Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPECTRUM PHARMACEUTICALS INC | a8-k.htm |

Spectrum Pharmaceuticals A Biopharmaceutical Company Developing Targeted and Novel Therapies in Oncology Joe Turgeon | President and CEO January 2020 | Investor Presentation

Safe Harbor Statement This presentation contains forward-looking statements regarding future events and the future performance of Spectrum Pharmaceuticals that involve risks and uncertainties that could cause actual results to differ materially. These statements are based on management’s current beliefs and expectations. These statements include but are not limited to statements that relate to our business and its future, our strategy, the success of our drug candidates, the safety and efficacy of our drug products, product approvals, market potential, product sales, revenue, development, regulatory and approval timelines, product launches, product acquisitions, capital resources and any statements that relate to the intent, belief, plans or expectations of Spectrum or its management, or that are not a statement of historical fact. Risks that could cause actual results to differ include the possibility that our existing and new drug candidates may not prove safe or effective, the possibility that our existing and new drug candidates may not receive approval from the FDA and other regulatory agencies in a timely manner or at all, the possibility that our existing and new drug candidates, if approved, may not be more effective, safer or more cost efficient than competing drugs, the possibility that price and other competitive pressures may make the marketing and sale of our drugs not commercially feasible, the possibility that our efforts to acquire or in-license and develop additional drug candidates may fail, our lack of sustained revenue history, our limited experience in establishing strategic alliances, our limited marketing experience, our customer concentration, the possibility for fluctuations in customer orders, evolving market dynamics, our dependence on third parties for clinical trials, manufacturing, distribution, information and quality control and other risks that are described in further detail in the Company's reports filed with the Securities and Exchange Commission. We do not plan to update any such forward-looking statements and expressly disclaim any duty to update the information contained in this presentation except as required by law. 2

Spectrum’s Pipeline Targeted & Novel Medicines POZIOTINIB ROLONTIS® FIT Platform (eflapegrastim) Program Update in Q1 PDUFA Date of October 24, 2020 Phase 1 Dose Escalation Study 3

Poziotinib Tyrosine Kinase Inhibitor targeting mutations in lung cancer Results from ZENITH20 cohort 2 in mid-2020 Results from ZENITH20 cohort 3 in 2020 Program update in Q1 4

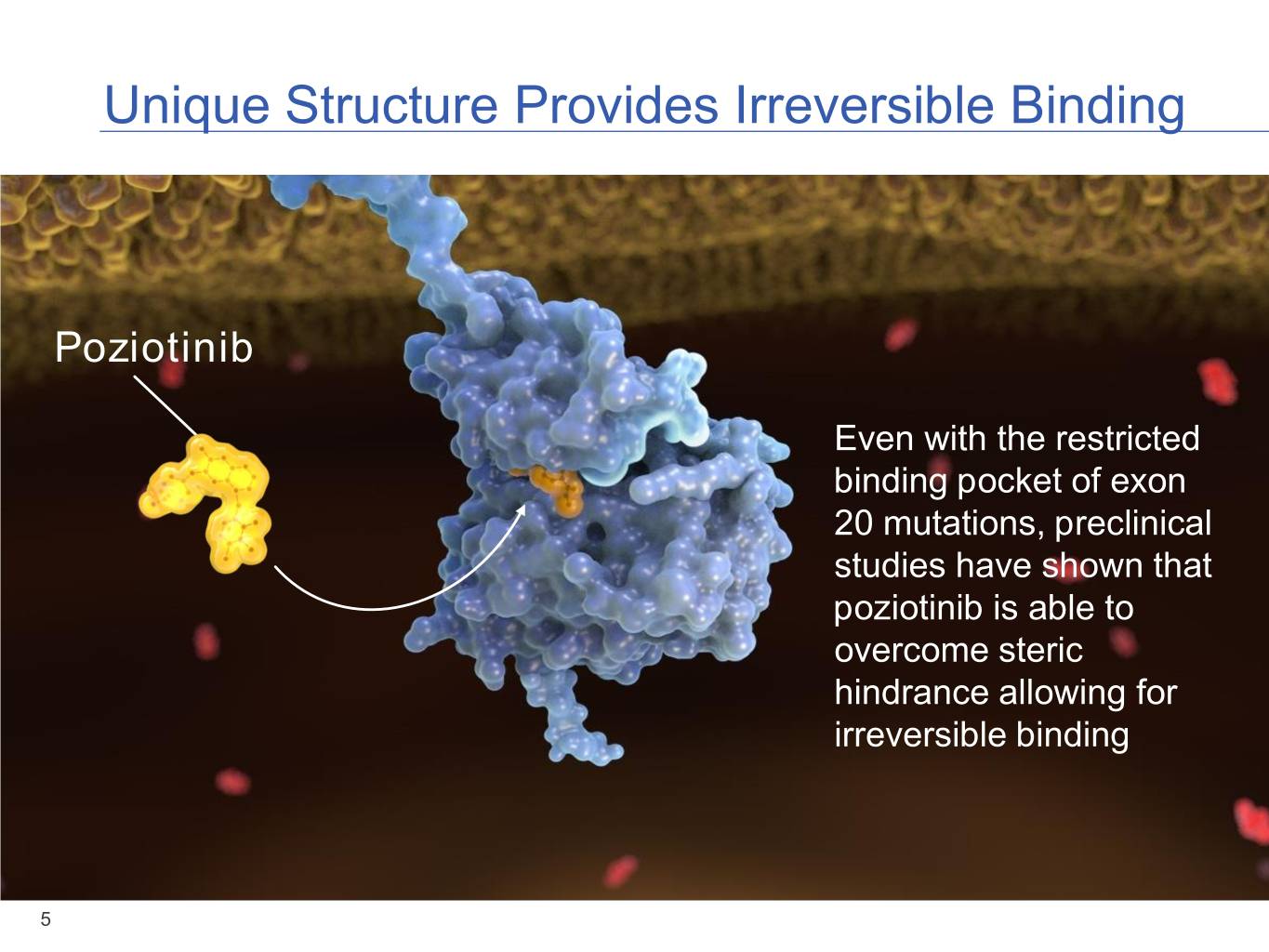

Unique Structure Provides Irreversible Binding Poziotinib Even with the restricted binding pocket of exon 20 mutations, preclinical studies have shown that poziotinib is able to overcome steric hindrance allowing for irreversible binding 5

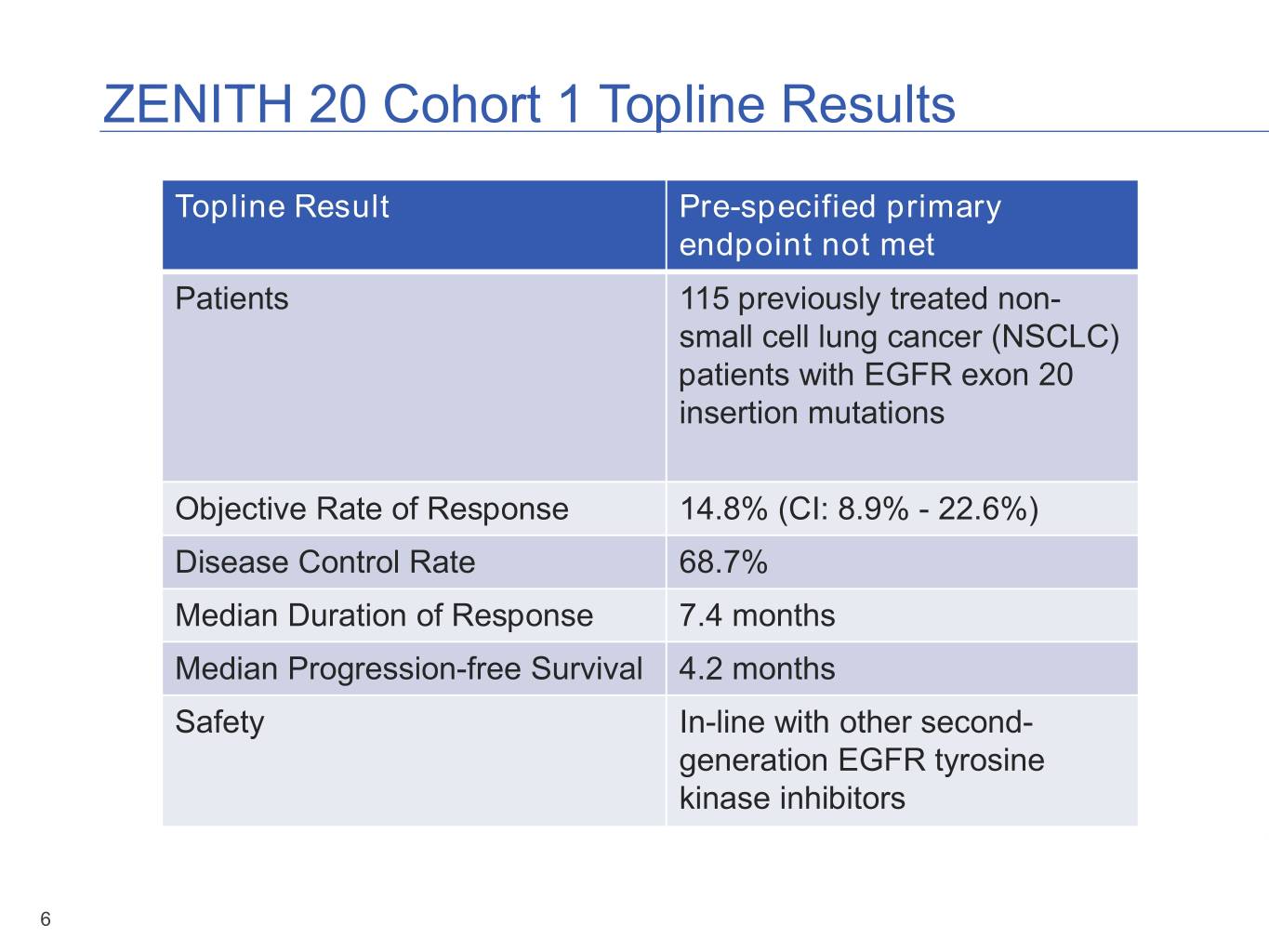

ZENITH 20 Cohort 1 Topline Results Topline Result Pre-specified primary endpoint not met Patients 115 previously treated non- small cell lung cancer (NSCLC) patients with EGFR exon 20 insertion mutations Objective Rate of Response 14.8% (CI: 8.9% - 22.6%) Disease Control Rate 68.7% Median Duration of Response 7.4 months Median Progression-free Survival 4.2 months Safety In-line with other second- generation EGFR tyrosine kinase inhibitors 6

