Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TERMINIX GLOBAL HOLDINGS INC | a2236664z8-k.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

Exhibit 99.1

September 10, 2018

Dear ServiceMaster Global Holdings, Inc. Stockholder:

We previously announced plans to separate our American Home Shield business from our Terminix and Franchise Services Group ("FSG") businesses. The separation will occur by means of a spin-off of a newly formed company named frontdoor, inc. ("Frontdoor"), which will own the assets and liabilities associated with the American Home Shield business. ServiceMaster Global Holdings, Inc. ("ServiceMaster"), the existing publicly traded company in which you currently own common stock, will continue to own and operate our Terminix and FSG businesses. The separation will create two companies with proven long-term strategies, scale and financial strength that will be leaders in their industries. The ServiceMaster board of directors believes that separating the American Home Shield business from the remaining businesses of ServiceMaster is in the best interest of ServiceMaster and its stockholders for a number of reasons, including:

- •

- The separation will allow investors to separately value ServiceMaster and Frontdoor based on each company's unique investment identities,

including the merits, strategy, performance and future prospects of their respective businesses.

- •

- The separation will allow each business to more effectively pursue its own distinct operating priorities and strategies and will enable the

management of both companies to pursue unique opportunities for long-term growth and profitability.

- •

- The separation will permit each company to concentrate its financial resources solely on its own operations, providing greater flexibility to

invest capital in its business at a time and in a manner appropriate for its distinct strategy and business needs.

- •

- The separation will provide greater opportunity to grow organically and pursue value-enhancing acquisitions in industries with active M&A

markets.

- •

- The separation will create independent, public companies that will afford each company direct access to capital markets and facilitate the ability to capitalize on its unique growth opportunities.

The ServiceMaster board of directors also considered a number of potentially negative factors in evaluating the separation, including, among others, risks relating to the creation of a new public company, possible increased costs and one-time separation costs, but concluded that the potential benefits of the separation significantly outweighed these factors. As two distinct publicly traded companies, ServiceMaster and Frontdoor will be better positioned, both strategically and operationally, to drive organic growth and capitalize on strategic opportunities.

ServiceMaster's Terminix business will continue to be a leader in the pest control industry, with an approximate 21 percent share of the $8 billion U.S. pest control services industry. ServiceMaster has recently implemented a number of strategic investments to transform the Terminix business that focus on process, talent, technology and customers. Following the separation of Frontdoor, ServiceMaster will be better positioned to continue a strategic focus on Terminix's field operations and sales force and progress on the path to higher organic growth and improved customer retention. Additionally, ServiceMaster's FSG businesses each hold a leading position in their respective categories with strong and trusted brands such as AmeriSpec®, Furniture Medic®, Merry Maids®, ServiceMaster Clean® and ServiceMaster Restore®. FSG will continue its key initiatives to grow its business and drive results, such as expanding service offerings and helping franchisees increase customer-level revenue growth.

The separation will provide ServiceMaster stockholders with equity ownership in both ServiceMaster and Frontdoor. The separation is intended to qualify as generally tax-free to ServiceMaster stockholders for U.S. federal income tax purposes.

The separation will be effected by means of a pro rata distribution of at least 80.1 percent of the outstanding shares of Frontdoor common stock to holders of ServiceMaster common stock. Following the distribution, Frontdoor will be a separate public company. Each ServiceMaster stockholder will receive one share of Frontdoor common stock for every two shares of ServiceMaster common stock held at the close of business on September 14, 2018, the record date for the distribution. No vote of ServiceMaster stockholders is required for distribution. You do not need to take any action to receive the shares of Frontdoor common stock to which you are entitled as a ServiceMaster stockholder. You will not be required to make any payments or to surrender or exchange your shares of ServiceMaster common stock.

Frontdoor's common stock has been approved for listing on the Nasdaq Global Select Market under the symbol "FTDR." Following the distribution, ServiceMaster will continue to trade on the New York Stock Exchange ("NYSE") under the symbol "SERV."

I encourage you to read the attached information statement, which is being provided to all ServiceMaster stockholders who held shares on the record date for the distribution. The information statement describes the separation in detail and contains important business and financial information about Frontdoor.

|

Sincerely, | |

|

|

September 10, 2018

Dear Future frontdoor, inc. Stockholder:

I am pleased to welcome you as a future stockholder of frontdoor, inc. ("Frontdoor," "we," "us," "our" or the "Company"). Frontdoor common stock has been approved for listing on the Nasdaq Global Select Market under the symbol "FTDR." Although we will be newly public, we have been a leader in providing homeowners affordable protection against inevitable home system component and appliance breakdowns for more than 45 years.

We decided to call our new company Frontdoor. The front door is where we open ourselves up to the world every day. It's the place we welcome friends and family, and greet new people. It's also where our company meets homeowners face-to-face to help them deal with the hassles of owning a home. We're a difference-maker for homeowners, delivering solutions powered by people and enabled by technology. We listen to them, share our expertise, anticipate their needs and fix their problems. Simply, we make homeownership simple. That's the opportunity that knocks for us every day. We feel this name encapsulates our broader mission for the Company. It allows us ample room to grow under a new name, but still provide the level of service customers expect. American Home Shield doesn't go away, it just becomes part of a larger mission.

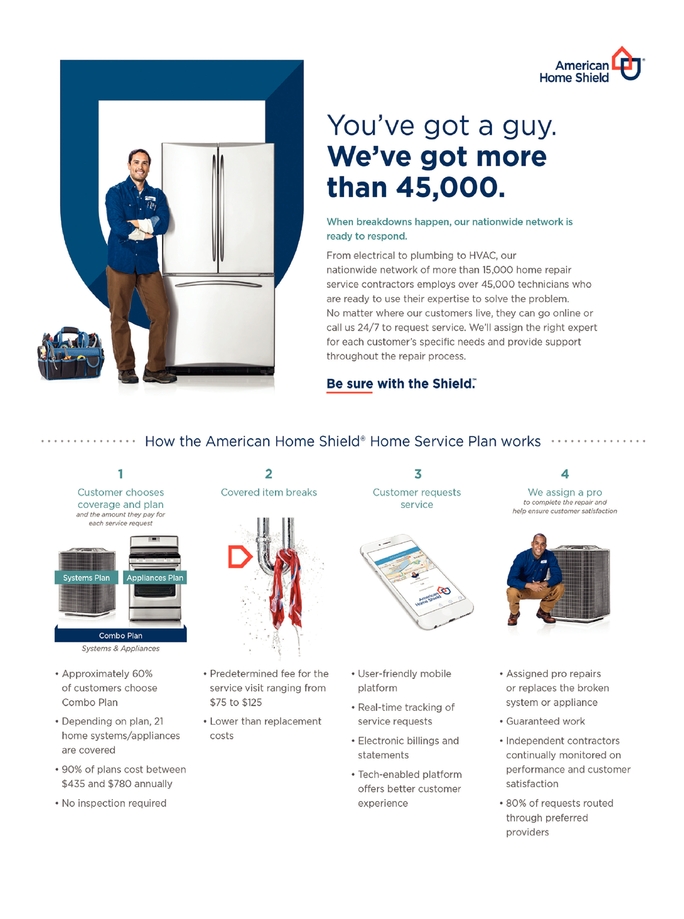

Frontdoor owns multiple home service brands including HSA, OneGuard, Landmark and American Home Shield, which is the largest provider of home service plans in the U.S. Through our home services platform, we respond to over four million service requests annually (or one every eight seconds) from homeowners who require assistance with technical home repair issues utilizing our nationwide network of over 15,000 pre-qualified professional contractor firms that employ more than 45,000 technicians. Our customizable home service plans help customers protect and maintain their homes, typically their most valuable asset, from costly and unplanned breakdowns of essential home systems and appliances. Our large recurring customer base provides our contractors a significant volume of work throughout the year, which is highly valued by them. We facilitate these interactions through our customer and service delivery platform.

We will continue to leverage this technology-enabled and people-driven platform as a catalyst of future sustained growth.

Our strong national brand recognition, industry leading contractor base and commitment to taking the hassle out of owning a home will allow us to invest in future growth of the Company. A strong track record of consistent revenue and free cash flow growth affords opportunities to expand via organic and inorganic means.

