Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Pattern Energy Group Inc. | pegi2016123110kexhbit32.htm |

| EX-31.2 - EXHIBIT 31.2 - Pattern Energy Group Inc. | pegi2016123110kexhbit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Pattern Energy Group Inc. | pegi2016123110kexhbit311.htm |

| EX-23.2 - EXHIBIT 23.2 - Pattern Energy Group Inc. | pegi2016123110kexhbit232.htm |

| EX-23.1 - EXHIBIT 23.1 - Pattern Energy Group Inc. | pegi2016123110kexhbit231.htm |

| EX-21.1 - EXHIBIT 21.1 - Pattern Energy Group Inc. | pegi2016123110kexhbit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2016.

-OR-

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36087

PATTERN ENERGY GROUP INC.

(Exact name of Registrant as specified in its charter)

Delaware | 90-0893251 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Pier 1, Bay 3, San Francisco, CA 94111

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (415) 283-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Class A Common Stock, par value $0.01 per share | NASDAQ Global Select Market Toronto Stock Exchange | |

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | ¨ | |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No ý

The aggregate market value of the voting stock and non-voting stock held by non-affiliates of the registrant based upon the last trading price of the registrant’s Class A common stock as reported on the NASDAQ Global Market on June 30, 2016 was approximately $1,308,543,222. This excludes 17,962,513 shares of Class A common stock held by directors, officers and Pattern Renewables LP and certain of its affiliates. Exclusion of shares does not reflect a determination that persons are affiliates for any other purpose.

The registrant’s Class A common stock began trading on the NASDAQ Global Market under the symbol "PEGI" and on the Toronto Stock Exchange under the symbol "PEG" on October 2, 2013.

On February 24, 2017, the registrant had 87,409,790 shares of Class A common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2017 annual meeting of stockholders (the "2017 Proxy Statement") are incorporated by reference into Part III of this Form 10-K where indicated. The 2017 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

1

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K ("Form 10-K") contains statements that may constitute forward-looking statements. You can identify these statements by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "should," "will," "would," or similar words. You should read statements that contain these words carefully because they discuss our current plans, strategies, prospects, and expectations concerning our business, operating results, financial condition, and other similar matters. While we believe that these forward-looking statements are reasonable as and when made, there may be events in the future that we are not able to predict accurately or control, and there can be no assurance that future developments affecting our business will be those that we anticipate. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause our actual results to differ from those in the forward-looking statements, include but are not limited to, those summarized below and further described in Part I, Item 1A "Risk Factors:"

• | our ability to complete acquisitions of power projects; |

• | our ability to complete construction of construction projects and transition them into financially successful operating projects; |

• | fluctuations in supply, demand, prices and other conditions for electricity, other commodities and renewable energy credits (RECs); |

• | our electricity generation, our projections thereof and factors affecting production, including wind and other conditions, other weather conditions, availability and curtailment; |

• | changes in law, including applicable tax laws; |

• | public response to and changes in the local, state, provincial and federal regulatory framework affecting renewable energy projects, including the U.S. federal production tax credit (PTC), investment tax credit (ITC) and potential reductions in Renewable Portfolio Standards (RPS) requirements; |

• | the ability of our counterparties to satisfy their financial commitments or business obligations; |

• | the availability of financing, including tax equity financing, for our power projects; |

• | an increase in interest rates; |

• | our substantial short-term and long-term indebtedness, including additional debt in the future; |

• | competition from other power project developers; |

• | development constraints, including the availability of interconnection and transmission; |

• | potential environmental liabilities and the cost and conditions of compliance with applicable environmental laws and regulations; |

• | our ability to operate our business efficiently, manage capital expenditures and costs effectively and generate cash flow; |

• | our ability to retain and attract executive officers and key employees; |

• | our ability to keep pace with and take advantage of new technologies; |

• | the effects of litigation, including administrative and other proceedings or investigations, relating to our wind power projects under construction and those in operation; |

• | conditions in energy markets as well as financial markets generally, which will be affected by interest rates, foreign currency exchange rate fluctuations and general economic conditions; |

• | the effectiveness of our currency risk management program; |

• | the effective life and cost of maintenance of our wind turbines and other equipment; |

• | the increased costs of, and tariffs on, spare parts; |

• | scarcity of necessary equipment; |

• | negative public or community response to wind power projects; |

• | the value of collateral in the event of liquidation; and |

• | other factors discussed under "Risk Factors." |

3

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

Statistical Data

The statistical data used throughout this Form 10-K, other than data relating specifically solely to us, are based upon independent industry publications, government publications, reports by market research firms or other published independent sources. We did not commission any of these publications or reports. These publications generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified such data and make no representation as to the accuracy of such information.

CURRENCY AND EXCHANGE RATE INFORMATION

In this Form 10-K, references to "C$" and "Canadian dollars" are to the lawful currency of Canada and references to "$", "US$" and "U.S. dollars" are to the lawful currency of the United States. All dollar amounts herein are in U.S. dollars, unless otherwise stated.

Our historical consolidated financial statements are presented in U.S. dollars. The following chart sets forth for each of 2016, 2015 and 2014, the high, low, period average and period end noon buying rates of Canadian dollars expressed as Canadian dollars per US$1.00.

Canadian Dollars per US$1.00 | |||||||||||||||||||

High | Low | Period Average | Period End | ||||||||||||||||

Year | |||||||||||||||||||

2016 | C$ | 1.4589 | C$ | 1.2544 | C$ | 1.3248 | C$ | 1.3427 | |||||||||||

2015 | 1.3987 | 1.1601 | 1.2788 | 1.3835 | |||||||||||||||

2014 | 1.1643 | 1.0614 | 1.1045 | 1.1501 | |||||||||||||||

The noon buying rate in Canadian dollars on February 24, 2017 was US$1.00 = C$1.3104.

The above rates differ from the actual rates used in our consolidated historical financial statements and the calculation of cash available for distribution and dividends we declared and paid described elsewhere in this Form 10-K. Our inclusion of these exchange rates is not meant to suggest that the U.S. dollar amounts actually represent such Canadian dollar amounts or that such amounts could have been converted into Canadian dollars at any particular rate or at all.

For information on the impact of fluctuations in exchange rates on our operations, see Item 1A "Risk Factors—Risks Related to Our Projects—Currency exchange rate fluctuations may have an impact on our financial results and condition" and Item 7A "Quantitative and Qualitative Disclosure about Market Risk—Foreign Currency Exchange Rate Risk."

4

MEANING OF CERTAIN REFERENCES

Unless the context provides otherwise, references herein to "we," "our," "us," "our company" and "Pattern" refer to Pattern Energy Group Inc., a Delaware corporation, together with its consolidated subsidiaries. In addition, unless the context requires otherwise, any reference in this Form 10-K to:

• | "employee transfer" refers to the event contemplated by the Multilateral Management Services Agreement pursuant to which we have the option, exercisable by delivery of written notice of exercise to Pattern Development 1.0 at any time prior to December 31 2017, to require Pattern Development 1.0 to cause the employees of Pattern Development 1.0 and its subsidiaries to become employees of us and our subsidiaries. From and after the occurrence of the employee transfer event, we, Pattern Development 1.0 and Pattern Development 2.0 will cooperate to cause such employee transfer to occur by the six month anniversary of the employee transfer event or as soon as reasonably practical thereafter; |

• | "FERC" refers to the U.S. Federal Energy Regulatory Commission; |

• | "FIT" refers to feed-in-tariff regime; |

• | "FPA" refers to the Federal Power Act; |

• | "Identified ROFO Projects" refers to projects that we have identified as development projects, owned by either of the Pattern Development Companies and subject to our Project Purchase Rights. As of February 24, 2017, the Identified ROFO Projects consist of Meikle, Conejo Solar, Belle River, Henvey Inlet, Mont Sainte-Marguerite, North Kent, Tsugaru, Ohorayama, Kanagi Solar and Futtsu Solar projects owned by Pattern Development 1.0 and Grady owned by Pattern Development 2.0 The Tsugaru, Ohorayama, Kanagi Solar and Futtsu Solar projects are held through Pattern Development 1.0’s majority stake investment in Green Power Investment Corporation (GPI) based in Tokyo, Japan; |

