q2 2016, given Jun-2015 IPO.

Limited access to low-cost capital needed to grow operations and dividend created headwinds for standalone company Standalone • Pattern Energy’s original sponsor sold out of its stake and left Company as only US YieldCo without a sponsor Company • Company consistently traded at discount to peers, exacerbating capital funding issue by making new equity highly Faces dilutive and difficult to obtain Headwinds • Pattern Energy has been limited in its ability to pursue acquisitions and development needed to sustain its dividend growth • As a result, dividend payout ratio elevated, DPS growth moderated and net leverage deteriorated 3 1 2 Dividend Payout Ratio DPS Growth Net Leverage CAGR 2018A-2021E: 0.5% 7.9 x 95% $ 1.70 $ 1.72 $ 1.69 $ 1.69 $ 1.67 $ 1.58 84% $ 1.43 6.7 x $ 1.30 2015A LTM Q3 2019 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E Peers (2019E) PEGI (2019E) Source: Bloomberg Market Data, Wall Street equity research and company filings as of 21-Feb-2020 1 Peers include median of broker research for merger proxy peers (NEP, TERP, CWEN, BEP, NPI, RNW, INE and AY). 2019E PEGI payout ratio based on median of broker estimates (MS, NBF, RBC, Oppenheimer, and GS). 2 2020E based on implied DPS from merger proxy; 2019E and 2021E based on IBES estimates. 3 Represents Net Debt / Adj. EBITDA per company disclosures. Q3 2019 Net Debt adjusted to include $260mm preferred stock raise in Oct-2019. PAGE 7Limited access to low-cost capital needed to grow operations and dividend created headwinds for standalone company Standalone • Pattern Energy’s original sponsor sold out of its stake and left Company as only US YieldCo without a sponsor Company • Company consistently traded at discount to peers, exacerbating capital funding issue by making new equity highly Faces dilutive and difficult to obtain Headwinds • Pattern Energy has been limited in its ability to pursue acquisitions and development needed to sustain its dividend growth • As a result, dividend payout ratio elevated, DPS growth moderated and net leverage deteriorated 3 1 2 Dividend Payout Ratio DPS Growth Net Leverage CAGR 2018A-2021E: 0.5% 7.9 x 95% $ 1.70 $ 1.72 $ 1.69 $ 1.69 $ 1.67 $ 1.58 84% $ 1.43 6.7 x $ 1.30 2015A LTM Q3 2019 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E Peers (2019E) PEGI (2019E) Source: Bloomberg Market Data, Wall Street equity research and company filings as of 21-Feb-2020 1 Peers include median of broker research for merger proxy peers (NEP, TERP, CWEN, BEP, NPI, RNW, INE and AY). 2019E PEGI payout ratio based on median of broker estimates (MS, NBF, RBC, Oppenheimer, and GS). 2 2020E based on implied DPS from merger proxy; 2019E and 2021E based on IBES estimates. 3 Represents Net Debt / Adj. EBITDA per company disclosures. Q3 2019 Net Debt adjusted to include $260mm preferred stock raise in Oct-2019. PAGE 7