We are committed to providing outstanding returns to our stockholders. We will achieve this by obsessing about customers, investing in growth and generating strong cash flow. I invite you to learn more about Frontdoor and our strategic initiatives by reading the attached information statement. We would be honored to have you as a future stockholder of Frontdoor.

|

Sincerely, |

|

|

||

|

Rexford J. Tibbens |

|

|

President and Chief Executive Officer |

|

|

frontdoor, inc. |

INFORMATION STATEMENT

![]()

frontdoor, inc.

This information statement is being furnished in connection with the distribution by ServiceMaster Global Holdings, Inc. ("ServiceMaster") to its stockholders of shares of common stock of frontdoor, inc., a Delaware corporation ("Frontdoor," "we," "us," "our" or the "Company"), currently an indirect, wholly owned subsidiary of ServiceMaster, that will hold directly or indirectly the assets and liabilities associated with the American Home Shield business. ServiceMaster will distribute at least 80.1 percent of the outstanding shares of Frontdoor common stock on a pro rata basis to ServiceMaster stockholders in a transaction intended to qualify as generally tax-free to ServiceMaster stockholders for U.S. federal income tax purposes, except with respect to any cash received in lieu of fractional shares. Following the distribution, we will be a separate public company. Immediately after the distribution becomes effective, ServiceMaster will own no more than 19.9 percent of the outstanding shares of Frontdoor common stock. Prior to completing the separation, ServiceMaster may adjust the percentage of Frontdoor common stock to be distributed to ServiceMaster stockholders and retained by ServiceMaster in response to market and other factors, and it will amend this information statement to reflect any such adjustment. The distribution is subject to certain conditions, as described in this information statement. You should consult your tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local and non-U.S. tax laws.

For every two shares of ServiceMaster common stock held of record by you as of the close of business on September 14, 2018, the record date for the distribution, you will receive one share of Frontdoor common stock. You will receive cash in lieu of any fractional shares of Frontdoor common stock that you would have received after application of the above ratio. As discussed under "The Separation and Distribution—Trading Between the Record Date and Distribution Date," if you sell your shares of ServiceMaster common stock in the "regular-way" market after the record date and before the distribution, you also will be selling your right to receive shares of Frontdoor common stock in the distribution. We expect the shares of Frontdoor common stock to be distributed by ServiceMaster to you at 12:01 a.m. Eastern Time, on October 1, 2018. We refer to the date of the distribution of the shares of Frontdoor common stock as the "distribution date."

No vote of ServiceMaster stockholders is required for the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send ServiceMaster a proxy, in connection with the distribution. You do not need to pay any consideration or exchange or surrender your existing shares of ServiceMaster common stock or take any other action to receive your shares of Frontdoor common stock.

There is no current trading market for Frontdoor common stock, although we expect that a limited market, commonly known as a "when-issued" trading market, will develop on or about the record date for the distribution, and we expect "regular-way" trading of Frontdoor common stock to begin on the first trading day following the completion of the distribution. Frontdoor common stock has been approved for listing on the Nasdaq Global Select Market ("NASDAQ") under the symbol "FTDR." ServiceMaster common shares will continue to trade on the New York Stock Exchange ("NYSE") under the symbol "SERV."

In reviewing this information statement, you should carefully consider the matters described under the caption "Risk Factors" beginning on page 33.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is September 10, 2018.

This information statement was first made available to ServiceMaster stockholders on or about September 10, 2018, and will be mailed to ServiceMaster stockholders on or about September 14, 2018.

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about Frontdoor assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to "Frontdoor," "we," "us," "our" or the "Company" refer to frontdoor, inc., a Delaware corporation, and its combined subsidiaries. References in this information statement to "ServiceMaster" or "Parent" refer to ServiceMaster Global Holdings, Inc., a Delaware corporation, and its consolidated subsidiaries (other than, after the distribution, Frontdoor and its consolidated subsidiaries), unless the context otherwise requires. References to our historical business and operations refer to the business and operations of ServiceMaster's American Home Shield business that will be transferred to Frontdoor in connection with the separation and distribution. References in this information statement to the "separation" refer to the separation of the American Home Shield business from ServiceMaster's other businesses and the creation, as a result of the distribution, of an independent, publicly traded company, Frontdoor, to hold the assets and liabilities associated with the American Home Shield business after the distribution. References in this information statement to the "distribution" refer to the distribution of shares of Frontdoor common stock to ServiceMaster stockholders on a pro rata basis.

The data included in this information statement regarding industry size and relative industry position is derived from a variety of sources, including company research, third-party studies and surveys, industry and general publications and estimates based on our knowledge and experience in the industries in which we operate. Our estimates have been based on information obtained from our customers, suppliers, trade and business organizations and other contacts in the industry. This information may prove to be inaccurate due to the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties.

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

What is Frontdoor, and why is ServiceMaster separating its American Home Shield business and distributing Frontdoor stock? |

Frontdoor, which is currently an indirect, wholly owned subsidiary of ServiceMaster, was formed to own and operate ServiceMaster's American Home Shield business. The separation of the American Home Shield business from ServiceMaster and the distribution of Frontdoor common stock are intended to provide you with equity ownership in two separate publicly traded companies that will be able to focus exclusively on each of their respective businesses. ServiceMaster and Frontdoor expect that the separation will result in enhanced long-term performance of each business for the reasons discussed in the section entitled "The Separation and Distribution—Reasons for the Separation." | |

Why am I receiving this document? |

ServiceMaster is delivering this document to you because you are a holder of ServiceMaster common stock. If you are a holder of ServiceMaster common stock as of the close of business on September 14, 2018, the record date for the distribution, you will be entitled to receive one share of Frontdoor common stock for every two shares of ServiceMaster common stock that you held at the close of business on such date. This document will help you understand how the separation and distribution will affect your post-separation ownership in ServiceMaster and Frontdoor, respectively. |

|

How will the separation of the American Home Shield business from ServiceMaster work? |

ServiceMaster will distribute at least 80.1 percent of the outstanding shares of Frontdoor common stock to ServiceMaster stockholders on a pro rata basis in a distribution intended to be generally tax-free to ServiceMaster stockholders for U.S. federal income tax purposes. As a result of the distribution, Frontdoor will become a separate public company. The number of shares of ServiceMaster common stock you own will not change as a result of the separation and distribution. |

|

What is the record date for the distribution? |

The record date for the distribution will be September 14, 2018. |

|

When will the distribution occur? |

It is expected that at least 80.1 percent of the outstanding shares of Frontdoor common stock will be distributed by ServiceMaster at 12:01 a.m. Eastern Time, on October 1, 2018, to holders of record of ServiceMaster common stock at the close of business on September 14, 2018, the record date for the distribution. |

1

What do stockholders need to do to participate in the distribution? |

Stockholders of ServiceMaster as of the record date for the distribution will not be required to take any action to receive shares of Frontdoor common stock in the distribution, but you are urged to read this entire information statement carefully. No stockholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of ServiceMaster common stock or take any other action to receive your shares of Frontdoor common stock. The distribution will not affect the number of outstanding shares of ServiceMaster common stock or any rights of ServiceMaster stockholders, although it will affect the market value of each outstanding share of ServiceMaster common stock. |

|

How will shares of Frontdoor common stock be issued? |

You will receive shares of Frontdoor common stock through the same channels that you currently use to hold or trade ServiceMaster common stock, whether through a brokerage account or other channel. Receipt of our shares will be documented for you in the same manner that you typically receive stockholder updates, such as monthly broker statements. |

|

|

If you own ServiceMaster common stock as of the close of business on September 14, 2018, the record date for the distribution, ServiceMaster, with the assistance of Computershare Trust Company, N.A. ("Computershare"), the distribution agent for the distribution, will electronically distribute shares of Frontdoor common stock to you or to your brokerage firm on your behalf in book-entry form. Computershare will mail you a book-entry account statement that reflects your shares of Frontdoor common stock, or your bank or brokerage firm will credit your account for the shares. |

|

How many shares of Frontdoor common stock will I receive in the distribution? |

ServiceMaster will distribute to you one share of Frontdoor common stock for every two shares of ServiceMaster common stock held by you as of close of business on the record date for the distribution. Based on approximately 135.6 million shares of ServiceMaster common stock outstanding as of August 22, 2018, and assuming a distribution of 80.2 percent of the outstanding shares of Frontdoor common stock, a total of approximately 67.8 million shares of Frontdoor common stock will be distributed to holders of record of ServiceMaster common stock at the close of business on September 14, 2018, and approximately 16.7 million shares of Frontdoor common stock will be retained by ServiceMaster, for a total of approximately 84.5 million shares of Frontdoor common stock outstanding. For additional information on the distribution, see "The Separation and Distribution." |