• | "IPPs" refers to independent power producers; |

• | "ISOs" refers to independent system organizations, which are organizations that administer wholesale electricity markets; |

• | "ITCs" refers to investment tax credits; |

• | "Multilateral Management Services Agreement" (MSA) refers to the multilateral services agreement between us and each of the Pattern Development Companies; |

• | "MW" refers to megawatts; |

• | "MWh" refers to megawatt hours; |

• | "Non-Competition Agreement" refers to a non-competition agreement between us and each of the Pattern Development Companies pursuant to which the Pattern Development Companies agree that, for so long as any of our respective Purchase Rights are exercisable, the Pattern Development Companies will not compete with us for acquisitions of power generation or transmission projects from third parties; |

• | "Pattern Development Companies" refers collectively to Pattern Development 1.0 and Pattern Development 2.0 and their respective subsidiaries (other than us and our subsidiaries); |

• | "Pattern Development Purchase Rights" refer collectively to our right to acquire Pattern Development 1.0 or substantially all of its assets, as contemplated by the Purchase Rights Agreement between us and Pattern Development 1.0 (Pattern Development 1.0 Purchase Right) and to our right to acquire Pattern Development 2.0 or substantially all of its assets, as contemplated by the Purchase Rights Agreement between us and Pattern Development 2.0 (Pattern Development 2.0 Purchase Right); |

• | “Pattern Development 1.0” refers to Pattern Energy Group LP, a Delaware limited partnership, and, where the context so requires, its subsidiaries (excluding us); |

• | “Pattern Development 2.0” refers to Pattern Energy Group 2 LP, a Delaware limited partnership, and, where the context so requires, its subsidiaries; |

• | "power sale agreements" refer to PPAs and/or hedging arrangements, as applicable; |

• | "PPAs" refer to power purchase agreements; |

5

• | "Project Purchase Rights" refers collectively to our right of first offer with respect to any power project that Pattern Development 1.0 decides to sell, as contemplated by the Purchase Rights Agreement between us and Pattern Development 1.0, and our right of first offer with respect to any power project that Pattern Development 2.0 decides to sell, as contemplated by the Purchase Rights Agreement between us and Pattern Development 2.0 (in each case including any Identified ROFO Projects); |

• | "Purchase Rights" refers collectively to the Project Purchase Rights, and the Pattern Development Purchase Rights, as contemplated by the Purchase Rights Agreement between us and Pattern Development 1.0 and the Purchase Rights Agreement between us and Pattern Development 2.0; |

• | "RECs" refers to renewable energy credits; |

• | "Riverstone" refers to Riverstone Holdings LLC; |

• | "ROFO" refers to right of first offer; |

• | "RPS" refers to Renewable Portfolio Standards; |

• | "Sarbanes-Oxley Act" refers to the Sarbanes-Oxley Act of 2002; and |

• | "U.S. Treasury" refers to the U.S. Department of the Treasury. |

6

PART I

Item 1. Business

Overview

We are an independent power company focused on owning and operating power projects with stable long-term cash flows in attractive markets with potential for continued growth of our business.

We hold interests in 18 wind power projects, including the Broadview project which we have committed to acquire in April 2017, located in the United States, Canada and Chile that use proven, best-in-class technology and have a total owned capacity of 2,644 MW. Each of our projects has contracted to sell all or a majority of its output pursuant to long-term, fixed-price or variable price, power sale agreements. Ninety-one percent of the electricity to be generated by our projects will be sold under our power sale agreements which have a weighted average remaining contract life of approximately 14 years as of December 31, 2016.

We were organized in the state of Delaware in October 2012. We issued 100 shares in October 2012 to Pattern Renewables LP, a 100% owned subsidiary of Pattern Development 1.0 and subsequently in October 2013 conducted an initial public offering.

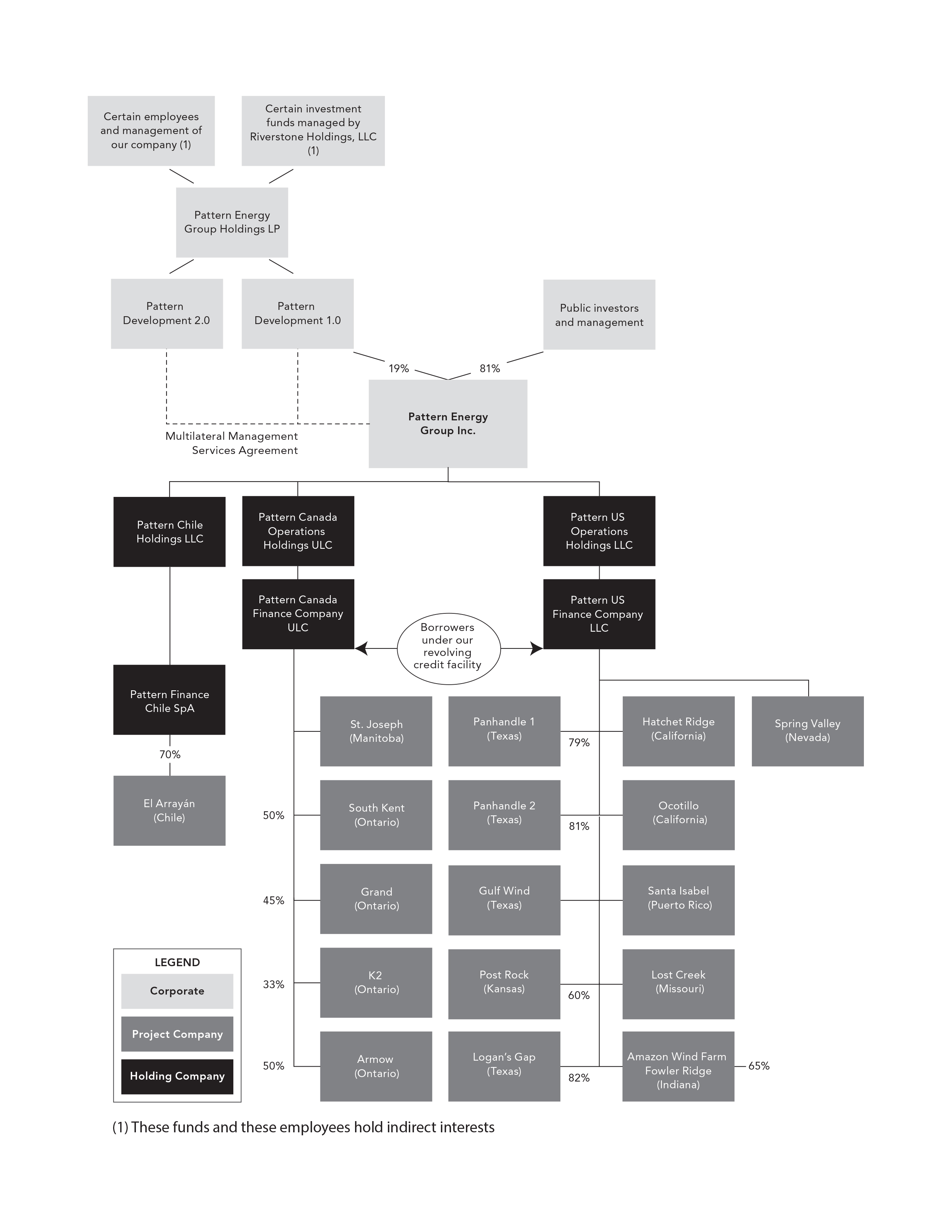

Our Relationship with the Pattern Development Companies

In December 2016, certain investment funds managed by Riverstone Holdings LLC, which own interests in Pattern Development 1.0, engaged in a transaction in which (a) certain assets of Pattern Development 1.0 consisting principally of early and mid-stage U.S. development assets (including the Grady project which is an Identified ROFO Project) were transferred to a newly formed entity, Pattern Development 2.0, and (b) Pattern Development 1.0 retained the remainder of its assets consisting principally of the other Identified ROFO Projects, non-U.S. development assets, and its ownership interest in our Class A common stock. The purpose of the transaction was to facilitate additional long-term capital raises by the Pattern Development 2.0 to support the growth in the development pipeline. We also entered into other agreements with Pattern Development 2.0 which are substantially the same as existing agreements we have previously entered into with Pattern Development 1.0, including a purchase rights agreement. Pattern Development 2.0 is structured to allow us to potentially invest in Pattern Development 2.0 in the future.