Even with recent peer trading, CPP Investments transaction is best path forward for stockholders • Peer company movement does not simply extrapolate to the Pattern KEY FACTS Peer Energy share price change Trade is A historically volatile market: • Market remains volatile and long-term sustainability of current price Affected levels is uncertain 26.4% 3-year weekly by Event- volatility for Pattern Energy • Predictions of standalone share price of Pattern Energy absent CPP 1 and 20.2% for sector Driven Investments transaction are speculative and often ignore the facts of what Compared to 13.1% for the weekly volatility of the is driving elevated prices Situations S&P 500 Share Price Change from Share Price 8/9/19 to Change from Unaffect unaffected unaffected date 1 1 ed Date Peer Event Driven Situation date to 2/21/20 24-Mar- Brookfield strategic partnership with sponsor TransAlta RNW N/A 35% 2019 Corp. 6-Nov- Announced Strategic Review on 2/13/19; reiterated on AY 1% 36% 2019 3Q19 earnings call Brookfield Renewable Partners to acquire remaining stake TERP (4%) 35% in TERP 10-Jan- 2020 BEP Brookfield affiliated (proposed to acquire TERP) 34% 17% 13-Jan- CWEN Public rumors of PG&E settlement 16% 13% 2020 05-Feb- INE Announced strategic partnership with Hydro-Quebec 24% 15% 2020 Source: FactSet 1 Share price change not adjusted for varying time periods (i.e., showing absolute change from the unaffected date to 2/21/2020) PAGE 8Even with recent peer trading, CPP Investments transaction is best path forward for stockholders • Peer company movement does not simply extrapolate to the Pattern KEY FACTS Peer Energy share price change Trade is A historically volatile market: • Market remains volatile and long-term sustainability of current price Affected levels is uncertain 26.4% 3-year weekly by Event- volatility for Pattern Energy • Predictions of standalone share price of Pattern Energy absent CPP 1 and 20.2% for sector Driven Investments transaction are speculative and often ignore the facts of what Compared to 13.1% for the weekly volatility of the is driving elevated prices Situations S&P 500 Share Price Change from Share Price 8/9/19 to Change from Unaffect unaffected unaffected date 1 1 ed Date Peer Event Driven Situation date to 2/21/20 24-Mar- Brookfield strategic partnership with sponsor TransAlta RNW N/A 35% 2019 Corp. 6-Nov- Announced Strategic Review on 2/13/19; reiterated on AY 1% 36% 2019 3Q19 earnings call Brookfield Renewable Partners to acquire remaining stake TERP (4%) 35% in TERP 10-Jan- 2020 BEP Brookfield affiliated (proposed to acquire TERP) 34% 17% 13-Jan- CWEN Public rumors of PG&E settlement 16% 13% 2020 05-Feb- INE Announced strategic partnership with Hydro-Quebec 24% 15% 2020 Source: FactSet 1 Share price change not adjusted for varying time periods (i.e., showing absolute change from the unaffected date to 2/21/2020) PAGE 8

Higher dividend yield implies lower valuation Pattern Dividend Yield At Leak (09-Aug-2019) 3-Year Average (Pre-Leak) 15.0% Energy Has PEGI 7.3% 8.2% Traded at a 1 ∆ vs. US YieldCos (222 bps) (172 bps) 2 ∆ vs. Canadian YieldCos (193 bps) (251 bps) Discount 12.0% 9.0% 6.0% 3.0% Aug-2016 Aug-2017 Aug-2018 Aug-2019 ---- Transaction Implied Yield PEGI US YieldCos¹ Canadian YieldCos² Source: Bloomberg Market Data as of 09-Aug-2019. 1 US YieldCos refers to median NTM dividend yield of NEP, TERP, CWEN. 2 PAGE 9 Canadian YieldCos refers to median NTM dividend yield of BEP, NPI, RNW, INE. NTM Dividend YieldHigher dividend yield implies lower valuation Pattern Dividend Yield At Leak (09-Aug-2019) 3-Year Average (Pre-Leak) 15.0% Energy Has PEGI 7.3% 8.2% Traded at a 1 ∆ vs. US YieldCos (222 bps) (172 bps) 2 ∆ vs. Canadian YieldCos (193 bps) (251 bps) Discount 12.0% 9.0% 6.0% 3.0% Aug-2016 Aug-2017 Aug-2018 Aug-2019 ---- Transaction Implied Yield PEGI US YieldCos¹ Canadian YieldCos² Source: Bloomberg Market Data as of 09-Aug-2019. 1 US YieldCos refers to median NTM dividend yield of NEP, TERP, CWEN. 2 PAGE 9 Canadian YieldCos refers to median NTM dividend yield of BEP, NPI, RNW, INE. NTM Dividend Yield