2

Will Frontdoor issue fractional shares of its common stock in the distribution? |

No. We will not issue fractional shares of Frontdoor common stock in the distribution. Fractional shares that ServiceMaster stockholders would otherwise have been entitled to receive will be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed pro rata (based on the fractional share such holder would otherwise be entitled to receive) to those stockholders who would otherwise have been entitled to receive fractional shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. |

|

What are the conditions to the distribution? |

The distribution is subject to final approval by the ServiceMaster board of directors, as well as to the satisfaction (or waiver by ServiceMaster in its sole discretion) of the following conditions: |

|

|

• the transfer of assets and liabilities from ServiceMaster to us shall be completed in accordance with the separation and distribution agreement that ServiceMaster and we will enter into prior to the distribution; |

|

|

• The private letter ruling from the Internal Revenue Service (the "IRS") regarding certain U.S. federal income tax matters relating to the separation and distribution received by ServiceMaster continuing to be valid and being satisfactory to the ServiceMaster board of directors; |

|

|

• ServiceMaster shall have received one or more opinions from its tax advisors, in each case satisfactory to the ServiceMaster board of directors, regarding certain U.S. federal income tax matters relating to the separation and distribution; |

|

|

• an independent appraisal firm acceptable to ServiceMaster shall have delivered one or more opinions to the board of directors of ServiceMaster at the time or times requested by the board of directors of ServiceMaster confirming the solvency and financial viability of ServiceMaster before the consummation of the distribution and each of ServiceMaster and Frontdoor after consummation of the distribution, and such opinions shall have been acceptable to ServiceMaster in form and substance in ServiceMaster's sole discretion and such opinions shall not have been withdrawn or rescinded; |

|

|

• the U.S. Securities and Exchange Commission (or the "SEC") shall have declared effective the registration statement of which this information statement forms a part, and this information statement shall have been made available to ServiceMaster stockholders; |

3

|

• all actions or filings necessary or appropriate under applicable U.S. federal, U.S. state or other securities laws shall have been taken and, where applicable, have become effective or been accepted by the applicable governmental entity; |

|

|

• we shall have received all necessary approvals from applicable state regulators; |

|

|

• the transaction agreements relating to the separation shall have been duly executed and delivered by the parties; |

|

|

• no order, injunction or decree issued by any court of competent jurisdiction, or other legal restraint or prohibition preventing the consummation of the separation, distribution or any of the related transactions, shall be in effect; |

|

|

• the shares of Frontdoor common stock to be distributed shall have been approved for listing on the NASDAQ, subject to official notice of distribution; |

|

|

• we shall have entered into the financing transactions described in this information statement that are contemplated to occur on or prior to the date of the separation and distribution; and |

|

|

• no other event or development shall exist or have occurred that, in the judgment of ServiceMaster's board of directors, in its sole discretion, makes it inadvisable to effect the separation, distribution and other related transactions. |

|

|

Neither we nor ServiceMaster can assure you that any or all of these conditions will be met. In addition, ServiceMaster can decline at any time to go forward with the separation and distribution. For a complete discussion of all of the conditions to the distribution, see "The Separation and Distribution—Conditions to the Distribution." |

|

What is the expected date of completion of the distribution? |

The completion and timing of the distribution are dependent upon a number of conditions. It is expected that the shares of Frontdoor common stock will be distributed by ServiceMaster at 12:01 a.m. Eastern Time, on October 1, 2018, to holders of record of ServiceMaster common stock at the close of business on September 14, 2018, the record date for the distribution. However, no assurance can be provided as to the timing of the distribution or that all conditions to the distribution will be met. |

4

Can ServiceMaster decide to cancel the distribution of Frontdoor common stock even if all the conditions have been met? |

Yes. The distribution is subject to the satisfaction or waiver of certain conditions. See the section entitled "The Separation and Distribution—Conditions to the Distribution." Until the distribution has occurred, ServiceMaster has the right to terminate the distribution, even if all of the conditions are satisfied. |

|

What if I want to sell my ServiceMaster common stock or my Frontdoor common stock? |

If you sell your shares of ServiceMaster common stock prior to or on the distribution date, you may also be selling your right to receive shares of Frontdoor common stock. See "The Separation and Distribution—Trading Between the Record Date and Distribution Date." You are encouraged to consult with your financial advisor regarding the specific implications of selling your ServiceMaster common stock prior to or on the distribution date. |

|

What is "regular-way" and "ex-distribution" trading of ServiceMaster common stock? |

Beginning on or shortly before the record date for the distribution and continuing up to and through the distribution date, it is expected that there will be two markets in ServiceMaster common stock: a "regular-way" market and an "ex-distribution" market. ServiceMaster common stock that trades in the "regular-way" market will trade with an entitlement to shares of Frontdoor common stock distributed pursuant to the distribution. Shares that trade in the "ex-distribution" market will trade without an entitlement to shares of Frontdoor common stock distributed pursuant to the distribution. If you hold shares of ServiceMaster common stock on the record date and then decide to sell any ServiceMaster common stock before the distribution date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your ServiceMaster common stock with or without your entitlement to Frontdoor common stock pursuant to the distribution. |

5

Where will I be able to trade shares of Frontdoor common stock? |

Frontdoor common stock has been approved for listing on the NASDAQ under the symbol "FTDR." We anticipate that trading in shares of Frontdoor common stock will begin on a "when-issued" basis on or about September 14, 2018, the record date for the distribution, and will continue up to and through the distribution date and that "regular-way" trading in Frontdoor common stock will begin on the first trading day following the completion of the distribution. If trading begins on a "when-issued" basis, you may purchase or sell shares of Frontdoor common stock up to and through the distribution date, but your transaction will not settle until after the distribution date. We cannot predict the trading prices for its common stock before, on or after the distribution date. |

|

What will happen to the listing of ServiceMaster common stock? |

ServiceMaster common stock will continue to trade on the NYSE under the symbol "SERV." |

|

Will the number of shares of ServiceMaster common stock that I own change as a result of the distribution? |

No. The number of shares of ServiceMaster common stock that you own will not change as a result of the distribution. |

|

Will the distribution affect the market price of my shares of ServiceMaster common stock? |

Yes. As a result of the distribution, ServiceMaster expects the trading price of ServiceMaster common stock immediately following the distribution to be lower than the "regular-way" trading price of such stock immediately prior to the distribution because the trading price will no longer reflect the value of the American Home Shield business. There can be no assurance that the aggregate market value of shares of ServiceMaster common stock and Frontdoor common stock following the distribution will be higher or lower than the market value of shares of ServiceMaster common stock if the separation and distribution did not occur. This means, for example, that the combined trading prices of one share of ServiceMaster common stock and one share of Frontdoor common stock after the distribution may be equal to, greater than or less than the trading price of one share of ServiceMaster common stock before the distribution. |

6

What are the material U.S. federal income tax consequences of the separation and distribution? |

It is a condition to the distribution that the private letter ruling from the IRS regarding certain U.S. federal income tax matters relating to the separation and distribution received by ServiceMaster remain valid and be satisfactory to the ServiceMaster board of directors and that the ServiceMaster board of directors receive one or more opinions from its tax advisors, in each case satisfactory to the ServiceMaster board of directors, regarding certain U.S. federal income tax matters relating to the separation and distribution. Accordingly, it is expected that ServiceMaster stockholders generally will not recognize any gain or loss upon receipt of Frontdoor common stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares. You should carefully read the section entitled "Material U.S. Federal Income Tax Consequences" and should consult your own tax advisor about the particular consequences of the distribution to you, including the application of U.S. federal, state and local and non-U.S. tax laws. |

|

What will happen to my tax basis in my ServiceMaster stock? |

If you do not sell your ServiceMaster stock in advance of the distribution, your tax basis will be adjusted and the aggregate tax basis of the ServiceMaster common stock and Frontdoor common stock received in the distribution (including any fractional share interest in Frontdoor common stock for which cash is received) will equal the aggregate tax basis of ServiceMaster common stock immediately prior to the distribution, allocated between the ServiceMaster common stock and Frontdoor common stock (including any fractional share interest in Frontdoor common stock for which cash is received) in proportion to the relative fair market value of each on the date of the distribution. You should carefully read the section entitled "Material U.S. Federal Income Tax Consequences" and should consult your own tax advisor about the particular consequences of the distribution to you, including the application of U.S. federal, state and local and non-U.S. tax laws. |