As of December 31, 2016, Pattern Development 1.0 owned approximately 19% of our outstanding Class A common stock. Our continuing relationship with the Pattern Development Companies provides us with access to a pipeline of acquisition opportunities. We believe the Pattern Development Companies’ focus on project development combined with our Project Purchase Rights will complement our acquisition strategy, which focuses on the identification and acquisition of operational and construction-ready power projects.

7

Structure of Our Company

8

Industry

Wind power has been one of the fastest growing sources of electricity generation in North America and globally over the past decade. According to the Global Wind Energy Council (GWEC), global installed wind capacity grew by 55 GW last year, bringing the worldwide total to nearly 487 GW at the end of 2016. Wind power is supplying more new power generation than any other technology, and government projections indicate that renewable energy will continue to grow at a faster rate than fossil fuels over the next two decades, according to the International Energy Agency.

The growth in the industry is largely attributable to renewable energy’s increasing cost competitiveness with other power generation technologies, the advantages of wind power over other renewable energy sources, and growing public support for renewable energy driven by energy security and environmental concerns. As global demand for electricity generation from wind power has increased, technology enhancements, supported by U.S. government incentives have reduced the cost of wind power by approximately 66% over the last six years according to the Department of Energy’s 2014 Wind Technologies Market Report.

Given supply diversity requirements, falling equipment costs, the inherent stability of the cost of wind power as an energy resource and an active market for the purchase and sale of power projects, we believe that our markets present substantial growth opportunities. We require a relatively small share of a very large market to meet our growth objectives, and we believe we will achieve growth through the acquisition of operational and construction-ready projects from the Pattern Development Companies and other third parties.

While we currently operate primarily in wind power markets, we expect to continue to evaluate other types of independent power projects for possible acquisition, including renewable energy projects other than wind power projects.

Our Current Markets

The GWEC expects the North American market to add about 60 GW over the next five years. The United States is the largest producer of wind power in the world. U.S. federal, state and local governments have established various incentives to support the development of renewable energy. These incentives make the development of renewable energy projects more competitive by providing accelerated depreciation, tax credits for a portion of the development costs, decreasing the costs associated with developing such projects or creating demand for renewable energy assets through RPS programs.

In 2015, the total wind power capacity in the United States reached 74,471 MW, representing 41% of new capacity additions and meeting approximately 4.7% of total electricity demand, according to GWEC. The U.S. Energy Information Administration expects that for the third consecutive year, more than half of the new capacity additions in 2016 were renewable technologies, especially wind and solar. According to the American Wind Energy Association, the country’s total wind power capacity reached 82,183 MW at the end of 2016, with an additional 18,300 MW under construction or in advanced development. The success of wind power in the United States is evidenced by over $128.0 billion being invested in the U.S. economy by new wind power projects over the last 10 years.

The Canadian wind power industry has also experienced dramatic growth in recent years. Installed wind power generating capacity in Canada reached 11,898 MW as of December 2016, according to the Canadian Wind Energy Association. Ontario, one of our markets, leads the nation with 4,781 MW installed. In 2015, wind energy in Canada supplied approximately 5% of the country’s electricity demand.

Chile has an abundant wind energy resource, which the Chile National Energy Commission estimates could reach 40 GW of installed wind energy capacity. The country’s total wind power capacity was 933 MW at the end of 2015, according to GWEC.

Our Developing Markets

Although we do not yet have assets or Identified ROFO Projects in Mexico, it is a key potential market for us as the Pattern Development Companies are actively working in the country and we expect to add Mexican projects to the Identified ROFO Projects list in the future. Mexico’s Congress has enacted sweeping reforms to its electric generation industry in recent years, opening new opportunities for private investment in generation and creating a mandate to obtain at least 35% of its generation from clean sources by 2024. The government expects energy demand to increase 4% annually over the next decade and has a target of 2,000 MW of additional wind capacity per year until 2023.

In June 2015, we added two Japanese wind projects and two Japanese solar projects to our list of Identified ROFO Projects. Following the nuclear meltdown at the Fukushima Daiichi plant in 2011, the Japanese government has placed a greater emphasis on the development of renewable resources in order to reduce its reliance on nuclear power, releasing its Innovative Strategy for Energy and the Environment plan, which calls for renewable power generation to triple compared to 2010, reaching about 30% of total generation. In 2012, Japan also introduced a FIT program that offers fixed-term, fixed-price contracts (up to 20 years) to renewable power projects. The tariff will be re-

9

assessed every year based on the latest market experience in Japan. At the end of 2015, 3,038 MW of wind capacity was operating in Japan, accounting for approximately 0.5% of the total electricity demand.

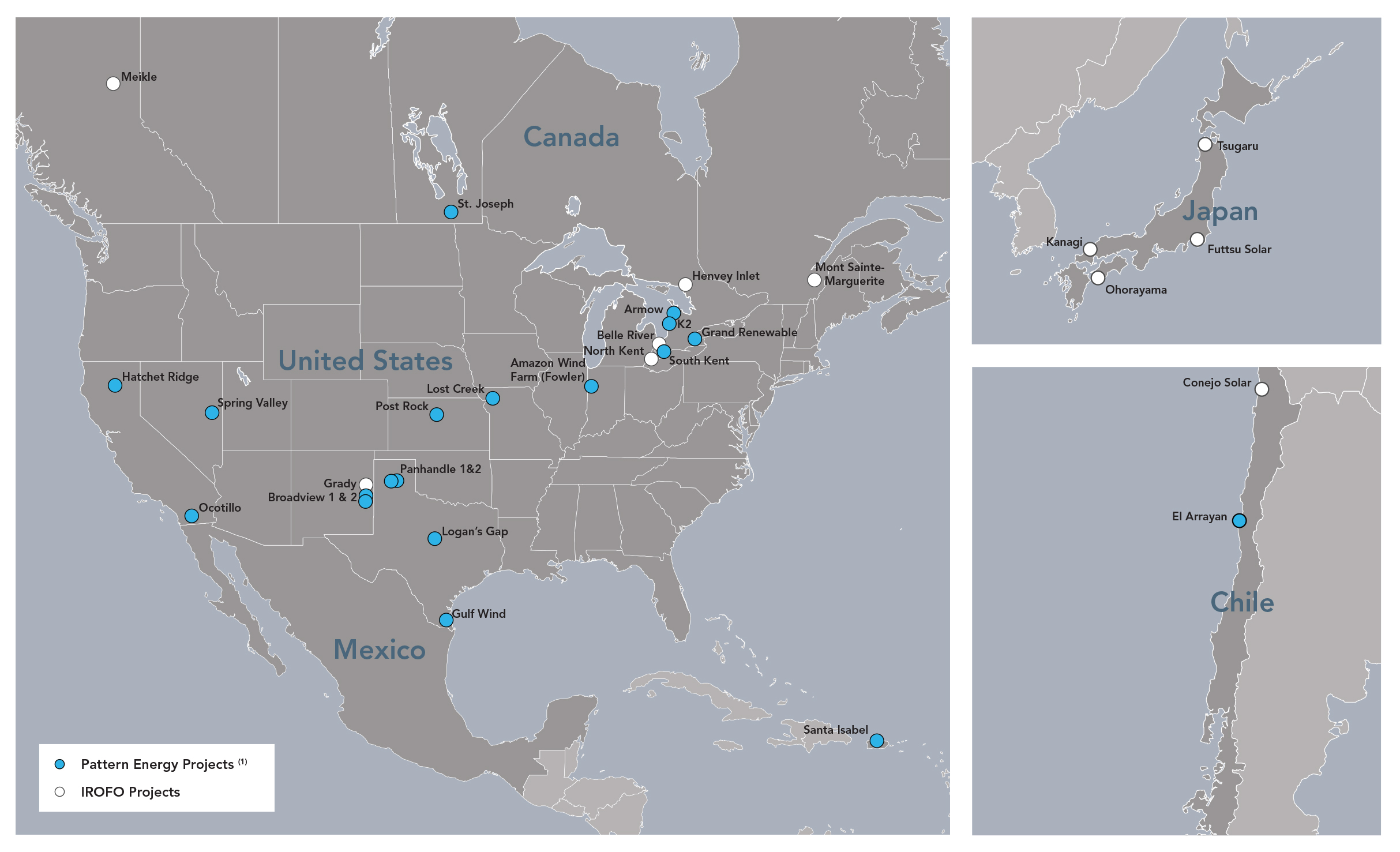

The map below provides a depiction of our projects and IROFO projects geographically:

(1) | Includes Broadview, a 324 MW wind project and the associated independent 35-mile 345 kV Western Interconnect transmission line, which we have committed to acquire in April 2017. |

Our Core Values and Financial Objectives

We intend to maximize long-term value for our stockholders in an environmentally responsible manner and with respect for the communities in which we operate. Our business is built around three core values of creative energy and spirit, pride of ownership and follow-through, and a team first attitude, which guide us in:

• | creating a safe and high-integrity work environment for our employees; |

• | applying rigorous analysis to all aspects of our business in a timely, disciplined and functionally integrated manner to understand patterns in wind regimes, technology developments, market trends and regulatory, financial and legal constraints; and |

• | working proactively with our stakeholders to address environmental and community concerns, which we believe is a socially responsible approach that also benefits our business by reducing operating risks at our projects. |

Our financial objectives, which we believe will maximize long-term value for our stockholders, are to:

• | produce stable and sustainable cash available for distribution; |

• | selectively grow our project portfolio and our dividend per Class A share of common stock; and |

• | maintain a strong balance sheet and flexible capital structure. |

10

Our Business Strategy

To achieve our financial objectives while adhering to our core values, we intend to execute the following business strategies:

Maintaining and Increasing the Value of Our Projects

We intend to efficiently operate our projects to meet projected revenue and cash available for distribution. We expect to maximize the long-term value of our projects by focusing on value-oriented project availability (by ensuring our projects are operational when the wind is strong and power sale agreement prices are at their highest) and by regularly scheduled and preventative maintenance. We believe that good operating performance begins with a long-term maintenance program for our equipment. We also seek to improve performance or lower operating costs by working closely with our equipment vendors and considering contracting with third parties, when appropriate.

We believe it is important to employ our own personnel in aspects of our business that we deem critical to the value of our projects. We are in the process of revising long-term turbine manufacturer service arrangements at certain of our projects pursuant to which the turbine manufacturer will continue to provide routine and corrective maintenance service, but we would become responsible for a portion of the maintenance and repairs, including on major component parts. We employ on-site personnel, maintain a 24/7 operations control center to monitor our projects and control all critical aspects of commercial asset management.

Selectively Growing Our Business

Our strategy for growth is focused on the acquisition of operational and construction-ready power projects from the Pattern Development Companies and other third parties that we believe will contribute to the growth of our business and enable us to increase our dividend per share of Class A common stock over time. We expect that projects we may acquire in the future will represent a logical extension of our existing business and be consistent with our risk profile, and that any incremental assumption of risk will require commensurate expectations of higher returns. As a result, our near-term growth strategy will remain focused on largely contracted cash flows with creditworthy counterparties and operating or in-construction projects.

We expect that new opportunities will arise from our relationship with the Pattern Development Companies, which provide us with the opportunity to acquire projects that they successfully develop and efficiently complete construction and achieve commercial operations at these projects.

From time to time, we may also consider the disposal of a project, particularly if we believe we can utilize funds realized from such a disposal in a more productive manner or generate a higher return on investment. In addition, from time to time we have had conversations with potential investors who have expressed interest in discussing a range of potential transactions which have included investing together with us in projects, including our owned projects and Identified ROFO Projects, or otherwise making investments which might potentially provide us an additional source of capital. No assurances can be given that any transaction will result from such potential interest, or (if a transaction did result from such discussions) what the final structure and terms of such a transaction would be or whether such a transaction would result in the realization of benefits expected or contemplated.

Maintaining a Prudent Capital Structure and Financial Flexibility

We intend to maintain a conservative approach to our capital structure to protect our ability to meet our financial obligations, pay our regular dividends and to fund investments for future growth. Power projects by their nature require significant capital investment, and as a result, we seek to protect our business through careful management of our capital structure.

The foundation of our capital structure is built on project finance arrangements intended to ensure risk segmentation across our large project portfolio, and our practice has been to structure our project finance arrangements comprised of a mix of debt, tax equity and equity to conform to investment grade-like credit standards. Specifically, we seek to structure our project finance arrangements to:

• | match assets with liabilities based on a project’s off-take tenor and currency denomination; |

• | fix or hedge project debt on a long term basis; |

• | amortize our third party project finance capital within the tenor of the off-take arrangement; and |

• | apply conservative debt service coverage or tax equity structuring standards. |

Our project capital structure is supplemented with a corporate capital layer that primarily relies on equity capital. Our corporate indebtedness, which includes unsecured senior notes with an aggregate principal amount of $350.0 million which we issued in January 2017 (the 2024 Unsecured Senior Notes), is modest, serviced from project distributions (after corporate overhead) and intended to ensure

11

broad capital access. We seek to ensure financial flexibility and stability through our corporate revolving credit facility, maturity staging, minimization of interest rate exposure, and maintenance of our credit ratings. Our foreign currency denominated project dividends are further managed through a short-to-medium term foreign exchange program. We believe this approach, together with a strategic consideration of project-level financial restructuring and recapitalization opportunities, will contribute to our ability to maintain and, over time, increase our cash available for distribution.

Working Closely With Our Stakeholders

We believe that close working relationships with our various stakeholders, including suppliers, power sales agreement counterparties, regulators, the local communities where we are located and environmental organizations and with the Pattern Development Companies and other developers enable us to best support our existing projects and will help us access attractive, construction-ready projects.

Competition

We compete with other wind power, infrastructure funds and renewable energy companies, as well as conventional power companies, to acquire profitable construction-ready and operating projects. In addition, competitive conditions may be substantially affected by various forms of energy legislation and regulation considered from time to time by federal, state, provincial and local legislatures and administrative agencies.

Competitive Strengths

We believe we compete with other industry participants by having high quality projects which are positioned to generate stable long-term cash flows which in turn give us access to low-cost project-level debt and strong stakeholder relationships. Some of the key attributes of our projects include long-term fixed priced power sale agreements, a geographically diverse market with varying wind regimes and regulatory environment; and state-of-the-art wind turbines. Further contributing to our competitive strength is our approach to project selection which focuses on the acquisition of projects that are operational and have long term power sales agreements with creditworthy counterparties. We believe our relationship with the Pattern Development Companies provides us with access to a pipeline of acquisition opportunities that also supplements our competitive strengths. Pattern Development 1.0's ownership interest in us is 19%.

Our Projects

We hold interests in 18 wind power projects, located in the United States, Canada and Chile, including the Broadview project which we have committed to acquire in April 2017, that use proven, best-in-class technology and have a total owned capacity of 2,644 MW. Each of our projects has contracted to sell all or a majority of its output pursuant to a long-term, fixed-price or variable price PSAs. Each of our projects has gone through a rigorous vetting process in order to meet our investment and our lenders’ financing criteria. As a result, our projects generally have the following characteristics:

• | multi-year on-site wind data analysis tied to one or more long-term wind energy reference sources; |

• | long-term power sale agreements designed to ensure a predictable revenue stream; |

• | contractually secured real estate property and easement rights for a period well in excess of the project’s expected useful life and contractual obligations; |

• | a firm right to interconnect to the electricity grid through interconnection agreements, which define the cost allocation and schedule for interconnection, as well as any upgrades required to connect the project to the transmission system; |

• | long-term, limited-recourse, amortizing project financing designed to match the long-lived nature of our power projects and the related power sales agreements; |

• | secured construction and operating permits and other requisite federal, state or provincial and local permits, and regulatory approvals; |

• | fixed-price turbine supply and construction contracts with guaranteed completion dates; |

• | an operations and maintenance service program based on our own on-site personnel and central operations management as well as equipment warranties (for at least the first two years of operation) and service arrangements with qualified contractors experienced in wind project maintenance; and |

• | safety, environmental and community programs to support our existing projects and relationships in the communities in which we operate. |

12

The following table provides an overview of our wind projects:

Operating Project | Location | Commencement of Commercial Operations | Rated Capacity in MW(1) | Our Owned Capacity(2) | Type | Contracted Volume(3) | Counterparty | Counterparty Credit Rating(4) | Contract Expiration | |||||||||||