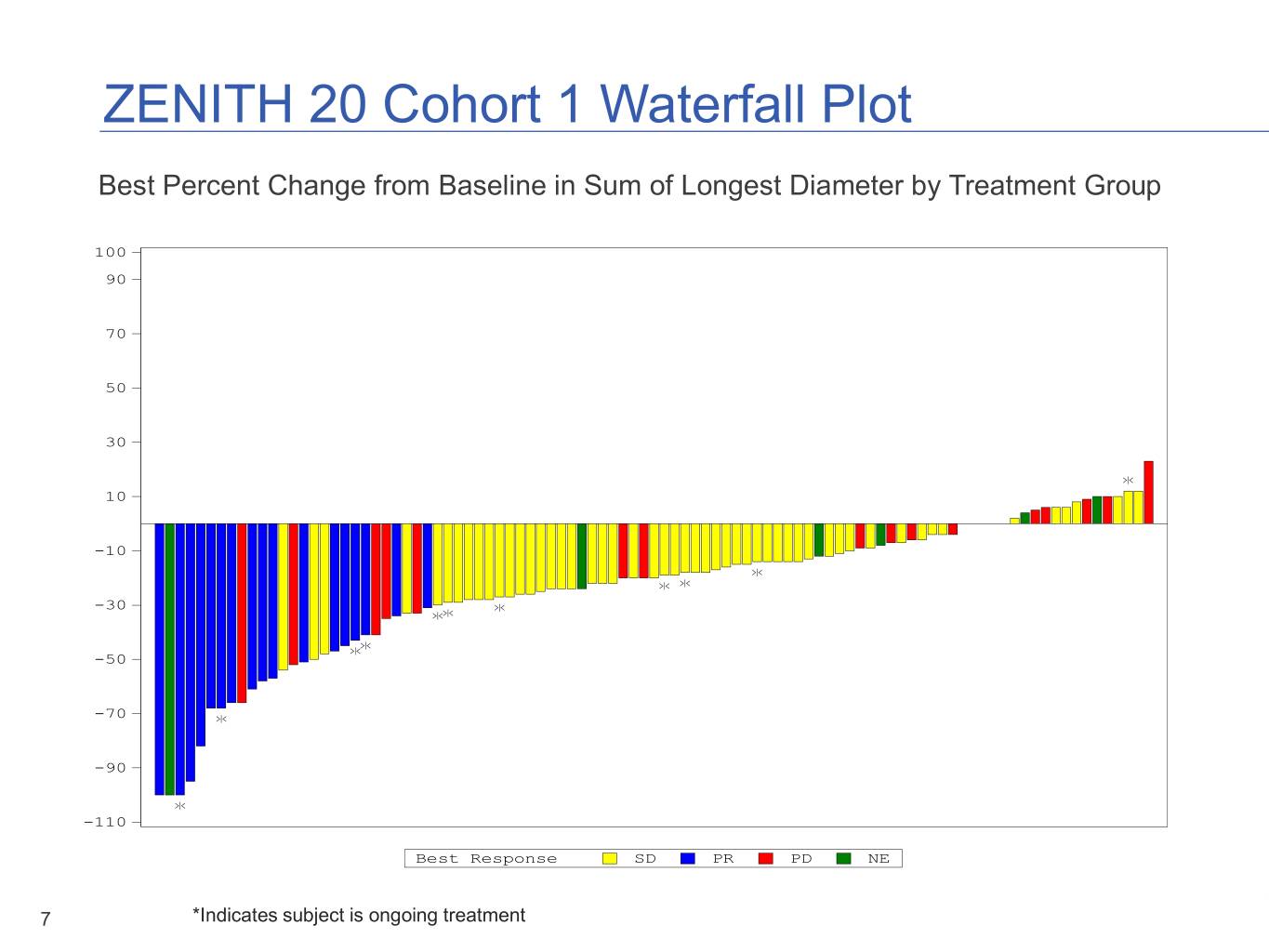

ZENITH 20 Cohort 1 Waterfall Plot Best Percent Change from BaselineF inigu Sumre 14.2 .of4 Longest Diameter by Treatment Group Percent Change from Baseline in Sum of Longest Diameter by Treatment Group- Waterfall Plots r e t e 100 m a i 90 D t s e 70 g n o L 50 f o m u 30 S n i 10 e n i l e -10 s a B m -30 o r f e -50 g n a h C -70 % -90 -110 Best Response SD PR PD NE Page 1 of 1 7PROGRAM NAME: *IndicatesF-WFALL subject is ongoing treatment DATE: 20DEC2019/10:26 * Indicates the subject is Ongoing Treatment

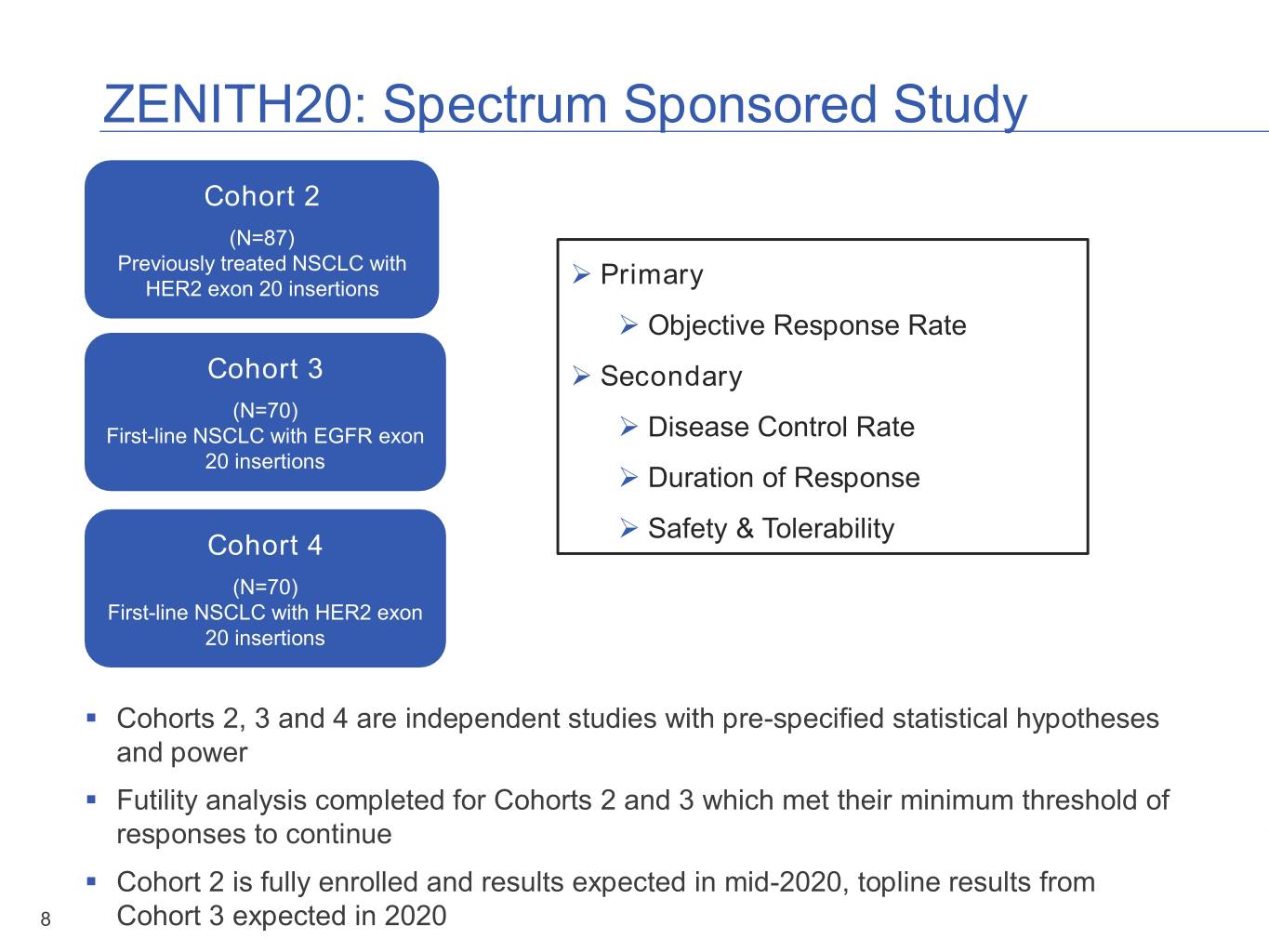

ZENITH20: Spectrum Sponsored Study Cohort 2 (N=87) Previously treated NSCLC with HER2 exon 20 insertions ➢ Primary ➢ Objective Response Rate Cohort 3 ➢ Secondary (N=70) First-line NSCLC with EGFR exon ➢ Disease Control Rate 20 insertions ➢ Duration of Response ➢ Safety & Tolerability Cohort 4 (N=70) First-line NSCLC with HER2 exon 20 insertions ▪ Cohorts 2, 3 and 4 are independent studies with pre-specified statistical hypotheses and power ▪ Futility analysis completed for Cohorts 2 and 3 which met their minimum threshold of responses to continue ▪ Cohort 2 is fully enrolled and results expected in mid-2020, topline results from 8 Cohort 3 expected in 2020