7

What will Frontdoor's relationship be with ServiceMaster following the separation and distribution? |

Following the distribution, ServiceMaster stockholders will directly own at least 80.1 percent of the outstanding shares of Frontdoor common stock, and ServiceMaster and Frontdoor will be separate companies with separate management teams and separate boards of directors. ServiceMaster will retain no more than 19.9 percent of the outstanding shares of Frontdoor common stock following the distribution. Prior to the distribution, we will enter into a separation and distribution agreement with ServiceMaster to effect the separation and distribution and provide a framework for our relationship with ServiceMaster after the separation and will enter into certain other agreements, such as a transition services agreement, a tax matters agreement, an employee matters agreement and a stockholder and registration rights agreement with respect to ServiceMaster's continuing ownership of shares of Frontdoor common stock. These agreements will provide for the separation between ServiceMaster and us of the assets, employees, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities) of ServiceMaster and its subsidiaries attributable to periods prior to, at and after our separation from ServiceMaster and will govern the relationship between ServiceMaster and us subsequent to the completion of the separation. For additional information regarding the separation and distribution agreement, other transaction agreements and certain other commercial agreements between ServiceMaster and us, see the sections entitled "Risk Factors—Risks Related to the Separation and the Distribution" and "Certain Relationships and Related Person Transactions." |

|

How will ServiceMaster vote any shares of Frontdoor common stock it retains? |

ServiceMaster will agree to vote any shares of Frontdoor common stock that it retains in proportion to the votes cast by our other stockholders and grant us a proxy to vote its shares of Frontdoor common stock in such proportion. For additional information on these voting arrangements, see "Certain Relationships and Related Person Transactions—Stockholder and Registration Rights Agreement." |

8

What does ServiceMaster intend to do with any shares of Frontdoor common stock it retains? |

ServiceMaster currently intends to responsibly dispose of all of the Frontdoor common stock that it retains after the distribution through one or more subsequent exchanges for debt by June 14, 2019 in accordance with the terms of the private letter ruling. | |

Who will manage Frontdoor after the separation? |

We have assembled a management team of highly experienced leaders who have strong track records in a wide variety of industries and economic conditions, led by Mr. Rexford J. Tibbens, who is our President and Chief Executive Officer, Brian K. Turcotte, our Senior Vice President and Chief Financial Officer and Jeffrey A. Fiarman, our Senior Vice President, General Counsel and Corporate Secretary. Our management team is highly focused on execution and driving growth and profitability. Further, we believe that we have a deep pool of talent across our organization, including long-tenured individuals with significant expertise and knowledge of our business. For more information regarding our management, see "Management." |

|

Are there risks associated with owning Frontdoor common stock? |

Yes. Ownership of Frontdoor common stock is subject to both general and specific risks relating to our business, the industry in which we operate, our ongoing contractual relationships with ServiceMaster and our status as a separate, publicly traded company. Ownership of Frontdoor common stock is also subject to risks relating to the separation and the distribution. These risks are described in the "Risk Factors" section of this information statement beginning on page 33. You are encouraged to read that section carefully. |

|

Does Frontdoor plan to pay dividends? |

We currently expect to retain all available funds and any future earnings for use in the operation and expansion of our business. The declaration and payment of any dividends in the future will be subject to the sole discretion of our board of directors and will depend on many factors. See "Dividend Policy." |

9

Will Frontdoor incur any indebtedness prior to or at the time of the distribution? |

In connection with the separation and distribution, we incurred long-term debt consisting of $350 million in aggregate principal amount of senior unsecured notes and $650 million in aggregate principal amount of senior secured term loans. We also entered into a senior secured revolving credit facility with commitments in aggregate principal amount of $250 million. The notes and term loans were incurred in favor of ServiceMaster's wholly owned subsidiary, The ServiceMaster Company, LLC ("The ServiceMaster Company"), as partial consideration for the contribution of the American Home Shield business assets to us. The ServiceMaster Company exchanged the notes and term loans with a certain financial institution for $1 billion in aggregate principal amount of outstanding debt of The ServiceMaster Company owed to such financial institution. |

|

|

Additional details regarding such financing arrangements will be included in an amendment to this information statement. See "Description of Material Indebtedness" and "Risk Factors—Risks Related to the Separation and the Distribution." |

|

Who will be the distribution agent, transfer agent and registrar for shares of Frontdoor common stock? |

The distribution agent, transfer agent and registrar for shares of Frontdoor common stock will be Computershare Trust Company, N.A. For questions relating to the transfer or mechanics of the stock distribution, you should contact Computershare toll free at 800-546-5141. |

|

Where can I find more information about ServiceMaster and Frontdoor? |

Before the distribution, if you have any questions relating to ServiceMaster's business performance, you should contact: |

|

|

ServiceMaster Global Holdings, Inc. |

|

|

After the distribution, our stockholders who have any questions relating to our business performance should contact us at: |

|

|

frontdoor, inc. |

10

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about Frontdoor assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to "Frontdoor," "we," "us," "our" or the "Company" refer to frontdoor, inc., a Delaware corporation, and its combined subsidiaries. References in this information statement to "ServiceMaster" or "Parent" refer to ServiceMaster Global Holdings, Inc., a Delaware corporation, and its consolidated subsidiaries (other than, after the distribution, Frontdoor and its consolidated subsidiaries), unless the context otherwise requires. References to our historical business and operations refer to the business and operations of ServiceMaster's American Home Shield business that will be transferred to us in connection with the separation and distribution. References in this information statement to the "separation" refer to the separation of the American Home Shield business from ServiceMaster's other businesses and the creation, as a result of the distribution, of an independent, publicly traded company, Frontdoor, to hold the assets and liabilities associated with the American Home Shield business after the distribution. References in this information statement to the "distribution" refer to the distribution of at least 80.1 percent of the shares of Frontdoor common stock to ServiceMaster stockholders on a pro rata basis.

Business Overview

Frontdoor is obsessed with taking the hassle out of owning a home. Frontdoor owns multiple home service brands including HSA, OneGuard, Landmark and American Home Shield, which is the largest provider of home service plans in the U.S., as measured by revenue. Through our home services platform, we respond to over four million service requests annually (or one every eight seconds) from homeowners who require assistance with technical home repair issues utilizing our nationwide network of over 15,000 pre-qualified professional contractor firms that employ more than 45,000 technicians. Our customizable home service plans help customers protect and maintain their homes, typically their most valuable asset, from costly and unplanned breakdowns of essential home systems and appliances. Our large recurring customer base provides our contractors a significant volume of work throughout the year, which is highly valued by them. We facilitate these interactions through our leading technology-enabled customer interface and service delivery platform. We will continue to leverage this technology-enabled and people-driven platform as a catalyst for future sustained growth.

For the six months ended June 30, 2018, we generated revenue, net income and Adjusted EBITDA of $602 million, $58 million and $105 million, respectively. Revenue represented year-over-year growth of nine percent while net income and Adjusted EBITDA reflected year-over-year decreases of seven percent and seven percent, respectively. The seven percent decrease in Adjusted EBITDA was primarily driven by $28 million of increased contract claims costs, incremental sales and marketing costs and customer service costs, offset, in part, by the impact of higher revenue. The seven percent decrease in net income was primarily driven by the above factors and $15 million of pre-tax spin-off charges, offset, in part, by lower income taxes due to the Tax Cuts and Jobs Act (the "Act" or "U.S. Tax Reform").