Premium transaction is a better alternative to the Company’s standalone plan • The Company would face the same issues absent the CPP Investments transaction Fundamentals • Its relative trading discount and limited access to capital would persist and could worsen Have Not Changed KEY FACTS 1 2 Market Driver 3 Months Ago Today Access to Accretive Equity Capital Needed to Grow? ûû Financial Sponsor? ûû Market View on PEGI Growth (IBES Consensus) 1.5% 1.3% Dividend Payout Ratio (IBES Consensus) ~95% ~95% 1 Wall Street equity research as of 21-Nov-2019. 2 Wall Street equity research as of 21-Feb-2020. PAGE 10Premium transaction is a better alternative to the Company’s standalone plan • The Company would face the same issues absent the CPP Investments transaction Fundamentals • Its relative trading discount and limited access to capital would persist and could worsen Have Not Changed KEY FACTS 1 2 Market Driver 3 Months Ago Today Access to Accretive Equity Capital Needed to Grow? ûû Financial Sponsor? ûû Market View on PEGI Growth (IBES Consensus) 1.5% 1.3% Dividend Payout Ratio (IBES Consensus) ~95% ~95% 1 Wall Street equity research as of 21-Nov-2019. 2 Wall Street equity research as of 21-Feb-2020. PAGE 10

CPP Investments transaction provides Illustrative Pattern Energy Share Prices Based on best opportunity to maximize value for Potential Standalone Dividend Yield Pattern Energy stockholders Dividend Yield (CY1) The Hard At Leak (09-Aug-2019) Current (21-Feb-2020) • Absent the CPP Investments Truth transaction, the Company’s plan has significant inherent risks, including: PEGI 7.3% Uncertain NEP 4.1% 3.8% NPI 4.7% 3.7% û Uncertain Pattern Development 2.0 contributions could lower Avg. of Undisturbed Peers 4.4% 3.8% dividend growth Discount to Peer Avg. 2.9% 2.9% û The need to cut the dividend to stabilize the payout ratio similar 2020E Dividend $1.70 to peers Illustrative PEGI Dividend Yield 6.7% (Based on Peer Trading) Implied PEGI Price Based on $25.37û Having to issue equity to fund 1 Average Discount to Peers growth Illustrative PEGI Dividend Yield 9.0% Total Return - 1.0% PEGI DPS Growth = 8.0% 2 (Based on Total Return) Meaningful downside risk to stockholders if Implied PEGI Price Based on transaction is not approved $21.25 3 9% Total Return Source: Bloomberg Market Data as of 21-Feb-2020 1 Implied PEGI Price calculated as PEGI 2020E dividend of $1.70 divided by estimated PEGI dividend yield of 6.7%. Estimated PEGI dividend yield calculated as current average yield of undisturbed peers (3.8%) plus the historical discount to those peers (2.9%). 2 Total return calculated as dividend yield plus 2 year forward DPS growth. Illustrative PEGI DPS growth in line with IBES consensus estimates as of 21-Feb-2020. 3 Implied PEGI Price calculated as PEGI 2020E dividend of $1.70 divided by illustrative PEGI dividend yield of 8.0%. Illustrative dividend yield of 8.0% (based on illustrative total return of 9.0% in PAGE 11 line with peer median, less illustrative dividend growth of 1.0%, in line with IBES consensus estimates). CPP Investments transaction provides Illustrative Pattern Energy Share Prices Based on best opportunity to maximize value for Potential Standalone Dividend Yield Pattern Energy stockholders Dividend Yield (CY1) The Hard At Leak (09-Aug-2019) Current (21-Feb-2020) • Absent the CPP Investments Truth transaction, the Company’s plan has significant inherent risks, including: PEGI 7.3% Uncertain NEP 4.1% 3.8% NPI 4.7% 3.7% û Uncertain Pattern Development 2.0 contributions could lower Avg. of Undisturbed Peers 4.4% 3.8% dividend growth Discount to Peer Avg. 2.9% 2.9% û The need to cut the dividend to stabilize the payout ratio similar 2020E Dividend $1.70 to peers Illustrative PEGI Dividend Yield 6.7% (Based on Peer Trading) Implied PEGI Price Based on $25.37û Having to issue equity to fund 1 Average Discount to Peers growth Illustrative PEGI Dividend Yield 9.0% Total Return - 1.0% PEGI DPS Growth = 8.0% 2 (Based on Total Return) Meaningful downside risk to stockholders if Implied PEGI Price Based on transaction is not approved $21.25 3 9% Total Return Source: Bloomberg Market Data as of 21-Feb-2020 1 Implied PEGI Price calculated as PEGI 2020E dividend of $1.70 divided by estimated PEGI dividend yield of 6.7%. Estimated PEGI dividend yield calculated as current average yield of undisturbed peers (3.8%) plus the historical discount to those peers (2.9%). 2 Total return calculated as dividend yield plus 2 year forward DPS growth. Illustrative PEGI DPS growth in line with IBES consensus estimates as of 21-Feb-2020. 3 Implied PEGI Price calculated as PEGI 2020E dividend of $1.70 divided by illustrative PEGI dividend yield of 8.0%. Illustrative dividend yield of 8.0% (based on illustrative total return of 9.0% in PAGE 11 line with peer median, less illustrative dividend growth of 1.0%, in line with IBES consensus estimates).