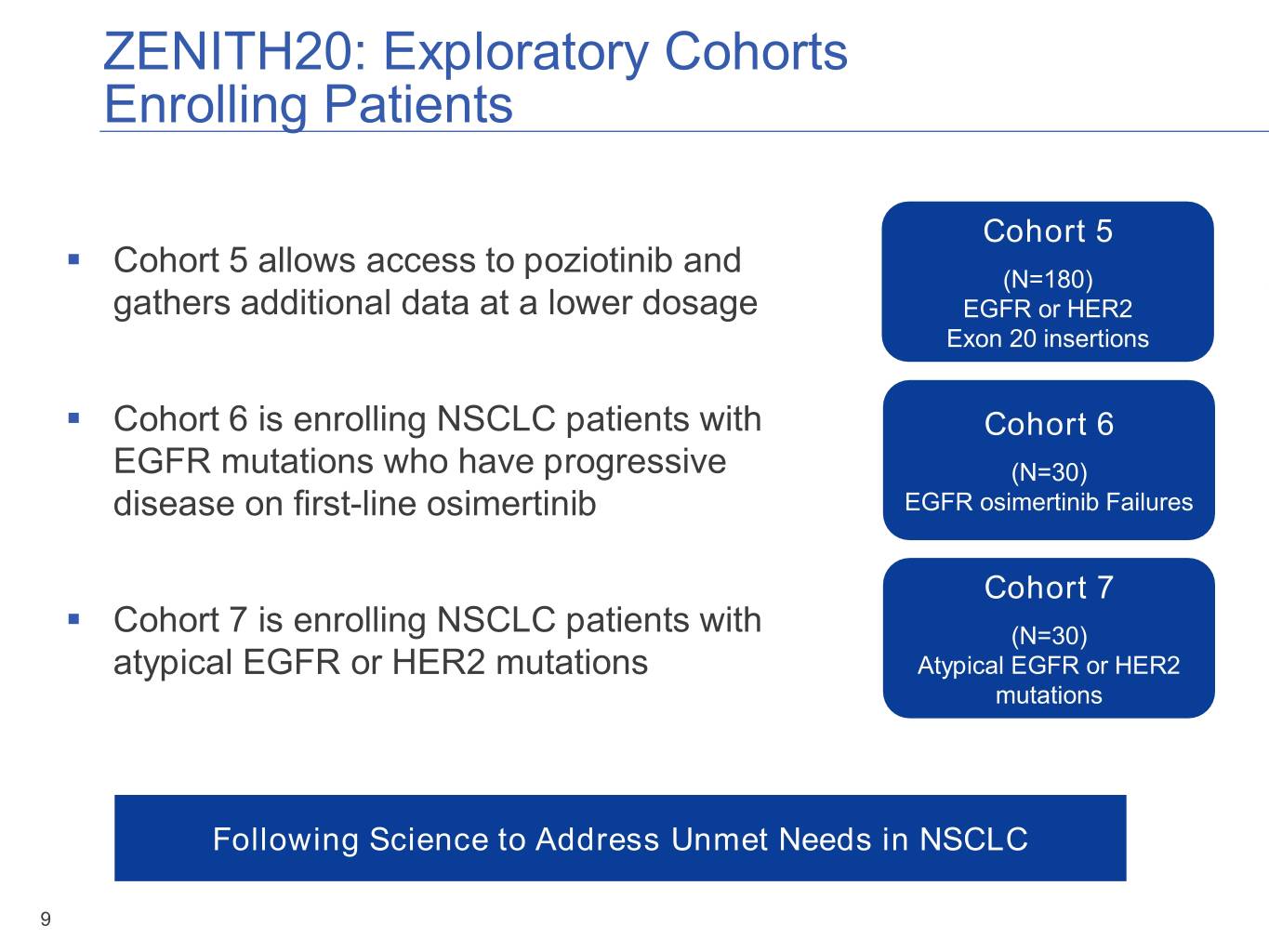

ZENITH20: Exploratory Cohorts Enrolling Patients Cohort 5 ▪ Cohort 5 allows access to poziotinib and (N=180) gathers additional data at a lower dosage EGFR or HER2 Exon 20 insertions ▪ Cohort 6 is enrolling NSCLC patients with Cohort 6 EGFR mutations who have progressive (N=30) disease on first-line osimertinib EGFR osimertinib Failures Cohort 7 ▪ Cohort 7 is enrolling NSCLC patients with (N=30) atypical EGFR or HER2 mutations Atypical EGFR or HER2 mutations Following Science to Address Unmet Needs in NSCLC 9

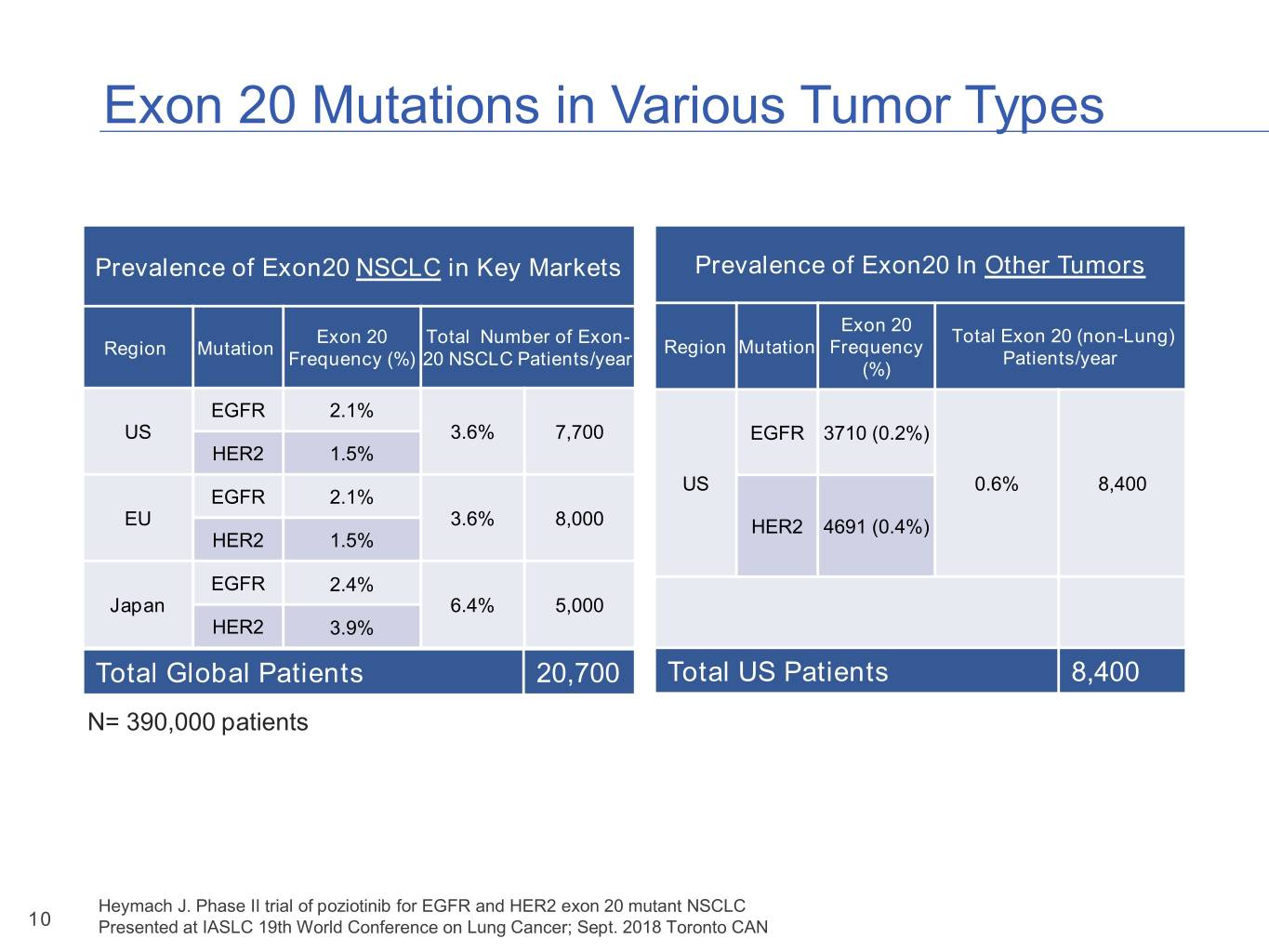

Exon 20 Mutations in Various Tumor Types Prevalence of Exon20 NSCLC in Key Markets Prevalence of Exon20 In Other Tumors Exon 20 Exon 20 Total Number of Exon- Total Exon 20 (non-Lung) Region Mutation Region Mutation Frequency Frequency (%) 20 NSCLC Patients/year Patients/year (%) EGFR 2.1% US 3.6% 7,700 EGFR 3710 (0.2%) HER2 1.5% US 0.6% 8,400 EGFR 2.1% EU 3.6% 8,000 HER2 4691 (0.4%) HER2 1.5% EGFR 2.4% Japan 6.4% 5,000 HER2 3.9% TotalTOTAL Global Patients Patients 20,70020,700 Total US Patients 8,400 N= 390,000 patients Heymach J. Phase II trial of poziotinib for EGFR and HER2 exon 20 mutant NSCLC 10 Presented at IASLC 19th World Conference on Lung Cancer; Sept. 2018 Toronto CAN