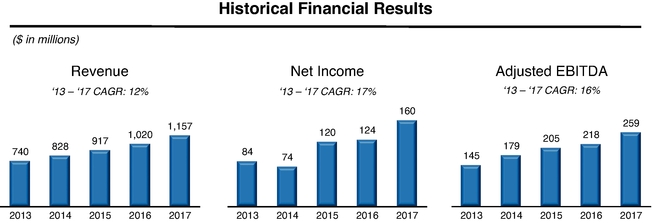

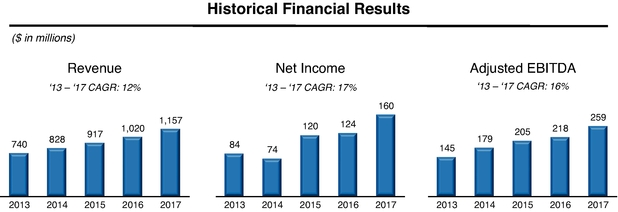

For the fiscal year ended December 31, 2017, we generated revenue, net income and Adjusted EBITDA of $1,157 million, $160 million, and $259 million, respectively. Revenue, net income and Adjusted EBITDA represented year-over-year growth of 13 percent, 29 percent and 19 percent, respectively. Additionally, we have grown through various business cycles as evidenced by the fact we

11

grew revenue from 2007 to 2017 at a compound annual growth rate ("CAGR") of eight percent. We believe that our strong performance through these cycles is attributable to the essential nature of our services, our strong value proposition and management's focus on driving results through strategic investment and operational execution. From 2013 to 2017, we grew revenue, net income and Adjusted EBITDA at a CAGR of 12 percent, 17 percent and 16 percent, respectively. For a reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to net income, see "—Summary Historical and Unaudited Pro Forma Combined Financial Data."

Our Value Proposition

Customer value proposition. We serve approximately two million customers who subscribe to a yearly service plan agreement that covers the repair or replacement of major components of up to 21 home systems and appliances, including electrical, plumbing, central heating and air conditioning ("HVAC") systems, water heaters, refrigerators, dishwashers and ranges/ovens/cooktops. Increasingly, these items tend to be the most critical and complicated items in a home, which lead to complex repairs. Product failures can result in significant emotional and financial inconvenience for our customers. We continuously upgrade our offerings through additional coverages and home services as homes become increasingly complex and connected. Our plans are generally structured as renewable one-year contracts, and, because our customers value the services we provide, 66 percent of our revenue base in 2017 was recurring. This drives consistency and predictability in our business performance.

Our service plans appeal to the growing segment of U.S. homeowners who want: (1) budget protection against unexpected and/or expensive home repair; and (2) the convenience of having repairs completed by experienced professionals. Given the high price of an appliance or home system breakdown, the length of time associated with vetting and hiring a qualified repairperson and, typically, the lack of formal guarantee for services performed, consumers are willing to pay for the peace of mind, convenience, repair expertise and guarantee provided by a home service plan. Our service plans appeal to a broad range of customer demographics.

From 2007 to 2017, our customer base has grown from 1.3 million to two million, representing a CAGR of four percent, our customer retention rate increased from 73 percent to 75 percent, and the annual revenue we generated from renewals grew from 60 percent to 66 percent.

Professional contractor value proposition. Our customers are serviced by a select group of high quality, pre-qualified independent contractors. Our reputation as a strong partner, our growth and our increasing scale have allowed us to attract one of the largest independent contractor networks in the U.S., which currently stands at more than 15,000 pre-qualified professional contractor firms that employ more than 45,000 technicians. Our large recurring customer base guarantees our contractors a

12

significant volume of work throughout the year, which is highly valued by them. In return for this volume, we are able to negotiate favorable rates for work performed. We estimate that approximately 95 percent of our contractor base plans to maintain or expand their relationship with us over the next two years.

We are highly selective in onboarding new contractors into our service network and actively monitor our existing contractors through a rigorous set of performance measures including direct feedback from customer satisfaction surveys. We believe substantial time and expense would be required to develop a contractor base that has comparable national reach, experience and quality of service. Our status as the largest provider of home service plans in the U.S. provides us a significant competitive advantage. We classify a subset of our independent contractor network as "preferred," and they represent a combination of our highest quality and longest-tenured independent contractors. Historically, approximately 80 percent of work orders are assigned to our preferred contractors, driving higher customer satisfaction and ultimately retention rates. We have the opportunity to leverage this supply base for improving and maintaining our customers' homes.

From 2013 to 2017, our network of professional contractor partners has grown from approximately 10,000 to over 15,000, all of whom have performed a service order for us in the past 12 months.

Our Go-to-Market Strategy

We founded the home service plan segment (commonly referred to as "home warranties") in 1971 and benefit from significant scale advantages as the leader in this highly fragmented segment. As we have grown, a greater number of homeowners and contractors have been attracted to, and joined, our network. We believe there is a significant opportunity for us to build on our current leadership position by investing in our customer service experience, increasing customer retention and expanding and further refining our lead generation channels and partners. To capture this opportunity, we are focused on the following customer acquisition channels:

Real estate channel. Our plans typically have been used to provide peace of mind to potential home buyers by protecting them from large, unanticipated out-of-pocket expenses related to the breakdown of major home systems and appliances during the first year after a home purchase. We leverage marketing service agreements and a team of field-based account executives to train, educate and market our plans via real estate brokers and agents, working directly with real estate offices and participating in broker meetings and national sales events. We have long-standing relationships with seven of the 10 largest real estate brokerages in the U.S. and continue to improve relationships with other key brokers. On average, we have been in business with these real estate brokerages for 16 years, and we have strategic partnership arrangements with many of these brokerages. Our long-standing relationships help to secure and grow our position. In addition, for 15 years running, we have had a strategic alliance agreement with the National Association of Realtors, which is the largest real estate association in the U.S. representing 1.3 million realtors.

We had a 32 percent share of plans sold in connection with a home resale transaction in 2017, up from 26 percent in 2012. In 2017, 1.5 million homes were sold with a home service plan out of the approximately 5.5 million homes sold. Customers acquired through the real estate channel represented 48 percent of our customer base in 2017, down from 56 percent in 2007, as we have rapidly grown our direct-to-consumer ("DTC") customer base. In 2017, customers in this channel renewed at 28 percent after the first contract year. Revenue from this channel, including associated renewals, was $400 million, $449 million and $533 million for the years ended December 31, 2015, 2016 and 2017, respectively. Overall revenues within this channel have grown at a five percent CAGR from 2007 through 2017.

Direct-to-consumer channel. Leveraging our experience in the real estate channel, we invested significant resources to develop the DTC channel to broaden our reach beyond home resale

13

transactions. Our value proposition resonates with a wide demographic of homeowners who find security in a plan protecting against expensive and unexpected breakdowns in the home. This strong value proposition is promoted to our potential customers through search engine marketing, content marketing, social media, direct mail and TV/radio and sold through our customer care centers and mobile-optimized e-commerce platform. Over the past decade, we have strategically invested to expand the DTC channel given its high retention rates and customer lifetime value. Our research indicates a relatively low home service plan penetration rate of four percent of occupied U.S. households. We believe that penetration rates will increase over time as consumers become more aware of, and educated about, home service plans.

Since 2012, we have maintained an over 50 percent share of home service plans purchased or renewed outside of a home resale transaction. This industry remains underpenetrated, with approximately three million homes out of the 115 million U.S. households (excluding home resales) having a home service plan. Customers acquired through the DTC channel represented 52 percent of our customer base in 2017, up from 44 percent in 2007. In 2017, customers in this channel renewed at 75 percent after the first contract year. Revenue from this channel, including associated renewals, was $513 million, $571 million and $618 million for the years ended December 31, 2015, 2016 and 2017, respectively. Overall revenues within this channel have grown at a nine percent CAGR from 2007 through 2017.

Customer renewals. We generated 66 percent of our revenue through existing customer renewals for the six months ended June 30, 2018 and the year ended December 31, 2017. We have made significant investments in our integrated technology platform, self-service capabilities, customer care center operations and contractor management systems, which we believe position us to further improve retention and drive consistency and predictability into our business. We estimate that each one-percent improvement in customer retention generates approximately $8 million of incremental revenue and $4 million of gross profit.