Pattern Energy’s Board undertook a robust process KEY FACTS led by a Special Committee 21 meetings • Reviewed Strategic Alternatives: Considered range of potential alternatives, By Special Committee over 16 months including investments, acquisitions, dispositions, financial and strategic M&A Conducted a transactions, and standalone prospects Robust 10 parties • Competitive Sale Process: Engaged 10 most likely strategic and financial buyers Contacted during sale process Process • All of these parties focused on ESG investing • Offered to pay go-forward expenses to one of the leading alternative 4 confidentiality agreements bidders to entice it to advance discussions as part of the process Entered into that resulted in diligence being conducted • Go-Shop Period: Conducted additional outreach during post-signing “go-shop” Reviewed multiple bids period From multiple parties • Did not result in a superior offer Received fairness opinion • Thorough Evaluation: Special Committee evaluated transaction against Company’s standalone prospects, performance and outlook relative to historical Regarding CPP Investments transaction trading multiples and yields 16 Parties Contacted out to during “go-shop” period Board continues to recommend stockholders vote FOR the transaction PAGE 12 Source: Company filings.Pattern Energy’s Board undertook a robust process KEY FACTS led by a Special Committee 21 meetings • Reviewed Strategic Alternatives: Considered range of potential alternatives, By Special Committee over 16 months including investments, acquisitions, dispositions, financial and strategic M&A Conducted a transactions, and standalone prospects Robust 10 parties • Competitive Sale Process: Engaged 10 most likely strategic and financial buyers Contacted during sale process Process • All of these parties focused on ESG investing • Offered to pay go-forward expenses to one of the leading alternative 4 confidentiality agreements bidders to entice it to advance discussions as part of the process Entered into that resulted in diligence being conducted • Go-Shop Period: Conducted additional outreach during post-signing “go-shop” Reviewed multiple bids period From multiple parties • Did not result in a superior offer Received fairness opinion • Thorough Evaluation: Special Committee evaluated transaction against Company’s standalone prospects, performance and outlook relative to historical Regarding CPP Investments transaction trading multiples and yields 16 Parties Contacted out to during “go-shop” period Board continues to recommend stockholders vote FOR the transaction PAGE 12 Source: Company filings.

Recognize “We see limiting factors at PEGI less supportive of higher premium bids, including only a ~13-year weighted average significant, Sell-side contract life and the ultimate run-off of tax assets. DevCo immediate ownership and international exposure add complexity as well. Analysts and certain Limited organic growth potential and merchant power exposure Understand also depress private market valuation, in our opinion.” value Transaction – JP Morgan, Nov-2019 Value* Reject argument “…In our view, investors’ recent strong appetite for renewable- that recent centric companies does not necessarily mean that investors will suddenly bless PEGI’s structure. We also agree with PEGI that increases in peer there are unique factors that have caused the recent strong share prices are performance in several of the yieldco peers.” relevant to Pattern Energy– Wells Fargo, Feb-2020 *Permission to use quotation neither sought nor obtained PAGE 13Recognize “We see limiting factors at PEGI less supportive of higher premium bids, including only a ~13-year weighted average significant, Sell-side contract life and the ultimate run-off of tax assets. DevCo immediate ownership and international exposure add complexity as well. Analysts and certain Limited organic growth potential and merchant power exposure Understand also depress private market valuation, in our opinion.” value Transaction – JP Morgan, Nov-2019 Value* Reject argument “…In our view, investors’ recent strong appetite for renewable- that recent centric companies does not necessarily mean that investors will suddenly bless PEGI’s structure. We also agree with PEGI that increases in peer there are unique factors that have caused the recent strong share prices are performance in several of the yieldco peers.” relevant to Pattern Energy– Wells Fargo, Feb-2020 *Permission to use quotation neither sought nor obtained PAGE 13