ROLONTIS® (eflapegrastim) BLA has been accepted with a PDUFA of Oct 24th 2020 11

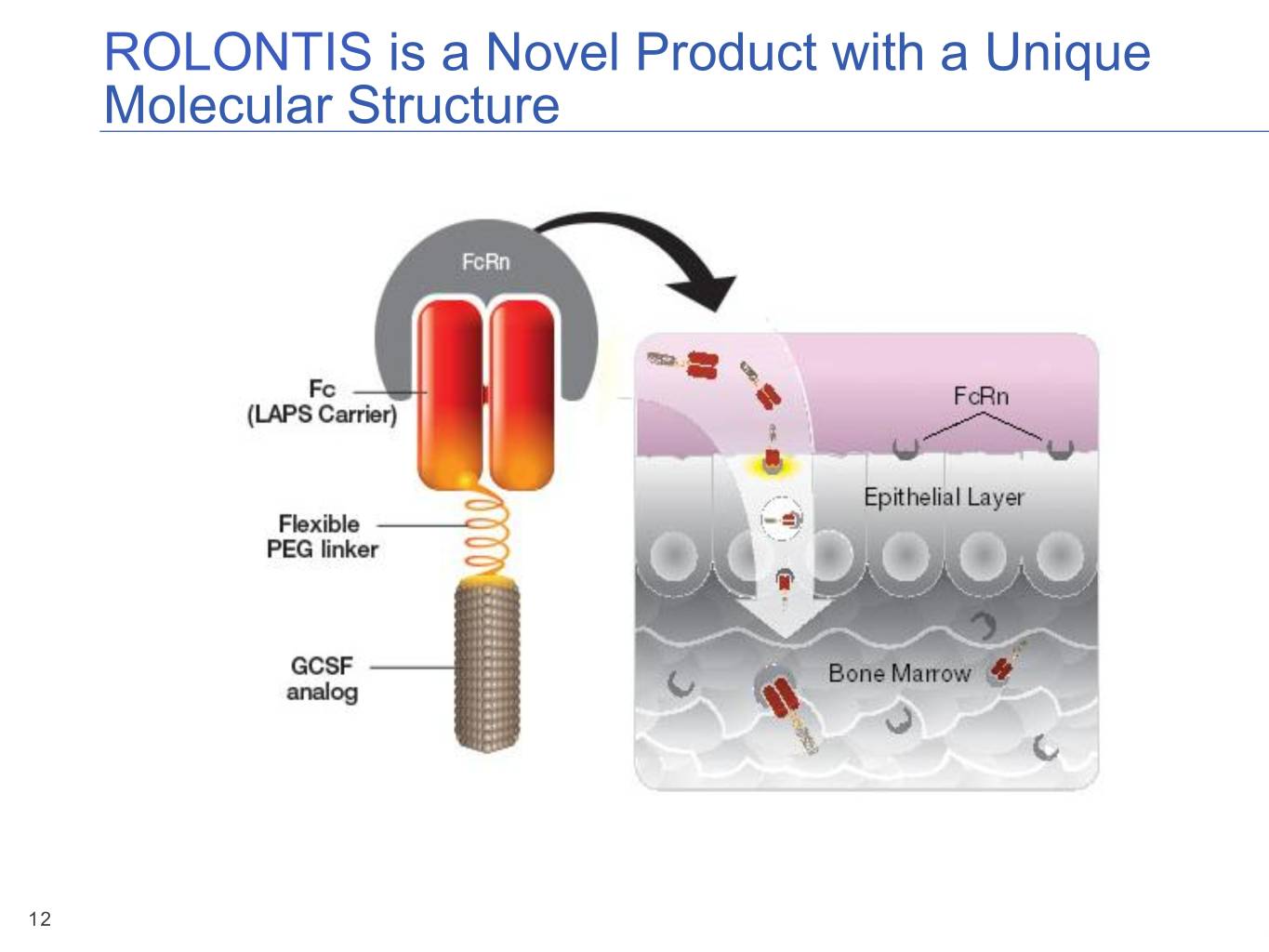

ROLONTIS is a Novel Product with a Unique Molecular Structure 12

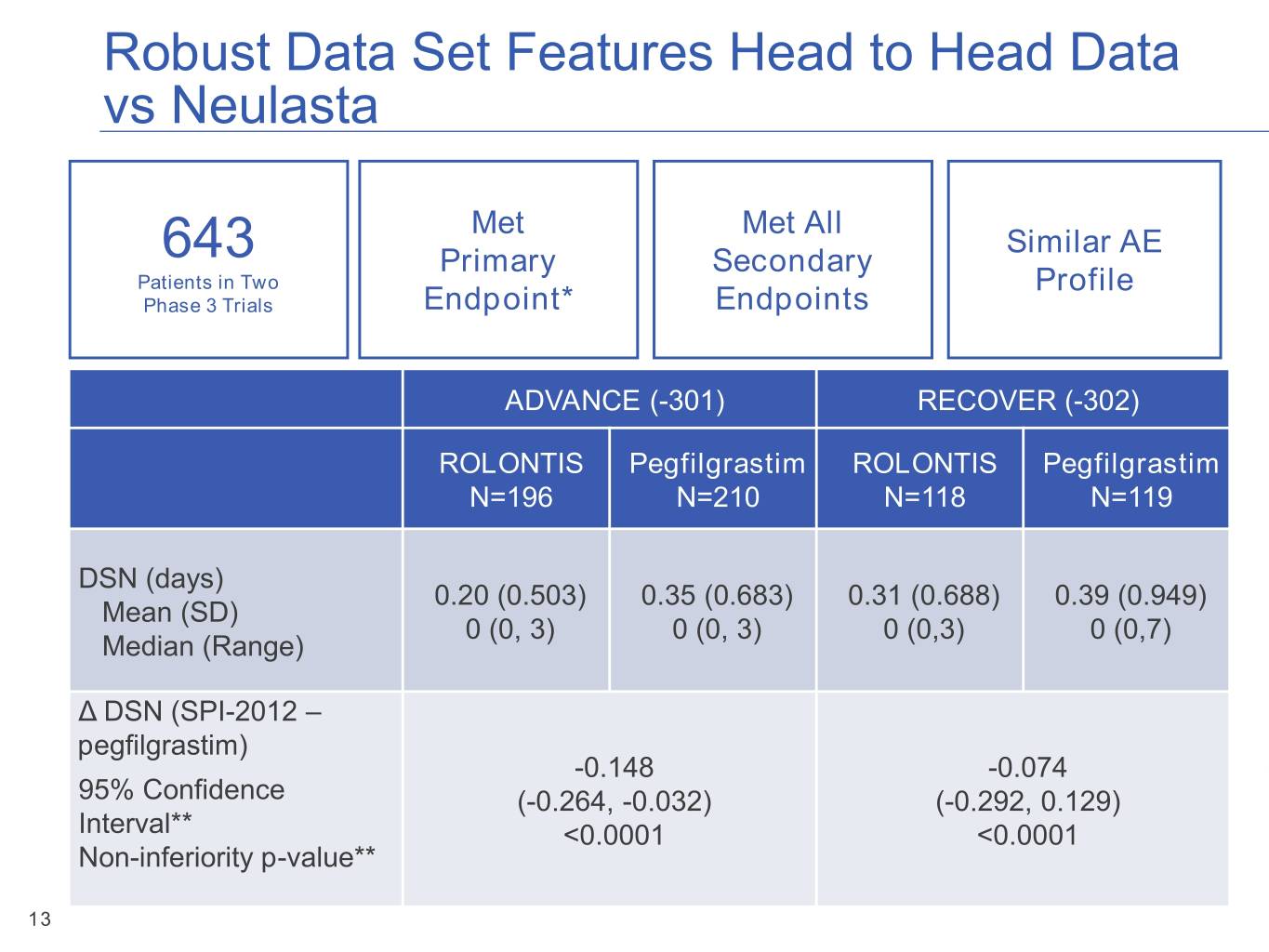

Robust Data Set Features Head to Head Data vs Neulasta Met Met All Similar AE 643 Primary Secondary Patients in Two Profile Phase 3 Trials Endpoint* Endpoints ADVANCE (-301) RECOVER (-302) ROLONTIS Pegfilgrastim ROLONTIS Pegfilgrastim N=196 N=210 N=118 N=119 DSN (days) 0.20 (0.503) 0.35 (0.683) 0.31 (0.688) 0.39 (0.949) Mean (SD) 0 (0, 3) 0 (0, 3) 0 (0,3) 0 (0,7) Median (Range) Δ DSN (SPI-2012 – * Non-inferiority of ROLONTIS versus pegfilgrastim in Duration of Severe Neutropenia in Cycle 1 pegfilgrastim)** 95% confidence intervals and p-value obtained from bootstrap sampling method -0.148 -0.074 95% Confidence (-0.264, -0.032) (-0.292, 0.129) Interval** <0.0001 <0.0001 Non-inferiority p-value** 13