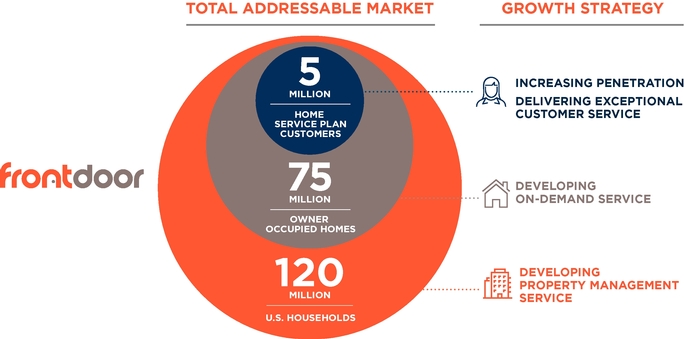

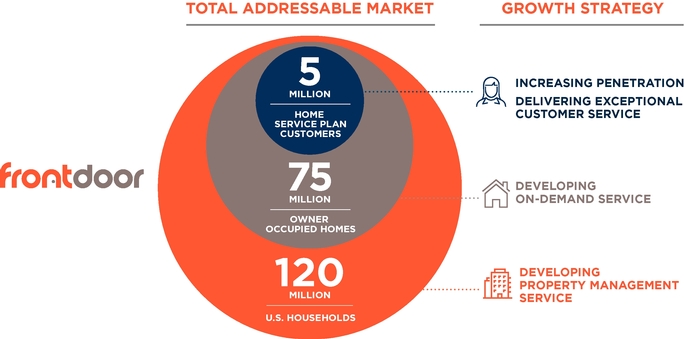

Our Opportunity

Frontdoor operates within the larger $400 billion U.S. home services market, of which the U.S. home service plan segment represents $2.3 billion. While the home service plan segment has grown at a CAGR of seven percent from 2013 to 2017, our revenue has grown at a 12 percent CAGR during the same period. We believe that we are well-positioned to capitalize on our leadership position, while leveraging our network to provide other services to consumers in the broader home services market, as it becomes more complex and connected.

We view the home service plan segment as a long-term growth space. This segment is characterized by low household penetration with approximately five million of nearly 120 million households (owner-occupied homes and rentals) covered by a home service plan, or approximately four percent of these households.

14

As consumer demand shifts towards more outsourced services, we believe we have an opportunity, as a reliable, scaled service provider with a national, licensed independent contractor network, to increase share and household penetration. Additionally, we believe that increasingly complex home systems and appliances may further highlight the value proposition of professional repair services and, accordingly, the coverage benefits offered by a home warranty or other service plans. We aim to capitalize on this opportunity through a comprehensive strategy built on the key strengths of our business.

Strategy

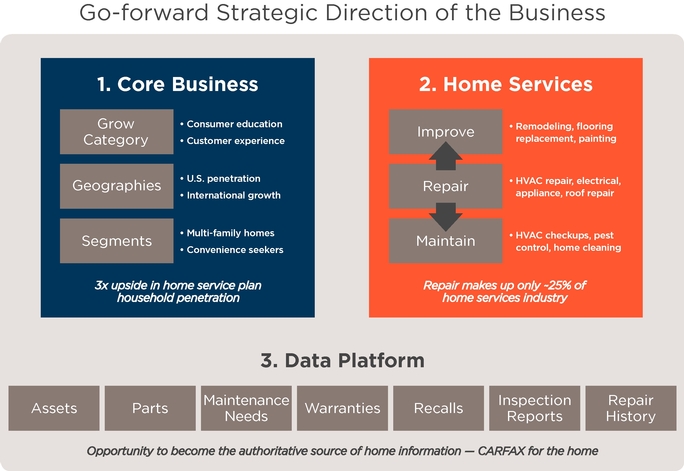

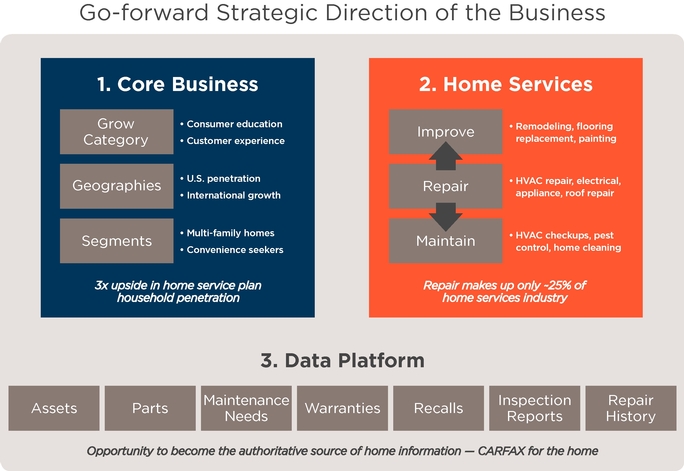

We have a three-pronged strategy for penetrating the $400 billion U.S. home services market:

- •

- Grow our core business: expand the home service plan business through growing the category, expanding into new geographies and expanding into

new customer segments;

- •

- Develop a broader home services offering: reach new customers with on-demand service and expand into home improvement and home maintenance

services; and

- •

- Develop a world class data platform: seek to capture valuable home data to facilitate home services and anticipate repair and maintenance needs.

15

1. Grow our Core Business

We see an opportunity to triple the size of our core business by increasing household penetration through consumer education and improvements to the customer experience, penetrating new geographies and expanding into new segments, including convenience seekers and multi-family homes.

Increase household penetration. To accelerate new customer growth, we make strategic investments in sales, marketing and advertising to drive new business leads, brand awareness and household penetration. We will continue to rapidly expand our core business via a focused effort on our two primary channels:

- •

- Direct-to-consumer; and

- •

- Real estate transactions.

We aim to increase household penetration by targeting homeowners more effectively, employing more sophisticated sales tactics, growing our product breadth and partnering with new providers. Between 2012 and 2016, such efforts have enabled us to increase our share of industry revenue from 38 percent to 46 percent, while the overall size of the home service plan category has increased from approximately three million to five million households. Increased household penetration ultimately allows us to build economies of scale, capitalize on our consistently high retention rates and drive long-term value to us.

Deliver superior customer experience. We will continue to improve the customer experience by investing in our integrated technology platform, self-service capabilities, customer care center operations and contractor management systems. These targeted investments deliver enhancements most

16

valued by our customers, including providing a convenient service experience and driving contractor service improvement. We believe these initiatives will lead to improved retention rates, more word-of-mouth marketing and the opportunity to deliver additional services to satisfied customers. Our customer retention rate has steadily grown from 73 percent in 2007 to 75 percent as of June 30, 2018.

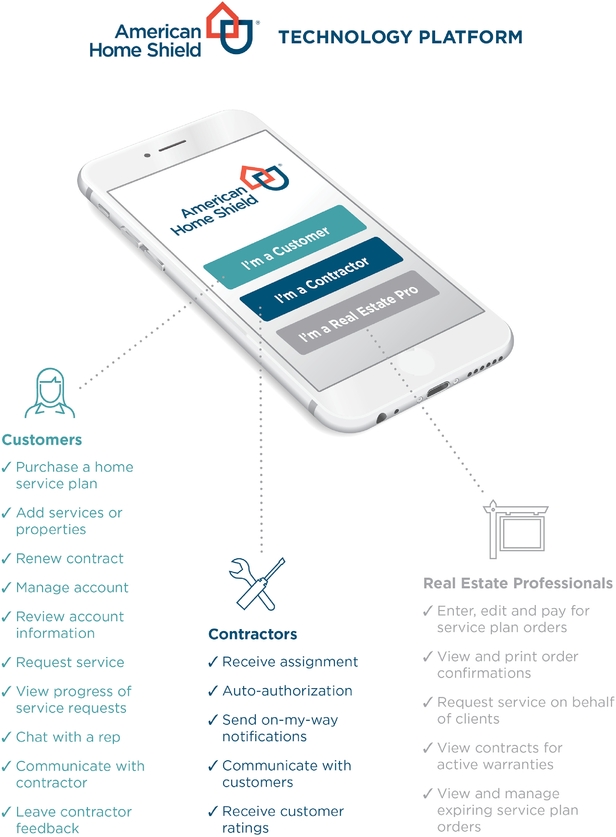

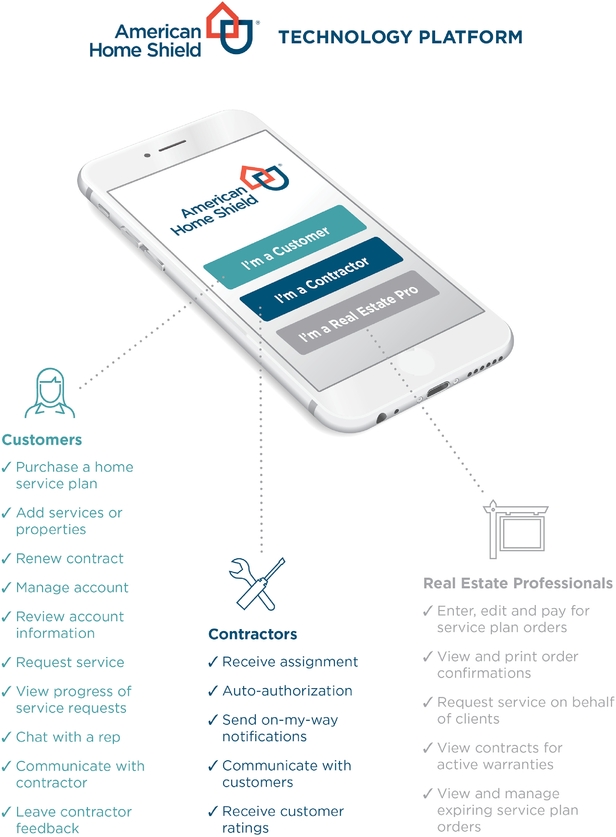

Continue digital innovation. We continue to invest in digital innovation to provide customers, contractors and realtors with a fully-integrated experience and increase profitability.