Hatchet Ridge | California | 2010 | 101 | 101 | PPA | 100% | Pacific Gas & Electric | BBB+/A3 | 2025 | |||||||||||

Ocotillo | California | 2012(5) | 265 | 265 | PPA | 100% | San Diego Gas & Electric | A/A1 | 2033 | |||||||||||

Spring Valley | Nevada | 2012 | 152 | 152 | PPA | 100% | NV Energy | A/Baa2 | 2032 | |||||||||||

Gulf Wind | Texas | 2009 | 283 | 283 | Hedge | 58% | Morgan Stanley | BBB+/A3 | 2019 | |||||||||||

Panhandle 1 | Texas | 2014 | 218 | 172 | Hedge | 80% | Citigroup Energy Inc. | BBB+/NA | 2027 | |||||||||||

Panhandle 2 | Texas | 2014 | 182 | 147 | Hedge | 80% | Morgan Stanley | BBB+/A3 | 2027 | |||||||||||

Logan's Gap | Texas | 2015 | 200 | 164 | PPA | 58% | Wal-Mart Stores, Inc. | AA/Aa2 | 2025 | |||||||||||

Logan's Gap | Hedge | 17% | Merrill Lynch Commodities, Inc. | BBB+/Baa1 | 2028 | |||||||||||||||

Post Rock | Kansas | 2012 | 201 | 120 | PPA | 100% | Westar Energy, Inc. | BBB+/Baa1 | 2032 | |||||||||||

Lost Creek | Missouri | 2010 | 150 | 150 | PPA | 100% | Associated Electric Cooperative, Inc. | AA/A2 | 2030 | |||||||||||

Amazon Wind Farm Fowler Ridge | Indiana | 2015 | 150 | 116 | PPA | 100% | Amazon.com, Inc. | AA-/NA | 2028 | |||||||||||

St. Joseph | Manitoba | 2011 | 138 | 138 | PPA | 100% | Manitoba Hydro | AA-/Aa2 | 2039 | |||||||||||

Santa Isabel | Puerto Rico | 2012 | 101 | 101 | PPA | 100% | Puerto Rico Electric Power Authority | D/Caa3 | 2037 | |||||||||||

El Arrayán | Chile | 2014 | 115 | 81 | Hedge | 74% | Minera Los Pelambres | NA | 2034 | |||||||||||

Grand | Ontario | 2014 | 149 | 67 | PPA | 100% | Independent Electricity System Operator(7) | NA/Aa2 | 2034 | |||||||||||

South Kent | Ontario | 2014 | 270 | 135 | PPA | 100% | Independent Electricity System Operator(7) | NA/Aa2 | 2034 | |||||||||||

K2 | Ontario | 2015 | 270 | 90 | PPA | 100% | Independent Electricity System Operator(7) | NA/Aa2 | 2035 | |||||||||||

Armow | Ontario | 2015 | 180 | 90 | PPA | 100% | Independent Electricity System Operator(7) | NA/Aa2 | 2035 | |||||||||||

Broadview(6) | New Mexico | 2017 | 324 | 272 | PPA | 100% | Southern California Edison | BBB+/A2 | 2037 | |||||||||||

3,449 | 2,644 | |||||||||||||||||||

(1) | Rated capacity represents the maximum electricity generating capacity of a project in MW. As a result of wind and other conditions, a project or a turbine will not operate at its rated capacity at all times and the amount of electricity generated may be less than its rated capacity. The amount of electricity generated may vary based on a variety of factors. |

(2) | Owned capacity represents the maximum, or rated, electricity generating capacity of the project in MW multiplied by our percentage ownership interest in the distributable cash flow of the project. |

(3) | Represents the approximate percentage of a project’s total estimated average annual MWh of electricity generation contracted under power purchase agreements or hedge arrangements. |

(4) | Reflects the counterparty’s or counterparty guarantor's corporate credit ratings issued by either Standard and Poor's (S&P) or Moody’s, or both S&P and Moody's, as of December 31, 2016. |

(5) | In 2013, 42 MW of owned capacity was added to our owned capacity. |

(6) | In June 2016, we committed to acquire from Pattern Development 1.0 an 84% interest in Broadview, a 324 MW wind project and a 99% interest in the associated independent 35-mile 345 kV Western Interconnect transmission line. |

(7) | Independent Electricity System Operator (IESO) acts as the settlement agent under the respective PPA. |

Identified Right of First Offer Projects

Our continuing relationship with the Pattern Development Companies provides us with access to a pipeline of acquisition opportunities. Currently, the Pattern Development Companies have a 5,900 MW pipeline of development projects, all of which are subject to our right of first offer. We target achieving a total owned capacity of 5,000 MW by year end 2019 through a combination of acquisitions from the Pattern Development Companies and other third parties capitalizing on the large and fragmented global renewable energy market. Our business is primarily focused in the U.S., Canada and Chile; however, we expect opportunities in Japan and Mexico will form part of our growth strategy.

Below is a summary of the Identified ROFO Projects that we expect to acquire from Pattern Development 1.0 and Pattern Development 2.0 in connection with our Project Purchase Rights:

Capacity (MW) | ||||||||||||||||

Identified ROFO Projects | Status | Location | Construction Start(1) | Commercial Operations(2) | Contract Type | Rated(3) | Owned Capacity(4) | |||||||||

Pattern Development 1.0 Projects | ||||||||||||||||

Kanagi Solar | Operational | Japan | 2014 | 2016 | PPA | 14 | 6 | |||||||||

Futtsu Solar | Operational | Japan | 2014 | 2016 | PPA | 42 | 19 | |||||||||

Conejo Solar | Operational | Chile | 2015 | 2016 | PPA | 104 | 104 | |||||||||

Meikle | Operational | British Columbia | 2015 | 2017 | PPA | 180 | 180 | |||||||||

Belle River | In construction | Ontario | 2016 | 2017 | PPA | 100 | 43 | |||||||||

Ohorayama | In construction | Japan | 2016 | 2018 | PPA | 33 | 31 | |||||||||

Mont Sainte-Marguerite | In construction | Québec | 2017 | 2017 | PPA | 147 | 147 | |||||||||

Henvey Inlet | Late stage development | Ontario | 2017 | 2018 | PPA | 300 | 150 | |||||||||

North Kent | Late stage development | Ontario | 2017 | 2018 | PPA | 100 | 43 | |||||||||

Tsugaru | Late stage development | Japan | 2017 | 2019 | PPA | 126 | 63 | |||||||||

Pattern Development 2.0 Projects | ||||||||||||||||

Grady | Late stage development | New Mexico | 2018 | 2019 | PPA | 220 | 176 | |||||||||

1,366 | 962 | |||||||||||||||

(1) | Represents year of actual or anticipated commencement of construction. |

(2) | Represents year of actual or anticipated commencement of commercial operations. |

(3) | Rated capacity represents the maximum electricity generating capacity of a project in MW. As a result of wind and other conditions, a project or a turbine will not operate at its rated capacity at all times and the amount of electricity generated may be less than its rated capacity. The amount of electricity generated may vary based on a variety of factors. |

(4) | Owned capacity represents the maximum, or rated, electricity generating capacity of the project in MW multiplied by either Pattern Development 1.0's or Pattern Development 2.0's percentage ownership interest in the distributable cash flow of the project. |

Government Incentives and Tax Credits

Renewable energy sources in the United States have benefited from various federal and state governmental incentives, such as production tax credits and investment tax credits. Production tax credits and investment tax credits for wind energy on the federal level were extended in December of 2015, under the Consolidated Appropriations Act which extended the expiration date for tax credits for wind facilities commencing construction, with a five year phase-down beginning for wind projects commencing construction after December 31, 2014.

Hedging Activity

Most of our revenue is subject to long-term PPAs. To the extent that PPAs are not available in a given market, but market prices allow for acceptable project economics, we will enter into hedging agreements to obtain a fixed price for the energy output of our projects, typically by hedging volumes that are expected to be exceeded 99.0% of the time. Those hedging agreements are executed for a monthly or hourly production profile that matches the forecasted production profile of the project.