Caution that “If PEGI remains independent, its prospects could remain significant tied to the sustainability of its dividend (payout ratio of ~100% over the 2017-2019 period)…Our downside scenario of risks face Sell-side $25 assumes that there are impediments that prevent the Pattern pending sale to CPPIB from closing and the company continues Analysts Energy’s as a stand alone entity. This scenario also assumes the Understand company is not able to sustain its current dividend.” standalone plan Transaction absent the – RBC, Feb-2020 Value* transaction Appreciate the “We think there is fairly low likelihood of a stronger offer coming robust process in given that the company ran a thorough process led by the PEGI board and Chairman with a special committee tasked undertaken by with reviewing strategic options.” Pattern Energy’s Board – Morgan Stanley, Nov-2019 of Directors *Permission to use quotation neither sought nor obtained PAGE 14Caution that “If PEGI remains independent, its prospects could remain significant tied to the sustainability of its dividend (payout ratio of ~100% over the 2017-2019 period)…Our downside scenario of risks face Sell-side $25 assumes that there are impediments that prevent the Pattern pending sale to CPPIB from closing and the company continues Analysts Energy’s as a stand alone entity. This scenario also assumes the Understand company is not able to sustain its current dividend.” standalone plan Transaction absent the – RBC, Feb-2020 Value* transaction Appreciate the “We think there is fairly low likelihood of a stronger offer coming robust process in given that the company ran a thorough process led by the PEGI board and Chairman with a special committee tasked undertaken by with reviewing strategic options.” Pattern Energy’s Board – Morgan Stanley, Nov-2019 of Directors *Permission to use quotation neither sought nor obtained PAGE 14

n All-cash consideration provides significant, immediate and certain value n Represents significant premium and is priced at the high end of valuation metrics CPP n 14.8% premium to PEGI unaffected price 8/9/19, last trading day prior to market rumors; 15.1% premium to 30-day VWAP prior to unaffected date Investments Transaction: n Standalone company faces significant headwinds Best Option n Absent the CPP Investments transaction, Pattern Energy would expect to continue to trade at a discount as a standalone company for Pattern n Maintaining the ability to grow may require cutting the dividend and raising equity Energy Stockholders n Recent movements at peer companies, driven by M&A speculation at those companies, should not be simply extrapolated to Pattern Energy’s stock price 1 n Pattern Energy trades in a historically volatile market - 20.2% for sector compared to 13.1% for the weekly volatility of the S&P 500 n Robust process led by Special Committee of the Board confirms this transaction provides the most value for Pattern Energy stockholders n Retained independent legal and financial advisors n Engaged in contact with or received indications of interest from 10 separate parties n Conducted additional outreach to 16 parties during “go-shop” that did not result in superior offer 1 Share price change not adjusted for varying time periods (i.e., showing absolute change from the unaffected date to 2/21/2020) PAGE 15n All-cash consideration provides significant, immediate and certain value n Represents significant premium and is priced at the high end of valuation metrics CPP n 14.8% premium to PEGI unaffected price 8/9/19, last trading day prior to market rumors; 15.1% premium to 30-day VWAP prior to unaffected date Investments Transaction: n Standalone company faces significant headwinds Best Option n Absent the CPP Investments transaction, Pattern Energy would expect to continue to trade at a discount as a standalone company for Pattern n Maintaining the ability to grow may require cutting the dividend and raising equity Energy Stockholders n Recent movements at peer companies, driven by M&A speculation at those companies, should not be simply extrapolated to Pattern Energy’s stock price 1 n Pattern Energy trades in a historically volatile market - 20.2% for sector compared to 13.1% for the weekly volatility of the S&P 500 n Robust process led by Special Committee of the Board confirms this transaction provides the most value for Pattern Energy stockholders n Retained independent legal and financial advisors n Engaged in contact with or received indications of interest from 10 separate parties n Conducted additional outreach to 16 parties during “go-shop” that did not result in superior offer 1 Share price change not adjusted for varying time periods (i.e., showing absolute change from the unaffected date to 2/21/2020) PAGE 15