Customers. In recent years, we have developed robust customer technology platforms, which make it easy for customers to purchase from us, request service and manage their account. Approximately 40 percent of our DTC sales in 2017 were entered online, and 55 percent of our total service request volume was entered online or through our interactive voice response system. Our customer MyAccount platform had over one million active users at the end of 2017, allowing customers to pay bills, request service, review account information or chat with a representative online without calling our customer care centers.

Contractors. Our contractor technology platform makes it easier for contractors to work with us and improves communication between contractors and customers. Our contractor portal had nearly 5,000 active users at the end of 2017, and our platform sent over one million "On-My-Way" notifications to customers, letting them know their contractor was en route to their home.

Realtors. Our realtor technology platform makes it easier for realtors to work with us, and therefore recommend our products to their clients. Approximately 55 percent of real estate channel orders were placed online in 2017. Our realtor portal had over 80,000 active users at the end of 2017, allowing realtors to enter, edit and pay for orders; view or print order confirmations, invoices, and contracts for active contracts; request service on behalf of their clients; and view and manage expiring orders.

17

18

2. Develop a broader home services offering

We see an opportunity to expand beyond repair services for home service plan customers by developing a lead generation engine for our contractor network, which we believe will increase customer satisfaction and enhance our contractor value proposition. Repair services make up only approximately 25 percent of the U.S. home services market, and home improvement and maintenance work is highly valued by our contractors. We see an asymmetrical opportunity to generate leads for our contractors at a low cost to them because it strengthens our relationship with our network and therefore benefits our core business.

We see a large opportunity to develop on-demand services for convenience seekers. Customers' expectations are changing and we intend to develop new services that meet those expectations. Our industry-leading contractor network will allow us to offer services that focus on speed and convenience.

Develop and expand service offerings. We intend to continue to leverage our existing sales channels and service platform to deliver additional value-added services to our customers. Our product development teams draw upon the experience of technicians in the field to both create innovative customer solutions for the existing product suite and to identify service and category adjacencies. In the real estate channel, we have recently launched a new nationwide service offering of re-keying locks for recent home buyers with a home service plan, which enhances the value proposition of our service offering and has been well received in the marketplace. We are currently piloting a new offering of central HVAC pre-season check ups, which we expect to launch nationwide in 2019. Additionally, we are testing smart home technology services, which we think will add value to our plans and result in increases in renewals.

As we seek to further expand our share in the home services market, we are exploring opportunities in on-demand service and property management to leverage our industry-leading repair services platform to provide new services to the nearly 120 million homeowners in the U.S. home services market.

Pursue selective acquisitions. We have a track record of sourcing and purchasing targets at attractive prices and successfully integrating them into our business. In 2016, we made two key acquisitions. In June 2016, we acquired OneGuard Home Warranties ("OneGuard"), and in November 2016, we acquired Landmark Home Warranty, LLC ("Landmark"), which together resulted in over 100,000 new customers. We anticipate that the highly fragmented nature of the home service plan industry will continue to create opportunities for further consolidation, and, with our scale, we believe we are the acquirer of choice in the industry. In the future, we intend to continue to take advantage of strategic acquisition opportunities, particularly in underserved regions where we can enhance and expand service capabilities. We use acquisitions to cost-effectively grow our home service plan contract count and deepen our customer base in high-growth geographies and may consider strategic acquisitions that will expand our reach into the home services market.

3. Develop a world class data platform that fuels our growth

We have the opportunity to become the authoritative source of home information. We are constantly looking to leverage our data, and have identified additional opportunities to use technology to capture valuable home data, make it easier for customers and contractors to interact and ultimately enable us to anticipate repair needs before the customer is aware of them. We believe these investments will both improve the customer experience and reduce our operating expenses. We believe building this data platform will provide additional revenue opportunities as real estate companies, manufacturers and other companies within the U.S. home services market see the benefit of this data. We intend for this platform to be the definitive source of information for homeowners to understand industry quality and service trends to make informed decisions to maintain, improve or repair their home.

19

Strengths

We enjoy the benefits of a large and diverse base of talent, assets and service offerings, which have helped us develop into and retain our position as the established segment leader. The following strengths support our business strategies:

Strong position in large, fragmented, growing segment. We have the leading position in the U.S. home service plan segment with a 46 percent share in 2016. We have spent decades developing a reputation built on brand reputation, fairness of contract terms, including price, and timely response to service claims. As a result, we enjoy industry-leading brand awareness and a reputation for high-quality customer service, both of which serve as key drivers of our customer acquisition efforts. Our nationwide presence also allows us to effectively serve local residential customers and to capitalize on lead generation sources such as real estate agencies. We believe our size and scale provide us a competitive advantage in contractor selection, purchasing power and marketing and operating efficiencies compared to smaller local and regional competitors. Additionally, we have an opportunity to leverage our contractor network into the broader home services market.

Diverse revenue stream across geographies. We are diversified by customer acquisition channel, real estate and DTC, and geography, with operations in all 50 states and the District of Columbia. Our ability to acquire customers through multiple channels mitigates the effect of a downturn in the real estate market, while our nationwide presence limits the risk of poor economic conditions or adverse weather conditions in any particular geography affecting our operations. Therefore, we believe we are better insulated from adverse economic conditions than our smaller regional competitors.

High-value service offerings resulting in high customer retention and recurring revenue. We believe our high annual customer retention demonstrates the highly valued nature of our services and the high level of execution and customer service that we provide. As a result of our high retention and renewal rates and long-standing contractor and real estate relationships, we enjoy significant predictability and stability in our business. These factors limit the effect of adverse economic cycles on our revenue.

Technology-enabled platform drives efficiency, quality of service and customer retention. We believe our fully integrated, technology-enabled platform is a competitive advantage and differentiates us from our competitors. Our technology-enabled platform allows customers to procure and utilize their home service plan without ever having to use a customer care center if they so choose. Customers can purchase a home service plan, electronically chat with a representative, pay bills and track the progress of their service requests, all from their mobile device or personal computer. Further, for our contractor and real estate broker base, we have created a robust platform that allows them to serve our customers and place home service plans, respectively. We believe our fully integrated, technology-enabled platform provides a better customer experience, drives customer retention, allows for seamless interaction with our contractor and real estate broker base and provides operating efficiencies superior to our competitors.

Capital-light business model. Our business model is characterized by strong Adjusted EBITDA margins, negative working capital and limited capital expenditure requirements. Our recurring capital expenditure requirements are typically less than two percent of our annual revenue. We may, from time-to-time, make more significant investments in capability-expanding technology, including investments to develop a world-class data platform to fuel our growth. Net cash provided from operating activities increased by $10 million to $122 million for the six months ended June 30, 2018 compared to $112 million for the six months ended June 30, 2017. Net cash provided from operating activities in the six months ended June 30, 2018 comprised $92 million in earnings adjusted for non-cash charges and a $41 million decrease in cash required for working capital, offset, in part, by

20

$11 million for cash payments related to restructuring and spin-off charges. Capital expenditures were $17 million and free cash flow was $105 million for the six months ended June 30, 2018.

Net cash provided from operating activities increased by $39 million to $194 million for the year ended December 31, 2017 compared to $155 million for the year ended December 31, 2016 and $135 million for the year ended December 31, 2015. Net cash provided from operating activities in 2017 comprised $162 million in earnings adjusted for non-cash charges and a $31 million decrease in cash required for working capital. Capital expenditures were $15 million in 2017, $11 million in 2016, and $7 million in 2015. Free Cash Flow was $179 million, $144 million and $127 million for the years ended December 31, 2017, 2016 and 2015, respectively. For a reconciliation of Free Cash Flow to net cash provided from operating activities from continuing operations, which we consider to be the most directly comparable financial measure presented in accordance with generally accepted accounting principles, see "Selected Historical Combined Financial Data" and "Unaudited Pro Forma Combined Financial Data."