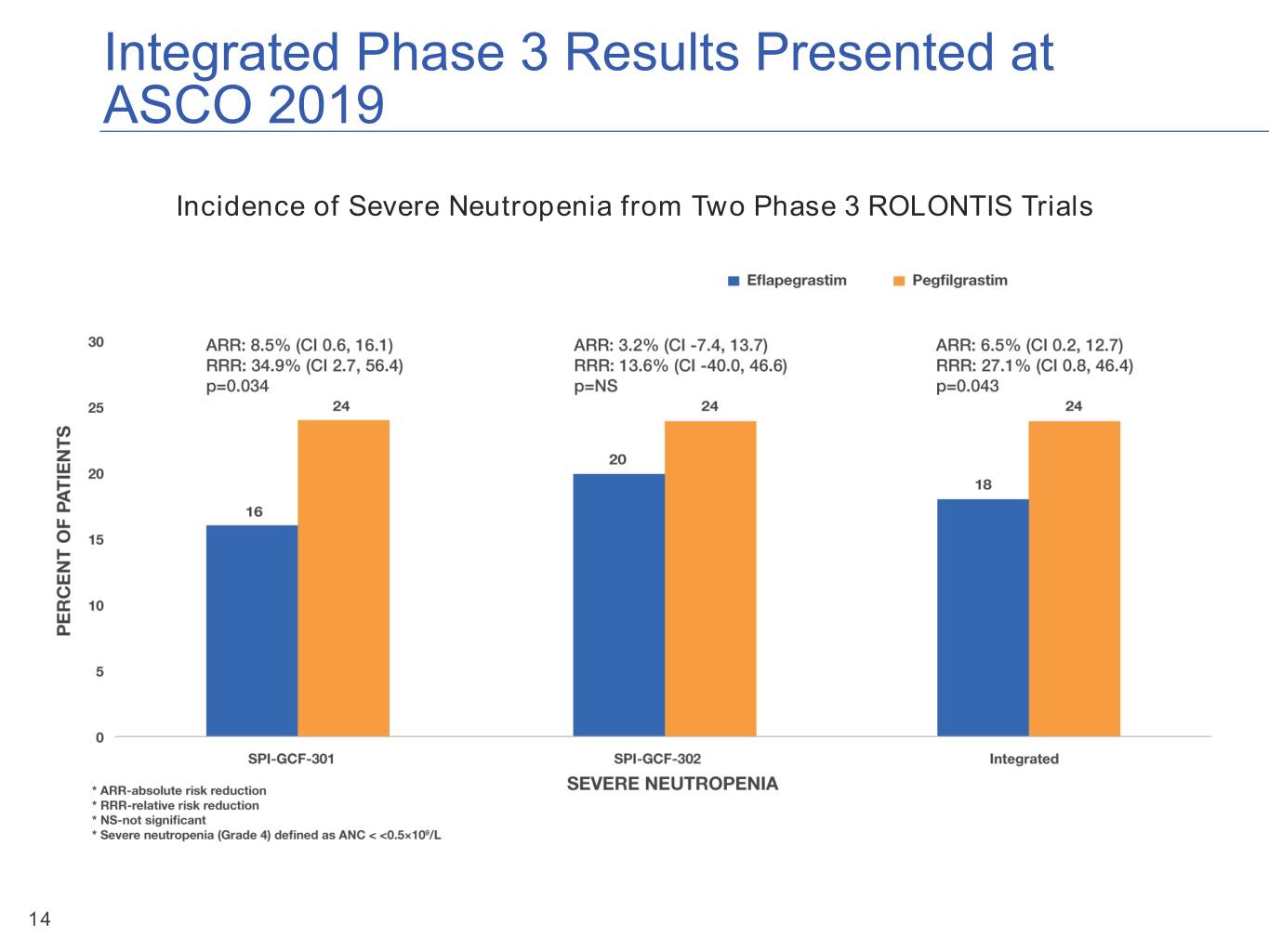

Integrated Phase 3 Results Presented at ASCO 2019 Incidence of Severe Neutropenia from Two Phase 3 ROLONTIS Trials 14

Long Acting G-CSF Market Presents a Compelling Opportunity ▪ >$3B total US market value Market Size ▪ Rational pricing behavior among competitors ▪ Unique reimbursement for novel products is a competitive advantage Reimbursement ▪ Value based care creates additional complexity in Dynamics customer’s decision matrix ▪ Commercial payers increasingly important stakeholders in decision-making ▪ Willingness to change products based on value Customer ▪ Onpro® volume declining with pre-filled syringe growth Behavior ▪ Providers receptive to incremental contracting opportunities 15

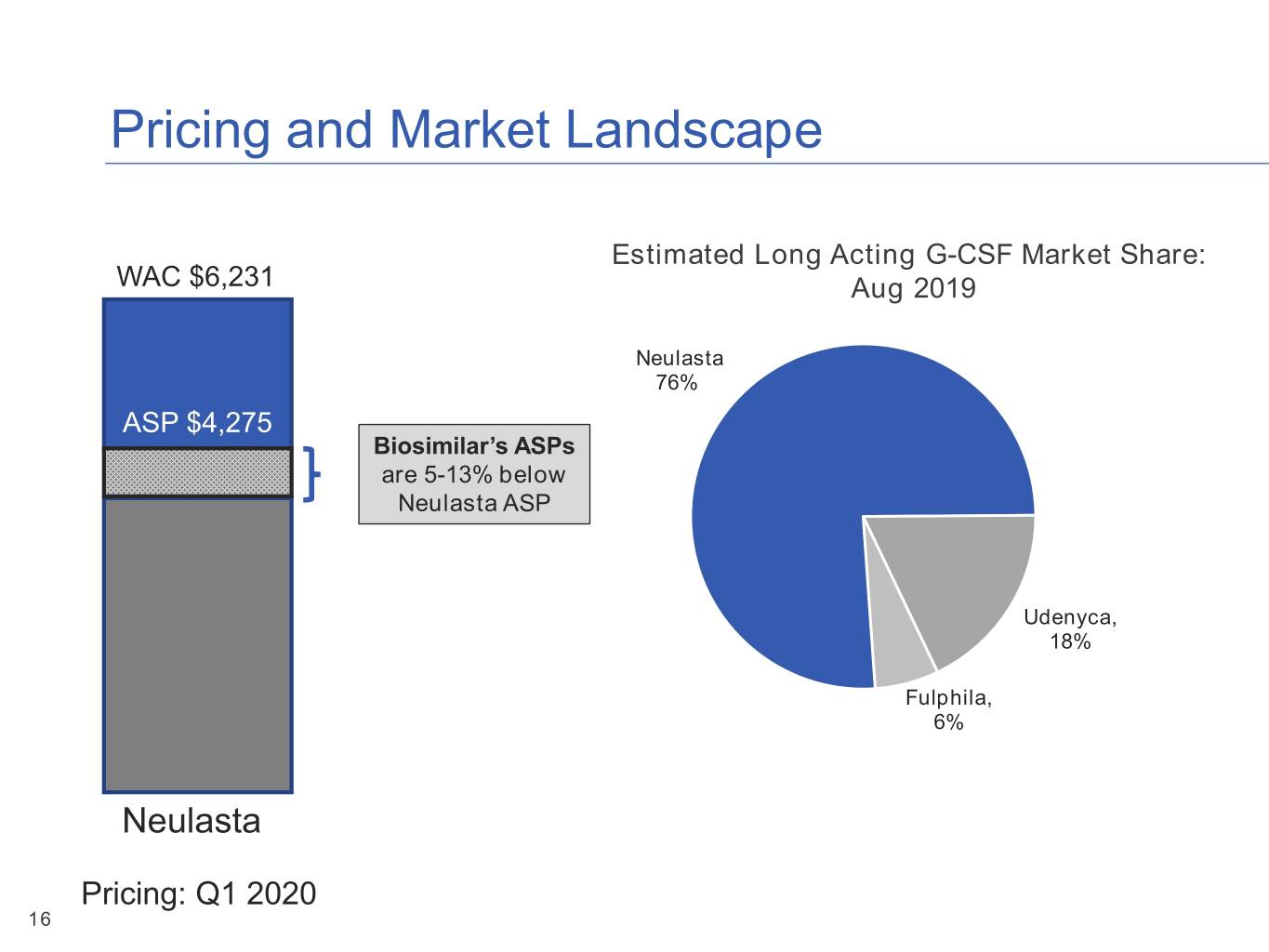

Pricing and Market Landscape Estimated Long Acting G-CSF Market Share: WAC $6,231 Aug 2019 Neulasta 76% ASP $4,275 Biosimilar’s ASPs are 5-13% below Neulasta ASP Udenyca, 18% Fulphila, 6% Neulasta Pricing: Q1 2020 16