Most of our interest rate exposure is hedged either through fixed-rate debt arrangements or hedging of floating rate loans. We enter into interest rate hedging agreements to convert floating-rate debt to fixed-rate debt for some of our projects, usually at the time we close

14

construction or term financing of a project. We also monitor our corporate-level interest rate exposure and may, from time to time, enter into interest rate hedges in order to mitigate our exposure.

We have a currency risk management program. The objective of the program is to mitigate the foreign exchange rate risk arising from transactions or cash flows that have a direct or underlying exposure in non-U.S. dollar denominated currencies in order to reduce volatility in our cash flow, which may have an adverse impact to our short-term liquidity or financial condition.

Geographic information

The table below provides information about our consolidated operations by country. Revenue is recorded in the country in which it is earned and assets are recorded in the country in which they are located (in thousands):

Revenue | Property, Plant and Equipment, net | |||||||||||||||||||||||

Year ended December 31, | December 31, | |||||||||||||||||||||||

2016 | 2015 | 2014 | 2016 | 2015 | 2014 | |||||||||||||||||||

United States | $ | 285,187 | $ | 258,542 | $ | 201,408 | $ | 2,652,122 | $ | 2,791,259 | $ | 1,810,414 | ||||||||||||

Canada | 39,207 | 39,178 | 46,593 | 177,093 | 184,115 | 233,690 | ||||||||||||||||||

Chile | 29,658 | 32,111 | 17,492 | 305,947 | 319,246 | 332,947 | ||||||||||||||||||

Total | $ | 354,052 | $ | 329,831 | $ | 265,493 | $ | 3,135,162 | $ | 3,294,620 | $ | 2,377,051 | ||||||||||||

Customers

We sell our electricity and RECs primarily to local utilities under long-term, fixed-price PPAs or, in limited instances, local liquid ISO markets. For the year ended December 31, 2016, significant customers representing greater than 10% of total revenue were San Diego Gas & Electric and Morgan Stanley Capital Group Inc., which accounted for 14.6% and 10.9% of our total revenue, respectively.

15

Suppliers

There are a limited number of turbine suppliers and, although demand for turbines in the past has generally been high relative to manufacturing capacity, we believe that current turbine manufacturing capacity is adequate. Our turbine supply strategy is largely based on maintaining strong relationships with leading turbine suppliers to secure our supply needs.

Project | Supplier | Number of Turbines | Turbine Type | |||

Hatchet Ridge | Siemens | 44 | SWT-2.3-93 | |||

Ocotillo | Siemens | 112 | SWT-2.3-108 | |||

Spring Valley | Siemens | 66 | SWT-2.3-101 | |||

Gulf Wind | Mitsubishi | 118 | MWT 95/2.4 | |||

Panhandle 1 | General Electric | 118 | 1.85 - 87 | |||

Panhandle 2 | Siemens | 79 | SWT-2.3-108 | |||

Logan’s Gap | Siemens | 87 | SWT-2.3-108 | |||

Post Rock | General Electric | 134 | 1.5-82.5 | |||

Lost Creek | General Electric | 100 | 1.5-82.5 | |||

Amazon Wind Farm Fowler Ridge | Siemens | 65 | SWT-2.3-108 | |||

St. Joseph | Siemens | 60 | SWT-2.3-101 | |||

Santa Isabel | Siemens | 44 | SWT-2.3-108 | |||

El Arrayán | Siemens | 50 | SWT-2.3-101 | |||

Grand | Siemens | 67 | SWT-2.3-101 | |||

South Kent | Siemens | 124 | SWT-2.3-101 | |||

K2 | Siemens | 140 | SWT-2.3-101 | |||

Armow | Siemens | 91 | SWT-2.3-101 | |||

Broadview(1) | Siemens | 141 | SWT-2.3-108 | |||

(1) | We have committed to acquire the Broadview project and expect to close in April 2017. |

Data from Siemens, which supplies the turbines for the majority of our fleet, indicates that worldwide fleet availability for the 2.3MW turbine class exceeds 97%, and our Siemens fleet availability also met 97% in 2016. Apart from Siemens we have relationships with other reputable turbine manufacturers such as General Electric and Mitsubishi. Our future projects may utilize turbines from these and other manufacturers.

Other important suppliers include engineering and construction companies, such as M. A. Mortenson Company, RES-Americas and Blattner Energy, Inc., with whom we contract to perform civil engineering, electrical work and other infrastructure construction for our projects.

We currently utilize service providers to provide maintenance services to our project equipment. These services are currently provided by the turbine manufacturers, such as Siemens or General Electric, at most of our project sites. We believe there are currently adequate independent service provider alternatives to the turbine manufacturers to meet our needs, and in some cases we do utilize such alternative providers. As discussed earlier, we are in the process of revising long-term turbine manufacturer service arrangements at certain of our projects pursuant to which the turbine manufacturer will continue to provide routine and corrective maintenance service, but we would become responsible for a portion of the maintenance and repairs, including on major component parts.

Regulatory Matters

Our operations are subject to regulation by various federal and state government agencies, including, but, not limited to, the following:

U.S. Federal Energy Regulatory Commission (FERC)

Our current projects in operation in the United States are operating as Exempt Wholesale Generators (EWGs) as defined under the Public Utility Holding Company Act of 2005, as amended, (PUHCA) and therefore are exempt from certain regulation under PUHCA. Other than Gulf Wind, Panhandle 1, Panhandle 2, and Logan’s Gap, our operating projects in the United States are, however, public utilities under the Federal Power Act subject to rate regulation by FERC. Our future projects in the United States will also likely be subject to

16

such rate regulation once they are placed into service. Our projects in the United States that are subject to FERC rate regulation are required to obtain acceptance of their rate schedules for wholesale sales of energy (i.e., not retail sales to consumers), capacity and ancillary services, including their ability to charge “market-based rates.”

Independent System Operators (ISOs)

Most of our North American projects are located in regions in which the wholesale electric markets are administered by ISOs and Regional Transmission Organizations (RTOs). Several of our current operating projects are subject to the California ISO (CAISO), which is the ISO that prescribes rules for the terms of participation in the California energy market; ERCOT, which is the ISO that prescribes the rules for and terms of participation in the Texas energy market; and the Independent Electricity System Operator (IESO) which is the ISO that administers the wholesale electricity market in Ontario.

North American Electric Reliability Corporation

All of our current operating projects located in North America are also subject to the reliability standards of the North American Electric Reliability Corporation (NERC). If we fail to comply with the mandatory reliability standards, we could be subject to sanctions, including substantial monetary penalties.

Regulatory Matters - Canada

All of our current operating projects in Canada are subject to exclusive provincial regulatory authority with respect to the generation and production of electricity, which varies across provincial jurisdictions. In Canada, activities related to owning and operating wind projects and participating in wholesale and retail energy markets are regulated at the provincial level. In Ontario, for example, electricity generation facilities must be licensed by the Ontario Energy Board and may also be required to complete registrations and maintain market participant status with the IESO, in which case they must agree to be bound by and comply with the provisions of the market rules for the Ontario electricity market as well as the mandatory reliability standards of the NERC.

Environmental Regulation

Our operations are required to comply with various environmental, health and safety laws and regulations in each of the jurisdictions in which we operate. These existing and future laws and regulations may impact existing and new projects, require us to obtain and maintain permits and approvals, comply with all environmental laws and regulations applicable within each jurisdiction and implement environmental, health and safety programs and procedures to monitor and control risks associated with the construction, operation and decommissioning of regulated or permitted energy assets, all of which involve a significant investment of time and resources. Existing initiatives and rules, some of which could potentially have a material effect (either positive or negative) on us, are as follows:

Avian/Bat Regulations and Wind Turbine Siting Guidelines

We are subject to numerous environmental regulations and guidelines related to threatened and endangered species and their habitats, as well as avian and bat species, for the ongoing operations of our facilities. Environmental laws in the U.S., including the Endangered Species Act, the Migratory Bird Treaty Act, and the Bald and Golden Eagle Protection Act as well as similar environmental laws in Canada (such as the Species at Risk Act, the Migratory Birds Convention Act and the Endangered Species Act of 2007), among others, provide for the protection of migratory birds, eagles and bats and endangered species of birds and bats and their habitats. In addition to regulations, voluntary wind turbine siting guidelines established by the U.S. Fish and Wildlife Service set forth siting, monitoring and coordination protocols that are designed to support wind development in the U.S. while also protecting both birds and bats and their habitats.