Resilient financial model with track record of consistent performance.

Solid revenue, net income and Adjusted EBITDA growth through business cycles. Our combined revenue, net income and Adjusted EBITDA CAGR from 2013 through 2017 was 12 percent, 17 percent and 16 percent, respectively. Although we can be impacted by economic and housing downturns, our revenue and earnings remained stable during the last major downturn. We believe that this strong performance is attributable to the essential nature of our services, our strong value proposition and management's focus on driving results through strategic investment and operational execution.

Solid margins with attractive operating leverage and productivity improvement initiatives. Our business model enjoys inherent operating leverage stemming from fixed investments in infrastructure and technology, among other factors. We have demonstrated our ability to expand our margins through a variety of initiatives, including metric-driven continuous improvement in our customer care centers and targeted systems investments, which we believe will continue to increase self-service capabilities for our customers, and leveraging our size and scale to deepen and improve our contractor network. We estimate that we enjoy industry-leading gross margins, in many cases significantly outpacing our largest competitors in the U.S.

Enhance our profitability. We continue to invest in initiatives designed to maintain or improve our margins and drive profitable growth. We have been able to increase productivity through actions such as continuous process improvement and targeted systems investments which we believe will continue to increase self-service capabilities for our customers, contractors and realtors, resulting in lower customer acquisition and service costs. We also focus on strategically capitalizing on our purchasing power to achieve more favorable pricing and terms on repair parts and home systems and appliances when replacement is necessary. In addition, we have implemented tools and processes to centralize and systematize pricing decisions. These tools and processes enable us to optimize pricing at the geographic market and product level while creating a flexible and scalable pricing architecture that is fully scalable across our business. We intend to leverage these investments and identify further opportunities to enhance profitability.

Multi-channel marketing approach supported by sophisticated consumer analytic modeling capabilities. Our multi-channel marketing approach focuses on building the value of our brand and generating revenue by understanding the decisions consumers make at each stage in the purchase of home services. The effectiveness of our marketing efforts is demonstrated by an increase in lead generation and online sales. In the DTC channel, new home service plan lead generation has benefited from increased spending in marketing as well as improved digital marketing. Testing we have performed suggests that customers' intent to purchase increases by approximately two times after being presented with a basic description of how our home service plans work. We also have been deploying increasingly

21

sophisticated consumer analytics models that allow us to more effectively segment our prospective customers and tailor campaigns towards them in order to keep cost-per-sale relatively flat. In addition, we have been successful with innovative ways of reaching and marketing to consumers, including content marketing, online reputation management and social media channels. Our marketing spend in 2017 was composed of digital (38 percent), direct mail (24 percent), broadcast (16 percent) and social & other (22 percent).

Operational and customer service excellence driven by superior contractor development. We are constantly focused on improving customer service. The customer experience is at the foundation of our business model, and we believe that each interaction between a customer and one of our independent contractors is an extension of our reputation. We employ rigorous contractor selection practices and continuously analyze ratings from customers to identify potential improvements in service and productivity.

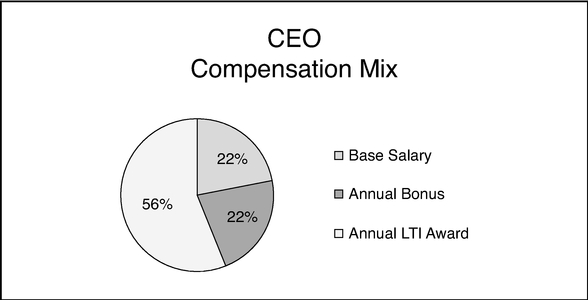

Experienced management team. We have assembled a management team of highly experienced leaders who have strong track records in a wide variety of industries and economic conditions. Our management team is highly focused on execution and driving growth and profitability, and, as such, our compensation structure, including incentive compensation, is tied to key performance metrics that are designed to incentivize senior management to drive the long-term success of our business. Further, we believe that we have a deep pool of talent across our organization, including long-tenured individuals with significant expertise and knowledge of our business.

Summary of Risk Factors

An investment in our company is subject to a number of risks, including risks relating to our business, the separation and distribution and Frontdoor common stock. Set forth below is a high-level summary of some, but not all, of these risks. Please read the information in the section captioned "Risk Factors" beginning on page 33 for a more thorough description of these and other risks.

Risks Related to Our Business

- •

- Our industry is highly competitive.

- •

- Weakening general economic conditions, especially as they may affect home sales, unemployment or consumer confidence or spending levels, may

adversely impact our business, financial position, results of operations and cash flows.

- •

- We may not successfully implement our business strategies, including achieving our growth objectives.

- •

- Adverse credit and financial market events and conditions could, among other things, impede access to or increase the cost of financing, which

could have a material adverse impact on our business, financial position, results of operations and cash flows.

- •

- Weather conditions and seasonality affect the demand for our services, labor costs and our results of operations and cash flows.

- •

- We may not be able to attract and retain qualified key executives or transition smoothly to new leadership, which could adversely impact us and

our businesses and inhibit our ability to operate and grow successfully.

- •

- We are dependent on labor availability at our customer care centers.

- •

- Changes in U.S. tariff and import/export regulations may impact our business, financial position, results of operations and cash flows.

22

- •

- Laws and government regulations applicable to our business and lawsuits, enforcement actions and other claims by third parties or governmental

authorities could increase our legal and regulatory expenses and impact our business, financial position, results of operations and cash flows.

- •

- Disruptions or failures in our information technology systems could create liability for us or limit our ability to effectively monitor,

operate and control our operations and adversely impact our reputation, business, financial position, results of operations and cash flows.

- •

- Increases in appliances, parts and system prices, fuel prices and other operating costs may impact our business, financial position, results of

operations and cash flows.

- •

- We depend on a limited number of third-party component suppliers.

- •

- Changes in the services we deliver or the products we use could affect our reputation, business, financial position, results of operations and

cash flows.

- •

- If we fail to protect the security of personal information about our customers, associates and third parties, we could be subject to

interruption of our business operations, private litigation, reputational damage and costly penalties.

- •

- We may not be able to adequately protect our intellectual property and other proprietary rights that are material to our business.

- •

- Future acquisitions or other strategic transactions could negatively affect our reputation, business, financial position, results of operations

and cash flows.

- •

- Under our new debt agreements, we expect to be subject to various restrictive covenants that could materially adversely impact our business,

financial position, results of operations and cash flows.

- •

- Our future success depends on our ability to attract, retain and maintain positive relations with third party contractors and vendors and their performance.

Risks Related to the Separation and Distribution

- •

- We have no history of operating as an independent, public company, and our historical and pro forma financial information is not necessarily

representative of the results that we would have achieved as a separate, publicly traded company and may not be a reliable indicator of our future results.

- •

- If the distribution, together with certain related transactions, does not qualify as a transaction that is generally tax-free for U.S. federal

income tax purposes, we, ServiceMaster, and ServiceMaster stockholders could be subject to significant tax liabilities and, in certain circumstances, we could be required to indemnify ServiceMaster

for material taxes and other related amounts pursuant to indemnification obligations under the tax matters agreement.

- •

- U.S. federal income tax consequences may restrict our ability to engage in certain desirable strategic or capital-raising transactions after

the separation.

- •

- Until the separation and distribution occur, ServiceMaster has sole discretion to change the terms of the separation and distribution in ways

that may be unfavorable to us.

- •

- We may not achieve some or all of the expected benefits of the separation, and the separation may materially and adversely affect our business, financial position, results of operations and cash flows.

23

- •

- ServiceMaster or we may fail to perform under various transaction agreements that will be executed as part of the separation, or we may fail to

have necessary systems and services in place when certain of the transaction agreements expire.

- •

- After the distribution, certain members of management, directors and stockholders will hold stock in both ServiceMaster and our Company and, as

a result, may face actual or potential conflicts of interest.

- •

- No vote of ServiceMaster stockholders is required in connection with the separation and distribution.

- •

- Failure to maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act could

materially and adversely affect us.