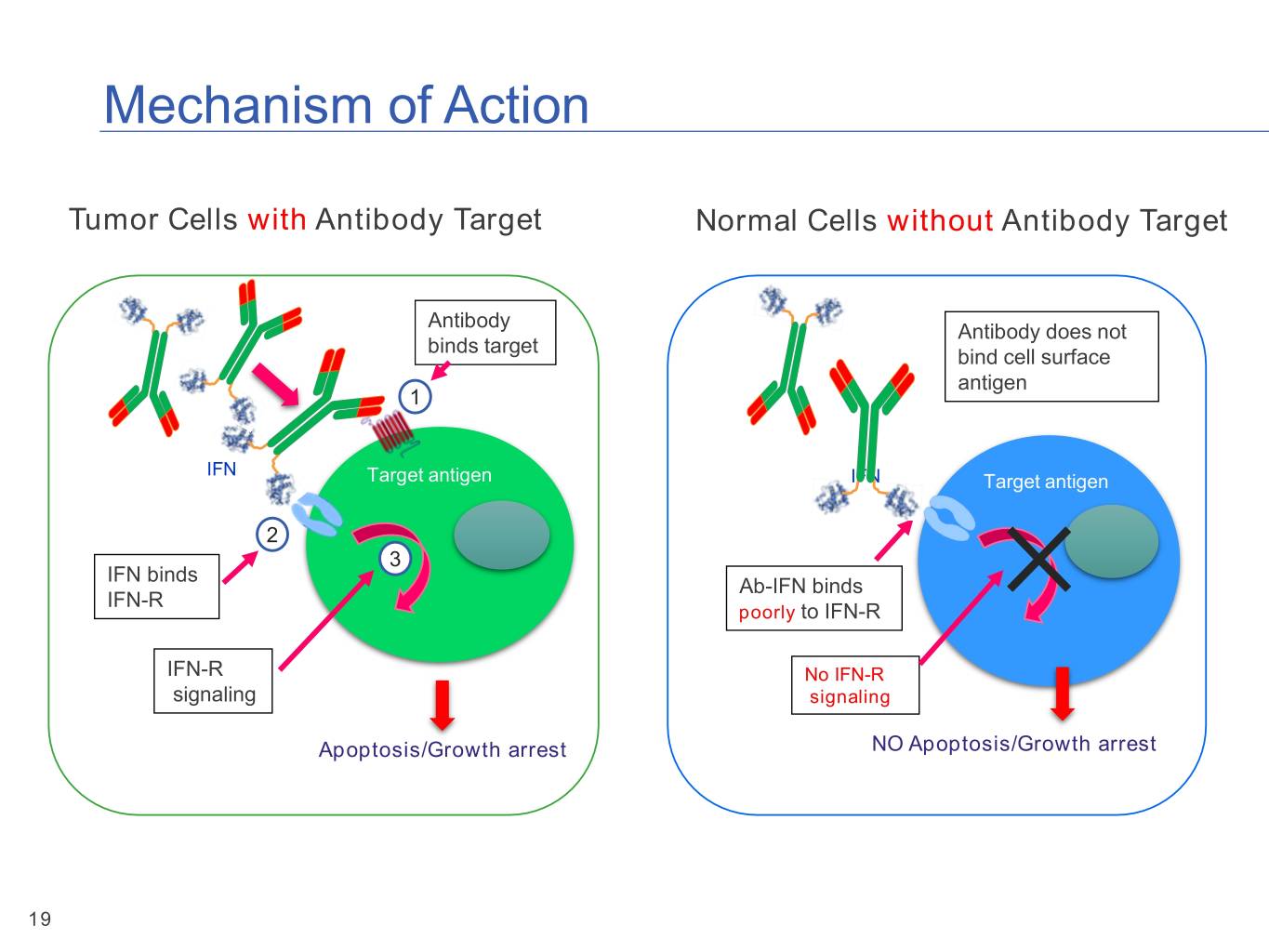

Focused Interferon Therapeutics Platform ▪ IFNa is an approved treatment for cancer ▪ But systemic IFNa therapy has limitations due to dose limiting toxicity ▪ Focused IFNa Therapeutics (FIT) Technology seeks to overcome the toxicity while maintaining efficacy FIT Platform ▪ By attaching IFNa to an antibody, FIT targets delivery of IFNa to tumor Targeted Antibody-Interferon microenvironment Fusion Technology 17

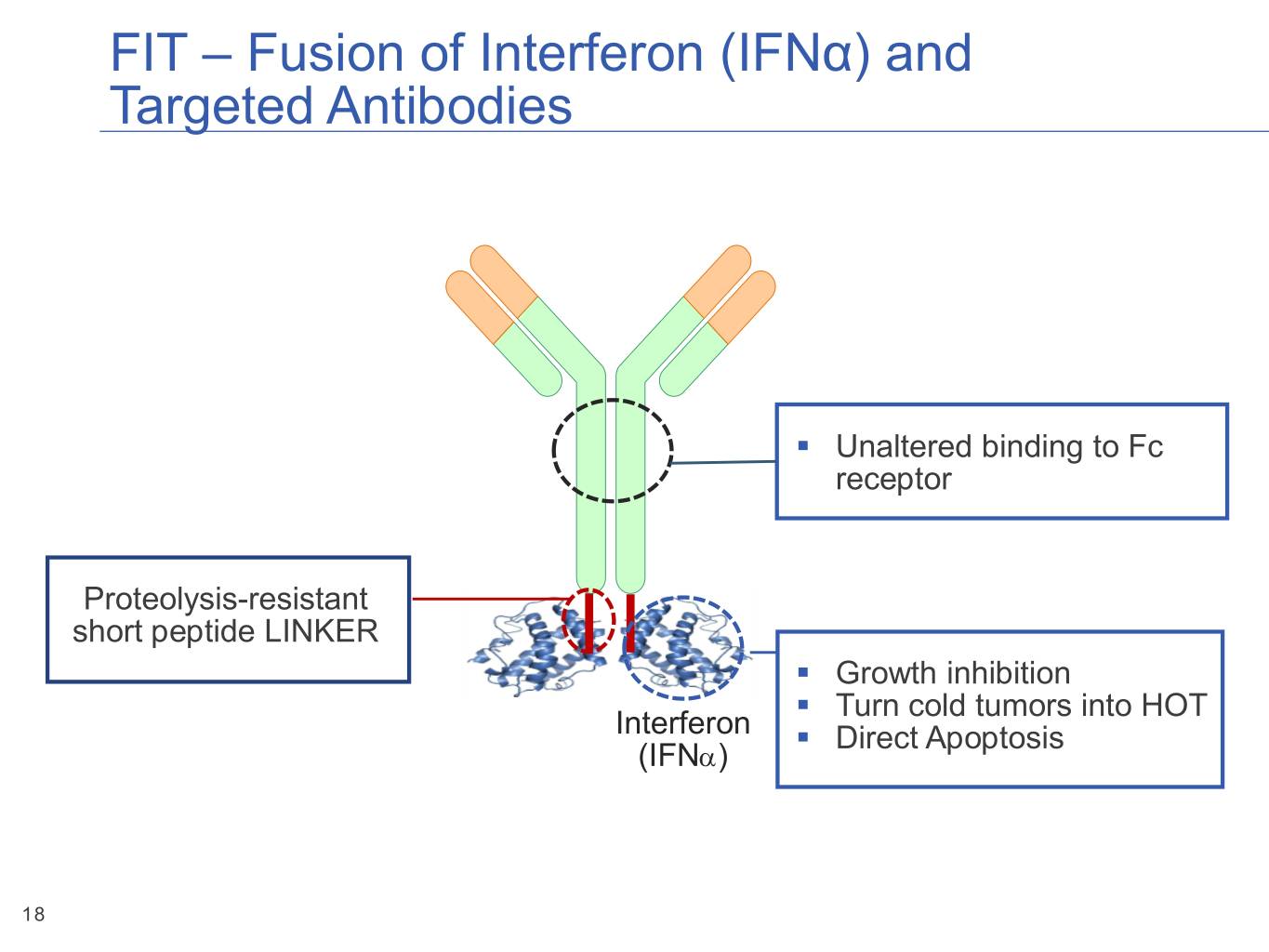

FIT – Fusion of Interferon (IFNα) and Targeted Antibodies ▪ Unaltered binding to Fc receptor Proteolysis-resistant short peptide LINKER ▪ Growth inhibition ▪ Turn cold tumors into HOT Interferon ▪ Direct Apoptosis (IFNa) 18

Mechanism of Action Tumor Cells with Antibody Target Normal Cells without Antibody Target Antibody Antibody does not binds target bind cell surface antigen 1 IFN Target antigen IFN Target antigen 2 3 IFN binds Ab-IFN binds IFN-R poorly to IFN-R IFN-R No IFN-R signaling signaling Apoptosis/Growth arrest NO Apoptosis/Growth arrest 19

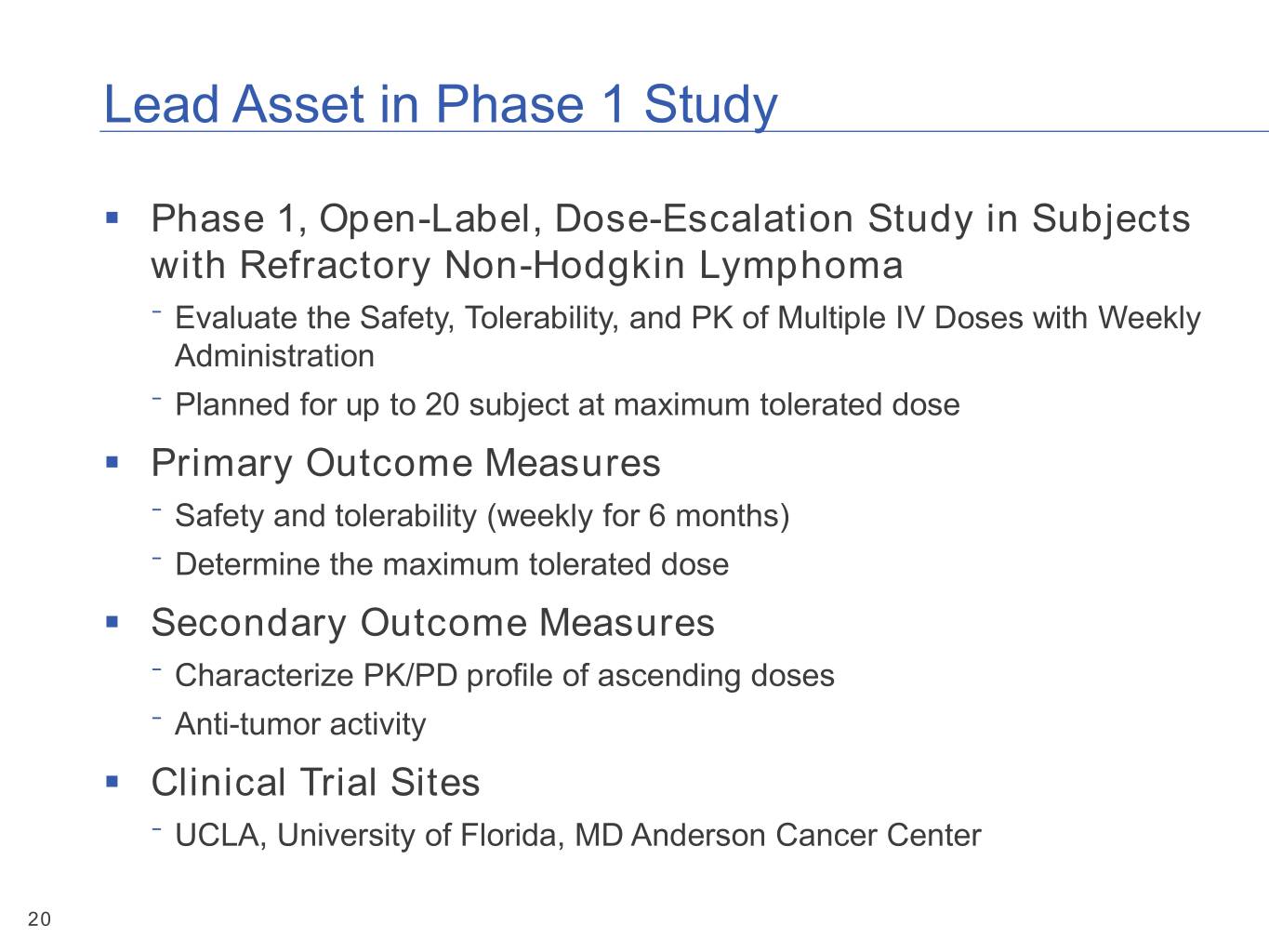

Lead Asset in Phase 1 Study ▪ Phase 1, Open-Label, Dose-Escalation Study in Subjects with Refractory Non-Hodgkin Lymphoma ⁻ Evaluate the Safety, Tolerability, and PK of Multiple IV Doses with Weekly Administration ⁻ Planned for up to 20 subject at maximum tolerated dose ▪ Primary Outcome Measures ⁻ Safety and tolerability (weekly for 6 months) ⁻ Determine the maximum tolerated dose ▪ Secondary Outcome Measures ⁻ Characterize PK/PD profile of ascending doses ⁻ Anti-tumor activity ▪ Clinical Trial Sites ⁻ UCLA, University of Florida, MD Anderson Cancer Center 20