Regulation of Greenhouse Gas (GHG) Emissions

The U.S. Congress and certain states and regions, as well as the Government of Canada and its provinces, have taken and continue to take certain actions, such as finalizing regulation or setting targets and goals, regarding the reduction of GHG emissions and the increase of renewable energy generation.

Environmental Matters— Domestic

We are required to obtain a range of environmental permits and other approvals to build and operate our projects, including, but not limited to, those described below from U.S. federal, state and local governmental authorities. In addition to being subject to these regulatory requirements, we could experience and have experienced significant opposition from third parties when we initially apply for permits or

17

when there is an appeal proceeding after permits are issued. The delay or denial of a permit or the imposition of conditions that are costly or difficult to comply with can impair or even prevent the development of a project or can increase the cost so substantially that the project is no longer attractive to us.

Federal Clean Water Act

Frequently, our U.S. projects are located near wetlands, and we are required to obtain permits under the Clean Water Act for the discharge of dredged or fill material into waters of the United States, including wetlands and streams. The Clean Water Act also requires that we mitigate any loss of wetland functions and values that accompanies our activities, obtain permits under the Clean Water Act for water discharges, such as storm water runoff associated with construction activities, and to follow a variety of best management practices to ensure that water quality is protected and impacts are minimized.

Federal Bureau of Land Management Permits

As some of our U.S. projects are located on lands administered by the Bureau of Land Management, we are required to obtain rights-of-way from the Bureau of Land Management. The Bureau of Land Management encourages the development of wind power within acceptable areas, consistent with Environmental Policy Act of 2005 and the Bureau of Land Management’s energy and mineral policy.

National Environmental Policy Act

Our U.S. projects may also be subject to environmental review under the U.S. National Environmental Policy Act (NEPA) which requires federal agencies to evaluate the environmental impact of all "major federal actions" significantly affecting the quality of the human environment. The granting of a land lease, a federal permit or similar authorization for a major development project, or the interconnection of a significant private project into a federal project generally is considered a "major federal action" that requires review under NEPA. As part of the NEPA review, the federal agency considers a broad array of environmental impacts, including impacts on air quality, water quality, wildlife, historical and archaeological resources, geology, socioeconomics and aesthetics and alternatives to the project. A federal agency may decide to deny a permit based on its environmental review under NEPA, though in most cases a project would be redesigned to reduce impacts or agree to provide some form of mitigation to offset impacts before a denial is issued.

National Historic Preservation Act

U.S. federal agencies consider a project’s impact on historical or archeological resources under the U.S. National Historic Preservation Act and may require us to conduct archeological surveys or take other measures to protect these resources. The National Historic Preservation Act requires federal agencies to evaluate the impact of all federally funded or permitted projects on historic properties (buildings, archaeological sites, etc.)

Other State and Local Programs

In addition to federal requirements, our U.S. projects, and any future U.S. projects we may acquire, are subject to a variety of state environmental review and permitting requirements. Many states where our projects are located, or may in the future be located, have laws that require state agencies to evaluate a broad array of environmental impacts before granting state permits. The state environmental review process often resembles the federal NEPA process and may be more stringent than the federal review. Our projects also often require state law based permits in addition to federal permits.

Our projects also are subject to local environmental and regulatory requirements, including county and municipal land use, zoning, building and transportation requirements. Local or state regulatory agencies may require modeling and measurement of permissible sound levels in connection with the permitting and approval of our projects. Local or state agencies also may require us to develop decommissioning plans for dismantling the project at the end of its functional life and establish financial assurances for carrying out the decommissioning plan.

Environmental Matters—Canada

We are required to obtain a range of environmental permits and other approvals to build and operate our Canadian projects, including, but not limited to, those described below from Canadian federal, provincial and local governmental authorities. In addition to being subject to these regulatory requirements, we could experience and have experienced significant opposition from third parties, including, but not limited to, environmental non-governmental organizations, neighborhood groups, municipalities and First Nations when the permits were initially applied for or when there is an appeal proceeding after permits are issued. The delay or denial of a permit or the

18

imposition of conditions that are costly or difficult to comply with can impair or even prevent the development of a project or can increase the cost so substantially that the project is no longer attractive to us.

Ontario Renewable Energy Approvals

Our projects in Ontario are subject to Ontario’s Environmental Protection Act, which requires proponents of significant renewable energy projects to obtain a Renewable Energy Approval (REA). The REA application requires a variety of studies on environmental, archeological and heritage issues. Significant public consultation, as well as consultation with indigenous communities, is also required. Before issuing a REA, the Ontario Ministry of the Environment evaluates a broad range of potential impacts, including on wildlife, wetlands and water resources, communities, scenic areas, species and heritage resources, as well as impacts on people. This review can be time consuming and expensive, and an approval can be rejected or approved with conditions that are costly or difficult to comply with. REAs are also subject to appeal by third parties and can result and have resulted in lengthy appeal tribunal hearings.

Quebec Environmental Impact Assessment

Quebec`s Environmental Impact Assessment (EIA) is a required permit for wind energy projects with a nameplate capacity above 10 MW. The EIA requires a variety of studies related to environmental, archeological and heritage issues. Significant public consultation, as well as consultation with indigenous communities, is also required. The culmination of this permitting process is the issuing of a project specific decree by the provincial council of ministers. Before issuing the decree, the Quebec Ministry of Environment evaluates a broad range of potential impacts, including on wildlife, wetlands and water resources, communities, scenic areas, species and heritage resources, as well as impacts on people.

Quebec Commission for the Protection of Agricultural Land

In addition to the EIA process, the other major permit in Quebec is granted by the Quebec Commission for the Protection of Agricultural Land. This permit is only required on land that is zoned agricultural. This permitting body will push proponents to minimize footprints during both the construction phase and the operations phase.

Manitoba Environment Act

The Manitoba Environment Act requires proponents of significant projects to submit a proposal with the Manitoba Conservation Environmental Assessment & Licensing Branch, and to comply with Manitoba’s environmental assessment process under the Environment Act. This process will consider a similar range of impacts on the environment, the heritage and scenic values of an area and on people, communities and wildlife as the Ontario process, and brings with it similar risks.

Endangered Species Legislation

Our Canadian renewable energy projects may be subject to endangered species legislation, either federally or provincially, which prohibits and imposes stringent penalties for harming endangered or threatened species and their habitats. Our projects may also be subject to the Migratory Birds Convention Act, which protects the habitat of migratory species, and which may also trigger federal "Species at Risk" requirements. Because the operation of wind turbines may result in injury or fatalities to birds and bats, avian and bat risk assessments are generally required both prior to permits being issued for projects and after commercial operations. In Ontario, if any of the affected species are listed as endangered or threatened, permits under the Endangered Species Act may also be required.

Other Approvals

Our Canadian projects, and any future projects we may acquire, are subject to a variety of other federal, provincial and municipal permitting and zoning requirements. Most provinces where our projects are located or may be located have laws that require provincial agencies to evaluate a broad array of environmental impacts before granting permits and approvals. These agencies evaluate similar issues as the permitting regimes above, including impact on wildlife, historic sites, aesthetics, wetlands and water resources, scenic areas, endangered and threatened species and communities. In addition, federal government approvals dealing with, among other things, aeronautics, fisheries, navigation or species protection may be required and could in some cases trigger additional environmental assessment requirements. Additional requirements related to the permitting of transmission lands may be applicable in some cases. Our projects are also subject to certain municipal requirements, including land use and zoning requirements except where superseded by Ontario’s Green Energy and Green Economy Act, 2009, as well as requirements for building permits and other municipal approvals that can be difficult or costly to comply with and impair or prevent the development of a project.

19

Environmental Matters – Chile

We are required to obtain a range of environmental permits and other approvals from various governmental agencies in Chile to build and operate our projects, including, but not limited to, items described below.

Ministry of Environment

The Ministry of the Environment is responsible for the formulation and implementation of environmental policies, including those affecting the wind industry, plans and programs, as well as for the formulation of environmental quality and emission standards, the protection and conservation of biological diversity, renewable natural resources and water resources, and for promoting sustainable development and the integrity of environmental policy and regulations.

Environmental Assessment Service

The Environmental Assessment Service is responsible for assessing whether projects that might have an adverse effect on the environment, including wind projects, comply with Chilean environmental laws and regulations.