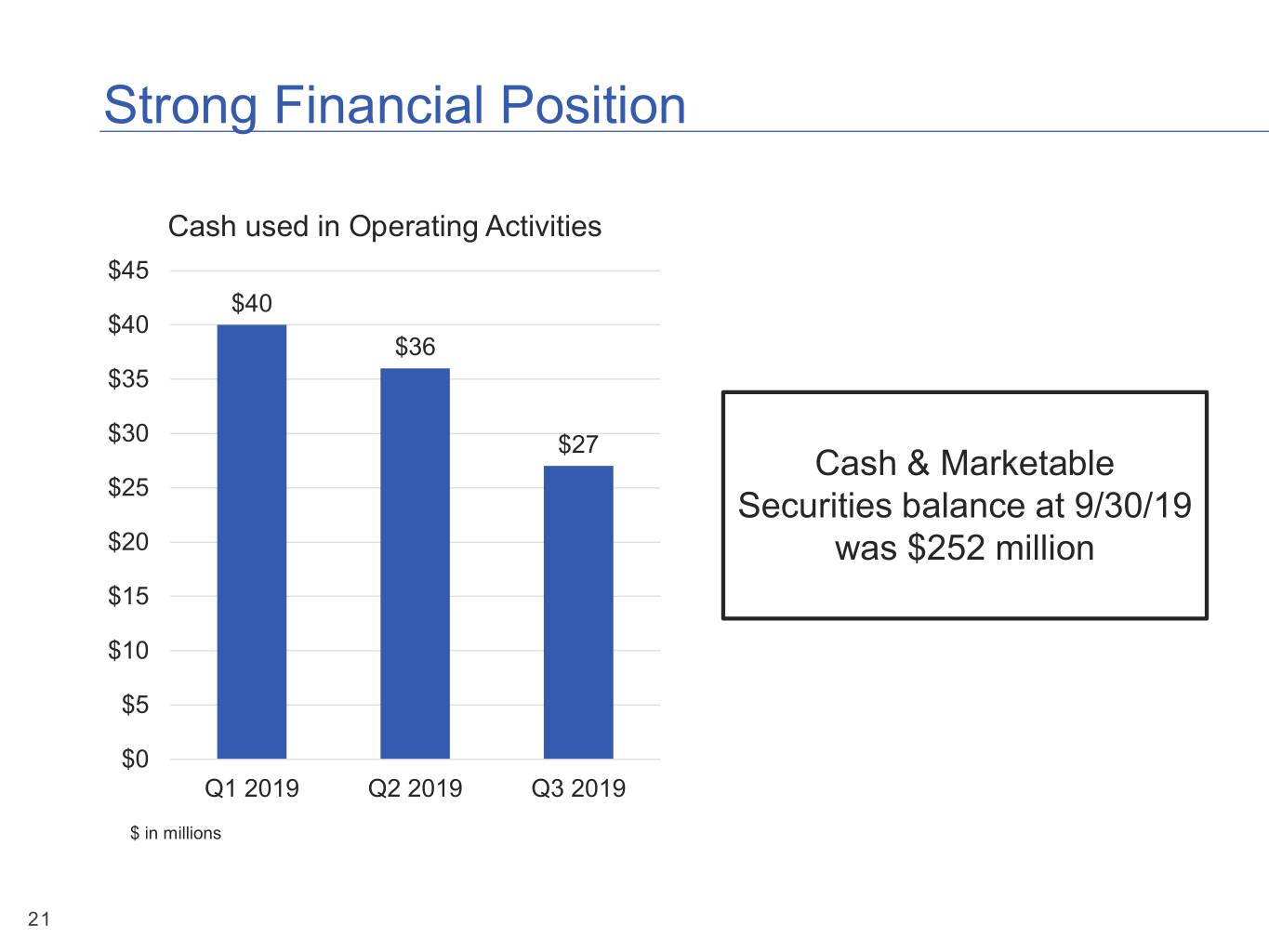

Strong Financial Position Cash used in Operating Activities $45 $40 $40 $36 $35 $30 $27 Cash & Marketable $25 Securities balance at 9/30/19 $20 was $252 million $15 $10 $5 $0 Q1 2019 Q2 2019 Q3 2019 $ in millions 21

Spectrum’s Pipeline Targeted & Novel Medicines POZIOTINIB ROLONTIS® FIT Platform (eflapegrastim) Program Update in Q1 PDUFA Date of October 24, 2020 Phase 1 Dose Escalation Study 22

Non-GAAP Financial Measures (from Continuing Operations) In this press release, Spectrum reports certain historical results that have not been prepared in accordance with generally accepted accounting principles (GAAP), including non-GAAP selling, general and administrative expenses, non-GAAP research and development expenses, non-GAAP net loss and non-GAAP net loss per share. Non-GAAP financial measures are reconciled to the most directly comparable GAAP financial measures in the tables of this press release and the accompanying footnotes. The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with GAAP. The non-GAAP financial measures presented exclude the items summarized in the below table. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results and that these items are not indicative of the company's on-going core operating performance. Management uses non-GAAP net income (loss) in its evaluation of the company's core after-tax results of operations and trends between fiscal periods and believes that these measures are important components of its internal performance measurement process. Management believes that these non-GAAP financial measures are useful to investors in providing greater transparency to the information used by management in its operational decision-making. Management believes that the use of these non-GAAP financial measures also facilitates a comparison of the Company’s underlying operating performance with that of other companies in its industry, which use similar non-GAAP measures to supplement their GAAP results. The non-GAAP financial measures presented herein have certain limitations in that they do not reflect all of the costs associated with the operations of the company's business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. In addition, other companies, including other companies in our industry, may calculate non- GAAP financial measures differently than we do, limiting their usefulness as a comparative tool. Investors and potential investors are encouraged to review the reconciliation of our non-GAAP financial measures contained within this news release with our GAAP financial results. 23