Superintendency of Environment

The Superintendency of the Environment’s primary responsibilities are monitoring compliance with the terms of the corresponding environmental licenses, as well as monitoring compliance with government plans to prevent environmental damage or to clean or restore contaminated geographical areas. The Superintendency of the Environment has the power to suspend activities that it deems to have an adverse environmental impact, even if such activities comply with a previously approved environmental impact assessment. In case of noncompliance with environmental regulations, it is enabled to apply fines, revoke the environmental license of a project or determine its closure.

The Environmental Courts, and Health and Safety

The Environmental Courts are principally responsible for hearing appeals of determinations made by the Superintendency of the Environment and for adjudicating claims for environmental damage.

Companies in the wind energy sector, like all companies, must comply with the general principles concerning employee health and safety contained in the Chilean Sanitary Code, Labor Code and other labor and health regulations. The Chilean Health Ministry and the Department of Labor are responsible for the enforcement of those standards, with the authority to impose fines among other sanctions. In addition, the Superintendence of Electricity and Fuels has the responsibility to monitor compliance and also the authority to impose fines and stop operations of violators.

Management, Disposal and Remediation of Hazardous Substances

We own and lease real property and may be subject to requirements regarding the storage, use and disposal of petroleum products and hazardous substances, including spill prevention, control and counter-measure requirements. If our owned or leased properties are contaminated, whether during or prior to our ownership or operation, we could be responsible for the costs of investigation and cleanup and for any related liabilities, including claims for damage to property, persons or natural resources. That responsibility may arise even if we were not at fault and did not cause or were not aware of the contamination. In addition, waste we generate is at times sent to third-party disposal facilities. If those facilities become contaminated, we and any other persons who arranged for the disposal or treatment of hazardous substances at those sites may be jointly and severally responsible for the costs of investigation and remediation, as well as for any claims for damage to third parties, their property or natural resources.

Employees

As of December 31, 2016, we had 140 full-time employees. None of our employees are represented by a labor union or covered by any collective bargaining agreement.

Available Information

We make our United States Securities and Exchange Commission (SEC) filings, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, available free of charge on our website, www.patternenergy.com, as soon as reasonably practicable after those documents are electronically filed with or furnished to the SEC.

20

The information and materials available on our website are not incorporated by reference into this Form 10-K. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC at www.sec.gov.

Item 1A. | Risk Factors. |

RISK FACTORS

You should carefully consider the following risks, together with other information provided to you in this Form 10-K. If any of the following risks were to occur, our business prospects, financial condition, results of operations and liquidity could be materially adversely affected. In that case, we might have to decrease, or may not be able to pay, dividends on our Class A shares, the trading price of our Class A shares could decline and you could lose all or part of your investment. The risks described below are not the only risks facing our company. Risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business prospects, financial condition and results of operations and liquidity.

Risks Related to Our Projects

Electricity generated from wind energy depends heavily on suitable wind conditions and wind turbines being available for operation. If wind conditions are unfavorable or below our expectations, or our wind turbines are not available for operation, our projects’ electricity generation and the revenue generated from our projects may be substantially below our expectations.

The revenue generated by our projects is principally dependent on the number of MWh generated in a given time period. The quantity of electricity generation from a wind power project depends heavily on wind conditions, which are variable. Variability in wind conditions can cause our project revenues to vary significantly from period to period. We base our decisions about which projects to acquire as well as our electricity generation estimates, in part, on the findings of long-term wind and other meteorological studies conducted on the project site and its region, which measure the wind’s speed, prevailing direction and seasonal variations. Projections of wind resources also rely upon assumptions about turbine placement, wind turbine power curves, interference between turbines and the effects of vegetation, land use and terrain, which involve uncertainty and require us to exercise considerable judgment. We may make incorrect assumptions in conducting these wind and other meteorological studies. Any of these factors could cause our projects to generate less electricity than we expect and reduce our revenue from electricity sales, which could have a material adverse effect on our business prospects, financial condition and results of operations.

Even if an operating project’s historical wind resources are consistent with our long-term estimates, the unpredictable nature of wind conditions often results in daily, monthly and yearly material deviations from the average wind resources we may anticipate during a particular period. If the wind resources at a project are materially below the average levels we expect for a particular period, our revenue from electricity sales from the project could correspondingly be less than expected. A diversified portfolio of projects located in different geographical areas tends to reduce the magnitude of the deviation, but material deviations may still occur. Our cash available for distribution is most directly affected by the volume of electricity generated and sold by our projects. However, for a static portfolio of projects, our consolidated expenses, including operating expenses and interest payments on indebtedness, have less variability than the volume of electricity generated and sold. Accordingly, decreases in the volume of electricity generated and sold by our projects typically result in a proportionately greater decrease in our cash available for distribution. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operation-Factors that Significantly Affect our Business-Factors Affecting our Operational Results-Electricity Sales and Energy Derivative Settlements of Our Operating Projects.”

A reduction in electricity generation and sales, whether due to the inaccuracy of wind energy assessments or otherwise, could lead to a number of material adverse consequences for our business, including:

• | our projects’ failure to produce sufficient electricity to meet our commitments under our PPAs, hedge arrangements or contracts for sale of RECs, which could result in our having to purchase electricity or RECs on the open market to cover our obligations or result in the payment of damages or the termination of a PPA; |

• | our projects not generating sufficient cash flow to make payments of principal and interest as they become due on project-related debt, or distributing sufficient cash flow to pay dividends to holders of our Class A shares. For example, certain of our projects have experienced lower than expected production and merchant power prices resulting in those projects failing to pass financial tests that measure cumulative cash distributions to the members. This will result in a temporary change of the cash percentage to be directed to the tax equity members until the shortfall is remedied. See “-Risks Related to Ownership of our Class A Shares - |

21

Our cash available for distribution to holders of our Class A shares may be reduced as a result of restrictions on our subsidiaries’ cash distributions to us under the terms of their indebtedness;” and

• | our projects’ hedging arrangements being ineffective or more costly. |

Our projects rely on a limited number of key power purchasers. The power purchaser for our Santa Isabel project has been downgraded.

There are a limited number of possible power purchasers for electricity and RECs produced in a given geographic location. Because our projects depend on sales of electricity and RECs to certain key power purchasers, our projects are highly dependent upon these power purchasers fulfilling their contractual obligations under their respective PPAs. Our projects’ power purchasers may not comply with their contractual payment obligations or may become subject to insolvency or liquidation proceedings during the term of the relevant contracts and, in such event, we may not be able to find another purchaser on similar or favorable terms or at all. In addition, we are exposed to the creditworthiness of our power purchasers and there is no guarantee that any power purchaser will maintain its credit rating, if any. To the extent that any of our projects’ power purchasers are, or are controlled by, governmental entities, our projects may also be subject to legislative or other political action that impairs their contractual performance. Failure by any key power purchasers to meet its contractual commitments or the insolvency or liquidation of one or more of our power purchasers could have a material adverse effect on our business prospects, financial condition and results of operations.

Our 101 MW Santa Isabel project located on the south coast of Puerto Rico sells 100% of its electricity generation including environmental attributes to the Puerto Rico Electric Power Authority (PREPA) under a 20-year PPA. PREPA’s credit ratings have been downgraded and as of February 24, 2017 were Caa3, D, and C, as rated by each of Moody’s, Standard & Poor’s, and Fitch, respectively, all of which are below investment grade. Furthermore, PREPA entered into a restructuring support agreement with certain lenders, bondholders and bond insurers which would implement a plan that would reduce PREPA’s bonds and fuel credit lines debt burden and provide principal debt service relief for five years. However, restructuring under such agreement has not occurred because several conditions precedent remain pending. While as of February 24, 2017, PREPA is current with respect to payments due under the PPA, a failure by PREPA to perform its payment obligations under the PPA, a failure to consummate the restructuring support agreement or to negotiate a new restructuring agreement with its creditors, or the initiation of bankruptcy proceedings for PREPA by its oversight board may affect its obligations under the PPA which could have an adverse effect on our business prospects, financial condition and results of operations.

A prolonged environment of low prices for natural gas, other conventional fuel sources, or competing renewable resources could have a material adverse effect on our long-term business prospects, financial condition and results of operations.