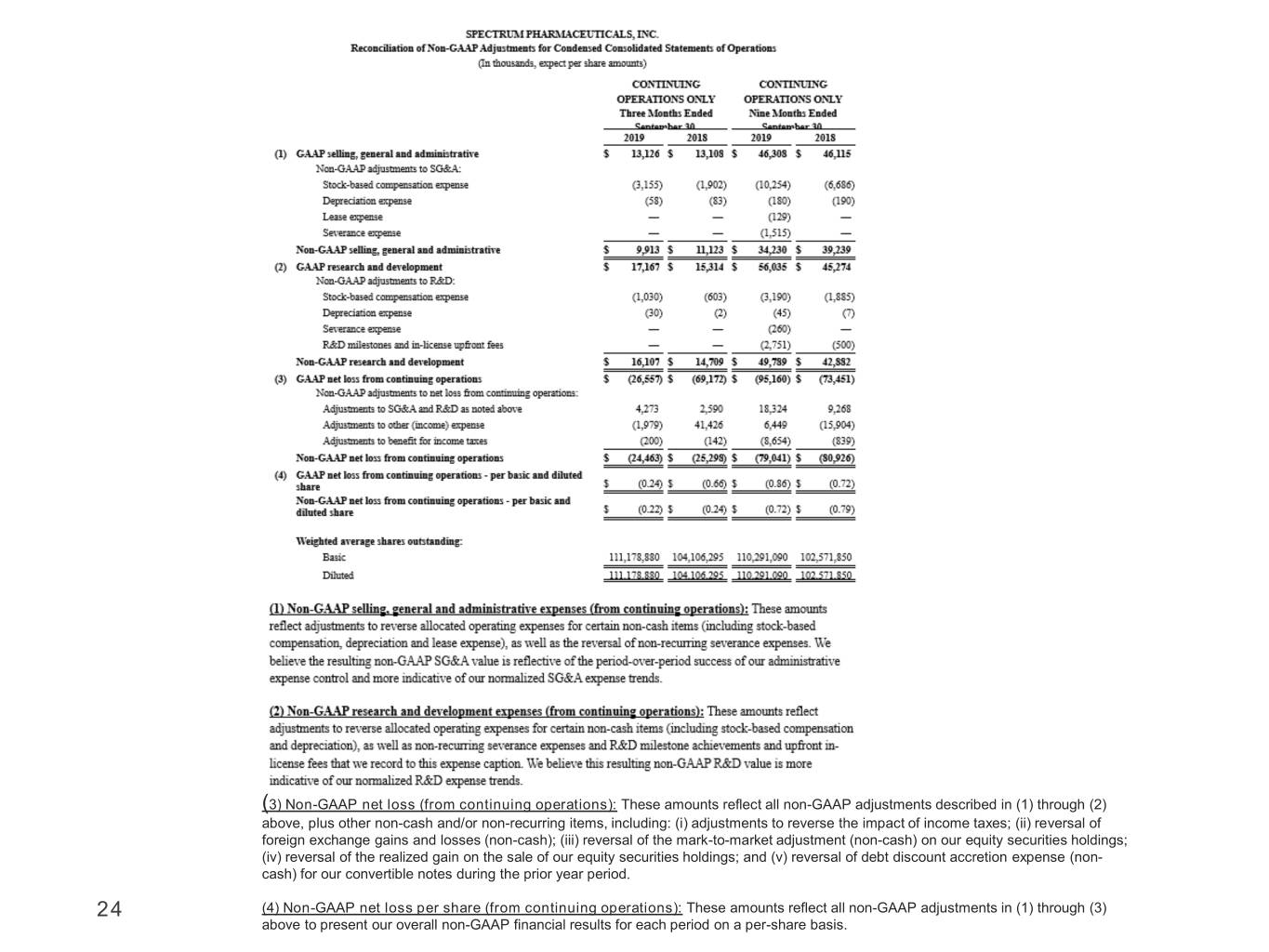

(3) Non-GAAP net loss (from continuing operations): These amounts reflect all non-GAAP adjustments described in (1) through (2) above, plus other non-cash and/or non-recurring items, including: (i) adjustments to reverse the impact of income taxes; (ii) reversal of foreign exchange gains and losses (non-cash); (iii) reversal of the mark-to-market adjustment (non-cash) on our equity securities holdings; (iv) reversal of the realized gain on the sale of our equity securities holdings; and (v) reversal of debt discount accretion expense (non- cash) for our convertible notes during the prior year period. 24 (4) Non-GAAP net loss per share (from continuing operations): These amounts reflect all non-GAAP adjustments in (1) through (3) above to present our overall non-GAAP financial results for each period on a per-share basis.

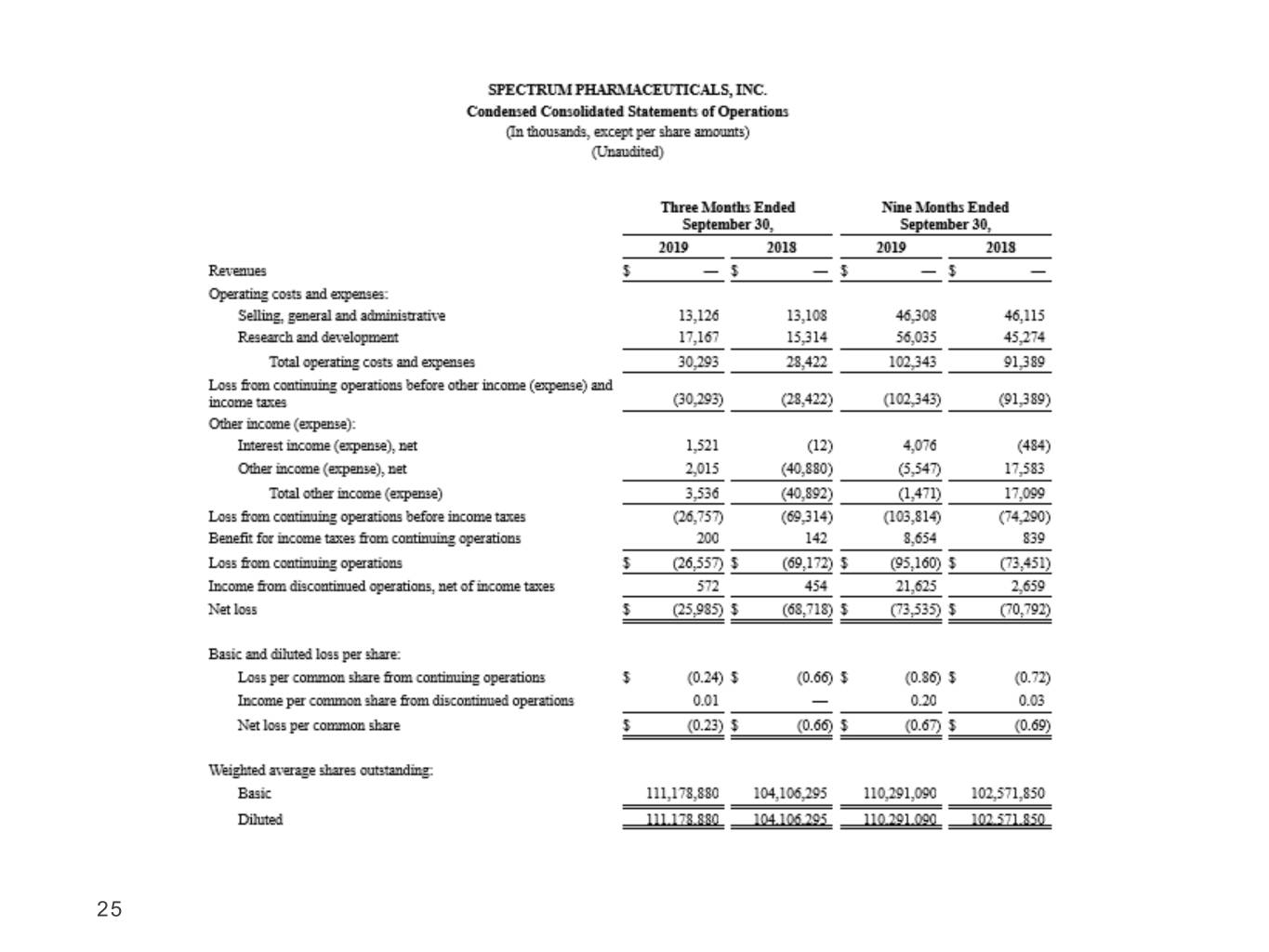

25

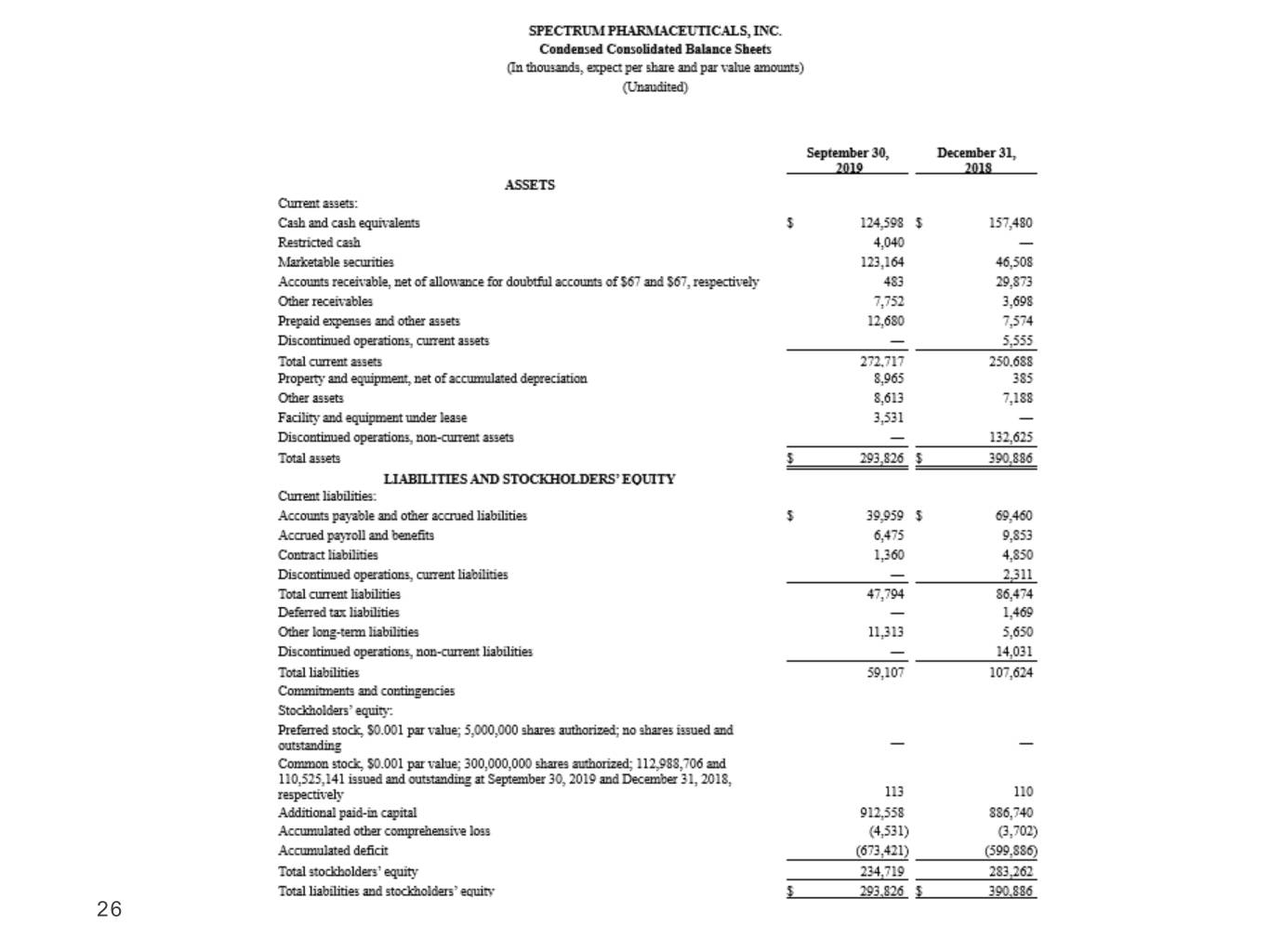

26